SKADDEN, ARPS, SLATE, MEAGHER & FLOM LLP

|

DIRECT DIAL |

ONE BEACON STREET BOSTON, MASSACHUSETTS 02108-3194 TEL: (617) 573-4800 FAX: (617) 573-4822 www.skadden.com |

FIRM/AFFILIATE OFFICES CHICAGO HOUSTON LOS ANGELES NEW YORK PALO ALTO WASHINGTON, D.C. WILMINGTON BEIJING BRUSSELS FRANKFURT HONG KONG LONDON MOSCOW MUNICH PARIS SÃO PAULO SHANGHAI SINGAPORE SYDNEY TOKYO TORONTO VIENNA |

|

|

January 21, 2014 |

VIA EDGAR AND OVERNIGHT DELIVERY

United States Securities and Exchange Commission

Office of Mergers and Acquisitions

Division of Corporation Finance

100 F Street, NE

Washington, D.C. 20549-0308

Attention: David L. Orlic, Special Counsel

RE: CommonWealth REIT

Revised Preliminary Consent Revocation Statement on Schedule 14A

Filed December 26, 2013

File No. 001-09317

Dear Mr. Orlic:

On behalf of CommonWealth REIT (the “Company”), please find below the responses of the Company to comments of the staff (the “Staff”) of the United States Securities and Exchange Commission (the “Commission”) contained in your letter dated December 27, 2013, in connection with the above-captioned preliminary proxy statement of the Company. A revised preliminary consent revocation statement on Schedule 14A is being filed simultaneously with this letter. For the convenience of the Staff, we have also sent to you a paper copy of this letter and clean and marked copies of the revised preliminary consent revocation statement.

Your numbered comments with respect to the preliminary consent revocation statement, as set forth in your letter dated December 27, 2013, have been reproduced below in italicized text. The Company’s responses thereto are set forth immediately following the reproduced comments to which they relate.

United States Securities and Exchange Commission

January 21, 2014

General

1. We reissue prior comment 1. All beliefs must be clearly characterized as such. Please revise the following disclosure accordingly: “… written consents solicited by a group of opportunistic shareholders….” While you no longer specifically name Corvex/Related in this phrase, it remains clear to whom the disclosure refers.

Company Response: The Company has revised its disclosure in the preliminary consent revocation statement in response to the Staff’s comment.

2. We note your statement that Related may seek to run CommonWealth “like a distressed opportunity fund.” Please provide the basis for this belief, disclose the operation of a “distressed opportunity fund,” and disclose the implications for security holders.

Company Response: The Company’s belief that Related Fund Management, LLC (“Related”) and its nominees may seek to run the Company like a distressed opportunity fund is based on a number of factors, including:

· Related Real Estate Recovery Fund, L.P. (“RRERF”), the fund managed by Related which has invested in the Company, is a “distressed real estate fund” with a primary investment focus that includes “acquiring equity positions in properties that require significant repositioning utilizing Related’s diverse real estate expertise.”1

