Exhibit 10.1

3043 Walton Road

Plymouth Meeting, PA

PURCHASE AND SALE AGREEMENT

by and between

HUB PROPERTIES TRUST,

as Seller,

and

SENIOR HOUSING PROPERTIES TRUST,

as Purchaser

September 20, 2011

3043 Walton Road

Plymouth Meeting, PA

TABLE OF CONTENTS

|

|

|

|

Page |

|

|

|

|

|

|

SECTION 1. |

DEFINITIONS |

|

1 |

|

|

|

|

|

|

SECTION 2. |

PURCHASE AND SALE; CLOSING |

|

3 |

|

2.1 |

Purchase and Sale |

|

3 |

|

2.2 |

Closing |

|

3 |

|

2.3 |

Purchase Price |

|

3 |

|

|

|

|

|

|

SECTION 3. |

TITLE, DILIGENCE MATERIALS, ETC. |

|

3 |

|

3.1 |

Title |

|

3 |

|

3.2 |

No Other Diligence |

|

4 |

|

|

|

|

|

|

SECTION 4. |

CONDITIONS TO THE PURCHASER’S OBLIGATION TO CLOSE |

|

5 |

|

4.1 |

Closing Documents |

|

5 |

|

4.2 |

Title Policy |

|

6 |

|

4.3 |

Environmental Reliance Letters |

|

6 |

|

4.4 |

Condition of Property |

|

6 |

|

4. |

Other Conditions |

|

6 |

|

|

|

|

|

|

SECTION 5. |

CONDITIONS TO SELLER’S OBLIGATION TO CLOSE |

|

6 |

|

5.1 |

Purchase Price |

|

6 |

|

5.2 |

Closing Documents |

|

6 |

|

5.3 |

Other Conditions |

|

6 |

|

|

|

|

|

|

SECTION 6. |

REPRESENTATIONS AND WARRANTIES OF SELLER |

|

7 |

|

6.1 |

Status and Authority of the Seller |

|

7 |

|

6.2 |

Action of the Seller |

|

7 |

|

6.3 |

No Violations of Agreements |

|

7 |

|

6.4 |

Litigation |

|

7 |

|

6.5 |

Existing Leases, Etc. |

|

7 |

|

6.6 |

Agreements, Etc. |

|

9 |

|

6.7 |

Not a Foreign Person |

|

9 |

|

|

|

|

|

|

SECTION 7. |

REPRESENTATIONS AND WARRANTIES OF PURCHASER |

|

10 |

|

7.1 |

Status and Authority of the Purchaser |

|

10 |

|

7.2 |

Action of the Purchaser |

|

10 |

|

7.3 |

No Violations of Agreements |

|

11 |

|

7.4 |

Litigation |

|

11 |

|

|

|

|

|

|

SECTION 8. |

COVENANTS OF THE SELLER |

|

11 |

|

8.1 |

Approval of Agreements |

|

11 |

|

8.2 |

Operation of Property |

|

11 |

|

8.3 |

Compliance with Laws, Etc. |

|

11 |

|

8.4 |

Compliance with Agreements |

|

12 |

|

8.5 |

Notice of Material Changes or Untrue Representations |

|

12 |

|

8.6 |

Insurance |

|

12 |

|

|

|

|

|

|

SECTION 9. |

APPORTIONMENTS |

|

12 |

|

9.1 |

Real Property Apportionments |

|

12 |

|

9.2 |

Closing Costs |

|

15 |

|

|

|

|

|

|

SECTION 10. |

DAMAGE TO OR CONDEMNATION OF PROPERTY |

|

16 |

|

10.1 |

Casualty |

|

16 |

|

10.2 |

Condemnation |

|

16 |

|

10.3 |

Survival |

|

17 |

|

|

|

|

|

|

SECTION 11. |

DEFAULT |

|

17 |

|

11.1 |

Default by the Seller |

|

17 |

|

11.2 |

Default by the Purchaser |

|

17 |

|

|

|

|

|

|

SECTION 12. |

MISCELLANEOUS |

|

17 |

|

12.1 |

Allocation of Liability |

|

17 |

|

12.2 |

Brokers |

|

18 |

|

12.3 |

Publicity |

|

18 |

|

12.4 |

Notices |

|

18 |

|

12.5 |

Waivers, Etc. |

|

20 |

|

12.6 |

Assignment; Successors and Assigns |

|

20 |

|

12.7 |

Severability |

|

20 |

|

12.8 |

Counterparts Complete Agreement, Etc. |

|

21 |

|

12.9 |

Performance on Business Days |

|

21 |

|

12.10 |

Section and Other Headings |

|

21 |

|

12.11 |

Time of Essence |

|

21 |

|

12.12 |

Governing Law |

|

21 |

|

12.13 |

Arbitration |

|

21 |

|

12.14 |

Like Kind Exchange |

|

25 |

|

12.15 |

Recording |

|

25 |

|

12.16 |

Non-liability of Trustees of Seller |

|

25 |

|

12.17 |

Non-liability of Trustees of Purchaser |

|

25 |

|

12.18 |

Waiver and Further Assurances |

|

26 |

3043 Walton Road

Plymouth Meeting, PA

PURCHASE AND SALE AGREEMENT

THIS PURCHASE AND SALE AGREEMENT is made as of September 20, 2011, by and between HUB PROPERTIES TRUST, a Maryland real estate investment trust (the “Seller”), and SENIOR HOUSING PROPERTIES TRUST, a Maryland real estate investment trust (the “Purchaser”).

WITNESSETH:

WHEREAS, the Seller is the owner of the Property (this and other capitalized terms used and not otherwise defined herein shall have the meanings given such terms in Section 1); and

WHEREAS, the Seller wishes to sell to the Purchaser, and the Purchaser desires to purchase from the Seller, the Property, subject to and upon the terms and conditions hereinafter set forth;

NOW, THEREFORE, in consideration of the mutual covenants herein contained and other good and valuable consideration, the mutual receipt and legal sufficiency of which are hereby acknowledged, the Seller and the Purchaser hereby agree as follows:

SECTION 1. DEFINITIONS.

Capitalized terms used in this Agreement shall have the meanings set forth below or in the section of this Agreement referred to below:

1.1 “Agreement” shall mean this Purchase and Sale Agreement, together with any exhibits and schedules attached hereto, as it and they may be amended from time to time as herein provided.

1.2 “Business Day” shall mean any day other than a Saturday, Sunday or any other day on which banking institutions in The Commonwealth of Massachusetts are authorized by law or executive action to close.

1.3 “Closing” shall have the meaning given such term in Section 2.2.

1.4 “Closing Date” shall have the meaning given such term in Section 2.2.

1.5 “Existing Survey” shall mean the existing ALTA survey of the Property.

1.6 “Existing Title Policy” shall mean, the existing title insurance policy for the Property.

1.7 “Improvements” shall mean, the Seller’s entire right, title and interest in and to the existing office buildings, fixtures and other structures and improvements situated on, or affixed to, the Land.

1.8 “Land” shall mean, the Seller’s entire right, title and interest in and to (a) the parcel(s) of land described in Schedule A hereto, together with (b) all easements, rights of way, privileges, licenses and appurtenances which the Seller may own with respect thereto.

1.9 “Leases” shall mean the leases identified in the Rent Roll and any other leases hereafter entered into in accordance with the terms of this Agreement.

1.10 “Other Property” shall mean the Seller’s entire right, title and interest in and to (a) all fixtures, machinery, systems, equipment and items of personal property owned by the Seller and attached or appurtenant to, located on and used in connection with the ownership, use, operation or maintenance of the Land or Improvements, if any, and (b) all intangible property owned by the Seller arising from or used in connection with the ownership, use, operation or maintenance of the Land or Improvements, if any.

1.11 “Permitted Exceptions” shall mean, collectively, (a) liens for taxes, assessments and governmental charges not yet due and payable or due and payable but not yet delinquent; (b) the Leases; (c) the exceptions to title set forth in the Existing Title Policy; (d) all matters shown on the Existing Survey, and (e) such other nonmonetary encumbrances with respect to the Property as may be shown on the Update which are not objected to by the Purchaser (or which are objected to, and subsequently waived, by the Purchaser) in accordance with Section 3.1.

1.12 “Property” shall mean, collectively, all of the Land, the Improvements and the Other Property.

1.13 “Purchase Price” shall mean Eleven Million Four Hundred Fifty-Six Thousand Two Hundred Dollars ($11,456,200).

1.14 “Purchaser” shall have the meaning given such term in the preambles to this Agreement, together with any permitted successors and assigns.

1.15 “Rent Roll” shall mean Schedule B to this Agreement.

1.16 “Seller” shall have the meaning given such term in the preambles to this Agreement, together with any permitted successors and assigns.

1.17 “Title Company” shall mean Stewart Title Guaranty Company.

1.18 “Update” shall have the meaning given such term in Section 3.1.

SECTION 2. PURCHASE AND SALE; CLOSING.

2.1 Purchase and Sale. In consideration of the payment of the Purchase Price by the Purchaser to the Seller and for other good and valuable consideration, the Seller hereby agrees to sell to the Purchaser, and the Purchaser hereby agrees to purchase from the Seller, the Property for the Purchase Price, subject to and in accordance with the terms and conditions of this Agreement.

2.2 Closing. The purchase and sale of the Property shall be consummated at a closing (the “Closing”) to be held at the offices of Sullivan & Worcester LLP, One Post Office Square, Boston, Massachusetts, or at such other location as the Seller and the Purchaser may agree, at 10:00 a.m., local time, on December 31, 2011, as the same may be accelerated or extended by agreement of the parties (the “Closing Date”).

2.3 Purchase Price.

(a) At Closing, the Purchaser shall pay the Purchase Price to the Seller, subject to adjustment as provided in Section 9.

(b) The Purchase Price, as adjusted as provided herein, shall be payable by wire transfer of immediately available funds on the Closing Date to an account or accounts to be designated by the Seller.

SECTION 3. TITLE, DILIGENCE MATERIALS, ETC.

3.1 Title. Prior to the execution of this Agreement, the Seller has delivered the Existing Title Policy and the Existing Survey to the Purchaser.

