As filed with the Securities and Exchange Commission on October 6, 2023

File No. 333-

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

¨

Pre-Effective Amendment No. ____

¨ Post-Effective Amendment No. ____

THE OBERWEIS

FUNDS

(Exact Name of Registrant as Specified in Charter)

c/o Oberweis Asset Management, Inc.

3333 Warrenville Road, Suite 500

Lisle, Illinois 60532

(Address of Principal Executive Offices, Zip Code)

Registrant’s Telephone Number, including Area Code (800) 323-6166

Eric V. Hannemann

Oberweis Asset Management, Inc.

3333 Warrenville Road, Suite 500

Lisle, Illinois 60532

(Name and Address of Agent for Service)

Copy to:

| Renee M. Hardt Vedder Price P.C. 222 North LaSalle Street, Suite 2600 Chicago, Illinois 60601 |

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

TITLE OF SECURITIES BEING REGISTERED: Institutional Class Shares of Beneficial Interest (no par value) of the Oberweis Internaitonal Opportunities Fund.

No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940.

It is proposed that this filing will become effective on November 5, 2023 pursuant to Rule 488 under the Securities Act of 1933.

Important Information for

Oberweis International Opportunities Institutional Fund Shareholders

At a special meeting of shareholders of Oberweis International Opportunities Institutional Fund (the “Target Fund”), a series of The Oberweis Funds (the “Trust”), you will be asked to vote upon an important change affecting your fund. The purpose of the special meeting is to allow you to vote on a reorganization of your fund into Oberweis International Opportunities Fund (the “Acquiring Fund”), another series of the Trust. If the reorganization is approved and completed, you will become a shareholder of the Acquiring Fund. The Target Fund and the Acquiring Fund are collectively referred to herein as the “Funds” or individually as a “Fund.”

Although we recommend that you read the complete Proxy Statement/Prospectus, for your convenience, we have provided the following brief overview of the matter to be voted on.

| Q. | Why am I receiving this Proxy Statement/Prospectus? |

| A. | The shareholders of the Target Fund are being asked to approve a reorganization between the Target Fund and the Acquiring Fund pursuant to an Agreement and Plan of Reorganization, as described in more detail in this Proxy Statement/Prospectus. |

| Q. | Why has the reorganization been proposed for the Target Fund? |

| A. | Oberweis Asset Management, Inc. (“OAM”), each Fund’s investment adviser, has proposed the reorganization of the Target Fund into the Acquiring Fund because OAM believes that it is more effective to operate one international opportunities fund with a multi-class structure rather than two international opportunities funds with different fee structures. The Acquiring Fund has the same investment objective and principal investment strategies as the Target Fund, and the share class of the Acquired Fund into which the Target Fund would reorganize will have the same fee structure as the Target Fund. Given these similarities and the potential for economies of scale, the Board of Trustees believes that it is in the best interests of the Target Fund to reorganize the Target Fund into the Acquiring Fund. |

| Q. | What are the similarities between the principal investment strategies of the Funds? |

| A. | The investment objectives of the Funds are identical. The investment objective of each Fund is to maximize long-term capital appreciation. The Funds have the same principal investment strategies. Each Fund invests, under normal circumstances, at least 80% of its net assets in securities of companies based outside the United States. Each Fund invests principally in the common stocks of companies that OAM believes have the potential for significant long-term growth in market value. There are no differences in the risks of the Funds. A more detailed comparison of the investment objectives, strategies and risks of the Funds is contained in the Proxy Statement/Prospectus. |

| Q. | How do total operating expenses compare between the two Funds? |

| A. | Currently, the management fee of the Acquiring Fund is higher than the management fee of the Target Fund. However, in connection with its approval of the reorganization and subject to the approval of the reorganization by Target Fund shareholders, the Board of Trustees approved lowering the management fee of the Acquiring Fund to match that of the Target Fund. In addition, the total operating expenses of the Acquiring Fund’s Institutional Class shares immediately following the reorganization are expected to be the same as the total and net operating expenses of the Target Fund. |

| Q. | Will Target Fund shareholders receive new shares in exchange for their current shares? |

| A. | Yes. If shareholders approve the reorganization and it is completed, each Target Fund shareholder will receive newly-created Institutional Class shares of the Acquiring Fund in an amount equal in total value to the total value of the Target Fund shares surrendered by such shareholder. |

| Q. | Will this reorganization create a taxable event for Target Fund shareholders? |

| A. | No. The reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. It is expected that Target Fund shareholders will recognize no gain or loss for federal income tax purposes as a direct result of the reorganization. Prior to the closing of the reorganization, the Target Fund expects to distribute all of its net investment income and net capital gains, if any. Such a distribution may be taxable to the Target Fund’s shareholders for federal income tax purposes. |

| Q. | Who will bear the costs of the reorganization? |

| A. | The costs of the reorganization will be paid by OAM. |

| Q. | What is the timetable for the reorganization? |

| A. | If approved by shareholders on December 21, 2023, the reorganization is expected to occur at the close of business on December 22, 2023. |

| Q. | What will happen if shareholders do not approve the reorganization? |

| A. | If the reorganization is not approved by shareholders, the Board of Trustees will take such actions as it deems to be in the best interests of the Target Fund, which may include additional solicitation, or continuing to operate the Target Fund as a stand-alone fund. |

| Q. | Whom do I call if I have questions? |

| A. | If you need any assistance, or have any questions regarding the proposal or how to vote your shares, please call Okapi Partners, your proxy solicitor, at (877) 629-6357 from 8:00 a.m. to 7:00 p.m. Central time on Monday through Friday or 11:00 a.m. to 4:00 p.m. Central time on Saturday. Please have your proxy materials available when you call. |

| Q. | How do I vote my shares? |

| A. | You may vote by mail or over the Internet: |

| · | To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. |

| · | To vote by phone, call the toll-free number provided on your proxy card and follow the instructions, using your proxy card as a guide. |

| · | To vote over the Internet, go to the Internet address provided on your proxy card and follow the instructions, using your proxy card as a guide. |

| Q. | Will OAM contact me? |

| A. | You may receive a call from representatives of Okapi Partners, the proxy solicitation firm retained by OAM on behalf of the Target Fund, to answer any questions you may have about the reorganization and to help facilitate your vote. |

| Q. | How does the Board of Trustees suggest that I vote? |

| A. | After careful consideration, the Board of Trustees has agreed unanimously that the reorganization is in the best interests of your Fund and recommends that you vote “FOR” the reorganization. |

november __, 2023

Oberweis International opportunities Institutional Fund

NOTICE OF SPECIAL

MEETING OF SHAREHOLDERS

TO BE HELD ON DECEMBER 21, 2023

To the Shareholders:

