| OMB APPROVAL | |||

| OMB Number: | 3235-0570 | ||

| Expires: | September 30, 2025 | ||

| UNITED STATES | Estimated average burden hours per response. . . . . . . . . . . . . . .7.8 | ||

| SECURITIES AND EXCHANGE COMMISSION | |||

| Washington, D.C. 20549 | |||

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-04889 |

| Tekla Healthcare Investors |

| (Exact name of registrant as specified in charter) |

| 100 Federal Street, 19th Floor, Boston, MA | 02110 | |

| (Address of principal executive offices) | (Zip code) |

| Laura

Woodward, Chief Compliance Officer and Vice President of Fund Administration 100 Federal Street, 19th Floor, Boston, MA 02110 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | 617-772-8500 |

| Date of fiscal year end: | September 30 |

| Date of reporting period: | October 1, 2021 to September 30, 2022 |

ITEM 1. REPORTS TO STOCKHOLDERS.

TEKLA HEALTHCARE INVESTORS

Annual Report

2 0 2 2

TEKLA HEALTHCARE INVESTORS

Distribution policy: The Fund has implemented a managed distribution policy (the Policy) that provides for quarterly distributions at a rate set by the Board of Trustees. Under the current Policy, the Fund intends to make quarterly distributions at a rate of 2% of the Fund's net assets to shareholders of record. The Policy would result in a return of capital to shareholders, if the amount of the distribution exceeds the Fund's net investment income and realized capital gains. A return of capital may occur, for example, when some or all of the money that you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund's investment performance and should not be confused with "yield" or "income."

The amounts and sources of distributions reported in the Fund's notices pursuant to Section 19(a) of the Investment Company Act of 1940 are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund's investment experience during its fiscal year and may be subject to changes based on tax regulations. The Fund will send you a Form 1099-DIV for the calendar year that tells you how to report distributions for federal income tax purposes.

You should not draw any conclusions about the Fund's investment performance from the amount of distributions pursuant to the Policy or from the terms of the Policy. The Policy has been established by the Trustees and may be changed or terminated by them without shareholder approval. The Trustees regularly review the Policy and the frequency and rate of distributions considering the purpose and effect of the Policy, the financial market environment, and the Fund's income, capital gains and capital available to pay distributions. The suspension or termination of the Policy could have the effect of creating a trading discount or widening an existing trading discount. At this time there are no reasonably foreseeable circumstances that might cause the Trustees to terminate the Policy.

Consider these risks before investing: As with any investment company that invests in equity securities, the Fund is subject to market risk—the possibility that the prices of equity securities will decline over short or extended periods of time. As a result, the value of an investment in the Fund's shares will fluctuate with the market generally and market sectors in particular. You could lose money over short or long periods of time. Political and economic news can influence marketwide trends and can cause disruptions in the U.S. or world financial markets. Other factors may be ignored by the market as a whole but may cause movements in the price of one company's stock or the stock of companies in one or more industries. All of these factors may have a greater impact on initial public offerings and emerging company shares. Different types of equity securities tend to shift into and out of favor with investors, depending on market and economic conditions. The performance of funds that invest in equity securities of healthcare companies may at times be better or worse than the performance of funds that focus on other types of securities or that have a broader investment style.

TEKLA HEALTHCARE INVESTORS

Dear Shareholders,

We are in an unusual economic moment during which stock market performance is being driven in large part by macroeconomics. On the one hand we have low unemployment while, on the other hand, we are seeing multi-decade high inflation and appear to be moving toward a low growth economy. This situation has put the U.S. Federal Reserve, which has a dual mandate to pursue maximum employment and price stability, in a position where it believes that it must aggressively increase rates and otherwise engage in quantitative tightening to hopefully quell inflation. Typically, times of increasing interest rates are associated with reduced spending, investment and, frequently, stock market retracement while times of low unemployment are traditionally associated with increased spending, investment and, frequently, stock market advancement. We believe this dichotomous situation has led to volatility and recently to a downward trajectory in the stock market.

Given these dynamics, we would argue that it would be beneficial to invest in a sector that can perform well in both defensive (e.g. rising interest rate) environments and in growth centric (i.e., decreasing interest rate and high employment) environments. Healthcare can be such a sector. It is large, containing almost 1,500 individual public companies in the U.S. alone and, we estimate, a similar number of private U.S. companies. On a global basis, Bloomberg reports there are more than 4,000 global public healthcare companies. As such there are always individual names that, based on fundamentals, are poised to perform well (or poorly). The sector is also diverse and is comprised of multiple subsectors, some of which can perform well in defensive markets and others that can perform well in permissive markets.

As noted, healthcare is large, and it is also growing. According to the U.S. Centers for Medicare and Medicaid Services (CMS), national health expenditure reached $4.1 trillion in 2020. This accounts for spending of $12,350 per person and accounted for 19.7% of U.S. Gross Domestic Product (GDP). According to CMS, such spending is expected to grow by 5.4% per year, 1.1% faster than overall GDP, and reach $6.2 trillion by 2028.

Sector diversity is also impressive. We break down the sector into individual subsectors such as pharmaceuticals, biotechnology, medical devices, life science tools, managed care, healthcare facilities, healthcare services, healthcare supplies, healthcare distributors, healthcare REITs and healthcare technology. In our experience, almost all economic environments provide an opportunity for the right companies in one or

1

more sectors to thrive. The following are several examples of the kinds of relationships we often see, though many other fundamental and market factors can have an impact on our analysis, investment decisions and portfolio construction.

Pharmaceuticals These companies tend to be large, well-managed, well-capitalized, multi-product companies that pay attractive dividends. In our experience, such entities tend to be defensive and perform best, on a relative basis, in flat, down or risk-off markets typified by rising rates or slowing growth.

Biotechnology Large biotech companies tend to perform similarly to pharmaceuticals though they can be a bit more volatile and may pay lower dividends. In our experience, during bull markets, large biotech companies can outperform pharmaceuticals. By contrast, Small- and Mid-sized (SMID) "biotechs" can perform well during bull markets. Conversely, SMID biotechs can underperform in risk-off bear markets, including during periods when rates are rising.

Medical Devices In our experience, "Medtech" company performance varies, particularly in the COVID-19 era. Traditionally, these companies, which typically sell therapeutic medical implant or function-assisting products, perform well in periods of increased utilization. This can occur when the economy is growing and/or when rates are low or decreasing.

Life Science Tools In our experience, this group often does well when global growth is thought to be accelerating. In recent years, performance of the group has been impacted by perceptions of Chinese growth rates.

Managed Care and Healthcare Facilities Performance of these groups is often inversely linked, in our experience. In general, healthcare facilities (e.g., hospitals) which perform medical procedures perform well when medical procedure growth is positive. Procedure growth tends to be positive when rates are declining and employment is high and/or growing. Managed care (e.g., HMOs), which pay for such procedures, do less well during such times.

Healthcare Distributors In our experience, this group typically exhibits strong free cash flow growth and is often thought of as being a defensive investment option. In recent years, the distributor group has benefitted from the advent and growth of biosimilar drugs, which it typically distributes.

Healthcare REITs This group borrows liberally to fund capital acquisition and, as such, is highly interest rate dependent. Healthcare REITs tend to perform well in decreasing or low-rate environments.

2

Healthcare Technology Healthcare Technology companies have traditionally focused on system sales to hospitals and other providers. In recent years, the group has diversified into providing more broad value-based core services. In our experience, the group can perform well in periods of high growth.

References: www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NHE-Fact-Sheet

Be well,

|

|||

Daniel R. Omstead

President and Portfolio Manager

3

Fund Essentials

Objective of the Fund

The Fund's investment objective is to seek long-term capital appreciation by investing primarily in securities of healthcare companies. In addition, the Fund seeks to provide regular distribution of realized capital gains.

Description of the Fund

Tekla Healthcare Investors ("HQH") is a non-diversified closed-end healthcare fund traded on the New York Stock Exchange under the ticker HQH. HQH primarily invests in healthcare industries and will emphasize both large established companies and smaller, emerging companies with a maximum of 40% of the Fund's assets in restricted securities of both public and private companies.

