UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

(Mark One) |

|

|

R |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

|

|

|

|

For the fiscal year ended September 30, 2012 |

|

|

|

|

|

OR |

|

|

|

|

£ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-12488

Powell Industries, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

88-0106100 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

8550 Mosley RD |

|

|

Houston, Texas (Address of principal executive offices) |

77075-1180 (Zip Code) |

Registrant’s telephone number, including area code:

(713) 944-6900

Securities registered pursuant to section 12(b) of the Act:

Common Stock, par value $.01 per share

Securities registered pursuant to Section 12(g) of Act:

None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. £ Yes R No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. £ Yes R No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. R Yes £ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). R Yes £ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

£ Large accelerated filer |

R Accelerated filer |

£ Non-accelerated filer |

£ Smaller reporting company |

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). £ Yes R No

The aggregate market value of the voting stock held by non-affiliates of the registrant as of the last business day of the most recently completed second fiscal quarter, March 31, 2012, was approximately $403,202,000.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

At November 30, 2012, there were 11,915,673 outstanding shares of the registrant’s common stock, par value $0.01 per share.

Documents Incorporated By Reference

Portions of the registrant’s definitive Proxy Statement for the 2013 annual meeting of stockholders to be filed not later than 120 days after September 30, 2012, are incorporated by reference into Part III of this Form 10-K.

POWELL INDUSTRIES, INC.

|

|

|

|

|

|

|

Page |

|

|

Cautionary Statement Regarding Forward-Looking Statements; Risk Factors |

3 |

|

|

|

|

|

|

||

|

Item 1. |

4 | |

|

Item 1A. |

7 | |

|

Item 1B. |

11 | |

|

Item 2. |

11 | |

|

Item 3. |

11 | |

|

Item 4. |

11 | |

|

|

|

|

|

|

||

|

Item 5. |

12 | |

|

Item 6. |

13 | |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

14 |

|

Item 7A. |

23 | |

|

Item 8. |

26 | |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

53 |

|

Item 9A. |

53 | |

|

Item 9B. |

53 | |

|

|

|

|

|

|

||

|

Item 10. |

54 | |

|

Item 11. |

54 | |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

54 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

54 |

|

Item 14. |

54 | |

|

|

|

|

|

|

||

|

Item 15. |

55 | |

| 58 | ||

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS;

RISK FACTORS

Forward-Looking Statements

This Annual Report on Form 10-K (Annual Report) includes forward-looking statements based on our current expectations, which are subject to risks and uncertainties. Forward-looking statements include information concerning future results of operations and financial condition. Statements that contain words such as “believes,” “expects,” “anticipates,” “intends,” “estimates,” “continue,” “should,” “could,” “may,” “plan,” “project,” “predict,” “will” or similar expressions may be forward-looking statements. These forward-looking statements are subject to risks and uncertainties, and many factors could affect the future financial results and condition of the Company. Factors that may have a material effect on our revenues, expenses and operating results include adverse business or market conditions, our ability to secure and satisfy customers, our customers’ financial conditions and their ability to secure financing to support current and future projects, the availability and cost of materials from suppliers, adverse competitive developments and changes in customer requirements as well as those circumstances discussed under “Item 1A. Risk Factors,” below. Accordingly, actual results may differ materially from those expressed or implied by the forward-looking statements contained in this Annual Report. Any forward-looking statements made by or on our behalf are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

The forward-looking statements contained in this Annual Report are based on current assumptions that we will continue to develop, market, manufacture and ship products and provide services on a competitive and timely basis; that competitive conditions in our markets will not change in a materially adverse way; that we will accurately identify and meet customer needs for products and services; that we will be able to retain and hire key employees; that our products and capabilities will remain competitive; that the financial markets and banking systems will stabilize and availability of credit will continue; that risks related to shifts in customer demand are minimized and that there will be no material adverse change in the operations or business of the Company. Assumptions relating to these factors involve judgments that are based on available information, which may not be complete, and are subject to changes in many factors beyond the Company’s control that can materially affect results. Because of these and other factors that affect our operating results, past financial performance should not be considered an indicator of future performance, and investors should not use historical trends to anticipate results or trends in future periods.

3

Overview

Powell Industries, Inc. (we, us, our, Powell or the Company) was incorporated in the state of Delaware in 2004 as a successor to a Nevada company incorporated in 1968. The Nevada corporation was the successor to a company founded by William E. Powell in 1947, which merged into the Company in 1977. Our major subsidiaries, all of which are wholly-owned, include: Powell Electrical Systems, Inc.; Transdyn, Inc.; Powell Industries International, Inc.; Switchgear & Instrumentation Limited (S&I) and Powell Canada Inc.

We develop, design, manufacture and service custom engineered-to-order equipment and systems for the management and control of electrical energy and other critical processes. Headquartered in Houston, Texas, we serve the transportation, environmental, energy, industrial and utility industries.

Our website is powellind.com. We make available, free of charge on or through our website, copies of our Annual Reports, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (SEC). Paper or electronic copies of such material may also be requested by contacting the Company at our corporate offices.

Our business operations are consolidated into two business segments: Electrical Power Products and Process Control Systems. Revenues from customers located in the United States of America (U.S.) accounted for approximately 58%, 67% and 71% of our consolidated revenues for the fiscal years ended September 30, 2012, 2011 and 2010, respectively. Approximately 76% of our long-lived assets were located in the U.S. at September 30, 2012, with the remaining long-lived assets located primarily in the United Kingdom (U.K.) and Canada. Financial information related to our business and geographical segments is included in Note M of Notes to Consolidated Financial Statements.

Electrical Power Products

Our Electrical Power Products business segment develops, designs, manufactures and markets custom engineered-to-order electrical power distribution and control systems designed (1) to distribute, monitor and control the flow of electrical energy and (2) to provide protection to motors, transformers and other electrically-powered equipment. Our principal products include integrated power control room substations, traditional and arc-resistant medium-voltage distribution switchgear, medium-voltage circuit breakers, offshore generator and control modules, monitoring and control communications systems, motor control centers and bus duct systems. These products are designed for application voltages ranging from 480 volts to 38,000 volts and are used in electric rail transportation, refining, chemical manufacturing, oil and gas production, electric utility systems and other heavy industrial markets. Our product scope includes designs tested to meet both U.S. standards (ANSI) and international standards (IEC). We also seek to assist customers by providing value-added services such as spare parts, field service inspection, installation, commissioning and repair, retrofit and retrofill components for existing systems and replacement circuit breakers for switchgear that is obsolete or that is no longer produced by the original manufacturer. We work to establish long-term relationships with the end users of our systems and with the design and construction engineering firms contracted by those end users.

Customers and Markets

This business segment’s principal products are designed for use by and marketed to technologically sophisticated users of large amounts of electrical energy that typically have a need for complex combinations of electrical components and systems. Our customers and their industries include oil and gas producers, oil and gas pipelines, refineries, petrochemical plants, electrical power generators, public and private utilities, co-generation facilities, mining/metals operations, pulp and paper plants, transportation authorities, governmental agencies and other large industrial customers.

