UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

Form 10-K |

[x] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

THE PROCTER & GAMBLE COMPANY |

One Procter & Gamble Plaza, Cincinnati, Ohio 45202 |

Telephone (513) 983-1100 |

IRS Employer Identification No. 31-0411980 |

State of Incorporation: Ohio |

Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Stock, without Par Value | PG | New York Stock Exchange |

4.125% EUR notes due December 2020 | PG20A | New York Stock Exchange |

0.275% Notes due 2020 | PG20 | New York Stock Exchange |

2.000% Notes due 2021 | PG21 | New York Stock Exchange |

2.000% Notes due 2022 | PG22B | New York Stock Exchange |

1.125% Notes due 2023 | PG23A | New York Stock Exchange |

0.500% Notes due 2024 | PG24A | New York Stock Exchange |

0.625% Notes due 2024 | PG24B | New York Stock Exchange |

1.375% Notes due 2025 | PG25 | New York Stock Exchange |

4.875% EUR notes due May 2027 | PG27A | New York Stock Exchange |

1.200% Notes due 2028 | PG28 | New York Stock Exchange |

1.250% Notes due 2029 | PG29B | New York Stock Exchange |

1.800% Notes due 2029 | PG29A | New York Stock Exchange |

6.250% GBP notes due January 2030 | PG30 | New York Stock Exchange |

5.250% GBP notes due January 2033 | PG33 | New York Stock Exchange |

1.875% Notes due 2038 | PG38 | New York Stock Exchange |

Large accelerated filer | þ | Accelerated filer | ¨ | |||||

Non-accelerated filer | ¨ | (Do not check if smaller reporting company) | ||||||

Smaller reporting company | ¨ | |||||||

Emerging growth company | ¨ | |||||||

FORM 10-K TABLE OF CONTENTS | Page | |||

PART I | Item 1. | |||

Item 1A. | ||||

Item 1B. | ||||

Item 2. | ||||

Item 3. | ||||

Item 4. | ||||

PART II | Item 5. | |||

Item 6. | ||||

Item 7. | ||||

Item 7A. | ||||

Item 8. | ||||

Item 9. | ||||

Item 9A. | ||||

Item 9B. | ||||

PART III | Item 10. | |||

Item 11. | ||||

Item 12. | ||||

Item 13. | ||||

Item 14. | ||||

PART IV | Item 15. | |||

Item 16. | ||||

Total Number of Employees | |

2019 | 97,000 |

2018 | 92,000 |

2017 | 95,000 |

2016 | 105,000 |

2015 | 110,000 |

2014 | 118,000 |

• | ordering and managing materials from suppliers; |

• | converting materials to finished products; |

• | shipping products to customers; |

• | marketing and selling products to consumers; |

• | collecting, transferring, storing and/or processing customer, consumer, employee, vendor, investor, and other stakeholder information and personal data, including such data from persons covered by an expanding landscape of privacy and data regulations, such as citizens of the European Union who are covered by the General Data Protection Regulation (“GDPR”); |

• | summarizing and reporting results of operations, including financial reporting; |

• | managing our banking and other cash liquidity systems and platforms; |

• | hosting, processing and sharing, as appropriate, confidential and proprietary research, business plans and financial information; |

• | collaborating via an online and efficient means of global business communications; |

• | complying with regulatory, legal and tax requirements; |

• | providing data security; and |

• | handling other processes necessary to manage our business. |

Name | Position | Age | First Elected to Officer Position | |||

David S. Taylor | Chairman of the Board, President and Chief Executive Officer | 61 | 2013 | |||

Jon R. Moeller | Vice Chairman, Chief Operating Officer and Chief Financial Officer | 55 | 2009 | |||

Steven D. Bishop | Chief Executive Officer - Health Care | 55 | 2016 | |||

Mary Lynn Ferguson-McHugh | Chief Executive Officer - Family Care and P&G Ventures | 59 | 2016 | |||

Carolyn M. Tastad | Group President - North America and Chief Sales Officer | 58 | 2014 | |||

Gary A. Coombe | Chief Executive Officer - Grooming | 55 | 2014 | |||

Kathleen B. Fish | Chief Research, Development and Innovation Officer | 62 | 2014 | |||

Fama Francisco | Chief Executive Officer - Baby and Feminine Care | 51 | 2018 | |||

M. Tracey Grabowski | Chief Human Resources Officer | 51 | 2018 | |||

Shailesh Jejurikar | Chief Executive Officer - Fabric and Home Care | 52 | 2018 | |||

R. Alexandra Keith | Chief Executive Officer - Beauty | 51 | 2017 | |||

Deborah P. Majoras | Chief Legal Officer and Secretary | 55 | 2010 | |||

Marc S. Pritchard | Chief Brand Officer | 59 | 2008 | |||

Valarie L. Sheppard | Controller and Treasurer and Executive Vice President - Company Transition Leader | 55 | 2005 | |||

Period | Total Number of Shares Purchased (1) | Average Price Paid per Share (2) | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (3) | Approximate Dollar Value of Shares that May Yet Be Purchased Under Our Share Repurchase Program | ||||

4/1/2019 - 4/30/2019 | 5,739,213 | $104.54 | 5,739,213 | (3) | ||||

5/1/2019 - 5/31/2019 | 6,125,301 | 106.12 | 6,125,301 | (3) | ||||

6/1/2019 - 6/30/2019 | 4,567,568 | 109.47 | 4,567,568 | (3) | ||||

Total | 16,432,082 | $106.50 | 16,432,082 | (3) | ||||

(1) | All transactions were made in the open market with large financial institutions. This table excludes shares withheld from employees to satisfy minimum tax withholding requirements on option exercises and other equity-based transactions. The Company administers cashless exercises through an independent third party and does not repurchase stock in connection with cashless exercises. |

(2) | Average price paid per share is calculated on a settlement basis and excludes commission. |

(3) | On April 23, 2019, the Company stated that in fiscal year 2019 the Company expected to reduce outstanding shares through direct share repurchases at a value of approximately $5 billion, notwithstanding any purchases under the Company's compensation and benefit plans. The share repurchases were authorized pursuant to a resolution issued by the Company's Board of Directors and were financed through a combination of operating cash flows and issuance of long-term and short-term debt. The total value of the shares purchased under the share repurchase plan was $5.0 billion. The share repurchase plan ended on June 30, 2019. |

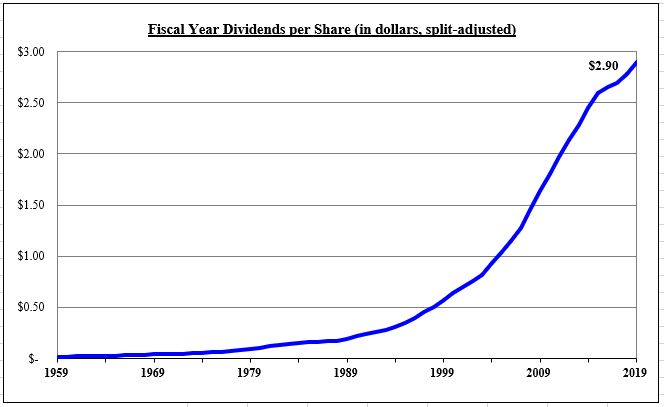

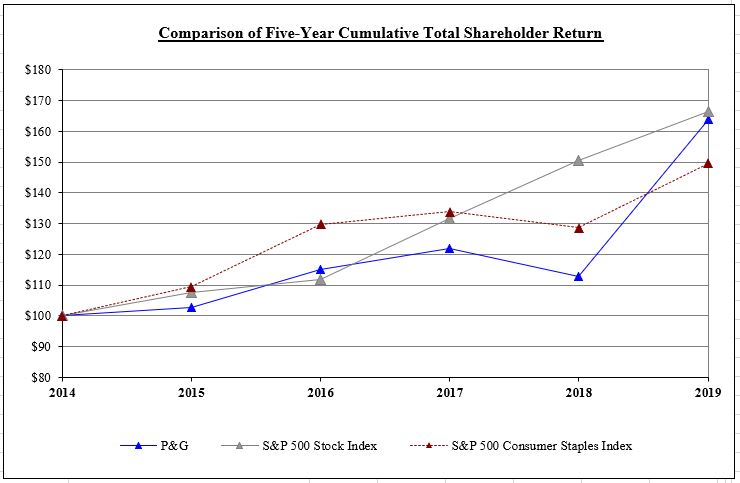

SHAREHOLDER RETURN PERFORMANCE GRAPHS

(in dollars; split-adjusted) | 1959 | 1969 | 1979 | 1989 | 1999 | 2009 | 2019 | |||||||

Dividends per share | $ | 0.02 | $ | 0.04 | $ | 0.10 | $ | 0.19 | $ | 0.57 | $ | 1.64 | $ | 2.90 |

Cumulative Value of $100 Investment, through June 30 | ||||||||||||||||||

Company Name/Index | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | ||||||||||||

P&G | $ | 100 | $ | 103 | $ | 115 | $ | 122 | $ | 113 | $ | 164 | ||||||

S&P 500 Stock Index | 100 | 107 | 112 | 132 | 151 | 166 | ||||||||||||

S&P 500 Consumer Staples Index | 100 | 109 | 130 | 134 | 129 | 150 | ||||||||||||

Amounts in millions, except per share amounts | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||||

Net sales | $ | 67,684 | $ | 66,832 | $ | 65,058 | $ | 65,299 | $ | 70,749 | $ | 74,401 | |||||||||||

Gross profit | 32,916 | 32,400 | 32,420 | 32,275 | 33,649 | 35,356 | |||||||||||||||||

Operating income | 5,487 | 13,363 | 13,766 | 13,258 | 11,056 | 13,958 | |||||||||||||||||

Net earnings from continuing operations | 3,966 | 9,861 | 10,194 | 10,027 | 8,287 | 10,658 | |||||||||||||||||

Net earnings/(loss) from discontinued operations | — | — | 5,217 | 577 | (1,143 | ) | 1,127 | ||||||||||||||||

Net earnings attributable to Procter & Gamble | $ | 3,897 | $ | 9,750 | $ | 15,326 | $ | 10,508 | $ | 7,036 | $ | 11,643 | |||||||||||

Net earnings margin from continuing operations | 5.9 | % | 14.8 | % | 15.7 | % | 15.4 | % | 11.7 | % | 14.3 | % | |||||||||||

