UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

abrdn Healthcare Investors

abrdn Healthcare Opportunities Fund

abrdn World Healthcare Fund

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(l) and 0-11.

ABRDN HEALTHCARE INVESTORS

ABRDN HEALTHCARE OPPORTUNITIES FUND

ABRDN WORLD HEALTHCARE FUND

1900 Market Street, Suite 200

Philadelphia, PA 19103

NOTICE OF ANNUAL MEETINGS OF SHAREHOLDERS

To be held on June 25, 2024

TO THE SHAREHOLDERS:

NOTICE IS HEREBY GIVEN that the annual meeting of shareholders of each of abrdn Healthcare Investors (formerly, Tekla Healthcare Investors), abrdn Healthcare Opportunities Fund (formerly, Tekla Healthcare Opportunities Fund) and abrdn World Healthcare Fund (formerly, Tekla World Healthcare Fund) (each, a "Fund," and collectively, the "Funds") and any adjournments or postponements thereof will be held at the offices of abrdn Inc., located at 1900 Market Street, Suite 200, Philadelphia, PA 19103 (each meeting, an "Annual Meeting," and collectively, the "Annual Meetings") on the following dates and at the following times:

|

abrdn Healthcare Investors (NYSE: HQH) |

June 25, 2024 |

12:30 p.m. Eastern Time |

|||||||||

|

abrdn Healthcare Opportunities Fund (NYSE: THQ) |

June 25, 2024 |

1:00 p.m. Eastern Time |

|||||||||

|

abrdn World Healthcare Fund (NYSE: THW) |

June 25, 2024 |

1:30 p.m. Eastern Time |

|||||||||

The purpose of the Annual Meetings is to consider and act upon the following proposals (each, a "Proposal") for each Fund, as applicable, and to consider and act upon such other matters as may properly come before the Annual Meetings or any adjournments or postponements thereof:

HQH — To elect two Class B Trustees to serve until the 2027 Annual Meeting of Shareholders or until such Trustee's successor is duly elected and qualified.

THQ — To elect two Class A Trustees to serve until the 2027 Annual Meeting of Shareholders or until such Trustee's successor is duly elected and qualified.

THW — To elect two Class C Trustees to serve until the 2027 Annual Meeting of Shareholders or until such Trustee's successor is duly elected and qualified.

Each Proposal is discussed in greater detail in the enclosed Joint Proxy Statement. You are entitled to notice of, and to vote at, the Annual Meeting of a Fund if you owned shares of such Fund at the close of business on April 1, 2024 (the "Record Date"). Even if you expect to attend an Annual Meeting, please complete, date, sign and return the enclosed proxy card(s) in the enclosed postage-paid envelope or authorize your proxy by telephone or through the Internet.

We will admit to an Annual Meeting (1) all shareholders of record on the Record Date, (2) persons holding proof of beneficial ownership on the Record Date, such as a letter or account statement from the person's broker, (3) persons who have been granted proxies, and (4) such other persons that we, in our sole discretion, may elect to admit. All persons wishing to be admitted to an Annual Meeting must present photo identification. If you plan to attend an Annual Meeting, we ask that you call us in advance at 1-800-522-5465.

This Notice and related proxy materials are first being mailed to shareholders on or about April 22, 2024.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meetings of Shareholders to Be Held on Thursday, June 25, 2024: This Notice, the Joint Proxy Statement and the form of proxy cards are available on the Internet at https://www.abrdnhqh.com (for HQH) https://www.abrdnthq.com (for THQ) and https://www.abrdnthw.com (for THW). On each Fund's website, you will be able to access the Notice, the Joint Proxy Statement, the form of proxy card(s) and any amendments or supplements to the foregoing materials that are required to be furnished to shareholders.

By order of the Boards of Trustees,

Megan Kennedy, Vice President and Secretary

abrdn Healthcare Investors

abrdn Healthcare Opportunities Fund

abrdn World Healthcare Fund

TO AVOID THE UNNECESSARY EXPENSE OF FURTHER SOLICITATION, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETINGS, IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AND VOTED AT THE ANNUAL MEETINGS. ACCORDINGLY, YOU ARE REQUESTED TO PLEASE DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD(S) FOR THE ANNUAL MEETINGS PROMPTLY, OR TO AUTHORIZE THE PROXY VOTE BY TELEPHONE OR THROUGH THE INTERNET PURSUANT TO THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD(S). NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. IT IS IMPORTANT THAT YOUR PROXY CARD(S) BE RETURNED PROMPTLY IN ORDER TO AVOID THE ADDITIONAL EXPENSE OF FURTHER SOLICITATION.

April 22, 2024

Philadelphia, Pennsylvania

ABRDN HEALTHCARE INVESTORS ("HQH")

ABRDN HEALTHCARE OPPORTUNITIES FUND ("THQ")

ABRDN WORLD HEALTHCARE FUND ("THW")

(each, a "Fund" and collectively, the "Funds")

1900 Market Street, Suite 200

Philadelphia, PA 19103

JOINT PROXY STATEMENT

For the Annual Meetings of Shareholders

each to be held on June 25, 2024

This Joint Proxy Statement is furnished in connection with the solicitation of proxies by each Fund's Board of Trustees (each, a "Board," and collectively, the "Boards," with members of each Board being referred to as "Trustees") to be voted at the Annual Meeting of Shareholders of each Fund (each, a "Meeting," and collectively, the "Meetings") and at any adjournments or postponements thereof to be held at the offices of abrdn Inc., located at 1900 Market Street, Suite 200, Philadelphia, PA 19103 on the following dates and at the following times:

|

abrdn Healthcare Investors (NYSE: HQH) |

June 25, 2024 |

12:30 p.m. Eastern Time |

|||||||||

|

abrdn Healthcare Opportunities Fund (NYSE: THQ) |

June 25, 2024 |

1:00 p.m. Eastern Time |

|||||||||

|

abrdn World Healthcare Fund (NYSE: THW) |

June 25, 2024 |

1:30 p.m. Eastern Time |

|||||||||

A Notice of Annual Meetings of Shareholders and a proxy card (the "Proxy Card") accompany this Joint Proxy Statement. This Joint Proxy Statement is first being mailed on or about April 22, 2024 to shareholders of record as of April 1, 2024.

The purpose of each Meeting is to consider and act upon the following proposals (each a "Proposal"), as applicable to each Fund:

HQH — To elect two Class B Trustees to serve until the 2027 Annual Meeting of Shareholders or until such Trustee's successor is duly elected and qualified.

THQ — To elect two Class A Trustees to serve until the 2027 Annual Meeting of Shareholders or until such Trustee's successor is duly elected and qualified.

THW — To elect two Class C Trustees to serve until the 2027 Annual Meeting of Shareholders or until such Trustee's successor is duly elected and qualified.

All properly executed proxies received prior to a Meeting will be voted at that Meeting, or at any adjournments or postponements thereof, in accordance with the instructions marked on the Proxy Card. Unless instructions to the contrary are marked on the Proxy Card, proxies received will be voted "FOR" each Proposal. The persons named as proxy holders on the Proxy Card will vote in their discretion on any other matters that may properly come before each Meeting or any adjournments or postponements thereof. Any Proxy Card may be revoked at any time prior to its exercise by submitting a properly executed, subsequently dated Proxy Card, giving written notice to Megan Kennedy, Secretary of the Fund(s), 1900 Market Street, Suite 200, Philadelphia, PA 19103, or by attending a Meeting and voting in person. Shareholders may authorize proxy voting by using the enclosed Proxy Card along with the enclosed envelope with pre-paid postage. Shareholders may also authorize proxy voting by telephone or through the internet by following the instructions contained on the Proxy Card. Shareholders do not have dissenter's rights of appraisal in connection with any of the matters to be voted on by the shareholders at each Meeting.

3

In order to transact business at the Meetings, a "quorum" must be present for each Meeting. Under each Fund's By-laws, a quorum is constituted by the presence in person or by proxy of the holders of a majority of the outstanding shares of the respective Fund on the record date. Abstentions and broker non-votes (i.e., proxies from brokers or nominees indicating that they have not received instructions from the beneficial owners on an item for which the brokers or nominees do not have discretionary power to vote) will be treated as present for determining whether a quorum is present with respect to a particular matter at a Meeting.

The election of a Trustee to a Board requires the affirmative vote of a plurality of the shares entitled to vote for the election of any Trustee present or represented by proxy at a Meeting with a quorum present. Under a plurality vote, the nominees who receive the highest number of votes will be elected even if they receive less than a majority of the votes. For purposes of the election of Trustees, abstentions and broker non-votes will be counted as shares present for quorum purposes, but will not be treated as votes cast. Abstentions and broker non-votes, therefore, will have no effect on the election of the Trustees. All properly executed proxies received prior to the Meetings will be voted, at the Meetings or at any adjournments or postponements thereof, in accordance with the instructions marked thereon. Proxies received prior to the Meetings on which no vote is indicated will be voted "FOR" the election of the Trustees.

Brokers holding shares of a Fund in "street name" for the benefit of their customers and clients will request the instructions of such customers and clients on how to vote their shares before the Meetings. Under the rules of the New York Stock Exchange ("NYSE"), such brokers may, for certain "routine" matters, grant discretionary authority to the proxies designated by a Board to vote if no instructions have been received from their customers and clients prior to the date specified in the brokers' request for voting instructions. Each Proposal is a "routine" matter and accordingly beneficial owners who do not provide proxy instructions or who do not return a proxy card may have their shares voted by broker-dealer firms in favor of the Proposal.