Products and services are principally sold directly to the end-user or to an engineering, procurement and construction (EPC) firm on behalf of the end-user. Each project is specifically tailored to meet the exact specifications and requirements of the individual customer. Powell’s expertise is in the engineering, project management and integration of the various systems into a single deliverable. We market and sell our products and services to a wide variety of customers, governmental agencies, markets and geographic regions, which are typically awarded in competitive bid situations. Contracts often represent complex projects with an individual customer. By their nature, these projects are typically nonrecurring. Thus, multiple and/or continuous projects of similar magnitude with the same customer may vary. As such, gaps in large project awards may cause material fluctuations in segment revenues.

We could be adversely impacted by a significant reduction in business volume from a particular industry which we currently serve. As a result of the fifteen-year supply agreement that we entered into with General Electric Company (GE) on August 7, 2006, our revenues from GE were

4

$64 million, $54 million and $58 million in fiscal 2012, fiscal 2011 and fiscal 2010, respectively, or 9%, 10% and 11% of our consolidated revenues for these periods. Aside from GE, with whom we have the long-term supply agreement, we do not believe that the loss of any specific customer would have a material adverse effect on our business. GE has become a significant customer and has accounted for, and could continue to account for, more than 10% of the annual revenues of this business segment as a result of the supply agreement that we entered into on August 7, 2006. Only one non-recurring petrochemical project being shipped to Colombia amounted to revenues in excess of 10% of consolidated revenues during fiscal 2012.

During fiscal year 2010, no one country outside of the U.S. accounted for more than 10% of revenues with customers. However, during fiscal years 2012 and 2011, our operations in Canada accounted for 13% and 17% of revenues with customers, respectively. During fiscal year 2012, one petrochemical project being shipped to Colombia accounted for 11% of revenues with customers. For information on the geographic areas in which our consolidated revenues were recorded in each of the past three fiscal years, see Note M of Notes to Consolidated Financial Statements.

Competition

We strive to be the supplier of choice for custom engineered system solutions and services to a variety of customers and markets. Our activities are predominantly in the oil and gas and the electric utility industries, but also include other markets where customers need to manage, monitor and control large amounts of electrical energy. The majority of our business is in support of capital investment projects which are highly complex and competitively bid. We compete with a small number of multinational competitors that sell to a broad industrial and geographic market and with smaller, regional competitors that typically have limited capabilities and scope of supply.

Our principal competitors include ABB, Eaton Corporation, GE, Schneider Electric and Siemens. The competitive factors used during bid evaluation by our customers vary from project to project and may include technical support and application expertise, engineering and manufacturing capabilities, equipment rating, delivered value, scheduling and price. While projects are typically non-recurring, a significant portion of our business is from repeat customers and many times involves third-party engineering and construction companies hired by the end-user and with which we also have long and established relationships. We consider our engineering, manufacturing and service capabilities vital to the success of our business, and believe our technical and project management strengths, together with our responsiveness and flexibility to the needs of our customers, give us a competitive advantage in our markets. Ultimately, our competitive position is dependent upon our ability to provide quality custom engineered-to-order products, services and systems on a timely basis at a competitive price.

Backlog

Backlog represents the dollar amount of revenue that we expect to realize from work to be performed on uncompleted contracts, including new contractual agreements on which work has not begun. Our methodology for determining backlog may not be comparable to the methodology used by other companies. Orders included in our backlog are represented by customer purchase orders and contracts, which we believe to be firm. Orders in the Electrical Power Products business segment backlog at September 30, 2012, totaled $361.9 million compared to $394.6 million at September 30, 2011. We anticipate that approximately $300 million of our fiscal 2012 ending backlog will be fulfilled during our fiscal year 2013. Conditions outside of our control have caused us to experience some customer delays and cancellations of certain projects in the past; accordingly, backlog may not be indicative of future operating results as orders in our backlog may be cancelled or modified by our customers.

Raw Materials and Suppliers

The principal raw materials used in Electrical Power Products’ operations include steel, copper, aluminum and various electrical components. Raw material costs represented 48% of our revenues in fiscal 2012. Unanticipated increases in raw material requirements, disruptions in supplies or price increases could increase production costs and adversely affect profitability.

We purchase certain key electrical components on a sole-sourced basis and maintain a qualification and performance monitoring program to control risk associated with sole-sourced items. Changes in our design to accommodate similar components from other suppliers could be implemented to resolve a supply problem related to a sole-sourced component. In this circumstance, supply problems could result in delays in our ability to meet commitments to our customers. We believe that sources of supply for raw materials and components are generally sufficient, and we have no reason to believe a shortage of raw materials will cause any material adverse impact during fiscal year 2013. While we are not dependent on any one supplier for a material amount of our raw materials, we are highly dependent on our suppliers in order to meet commitments to our customers. We did not experience significant or unusual issues in the purchase of key raw materials and commodities in the past three years.

This business segment is subject to the effects of changing material prices. During the last three fiscal years, we experienced price volatility for certain commodities, in particular steel, copper and aluminum products, which are used in the production of our products. While the cost outlook for commodities used in the production of our products is not certain, we believe we can manage these inflationary pressures through contract

5

pricing adjustments, material-cost predictive estimating and by actively pursuing internal cost reduction efforts. We did not enter into any derivative contracts to hedge our exposure to commodity price changes in fiscal years 2012, 2011 or 2010.

Employees

At September 30, 2012, the Electrical Power Products business segment had 2,812 full-time employees located in the United States, the United Kingdom and Canada. Our employees are not represented by unions, and we believe that our relationship with our employees is good.

Research and Development

This business segment’s research and development activities are directed toward the development of new products and processes as well as improvements in existing products and processes. Research and development expenditures were $6.3 million, $6.4 million and $6.0 million in fiscal years 2012, 2011 and 2010, respectively, and are reported in selling, general and administrative expenses in the consolidated statement of operations.

Intellectual Property

While we are the holder of various patents, trademarks and licenses relating to this business segment, we do not consider any individual intellectual property to be material to our consolidated business operations.

Process Control Systems

Our Process Control Systems business segment designs and delivers custom engineered-to-order technology solutions that help our customers manage their critical transportation, environmental and energy management processes and facilities. Our proprietary DYNAC® software suite provides a highly integrated operations management solution for these vital operations. The mission-critical information may be traffic flow in our intelligent transportation management solutions, water quality in our environmental treatment solutions or electrical power management in the case of our substation automation solutions. DYNAC® has user configurable applications designed specifically for clients that require high performance, 24/7 availability and superior data integrity in a secure environment.

We provide a comprehensive set of technical services to deliver these systems. A diverse team of professional systems engineers, software engineers, analysts, network specialists and automation engineers provide expertise for the entire life cycle of a technology project. We have designed and built systems for various transit facilities and roadways around the world.

Customers and Markets

This business segment’s products and services are principally sold directly to end-users in the transportation, environmental and energy sectors. From time to time, a significant percentage of revenues may result from one specific contract or customer due to the nature of large projects common to this business segment. In fiscal year 2010, revenues with two customers individually accounted for more than 10% of our segment revenues. Revenues from these customers totaled $3.2 million in fiscal 2010. In fiscal years 2012 and 2011, no customer individually accounted for more than 10% of our segment revenues. Contracts often represent large-scale, single-need projects with an individual customer. By their nature, these projects are typically nonrecurring for a given customer. Thus, multiple and/or continuous projects of similar magnitude with the same customer are rare. As such, gaps in large project awards may cause material fluctuations in segment revenues.

