ex_317197.htm

Exhibit 10.1

STOCK PURCHASE AGREEMENT

among

JEFFERY P. GERALD,

GRAY MATTERS, INC.

and

INFORMATION ANALYSIS INCORPORATED

dated as of

November 12, 2021

TABLE OF CONTENTS

|

ARTICLE I DEFINITIONS

|

1

|

|

ARTICLE II PURCHASE AND SALE

|

16

|

|

Section 2.01 Purchase and Sale.

|

16

|

|

Section 2.02 Purchase Price.

|

16

|

|

Section 2.03 Closing and Payments at Closing.

|

18

|

|

Section 2.04 Closing Deliverables.

|

22

|

| Section 2.05 Withholding. |

24 |

|

ARTICLE III REPRESENTATIONS AND WARRANTIES OF SELLER

|

25

|

|

Section 3.01 Authority of Seller.

|

25

|

|

Section 3.02 Organization, Authority and Qualification of the Company.

|

25

|

|

Section 3.03 Capitalization.

|

26

|

|

Section 3.04 RESERVED

|

27

|

|

Section 3.05 No Conflicts; Consents.

|

27

|

|

Section 3.06 Financial Statements.

|

28

|

|

Section 3.07 Undisclosed Liabilities.

|

28

|

|

Section 3.08 Absence of Certain Changes, Events and Conditions.

|

28

|

|

Section 3.09 Material Contracts.

|

31

|

|

Section 3.10 Title to Assets; Real Property.

|

33

|

|

Section 3.11 Condition and Sufficiency of Assets.

|

34

|

|

Section 3.12 Intellectual Property.

|

34

|

|

Section 3.13 Inventory.

|

37

|

|

Section 3.14 Accounts Receivable.

|

37

|

|

Section 3.15 Customers and Suppliers.

|

38

|

|

Section 3.16 Insurance.

|

38

|

|

Section 3.17 Legal Proceedings; Governmental Orders.

|

38

|

|

Section 3.18 Compliance With Laws; Permits.

|

39

|

|

Section 3.19 Environmental Matters.

|

39

|

|

Section 3.20 Employee Benefit Matters.

|

39

|

|

Section 3.21 Employment Matters.

|

41

|

|

Section 3.22 Taxes.

|

42

|

|

Section 3.23 Books and Records.

|

44

|

|

Section 3.24 Brokers.

|

44

|

|

Section 3.25 Certain Business Relationships with Company.

|

45

|

| Section 3.26 Government Contract Matters. |

45 |

| Section 3.27 Systems and Data Privacy. |

56 |

| Section 3.28 Full Disclosure. |

56 |

|

ARTICLE IV REPRESENTATIONS AND WARRANTIES OF BUYER

|

56

|

|

Section 4.01 Organization and Authority of Buyer.

|

57

|

|

Section 4.02 No Conflicts; Consents.

|

57

|

|

Section 4.03 Investment Purpose.

|

57

|

|

Section 4.04 Brokers.

|

57

|

|

Section 4.05 Sufficiency of Funds.

|

57

|

|

Section 4.06 Legal Proceedings.

|

57

|

| Section 4.07 Full Disclosure. |

58 |

|

ARTICLE V COVENANTS

|

58

|

|

Section 5.01 Conduct of Business Prior to the Closing.

|

58

|

|

Section 5.02 Access to Information.

|

59

|

|

Section 5.03 Seller Release.

|

59

|

|

Section 5.04 Notice of Certain Events.

|

59

|

|

Section 5.05 Confidentiality.

|

60

|

|

Section 5.06 Non-Competition; Non-Solicitation.

|

60

|

|

Section 5.07 Closing Conditions.

|

61

|

|

Section 5.08 Public Announcements.

|

61

|

|

Section 5.09 Exclusivity.

|

61

|

| Section 5.10 Further Assurances. |

62 |

| Section 5.11 Due Diligene; Preparation of Disclosure Schedules. |

63 |

|

ARTICLE VI TAX MATTERS

|

64

|

|

Section 6.01 Tax Covenants.

|

64

|

|

Section 6.02 Termination of Existing Tax Sharing Agreements.

|

65

|

|

Section 6.03 Straddle Period; Interest and Penalties.

|

65

|

|

Section 6.04 Contests.

|

66

|

|

Section 6.05 Cooperation and Exchange of Information.

|

66

|

|

Section 6.06 Tax Treatment of Indemnification Payments.

|

66

|

|

Section 6.07 Survival.

|

66

|

|

Section 6.08 Overlap.

|

66

|

|

ARTICLE VII CONDITIONS TO CLOSING

|

67

|

|

Section 7.01 Conditions to Obligations of Buyer.

|

67

|

|

Section 7.02 Conditions to Obligations of Seller.

|

68

|

|

ARTICLE VIII INDEMNIFICATION

|

69

|

|

Section 8.01 Survival.

|

69

|

|

Section 8.02 Indemnification By Seller.

|

70

|

|

Section 8.03 Indemnification By Buyer.

|

71

|

|

Section 8.04 Certain Limitations.

|

71

|

|

Section 8.05 Indemnification Procedures.

|

72

|

|

Section 8.06 Payments.

|

74

|

|

Section 8.07 Tax Treatment of Indemnification Payments.

|

74

|

|

Section 8.08 Right of Setoff.

|

74

|

| Section 8.09 Remedies Cumulative. |

74 |

| Section 8.10 Exclusive Remedites. |

74 |

| Section 8.11 Stock Indemnity Escrow. |

75 |

| Section 8.12 Order of Recourse. |

75 |

|

ARTICLE IX TERMINATION

|

75

|

|

Section 9.01 Termination.

|

75

|

|

Section 9.02 Effect of Termination.

|

76

|

|

ARTICLE X MISCELLANEOUS

|

77

|

|

Section 10.01 Expenses.

|

77

|

|

Section 10.02 Notices.

|

77

|

|

Section 10.03 Interpretation.

|

78

|

|

Section 10.04 Headings.

|

78

|

|

Section 10.05 Severability.

|

78

|

|

Section 10.06 Entire Agreement.

|

78

|

|

Section 10.07 Successors and Assigns.

|

78

|

|

Section 10.08 No Third-party Beneficiaries.

|

78

|

|

Section 10.09 Amendment and Modification; Waiver.

|

79

|

|

Section 10.10 Governing Law; Submission to Jurisdiction; Waiver of Jury Trial.

|

79

|

|

Section 10.11 Counterparts.

|

80

|

| Section 10.12 Specific Performance |

80 |

Attachments and Schedules:

Disclosure Schedules

Exhibit A Rollover Agreement

Exhibit B Seller Employment Agreement

STOCK PURCHASE AGREEMENT

This Stock Purchase Agreement (this “Agreement”), dated as of November 12, 2021 (the “Effective Date”), is entered into by and among JEFFREY P. GERALD, an individual (“Seller”), GRAY MATTERS, INC., a Delaware corporation (the “Company”), and Information Analysis Incorporated, a Virginia corporation (“Buyer”).

RECITALS

WHEREAS, Seller owns all of the issued and outstanding shares of common stock, par value $0.01 (the “Shares”), of the Company;

WHEREAS, Seller wishes to sell to Buyer, and Buyer wishes to purchase from Seller, the Shares, subject to the terms and conditions set forth herein; and

WHEREAS, Upon the terms and subject to the conditions set forth herein, Seller desires to assign, transfer and contribute to Buyer pursuant to a contribution and subscription agreement in the form attached hereto as Exhibit A (the “Rollover Agreement”) 146 of the issued and outstanding Shares (the “Rollover Shares”) valued for purposes of this Agreement at One Million Five Hundred Thousand Dollars ($1,500,000) (the “Rollover Amount”), and Buyer shall issue that number of shares of fully paid and non-assessable $0.01 par value common stock of Buyer (“Buyer Stock”) equal to the Rollover Amount as determined based on the Average Price (as defined below), in exchange for the Rollover Shares (the “Buyer Rollover Stock”).

NOW, THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

DEFINITIONS

The following terms have the meanings specified or referred to in this Article I:

“2022 Earnout Consideration” has the meaning set forth in Section 2.02(b).

“2022 Revenue Report” has the meaning set forth in Section 2.02(b)(vii).

“Action” means any claim, action, cause of action, demand, lawsuit, arbitration, inquiry, audit, notice of violation, proceeding, litigation, citation, summons, subpoena or investigation of any nature, civil, criminal, administrative, regulatory or otherwise, whether at law or in equity.

“Affiliate” of a Person means any other Person that directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with, such Person. The term “control” (including the terms “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise.

“Agreement” has the meaning set forth in the preamble.

“Ancillary Documents” means any documents as referenced in this Agreement.

“Anti-Kickback Act” has the meaning set forth in Section 3.27(h).