Within ten (10) days after the execution hereof, the Purchaser shall order an update to the Existing Title Policy (an

“Update”) from the Title Company. The Purchaser shall deliver to the Seller a copy of the Update promptly upon receipt thereof. Promptly after receipt of the Update, but, in any event, prior to the Closing Date, the Purchaser shall give the Seller written notice of any title exceptions (other than Permitted Exceptions) set forth on the Update as to which the Purchaser objects. The Seller shall have the right, but not the obligation, to attempt to remove, satisfy or otherwise cure any exceptions to title to which the Purchaser so objects. If, for any reason, in its sole discretion, the Seller is unable or unwilling to take such actions as may be required to cause such exceptions to be removed from the Update, the Seller shall give the Purchaser notice thereof; it being understood and agreed that the failure of the Seller to give prompt notice of objection shall be deemed an election by the Seller not to remedy such matters. If the Seller shall be unable or unwilling to remove any title defects to which the Purchaser has so objected, the Purchaser may elect (i) to terminate this Agreement or (ii) to consummate the transactions contemplated hereby, notwithstanding such title defect, without any abatement or reduction in the Purchase Price on account thereof (whereupon such objected to exceptions or matters shall be deemed to be Permitted Exceptions). The Purchaser shall make any such election by written notice to the Seller given on or prior to the fifth (5th) Business Day after the Seller’s notice of its unwillingness or inability to cure (or deemed election not to cure) such defect and time shall be of the essence with respect to the giving of such notice. Failure of the Purchaser to give such notice shall be deemed an election by the Purchaser to proceed in accordance with clause (ii) above.

3.2 No Other Diligence. The Purchaser acknowledges that, except as provided in Section 3.1, (i) the Purchaser has had the opportunity to fully investigate and inspect the physical and environmental condition of the Property, and to review and analyze all title examinations, surveys, environmental assessment reports, building evaluations, financial data and other investigations and materials pertaining to the Property which the Purchaser deems necessary to determine the feasibility of the Property and its decision to acquire the Property, (ii) the Purchaser shall not be conducting any further title examinations, surveys, environmental assessments, building evaluations, financial analyses or other investigations with respect to the Property, and (iii) the Purchaser shall not have any right to terminate this Agreement as a result of any title examinations, surveys, environmental assessments, building

valuations, financial analyses or other investigations with respect to the Property.

SECTION 4. CONDITIONS TO THE PURCHASER’S OBLIGATION TO CLOSE.

The obligation of the Purchaser to acquire the Property shall be subject to the satisfaction of the following conditions precedent on and as of the Closing Date:

4.1 Closing Documents. The Seller shall have delivered, or cause to have been delivered, to the Purchaser the following:

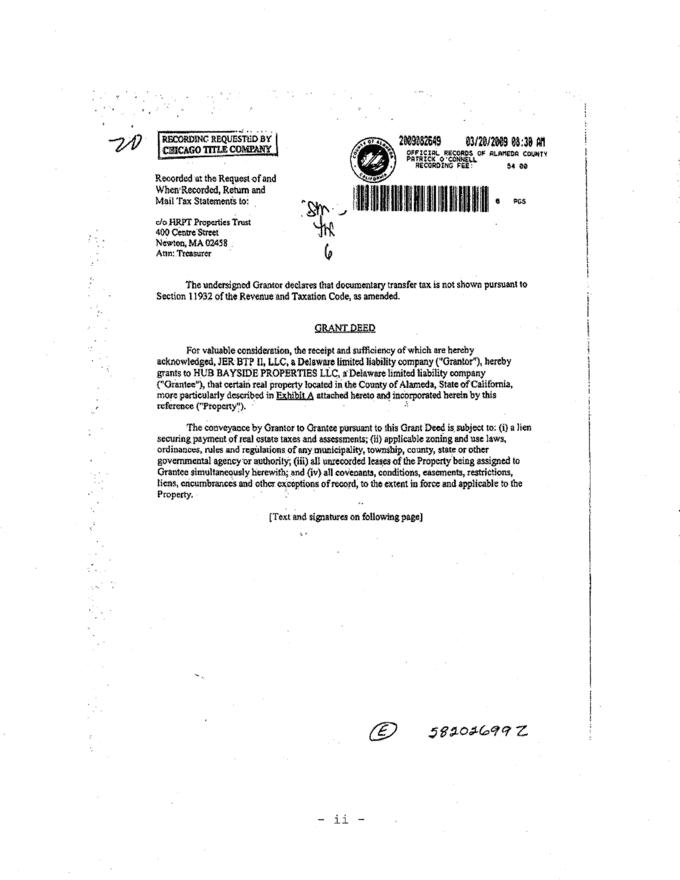

(a) A good and sufficient deed in the form attached as Schedule C hereto, with respect to the Property, in proper statutory form for recording, duly executed and acknowledged by the Seller, conveying title to the Property, free from all liens and encumbrances other than the Permitted Exceptions;

(b) An assignment by the Seller and an assumption by the Purchaser, in form and substance reasonably satisfactory to the Seller and the Purchaser, duly executed and acknowledged by the Seller and the Purchaser, of all of the Seller’s right, title and interest in, to and under the Leases and all of the Seller’s right, title and interest, if any, in, to and under all transferable licenses, contracts, permits and agreements affecting the Property;

(c) A bill of sale by the Seller, without warranty of any kind, in form and substance reasonably satisfactory to the Seller and the Purchaser, with respect to any personal property owned by the Seller, situated at the Property and used exclusively by the Seller in connection with the Property (it being understood and agreed that no portion of the Purchase Price is allocated to personal property);

(d) To the extent the same are in the Seller’s possession, original, fully executed copies of all material documents and agreements, plans and specifications and contracts, licenses and permits pertaining to the Property;

(e) To the extent the same are in the Seller’s possession, duly executed original copies of the Leases;

(f) A closing statement showing the Purchase Price, apportionments and fees, and costs and expenses paid in connection with the Closing; and

(g) Such other conveyance documents, certificates, deeds and other instruments as the Purchaser, the Seller or the Title Company may reasonably require and as are customary in like transactions in sales of property in similar transactions.

4.2 Title Policy. The Title Company shall be prepared to issue, upon payment of the title premium at its regular rates, a title policy in the amount of the Purchase Price, insuring title to the Property is vested in the Purchaser or its designee or assignee, subject only to the Permitted Exceptions, with such endorsements as shall be reasonably required by the Purchaser.

4.3 Environmental Reliance Letters. The Purchaser shall have received a reliance letter, authorizing the Purchaser and its designees and assignees to rely on the most recent environmental assessment report prepared for the Property, in form and substance reasonably acceptable to the Purchaser.

4.4 Condition of Property. The Property shall be in substantially the same physical condition as on the date of this Agreement, ordinary wear and tear and, subject to Section 10.1, casualty excepted.

4.5 Other Conditions. All representations and warranties of the Seller herein shall be true, correct and complete in all material respects on and as of the Closing Date and the Seller shall have performed in all material respects all covenants and obligations required to be performed by the Seller on or before the Closing Date.

SECTION 5. CONDITIONS TO SELLER’S OBLIGATION TO CLOSE.

The obligation of the Seller to convey the Property to the Purchaser is subject to the satisfaction of the following conditions precedent on and as of the Closing Date:

5.1 Purchase Price. The Purchaser shall have delivered to the Seller the Purchase Price payable hereunder, subject to the adjustments set forth in Section 2.3, together with any closing costs to be paid by the Purchaser under Section 9.2.

5.2 Closing Documents. The Purchaser shall have delivered to the Seller duly executed and acknowledged counterparts of the documents described in Section 4.1, where applicable.

5.3 Other Conditions. All representations and warranties of the Purchaser herein shall be true, correct and complete in

all material respects on and as of the Closing Date and the Purchaser shall have performed in all material respects all covenants and obligations required to be performed by the Purchaser on or before the Closing Date.

SECTION 6. REPRESENTATIONS AND WARRANTIES OF SELLER.

To induce the Purchaser to enter into this Agreement, the Seller represents and warrants to the Purchaser as follows:

6.1 Status and Authority of the Seller. The Seller is duly organized, validly existing and in good standing under the laws of its state of organization or formation, and has all requisite power and authority under its charter documents to enter into and perform its obligations under this Agreement and to consummate the transactions contemplated hereby.

6.2 Action of the Seller. The Seller has taken all necessary action to authorize the execution, delivery and performance of this Agreement, and upon the execution and delivery of any document to be delivered by the Seller on or prior to the Closing Date, this Agreement and such document shall constitute the valid and binding obligation and agreement of the Seller, enforceable against the Seller in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar laws of general application affecting the rights and remedies of creditors.

6.3 No Violations of Agreements. Neither the execution, delivery or performance of this Agreement by the Seller, nor compliance with the terms and provisions hereof, will result in any breach of the terms, conditions or provisions of, or conflict with or constitute a default under, or result in the creation of any lien, charge or encumbrance upon the Property pursuant to the terms of any indenture, mortgage, deed of trust, note, evidence of indebtedness or any other agreement or instrument by which the Seller is bound.

6.4 Litigation. To the Seller’s actual knowledge, it has not received written notice that any investigation, action or proceeding is pending or threatened, which (i) questions the validity of this Agreement or any action taken or to be taken pursuant hereto, or (ii) involves condemnation or eminent domain proceedings against the Property or any portion thereof.