During each of the past three fiscal years, the U.S. is the only country that accounted for more than 10% of segment revenues. For information on the geographic areas in which our consolidated revenues were recorded in each of the past three fiscal years, see Note M of Notes to Consolidated Financial Statements.

Competition

This business segment operates in a competitive market where competition for each contract varies. Depending upon the type of system and customer requirements, the competition may include large multinational firms as well as smaller regional competitors.

Our customized systems are designed to meet the specifications of our customers. Each system is designed, delivered and installed to the specific requirements of the particular application. We consider our engineering, systems integration and technical support capabilities vital to the success of our business. We believe our turnkey systems integration capabilities, customizable software, domain expertise, specialty contracting experience and financial strength give us a competitive advantage in our markets.

Backlog

Backlog represents the dollar amount of revenue that we expect to realize from work to be performed on uncompleted contracts, including new contractual agreements on which work has not begun. Our methodology for determining backlog may not be comparable to the methodology used by other companies. Orders included in our backlog are represented by customer purchase orders and contracts, which we believe to be firm. Orders in the Process Control Systems business segment backlog at September 30, 2012, totaled $74.8 million compared to $48.4 million at

6

September 30, 2011. We anticipate that approximately $21.0 million of our ending fiscal 2012 backlog will be fulfilled during our 2013 fiscal year. Conditions outside of our control have caused us to experience some customer delays and cancellations of certain projects in the past; accordingly, backlog may not be indicative of future operating results as orders in our backlog may be cancelled or modified by our customers.

Employees

The Process Control Systems business segment had 169 full-time employees at September 30, 2012, primarily located in the United States. Our employees are not represented by unions, and we believe that our relationship with our employees is good.

Research and Development

The majority of research and development activities of this business segment are directed toward the development of our software suites for the management and control of the critical processes and facilities of our customers. Non-project research and development expenditures were $1.4 million, $1.1 million and $0.4 million in fiscal years 2012, 2011 and 2010, respectively, and are reported in selling, general and administrative expenses in the Consolidated Statements of Operations.

Intellectual Property

While we are the holder of various copyrights related to software for this business segment, we do not consider any individual intellectual property to be material to our consolidated business operations.

Our business is subject to a variety of risks and uncertainties, including, but not limited to, the most significant risks and uncertainties described below. Additional risks and uncertainties not known to us or not described below may also impair our business operations. If any of the following risks actually occur, our business, financial condition and results of operations could be harmed and we may not be able to achieve our goals. This Annual Report also includes statements reflecting assumptions, expectations, projections, intentions or beliefs about future events that are intended as “forward-looking statements” under the Private Securities Litigation Reform Act of 1995 and should be read in conjunction with the discussion under “Forward-Looking Statements,” above.

Economic uncertainty and financial market conditions may impact our customer base, suppliers and backlog.

Various factors drive demand for our products and services, including the price of oil and gas, capital expenditures, economic forecasts and financial markets. Continued uncertainty regarding these factors could impact our customers and severely impact the demand for projects that would result in orders for our products and services. If one or more of our suppliers or subcontractors experiences difficulties that result in a reduction or interruption in supply to us, or they fail to meet our manufacturing requirements, our business could be adversely impacted until we are able to secure alternative sources. Furthermore, our ability to expand our business would be limited in the future if we are unable to increase our bonding capacity or our credit facility on favorable terms or at all. These disruptions could lead to a lower demand for our products and services and could materially impact our business, financial condition, cash flows and results of operations and potentially impact the trading price of our common stock.

Our backlog is subject to unexpected adjustments and cancellations and, therefore, may not be a reliable indicator of our future earnings.

We have a backlog of uncompleted contracts. Orders included in our backlog are represented by customer purchase orders and contracts, which we believe to be firm. Backlog develops as a result of new business taken, which represents the revenue value of new project commitments received. Backlog consists of projects which either (1) have not yet been started or (2) are in progress and are not yet completed. In the latter case, the revenue value reported in backlog is the remaining value associated with work that has not yet been completed. From time to time, projects are cancelled that appeared to have a high certainty of going forward at the time they were recorded as new business taken. In the event of a project cancellation, we may be reimbursed for certain costs but typically have no contractual right to the total revenue reflected in our backlog. In addition to our being unable to recover certain direct costs, cancelled projects may also result in additional unrecoverable costs due to underutilization of our assets.

Our volume of fixed-price contracts and use of percentage-of-completion accounting could result in volatility in our results of operations.

As discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Critical Accounting Policies and Estimates” and in Notes to Consolidated Financial Statements, our revenues are recognized on the percentage-of-completion method of accounting. The percentage-of-completion accounting practice we use results in our recognizing contract revenues and earnings ratably over the contract term in proportion to our incurrence of contract costs. The earnings or losses recognized on individual contracts are based on estimates of contract revenues, costs and profitability. The process of estimating costs on projects requires a significant amount of judgment and combines

7

professional engineering, cost estimating, pricing and accounting inputs. Contract losses are recognized in full when determined, and estimates of revenue and cost to complete are adjusted based on ongoing reviews of estimated contract performance. Previously recorded estimates are adjusted as the project progresses. In certain circumstances, it is possible that such adjustments could have a significant impact on our operating results for any fiscal quarter or year.

A portion of our contracts contain terms with penalty provisions.

Some of our contracts contain penalty provisions for the failure to meet specified contractual provisions. These contractual provisions define the conditions under which our customers may make claims against us. In many cases in which we have had potential exposure for damages, such damages ultimately were not fully asserted by our customers.

Fluctuations in the price and supply of raw materials used to manufacture our products may reduce our profits and could materially impact our ability to meet commitments to our customers.

Our raw material costs represented 47% of our consolidated revenues for the fiscal year ended September 30, 2012. We purchase a wide variety of raw materials to manufacture our products, including steel, aluminum, copper and various electrical components. Unanticipated increases in raw material requirements, supplier availability or price increases could increase production costs and adversely affect profitability. Our ability to meet customer commitments could be negatively impacted due to the time and effort associated with the selection and qualification of a new supplier.

Our industry is highly competitive.

Some of our competitors are significantly larger and have substantially greater resources than we do. Competition in the industry depends on a number of factors, including price. Certain of our competitors may have lower cost structures and may, therefore, be able to provide their products or services at lower prices than we are able to provide. Similarly, we cannot be certain that we will be able to maintain or enhance our competitive position within our industry, maintain our customer base at current levels or increase our customer base.

Our operations could be adversely impacted by the continuing effects from government regulations.

Various regulations have been implemented related to new safety and certification requirements applicable to oil and gas drilling and production activities. While certain new drilling plans and drilling permits have been approved, we cannot predict whether operators will be able to satisfy these requirements. Further, we cannot predict what the continuing effects of government regulations on offshore deepwater drilling projects may have on offshore oil and gas exploration and development activity, or what actions may be taken by our customers or other industry participants in response to these regulations. Changes in laws or regulations regarding offshore oil and gas exploration and development activities and decisions by customers and other industry participants could reduce demand for our services, which would have a negative impact on our operations. Similarly, we cannot accurately predict future regulations by the government in any country in which we operate and how those regulations may affect our ability to perform projects in those regions.

International and political events may adversely affect our operations.

