SEI Institutional Managed Trust

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04878

SEI Institutional Managed Trust

(Exact name of Registrant as specified in charter)

SEI

Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

CT Corporation

101 Federal Street

Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-342-5734

Date of fiscal year end:

September 30, 2011

Date of reporting period: September 30, 2011

| Item 1. |

Reports to Stockholders. |

SEI

Institutional Managed Trust

Annual Report as of September 30, 2011

Large Cap Fund

Large Cap Value Fund

Large Cap Growth Fund

Tax-Managed Large Cap Fund

S&P 500 Index Fund

Small Cap Fund

Small Cap Value Fund

Small Cap Growth Fund

Tax-Managed Small/Mid Cap Fund (formerly, Tax-Managed Small Cap Fund)

Mid-Cap Fund

U.S. Managed Volatility Fund

Global Managed Volatility Fund

Tax-Managed Managed Volatility Fund

Real Estate Fund

Enhanced Income Fund

Core Fixed Income Fund

U.S. Fixed Income Fund

High Yield Bond Fund

Real Return Fund

Multi-Strategy Alternative Fund

TABLE OF CONTENTS

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission

(“Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after period end. The Trust’s Form N-Q is available on the Commission’s website at http://www.sec.gov, and may be reviewed and

copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to

portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-800-DIAL-SEI; and (ii) on the Commission’s website at http://www.sec.gov.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

Large Cap Fund

I. Objective

The Large Cap Fund (the “Fund”) seeks to provide long-term growth of capital and income.

II.

Multi-Manager Approach Statement

The Fund uses a multi-manager approach, relying on a number of sub-advisers with differing investment approaches

to manage portions of the Fund’s portfolio under the general supervision of SEI Investments Management Corp. The Fund utilized the following sub-advisers as of September 30, 2011: AQR Capital Management, LLC, Aronson + Johnson + Ortiz, L.P.,

Brown Investment Advisory Incorporated, Delaware Management Company, LSV Asset Management, Neuberger Berman Management LLC, Waddell + Reed Asset Management Company and WestEnd Advisors LLC. During the fiscal year, Analytic Investors, LLC, Legg Mason

Capital Management, Inc. and Quantitative Management Associates, LLC were terminated. AQR Capital Management, LLC, Brown Investment Advisory Incorporated, Waddell + Reed Asset Management Company and WestEnd Advisors LLC were added during the period.

III. Market Commentary

The markets

gained 0.91% for the year ended September 30, 2011, as measured by the Russell 1000 Index (the “Index”). Investor confidence and the subsequent “risk-on” trade that returned during the second quarter of 2010 continued through the

end of the year and the first quarter of 2011 as fears of a double-dip recession subsided. Macro events that previously drove the market, along with high correlations and volatility, abated and investors appeared to focus on individual stocks. The

second quarter of 2011 saw the resurgence of macro concerns inspired by civil unrest in the Middle East, the European sovereign debt crisis and a legislative stalemate in Washington over the U.S. debt ceiling. The “risk-off” trade last

seen in the second quarter of 2010 appeared again. This environment persisted through the third quarter, sustained by U.S. debt ceiling debates, the subsequent downgrade of the U.S. credit rating by Standard & Poor’s and further

complications regarding the debt situation in Greece.

From a style perspective, growth stocks outperformed their value counterparts until early

August, when the two nearly converged before growth once again outperformed. Through September 30, 2011, growth outperformed value by nearly 7.5%. Large-cap stocks

outperformed small-cap stocks by a few percentage points, though dispersion between the two groups narrowed in August and remained narrow through September.

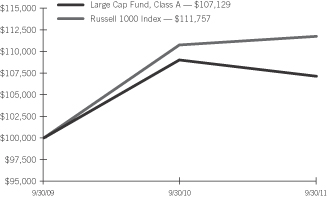

IV. Return vs. Benchmark

For the year ended

September 30, 2011, the Large Cap Fund, Class A underperformed the Russell 1000 Index, returning (1.71)% versus the Index return of 0.91%.

V.

Fund Attribution

The Fund’s underperformance was driven largely by negative stock selection across several sectors, particularly Energy.

Within the Consumer Discretionary sector, stock picking in the retailing and consumer services industry groups was lackluster. Positions in Information Technology helped performance.

Large Cap Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

Inception

to Date |

|

| Large Cap Fund, Class A |

|

|

(1.71)% |

|

|

|

3.50% |

|

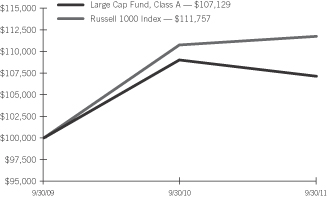

Comparison of Change in the Value of a $100,000 Investment in the Large Cap Fund, Class A, versus the Russell 1000 Index

| |

1 |

|

For the period ended 9/30/11. Past performance is no indication of future performance. Class A shares were offered beginning 10/01/09. Returns shown

do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for the period reflect fee waivers and/or reimbursements in effect for the period; absent fee waivers and

reimbursements, performance would have been lower. |

|

|

|

|

|

| SEI Institutional Managed Trust / Annual Report / September 30, 2011 |

|

|

1 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

Large Cap Value Fund

I. Objective

The Large Cap Value Fund (the “Fund”) seeks to provide long-term growth of capital and income.

II. Multi-Manager Approach Statement

The Fund uses a

multi-manager approach, relying on a number of sub-advisers with differing investment approaches to manage portions of the Fund’s portfolio under the general supervision of SEI Investments Management Corp. The Fund utilized the following

sub-advisers as of September 30, 2011: Aronson + Johnson + Ortiz, LP, INTECH Investment Management, LLC, Lazard Asset Management LLC, Tocqueville Asset Management LP and LSV Asset Management. During the year ended September 30, 2011, the Fund added

Tocqueville Asset Management LP.

III. Market Commentary

The markets declined 1.89% for the year ended September 30, 2011, as measured by the Russell 1000 Value Index (the “Index”). Investor confidence and the subsequent “risk-on” trade

that returned during the second quarter of 2010 continued through the first quarter of 2011 as fears of a double-dip recession subsided. Macro events that previously drove the market, along with high correlations and volatility, abated and investors

appeared to focus on individual stocks. The second quarter of 2011 saw the resurgence of macro concerns inspired by civil unrest in the Middle East, the European sovereign debt crisis and a legislative stalemate in Washington over the U.S. debt

ceiling. The “risk-off” trade last seen in the second quarter of 2010 appeared again. This environment persisted through the third quarter of 2011, sustained by U.S. debt ceiling debates, the subsequent downgrade of the U.S. credit rating

by Standard & Poor’s and further complications regarding the debt situation in Greece.

From a style perspective, growth stocks

outperformed their value counterparts until early August, when the two nearly converged before growth once again outperformed. Through September 30, 2011, growth outperformed value by nearly 7.5%. Large-cap stocks outperformed small-cap stocks by a

few percentage points, though the dispersion between the two groups narrowed in August and remained narrow through September.

IV. Return vs.

Benchmark

For the year ended September 30, 2011, the Large Cap Value Fund, Class A, underperformed the Russell 1000 Value Index, returning

(2.89)% versus the Index return of (1.89)%.

V. Fund Attribution:

The Fund’s underperformance was driven by subpar stock selection decisions that were somewhat mitigated by sector allocation decisions. From a sector allocation perspective, an underweight to

Financials, which sold off significantly during the period, benefitted the Fund, while an underweight to Utilities and an overweight to Materials detracted. Lackluster stock selection within Utilities and Materials further exacerbated

underperformance.

