Strategic and Operational

Overview

February 8, 2017

Exhibit 99.1

2

Safe Harbor Statement

This presentation contains several “forward-looking statements.” Forward-looking statements are those that use words

such as “believe,” “expect,” “intend,” “plan,” “may,” “likely,” “should,” “estimate,” “continue,” “future” or "anticipate" and

other comparable expressions. These words indicate future events and trends. Forward-looking statements are our

current views with respect to future events and financial performance. These forward-looking statements are subject to

many assumptions, risks and uncertainties that could cause actual results to differ significantly from historical results or

from those anticipated by us. The most significant risks are detailed from time to time in our filings and reports with the

Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31,

2016. Such risks include - but are not limited to - GM’s ability to sell new vehicles that we finance in the markets we

serve in North America, Latin America, China and Europe, particularly the United Kingdom where automobile sales may

be negatively impacted due to the passage of the referendum to discontinue its membership in the European Union; the

viability of GM-franchised dealers that are commercial loan customers; the availability and cost of sources of financing;

the level of net charge-offs, delinquencies and prepayments on the loans and leases we originate; the effect,

interpretation or application of new or existing laws, regulations, court decisions and accounting pronouncements; the

prices at which used cars are sold in the wholesale auction markets; vehicle return rates and the residual value

performance on vehicles we lease; interest rate and currency exchange rate fluctuations; competition; our ability to

manage risks related to security breaches and other disruptions to our networks and systems; changes in general

economic and business conditions; and changes in business strategy, including expansion of product lines and credit risk

appetite, acquisitions and divestitures. If one or more of these risks or uncertainties materialize, or if underlying

assumptions prove incorrect, actual events or results may vary materially from those expected, estimated or projected. It

is advisable not to place undue reliance on our forward-looking statements. We undertake no obligation to, and do not,

publicly update or revise any forward-looking statements, except as required by federal securities laws, whether as a

result of new information, future events or otherwise.

3

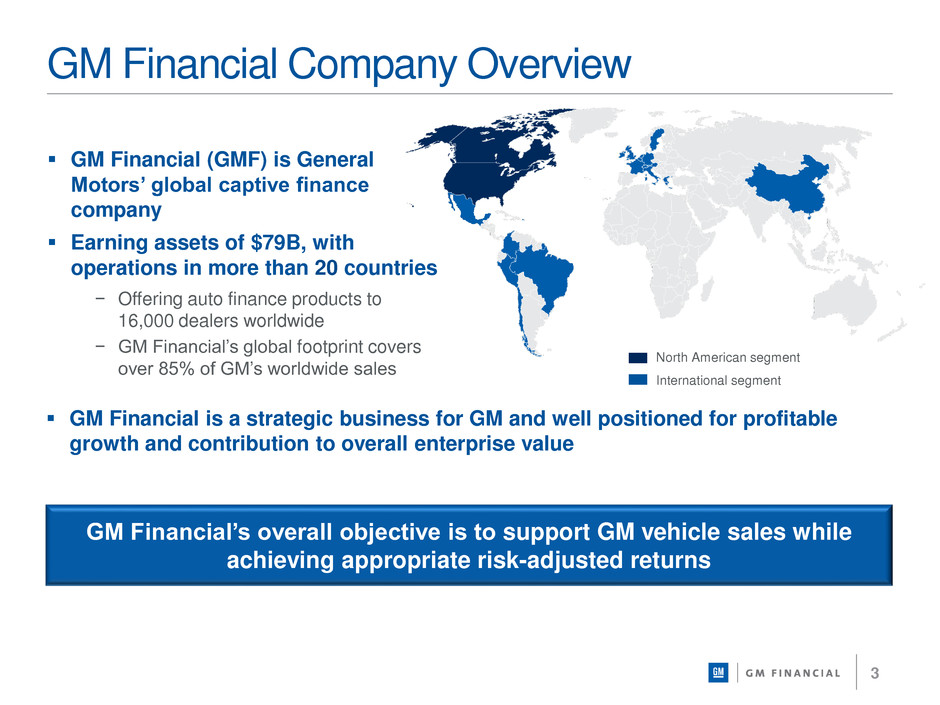

GM Financial Company Overview

GM Financial’s overall objective is to support GM vehicle sales while

achieving appropriate risk-adjusted returns

GM Financial (GMF) is General

Motors’ global captive finance

company

Earning assets of $79B, with

operations in more than 20 countries

− Offering auto finance products to

16,000 dealers worldwide

− GM Financial’s global footprint covers

over 85% of GM’s worldwide sales

GM Financial is a strategic business for GM and well positioned for profitable

growth and contribution to overall enterprise value

North American segment

International segment

4

General Motors Strategic Priorities

GM Financial strategic value

− Drive vehicle sales

Offer attractive products and services with efficient delivery

− Enhance customer experience and loyalty

Integrate with GM initiatives to enrich the customer experience and increase retention

− Support GM customers and dealers

Provide financing support across economic cycles

− Contribute to enterprise profitability

Pre-tax income expected to double from 2014 when full captive penetration levels are achieved

5

GM Financial Evolution

Full captive evolution substantially complete; GMF now in captive expansion phase

China

Acquisition

GM Financial

Acquisition

2010 2015

U.S.