Notice is hereby given that a special meeting of shareholders of Oberweis International Opportunities Institutional Fund (the “Target Fund”), a series of The Oberweis Funds (the “Trust”), a Massachusetts business trust, will be held at the offices of Oberweis Asset Management, Inc., 3333 Warrenville Road, Suite 500, Lisle, IL, 60532, on December 21, 2023 at 9:00 a.m., Central time (the “Special Meeting”), for the following purposes:

1. To approve an Agreement and Plan of Reorganization (and the related transactions) which provides for: (a) the transfer of all the assets of the Target Fund to Oberweis International Opportunities Fund (the “Acquiring Fund”), in exchange solely for voting Institutional Class shares of beneficial interest, no par value, of the Acquiring Fund (“Acquiring Fund Shares”) and the assumption by the Acquiring Fund of all the liabilities of the Target Fund; and (b) the distribution of the Acquiring Fund Shares to the shareholders of the Target Fund in complete liquidation of the Target Fund and the termination and dissolution of the Target Fund thereafter, all upon the terms and conditions set forth in this Agreement (the “Reorganization”).

2. To transact such other business as may properly come before the Special Meeting.

Only shareholders of record as of the close of business on October 23, 2023 are entitled to vote at the Special Meeting or any adjournments thereof.

All shareholders are cordially invited to attend the Special Meeting. In order to avoid delay and additional expense, and to assure that your shares are represented, please vote as promptly as possible, whether or not you plan to attend the Special Meeting. You may vote by mail, telephone or over the Internet.

| · | To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. |

| · | To vote by phone, call the toll-free number provided on your proxy card and follow the instructions, using your proxy card as a guide. |

| · | To vote over the Internet, go to the Internet address provided on your proxy card and follow the instructions, using your proxy card as a guide. |

| Thomas P. Joyce | |

| Secretary |

Proxy Statement/Prospectus

Dated November __, 2023

Relating to the Acquisition of the Assets and Liabilities of

OBERWEIS INTERNATIONAL OPPORTUNITIES INSTITUTIONAL FUND

by OBERWEIS INTERNATIONAL OPPORTUNITIES FUND

This Proxy Statement/Prospectus is being furnished to shareholders of Oberweis International Opportunities Institutional Fund (the “Target Fund”), a series of The Oberweis Funds (the “Trust”), a Massachusetts business trust and an open-end investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and relates to the special meeting of shareholders of the Target Fund to be held at the offices of Oberweis Asset Management, Inc. (“OAM”), 3333 Warrenville Road, Suite 500, Lisle, Illinois, 60532, on December 21, 2023 at 9:00 a.m., Central time and at any and all adjournments thereof (the “Special Meeting”). This Proxy Statement/Prospectus is provided in connection with the solicitation by the Board of Trustees of the Trust (the “Board”) of proxies to be voted at the Special Meeting, and any and all adjournments or postponements thereof. The purpose of the Special Meeting is to consider the proposed reorganization (the “Reorganization”) of the Target Fund into Oberweis International Opportunities Fund (the “Acquiring Fund”), another series of the Trust. The Target Fund and the Acquiring Fund are referred to herein collectively as the “Funds” and individually as a “Fund.” If shareholders approve the Reorganization and it is completed, shareholders of the Target Fund will receive Institutional Class shares of the Acquiring Fund, with the same total value as the total value of the Target Fund shares surrendered by such shareholders, in each case determined as of the close of regular trading on the New York Stock Exchange on the date the Reorganization closes. The Board has determined that the Reorganization is in the best interests of the Target Fund. The address, principal executive office and telephone number of the Funds and the Trust is 3333 Warrenville Road, Suite 500, Lisle, Illinois, 60532, (800) 323-6166.

The enclosed proxy and this Proxy Statement/Prospectus are first being sent to shareholders of the Target Fund on or about November ___, 2023. Shareholders of record as of the close of business on October 23, 2023 are entitled to vote at the Special Meeting and any adjournments thereof.

_________________________

The Securities and Exchange Commission has not approved or disapproved these securities or determined whether the information in this Proxy Statement/Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

_________________________

This Proxy Statement/Prospectus concisely sets forth the information shareholders of the Target Fund should know before voting on the Reorganization (in effect, investing in the Acquiring Fund) and constitutes an offering of voting Institutional Class shares of beneficial interest, no par value, of the Acquiring Fund. Please read it carefully and retain it for future reference.

The following documents contain additional information about the Funds, have been filed with the SEC and are incorporated into this Proxy Statement/Prospectus by reference:

| (1) | the Statement of Additional Information relating to the proposed Reorganization, dated November __, 2023 (the “Reorganization SAI”); |

| (2) | the audited financial statements contained in the Acquiring Fund’s Annual Report, only insofar as they relate to the Acquiring Fund, for the fiscal year ended December 31, 2022; |

| (3) | the audited financial statements contained in the Target Fund’s Annual Report, only insofar as they relate to the Target Fund, for the fiscal year ended December 31, 2022; |

| (4) | the unaudited financial statements contained in the Acquiring Fund’s Semi-Annual Report, only insofar as they relate to the Acquiring Fund, for the period ended June 30, 2023; and |

| (5) | the unaudited financial statements contained in the Target Fund’s Semi-Annual Report, only insofar as they relate to the Target Fund, for the period ended June 30, 2023. |

No other parts of the documents referenced above are incorporated by reference herein.