Investment Philosophy

Tekla Capital Management LLC, the Investment Adviser to the Fund, believes that:

• Aging demographics and adoption of new medical products and services can provide long-term tailwinds for healthcare companies

• Late stage biotechnology product pipeline could lead to significant increases in biotechnology sales

• Robust M&A activity in healthcare may create additional investment opportunities

Fund Overview and Characteristics as of 9/30/22

|

Market Price1 |

$17.28 | ||||||

|

NAV2 |

$19.36 | ||||||

|

Premium/(Discount) |

-10.74% | ||||||

|

Average 30 Day Volume |

98,912 | ||||||

|

Net Assets |

$916,564,588 | ||||||

|

Ticker |

HQH |

||||||

|

NAV Ticker |

XHQHX |

||||||

|

Commencement of Operations Date |

4/22/87 |

||||||

|

Fiscal Year to Date Distributions Per Share |

$1.83 | ||||||

1 The closing price at which the Fund's shares were traded on the exchange.

2 Per-share dollar value of the Fund, calculated by dividing the total value of all the securities in its portfolio, plus any other assets and less liabilities, by the number of Fund shares outstanding.

Holdings of the Fund (Data is based on net assets)

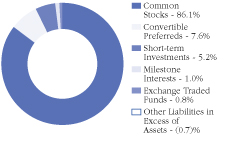

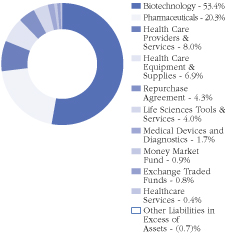

Asset Allocation as of 9/30/22

Sector Diversification as of 9/30/22

This data is subject to change on a daily basis.

4

Largest Holdings by Issuer

(Excludes Short-Term Investments)

As of September 30, 2022

| Issuer – Sector |

% of Net Assets |

||||||

| Amgen, Inc. – Biotechnology |

7.0 |

% |

|||||

| Gilead Sciences, Inc. – Biotechnology |

5.8 |

% |

|||||

| Vertex Pharmaceuticals, Inc. – Biotechnology |

5.1 |

% |

|||||

| Regeneron Pharmaceuticals, Inc. – Biotechnology |

4.9 |

% |

|||||

| Illumina, Inc. – Life Sciences Tools & Services |

3.0 |

% |

|||||

| AstraZeneca plc – Pharmaceuticals |

3.0 |

% |

|||||

| Horizon Therapeutics plc – Pharmaceuticals |

2.8 |

% |

|||||

| UnitedHealth Group, Inc. – Health Care Providers & Services |

2.4 |

% |

|||||

| Bristol-Myers Squibb Co. – Pharmaceuticals |

2.3 |

% |

|||||

| Alnylam Pharmaceuticals, Inc. – Biotechnology |

2.0 |

% |

|||||

| AbbVie, Inc. – Biotechnology |

1.9 |

% |

|||||

| Biogen, Inc. – Biotechnology |

1.9 |

% |

|||||

| Moderna, Inc. – Biotechnology |

1.8 |

% |

|||||

| Johnson & Johnson – Pharmaceuticals |

1.7 |

% |

|||||

| Jazz Pharmaceuticals plc – Pharmaceuticals |

1.5 |

% |

|||||

| United Therapeutics Corp. – Biotechnology |

1.5 |

% |

|||||

| Neurocrine Biosciences, Inc. – Biotechnology |

1.4 |

% |

|||||

| Apellis Pharmaceuticals, Inc. – Biotechnology |

1.4 |

% |

|||||

| argenx SE – Biotechnology |

1.4 |

% |

|||||

| Eli Lilly & Co. – Pharmaceuticals |

1.3 |

% |

|||||

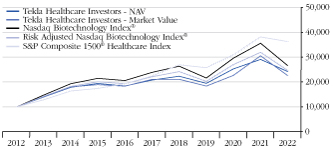

Fund Performance

HQH is a closed-end fund which invests predominantly in healthcare companies. Subject to regular consideration, the Trustees of HQH have instituted a policy of making quarterly distributions to shareholders. The Fund seeks to make such distributions in the form of long-term capital gains.

The Fund considers investments in companies of all sizes and in all healthcare subsectors, including but not limited to, biotechnology, pharmaceuticals, healthcare equipment, healthcare supplies, life science tools and services, healthcare distributors, managed healthcare, healthcare technology, and healthcare facilities. The Fund emphasizes innovation, investing both in public and pre-public venture companies. The Fund considers its venture investments to be a differentiating characteristic. Among the various healthcare subsectors, HQH has considered the biotechnology subsector, including both pre-public and public companies, to be a key contributor to the healthcare sector. The Fund holds biotech assets, including both public and pre-public, often representing 50-65% of net assets.

5

There is no commonly published index which matches the investment strategy of HQH. The S&P Composite 1500® Health Care Index* (S15HLTH) consists of approximately 180 companies representing most or all of the healthcare subsectors in which HQH typically invests; biotechnology often represents 15-20% of this index. By contrast, the NASDAQ Biotechnology Index®* (NBI), which contains over 350 constituents, is much more narrowly constructed. The vast majority of this index is comprised of biotechnology, pharmaceutical and life science tools companies. In recent years, biotechnology has often represented 72-82% of the NBI. Neither the S15HLTH nor NBI indices contain any material amount of pre-public company assets.

Given the circumstances, we present both NAV and stock returns for the Fund in comparison to several commonly published indices. One index, the S&P 500® Index* (SPX), is a commonly considered broad based index; this index is comprised of companies in many areas of the economy, including, but not limited to healthcare. As described above, the NBI is a healthcare index mostly focused in three healthcare sectors with a uniquely high level of biotechnology by comparison. The S15HLTH contains a wider representation of healthcare subsectors, but typically contains a much lower biotechnology composition.

HQH generally invests in a combination of large-cap growth-oriented and earlier stage innovative healthcare companies with a focus on the biotechnology sector. Generally, HQH targets biotechnology exposure below that of the NBI and a higher biotechnology exposure than that of the S15HLTH. We note that, in recent periods, biotechnology has been a significant contributor to returns (both positive and negative) associated with those indices. We believe this sector continues to have significant potential for growth in the future.

Fund Performance for the Period Ending September 30, 2022

|

Period |

HQH NAV |

HQH MKT |

NBI |

S15HLTH |

SPX |

||||||||||||||||||

| 6 month |

-7.58 |

-12.86 |

-9.14 |

-11.23 |

-20.21 |

||||||||||||||||||

| 1 year |

-16.78 |

-26.01 |

-25.24 |

-4.91 |

-15.50 |

||||||||||||||||||

| 5 year |

3.08 |

1.39 |

2.17 |

10.06 |

9.22 |

||||||||||||||||||

| 10 year |

9.25 |

8.50 |

10.29 |

13.75 |

11.69 |

||||||||||||||||||

6

Change in the value of a $10,000 investment

Cumulative total return from 9/30/2012 to 9/30/2022

All performance over one-year has been annualized. Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. The NAV total return takes into account the Fund's total annual expenses and does not reflect transaction charges. If transaction charges were reflected, NAV total return would be reduced. All distributions are assumed to be reinvested either in accordance with the dividend reinvestment plan (DRIP) for market price returns or NAV for NAV returns. Until the DRIP price is available from the Plan Agent, the market price returns reflect the reinvestment at the closing market price on the last business day of the month. Once the DRIP is available around mid-month, the market price returns are updated to reflect reinvestment at the DRIP price. The graph and table do not reflect the deduction of taxes a shareholder would pay on fund distributions or the sale of fund shares.

Risk Adjusted NASDAQ Biotechnology Index® computed by Tekla using Bloomberg data for the NBI and applying the fund's computed 0.90 beta to NBI performance to reflect the fund's lower historical risk.

Portfolio Management Commentary

Fund and Benchmark Performance and Other Influencing Factors

For the 12-month period ending September 30, 2022, the Fund net asset value was down 16.8% and market value down 26.0%, including reinvestment of dividends and distributions. Over the same period, the NBI was down 25.2% and the S15HLTH was down 4.9%, including reinvestment of dividends.

The largest positive contribution to Fund relative performance was company stock selection and an underweight allocation to small and midcap biotechnology stocks. Small and midcap biotechnology stocks suffered greater losses in the period than large companies and the Fund benefitted by underweighting these more volatile names. Fund stock selection was positive for smid-cap biotechnology stocks with contributions from positions in Karuna Therapeutics, Inc. (KRTX), up 84%, and Apellis Pharmaceuticals, Inc. (APLS), up 107%. An overweight allocation to healthcare distributors benefitted Fund performance, led by a position in McKesson Corp. (MCK), up 72%. A large contribution to

7

Fund performance came from a correct bet against Moderna, Inc. (MRNA) stock. Believing that the company's valuation would fall once covid vaccination sales estimates declined, the Fund hedged its Moderna stock position buying put options expiring January 2022 giving the Fund the right to sell MRNA stock at $380 and $400. At expiration Moderna stock closed at $160.07, well below the put option strike price and the Fund gained performance from this effectively underweight position.