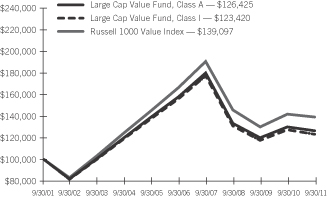

Large Cap Value Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

| Large Cap Value Fund, Class A |

|

|

(2.89)% |

|

|

|

(1.73)% |

|

|

|

(4.35)% |

|

|

|

2.37% |

|

|

|

6.83% |

|

| Large Cap Value Fund, Class I |

|

|

(3.14)% |

|

|

|

(1.94)% |

|

|

|

(4.57)% |

|

|

|

2.13% |

|

|

|

6.66% |

|

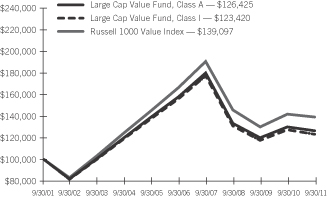

Comparison of Change in the Value of a $100,000 Investment in the Large Cap Value Fund, Class A and Class I, versus the

Russell 1000 Value Index

| |

1 |

|

For the period ended 9/30/11. Past performance is no indication of future performance. The performance indicated above for Class A Shares begins on

10/3/94 at which time Mellon Equity Associates acted as investment adviser to the Fund. Previous periods during which the Fund was advised by another investment adviser are not shown. Class I Shares performance for the period prior to 8/6/01 is

performance derived from the performance of the Class A Shares. The performance of Class I Shares may be lower than the performance of Class A Shares because of different distribution fees paid by Class I shareholders. Class A Shares

were offered beginning 10/3/94 and Class I Shares were offered beginning 8/6/01. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods

reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower.

|

|

|

|

| 2 |

|

SEI Institutional Managed Trust / Annual Report / September 30, 2011 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

Large Cap Growth Fund

I. Objective

The Large Cap Growth Fund (the “Fund”) seeks to provide capital appreciation.

II.

Multi-Manager Approach Statement

The Fund uses a multi-manager approach, relying on a number of sub-advisers with differing investment approaches

to manage portions of the Fund’s portfolio under the general supervision of SEI Investments Management Corp. The Fund utilized the following sub-advisers as of September 30, 2011: Brown Investment Advisory Incorporated, Delaware Management

Company, INTECH Investment Management, LLC and Neuberger Berman LLC. During the year ended September 30, 2011, the Fund terminated Legg Mason Capital Management Inc.

III. Market Commentary

The markets gained 3.78% for the year ended September 30, 2011, as measured by

the Russell 1000 Growth Index (the “Index”). Investor confidence and the subsequent “risk-on” trade that returned during the second quarter of 2010 continued through the first quarter of 2011 as fears of a double-dip

recession subsided. Macro events that previously drove the market, along with high correlations and volatility, abated and investors appeared to focus on individual stocks. The second quarter of 2011 saw the resurgence of macro concerns inspired by

civil unrest in the Middle East, the European sovereign debt crisis and a legislative stalemate in Washington over the U.S. debt ceiling. The “risk-off” trade last seen in the second quarter of 2010 appeared again. This environment

persisted through the third quarter of 2011, sustained by U.S. debt ceiling debates, the subsequent downgrade of the U.S. credit rating by Standard & Poor’s and further complications regarding the debt situation in Europe.

From a style perspective, growth stocks outperformed their value counterparts until early August, when the two nearly converged before growth once again

outperformed. Through September 30, 2011, growth outperformed value by nearly 7.5%. Large-cap stocks outperformed small-cap stocks by a few percentage points, though the dispersion between the two groups narrowed in August and remained narrow

through September.

IV. Return vs. Benchmark

For the year ended September 30, 2011, the Large Cap Growth Fund, Class A underperformed the Russell 1000 Growth Index, returning 0.97% versus the Index return of 3.78%.

V. Fund Attribution

The Fund’s underperformance was driven by subpar stock selection across multiple sectors. Holdings in the Energy sector were the most notable performance detractors. The Information Technology sector

also proved to be challenging in terms of stock selection. Holdings in Materials as well as an underweight to the sector were beneficial.

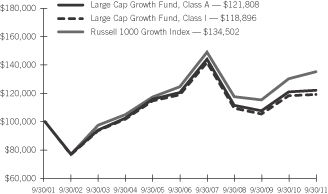

Large

Cap Growth Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

| Large Cap Growth Fund, Class A |

|

|

0.97% |

|

|

|

3.05% |

|

|

|

0.29% |

|

|

|

1.99% |

|

|

|

5.85% |

|

| Large Cap Growth Fund, Class I |

|

|

0.73% |

|

|

|

2.82% |

|

|

|

0.05% |

|

|

|

1.75% |

|

|

|

5.52% |

|

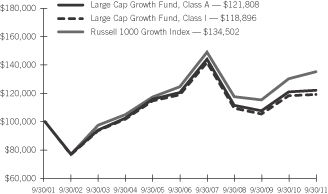

Comparison of Change in the Value of a $100,000 Investment in the Large Cap Growth Fund, Class A and Class I, versus the

Russell 1000 Growth Index

| |

1 |

|

For the period ended 9/30/11. Past performance is no indication of future performance. Class I Shares performance for the period prior to 8/6/01 is the

performance derived from the performance of the Class A Shares. The performance of Class I Shares may be lower than the performance of Class A Shares because of different distribution fees paid by Class I shareholders. Class A Shares

were offered beginning 12/20/94 and Class I Shares were offered beginning 8/6/01. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain

periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower.

|

|

|

|

|

|

| SEI Institutional Managed Trust / Annual Report / September 30, 2011 |

|

|

3 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

Tax-Managed Large Cap Fund

I. Objective

The Tax-Managed Large Cap Fund (the “Fund”) aims to provide high long-term after-tax returns.

II. Multi-Manager Approach Statement

The Fund uses a

multi-manager approach, relying on a number of sub-advisers with differing investment approaches to manage portions of the Fund’s portfolio under the general supervision of SEI Investments Management Corp. The Fund utilized the following

sub-advisers as of September 30, 2011: AQR Capital Management LLC, Aronson + Johnson + Ortiz, L.P., Brown Investment Advisory Incorporated, Delaware Management Company, LSV Asset Management, Neuberger Berman Management LLC, Parametric Portfolio

Associates, Waddell + Reed Investment Management Company and WestEnd Advisors. For the fiscal year, Analytic Investors LLC, Legg Mason Capital Management, Inc. and Quantitative Management Associates, LLC were terminated. AQR Capital Management LLC,

Brown Investment Advisory Incorporated, Waddell + Reed Investment Management Company and WestEnd Advisors were added during the fiscal year.

III. Market Commentary

The markets gained 0.91% for

the year ended September 30, 2011, as measured by the Russell 1000 Index (the “Index”). Investor confidence and the subsequent “risk-on” trade that returned during the second quarter of 2010 continued through the first

quarter of 2011 as fears of a double-dip recession subsided. Macro events that previously drove the market, along with high correlations and volatility, abated and investors appeared to focus on individual stocks. The second quarter of 2011 saw the

resurgence of macro concerns inspired by civil unrest in the Middle East, the European sovereign debt crisis and a legislative stalemate in Washington over the U.S. debt ceiling. The “risk-off” trade last seen in the second quarter of 2010

appeared again. This environment persisted through the third quarter, sustained by U.S. debt ceiling debates, the subsequent downgrade of the U.S. credit rating by Standard & Poor’s and further complications regarding the debt situation in

Greece.

From a style perspective, growth stocks outperformed their value counterparts until early August, when the two nearly converged before

growth once again outperformed. Through September 30, 2011, growth outperformed value by nearly 7.5%. Large-cap stocks outperformed small-cap stocks by a few percentage points, though dispersion between the two groups narrowed in August and remained

narrow through September.

IV. Return vs. Benchmark

For the year ended September 30, 2011, the Tax-Managed Large Cap Fund, Class A, underperformed the Russell 1000 Index, returning (1.20)% versus the Index return of 0.91%.

V. Fund Attribution

The Fund’s underperformance

was driven largely by negative stock selection across several sectors, particularly Energy. Within the Consumer Discretionary sector, stock picking in the retailing and consumer services industry groups was lackluster. Positions in Information

Technology helped performance.