The financial highlights for the Acquiring Fund contained in the Acquiring Fund’s Semi-Annual Report for the period ended June 30, 2023 are attached to this Prospectus/Proxy Statement as Appendix I.

Copies of the foregoing may be obtained without charge by calling or writing the Funds at the telephone number or address shown above. If you wish to request the Reorganization SAI, please ask for the “Reorganization SAI.” In addition, the Acquiring Fund will furnish, without charge, a copy of its most recent annual report and semi-annual report to a shareholder upon request. Any such request should be directed to the Acquiring Fund by calling (800) 323-6166 or by writing the Acquiring Fund at 3333 Warrenville Road, Suite 500, Lisle, Illinois 60532.

The Trust is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act, and in accordance therewith files reports and other information with the SEC. Reports, proxy statements, registration statements and other information filed by the Trust (including the registration statement relating to the Acquiring Fund on Form N-14 of which this Proxy Statement/Prospectus is a part) may be obtained, with payment of a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549. You may also access reports and other information about the Funds on the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON DECEMBER 21, 2023.

This Notice of Special Meeting of Shareholders and the Proxy Statement/Prospectus are available on the Internet at www.OkapiVote.com/Oberweis. On this website, you will be able to access the Notice of Special Meeting of Shareholders, the Proxy Statement/Prospectus and any amendments or supplements to the foregoing material that are required to be furnished to shareholders.

Table of Contents

- i -

The following is a summary of, and is qualified by reference to, the more complete information contained in this Proxy Statement/Prospectus and the information attached hereto or incorporated herein by reference, including the Agreement and Plan of Reorganization. As discussed more fully below and elsewhere in this Proxy Statement/Prospectus, the Board believes the proposed Reorganization is in the best interests of each Fund and that the interests of each Fund’s existing shareholders would not be diluted as a result of the Reorganization. If the Reorganization is approved and completed, shareholders of the Target Fund will become Institutional Class shareholders of the Acquiring Fund and will cease to be shareholders of the Target Fund.

Shareholders should read the entire Proxy Statement/Prospectus carefully together with the Acquiring Fund’s Prospectus that accompanies this Proxy Statement/Prospectus, which is incorporated herein by reference. This Proxy Statement/Prospectus constitutes an offering of Institutional Class shares of the Acquiring Fund only.

OAM has proposed the Reorganization because OAM believes that it is more effective to operate one international opportunities fund with a multi-class structure rather than two international opportunities funds with different fee structures. The Acquiring Fund has the same investment objective and principal investment strategies as the Target Fund, and the share class of the Acquired Fund into which the Target Fund would reorganize will have the same fee structure as the Target Fund. Given these similarities and the potential for economies of scale, the Board of Trustees believes that it is in the best interests of the Target Fund to reorganize the Target Fund into the Acquiring Fund.

This Proxy Statement/Prospectus is being furnished to shareholders of the Target Fund in connection with the proposed combination of the Target Fund with and into the Acquiring Fund pursuant to the terms and conditions of the Agreement and Plan of Reorganization entered into by the Trust, on behalf of the Target Fund and the Acquiring Fund, and OAM (the “Agreement”). The Agreement provides for: (1) the transfer of all the assets of the Target Fund to Oberweis International Opportunities Fund (the “Acquiring Fund”), in exchange solely for voting Institutional Class shares of beneficial interest, no par value, of the Acquiring Fund (“Acquiring Fund Shares”) and the assumption by the Acquiring Fund of all the liabilities of the Target Fund; and (2) the distribution of the Acquiring Fund Shares to the shareholders of the Target Fund in complete liquidation of the Target Fund and the termination and dissolution of the Target Fund thereafter.

If shareholders approve the Reorganization and it is completed, Target Fund shareholders will become Institutional Class shareholders of the Acquiring Fund. The Board has determined that the Reorganization is in the best interests of the Target Fund and that the interests of existing shareholders will not be diluted as a result of the Reorganization. The Board unanimously approved the Reorganization and the Agreement at a meeting held on October 2, 2023. The Board recommends a vote “FOR” the Reorganization.

OAM will pay the expenses incurred in connection with the Reorganization.

The Board is asking shareholders of the Target Fund to approve the Reorganization at the Special Meeting to be held on December 21, 2023. Approval of the Reorganization requires the affirmative vote of Target Fund shareholders entitled to vote more than 50% of the total number of shares outstanding and entitled to be cast. See “Voting Information and Requirements” below.

2

If shareholders of the Target Fund approve the Reorganization, it is expected that the closing of the Reorganization (the “Closing”) will occur at the close of business on December 22, 2023 (the “Closing Date”), but it may be at a different time as described herein. If the Reorganization is not approved, the Board will take such action as it deems to be in the best interests of the Target Fund. The Closing may be delayed and the Reorganization may be abandoned at any time by the mutual agreement of the parties. In addition, either Fund may at its option terminate the Agreement at or before the Closing due to (1) a breach by any other party of any representation, warranty, or agreement contained in the Agreement to be performed at or before the Closing, if not cured within 30 days and prior to the Closing, (2) a condition precedent to the obligations of the terminating party that has not been met and it reasonably appears that it will not or cannot be met, or (3) a determination by the Board that the consummation of the transactions contemplated by the Agreement is not in the best interests of a Fund.

Reasons for the Proposed Reorganization

The Board believes that the proposed Reorganization would be in the best interests of each Fund. In approving the Reorganization, the Board considered a number of principal factors in reaching its determination, including the following:

| · | the fact that the Funds’ investment objectives and principal investment strategies are the same; |

| · | the fact that the Funds’ principal risks are the same; |

| · | the Funds’ relative sizes; |

| · | the relative investment performance of the Funds; |

| · | the relative fees and expense ratios of the Funds; |

| · | the anticipated federal income tax-free nature of the Reorganization; |

| · | the expected costs of the Reorganization and that the Funds would not bear any of such costs; |

| · | the terms of the Reorganization and whether the Reorganization would dilute the interests of shareholders of the Funds; |

| · | the effect of the Reorganization on shareholder services and shareholder rights; and |

| · | alternatives to the Reorganization. |

For a more detailed discussion of the Board’s considerations regarding the approval of the Reorganization, see “The Board’s Approval of the Reorganization.”