The largest negative contribution to Fund relative performance was company stock selection and an underweight allocation to pharmaceuticals. The Fund overweight position leading to the greatest underperformance was a Fund position in Horizon Therapeutics plc (HZNP) which fell 44% in the period. In a large negative performance period for smaller biotechnology and growth stocks, large pharmaceutical companies outperformed by declining less. The Fund was underweight pharmaceuticals and this detracted from relative performance. In terms of stock selection, some the largest negative contributors to Fund performance were due to underweight positions in selected large cap companies that outperformed. Fund underweight positions in the period that contributed negatively to relative performance included AstraZeneca plc (AZN), down 7%, and Regeneron Pharmaceuticals, Inc. (REGN), up 14%.

Portfolio Highlights as of September 30, 2022

Among other investments, Tekla Healthcare Investors' performance benefitted in the past year by the following:

Moderna, Inc. (MRNA) is a vaccine company based on a new therapeutic modality, messenger RNA. The Company has multiple development programs in the clinic but is most well-known for its commercially successful vaccine candidate targeting the COVID-19 virus. At its peak in summer 2021, Moderna had a market capitalization of nearly $200 billion with roughly $20 billion in COVID-19 vaccines sales expected for 2021 and 2022. While the future path of the COVID-19 pandemic is uncertain, we decided the valuation for Moderna reflected too much optimism on the recurring nature of the booster vaccine business in the next decade. The Fund was underweight MRNA, yielding benchmark relative performance in the period as its stock price declined sharply in accordance with diminished expectations for vaccine sales.

McKesson Corp. (MCK) distributes pharmaceutical and medical-surgical supplies and also provides specialty pharmacy and biopharma services. The Company is benefiting from the renewal of its U.S. government contract to distribute COVID-19 vaccines and supplies, which helped

8

accelerate earnings growth over the past few years. Investor sentiment has also improved thanks to better visibility around the Company's opioid liability exposure. The Fund was overweight MCK, which delivered strong stock gains during the reporting period.

Rallybio Corp. (RLYB) is a clinical stage biotechnology company developing therapies for patients with severe and rare disorders. Its lead candidate, RLYB212, is a monoclonal antibody for the prevention of fetal and neonatal alloimmune thrombocytopenia, a rare condition with no currently approved therapies. RLYB completed a successful IPO in August 2021. Over the reporting period, RLYB provided positive clinical updates for lead candidate, RLYB212, as well as expanded its preclinical pipeline. The Fund benefited from being overweight RLYB during this period of outperformance.

Among other examples, Tekla Healthcare Investors' performance was negatively impacted by the following investments:

Horizon Therapeutics plc (HZNP) is a specialty pharmaceuticals company transitioning to a focused orphan disease business model centered around two key products, one for gout and the other for thyroid disease. Despite a strong early launch for the Company's thyroid disease product Tepezza, sales growth slowed during the reporting period. As a result, the Company's stock underperformed while the Fund was overweight.

AstraZeneca plc (AZN) is a large multinational pharmaceutical company with geographic sales exposure across developed and emerging markets and a strong growth profile relative to most of its large-cap peers. The Company reported strong data from several key trials over the past year, most notably with Enhertu in breast cancer, causing the stock to perform well while the Fund was underweight.

Regeneron Pharmaceuticals, Inc. (REGN) is a leading, large biotechnology company developing novel antibody-based therapies across various indications. Regeneron's leading product is Eylea, an anti-VEGF antibody, for the treatment of macular degeneration, macular edema, and diabetic retinopathy. Of note, Eylea's patents will likely expire in the next 1-2 years and face significant biosimilar competition. Because the Eylea franchise is a key driver behind Regeneron's stock performance, we believed the stock would face significant downward pressure. However, a re-formulation of Eylea in higher concentration, named "High Dose Eylea" showed unexpectedly positive results in treating patients at longer durations while the Fund was underweight. This next generation product may protect some or even the majority of the Eylea franchise from competition.

9

Distributions

The Fund intends to make quarterly distributions at a rate of 2% of the Fund's net assets. The Fund intends to use net realized capital gains when making quarterly distributions, if available, but would make return of capital distributions if the amount of the distribution exceeds the Fund's net investment income and realized capital gains. During the last fiscal year, the Fund made quarterly distributions totaling $1.8300 per share, which were characterized as $0.1143 per share of net investment income and $1.7157 per share of net realized long-term capital gains. Final determination of the tax character of the distributions paid by the Fund in 2022 will be reported to shareholders in January 2023.

Distributions of return of capital decrease the Fund's total assets and total assets per share and, therefore, could have the effect of increasing the Fund's expense ratio. In general, the policy of making quarterly distributions at a fixed rate does not affect the Fund's investment strategy. However, in order to make these distributions, the Fund might need to sell portfolio securities at a less than opportune time.

*The trademarks NASDAQ Biotechnology Index®, S&P Composite 1500® Health Care Index and S&P 500® Index referenced in this report are the property of their respective owners. These trademarks are not owned by or associated with the Fund or its service providers, including Tekla Capital Management LLC.

10

TEKLA HEALTHCARE INVESTORS

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2022

|

SHARES |

CONVERTIBLE PREFERREDS (Restricted) (a) (b) - 7.6% of Net Assets |

VALUE |

|||||||||

|

Biotechnology - 4.7% |

|||||||||||

|

326,667 |

Amphivena Therapeutics, Inc. Series B (c) |

$ |

33 |

||||||||

|

525,972 |

Amphivena Therapeutics, Inc. Series C, 6.00% (c) |

53 |

|||||||||

|

82,076 |

Arbor Biotechnologies, Series B, 8.00% |

1,359,999 |

|||||||||

|

2,353,932 |

Arkuda Therapeutics, Inc. Series A, 6.00% (c) |

4,162,222 |

|||||||||

|

487,526 |

Arkuda Therapeutics, Inc. Series B, 6.00% (c) |

862,043 |

|||||||||

|

602,572 |

Dynacure Series C (d) |

1,715,550 |

|||||||||

|

2,875,000 |

Hotspot Therapeutics, Inc. Series B, 6.00% |

9,317,587 |

|||||||||

|

632,394 |

Hotspot Therapeutics, Inc. Series C, 6.00% |

2,049,526 |

|||||||||

|

1,020,000 |

ImmuneID, Inc. Series A, 8.00% |

2,040,000 |

|||||||||

|

7,187,500 |

Invetx, Inc. Series A, 8.00% (c) |

4,816,344 |

|||||||||

|

3,089,091 |

Invetx, Inc. Series B, 8.00% (c) |

2,070,000 |

|||||||||

|

277,444 |

Oculis SA, Series B2, 6.00% (d) |

2,952,004 |

|||||||||

|

75,367 |

Oculis SA, Series C, 6.00% (d) |

801,905 |

|||||||||

|

528,339 |

Parthenon Therapeutics, Inc. Series A |

2,092,307 |

|||||||||

|

346,666 |

Priothera Ltd. Series A, 6.00% (c) |

3,397,500 |

|||||||||

|

1,553,631 |

Quell Therapeutics, Series B (d) |

2,936,363 |

|||||||||

|

294,589 |

ReCode Therapeutics, Series B, 5.00% |

2,719,999 |

|||||||||

|

43,293,435 |

|||||||||||

|

Health Care Equipment & Supplies - 0.2% |

|||||||||||

|

421,634 |

IO Light Holdings, Inc. Series A2 |

1,423,015 |

|||||||||

|

1,423,015 |

|||||||||||

|

Pharmaceuticals - 2.7% |

|||||||||||

|

616,645 |

Aristea Therapeutics, Inc. Series B, 8.00% |

3,399,996 |

|||||||||

|

1,295,238 |

Biotheryx, Inc. Series E, 8.00% |

6,800,000 |

|||||||||

|

17,547,740 |

Curasen Therapeutics, Inc. Series A (c) |

8,414,141 |

|||||||||

|

657,322 |

Endeavor Biomedicines, Inc. Series B, 8.00% |

3,099,996 |

|||||||||

|

2,773,472 |

HiberCell, Inc. Series B |

3,399,999 |

|||||||||

|

25,114,132 |

|||||||||||

|

TOTAL CONVERTIBLE PREFERREDS (Cost $78,275,680) |

69,830,582 |

||||||||||

|

PRINCIPAL AMOUNT |

CONVERTIBLE NOTES (Restricted) (a) (b) (c) - 0.0% of Net Assets |

|

|||||||||

|

Biotechnology - 0.0% |

|||||||||||

|

$ |

303,323 |

Amphivena Therapeutics, Inc., 8.00%, due 10/25/22 |

0 |

||||||||

|

TOTAL CONVERTIBLE NOTES (Cost $303,323) |

0 |

||||||||||

The accompanying notes are an integral part of these financial statements.