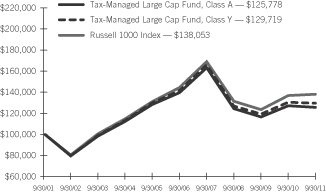

Tax-Managed Large Cap Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

| Tax-Managed Large Cap Fund, Class A |

|

|

(1.20)% |

|

|

|

0.33% |

|

|

|

(2.06)% |

|

|

|

2.32% |

|

|

|

1.49% |

|

| Tax-Managed Large Cap Fund, Class Y |

|

|

(0.68)% |

|

|

|

0.71% |

|

|

|

(1.71)% |

|

|

|

2.64% |

|

|

|

1.72% |

|

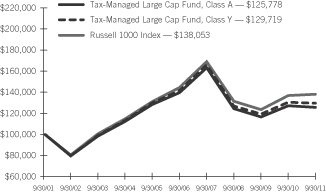

Comparison of Change in the Value of a $100,000 Investment in the Tax-Managed Large Cap Fund, Class A and Class Y, versus the

Russell 1000 Index

| |

1 |

|

For the period ended 9/30/11. Past performance is no indication of future performance. Class Y Shares performance for the period prior to 4/8/02 is

performance derived from the performance of the Class A Shares. The performance of Class Y Shares may be different from the performance of Class A Shares because of different distribution fees paid by Class Y shareholders. Class A

Shares were offered beginning 3/5/98 and Class Y Shares were offered beginning 4/8/02. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain

periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower.

|

|

|

|

| 4 |

|

SEI Institutional Managed Trust / Annual Report / September 30, 2011 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

S&P 500 Index Fund

I. Objective

The S&P 500 Index Fund (the “Fund”) seeks to achieve investment results that correspond to the aggregate price and dividend performance of the securities in the S&P 500 Index (the

“Index”).

II. Multi-Manager Approach Statement

The Fund uses a sub-adviser to manage the Fund under the supervision of SIMC. Currently, the sub-adviser is SSgA Funds Management, Inc. No manager changes were made during the fiscal year.

III. Market Commentary

The markets gained 1.14% for

the year ended September 30, 2011, as measured by the Index. Investor confidence and the subsequent “risk-on” trade that returned during the second quarter of 2010 continued through the first quarter of 2011 as fears of a double-dip

recession subsided. Macro events that previously drove the market, along with high correlations and volatility, abated and investors appeared to focus on individual stocks. The second quarter of 2011 saw the resurgence of macro concerns inspired by

civil unrest in the Middle East, the European sovereign debt crisis and a legislative stalemate in Washington over the U.S. debt ceiling. The “risk-off” trade last seen in the second quarter of 2010 appeared again. This environment

persisted through the third quarter, sustained by U.S. debt ceiling debates, the subsequent downgrade of the U.S. credit rating by Standard & Poor’s and further complications regarding the debt situation in Greece.

From a style perspective, growth stocks outperformed their value counterparts until early August, when the two nearly converged before growth once again

outperformed. Through September 30, 2011, growth outperformed value by nearly 7.5%. Large-cap stocks outperformed small-cap stocks by a few percentage points, though the dispersion between the two groups narrowed in August and remained narrow

through September.

IV. Return vs. Benchmark:

For the year ended September 30, 2011, the S&P 500 Fund, Class A, underperformed the S&P 500 Index, returning 0.75% versus the Index return of 1.14%. Please note that one cannot invest directly in an

index. Unlike a mutual fund, an index does not have an investment adviser and does not pay any commissions or expenses; therefore, its performance is higher than that of a mutual fund that passively invests in the same index.

V. Fund Attribution

The Fund’s performance

followed a pattern similar to the performance of the Index, since it invested in the same securities with generally the

same weights. Though Index performance seemed unimpressive, individual sector performance was significantly dispersed. Defensive sectors, most notably Utilities and Consumer Staples, were the

best performers. Energy performed strongly for the year as the sector experienced solid gains in the third quarter of 2010 and first quarter of 2011. The selloff that ensued in the following quarter and persisted through next, however, chipped away

at the sector’s outperformance-but not enough to send the Energy into negative territory. Financials were the clear laggards for the period, as the sector outperformed the broader market in only one of the past four quarters. The sector has

been plagued by uncertainty, both domestically (with regard to regulation) and overseas (with regard to the European sovereign debt crisis).

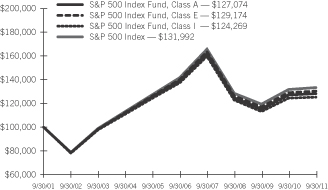

S&P 500 Index Fund:

AVERAGE

ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

| S&P 500 Index Fund, Class A |

|

|

0.75% |

|

|

|

0.87% |

|

|

|

(1.54)% |

|

|

|

2.42% |

|

|

|

5.13% |

|

| S&P 500 Index Fund, Class E |

|

|

0.96% |

|

|

|

1.06% |

|

|

|

(1.37)% |

|

|

|

2.59% |

|

|

|

9.23% |

|

| S&P 500 Index Fund, Class I |

|

|

0.56% |

|

|

|

0.66% |

|

|

|

(1.76)% |

|

|

|

2.20% |

|

|

|

4.84% |

|

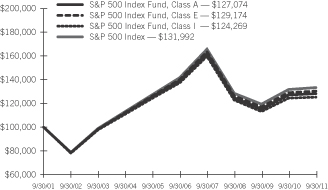

Comparison of Change in the Value of a $100,000 Investment in the S&P 500 Index Fund, Class A, Class E, and Class I,

versus the S&P 500 Index

| |

1 |

|

For the period ended 9/30/11. Past performance is no indication of future performance. Class A shares were offered beginning 2/28/96. Class E shares

were offered beginning 7/31/85. Class I shares were offered beginning 6/28/02. Class I shares performance for the period prior to 6/28/02 is performance derived from performance of the Class A shares. The performance of the Class A and

Class I shares may be lower than the performance of Class E shares because of different distribution fees paid by Class A and Class I shareholders. Effective 7/31/97, the Board of Trustees approved the renaming of Class A and Class E

shares to Class E and Class A shares, respectively. In addition, returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

|

|

|

|

| SEI Institutional Managed Trust / Annual Report / September 30, 2011 |

|

|

5 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

Small Cap Fund

I. Objective

The Small Cap Fund (the “Fund”) seeks to provide capital appreciation.

II. Multi-Manager

Approach Statement

The Fund uses a multi-manager approach, relying on a number of sub-advisers with differing investment approaches to manage

portions of the Fund’s portfolio under the general supervision of SEI Investments Management Corp. The Fund utilized the following sub-advisers as of September 30, 2011: Allianz Global Investors Capital LLC, AQR Capital Management, LLC,

Integrity Asset Management, LLC, JP Morgan Investment Management Company, Los Angeles Capital Management and Equity Research, Inc., Robeco Investment Management, Inc. and Wellington Management Company, LLP. For the year ended September 30, 2011, JP

Morgan Investment Management Company was added to the Fund.

III. Market Commentary

The markets, as measured by the Russell 2000 Index (the “Index”), declined 3.53% for the year ended September 30, 2011. Small-cap stocks, which gained nearly 160% from their bottom in March

2009 to their peak in the second quarter of 2011, faced steep declines in the three months ending September due to fears of the spreading European debt crisis and a double-dip recession. The first half of the fiscal year was marked by relatively

positive expectations and strong market returns as investors shrugged off negative macroeconomic events such as the Japanese earthquake and the approaching U.S. debt ceiling debate. In the three months ending June, though, markets began to discount

a slowdown in economic growth resulting from sustained high unemployment and cutbacks in government spending. This was followed by uncertainty over the stability of European banks given Greece’s debt issues and the impact of an International

Monetary Fund resolution, which sent investors into a flight to safety in the three-month period ending September. Volatility spiked and the market declined precipitously (small caps lost 22%), and virtually all gains made during the year were lost.

Real estate securities performed relatively well over the fiscal year given the returns of equities overall, with the Wilshire Real Estate

Securities Index returning 1.76%.

Growth-oriented stocks consistently beat value-oriented investments through the first three quarters of the

fiscal year. In the fourth quarter, value declined slightly less than growth; but for the full fiscal year, growth stocks still outperformed by nearly 5%. Large-cap stocks outperformed their small-cap counterparts by about 4% for the fiscal

year despite a small-cap advantage through the first three quarters.