“Average Price” means, for any particular date, (i) the average closing price for Buyer Stock, as reported on the OTC Markets website (www.otcmarkets.com/stock/IAIC/overview), for each of the five (5) consecutive trading days preceding such date or (ii) at any time following the listing of Buyer Stock on the New York Stock Exchange or another public securities exchange following the Closing Date, the average closing price for Buyer Stock as reported by such exchange (or on the OTC Markets website, as applicable, for the portion of the applicable five-day period that ends on the day prior to the date on which the Surviving Entity Common Stock is listed on the New York Stock Exchange or another public securities exchange following the Closing Date) for each of the five (5) consecutive trading days preceding such date.

“Balance Sheet” has the meaning set forth in Section 3.06.

“Balance Sheet Date” has the meaning set forth in Section 3.06.

“Base Purchase Price” has the meaning set forth in Section 2.02

“Basket” has the meaning set forth in Section 8.04(a).

“Business Day” means any day except Saturday, Sunday or any other day on which commercial banks located in Baltimore, Maryland are authorized or required by Law to be closed for business.

“Buyer” has the meaning set forth in the preamble.

“Buyer Indemnitees” has the meaning set forth in Section 8.02.

“Buyer Prepared Tax Returns” has the meaning set forth in Section 6.01(d).

“Buyer Rollover Stock” has the meaning set forth in Section 2.03(c).

“Cap” has the meaning set forth in Section 8.04(b).

“Cardholder Data” shall have the same meaning as in the Payment Card Industry Data Security Standard, solely to the extent such information and data regulated by the Payment Card Industry Data Security Standard is applicable to the Company’s Business.

“Closing” has the meaning set forth in Section 2.03(a).

“Closing Balance Sheet” has the meaning set forth in Section 2.03(f).

“Closing Cash Consideration” has the meaning set forth in Section 2.02.

“Closing Date” has the meaning set forth in Section 2.03(a).

“Closing Date Payment” has the meaning set forth in Section 2.02.

“Closing Payment” has the meaning set forth in Section 2.02.

“Code” means the Internal Revenue Code of 1986, as amended.

“Common Stock” has the meaning set forth in Section 3.03(a).

“Company” has the meaning set forth in the recitals.

“Company Intellectual Property” means all Intellectual Property that is owned or controlled by the Company, that a Person is under an obligation to assign to the Company, or that the Company has a right or option to own or control, excluding implied non-exclusive licenses from third parties that accompany the lease or sale of products or services (“Company Implied Licenses”).

“Company IP Agreements” means all licenses, sublicenses, consent to use agreements, settlements, coexistence agreements, covenants not to sue, development agreements, joint research agreements, assignment agreements, waivers, releases, permissions and other Contracts, whether written or oral, relating to Intellectual Property to which the Company is a party, beneficiary or otherwise bound.

“Company IP Registrations” means all Company Intellectual Property that is registered, granted or issued by or with any Governmental Authority or authorized private registrar in any jurisdiction, including issued or granted patents, registered trademarks, domain names and registered copyrights, or any applications for having any of the foregoing registered, granted or issued that are currently pending or are in process of being prepared.

“Company IT Systems” means all Software, computer hardware, servers, networks, platforms, peripherals, and similar or related items of automated, computerized, or other information technology (IT) networks and systems (including telecommunications networks and systems for voice, data and video) owned, leased, licensed, or used (including through cloud-based or other third-party service providers) by the Company.

“Contracts” means all contracts, leases, deeds, mortgages, licenses, instruments, notes, commitments, undertakings, indentures, joint ventures and all other agreements, commitments and legally binding arrangements, whether written or oral.

“COVID-19” means the novel coronavirus COVID-19 and related pandemic.

“Current Assets” means, without duplication, cash and cash equivalents, valid and collectible accounts receivable, inventory and prepaid expenses, but excluding (a) the portion of any prepaid expense of which Buyer will not receive the benefit following the Closing, (b) deferred Tax assets, and (c) receivables from any of the Company's Affiliates, directors, employees, officers or stockholders and any of their respective Affiliates, all as determined in accordance with GAAP applied using the same accounting methods, practices, principles, policies and procedures, with consistent classifications, judgments and valuation and estimation methodologies that were used in the preparation of the Financial Statements for the most recent fiscal year end as if such accounts were being prepared and audited as of a fiscal year end.

“Current Government Contracts” has the meaning set forth in Section 3.27(a).

“Current Liabilities” means, without duplication, accounts payable, accrued Taxes and accrued expenses, deferred revenue, Contract liabilities, any outstanding or unclear checks or bank overdrafts, and any other off balance sheet obligations of the Company that may arise, but excluding payables to any of the Company's Affiliates, directors, employees, officers or stockholders and any of their respective Affiliates, deferred Tax liabilities, Transaction Expenses and the current portion of any Indebtedness of the Company, all as determined in accordance with GAAP applied using the same accounting methods, practices, principles, policies and procedures, with consistent classifications, judgments and valuation and estimation methodologies that were used in the preparation of the Financial Statements for the most recent fiscal year end as if such accounts were being prepared.

“Customs Laws” has the meaning set forth in Section 3.27(i)(iii).

“DCAA” has the meaning set forth in Section 3.27(b)(iv)(M).

“DCMA” has the meaning set forth in Section 3.27(b)(iv)(M)

“DCSA” has the meaning set forth in Section 3.27(g).

“Deferred Consideration” has the meaning set forth in Section 2.02(a).

“Direct Claim” has the meaning set forth in Section 8.05(c).

“Disclosure Schedules” means the Disclosure Schedules delivered by Seller and Buyer in connection with the Closing of this Agreement.

“Dispute Notice” has the meaning set forth in Section 2.03(f)(ii).

“Dispute Resolution Procedure” means the procedure pursuant to which the items in dispute are referred by either Buyer or Seller for determination as promptly as practicable to the Independent Accountants, which shall be jointly engaged by Buyer, on the one hand, and Seller, on the other hand, pursuant to an engagement letter in customary form which each of Buyer and Seller must execute. The Independent Accountants must prescribe procedures for resolving the disputed items and in all events must make a written determination, with respect to such disputed items only (each such written determination, a “Determination”). The Determination must be based solely on presentations with respect to such disputed items by Buyer and Seller to the Independent Accountants and not on the Independent Accountants’ independent review; provided, that such presentations shall be deemed to include any work papers, records, accounts or similar materials delivered to the Independent Accountants by Buyer or Seller in connection with such presentations and any materials delivered to the Independent Accountants in response to requests by the Independent Accountants. Each of Buyer and Seller shall use commercially reasonable efforts to make its presentation as promptly as practicable following submission to the Independent Accountants of the disputed items, and each such party shall be entitled, as part of its presentation, to respond to the presentation of the other party and any question and requests of the Independent Accountants. Buyer and Seller must instruct the Independent Accountants to deliver the Determination to Buyer and Seller no later than thirty (30) calendar days following the date on which the disputed items are referred to the Independent Accountants. In deciding any matter, the Independent Accountants: (a) may only assign values to items in dispute and such values must be the same as or between the values asserted by Buyer and by Seller, and (b) shall be bound by the express terms, conditions and covenants set forth in the Agreement, including the provisions of Section 2.03 and the definitions contained herein. The Independent Accountants may consider only those items and amounts in Buyer’s written notices or Seller’s written responses that Buyer and Seller were unable to resolve. The Independent Accountants may engage legal counsel to consider and provide guidance on any part of a dispute that involves a legal question. In the absence of fraud or manifest error, the Determination shall be conclusive and binding upon the parties hereto. It is the intent of the parties hereto that the process set forth in this definition of “Dispute Resolution Procedure” and the activities of the Independent Accountants in connection herewith are treated like an arbitration for legal purposes. All fees and expenses (including reasonable attorney’s fees and expenses and fees and expenses of the Independent Accountants) incurred in connection with such dispute shall be borne by the parties based on the percentage which the portion of the contested amount not awarded to such party bears to the amount actually contested by the parties. By way of example and not by way of limitation, if Seller seeks a $70,000 upward adjustment to Net Working Capital and the Independent Accountants determine that there should be a $40,000 upward adjustment, then Seller shall be responsible for three-sevenths (3/7th) of the fees and expenses and Buyer shall be responsible for four-sevenths (4/7th) of the fees and expenses.

“Dollars or $” means the lawful currency of the United States.

“Downward Post-Closing Purchase Price Adjustment” has the meaning set forth in Section 2.03(i).

“Due Diligence Period” means the period (a) beginning on the Effective Date and (b) expiring (i) at 5:00 p.m. (Annapolis, Maryland time) on the thirtieth (30th) Business Day following the Effective Date or (ii) at such earlier or later date and time as to which Buyer and Seller mutually agree in writing or as may result pursuant to an extension under Section 5.11(c).