International sales accounted for 42% of our revenues in fiscal 2012, including sales from our operations in the United Kingdom and Canada. Our manufacturing facilities are in developed countries with historically stable operating and fiscal environments. Our consolidated results of operations, cash flows and financial condition could be adversely affected by the occurrence of political and economic instability; social unrest, acts of terrorism, force majeure, war or other armed conflict; inflation; currency fluctuations, devaluations and conversion restrictions; governmental activities that limit or disrupt markets, restrict payments or limit the movement of funds and trade restrictions and economic embargoes imposed by the U.S. or other countries.

Acquisitions involve a number of risks.

Our strategy has been to pursue growth and product diversification through the acquisition of companies or assets that will enable us to expand our product and service offerings. We routinely review potential acquisitions. We may be unable to implement this strategy if we cannot reach agreement on potential strategic acquisitions on acceptable terms or for other reasons. Acquisitions involve certain risks, including difficulties in the integration of operations and systems; failure to realize cost savings; the termination of relationships by key personnel and customers of the acquired company and a failure to add additional employees to handle the increased volume of business. Additionally, financial and accounting challenges and complexities in areas such as valuation, tax planning, treasury management and financial reporting from our acquisitions pose risks to our strategy. Due diligence may not reveal all risks and challenges associated with our acquisitions. It is possible impairment charges resulting from the overpayment for an acquisition may negatively impact our earnings. Financing for acquisitions may require us to obtain additional equity or debt financing, which, if available, may not be available on attractive terms.

8

Our operating results may vary significantly from quarter to quarter.

Our quarterly results may be materially and adversely affected by changes in estimated costs or revenues under fixed-price contracts; the timing and volume of work under new agreements; general economic conditions; the spending patterns of customers; variations in the margins of projects performed during any particular quarter; losses experienced in our operations not otherwise covered by insurance; a change in the demand or production of our products and our services caused by severe weather conditions; a change in the mix of our customers, contracts and business; increases in design and manufacturing costs; the ability of customers to pay their invoices owed to us and disagreements with customers related to project performance on delivery.

Accordingly, our operating results in any particular quarter may not be indicative of the results that you can expect for any other quarter or for an entire year.

We may be unsuccessful at generating profitable internal growth.

Our ability to generate profitable internal growth will be affected by, among other factors, potential regulatory changes, our ability to attract new customers, increase the number or size of projects performed for existing customers, hire and retain employees, increase volume utilizing our existing facilities and our ability to construct and integrate new facilities.

In addition, our customers may reduce the number or size of projects available to us. Many of the factors affecting our ability to generate internal growth may be beyond our control, and we cannot be certain that our strategies will be successful or that we will be able to generate cash flow sufficient to fund our operations and to support internal growth. If we are unsuccessful, we may not be able to achieve internal growth, expand our operations or grow our business.

The departure of key personnel could disrupt our business.

We depend on the continued efforts of our executive officers and senior management. We cannot be certain that any individual will continue in such capacity for any particular period of time. The loss of key personnel, or the inability to hire and retain qualified employees, could negatively impact our ability to manage our business.

9

Our business requires skilled labor, and we may be unable to attract and retain qualified employees.

Our ability to maintain our productivity and profitability will be limited by our ability to employ, train and retain skilled personnel necessary to meet our requirements. We may experience shortages of qualified personnel. We cannot be certain that we will be able to maintain an adequate skilled labor force necessary to operate efficiently and to support our growth strategy or that our labor expenses will not increase as a result of a shortage in the supply of skilled personnel. Labor shortages or increased labor costs could impair our ability to maintain our business or grow our revenues, and may adversely impact our profitability.

Actual and potential claims, lawsuits and proceedings could ultimately reduce our profitability and liquidity and weaken our financial condition.

We could be named as a defendant in future legal proceedings claiming damages from us in connection with the operation of our business. Most of the actions against us arise out of the normal course of our performing services or manufacturing equipment. We are and will likely continue to be a plaintiff in legal proceedings against customers, in which we seek to recover payment of contractual amounts due to us, as well as claims for increased costs incurred by us. When appropriate, we establish provisions against certain legal exposures, and we adjust such provisions from time to time according to ongoing developments related to each exposure. If in the future our assumptions and estimates related to such exposures prove to be inadequate or wrong, our consolidated results of operations, cash flows and financial condition could be adversely affected. In addition, claims, lawsuits and proceedings may harm our reputation or divert management resources away from operating our business.

Unforeseen difficulties with the implementation or operation of our enterprise resource planning system could adversely affect our internal controls and our business.

The efficient execution of our business is dependent upon the proper functioning of our enterprise resource planning (ERP) system that supports our human resources, accounting, estimating, financial, job management and customer systems. Any significant failure or malfunction of our ERP system may result in disruption of our operations. Our results of operations could be adversely affected if we encounter unforeseen problems with respect to the operation of this ERP system.

We carry insurance against many potential liabilities, and our management of risk may leave us exposed to unidentified or unanticipated risks.

Although we maintain insurance policies with respect to our related exposures, including certain casualty, business interruption, self-insured medical and dental programs, these policies contain deductibles, self-insured retentions and limits of coverage. We estimate our liabilities for known claims and unpaid claims and expenses based on information available as well as projections for claims incurred but not reported. However, insurance liabilities, some of which are self-insured, are difficult to estimate due to various factors. If any of our insurance policies or programs are not effective in mitigating our risks, we may incur losses that are not covered by our insurance policies or that exceed our accruals or that exceed our coverage limits and could adversely impact our consolidated results of operations, cash flows and financial position.

We may incur additional healthcare costs arising from federal healthcare reform legislation.

In March 2010, the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010 were signed into law in the U.S. This legislation expands health care coverage to many uninsured individuals and expands coverage to those already insured. The changes required by this legislation could cause us to incur additional healthcare and other costs.

Technological innovations by competitors may make existing products and production methods obsolete.

All of the products manufactured and sold by the Company depend upon the best available technology for success in the marketplace. The competitive environment is highly sensitive to technological innovation in both segments of our business. It is possible for competitors (both domestic and international) to develop products or production methods which will make current products or methods obsolete or at least hasten their obsolescence; therefore, we cannot be certain that our competitors will not develop the expertise, experience and resources to provide products and services that are superior in both price and quality.

10

Catastrophic events could disrupt our business.

The occurrence of catastrophic events ranging from natural disasters such as hurricanes to epidemics such as health epidemics to acts of war and terrorism could disrupt or delay the Company’s ability to complete projects for its customers and could potentially expose the Company to third-party liability claims. Such events may or may not be fully covered by our various insurance policies or may be subject to deductibles. In addition, such events could impact the Company’s customers and suppliers, resulting in temporary or long-term delays and/or cancellations of orders or raw materials used in normal business operations. These situations are outside the Company’s control and could have a significant adverse impact on the results of operations.

Unforeseen difficulties with the construction, relocation and start-up of our two new facilities could adversely affect our operations.

We are currently constructing a manufacturing/assembly facility in the United States, as well as one in Canada. We will relocate from two of our existing facilities upon completion of these two facilities. Any significant delay in the construction, relocation or start-up of either of these new facilities could adversely affect our operations.

Item 1B. Unresolved Staff Comments

None.

We own or lease manufacturing facilities, sales offices, field offices and repair centers located throughout the U.S. and Canada, and we have a manufacturing facility located in the United Kingdom. Our facilities are generally located in areas that are readily accessible to raw materials and labor pools and are maintained in good condition. These facilities, together with recent expansions, are expected to meet our needs for the foreseeable future.