IV. Return vs. Benchmark

For the year ended September 30, 2011, the Small Cap Fund, Class A, underperformed the Russell 2000 Index, returning (6.54)% versus the Index return of (3.53)%.

V. Fund Attribution

The Fund underperformed its

benchmark due to poor stock selection, which overwhelmed its slightly favorable asset allocation. The major detractor was the Energy sector, in which the Fund’s holdings in oil, gas and consumable fuels struggled. Health Care and Industrials

both significantly detracted as well. In the Health Care sector, the Fund’s stock picks in the equipment and services area were disappointing. In the Industrials sector, the Fund’s holdings in capital goods companies dragged on

performance. Strong security selection in the Consumer Discretionary sector, mostly in durables and apparel, helped performance. The Materials sector contributed as well, largely through stocks in the chemicals, metals and mining areas.

Small Cap Fund:

AVERAGE ANNUAL

TOTAL RETURN1

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

Inception

to Date |

|

| Small Cap Fund, Class A |

|

|

(6.54)% |

|

|

|

2.14% |

|

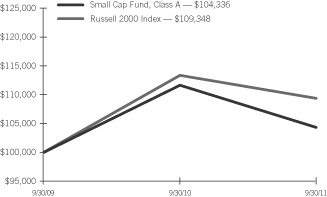

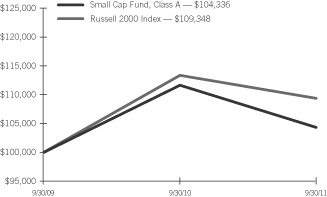

Comparison of Change in the Value of a $100,000 Investment in the Small Cap Fund, Class A, versus the Russell 2000 Index

| |

1 |

|

For the period ended 9/30/11. Past performance is no indication of future performance. Class A shares were offered beginning 10/01/09. Returns shown

do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for the period reflect fee waivers and/or reimbursements in effect for the period; absent fee waivers and

reimbursements, performance would have been lower. |

|

|

|

| 6 |

|

SEI Institutional Managed Trust / Annual Report / September 30, 2011 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

Small Cap Value Fund

I. Objective

The Small Cap Value Fund (the “Fund”) seeks to provide capital appreciation.

II.

Multi-Manager Approach Statement

The Fund uses a multi-manager approach, relying on a number of sub-advisers with differing investment approaches

to manage portions of the Fund’s portfolio under the general supervision of SEI Investments Management Corp. The Fund utilized the following sub-advisers as of September 30, 2011: Artisan Partners Limited Partnership, Lee Munder Capital Group

LLC, LSV Asset Management, Martingale Asset Management, L.P., Robeco Investment Management, Security Capital Research + Management Incorporated, Wellington Management Company, LLP and William Blair + Company, LLC. For the year ended September 30,

2011, Security Capital Research & Management Incorporated was added to the Fund.

III. Market Commentary

The markets, as measured by the Russell 2000 Value Index (the “Index”), declined 5.99% for the year ended September 30, 2011. Small-cap

stocks, which gained nearly 160% from their bottom in March 2009 to their peak in the second quarter of 2011, faced steep declines in the September quarter due to fears of the spreading European debt crisis and a double-dip recession. The first half

of the fiscal year was marked by relatively positive expectations and strong market returns as investors shrugged off negative macroeconomic events such as the Japanese earthquake and the approaching U.S. debt ceiling debate. In the three months

ending June, though, markets began to discount a slowdown in economic growth resulting from sustained high unemployment and cutbacks in government spending. This was followed by uncertainty over the stability of European banks given Greece’s

debt issues and the impact of an International Monetary Fund resolution, which sent investors into a flight to safety in the three months ending September. Volatility spiked and the market declined precipitously (small caps lost 22%), and virtually

all gains made during the year were lost.

Real estate securities performed relatively well over the 12-month period given the returns of equities

overall, with the Wilshire Real Estate Securities Index returning 1.76%.

Growth-oriented stocks consistently beat value-oriented investments

through the first three quarters of the fiscal year. In the fourth quarter, value declined slightly less than growth; but for the full fiscal year, growth stocks outperformed by nearly 5%. Large-cap stocks outperformed their small-cap

counterparts by about 4% for the fiscal year despite a small-cap advantage through the first three quarters.

IV. Return vs. Benchmark

For the year ended September 30, 2011, the Small Cap Value Fund, Class A, underperformed the Russell 2000 Value Index, returning (7.15)% versus

the Index return of (5.99)%.

V. Fund Attribution

Unfavorable sector allocation was the cause of the Fund’s slight underperformance, while stock selection was positive. The Energy sector detracted the most during the fiscal year due to an underweight

position at the portfolio level as well as unfavorable security selection within the oil, gas and consumable fuel segment, which was affected by volatile commodity prices. An underweight to the Utilities sector also hurt. On the positive side, stock

picks in the Financials sector helped performance, particularly among the Fund’s real estate holdings. Materials added value as well, especially in chemicals.

Small Cap Value Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

| Small Cap Value Fund, Class A |

|

|

(7.15)% |

|

|

|

(1.38)% |

|

|

|

(2.26)% |

|

|

|

6.60% |

|

|

|

8.72% |

|

| Small Cap Value Fund, Class I |

|

|

(7.40)% |

|

|

|

(1.62)% |

|

|

|

(2.51)% |

|

|

|

6.33% |

|

|

|

8.37% |

|

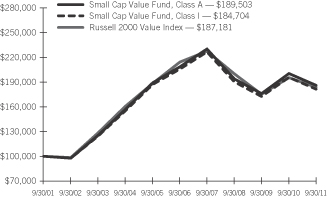

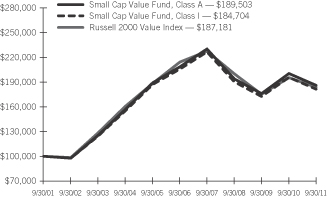

Comparison of Change in the Value of a $100,000 Investment in the Small Cap Value Fund, Class A and Class I, versus the

Russell 2000 Value Index

| |

1 |

|

For the period ended 9/30/11. Past performance is no indication of future performance. Class I Shares performance for the period prior to 2/11/02 is

performance derived from the performance of the Class A Shares. The performance of Class I Shares may be lower than the performance of Class A Shares because of different distribution fees paid by Class I shareholders. Class A Shares

were offered beginning 12/20/94 and Class I Shares were offered beginning 2/11/02. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain

periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower.

|

|

|

|

|

|

| SEI Institutional Managed Trust / Annual Report / September 30, 2011 |

|

|

7 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

Small Cap Growth Fund

I. Objective

The Small Growth Fund (the “Fund”) seeks to provide long-term capital appreciation.

II.

Multi-Manager Approach Statement

The Fund uses a multi-manager approach, relying on a number of sub-advisers with differing investment approaches

to manage portions of the Fund’s portfolio under the general supervision of SEI Investments Management Corp. The Fund utilized the following sub-advisers as of September 30, 2011: Allianz Global Investors Capital LLC, AQR Capital Management

LLC, Janus Capital Management LLC and Los Angeles Capital Management and Equity Research, Inc. For the year ended September 30, 2011, Lee Munder Capital Group, LLC was terminated from the Fund.

III. Market Commentary

The markets, as measured by

the Russell 2000 Growth Index, declined 1.12% for the year ended September 30, 2011. Small-cap stocks, which gained nearly 160% from their bottom in March 2009 to their peak in the second quarter of 2011, faced steep declines in the three-month

period ending September due to fears of the spreading European debt crisis and a double-dip recession. The first half of the fiscal year was marked by relatively positive expectations and strong market returns as investors shrugged off negative

macroeconomic events such as the Japanese earthquake and the approaching U.S. debt ceiling debate. In the three-month period ending June, though, markets began to discount a slowdown in economic growth resulting from sustained high unemployment and

cutbacks in government spending. This was followed by uncertainty over the stability of European banks given Greece’s debt issues and the impact of an International Monetary Fund resolution, which sent investors into a flight to safety in the

three-month period ending September. Volatility spiked and the market declined precipitously (small caps lost 22%), and virtually all gains made during the fiscal year were lost.