The chair of a Meeting shall have the power to adjourn the Meeting without further notice other than announcement at that Meeting. Each Board of Trustees also has the power to postpone a Meeting to a later date and/or time or change the place of a Meeting (including by specifying that the Meeting will be held by remote communication) one or more times for any reason by giving, within a reasonable period of time prior to such Meeting, notice to each shareholder entitled to vote at such Meeting of the place (including that the Meeting will be held by remote communication), date and hour at which such Meeting will be held. Such notice shall be given not fewer than two (2) days before the date of such Meeting and otherwise in accordance with each Fund's By-Laws. No notice of adjournment of a Meeting to another time or place need be given to shareholders. Abstentions and broker non-votes will have the same effect at any adjourned or postponed meeting as noted above. Any business that might have been transacted at a Meeting may be transacted at any such adjourned or postponed session(s) at which a quorum is present.

We will admit to each Meeting (1) all shareholders of record on April 1, 2024 (the "Record Date"), (2) persons holding proof of beneficial ownership on the Record Date, such as a letter or account statement from the person's broker, (3) persons who have been granted proxies, and (4) such other persons that we, in our sole discretion, may elect to admit. To gain admittance, if you are a shareholder of record or a proxy holder of a shareholder of record, you must bring a form of personal identification to the Meeting, where your name will be verified against our shareholder list. If a broker or other nominee holds your shares and you plan to attend a Meeting, you should bring a recent brokerage statement showing your ownership of the shares, as well as a form of personal identification. If you are a beneficial owner and plan to vote at a Meeting, you should also bring a proxy card from your broker.

Each Board has fixed the close of business on April 1, 2024 as the Record Date for the determination of shareholders entitled to notice of, and to vote at, each Meeting and at any adjournment or postponement thereof.

4

Each Fund has one class of shares, no par value per share. Each share of a Fund is entitled to one vote at the Meeting, and fractional shares are entitled to a proportionate share of one vote. On the Record Date, the following number of shares of each Fund were issued and outstanding:

| HQH |

50,624,847.00 |

||||||

| THQ |

41,356,057.70 |

||||||

| THW |

38,244,600.60 |

||||||

Important Notice Regarding the Availability of Proxy Materials for the Meetings to Be Held on Thursday, June 25, 2024: The Proxy Materials and each Fund's most recent annual report for the fiscal year ended September 30, 2023 are available on the Internet at https://www.abrdnhqh.com (for HQH) https://www.abrdnthq.com (for THQ) and https://www.abrdnthw.com (for THW). Each Fund will furnish, without charge, a copy of its annual report for the fiscal year ended September 30, 2023 and any more recent reports, to any Fund shareholder upon request. To request a copy, please write to the Funds c/o abrdn Inc., 1900 Market Street, Suite 200, Philadelphia, PA 19103, or call 1-800-522-5465. You may also call for information on how to obtain directions to be able to register to attend a Meeting.

The Election of Trustees

Each Fund's Declaration of Trust, as amended to date (the "Declaration of Trust"), provides that its Board shall be divided into three classes with staggered terms. The term of office of each Class of Trustees for each Fund will expire in the year indicated in the following chart:

|

Fund |

Class A |

Class B |

Class C |

||||||||||||

|

HQH |

2026 |

2027 |

2025 |

||||||||||||

|

THQ |

2027 |

2025 |

2026 |

||||||||||||

|

THW |

2025 |

2026 |

2027 |

||||||||||||

Each Fund's Declaration of Trust provides that a majority of its Trustees shall fix the number of the entire Board of Trustees and that such number shall be at least three and no greater than fifteen. Each Fund's Board has fixed the number of Trustees at six. Proxies will be voted for the election of the following nominees for HQH, THQ and THW. In the event that a nominee is unable to serve for any reason when the election occurs, the accompanying Proxy will be voted for such other person or persons as the applicable Fund's Board may recommend. Each nominee is presently serving as a Trustee.

Each Board, including the Independent Trustees, upon the recommendation of such Board's Nominating and Corporate Governance Committee, which is composed entirely of Independent Trustees, has nominated the following nominees as Trustees to its Board:

|

abrdn Healthcare Investors |

Rose DiMartino (Class B Trustee, 3 year term ending 2027) C. William Maher (Class B Trustee, 3 year term ending 2027) |

||||||

|

abrdn Healthcare Opportunities Fund |

Kathleen Goetz (Class A Trustee, 3 year term ending 2027) Todd Reit (Class A Trustee, 3 year term ending 2027) |

||||||

|

abrdn World Healthcare Fund |

Jeffrey A. Bailey (Class C Trustee, 3 year term ending 2027) C. William Maher (Class C Trustee, 3 year term ending 2027) |

||||||

Each nominee has indicated an intention to serve as Trustee if elected and has consented to be named in this Joint Proxy Statement.

5

It is the intention of the persons named as proxies on the enclosed Proxy Card(s) to vote "FOR" the election of the nominees for each Class of Trustee to serve for a three-year term. In the event that a nominee is unable to serve for any reason when the election occurs, the proxies received will be voted for such substituted nominees as such Board may recommend.

The following tables set forth certain information regarding the nominees for election to the Boards of the Funds, Trustees whose terms of office continue beyond the Meetings, and the principal officers of the Funds. abrdn Inc., its parent company abrdn plc, and its advisory affiliates are collectively referred to as "abrdn" in the tables below.

|

Name, Address and Year of Birth |

Position(s) Held with Fund |

Term of Office and Length of Time Served |

Principal Occupation(s) During at Least the Past Five Years |

Number of Registrants in Fund Complex* Overseen by Trustee |

Other Directorships Held by Trustee or Nominee for Trustee |

||||||||||||||||||

|

Nominees for Independent Trustee: |

|||||||||||||||||||||||

|

Jeffrey A. Bailey**† c/o abrdn Inc. 1900 Market Street, Suite 200 Philadelphia, PA 19103 Year of Birth: 1972 |

Chair of the Board; Class A Trustee (THQ); Class B Trustee (HQH); Class C Trustee (THW) |

Term expires 2024 (HQH and THW); 2026 (THQ) Trustee of each Fund since 2020 |

Mr. Bailey is a seasoned operational healthcare executive with over 30 years of leadership experience within the healthcare industry. Mr. Bailey has extensive business development and transactional expertise, with diverse leadership experiences in commercial and supply chain management, finance, business development and product development for various pharmaceutical medical device companies. He serves as Chairman of the Board of Trustees and also on the Valuation Committee and on the Governance and Nominating Committee of each Fund. Most recently, Mr. Bailey served as chief executive officer and director of BioDelivery Sciences, a biotechnology company, from 2020-2022. He served as president and chief executive officer of IlluminOss Medical, Inc., a medical device company, from 2018 to 2020. From 2015 until 2017, Mr. Bailey served as chief executive officer of Neurovance, Inc., a biotechnology company. Previously, from 2013 through 2015, Mr. Bailey served as president and chief executive officer and as a director of Lantheus Medical Imaging, Inc., a public medical diagnostic company. Prior to 2013, Mr. Bailey held various |

4 Registrants consisting of 4 Portfolios |

Board Chairman, Aileron Therapeutics Inc. (since 2017); Director, Madison Vaccines, Inc. (since 2018); Director and CEO, BioDelivery Systems, Inc. (2020-2022). |

||||||||||||||||||

6

|

Name, Address and Year of Birth |

Position(s) Held with Fund |

Term of Office and Length of Time Served |

Principal Occupation(s) During at Least the Past Five Years |

Number of Registrants in Fund Complex* Overseen by Trustee |

Other Directorships Held by Trustee or Nominee for Trustee |

||||||||||||||||||

|

leadership positions with several public and private pharmaceutical and medical device companies, including president and general manager at Novartis Pharmaceuticals, a multinational pharmaceutical company, and a 22-year career with Johnson & Johnson, a multinational medical devices, pharmaceutical and consumer packaged goods manufacturing company. Mr. Bailey also has extensive board member experience, having previously served on boards of directors for eight companies. Mr. Bailey currently serves as a director for Aileron Therapeutics, Inc. and Madison Vaccines, Inc. Mr. Bailey holds a BA in business administration from Rutgers University. |

|||||||||||||||||||||||

|

Kathleen Goetz**† c/o abrdn Inc. 1900 Market Street, Suite 200 Philadelphia, PA 19103 Year of Birth: 1966 |

Class A Trustee (THQ) and (THW); Class C Trustee (HQH) |

Term expires 2024 (HQH); 2025 (THQ) and 2026 (THW) Trustee of each Fund since 2021 |

Ms. Goetz brings to the Fund over 30 years of healthcare business and leadership experience. She brings extensive knowledge of healthcare markets, with leadership experience across product development, operational effectiveness, organizational governance and design, and marketing and sales strategy. She currently acts as a consultant and an advisor within the pharmaceutical, biotech, and medical technology sectors. Ms. Goetz was Vice President Head of Sales at Novartis Pharmaceuticals, a global healthcare company until 2019. During her 28 years with Novartis, Ms. Goetz held positions of increasing responsibility, leading marketing, sales and reimbursement teams through various stages of commercialization from pre-launch planning through to loss of exclusivity across diverse therapeutic areas. Other key roles during her time at Novartis also |