Basic net earnings per common share: (1) | |||||||||||||||||||||||

Earnings from continuing operations | $ | 1.45 | $ | 3.75 | $ | 3.79 | $ | 3.59 | $ | 2.92 | $ | 3.78 | |||||||||||

Earnings/(loss) from discontinued operations | — | — | 2.01 | 0.21 | (0.42 | ) | 0.41 | ||||||||||||||||

Basic net earnings per common share | $ | 1.45 | $ | 3.75 | $ | 5.80 | $ | 3.80 | $ | 2.50 | $ | 4.19 | |||||||||||

Diluted net earnings per common share: (1) | |||||||||||||||||||||||

Earnings from continuing operations | $ | 1.43 | $ | 3.67 | $ | 3.69 | $ | 3.49 | $ | 2.84 | $ | 3.63 | |||||||||||

Earnings/(loss) from discontinued operations | — | — | 1.90 | 0.20 | (0.40 | ) | 0.38 | ||||||||||||||||

Diluted net earnings per common share | $ | 1.43 | $ | 3.67 | $ | 5.59 | $ | 3.69 | $ | 2.44 | $ | 4.01 | |||||||||||

Dividends per common share | $ | 2.90 | $ | 2.79 | $ | 2.70 | $ | 2.66 | $ | 2.59 | $ | 2.45 | |||||||||||

Research and development expense | $ | 1,861 | $ | 1,908 | $ | 1,874 | $ | 1,879 | $ | 1,991 | $ | 1,910 | |||||||||||

Advertising expense | 6,751 | 7,103 | 7,118 | 7,243 | 7,180 | 7,867 | |||||||||||||||||

Total assets | 115,095 | 118,310 | 120,406 | 127,136 | 129,495 | 144,266 | |||||||||||||||||

Capital expenditures | 3,347 | 3,717 | 3,384 | 3,314 | 3,736 | 3,848 | |||||||||||||||||

Long-term debt | 20,395 | 20,863 | 18,038 | 18,945 | 18,327 | 19,807 | |||||||||||||||||

Shareholders' equity | $ | 47,579 | $ | 52,883 | $ | 55,778 | $ | 57,983 | $ | 63,050 | $ | 69,976 | |||||||||||

(1) | Basic net earnings per common share and Diluted net earnings per common share are calculated based on Net earnings attributable to Procter & Gamble. |

• | Overview |

• | Summary of 2019 Results |

• | Economic Conditions and Uncertainties |

• | Results of Operations |

• | Segment Results |

• | Cash Flow, Financial Condition and Liquidity |

• | Significant Accounting Policies and Estimates |

• | Other Information |

Reportable Segments | % of Net Sales (1) | % of Net Earnings (1) | Product Categories (Sub-Categories) | Major Brands |

Beauty | 19% | 22% | Hair Care (Conditioner, Shampoo, Styling Aids, Treatments) | Head & Shoulders, Herbal Essences, Pantene, Rejoice |

Skin and Personal Care (Antiperspirant and Deodorant, Personal Cleansing, Skin Care) | Olay, Old Spice, Safeguard, SK-II, Secret | |||

Grooming | 9% | 13% | Grooming (2) (Shave Care - Female Blades & Razors, Male Blades & Razors, Pre- and Post-Shave Products, Other Shave Care; Appliances) | Braun, Gillette, Venus |

Health Care | 12% | 13% | Oral Care (Toothbrushes, Toothpaste, Other Oral Care) | Crest, Oral-B |

Personal Health Care (Gastrointestinal, Rapid Diagnostics, Respiratory, Vitamins/Minerals/Supplements, Pain Relief, Other Personal Health Care) | Metamucil, Neurobion, Pepto Bismol, Vicks | |||

Fabric & Home Care | 33% | 29% | Fabric Care (Fabric Enhancers, Laundry Additives, Laundry Detergents) | Ariel, Downy, Gain, Tide |

Home Care (Air Care, Dish Care, P&G Professional, Surface Care) | Cascade, Dawn, Fairy, Febreze, Mr. Clean, Swiffer | |||

Baby, Feminine & Family Care | 27% | 23% | Baby Care (Baby Wipes, Taped Diapers and Pants) | Luvs, Pampers |

Feminine Care (Adult Incontinence, Feminine Care) | Always, Always Discreet, Tampax | |||

Family Care (Paper Towels, Tissues, Toilet Paper) | Bounty, Charmin, Puffs | |||

(1) | Percent of Net sales and Net earnings from continuing operations for the year ended June 30, 2019 (excluding results held in Corporate). |

(2) | The Grooming product category is comprised of the Shave Care and Appliances GBUs. |

• | Organic sales growth above market growth rates in the categories and geographies in which we compete; |

• | Core EPS growth of mid-to-high single digits; and |

• | Adjusted free cash flow productivity of 90% or greater. |

Amounts in millions, except per share amounts | 2019 | 2018 | Change vs. Prior Year | |||||||

Net sales | $ | 67,684 | $ | 66,832 | 1 | % | ||||

Operating income | 5,487 | 13,363 | (59 | )% | ||||||

Net earnings | 3,966 | 9,861 | (60 | )% | ||||||

Net earnings attributable to Procter & Gamble | 3,897 | 9,750 | (60 | )% | ||||||

Diluted net earnings per common share | 1.43 | 3.67 | (61 | )% | ||||||

Core earnings per share | 4.52 | 4.22 | 7 | % | ||||||

Cash flow from operating activities | 15,242 | 14,867 | 3 | % | ||||||

• | Net sales increased 1% to $67.7 billion on a 3% increase in unit volume. Foreign exchange had a negative 4% impact on net sales. Net sales growth was driven by mid-single digit increases in Beauty and Health Care and a low single digit increase in Fabric & Home Care, partially offset by a low single digit decline in Baby, Feminine & Family Care and a mid-single digit decline in Grooming. |

◦ | Organic sales increased 5% on a 2% increase in organic volume. Organic sales increased high single digits in Beauty and Fabric & Home Care, increased mid-single digits in Health Care and increased low single digits in Grooming and Baby, Feminine & Family Care. |

◦ | Unit volumes increased 3%. Volume increased mid-single digits in Health Care and Fabric & Home Care and increased low single digits in Beauty and Baby, Feminine & Family Care. Volume decreased low single digits in Grooming. |

• | Operating income decreased $7.9 billion, or 59%, due primarily to non-cash impairment charges of $8.3 billion related to Shave Care goodwill and Gillette indefinite-lived intangible assets (Shave Care impairment), partially offset by the benefit from the net sales increase. For a more detailed discussion on the Shave Care impairment refer to |

• | Net earnings decreased $5.9 billion or 60% due to the after-tax impact of the Shave Care impairment, partially offset by a reduction in current year income tax expense, a current year gain on the dissolution of the PGT Healthcare partnership and the base period charges for the early extinguishment of debt. The reduction in current year income tax expense was driven by the impacts of the U.S. Tax Cuts and Jobs Act enacted in December 2017 (U.S. Tax Act), comprised of the reduction in tax rate on the current year earnings and the base period charges related to the transitional impacts of the U.S. Tax Act. Foreign exchange impacts negatively affected net earnings by approximately $900 million. |

• | Net earnings attributable to Procter & Gamble were $3.9 billion, a decrease of $5.9 billion or 60% versus the prior year primarily due to the aforementioned items. |

• | Diluted net earnings per share decreased 61% to $1.43. |

◦ | Core EPS increased 7% to $4.52. |

• | Cash flow from operating activities was $15.2 billion. |

◦ | Adjusted free cash flow was $12.1 billion. |

◦ | Adjusted free cash flow productivity was 105%. |

Comparisons as a percentage of net sales; Years ended June 30 | 2019 | 2018 | Basis Point Change | |||||

Gross margin | 48.6 | % | 48.5 | % | 10 | |||

Selling, general and administrative expense | 28.2 | % | 28.5 | % | (30 | ) | ||

Operating margin | 8.1 | % | 20.0 | % | (1,190 | ) | ||

Earnings from continuing operations before income taxes | 9.0 | % | 19.9 | % | (1,090 | ) | ||

Net earnings | 5.9 | % | 14.8 | % | (890 | ) | ||

Net earnings attributable to Procter & Gamble | 5.8 | % | 14.6 | % | (880 | ) | ||

• | a 100 basis-point decline from unfavorable product mix and other impacts (primarily mix within segments due to the growth of lower margin product forms and the club channel in certain categories and due to the disproportionate growth of the Fabric Care category, which is one of our largest categories and has lower than company-average gross margins), |

• | an 80 basis-point negative impact due to higher commodity costs and |

• | a 50 basis-point negative impact from unfavorable foreign exchange. |

• | Marketing spending as a percentage of net sales decreased 80 basis points due to the positive scale impacts of the organic net sales increase, reductions in agency compensation and the impact of adopting the new standard on "Revenue from Contracts with Customers" which prospectively reclassified certain customer spending from marketing (SG&A) expense to a reduction of net sales. |

• | Overhead costs as a percentage of net sales increased 30 basis points, as productivity savings and fixed cost leverage from the increased organic net sales, were more than offset by the impact of inflation, higher incentive compensation costs and other cost increases, including the ongoing and integration-related overhead costs of the Merck OTC acquisition. |

• | Other net operating expenses as a percentage of net sales increased 20 basis points primarily due to an increase in foreign exchange transactional charges and the net impact of changes in indirect tax reserves, partially offset by the gain on sale of real estate in the current year. |

• | Interest expense was $509 million in 2019, a marginal increase of $3 million versus the prior year due to an increase in average debt balances and an increase in U.S. interest rates. |

• | Interest income was $220 million in 2019, a reduction of $27 million versus the prior year due to a reduction in average investment securities balances. |

• | Other non-operating income, which consists primarily of divestiture gains, investment income and other non-operating items increased $649 million to $871 million, primarily due to a $355 million before-tax gain from the dissolution of the PGT Healthcare partnership in the current year (discussed earlier in the Recent Developments section) and $346 million of base year charges for the early extinguishment of debt, partially offset by higher minor brand divestiture gains in the base year. |

• | a 500 basis-point reduction from the impact of the lower blended U.S. federal tax rate on current year earnings versus the prior year rate, and |