6.5 Existing Leases, Etc. Subject to Section 8.1, other than the Leases listed in the Rent Roll, the Seller has not

entered into a contract or agreement with respect to the occupancy of the Property that will be binding on the Purchaser after the Closing. To the Seller’s actual knowledge: (a) the copies of the Leases heretofore delivered by the Seller to the Purchaser are true, correct and complete copies thereof; and (b) such Leases have not been amended except as evidenced by amendments similarly delivered and constitute the entire agreement between the Seller and the tenants thereunder. Except as otherwise set forth in the Rent Roll or the Leases: (i) to the Seller’ actual knowledge, each of its Leases is in full force and effect on the terms set forth therein; (ii) to the Seller’s actual knowledge, there are no uncured defaults or circumstances which with the giving of notice, the passage of time or both would constitute a default thereunder which would have a material adverse effect on the business or operations of the Property; (iii) to the Seller’s actual knowledge, each of its tenants is legally required to pay all sums and perform all material obligations set forth therein without any ongoing concessions, abatements, offsets, defenses or other basis for relief or adjustment; (iv) to the Seller’s actual knowledge, none of its tenants has asserted in writing or has any defense to, offsets or claims against, rent payable by it or the performance of its other obligations under its Lease which would have a material adverse effect on the on-going business or operations of the Property; (v) the Seller has no outstanding obligation to provide any of its tenants with an allowance to perform, or to perform at its own expense, any tenant improvements; (vi) none of its tenants has prepaid any rent or other charges relating to the post-Closing period; (vii) to the Seller’s actual knowledge, none of its tenants has filed a petition in bankruptcy or for the approval of a plan of reorganization or management under the Federal Bankruptcy Code or under any other similar state law, or made an admission in writing as to the relief therein provided, or otherwise become the subject of any proceeding under any federal or state bankruptcy or insolvency law, or has admitted in writing its inability to pay its debts as they become due or made an assignment for the benefit of creditors, or has petitioned for the appointment of or has had appointed a receiver, trustee or custodian for any of its property, in any case that would have a material adverse effect on the business or operations of the Property; (viii) to the Seller’s actual knowledge, none of its tenants has requested in writing a modification of its Lease, or a release of its obligations under its Lease in any material respect or has given written notice terminating its Lease, or has been released of its obligations thereunder in any material respect prior to the normal expiration of the term thereof, in

any case that would have a material adverse effect on the on-going business or operations of the Property; (ix) to the Seller’s actual knowledge, except as set forth in the Leases, no guarantor has been released or discharged, voluntarily or involuntarily, or by operation of law, from any obligation under or in connection with any of its Leases or any transaction related thereto; and (x) all brokerage commissions currently due and payable with respect to each of its Leases have been paid. To the Seller’s actual knowledge, the other information set forth in the Rent Roll is true, correct and complete in all material respects.

6.6 Agreements, Etc. Other than the Leases, the Seller has not entered into any contract or agreement with respect to the Property which will be binding on the Purchaser after the Closing other than contracts and agreements being assumed by the Purchaser or which are terminable upon thirty (30) days notice without payment of premium or penalty.

6.7 Not a Foreign Person. The Seller is not a “foreign person” within the meaning of Section 1445 of the United States Revenue Code of 1986, as amended, and the regulations promulgated thereunder.

The representations and warranties made in this Agreement by the Seller shall be continuing and shall be deemed remade by the Seller as of the Closing Date, with the same force and effect as if made on, and as of, such date. All representations and warranties made in this Agreement by the Seller shall survive the Closing for a period of one (1) year, and upon expiration shall be of no further force or effect except to the extent that with respect to any particular alleged breach, the Purchaser gives the Seller written notice prior to the expiration of said one (1) year period of such alleged breach with reasonable detail as to the nature of such breach.

Except as otherwise expressly provided in this Agreement or in any documents to be delivered to the Purchaser at the Closing, the Seller has not made, and the Purchaser has not relied on, any information, promise, representation or warranty, express or implied, regarding the Property, whether made by the Seller, on the Seller’s behalf or otherwise, including, without limitation, the physical condition of the Property, the financial condition of the tenants under the Leases, title to or the boundaries of the Property, pest control matters, soil conditions, the presence, existence or absence of hazardous wastes, toxic substances or other environmental matters, compliance with building, health, safety, land use and zoning

laws, regulations and orders, structural and other engineering characteristics, traffic patterns, market data, economic conditions or projections, and any other information pertaining to the Property or the market and physical environments in which they are located. The Purchaser acknowledges that (i) the Purchaser has entered into this Agreement with the intention of relying upon its own investigation or that of third parties with respect to the physical, environmental, economic and legal condition of the Property and (ii) the Purchaser is not relying upon any statements, representations or warranties of any kind, other than those specifically set forth in this Agreement or in any document to be delivered to the Purchaser at the Closing, made (or purported to be made) by the Seller or anyone acting or claiming to act on the Seller’s behalf. The Purchaser has inspected the Property and is fully familiar with the physical condition thereof and shall purchase the Property in its “as is”, “where is” and “with all faults” condition on the Closing Date. Notwithstanding anything to the contrary contained herein, in the event that any party hereto has actual knowledge of the default of any other party (a “Known Default”), but nonetheless elects to consummate the transactions contemplated hereby and proceeds to Closing, then the rights and remedies of such non-defaulting party shall be waived with respect to such Known Default upon the Closing and the defaulting party shall have no liability with respect thereto.

SECTION 7. REPRESENTATIONS AND WARRANTIES OF PURCHASER.

To induce the Seller to enter into this Agreement, the Purchaser represents and warrants to the Seller as follows:

7.1 Status and Authority of the Purchaser. The Purchaser is duly organized, validly existing and in good standing under the laws of its state of organization or formation, and has all requisite power and authority under its charter documents to enter into and perform its obligations under this Agreement and to consummate the transactions contemplated hereby.

7.2 Action of the Purchaser. The Purchaser has taken all necessary action to authorize the execution, delivery and performance of this Agreement, and upon the execution and delivery of any document to be delivered by the Purchaser on or prior to the Closing Date, this Agreement and such document shall constitute the valid and binding obligation and agreement of the Purchaser, enforceable against the Purchaser in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or

similar laws of general application affecting the rights and remedies of creditors.

7.3 No Violations of Agreements. Neither the execution, delivery or performance of this Agreement by the Purchaser, nor compliance with the terms and provisions hereof, will result in any breach of the terms, conditions or provisions of, or conflict with or constitute a default under, or result in the creation of any lien, charge or encumbrance upon any property or assets of the Purchaser pursuant to the terms of any indenture, mortgage, deed of trust, note, evidence of indebtedness or any other agreement or instrument by which the Purchaser is bound.

7.4 Litigation. The Purchaser has received no written notice that any investigation, action or proceeding is pending or threatened which questions the validity of this Agreement or any action taken or to be taken pursuant hereto.

The representations and warranties made in this Agreement by the Purchaser shall be continuing and shall be deemed remade by the Purchaser as of the Closing Date with the same force and effect as if made on, and as of, such date. All representations and warranties made in this Agreement by the Purchaser shall survive the Closing for a period of one (1) year, and upon expiration shall be of no further force or effect except to the extent that with respect to any particular alleged breach, the Seller gives the Purchaser written notice prior to the expiration of said one (1) year period of such alleged breach with reasonable detail as to the nature of such breach.

SECTION 8. COVENANTS OF THE SELLER.

The Seller hereby covenants with the Purchaser between the date of this Agreement and the Closing Date as follows:

8.1 Approval of Agreements. Not to enter into, modify, amend or terminate any Lease or any other material agreement with respect to the Property, which would encumber or be binding upon the Property from and after the Closing Date, without in each instance obtaining the prior written consent of the Purchaser.

8.2 Operation of Property. To continue to operate the Property consistent with past practices.

8.3 Compliance with Laws, Etc. To comply in all material respects with (i) all laws, regulations and other requirements from time to time applicable of every governmental body having

jurisdiction of the Property, or the use or occupancy thereof, and (ii) all material terms, covenants and conditions of all agreements affecting the Property.

8.4 Compliance with Agreements. To comply with each and every material term, covenant and condition contained in the Leases and any other material document or agreement affecting the Property and to monitor compliance thereunder consistent with past practices.

8.5 Notice of Material Changes or Untrue Representations. Upon learning of any material change in any condition with respect to the Property or of any event or circumstance which makes any representation or warranty of the Seller to the Purchaser under this Agreement untrue or misleading, promptly to notify the Purchaser thereof.

8.6 Insurance. To maintain, or cause to be maintained, all existing property insurance relating to the Property.

SECTION 9. APPORTIONMENTS.

9.1 Real Property Apportionments. (a) The following items shall be apportioned at the Closing as of the close of business on the day immediately preceding the Closing Date:

(i) annual rents, operating costs, taxes and other fixed charges payable under the Leases;

(ii) percentage rents and other unfixed charges payable under the Leases;

(iii) fuel, electric, water and other utility costs;

(iv) municipal assessments and governmental license and permit fees;

(v) Real estate taxes and assessments other than special assessments, based on the rates and assessed valuation applicable in the fiscal year for which assessed;

(vi) Water rates and charges;

(vii) Sewer and vault taxes and rents; and

(viii) all other items of income and expense normally apportioned in sales of property in similar

situations in the jurisdiction where the Property is located.

If any of the foregoing cannot be apportioned at the Closing because of the unavailability of the amounts which are to be apportioned, such items shall be apportioned on the basis of a good faith estimate by the parties and reconciled as soon as practicable after the Closing Date but, in any event, no later than one (1) year after the Closing Date.

(b) If there are water, gas or electric meters located at the Property, the Seller shall obtain readings thereof to a date not more than thirty (30) days prior to the Closing Date and the unfixed water rates and charges, sewer taxes and rents and gas and electricity charges, if any, based thereon for the intervening time shall be apportioned on the basis of such last readings. If such readings are not obtainable by the Closing Date, then, at the Closing, any water rates and charges, sewer taxes and rents and gas and electricity charges which are based on such readings shall be prorated based upon the per diem charges obtained by using the most recent period for which such readings shall then be available. Upon the taking of subsequent actual readings, the apportionment of such charges shall be recalculated and the Seller or the Purchaser, as the case may be, promptly shall make a payment to the other based upon such recalculations. The parties agree to make such final recalculations within sixty (60) days after the Closing Date.

(c) If any refunds of real property taxes or assessments, water rates and charges or sewer taxes and rents shall be made after the Closing, the same shall be held in trust by the Seller or the Purchaser, as the case may be, and shall first be applied to the unreimbursed costs incurred in obtaining the same, then to any required refunds to tenants under the Leases, and the balance, if any, shall be paid to the Seller (for the period prior to the Closing Date) and to the Purchaser (for the period commencing with the Closing Date).

(d) If, on the Closing Date, the Property shall be or shall have been affected by any special or general assessment or assessments or real property taxes payable in a lump sum or which are or may become payable in installments of which the first installment is then a charge or lien and has become payable, the Seller shall pay

or cause to be paid at the Closing the unpaid installments of such assessments due and as of the Closing Date.

(e) No insurance policies of the Seller are to be transferred to the Purchaser, and no apportionment of the premiums therefor shall be made.