“Effective Time” has the meaning set forth in Section 2.03(a).

“Employee Benefit Plan” has the meaning set forth in Section 3.20(a).

“Encumbrance” means any charge, claim, community property interest, pledge, condition, equitable interest, lien (statutory or other), option, security interest, mortgage, easement, encroachment, right of way, right of first refusal, or restriction of any kind, including any restriction on use, voting, transfer, receipt of income or exercise of any other attribute of ownership.

“Environmental Claim” means any Action, Governmental Order, lien, fine, penalty, or, as to each, any settlement or judgment arising therefrom, by or from any Person alleging liability of whatever kind or nature (including liability or responsibility for the costs of enforcement proceedings, investigations, cleanup, governmental response, removal or remediation, natural resources damages, property damages, personal injuries, medical monitoring, penalties, contribution, indemnification and injunctive relief) arising out of, based on or resulting from: (a) the presence, Release of, or exposure to, any Hazardous Materials; or (b) any actual or alleged non-compliance with any Environmental Law or term or condition of any Environmental Permit.

“Environmental Law” means any applicable Law, and any Governmental Order or binding agreement with any Governmental Authority: (a) relating to pollution (or the cleanup thereof) or the protection of natural resources, endangered or threatened species, human health or safety, or the environment (including ambient air, soil, surface water or groundwater, or subsurface strata); or (b) concerning the presence of, exposure to, or the management, manufacture, use, containment, storage, recycling, reclamation, reuse, treatment, generation, discharge, transportation, processing, production, disposal or remediation of any Hazardous Materials. The term “Environmental Law” includes, without limitation, the following (including their implementing regulations and any state analogs): the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended by the Superfund Amendments and Reauthorization Act of 1986, 42 U.S.C. §§ 9601 et seq.; the Solid Waste Disposal Act, as amended by the Resource Conservation and Recovery Act of 1976, as amended by the Hazardous and Solid Waste Amendments of 1984, 42 U.S.C. §§ 6901 et seq.; the Federal Water Pollution Control Act of 1972, as amended by the Clean Water Act of 1977, 33 U.S.C. §§ 1251 et seq.; the Toxic Substances Control Act of 1976, as amended, 15 U.S.C. §§ 2601 et seq.; the Emergency Planning and Community Right-to-Know Act of 1986, 42 U.S.C. §§ 11001 et seq.; the Clean Air Act of 1966, as amended by the Clean Air Act Amendments of 1990, 42 U.S.C. §§ 7401 et seq.; and the Occupational Safety and Health Act of 1970, as amended, 29 U.S.C. §§ 651 et seq.

“Environmental Notice” means any written directive, notice of violation or infraction, or notice respecting any Environmental Claim relating to actual or alleged non-compliance with any Environmental Law or any term or condition of any Environmental Permit.

“Environmental Permit” means any Permit, letter, clearance, consent, waiver, closure, exemption, decision or other action required under or issued, granted, given, authorized by or made pursuant to Environmental Law.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and the regulations promulgated thereunder.

“ERISA Affiliate” means all employers (whether or not incorporated) that would be treated together with the Company or any of its Affiliates as a “single employer” within the meaning of Section 414 of the Code or Section 4001 of ERISA.

“Estimated Closing Date Balance Sheet” has the meaning set forth in Section 2.03(d).

“Estimated Closing Indebtedness” has the meaning set forth in Section 2.03(d).

“Estimated Net Working Capital Deficit” has the meaning set forth in Section 2.03(e).

“Estimated Net Working Capital Excess” has the meaning set forth in Section 2.03(e).

“Estimated Net Working Capital” has the meaning set forth in Section 2.03(d).

“Estimated Transaction Expenses” has the meaning set forth in Section 2.03(d).

“Escrow Agreement” means that certain stock escrow agreement dated as of the Closing Date by and among Buyer, Seller, and the Transfer Agent.

“Facility Security Clearances” has the meaning set forth in Section 2.03(e).

“FAR” means the Federal Acquisition Regulation, which is codified in Title 48 of the U.S. Code of Federal Regulations.

“FCPA” has the meaning set forth in Section 3.27(b)(iv)(E).

“Final Closing Indebtedness” has the meaning set forth in Section 2.03(g).

“Final Flow of Funds Memorandum.” has the meaning set forth in Section 2.03(d).

“Final Net Working Capital” has the meaning set forth in Section 2.03(g)(iii).

“Final Transaction Expenses” has the meaning set forth in Section 2.03(g)(ii).

“Financial Statements” has the meaning set forth in Section 3.06.

“Fiscal Year 2021” means the period beginning on January 1, 2021 and ending on December 31, 2021.

“Fiscal Year 2022” means the period beginning on January 1, 2022 and ending on December 31, 2022.

“Flow of Funds Memorandum” has the meaning set forth in Section 2.03(d).

“Fundamental Representations” means the representations and warranties set forth in Section 3.01 (“Authority of Seller”) Section 3.02 (“Organization, Authority and Qualification of the Company”) Section 3.03 (“Capitalization”) Section 3.05 (“No Conflicts; Consents”) and Section 3.24 (“Brokers”).

“Funded Backlog” has the meaning set forth in Section 3.27(f)(i).

“GAAP” means United States generally accepted accounting principles.

“Government Bid” means any bid, proposal, offer or quote for supplies, services or construction, whether solicited or unsolicited, made by the Company prior to the Closing Date that, if accepted, would result in a Government Contract.

“Government Contract” means any Contract, prime contract, subcontract, joint venture, basic ordering agreement, other transaction agreement, blanket purchase agreement, pricing agreement, letter contract, award under the Federal Supply Schedule program, purchase order, task order, delivery order or other Contract or similar contract agreement of any kind, between the Company and (a) any Governmental Authority, (b) any prime contractor to a Governmental Authority in its capacity as a prime contractor or (c) any subcontractor (at any tier) with respect to any contract of a type described in clauses (a) or (b) above. A task, purchase, or delivery order under a Government Contract shall constitute a separate Government Contract for purposes of this definition.

“Government Facilities” has the meaning set forth in Section 3.10(c).

“Government Facility” has the meaning set forth in Section 3.10(c).

“Government Furnished Items” has the meaning set forth in Section 3.27(f)(ii).

“Government Vendor Subcontract” means any Contract, agreement or other arrangement between the Company, acting in its capacity as a prime contractor or subcontractor under any Government Contract, and another Person to furnish supplies or services to the Company to be used in performing a Government Contract.

“Governmental Authority” means any federal, state, local or foreign government or political subdivision thereof, or any agency or instrumentality of such government or political subdivision, or any self-regulated organization or other non-governmental regulatory authority or quasi-governmental authority (to the extent that the rules, regulations or orders of such organization or authority have the force of Law), or any arbitrator, court or tribunal of competent jurisdiction.

“Governmental Order” means any order, writ, judgment, injunction, decree, stipulation, determination or award entered by or with any Governmental Authority.

“Gross Profit” means, with respect to any time period, the Company’s Gross Revenue for that time period, less the Company’s costs of goods and services sold for such time period, including without limitation, cost of materials, direct labor, sales commissions, and any other direct project costs that vary with Gross Revenue, all as determined in accordance with GAAP.

“Gross Revenue” means, with respect to any period of time, the Company’s gross receipts from the sale of the goods and services sold to third parties during that period of time, but excluding any receipts from Affiliates of the Company or Seller, or any of their respective directors, officers, employees, or family members.

“Hazardous Materials” means: (a) any material, substance, chemical, waste, product, derivative, compound, mixture, solid, liquid, mineral or gas, in each case, whether naturally occurring or manmade, that is hazardous, acutely hazardous, toxic, or words of similar import or regulatory effect under Environmental Laws; and (b) any petroleum or petroleum-derived products, radon, radioactive materials or wastes, asbestos in any form, lead or lead-containing materials, urea formaldehyde foam insulation, and polychlorinated biphenyls.

“Indebtedness” means, without duplication and with respect to the Company, all (a) indebtedness for borrowed money, whether or not contingent; (b) obligations for the deferred purchase price of property or services (other than Current Liabilities taken into account in the calculation of Closing Working Capital), (c) long or short-term obligations evidenced by notes, bonds, debentures or other similar instruments; (d) obligations under any interest rate, currency swap or other hedging agreement or arrangement; (e) capital lease obligations; (f) reimbursement obligations under any letter of credit, banker's acceptance or similar credit transactions; (g) all obligations of the Company to purchase, redeem, retire, defease or otherwise acquire for value any capital stock, units or other equity interests of the Company or any warrants, rights or options to acquire such capital stock, units or other equity interests, valued, in the case of redeemable equity interests, at the greater of its voluntary or involuntary liquidation preference plus accrued and unpaid dividends, (h) obligations of the Company secured by any lien or Encumbrance, (i) all unfunded obligations under any pension, retirement, retiree medical, deferred compensation, non-qualified retirement, severance, sick leave, vacation leave or paid time off plan, program, agreement or arrangement, and any accrued or earned but unpaid bonuses or commissions related to periods prior to the Closing (in each case including the employer portion of any employment or payroll taxes related thereto) (j) guarantees made by the Company on behalf of any third party in respect of obligations of the kind referred to in the foregoing clauses (a) through (i); and (k) any unpaid interest, prepayment penalties, premiums, costs and fees that would arise or become due as a result of the prepayment of any of the obligations referred to in the foregoing clauses (a) through (j).