11

TEKLA HEALTHCARE INVESTORS

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2022

(continued)

|

SHARES |

COMMON STOCKS - 86.1% of Net Assets |

VALUE |

|||||||||

|

Biotechnology - 48.6% |

|||||||||||

|

132,179 |

AbbVie, Inc. |

$ |

17,739,744 |

||||||||

|

367,414 |

Affimed N.V. (b) (d) |

756,873 |

|||||||||

|

173,907 |

Alkermes plc (b) |

3,883,343 |

|||||||||

|

92,438 |

Alnylam Pharmaceuticals, Inc. (b) |

18,502,390 |

|||||||||

|

284,326 |

Amgen, Inc. |

64,087,080 |

|||||||||

|

185,538 |

Apellis Pharmaceuticals, Inc. (b) |

12,672,245 |

|||||||||

|

86,869 |

Arcutis Biotherapeutics, Inc. (b) |

1,660,067 |

|||||||||

|

35,465 |

argenx SE ADR (b) |

12,520,918 |

|||||||||

|

87,937 |

Arrowhead Pharmaceuticals, Inc. (b) |

2,906,318 |

|||||||||

|

43,409 |

Ascendis Pharma A/S ADR (b) |

4,482,413 |

|||||||||

|

137,035 |

BioCryst Pharmaceuticals, Inc. (b) |

1,726,641 |

|||||||||

|

66,310 |

Biogen, Inc. (b) |

17,704,770 |

|||||||||

|

28,433 |

Biohaven Pharmaceutical Holding Co., Ltd. (b) |

4,298,217 |

|||||||||

|

71,154 |

BioMarin Pharmaceutical, Inc. (b) |

6,031,725 |

|||||||||

|

57,580 |

BioNTech SE ADR |

7,766,390 |

|||||||||

|

90,404 |

Black Diamond Therapeutics, Inc. (b) (e) |

152,783 |

|||||||||

|

385,660 |

Caribou Biosciences, Inc. (b) |

4,068,713 |

|||||||||

|

102,322 |

Cerevel Therapeutics Holdings, Inc. (b) |

2,891,620 |

|||||||||

|

51,708 |

ChemoCentryx, Inc. (b) |

2,671,235 |

|||||||||

|

143,592 |

Denali Therapeutics, Inc. (b) |

4,406,838 |

|||||||||

|

158,501 |

Design Therapeutics, Inc. (b) |

2,650,137 |

|||||||||

|

15,186 |

Fusion Pharmaceuticals, Inc. (b) (d) |

45,710 |

|||||||||

|

7,593 |

Fusion Pharmaceuticals, Inc. (Restricted) (a) (b) (d) |

20,569 |

|||||||||

|

200,492 |

G1 Therapeutics, Inc. (b) (e) |

2,504,145 |

|||||||||

|

296,462 |

Galera Therapeutics, Inc. (b) |

515,844 |

|||||||||

|

854,746 |

Gilead Sciences, Inc. |

52,729,281 |

|||||||||

|

53,885 |

I-Mab ADR (b) |

216,079 |

|||||||||

|

103,664 |

Intellia Therapeutics, Inc. (b) |

5,801,037 |

|||||||||

|

33,437 |

Intercept Pharmaceuticals, Inc. (b) |

466,446 |

|||||||||

|

56,499 |

Ionis Pharmaceuticals, Inc. (b) |

2,498,951 |

|||||||||

|

15,557 |

Karuna Therapeutics, Inc. (b) |

3,499,236 |

|||||||||

|

1,063,799 |

Mereo Biopharma Group plc ADR (b) (e) |

916,037 |

|||||||||

|

138,636 |

Moderna, Inc. (b) |

16,393,707 |

|||||||||

|

205,800 |

MoonLake Immunotherapeutics AG Class A (b) |

1,638,168 |

|||||||||

|

125,116 |

Neurocrine Biosciences, Inc. (b) |

13,288,570 |

|||||||||

|

2,970 |

NexGel, Inc. (b) |

4,485 |

|||||||||

|

37,188 |

Novavax, Inc. (b) |

676,822 |

|||||||||

|

51,406 |

Praxis Precision Medicines, Inc. (b) |

116,692 |

|||||||||

|

154,807 |

Precision BioSciences, Inc. (b) |

201,249 |

|||||||||

|

481,646 |

Pyxis Oncology, Inc. (b) |

948,843 |

|||||||||

|

761,137 |

Rallybio Corp. (b) (e) |

11,013,652 |

|||||||||

|

65,792 |

Regeneron Pharmaceuticals, Inc. (b) |

45,322,135 |

|||||||||

The accompanying notes are an integral part of these financial statements.

12

TEKLA HEALTHCARE INVESTORS

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2022

(continued)

|

SHARES |

Biotechnology - continued |

VALUE |

|||||||||

|

88,712 |

Sarepta Therapeutics, Inc. (b) |

$ |

9,806,225 |

||||||||

|

68,117 |

Scholar Rock Holding Corp. (b) (e) |

472,051 |

|||||||||

|

17,298 |

Seagen, Inc. (b) |

2,366,885 |

|||||||||

|

115,649 |

Sutro Biopharma, Inc. (b) |

641,852 |

|||||||||

|

142,714 |

Travere Therapeutics, Inc. (b) |

3,516,473 |

|||||||||

|

138,057 |

TScan Therapeutics, Inc. (b) |

421,074 |

|||||||||

|

44,502 |

Ultragenyx Pharmaceutical, Inc. (b) |

1,842,828 |

|||||||||

|

357,080 |

uniQure N.V. (b) (d) |

6,698,821 |

|||||||||

|

65,672 |

United Therapeutics Corp. (b) |

13,750,403 |

|||||||||

|

567,550 |

Vectivbio Holding AG (b) |

3,405,300 |

|||||||||

|

160,545 |

Vertex Pharmaceuticals, Inc. (b) |

46,484,199 |

|||||||||

|

101,994 |

Xencor, Inc. (b) |

2,649,804 |

|||||||||

|

27,684 |

Zai Lab Ltd. ADR (b) |

946,793 |

|||||||||

|

445,400,826 |

|||||||||||

|

Health Care Equipment & Supplies - 6.8% |

|||||||||||

|

114,588 |

Abbott Laboratories |

11,087,535 |

|||||||||

|

174,859 |

Cardiovascular Systems, Inc. (b) |

2,423,546 |

|||||||||

|

160,000 |

Cercacor Laboratories, Inc. (Restricted) (a) |

618,886 |

|||||||||

|

39,619 |

DexCom, Inc. (b) |

3,190,914 |

|||||||||

|

43,827 |

Edwards Lifesciences Corp. (b) |

3,621,425 |

|||||||||

|

173,673 |

Guardant Health, Inc. (b) |

9,348,817 |

|||||||||

|

15,551 |

IDEXX Laboratories, Inc. (b) |

5,066,516 |

|||||||||

|

105,283 |

Lantheus Holdings, Inc. (b) |

7,404,553 |

|||||||||

|

29,380 |

Medtronic plc |

2,372,435 |

|||||||||

|

42,065 |

Stryker Corp. |

8,519,845 |

|||||||||

|

80,863 |

Zimmer Biomet Holdings, Inc. |

8,454,227 |

|||||||||

|

62,108,699 |

|||||||||||

|

Health Care Providers & Services - 8.0% |

|||||||||||

|

17,832 |

Addus HomeCare Corp. (b) |

1,698,320 |

|||||||||

|

22,890 |

Charles River Laboratories International, Inc. (b) |

4,504,752 |

|||||||||

|

41,860 |

Cigna Corp. |

11,614,894 |

|||||||||

|

51,696 |

Contra Zogenix, Inc. CVR (a) (b) |

78,578 |

|||||||||

|

2,644 |

Evelance Health, Inc. |

1,201,011 |

|||||||||

|

24,237 |

HCA Healthcare, Inc. |

4,454,518 |

|||||||||

|

47,561 |

HealthEquity, Inc. (b) |

3,194,672 |

|||||||||

|

20,290 |

Humana, Inc. |

9,844,505 |

|||||||||

|

222,222 |

InnovaCare, Inc. Escrow Shares (Restricted) (a) |

56,533 |

|||||||||

|

6,524 |

Medpace Holdings, Inc. (b) |

1,025,377 |

|||||||||

|

34,160 |

Molina Healthcare, Inc. (b) |

11,267,335 |

|||||||||

|

107,595 |

Owens & Minor, Inc. |

2,593,040 |

|||||||||

|

42,732 |

UnitedHealth Group, Inc. |

21,581,369 |

|||||||||

|

73,114,904 |

|||||||||||

The accompanying notes are an integral part of these financial statements.