• | a 450 basis-point reduction due to prior year transitional impacts from the U.S. Tax Act. |

• | a 160 basis-point increase from unfavorable impacts of geographic mix of earnings, |

• | a 10 basis-point increase from reduced favorable discrete impacts related to uncertain tax positions (which netted to approximately 15 basis points in the current year versus 25 basis points in the prior year), and |

• | a 100 basis-point reduction from increased excess tax benefits of share-based compensation (160 basis points in the current year versus 60 basis points in the prior year). |

Net Sales Change Drivers 2019 vs. 2018 (1) | ||||||||||||||||||||

Volume with Acquisitions & Divestitures | Volume Excluding Acquisitions & Divestitures | Foreign Exchange | Price | Mix | Other (2) | Net Sales Growth | ||||||||||||||

Beauty | 3 | % | 2 | % | (4 | )% | 2 | % | 4 | % | (1 | )% | 4 | % | ||||||

Grooming | (1 | )% | (1 | )% | (5 | )% | 2 | % | — | % | (1 | )% | (5 | )% | ||||||

Health Care | 5 | % | 4 | % | (3 | )% | 1 | % | 2 | % | — | % | 5 | % | ||||||

Fabric & Home Care | 4 | % | 5 | % | (3 | )% | 1 | % | 1 | % | — | % | 3 | % | ||||||

Baby, Feminine & Family Care | 1 | % | 1 | % | (4 | )% | 1 | % | — | % | — | % | (2 | )% | ||||||

TOTAL COMPANY | 3 | % | 2 | % | (4 | )% | 2 | % | 1 | % | (1 | )% | 1 | % | ||||||

($ millions) | 2019 | 2018 | Change vs. 2018 | ||

Volume | N/A | N/A | 3% | ||

Net sales | $12,897 | $12,406 | 4% | ||

Net earnings | $2,637 | $2,320 | 14% | ||

% of net sales | 20.4% | 18.7% | 170 bps | ||

• | Volume in Hair Care increased low single digits. Volume in developed regions increased low single digits due to product innovation and increased distribution. Developing regions volume increased low single digits due to product innovation and market growth. Global market share of the hair care category was unchanged. |

• | Volume in Skin and Personal Care increased high single digits. Excluding the impact of minor brand acquisitions, organic volume increased mid-single digits. Developed regions volume increased mid-single digits. Excluding the impact of minor brand acquisitions, developed regions |

($ millions) | 2019 | 2018 | Change vs. 2018 | ||

Volume | N/A | N/A | (1)% | ||

Net sales | $6,199 | $6,551 | (5)% | ||

Net earnings | $1,529 | $1,432 | 7% | ||

% of net sales | 24.7% | 21.9% | 280 bps | ||

• | Shave Care volume decreased low single digits. Volume increased low single digits in developed regions due to increased competitiveness following price reductions in the prior year and product innovation. Volume in developing regions decreased low single digits due to reduced demand following devaluation related price increases and competitive activity. Global market share of the shave care category decreased half a point. |

• | Appliances volume increased low single digits. Volume increased mid-single digits in developed regions due to innovation and market growth. Volume in developing regions was unchanged. Global market share of the appliances category decreased more than half a point. |

($ millions) | 2019 | 2018 | Change vs. 2018 | ||

Volume | N/A | N/A | 5% | ||

Net sales | $8,218 | $7,857 | 5% | ||

Net earnings | $1,519 | $1,283 | 18% | ||

% of net sales | 18.5% | 16.3% | 220 bps | ||

• | Oral Care volume increased low single digits. Volume increased mid-single digits in developed regions due to product innovation. Volume increased low single digits in developing regions due to product innovation, partially offset by competitive activity. Global market share of the oral care category increased nearly half a point. |

• | Volume in Personal Health Care increased double digits. Excluding the impacts of the acquisition and dissolution described above, organic volume increased mid-single digits. Developed regions volume was unchanged, while organic volume grew mid-single digits due to product innovation. Volume in developing regions increased double digits, while organic volume was up high single digits due to innovation and market growth. Global market share of the personal health care category increased more than half a point. |

($ millions) | 2019 | 2018 | Change vs. 2018 | ||

Volume | N/A | N/A | 4% | ||

Net sales | $22,080 | $21,441 | 3% | ||

Net earnings | $3,518 | $2,708 | 30% | ||

% of net sales | 15.9% | 12.6% | 330 bps | ||

• | Fabric Care volume increased mid-single digits. Volume increased mid-single digits in both developed and developing regions, due to product innovation and market growth. Global market share of the Fabric Care category increased less than half a point. |

• | Home Care volume increased mid-single digits. Volume in developed regions increased mid-single digits driven by product innovation and market growth. Volume in developing regions increased low single digits driven by product innovation, partially offset by volume declines following devaluation related price increases. Global market share of the Home Care category increased nearly a point. |

($ millions) | 2019 | 2018 | Change vs. 2018 | ||

Volume | N/A | N/A | 1% | ||

Net sales | $17,806 | $18,080 | (2)% | ||

Net earnings | $2,734 | $2,251 | 21% | ||

% of net sales | 15.4% | 12.5% | 290 bps | ||

• | Baby Care volume decreased mid-single digits. Volume in developed regions decreased low single digits due to competitive activity, including competitive pricing activity in certain markets, and category contraction. Volume in developing regions decreased high single digits due to competitive activity, volume declines following devaluation related price increases and category contraction in certain markets. Global market share of the baby care category decreased more than half a point. |

• | Feminine Care volume increased mid-single digits. Volume in developed regions increased mid-single digits. Excluding a minor brand acquisition, organic volume increased low single digits due to product innovation and adult incontinence category growth. Volume in developing regions increased mid-single digits due to product innovation. Global market share of the feminine care category increased nearly half a point. |

• | Volume in Family Care, which is predominantly a North American business, increased mid-single digits driven by product innovation and market growth. In the U.S., all-outlet share of the family care category increased more than half a point. |

($ millions) | 2019 | 2018 | Change vs. 2018 | ||

Net sales | $484 | $497 | (3)% | ||

Net earnings/(loss) | $(7,971) | $(133) | N/A | ||

• | the base period net charge for the transitional impacts of the U.S. Tax Act, |

• | the base period loss on early debt extinguishment, |

• | lower restructuring charges in fiscal 2019 compared to the prior year and |

• | higher current year divestiture gains (primarily driven by gain on the dissolution of the PGT healthcare partnership) |

• | An increase in accounts receivable used $276 million of cash due to increased sales and the timing of the end of the fiscal year (which fell on a weekend, resulting in fewer |

• | Higher inventory used $239 million of cash mainly due to inventory increases to support initiatives and business growth across all segments. Inventory days on hand increased approximately 2 days primarily due to initiative support and foreign exchange impacts. |

• | Accounts payable, accrued and other liabilities increased, generating $1.9 billion of cash. This was primarily driven by extended payment terms with our suppliers and an increase in fourth quarter marketing activity versus the prior year. These factors, along with foreign exchange, drove an approximate 8 day increase in days payable outstanding. Although difficult to project due to market and other dynamics, we anticipate incremental cash flow benefits from the extended payment terms with suppliers could decline in fiscal 2020. |

• | Other operating assets and liabilities used $1.0 billion of cash, primarily driven by the payment of the current year portion of taxes due related to the U.S. Tax Act repatriation charge and statutory pension contributions. |

Amounts in millions | Total | Less Than 1 Year | 1-3 Years | 3-5 Years | After 5 Years | ||||||||||||||

RECORDED LIABILITIES | |||||||||||||||||||

Total debt | $ | 29,988 | $ | 9,695 | $ | 4,791 | $ | 4,807 | $ | 10,695 | |||||||||

Capital leases | 33 | 9 | 15 | 7 | 2 | ||||||||||||||

U.S. Tax Act transitional charge (1) | 2,557 | 214 | 449 | 646 | 1,248 | ||||||||||||||

Uncertain tax positions (2) | 143 | 143 | — | — | — | ||||||||||||||

OTHER | |||||||||||||||||||

Interest payments relating to long-term debt | 4,682 | 572 | 979 | 737 | 2,394 | ||||||||||||||

Operating leases | 1,218 | 255 | 375 | 300 | 288 | ||||||||||||||

Minimum pension funding (3) | 471 | 153 | 318 | — | — | ||||||||||||||

Purchase obligations (4) | 1,491 | 633 | 397 | 193 | 268 | ||||||||||||||

TOTAL CONTRACTUAL COMMITMENTS | $ | 40,583 | $ | 11,674 | $ | 7,324 | $ | 6,690 | $ | 14,895 | |||||||||

(1) | Represents the U.S. federal tax liability associated with the repatriation provisions of the U.S. Tax Act. Does not include any provisions made for foreign withholding taxes on expected repatriations as the timing of those payments is uncertain. |

(2) | As of June 30, 2019, the Company's Consolidated Balance Sheet reflects a liability for uncertain tax positions of $617 million, including $150 million of interest and penalties. Due to the high degree of uncertainty regarding the timing of future cash outflows of liabilities for uncertain tax positions beyond one year, a reasonable estimate of the period of cash settlement beyond twelve months from the balance sheet date of June 30, 2019, cannot be made. |

(3) | Represents future pension payments to comply with local funding requirements. These future pension payments assume the Company continues to meet its future statutory funding requirements. Considering the current economic environment in which the Company operates, the Company believes its cash flows are adequate to meet the future statutory funding requirements. The projected payments beyond fiscal year 2022 are not currently determinable. |

(4) | Primarily reflects future contractual payments under various take-or-pay arrangements entered into as part of the normal course of business. Commitments made under take-or-pay obligations represent minimum commitments under take-or-pay agreements with suppliers and are in line with expected usage. This includes service contracts for information technology, human resources management and facilities management activities that have been outsourced. While the amounts listed represent contractual obligations, we do not believe it is likely that the full contractual amount would be paid if the underlying contracts were canceled prior to maturity. In such cases, we generally are able to negotiate new contracts or cancellation penalties, resulting in a reduced payment. The amounts do not include other contractual purchase obligations that are not take-or-pay arrangements. Such contractual purchase obligations are primarily purchase orders at fair value that are part of normal operations and are reflected in historical operating cash flow trends. We do not believe such purchase obligations will adversely affect our liquidity position. |