“Indemnified Party” has the meaning set forth in Section 8.05.

“Indemnifying Party” has the meaning set forth in Section 8.05.

“Indemnity Claim Notice” has the meaning set forth in Section 8.01.

“Independent Accountants” means Aronson LLC, or, if Aronson LLC is unable or unwilling to serve or as otherwise mutually agreed by Buyer and Seller, an independent accounting firm as mutually agreed upon between Buyer and Seller in good faith. Independent as used in the immediately preceding sentence means the Independent Accountant has no financial existing or pending arrangements with either the Buyer or Seller or had such arrangements within the preceding twelve (12) months for which such Independent shall provide services pursuant to this Agreement.

“Insurance Policies” has the meaning set forth in Section 3.16.

“Intellectual Property” means any and all rights in, arising out of, or associated with any of the following in any jurisdiction throughout the world: (a) issued patents and patent applications (whether provisional or non-provisional), including divisionals, continuations, continuations-in-part, substitutions, reissues, reexaminations, extensions, or restorations of any of the foregoing, and other Governmental Authority-issued indicia of invention ownership (including certificates of invention, petty patents, and patent utility models) (“Patents”); (b) trademarks, service marks, brands, certification marks, logos, trade dress, trade names, and other similar indicia of source or origin, together with the goodwill connected with the use of and symbolized by, and all registrations, applications for registration, and renewals of, any of the foregoing (“Trademarks”); (c) copyrights and works of authorship, whether or not copyrightable, and all registrations, applications for registration, and renewals of any of the foregoing (“Copyrights”); (d) internet domain names and social media account or user names (including “handles”), whether or not Trademarks, all associated web addresses, URLs, websites and web pages, social media sites and pages, and all content and data thereon or relating thereto, whether or not Copyrights; (e) mask works, and all registrations, applications for registration, and renewals thereof; (f) industrial designs, and all Patents, registrations, applications for registration, and renewals thereof; (g) trade secrets, know-how, inventions (whether or not patentable), discoveries, improvements, technology, business and technical information, databases, data compilations and collections, tools, methods, processes, techniques, and other confidential and proprietary information and all rights therein (“Trade Secrets”); (h) computer programs, operating systems, applications, firmware, and other code, including all source code, object code, application programming interfaces, data files, databases, protocols, specifications, and other documentation thereof; (i) rights of publicity; (j) all other intellectual or industrial property and proprietary rights; and (k) the subject matter and all tangible embodiments of any of the foregoing.

“Interim Financial Statements” has the meaning set forth in Section 3.06.

“IP Contributors” has the meaning set forth in Section 5.10(b).

“IT Systems” has the meaning set forth in Section 3.28(a).

“Law” means any statute, law, ordinance, regulation, rule, code, order, constitution, treaty, common law, judgment, decree, other requirement or rule of law of any Governmental Authority.

“Leased Premises” has the meaning set forth in Section 3.10(c).

“Leases” has the meaning set forth in Section 3.10(c).

“Liabilities” has the meaning set forth in Section 3.07.

“Licensed Intellectual Property” means all Intellectual Property in which the Company holds any rights or interests granted by other Persons, including Seller or any of its Affiliates, including Intellectual Property to which the Company has licenses in, to and/or under and that is used or reasonably anticipated to be used by the Company in the conduct of the Company’s business as now conducted and as presently proposed to be conducted, all of the foregoing excluding Company Implied Licenses and Company Intellectual Property.

“Losses” means losses, damages, liabilities, deficiencies, Taxes, Actions, judgments, interest, awards, penalties, fines, costs or expenses of whatever kind, including reasonable attorneys’, accountants’, and other professional advisors’ fees and the cost of enforcing any right to indemnification hereunder and the cost of pursuing any insurance providers; provided, however, that “Losses” shall not include punitive damages, except to the extent actually awarded to a Governmental Authority or other third party.

“Material Adverse Effect” means any event, occurrence, fact, condition or change that is, or could reasonably be expected to become, individually or in the aggregate, materially adverse to (a) the business, results of operations, condition (financial or otherwise) or assets (including Intellectual Property) of the Company, or (b) the ability of Seller or the Company to consummate the transactions contemplated hereby on a timely basis.

“Material Contracts” has the meaning set forth in Section 3.09(a).

“Material Customers” has the meaning set forth in Section 3.15(a).

“Material Suppliers” has the meaning set forth in Section 3.15(b).

“Maximum 2022 Earnout Amount” has the meaning set forth in Section 2.02(b).

“Net Working Capital” means, with respect to the Company (i) total Current Assets (excluding cash and cash equivalents) less (ii) total Current Liabilities, as those categories are determined in accordance with GAAP, as consistently and historically applied by the Company.

“NISPOM” has the meaning set forth in Section 3.27(g).

“Patent Documents” means any and all of the following that are in the possession of Seller or Company or any of its or their attorneys or representatives: (i) prosecution files and docketing reports for any Patents identified in Section 3.12(l) of the Disclosure Schedules (“Company Patents”); (ii) any inventor assignment agreements for the Company Patents; (iii) a list of the names and addresses of each agent or counsel who filed, assisted with, is handing, has prosecuted or is prosecuting any Company Patents; and (iv) all documents, records and files in the possession or control of Seller, its counsel or its agents or any inventor with respect to (A) the conception or reduction to practice of the claims of any of the Company Patents, or (B) the acquisition, prosecution, registration, continuation, continuation-in-part, divisional, reissuance, renewal, extension, correction, enforcement, defense, or maintenance of the Company Patents. Notwithstanding the foregoing, Patent Documents shall not include attorney-client privileged information, attorney work product information, proprietary information of Seller relating to products or services of Seller or information related to patents that are not Company Patents.

“Payment Card Industry Data Security Standard” shall mean the Payment Card Industry Data Security Standard promulgated by the Payment Card Industry Standards Council, including all prior versions and updates thereto and solely to the extent applicable to the Company’s Business.

“Permits” means all permits, licenses, franchises, approvals, authorizations, registrations, certificates, variances and similar rights obtained, or required to be obtained, from Governmental Authorities.

“Person” means an individual, corporation, partnership, joint venture, limited liability company, Governmental Authority, unincorporated organization, trust, association or other entity.

“Personal Data” means any personally identifiable information or any information that is regulated or protected by one or more Privacy and Security Laws applicable to the Company’s Business.

“Personnel Security Clearances” has the meaning set forth in Section 3.27(g).

“Post-Closing Purchase Price Statement” has the meaning set forth in Section 2.03(f)(i).

“Post-Closing Tax Period” means any taxable period beginning after the Closing Date and, with respect to any taxable period beginning before and ending after the Closing Date, the portion of such taxable period beginning after the Closing Date.

“Post-Closing Taxes” means Taxes of the Company for any Post-Closing Tax Period.

“Pre-Closing Period Tax Returns” has the meaning set forth in Section 6.01(c).

“Preferred Bidder Status” has the meaning set forth in Section 3.27(a)(v).

“Privacy and Security Laws” means all applicable Laws concerning the privacy and/or security of personally identifiable information, and all regulations promulgated thereunder, including but not limited to, and solely to the extent applicable to the Company’s Business, the Health Insurance Portability and Accountability Act of 1996, the Health Information Technology for Clinical Health Act provisions of the American Recovery and Reinvestment Act of 2009, Pub. Law No. 111-5, the Gramm-Leach-Bliley Act, the Fair Credit Reporting Act, the Fair and Accurate Credit Transaction Act, the Federal Trade Commission Act, the Privacy Act of 1974, the CAN-SPAM Act, the Telephone Consumer Protection Act, the Telemarketing and Consumer Fraud and Abuse Prevention Act, the Children’s Online Privacy Protection Act, state social security number protection Laws, state data breach notification Laws and state consumer protection Laws, and applicable non-U.S. Laws, including the European General Data Protection Regulation No. 2016/679 dated April 27, 2016 applicable as of May 25, 2018.

“Purchase Price” has the meaning set forth in Section 2.02.

“Real Property” means the real property owned, leased or subleased by the Company, together with all buildings, structures and facilities located thereon.

