SEI Institutional Managed Trust

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-04878

SEI Institutional Managed Trust

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

Timothy D. Barto, Esq.

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s

telephone number, including area code: 610-676-1000

Date of fiscal year end: September 30, 2019

Date of reporting period:

March 31, 2019

| Item 1. |

Reports to Stockholders. |

March 31, 2019

SEMI-ANNUAL REPORT

SEI Institutional Managed Trust

| › |

|

Tax-Managed Large Cap Fund |

| › |

|

Tax-Managed Small/Mid Cap Fund |

| › |

|

U.S. Managed Volatility Fund |

| › |

|

Global Managed Volatility Fund |

| › |

|

Tax-Managed Managed Volatility Fund |

| › |

|

Tax-Managed International Managed Volatility Fund |

| › |

|

Conservative Income Fund |

| › |

|

Tax-Free Conservative Income Fund |

| › |

|

Dynamic Asset Allocation Fund |

| › |

|

Multi-Strategy Alternative Fund |

| › |

|

Multi-Asset Accumulation Fund |

| › |

|

Multi-Asset Income Fund |

| › |

|

Multi-Asset Inflation Managed Fund |

| › |

|

Multi-Asset Capital Stability Fund |

| › |

|

Long/Short Alternative Fund |

Beginning on January 1, 2021, as permitted by

regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your

financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to

receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary.

You may elect to receive all

future reports in paper free of charge. If you invest through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or you can contact your financial intermediary to inform it that you wish to

continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-DIAL-SEI. Your election to

receive reports in paper will apply to all funds held with the SEI Funds or your financial intermediary.

TABLE OF CONTENTS

The Trust files its complete schedule of portfolio holdings

with the Securities and Exchange Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Trust’s Form N-PORT reports are available on the Commission’s website at http://www.sec.gov.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information

relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-800-DIAL-SEI; and (ii) on the Commission’s

website at http://www.sec.gov.

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2019

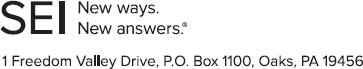

Large Cap Fund

†Percentages are based

on total investments. Includes investments held as collateral for securities held on loan (see Note 10).