Distribution, Purchase, Redemption, Exchange of Shares and Dividends

The Target Fund and the Institutional Class of the Acquiring Fund will have identical procedures for purchasing, exchanging and redeeming shares. Each Fund normally declares and pays dividends from net investment income, if any, annually. For each Fund, any net capital gains are normally distributed at least once a year. See “Comparison of the Funds—Distribution, Purchase, Redemption, Exchange of Shares and Dividends” below for a more detailed discussion.

3

Material Federal Income Tax Consequences of the Reorganization

As a condition to closing, the Funds will receive an opinion from Vedder Price P.C. (which will be based on certain factual representations and certain customary assumptions and exclusions) substantially to the effect that the Reorganization will qualify as a “reorganization” under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, it is expected that neither Fund will recognize gain or loss for federal income tax purposes as a direct result of the Reorganization. It is also expected that shareholders of the Target Fund who receive solely Acquiring Fund Shares pursuant to the Reorganization will recognize no gain or loss for federal income tax purposes as a result of such exchange. Prior to the closing of the Reorganization, the Target Fund expects to declare a distribution of all its net investment income and net capital gains, if any. Such a distribution may be taxable to the Target Fund’s shareholders for federal income tax purposes. For a more detailed discussion of the federal income tax consequences of the Reorganization, please see “The Proposed Reorganization—Material Federal Income Tax Consequences” below.

The Funds have identical investment objectives. Each Fund’s investment objective is to maximize long-term capital appreciation. Each Fund’s investment objective is fundamental and cannot be changed without the approval of shareholders of the Fund.

Principal Investment Strategies

The Target Fund and the Acquiring Fund have the same principal investment strategies and principal risks, which are:

Each Fund invests, under normal circumstances, at least 80% of its net assets in securities of companies based outside the United States. Currently, securities based outside the United States include (1) equity securities of companies that are organized under other than U.S. laws or that are primarily traded on an exchange or over-the-counter outside of the United States; or (2) equity securities of companies that have at least 50% of their assets based outside the United States or that derive at least 50% of their revenues from business activities outside of the United States.

Each Fund invests principally in the common stocks of companies that OAM believes have the potential for significant long-term growth in market value. The Fund may invest in Chinese securities acquired through the Shanghai-Hong Kong Stock Connect.

Each Fund seeks to invest in those companies which OAM considers to have above-average long-term growth potential. OAM selects companies which meet this criteria based on, among other things, fundamental analysis of individual securities. OAM’s fundamental analysis entails an evaluation of an individual company’s future growth prospects. OAM’s evaluation may be based on, among other things, financial statement analysis, stock valuation in relation to OAM’s estimate of future earnings, evaluation of competitive product or service offerings, future research and development pipeline and management interviews. OAM may actively trade the Funds’ portfolios, and as a result, the Funds’ portfolio turnover rates may be high. There are no restrictions on the capitalization of companies whose securities the Funds may buy; however, the Funds generally invest in the stocks of smaller companies (generally companies with a market capitalization of less than $5 billion). Each Fund may also invest in securities of countries in developed and developing (or emerging) markets. Each Fund generally will invest less than 25% of its assets in securities of countries in emerging markets.

4

Each Fund seeks to invest in equity securities that typically exhibit the following characteristics:

Under-Appreciated Revenue and Earnings Growth – potential for revenue and/or earnings growth in excess of consensus expectations.

Timely Catalyst – a recent positive earnings release or an earnings surprise that tangibly and quantitatively begins to confirm that consensus analyst expectations are too low.

Inflection Point of Change – a business that is experiencing change – often from a new product, a new management team or a regulatory change – as these changes can drive unexpected or underestimated growth. A significant gap generally exists between OAM’s forecasts and consensus analyst expectations.

Limited Analyst Coverage – a company not widely followed by other analysts to maximize the chances of finding misunderstood situations.

Sustainability – a sustainable business with a competitive position driven by niche market leadership, intellectual capital or unique manufacturing processes. Put another way, a reasonable barrier to competitive entry.

Operating Leverage – profitable and scalable business model, which tends to generate rising net profits margins as revenue growth accelerates.

Valuation – undervalued based on OAM’s growth forecasts and historical valuation metrics afforded the company and/or peers.

Comparison of Principal Investment Strategies

The investment objectives of the Funds are the same, and the Funds employ the same investment strategies to achieve their investment objectives. In evaluating the Reorganization, each Target Fund shareholder should consider the risks of investing in the Acquiring Fund. The principal risks of investing in the Acquiring Fund, which are the same as the principal risks of the Target Fund, are described in the section below entitled “Risk Factors.”

The tables below provide information about the fees and expenses attributable to each Fund, and the pro forma fees and expenses of the combined fund. Excepted as noted below, shareholder fees reflect the fees currently in effect for each Fund as of their semi-annual period ended June 30, 2023. Excepted as noted below, the pro forma fees and expenses are based on the amounts shown in the table for each Fund, assuming the Reorganization occurred as of June 30, 2023.

5

Shareholder Fees

(Fees paid directly from your investments)

| Target Fund | Acquiring Fund | Combined Fund Pro Forma | ||||||||||

| Redemption Fee as a percentage of amount redeemed within 90 calendar days of purchase | 2.00 | % | 2.00 | % | 2.00 | % | ||||||

| Exchange Fee as a percentage of amount exchanged within 90 calendar days of purchase | 2.00 | % | 2.00 | % | 2.00 | % | ||||||