(f) At the Closing, the Seller shall transfer to the Purchaser the amount of all unapplied security deposits held pursuant to the terms of the Leases.

(g) Brokerage commissions, tenant improvement expenses and other amounts payable by the Seller as landlord under Leases entered into by the Seller after the date hereof, or in connection with the renewal or extension of any existing Lease, shall be allocated between the Seller and the Purchaser at Closing based upon their respective periods of ownership (calculated on a straight-line basis over the initial term or extension or renewal period, as applicable), and the Purchaser shall reimburse the Seller at the Closing for all amounts so allocated to the Purchaser and paid by the Seller prior to the Closing. The Purchaser shall receive a credit at Closing for all unpaid brokerage commissions, tenant improvement expenses and other amounts payable by the Seller as landlord under any such new Lease, renewal or extension that are allocated to the Seller in accordance with the terms hereof.

(h) Amounts payable after the date hereof on account of capital expenditures under the 2011 capital expenditure budget previously prepared by the Seller (the “CapEx Budget”) (including, without limitation, budgeted items for “building improvements” and “development and redevelopment”), shall be allocated between the Seller and the Purchaser at Closing based upon their respective periods of ownership (on a straight line basis), and the Purchaser shall reimburse the Seller at the Closing for all amounts so allocated to the Purchaser and paid by the Seller prior to the Closing. The Purchaser shall receive a credit at Closing for all unpaid amounts payable on account of capital expenditures under the CapEx Budget allocated to the Seller in accordance with the terms hereof.

(i) If a net amount is owed by the Seller to the Purchaser pursuant to this Section 9.1, such amount shall be credited against the Purchase Price. If a net amount is owed by the Purchaser to the Seller pursuant to this

Section 9.1, such amount shall be added to the Purchase Price paid to the Seller.

(j) If, on the Closing Date, there are past due rents with respect to any Lease, amounts received by the Purchaser with respect to such Lease after the Closing Date shall be applied, first, to rents due or to become due during the calendar month in which the Closing occurs, and then, to all other rents due or past due in inverse order to the order in which they became due (i.e., first to arrearages most recently occurring, then to older arrearages). Any such past due rents received by the Purchaser, once applied in the foregoing order of priority, to the extent applicable to the period prior to the Closing Date, shall be paid by the Purchaser to the Seller. In no event shall the Seller have any right to take any action to collect any past due rents or other amounts following the Closing; provided, however, the Purchaser shall use commercially reasonable efforts to collect such past due rents and other amounts, except that the Purchaser shall have no obligation to institute any legal action or proceeding or otherwise enforce any of its rights and remedies under any Lease in connection with such commercially reasonable efforts.

The provisions of this Section 9.1 shall survive the Closing.

9.2 Closing Costs.

(a) The Purchaser shall pay (i) the costs of closing and diligence in connection with the transactions contemplated hereby (including, without limitation, all premiums, charges and fees of the Title Company in connection with the title examination and insurance policies to be obtained by the Purchaser, including affirmative endorsements), (ii) fifty percent (50%) of all documentary, stamp, sales, intangible and other transfer taxes and fees incurred in connection with the transactions contemplated by this Agreement, and (iii) fifty percent (50%) of all state, city, county, municipal and other governmental recording and filing fees and charges.

(b) The Seller shall pay (i) fifty percent (50%) of all documentary, stamp, sales, intangible and other transfer taxes and fees incurred in connection with the transactions contemplated by this Agreement, and (ii) fifty

percent (50%) of all state, city, county, municipal and other governmental recording and filing fees and charges.

(c) Except as otherwise set forth in this Section 9.2, each party shall pay the fees and expenses of its attorneys and other consultants.

SECTION 10. DAMAGE TO OR CONDEMNATION OF PROPERTY.

10.1 Casualty. If, prior to the Closing, the Property is materially destroyed or damaged by fire or other casualty, the Seller shall promptly notify the Purchaser of such fact. In such event, the Purchaser shall have the right to terminate this Agreement by giving notice to the Seller not later than ten (10) days after the giving of the Seller’s notice (and, if necessary, the Closing Date shall be extended until one day after the expiration of such ten-day period). If the Purchaser elects to terminate this Agreement as aforesaid, this Agreement shall terminate and be of no further force and effect and no party shall have any liability to the other hereunder. If less than a material part of the Property shall be affected by fire or other casualty or if the Purchaser shall not elect to terminate this Agreement as aforesaid, there shall be no abatement of the Purchase Price and the Seller shall assign to the Purchaser at the Closing the rights of the Seller to the proceeds, if any, under the Seller’s insurance policies covering the Property with respect to such damage or destruction and there shall be credited against the Purchase Price the amount of any deductible, any proceeds previously received by Seller on account thereof and any deficiency in proceeds.

10.2 Condemnation. If, prior to the Closing, a material part of the Property (including access or parking thereto), is taken by eminent domain (or is the subject of a pending taking which has not yet been consummated), the Seller shall notify the Purchaser of such fact promptly after obtaining knowledge thereof and the Purchaser shall have the right to terminate this Agreement by giving notice to the Seller not later than ten (10) days after the giving of the Seller’s notice (and, if necessary, the Closing Date shall be extended until one day after the expiration of such ten-day period). If the Purchaser elects to terminate this Agreement as aforesaid, this Agreement shall terminate and be of no further force and effect and no party shall have any liability to the other hereunder. If less than a material part of the Property shall be affected or if the Purchaser shall not elect to terminate this Agreement as aforesaid, the sale of the Property shall be consummated as herein provided without any adjustment to the Purchase Price

(except to the extent of any condemnation award received by the Seller prior to the Closing) and the Seller shall assign to the Purchaser at the Closing all of the Seller’s right, title and interest in and to all awards, if any, for the taking, and the Purchaser shall be entitled to receive and keep all awards for the taking of the Property or portion thereof.

10.3 Survival. The parties’ obligations, if any, under this Section 10 shall survive the Closing.

SECTION 11. DEFAULT.

11.1 Default by the Seller. If the transaction herein contemplated fails to close as a result of the default of the Seller hereunder, or the Seller having made any representation or warranty herein which shall be untrue or misleading in any material respect, or the Seller having failed to perform any of the material covenants and agreements contained herein to be performed by the Seller, the Purchaser may, as its sole remedy, either (x) terminate this Agreement (in which case, the Seller shall reimburse the Purchaser for all of the fees, charges, disbursements and expenses of the Purchaser’s attorneys), or (y) pursue a suit for specific performance.

11.2 Default by the Purchaser. If the transaction herein contemplated fails to close as a result of the default of the Purchaser hereunder, or the Purchaser having made any representation or warranty herein which shall be untrue or misleading in any material respect, or the Purchaser having failed to perform any of the covenants and agreements contained herein to be performed by it, the Seller may terminate this Agreement (in which case, the Purchaser shall reimburse the Seller for all of the fees, charges, disbursements and expenses of the Seller’s attorneys).

SECTION 12. MISCELLANEOUS.

12.1 Allocation of Liability. It is expressly understood and agreed that the Seller shall be liable to third parties for any and all obligations, claims, losses, damages, liabilities, and expenses to the extent arising out of events, contractual obligations, acts, or omissions of the Seller that occurred in connection with the ownership or operation of the Property during the period in which the Seller owned the Property prior to the Closing and the Purchaser shall be liable to third parties for any and all obligations, claims, losses, damages, liabilities and expenses to the extent arising out of events, contractual obligations, acts, or omissions of the Purchaser

that occur in connection with the ownership or operation of the Property during the period in which the Purchaser owns the Property after the Closing. The provisions of this Section 12.1 shall survive the Closing.

12.2 Brokers. Each of the parties hereto represents to the other parties that it dealt with no broker, finder or like agent in connection with this Agreement or the transactions contemplated hereby. Each party shall indemnify and hold harmless the other party and its respective legal representatives, heirs, successors and assigns from and against any loss, liability or expense, including reasonable attorneys’ fees, charges and disbursements arising out of any claim or claims for commissions or other compensation for bringing about this Agreement or the transactions contemplated hereby made by any other broker, finder or like agent, if such claim or claims are based in whole or in part on dealings with the indemnifying party. The provisions of this Section 12.2 shall survive the Closing.

12.3 Publicity. The parties agree that, except as otherwise required by law or the rules of the national securities exchange upon which the applicable party’s shares are listed for trading, and except for the exercise of any remedy hereunder, no party shall, with respect to this Agreement and the transactions contemplated hereby, contact or conduct negotiations with public officials, make any public pronouncements, issue press releases or otherwise furnish information regarding this Agreement or the transactions contemplated to any third party without the consent of the other party, which consent shall not be unreasonably withheld, conditioned or delayed.

12.4 Notices. (a) Any and all notices, demands, consents, approvals, offers, elections and other communications required or permitted under this Agreement shall be deemed adequately given if in writing and the same shall be delivered either in hand, by telecopier with confirmed receipt, or by mail or Federal Express or similar expedited commercial carrier, addressed to the recipient of the notice, postpaid and registered or certified with return receipt requested (if by mail), or with all freight charges prepaid (if by Federal Express or similar carrier).

(b) All notices required or permitted to be sent hereunder shall be deemed to have been given for all purposes of this Agreement upon the date of acknowledged receipt, in the case of a notice by telecopier, and, in all

other cases, upon the date of receipt or refusal, except that whenever under this Agreement a notice is either received on a day which is not a Business Day or is required to be delivered on or before a specific day which is not a Business Day, the day of receipt or required delivery shall automatically be extended to the next Business Day.

(c) All such notices shall be addressed,

if to the Seller, to:

c/o CommonWealth REIT

Two Newton Place

255 Washington Street, Suite 300

Newton, Massachusetts 02458-1632

Attn: Mr. John C. Popeo

Telecopier No. (617) 928-1305

with a copy to:

Skadden, Arps, Slate, Meagher & Flom LLP

300 South Grand Avenue, 34th Floor

Los Angeles, California 90071

Attn: Meryl K. Chae, Esq.

Telecopier No. (213) 621-5035

if to the Purchaser, to:

Senior Housing Properties Trust

Two Newton Place

255 Washington Street, Suite 300

Newton, Massachusetts 02458-1632

Attn: Mr. David J. Hegarty

Telecopier No. (617) 796-8349

with a copy to:

Sullivan & Worcester LLP

One Post Office Square

Boston, Massachusetts 02109

Attn: Nancy S. Grodberg, Esq.

