September 14, 2017 |

Chicago New York Washington, DC London San Francisco Los Angeles Singapore vedderprice.com

Renee M. Hardt Shareholder +1 312 609 7616 rhardt@vedderprice.com |

|

Via Edgar

Ms. Deborah

O’Neal-Johnson

|

| Re: | The Oberweis Funds Post-Effective Amendment No. 56 |

| (File Nos. 033-09093 and 811-04854) |

Dear Ms. O’Neal-Johnson:

On behalf of The Oberweis Funds (the “Trust”), this letter is in response to the comments you provided on July 26, 2017 during our telephone conference regarding the post-effective amendment filing of the Trust made on June 7, 2017.

| 1. | General |

Comment: Please confirm supplementally whether the Oberweis Small-Cap Value Fund (the “Fund”) may charge a sales load.

Response: The Fund may not charge a sales load.

| 2. | Fees and Expenses of the Fund |

| a. | Comment: Please provide a completed fee table and expense examples with the Trust’s response letter. |

Response: The completed fee table and expense examples are attached hereto as Appendix A.

| b. | Comment: Please explain how the “grandfathering” of the redemption fee and exchange fee described in footnote 1 will operate. |

Response: The Registrant has determined not to impose a redemption fee or exchange fee for the Fund. Accordingly, the referenced footnote has been deleted.

| c. | Comment: The Principal Investment Strategies section states that the Fund may hold money market funds. Please consider whether the expense limitation should exclude acquired fund fees and expenses (“AFFE”). Also confirm whether AFFE should be reflected in the fee table. |

Response: The expense limitation agreement and related prospectus disclosure have been revised to exclude AFFE. The Fund will disclose AFFE in the fee table as required by Form N-1A, Item 3, as applicable.

222 North LaSalle Street | Chicago, Illinois 60601 | T +1 312 609 7500 | F +1 312 609 5005 |

| Vedder Price P.C. is affiliated with Vedder Price LLP, which operates in England and Wales, Vedder Price (CA), LLP, which operates in California, and Vedder Price Pte. Ltd., which operates in Singapore |

Ms. Deborah O’Neal-Johnson

September 14, 2017

Page 2

| d. | Comment: Footnote 3 states that the expense limitation agreement expires on April 30, 2018. Please remove the references to the expense reimbursement in the fee table since the expense limitation is in effect for less than one year. |

Response: The footnote has been revised to reflect that the expense limitation is in effect through April 30, 2019.

| e. | Comment: With respect to footnote 3, clarify whether an amendment to the expense limitation agreement could include termination of the agreement. Please also clarify if the reference to the Fund in the sentence regarding amendment should be to the Board. |

Response: The disclosure has been revised to state that an amendment to the expense limitation agreement may not include termination of the agreement. The disclosure has also been revised to state that any amendment is subject to Board approval.

| f. | Comment: With respect to footnote 3, please clarify that expenses may only be recouped within three years of the date of the waiver. |

Response: As disclosed in the footnote, expenses may only be recouped during the term of the agreement (which is through April 30, 2019). Accordingly, expenses could not be recouped for up to three years.

| 3. | Fund Performance |

| a. | Comment: Please provide completed performance information with the Trust’s response letter. |

Response: The completed performance information is attached hereto as Appendix B.

| b. | Comment: Footnote 2 includes references to a prior reorganization. Please consider using different terminology here to avoid confusion with the reorganization of the Cozad Small Cap Value Fund into the Fund. |

Response: The footnote has been revised to remove the defined terms which use “Reorganization” and to refer to the limited partnership by name throughout and to refer to July 1, 2014 rather than the Reorganization.

* * *

Ms. Deborah O’Neal-Johnson

September 14, 2017

Page 3

Please call me at (312) 609-7616 if you have any questions.