Floorplan

Launch

2011 2012 2014

NA Lease

Launch

2013

Canada Lease

Acquisition of

FinancialLinx

Canada Sub-

Prime Launch

Canada

Floorplan

Launch

International

Acquisition

U.S. Prime

Loan

Launch

Commercial

Lease

Launch

GM Lease

Exclusivity

U.S. Prime

Loan

Expansion

Commercial

Loan Launch

2016

U.S. Lease

Share

Expansion

GM Loan

Subvention

Exclusivity

Captive

Expansion

Increase share of

prime loan in NA

Strategically grow

NA floorplan

Expand Customer

Relationship

Management

Maintain IO’s

dominant GM share;

potential

geographic/product

expansion

6

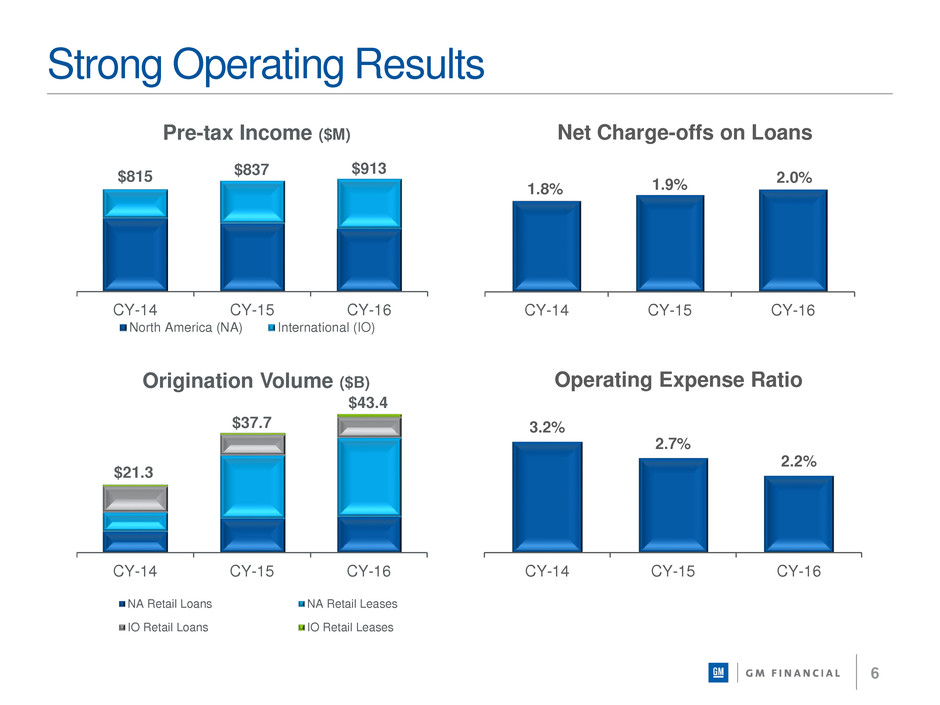

Strong Operating Results

$815 $837

$913

CY-14 CY-15 CY-16

Pre-tax Income ($M)

North America (NA) International (IO)

$21.3

$37.7

$43.4

CY-14 CY-15 CY-16

Origination Volume ($B)

NA Retail Loans NA Retail Leases

IO Retail Loans IO Retail Leases

3.2%

2.7%

2.2%

CY-14 CY-15 CY-16

Operating Expense Ratio

1.8% 1.9%

2.0%

CY-14 CY-15 CY-16

Net Charge-offs on Loans

7

Solid Balance Sheet

Tangible net worth is net of accumulated losses on foreign exchange translation

‒ Accumulated other comprehensive loss related to FX of $1.2B at December 31, 2016

Year-over-year leverage increase consistent with earning asset expansion in higher credit quality

tiers and within the applicable level of the Support Agreement

1. Calculated consistent with GM/GMF Support Agreement, filed on Form 8-K with the Securities and Exchange Commission on

September 4, 2014.