Telecopier No. (617) 338-2880

(d) By notice given as herein provided, the parties hereto and their respective successors and assigns shall have the right from time to time and at any time during the term of this Agreement to change their respective addresses

effective upon receipt by the other parties of such notice and each shall have the right to specify as its address any other address within the United States of America.

12.5 Waivers, Etc. Subject to the terms of the last paragraph of Section 6, any waiver of any term or condition of this Agreement, or of the breach of any covenant, representation or warranty contained herein, in any one instance, shall not operate as or be deemed to be or construed as a further or continuing waiver of any other breach of such term, condition, covenant, representation or warranty or any other term, condition, covenant, representation or warranty, nor shall any failure at any time or times to enforce or require performance of any provision hereof operate as a waiver of or affect in any manner such party’s right at a later time to enforce or require performance of such provision or any other provision hereof. This Agreement may not be amended, nor shall any waiver, change, modification, consent or discharge be effected, except by an instrument in writing executed by or on behalf of the party against whom enforcement of any amendment, waiver, change, modification, consent or discharge is sought.

12.6 Assignment; Successors and Assigns. Subject to Section 12.14, this Agreement and all rights and obligations hereunder shall not be assignable, directly or indirectly, by any party without the written consent of the other, except that the Purchaser may assign this Agreement to any entity wholly owned, directly or indirectly, by the Purchaser; provided, however, that, in the event this Agreement shall be assigned to any one or more entities wholly owned, directly or indirectly, by the Purchaser, the Purchaser named herein shall remain liable for the obligations of the “Purchaser” hereunder. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective legal representatives, successors and permitted assigns. This Agreement is not intended and shall not be construed to create any rights in or to be enforceable in any part by any other persons.

12.7 Severability. If any provision of this Agreement shall be held or deemed to be, or shall in fact be, invalid, inoperative or unenforceable as applied to any particular case in any jurisdiction or jurisdictions, or in all jurisdictions or in all cases, because of the conflict of any provision with any constitution or statute or rule of public policy or for any other reason, such circumstance shall not have the effect of rendering the provision or provisions in question invalid, inoperative or unenforceable in any other jurisdiction or in any

other case or circumstance or of rendering any other provision or provisions herein contained invalid, inoperative or unenforceable to the extent that such other provisions are not themselves actually in conflict with such constitution, statute or rule of public policy, but this Agreement shall be reformed and construed in any such jurisdiction or case as if such invalid, inoperative or unenforceable provision had never been contained herein and such provision reformed so that it would be valid, operative and enforceable to the maximum extent permitted in such jurisdiction or in such case.

12.8 Counterparts Complete Agreement, Etc. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. This Agreement constitutes the entire agreement of the parties hereto with respect to the subject matter hereof and shall supersede and take the place of any other instruments purporting to be an agreement of the parties hereto relating to the subject matter hereof.

12.9 Performance on Business Days. In the event the date on which performance or payment of any obligation of a party required hereunder is other than a Business Day, the time for payment or performance shall automatically be extended to the first Business Day following such date.

12.10 Section and Other Headings. The headings contained in this Agreement are for reference purposes only and shall not in any way affect the meaning or interpretation of this Agreement.

12.11 Time of Essence. Time shall be of the essence with respect to the performance of each and every covenant and obligation, and the giving of all notices, under this Agreement.

12.12 Governing Law. This Agreement shall be interpreted, construed, applied and enforced in accordance with the laws of The Commonwealth of Massachusetts.

12.13 Arbitration.

(a) Any disputes, claims or controversies between the Seller and the Purchaser (i) arising out of or relating to this Agreement, or (ii) brought by or on behalf of any shareholder of the Seller or the Purchaser (which, for purposes of this Section 12.13, shall mean any shareholder of record or any beneficial owner of shares of the Seller or the Purchaser, or any former shareholder of record or

beneficial owner of shares of the Seller or the Purchaser), either on his, her or its own behalf, on behalf of the Seller or the Purchaser or on behalf of any series or class of shares of the Seller or the Purchaser or shareholders of the Seller or the Purchaser against the Seller or the Purchaser or any trustee, director, officer, manager (including Reit Management & Research LLC or its successor), agent or employee of the Seller or the Purchaser, including disputes, claims or controversies relating to the meaning, interpretation, effect, validity, performance or enforcement of this Agreement, including this arbitration agreement, the declaration of trust, limited liability company agreement, partnership agreement or analogous governing instruments, as applicable, of the Purchaser or the Seller, or the bylaws of the Purchaser or the Seller (all of which are referred to as “Disputes”), or relating in any way to such a Dispute or Disputes, shall on the demand of any party to such Dispute be resolved through binding and final arbitration in accordance with the Commercial Arbitration Rules (the “Rules”) of the American Arbitration Association (“AAA”) then in effect, except as those Rules may be modified in this Section 12.13. For the avoidance of doubt, and not as a limitation, Disputes are intended to include derivative actions against trustees, directors, officers or managers of the Seller or the Purchaser and class actions by a shareholder against those individuals or entities and the Seller or the Purchaser. For the avoidance of doubt, a Dispute shall include a Dispute made derivatively on behalf of one party against another party.

(b) There shall be three arbitrators. If there are only two parties to the Dispute (with, for purposes of this Section 12.13, any and all parties involved in the Dispute and owned by the same ultimate parent entity treated as one party), each party shall select one arbitrator within 15 days after receipt of a demand for arbitration. Each party shall be entitled to appoint as its party appointed arbitrator an affiliated or interested person of such party. If there are more than two parties to the Dispute, all claimants, on the one hand, and all respondents, on the other hand, shall each select, by the vote of a majority of the claimants or the respondents, as the case may be, one arbitrator within 15 days after receipt of a demand for arbitration. The respondents, on the one hand, and the claimants, on the other hand, shall each be entitled to appoint as its party appointed arbitrator an affiliated or

interested person of such party. If either a claimant (or all claimants) or a respondent (or all respondents) fails to timely select an arbitrator then the party (or parties) who has selected an arbitrator may request the AAA to provide a list of three proposed arbitrators in accordance with the Rules (each of whom shall be neutral, impartial and unaffiliated with any party) and the party (or parties) that failed to timely appoint an arbitrator shall have ten days from the date the AAA provides such list to select one of the three arbitrators proposed by AAA. If such party (or parties) fails to select such arbitrator by such time, the party (or parties) who has appointed the first arbitrator shall then have ten days to select one of the three arbitrators proposed by AAA to be the second arbitrator; and, if he/they should fail to select such arbitrator by such time, the AAA shall select, within 15 days thereafter, one of the three arbitrators it had proposed as the second arbitrator. The two arbitrators so appointed shall jointly appoint the third and presiding arbitrator (who shall be neutral, impartial and unaffiliated with any party) within 15 days of the appointment of the second arbitrator. If the third arbitrator has not been appointed within the time limit specified herein, then the AAA shall provide a list of proposed arbitrators in accordance with the Rules, and the arbitrator shall be appointed by the AAA in accordance with a listing, striking and ranking procedure, with each party having a limited number of strikes, excluding strikes for cause.

(c) The place of arbitration shall be Boston, Massachusetts unless otherwise agreed by the parties.

(d) There shall be only limited documentary discovery of documents directly related to the issues in dispute, as may be ordered by the arbitrators.

(e) In rendering an award or decision (the “Award”), the arbitrators shall be required to follow the laws of the Commonwealth of Massachusetts. Any arbitration proceedings or Award rendered hereunder and the validity, effect and interpretation of this arbitration agreement shall be governed by the Federal Arbitration Act, 9 U.S.C. §1 et seq. The Award shall be in writing and may, but shall not be required to, briefly state the findings of fact and conclusions of law on which it is based.

(f) Except to the extent expressly provided by

Section 12.2 or as otherwise agreed by the parties, each party involved in a Dispute shall bear its own costs and expenses (including attorneys’ fees), and the arbitrators shall not render an award that would include shifting of any such costs or expenses (including attorneys’ fees) or, in a derivative case or class action, award any portion of the Seller’s or the Purchaser’s award to the claimant or the claimant’s attorneys. Except to the extent expressly provided by Section 12.2 or as otherwise agreed by the parties, each party (or, if there are more than two parties to the Dispute, all claimants, on the one hand, and all respondents, on the other hand, respectively) shall bear the costs and expenses of its (or their) selected arbitrator and the parties (or, if there are more than two parties to the Dispute, all claimants, on the one hand, and all respondents, on the other hand) shall equally bear the costs and expenses of the third appointed arbitrator.

(g) An Award shall be final and binding upon the parties thereto and shall be the sole and exclusive remedy between such parties relating to the Dispute, including any claims, counterclaims, issues or accounting presented to the arbitrators. Judgment upon the Award may be entered in any court having jurisdiction. To the fullest extent permitted by law, no application or appeal to any court of competent jurisdiction may be made in connection with any question of law arising in the course of arbitration or with respect to any award made except for actions relating to enforcement of this agreement to arbitrate or any arbitral award issued hereunder and except for actions seeking interim or other provisional relief in aid of arbitration proceedings in any court of competent jurisdiction.

(h) Any monetary award shall be made and payable in U.S. dollars free of any tax, deduction or offset. Each party against which the Award assesses a monetary obligation shall pay that obligation on or before the 30th day following the date of the Award or such other date as the Award may provide.

(i) This Section 12.13 is intended to benefit and be enforceable by the shareholders, trustees, directors, officers, managers (including Reit Management & Research LLC or its successor), agents or employees of any party and the parties and shall be binding on the shareholders of any party and the parties, as applicable, and shall be in addition to, and not in substitution for, any other rights

to indemnification or contribution that such individuals or entities may have by contract or otherwise.