4 Registrants consisting of 4 Portfolios |

|||||||||||||||||||

7

|

Name, Address and Year of Birth |

Position(s) Held with Fund |

Term of Office and Length of Time Served |

Principal Occupation(s) During at Least the Past Five Years |

Number of Registrants in Fund Complex* Overseen by Trustee |

Other Directorships Held by Trustee or Nominee for Trustee |

||||||||||||||||||

|

include National Executive Director of Strategic Accounts, Integrated Market Planning and Marketing Director, providing her with valuable experience leading organizational transformation, resourcing, forecasting, and analytics. She continues to act as a mentor to future leaders and as a champion for diversity through her past work as an Executive Leadership Development mentor and a former Novartis Pharmaceuticals Women in Leadership Chair. Ms. Goetz has won numerous healthcare and business leadership awards and recognition throughout her career, including being recognized with the Healthcare Women's Business Association Rising Star Award. She serves on the Audit Committee and Valuation Committee of the Fund. Ms. Goetz holds a Business Finance degree from Iowa State University. |

|||||||||||||||||||||||

|

Rose DiMartino**† c/o abrdn Inc. 1900 Market Street, Suite 200 Philadelphia, PA 19103 Year of Birth: 1952 |

Class B Trustee (HQH); (THQ) and THW) |

Term expires 2024 (HQH); 2025 (THQ) and 2026 (THW) Trustee of each Fund since 2023 |

Retired since 2019. Partner (1991-2017) and Senior Counsel (2017-2019) at the law firm of Willkie Farr & Gallagher LLP. |

5 Registrants consisting of 7 Portfolios |

None. |

||||||||||||||||||

|

C. William Maher**† c/o abrdn Inc. 1900 Market Street, Suite 200 Philadelphia, PA 19103 Year of Birth: 1961 |

Class B Trustee (HQH) and (THQ); Class C Trustee (THW) |

Term expires 2024 (HQH) and (THW); 2025 (THQ) Trustee of each Fund since 2023 |

Mr. Maher is a Co-founder of Asymmetric Capital Management LLC from May 2018 to September 2020. Formerly Chief Executive Officer of Santa Barbara Tax Products Group from October 2014 to April 2016. |

7 Registrants consisting of 7 Portfolios |

None. |

||||||||||||||||||

|

Todd Reit**† c/o abrdn Inc. 1900 Market Street, Suite 200 Philadelphia, PA 19103 Year of Birth: 1968 |

Class A Trustee (THQ); Class B Trustee (THW); Class C Trustee (HQH) |

Term expires 2024 (THQ); 2025 (HQH); 2026 (THW) Trustee of each Fund since 2023 |

Mr. Reit is a Managing Member of Cross Brook Partners LLC, a real estate investment and management company since 2017. Mr. Reit is also Director and Financial Officer of Shelter Our Soldiers, a charity to support military veterans, since 2016. Mr. Reit was formerly a |

9 Registrants consisting of 9 Portfolios |

None. |

||||||||||||||||||

8

|

Name, Address and Year of Birth |

Position(s) Held with Fund |

Term of Office and Length of Time Served |

Principal Occupation(s) During at Least the Past Five Years |

Number of Registrants in Fund Complex* Overseen by Trustee |

Other Directorships Held by Trustee or Nominee for Trustee |

||||||||||||||||||

|

Managing Director and Global Head of Asset Management Investment Banking for UBS AG, where he was responsible for overseeing all the bank's asset management client relationships globally, including all corporate security transactions, mergers and acquisitions. Mr. Reit retired from UBS in 2017 after an over 25-year career at the company and its predecessor company, PaineWebber Incorporated (merged with UBS AG in 2000). |

|||||||||||||||||||||||

|

Interested Nominee for Trustee: |

|||||||||||||||||||||||

|

Stephen Bird†† c/o abrdn Inc. 1900 Market St., Suite 200, Philadelphia, PA 19103 Year of Birth: 1967 |

Class A Trustee (HQH and THW); Class C Trustee (THQ) |

Term expires 2025 (THW); 2026 (HQH and THQ) Trustee of each Fund since 2023 |

Mr. Bird joined the Board of abrdn plc in July 2020 as Chief Executive-Designate and was formally appointed Chief Executive Officer in September 2020. Previously, Mr. Bird served as chief executive officer of global consumer banking at Citigroup from 2015, retiring from the role in November 2019. His responsibilities encompassed all consumer and commercial banking businesses in 19 countries, including retail banking and wealth management, credit cards, mortgages, and operations and technology supporting these businesses. Prior to this, Mr. Bird was chief executive for all of Citigroup's Asia Pacific business lines across 17 markets in the region, including India and China. Mr. Bird joined Citigroup in 1998, and during his 21 years with the company he held a number of leadership roles in banking, operations and technology across its Asian and Latin American businesses. Before this, he held management positions in the UK at GE Capital—where he was director of UK operations from 1996 to 1998—and at British Steel. |

15 Registrants consisting of 33 Portfolios |

None. |

||||||||||||||||||

9

* On October 27, 2023, abrdn Inc. assumed responsibility for abrdn Healthcare Investors, formerly Tekla Healthcare Investors, abrdn Life Sciences Investors, formerly Tekla Life Sciences Investors, abrdn Healthcare Opportunities Fund, formerly Tekla Healthcare Opportunities Fund and abrdn World Healthcare Fund, formerly Tekla World Healthcare Fund. Effective October 27, 2023, the "Fund Complex" has a total of 18 Registrants with each Board member serving on the number of Registrants listed. Each Registrant in the Fund Complex has one Portfolio except for two Registrants that are open-end funds, abrdn Funds and abrdn ETFs, which each have multiple portfolios. The Registrants in the Fund Complex are as follows: abrdn Asia-Pacific Income Fund, Inc., abrdn Global Income Fund, Inc., abrdn Australia Equity Fund, Inc., abrdn Japan Equity Fund, Inc., The India Fund, Inc., abrdn Emerging Markets Equity Income Fund, Inc., abrdn Income Credit Strategies Fund, abrdn Global Dynamic Dividend Fund, abrdn Total Dynamic Dividend Fund, abrdn Global Premier Properties Fund, abrdn Global Infrastructure Income Fund, abrdn National Municipal Income Fund, abrdn Healthcare Investors, abrdn Life Sciences Investors, abrdn Healthcare Opportunities Fund, abrdn World Healthcare Fund, abrdn Funds (which consists of 19 portfolios) and abrdn ETFs (which consists of 3 portfolios).

** Member of the Nominating and Corporate Governance Committee.

† Member of the Audit Committee.

†† Deemed to be an Interested Trustee of each Fund because of his affiliation held with the Funds' Investment Adviser.

ADDITIONAL INFORMATION ABOUT THE TRUSTEES

The Boards believe that each Trustee's experience, qualifications, attributes and skills on an individual basis and in combination with those of other Trustees lead to the conclusion that each Trustee should serve in such capacity. Among the attributes or skills common to all Trustees are their ability to review critically and to evaluate, question and discuss information provided to them, to interact effectively with the other Trustees, the Fund's investment adviser, the administrator and other service providers, counsel and independent registered public accounting firm, and to exercise effective and independent business judgment in the performance of their duties as Trustees. Each Trustee's ability to perform the duties of a trustee effectively has been attained and enhanced through the Trustee's education, professional training and other life experiences, such as business, consulting or public service positions and through experience from service as a member of each Fund's Board, public companies, or non- profit entities or other organizations.

OFFICERS

|

Name, Address and Year of Birth |

Position(s) Held With the Funds |

Term of Office* and Length of Time Served |

Principal Occupation(s) During Past Five Years |

||||||||||||

|

Joseph Andolina** c/o abrdn Inc. 1900 Market St, Suite 200 Philadelphia, PA 19103 Year of Birth: 1978 |

Chief Compliance Officer; Vice President, Compliance of the Funds |

Since 2023 |

Currently, Chief Risk Officer—Americas and serves as the Chief Compliance Officer for abrdn Inc. Prior to joining the Risk and Compliance Department, he was a member of abrdn Inc.'s Legal Department, where he served as U.S. Counsel since 2012. |

||||||||||||

|

Jason Akus** abrdn Inc. 28 State Street 17th Floor Boston, MA 02109 Year of Birth: 1974 |

Vice President of the Funds |

Since 2023 |

Currently Senior Investment Director. Dr. Akus joined abrdn Inc in October 2023 from Tekla Capital Management where he was employed as a senior vice president of research. |

||||||||||||

|

Josh Duitz** abrdn Inc. 875 Third Ave 4th Floor, Suite 403 New York, NY 10022 Year of Birth: 1970 |

Vice President of the Funds |

Since 2023 |

Currently, Head of Global Income at abrdn, Inc. Mr. Duitz joined abrdn Inc. in 2018 from Alpine Woods Capital Investors LLC where he was a Portfolio Manager. |

||||||||||||

10

|

Name, Address and Year of Birth |

Position(s) Held With the Funds |

Term of Office* and Length of Time Served |

Principal Occupation(s) During Past Five Years |

||||||||||||

|

Sharon Ferrari** c/o abrdn Inc. 1900 Market St, Suite 200 Philadelphia, PA 19103 Year of Birth: 1977 |