$40.8

$57.7

$78.6

Dec-14 Dec-15 Dec-16

Ending Earning Assets ($B)

Retail Loans Commercial Loans Retail Leases

Dec-14 Dec-15 Dec-16

Liquidity ($B)

Borrowing capacity Cash

$9.3

$14.7 $14.2

6.5x

8.3x

10.4x

Dec-14 Dec-15 Dec-16

Leverage Ratio1

$6.1

$6.9

$7.5

Dec-14 Dec-15 Dec-16

Tangible Net Worth ($B)

8

Earning Assets Composition

Earning assets evolving to more

captive-like mix with over 85% of

earning assets related to financing GM

new vehicles

Portfolio shifting to predominantly

higher credit quality assets

− Sub-prime loan portfolio (<620 FICO)

represented approximately 13% of ending

earning assets at December 31, 2016

Earning asset expansion in North

America aligns with GM’s geographic

sales footprint

Lease 13%

Lease 13%

$78.6B

At December 31, 2016

Earning assets composition is shifting towards full captive state

Latin America

Commercial

2%

Latin America

Retail 6%

Europe

Commercial

4%

Europe

Retail 8%

North America

Commercial

8%

North America

Lease 44%

North America

Retail 28%

9

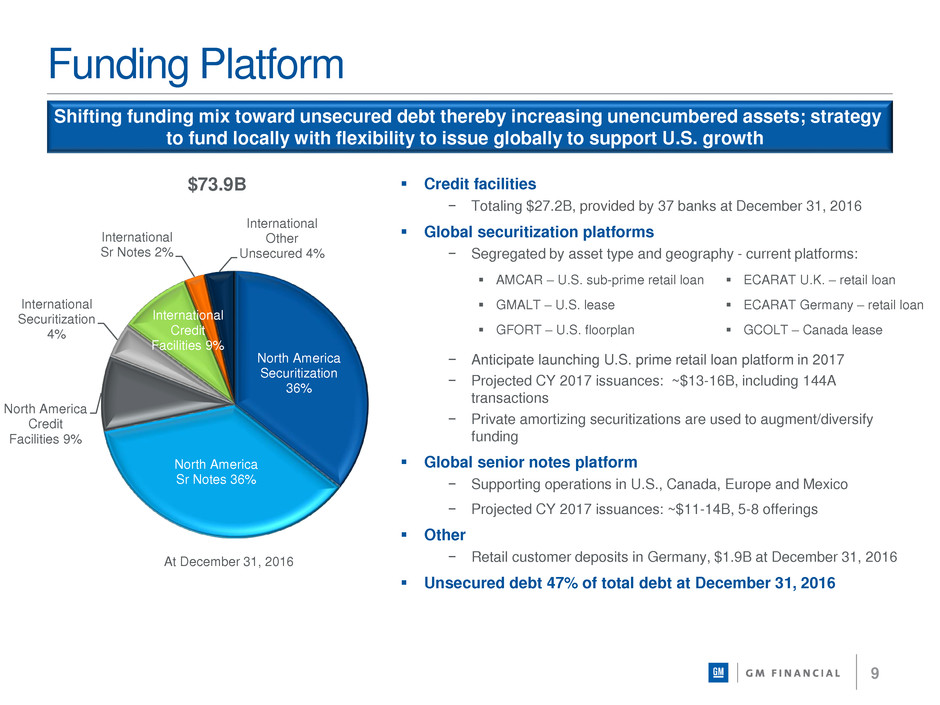

AMCAR – U.S. sub-prime retail loan ECARAT U.K. – retail loan

GMALT – U.S. lease ECARAT Germany – retail loan

GFORT – U.S. floorplan GCOLT – Canada lease

Funding Platform

Credit facilities

− Totaling $27.2B, provided by 37 banks at December 31, 2016

Global securitization platforms

− Segregated by asset type and geography - current platforms:

− Anticipate launching U.S. prime retail loan platform in 2017

− Projected CY 2017 issuances: ~$13-16B, including 144A

transactions

− Private amortizing securitizations are used to augment/diversify

funding

Global senior notes platform

− Supporting operations in U.S., Canada, Europe and Mexico

− Projected CY 2017 issuances: ~$11-14B, 5-8 offerings

Other

− Retail customer deposits in Germany, $1.9B at December 31, 2016

Unsecured debt 47% of total debt at December 31, 2016

At December 31, 2016

$73.9B

Shifting funding mix toward unsecured debt thereby increasing unencumbered assets; strategy

to fund locally with flexibility to issue globally to support U.S. growth

North America

Securitization

36%

North America

Sr Notes 36%

North America

Credit

Facilities 9%

International

Securitization

4%

International

Credit

Facilities 9%

International

Sr Notes 2%

International

Other

Unsecured 4%

10

1. Measured at each calendar quarter

Financial Support from GM

Support Agreement in place between GM and GMF

‒ Agreement solidifies GMF’s position as a core component of GM’s business and strengthens GMF’s capability

to support GM’s strategy

‒ Five-year agreement that automatically renews annually in September

Requires 100% ownership of GMF by GM as long as GMF has unsecured debt securities

outstanding

Solidifies GMF’s liquidity position

‒ Junior subordinated unsecured credit line of $1.0B from GM; renews with Support Agreement renewal