Approximate Percent Change in Estimated Fair Value | |||

+25 bps Discount Rate | -25 bps Growth Rate | ||

Shave Care goodwill reporting unit | (5)% | (6)% | |

Gillette indefinite-lived intangible asset | (5)% | (5)% | |

Year ended June 30, 2019 | Net Sales Growth | Foreign Exchange Impact | Acquisition & Divestiture Impact/Other (1) | Organic Sales Growth | ||||

Beauty | 4 | % | 4 | % | — | % | 8 | % |

Grooming | (5 | )% | 5 | % | 1 | % | 1 | % |

Health Care | 5 | % | 3 | % | (2 | )% | 6 | % |

Fabric & Home Care | 3 | % | 3 | % | 1 | % | 7 | % |

Baby, Feminine & Family Care | (2 | )% | 4 | % | — | % | 2 | % |

TOTAL COMPANY | 1 | % | 4 | % | — | % | 5 | % |

(1) | Acquisition & Divestiture Impact/Other includes the volume and mix impact of acquisitions and divestitures, the impact from the July 1, 2018 adoption of a new accounting standard for "Revenue from Contracts with Customers" and rounding impacts necessary to reconcile net sales to organic sales. |

Operating Cash Flow | Capital Spending | Adjustments to Operating Cash Flow (1) | Adjusted Free Cash Flow | |||||||||

2019 | $ | 15,242 | $ | (3,347 | ) | $ | 235 | $ | 12,130 | |||

2018 | $ | 14,867 | $ | (3,717 | ) | $ | — | $ | 11,150 | |||

(1) | Adjustments to Operating Cash Flow relate to tax payments for the transitional tax resulting from the U.S. Tax Act. |

Net Earnings | Adjustments to Net Earnings (1) | Net Earnings Excluding Adjustments | Adjusted Free Cash Flow | Adjusted Free Cash Flow Productivity | ||||||||||

2019 | $ | 3,966 | $ | 7,625 | $ | 11,591 | $ | 12,130 | 105 | % | ||||

(1) | Adjustments to Net Earnings relate to the Shave Care impairment charges and the gain on the dissolution of the PGT Healthcare partnership in fiscal 2019. |

• | Incremental Restructuring: The Company has had and continues to have an ongoing level of restructuring activities. Such activities have resulted in ongoing annual restructuring related charges of approximately $250 - $500 million before tax. In 2012, the Company began a $10 billion strategic productivity and cost savings initiative that includes incremental restructuring activities. In 2017, we communicated details of an additional multi-year productivity and cost savings plan. This results in incremental restructuring charges to accelerate productivity efforts and cost savings. The adjustment to Core earnings includes only the restructuring costs above what we believe are the normal recurring level of restructuring costs. |

• | Gain on Dissolution of the PGT Healthcare Partnership: The Company dissolved our PGT Healthcare partnership, a venture between the Company and Teva Pharmaceuticals Industries, Ltd (Teva) in the OTC consumer healthcare business, during the year ended June 30, 2019. The transaction was accounted for as a sale of the Teva portion of the PGT business; the Company recognized an after-tax gain on the dissolution of $353 million. |

• | Transitional Impacts of the U.S. Tax Act: As discussed in Note 5 to the Consolidated Financial Statements, the U.S. government enacted comprehensive tax legislation commonly referred to as the Tax Cuts and Jobs Act (the “U.S. Tax Act”) in December 2017. This resulted in a net charge of $602 million for the fiscal year 2018. The adjustment to core earnings only includes this transitional impact. It does not include the ongoing impacts of the lower U.S. statutory rate on pre-tax earnings. |

• | Early debt extinguishment charges: In fiscal 2018, the Company recorded after-tax charges of $243 million, due to the early extinguishment of certain long-term debt. These charges represent the difference between the reacquisition price and the par value of the debt extinguished. |

• | Shave Care Impairment: As discussed in Note 4 to the Consolidated Financial Statements and in the Significant Accounting Policies and Estimates section of the MD&A, in the fourth quarter of fiscal 2019, the Company recognized a one-time, non-cash after-tax charge of $8.0 billion ($8.3 billion before tax) to adjust the carrying values of the Shave Care reporting unit. This was comprised of a before and after-tax impairment charge of $6.8 billion related to goodwill and an after-tax impairment charge of $1.2 billion ($1.6 billion before tax) to reduce the carrying value of the Gillette indefinite-lived intangible assets. |

• | Anti-Dilutive Impacts: As discussed in Note 6 to the Consolidated Financial Statements, the Shave Care impairment charges caused preferred shares that are normally dilutive (and hence, normally assumed converted for purposes of determining diluted earnings per share) to be anti-dilutive. Accordingly for U.S. GAAP, the preferred shares were not assumed to be converted into common shares for diluted earnings per share and the related dividends paid to the preferred shareholders were deducted from net income to calculate earnings available to common shareholders. As a result of the non-GAAP Shave Care impairment adjustment, these instruments are dilutive for non-GAAP core earnings per share. |

THE PROCTER & GAMBLE COMPANY AND SUBSIDIARIES (Amounts in Millions Except Per Share Amounts) Reconciliation of Non-GAAP Measures | |||||||||||||||||||||||||||

Twelve Months Ended June 30, 2019 | |||||||||||||||||||||||||||

AS REPORTED (GAAP) | ANTI-DILUTIVE IMPACTS | INCREMENTAL RESTRUCTURING | SHAVE CARE IMPAIRMENT | GAIN ON DISSOLUTION OF PGT PARTNERSHIP | ROUNDING | NON-GAAP (CORE) | |||||||||||||||||||||

COST OF PRODUCTS SOLD | $ | 34,768 | $ | — | $ | (426 | ) | $ | — | $ | — | $ | — | $ | 34,342 | ||||||||||||

SELLING, GENERAL, AND ADMINISTRATIVE EXPENSE | 19,084 | — | 23 | — | — | (1 | ) | 19,106 | |||||||||||||||||||

OPERATING INCOME | 5,487 | — | 403 | 8,345 | — | 1 | 14,236 | ||||||||||||||||||||

INCOME TAX ON CONTINUING OPERATIONS | 2,103 | — | 69 | 367 | (2 | ) | — | 2,537 | |||||||||||||||||||

NET EARNINGS ATTRIBUTABLE TO P&G | 3,897 | — | 354 | 7,978 | (353 | ) | 1 | 11,877 | |||||||||||||||||||

Core EPS | |||||||||||||||||||||||||||

Diluted Net Earnings attributable to common shareholders (1) | 3,634 | 263 | 354 | 7,978 | (353 | ) | 1 | 11,877 | |||||||||||||||||||

Diluted Weighted Average Common Shares Outstanding (1) | 2,539.5 | 90.2 | 2,629.7 | ||||||||||||||||||||||||

DILUTED NET EARNINGS PER COMMON SHARE | $ | 1.43 | $ | 0.06 | $ | 0.13 | $ | 3.03 | $ | (0.13 | ) | $ | — | $ | 4.52 | ||||||||||||

CHANGE VERSUS YEAR AGO | ||||

CORE EPS | 7 | % | ||

THE PROCTER & GAMBLE COMPANY AND SUBSIDIARIES (Amounts in Millions Except Per Share Amounts) Reconciliation of Non-GAAP Measures | |||||||||||||||||||||||

Twelve Months Ended June 30, 2018 | |||||||||||||||||||||||

AS REPORTED (GAAP) | INCREMENTAL RESTRUCTURING | TRANSITIONAL IMPACTS OF THE U.S. TAX ACT | EARLY DEBT EXTINGUISHMENT | ROUNDING | NON-GAAP (CORE) | ||||||||||||||||||

COST OF PRODUCTS SOLD | $ | 34,432 | $ | (724 | ) | $ | — | $ | — | $ | (1 | ) | $ | 33,707 | |||||||||

SELLING, GENERAL, AND ADMINISTRATIVE EXPENSE | 19,037 | (1 | ) | — | — | 1 | 19,037 | ||||||||||||||||

OPERATING INCOME | 13,363 | 725 | — | — | — | 14,088 | |||||||||||||||||

INCOME TAX ON CONTINUING OPERATIONS | 3,465 | 129 | (602 | ) | 103 | — | 3,095 | ||||||||||||||||

NET EARNINGS ATTRIBUTABLE TO P&G | 9,750 | 610 | 602 | 243 | (1 | ) | 11,204 | ||||||||||||||||

Core EPS | |||||||||||||||||||||||

DILUTED NET EARNINGS PER COMMON SHARE* | $ | 3.67 | $ | 0.23 | $ | 0.23 | $ | 0.09 | $ | — | $ | 4.22 | |||||||||||

/s/ David S. Taylor |

David S. Taylor |

Chairman of the Board, President and Chief Executive Officer |

/s/ Jon R. Moeller |

Jon R. Moeller |

Vice Chairman, Chief Operating Officer and Chief Financial Officer |

August 6, 2019 |

Goodwill and Intangible Assets - Shave Care Goodwill and Gillette Indefinite Lived Intangible Asset - Refer to Notes 1 and 4 to the financial statements |