Treasurer and Chief Financial Officer |

Since 2023 |

Currently, Director Product Management—US for abrdn Inc. Ms.Ferrari joined abrdn Inc. as a Senior Fund Administrator in 2008. |

||||||||||||

|

Alan Goodson** c/o abrdn Inc. 1900 Market Street, Suite 200 Philadelphia, PA 19103 Year of Birth: 1974 |

Vice President of the Funds |

Since 2023 |

Currently, Director, Vice President and Head of Product& Client Solutions—Americas for abrdn Inc., overseeing Product Management& Governance, Product Development and Client Solutions for registered and unregistered investment companies in the U.S., Brazil and Canada. Mr.Goodson is Director and Vice President of abrdn Inc. and joined abrdn Inc. in 2000. |

||||||||||||

|

Megan Kennedy** c/o abrdn Investments Limited c/o abrdn Inc. 1900 Market Street, Suite 200 Philadelphia, PA 19103 Year of Birth: 1974 |

Vice President of the Funds |

Since 2023 |

Currently, Senior Director,Product Governance for abrdn Inc. Ms.Kennedy joined abrdn Inc. in 2005. |

||||||||||||

|

Daniel R. Omstead, Ph.D.** c/o abrdn Inc. 1900 Market St, Suite 200 Philadelphia, PA 19103 Year of Birth: 1953 |

Vice President of the Funds |

Since 2023 |

Currently Head of Healthcare Investments at abrdn. Previously, President of HQH and abrdn Life Sciences Investors (from 2001 to October2023), THQ (from 2014 to October2023) and THW (from 2015 to October2023); President, Chief Executive Officer and Managing Member of Tekla Capital Management, LLC from 2002 to October2023). |

||||||||||||

|

Ben Ritchie** abrdn Investments Limited 280 Bishopsgate London, E2M 4AG Year of Birth: 1980 |

Vice President of the Funds |

Since 2023 |

Currently Head of the Developed Markets Equity team at abrdn. |

||||||||||||

|

Christian Pittard** c/o abrdn Investments Limited 280 Bishopsgate London, EC2M 4AG Year of Birth: 1973 |

President of the Funds |

Since 2023 |

Currently, Director of Corporate Finance and Head of Listed Funds. Mr. Pittard joined abrdn from KPMG in 1999. |

||||||||||||

|

Lucia Sitar** c/o abrdn Inc. 1900 Market St, Suite 200 Philadelphia, PA 19103 Year of Birth: 1971 |

Vice President of the Funds |

Since 2023 |

Currently, Vice President and Head of Product Management and Governance for abrdn Inc. since 2020. Previously Ms. Sitar was Managing U.S. Counsel for abrdn Inc. Ms. Sitar joined abrdn Inc. as U.S. Counsel in July 2007. |

||||||||||||

|

Loretta Tse** abrdn Inc. 28 State Street 17th Floor Boston, MA 02109 Year of Birth: 1967 |

Vice President of the Funds |

Since 2024 |

Currently Investment Director at abrdn. Ms. Tse joined abrdn in October 2023 from Tekla Capital Management LLC where she was a Vice President investing in venture. Previously, she worked for the Fred Hutchinson Cancer Research Center and Oxford Biosciences Partners. |

||||||||||||

* Officers hold their positions with the Fund until a successor has been duly elected and qualifies. Officers are appointed annually at a meeting of the Fund Board.

** Each officer may hold officer position(s) in one or more other funds which are part of the Fund Complex.

11

Ownership of Securities

Set forth in the table below is the dollar range of equity securities in each Fund and the aggregate dollar range of equity securities in the abrdn Family of Investment Companies (as defined below) beneficially owned by each Trustee or nominee.

|

Name of Trustee or Nominee |

Dollar Range of Equity Securities Owned(1) |

Aggregate Dollar Range of Equity Securities in All Funds Overseen by Trustee or Nominee in Family of Investment Companies(2) |

|||||||||

|

Nominee for Independent Trustee: |

|||||||||||

|

Jefferey Bailey |

HQH: $10,001 — $50,000 |

$10,001 — $50,000 | |||||||||

|

THQ: $10,001 — $50,000 |

|||||||||||

|

THW: $10,001 — $50,000 |

|||||||||||

|

Kathleen Goetz |

HQH: $1 — $10,000 |

$10,001 — $50,000 | |||||||||

|

THQ: $10,001 — $50,000 |

|||||||||||

|

THW: $10,001 — $50,000 |

|||||||||||

|

Rose DiMartino |

HQH: None |

$10,001 — $50,000 | |||||||||

|

THQ: None |

|||||||||||

|

THW: None |

|||||||||||

|

C. William Maher |

HQH: None |

$50,001 — $100,000 | |||||||||

|

THQ: None |

|||||||||||

|

THW: None |

|||||||||||

|

Todd Reit |

HQH: None |

$10,001 — $50,000 | |||||||||

|

THQ: None |

|||||||||||

|

THW: None |

|||||||||||

|

Independent Trustees: |

|||||||||||

|

Stephen Bird |

HQH: None |

$50,001 — $100,000 | |||||||||

|

THQ: None |

|||||||||||

|

THW: None |

|||||||||||

(1) This information has been furnished by each Trustee as of October 31, 2023. "Beneficial ownership" is determined in accordance with Rule 16a-1(a)(2) promulgated under the Securities Exchange Act of 1934, as amended (the "1934 Act").

(2) "Family of Investment Companies" means those registered investment companies that are advised by the Investment Adviser, or an affiliate of the Investment Adviser, and that hold themselves out to investors as related companies for purposes of investment and investor services.

As of October 31, 2023, each Fund's Trustees and officers, in the aggregate, owned less than 1% of that Fund's outstanding equity securities. As of October 31, 2023, none of the Independent Trustees or their immediate family members owned any shares of the Investment Adviser or of any person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with the Investment Adviser.

12

Mr. Pittard and Ms. Ferrari serve as executive officers of the Funds. As of April 1, 2024, Mr. Pittard and Ms. Ferrari did not own shares of the Funds.

BOARD AND COMMITTEE STRUCTURE

The Board of each Fund is comprised of six individuals, five of whom are not "interested persons" of the Fund as defined in the Investment Company Act of 1940, as amended (the "1940 Act") ("Independent Trustees"). Each Fund divides the Board into three classes, with each class having a term of three years. Each year, the term of office of one class will expire and the successor(s) elected to such class will serve for a three-year term.

Each Board has appointed Mr. Reit, an Independent Trustee, as Chair. The Chair presides at meetings of the Trustees, participates in the preparation of the agenda for meetings of the Board, and acts as a liaison between the Trustees and management between Board meetings. Except for any duties specified herein, the designation as Chair does not impose on such Trustee any duties, obligations or liability that is greater than the duties, obligations or liability imposed on such person as a member of a Board, generally.

The Board of each Fund holds regular quarterly meetings to consider and address matters involving the respective Fund. Each Board also may hold special meetings to address matters arising between regular meetings. The Independent Trustees also meet outside the presence of management in executive session and have engaged separate, independent legal counsel to assist them in performing their oversight responsibilities.

The Board of each Fund has established a committee structure that includes an Audit Committee, Nominating and Corporate Governance Committee and Private Venture Valuation Committee (each discussed in more detail below) to assist each Board in the oversight and direction of the business affairs of the respective Fund. All of the members of these Committees are Independent Trustees. Each Board may also designate working groups or ad hoc committees as it deems appropriate.

The Board of each Fund has determined that its leadership structure is appropriate for the Fund because it enables the Board to exercise informed and independent judgment over matters under its purview, allocates responsibility among committees in a manner that fosters effective oversight and allows the Board to devote appropriate resources to specific issues in a flexible manner as they arise. The Board periodically reviews its leadership structure as well as its overall structure, composition, and functioning and may make changes at its discretion at any time.

Audit Committee

Each Fund has an Audit Committee comprised solely of Independent Trustees who are "independent" as defined in the New York Stock Exchange ("NYSE") Listing Standards. The Board of each Fund has adopted a written charter for the Audit Committee. The Audit Committee charter of the Funds is available at www.abrdnhqh.com, www.abrdnthq.com and www.abrdnthw.com. The principal purpose of each Fund's Audit Committee is to assist the Board in fulfilling its responsibility to oversee the integrity of the Fund's financial statements and the Fund's compliance with legal and regulatory requirements (including related tax requirements) and to oversee management's conduct of the Fund's financial reporting process, including reviewing the financial reports and other financial information provided by the Fund, the Fund's systems of internal accounting and financial controls and the annual independent audit process. Each Audit Committee is responsible for the selection and engagement of the respective Fund's independent registered public accounting firm (subject to ratification by the Fund's Independent Trustees).

Each Audit Committee's role is one of oversight, and it is recognized that each Fund's officers are responsible for preparing each Fund's financial statements and that each Fund's independent registered public accountant is responsible for auditing those financial statements. Although each Audit Committee member must be financially literate and one member must have accounting or financial management expertise (as determined by the Board in

13

its business judgment), Audit Committee members are not professionally engaged in the practice of accounting or auditing and are not experts in the fields of accounting or auditing, including with respect to auditor independence. Audit Committee members rely, without independent verification, on the information provided to them and on the representations made by management and each Fund's independent registered public accountants.

The members of each Fund's Audit Committee are Mr. Bailey, Ms. DiMartino, Ms. Goetz, Mr. Maher and Mr. Reit. Mr. Maher is the Chair of each Fund's Audit Committee and is the Audit Committee Financial Expert.