13

TEKLA HEALTHCARE INVESTORS

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2022

(continued)

|

SHARES |

Healthcare Services - 0.3% |

VALUE |

|||||||||

|

15,929 |

Laboratory Corporation of America Holdings |

$ |

3,262,418 |

||||||||

|

Life Sciences Tools & Services - 4.0% |

|||||||||||

|

216,209 |

Adaptive Biotechnologies Corp. (b) |

1,539,408 |

|||||||||

|

143,346 |

Illumina, Inc. (b) |

27,348,983 |

|||||||||

|

14,873 |

Thermo Fisher Scientific, Inc. |

7,543,437 |

|||||||||

|

36,431,828 |

|||||||||||

|

Medical Devices and Diagnostics - 1.7% |

|||||||||||

|

4,063 |

Align Technology, Inc. (b) |

841,488 |

|||||||||

|

144,489 |

Boston Scientific Corp. (b) |

5,596,059 |

|||||||||

|

15,181 |

Danaher Corp. |

3,921,101 |

|||||||||

|

26,837 |

Intuitive Surgical, Inc. (b) |

5,030,327 |

|||||||||

|

15,388,975 |

|||||||||||

|

Pharmaceuticals - 16.7% |

|||||||||||

|

51,378 |

Arvinas, Inc. (b) |

2,285,807 |

|||||||||

|

494,952 |

AstraZeneca plc ADR |

27,143,168 |

|||||||||

|

297,171 |

Bristol-Myers Squibb Co. |

21,125,886 |

|||||||||

|

37,470 |

Eli Lilly & Co. |

12,115,924 |

|||||||||

|

465,507 |

Endo International plc (b) |

45,014 |

|||||||||

|

411,374 |

Horizon Therapeutics plc (b) |

25,459,937 |

|||||||||

|

120,019 |

Intra-Cellular Therapies, Inc. (b) |

5,584,484 |

|||||||||

|

17,633 |

IQVIA Holdings, Inc. (b) |

3,194,042 |

|||||||||

|

105,172 |

Jazz Pharmaceuticals plc (b) (d) |

14,018,376 |

|||||||||

|

93,399 |

Johnson & Johnson |

15,257,661 |

|||||||||

|

19,916 |

McKesson Corp. |

6,768,851 |

|||||||||

|

71,668 |

Merck & Co., Inc. |

6,172,048 |

|||||||||

|

82,038 |

Mirati Therapeutics, Inc. (b) |

5,729,534 |

|||||||||

|

7,050 |

Perrigo Co. plc |

251,403 |

|||||||||

|

60,450 |

Pfizer, Inc. |

2,645,292 |

|||||||||

|

79,790 |

Spectrum Pharmaceuticals, Inc. (b) |

34,310 |

|||||||||

|

28,747 |

Tetraphase Pharmaceuticals, Inc. CVR (a) (b) |

1,725 |

|||||||||

|

291,666 |

Teva Pharmaceutical Industries Ltd. ADR (b) |

2,353,745 |

|||||||||

|

69,000 |

Theseus Pharmaceuticals, Inc. (b) (e) |

400,200 |

|||||||||

|

94,775 |

VYNE Therapeutics, Inc. (b) (e) |

21,144 |

|||||||||

|

17,924 |

Zoetis, Inc. |

2,657,950 |

|||||||||

|

153,266,501 |

|||||||||||

|

TOTAL COMMON STOCKS (Cost $732,034,820) |

788,974,151 |

||||||||||

The accompanying notes are an integral part of these financial statements.

14

TEKLA HEALTHCARE INVESTORS

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2022

(continued)

|

SHARES |

EXCHANGE TRADED FUNDS (e) - 0.8% of Net Assets |

VALUE |

|||||||||

|

24,569 |

iShares Nasdaq Biotechnology ETF |

$ |

2,873,590 |

||||||||

|

57,000 |

SPDR S&P Biotech ETF |

4,521,240 |

|||||||||

|

TOTAL EXCHANGE TRADED FUNDS (Cost $7,597,985) |

7,394,830 |

||||||||||

|

PRINCIPAL AMOUNT |

SHORT-TERM INVESTMENTS - 5.2% of Net Assets |

||||||||||

|

$ |

39,792,000 |

Repurchase Agreement, Fixed Income Clearing Corp., repurchase value $39,792,000, 0.83%, dated 09/30/22, due 10/03/22 (collateralized by U.S. Treasury Note 0.125%, due 07/15/2024, market value $21,299,857 and U.S. Treasury Bond 2.50% due 02/15/46, market value $19,288,075) |

39,792,000 |

||||||||

|

SHARES |

|||||||||||

|

8,495,653 |

State Street Institutional U.S. Government Money Market Fund, Institutional Class, 2.91% (f) |

8,495,653 |

|||||||||

|

TOTAL SHORT-TERM INVESTMENTS (Cost $48,287,653) |

48,287,653 |

||||||||||

|

TOTAL INVESTMENTS BEFORE MILESTONE INTERESTS - 99.7% (Cost $866,499,461) |

914,487,216 |

||||||||||

|

INTERESTS |

MILESTONE INTERESTS (Restricted) (a) (b) - 1.0% of Net Assets |

|

|||||||||

|

Biotechnology - 0.2% |

|||||||||||

|

1 |

Rainier Therapeutics Milestone Interest |

285,190 |

|||||||||

|

1 |

Therachon Milestone Interest |

1,243,901 |

|||||||||

|

1,529,091 |

|||||||||||

|

Health Care Equipment & Supplies - 0.0% |

|||||||||||

|

1 |

Therox Milestone Interest |

1,090 |

|||||||||

|

1,090 |

|||||||||||

The accompanying notes are an integral part of these financial statements.

15

TEKLA HEALTHCARE INVESTORS

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2022

(continued)

|

INTERESTS |

Pharmaceuticals - 0.8% |

VALUE |

|||||||||

|

1 |

Afferent Milestone Interest |

$ |

272,563 |

||||||||

|

1 |

Ethismos Research Milestone Interest |

0 |

|||||||||

|

1 |

Impact Biomedicines Milestone Interest |

1,720,697 |

|||||||||

|

1 |

Neurovance Milestone Interest |

5,347,058 |

|||||||||

|

7,340,318 |

|||||||||||

|

TOTAL MILESTONE INTERESTS (Cost $7,960,390) |

8,870,499 |

||||||||||

|

TOTAL INVESTMENTS - 100.7% (Cost $874,459,851) |

923,357,715 |

||||||||||

|

OTHER LIABILITIES IN EXCESS OF ASSETS - (0.7)% |

(6,793,127 |

) |

|||||||||

|

NET ASSETS - 100% |

$ |

916,564,588 |

|||||||||

(a) Security fair valued using significant unobservable inputs. See Investment Valuation and Fair Value Measurements.

(b) Non-income producing security.

(c) Affiliated issuers in which the Fund holds 5% or more of the voting securities (total market value of $23,722,336).

(d) Foreign security.

(e) All or a portion of this security is on loan as of September 30, 2022. See Note 1.

(f) This security represents the investment of cash collateral received for securities lending and is a registered investment company advised by State Street Global Advisors. The rate shown is the annualized seven-day yield as of September 30, 2022.

ADR American Depository Receipt

CVR Contingent Value Right

The accompanying notes are an integral part of these financial statements.