Our principal locations by segment as of September 30, 2012, are as follows:

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

Approximate |

|||||

|

|

Number |

|

|

Square Footage |

|||||

|

Location |

of Facilities |

Acres |

|

Owned |

|

Leased |

|||

|

Electrical Power Products: |

|

|

|

|

|

|

|||

|

Houston, TX |

3 | 152.5 |

|

446,600 |

|

138,600 | |||

|

North Canton, OH |

1 | 8.0 |

|

115,200 |

|

— |

|||

|

Northlake, IL |

1 | 10.0 |

|

103,500 |

|

— |

|||

|

Bradford, United Kingdom |

1 | 7.9 |

|

129,200 |

|

— |

|||

|

Acheson, Alberta, Canada |

— |

20.1 |

|

— |

|

— |

|||

|

Edmonton, Alberta, Canada |

2 |

|

|

— |

|

70,700 | |||

|

Calgary, Alberta, Canada |

1 |

|

|

— |

|

8,200 | |||

|

Process Control Systems: |

|

|

|

|

|

|

|||

|

Pleasanton, CA |

1 |

|

|

— |

|

21,200 | |||

|

Duluth, GA |

1 |

|

|

— |

|

41,700 | |||

|

Chantilly, VA |

1 |

|

|

— |

|

9,900 | |||

|

East Rutherford, NJ |

1 |

|

|

— |

|

8,700 | |||

All leased properties are subject to long-term leases with remaining lease terms ranging from one to 11 years as of September 30, 2012. We do not anticipate experiencing significant difficulty in retaining occupancy of any of our leased facilities through lease renewals prior to expiration or through month-to-month occupancy, or in replacing them with equivalent facilities.

In fiscal 2012, we acquired land in Houston, Texas, and in Acheson, Alberta, Canada, and began construction of two facilities to allow us to expand our operations. We estimate the total cost of these facilities, including the land, will be approximately $75 million. Such costs are expected to be funded from our existing cash and cash equivalents and future cash flow from operations.

We are involved in various legal proceedings, claims and other disputes arising in the ordinary course of business which, in general, are subject to uncertainties and the outcomes are not predictable. We do not believe that the ultimate conclusion of these disputes could materially affect our financial position or results of operations.

Item 4. Mine Safety Disclosures

Not applicable.

11

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Price Range of Common Stock

Our common stock trades on the NASDAQ Global Market (NASDAQ) under the symbol “POWL.” The following table sets forth, for the periods indicated, the high and low sales prices per share as reported on the NASDAQ for our common stock.

|

36.47 |

|

|

|

|

|

|

|

|

High |

|

|

Low |

|

Fiscal Year 2011: |

|

|

|

|

|

|

First Quarter |

$ |

37.65 |

|

$ |

29.13 |

|

Second Quarter |

|

40.88 |

|

|

32.97 |

|

Third Quarter |

|

40.82 |

|

|

32.01 |

|

Fourth Quarter |

|

41.64 |

|

|

30.28 |

|

Fiscal Year 2012: |

|

|

|

|

|

|

First Quarter |

$ |

36.47 |

|

$ |

25.76 |

|

Second Quarter |

|

38.51 |

|

|

30.67 |

|

Third Quarter |

|

38.62 |

|

|

30.00 |

|

Fourth Quarter |

|

43.65 |

|

|

33.37 |

As of November 30, 2012, the last reported sales price of our common stock on the NASDAQ was $40.04 per share. As of November 30, 2012, there were 496 stockholders of record of our common stock. All common stock held in street names are recorded in the Company’s stock register as being held by one stockholder.

See Part III, Item 12 for information regarding securities authorized for issuance under our equity compensation plans.

Dividend Policy

Our current credit agreements limit the payment of dividends, other than dividends payable solely in our capital stock, without prior consent of our lenders. To date, we have not paid cash dividends on our common stock, and for the foreseeable future we intend to retain earnings for the development of our business. Future decisions to pay cash dividends will be at the discretion of the Board of Directors and will depend upon our results of operations, financial condition and capital expenditure plans and restrictive covenants under our credit facilities, along with other relevant factors.

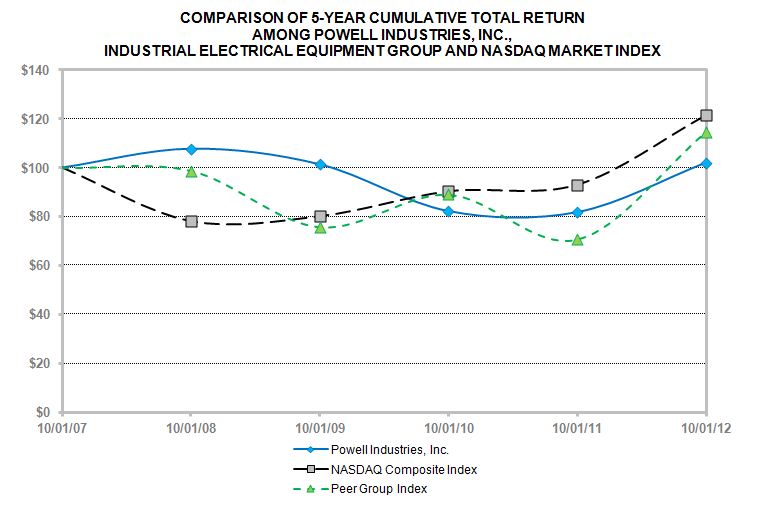

Performance Graph

The following Performance Graph and related information shall not be deemed “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing.

The following graph compares, for the period from October 1, 2007, to September 30, 2012, the cumulative stockholder return on our common stock with the cumulative total return on the NASDAQ Market Index and Industrial Electrical Equipment Group (a select group of peer companies – Advanced Energy Industries, Inc.; Altra Holdings Inc.; AZZ Inc.; CTC Corporation; DXP Enterprises Inc.; ENGlobal Corporation; ESCO Technologies Inc.; Franklin Electric Company, Inc.; Integrated Electrical Services, Inc.; Methode Electronics Inc. and Power-One Inc.). The comparison assumes that $100 was invested on October 1, 2007, in our common stock, the NASDAQ Market Index and Industrial Electrical Equipment Group. The stock price performance reflected on the following graph is not necessarily indicative of future stock price performance.

12

Item 6. Selected Financial Data

The selected financial data shown below for the past five years was derived from our audited financial statements. The historical results are not necessarily indicative of the operating results to be expected in the future. The selected financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes included elsewhere in this Annual Report.

In December 2009, we acquired the business and certain assets of PowerComm Inc. and its subsidiaries, Redhill Systems Ltd., Nextron Corporation, PCG Technical Services Inc. and Concorde Metal Manufacturing Ltd (the entire business of which is referred to herein as Powell Canada). Powell Canada is headquartered in Edmonton, Alberta, Canada, and provides electrical equipment, maintenance and services. Powell Canada is also a manufacturer of switchgear and related products, primarily serving the oil and gas industry in western Canada. The operating results of Powell Canada are included in our Electrical Power Products business segment from the acquisition date.