“Release” means any actual or threatened release, spilling, leaking, pumping, pouring, emitting, emptying, discharging, injecting, escaping, leaching, dumping, abandonment, disposing or allowing to escape or migrate into or through the environment (including, without limitation, ambient air (indoor or outdoor), surface water, groundwater, land surface or subsurface strata or within any building, structure, facility or fixture).

“Released Claims” has the meaning set forth in Section 5.03.

“Released Parties” has the meaning set forth in Section 5.03.

“Releasing Parties” has the meaning set forth in Section 5.03.

“Representative” means, with respect to any Person, any and all directors, officers, employees, consultants, financial advisors, counsel, accountants and other agents of such Person.

“Restricted Business” means blockchain, blockchain ledger development, services related to blockchain and associated technologies and their incorporation in all aspects of the global economy.

“Restricted Period” has the meaning set forth in Section 5.06(a).

“Reviewable Buyer Prepared Tax Return” has the meaning set forth in Section 6.01(d).

“Rollover Agreement” has the meaning set forth in the recitals.

“Rollover Amount” has the meaning set forth in the recitals.

“Rollover Shares” has the meaning set forth in in the recitals.

“Sanctioned Country” means, at any time, a country, region or territory which is itself the subject or target of any Sanctions (at the time of this Agreement, Crimea, Cuba, Iran, North Korea, and Syria).

“Sanctioned Person” means, at any time, (a) any Person listed in any Sanctions-related list of designated Persons maintained by the Office of Foreign Assets Control of the U.S. Department of the Treasury, the U.S. Department of State, or by the United Nations Security Council, the European Union or any European Union member state; (b) any Person operating, organized or resident in a Sanctioned Country; (c) any Person owned or controlled by any such Person or Persons described in the foregoing clauses (a) or (b); or (d) otherwise a target of Sanctions (“target of Sanctions” signifying a person with whom a U.S. Person would be prohibited or restricted by Law from engaging in trade, business, or other activities).

“Sanctions” means all economic or financial sanctions or trade embargoes imposed, administered or enforced from time to time by the U.S. government, including those administered by the Office of Foreign Assets Control (OFAC) of the U.S. Department of the Treasury or the U.S. Department of State (including but not limited to the Laws implemented by OFAC at 31 C.F.R. Parts 500-599), or the United Nations Security Council, the European Union, any European Union member state or Her Majesty’s Treasury of the United Kingdom.

“Seller” has the meaning set forth in the preamble.

“Seller Employment Agreement” has the meaning set forth in Section 2.04(a)(xiv).

“Seller Indemnitees” has the meaning set forth in Section 8.03.

“Seller Taxes” means (i) any and all Taxes due or payable by the Company or imposed on the Company for any Tax period ending on or prior to the Closing Date; (ii) any and all Taxes due or payable by the Company or imposed on the Company for the portion of any Straddle Period ending on the Closing Date (determined in accordance with the principles of Section 6.03); (iii) any and all Taxes of an affiliated, consolidated, combined, unitary or similar group (or any member thereof) for which the Company is liable (including under Treasury Regulation Section 1.1502-6 or any similar provision of state, local or non-U.S. applicable Law) as a result of the Company (or any predecessor of the Company) being a member of (or leaving) such group on or before the Closing Date; (iv) any and all Taxes of another Person imposed on the Company as a transferee or successor, by Contract or otherwise, which Taxes relate to an event or transaction occurring before the Closing; (v) any and all payroll or similar Taxes for all Tax periods (or portions thereof) ending on or before the Closing Date that are deferred under Section 2302 of the CARES Act, the President’s Memorandum of August 8, 2020 Deferring Payroll Tax Obligations in Light of the Ongoing COVID-19 Disaster, IRS Notice 2020-65 or IRS Notice 2021-11 (or, in each case, any analogous provision of applicable state, local or foreign Law) until after the Closing Date; (vi) any Taxes for which Seller is liable pursuant to Section 6.01(b); (vii) any and all amounts required to be paid by the Company or any Company Subsidiary pursuant to any Tax indemnity, Tax sharing or Tax allocation agreement that the Company was a party to prior to the Closing; (viii) any and all Taxes withheld by Buyer pursuant to Section 2.05; (ix) any Loss attributable to any breach of or inaccuracy in any representation or warranty made in Section 3.22 (without regard to any disclosures made in the Disclosure Schedules with respect thereto); provided that Seller Taxes shall not include any Taxes to the extent such Taxes are specifically taken into account in the determination of Net Working Capital, as finally determined pursuant to Section 2.03(f), but were not specifically taken into account in the determination of the Target Net Working Capital.

“Seller's Actual Knowledge” means the actual knowledge of Seller, Kathryn Steele, or Robert Schlicher.

“Sexual Harassment” means any acts or statements, separately or in the aggregate, that (i) create a sexually hostile work environment under applicable federal, state or local law; (ii) imply or expressly state that providing sexual favors is a condition of the individual to receive a material employment benefit (e.g., wage increase, bonus, promotion, initial employment); (iii) constitute criminal assault or battery, including sexual assault, or rape; or (iv) otherwise constitute unwelcome physical contact.

“Shares” has the meaning set forth in the recitals.

“Software” means computer software, including (a) object code, (b) Source Code, (c) executable code, (d) software development tools, including software development kits, related flow charts, architecture documents, and diagrams, (e) application programming interfaces, (f) assemblers and compilers; (g) data files, (h) software libraries, (i) device drivers, (j) databases and database schema, and (k) firmware. The term “Software” also includes user manuals, developers’ documentation, and related instructional materials for any subject matter identified in the foregoing sentence.

“Source Code” means computer programming code that can be printed out (or displayed) in a form readable and understandable by a programmer of ordinary skill in the applicable programming language(s).

“Statutory Representations” means the representations and warranties set forth in Section 3.12 (“Intellectual Property”), Section 3.19 (“Environmental Matters”), Section 3.20 (“Employee Benefit Matters”), Section 3.22 (“Taxes”), and Section 3.27 (“Government Contract Matters”).

“Survival Date” has the meaning set forth in Section 8.01.

“Target Net Working Capital” means $350,000.

“Taxes” means all (a) federal, state, local, foreign and other taxes, charges, withholdings, deductions at source, fees, levies, customs, imposts, duties and governmental fees or other like assessments or charges of any kind whatsoever (including income, gross receipts, sales, use, value added, production, ad valorem, transfer, documentary, franchise, business privilege, transaction, title, recording, registration, profits, license, lease, service, service use, withholding, payroll (including social security contributions), employment, unemployment, alternative or add-on minimum, estimated, excise, severance, environmental, stamp, occupation, premium, property (real or personal), real property gains, capital, paid-up capital, federal highway use, commercial rent, environmental, windfall profits, or other taxes and any liability under unclaimed property, escheat, or similar Laws), and (b) any interest, additions or penalties (and any interest in respect of such additions or penalties) imposed by any Governmental Authority with respect to (i) any item described in clause (a) or (ii) the failure to comply with any requirement with respect to any Tax Return.

“Tax Claim” has the meaning set forth in Section 6.03.

“Tax Return” means any return, declaration, form, report, claim for refund, information return or statement or other document filed or required to be filed with any Governmental Authority relating to Taxes, including any schedule or attachment thereto, and including any amendment thereof.

“Teaming Agreement” means each teaming or joint venture agreement to which the Company is a party (i) with respect to which the applicable term has not yet expired, (ii) which has not been terminated pursuant to its terms, or (iii) which has not been superseded by the award of the Contract for which the teaming agreement was entered into.

“Territory” means globally.

“Third Party Claim” has the meaning set forth in Section 8.05(a).

“Trade Compliance Laws” means any requirement of Law relating to the regulation of exports, re-exports, imports, transfers, releases, shipments, transmissions or any other provision of goods, technology, Software or services, including: (a) Laws enforced by U.S. Customs and Border Protection; (b) the Arms Export Control Act (22 U.S.C. §§ 2778 et seq.), and the International Traffic in Arms Regulations (22 C.F.R. Parts 120-130); (c) the Export Control Reform Act of 2018 and the Export Administration Regulations (15 C.F.R. Parts 730-734.); (d) the U.S. anti-boycott Laws administered by the U.S. Department of Commerce’s BIS and the U.S. Department of the Treasury’s International Revenue Service; (e) any Law, executive order or implementing regulations of the U.S. Department of the Treasury Office of Foreign Assets Controls (31 C.F.R. Parts 500-599), and Sanctions; and (f) all other Laws concerning exports and imports.

“Transaction Expenses” means to the extent unpaid prior to the Closing and without duplication: (A) the investment banking, legal, accounting and other professional fees, costs and expenses incurred by the Company or Seller on or before the Closing Date in connection with the transactions contemplated by this Agreement; and (B) all amounts (plus any associated employer-side payroll Taxes required to be paid by Company with respect thereto) payable by the Company whether immediately or in the future, under any “change of control,” stock appreciation rights, transaction bonus, retention, termination, compensation, severance or other similar arrangements established by the Company prior to the Closing, in each case where the amount is payable as a result of the consummation of the transactions contemplated by this Agreement, (collectively, the “Transaction Payments”).