16

TEKLA HEALTHCARE INVESTORS

STATEMENT OF ASSETS AND LIABILITIES

SEPTEMBER 30, 2022

|

ASSETS: |

|||||||

|

Investments in unaffiliated issuers (cost $834,950,179), at value including $8,253,577 of securities loaned |

$ |

890,764,880 |

|||||

|

Investments in affiliated issuers, at value (cost $31,549,282) |

23,722,336 |

||||||

|

Milestone interests, at value (cost $7,960,390) |

8,870,499 |

||||||

|

Total investments |

923,357,715 |

||||||

|

Cash |

743 |

||||||

|

Foreign currency, at value (cost $58) |

49 |

||||||

|

Dividends and interest receivable |

194,459 |

||||||

|

Securities lending income receivable |

4,711 |

||||||

|

Receivable for investments sold |

2,668,312 |

||||||

|

Prepaid expenses |

49,104 |

||||||

|

Other assets (see Note 1) |

272 |

||||||

|

Total assets |

926,275,365 |

||||||

|

LIABILITIES: |

|||||||

|

Payable upon return of securities loaned |

8,495,653 |

||||||

|

Accrued advisory fee |

775,047 |

||||||

|

Accrued investor support service fees |

40,875 |

||||||

|

Accrued shareholder reporting fees |

43,421 |

||||||

|

Accrued other |

355,781 |

||||||

|

Total liabilities |

9,710,777 |

||||||

|

Commitments and Contingencies (see Notes 1 and 5) |

|||||||

|

NET ASSETS |

$ |

916,564,588 |

|||||

|

SOURCES OF NET ASSETS: |

|||||||

|

Shares of beneficial interest, par value $.01 per share, unlimited number of shares authorized, amount paid in on 47,343,726 shares issued and outstanding |

$ |

473,437 |

|||||

|

Additional paid-in-capital |

$ |

891,270,791 |

|||||

|

Total distributable earnings (loss) |

$ |

24,820,360 |

|||||

|

Total net assets (equivalent to $19.36 per share based on 47,343,726 shares outstanding) |

$ |

916,564,588 |

|||||

The accompanying notes are an integral part of these financial statements.

17

TEKLA HEALTHCARE INVESTORS

STATEMENT OF OPERATIONS

YEAR ENDED SEPTEMBER 30, 2022

|

INVESTMENT INCOME: |

|||||||

|

Dividend income (net of foreign tax of $18,181) |

$ |

7,986,287 |

|||||

|

Interest and other income |

112,314 |

||||||

|

Securities lending, net |

172,166 |

||||||

|

Total investment income |

8,270,767 |

||||||

|

EXPENSES: |

|||||||

|

Advisory fees |

9,976,451 |

||||||

|

Investor support service fees |

504,283 |

||||||

|

Legal fees |

236,295 |

||||||

|

Administration fees |

207,935 |

||||||

|

Custodian fees |

198,656 |

||||||

|

Shareholder reporting |

174,558 |

||||||

|

Trustees' fees and expenses |

174,292 |

||||||

|

Professional services fees |

128,556 |

||||||

|

Transfer agent fees |

59,862 |

||||||

|

Other (see Note 2) |

280,061 |

||||||

|

Total expenses |

11,940,949 |

||||||

|

Net investment loss |

(3,670,182 |

) |

|||||

|

REALIZED AND UNREALIZED GAIN (LOSS): |

|||||||

|

Net realized gain (loss) on: |

|||||||

|

Investments in unaffiliated issuers |

58,756,545 |

||||||

|

Closed or expired option contracts written |

7,619,045 |

||||||

|

Foreign currency transactions |

5,493 |

||||||

|

Net realized gain |

66,381,083 |

||||||

|

Net change in unrealized appreciation (depreciation) on: |

|||||||

|

Investments in unaffiliated issuers |

(252,596,821 |

) |

|||||

|

Investments in affiliated issuers |

2,083,711 |

||||||

|

Milestone interests |

(2,077,996 |

) |

|||||

|

Option contracts written |

(4,349,159 |

) |

|||||

|

Foreign currency |

(9 |

) |

|||||

|

Net change in unrealized appreciation (depreciation) |

(256,940,274 |

) |

|||||

|

Net realized and unrealized gain (loss) |

(190,559,191 |

) |

|||||

|

Net decrease in net assets resulting from operations |

$ |

(194,229,373 |

) |

||||

The accompanying notes are an integral part of these financial statements.

18

TEKLA HEALTHCARE INVESTORS

STATEMENTS OF CHANGES IN NET ASSETS

|

Year ended September 30, 2022 |

Year ended September 30, 2021 |

||||||||||

|

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS: |

|||||||||||

|

Net investment loss |

($ |

3,670,182 |

) |

($ |

6,230,384 |

) |

|||||

|

Net realized gain |

66,381,083 |

82,529,358 |

|||||||||

|

Change in net unrealized appreciation (depreciation) |

(256,940,274 |

) |

78,876,879 |

||||||||

|

Net increase (decrease) in net assets resulting from operations |

(194,229,373 |

) |

155,175,853 |

||||||||

|

DISTRIBUTIONS TO SHAREHOLDERS (See Note 1): |

(84,311,515 |

) |

(91,590,428 |

) |

|||||||

|

CAPITAL SHARE TRANSACTIONS: |

|||||||||||

|

Reinvestment of distributions (1,918,258 and 1,553,813 shares, respectively) |

38,203,392 |

38,621,063 |

|||||||||

|

Total capital share transactions |

38,203,392 |

38,621,063 |

|||||||||

|

Net increase (decrease) in net assets |

(240,337,496 |

) |

102,206,488 |

||||||||

|

NET ASSETS: |

|||||||||||

|

Beginning of year |

1,156,902,084 |

1,054,695,596 |

|||||||||

|

End of year |

$ |

916,564,588 |

$ |

1,156,902,084 |

|||||||

The accompanying notes are an integral part of these financial statements.

19

TEKLA HEALTHCARE INVESTORS

FINANCIAL HIGHLIGHTS

|

For the years ended September 30, |

|||||||||||||||||||||||

|

2022 |

2021 |

2020 |

2019 |

2018 |

|||||||||||||||||||

|

OPERATING PERFORMANCE FOR A SHARE OUTSTANDING THROUGHOUT EACH YEAR |

|||||||||||||||||||||||

|

Net asset value per share, beginning of year |

$ |

25.47 |

$ |

24.04 |

$ |

20.33 |

$ |

25.62 |

$ |

26.02 |

|||||||||||||

|

Net investment loss (1) |

(0.08 |

) |

(0.14 |

) |

(0.05 |

) |

(0.07 |

) |

(0.10 |

) |

|||||||||||||

|

Net realized and unrealized gain (loss) |

(4.20 |

) |

3.63 |

5.50 |

(3.46 |

) |

1.63 |

||||||||||||||||

|

Total increase (decrease) from investment operations |

(4.28 |

) |

3.49 |

5.45 |

(3.53 |

) |

1.53 |

||||||||||||||||

|

Distributions to shareholders from: |

|||||||||||||||||||||||

|

Net investment income |

(0.11 |

) |

(0.61 |

) |

(0.01 |

) |

(0.17 |

) |

(0.15 |

)(2) |

|||||||||||||

|

Net realized capital gains |

(1.72 |

) |

(1.45 |

) |

(1.77 |

) |

(1.65 |

) |

(1.79 |

)(2) |

|||||||||||||

|

Total distributions |

(1.83 |

) |

(2.06 |

) |

(1.78 |

) |

(1.82 |

) |

(1.94 |

) |

|||||||||||||

|

Increase resulting from shares repurchased (1) |

— |

— |

0.04 |

0.06 |

0.01 |

||||||||||||||||||

|

Net asset value per share, end of year |

$ |

19.36 |

$ |

25.47 |

$ |

24.04 |

$ |

20.33 |

$ |

25.62 |

|||||||||||||

|

Per share market value, end of year |

$ |

17.28 |

$ |

25.57 |

$ |

20.62 |

$ |

18.34 |

$ |

23.15 |

|||||||||||||

|

Total investment return at market value |

(26.01 |

%) |

34.64 |

% |

23.38 |

% |

(12.88 |

%) |

0.05 |

% |

|||||||||||||

|

Total investment return at net asset value |

(16.78 |

%) |

15.03 |

% |

29.77 |

% |

(12.74 |

%) |

7.37 |

% |

|||||||||||||

|

RATIOS |

|||||||||||||||||||||||

|

Net investment loss to average net assets |

(0.36 |

%) |

(0.54 |

%) |

(0.20 |

%) |

(0.31 |

%) |

(0.41 |

%) |

|||||||||||||

|

Expenses to average net assets |

1.19 |

% |

1.11 |

% |

1.10 |

% |

1.12 |

% |

1.08 |

% |

|||||||||||||

|

SUPPLEMENTAL DATA |

|||||||||||||||||||||||

|

Net assets at end of year (in millions) |

$ |

917 |

$ |

1,157 |

$ |

1,055 |

$ |

871 |

$ |

1,082 |

|||||||||||||

|

Portfolio turnover rate |

41.21 |

% |

69.19 |

% |

52.44 |

% |

47.65 |

% |

45.75 |

% |

|||||||||||||

(1) Computed using average shares outstanding.