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

Shares |

|

Market Value

($ Thousands) |

|

|

| COMMON STOCK — 97.9% |

|

|

|

|

|

|

|

| Communication Services — 7.1% |

|

|

|

|

|

| Alphabet Inc, Cl A * |

|

|

1.3 |

% |

|

|

24,804 |

|

|

$ |

29,192 |

|

| Alphabet Inc, Cl C * |

|

|

0.1 |

|

|

|

2,151 |

|

|

|

2,524 |

|

| AT&T Inc |

|

|

0.7 |

|

|

|

501,527 |

|

|

|

15,728 |

|

| Facebook Inc, Cl A * |

|

|

1.3 |

|

|

|

176,696 |

|

|

|

29,453 |

|

| Omnicom Group Inc |

|

|

0.7 |

|

|

|

211,517 |

|

|

|

15,439 |

|

| Verizon Communications Inc |

|

|

1.1 |

|

|

|

451,877 |

|

|

|

26,719 |

|

| Other Securities |

|

|

1.9 |

|

|

|

|

|

|

|

47,546 |

|

|

|

|

|

|

|

|

|

|

|

|

166,601 |

|

| Consumer Discretionary — 10.0% |

|

|

|

|

|

| Amazon.com Inc, Cl A * |

|

|

2.3 |

|

|

|

30,715 |

|

|

|

54,696 |

|

| Dollar General Corp |

|

|

0.7 |

|

|

|

142,657 |

|

|

|

17,019 |

|

| Lowe’s Cos Inc |

|

|

0.7 |

|

|

|

139,789 |

|

|

|

15,303 |

|

| Ross Stores Inc |

|

|

0.8 |

|

|

|

192,997 |

|

|

|

17,968 |

|

| Other Securities (A) |

|

|

5.5 |

|

|

|

|

|

|

|

129,545 |

|

|

|

|

|

|

|

|

|

|

|

|

234,531 |

|

| Consumer Staples — 6.9% |

|

|

|

|

|

| JM Smucker Co/The |

|

|

0.7 |

|

|

|

139,997 |

|

|

|

16,310 |

|

| Kroger Co/The |

|

|

0.7 |

|

|

|

641,242 |

|

|

|

15,775 |

|

| Philip Morris International Inc |

|

|

0.8 |

|

|

|

222,296 |

|

|

|

19,649 |

|

| Unilever NV |

|

|

0.6 |

|

|

|

257,120 |

|

|

|

14,987 |

|

| Other Securities |

|

|

4.1 |

|

|

|

|

|

|

|

94,363 |

|

|

|

|

|

|

|

|

|

|

|

|

161,084 |

|

| Energy — 6.3% |

|

|

|

|

|

| Chevron Corp |

|

|

1.4 |

|

|

|

267,288 |

|

|

|

32,924 |

|

| Marathon Petroleum Corp |

|

|

0.8 |

|

|

|

330,584 |

|

|

|

19,785 |

|

| Schlumberger Ltd, Cl A |

|

|

0.8 |

|

|

|

401,281 |

|

|

|

17,484 |

|

| Other Securities (A) |

|

|

3.3 |

|

|

|

|

|

|

|

78,395 |

|

|

|

|

|

|

|

|

|

|

|

|

148,588 |

|

| Financials — 16.5% |

|

|

|

|

|

| Aflac Inc |

|

|

0.7 |

|

|

|

348,811 |

|

|

|

17,441 |

|

| Bank of America Corp |

|

|

1.2 |

|

|

|

981,805 |

|

|

|

27,088 |

|

| Berkshire Hathaway Inc, Cl B * |

|

|

1.1 |

|

|

|

126,314 |

|

|

|

25,375 |

|

| Citigroup Inc |

|

|

1.4 |

|

|

|

513,200 |

|

|

|

31,931 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

Shares |

|

Market Value

($ Thousands) |

|

|

| COMMON STOCK (continued) |

|

|

|

|

|

| JPMorgan Chase & Co |

|

|

1.3 |

% |

|

|

301,012 |

|

|

$ |

30,471 |

|

| Markel Corp * |

|

|

0.7 |

|

|

|

17,107 |

|

|

|

17,043 |

|

| State Street Corp |

|

|

0.6 |

|

|

|

205,088 |

|

|

|

13,497 |

|

| US Bancorp |

|

|

0.6 |

|

|

|

280,419 |

|

|

|

13,513 |

|

| Other

Securities

‡(A)(B) |

|

|

8.9 |

|

|

|

|

|

|

|

210,428 |

|

|

|

|

|

|

|

|

|

|

|

|

386,787 |

|

| Health Care — 14.9% |

|

|

|

|

|

|

|

|

|

|

|

|

| Abbott Laboratories |

|

|

1.4 |

|

|

|

424,218 |

|

|

|

33,912 |

|

| AmerisourceBergen Corp, Cl A |

|

|

0.8 |

|

|

|

243,656 |

|

|

|

19,375 |

|

| Amgen Inc, Cl A |

|

|

0.9 |

|

|

|

108,639 |

|

|

|

20,639 |

|

| CVS Health Corp |

|

|

0.6 |

|

|

|

282,416 |

|

|

|

15,231 |

|

| Humana Inc |

|

|

0.6 |

|

|

|

55,343 |

|

|

|

14,721 |

|

| Johnson & Johnson |

|

|

1.6 |

|

|

|

276,269 |

|

|

|

38,620 |

|

| Merck & Co Inc |

|

|

1.3 |

|

|

|

367,900 |

|

|

|

30,598 |

|

| Pfizer Inc |

|

|

0.7 |

|

|

|

404,922 |

|

|

|

17,197 |

|

| Teleflex Inc |

|

|

0.6 |

|

|

|

46,383 |

|

|

|

14,015 |

|

| UnitedHealth Group Inc |

|

|

1.4 |

|

|

|

135,344 |

|

|

|

33,465 |

|

| Zimmer Biomet Holdings Inc |

|

|

0.6 |

|

|

|

112,033 |

|

|

|

14,307 |

|

| Other Securities |

|

|

4.4 |

|

|

|

|

|

|

|

99,297 |

|

|

|

|

|

|

|

|

|

|

|

|

351,377 |

|

| Industrials — 10.0% |

|

|

|

|

|

| Honeywell International Inc |

|

|

1.5 |

|

|

|

217,424 |

|

|

|

34,553 |

|

| Roper Technologies Inc |

|

|

0.7 |

|

|

|

47,516 |

|

|

|

16,249 |

|

| Other Securities |

|

|

7.8 |

|

|

|

|

|

|

|

185,379 |

|

|

|

|

|

|

|

|

|

|

|

|

236,181 |

|

| Information Technology — 18.0% |

|

|

|

|

|

| Adobe Inc * |

|

|

1.2 |

|

|

|

105,389 |

|

|

|

28,085 |

|

| Apple Inc |

|

|

1.0 |

|

|

|

122,748 |

|

|

|

23,316 |

|

| Cisco Systems Inc |

|

|

0.7 |

|

|

|

321,695 |

|

|

|

17,368 |

|

| Intel Corp |

|

|

0.8 |

|

|

|

345,841 |

|

|

|

18,572 |

|

| Intuit Inc |

|

|

1.1 |

|

|

|

97,447 |

|

|

|

25,474 |

|

| Microchip Technology Inc (A) |

|

|

1.1 |

|

|

|

308,253 |

|

|

|

25,573 |

|

| Microsoft Corp |

|

|

1.9 |

|

|

|

370,704 |

|

|

|

43,721 |

|

| Oracle Corp, Cl B |

|

|

0.6 |

|

|

|

282,015 |

|

|

|

15,147 |

|

| salesforce.com * |

|

|

0.8 |

|

|

|

123,745 |

|

|

|

19,598 |

|

| Visa Inc, Cl A |

|

|

1.2 |

|

|

|

182,351 |

|

|

|

28,481 |

|

| Other Securities |

|

|

7.6 |

|

|

|

|

|

|

|

177,256 |

|

|

|

|

|

|

|

|

|

|

|

|

422,591 |

|

| Materials — 3.6% |

|

|

|

|

|

| DowDuPont Inc |

|

|

0.6 |

|

|

|

258,426 |

|

|

|

13,777 |

|

| Other Securities |

|

|

3.0 |

|

|

|

|

|

|

|

70,043 |

|

|

|

|

|

|

|

|

|

|

|

|

83,820 |

|

| Real Estate — 2.9% |

|

|

|

|

|

| American Tower Corp, Cl A

‡ |

|

|

1.1 |

|

|

|

132,231 |

|

|

|

26,057 |

|

| Crown Castle International Corp

‡ |

|

|

0.6 |

|

|

|

108,136 |

|

|

|

13,841 |

|

| Other Securities

‡ |

|

|

1.2 |

|

|

|

|

|

|

|

28,774 |

|

|

|

|

|

|

|

|

|

|

|

|

68,672 |

|

|

|

|

| SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2019 |

|

1 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2019

Large Cap Fund (Concluded)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

Shares |

|

Market Value

($ Thousands) |

|

|

| COMMON STOCK (continued) |

|

|

|

|

|

|

|

|

|

| Utilities — 1.7% |

|

|

|

|

|

|

|

|

|

|

|

|

| Other Securities |

|

|

1.7 |

% |

|

|

|

|

|

$ |

40,205 |

|

|

|

| Total Common Stock

(Cost $1,866,690) ($ Thousands) |

|

|

|

2,300,437 |

|

|

|

| AFFILIATED PARTNERSHIP — 0.6% |

|

|

|

|

|

| SEI Liquidity Fund, L.P. |

|

|

|

|

|

|

2.480% **†(C) |

|

|

0.6 |

|

|

|

14,869,849 |

|

|

|

14,878 |

|

|

|

| Total Affiliated Partnership

(Cost $14,867) ($ Thousands) |

|

|

|

14,878 |

|

|

| CASH EQUIVALENT — 2.0% |

|

| SEI Daily Income Trust, Government Fund, Cl F |

|

|

|

|

|

|

|

|

|

|

|

|

| 2.220%

**† |

|

|

2.0 |

|

|

|

46,074,280 |

|

|

|

46,074 |

|

|

|

| Total Cash Equivalent

(Cost $46,074) ($ Thousands) |

|

|

|

46,074 |

|

|

|

| Total Investments in Securities — 100.5%

(Cost $1,927,631)

($ Thousands) |

|

|

$ |

2,361,389 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A list of the open futures contracts held at March 31, 2019 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Type of

Contract |

|

Number of

Contracts Long/(Short) |

|

Expiration

Date |

|

|

Notional Amount

(Thousands) |

|

Value

(Thousands) |

|

Unrealized

Appreciation

(Depreciation)