‒ Maintains GMF’s access to GM’s revolvers with sublimit availability of $4.0B

Establishes leverage limits and provides funding support to GMF if needed

‒ Leverage limits (Net Earning Assets divided by Adjusted Equity, which includes amounts outstanding on the

Junior Subordinated Revolving Credit Facility, if any) above the thresholds triggers funding request from GMF

to GM:

‒ In the December 2016 quarter, GMF repaid $0.4B borrowed on the Junior Subordinated Revolving Credit

Facility with GM, which was drawn to support the leverage ratio in the September 2016 quarter

‒ With net earning assets of $77.7B at December 31, 2016, the applicable Support Agreement ratio increased to

11.5x

Additional support evidenced by GM’s $6.4B investment to date in GMF

GMF’s Net Earning Assets1 Leverage1

Less than $50B 8.0:1.0

Greater than or equal to $50B but less than $75B 9.5:1.0

Greater than or equal to $75B but less than $100B 11.5:1.0

Greater than or equal to $100B 12.0:1.0

At December 31, 2016

11

Current Ratings

GM GM Financial

Company

Rating

Bond

Rating Outlook

Company

Rating

Bond

Rating Outlook

DBRS BBB N/A Stable BBB BBB Stable

Fitch BBB- BBB- Positive BBB- BBB- Positive

Moody’s I.G. Baa3 Stable Baa3 Baa3 Stable

Standard and Poor’s BBB BBB Stable BBB BBB Stable

Committed to Investment Grade

Investment grade status achieved with all agencies, consistent with GM’s ratings

− January 2017, Standard and Poor’s and Moody’s upgrade to BBB and Baa3, respectively; outlook stable

− June 2016, Fitch changed outlook to positive

Investment grade rating critical for captive strategy execution

GM targeting performance consistent with “A” ratings criteria

12

North America

13

GM and GMF Penetration Statistics

Dec-16 Sept-16 Dec-15

GMF as a % of GM Retail Sales

U.S. 32.2% 31.8% 33.4%

Canada 18.7% 14.3% 13.1%

GMF Wholesale Dealer Penetration

U.S. 15.9% 14.8% 12.8%

Canada 12.2% 12.2% 11.7%

GM as % of GMF Retail Originations

(GM New / GMF Retail Loan and Lease)

U.S. 86.3% 87.2% 87.8%

Canada 99.3% 98.5% 97.9%

GMF penetration of GM retail sales largely dependent on level of lease and subvented loan

products in the market

U.S. wholesale dealer penetration in the December 2016 quarter continued, steady

increases both sequentially and year-over-year

14

Origination Mix by Credit Tier

Three Months Ended

(Loan and Lease Originations, $M)1 Dec-16 Dec-15

Amount Percent Amount Percent

Prime – FICO Score 680 and greater $6,471 72.7% $5,700 69.3%

Near prime – FICO Score 620 to 679 1,065 12.0% 1,048 12.7%

Sub-prime – FICO Score less than 620 1,359 15.3% 1,479 18.0%

Total loan and lease originations $8,895 100.0% $8,227 100.0%

Origination mix continuing to shift to prime credit tiers

1. For originations associated with the commercial vehicle program, FICO scores or equivalents are used in determining prime, near-prime and sub-prime classifications