13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years Ended September 30, |

|||||||||||||

|

|

2012 |

|

2011 |

|

2010 |

|

2009 |

|

2008 |

|||||

|

|

(In thousands, except per share data) |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

717,194 |

|

$ |

562,397 |

|

$ |

550,692 |

|

$ |

665,851 |

|

$ |

638,704 |

|

Cost of goods sold |

|

577,256 |

|

|

462,467 |

|

|

408,635 |

|

|

520,802 |

|

|

512,298 |

|

Gross profit |

|

139,938 |

|

|

99,930 |

|

|

142,057 |

|

|

145,049 |

|

|

126,406 |

|

Selling, general and administrative expenses |

|

88,947 |

|

|

85,058 |

|

|

84,457 |

|

|

79,954 |

|

|

80,416 |

|

Amortization of intangible assets |

|

2,599 |

|

|

4,752 |

|

|

4,477 |

|

|

3,460 |

|

|

3,585 |

|

Impairments |

|

— |

|

|

7,158 |

|

|

7,452 |

|

|

— |

|

|

— |

|

Operating income |

|

48,392 |

|

|

2,962 |

|

|

45,671 |

|

|

61,635 |

|

|

42,405 |

|

Gain on sale of investment |

|

— |

|

|

(1,229) |

|

|

— |

|

|

— |

|

|

— |

|

Interest expense, net |

|

158 |

|

|

194 |

|

|

610 |

|

|

976 |

|

|

2,537 |

|

Income before income taxes |

|

48,234 |

|

|

3,997 |

|

|

45,061 |

|

|

60,659 |

|

|

39,868 |

|

Income tax provision |

|

18,577 |

|

|

6,712 |

|

|

19,894 |

|

|

20,734 |

|

|

14,072 |

|

Net income (loss) |

|

29,657 |

|

|

(2,715) |

|

|

25,167 |

|

|

39,925 |

|

|

25,796 |

|

Net (income) loss attributable to noncontrolling interest |

|

— |

|

|

— |

|

|

(159) |

|

|

(208) |

|

|

51 |

|

Net income (loss) attributable to Powell Industries, Inc. |

$ |

29,657 |

|

$ |

(2,715) |

|

$ |

25,008 |

|

$ |

39,717 |

|

$ |

25,847 |

|

Basic earnings (loss) per share attributable to Powell Industries, Inc. |

$ |

2.50 |

|

$ |

(0.23) |

|

$ |

2.17 |

|

$ |

3.48 |

|

$ |

2.29 |

|

Diluted earnings (loss) per share attributable to Powell Industries, Inc. |

$ |

2.49 |

|

$ |

(0.23) |

|

$ |

2.14 |

|

$ |

3.43 |

|

$ |

2.26 |

|

|

|

|

|

|

|

|||||

|

|

|

|

||||||||

|

|

As of September 30, |

|||||||||

|

|

2012 |

2011 |

2010 |

2009 | 2008 | |||||

|

|

(In thousands) |

|||||||||

|

Balance Sheet Data: |

|

|

|

|

|

|||||

|

Cash and cash equivalents |

$ 90,040

|

$ 123,466

|

$ 115,353

|

$ 97,403

|

$ 10,134

|

|||||

|

Property, plant and equipment, net |

78,652 | 59,637 | 63,676 | 61,036 | 61,546 | |||||

|

Total assets |

448,312 | 421,676 | 400,712 | 404,840 | 397,634 | |||||

|

Long-term debt and capital lease obligations, including current maturities |

4,355 | 5,441 | 6,885 | 9,492 | 41,758 | |||||

|

Total stockholders’ equity |

310,103 | 275,343 | 277,303 | 246,761 | 206,874 | |||||

|

Total liabilities and stockholders’ equity |

448,312 | 421,676 | 400,712 | 404,840 | 397,634 | |||||

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the accompanying consolidated financial statements and related notes. Any forward-looking statements made by or on our behalf are made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Readers are cautioned that such forward-looking statements involve risks and uncertainties in that the actual results may differ materially from those projected in the forward-looking statements. For a description of the risks and uncertainties, please see “Cautionary Statement Regarding Forward-Looking Statements; Risk Factors” and “Item 1A. Risk Factors” contained in this Annual Report.

Overview

We develop, design, manufacture and service custom engineered-to-order equipment and systems for the management and control of electrical energy and other critical processes. Headquartered in Houston, Texas, we serve the transportation, environmental, energy, industrial and utility industries. Our business operations are consolidated into two business segments: Electrical Power Products and Process Control Systems. Revenues and costs are primarily related to engineered-to-order equipment and systems which precludes us from providing detailed price and volume information.

The markets in which Powell participates in are capital-intensive and cyclical in nature. Cyclicality is predominantly driven by customer demand, global economic conditions and anticipated environmental or regulatory changes which affect the manner in which our customers proceed with capital investments. Our customers analyze various factors including the demand for oil, gas and electrical energy, the overall financial environment, governmental budgets, regulatory actions and environmental concerns. These factors influence the release of new capital projects by our customers.

14

We entered fiscal 2012 with a backlog of unfilled orders of $443.0 million, an increase of $160.7 million over the prior year, which provided our revenue growth during fiscal 2012. As of September 30, 2012, our order backlog remains strong; however, the quotation-to-order period is beginning to lengthen. We enter fiscal 2013 with a backlog of unfilled orders of $436.7 million. Our backlog includes various projects, some of which are for petrochemical, oil and gas construction and transportation infrastructure projects which take a number of months to produce.

Results of Operations

Twelve Months Ended September 30, 2012 (Fiscal 2012) Compared to Twelve Months Ended September 30, 2011(Fiscal 2011)

Revenue and Gross Profit

Consolidated revenues increased 27.5%, or $154.8 million, to $717.2 million in Fiscal 2012. Domestic revenues increased by 8.9%, or $33.9 million, to $412.8 million in Fiscal 2012 and international revenues increased 65.9%, or $120.9 million, to $304.4 million in Fiscal 2012. Revenues increased primarily as a result of an increase in activity in complex petrochemical and oil and gas construction projects, as a result of our Electrical Power Products business segment.

Gross profit in Fiscal 2012 increased 40.0%, or $40.0 million, to $139.9 million in Fiscal 2012. Gross profit as a percentage of revenues increased to 19.5% in Fiscal 2012, compared to 17.8% in Fiscal 2011 primarily as a result of our Electrical Power Products business segment.

Electrical Power Products

Electrical Power Products business segment revenues increased 28.7%, or $153.3 million, to $686.6 million in Fiscal 2012. Revenues increased primarily as a result of an increase in project activity in certain markets. Revenues from public and private utilities decreased $51.3 million to $115.3 million in Fiscal 2012. Revenues from commercial and industrial customers increased $202.2 million to $522.7 million in Fiscal 2012. Revenues from municipal and transit projects increased $2.4 million to $48.6 in Fiscal 2012.

Electrical Power Products business segment gross profit increased 44.4%, or $40.7 million, to $132.5 million in Fiscal 2012. Gross profit, as a percentage of revenues, increased to 19.3% in Fiscal 2012 compared to 17.2% in Fiscal 2011, as a result of favorable operational execution and project management on certain large complex projects that were completed or near completion. Our increase in project activity in Fiscal 2012 also improved our ability to cover fixed and overhead operating costs, partially offset by the challenges on certain large projects at Powell Canada. These challenges resulted from scope changes and cost overruns on certain Canadian projects. We are currently pursuing recovery of certain of these costs; however, there is no assurance these costs can be recovered. Revenues have not been recognized on such costs as recovery has not been deemed probable until change orders are approved by the customer.