(Thousands) |

| S&P 500 Index E-MINI |

|

|

182 |

|

|

|

Jun-2019 |

|

|

|

$ 25,401 |

|

|

$ |

25,824 |

|

|

$ |

423 |

|

| S&P Mid Cap 400 Index E-MINI |

|

|

12 |

|

|

|

Jun-2019 |

|

|

|

2,259 |

|

|

|

2,280 |

|

|

|

21 |

|

|

|

|

|

|

|

|

|

|

|

|

$ 27,660 |

|

|

$ |

28,104 |

|

|

$ |

444 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Percentages are based on a Net Assets of $2,349,301 ($ Thousands). |

| * |

Non-income producing security. |

| ** |

The rate reported is the 7-day effective yield as of March 31, 2019. |

| ‡ |

Real Estate Investment Trust. |

| † |

Investment in Affiliated Security (see Note 6). |

| (A) |

Certain securities or partial positions of certain securities are on loan at March 31, 2019 (see Note 10). The total

market value of securities on loan at March 31, 2019, was $14,761 ($ Thousands). |

| (B) |

Security is a Master Limited Partnership. At March 31, 2019, such securities amounted to $7,538 ($ Thousands), or

0.3% of Net Assets (See Note 2). |

| (C) |

This security was purchased with cash collateral held from securities on loan (see Note 10). The total market value of

such securities as of March 31, 2019 was $14,878 ($ Thousands). |

Cl — Class

L.P. — Limited Partnership

Ltd. — Limited

S&P — Standard & Poor’s

|

|

|

| 2 |

|

SEI Institutional Managed Trust / Semi-Annual Report / March 31,

2019 |

The Summary Schedule of Investments does not reflect the complete portfolio holdings. It includes the Fund’s 50

largest holdings and each investment of any issuer that exceeds 1% of the Fund’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission

(“SEC”). In certain instances, securities for which footnotes listed above may otherwise apply are included in the Other Securities caption. The complete schedule of portfolio holdings is available (i) without charge, upon request, by

calling (800) 342-5734; and (ii) on the SEC’s website at http://www.sec.gov.

The following is a list of the level of inputs used as of March 31, 2019, in valuing the Fund’s investments and

other financial instruments carried at value ($ Thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Investments in

Securities |

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

| Common Stock |

|

$ |

2,300,437 |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

2,300,437 |

|

| Affiliated Partnership |

|

|

– |

|

|

|

14,878 |

|

|

|

– |

|

|

|

14,878 |

|

| Cash Equivalent |

|

|

46,074 |

|

|

|

– |

|

|

|

– |

|

|

|

46,074 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments in Securities |

|

$ |

2,346,511 |

|

|

$ |

14,878 |

|

|

$ |

– |

|

|

$ |

2,361,389 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Financial

Instruments |

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

| Futures Contracts* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized Appreciation |

|

$ |

444 |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

444 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Other Financial Instruments |

|

$ |

444 |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

444 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Futures contracts are valued at the unrealized appreciation on the instrument.

For the period ended March 31, 2019, there were no transfers between Level 1 and Level 2 assets and liabilities.

For the period ended March 31, 2019, there were no transfers between Level 2 and Level 3 assets and liabilities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

The following is a summary of the Fund’s transactions with affiliates for the period ended March 31, 2019 ($

Thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Security Description |

|

Value at 9/30/18 |

|

Purchases at

Cost |

|

Proceeds from

Sales |

|

Realized Gain |

|

Change in

Unrealized

Depreciation |

|

Value 3/31/19 |

|

Income |

| SEI Daily Income Trust, Government Fund, Cl F |

|

$ 57,680 |

|

$ 316,891 |

|

$ (328,497) |

|

$ — |

|

$ — |

|

$ 46,074 |

|

$ 551 |

| SEI Liquidity Fund, L.P. |

|

52,638 |

|

125,593 |

|

(163,358) |

|

5 |

|

— |

|

14,878 |

|

52 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Totals |

|

$ 110,318 |

|

$ 442,484 |

|

$ (491,855) |

|

$ 5 |

|

$ — |

|

$ 60,952 |

|

$ 603 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

|

|

|

| SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2019 |

|

3 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2019

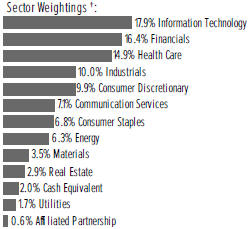

Large Cap Value Fund

†Percentages are based

on total investments. Includes investments held as collateral for securities held on loan (see Note 10).