“Transfer Agent” means Issuer Direct Corporation.

“Unfunded Backlog” has the meaning set forth in Section 3.27(f)(i).

“Union” has the meaning set forth in Section 3.21(b).

“Upward Post-Closing Purchase Price Adjustment” has the meaning set forth in Section 2.03(i).

“WARN Act” means the federal Worker Adjustment and Retraining Notification Act of 1988, and similar state, local and foreign laws related to plant closings, relocations, mass layoffs and employment losses.

ARTICLE II

PURCHASE AND SALE

Section 2.01 Purchase and Sale. Subject to the terms and conditions set forth herein, at the Closing, Seller shall sell to Buyer, and Buyer shall purchase from Seller, the Shares, free and clear of all Encumbrances, for the consideration specified in Section 2.02.

Section 2.02 Purchase Price. In full payment for the Shares and in consideration of Seller’s covenants and agreements in this Agreement and the Ancillary Documents, Buyer shall pay or cause to be paid at Closing (the “Closing Payment”), in the manner described in Section 2.03: (i) cash consideration in the amount of Seven Million Five Hundred Thousand Dollars ($7,500,000.00) (the “Closing Cash Consideration”); plus (ii) the Rollover Amount, in the form of Buyer Rollover Stock (collectively, with the Closing Cash Consideration, the “Base Purchase Price”); minus (iii) the amount of Estimated Closing Indebtedness; minus (iv) the Estimated Transaction Expenses; plus (v) the Estimated Net Working Capital Excess, if any, minus (vi) the Estimated Net Working Capital Deficit, if any. The term “Purchase Price” means the Base Purchase Price; plus (a) the Deferred Consideration paid pursuant to Section 2.02(a); plus (c) the amount of any 2022 Earnout Consideration, as determined pursuant to Section 2.02(b), all as adjusted pursuant to Section 2.03.

(a) Deferred Consideration. Following the Closing, Buyer shall pay to One Million Five Hundred Thousand Dollars ($1,500,000.00) (the “Deferred Consideration”), subject to any setoff exercised by Buyer in accordance with this Agreement, upon the date that is twenty-four (24) months following the Closing Date.

(b) 2022 Earnout Consideration. Seller shall be eligible to receive from Buyer up to Four Million Dollars ($4,000,000.00) (the “Maximum 2022 Earnout Amount”), subject to any setoff exercised by Buyer in accordance with this Agreement, pursuant to the terms and conditions set forth below in this Section 2.02(b). The actual amount of any consideration earned by Seller pursuant to this Section 2.02(b) based on Gross Revenue of the Company is referred to as the “2022 Gross Revenue Earnout Consideration,” and the actual amount of any consideration earned by Seller pursuant to this Section 2.02(b) based on Gross Profit of the Company is referred to as the “2022 Gross Profit Earnout Consideration.”

(i) If (a) the Gross Revenue of the Company for Fiscal Year 2022 is equal to or greater than $3,500,000 and less than $4,000,000, Seller shall be entitled to receive from Buyer an amount equal to Five Hundred Thousand Dollars ($500,000.00), and (b) the Gross Profit of the Company for Fiscal Year 2022 is equal to or greater than $1,500,000 and less than $1,750,000, Seller shall be entitled to receive from Buyer an amount equal to Five Hundred Thousand Dollars ($500,000.00).

(ii) If (a) the Gross Revenue of the Company for Fiscal Year 2022 is equal to or greater than $4,000,000 and less than $4,500,000, Seller shall be entitled to receive from Buyer an amount equal to One Million Dollars ($1,000,000.00), and (b) the Gross Profit of the Company for Fiscal Year 2022 is equal to or greater than $1,750,000 and less than $2,250,000, Seller shall be entitled to receive from Buyer an amount equal to One Million Dollars ($1,000,000.00).

(iii) If (a) the Gross Revenue of the Company for Fiscal Year 2022 is equal to or greater than $4,500,000 and less than $5,000,000, Seller shall be entitled to receive from Buyer an amount equal to One Million Five Hundred Thousand Dollars ($1,500,000.00), and (b) the Gross Profit of the Company for Fiscal Year 2022 is equal to or greater than $2,250,000 and less than $2,750,000, Seller shall be entitled to receive from Buyer an amount equal to One Million Five Hundred Thousand Dollars ($1,500,000.00).

(iv) If (a) the Gross Revenue of the Company for Fiscal Year 2022 is equal to or greater than $5,000,000 and less than $6,000,000, Seller shall be entitled to receive from Buyer an amount equal to One Million Seven Hundred Fifty Thousand Dollars ($1,750,000.00), and (b) the Gross Profit of the Company for Fiscal Year 2022 is equal to or greater than $2,750,000 and less than $3,750,000, Seller shall be entitled to receive from Buyer an amount equal to One Million Seven Hundred Fifty Thousand Dollars ($1,750,000.00).

(v) If (a) the Gross Revenue of the Company for Fiscal Year 2022 is equal to or greater than $6,000,000, Seller shall be entitled to receive from Buyer an amount equal to Two Million Dollars ($2,000,000.00), and (b) the Gross Profit of the Company for Fiscal Year 2022 is equal to or greater than $3,750,000, Seller shall be entitled to receive from Buyer an amount equal to Two Million Dollars ($2,000,000.00).

(vi) For the avoidance of doubt, if (a) the Gross Revenue of the Company for Fiscal Year 2022 is less than $3,500,000, the 2022 Gross Revenue Earnout Consideration shall be equal to Zero Dollars ($0.00), and (b) the Gross Profit of the Company for Fiscal Year 2022 is less than $1,500,000, the 2022 Gross Profit Earnout Consideration shall be equal to Zero Dollars ($0.00). In no event shall (1) the 2022 Gross Revenue Earnout Consideration exceed Two Million Dollars ($2,000,000.00), (2) the 2022 Gross Profit Earnout Consideration exceed Two Million Dollars ($2,000,000.00), or (3) 2022 Earnout Consideration exceed the Maximum Earnout Amount. Buyer’s obligation to pay each of the 2022 Gross Revenue Earnout Consideration and the 2022 Gross Profit Earnout Consideration as set forth in this Section 2.02(b) is an independent obligation of Buyer, and no satisfaction of any condition precedent to the payment of either the 2022 Gross Revenue Earnout Consideration or the 2022 Gross Profit Earnout Consideration shall be considered the satisfaction of the other 2022 Earnout Consideration.

(vii) Determination and Payment of 2022 Earnout Consideration. Upon the earlier of (a) fourteen (14) Business Days following Seller’s submission of its annual report on Form 10-K to the U.S. Securities and Exchange Commission, or (b) one hundred eighty (180) days following the end of Fiscal Year 2022, Buyer will prepare and deliver to Seller a report setting forth, in reasonable detail, a computation of the Gross Revenue of the Company for Fiscal Year 2022 (the “2022 Revenue Report”). Unless Seller, within thirty (30) days after receipt of the 2022 Revenue Report, notifies Buyer in writing that it objects to the computation of Gross Revenue set forth therein, the 2022 Revenue Report shall be deemed accepted by Seller and shall be binding and conclusive for all purposes of this Agreement. If Seller delivers a written objection in such thirty (30) day period, in reasonable detail, to the computation of Gross Revenue set forth in the 2022 Revenue Report, the amount of Gross Revenue shall be determined through good faith negotiation between Seller and Buyer. If Seller and Buyer are unable to reach agreement on the disputed matter(s) within thirty (30) days following Buyer’s receipt of Seller’s written notice of objection in accordance with this Section, the determination of the disputed matters shall be resolved by way of the Dispute Resolution Procedure. Upon the final determination of the 2022 Earnout Consideration due in accordance with this Section 2.02(b), if any, Buyer shall pay to Seller no later than forty-five (45) days after the date of such final determination the aggregate amount of such 2022 Earnout Consideration due by wire transfer of immediately available funds (or such other method agreed to between Buyer and Seller) to the account designated by Seller in Seller’s wire instructions included in the Final Flow of Funds Memorandum or such other account as Seller may designate in writing to Buyer at least three (3) Business Days prior to the date of any 2022 Earnout Consideration payment.

Section 2.03 Closing and Payments at Closing.