Critical Audit Matter Description The Company’s evaluation of goodwill and indefinite lived intangible assets for impairment involves the comparison of the fair value of each reporting unit or indefinite lived intangible asset to its carrying value. The Company estimates fair value using the income method, which is based on the present value of estimated future cash flows attributable to the respective assets. This requires management to make significant estimates and assumptions related to forecasts of future net sales and earnings, including growth rates beyond a 10-year time period, royalty rates and discount rates. Changes in the assumptions could have a significant impact on either the fair value, the amount of any impairment charge, or both. The Company performed their annual impairment assessments of the Shave Care reporting unit as of October 1, 2018 and the Gillette brand indefinite-lived intangible asset (the “Gillette brand”) as of December 31, 2018. Because the estimated fair values exceeded their carrying values, no impairments were recorded. Given recent reductions in cash flows caused by currency devaluations, changing consumer grooming habits affecting demand and an increase in the competitive market environment, the Company revised their cash flow estimates and |

updated their fair value estimates for both the Shave Care reporting unit and the Gillette brand as of June 30, 2019 and determined the carrying values exceeded the fair values resulting in an impairment of the Shave Care Goodwill and the Gillette brand. The Company measured the impairment of goodwill using the two-step method which requires management to make significant estimates and judgments to allocate the fair value of the Shave Care reporting unit to its identifiable assets and liabilities including estimating the fair value of property, plant and equipment and intangibles. The residual fair value of the Shave Care reporting unit was compared to the carrying value of its goodwill with the excess in carrying value of $6.8 billion before and after tax recorded as an impairment. The impairment of the Gillette brand of $1.6 billion before tax and $1.2 billion after tax was measured as the difference between its fair value and carrying value. As of June 30, 2019, after recording of the impairments, the Shave Care reporting unit goodwill was $12.6 billion, and the Gillette brand was $14.1 billion. We identified the Company’s impairment evaluations of goodwill for the Shave Care reporting unit and the Gillette brand as a critical audit matter because of the recent reductions in cash flows and the significant judgments made by management to estimate the fair values of the reporting unit and the brand and to estimate the fair value of the reporting unit’s assets and liabilities for purposes of measuring the impairment of goodwill. A high degree of auditor judgment and an increased extent of effort was required when performing audit procedures to evaluate the reasonableness of management’s estimates and assumptions related to the forecasts of future net sales and earnings as well as the selection of royalty rates and discount rates and the estimation and allocation of fair value to the reporting unit’s assets and liabilities including the need to involve our fair value specialists. | |

How the Critical Audit Matter Was Addressed in the Audit Our audit procedures related to forecasts of future net sales and earnings and the selection of the royalty rates and discount rates for the Shave Care reporting unit and the Gillette brand included the following, among others: • We tested the effectiveness of controls over goodwill and indefinite lived intangible assets, including those over the determination of fair value, such as controls related to management’s development of forecasts of future net sales, earnings, the selection of royalty rates, discount rates and allocation of the reporting unit fair value to its identifiable assets and liabilities. • We evaluated management’s ability to accurately forecast net sales and earnings by comparing actual results to management’s historical forecasts. • We evaluated the reasonableness of management’s forecast of net sales and earnings by comparing the forecasts to:• Historical net sales and earnings.• Underlying analysis detailing business strategies and growth plans.• Internal communications to management and the Board of Directors. • Forecasted information included in Company press releases as well as in analyst and industry reports for the Company and certain of its peer companies. • With the assistance of our fair value specialists, we evaluated the reasonableness of the valuation methodology, net sales and earnings growth rates, royalty rates, discount rates and estimation and allocation of the reporting unit fair value to its identifiable assets and liabilities by:• Testing the source information underlying the determination of net sales and earnings growth rates, royalty rates, discount rates, estimation and allocation of the reporting unit fair value to its identifiable assets and liabilities and the mathematical accuracy of the calculations.• Developing a range of independent estimates for the discount rates and comparing those to the discount rates selected by management. | |

Acquisition of the over the counter healthcare business of Merck KGaA - Refer to Note 14 to the financial statements | |

Critical Audit Matter Description The Company completed the acquisition of the over the counter healthcare business of Merck KGaA (Merck OTC) for $3.7 billion on November 30, 2018. The Company accounted for this transaction under the acquisition method of accounting for business combinations. Accordingly, the purchase price was allocated, on a preliminary basis, to the assets acquired and liabilities assumed based on their respective fair values, including identified intangible assets of $2.1 billion and resulting goodwill of $2.1 billion. Of the identified intangible assets acquired, the most significant included brand indefinite lived intangible assets of $946 million and brand defined life intangible assets of $701 million (the “brand intangible assets”). The Company estimated the fair value of the brand intangible assets using the royalty savings method, which is a specific discounted cash flow method that required management to make significant estimates and assumptions related to future cash flows and the selection of royalty rates and discount rates. | |

We identified the brand intangible assets for Merck OTC as a critical audit matter because of the significant estimates and assumptions management makes to fair value these assets for purposes of recording the acquisition. This required a high degree of auditor judgment and an increased extent of effort when performing audit procedures to evaluate the reasonableness of management’s forecasts of future cash flows as well as the selection of the royalty rates and discount rates, including the need to involve our fair value specialists. |

How the Critical Audit Matter Was Addressed in the Audit Our audit procedures related to the forecasts of future cash flows and the selection of the royalty rates and discount rates for the brand intangible assets included the following, among others: • We tested the effectiveness of controls over the valuation of the brand intangible assets, including management’s controls over forecasts of future cash flows and selection of the royalty rates and discount rates. • We evaluated the reasonableness of management’s forecasts of future cash flows by comparing the projections to historical results and certain peer companies. • With the assistance of our fair value specialists, we evaluated the reasonableness of the valuation methodology, royalty rates and discount rates by:• Testing the source information underlying the determination of the royalty rates and discount rates and testing the mathematical accuracy of the calculations.• Developing a range of independent estimates for the discount rates and comparing those to the discount rates selected by management. |

/s/ Deloitte & Touche LLP |

Cincinnati, Ohio |

August 6, 2019 |

We have served as the Company’s auditor since 1890. |

/s/ Deloitte & Touche LLP |

Cincinnati, Ohio |

August 6, 2019 |

Amounts in millions except per share amounts; Years ended June 30 | 2019 | 2018 | 2017 | ||||||||

NET SALES | $ | $ | $ | ||||||||

Cost of products sold | |||||||||||

Selling, general and administrative expense | |||||||||||

Goodwill and indefinite lived intangibles impairment charges | |||||||||||

OPERATING INCOME | |||||||||||

Interest expense | |||||||||||

Interest income | |||||||||||

Other non-operating income/(expense), net | ( | ) | |||||||||

EARNINGS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES | |||||||||||

Income taxes on continuing operations | |||||||||||

NET EARNINGS FROM CONTINUING OPERATIONS | |||||||||||

NET EARNINGS FROM DISCONTINUED OPERATIONS | |||||||||||

NET EARNINGS | |||||||||||

Less: Net earnings attributable to noncontrolling interests | |||||||||||

NET EARNINGS ATTRIBUTABLE TO PROCTER & GAMBLE | $ | $ | $ | ||||||||

BASIC NET EARNINGS PER COMMON SHARE: (1) | |||||||||||

Earnings from continuing operations | $ | $ | $ | ||||||||

Earnings from discontinued operations | |||||||||||

BASIC NET EARNINGS PER COMMON SHARE | $ | $ | $ | ||||||||

DILUTED NET EARNINGS PER COMMON SHARE: (1) | |||||||||||

Earnings from continuing operations | $ | $ | $ | ||||||||

Earnings from discontinued operations | |||||||||||

DILUTED NET EARNINGS PER COMMON SHARE | $ | $ | $ | ||||||||

(1) |

Amounts in millions; Years ended June 30 | 2019 | 2018 | 2017 | ||||||||

NET EARNINGS | $ | $ | $ | ||||||||

OTHER COMPREHENSIVE INCOME/(LOSS), NET OF TAX | |||||||||||

Foreign currency translation (net of $78, $(279) and $(186) tax, respectively) | ( | ) | ( | ) | ( | ) | |||||

Unrealized gains/(losses) on investment securities (net of $0, $0 and $(6) tax, respectively) | ( | ) | ( | ) | |||||||

Unrealized gains on defined benefit retirement plans (net of $22, $68 and $551 tax, respectively) | |||||||||||

TOTAL OTHER COMPREHENSIVE INCOME/(LOSS), NET OF TAX | ( | ) | |||||||||

TOTAL COMPREHENSIVE INCOME | |||||||||||

Less: Total comprehensive income attributable to noncontrolling interests | |||||||||||

TOTAL COMPREHENSIVE INCOME ATTRIBUTABLE TO PROCTER & GAMBLE | $ | $ | $ | ||||||||

Amounts in millions; As of June 30 | 2019 | 2018 | |||||

Assets | |||||||

CURRENT ASSETS | |||||||

Cash and cash equivalents | $ | $ | |||||

Available-for-sale investment securities | |||||||

Accounts receivable | |||||||

INVENTORIES | |||||||

Materials and supplies | |||||||

Work in process | |||||||

Finished goods | |||||||

Total inventories | |||||||

Prepaid expenses and other current assets | |||||||

TOTAL CURRENT ASSETS | |||||||

PROPERTY, PLANT AND EQUIPMENT, NET | |||||||

GOODWILL | |||||||

TRADEMARKS AND OTHER INTANGIBLE ASSETS, NET | |||||||

OTHER NONCURRENT ASSETS | |||||||

TOTAL ASSETS | $ | $ | |||||

Liabilities and Shareholders' Equity | |||||||

CURRENT LIABILITIES | |||||||

Accounts payable | $ | $ | |||||

Accrued and other liabilities | |||||||

Debt due within one year | |||||||

TOTAL CURRENT LIABILITIES | |||||||

LONG-TERM DEBT | |||||||

DEFERRED INCOME TAXES | |||||||

OTHER NONCURRENT LIABILITIES | |||||||

TOTAL LIABILITIES | |||||||

SHAREHOLDERS' EQUITY | |||||||

Convertible Class A preferred stock, stated value $1 per share (600 shares authorized) | |||||||

Non-Voting Class B preferred stock, stated value $1 per share (200 shares authorized) | |||||||

Common stock, stated value $1 per share (10,000 shares authorized; shares issued: 2019 - 4,009.2, 2018 - 4,009.2) | |||||||

Additional paid-in capital | |||||||

Reserve for ESOP debt retirement | ( | ) | ( | ) | |||

Accumulated other comprehensive income/(loss) | ( | ) | ( | ) | |||

Treasury stock, at cost (shares held: 2019 - 1,504.5, 2018 -1,511.2) | ( | ) | ( | ) | |||

Retained earnings | |||||||

Noncontrolling interest | |||||||

TOTAL SHAREHOLDERS' EQUITY | |||||||

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | $ | |||||

Dollars in millions; shares in thousands | Common Stock | Preferred Stock | Add-itional Paid-In Capital | Reserve for ESOP Debt Retirement | Accumu-lated Other Comp-rehensive Income/(Loss) | Treasury Stock | Retained Earnings | Non-controlling Interest | Total Share-holders' Equity | ||||||||||||||||||||

Shares | Amount | ||||||||||||||||||||||||||||

BALANCE JUNE 30, 2016 | $ | $ | $ | ($ | ) | ($ | ) | ($ | ) | $ | $ | $ | |||||||||||||||||

Net earnings | |||||||||||||||||||||||||||||

Other comprehensive income/(loss) | |||||||||||||||||||||||||||||

Dividends and dividend equivalents ($2.6981 per share): | |||||||||||||||||||||||||||||