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

Shares |

|

Market Value

($ Thousands) |

|

|

| COMMON STOCK — 97.5% |

|

|

|

|

|

|

|

| Communication Services — 6.3% |

|

|

|

|

|

| AT&T Inc |

|

|

2.4 |

% |

|

|

1,025,830 |

|

|

$ |

32,170 |

|

| BCE Inc |

|

|

0.7 |

|

|

|

219,735 |

|

|

|

9,754 |

|

| Verizon Communications Inc |

|

|

1.0 |

|

|

|

237,848 |

|

|

|

14,064 |

|

| Other Securities |

|

|

2.2 |

|

|

|

|

|

|

|

29,600 |

|

|

|

|

|

|

|

|

|

|

|

|

85,588 |

|

| Consumer Discretionary — 7.6% |

|

|

|

|

|

| General Motors Co |

|

|

1.0 |

|

|

|

367,789 |

|

|

|

13,645 |

|

| Genuine Parts Co |

|

|

0.9 |

|

|

|

109,513 |

|

|

|

12,269 |

|

| Target Corp, Cl A |

|

|

0.6 |

|

|

|

105,907 |

|

|

|

8,500 |

|

| Other Securities (A) |

|

|

5.1 |

|

|

|

|

|

|

|

68,534 |

|

|

|

|

|

|

|

|

|

|

|

|

102,948 |

|

| Consumer Staples — 8.2% |

|

|

|

|

|

| Altria Group Inc |

|

|

0.6 |

|

|

|

132,361 |

|

|

|

7,601 |

|

| Diageo PLC ADR |

|

|

0.7 |

|

|

|

61,169 |

|

|

|

10,008 |

|

| Kimberly-Clark Corp |

|

|

0.8 |

|

|

|

88,522 |

|

|

|

10,968 |

|

| Philip Morris International Inc |

|

|

1.0 |

|

|

|

156,750 |

|

|

|

13,855 |

|

| Tyson Foods Inc, Cl A |

|

|

0.6 |

|

|

|

107,097 |

|

|

|

7,436 |

|

| Unilever NV |

|

|

0.6 |

|

|

|

140,802 |

|

|

|

8,207 |

|

| Walgreens Boots Alliance Inc |

|

|

0.8 |

|

|

|

178,672 |

|

|

|

11,305 |

|

| Walmart Inc |

|

|

1.0 |

|

|

|

135,544 |

|

|

|

13,220 |

|

| Other Securities |

|

|

2.1 |

|

|

|

|

|

|

|

27,638 |

|

|

|

|

|

|

|

|

|

|

|

|

110,238 |

|

| Energy — 11.0% |

|

|

|

|

|

| Chevron Corp |

|

|

2.1 |

|

|

|

235,172 |

|

|

|

28,969 |

|

| ConocoPhillips |

|

|

1.7 |

|

|

|

345,296 |

|

|

|

23,045 |

|

| Exxon Mobil Corp |

|

|

1.9 |

|

|

|

316,864 |

|

|

|

25,603 |

|

| Marathon Petroleum Corp |

|

|

0.7 |

|

|

|

153,825 |

|

|

|

9,206 |

|

| Royal Dutch Shell PLC ADR, Cl A |

|

|

0.6 |

|

|

|

139,866 |

|

|

|

8,754 |

|

| Valero Energy Corp |

|

|

0.7 |

|

|

|

104,174 |

|

|

|

8,837 |

|

| Other Securities |

|

|

3.3 |

|

|

|

|

|

|

|

44,466 |

|

|

|

|

|

|

|

|

|

|

|

|

148,880 |

|

| Financials — 19.9% |

|

|

|

|

|

| Aflac Inc |

|

|

0.6 |

|

|

|

149,859 |

|

|

|

7,493 |

|

| Allstate Corp/The |

|

|

0.6 |

|

|

|

78,965 |

|

|

|

7,437 |

|

| Bank of America Corp |

|

|

1.2 |

|

|

|

591,845 |

|

|

|

16,329 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

Shares |

|

Market Value

($ Thousands) |

|

|

| COMMON STOCK (continued) |

|

|

|

|

|

| Berkshire Hathaway Inc, Cl B * |

|

|

1.2 |

% |

|

|

82,741 |

|

|

$ |

16,622 |

|

| Chubb Ltd |

|

|

0.8 |

|

|

|

73,483 |

|

|

|

10,294 |

|

| Citigroup Inc |

|

|

1.5 |

|

|

|

323,897 |

|

|

|

20,153 |

|

| JPMorgan Chase & Co |

|

|

2.9 |

|

|

|

384,576 |

|

|

|

38,931 |

|

| KKR & Co Inc |

|

|

0.6 |

|

|

|

321,877 |

|

|

|

7,561 |

|

| SunTrust Banks Inc |

|

|

1.0 |

|

|

|

234,504 |

|

|

|

13,894 |

|

| Travelers Cos Inc/The |

|

|

1.0 |

|

|

|

97,005 |

|

|

|

13,305 |

|

| Wells Fargo & Co |

|

|

1.1 |

|

|

|

312,120 |

|

|

|

15,082 |

|

| Other

Securities

‡(A)(B) |

|

|

7.4 |

|

|

|

|

|

|

|

100,543 |

|

|

|

|

|

|

|

|

|

|

|

|

267,644 |

|

| Health Care — 14.2% |

|

|

|

|

|

| Bristol-Myers Squibb Co |

|

|

0.6 |

|

|

|

176,482 |

|

|

|

8,420 |

|

| Eli Lilly & Co |

|

|

1.1 |

|

|

|

107,835 |

|

|

|

13,993 |

|

| Johnson & Johnson |

|

|

2.4 |

|

|

|

229,920 |

|

|

|

32,141 |

|

| Merck & Co Inc |

|

|

2.0 |

|

|

|

327,493 |

|

|

|

27,238 |

|

| Novartis AG ADR |

|

|

0.8 |

|

|

|

109,770 |

|

|

|

10,553 |

|

| Pfizer Inc |

|

|

2.7 |

|

|

|

859,268 |

|

|

|

36,493 |

|

| Other Securities (C) |

|

|

4.6 |

|

|

|

|

|

|

|

61,963 |

|

|

|

|

|

|

|

|

|

|

|

|

190,801 |

|

| Industrials — 7.2% |

|

|

|

|

|

| 3M Co |

|

|

0.6 |

|

|

|

40,786 |

|

|

|

8,475 |

|

| Delta Air Lines Inc, Cl A |

|

|

0.6 |

|

|

|

152,815 |

|

|

|

7,893 |

|

| Johnson Controls International plc |

|

|

0.7 |

|

|

|

242,079 |

|

|

|

8,942 |

|

| Raytheon Co |

|

|

0.7 |

|

|

|

54,023 |

|

|

|

9,837 |

|

| Other Securities |

|

|

4.6 |

|

|

|

|

|

|

|

61,339 |

|

|

|

|

|

|

|

|

|

|

|

|

96,486 |

|

| Information Technology — 11.2% |

|

|

|

|

|

| Cisco Systems Inc |

|

|

2.5 |

|

|

|

617,328 |

|

|

|

33,330 |

|

| Corning Inc, Cl B |

|

|

0.9 |

|

|

|

386,238 |

|

|

|

12,784 |

|

| Intel Corp |

|

|

2.3 |

|

|

|

584,123 |

|

|

|

31,367 |

|

| Microsoft Corp |

|

|

1.2 |

|

|

|

135,407 |

|

|

|

15,970 |

|

| Other Securities |

|

|

4.3 |

|

|

|

|

|

|

|

57,534 |

|

|

|

|

|

|

|

|

|

|

|

|

150,985 |

|

| Materials — 3.9% |

|

|

|

|

|

| DowDuPont Inc |

|

|

1.0 |

|

|

|

258,229 |

|

|

|

13,766 |

|

| Other Securities |

|

|

2.9 |

|

|

|

|

|

|

|

38,723 |

|

|

|

|

|

|

|

|

|

|

|

|

52,489 |

|

| Real Estate — 3.4% |

|

|

|

|

|

| HCP Inc

‡ |

|

|

0.7 |

|

|

|

284,637 |

|

|

|

8,909 |

|

| Welltower Inc

‡ |

|

|

1.2 |

|

|

|

200,627 |

|

|

|

15,569 |

|

| Other Securities

‡(A) |

|

|

1.5 |

|

|

|

|

|

|

|

21,296 |

|

|

|

|

|

|

|

|

|

|

|

|

45,774 |

|

| Utilities — 4.6% |

|

|

|

|

|

| Exelon Corp |

|

|

0.9 |

|

|

|

248,451 |

|

|

|

12,455 |

|

| NextEra Energy Inc |

|

|

1.3 |

|

|

|

91,339 |

|

|

|

17,658 |

|

| Other Securities |

|

|

2.4 |

|

|

|

|

|

|

|

31,897 |

|

|

|

|

|

|

|

|

|

|

|

|

62,010 |

|

| Total Common Stock

(Cost $1,084,172) ($ Thousands) |

|

|

|

1,313,843 |

|

|

|

|

| 4 |

|

SEI Institutional Managed Trust / Semi-Annual Report / March 31,

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

Shares |

|

Market Value