(a) Closing. Subject to the terms and conditions of this Agreement, the closing of the transactions contemplated by this Agreement shall take place at a closing (the “Closing”) to be held no more than five (5) days following the date on which the conditions to Closing set forth in ARTICLE VII have been satisfied or waived (other than conditions which, by their nature, are to be satisfied on the Closing Date), remotely by exchange of documents and signatures (or their electronic counterparts), or at such other time or on such other date or at such other place as Seller and Buyer may mutually agree upon in writing (the day on which the Closing takes place being the “Closing Date”). To the extent permitted by Law and GAAP, for Tax and accounting purposes, the parties shall treat the Closing as being effective as of 11:59 p.m. Eastern Time on the Closing Date (the “Effective Time”).

(b) Closing Cash Consideration. At the Closing, with respect to the Closing Cash Consideration, Buyer is causing or is itself undertaking to do each of the following:

(i) pay any unpaid Estimated Transaction Expenses identified in the Final Flow of Funds Memorandum that have not been paid by the Company or Seller prior to the Closing (provided that the amount of any such payments shall be deducted from the Base Purchase Price in accordance with Section 2.02, and provided further that the aggregate amount of the Transaction Payments included on the Final Flow of Funds Memorandum shall be paid to the Company for the Company to remit to the applicable recipients (net of all applicable withholding Taxes including any employer-side payroll Taxes payable by the Company) and the amount of such Tax withholdings and Taxes payable by the Company shall be paid by the Company to the appropriate Tax authorities);

(ii) pay any unpaid Estimated Closing Indebtedness identified in the Final Flow of Funds Memorandum that is payable to a Person (provided that the amount of any such payments shall be deducted from the Base Purchase Price in accordance with Section 2.02);

(iii) pay to Seller, the Closing Payment (excluding the Rollover Amount, which will be delivered pursuant to Section 2.03(c)). The amount of the Closing Payment that is payable to Seller shall be set forth on the Final Flow of Funds Memorandum.

The foregoing payments at the Closing shall be made to such Persons, in such accounts and according to such wire instructions and other payment instructions as set forth in the Final Flow of Funds Memorandum.

(c) Buyer Rollover Stock. At the Closing, the Buyer shall deliver to Seller (i) a determination of the Average Price as of the Closing Date and the resulting number of Buyer Rollover Stock, and (ii) evidence of the request of the book entry Buyer Rollover Stock in the name of Seller, and within five (5) Business Days following Closing Buyer shall deliver to Seller evidence of the book entry Buyer Rollover Stock in the name of Seller, which Buyer Rollover Stock shall be held in escrow with the Transfer Agent for a period of twenty-four (24) months following the Closing as security, in part, for any claims by a Buyer Indemnitee for indemnification under this Agreement (the “Stock Indemnity Escrow”), to be released in accordance with the terms of the Escrow Agreement and Section 8.11. Seller acknowledges that the Buyer Rollover Stock shall be subject to restriction on transfer at all times while held in the Stock Indemnity Escrow and that the book entry for the Buyer Rollover Stock shall reflect such restriction on transfer and the Stock Indemnity Escrow arrangement.

(d) Closing Payment Certificate and Flow of Funds Memorandum. At least three (3) Business Days prior to the Closing Date, the chief executive officer of the Company and Seller shall prepare and deliver to Buyer a certificate signed by the Company and Seller certifying the Company’s and Seller’s good faith estimate (including all calculations in reasonable detail) of: (i) the Net Working Capital as of the Effective Time (prepared in accordance with GAAP applied on a consistent basis with the Company’s past practice (the “Estimated Net Working Capital”) along with an estimated unaudited balance sheet of the Company as of the Closing Date (the “Estimated Closing Date Balance Sheet”, prepared in accordance with GAAP applied on a consistent basis with the Company’s past practice, (ii) the amount of Indebtedness as of the Closing Date (the “Estimated Closing Indebtedness”) together with payoff letters, in form and substance reasonably satisfactory to Buyer, from each holder of any such Indebtedness that is payable to a Person, which letter specifies the aggregate amount required to be paid in order to repay in full the Indebtedness related to such payoff letter and payment instructions, (iii) the amount of unpaid Transaction Expenses to be paid at the Closing (the “Estimated Transaction Expenses”), including a schedule of the amounts to be paid to each recipient of a Transaction Payment (and the amount of all applicable withholding Taxes including any employer-side payroll Taxes associated therewith), and payment instructions with respect to each party to which such Transaction Expenses are to be paid, and (iv) based on the foregoing, the amount of the Closing Payment to be paid to Seller (collectively items (i) through (iv), the “Flow of Funds Memorandum”). These calculations shall be used in connection with Buyer’s payments described in Section 2.03(b). The Flow of Funds Memorandum shall contain wire transfer instructions for each of the forgoing payments. The Flow of Funds Memorandum delivered by the Company and Seller, and agreed to and countersigned by Buyer, is referred to herein as the “Final Flow of Funds Memorandum.”

(e) Preliminary Adjustment to Closing Payment. For purposes of determining the components of the Closing Payment with respect to Net Working Capital, if the Estimated Net Working Capital is less than the Target Net Working Capital, then such excess of Target Net Working Capital over Estimated Net Working Capital shall constitute the “Estimated Net Working Capital Deficit”, and if the Estimated Net Working Capital is greater than the Target Net Working Capital, then such excess of Estimated Net Working Capital over Target Net Working Capital shall constitute the “Estimated Net Working Capital Excess”.

(f) Determination of Final Purchase Price.

(i) Within ninety (90) days after the Closing Date, Buyer shall prepare and deliver to Seller a balance sheet of the Company as of the Effective Time (the “Closing Balance Sheet”) and a statement (the “Post-Closing Purchase Price Statement”) setting forth Buyer’s calculation of the Indebtedness outstanding as of the Closing Date, the Transaction Expenses outstanding as of the Closing Date, and Net Working Capital as of the Effective Time, which shall be prepared in accordance with this Section 2.03(f) and include reasonable support for the calculations made therein. The Net Working Capital as of the Effective Time and the Closing Balance Sheet will be prepared in accordance with GAAP applied on a consistent basis.

(ii) If Seller disagrees with the Closing Balance Sheet or the Post-Closing Purchase Price Statement, Seller may, within thirty (30) days after its receipt of the Closing Balance Sheet and the Post-Closing Purchase Price Statement, provide written notice thereof to Buyer (the “Dispute Notice”), which shall indicate each item that Seller disputes in the Closing Balance Sheet and the Post-Closing Purchase Price Statement and provide reasonable detail (to the extent available to Seller) of the basis for such dispute. During such 30-day period and any subsequent time period in which the Closing Balance Sheet or the Post-Closing Purchase Price Statement is being disputed as provided in this Section 2.03(f), Buyer shall provide Seller and its Representatives with access to such work papers relating to the preparation of the Closing Balance Sheet and the Post-Closing Purchase Price Statement, as may be reasonably necessary to permit Seller to review in reasonable detail the manner in which the Closing Balance Sheet and the Post-Closing Purchase Price Statement was prepared, and all information received pursuant to this Section 2.03(f) shall be kept confidential pursuant to this Agreement by the party receiving it.

(iii) Unless Seller delivers a Dispute Notice within the 30-day period following delivery of the Closing Balance Sheet and the Post-Closing Purchase Price Statement, the Closing Balance Sheet and the Post-Closing Purchase Price Statement (and calculations of Indebtedness, Transaction Expenses, and Net Working Capital thereon) shall be conclusively deemed final and binding upon Buyer, the Company, and Seller for purposes of this Section 2.03.

(iv) For thirty (30) days after receipt by Buyer of a Dispute Notice, Buyer and Seller shall use good faith efforts to resolve the disputed items set forth on the Dispute Notice between themselves and, if they are able to resolve all of such disputed items during such time period, the Post-Closing Purchase Price Statement (and calculations of Indebtedness, Transaction Expenses, Net Working Capital thereon) shall be revised to the extent necessary to reflect such resolution, and as so revised shall be conclusively deemed final and binding upon Buyer, the Company, and Seller for purposes of this Section 2.03.

(v) If Buyer and Seller are unable to resolve all of the disputed items set forth on a Dispute Notice within such thirty (30) day period (or such longer period as the parties may mutually agree in writing at such time), then upon written request of either party, the parties shall resolve the dispute by way of the Dispute Resolution Procedure.

(g) For purposes of this Section 2.03:

(i) the Indebtedness outstanding as of the Closing Date, as finally determined pursuant to Section 2.03(f), shall be referred to as the “Final Closing Indebtedness”;

(ii) the Transaction Expenses, as finally determined pursuant to Section 2.03(f), shall be referred to as the “Final Transaction Expenses”; and

(iii) the Net Working Capital as of the Effective Time, as finally determined pursuant to Section 2.03(f), shall be referred to as the “Final Net Working Capital”.

(h) Post-Closing Purchase Price Adjustment.