12.14 Like Kind Exchange. At either party’s request, the non-requesting party will take all actions reasonably requested by the requesting party in order to effectuate all or any part of the transactions contemplated by this Agreement as a forward or reverse like-kind exchange for the benefit of the requesting party in accordance with Section 1031 of the Internal Revenue Code and, in the case of a reverse exchange, Rev. Proc. 2000-37, including executing an instrument acknowledging and consenting to any assignment by the requesting party of its rights hereunder to a qualified intermediary or an exchange accommodation titleholder. In furtherance of the foregoing and notwithstanding anything contained in this Agreement to the contrary, the requesting party may assign its rights under this Agreement to a “qualified intermediary” or an “exchange accommodation titleholder” in order to facilitate, at no cost or expense to the other, a forward or reverse like-kind exchange under Section 1031 of the Internal Revenue Code; provided, however, that such assignment will not relieve the requesting party of any of its obligations hereunder. The non-requesting party will also agree to issue all closing documents, including the deed or other operative conveyance instrument, to the applicable qualified intermediary or exchange accommodation titleholder if so directed by the requesting party prior to Closing. Notwithstanding the foregoing, in no event shall the non-requesting party incur or be subject to any liability that is not otherwise provided for in this Agreement.

12.15 Recording. This Agreement may not be recorded without the prior written consent of both parties.

12.16 Non-liability of Trustees of Seller. The Declaration of Trust establishing the Seller, dated September 12, 1996, as amended and supplemented, as filed with the State Department of Assessments and Taxation of Maryland, provides that no trustee, officer, shareholder, employee or agent of the Seller shall be held to any personal liability, jointly or severally, for any obligation of, or claim against, the Seller. All persons dealing with the Seller in any way shall look only to the assets of the Seller for the payment of any sum or the performance of any obligation.

12.17 Non-liability of Trustees of Purchaser. The Amended and Restated Declaration of Trust establishing Senior Housing Properties Trust, dated September 20, 1999, as amended and supplemented, as filed with the State Department Of Assessments

and Taxation of Maryland, provides that no trustee, officer, shareholder, employee or agent of Senior Housing Properties Trust shall be held to any personal liability, jointly or severally, for any obligation of, or claim against, Senior Housing Properties Trust. All persons dealing with Senior Housing Properties Trust in any way shall look only to the assets of Senior Housing Properties Trust for the payment of any sum or the performance of any obligation.

12.18 Waiver and Further Assurances. The Purchaser hereby acknowledges that it is a sophisticated purchaser of real properties and that it is aware of all disclosures the Seller is or may be required to provide to the Purchaser in connection with the transactions contemplated hereby pursuant to any law, rule or regulation (including those of Massachusetts and those of the state in which the Property is located). The Purchaser hereby acknowledges that, prior to the execution of this Agreement, the Purchaser has had access to all information necessary to acquire the Property and the Purchaser acknowledges that the Seller has fully and completely fulfilled any and all disclosure obligations with respect thereto. The Purchaser hereby fully and completely discharges the Seller from any further disclosure obligations whatsoever relating to the Property. In addition to the actions recited herein and contemplated to be performed, executed, and/or delivered by the Seller and the Purchaser, the Seller and the Purchaser agree to perform, execute and/or deliver or cause to be performed, executed and/or delivered at the Closing or after the Closing any and all such further acts, instruments, deeds and assurances as may be reasonably required to establish, confirm or otherwise evidence the Seller’s satisfaction of any disclosure obligations or to otherwise consummate the transactions contemplated hereby.

[Signature page follows.]

IN WITNESS WHEREOF, the parties have caused this Agreement to be executed as a sealed instrument as of the date first above written.

|

|

SELLER: | |

|

|

| |

|

|

HUB PROPERTIES TRUST, a Maryland real estate investment trust | |

|

|

| |

|

|

By: |

/s/ John C. Popeo |

|

|

Name: |

John C. Popeo |

|

|

Its: |

Treasurer |

|

|

| |

|

|

PURCHASER: | |

|

|

| |

|

|

SENIOR HOUSING PROPERTIES TRUST, a Maryland real estate investment trust | |

|

|

| |

|

|

By: |

/s/ David J. Hegarty |

|

|

Name: |

David J. Hegarty |

|

|

Its: |

President |

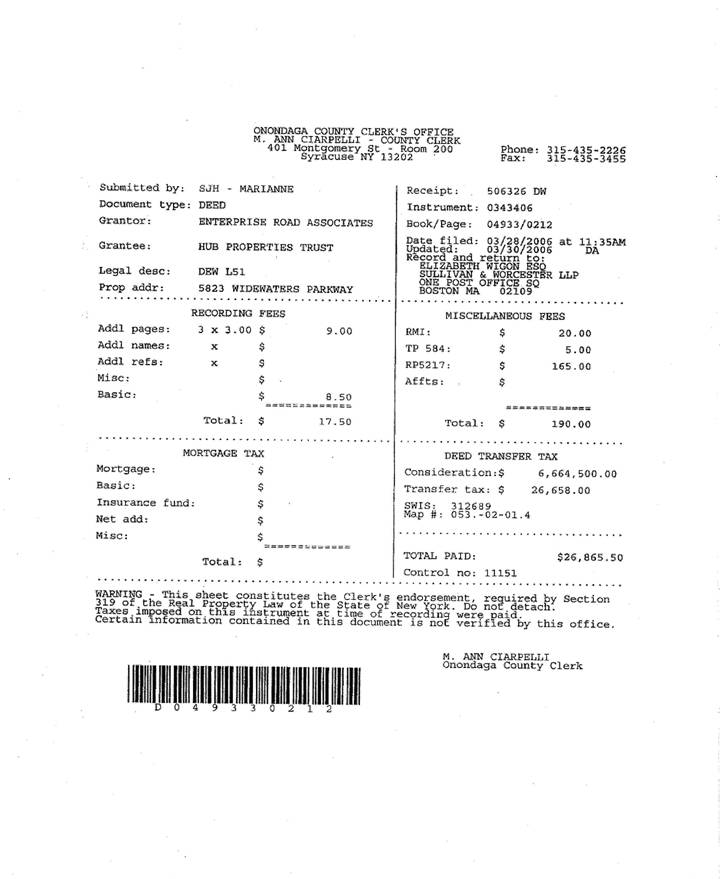

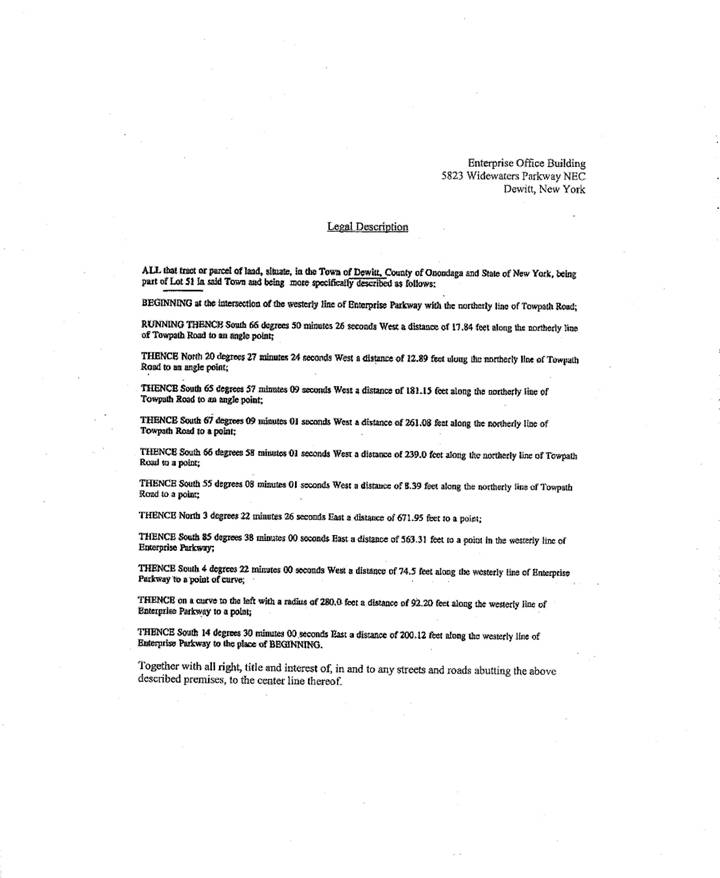

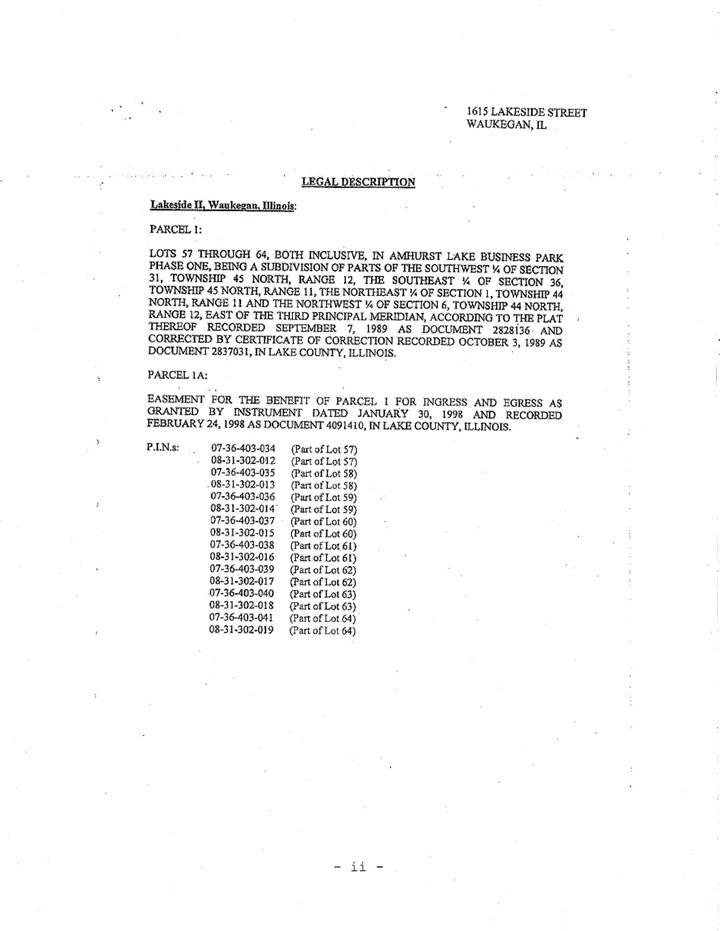

SCHEDULE A

Land

[See attached legal description.]