Process Control Systems

Process Control Systems business segment revenues increased 5.2%, or $1.5 million, to $30.6 million in Fiscal 2012. Business segment gross profit, as a percentage of revenues, decreased to 24.4% for Fiscal 2012, compared to 28.2% for Fiscal 2011. This decrease in gross profit as a percentage of revenues is related to the mix of project types.

For additional information related to our business segments, see Note M of Notes to Consolidated Financial Statements.

Consolidated Selling, General and Administrative Expenses

Selling, general and administrative expenses, as a percentage of revenues, decreased to 12.4% in Fiscal 2012 from 15.1% in Fiscal 2011. Selling, general and administrative expenses decreased as a percentage of revenues in Fiscal 2012 as a result of our increase in revenues. Consolidated selling, general and administrative expenses increased $3.8 million to $88.9 million in Fiscal 2012. This increase is primarily related to increased personnel costs and incentive compensation resulting from higher levels of operating performance. Additionally, separation payments of $2.6 million to our former CEO were recorded in selling, general and administrative expenses in the fourth quarter of Fiscal 2011.

15

Amortization of Intangible Assets

Amortization of intangible assets decreased to $2.6 million in Fiscal 2012, compared to $4.8 million in Fiscal 2011. This decrease resulted from the impairment of the intangible assets recorded in Fiscal 2011 related to Powell Canada.

Income Tax Provision

Our provision for income taxes reflected an effective tax rate on earnings before income taxes of 38.5% in Fiscal 2012 compared to 167.9% in Fiscal 2011. The effective tax rate for both Fiscal 2012 and 2011 were negatively impacted by our inability to record the tax benefit related to pre-tax losses in Canada, offset by the favorable impact on our effective tax rate for the domestic production activities deduction in the United States.

Net Income (Loss) Attributable to Powell Industries, Inc.

In Fiscal 2012, we recorded net income of $29.7 million, or earnings of $2.49 per diluted share, compared to a net loss of $2.7 million, or a loss of $0.23 per diluted share, in Fiscal 2011. Net income improved in Fiscal 2012 as a result of increased revenue and earnings from increased activity and favorable operational and project execution in Fiscal 2012. Fiscal 2011 was negatively impacted by the impairment of intangible assets for Powell Canada of $7.2 million, the $2.6 million separation charge with our former CEO and our inability to record the tax benefits related to the pre-tax losses in Canada.

Backlog

The order backlog at September 30, 2012, was $436.7 million, compared to $443.0 million at September 30, 2011. New orders placed during Fiscal 2012 totaled $710.7 million compared to $725.2 million in Fiscal 2011. The backlog for Fiscal 2012 decreased slightly due to the completion of certain complex oil and gas production and petrochemical projects.

Twelve Months Ended September 30, 2011 (Fiscal 2011) Compared to Twelve Months Ended September 30, 2010 (Fiscal 2010)

Revenue and Gross Profit

Consolidated revenues increased $11.7 million to $562.4 million in Fiscal 2011 compared to $550.7 million in Fiscal 2010. Revenues increased primarily as a result of the $25.0 million full year impact of revenues from Powell Canada which was acquired in the first quarter of Fiscal 2010. Domestic revenues decreased by 3.6% to $378.9 million in Fiscal 2011 compared to $393.3 million in Fiscal 2010, primarily due to reduced manufacturing and service activities because of the lower level of backlog at the beginning of Fiscal 2011. International revenues increased from $157.6 million in Fiscal 2010 to $183.5 million in Fiscal 2011. Gross profit in Fiscal 2011 decreased by $42.1 million compared to Fiscal 2010, as a result of the competitive pressure on margins, as well as execution-related challenges on certain large projects at Powell Canada. These factors also contributed to the decrease in gross profit as a percentage of revenues to 17.8% in Fiscal 2011, compared to 25.8% in Fiscal 2010.

Electrical Power Products

Our Electrical Power Products business segment recorded revenues of $533.3 million in Fiscal 2011, compared to $517.1 million in Fiscal 2010. Revenues increased as a result of the $25.0 million full year impact of revenues from Powell Canada which was acquired in the first quarter of Fiscal 2010. Excluding the increase related to the revenues at Powell Canada, revenues decreased primarily due to reduced manufacturing and service activities because of the lower level of backlog at the beginning of Fiscal 2011. In Fiscal 2011, revenues from public and private utilities were $166.6 million compared to $148.6 million in Fiscal 2010. Revenues from commercial and industrial customers totaled $320.5 million in Fiscal 2011, a decrease of $10.2 million compared to Fiscal 2010. Municipal and transit projects generated revenues of $46.2 million in Fiscal 2011 compared to $37.6 million in Fiscal 2010.

Business segment gross profit, as a percentage of revenues, was 17.2% in Fiscal 2011 compared to 25.1% in Fiscal 2010. This decrease in gross profit as a percentage of revenues resulted primarily from the competitive pressure on margins, as well as execution-related challenges on certain large projects at Powell Canada. Gross profit in Fiscal 2010 benefitted from the favorable execution of large projects, as well as cancellation fees and the successful negotiation of change orders on projects which were substantially completed in prior periods.

16

Process Control Systems

In Fiscal 2011, our Process Control Systems business segment recorded revenues of $29.1 million, a decrease from $33.6 million in Fiscal 2010. Business segment gross profit, as a percentage of revenues, decreased to 28.2% for Fiscal 2011, compared to 36.5% for Fiscal 2010. This decrease in revenues and gross profit as a percentage of revenues resulted from a less favorable mix of projects.

For additional information related to our business segments, see Note M of Notes to Consolidated Financial Statements.

Consolidated Selling, General and Administrative Expenses

Consolidated selling, general and administrative expenses decreased to 15.1% of revenues in Fiscal 2011 compared to 15.3% of revenues in Fiscal 2010. Selling, general and administrative expenses remained relatively unchanged at $85.1 million in Fiscal 2011 compared to $84.5 million in Fiscal 2010. Decreases in short-term and long-term incentive compensation resulting from lower earnings compared to Fiscal 2010 were offset by increased depreciation expense related to the Company’s ERP system in Fiscal 2011, compared to Fiscal 2010. Additionally, separation payments of $2.6 million to our former CEO were recorded in selling, general and administrative expenses in the fourth quarter of which $1.2 million was paid in October 2011, with the balance being comprised of deferred payments and compensation expense related to the vesting of outstanding equity-based awards. In the prior year there were acquisition-related costs of $2.4 million related to the acquisition of Powell Canada. Selling, general and administrative expenses decreased as a percentage of revenues in Fiscal 2011 as a result of the increase in revenue of $11.7 million.

Amortization of Intangible Assets

Amortization of intangible assets increased to $4.8 million in Fiscal 2011, compared to $4.5 million in Fiscal 2010. This increase was from the full year impact of the amortization of the intangible assets recorded as a result of acquisitions in Canada.

Gain on sale of investment

Gain on sale of investment resulted from a $1.2 million gain recorded in the second quarter of Fiscal 2011 from cash received for the sale of our 50% equity investment in Kazakhstan which was previously a part of the acquisition of Powell Canada in Fiscal 2010.