Nominating and Corporate Governance Committee

Each Fund has a Nominating and Corporate Governance Committee comprised solely of Independent Trustees who are "independent" as defined in the NYSE Listing Standards. The Nominating and Corporate Governance Committee charter of the Funds is available at www.abrdnhqh.com, www.abrdnthq.com and www.abrdnthw.com.

The principal missions of the Nominating and Corporate Governance Committee of each Fund are to promote the effective participation of qualified individuals on the Board, committees of the Board, and to review, evaluate and enhance the effectiveness of the Board in its role in governing the Fund and overseeing the management of the Fund.

The Nominating and Corporate Governance Committee of each Fund reviews, discusses and makes recommendations to the Board relating to those issues that pertain to the effectiveness of the Board in carrying out its responsibilities in governing the Fund and overseeing the Fund's management. The Committee shall make nominations for Trustees of the Fund and for membership on all committees of the Board and submits such nominations to the full Board for consideration.

Each Fund's By-Laws require that each prospective trustee candidate have substantial expertise, experience or relationships relevant to the business of the Fund and a college degree or equivalent business experience. Each Fund's By-Laws also provide that a prospective trustee candidate shall not serve as a director, trustee, officer, partner or employee of another investment company (as defined in the 1940 Act) that focuses its investments in the healthcare and/or life sciences industries, unless such investment company is managed by the Adviser or an affiliate thereof, oras a director, officer, partner or employee of the investment adviser, sponsor or equivalent of such an investment company with supervisory responsibility for the day-to-day operations of such investment company or investment decisions made with respect to such investment company. Each Committee may also take into account other factors when considering and evaluating potential trustee candidates, including but not limited to, the background, experience, qualifications, attributes, skills and diversity that a prospective trustee candidate will bring to the Board. The Committee may also consider other factors or attributes as they may determine appropriate in their judgment.

The Nominating and Corporate Governance Committee of each Fund may identify prospective trustees from any reasonable source, including, but not limited to, the consultation of third-party trustee search services. The Committee will consider potential trustee candidates recommended by shareholders, provided that the proposed candidates (i) satisfy any minimum qualifications of the Fund for its trustees; (ii) are not "interested persons" (as that term is defined in Section 2(a)(19) of the 1940 Act) of the Fund or the Adviser; and (iii) are "independent" as defined in the NYSE Listing Standards. In order to be evaluated by the Committee, trustee candidates recommended by shareholders must also meet certain eligibility requirements as set out in the Committees' charter. Other than those eligibility requirements, the Committee shall not evaluate shareholder trustee nominees in a different manner than other nominees. The standard of the Committee is to treat all equally qualified nominees in the same manner.

All recommendations by shareholders must be received by a Fund by the deadline for submission of any shareholder proposals which would be included in the Fund's proxy statement for the next annual meeting of the Fund. Each shareholder or shareholder group must meet the requirements stated in the Committee's charter in order

14

to recommend a candidate. The Committee will make such determinations in its sole discretion and such determinations shall be final.

The members of each Fund's Committee are Mr. Bailey, Ms. DiMartino, Ms. Goetz, Mr. Maher and Mr. Reit. Mr. Reit is the Chair of the Committee. Prior to the change in the Funds' investment adviser in October 2023, the Nominating and Corporate Governance Committee was referred to as the "Governance and Nominating Committee".

Private Venture Valuation Committee. Each Fund's Board has delegated to the Fund's Private Venture Valuation Committee general responsibility for determining, subject to Board ratification, in accordance with the Fund's valuation procedures, the value of the "start-up", early and/or later stage financing of a privately held company, securities (referred to as "Venture Capital Securities") held by the Fund. With respect to Venture Capital Securities for the Fund, the Private Venture Valuation Committee ("PV Valuation Committee"), has general responsibility for determining, subject to Board review, in accordance with the Fund's Valuation Procedures, the value of the Venture Capital Securities and Milestone Holdings held by the Fund on any day on which the net asset value per share is determined ("Valuation Date"). The PV Valuation Committee shall meet as often as necessary to ensure that prices are updated in a timely manner. No less than quarterly, the PV Valuation Committee will meet to review and/or update pricing in connection with the Venture Capital Securities and/or milestone holdings.

The members of each Fund's PV Valuation Committee are Mr. Bailey, Ms. Goetz and Mr. Maher. Mr. Bailey is the Chair of the Fund's PV Valuation Committee. Prior to the change in each Fund's investment adviser in October 2023, the PV Valuation Committee was referred to as the "Valuation Committee".

Board and Committee Meetings in Fiscal Year 2023

During the fiscal year ended September 30, 2023, HQH, THQ and THW's Boards each held six meetings; each Fund's Audit Committee held five meetings; each Fund's Nominating and Corporate Governance Committee (formerly, the Governance and Nominating Committee) held three meetings; and each Fund's PV Valuation Committee (formerly, the Valuation Committee) held four meetings. Also during the fiscal year ended September 30, 2023, each Fund's Board had a Qualified Legal Compliance Committee ("QLCC") comprised solely of Independent Trustees. Each Fund's QLCC had no cause to meet during the fiscal year ended September 30, 2023. Effective October 27, 2023, each Board has appointed a chief legal officer to serve in lieu of the QLCC.

Each of the incumbent Trustees attended at least 75% of the aggregate number of meetings of the Boards of each Fund during the period for which he or she served as a Trustee. Each of the incumbent Trustees attended at least 75% of the aggregate number of meetings of the Committees of the Board of each Fund on which such Trustee served during the period that he or she has served.

Board Oversight of Risk Management

Each Fund is subject to a number of risks including investment, compliance, operational and valuation risks. Although the Adviser and the officers of each Fund are responsible for managing these risks on a day-to-day basis, the Board of each Fund has adopted, and periodically reviews, policies and procedures designed to address these risks. As part of its regular oversight, the Board of each Fund, directly or through a Committee, interacts with the Fund's Chief Compliance Officer, the Fund's independent public accounting firm and the Fund's legal counsel. These interactions include discussing the Fund's risk management and controls with the independent registered public accounting firm engaged by the Fund, reviewing valuation policies and procedures and the valuations of specific restricted securities, and receiving periodic reports from the Fund's Chief Compliance Officer regarding compliance matters relating to the Fund and its major service providers, including results of the implementation and testing of the Fund's and such providers' compliance programs. The Board's oversight function is facilitated by management reporting processes designed to provide information to the Board regarding the identification, assessment, and management of critical risks and the controls and policies and procedures used to mitigate those

15

risks. The Board reviews its role in supervising the Fund's risk management from time to time and may change the manner in which it fulfills its oversight responsibilities at its discretion at any time.

Communications with the Board of Trustees

Shareholders who wish to communicate with Board members with respect to matters relating to the Funds may address their written correspondence to the Boards as a whole or to individual Board members c/o abrdn Inc. at 1900 Market Street, Suite 200, Philadelphia, PA 19103, or via e-mail to the Trustee(s) c/o abrdn Inc. at Investor.Relations@abrdn.com.

REPORTS OF THE AUDIT COMMITTEES; INFORMATION REGARDING THE FUNDS' INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

At a meeting held on December 13, 2023, the Board of each Fund, including a majority of the Trustees who are not "interested persons," as defined under the 1940 Act, selected KPMG LLP ("KPMG") to act as the independent registered public accounting firm for each Fund for the fiscal year ending September 30, 2024. Representatives from KPMG are not expected to be present at the Meetings to make a statement or respond to questions from shareholders. If requested by any shareholder by two (2) business days before the Meetings, a representative of KPMG will be present by telephone at the Meetings to respond to appropriate questions and will have an opportunity to make a statement if he or she chooses to do so.

Each Fund's financial statements for the fiscal year ended September 30, 2023 were audited by KPMG. The Audit Committee of each Fund has reviewed and discussed the audited financial statements of the Fund with management of the Fund. The Audit Committee of each Fund has received the written disclosures and the letter from KPMG required by The Public Company Accounting Oversight Board ("PCAOB") Rule 3526 (PCAOB Rule 1, Communication with Audit Committees Concerning Independence), as may be modified or supplemented, and have discussed with KPMG its independence with respect to the Fund. The Funds know of no direct financial or material indirect financial interest of KPMG in the Funds. The Audit Committees have discussed with KPMG the matters required to be discussed by the applicable requirements of the PCAOB and the SEC. Based on the foregoing review and discussions, the Audit Committee of each Fund recommended to the respective Board that the audited financial statements of each Fund for the fiscal year ended September 30, 2023 be included in each Fund's most recent annual report filed with the SEC.