|

|

3043 WALTON ROAD PLYMOUTH MEETING, PA Legal Description ALL THAT CERTAIN tract of land situate in the Township of Plymouth, County of Montgomery, Commonwealth of Pennsylvania, as shown as Tract 1 and Tract 2 on Plan of Survey prepared for Preferred Real Estate Investments, Inc., by Urwiler and Walter, Inc., dated November 29, 1995, last revised January 24, 1996, bounded and described as follows, to wit:- BEGINNING at a point in the centerline of Walton Road (as widened to 40 feet from its centerline), said point being located Southwest 411 feet more or less from the centerline of Township Line Road, said point being in line of lands of Stanley and Mildred Wannop; THENCE (1) extending along said Walton Road centerline South 45 degrees 29 minutes 30 seconds West 255.64 feet to a point in line of lands of Hatfield Township Industrial Development Authority Child Care Centers; THENCE (2) extending along said Hatfield Township Industrial Development Authority Child Care Centers North 41 degrees 57 minutes 40 seconds West 350.35 feet to a point (1” solid pin); THENCE (3) continuing along said lands of Hatfield Township Industrial Development Authority Child Care Centers South 45 degrees 29 minutes 30 seconds West 194.75 feet to a point, said point being in line of lands of United Food and Comm. Workers Local 1357 AFL-CIO W.W. Young, II; THENCE (4) extending along W.W. Young, II, lands and along a 25 foot wide sanitary sewer easement North 41 degrees 49 minutes 40 seconds West 754.18 feet to a point in line of lands of Valley Square Associates; THENCE (5) extending along said Valley Square Associates’ lands and along a 20 foot wide sanitary sewer easement North 46 degrees 05 minutes 30 seconds East 303.16 feet to a point (1/2” rebar), said point being in line of lands of Four Valley Square Associates; THENCE (6) extending along said Four Valley Square Associates’ lands North 45 degrees 38 minutes East 145.32 feet to a point (iron pin found), said point being in line of lands of David E. Albrecht; THENCE (7) continuing along said Albrecht lands and partly along a 20 foot wide sanitary sewer easement, and along lands of Patrick J. and Lisa C. Delaney, Tompkins Rubber Co., other lands of Tompkins Rubber Co., and lands of Stanley and Mildred Wannop South 41 degrees 57 minutes 40 seconds East 1100.91 feet to a point in the centerline of Walton Road aforesaid, said point being the point and place of BEGINNING. BEING COUNTY TAX PARCEL NUMBER - 49-00-12904-00-7 and MONTGOMERY COUNTY COMMISSIONERS REGISTRY 49-00-12904-00-7 PLYMOUTH 3043 WALTON RD WALROAD ASSOCIATES LP B 028 U 110 L 3330 DATE: 01/23/98 DB5216PG0182 |

|

|

Legal Description (continued) BEING AS TO PART (TRACT 1) THE SAME PREMISES WHICH C & D CHARTER POWER SYSTEMS, INC., A DELAWARE CORPORATION, FORMERLY C & D POWER SYSTEMS, INC., A DELAWARE CORPORATION BY DEED DATED JANUARY 26, 1996 AND RECORDED IN THE OFFICE FOR THE RECORDING OF DEEDS IN AND FOR THE COUNTY OF MONTGOMERY, COMMONWEALTH OF PENNSYLVANIA IN DEED BOOK 5140 PAGE 5, GRANTED AND CONVEYED UN WALROAD ASSOCIATES, L.P., ITS SUCCESSORS AND ASSIGNS, IN FEE. BEING AS TO PART (TRACT 2) THE SAME PREMISES WHICH GERTRUDE C. FORD, WIDOW, BY DEED DATED MARCH 29. 1996 AND RECORDED IN THE OFFICE FOR THE RECORDING OF DEEDS IN AND FOR THE COUNTY OF MONTGOMERY, COMMONWEALTH OF PENNSYLVANIA IN DEED BOOK 5145 PAGE 2039, GRANTED AND CONVEYED UNTO WALROAD ASSOCIATES, L.P., ITS SUCCESSORS AND ASSIGNS, IN FEE. BEING PART OF THE SAME PREMISES WHICH WALROAD ASSOCIATES, L.P. BY DEED OF CONSOLIDATION, DATED MAY 22, 1996 AND RECORDED MAY 23, 1996 IN THE OFFICE FOR THE RECORDING OF DEEDS, IN AND FOR THE COUNTY OF MONTGOMERY, COMMONWEALTH OF PENNSYLVANIA IN DEED BOOK 5148 PAGE 2250, GRANTED AND CONVEYED UNTO WALROAD ASSOCIATES, L.P., ITS SUCCESSORS AND ASSIGNS, IN FEE. [SEAL] DB5216PG0183 |

SCHEDULE B

Rent Roll

[See attached copy.]

INDEX

Lease

1. Right of Entry Agreement dated November 11, 2008, by and between Hub Properties Trust (“Owner”) and Reliance Globalcom Services, Inc. (“Operator”).

INDEX

Lease

1. Letter Agreement, dated November 11, 2004, from Jennifer B. Clark, Senior Vice President, Hub Properties Trust agreed to by Iris Davis Brownstein, General Counsel and Corporate Secretary, Health Advocate, Inc.

2. Office Lease, dated November 24, 2004, by and between Hub Properties Trust (“Landlord”) and Health Advocate, Inc. (“Tenant”).

3. First Amendment to Office Lease, dated March 15, 2007, by and between Hub Properties Trust (“Landlord”) and Health Advocate, Inc. (“Tenant”). Re: Expansion and extension of lease

4. Second Amendment to Office Lease, dated January 30, 2008, by and between Hub Properties Trust (“Landlord”) and Health Advocate, Inc. (“Tenant”).

5. Third Amendment to Office Lease, dated May 28, 2009, by and between Hub Properties Trust (“Landlord”) and Health Advocate, Inc. (“Tenant”). Re: Expansion to Ste. 100

6. Fourth Amendment to Office Lease, dated March 31, 2010, by and between Hub Properties Trust (“Landlord”) and Health Advocate, Inc. (“Tenant”). Re: Expansion to Ste. 200.