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

| Target Fund | Acquiring Fund-Institutional Class | Combined Fund-Institutional Class Pro Forma | ||||||||||

| Management Fees | 1.00 | % | 1.25 | % | 1.00 | %3 | ||||||

| Distribution and/or Service (12b-1) Fees | .00 | % | .00 | % | .00 | % | ||||||

| Other Expenses | .21 | % | .42 | % | .24 | %4 | ||||||

| Acquired Fund Fees and Expenses | .00 | % | .00 | % | .00 | % | ||||||

| Total Annual Fund Operating Expenses Before Expense Reimbursement | 1.21 | %1 | 1.67 | %2 | 1.24 | %5 | ||||||

| Expense Reimbursement | .11 | % | .32 | % | .14 | % | ||||||

| Total Annual Fund Operating Expenses After Expense Reimbursement | 1.10 | % | 1.35 | % | 1.10 | % | ||||||

| 1 | The Target Fund’s adviser has a contractual arrangement with the Fund to reimburse it for total annual fund operating expenses in excess of 1.10% of average daily net assets, excluding any interest, taxes, brokerage commissions and extraordinary expenses (the “expense limitation”). The contractual arrangement continues until April 30, 2024. Except with respect to termination, The contractual arrangement may be amended at any time by the mutual written consent of the adviser and the Fund. The adviser may recoup the amount of any expenses reimbursed under the contract within three years if the recoupment does not cause the Fund’s expenses to exceed the expense limitation in place at the time of the recoupment or at the time of the reimbursement, whichever is lower. |

| 2 | The Acquiring Fund’s adviser has a contractual arrangement with the Fund to reimburse it for total annual fund operating expenses in excess of 1.10% of average daily net assets, excluding any interest, taxes, brokerage commissions and extraordinary expenses (the “expense limitation”). The contractual arrangement continues until April 30, 2025. Except with respect to termination, the contractual arrangement may be amended at any time by the mutual written consent of the adviser and the Fund. The adviser may recoup the amount of any expenses reimbursed under the contract within three years if the recoupment does not cause the Fund’s expenses to exceed the expense limitation in place at the time of the recoupment or at the time of the reimbursement, whichever is lower. |

| 3 | Management fees have been restated to reflect the Board’s approval of a decrease in the management fee subject to Target Fund shareholder approval of the Reorganization and effective upon the closing of the Reorganization. |

| 4 | “Other Expenses” have been estimated because the Institutional Class shares have no operating history as of the date hereof. |

| 5 | The Acquiring Fund’s adviser has a contractual arrangement with the Fund to reimburse it for total annual fund operating expenses in excess of 1.10% of average daily net assets, excluding any interest, taxes, brokerage commissions and extraordinary expenses (the “expense limitation”). The contractual arrangement continues until April 30, 2025. Except with respect to termination, the contractual arrangement may be amended at any time by the mutual written consent of the adviser and the Fund. The adviser may recoup the amount of any expenses reimbursed under the contract within three years if the recoupment does not cause the Fund’s expenses to exceed the expense limitation in place at the time of the recoupment or at the time of the reimbursement, whichever is lower. |

6

Example

The example below is intended to help you compare the cost of investing in each Fund and the pro forma cost of investing in the combined fund. The example assumes you invest $10,000 in a Fund for the time periods indicated (based on information in the tables above) and then either redeem or do not redeem your shares at the end of a period. The example assumes that your investment has a 5% return each year and that a Fund’s expenses remain at the level shown in the table above. Expense caps are taken into account for the period stated in the table above. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Target Fund | Acquiring Fund- Institutional Class | Combined Fund-Institutional Class Pro Forma | ||||||||||

| 1 Year | $ | 112 | $ | 163 | $ | 112 | ||||||

| 3 Years | $ | 358 | $ | 564 | $ | 358 | ||||||

| 5 Years | $ | 623 | $ | 991 | $ | 623 | ||||||

| 10 Years | $ | 1,378 | $ | 2,192 | $ | 1,377 | ||||||

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in a greater amount of taxes on shareholders when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect each Fund’s performance. The Funds’ portfolio turnover rates for the most recent fiscal year and semi-annual period are set forth below.

| Fund | Fiscal Year Ended | Rate | Semi-Annual Period Ended | Rate | ||||||||

| Target Fund | 12/31/22 | 77 | % | 6/30/23 | 68 | % | ||||||

| Acquiring Fund | 12/31/22 | 74 | % | 6/30/23 | 69 | % | ||||||

In evaluating the Reorganization, you should consider carefully the risks of the Acquiring Fund to which you will be subject if the Reorganization is approved and completed. These risks are the same as the risks to which you are currently subject to as a shareholder of the Target Fund. Investing in a mutual fund involves risk, including the risk that you may receive little or no return on your investment or even that you may lose part or all of your investment. Because of these and other risks, you should consider an investment in the Acquiring Fund to be a long-term investment. An investment in the Acquiring Fund may not be appropriate for all shareholders.

The biggest risk is that the Fund’s returns may vary, and you could lose money by investing in the Fund. Because the Fund may invest substantially all of its assets in common stocks, the main risk is that the value of the stocks it holds might decrease in response to the activities of an individual company or in response to general market and/or economic conditions. If this occurs, the Fund’s share price may also decrease.

7

The Fund is designed for long-term investors who seek growth of capital and who can tolerate the greater risks associated with seeking maximum capital appreciation. Investment in common stocks, particularly in common stocks of small- and medium-sized companies with high growth potential, can be volatile. The value of the Fund’s shares will go up and down due to movement of the overall stock market or of the value of the individual securities held by the Fund. The value of each security held by the Fund may decline in response to conditions affecting the general economy; political, social, or economic instability at the local, regional, or global level; pandemics, epidemics and other similar circumstances in one or more countries or regions; and currency and interest rate fluctuations. Because of this volatility, we recommend that you invest in the Fund as a long-term investment only, and only for a portion of your investment portfolio, not for all of it. There can be no assurance that the Fund’s objective will be met.

As noted above, because the Funds have substantially similar investment strategies, the principal risks of each Fund are the same. The principal risks of investing in the Acquiring Fund are described below.

Small-sized Company Risk. The Fund is subject to small company risk, because although there are no restrictions on the capitalization of companies whose securities the Fund may buy, the Fund generally invests in small-sized companies. Although the Fund seeks to reduce risk by investing in a diversified portfolio, you must realize that investing in smaller, and often newer, companies involves greater risk than there usually is with investing in larger, more established companies. Smaller and newer companies often have limited product lines, markets, management personnel, research and/or financial resources. The securities of small companies, which may be thinly capitalized, may not be as marketable as those of larger companies. Therefore the securities of these smaller, newer companies may be subject to more abrupt or erratic market movements than the securities of larger companies or the market averages in general.