(2) Amount previously presented incorrectly as solely distributions from net realized capital gains has been revised to reflect the proper classification.

The accompanying notes are an integral part of these financial statements.

20

TEKLA HEALTHCARE INVESTORS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(1) Organization and Significant Accounting Policies

Tekla Healthcare Investors (the Fund) is a Massachusetts business trust formed on October 31, 1986 and registered under the Investment Company Act of 1940 as a non-diversified closed-end management investment company. The Fund commenced operations on April 22, 1987. The Fund's investment objective is long-term capital appreciation through investment in U.S. and foreign companies in the healthcare industry. The Fund invests primarily in securities of public and private companies that are believed by the Fund's Investment Adviser, Tekla Capital Management LLC (the Adviser), to have significant potential for above-average growth. The Fund may invest up to 20% of its net assets in securities of foreign issuers, expected to be located primarily in Western Europe, Canada and Japan, and securities of U.S. issuers that are traded primarily in foreign markets.

The preparation of these financial statements requires the use of certain estimates by management in determining the Fund's assets, liabilities, revenues and expenses. Actual results could differ from these estimates and such differences could be material. The following is a summary of significant accounting policies followed by the Fund, which are in conformity with accounting principles generally accepted in the United States of America (GAAP). The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board Accounting Standards Codification 946. Events or transactions occurring after September 30, 2022, through the date that the financial statements were issued, have been evaluated in the preparation of these financial statements.

The market value of the Fund's investments will move up and down, sometimes rapidly and unpredictably, based upon political, regulatory, market, economic, and social conditions, as well as developments that impact specific economic sectors, industries, or segments of the market, including conditions that directly relate to the issuers of the Fund's investments, such as management performance, financial condition, and demand for the issuers' goods and services. The Fund is subject to the risk that geopolitical events will adversely affect global economies and markets. War, terrorism, and related geopolitical events have led, and in the future may lead, to increased short-term market volatility and may have adverse long-term effects on global economies and markets. Likewise, natural and environmental disasters and epidemics or pandemics may be highly disruptive to economies and markets. This means that the Fund may lose money on its investment due to unpredictable drops in a security's value or

21

TEKLA HEALTHCARE INVESTORS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(continued)

periods of below-average performance in a given security or in the securities market as a whole.

Investment Valuation

Shares of publicly traded companies listed on national securities exchanges or trading in the over-the-counter market are typically valued at the last sale price, as of the close of trading, generally 4 p.m., Eastern Time. The Board of Trustees of the Fund (the Trustees) has established and approved fair valuation policies and procedures with respect to securities for which quoted prices may not be available or which do not reflect fair value. Convertible, corporate and government bonds are valued using a third-party pricing service. Convertible bonds are valued using this pricing service only on days when there is no sale reported. Restricted securities of companies that are publicly traded are typically valued based on the closing market quote on the valuation date adjusted for the impact of the restriction as determined in good faith by the Adviser also using fair valuation policies and procedures approved by the Trustees described below. Non-exchange traded warrants of publicly traded companies are generally valued using the Black-Scholes model, which incorporates both observable and unobservable inputs. Short-term investments with a maturity of 60 days or less are generally valued at amortized cost, which approximates fair value.

Convertible preferred shares, warrants or convertible note interests in private companies, milestone interests and other restricted securities, as well as shares of publicly traded companies for which market quotations are not readily available, such as stocks for which trading has been halted or for which there are no current day sales, or which do not reflect fair value, are typically valued in good faith, based upon the recommendations made by the Adviser pursuant to fair valuation policies and procedures approved by the Trustees.

The Adviser has a Valuation Sub-Committee comprised of senior management which reports to the Valuation Committee of the Board at least quarterly. Each fair value determination is based on a consideration of relevant factors, including both observable and unobservable inputs. Observable and unobservable inputs may include (i) the existence of any contractual restrictions on the disposition of securities; (ii) information obtained from the company, which may include an analysis of the company's financial statements, products, intended markets or technologies; (iii) the price of the same or similar security negotiated at arm's length in an issuer's completed subsequent round of financing; (iv) the price and extent of public trading in similar securities of

22

TEKLA HEALTHCARE INVESTORS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(continued)

the issuer or of comparable companies; or (v) a probability and time value adjusted analysis of contractual terms. Where available and appropriate, multiple valuation methodologies are applied to confirm fair value. Significant unobservable inputs identified by the Adviser are often used in the fair value determination. A significant change in any of these inputs may result in a significant change in the fair value measurement. Due to the uncertainty inherent in the valuation process, such estimates of fair value may differ significantly from the values that would have been used had a ready market for the investments existed, and differences could be material. Additionally, changes in the market environment and other events that may occur over the life of the investments may cause the gains or losses ultimately realized on these investments to be different from the valuations used at the date of these financial statements.

Milestone Interests

The Fund holds financial instruments which reflect the current value of future milestone payments the Fund may receive as a result of contractual obligations from other parties. The value of such payments are adjusted to reflect the estimated risk based on the relative uncertainty of both the timing and the achievement of individual milestones. A risk to the Fund is that the milestones will not be achieved and no payment will be received by the Fund. The milestone interests were received as part of the proceeds from the sale of seven private companies. Any payments received are treated as a reduction of the cost basis of the milestone interest with payments received in excess of the cost basis treated as a realized gain. The contractual obligations with respect to the milestone interests provide for payments at various stages of the development of Afferent, Ethismos Research, Neurovance, Impact Biomedicines, Therachon, Rainier Therapeutics, Inc., and Therox's principal product candidate as of the date of the sale.

The following is a summary of the impact of the milestone interests on the financial statements as of and for the year ended September 30, 2022:

|

Statement of Assets and Liabilities, Milestone interests, at value |

$ |

8,870,499 |

|||||

|

Statement of Assets and Liabilities, Total distributable earnings |

$ |

910,109 |

|||||

|

Statement of Operations, Change in unrealized appreciation (depreciation) on Milestone interests |

($ |

2,077,996 |

) |

||||

Options on Securities

An option contract is a contract in which the writer (seller) of the option grants the buyer of the option, upon payment of a premium, the right to purchase

23

TEKLA HEALTHCARE INVESTORS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(continued)

from (call option) or sell to (put option) the writer a designated instrument at a specified price within a specified period of time. Certain options, including options on indices, will require cash settlement by the Fund if the option is exercised.

The Fund's obligation under an exchange traded written option or investment in an exchange traded purchased option is valued at the last sale price or in the absence of a sale, the mean between the closing bid and asked prices. Gain or loss is recognized when the option contract expires, is exercised or is closed.

If the Fund writes a covered call option, the Fund foregoes, in exchange for the premium, the opportunity to profit during the option period from an increase in the market value of the underlying security above the exercise price. If the Fund writes a put option it accepts the risk of a decline in the market value of the underlying security below the exercise price. Over-the-counter options have the risk of the potential inability of counterparties to meet the terms of their contracts. The Fund's maximum exposure to purchased options is limited to the premium initially paid. In addition, certain risks may arise upon entering into option contracts including the risk that an illiquid secondary market will limit the Fund's ability to close out an option contract prior to the expiration date and that a change in the value of the option contract may not correlate exactly with changes in the value of the securities or currencies hedged.

All options on securities and securities indices written by the Fund are required to be covered. When the Fund writes a call option, this means that during the life of the option the Fund may own or have the contractual right to acquire the securities subject to the option or may maintain with the Fund's custodian in a segregated account appropriate liquid securities in an amount at least equal to the market value of the securities underlying the option. When the Fund writes a put option, this means that the Fund will maintain with the Fund's custodian in a segregated account appropriate liquid securities in an amount at least equal to the exercise price of the option.