($ Thousands) |

|

|

| AFFILIATED PARTNERSHIP — 0.3% |

|

|

|

|

|

| SEI Liquidity Fund, L.P. |

|

|

|

|

|

|

|

|

|

|

|

|

| 2.480% **†

(D) |

|

|

0.3 |

% |

|

|

4,536,876 |

|

|

$ |

4,538 |

|

|

|

| Total Affiliated Partnership

(Cost $4,536) ($ Thousands) |

|

|

|

4,538 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

Shares |

|

Market Value

($ Thousands) |

|

|

| CASH EQUIVALENT — 2.3% |

|

|

|

|

|

| SEI Daily Income Trust,

Government Fund, Cl F |

|

|

|

|

|

| 2.220%

**† |

|

|

2.3 |

% |

|

|

31,561,067 |

|

|

$ |

31,561 |

|

| Total Cash

Equivalent

(Cost $31,561) ($ Thousands) |

|

|

|

31,561 |

|

|

|

| Total Investments in Securities — 100.1%

(Cost $1,120,269)

($ Thousands) |

|

|

$ |

1,349,942 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A list of the open futures contracts held at March 31, 2019 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Type of

Contract |

|

Number of

Contracts Long |

|

Expiration

Date |

|

|

Notional Amount

(Thousands) |

|

Value

(Thousands) |

|

Unrealized

Appreciation

(Thousands) |

| S&P 500 Index E-MINI |

|

|

71 |

|

|

|

Jun-2019 |

|

|

$ |

9,804 |

|

|

$ |

10,074 |

|

|

$ |

270 |

|

| S&P Mid Cap 400 Index E-MINI |

|

|

41 |

|

|

|

Jun-2019 |

|

|

|

7,672 |

|

|

|

7,794 |

|

|

|

122 |

|

|

|

|

|

|

|

|

|

|

|

$ |

17,476 |

|

|

$ |

17,868 |

|

|

$ |

392 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Percentages are based on a Net Assets of $1,348,144 ($ Thousands). |

| * |

Non-income producing security. |

| ** |

The rate reported is the 7-day effective yield as of March 31, 2019. |

| ‡ |

Real Estate Investment Trust. |

| † |

Investment in Affiliated Security (see Note 6). |

| (A) |

Certain securities or partial positions of certain securities are on loan at March 31, 2019 (see Note 10). The total

market value of securities on loan at March 31, 2019, was $4,377 ($ Thousands). |

| (B) |

Security is a Master Limited Partnership. At March 31, 2019, such securities amounted to $5,817 ($ Thousands), or

0.4% of Net Assets (See Note 2). |

| (C) |

Securities considered illiquid. The total value of such securities as of March 31, 2019 was $4,595 ($ Thousands) and

represented 0.3% of Net Assets. |

| (D) |

This security was purchased with cash collateral held from securities on loan (see Note 10). The total market value of

such securities as of March 31, 2019 was $4,538 ($ Thousands). |

ADR — American Depositary Receipt

Cl — Class

L.P. — Limited Partnership

PLC — Public Limited Company

S&P — Standard & Poor’s

The Summary Schedule of Investments does not reflect the complete portfolio holdings. It includes the Fund’s 50 largest holdings and each investment of any issuer

that exceeds 1% of the Fund’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). In certain instances, securities

for which footnotes listed above may otherwise apply are included in the Other Securities caption. The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 342-5734; and (ii) on the

SEC’s website at http://www.sec.gov.

The following is a list of the level of inputs used as of March 31, 2019, in valuing the Fund’s investments

carried and other financial instruments at value ($ Thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| Investments in Securities |

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

| Common Stock |

|

$ 1,313,843 |

|

$ |

– |

|

|

$ |

– |

|

|

$ |

1,313,843 |

|

| Affiliated Partnership |

|

– |

|

|

4,538 |

|

|

|

– |

|

|

|

4,538 |

|

| Cash Equivalent |

|

31,561 |

|

|

– |

|

|

|

– |

|

|

|

31,561 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments in Securities |

|

$ 1,345,404 |

|

$ |

4,538 |

|

|

$ |

– |

|

|

$ |

1,349,942 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Financial

Instruments |

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

| Futures Contracts * |

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized Appreciation |

|

$ 392 |

|

$ |

– |

|

|

$ |

– |

|

|

$ |

392 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Other Financial Instruments |

|

$ 392 |

|

$ |

– |

|

|

$ |

– |

|

|

$ |

392 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Futures contracts are valued at the unrealized appreciation on the instrument.

For the period ended March 31, 2019, there were no transfers between Level 1 and Level 2 assets and liabilities.

For the period ended March 31, 2019, there were no transfers between Level 2 and Level 3 assets and liabilities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

|

|

|

| SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2019 |

|

5 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2019

Large Cap Value Fund (Concluded)

The following is a summary of the Fund’s transactions with affiliates for the period ended March 31, 2019 ($

Thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Security Description |

|

Value 9/30/18 |

|

Purchases at

Cost |

|

Proceeds from

Sales |

|

Realized Gain |

|

Change in Unrealized

Appreciation |

|

Value 3/31/19 |

|

Income |

| SEI Liquidity Fund, L.P. |

|

|

$ 10,516 |

|

|

|

$ 93,706 |

|

|

|

$ (99,688) |

|

|

|

$ 3 |

|

|

|

$ 1 |

|

|

|

$ 4,538 |

|

|

|

$ 24 |

|

| SEI Daily Income Trust, Government Fund, Cl F |

|

|

42,653 |

|

|

|

101,670 |

|

|

|

(112,762) |

|

|

|

— |

|

|

|

— |

|

|

|

31,561 |

|

|

|

369 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Totals |

|

|

$ 53,169 |

|

|

|

$ 195,376 |

|

|

|

$ (212,450) |

|

|

|

$ 3 |

|

|

|

$ 1 |

|

|

|

$ 36,099 |

|

|

|

$ 393 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

|

|

|

| 6 |

|

SEI Institutional Managed Trust / Semi-Annual Report / March 31,

2019 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2019

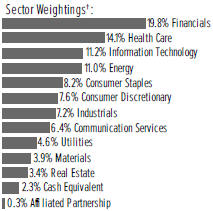

Large Cap Growth Fund

†Percentages are based

on total investments. Includes investments held as collateral for securities held on loan (see Note 10).