C. William Maher, Chair of the Audit Committee

Jeffrey Bailey, Member of the Audit Committee

Rose DiMartino, Member of the Audit Committee

Kathleen Goetz, Member of the Audit Committee

Todd Reit, Member of the Audit Committee

16

The following table sets forth the aggregate fees billed for professional services rendered by the principal accountant during the Funds' two most recent fiscal years ended September 30:

|

Fund |

Fiscal year |

Audit Fees |

Audit-Related Fees |

Tax Fees |

All Other Fees |

||||||||||||||||||

|

HQH |

2023 |

$ |

118,500 |

$ |

0 |

$ |

0 |

$ |

0 |

||||||||||||||

|

2022 |

$ |

114,230 |

* |

$ |

0 |

$ |

6,670 |

* |

$ |

0 |

|||||||||||||

|

THQ |

2023 |

$ |

85,000 |

$ |

0 |

$ |

0 |

$ |

0 |

||||||||||||||

|

2022 |

$ |

72,930 |

* |

$ |

0 |

$ |

6,670 |

* |

$ |

0 |

|||||||||||||

|

THW |

2023 |

$ |

85,000 |

$ |

0 |

$ |

0 |

$ |

0 |

||||||||||||||

|

2022 |

$ |

72,930 |

* |

$ |

0 |

$ |

14,170 |

* |

$ |

0 |

|||||||||||||

* Beginning with the year ended September 30, 2023, the Fund's financial statements were audited by KPMG LLP. Previous years were audited by a different independent registered public accounting firm.

All of the services described in the table above were pre-approved by the relevant Audit Committee.

Each Audit Committee has adopted an Audit Committee Charter that provides that the Audit Committee shall appoint, retain, and oversee an independent auditor and evaluate the terms of the engagement (including compensation of the auditor) and the qualifications and independence of the independent auditor, including whether the independent auditor provides any consulting, auditing or tax services to the Investment Adviser (as defined below), and receive the independent auditor's specific representations as to its independence, delineating all relationships between the independent auditor and the Fund, consistent with the Independent Standards Board ("ISB") Standard No. 1. Each Audit Committee Charter also provides that the Committee shall review in advance, and consider approval of, any and all proposals by Fund management or the Investment Adviser that the Fund, Investment Adviser or their affiliated persons to employ the independent auditor to render "permissible non-audit services" to the Fund and to consider whether such services are consistent with the independent auditor's independence.

Each Audit Committee has considered whether the provision of non-audit services that were rendered to the investment adviser that managed the Funds during the fiscal years ended September 30, 2022 and September 30, 2023, and any entity controlling, controlled by, or under common control with any Covered Service Provider that provides ongoing services to the Funds that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, is compatible with maintaining the independent auditor's independence and has concluded that it is independent.

COMPENSATION

The following table sets forth information regarding compensation of Trustees from the Funds and by the Fund Complex of which the Funds are a part for the fiscal year ended September 30, 2023. All officers of the Funds are employees of and are compensated by abrdn Inc., the Funds' administrator, or an affiliate. None of the Funds' executive officers or Directors who are also officers or directors of abrdn Inc., the Investment Adviser or an affiliate

17

received any compensation from any Fund for such period. None of the Funds have any bonus, profit sharing, pension or retirement plans.

|

Name of Trustee*: |

Aggregate Compensation |

Total Compensation |

|||||||||||||||||

|

HQH |

THQ |

THW |

|||||||||||||||||

|

Interested Trustee: |

|||||||||||||||||||

|

Stephen Bird |

N/A |

N/A |

N/A |

N/A |

|||||||||||||||

|

Daniel R. Omstead |

N/A |

N/A |

N/A |

N/A |

|||||||||||||||

|

Nominee for Independent Trustees: |

|||||||||||||||||||

|

Jeffrey Bailey |

$ |

36,500 |

$ |

36,500 |

$ |

36,500 |

$ |

146,000 |

|||||||||||

|

Rose DiMartino |

N/A |

N/A |

N/A |

N/A |

|||||||||||||||

|

Kathleen Goetz |

$ |

30,250 |

$ |

30,250 |

$ |

30,250 |

$ |

121,000 |

|||||||||||

|

Rakesh K. Jain |

$ |

27,500 |

$ |

27,500 |

$ |

27,500 |

$ |

110,000 |

|||||||||||

|

Thomas M. Kent |

$ |

31,500 |

$ |

31,500 |

$ |

31,500 |

$ |

126,000 |

|||||||||||

|

C. William Maher |

N/A |

N/A |

N/A |

N/A |

|||||||||||||||

|

Todd Reit |

N/A |

N/A |

N/A |

N/A |

|||||||||||||||

|

W. Mark Watson |

$ |

30,250 |

$ |

30,250 |

$ |

30,250 |

$ |

121,000 |

|||||||||||

* Effective at the close of business on October 27, 2023, abrdn Inc. assumed responsibility for management of the Funds. Effective upon abrdn's appointment as adviser, Rakesh K. Jain, Thomas M. Kent, W. Mark Watson and Daniel R. Omstead resigned from each Fund's Board, and Stephen Bird, Rose DiMartino, C. William Maher and Todd Reit (the "New Trustees"), who were elected by shareholders, joined Jeffrey Bailey and Kathleen Goetz on each Fund's Board. Because the New Trustees did not serve during the fiscal year ended September 30, 2023, no compensation was paid by the Funds to the New Trustees for that period.

** As of the Funds' fiscal year ended September 30, 2023, the "Fund Complex" consisted of the Funds and Tekla Life Sciences Investors. For the number of funds currently within the Fund Complex, see the "Trustees" table above.

Relationship of Directors or Nominees with the Investment Adviser and Administrator

abrdn Inc. serves as the investment adviser ("Investment Adviser") to each Fund pursuant to an advisory agreement dated as of October 27, 2023. Prior to October 27, 2023, the Funds were managed by Tekla Capital Management LLC. The Investment Adviser is a Delaware corporation with its registered offices located at 1900 Market Street, Suite 200, Philadelphia, PA 19103. abrdn Inc. also provides administrative services to each Fund under an administration agreement. The Investment Adviser/Administrator is an indirect subsidiary of abrdn plc, which has its registered offices at 1 George Street, Edinburgh, EH2 2LL, Scotland. Messrs. Andolina and Goodson and Mmes. Kennedy and Sitar, who serve as officers of each Fund, are also directors and/or officers of abrdn Inc.

Delinquent Section 16(a) Reports

Section 16(a) of the 1934 Act and Section 30(h) of the 1940 Act, as applied to the Funds, require the Funds' officers and Trustees, certain officers and directors of the Investment Adviser, affiliates of the Investment Adviser,

18

and persons who beneficially own more than 10% of the Funds' outstanding securities to electronically file reports of ownership of the Funds' securities and changes in such ownership with the SEC and the NYSE.

Based solely on each Fund's review of such forms filed on EDGAR or written representations from reporting persons that all reportable transactions were reported, to the knowledge of each Fund, during the fiscal year ended September 30, 2023, each Fund's officers, Trustees and greater than 10% owners timely filed all reports they were required to file under Section 16(a).

EACH FUND'S BOARD, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" EACH NOMINEE.

ADDITIONAL INFORMATION

Sub-Administrator. State Street Bank & Trust Company, located at 1 Heritage Drive, 3rd Floor, North Quincy, MA 02171, serves as sub-administrator to the Funds.

Expenses. The expense of preparation, printing and mailing of the enclosed proxy card and accompanying Notice and Joint Proxy Statement will be borne proportionately by each Fund. Each Fund will reimburse banks, brokers and others for their reasonable expenses in forwarding proxy solicitation material to the beneficial owners of the shares of each Fund. In order to obtain the necessary quorum at each Meeting, supplementary solicitation may be made by mail, telephone, telegraph or personal interview. Such solicitation may be conducted by, among others, officers, Trustees and employees of the Funds, the Investment Adviser, abrdn Inc. or its affiliates.

EQ Fund Solutions, LLC ("EQ") has been retained to assist in the solicitation of proxies and will receive an estimated fee of $2,500 per Fund and be reimbursed for its reasonable expenses, which are estimated to be $825-$1,350 for each Fund.

Solicitation and Voting of Proxies. Solicitation of proxies is being made primarily by the mailing of this Joint Proxy Statement with its enclosures on or about April 22, 2024. As mentioned above, EQ has been engaged to assist in the solicitation of proxies. As the date of the Meetings approach, certain shareholders of a Fund may receive a call from a representative of EQ, if the Fund has not yet received their vote. Authorization to permit EQ to execute proxies may be obtained by telephonic instructions from shareholders of a Fund. Proxies that are obtained telephonically will be recorded in accordance with procedures that management of each of the Funds believes are reasonably designed to ensure that the identity of the shareholder casting the vote is accurately determined and that the voting instructions of the shareholder are accurately determined.

Beneficial Owners. Based upon filings made with the SEC, as of April 1, 2024, the following table shows certain information concerning persons who may be deemed beneficial owners of 5% or more of the shares of the Funds because they possessed or shared voting or investment power with respect to a Fund's shares:

|

Fund |

Class |

Name and Address |

Number of Shares Beneficially Owned |

Percentage of Shares |

|||||||||||||||

|

HQH |

Common Stock |

Morgan Stanley* Morgan Stanley Smith Barney LLC* 1585 Broadway New York, NY 10036 |

3,021,764 |

6.1 |

% |

||||||||||||||

19

|

Fund |

Class |

Name and Address |

Number of Shares Beneficially Owned |

Percentage of Shares |

|||||||||||||||

|

HQH |

Common Stock |

Saba Capital Management, L.P.** Saba Capital Management GP, LLC** Boaz R. Weinstein** 405 Lexington Avenue 58th Floor New York, NY 10174 |

2,557,469 |

5.17 |

% |

||||||||||||||

* These entities jointly filed a Schedule 13G for the share amount and percentage shown.

** These entities jointly filed a Schedule 13D for the share amount and percentage shown.

Shareholder Proposals.