Real estate securities performed relatively well over the 12-month period given the returns of equities overall, with the Wilshire Real Estate Securities Index returning 1.76%.

Growth-oriented stocks consistently beat value-oriented investments through the first three quarters of the fiscal year. In the fourth quarter, value

declined slightly less than growth; but for the full fiscal year, growth stocks outperformed by nearly 5%. Large-cap stocks outperformed their small-cap counterparts by about 4% for the fiscal year despite a small-cap advantage through the

first three quarters.

IV. Return vs. Benchmark

For the year ended September 30, 2011, the Small Cap Growth Fund, Class A, underperformed the Russell 2000 Growth Index, returning (3.34)% versus the Index return of (1.12)%.

V. Fund Attribution

The Fund underperformed the Index due to poor stock selection, which more than offset a slight benefit from sector allocation choices. The Energy sector was the biggest detractor during the fiscal year due

to security selection in the oil, gas and consumable fuels segment. An underweight to the Consumer Staples sector was broadly disadvantageous, and holdings in transportation weighed on the Fund’s performance in the Industrials sector. The

Materials sector contributed the most with favorable stock picks in metals and mining. The Fund also benefited from solid stock selection in the durables and apparel portion of the Consumer Discretionary sector.

Small Cap Growth Fund:

AVERAGE

ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

| Small Cap Growth Fund, Class A |

|

|

(3.34)% |

|

|

|

0.53% |

|

|

|

(3.53)% |

|

|

|

2.30% |

|

|

|

7.29% |

|

| Small Cap Growth Fund, Class I |

|

|

(3.63)% |

|

|

|

0.27% |

|

|

|

(3.80)% |

|

|

|

2.03% |

|

|

|

6.96% |

|

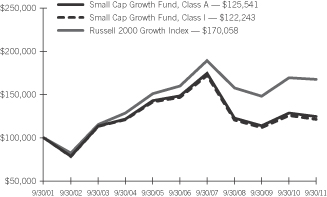

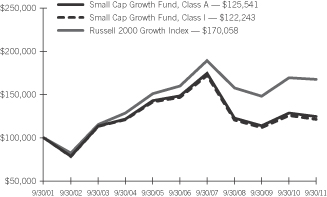

Comparison of Change in the Value of a $100,000 Investment in the Small Cap Growth Fund, Class A and Class I, versus the

Russell 2000 Growth Index

| |

1 |

|

For the period ended 9/30/11. Past performance is no indication of future performance. Class I Shares performance for the period prior to 8/6/01 is

performance derived from the performance of the Class A Shares. The performance of Class I Shares may be lower than the performance of Class A Shares because of different distribution fees paid by Class I shareholders. Class A Shares

were offered beginning 4/20/92 and Class I Shares were offered beginning 8/6/01. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods

reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower.

|

|

|

|

| 8 |

|

SEI Institutional Managed Trust / Annual Report / September 30, 2011 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

Tax-Managed Small/Mid Cap Fund‡

I. Objective

The Tax-Managed Small/Mid Cap Fund (the “Fund”), formerly the Tax-Managed Small Cap Fund, seeks to provide high long-term after-tax returns.

II. Multi-Manager Approach Statement

The Fund uses a

multi-manager approach, relying on a number of sub-advisers with differing investment approaches to manage portions of the Fund’s portfolio under the general supervision of SEI Investments Management Corp. The Fund utilized the following

sub-advisers as of September 30, 2011: Century Capital Management, LLC, Lee Munder Capital Group LLC, Los Angeles Capital Management and Equity Research, Inc., LSV Asset Management, Parametric Portfolio Associates, Wellington Management Company, LLP

and William Blair + Company, LLC. For the year ended September 30, 2011, Wells Capital Management was terminated from the Fund.

III. Market

Commentary

The markets, as measured by the Russell 2500 Index (the “Index”), declined 2.22% for the year ended September 30,

2011. Small-cap stocks, which gained nearly 160% from their bottom in March 2009 to their peak in the second quarter of 2011, faced steep declines in the three-month period ending September due to fears of the spreading European debt crisis and

a double-dip recession. The first half of the fiscal year was marked by relatively positive expectations and strong market returns as investors shrugged off negative macroeconomic events such as the Japanese earthquake and the approaching U.S. debt

ceiling debate. In the three-month period ending June, though, markets began to discount a slowdown in economic growth resulting from sustained high unemployment and cutbacks in government spending. This was followed by uncertainty over the

stability of European banks given Greece’s debt issues and the impact of an International Monetary Fund resolution, which sent investors into a flight to safety in the three-month period ending September. Volatility spiked and the market

declined precipitously (small caps lost 22%), and virtually all gains made during the year were lost.

Real estate securities performed relatively

well over the fiscal year given the positive returns of equities overall, with the Wilshire Real Estate Securities Index returning 1.76%.

Growth-oriented stocks consistently beat value-oriented investments through the first three quarters of the fiscal year. In the fourth quarter, value

declined slightly less than growth; but for the full fiscal year, growth stocks outperformed by nearly 5%. Large-cap stocks outperformed their small-cap counterparts by about 4% for the fiscal year despite a small-cap advantage through the

first three quarters.

IV. Return vs. Benchmark

For the year ended September 30, 2011, the Tax-Managed Small/Mid Cap Fund, Class A, underperformed the Russell 2500 Index, returning (3.66)% versus the Index return of (2.22)%.

V. Fund Attribution

Favorable sector positioning was

unable to offset weak stock selection in the fiscal year, causing the Fund to underperform the Russell 2500 Index. Energy was the biggest detractor because of both an underweight position in the sector and poor stock picks in the oil, gas, and

consumable fuel segment. Information Technology also weighed on returns due to unfavorable security selection in the internet software and services area. Exposure to Health Care providers and services added value. An underweight to the Financials

sector, especially in the capital markets industry, contributed to performance as well.

Futures contracts are used to equitize the cash balance

for the Fund. The use of derivatives did not have a material impact on performance.

Tax-Managed Small/Mid Cap Fund‡:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

Tax-Managed Small/Mid Cap Fund,

Class A‡ |

|

|

(3.66)% |

|

|

|

1.15% |

|

|

|

(1.65)% |

|

|

|

5.29% |

|

|

|

2.89% |

|

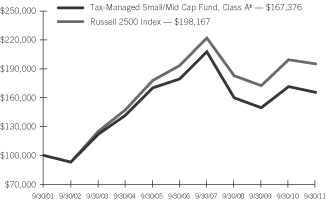

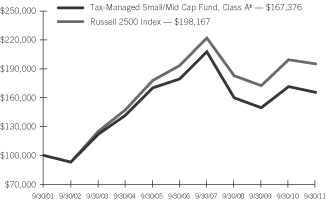

Comparison of Change in the Value of a $100,000 Investment in the Tax-Managed Small/Mid Cap Fund‡, Class A, versus the Russell 2500 Index

| |

1 |

|

For the period ended 9/30/11. Past performance is no indication of future performance. Fund shares were offered beginning 10/31/00. Returns shown do not

reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and

reimbursements, performance would have been lower |

| |

‡ |

|

See Note 1 in Notes to Financial Statements.

|

|

|

|

|

|

| SEI Institutional Managed Trust / Annual Report / September 30, 2011 |

|

|

9 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

Mid-Cap Fund

I. Objective

The Mid-Cap Fund (the “Fund”) seeks to provide long-term capital appreciation.

II.

Multi-Manager Approach Statement

The Fund uses a multi-manager approach, relying on a number of sub-advisers with differing investment approaches

to manage portions of the Fund’s portfolio under the general supervision of SEI Investments Management Corp. The Fund utilized the following sub-advisers as of September 30, 2011: JP Morgan Investment Management Company, Lee Munder Capital

Group LLC and Quantitative Management Associates LLC. For the year ended September 30, 2011, Wells Capital Management was terminated from the Fund and JP Morgan Investment Management Company was added.