Equity Securities Risk. Equity securities are susceptible to general stock market fluctuations and to volatile increases and decreases in value. The equity securities held by the Fund may experience sudden, unpredictable drops in value or long periods of decline in value. This may occur because of factors affecting securities markets generally, or a particular company.

Risks Associated with Non-U.S. Companies. Investments by the Fund in the securities of non-U.S. issuers involve certain additional investment risks different from those of U.S. issuers. These risks include: possibility of political or economic instability of the country of issue, possibility of disruption to international trade patterns, possibility of currency risk, possibility of currency exchange controls, imposition of foreign withholding taxes, seizure or nationalization of foreign deposits or assets, and adoption of adverse foreign government trade restrictions. There may be less publicly available information about an Asian company than about a U.S. company. Sometimes Asian companies are subject to different accounting, auditing, and financial reporting standards, practices and requirements than U.S. companies. There is generally less government regulation of stock exchanges, brokers and listed companies abroad than in the U.S., which may result in less transparency with respect to a company’s operations. The absence of negotiated brokerage in certain countries may result in higher brokerage fees.

Emerging Markets Risk. In addition to the risks associated with non-U.S. companies in developing or emerging markets, there is a possibility of expropriation, nationalization, confiscatory taxation or diplomatic developments that could affect investments in those countries. In addition, political and economic structures in emerging markets countries may be new and developing rapidly, which may cause instability. Emerging markets countries are also more likely to experience high levels of inflation, deflation or currency devaluations, which could hurt their economies and securities markets.

8

Currency Risk. Currency risk is the risk that fluctuations in exchange rates may adversely affect the U.S. dollar value of a fund’s investments. Currency risk includes both the risk that currencies in which a fund’s investments are traded will decline in value relative to the U.S. dollar. Currency rates in foreign countries may fluctuate significantly for a number of reasons, including the forces of supply and demand in the foreign exchange markets, actual or perceived changes in interest rates, intervention (or the failure to intervene) by U.S. or foreign governments or central banks, or currency political developments in the United States or abroad. The Fund may incur currency conversion costs (being the spread between buying and selling of the currency) and subject to exchange rate fluctuation risks in any such currency conversion, which may adversely affect the market value of the Fund’s investments.

Technology Sector Risk. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. Like other technology companies, information technology companies may have limited product lines, markets, financial resources or personnel. The products of information technology companies may face product obsolescence due to rapid technological developments and frequent new product introduction, unpredictable changes in growth rates and competition for the services of qualified personnel. Technology companies and companies that rely heavily on technology, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Companies in the information technology sector are heavily dependent on patent and intellectual property rights. The loss or impairment of these rights may adversely affect the profitability of these companies. Finally, while all companies may be susceptible to network security breaches, certain companies in the information technology sector may be particular targets of hacking and potential theft of proprietary or consumer information or disruptions in service, which could have a material adverse effect on their businesses. These risks are heightened for information technology companies in foreign markets.

Consumer Discretionary Sector Risk. Because companies in the consumer discretionary sector manufacture products and provide discretionary services directly to the consumer, the success of these companies is tied closely to the performance of the overall domestic and international economy, interest rates, competition and consumer confidence. Success depends heavily on disposable household income and consumer spending. Changes in demographics and consumer tastes also can affect the demand for, and success of, consumer discretionary products in the marketplace.

Portfolio Turnover Risk. In the past, the Fund has experienced high rates of portfolio turnover, which results in above average transaction costs and the payment by shareholders of taxes on above-average amounts of recognized investment gains, including net short-term capital gains, which are taxed as ordinary income for federal income tax purposes when distributed to shareholders.

Fundamental Investment Restrictions

The Funds have identical fundamental investment restrictions that cannot be changed without shareholder approval. In addition, each Fund is a diversified fund.

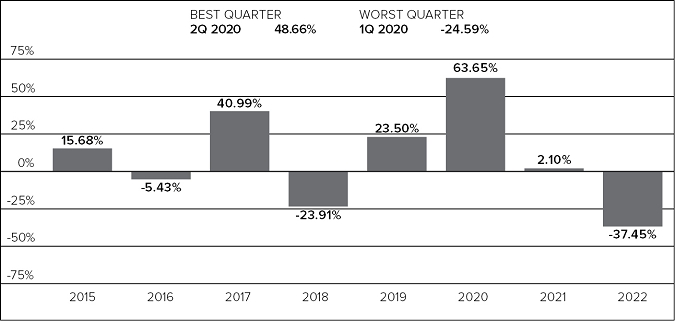

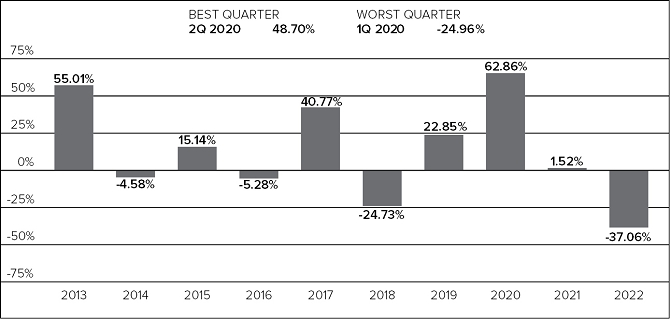

The total returns of the Funds for the periods ended December 31, 2022, based on historical fees and expenses for each period, are set forth in the bar charts and tables below. Performance shown for the Acquiring Fund is that of the Investor Class shares which have higher expenses than the Institutional Class shares of the Acquiring Fund. Institutional Class shares performance is not shown because the Institutional Class shares have no operating history as of the date hereof.

The following bar charts and tables provide some indication of the potential risks of investing in each Fund. Each Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at www.oberweisfunds.com or by calling (800) 245-7311.