Common | ( | ) | ( | ) | |||||||||||||||||||||||||

Preferred, net of tax benefits | ( | ) | ( | ) | |||||||||||||||||||||||||

Treasury stock purchases (1) | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||

Employee stock plans | ( | ) | |||||||||||||||||||||||||||

Preferred stock conversions | ( | ) | |||||||||||||||||||||||||||

ESOP debt impacts | |||||||||||||||||||||||||||||

Noncontrolling interest, net | ( | ) | ( | ) | |||||||||||||||||||||||||

BALANCE JUNE 30, 2017 | $ | $ | $ | ($ | ) | ($ | ) | ($ | ) | $ | $ | $ | |||||||||||||||||

Net earnings | |||||||||||||||||||||||||||||

Other comprehensive income/(loss) | ( | ) | (2 | ) | ( | ) | |||||||||||||||||||||||

Dividends and dividend equivalents ($2.7860 per share): | |||||||||||||||||||||||||||||

Common | ( | ) | ( | ) | |||||||||||||||||||||||||

Preferred, net of tax benefits | ( | ) | ( | ) | |||||||||||||||||||||||||

Treasury stock purchases | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||

Employee stock plans | |||||||||||||||||||||||||||||

Preferred stock conversions | ( | ) | |||||||||||||||||||||||||||

ESOP debt impacts | |||||||||||||||||||||||||||||

Noncontrolling interest, net | ( | ) | ( | ) | |||||||||||||||||||||||||

BALANCE JUNE 30, 2018 | $ | $ | $ | ($ | ) | ($ | ) | ($ | ) | $ | $ | $ | |||||||||||||||||

Impact of adoption of new accounting standards | ( | ) | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||

Net earnings | |||||||||||||||||||||||||||||

Other comprehensive income/(loss) | |||||||||||||||||||||||||||||

Dividends and dividend equivalents ($2.8975 per share): | |||||||||||||||||||||||||||||

Common | ( | ) | ( | ) | |||||||||||||||||||||||||

Preferred, net of tax benefits | ( | ) | ( | ) | |||||||||||||||||||||||||

Treasury stock purchases | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||

Employee stock plans | |||||||||||||||||||||||||||||

Preferred stock conversions | ( | ) | |||||||||||||||||||||||||||

ESOP debt impacts | |||||||||||||||||||||||||||||

Noncontrolling interest, net | (118 | ) | ( | ) | ( | ) | |||||||||||||||||||||||

BALANCE JUNE 30, 2019 | $ | $ | $ | ($ | ) | ($ | ) | ($ | ) | $ | $ | $ | |||||||||||||||||

Amounts in millions; Years ended June 30 | 2019 | 2018 | 2017 | |||||||||

CASH, CASH EQUIVALENTS AND RESTRICTED CASH, BEGINNING OF YEAR | $ | $ | $ | |||||||||

OPERATING ACTIVITIES | ||||||||||||

Net earnings | ||||||||||||

Depreciation and amortization | ||||||||||||

Loss on early extinguishment of debt | ||||||||||||

Share-based compensation expense | ||||||||||||

Deferred income taxes | ( | ) | ( | ) | ( | ) | ||||||

Gain on sale of assets | ( | ) | ( | ) | ( | ) | ||||||

Goodwill and indefinite-lived intangible impairment charges | — | — | ||||||||||

Change in accounts receivable | ( | ) | ( | ) | ( | ) | ||||||

Change in inventories | ( | ) | ( | ) | ||||||||

Change in accounts payable, accrued and other liabilities | ( | ) | ||||||||||

Change in other operating assets and liabilities | ( | ) | ( | ) | ||||||||

Other | ||||||||||||

TOTAL OPERATING ACTIVITIES | ||||||||||||

INVESTING ACTIVITIES | ||||||||||||

Capital expenditures | ( | ) | ( | ) | ( | ) | ||||||

Proceeds from asset sales | ||||||||||||

Acquisitions, net of cash acquired | ( | ) | ( | ) | ( | ) | ||||||

Purchases of short-term investments | ( | ) | ( | ) | ( | ) | ||||||

Proceeds from sales and maturities of short-term investments | ||||||||||||

Cash transferred at closing related to the Beauty Brands divestiture | ( | ) | ||||||||||

Change in other investments | ( | ) | ( | ) | ||||||||

TOTAL INVESTING ACTIVITIES | ( | ) | ( | ) | ( | ) | ||||||

FINANCING ACTIVITIES | ||||||||||||

Dividends to shareholders | ( | ) | ( | ) | ( | ) | ||||||

Change in short-term debt | ( | ) | ( | ) | ||||||||

Additions to long-term debt | ||||||||||||

Reductions of long-term debt (1) | ( | ) | ( | ) | ( | ) | ||||||

Treasury stock purchases | ( | ) | ( | ) | ( | ) | ||||||

Impact of stock options and other | ||||||||||||

TOTAL FINANCING ACTIVITIES | ( | ) | ( | ) | ( | ) | ||||||

EFFECT OF EXCHANGE RATE CHANGES ON CASH, CASH EQUIVALENTS AND RESTRICTED CASH | ( | ) | ( | ) | ||||||||

CHANGE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | ( | ) | ( | ) | ||||||||

CASH, CASH EQUIVALENTS AND RESTRICTED CASH, END OF YEAR | $ | $ | $ | |||||||||

SUPPLEMENTAL DISCLOSURE | ||||||||||||

Cash payments for interest | $ | $ | $ | |||||||||

Cash payment for income taxes | ||||||||||||

Divestiture of Beauty business in exchange for shares of P&G stock and assumption of debt | ||||||||||||

Assets acquired through non-cash capital leases are immaterial for all periods. | ||||||||||||

(1) | Includes early extinguishment of debt costs of $ |

• | Beauty: Hair Care (Conditioner, Shampoo, Styling Aids, Treatments); Skin and Personal Care (Antiperspirant and Deodorant, Personal Cleansing, Skin Care); |

• | Grooming: Shave Care (Female Blades & Razors, Male Blades & Razors, Pre- and Post-Shave Products, Other Shave Care); Appliances |

• | Health Care: Oral Care (Toothbrushes, Toothpaste, Other Oral Care); Personal Health Care (Gastrointestinal, Rapid Diagnostics, Respiratory, Vitamins/Minerals/Supplements, Pain Relief, Other Personal Health Care); |

• | Fabric & Home Care: Fabric Care (Fabric Enhancers, Laundry Additives, Laundry Detergents); Home Care (Air Care, Dish Care, P&G Professional, Surface Care); and |

• | Baby, Feminine & Family Care: Baby Care (Baby Wipes, Taped Diapers and Pants); Feminine Care (Adult Incontinence, Feminine Care); Family Care (Paper Towels, Tissues, Toilet Paper). |

% of Sales by Business Unit (1) | |||||

Years ended June 30 | 2019 | 2018 | 2017 | ||

Fabric Care | |||||

Baby Care | |||||

Hair Care | |||||

Home Care | |||||

Skin and Personal Care | |||||

Family Care | |||||

Oral Care | |||||

Shave Care | |||||

Feminine Care | |||||

All Other | |||||

TOTAL | |||||

(1) | % of sales by business unit excludes sales held in Corporate. |

Years ended June 30 | 2019 | 2018 | 2017 | |||||||||

NET SALES | ||||||||||||

United States | $ | $ | $ | |||||||||

International | $ | $ | $ | |||||||||

LONG-LIVED ASSETS (1) | ||||||||||||

United States | $ | $ | $ | |||||||||

International | $ | $ | $ | |||||||||

(1) |

Global Segment Results | Net Sales | Earnings/(Loss) from Continuing Operations Before Income Taxes | Net Earnings/(Loss) from Continuing Operations | Depreciation and Amortization | Total Assets | Capital Expenditures | |||||||||||||||||||

BEAUTY | 2019 | $ | $ | $ | $ | $ | $ | ||||||||||||||||||

2018 | |||||||||||||||||||||||||

2017 | |||||||||||||||||||||||||

GROOMING | 2019 | ||||||||||||||||||||||||

2018 | |||||||||||||||||||||||||

2017 | |||||||||||||||||||||||||

HEALTH CARE | 2019 | ||||||||||||||||||||||||

2018 | |||||||||||||||||||||||||

2017 | |||||||||||||||||||||||||

FABRIC & HOME CARE | 2019 | ||||||||||||||||||||||||

2018 | |||||||||||||||||||||||||

2017 | |||||||||||||||||||||||||

BABY, FEMININE & FAMILY CARE | 2019 | ||||||||||||||||||||||||

2018 | |||||||||||||||||||||||||

2017 | |||||||||||||||||||||||||

CORPORATE (1) | 2019 | ( | ) | ( | ) | ||||||||||||||||||||

2018 | ( | ) | ( | ) | |||||||||||||||||||||

2017 | ( | ) | |||||||||||||||||||||||

TOTAL COMPANY | 2019 | $ | $ | $ | $ | $ | $ | ||||||||||||||||||

2018 | |||||||||||||||||||||||||

2017 | |||||||||||||||||||||||||

(1) |

As of June 30 | 2019 | 2018 | |||||

PROPERTY, PLANT AND EQUIPMENT | |||||||

Buildings | $ | $ | |||||

Machinery and equipment | |||||||

Land | |||||||

Construction in progress | |||||||

TOTAL PROPERTY, PLANT AND EQUIPMENT | |||||||

Accumulated depreciation | ( | ) | ( | ) | |||

PROPERTY, PLANT AND EQUIPMENT, NET | $ | $ | |||||

As of June 30 | 2019 | 2018 | |||||

ACCRUED AND OTHER LIABILITIES - CURRENT | |||||||

Marketing and promotion | $ | $ | |||||

Compensation expenses | |||||||

Restructuring reserves | |||||||

Taxes payable | |||||||

Other | |||||||

TOTAL | $ | $ | |||||

OTHER NONCURRENT LIABILITIES | |||||||

Pension benefits | $ | $ | |||||

Other postretirement benefits | |||||||

Uncertain tax positions | |||||||

U.S. Tax Act transitional tax payable | |||||||

Other | |||||||

TOTAL | $ | $ | |||||

Amounts in millions | Separations | Asset-Related Costs | Other | Total | ||||||||