III. Market Commentary

The markets, as measured by

the Russell Midcap Index (the “Index”), declined 0.88% for the year ended September 30, 2011. Small-cap stocks, which gained nearly 160% from their bottom in March 2009 to their peak in the second quarter of 2011, faced steep declines

in the three-month period ending September due to fears of the spreading European debt crisis and a double-dip recession. The first half of the fiscal year was marked by relatively positive expectations and strong market returns as investors

shrugged off negative macroeconomic events such as the Japanese earthquake and the approaching U.S. debt ceiling debate. In the three-month period ending June, though, markets began to discount a slowdown in economic growth resulting from sustained

high unemployment and cutbacks in government spending. This was followed by uncertainty over the stability of European banks given Greece’s debt issues and the impact of an International Monetary Fund resolution, which sent investors into a

flight to safety in the three-months ending September. Volatility spiked and the market declined precipitously (small caps lost 22%), and virtually all gains made during the year were lost.

Real estate securities performed relatively well over the period given the returns of equities overall, with the Wilshire Real Estate Securities Index returning 1.76%.

Growth-oriented stocks consistently beat value-oriented investments through the first three quarters of the fiscal year. In the fourth quarter, value

declined slightly less than growth; but for the full fiscal year, growth stocks still outperformed by nearly 5%. Large-cap stocks outperformed their small-cap counterparts by about 4% for the fiscal year despite a small-cap advantage through

the first three quarters.

IV. Return vs. Benchmark

For the year ended September 30, 2011, the Mid Cap Fund, Class A, underperformed the Russell Midcap Index, returning (4.67)% versus the Index return of (0.88)%.

V. Fund Attribution

The Fund underperformed the

Index due to poor stock selection and a slightly unfavorable sector positioning. Consumer Discretionary was the weakest sector for the Fund as holdings in services, media and retailing all detracted. An underweight to the Consumer Staples sector

hurt performance as well, mostly due to the food product segment. The Industrials sector was a strong performer, with portfolio holdings in capital goods adding significant value. Energy contributed through selections in oil, gas and consumable

fuels.

Mid-Cap Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

10 Year

Return |

|

|

Annualized

Inception

to Date |

|

| Mid-Cap Fund, Class A |

|

|

(4.67)% |

|

|

|

0.99% |

|

|

|

(2.04)% |

|

|

|

6.69% |

|

|

|

8.10% |

|

Mid-Cap Fund,

Class I |

|

|

(4.95)% |

|

|

|

0.78% |

|

|

|

(2.27)% |

|

|

|

6.42% |

|

|

|

7.79% |

|

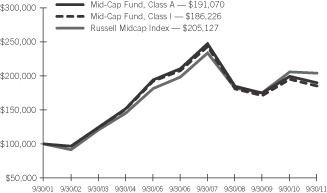

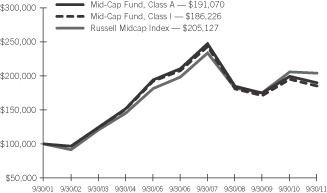

Comparison of Change in the Value of a $100,000 Investment in the Mid-Cap Fund, Class A and Class I, versus the Russell

Midcap Index

| |

1 |

|

For the period ended 9/30/11. Past performance is no indication of future performance. Class I Shares performance for the period prior to 10/01/07 is

performance derived from the performance of the Class A Shares. The performance of Class I Shares may be lower than the performance of Class A Shares because of different distribution fees paid by Class I Shares. Class A Shares were

offered beginning 2/16/93 and Class I Shares were offered beginning 10/01/07. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods

reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower.

|

|

|

|

| 10 |

|

SEI Institutional Managed Trust / Annual Report / September 30, 2011 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

U.S. Managed Volatility Fund

I. Objective

The U.S. Managed Volatility Fund (the “Fund”) seeks capital appreciation with less volatility than the broad U.S. equity markets.

II. Multi-Manager Approach Statement

The Fund uses a multi-manager approach, relying on a number of

sub-advisers with differing investment approaches to manage portions of the Fund’s portfolio under the general supervision of SEI Investments Management Corp. The Fund utilized the following sub-advisers as of September 30, 2011: Analytic

Investors, LLC, Aronson + Johnson + Ortiz, LP and LSV Asset Management. For the year ended September 30, 2011, LSV Asset Management was added to the Fund.

III. Market Commentary

The year ended September 30, 2011, saw a strong market rally for the remainder

of 2010 and the beginning of 2011 followed by a strong selloff in the last two quarters. With all the volatility, the Russell 3000 Index (the “Index”) ended up posting a meager 0.55% for the period.

The U.S. Federal Reserve’s quantitative easing fueled commodity price inflation, and in turn, the prices of Materials and Energy stocks. By the time the

market peaked in April 2011, the Energy sector posted the best performance in the U.S. by a wide margin. Materials and Industrials followed, with the latter benefitting from the weak dollar.

The last two quarters of the period fiscal year were far less rosy. The Japanese disaster, lingering sovereign defaults in Europe, a stumbling U.S. recovery and faltering Chinese growth were enough to send

equity prices spiraling downward worldwide. Ineffectiveness on the part of politicians on both sides of the Atlantic only exacerbated the fragile sentiment.

With a European recession almost certain, an economic slowdown in China, and the U.S. recovery on hold, high-beta sectors significantly underperformed in the second and third quarters of calendar year

2011—and many, including Industrials and Materials, posted negative returns for the entire 12 months.

Financials was the worst performing

sector as economic issues were further compounded by solvency and liquidity fears. Investors’ fear of

contagion within Europe was a source of banking misery, while the mortgage litigation saga did nothing to help on the U.S. front. Consumer staples and Utilities proved to be most immune to

volatility, delivering the best returns over the last 12 months.

IV. Return vs. Benchmark

For the year ended September 30, 2011, the U.S. Managed Volatility Fund, Class A, outperformed the Russell 3000 Index, returning 7.63% versus the Index

return of 0.55%.

V. Fund Attribution

For

the fiscal year, the Fund achieved its primary objective of lowering volatility, with the realized annualized standard deviation of 16.6% (daily frequency), compared to the Index’s results of 20.8%, constituting a 20% relative reduction and

exceeding the long-term target of 17%.

With high-beta names significantly lagging the broad market, the Fund benefited from its low-volatility

profile. As the markets began their slump in May 2011, the Fund began to preserve more capital for further compounding when the markets eventually start recovering in the months ahead.

Industry positioning was also beneficial. In particular, the Fund’s strong underweight to Diversified Financials added 1.35% at the total portfolio level as worries about European contagion and domestic

litigation drove big banking shares down. Overweighting the stable Utilities sector and the health care equipment and food and beverage sub-sectors added approximately 1.0% each to the Fund’s performance over the period. An underweight to the

volatile Energy sector was the biggest detractor; by the market peak in April, it accounted for a 1.0% negative contribution to the Fund’s return. The position was profitable since then, however, and the overall impact was limited to 0.35% for

the entire 12-month period.

|

|

|

|

|

| SEI Institutional Managed Trust / Annual Report / September 30, 2011 |

|

|

11 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

U.S. Managed Volatility Fund (Concluded)

U.S. Managed Volatility Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

Return |

|

|

Annualized

Inception

to Date |

|

| U.S. Managed Volatility Fund, Class A |

|

|

7.63% |

|

|

|

2.13% |

|

|

|

1.62% |

|

|

|

4.32% |

|

| U.S. Managed Volatility Fund, Class I |

|

|

7.39% |

|

|

|

1.87% |

|

|

|

1.32% |

|

|

|

3.99% |

|

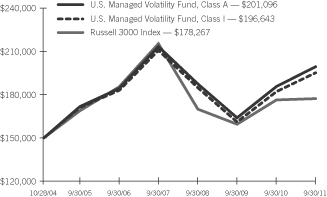

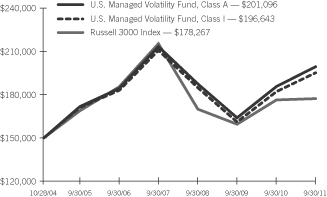

Comparison of Change in the Value of a $150,000 Investment in the U.S. Managed Volatility Fund, Class A and Class I, versus

the Russell 3000 Index

| |

1 |

|

For the period ended 9/30/11. Past performance is no indication of future performance. Class I Shares performance for the period prior to 6/29/07 is

performance derived from the performance of the Class A Shares. The performance of the Class I Shares may be lower then the performance of the Class A Shares because of different distribution fees paid by Class I shareholders. Class A

Shares were offered beginning 10/28/04 and Class I Shares were offered beginning 6/29/07. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for

certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower.

|

|

|

|

| 12 |

|

SEI Institutional Managed Trust / Annual Report / September 30, 2011 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

Global Managed Volatility Fund

I. Objective

The Global Managed Volatility Fund (the “Fund”) seeks capital appreciation with less volatility than the broad global equity markets.