9

The bar charts below show the annual calendar year returns for each Fund. The tables below compare each Fund’s average annual returns for the periods indicated to broad-based securities market index(es). The table also shows returns on a before and after tax basis. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your individual tax situation and may differ from those shown. The after-tax return information shown does not apply to Fund shares held through a tax-advantaged account, such as a 401(k) plan or individual retirement account (“IRA”). This information is intended to help you assess the variability of Fund returns (and consequently, the potential risks of a Fund investment).

Both the bar charts and the tables assume that all distributions have been reinvested. Performance reflects expense limitations, if any, in effect during the periods presented. If any such expense limitations were not in place, performance would be reduced.

Target Fund – Annual Total Return

Acquiring Fund –Annual Total Return

10

| Average Annual Total Returns for the Periods Ended December 31, 2022 | ||||||||||||

| Target Fund | 1 Year | 5 Years | Life of Fund (3/10/14) | |||||||||

| Return Before Taxes | (37.45 | )% | (0.36 | )% | 3.57 | % | ||||||

| Return After Taxes on Distributions | (37.45 | )% | (2.32 | )% | 2.16 | % | ||||||

| Return After Taxes on Distributions and Sale of Fund Shares | (22.17 | )% | 0.01 | % | 2.94 | % | ||||||

| MSCI ACWI Ex US Small- Cap Growth Index (reflects no deduction for fees, expenses or taxes) | (27.02 | )% | 0.55 | % | 3.93 | % | ||||||

| Average Annual Total Returns for the Periods Ended December 31, 2022 | ||||||||||||

| Acquiring Fund – Investor Class | 1 Year | 5 Years | 10 Years | |||||||||

| Return Before Taxes | (37.06 | )% | (.76 | )% | 8.13 | % | ||||||

| Return After Taxes on Distributions | (37.06 | )% | (2.60 | )% | 6.78 | % | ||||||

| Return After Taxes on Distributions and Sale of Fund Shares | (21.94 | )% | (.50 | )% | 6.65 | % | ||||||

| MSCI World Ex US Small Cap Growth Index (reflects no deduction for fees, expenses or taxes) | (27.02 | )% | .55 | % | 6.03 | % | ||||||

Other Investment Policies and Risks

In addition to having identical investment objectives and the same principal strategies and principal risks, the Target Fund and the Acquiring Fund have the same other investment policies and risks.

Although the Fund may invest substantially all of its assets in common stocks, the Fund may also invest in convertible securities, preferred stocks and restricted securities. In addition, each Fund may establish and maintain reserves for temporary defensive purposes or to enable it to take advantage of buying opportunities. The Fund’s reserves may be held in cash or invested in high quality money market instruments. The Fund may also lend its portfolio securities and may write (sell) call options against investment positions and purchase put and call options.

Restricted Securities and Illiquid Securities

The Fund may invest up to 15% of its net assets in securities that are not readily marketable, including securities where resale is legally or contractually restricted (all of which are collectively referred to as “restricted securities”) and equity-linked certificates. The sale of restricted securities often takes more time than more liquid securities and may result in higher selling expenses. Also, the Fund may have to dispose of restricted securities at less desirable prices or at prices lower than the Fund valued the securities. The Fund may resell restricted securities to other institutions. If there is a dealer or institutional trading market in such securities, restricted securities and equity-linked certificates may be treated as exempt from the Fund’s limitation on illiquid securities.

Temporary Defensive Investments

To respond to adverse market, political or other conditions, the Fund’s cash or other similar investments may increase from time to time. When OAM temporarily increases the Fund’s cash position, the Fund may not achieve its investment objective. Securities that the Fund may invest in as a means of receiving a return on idle cash include U.S. government obligations, certificates of deposit, commercial paper (rated prime 3 or better by Moody’s Investor Services, Inc. (“Moody’s”) or the equivalent), corporate debt securities (rated A or better by Moody’s or Standard & Poor’s Corporation) and repurchase agreements. When the Fund’s investments in cash or similar investments increase, it may not participate in market advances or declines to the same extent that it would if the Fund remained more fully invested in stocks.

Repurchase Agreements

As a means of earning income on idle cash, the Fund may enter into repurchase agreements. This technique involves the purchase of a security by the Fund and a simultaneous agreement by the seller (generally a bank or dealer) to repurchase the security from the Fund at a specified date or upon demand. These securities involve the risk that the seller will fail to repurchase the security, as agreed. In that case, the Fund will bear the risk of market value fluctuations until the security can be sold and may encounter delays and incur costs in liquidating the security. The Fund cannot enter into repurchase agreements in excess of 25% of its total assets. The Fund cannot invest in repurchase agreements with maturities of seven days or more if, taken together with all other illiquid securities in the Fund’s portfolio, more than 15% of the Fund’s net assets would be invested in illiquid securities.

Lending of Fund Securities

To generate additional income, the Fund may lend its portfolio securities to qualified brokers/dealers or institutional investors. Such loans may not exceed 30% of the Fund’s total assets measured at the time of the most recent loan. For each loan, the borrower must maintain collateral at the Fund’s custodian with a value at least equal to 100% of the current market value of the security loaned.

Convertible Securities

The Fund may invest in convertible securities. The market value of a convertible security performs like that of a regular debt security; that is, when interest rates rise, the price of a convertible security generally declines. In addition, convertible securities are subject to the risk that the issuer will not be able to pay interest or dividends when due, and their price may change based on changes in the issuer’s financial condition. Because a convertible security derives a portion of its value from the common stock into which it may be converted, market and issuer risks that apply to the underlying common stock could impact the price of the convertible security.

11

A description of the policies and procedures with respect to the disclosure of each Fund’s investments is available in their Statements of Additional Information and on The Oberweis Funds’ Website at oberweisfunds.com.

Oberweis Asset Management, Inc., 3333 Warrenville Road, Suite 500, Lisle, Illinois, 60532, an investment adviser registered with the SEC, is the investment adviser to each Fund and is responsible for the day-to-day management of their investment portfolios and other business affairs of Trust and each of its Funds. OAM also offers investment advice to institutions and individual investors regarding a broad range of investment products. Certain OAM officers and employees serve as officers of the Funds.