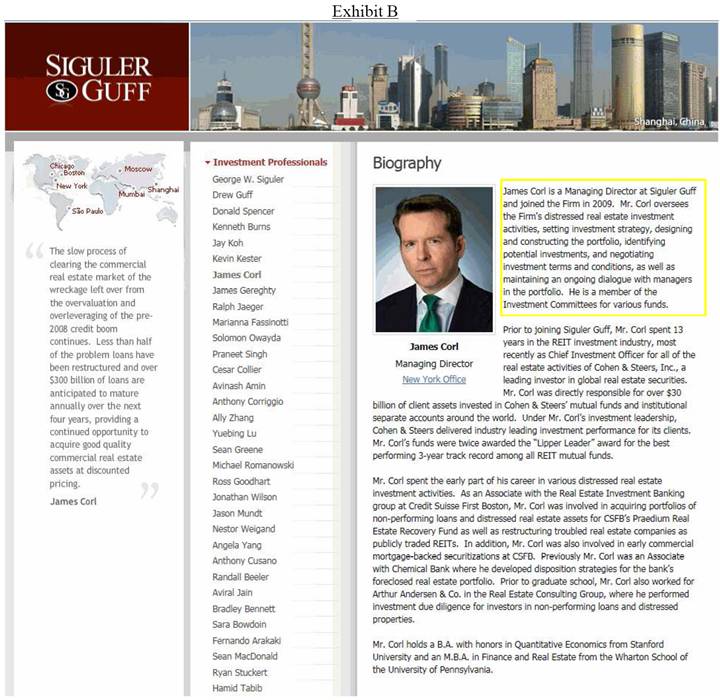

· James Corl, one of Related/Corvex’s identified nominees, is currently a Managing Director at Siguler Guff & Company (“Siguler Guff”), a private equity investment firm that manages several distressed asset and opportunity funds, including Siguler Guff’s Distressed Real Estate Opportunities Fund. Mr. Corl is described at the Siguler Guff website as the principal contact for Siguler Guff’s Distressed Real Estate Opportunities Fund and the person who “oversees [Siguler Guff’s] distressed real estate investment activities” (Attached hereto as Exhibit B). According to Related/Corvex’s most recently filed preliminary solicitation statement, funds affiliated with Siguler Guff are investors in RRERF and Mr. Corl is entitled to a carried interest payment dependent upon the success of these funds. In addition, Mr. Corl was previously employed at Credit Suisse First Boston (“CSFB”), where he was responsible for acquiring distressed real estate assets for CSFB’s Real Estate Recovery Fund and restructuring troubled real estate companies.

· Jim Lozier, another of Related/Corvex’s identified nominees, is and for some time has been a paid consultant of Related, which manages RRERF, Related’s distressed real estate fund. Mr. Lozier was also the co-founder and previously served as CEO of Archon Group L.P. from 1996 until 2012, a real estate services and advisory firm focused on turnaround investments.

· Related/Corvex’s real estate strategy for the Company is driven by Related and its hired consultant, Mr. Lozier. As between Corvex and Related, Related is responsible for valuation of the Company’s portfolio, including underwriting assumptions (February 26, 2013 Presentation, slide 30, attached hereto as Exhibit C).

· The Related/Corvex April 18, 2013 Presentation slide 53 under the heading “New Management Team and Strategy” describes Related and specifically notes its “[E]xperience with portfolios of assets in distressed or hostile situations” (Attached hereto as Exhibit D).

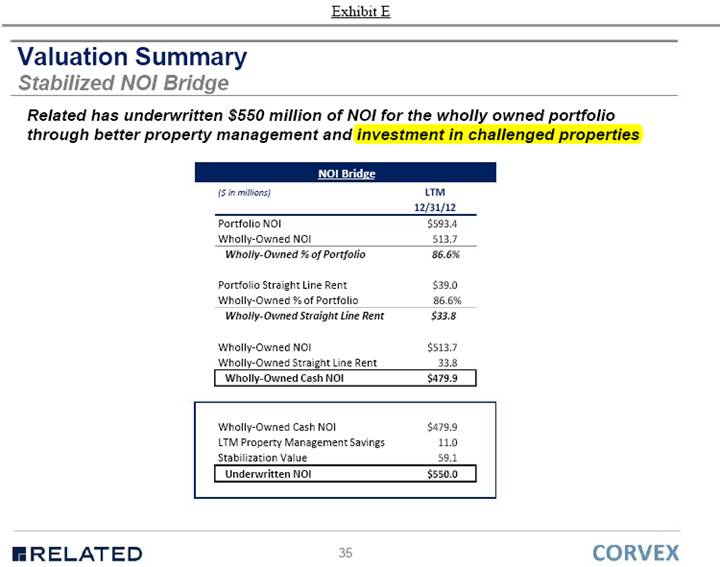

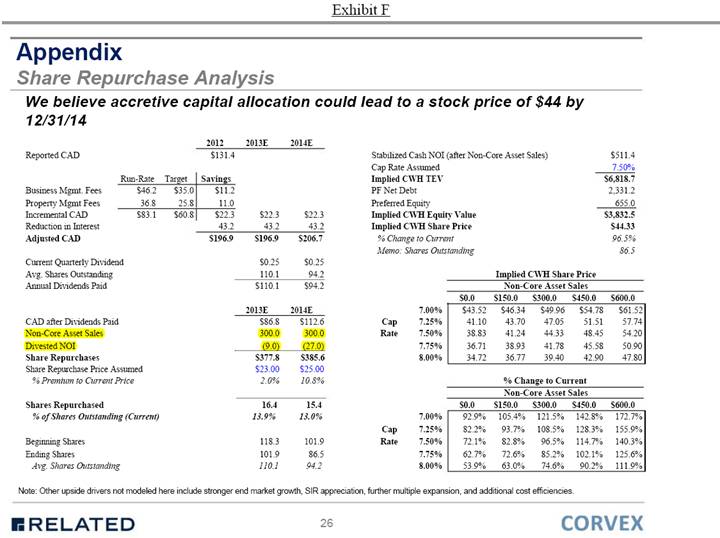

· Related/Corvex’s presentations filed with the Commission during February through May of 2013 projected that, with removal of the Trustees, the Company’s net operating income (“NOI”) could be improved by $59 million annually through “investment in challenged properties” (February 26, 2013 Presentation, slide 35, attached hereto as Exhibit E). As further detailed in my letter of December 6, 2013, at the same time, Related/Corvex also presented an analysis of how they would achieve an increase in the Company’s share value by selling unidentified properties of the Company that they label as “non-core” assets for proceeds of $600 million and using the proceeds of such sales to repurchase Company

1 See January 23, 2012 Press Release titled “Related Companies Announces Closing of $825 Million Distressed Real Estate Fund — Fund Closure is Latest Milestone in Related’s Multi-Pronged Investment Strategy”, attached hereto as Exhibit A.