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

Shares |

|

Market Value

($ Thousands) |

|

|

| COMMON STOCK — 98.2% |

|

|

|

|

|

|

|

| Communication Services — 10.2% |

|

|

|

|

|

| Alphabet Inc, Cl A * |

|

|

3.8 |

% |

|

|

47,240 |

|

|

$ |

55,596 |

|

| Alphabet Inc, Cl C * |

|

|

0.9 |

|

|

|

10,824 |

|

|

|

12,700 |

|

| Facebook Inc, Cl A * |

|

|

2.2 |

|

|

|

198,862 |

|

|

|

33,148 |

|

| T-Mobile US Inc * |

|

|

0.7 |

|

|

|

147,591 |

|

|

|

10,199 |

|

| Other Securities (A) |

|

|

2.6 |

|

|

|

|

|

|

|

38,963 |

|

|

|

|

|

|

|

|

|

|

|

|

150,606 |

|

| Consumer Discretionary — 15.6% |

|

|

|

|

|

| Alibaba Group Holding Ltd ADR * |

|

|

1.1 |

|

|

|

88,263 |

|

|

|

16,104 |

|

| Amazon.com Inc, Cl A * |

|

|

5.3 |

|

|

|

44,429 |

|

|

|

79,117 |

|

| AutoZone Inc * |

|

|

1.5 |

|

|

|

22,155 |

|

|

|

22,689 |

|

| Lowe’s Cos Inc |

|

|

0.8 |

|

|

|

102,559 |

|

|

|

11,227 |

|

| Lululemon Athletica Inc * |

|

|

0.7 |

|

|

|

63,993 |

|

|

|

10,486 |

|

| NIKE Inc, Cl B |

|

|

1.0 |

|

|

|

172,922 |

|

|

|

14,562 |

|

| TJX Cos Inc/The |

|

|

1.2 |

|

|

|

339,896 |

|

|

|

18,086 |

|

| Other Securities |

|

|

4.0 |

|

|

|

|

|

|

|

59,192 |

|

|

|

|

|

|

|

|

|

|

|

|

231,463 |

|

| Consumer Staples — 4.2% |

|

|

|

|

|

| Colgate-Palmolive Co |

|

|

0.9 |

|

|

|

184,478 |

|

|

|

12,644 |

|

| Hershey Co/The |

|

|

0.7 |

|

|

|

92,045 |

|

|

|

10,569 |

|

| PepsiCo Inc |

|

|

1.3 |

|

|

|

157,598 |

|

|

|

19,314 |

|

| Other Securities |

|

|

1.3 |

|

|

|

|

|

|

|

18,870 |

|

|

|

|

|

|

|

|

|

|

|

|

61,397 |

|

| Energy — 0.3% |

|

|

|

|

|

| Other Securities |

|

|

0.3 |

|

|

|

|

|

|

|

4,241 |

|

|

|

|

|

| Financials — 7.8% |

|

|

|

|

|

|

|

|

|

|

|

|

| CME Group Inc |

|

|

0.8 |

|

|

|

72,684 |

|

|

|

11,962 |

|

| Moody’s Corp |

|

|

1.6 |

|

|

|

129,490 |

|

|

|

23,449 |

|

| MSCI Inc, Cl A |

|

|

1.1 |

|

|

|

78,786 |

|

|

|

15,666 |

|

| Progressive Corp/The |

|

|

1.6 |

|

|

|

319,594 |

|

|

|

23,040 |

|

| US Bancorp |

|

|

0.9 |

|

|

|

273,464 |

|

|

|

13,178 |

|

| Other Securities |

|

|

1.8 |

|

|

|

|

|

|

|

28,577 |

|

|

|

|

|

|

|

|

|

|

|

|

115,872 |

|

| Health Care — 15.5% |

|

|

|

|

|

|

|

|

|

|

|

|

| Abbott Laboratories |

|

|

1.1 |

|

|

|

205,567 |

|

|

|

16,433 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

Shares |

|

Market Value

($ Thousands) |

|

|

| COMMON STOCK (continued) |

|

|

|

|

|

| Becton Dickinson and Co |

|

|

1.4 |

% |

|

|

81,942 |

|

|

$ |

20,463 |

|

| Danaher Corp, Cl A |

|

|

0.8 |

|

|

|

89,177 |

|

|

|

11,773 |

|

| Johnson & Johnson |

|

|

1.4 |

|

|

|

150,630 |

|

|

|

21,057 |

|

| Mettler-Toledo International Inc * |

|

|

1.0 |

|

|

|

21,426 |

|

|

|

15,491 |

|

| Regeneron Pharmaceuticals

Inc * |

|

|

0.7 |

|

|

|

26,257 |

|

|

|

10,782 |

|

| UnitedHealth Group Inc |

|

|

3.5 |

|

|

|

207,463 |

|

|

|

51,297 |

|

| Varian Medical Systems Inc * |

|

|

0.7 |

|

|

|

74,409 |

|

|

|

10,545 |

|

| Vertex Pharmaceuticals

Inc * |

|

|

0.8 |

|

|

|

63,443 |

|

|

|

11,670 |

|

| Other Securities (B) |

|

|

4.1 |

|

|

|

|

|

|

|

60,638 |

|

|

|

|

|

|

|

|

|

|

|

|

230,149 |

|

| Industrials — 10.3% |

|

|

|

|

|

| 3M Co |

|

|

1.0 |

|

|

|

70,234 |

|

|

|

14,593 |

|

| Boeing Co/The |

|

|

1.8 |

|

|

|

67,507 |

|

|

|

25,749 |

|

| Cintas Corp |

|

|

1.0 |

|

|

|

75,177 |

|

|

|

15,194 |

|

| Graco Inc |

|

|

1.0 |

|

|

|

300,933 |

|

|

|

14,902 |

|

| Middleby Corp/The * |

|

|

0.8 |

|

|

|

87,227 |

|

|

|

11,342 |

|

| Robert Half International Inc |

|

|

0.7 |

|

|

|

157,721 |

|

|

|

10,277 |

|

| Union Pacific Corp |

|

|

1.1 |

|

|

|

97,386 |

|

|

|

16,283 |

|

| United Technologies Corp |

|

|

0.9 |

|

|

|

106,872 |

|

|

|

13,775 |

|

| Other Securities |

|

|

2.0 |

|

|

|

|

|

|

|

31,047 |

|

|

|

|

|

|

|

|

|

|

|

|

153,162 |

|

| Information Technology — 29.5% |

|

|

|

|

|

| Adobe Inc * |

|

|

2.1 |

|

|

|

116,876 |

|

|

|

31,146 |

|

| Analog Devices Inc |

|

|

1.0 |

|

|

|

147,089 |

|

|

|

15,484 |

|

| Apple Inc |

|

|

2.7 |

|

|

|

214,018 |

|

|

|

40,653 |

|

| Broadcom Inc |

|

|

1.3 |

|

|

|

62,672 |

|

|

|

18,846 |

|

| Mastercard Inc, Cl A |

|

|

2.7 |

|

|

|

171,148 |

|

|

|

40,297 |

|