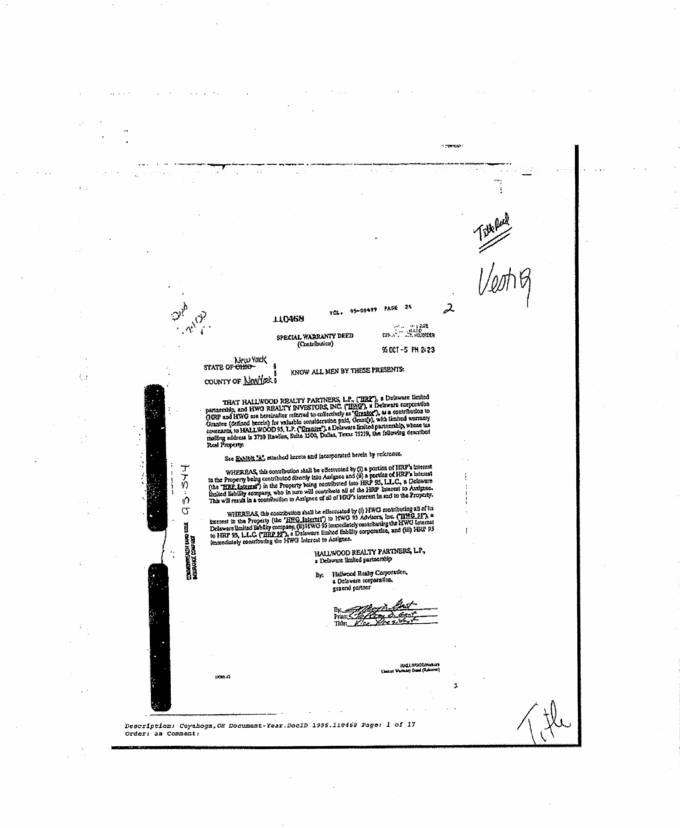

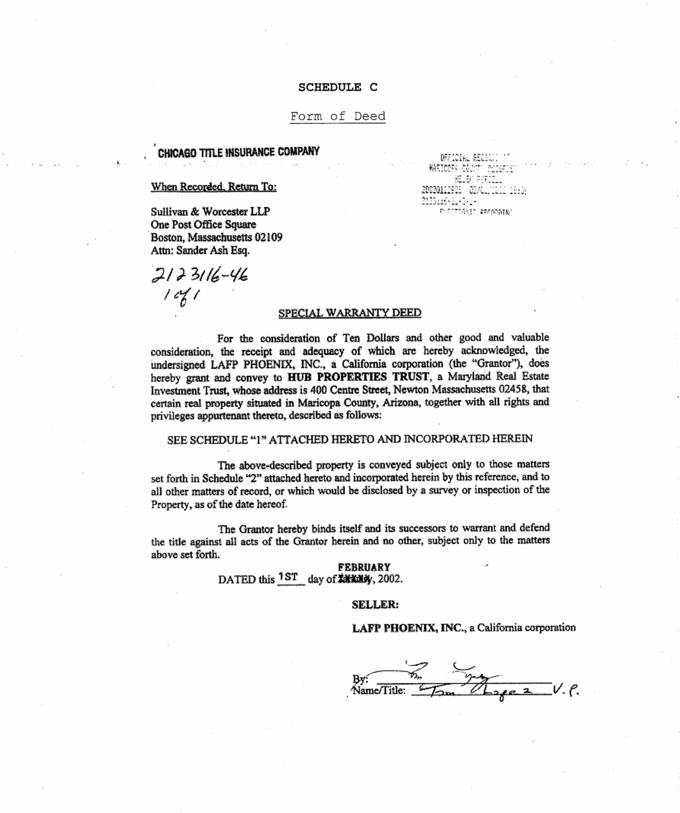

SCHEDULE C

Form of Deed

|

|

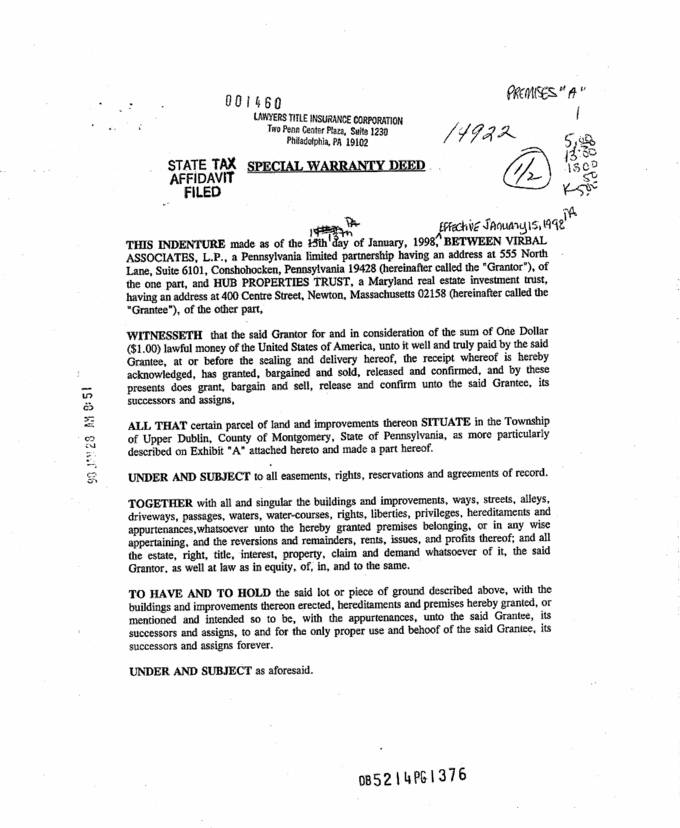

002369 LAWYERS TITLE INSURANCE CORPORATION Two Penn Center Plaza, Suite 1230 Philadelphia, PA 19102 STATE TAX AFFIDAVIT FILED SPECIAL WARRANTY DEED THIS INDENTURE made as of the 15th day of January, 1998, BETWEEN WALROAD ASSOCIATES, L.P., a Pennsylvania limited partnership having an address at 555 North Lane, Suite 6101, Conshohocken, Pennsylvania 19428 (hereinafter called the “Grantor”), of the one part, and HUB PROPERTIES TRUST, a Maryland real estate investment trust, having an address at 400 Centre Street, Newton, Massachusetts 02158 (hereinafter called the “Grantee”), of the other part. WITNESSETH that the said Grantor for and in consideration of the sum of One Dollar ($1.00) lawful money of the United States of America, unto it well and truly paid by the said Grantee, at or before the sealing and delivery hereof, the receipt whereof is hereby acknowledged, has granted, bargained and sold, released and confirmed, and by these presents does grant, bargain and sell, release and confirm unto the said Grantee, its successors and assigns. ALL THAT certain parcel of land and improvements thereon SITUATE in the Township of Plymouth, County of Montgomery, State of Pennsylvania, as more particularly described on Exhibit “A” attached hereto and made a part hereof. UNDER AND SUBJECT to all easements, rights, reservations and agreements of record. TOGETHER with all and singular the buildings and improvements, ways, streets, alleys, driveways, passages, waters, water-courses, rights, liberties, privileges, hereditaments and appurtenances, whatsoever unto the hereby granted premises belonging, or in any wise appertaining, and the reversions and remainders, rents, issues, and profits thereof; and all the estate, right, title, interest, property, claim and demand whatsoever of it, the said Grantor, as well at law as in equity, of, in, and to the same. TO HAVE AND TO HOLD the said lot or piece of ground described above, with the buildings and improvements thereon erected, hereditaments and premises hereby granted, or mentioned and intended so to be, with the appurtenances, unto the said Grantee, its successors and assigns, to and for the only proper use and behoof of the said Grantee, its successors and assigns forever. UNDER AND SUBJECT as aforesaid. REALTY TRANS TAX PAID STATE 87,300.00 LOCAL 87,300.00 PER DB5216PG0178 |

|

|

AND the said Grantor, for itself and its successors, does covenant, promise and agree, to and with the said Grantee, its successors and assigns, by these presents, that it the said Grantor and its successors, all and singular the hereditaments and premises hereby granted or mentioned and intended so to be, with the appurtenances, unto the said Grantee, its successors and assigns, against it, the said Grantor and its successors, and against all and every person and persons whomsoever lawfully claiming or to claim the same or any part thereof, by, from or under it, them or any of them, shall and will, SUBJECT as aforesaid, WARRANT and forever DEFEND. IN WITNESS WHEREOF, the party of the first part has caused this Indenture to be signed in its name and its behalf by its duly authorized general partner. Dated the day and year first above written. WALROAD ASSOCIATES, L.P., a Pennsylvania limited partnership By: WALROAD DEVELOPERS, L.P., its general partner Attest: By: WALROAD INC., its general partner /s/ MICHAEL FINK MICHAEL FINK, SECRETARY By: /s/ MICHAEL G. O’NEILL Name: MICHAEL G. O’NEILL Title: PRESIDENT [ILLEGIBLE DB5216PG0179 |

|

|

COMMONWEALTH OF PENNSYLVANIA : :ss. COUNTY OF MONTGOMERY: On this the 13th day of January, 1998, before me, a Notary Public for the Commonwealth of Pennsylvania, the undersigned officer, personally appeared Michael G. O’Neill, who acknowledged himself to be the (Vice) President of Walroad, Inc., the general partner of the general partner of the within-named Grantor, and that he, as such officer, being authorized to do so, executed the foregoing instrument for the purposes therein contained by signing the name of such corporation by himself as Vice President. IN WITNESS WHEREOF, I hereunto set my hand and official seal. Notary Public DB5216PG0180 |

|

|

The address of the above-named Grantee is: HUB PROPERTIES TRUST 400 Centre Street Newton, Massachusetts 02158 On behalf of the Grantee: /s/ THIS DEED REGISTERED AT PLYMOUTH TOWNSHIP DATE 1/21/98 BY DB5216PG0181 |

|

|

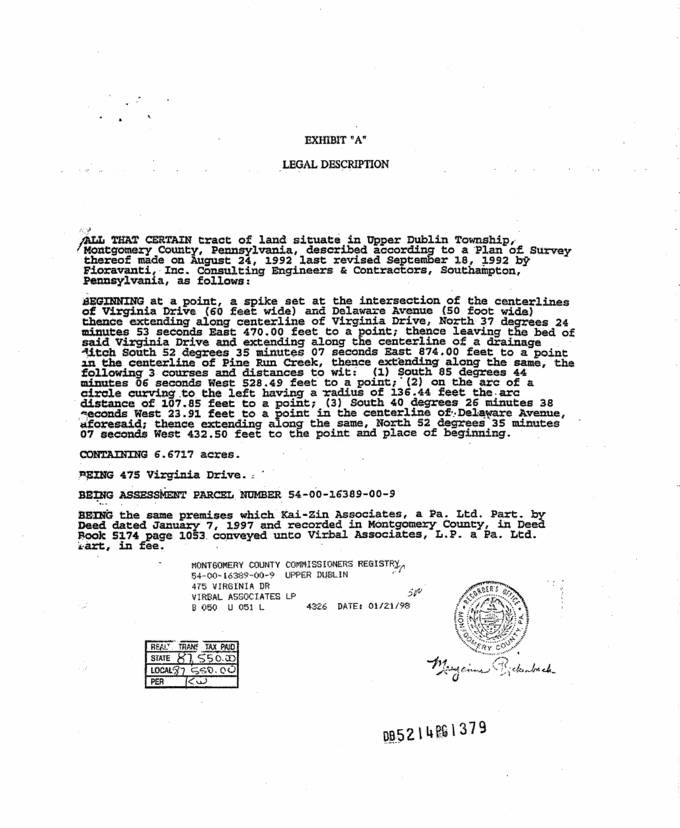

[3043 Walton Road] Exhibit A Legal Description ALL THAT CERTAIN tract of land situate in the Township of Plymouth. County of Montgomery Commonwealth of Pennsylvania, as shown as Tract 1 and Tract 2 on Plan of Survey prepared for Preferred Real Estate Investments, Inc., by Urwiler and Walter, Inc., dated November 29, 1995, last revised January 24, 1996, bounded and described as follows, to wit:- BEGINNING at a point in the centerline of Walton Road (as widened to 40 feet from its centerline), said point being located Southwest 411 feet more or less from the centerline of Township Line Road. said point being in line of lands of Stanley and Mildred Wannop; THENCE (1) extending along said Walton Road centerline South 45 degrees 29 minutes 30 seconds West 255.64 feet to a point in line of lands of Hatfield Township Industrial Development Authority Child Care Centers; THENCE (2) extending along said Hatfield Township Industrial Development Authority Child care Centers North 41 degrees 57 minutes 40 seconds West 350.35 feet to a point (1” solid pin); THENCE (3) continuing along said lands of Hatfield Township Industrial Development Authority Child Care Centers South 45 degrees 29 minutes 30 seconds West 194.75 feet to a point, said point being in line of lands of United Food and Comm. Workers Local 1357 AFL-CIO W.W. Young. Lit; THENCE (4) extending along W.W. Young. II, lands and along a 25 foot wide sanitary sewer easement North 41 degrees 49 minutes 40 seconds West 754.18 feet to a point in line of lands of Valley Square Associates; THENCE (5) extending along said Valley Square Associates’ lands and along a 20 foot wide sanitary sewer easement North 46 degrees 05 minutes 30 seconds East 303.16 feet to a point (1/2” rebar). said point being in line of lands of Four Valley Square Associates; THENCE (6) extending along said Four Valley Square Associates’ lands North 45 degrees 38 minutes East 145.32 feet to a point (iron pin found). said point being in line of lands of David E. Albrecht: THENCE (7) continuing along said Albrecht lands and partly along a 20 foot wide sanitary sewer easement, and along lands of Patrick J. and Lisa C. Delaney, Tompkins Rubber Co., other lands of Tompkins Rubber Co., and lands of Stanley and Mildred. Wannop South 41 degrees 57 minutes 40 seconds East 1100.91 feet to a point in the centerline of Walton Road aforesaid, said point being the point and place of BEGINNING. BEING COUNTY TAX PARCEL NUMBER - 49-00-12904-00-7 and MONTGOMERY COUNTY COMMISSIONERS REGISTRY 49-00-12904-00-7 PLYMOUTH 3043 WALTON RD WALROAD ASSOCIATES LP B 028 U 110 L 3330 DATE: 01/28/98 DB5216PG0182 |

|

|