United States Securities and Exchange Commission

January 21, 2014

common shares (May 7, 2013 Presentation, slide 26, attached hereto as Exhibit F). While Related/Corvex did not identify which properties comprise these “non-core” assets, they did assign an annual NOI of $36 million to them (represented on Exhibit F as “Divested NOI”). A sale of properties with aggregate annual NOI of $36 million for $600 million implies the properties to be sold have, on average, a 6% cap rate, which suggests that these are very valuable assets. Together, these slides suggest that Related/Corvex’s plan is for the Company to sell off some of its most valuable, stable assets, while at the same time making significant investments in its challenged, riskier assets.

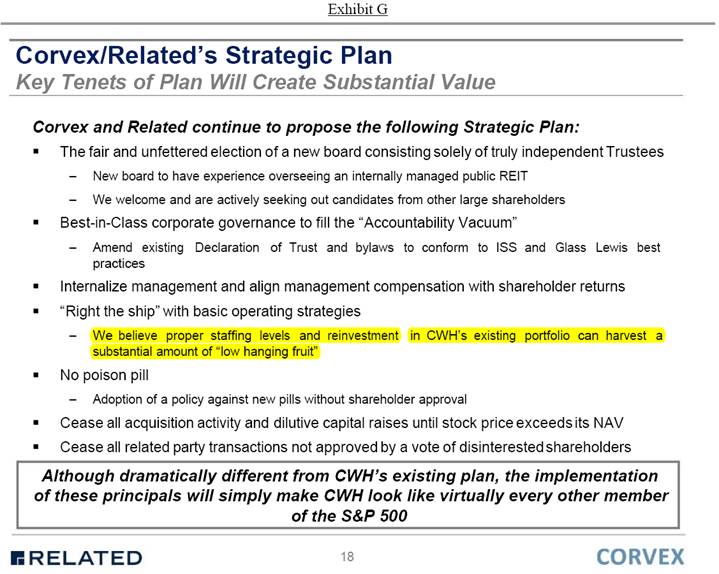

· Related/Corvex’s most recent presentation filed with the Commission on December 18, 2013 continues the theme that “reinvestment in CWH’s existing portfolio can harvest a substantial amount of ‘low hanging fruit’” and criticizes the Company for selling assets to opportunistic funds (December 18, 2013 Presentation, slide 18, attached hereto as Exhibit G).

These factors strongly suggest that Related/Corvex’s plan for the Company contemplates a change in the Company’s business plan so that the Company makes significant investments in underperforming assets — most likely assets that the Company has classified as held for sale — and sells some of its best performing, high quality and high occupancy Class A office properties that produce stable returns. This change in business plan would represent a fundamental shift in the nature of the Company’s portfolio and the risk profile offered to the Company’s shareholders. It may also jeopardize the Company’s ability to pay dividends.

The Company respectfully submits that Related/Corvex should clearly inform security holders of their plans for the Company and fairly present the implications of those plans. The Company believes that such disclosure is important information that should be included as part of the Related/Corvex solicitation statement, especially since Related/Corvex have made claims about dramatic increases in shareholder value. Based on the information that Related/Corvex have made publicly available to date, the Company believes that Related/Corvex do not have a viable long term plan for the Company; however, without reasonably detailed public disclosure by Related/Corvex of their plans, an analysis of the implications of those plans by the Company is challenging. The Company notes that Related/Corvex could have, but did not, make the assumptions and data behind their NOI projections publicly available. Such disclosure would help clarify the Related/Corvex business plan for the Company and its shareholders and allow an evaluation of the merits and implications of the Related/Corvex business plan by the Company and its shareholders.

United States Securities and Exchange Commission

January 21, 2014

3. We note your response to prior comment 4. Please disclose whether the election not to be subject to Section 3-803 of the Maryland Unsolicited Takeovers Act is permanent, or may be reversed by the board at any time, acting unilaterally and without regard to any contrary provision in your organizational documents, which we understand to be the case.

Company Response: The Company has revised its disclosure in the preliminary consent revocation statement in response to the Staff’s comment.