| Microsoft Corp |

|

|

5.8 |

|

|

|

731,873 |

|

|

|

86,317 |

|

| Oracle Corp, Cl B |

|

|

1.0 |

|

|

|

274,986 |

|

|

|

14,770 |

|

| PayPal Holdings Inc * |

|

|

0.7 |

|

|

|

104,842 |

|

|

|

10,887 |

|

| salesforce.com * |

|

|

1.5 |

|

|

|

137,437 |

|

|

|

21,766 |

|

| Visa Inc, Cl A |

|

|

3.0 |

|

|

|

283,381 |

|

|

|

44,261 |

|

| VMware Inc, Cl A * |

|

|

0.7 |

|

|

|

59,886 |

|

|

|

10,810 |

|

| Zebra Technologies Corp, Cl A * |

|

|

0.7 |

|

|

|

49,225 |

|

|

|

10,314 |

|

| Other Securities (A) |

|

|

6.3 |

|

|

|

|

|

|

|

91,846 |

|

|

|

|

|

|

|

|

|

|

|

|

437,397 |

|

| Materials — 3.1% |

|

|

|

|

|

| Linde PLC |

|

|

0.8 |

|

|

|

64,004 |

|

|

|

11,260 |

|

| Sherwin-Williams Co/The, Cl A |

|

|

1.5 |

|

|

|

51,845 |

|

|

|

22,330 |

|

| Other Securities |

|

|

0.8 |

|

|

|

|

|

|

|

11,681 |

|

|

|

|

|

|

|

|

|

|

|

|

45,271 |

|

| Real Estate — 1.3% |

|

|

|

|

|

|

|

|

|

|

|

|

| EPR Properties, Cl A

‡ |

|

|

0.8 |

|

|

|

142,436 |

|

|

|

10,953 |

|

| Other Securities

‡ |

|

|

0.5 |

|

|

|

|

|

|

|

8,024 |

|

|

|

|

|

|

|

|

|

|

|

|

18,977 |

|

|

|

|

| SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2019 |

|

7 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2019

Large Cap Growth Fund (Concluded)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Description |

|

Percentage of

Net Assets (%) |

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

| COMMON STOCK (continued) |

|

|

|

|

|

|

|

| Utilities — 0.4% |

|

|

|

|

|

| Other Securities |

|

|

0.4 |

% |

|

|

|

|

|

$ |

6,511 |

|

|

|

| Total Common Stock

(Cost $993,297) ($ Thousands) |

|

|

|

1,455,046 |

|

|

|

| AFFILIATED PARTNERSHIP — 0.8% |

|

|

|

|

|

| SEI Liquidity Fund, L.P. |

|

|

|

|

|

|

2.480% **†(C) |

|

|

0.8 |

|

|

|

11,088,940 |

|

|

|

11,089 |

|

|

|

| Total Affiliated Partnership

(Cost $11,088) ($ Thousands) |

|

|

|

11,089 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Description |

|

Percentage of

Net Assets (%) |

|

Shares |

|

|

Market Value

($ Thousands) |

|

|

|

| CASH EQUIVALENT — 1.4% |

|

|

|

|

|

| SEI Daily Income Trust,

Government Fund, Cl F |

|

|

|

|

|

| 2.220%

**† |

|

|

1.4 |

% |

|

|

21,242,105 |

|

|

$ |

21,242 |

|

|

|

| Total Cash Equivalent

(Cost $21,242) ($ Thousands) |

|

|

|

21,242 |

|

|

|

| Total Investments in Securities — 100.4%

(Cost $1,025,627)

($ Thousands) |

|

|

$ |

1,487,377 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A list of the open futures contracts held at

March 31, 2019 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Type of

Contract |

|

Number of

Contracts

Long |

|

Expiration

Date |

|

|

Notional Amount

(Thousands) |

|

Value

(Thousands) |

|

Unrealized

Appreciation

(Thousands) |

| S&P 500 Index E-MINI |

|

|

110 |

|

|

|

Jun-2019 |

|

|

$ |

15,305 |

|

|

$ |

15,608 |

|

|

$ |

303 |

|

| |

Percentages are based on Net Assets of $1,481,763 ($ Thousands). |

| * |

Non-income producing security. |

| ** |

Rate shown is the 7-day effective yield as of March 31, 2019. |

| † |

Investment in Affiliated Security (see Note 6). |

| ‡ |

Real Estate Investment Trust. |

| (A) |

Certain securities or partial positions of certain securities are on loan at March 31, 2019 (see Note 10). The total

market value of securities on loan at March 31, 2019 was $11,014 ($ Thousands). |

| (B) |

Securities considered illiquid. The total value of such securities as of March 31, 2019 was $5,576 ($ Thousands) and

represented 0.4% of the Net Assets of the Fund. |

| (C) |

This security was purchased with cash collateral held from securities on loan (see Note 10). The total market value of

such securities as of March 31, 2019 was $11,089 ($ Thousands). |

ADR — American Depositary Receipt

Cl — Class

L.P. — Limited Partnership

Ltd. — Limited

S&P — Standard & Poor’s

The Summary Schedule of Investments does not reflect the complete portfolio holdings. It includes the Fund’s 50 largest holdings and each investment of any issuer

that exceeds 1% of the Fund’s net assets.

“Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S.

Securities and Exchange Commission (“SEC”). In certain instances, securities for which footnotes listed above may otherwise apply are included in the Other Securities caption. The complete schedule of portfolio holdings is available

(i) without charge, upon request, by calling (800) 342-5734; and (ii) on the SEC’s website at http://www.sec.gov.