15

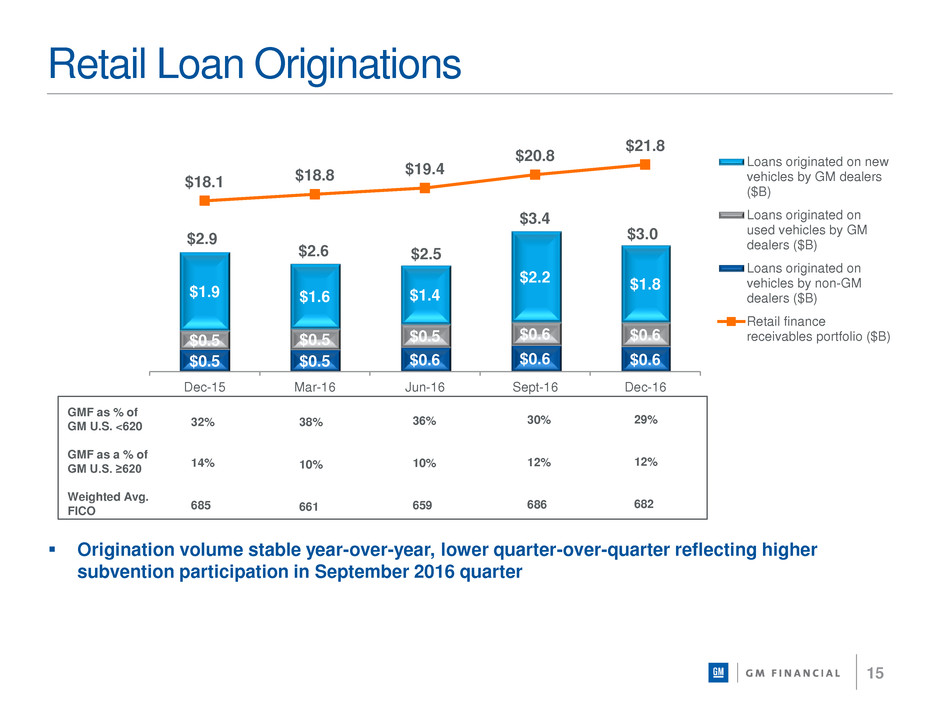

Retail Loan Originations

GMF as % of

GM U.S. <620

GMF as a % of

GM U.S. ≥620

Weighted Avg.

FICO

32%

14%

685

38%

10%

661

36%

10%

659

30%

12%

686

Origination volume stable year-over-year, lower quarter-over-quarter reflecting higher

subvention participation in September 2016 quarter

29%

12%

682

$0.5 $0.5 $0.6 $0.6 $0.6

$0.5 $0.5 $0.5 $0.6 $0.6

$1.9 $1.6 $1.4

$2.2 $1.8

$18.1 $18.8

$19.4

$20.8

$21.8

Dec-15 Mar-16 Jun-16 Sept-16 Dec-16

Loans originated on new

vehicles by GM dealers

($B)

Loans originated on

used vehicles by GM

dealers ($B)

Loans originated on

vehicles by non-GM

dealers ($B)

Retail finance

receivables portfolio ($B)

$2.6

$3.4

$2.5

$3.0 $2.9

16

Retail Loan Credit Performance

December 2016 net charge-off percentage is down compared to December 2015 due

to positive impact of mix shift to prime, partially offset by credit normalization and a

decline in recovery values

− Finance receivables with FICO scores <620 comprise 48% of the North America retail loan portfolio

at December 31, 2016, compared to 60% at December 31, 2015

Recovery rates are expected to continue trending down year-over-year in 2017

Net annualized

charge-offs

31-60 day

delinquency

61+ day

delinquency

Recovery

Rate

54% 55% 52% 50% 53%

3.0%

2.6%

2.3%

2.7% 2.8%

0.0%

2.0%

4.0%

6.0%

8.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

Dec-15 Mar-16 Jun-16 Sept-16 Dec-16

De

linqu

e

nc

y

N

et

A

n

n

ual

ized

C

harg

e

-o

ff

s

Credit Metrics

17

Lease Portfolio

GMF is GM’s exclusive subvented lease provider

Leasing provides an attractive option to consumers looking to manage their

monthly payment and enhances GM loyalty and retention

Credit performance commensurate with the predominately prime credit portfolio

Origination volume impacted by GM sales’ attributable to lease

$5.2

$6.5 $6.1 $5.9 $5.6

$0.2

$0.2

$0.3

$0.2 $0.3

$20.1

$24.4

$28.3

$31.6

$34.3

-25

-15

-5

5

15

25

35

Dec-15 Mar-16 Jun-16 Sep-16 Dec-16

Canada Lease Volume ($B)

U.S. Lease Volume ($B)

Lease Portfolio ($B)