RESERVE JUNE 30, 2017 | $ | $ | $ | $ | ||||||||

Charges | ||||||||||||

Cash spent | ( | ) | ( | ) | ( | ) | ||||||

Charges against assets | ( | ) | ( | ) | ||||||||

RESERVE JUNE 30, 2018 | ||||||||||||

Charges | ||||||||||||

Cash spent | ( | ) | ( | ) | ( | ) | ||||||

Charges against assets | ( | ) | ( | ) | ||||||||

RESERVE JUNE 30, 2019 | $ | $ | $ | $ | ||||||||

Years ended June 30 | 2019 | 2018 | 2017 | ||||||

Beauty | $ | $ | $ | ||||||

Grooming | |||||||||

Health Care | |||||||||

Fabric & Home Care | |||||||||

Baby, Feminine & Family Care | |||||||||

Corporate (1) | |||||||||

Total Company | $ | $ | $ | ||||||

(1) | Corporate includes costs related to allocated overheads, including charges related to our Sales and Market Operations, Global Business Services and Corporate Functions activities, along with costs related to discontinued operations from our Beauty Brands business in 2017. |

Beauty | Grooming | Health Care | Fabric & Home Care | Baby, Feminine & Family Care | Corporate | Total Company | |||||||||||||||

Balance at June 30, 2017 - Net (1) | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||

Acquisitions and divestitures | |||||||||||||||||||||

Translation and other | |||||||||||||||||||||

Balance at June 30, 2018 - Net (1) | |||||||||||||||||||||

Acquisitions and divestitures | |||||||||||||||||||||

Goodwill impairment charges | ( | ) | ( | ) | |||||||||||||||||

Translation and other | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | |||||||||

Balance at June 30, 2019 - Net (1) | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||

(1) |

2019 | 2018 | ||||||||||||

As of June 30 | Gross Carrying Amount | Accumulated Amortization | Gross Carrying Amount | Accumulated Amortization | |||||||||

INTANGIBLE ASSETS WITH DETERMINABLE LIVES | |||||||||||||

Brands | $ | $ | ( | ) | $ | $ | ( | ) | |||||

Patents and technology | ( | ) | ( | ) | |||||||||

Customer relationships | ( | ) | ( | ) | |||||||||

Other | ( | ) | ( | ) | |||||||||

TOTAL | $ | $ | ( | ) | $ | $ | ( | ) | |||||

INTANGIBLE ASSETS WITH INDEFINITE LIVES | |||||||||||||

Brands | — | — | |||||||||||

TOTAL | $ | $ | ( | ) | $ | $ | ( | ) | |||||

Years ended June 30 | 2019 | 2018 | 2017 | ||||||||

Intangible asset amortization | $ | $ | $ | ||||||||

Years ending June 30 | 2020 | 2021 | 2022 | 2023 | 2024 | ||||||||||

Estimated amortization expense | $ | $ | $ | $ | $ | ||||||||||

Years ended June 30 | 2019 | 2018 | 2017 | ||||||||

United States | $ | $ | $ | ||||||||

International | |||||||||||

TOTAL | $ | $ | $ | ||||||||

Years ended June 30 | 2019 | 2018 | 2017 | ||||||||

CURRENT TAX EXPENSE | |||||||||||

U.S. federal | $ | $ | $ | ||||||||

International | |||||||||||

U.S. state and local | |||||||||||

DEFERRED TAX EXPENSE | |||||||||||

U.S. federal | ( | ) | ( | ) | |||||||

International and other | ( | ) | |||||||||

( | ) | ( | ) | ||||||||

TOTAL TAX EXPENSE | $ | $ | $ | ||||||||

Years ended June 30 | 2019 | 2018 | 2017 | |||||

U.S. federal statutory income tax rate | % | % | % | |||||

Country mix impacts of foreign operations | ( | )% | ( | )% | ( | )% | ||

Changes in uncertain tax positions | ( | )% | ( | )% | ( | )% | ||

Excess tax benefits from the exercise of stock options | ( | )% | ( | )% | ( | )% | ||

Goodwill impairment | % | % | % | |||||

Net transitional impact of U.S. Tax Act | % | % | % | |||||

Other | ( | )% | ( | )% | ( | )% | ||

EFFECTIVE INCOME TAX RATE | % | % | % | |||||

Years ended June 30 | 2019 | 2018 | 2017 | ||||||||

BEGINNING OF YEAR | $ | $ | $ | ||||||||

Increases in tax positions for prior years | |||||||||||

Decreases in tax positions for prior years | ( | ) | ( | ) | ( | ) | |||||

Increases in tax positions for current year | |||||||||||

Settlements with taxing authorities | ( | ) | ( | ) | ( | ) | |||||

Lapse in statute of limitations | ( | ) | ( | ) | ( | ) | |||||

Currency translation | ( | ) | ( | ) | ( | ) | |||||

END OF YEAR | $ | $ | $ | ||||||||

As of June 30 | 2019 | 2018 | |||||

DEFERRED TAX ASSETS | |||||||

Pension and postretirement benefits | $ | $ | |||||

Loss and other carryforwards | |||||||

Stock-based compensation | |||||||

Fixed assets | |||||||

Accrued marketing and promotion | |||||||

Unrealized loss on financial and foreign exchange transactions | |||||||

Inventory | |||||||

Accrued interest and taxes | |||||||

Advance payments | |||||||

Other | |||||||

Valuation allowances | ( | ) | ( | ) | |||

TOTAL | $ | $ | |||||

DEFERRED TAX LIABILITIES | |||||||

Goodwill and intangible assets | $ | $ | |||||

Fixed assets | |||||||

Foreign withholding tax on earnings to be repatriated | |||||||

Unrealized gain on financial and foreign exchange transactions | |||||||

Other | |||||||

TOTAL | $ | $ | |||||

Years ended June 30 | 2019 | 2018 | 2017 | ||||||||||||||

CONSOLIDATED AMOUNTS | Total | Total | Continuing Operations | Discontinued Operations | Total | ||||||||||||

Net earnings | $ | $ | $ | $ | $ | ||||||||||||

Less: Net earnings attributable to noncontrolling interests | |||||||||||||||||

Net earnings attributable to P&G | |||||||||||||||||

Less: Preferred dividends, net of tax | |||||||||||||||||

Net earnings attributable to P&G available to common shareholders (Basic) | $ | $ | $ | $ | $ | ||||||||||||

Net earnings attributable to P&G available to common shareholders (Diluted) | $ | $ | $ | $ | $ | ||||||||||||

SHARES IN MILLIONS | |||||||||||||||||

Basic weighted average common shares outstanding | |||||||||||||||||

Add: Effect of dilutive securities | |||||||||||||||||

Impact of stock options and other unvested equity awards (1) | |||||||||||||||||

Conversion of preferred shares (2) | |||||||||||||||||

Diluted weighted average common shares outstanding | |||||||||||||||||

NET EARNINGS PER SHARE (3) | |||||||||||||||||

Basic | $ | $ | $ | $ | $ | ||||||||||||

Diluted | $ | $ | $ | $ | $ | ||||||||||||

(1) | Weighted average outstanding stock options of approximately |

(2) | Despite being included in Diluted net earnings per common share, the actual conversion to common stock occurs when the preferred shares are sold. Shares may only be sold after being allocated to the ESOP participants pursuant to the repayment of the ESOP's obligations through 2035. In fiscal year 2019, weighted average outstanding preferred shares of |

(3) | Net earnings per share are calculated on Net earnings attributable to Procter & Gamble. |

Years ended June 30 | 2019 | 2018 | 2017 (1) | ||||||||

Stock options | $ | $ | $ | ||||||||

RSUs and PSUs | |||||||||||

Total stock-based expense | $ | $ | $ | ||||||||

Income tax benefit | $ | $ | $ | ||||||||

(1) | Includes amounts related to discontinued operations, which are not material. |

Years ended June 30 | 2019 | 2018 | 2017 | |||||||||||

Interest rate | - | % | - | % | - | % | ||||||||

Weighted average interest rate | % | % | % | |||||||||||

Dividend yield | % | % | % | |||||||||||

Expected volatility | % | % | % | |||||||||||

Expected life in years | ||||||||||||||

Options | Options (in thousands) | Weighted Average Exercise Price | Weighted Average Contract-ual Life in Years | Aggregate Intrinsic Value | |||||

Outstanding, beginning of year | $ | ||||||||

Granted | |||||||||

Exercised | ( | ) | |||||||

Forfeited/expired | ( | ) | |||||||

OUTSTANDING, END OF YEAR | $ | $ | |||||||

EXERCISABLE | $ | $ | |||||||

Years ended June 30 | 2019 | 2018 | 2017 | ||||||||

Weighted average grant-date fair value of options granted | $ | $ | $ | ||||||||

Intrinsic value of options exercised | |||||||||||

Grant-date fair value of options that vested | |||||||||||

Cash received from options exercised | |||||||||||

Actual tax benefit from options exercised | |||||||||||

RSUs | PSUs | ||||||||||

RSU and PSU awards | Units (in thousands) | Weighted Average Grant Date Fair Value | Units (in thousands) | Weighted Average Grant Date Fair Value | |||||||