Joseph L. Morea, page III-2

4. We note your response to prior comment 11, and continue to believe that the disclosure should be clarified. You state that security holders will have the opportunity “to hold Mr. Morea accountable for delivering on an improved governance structure going forward.” Please specify that any removal of Mr. Morea at that time will be subject to his unilateral reappointment by the Board, as has happened in the recent past. In other words, recent attempts by security holders to “hold Mr. Morea accountable” in the manner you describe appear not to have been effective. Alternatively, revise your disclosure to specify the meaning of the phrase “hold Mr. Morea accountable.”

Company Response: The Company has revised its disclosure in the preliminary consent revocation statement in response to the Staff’s comment.

Form of Consent Revocation

5. Please clarify that security holders may write-in “future trustees” as candidates for removal on the blank line.

Company Response: The Company has revised its disclosure in the preliminary consent revocation statement in response to the Staff’s comment.

United States Securities and Exchange Commission

January 21, 2014

If you have any questions regarding the responses to the comments of the Staff, or require additional information, please contact the undersigned at (617) 573-4859.

|

|

|

Very truly yours, | |

|

|

|

| |

|

|

|

| |

|

|

|

/s/ Margaret R. Cohen | |

|

|

|

Margaret R. Cohen | |

|

|

|

| |

|

cc: |

Michele Anderson |

| |

|

|

Securities and Exchange Commission |

| |

|

|

|

| |

|

|

Adam D. Portnoy |

| |

|

|

CommonWealth REIT |

| |

|

|

|

| |

|

|

Brian V. Breheny |

| |

|

|

Skadden, Arps, Slate, Meagher & Flom LLP |

| |

|

|

|

| |

|

|

Richard J. Grossman |

|

|

|

|

Skadden, Arps, Slate, Meagher & Flom LLP |

|

|

RELATED COMPANIES ANNOUNCES CLOSING OF $825 MILLION DISTRESSED REAL ESTATE FUND — FUND CLOSURE IS LATEST MILESTONE IN RELATED’S MULTI-PRONGED FUND MANAGEMENT STRATEGY

Joanna Rose 212.801.3902

1/23/2012 Related Companies, one of the nation’s most prolific real estate development and investment firms, today announced the final closing of the Related Real Estate Recovery Fund with equity commitments of $825 million. The distressed asset fund’s target of $750 million was exceeded due to high investor interest and strong investment deal flow. This ranks the fund among the biggest U.S. real estate-related vehicles raised in 2011, and one of the largest operator-led investment funds. Included in the roster of limited partners are some of the world’s most prominent sovereign wealth funds, public pension plans, multi-managers, endowments and family offices. The program’s primary investments focus is on the acquisition of distressed loans that were originated for new development, property conversion and renovation, as well as equity positions in properties that require significant repositioning utilizing Related’s diverse real estate expertise. The fund is managed by Related Fund Management LLC, the fund management platform of Related. Greenhill & Co., Inc. served as the fund’s exclusive global placement agent in the transaction.

“Our global real estate footprint and vertically integrated in-house suite of real estate services creates a one-stop shop for sourcing, due diligence, financing, construction, design, leasing, sales, asset management and financial reporting. With Related’s decades of real estate operational expertise, diverse finance experience and a history of managing private and public funds, our fund management platform and its focus on project execution is a natural extension of Related’s core competencies,” said Related Companies President Jeff T. Blau.

Justin Metz, Managing Principal of Related Fund Management said, “We are thrilled with the response we have received from the investor community who share our strategic vision to unlock value through the pursuit of off market, execution-focused property deals. Our focused strategy, access to deal flow and deep skill set enable us to move quickly on investments, differentiates us in the marketplace and offers a compelling and distinct investment opportunity.”

Related made the strategic decision to build a private equity real estate fund business in order to offer its institutional partners unique investment opportunities capitalizing on the recent property market distress that the organization was seeing in the U.S. markets. The company launched the fund management platform by hiring real estate dealmaker Justin Metz, formerly of Goldman Sachs, in 2009 to build out a team. Related Fund Management is staffed by 20 seasoned professionals and currently manages approximately $1.5 billion of equity capital on behalf of sovereign wealth funds, public pension plans, multi-managers, endowments, Taft Hartley plans and family offices across three areas: distressed real estate opportunities, origination and acquisition of construction loans, and multi-family housing opportunities.

The Related Real Estate Recovery Fund has made several investments including 111 West Wacker Drive in Chicago, 511-541 West 25th Street, 225 Rector Place and One Madison Park in New York City, Oasis in Fort Myers, Florida and a fund portfolio recapitalization.

###

![]()