Any Rule 14a-8 shareholder proposal to be considered for inclusion in the Funds' proxy statement and form of proxy for the annual meetings of shareholders to be held in 2025 should be received by the Secretary of the Funds no later than December 23, 2024. There are additional requirements regarding proposals of shareholders, and a shareholder contemplating submission of a proposal for inclusion in the Funds' proxy materials is referred to Rule 14a-8 under the 1934 Act.

In addition, shareholder proposals for each Fund's 2025 Annual Meeting (other than proposals submitted for inclusion in the Fund's 2025 proxy statement pursuant to Rule 14a-8) must be submitted to the Fund's Secretary between February 25, 2025 and March 27, 2025, unless the meeting date is more than 30 days before or after June 25, 2025, in which case the proposal must be submitted by the later of the close of business on (1) the date 90 days prior to the 2025 Annual Meeting date or (2) the tenth business day following the date on which the 2025 Annual Meeting date is first publicly announced or disclosed.

In accordance with Rule 14a-4(c), each Fund may exercise discretionary voting authority with respect to any shareholder proposals for the Annual Meetings not included in the proxy statement and form of proxy card which are not submitted to the Funds within the time-frame indicated above. Even if timely notice is received, a Fund may exercise discretionary voting authority in certain other circumstances permitted by Rule 14a-4(c) and SEC guidance related thereto. Discretionary voting authority is the ability to vote proxies that shareholders have executed and returned to a Fund on matters not specifically reflected on the form of proxy card.

SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE MEETINGS AND WHO WISH TO HAVE THEIR SHARES VOTED ARE REQUESTED TO DATE AND SIGN THE ENCLOSED PROXY CARD(S) AND RETURN THEM IN THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

Delivery of Joint Proxy Statement

Unless the Funds have received contrary instructions from shareholders, only one copy of this Joint Proxy Statement may be mailed to households, even if more than one person in a household is a shareholder of record. If a shareholder needs an additional copy of this Joint Proxy Statement, please contact the Funds at 1-800-522-5465. If any shareholder does not want the mailing of this Joint Proxy Statement to be combined with those for other members of its household, please contact the Funds in writing at: 1900 Market Street, Suite 200, Philadelphia, PA 19103 or call the Funds at 1-800-522-5465.

20

Other Business

The Investment Adviser knows of no business to be presented at the Meetings, other than the Proposals set forth in this Joint Proxy Statement, but should any other matter requiring the vote of shareholders arise, the proxies will vote thereon according to their discretion.

By order of the Boards of Trustees,

Megan Kennedy, Vice President and Secretary

abrdn Healthcare Investors

abrdn Healthcare Opportunities Fund

abrdn World Healthcare Fund

21

| EVERY VOTE IS IMPORTANT ABRDN HEALTHCARE INVESTORSPO Box 43131 Providence, RI 02940-3131 EASY VOTING OPTIONS: Please detach at perforation before mailing. PROXY ABRDN HEALTHCARE INVESTORS ANNUAL MEETING OF SHAREHOLDERS TO BE HELD JUNE 25, 2024 THIS PROXY IS BEING SOLICITED BY THE BOARD OF DIRECTORS. The undersigned stockholder(s) of abrdn Healthcare Investors (the “Fund”), revoking previous proxies, hereby appoints Megan Kennedy, Katherine Corey, Andrew Kim and Robert Hepp, or any one of them true and lawful attorneys with power of substitution of each, to vote all shares of abrdn Healthcare Investors which the undersigned is entitled to vote, at the Annual Meeting of Stockholders to be held on Tuesday, June 25, 2024, at 12:30 p.m. Eastern Time, at the offices of abrdn Inc., located at 1900 Market Street, Suite 200, Philadelphia, Pennsylvania 19103, and at any adjournment thereof as indicated on the reverse side. Please refer to the Proxy Statement for a discussion of these matters, including instructions related to meeting attendance. In their discretion, the proxy holders named above are authorized to vote upon such other matters as may properly come before the meeting or any adjournment thereof. Receipt of the Notice of the Annual Meeting and the accompanying Proxy Statement is hereby acknowledged. If this Proxy is executed but no instructions are given, the votes entitled to be cast by the undersigned will be cast “FOR” the nominees for director. VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA THE TELEPHONE: 1-800-337-3503 HQH_33958_041824 PLEASE MARK, SIGN, DATE ON THE REVERSE SIDE AND RETURN THIS PROXY PROMPTLY USING THE ENCLOSED ENVELOPE. xxxxxxxxxxxxxx code VOTE ON THE INTERNET Log on to: www.proxy-direct.com or scan the QR code Follow the on-screen instructions available 24 hours VOTE BY PHONE Call 1-800-337-3503 Follow the recorded instructions available 24 hours VOTE BY MAIL Vote, sign and date this Proxy Card and return in the postage-paid envelope VOTE IN PERSON Attend Shareholder Meeting 1900 Market Street, Suite 200, Philadelphia, PA on June 25, 2024 |

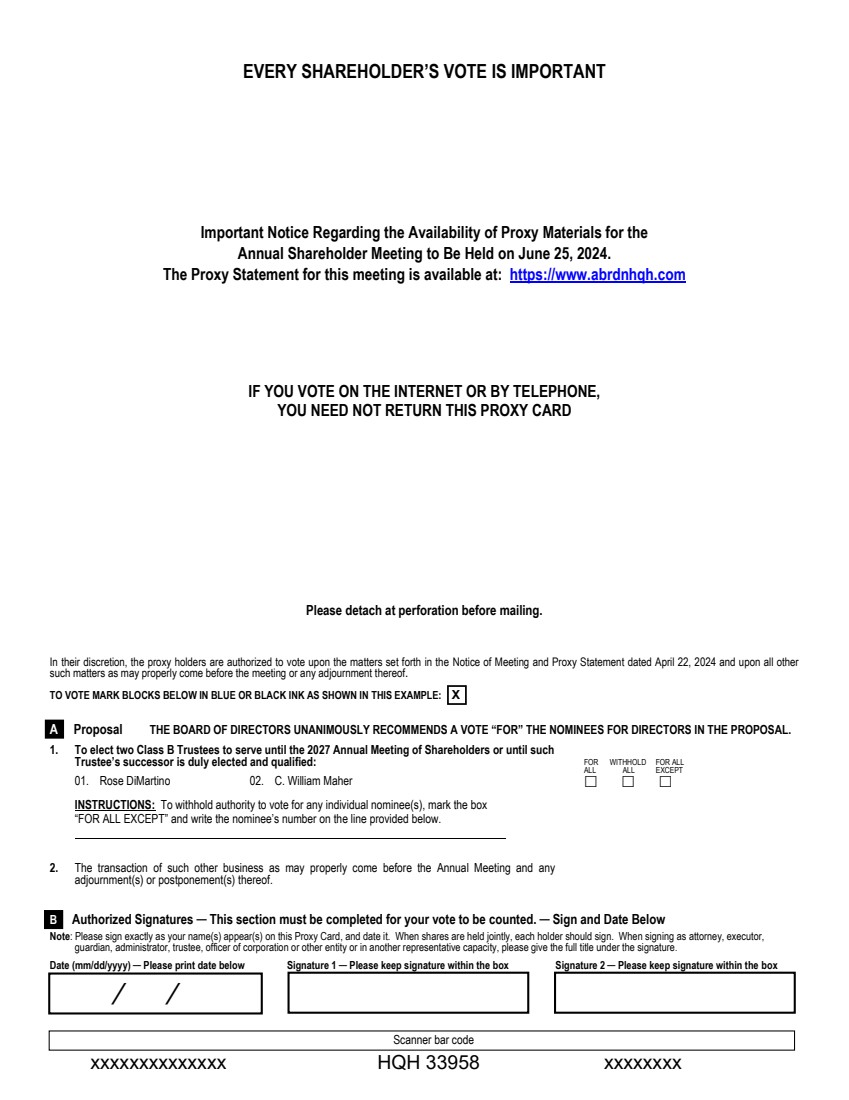

| FOR WITHHOLD FOR ALL ALL ALL EXCEPT EVERY SHAREHOLDER’S VOTE IS IMPORTANT Important Notice Regarding the Availability of Proxy Materials for the Annual Shareholder Meeting to Be Held on June 25, 2024. The Proxy Statement for this meeting is available at: https://www.abrdnhqh.com IF YOU VOTE ON THE INTERNET OR BY TELEPHONE, YOU NEED NOT RETURN THIS PROXY CARD Please detach at perforation before mailing. In their discretion, the proxy holders are authorized to vote upon the matters set forth in the Notice of Meeting and Proxy Statement dated April 22, 2024 and upon all other such matters as may properly come before the meeting or any adjournment thereof. TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: X A Proposal THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NOMINEES FOR DIRECTORS IN THE PROPOSAL. 1. To elect two Class B Trustees to serve until the 2027 Annual Meeting of Shareholders or until such Trustee’s successor is duly elected and qualified: 01. Rose DiMartino 02. C. William Maher INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark the box “FOR ALL EXCEPT” and write the nominee’s number on the line provided below. 2. The transaction of such other business as may properly come before the Annual Meeting and any adjournment(s) or postponement(s) thereof. B Authorized Signatures ─ This section must be completed for your vote to be counted. ─ Sign and Date Below Note: Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature. Date (mm/dd/yyyy) ─ Please print date below Signature 1 ─ Please keep signature within the box Signature 2 ─ Please keep signature within the box Scanner bar code xxxxxxxxxxxxxx HQH 33958 xxxxxxxx / / |