Lease Originations

18

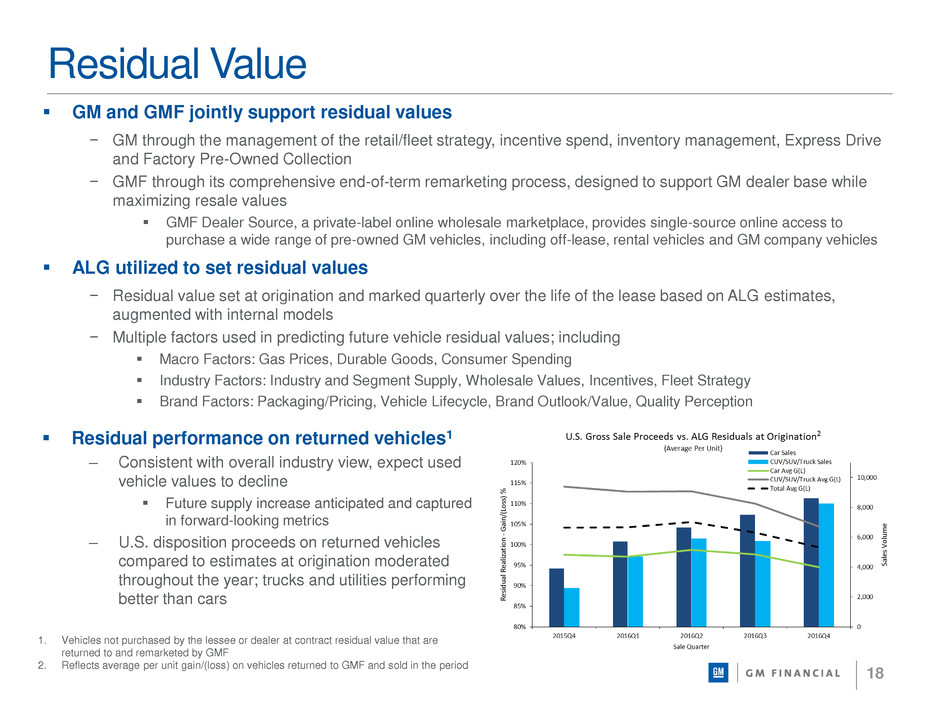

Residual Value

GM and GMF jointly support residual values

− GM through the management of the retail/fleet strategy, incentive spend, inventory management, Express Drive

and Factory Pre-Owned Collection

− GMF through its comprehensive end-of-term remarketing process, designed to support GM dealer base while

maximizing resale values

GMF Dealer Source, a private-label online wholesale marketplace, provides single-source online access to

purchase a wide range of pre-owned GM vehicles, including off-lease, rental vehicles and GM company vehicles

ALG utilized to set residual values

− Residual value set at origination and marked quarterly over the life of the lease based on ALG estimates,

augmented with internal models

− Multiple factors used in predicting future vehicle residual values; including

Macro Factors: Gas Prices, Durable Goods, Consumer Spending

Industry Factors: Industry and Segment Supply, Wholesale Values, Incentives, Fleet Strategy

Brand Factors: Packaging/Pricing, Vehicle Lifecycle, Brand Outlook/Value, Quality Perception

Residual performance on returned vehicles1

‒ Consistent with overall industry view, expect used

vehicle values to decline

Future supply increase anticipated and captured

in forward-looking metrics

‒ U.S. disposition proceeds on returned vehicles

compared to estimates at origination moderated

throughout the year; trucks and utilities performing

better than cars

1. Vehicles not purchased by the lessee or dealer at contract residual value that are

returned to and remarketed by GMF

2. Reflects average per unit gain/(loss) on vehicles returned to GMF and sold in the period

19

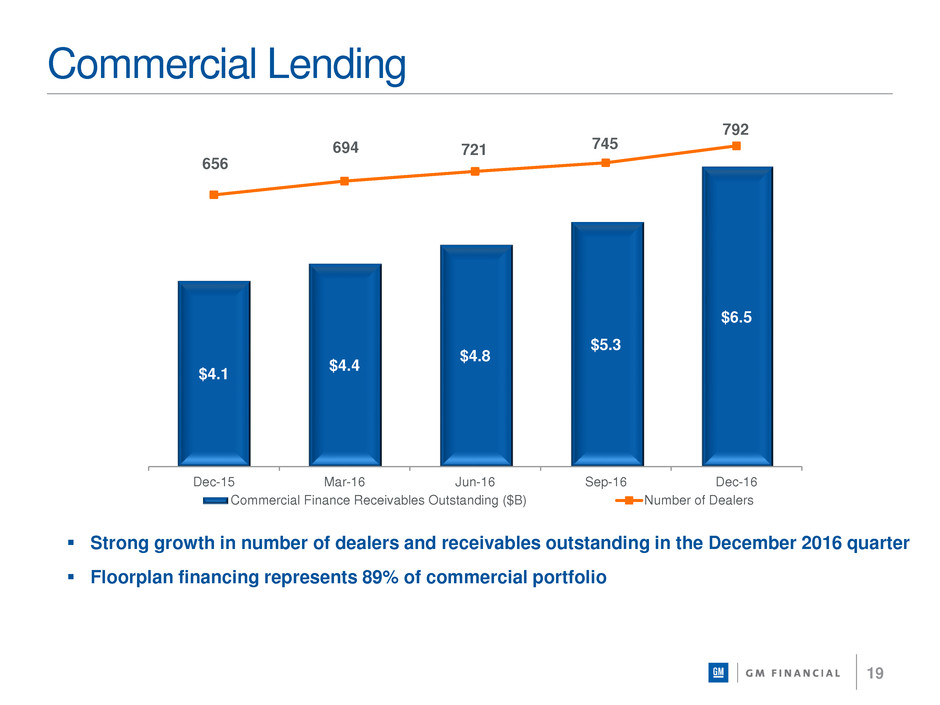

Commercial Lending

Strong growth in number of dealers and receivables outstanding in the December 2016 quarter