The following is a list of the level of inputs used as of March 31, 2019, in valuing the Fund’s investments and

other financial instrument carried at value ($ Thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Investments in

Securities |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| Common Stock |

|

$ |

1,455,046 |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

1,455,046 |

|

| Affiliated Partnership |

|

|

– |

|

|

|

11,089 |

|

|

|

– |

|

|

|

11,089 |

|

| Cash Equivalent |

|

|

21,242 |

|

|

|

– |

|

|

|

– |

|

|

|

21,242 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments in Securities |

|

$ |

1,476,288 |

|

|

$ |

11,089 |

|

|

$ |

– |

|

|

$ |

1,487,377 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Financial

Instruments |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| Futures Contracts* |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized Appreciation |

|

$ |

303 |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

303 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Other Financial Instruments |

|

$ |

303 |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

303 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Futures contracts are valued at the unrealized appreciation on the instrument.

For the period ended March 31, 2019, there were no transfers between Level 1 and Level 2 assets and liabilities.

For the period ended March 31, 2019, there were no transfers between Level 2 and Level 3 assets and liabilities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

|

|

|

| 8 |

|

SEI Institutional Managed Trust / Semi-Annual Report / March 31,

2019 |

The following is a summary of the Fund’s transactions with affiliates for the period ended March 31, 2019 ($

Thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Security Description |

|

Value at 9/30/18 |

|

Purchases at

Cost |

|

Proceeds from

Sales |

|

Realized Gain |

|

Change in

Unrealized

Appreciation |

|

Value 3/31/19 |

|

Income |

| SEI Daily Income Trust, Government Fund, Cl F |

|

$ 46,852 |

|

$ 152,380 |

|

$ (177,990) |

|

$ — |

|

$ — |

|

$ 21,242 |

|

$ 392 |

| SEI Liquidity Fund, L.P. |

|

18,951 |

|

70,563 |

|

(78,427) |

|

— |

|

2 |

|

11,089 |

|

187 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Totals |

|

$ 65,803 |

|

$ 222,943 |

|

$ (256,417) |

|

$ — |

|

$ 2 |

|

$ 32,331 |

|

$ 579 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

|

|

|

| SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2019 |

|

9 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2019

Large Cap Index Fund

†Percentages are based

on total investments. Includes investments held as collateral for securities held on loan (see Note 10).

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

Shares |

|

Market Value

($ Thousands) |

|

|

| COMMON STOCK — 97.9% |

|

|

|

|

|

|

|

| Communication Services — 9.3% |

|

|

|

|

|

| Alphabet Inc, Cl A * |

|

|

1.3 |

% |

|

|

3,425 |

|

|

$ |

4,031 |

|

| Alphabet Inc, Cl C * |

|

|

1.3 |

|

|

|

3,491 |

|

|

|

4,096 |

|

| AT&T Inc |

|

|

0.9 |

|

|

|

83,521 |

|

|

|

2,619 |

|

| Comcast Corp, Cl A |

|

|

0.7 |

|

|

|

51,701 |

|

|

|

2,067 |

|

| Facebook Inc, Cl A * |

|

|

1.5 |

|

|

|

27,345 |

|

|

|

4,558 |

|

| Netflix Inc * |

|

|

0.6 |

|

|

|

4,828 |

|

|

|

1,721 |

|

| Verizon Communications Inc |

|

|

0.9 |

|

|

|

47,515 |

|

|

|

2,810 |

|

| Walt Disney Co/The |

|

|

0.7 |

|

|

|

20,167 |

|

|

|

2,239 |

|

| Other Securities |

|

|

1.4 |

|

|

|

|

|

|

|

4,674 |

|

|

|

|

|

|

|

|

|

|

|

|

28,815 |

|

| Consumer Discretionary — 10.0% |

|

|

|

|

|

| Amazon.com Inc, Cl A * |

|

|

2.7 |

|

|

|

4,718 |

|

|

|

8,402 |

|

| Home Depot Inc/The |

|

|

0.8 |

|

|

|

13,014 |

|

|

|

2,497 |

|

| McDonald’s Corp |

|

|

0.6 |

|

|

|

8,936 |

|

|

|

1,697 |

|

| Other Securities |

|

|

5.9 |

|

|

|

|

|

|

|

18,407 |

|

|

|

|

|

|

|

|

|

|

|

|

31,003 |

|

| Consumer Staples — 6.7% |

|

|

|

|

|

| Altria Group Inc |

|

|

0.4 |

|

|

|

21,662 |

|

|

|

1,244 |

|

| Coca-Cola Co/The |

|

|

0.7 |

|

|

|

43,980 |

|

|

|

2,061 |

|

| PepsiCo Inc |

|

|

0.6 |

|

|

|

16,235 |

|

|

|

1,989 |

|

| Philip Morris International Inc |

|

|

0.5 |

|

|

|

17,950 |

|

|

|

1,587 |

|

| Procter & Gamble Co/The |

|

|

1.0 |

|

|

|

28,579 |

|

|

|

2,974 |

|

| Walmart Inc |

|

|

0.5 |

|

|

|

16,110 |

|

|

|

1,571 |

|

| Other Securities |

|

|

3.0 |

|

|

|

|

|

|

|

9,238 |

|

|

|

|

|

|

|

|

|

|

|

|

20,664 |

|

| Energy — 5.1% |

|

|

|

|

|

|

|

|

|

|

|

|

| Chevron Corp |

|

|

0.9 |

|

|

|

21,928 |

|

|

|

2,701 |

|

| Exxon Mobil Corp |

|

|

1.3 |

|

|

|

48,657 |

|

|

|

3,931 |

|

| Other Securities |

|

|

2.9 |

|

|

|

|

|

|

|

9,025 |

|

|

|

|

|

|

|

|

|

|

|

|

15,657 |

|

| Financials — 12.6% |

|

|

|

|

|

|

|

|

|

|

|

|

| Bank of America Corp |

|

|

0.9 |

|

|

|

103,564 |

|

|

|

2,857 |

|

| Berkshire Hathaway Inc, Cl B * |

|

|

1.5 |

|

|

|

22,309 |

|

|

|

4,482 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Description |

|

Percentage of

Net Assets (%) |

|

Shares |

|

Market Value

($ Thousands) |

|

|

| COMMON STOCK (continued) |

|

|

|

|

|

| Citigroup Inc |

|

|

0.6 |

% |

|

|

27,322 |

|

|