Non-vested at July 1, 2018 | $ | $ | |||||||||

Granted | |||||||||||

Vested | ( | ) | ( | ) | |||||||

Forfeited | ( | ) | ( | ) | |||||||

Non-vested at June 30, 2019 | $ | $ | |||||||||

Pension Benefits (1) | Other Retiree Benefits (2) | ||||||||||||||

Years ended June 30 | 2019 | 2018 | 2019 | 2018 | |||||||||||

CHANGE IN BENEFIT OBLIGATION | |||||||||||||||

Benefit obligation at beginning of year (3) | $ | $ | $ | $ | |||||||||||

Service cost | |||||||||||||||

Interest cost | |||||||||||||||

Participants' contributions | |||||||||||||||

Amendments | ( | ) | |||||||||||||

Net actuarial loss/(gain) | ( | ) | ( | ) | |||||||||||

Acquisitions/(divestitures) | |||||||||||||||

Special termination benefits | |||||||||||||||

Currency translation and other | ( | ) | |||||||||||||

Benefit payments | ( | ) | ( | ) | ( | ) | ( | ) | |||||||

BENEFIT OBLIGATION AT END OF YEAR (3) | $ | $ | $ | $ | |||||||||||

CHANGE IN PLAN ASSETS | |||||||||||||||

Fair value of plan assets at beginning of year | $ | $ | $ | $ | |||||||||||

Actual return on plan assets | ( | ) | |||||||||||||

Acquisitions/(divestitures) | |||||||||||||||

Employer contributions | |||||||||||||||

Participants' contributions | |||||||||||||||

Currency translation and other | ( | ) | ( | ) | ( | ) | |||||||||

ESOP debt impacts (4) | |||||||||||||||

Benefit payments | ( | ) | ( | ) | ( | ) | ( | ) | |||||||

FAIR VALUE OF PLAN ASSETS AT END OF YEAR | $ | $ | $ | $ | |||||||||||

FUNDED STATUS | $ | ( | ) | $ | ( | ) | $ | $ | ( | ) | |||||

(1) | Primarily non-U.S.-based defined benefit retirement plans. |

(2) | Primarily U.S.-based other postretirement benefit plans. |

(3) | For the pension benefit plans, the benefit obligation is the projected benefit obligation. For other retiree benefit plans, the benefit obligation is the accumulated postretirement benefit obligation. |

(4) | Represents the net impact of ESOP debt service requirements, which is netted against plan assets for other retiree benefits. |

Pension Benefits | Other Retiree Benefits | ||||||||||||||

As of June 30 | 2019 | 2018 | 2019 | 2018 | |||||||||||

CLASSIFICATION OF NET AMOUNT RECOGNIZED | |||||||||||||||

Noncurrent assets | $ | $ | $ | $ | |||||||||||

Current liabilities | ( | ) | ( | ) | ( | ) | ( | ) | |||||||

Noncurrent liabilities | ( | ) | ( | ) | ( | ) | ( | ) | |||||||

NET AMOUNT RECOGNIZED | $ | ( | ) | $ | ( | ) | $ | $ | ( | ) | |||||

AMOUNTS RECOGNIZED IN ACCUMULATED OTHER COMPREHENSIVE INCOME (AOCI) | |||||||||||||||

Net actuarial loss | $ | $ | $ | $ | |||||||||||

Prior service cost/(credit) | ( | ) | ( | ) | |||||||||||

NET AMOUNTS RECOGNIZED IN AOCI | $ | $ | $ | $ | |||||||||||

Accumulated Benefit Obligation Exceeds the Fair Value of Plan Assets | Projected Benefit Obligation Exceeds the Fair Value of Plan Assets | ||||||||||||||

As of June 30 | 2019 | 2018 | 2019 | 2018 | |||||||||||

Projected benefit obligation | $ | $ | $ | $ | |||||||||||

Accumulated benefit obligation | |||||||||||||||

Fair value of plan assets | |||||||||||||||

Pension Benefits | Other Retiree Benefits | |||||||||||||||||||||||

Years ended June 30 | 2019 | 2018 | 2017 | 2019 | 2018 | 2017 | ||||||||||||||||||

AMOUNTS RECOGNIZED IN NET PERIODIC BENEFIT COST | ||||||||||||||||||||||||

Service cost | $ | $ | $ | (1) | $ | $ | $ | (1) | ||||||||||||||||

Interest cost | ||||||||||||||||||||||||

Expected return on plan assets | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||

Amortization of net actuarial loss | ||||||||||||||||||||||||

Amortization of prior service cost/(credit) | ( | ) | ( | ) | ( | ) | ||||||||||||||||||

Amortization of net actuarial loss/prior service cost due to settlements and curtailments | (2) | (2) | ||||||||||||||||||||||

Special termination benefits | (2) | |||||||||||||||||||||||

GROSS BENEFIT COST/(CREDIT) | ( | ) | ( | ) | ( | ) | ||||||||||||||||||

Dividends on ESOP preferred stock | ( | ) | ( | ) | ( | ) | ||||||||||||||||||

NET PERIODIC BENEFIT COST/(CREDIT) | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||||||||||

CHANGE IN PLAN ASSETS AND BENEFIT OBLIGATIONS RECOGNIZED IN AOCI | ||||||||||||||||||||||||

Net actuarial loss/(gain) - current year | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||

Prior service cost/(credit) - current year | ( | ) | ||||||||||||||||||||||

Amortization of net actuarial loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||||

Amortization of prior service (cost)/credit | ( | ) | ( | ) | ||||||||||||||||||||

Amortization of net actuarial loss/prior service costs due to settlements and curtailments | ( | ) | ||||||||||||||||||||||

Currency translation and other | ( | ) | ( | ) | ||||||||||||||||||||

TOTAL CHANGE IN AOCI | ( | ) | ( | ) | ||||||||||||||||||||

NET AMOUNTS RECOGNIZED IN PERIODIC BENEFIT COST AND AOCI | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||

(1) | Service cost includes amounts related to discontinued operations in fiscal year ended June 30, 2017, which are not material. |

(2) | For fiscal year ended June 30, 2017, amortization of net actuarial loss/prior service cost due to settlement and curtailments and $ |

Pension Benefits | Other Retiree Benefits | ||||||

Net actuarial loss | $ | $ | |||||

Prior service cost/(credit) | ( | ) | |||||

Pension Benefits | Other Retiree Benefits | ||||||||||

As of June 30 | 2019 | 2018 | 2019 | 2018 | |||||||

Discount rate | % | % | % | % | |||||||

Rate of compensation increase | % | % | N/A | N/A | |||||||

Health care cost trend rates assumed for next year | N/A | N/A | % | % | |||||||

Rate to which the health care cost trend rate is assumed to decline (ultimate trend rate) | N/A | N/A | % | % | |||||||

Year that the rate reaches the ultimate trend rate | N/A | N/A | |||||||||

(1) | Determined as of end of fiscal year. |

Pension Benefits | Other Retiree Benefits | ||||||||||||||||

Years ended June 30 | 2019 | 2018 | 2017 | 2019 | 2018 | 2017 | |||||||||||

Discount rate | % | % | % | % | % | % | |||||||||||

Expected return on plan assets | % | % | % | % | % | % | |||||||||||

Rate of compensation increase | % | % | % | N/A | N/A | N/A | |||||||||||

(1) | Determined as of beginning of fiscal year. |

One-Percentage Point Increase | One-Percentage Point Decrease | ||||||

Effect on the total service and interest cost components | $ | $ | ( | ) | |||

Effect on the accumulated postretirement benefit obligation | ( | ) | |||||

Target Asset Allocation | Actual Asset Allocation at June 30 | ||||||||||||||||

Pension Benefits | Other Retiree Benefits | Pension Benefits | Other Retiree Benefits | ||||||||||||||

Asset Category | 2019 | 2018 | 2019 | 2018 | |||||||||||||

Cash | % | % | % | % | % | % | |||||||||||

Debt securities | % | % | % | % | % | % | |||||||||||

Equity securities | % | % | % | % | % | % | |||||||||||

TOTAL | % | % | % | % | % | % | |||||||||||

Pension Benefits | Other Retiree Benefits | ||||||||||||||||||

As of June 30 | Fair Value Hierarchy Level | 2019 | 2018 | Fair Value Hierarchy Level | 2019 | 2018 | |||||||||||||

ASSETS AT FAIR VALUE | |||||||||||||||||||

Cash and cash equivalents | 1 | $ | $ | 1 | $ | $ | |||||||||||||

Company stock (1) | 1 & 2 | ||||||||||||||||||

Other (2) | 1, 2 & 3 | 1 | |||||||||||||||||

TOTAL ASSETS IN THE FAIR VALUE HEIRARCHY | |||||||||||||||||||

Investments valued at net asset value | |||||||||||||||||||

TOTAL ASSETS AT FAIR VALUE | $ | $ | |||||||||||||||||

(1) |

(2) | The Company's other pension plan assets measured at fair value are generally classified as Level 3 within the fair value hierarchy. There are no material other pension plan asset balances classified as Level 1 or Level 2 within the fair value hierarchy. |

Years ending June 30 | Pension Benefits | Other Retiree Benefits | |||||

EXPECTED BENEFIT PAYMENTS | |||||||

2020 | $ | $ | |||||

2021 | |||||||

2022 | |||||||

2023 | |||||||

2024 | |||||||

2025 - 2029 | |||||||

Shares in thousands | 2019 | 2018 | 2017 | |||||

Allocated | ||||||||

Unallocated | ||||||||

TOTAL SERIES A | ||||||||

Allocated | ||||||||

Unallocated | ||||||||

TOTAL SERIES B | ||||||||

• | Level 1: Quoted market prices in active markets for identical assets or liabilities. |

• | Level 2: Observable market-based inputs or unobservable inputs that are corroborated by market data. |

• | Level 3: Unobservable inputs reflecting the reporting entity's own assumptions or external inputs from inactive markets. |

Fair Value Asset | |||||||

As of June 30 | 2019 | 2018 | |||||

Investments: | |||||||

U.S. government securities | $ | $ | |||||

Corporate bond securities | |||||||

Other investments | |||||||

TOTAL | $ | $ | |||||

Notional Amount | Fair Value Asset | Fair Value (Liability) | |||||||||||||||||||||

As of June 30 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | |||||||||||||||||

DERIVATIVES IN FAIR VALUE HEDGING RELATIONSHIPS | |||||||||||||||||||||||

Interest rate contracts | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | |||||||||||||

DERIVATIVES IN NET INVESTMENT HEDGING RELATIONSHIPS | |||||||||||||||||||||||

Foreign currency interest rate contracts | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | |||||||||||||

TOTAL DERIVATIVES DESIGNATED AS HEDGING INSTRUMENTS | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | |||||||||||||

DERIVATIVES NOT DESIGNATED AS HEDGING INSTRUMENTS | |||||||||||||||||||||||

Foreign currency contracts | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | |||||||||||||

TOTAL DERIVATIVES AT FAIR VALUE | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | |||||||||||||

Amount of Gain/(Loss) Recognized in OCI on Derivatives | |||||||

Years ended June 30 | 2019 | 2018 | |||||

DERIVATIVES IN NET INVESTMENT HEDGING RELATIONSHIPS (1) (2) | |||||||