(i) The Purchase Price shall be:

(A) reduced, on a dollar-for-dollar basis, by the amount (if any) by which the Final Net Working Capital is less than the Estimated Net Working Capital, or increased, on a dollar-for dollar basis, by the amount (if any) by which the Final Net Working Capital is greater than the Estimated Net Working Capital;

(B) reduced, on a dollar-for-dollar basis, by the amount (if any) by which the Final Closing Indebtedness is greater than the Estimated Closing Indebtedness, or increased, on a dollar-for dollar basis, by the amount (if any) by which the Final Closing Indebtedness is less than the Estimated Closing Indebtedness; and

(C) reduced, on a dollar-for-dollar basis, by the amount (if any) by which the Final Transaction Expenses are greater than the Estimated Transaction Expenses, or increased, on a dollar-for dollar basis, by the amount (if any) by which the Final Transaction Expenses are less than the Estimated Transaction Expenses.

(i) Without duplication, all reductions or increases set forth in Section 2.03(h)(i) shall be aggregated and the Purchase Price shall be reduced by such aggregate amount (a “Downward Post-Closing Purchase Price Adjustment”) or increased by such aggregate amount (an “Upward Post-Closing Purchase Price Adjustment”), accordingly. If:

(i) there is an Upward Post-Closing Purchase Price Adjustment, then, within five (5) Business Days after the date on which the Purchase Price is finally determined pursuant to Section 2.03(f), (A) Buyer shall pay to Seller an amount equal to the Upward Post-Closing Purchase Price Adjustment by wire transfer of immediately available funds (pursuant to Seller’s wire instructions included in the Final Flow of Funds Memorandum); or

(ii) there is a Downward Post-Closing Purchase Price Adjustment, then, within five (5) Business Days after the date on which the Purchase Price is finally determined pursuant to Section 2.03(f), Seller shall pay to Buyer by wire transfer of immediately available funds pursuant to Buyer’s wire transfer instructions provided to Seller an amount equal to Downward Post-Closing Purchase Price Adjustment within five (5) Business Days after the later of (1) the date on which the Purchase Price is finally determined pursuant to Section 2.03(f) or (2) the date on which Buyer provides its wiring instructions for such payment. If Seller fails to make any payment required pursuant to this Section within such five (5) day period, Buyer shall have the right, at Buyer’s option and in Buyer’s sole discretion, to satisfy the amount of any Downward Post-Closing Purchase Price Adjustment by setoff, offset, and reduction of any amounts otherwise due to Seller pursuant to this Agreement or any Ancillary Document, including without limitation on account of the Buyer Rollover Stock, the Deferred Consideration, or the 2022 Earn Out Consideration.

Section 2.04 Closing Deliverables.

(a) Seller and Company Closing Deliverables. At the Closing, the Company or Seller, as appropriate, shall deliver to Buyer:

(i) stock certificates evidencing the Shares, free and clear of all Encumbrances, duly endorsed in blank or accompanied by stock powers or other instruments of transfer duly executed in blank, with all required stock transfer tax stamps affixed thereto;

(ii) all corporate records of the Company, including without limitation all stock records, shareholders records, minute books, and recording of proceedings of the Company;

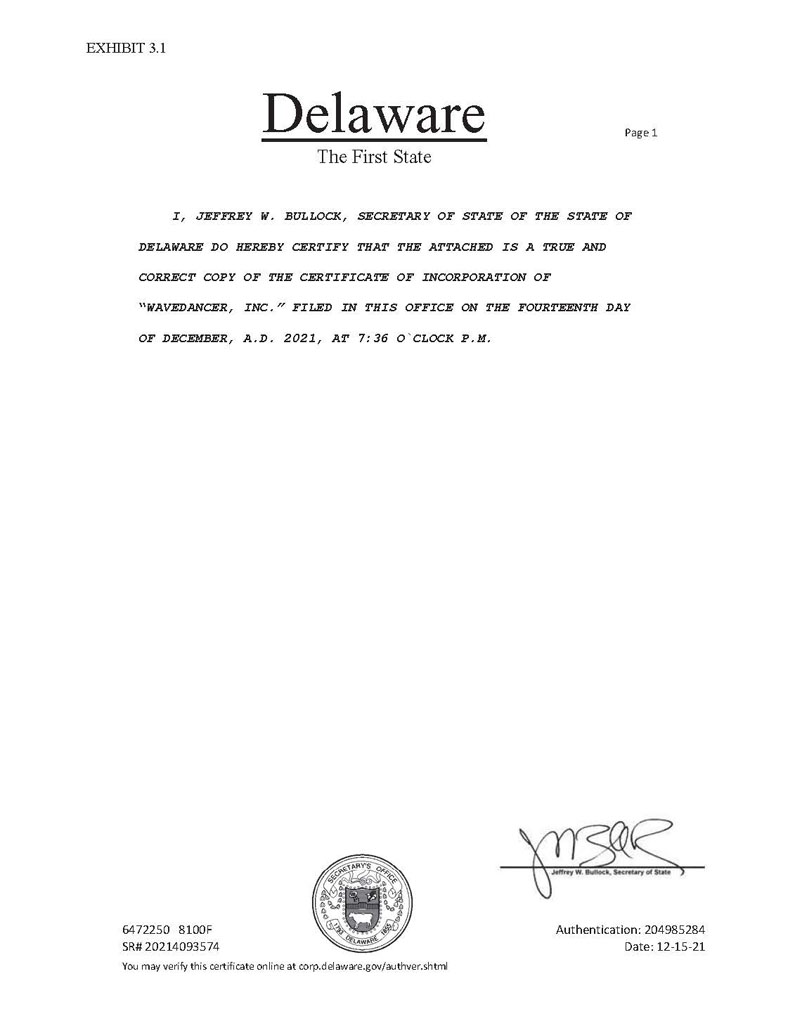

(iii) (1) a copy of resolutions of the Company’s board of directors and shareholders authorizing the execution, delivery and performance of this Agreement, the Ancillary Documents, and the transactions contemplated hereby and thereby, as certified as being current and complete by the Company’s secretary (or equivalent officer) (2) a copy of the Company’s certificate of incorporation, as amended, as in effect as of the Closing and certified by the Secretary of State of the State of Delaware, and (3) a copy of the Company’s bylaws in effect as of the Closing, as certified as being current and complete by the Company’s secretary (or equivalent officer);

(iv) a good standing certificate issued by (1) the Secretary of State of the State of Delaware, (2) the Maryland State Department of Assessments and Taxation, and (3) of the proper office in each state other than the State of Delaware in which the Company is qualified to do business as a foreign corporation, each dated no more than fifteen (15) days before the Closing;

(v) the Final Flow of Funds Memorandum executed by the Company and Seller;

(vi) payoff letters and evidence of the release of all Encumbrances with respect to the Indebtedness to be paid at Closing pursuant to Section 2.03(b)(ii), in form and substance reasonably satisfactory to Buyer;

(vii) resignations, effective immediately following the Closing, of each officer and director of the Company as required by Buyer;

(viii) evidence of the termination of: (1) all Affiliate transactions of the Company, and (2) all transactions identified by Buyer prior to Closing, each of (1) and (2) in full without any consideration or further liability to the Company and in a form and substance reasonably acceptable to Buyer;

(ix) executed copies of the consents from the Persons identified by Buyer prior to Closing;

(x) an IRS Form W-9 completed by Seller;

(xi) the Rollover Agreement, duly executed by Seller;

(xii) the Escrow Agreement, duly executed by Seller;

(xiii) suitable documentation for the control of all bank and other financial accounts of the Company, as prescribed by Buyer;

(xiv) an employment agreement between Seller and the Company or Buyer (in Buyer’s discretion), in the form attached hereto as Exhibit B (the “Seller Employment Agreement”), duly executed by Seller;

(xv) a patent assignment (the “Patent Assignment”), duly executed by Seller and Robert Schlicher, in form and substance satisfactory to Buyer in its sole and absolute discretion, which Patent Assignment assigns U.S. Provisional Patent Application No. 63/183,744, Filing Date May 4, 2021, Title “Secure Blockchain Supply Management System and Method of Use,” to Company and identifies Robert Schlicher as an

inventor thereof;

(xvi) a copy of a notice of recordation issued by the U.S. Patent and Trademark Office evidencing the recordation of the Patent Assignment;

(xvii) an assignment, consent, and release agreement, duly executed by Isaac Valentin, the Company, and Seller, releasing the Company from any liability associated with the Investment Matter (as defined below), in form and substance satisfactory to Buyer in its sole and absolute discretion;

(xviii) evidence in form and substance satisfactory to Buyer that the Merger Transaction (as defined below) was properly effectuated;

(xix) a certificate duly executed by Seller, dated as of the Closing Date, stating that the conditions to the obligations of Buyers set forth in Section 7.01(a) and Section 7.01(b) have been satisfied; and

(xx) such other documents and agreements to effectuate the transactions contemplated by this Agreement as Buyer may reasonably request.