II. Multi-Manager Approach Statement

The Fund uses a multi-manager approach, relying on a number of

sub-advisers with differing investment approaches to manage portions of the Fund’s portfolio under the general supervision of SEI Investments Management Corp. The Fund utilized the following sub-advisers as of September 30, 2011: Acadian Asset

Management LLC and Analytic Investors, LLC. For the year ended September 30, 2011, no manager changes were made in the Fund.

III. Market

Commentary

The year ended September 30, 2011, saw a strong rally for the remainder of 2010 and the beginning of 2011, followed by a strong

selloff in the last two quarters of the fiscal year. With all the volatility, the MSCI World Index, Hedged (the “Index”) ended up dropping 5.04% for the period.

The U.S. Federal Reserve’s quantitative easing fueled commodity price inflation, and in turn, the prices of Materials and Energy stocks. By the time the market reached its peak in April 2011, Energy

posted the best performance globally by far, followed by Materials and Industrials.

The last two quarters of the fiscal year were far less rosy.

The Japanese disaster, lingering sovereign defaults in Europe, a stumbling U.S. recovery and faltering Chinese growth were enough to send equity prices spiraling downward worldwide. Ineffectiveness on the part of politicians on both sides of the

Atlantic only exacerbated the fragile sentiment.

With a European recession almost certain, an economic slowdown in China, and the U.S. recovery

on hold, high-beta sectors significantly underperformed in the second and third quarters of calendar year 2011—and many posted negative returns for the entire 12-months.

Financials was the worst performing sector as economic issues were further compounded by solvency and liquidity fears. European banks were hit particularly hard as the possibility of a disorderly sovereign

default became less remote. The mortgage litigation saga did nothing

to help U.S. banks. Consumer Staples and Health Care proved to be most immune to volatility and delivered the best returns over the last 12 months. Uncharacteristically for a defensive sector,

Utilities finished the fiscal year broadly in line with the Index, as its defensive properties were offset by the direct effects of the tsunami in Japan and subsequent German legislation that outlawed nuclear power.

With the country in a virtual default and a severe recession, Greek equities were the worst performers for the year. New Zealand delivered the best results.

Among the major economies, U.S. markets performed best, benefitting from the depreciating U.S. dollar in the first half and an improved economic outlook in the second half of the fiscal year. Germany, Europe’s strongest economy, was the best

performing market by April 2011 but ended up at the bottom with Italy and Israel by September 2011. Germany lost over 50% since its peak less than six months ago.

IV. Return vs. Benchmark

For the year ended September 30, 2011, the Global Managed Volatility Fund,

Class A, outperformed the MSCI World Index, Hedged, returning 3.90% versus the Index return of (5.04)%.

V. Fund Attribution

For the fiscal year, the Fund successfully reached its objective of smoothing market volatility. In local terms, it realized an annualized intra-year

standard deviation more than 40% lower than that of the Index. With high-beta names significantly lagging the broad market, the Fund benefited from its low-volatility profile. As the markets began their slump in May 2011, the Fund began to preserve

more capital for further compounding when the markets eventually start recovering in the months ahead.

Industry positioning was beneficial. In

particular, an overweight to the food, beverage and tobacco industry added over 1.0% for the period. Underweighting the volatile capital goods and Materials also contributed strongly. Staying out of U.S. and European big banks helped returns as

worries about European contagion and U.S. litigation drove shares down. An underweight to the volatile Energy sector was the biggest detractor; by the market peak in April, it accounted for a 1.0% negative contribution to the Fund’s return. The

position was profitable since then, and over the entire period the impact was limited to 0.55%.

|

|

|

|

|

| SEI Institutional Managed Trust / Annual Report / September 30, 2011 |

|

|

13 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

Global Managed Volatility Fund (Concluded)

Derivatives were used in the Fund to hedge currency risks. Currency forwards were used to sell foreign

currencies against the U.S. dollar in order to mitigate their risk from impacting investors’ portfolios. Currency hedging activity subtracted from the Fund’s returns as the U.S. dollar depreciated over most currencies during the period. In

the stressful months during the summer of 2011, hedging protected the Fund’s returns as intended, positively contributing to the results.

Global Managed Volatility Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

5 Year

return |

|

|

Annualized

Inception

to Date |

|

| Global Managed Volatility Fund, Class A |

|

|

3.90% |

|

|

|

(1.91)% |

|

|

|

(2.84)% |

|

|

|

(2.06)% |

|

| Global Managed Volatility Fund, Class I |

|

|

3.56% |

|

|

|

(2.10)% |

|

|

|

(3.12)%

|

|

|

|

(2.36)% |

|

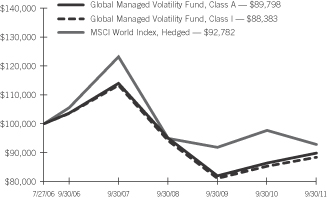

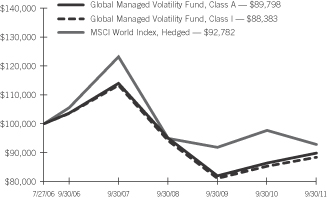

Comparison of Change in the Value of a $100,000 Investment in the Global Managed Volatility Fund, Class A and Class I, versus

the MSCI World Index, Hedged

| |

1 |

|

For the period ended 9/30/11. Past performance is no indication of future performance. Class I Shares performance for the period prior to 6/29/07 is

performance derived from the performance of the Class A Shares. The performance of the Class I Shares may be lower then the performance of the Class A Shares because of different distribution fees paid by Class I shareholders. Class A

Shares were offered beginning 7/27/06 and Class I Shares were offered beginning 6/29/07. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain

periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower.

|

|

|

|

| 14 |

|

SEI Institutional Managed Trust / Annual Report / September 30, 2011 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

Tax-Managed Managed Volatility Fund

I. Objective

The Tax-Managed Managed Volatility Fund (the “Fund”) seeks to maximize after-tax returns, but with a lower level of volatility than the broad U.S. equity markets.

II. Multi-Manager Approach Statement

The Fund uses a

multi-manager approach, relying on a number of sub-advisers with differing investment approaches to manage portions of the Fund’s portfolio under the general supervision of SEI Investments Management Corp. The Fund utilized the following

sub-advisers as of September 30, 2011: Analytic Investors LLC, Aronson + Johnson + Ortiz, LP and LSV Asset Management. For the year ended September 30, 2011, LSV Asset Management was added to the Fund.

III. Market Commentary

The year ended September 30,

2011, saw a strong rally for the remainder of 2010 and the beginning of 2011 followed by a strong selloff in the last two quarters. With all the volatility, the Russell 3000 Index (the “Index”) ended up posting a meager 0.55% for the

period.

The U.S. Federal Reserve’s quantitative easing fueled commodity price inflation, and in turn, the prices of Materials and Energy

stocks. By the time the market reached its peak in April 2011, the Energy sector posted the best performance in the U.S. by a wide margin. Materials and Industrials followed, with the latter benefitting from the weak dollar.

The last two quarters of the one-year period were far less rosy. The Japanese disaster, lingering sovereign defaults in Europe, a stumbling U.S. recovery and

faltering Chinese growth were enough to send equity prices spiraling worldwide. Ineffectiveness on the part of politicians on both sides of the Atlantic only exacerbated the fragile sentiment.