Very truly yours,

/s/ Renee M. Hardt

Renee M. Hardt

RMH/ser

| cc: | Patrick B. Joyce James A. Arpaia |

Appendix A

Shareholder Fees

(Fees paid directly from your investments)

| Redemption Fee as a percentage of amount redeemed within 90 calendar days of purchase | None |

| Exchange Fee as a percentage of amount exchanged within 90 calendar days of purchase | None |

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

| Management Fees | 1.00 | % | ||

| Distribution and/or Service (12b-1) Fees | None | |||

| Other Expenses | .73 | %(1) | ||

| Total Annual Fund Operating Expenses | 1.73 | % | ||

| Fee Waiver and Expense Reimbursement | (.43 | )%(2) | ||

| Total Annual Fund Operating Expenses After Expense Reimbursement | 1.30 | % |

| (1) | “Other Expenses” have been estimated because the Institutional Class shares have no operating history as of the date hereof. |

| (2) | The Fund’s adviser has a contractual arrangement with the Fund to reimburse it for total annual fund operating expenses in excess of 1.30% of average daily net assets, excluding any interest, taxes, brokerage commissions, acquired fund fees and expenses and extraordinary expenses (the ‘‘expense limitation’’). The contractual arrangement continues until April 30, 2019. Except for termination, the contractual arrangement may be amended at any time by the mutual written consent of the Fund’s adviser and the Fund, subject to approval by the Board of Trustees of the Oberweis Trust. The Fund’s adviser may recoup the amount of any expenses reimbursed during the term of the contract if the recoupment does not cause the Fund’s expenses to exceed the expense limitation in place at the time of the reimbursement or currently, whichever is less. |

Example

The example below is intended to help you compare the cost of investing in the Fund. The example assumes you invest $10,000 in the Fund for the time periods indicated (based on information in the tables above) and then either redeem or do not redeem your shares at the end of a period. The example assumes that your investment has a 5% return each year and that the Fund’s expenses remain at the level shown in the table above. Expense caps are taken into account for the period stated in the table above. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | $132 |

| 3 Years | $503 |

| 5 Years | $898 |

| 10 Years | $2,005 |

| Appendix A – Page 1 |

Appendix B

Performance Information

Both the bar chart and the table assume that all distributions have been reinvested. Performance reflects expense limitations, if any, in effect during the periods presented. If any such expense limitations were not in place, performance would be reduced.

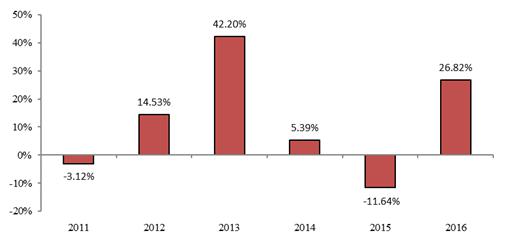

Predecessor Fund — Class I — Annual Total Return (for calendar years ended December 31)

The Predecessor Fund’s calendar year-to-date total return for Class I shares as of June 30, 2017 was 0.14%.

During the periods shown in the bar chart, the Predecessor Fund’s highest and lowest calendar quarterly returns were 15.38% and -18.23%, respectively, for the quarters ended December 31, 2011 and September 30, 2011.

|

Average

Annual Total Returns | |||

|

1 Year |

5 Years |

Since | |

| Predecessor Fund – Class I Shares(1) | |||

| Return Before Taxes | 26.82% | 13.98% | 13.37%(2) |

| Return After Taxes on Distributions(1) | 26.53% | 13.67% | 13.13%(2) |

| Return After Taxes on Distributions and Sale of Fund Shares | 15.43% | 11.19% | 10.84%(2) |

| Russel 2000 Value Index (reflects no deduction for fees, expenses or taxes) |

31.74% | 15.07% | 8.24%(2) |

| (1) | The Predecessor Fund acquired all of the assets and liabilities of Cozad Small Cap Value Fund I, LP in a tax-free reorganization on July 1, 2014. As a result of the different tax treatment of Cozad Small Cap Value Fund I, LP, we are unable to calculate after-tax returns for the periods prior to July 1, 2014. Cozad Small Cap Value Fund I, LP did not have a distribution policy. It was an unregistered limited partnership, did not qualify as a regulated investment company for federal income tax purposes and it did not pay dividends and distributions. |

| (2) | Since September 30, 2010. |

| Appendix B – Page 1 |