Floorplan financing represents 89% of commercial portfolio

$4.1

$4.4

$4.8

$5.3

$6.5

656

694 721 745

792

Dec-15 Mar-16 Jun-16 Sep-16 Dec-16

Commercial Finance Receivables Outstanding ($B) Number of Dealers

20

International Operations

21

GM and GMF Penetration Statistics

Dec-16 Sept-16 Dec-15

GMF as a % of GM Retail Sales

Europe 43.2% 43.4% 43.4%

Latin America 53.3% 60.8% 52.0%

GMF Wholesale Dealer Penetration

Europe 98.9% 99.9% 99.6%

Latin America 97.2% 95.1% 96.9%

GM as % of GMF Retail Originations

(GM New / GMF Retail Loan and Lease)

Europe 80.6% 80.7% 80.5%

Latin America 94.9% 96.0% 94.5%

Penetration levels stable in Europe, with lower quarter-over-quarter penetration in Latin

America reflecting stronger GM support programs in September 2016 quarter

22

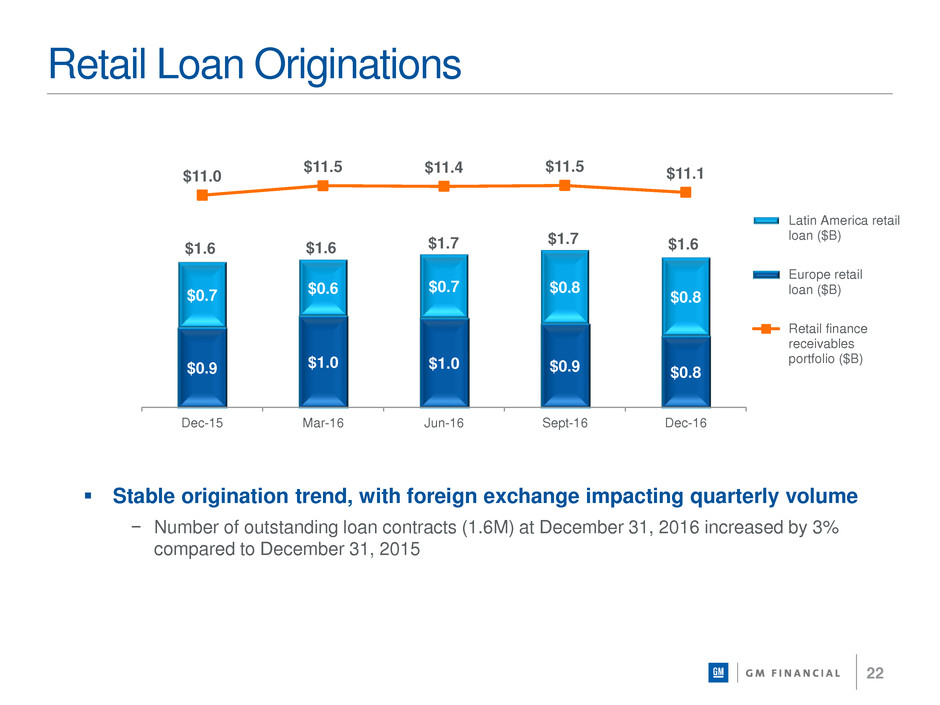

Retail Loan Originations

Stable origination trend, with foreign exchange impacting quarterly volume

− Number of outstanding loan contracts (1.6M) at December 31, 2016 increased by 3%

compared to December 31, 2015

$0.9 $1.0 $1.0 $0.9 $0.8

$0.7 $0.6

$0.7 $0.8

$0.8

$11.0

$11.5 $11.4 $11.5 $11.1

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

Dec-15 Mar-16 Jun-16 Sept-16 Dec-16

Latin America retail

loan ($B)

Europe retail

loan ($B)

Retail finance

receivables

portfolio ($B)

$1.6 $1.6 $1.7

$1.7 $1.6

23

Retail Loan Credit Performance

Credit metrics generally stable, consistent with a predominantly

prime portfolio

Net annualized

charge-offs

31-60 day

delinquency

61+ day

delinquency

0.9% 0.8% 0.9% 0.9% 1.0%

0.0%

0.2%

0.4%

0.6%

0.8%

1.0%

1.2%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

Dec-15 Mar-16 Jun-16 Sept-16 Dec-16

De

linqu

e

nc

y

Net

A

nnua

liz

e

d

Charg

e

-o

ff

s

Credit Metrics

24

Commercial Lending

At December 31, 2016, commercial finance receivables were comprised of

94% floorplan and 6% primarily real estate and dealer loans

$3.1

$3.6 $3.4 $3.2 $3.2

$1.3

$1.2 $1.2 $1.2 $1.4

2,139 2,147 2,146 2,143 2,150

1,400

1,500

1,600

1,700

1,800

1,900

2,000

2,100

2,200

2,300

Dec-15 Mar-16 Jun-16 Sep-16 Dec-16

Europe Commercial Receivables Outstanding ($B) Latin America Commercial Receivables Outstanding ($B)