Impairments

An impairment charge of $7.2 million was recorded in Fiscal 2011 related to the impairment of the intangible assets related to Powell Canada. This impairment of intangible assets was the result of continued operating losses from Powell Canada and the execution-related challenges on certain large projects, which reduced the Company’s projections for future revenues and cash flows from Powell Canada.

An impairment of goodwill of $7.5 million was recorded in Fiscal 2010 related to the Powell Canada acquisition. The Company’s strategic decision to exit the 50% owned joint venture in Kazakhstan and delays in the anticipated growth in capital investments in the Oil Sands Region of western Canada, relative to our expectations, resulted in the impairment charge.

Income Tax Provision

Our provision for income taxes reflected an effective tax rate on earnings before income taxes of 167.9% in Fiscal 2011 compared to 44.1% in Fiscal 2010. The effective tax rate for Fiscal 2011 was negatively impacted by our inability to record the tax benefit of $4.5 million related to pre-tax losses in Canada, offset by the favorable impact on our effective tax rate for the domestic production activities deduction and the research and development credit in the United States.

Net Income (Loss) Attributable to Powell Industries, Inc.

In Fiscal 2011, we recorded a net loss of $2.7 million, or a loss of $0.23 per diluted share, compared to net income of $25.0 million, or earnings of $2.14 per diluted share, in Fiscal 2010. The impairment of intangible assets for Powell Canada of $7.2 million, and our inability to record the tax benefits of $4.5 million related to the pre-tax losses in Canada contributed to our net loss in Fiscal 2011. Fiscal 2011 was also negatively impacted by execution-related challenges on certain large projects at Powell Canada. The overall decrease in net income in Fiscal 2011 compared to Fiscal 2010 resulted from competitive pressure on gross margins compared to Fiscal 2010 which benefitted from the favorable execution of large projects, as well as cancellation fees and the successful negotiation of change orders on projects which were substantially completed in prior periods. Net income for Fiscal 2010 was negatively impacted by the impairment of goodwill of approximately $7.5 million and our inability to record the tax benefit of $3.7 million related to the pre-tax losses in Canada.

17

Backlog

The order backlog at September 30, 2011, was $443.0 million, compared to $282.3 million at September 30, 2010. New orders placed during Fiscal 2011 totaled $725.2 million compared to $466.8 million in Fiscal 2010. Backlog increased primarily due to increased activity in petrochemical and offshore oil and gas construction projects. Some of our recent orders received were for large petrochemical and offshore oil and gas construction projects which take several months to produce, and most were awarded in competitive bid situations.

Liquidity and Capital Resources

Cash and cash equivalents decreased to $90.0 million at September 30, 2012, compared to $123.5 million at September 30, 2011, primarily as a result of the recent purchases of land to build facilities in the United States and Canada during Fiscal 2012 to support our continued expansion of the offshore production markets and the Canadian Oil Sands market. As of September 30, 2012, current assets exceeded current liabilities by 2.6 times and our debt to total capitalization ratio was 1.4%.

We have a $75.0 million revolving credit facility in the U.S., which expires in December 2016. As of September 30, 2012, there were no amounts borrowed under this line of credit. We also have a $10.2 million revolving credit facility in Canada. At September 30, 2012, there was no balance outstanding under the Canadian revolving credit facility. Total long-term debt and capital lease obligations, including current maturities, totaled $4.4 million at September 30, 2012, compared to $5.4 million at September 30, 2011. Letters of credit outstanding were $36.6 million and $13.2 million at September 30, 2012 and 2011, respectively, which reduce our availability under our U.S. credit facility and our Canadian revolving credit facility. Amounts available under the U.S. revolving credit facility were $38.5 million at September 30, 2012. Amounts available under the Canadian revolving credit facility were $10.0 million at September 30, 2012. For further information regarding our debt, see Notes G and K of Notes to Consolidated Financial Statements.

Approximately $8.0 million of our cash at September 30, 2012, was held internationally for international operations. It is our intention to indefinitely reinvest all current and future foreign earnings internationally in order to ensure sufficient working capital and support and expand these operations. In the event that the Company elects to repatriate some or all of the foreign earnings that were previously deemed to be indefinitely reinvested outside the U.S., under current tax laws we would incur additional tax expense upon such repatriation.

We believe that cash available and borrowing capacity under our existing credit facilities should be sufficient to finance anticipated operating activities, capital improvements and expansions, as well as debt repayments for the foreseeable future. We will continue to monitor the factors that drive our markets and strive to maintain our leadership and competitive advantage in the markets we serve while aligning our cost structures with market conditions.

Operating Activities

During Fiscal 2012, cash used in operating activities was $6.0 million. During Fiscal 2011 and Fiscal 2010, cash provided by operating activities was $15.5 million and $64.1 million, respectively. Cash flow from operations is primarily influenced by demand for our products and services and is impacted as our progress payment terms with our customers are matched with the payment terms with our suppliers. During Fiscal 2012, the cash used in operations of $6.0 million was primarily the result of increased unbilled contract receivables based on progress billing milestones. The decrease in Fiscal 2011 cash flow from operations resulted primarily from the net loss and increase in accounts receivable. During Fiscal 2010, cash provided by operating activities was $64.1 million and resulted primarily from net income and decreases in accounts receivable, offset by decreases in accounts payable and income taxes payable.

Investing Activities

Purchases of property, plant and equipment during Fiscal 2012 totaled $29.1 million compared to $7.3 million and $4.4 million in Fiscal 2011 and 2010, respectively. A significant portion of the investments in Fiscal 2012 was to acquire land and build facilities in the United States and Canada to support our continued expansion in the offshore production markets and Canadian Oil Sands. During Fiscal 2011, we received cash of $1.2 million from the sale of our 50% equity investment in Kazakhstan and established a restricted cash account of $1.0 million for the purchase of land near Houston, Texas, which subsequently occurred in October 2011. During Fiscal 2011, our capital expenditures primarily related to the implementation of ERP systems and construction of a warehouse at one of our U.S. facilities. During Fiscal 2010, we paid cash of $23.4 million, excluding debt assumed and acquisition-related expenses, to acquire Powell Canada. Additionally, $0.6 million was paid to acquire the noncontrolling interest related to our joint venture in Singapore (Powell Asia), which has been strategically realigned from an operating entity to a sales and marketing function within Powell.

There were no significant proceeds from the sale of fixed assets in Fiscal 2012, 2011 or 2010.

Financing Activities

18

Net cash provided by financing activities was $1.3 million during Fiscal 2012 due to cash being received from the exercise of stock options. Net cash used in financing activities was $0.8 million during Fiscal 2011. Net cash used in financing activities was $19.4 million in Fiscal 2010, as we paid down our Canadian revolving line of credit and term loan from the cash flow provided by our operating activities.

Contractual and Other Obligations

At September 30, 2012, our long-term contractual obligations were limited to debt and leases. The table below details our commitments by type of obligation, including interest if applicable, and the period that the payment will become due (in thousands).

|

|

|

|

|

|

|

As of September 30, 2012, Payments Due by Period: |

Long-Term Debt Obligations |

Capital Lease Obligations |

Operating Lease Obligations |

Total |

|

Less than 1 year |

$ 416

|

$ 347

|

$ 5,597

|

$ 6,360

|

|

1 to 3 years |

827 | 32 | 8,108 | 8,967 |

|

3 to 5 years |

820 |

— |

5,184 | 6,004 |

|