| EVERY VOTE IS IMPORTANT ABRDN HEALTHCARE OPPORTUNITIES FUNDPO Box 43131 Providence, RI 02940-3131 EASY VOTING OPTIONS: Please detach at perforation before mailing. PROXY ABRDN HEALTHCARE OPPORTUNITIES FUND ANNUAL MEETING OF SHAREHOLDERS TO BE HELD JUNE 25, 2024 THIS PROXY IS BEING SOLICITED BY THE BOARD OF DIRECTORS. The undersigned stockholder(s) of abrdn Healthcare Opportunities Fund (the “Fund”), revoking previous proxies, hereby appoints Megan Kennedy, Katherine Corey, Andrew Kim and Robert Hepp, or any one of them true and lawful attorneys with power of substitution of each, to vote all shares of the Fund which the undersigned is entitled to vote, at the Annual Meeting of Stockholders to be held on Tuesday, June 25, 2024, at 1:00 p.m. Eastern Time, at the offices of abrdn Inc., located at 1900 Market Street, Suite 200, Philadelphia, Pennsylvania 19103, and at any adjournment thereof as indicated on the reverse side. Please refer to the Proxy Statement for a discussion of these matters, including instructions related to meeting attendance. In their discretion, the proxy holders named above are authorized to vote upon such other matters as may properly come before the meeting or any adjournment thereof. Receipt of the Notice of the Annual Meeting and the accompanying Proxy Statement is hereby acknowledged. If this Proxy is executed but no instructions are given, the votes entitled to be cast by the undersigned will be cast “FOR” the nominees for director. VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA THE TELEPHONE: 1-800-337-3503 THQ_33958_041824 PLEASE MARK, SIGN, DATE ON THE REVERSE SIDE AND RETURN THIS PROXY PROMPTLY USING THE ENCLOSED ENVELOPE. xxxxxxxxxxxxxx code VOTE ON THE INTERNET Log on to: www.proxy-direct.com or scan the QR code Follow the on-screen instructions available 24 hours VOTE BY PHONE Call 1-800-337-3503 Follow the recorded instructions available 24 hours VOTE BY MAIL Vote, sign and date this Proxy Card and return in the postage-paid envelope VOTE IN PERSON Attend Shareholder Meeting 1900 Market Street, Suite 200, Philadelphia, PA on June 25, 2024 |

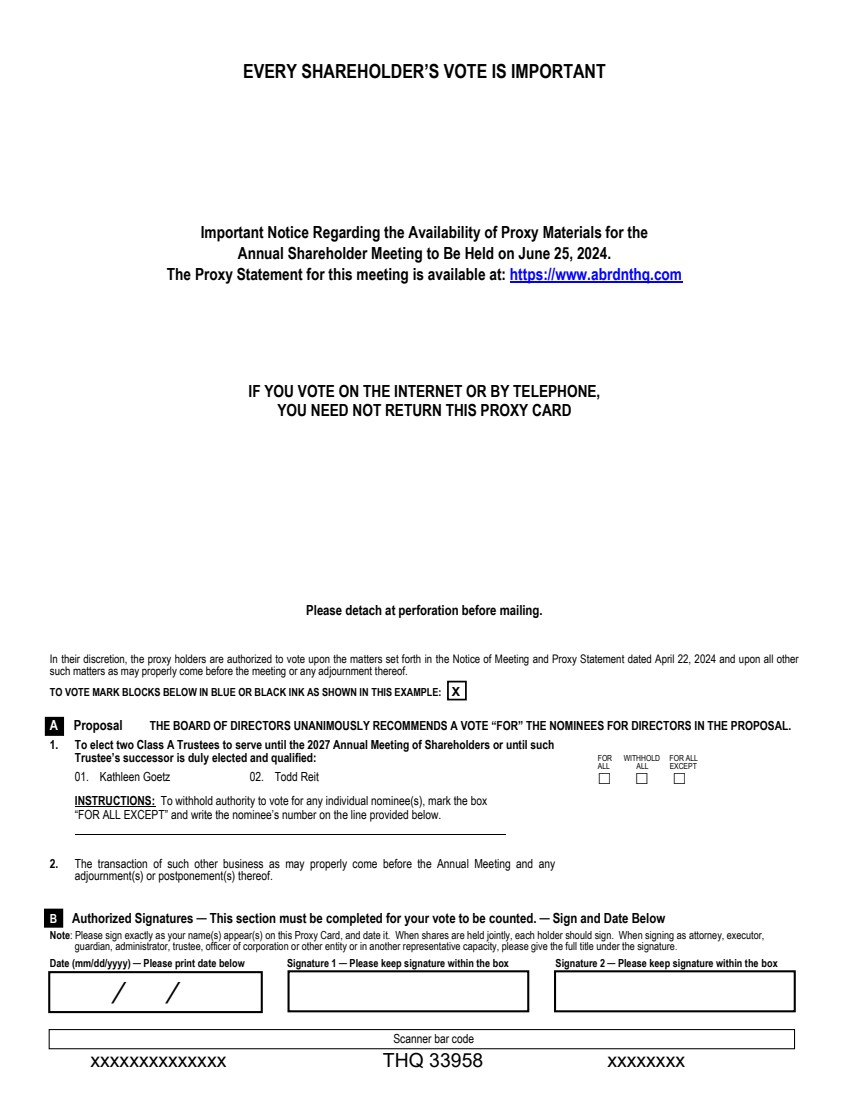

| FOR WITHHOLD FOR ALL ALL ALL EXCEPT EVERY SHAREHOLDER’S VOTE IS IMPORTANT Important Notice Regarding the Availability of Proxy Materials for the Annual Shareholder Meeting to Be Held on June 25, 2024. The Proxy Statement for this meeting is available at: https://www.abrdnthq.com IF YOU VOTE ON THE INTERNET OR BY TELEPHONE, YOU NEED NOT RETURN THIS PROXY CARD Please detach at perforation before mailing. In their discretion, the proxy holders are authorized to vote upon the matters set forth in the Notice of Meeting and Proxy Statement dated April 22, 2024 and upon all other such matters as may properly come before the meeting or any adjournment thereof. TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: X A Proposal THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NOMINEES FOR DIRECTORS IN THE PROPOSAL. 1. To elect two Class A Trustees to serve until the 2027 Annual Meeting of Shareholders or until such Trustee’s successor is duly elected and qualified: 01. Kathleen Goetz 02. Todd Reit INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark the box “FOR ALL EXCEPT” and write the nominee’s number on the line provided below. 2. The transaction of such other business as may properly come before the Annual Meeting and any adjournment(s) or postponement(s) thereof. B Authorized Signatures ─ This section must be completed for your vote to be counted. ─ Sign and Date Below Note: Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature. Date (mm/dd/yyyy) ─ Please print date below Signature 1 ─ Please keep signature within the box Signature 2 ─ Please keep signature within the box Scanner bar code xxxxxxxxxxxxxx THQ 33958 xxxxxxxx / / |

| EVERY VOTE IS IMPORTANT ABRDN WORLD HEALTHCARE FUNDPO Box 43131 Providence, RI 02940-3131 EASY VOTING OPTIONS: Please detach at perforation before mailing. PROXY ABRDN WORLD HEALTHCARE FUND ANNUAL MEETING OF SHAREHOLDERS TO BE HELD JUNE 25, 2024 THIS PROXY IS BEING SOLICITED BY THE BOARD OF DIRECTORS. The undersigned stockholder(s) of abrdn World Healthcare Fund (the “Fund”), revoking previous proxies, hereby appoints Megan Kennedy, Katherine Corey, Andrew Kim and Robert Hepp, or any one of them true and lawful attorneys with power of substitution of each, to vote all shares of the Fund which the undersigned is entitled to vote, at the Annual Meeting of Stockholders to be held on Tuesday, June 25, 2024, at 1:30 p.m. Eastern Time, at the offices of abrdn Inc., located at 1900 Market Street, Suite 200, Philadelphia, Pennsylvania 19103, and at any adjournment thereof as indicated on the reverse side. Please refer to the Proxy Statement for a discussion of these matters, including instructions related to meeting attendance. In their discretion, the proxy holders named above are authorized to vote upon such other matters as may properly come before the meeting or any adjournment thereof. Receipt of the Notice of the Annual Meeting and the accompanying Proxy Statement is hereby acknowledged. If this Proxy is executed but no instructions are given, the votes entitled to be cast by the undersigned will be cast “FOR” the nominees for director. VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA THE TELEPHONE: 1-800-337-3503 THW_33958_041724 PLEASE MARK, SIGN, DATE ON THE REVERSE SIDE AND RETURN THIS PROXY PROMPTLY USING THE ENCLOSED ENVELOPE. xxxxxxxxxxxxxx code VOTE ON THE INTERNET Log on to: www.proxy-direct.com or scan the QR code Follow the on-screen instructions available 24 hours VOTE BY PHONE Call 1-800-337-3503 Follow the recorded instructions available 24 hours VOTE BY MAIL Vote, sign and date this Proxy Card and return in the postage-paid envelope VOTE IN PERSON Attend Shareholder Meeting 1900 Market Street, Suite 200, Philadelphia, PA 19103 on June 25, 2024 |