The average number of outstanding put options purchased and call options written for the year ended September 30, 2022 were 363 and 363, respectively.

24

TEKLA HEALTHCARE INVESTORS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(continued)

|

Derivatives not accounted for as hedging instruments under ASC 815 |

Statement of Assets and Liabilities Location |

Statement of Operations Location |

|||||||||||||||||||||

|

Equity Contracts |

Assets, Investments, at value |

$ |

— |

Net realized gain on investments |

($ |

95,213 |

) |

||||||||||||||||

|

|

|

|

Change in unrealized appreciation (depreciation) on investments |

$ |

1,465,848 |

||||||||||||||||||

|

|

Liabilities, options written, at value |

$ |

— |

Net realized gain (loss) on closed or expired option contracts written |

$ |

7,619,045 |

|||||||||||||||||

|

|

|

|

Change in unrealized appreciation (depreciation) on option contracts written |

($ |

4,349,159 |

) |

|||||||||||||||||

Other Assets

Other assets in the Statement of Assets and Liabilities consists of amounts due to the Fund at various times in the future in connection with the sale of investments in one private company.

Investment Transactions and Income

Investment transactions are recorded on a trade date basis. Gains and losses from sales of investments are recorded using the "identified cost" method. Interest income is recorded on the accrual basis, adjusted for amortization of premiums and accretion of discounts. Dividend income is recorded on the ex-dividend date, less any foreign taxes withheld. Upon notification from issuers, some of the dividend income received may be redesignated as a reduction of cost of the related investment if it represents a return of capital.

The aggregate cost of purchases and proceeds from sales of investment securities (other than short-term investments) for the year ended September 30, 2022 totaled $404,629,825 and $484,868,414, respectively.

Securities Lending

The Fund may lend its securities to approved borrowers to earn additional income. The Fund receives cash collateral from the borrower and the initial collateral received by the fund is required to have a value of at least 102% of the current value of the loaned securities traded on U.S. exchanges, and a value of at least 105% for all other securities. The Fund will invest its cash collateral in State Street Institutional U.S. Government Money Market Fund (SAHXX), which is registered with the Securities and Exchange Commission (SEC) as an investment company. SAHXX invests substantially all of its assets in the State Street U.S. Government Money Market Portfolio. The Fund will receive the benefit of

25

TEKLA HEALTHCARE INVESTORS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(continued)

any gains and bear any losses generated by SAHXX with respect to the cash collateral.

The Fund has the right to recall loaned securities on demand. If a borrower fails to return loaned securities when due, then the lending agent is responsible and indemnifies the Fund for the lent securities. The lending agent uses the collateral received from the borrower to purchase replacement securities of the same issue, type, class and series of the loaned securities. If the value of the collateral is less than the purchase cost of replacement securities, the lending agent is responsible for satisfying the shortfall but only to the extent that the shortfall is not due to any decrease in the value of SAHXX.

Although the risk of loss on securities lent is mitigated by receiving collateral from the borrower and through lending agent indemnification, the Fund could experience a delay in recovering securities or could experience a lower than expected return if the borrower fails to return the securities on a timely basis. The Fund receives compensation for lending its securities by retaining a portion of the return on the investment of the collateral and compensation from fees earned from borrowers of the securities. Securities lending income received by the Fund is net of fees retained by the securities lending agent. Net income received from SAHXX is a component of securities lending income as recorded on the Statement of Operations.

Obligations to repay collateral received by the Fund are shown on the Statement of Assets and Liabilities as Payable upon return of securities loaned and are secured by the loaned securities. As of September 30, 2022, the Fund loaned securities valued at $8,253,577 and received $8,495,653 of cash collateral.

Repurchase Agreements

In managing short-term investments the Fund may from time to time enter into transactions in repurchase agreements. In a repurchase agreement, the Fund's custodian takes possession of the underlying collateral securities from the counterparty, the market value of which is at least equal to the principal, including accrued interest, of the repurchase transaction at all times. In the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral by the Fund may be delayed. The Fund may enter into repurchase transactions with any broker, dealer, registered clearing agency or bank. Repurchase agreement transactions are not counted for purposes of the limitations imposed on the Fund's investment in debt securities.

26

TEKLA HEALTHCARE INVESTORS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(continued)

Distribution Policy

Pursuant to a Securities and Exchange Commission exemptive order, the Fund may make periodic distributions that include capital gains as frequently as 12 times in any one taxable year in respect of its common shares, and the Fund has implemented a managed distribution policy (the Policy) providing for quarterly distributions at a rate set by the Trustees. Under the current Policy, the Fund intends to make quarterly distributions at a rate of 2% of the Fund's net assets to shareholders of record. The Fund intends to use net realized capital gains when making quarterly distributions, if available, but the Policy would result in a return of capital to shareholders if the amount of the distribution exceeds the Fund's net investment income and realized capital gains. If taxable income and net long-term realized gains exceed the amount required to be distributed under the Policy, the Fund will at a minimum make distributions necessary to comply with the requirements of the Internal Revenue Code. The Policy has been established by the Trustees and may be changed by them without shareholder approval. The Trustees regularly review the Policy and the frequency and rate of distribution considering the purpose and effect of the Policy, the financial market environment, and the Fund's income, capital gains and capital available to pay distributions.

The Fund's policy is to declare quarterly distributions in stock. The distributions are automatically paid in newly-issued full shares of the Fund unless otherwise instructed by the shareholder. Fractional shares will generally be settled in cash, except for registered shareholders with book entry accounts of the Fund's transfer agent who will have whole and fractional shares added to their accounts. The Fund's transfer agent delivers an election card and instructions to each registered shareholder in connection with each distribution. The number of shares issued will be determined by dividing the dollar amount of the distribution by the lower of net asset value or market price on the pricing date. If a shareholder elects to receive a distribution in cash, rather than in shares, the shareholder's relative ownership in the Fund will be reduced. The shares reinvested will be valued at the lower of the net asset value or market price on the pricing date. Distributions in stock will not relieve shareholders of any federal, state or local income taxes that may be payable on such distributions. Additional distributions, if any, made to satisfy requirements of the Internal Revenue Code may be paid in stock, as described above, or in cash.

27

TEKLA HEALTHCARE INVESTORS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(continued)

Share Repurchase Program

In March 2022, the Trustees approved the renewal of the repurchase program to allow the Fund to repurchase up to 12% of its outstanding shares in the open market for a one-year period ending July 14, 2023. Prior to this renewal, in March 2021, the Trustees approved the renewal of the share repurchase program to allow the Fund to repurchase up to 12% of its outstanding shares for a one-year period ending July 14, 2022. The share repurchase program is intended to enhance shareholder value and potentially reduce the discount between the market price of the Fund's shares and the Fund's net asset value.

During the years ended September 30, 2022 and September 30, 2021, the Fund did not repurchase any shares through the repurchase program.

Federal Taxes

It is the Fund's policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute to its shareholders substantially all of its taxable income and its net realized capital gains, if any. Therefore, no Federal income or excise tax provision is required.

As of September 30, 2022, the Fund had no uncertain tax positions that would require financial statement recognition or disclosure. The Fund's federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distributions

The Fund records all distributions to shareholders on the ex-dividend date. Such distributions are determined in conformity with income tax regulations, which may differ from GAAP. These differences include temporary and permanent differences from losses on wash sale transactions, passive foreign investment companies transactions, installment sale adjustments, foreign currency gains and losses, book to tax difference due to merger, partnership basis adjustment and net operating losses. Reclassifications are made to the Fund's capital accounts to reflect income and gains available for distribution under income tax regulations. At September 30, 2022, the Fund reclassified ($1,366,783) from accumulated net realized loss on investment and $1,625,298 to undistributed net investment income, with a net impact of ($258,515) to paid in capital, for current period book/tax differences.

28

TEKLA HEALTHCARE INVESTORS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2022

(continued)

The tax basis components of distributable earnings and the tax cost as of September 30, 2022 were as follows:

|

Cost of Investments for tax purposes |

$ |

884,560,040 |

|||||

|

Gross tax unrealized appreciation |

$ |

173,732,458 |

|||||

|

Gross tax unrealized depreciation |

($ |

134,934,783 |

) |

||||

|