$4.8

$4.6 $4.4 $4.6 $4.4

Number of Dealers

25

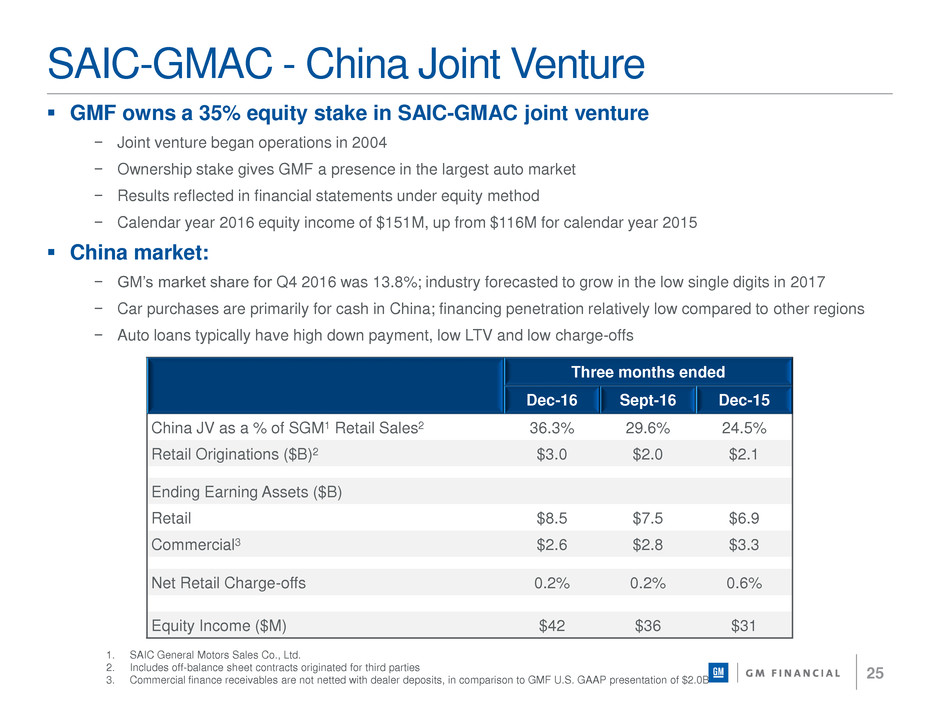

SAIC-GMAC - China Joint Venture

GMF owns a 35% equity stake in SAIC-GMAC joint venture

− Joint venture began operations in 2004

− Ownership stake gives GMF a presence in the largest auto market

− Results reflected in financial statements under equity method

− Calendar year 2016 equity income of $151M, up from $116M for calendar year 2015

China market:

− GM’s market share for Q4 2016 was 13.8%; industry forecasted to grow in the low single digits in 2017

− Car purchases are primarily for cash in China; financing penetration relatively low compared to other regions

− Auto loans typically have high down payment, low LTV and low charge-offs

Three months ended

Dec-16 Sept-16 Dec-15

China JV as a % of SGM1 Retail Sales2 36.3% 29.6% 24.5%

Retail Originations ($B)2 $3.0 $2.0 $2.1

Ending Earning Assets ($B)

Retail $8.5 $7.5 $6.9

Commercial3 $2.6 $2.8 $3.3

Net Retail Charge-offs 0.2% 0.2% 0.6%

Equity Income ($M) $42 $36 $31

1. SAIC General Motors Sales Co., Ltd.

2. Includes off-balance sheet contracts originated for third parties

3. Commercial finance receivables are not netted with dealer deposits, in comparison to GMF U.S. GAAP presentation of $2.0B

26

GM Financial Key Strengths

Strategic interdependence with GM

− GM priority to grow GM Financial

− Expansion of captive presence in North America; captive penetration levels in International

Operations

Full suite of auto finance solutions offered in served markets with incremental

growth opportunities

− Operations covering over 85% of GM’s worldwide sales

− Additional product offerings and enhancements and geographic expansion

Solid global funding platform supported by investment grade ratings

− Committed bank lines, well-established global ABS and unsecured debt issuance programs

− Along with GM, committed to running the business consistent with “A” ratings criteria

Strong financial performance

− Solid balance sheet supporting originations growth

− Liquidity of $14.2B at December 31, 2016

− Earned $913M in pre-tax income in CY 2016; expect continued earnings growth in CY 2017

with expansion of captive presence in North America and overall growth of portfolio

Experienced and seasoned management team operating across business and

economic cycles

For more information, visit

gmfinancial.com