With a European recession almost certain, an economic slowdown in China, and the U.S. recovery on hold, high-beta sectors significantly underperformed in the second and third quarters of calendar year

2011—and many, including Industrials and Materials, posted negative returns for the entire 12 months.

Financials was the worst performing

sector as economic issues were further compounded by solvency and liquidity fears. Contagion in

Europe was a source of the banking misery while the mortgage litigation saga did nothing to help on the U.S. front. Consumer staples and Utilities have proved to be most immune to volatility,

delivering the best returns over the last 12 months.

IV. Return vs. Benchmark:

For the year ended September 30, 2011, the Tax-Managed Managed Volatility Fund, Class A, outperformed the Russell 3000 Index, returning 7.13% versus the index return of 0.55%.

V. Fund Attribution

For the fiscal year, the Fund

achieved its primary objective of lowering volatility, with the realized annualized standard deviation of 16% (daily frequency), compared to the Index’s results of 20.8%, constituting a 23% relative risk reduction and exceeding the long-term

target of 17%.

With high-beta names significantly lagging the broad market, the Fund benefited from its low-volatility profile. As the

markets began their slump in May 2011, the Fund began to preserve more capital for further compounding when the markets eventually start recovering in the months ahead.

Industry positioning was also beneficial. In particular, the Fund’s strong underweight to the Diversified Financials industry added 1.25% at the total portfolio level as worries about European contagion

and domestic litigation drove big banking shares down. Overweighting the stable Utilities sector and the health care equipment and food and beverage sub-sectors added approximately 1.0% each to the Fund’s performance over the period. An

underweight to the volatile Energy sector was the biggest detractor; by the market peak in April, it accounted for a 1.3% negative contribution to the Fund’s return. The position was profitable since then, and over the entire period the impact

was limited to 0.40%.

|

|

|

|

|

| SEI Institutional Managed Trust / Annual Report / September 30, 2011 |

|

|

15 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

Tax-Managed Managed Volatility Fund (Concluded)

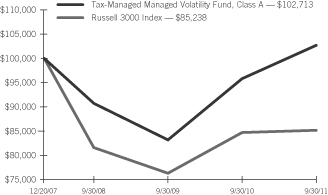

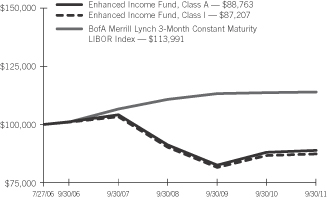

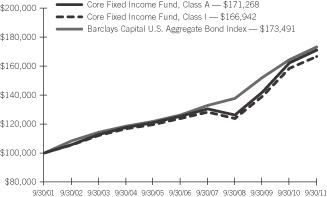

Tax-Managed Managed Volatility Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3 Year

Return |

|

|

Annualized

Inception

to Date |

|

| Tax-Managed Managed Volatility Fund, Class A |

|

|

7.13% |

|

|

|

4.21% |

|

|

|

0.71% |

|

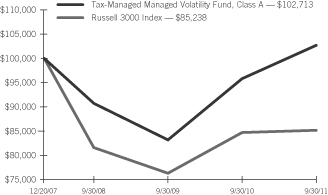

Comparison of Change in the Value of a $100,000 Investment in the Tax-Managed Managed Volatility Fund, Class A versus the

Russell 3000 Index

| |

1 |

|

For the period ended 9/30/11. Past performance is no indication of future performance. Fund shares were offered beginning 12/20/07. Returns shown do not

reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and

reimbursements, performance would have been lower.

|

|

|

|

| 16 |

|

SEI Institutional Managed Trust / Annual Report / September 30, 2011 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

SEI INSTITUTIONAL MANAGED TRUST — SEPTEMBER 30, 2011

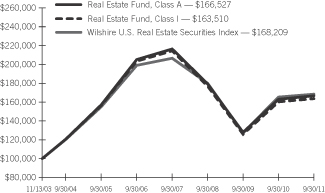

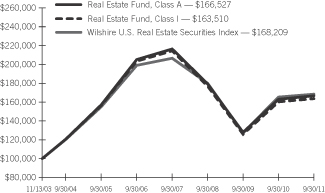

Real Estate Fund

I. Objective

The Real Estate Fund (the “Fund”) seeks to provide total return, including current income and capital appreciation.

II. Multi-Manager Approach Statement

The Fund uses a multi-manager approach, relying on a number of

sub-advisers with differing investment approaches to manage portions of the Fund’s portfolio under the general supervision of SEI Investments Management Corp. The Fund utilized the following sub-advisers as of September 30, 2011: Security

Capital Research and Management, Inc. and Urdang Capital Management. For the year ended September 30, 2011, Wellington Management Company, LLP was terminated from the Fund and Urdang Capital Management was added.

III. Market Commentary

The markets, as measured by

the Russell 2000 Index, declined 3.53% for the one-year period ending September 30, 2011. Small-cap stocks, which gained nearly 160% from their bottom in March 2009 to their peak in the second quarter of 2011, faced steep declines in the

three-month period ending September due to fears of the spreading European debt crisis and a double-dip recession. The first half of the fiscal year was marked by relatively positive expectations and strong market returns as investors shrugged off

negative macroeconomic events such as the Japanese earthquake and the approaching U.S. debt ceiling debate. In the three-month period ending June, though, markets began to discount a slowdown in economic growth resulting from sustained high

unemployment and cutbacks in government spending. This was followed by uncertainty over the stability of European banks given Greece’s debt issues and the impact of an International Monetary Fund resolution, which sent investors into a flight

to safety in the three-month period ending September. Volatility spiked and the market declined precipitously (small caps lost 22%), and virtually all gains made during the year were lost.

Real estate securities performed relatively well over the fiscal year given the returns of equities overall, with the Wilshire Real Estate Securities Index (the “RESI”) returning 1.76%. In the

third quarter, the RESI lost about 15%, beating small-cap stocks by nearly 7% as their value was buoyed by the yield advantage they held over other cash flow-producing securities.

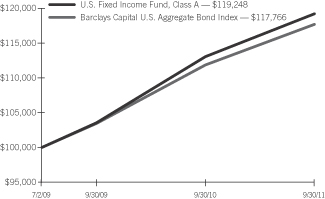

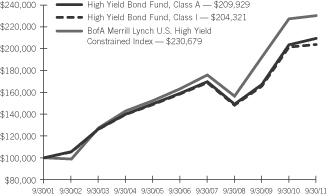

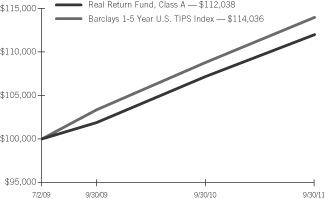

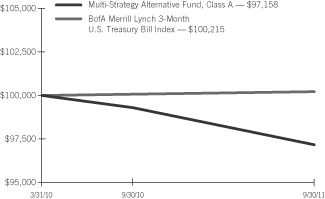

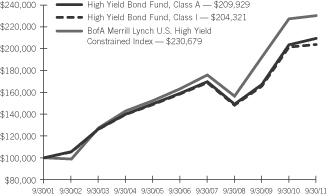

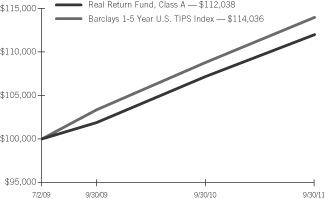

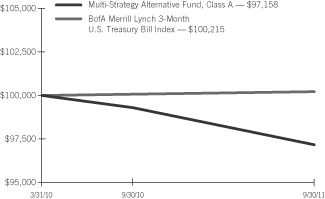

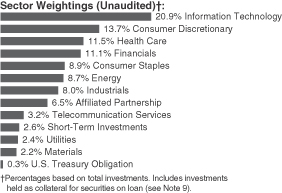

From a factor perspective, growth-oriented stocks consistently beat value-oriented investments through the first three quarters of the fiscal year. In the fourth quarter, value declined slightly less than