OAM furnishes continuous advice and recommendations concerning the Funds’ investments. OAM also provides The Oberweis Funds with non-investment advisory management and administrative services necessary for the conduct of the Funds’ business. OAM furnishes the Funds with certain administrative, compliance and accounting services and provides information and certain administrative services for shareholders of the Funds. For each Fund, OAM provides these services under combined investment advisory and management agreements. OAM also provides office space and facilities for the management of the Funds and pays the salaries and fees of the Funds’ officers.

In rendering investment advisory services to the Funds, OAM will use the resources of its wholly-owned subsidiaries, Oberweis Asset Management UK Limited (“OAMUK”) located in the United Kingdom, and Oberweis Asset Management (Hong Kong) Limited (“OAMHK”) located in Hong Kong. Such services will be provided subject to the terms of a no-action letter granted by the SEC in 1997 governing the use of “Participating Affiliates.” Each of OAMUK and OAMHK and their associated persons who provide services to U.S. clients are subject to the supervision of OAM and other conditions of the no-action letter.

Ralf A. Scherschmidt is the portfolio manager of the Funds. Ralf A. Scherschmidt joined The Oberweis Funds in 2006 in conjunction with the Acquiring Fund. Prior to joining the Funds, Ralf A. Scherschmidt worked as an analyst with Jetstream Capital, LLC from 2005 to 2006 and Aragon Global Management. LLC from 2004 to 2005. From 1999 to 2002, Ralf A. Scherschmidt was an analyst and then an executive with NM Rothschild & Sons Limited. Ralf A. Scherschmidt has an M.B.A. from Harvard University and bachelor’s degree from Georgetown University.

For a complete description of the advisory services provided to the Acquiring Fund, see the section of the Acquiring Fund’s Statement of Additional Information entitled “Management.” Additional information about the portfolio manager compensation structure, other accounts managed by the portfolio manager and the portfolio manager’s ownership of securities in the Acquiring Fund is provided in the Acquiring Fund’s Statements of Additional Information.

As compensation for its investment advisory services, for managing the business affairs and providing certain administrative services, each Fund pays OAM pursuant to an Investment Advisory and Management Agreement an annual fee which is computed and accrued daily and paid monthly. OAM currently receives 1.25% and 1.00% of the average daily net assets of the Acquiring Fund and the Target Fund, respectively, subject to reduction because of each Fund’s annual expense limitation, if applicable. In connection with the Reorganization and subject to approval of the Reorganization by the Target Fund shareholders, the Board of Trustees approved lowering the advisory and management fee of the Acquiring Fund to 1.00% of its average daily net assets to take effective upon the closing of the Reorganization.

12

For the Funds’ fiscal year ended December 31, 2022, each Fund paid OAM the following investment advisory and management fees as a percentage of average net assets:

| Advisory and Management Fee Rate | ||||

| Target Fund | 1.00 | %* | ||

| Acquiring Fund | 1.25 | %** | ||

*.97% net of any fee waivers and expense reimbursements.

**.99% net of any fee waivers and expense reimbursements.

A discussion regarding the basis for the Board of Trustee’s approval of the Funds’ Investment Advisory and Management Agreements are available in the Funds’ annual reports to shareholders for the period ended December 31, 2022.

The Funds have appointed Oberweis Securities, Inc. (“OSI”) to act as the principal distributor of the Funds’ shares and as a shareholder service agent. The Acquiring Fund’s Institutional Class shares do not pay Rule 12b-1 fees.

Both Funds are series of the Trust and, as a result, have the same Board and the same officers. The management of each Fund, including general oversight of the duties performed by OAM under the Investment Advisory and Management Agreement for each Fund, is the responsibility of the Board. As of the date of this Proxy Statement/Prospectus, there are four members of the Board, one of whom is an “interested person” (as defined in the 1940 Act) and three of whom are not interested persons (the “independent Trustees”). The names and business addresses of the Trustees and officers of the Trust and their principal occupations and other affiliations during the past five years are set forth under “Management of the Trust” in the Statement of Additional Information for the Acquiring Fund, which is incorporated herein by reference.

Distribution, Purchase, Redemption, Exchange of Shares and Dividends

You may purchase, redeem or exchange shares of the Funds on any business day, which is any day the New York Stock Exchange is open for business. The minimum initial investment for each Fund is $1,000,000. The Funds reserve the right to change at any time the initial or subsequent investment minimums, to waive the initial or subsequent investment minimums, to withdraw the offering or to reject any purchase in whole or part.

You may purchase shares of the Funds directly through OSI or through a securities broker/dealer or its designated agent, through a bank or other institution having a sales agreement with OSI, or by contacting the Funds’ Transfer Agent, UMB Fund Services, Inc. (“UMBFS”). Some broker/dealers, banks or other institutions may independently impose different minimum investment amounts for purchases by their customers and/or charge for their services in purchasing shares of the Funds.

13

Each Fund normally declares and pays dividends from net investment income, if any, annually. For each Fund, any net capital gains are normally distributed at least once a year. If the Reorganization is approved by the shareholders of the Target Fund, the Target Fund intends to distribute to its shareholders, prior to the closing of the Reorganization, all its net investment income and net capital gains, if any, for all periods ending on or prior to the Closing Date. See “The Proposed Reorganization—Material Federal Income Tax Consequences” below.

All purchases, redemptions and exchanges will be processed at the NAV next calculated after your request is received and accepted by the Fund (or the Fund’s agent or authorized designee). NAV per share is computed by dividing the value of the Fund’s net assets (i.e., the value of its assets less liabilities) by the total number of shares then outstanding. A separate NAV is calculated for each share class of the Fund.

The Fund’s investments are valued based on market value or, where quotations are not readily available or are deemed unreliable, on fair value as determined in good faith by OAM, the Fund’s valuation designee. Since the Fund invests in equity securities of micro-, small- and mid-cap companies, these circumstances may arise, for instance, when trading in a security is suspended or the trading volume in a security is limited, calling into question the reliability of market quotations. The value of fair valued securities may be different from the last reported sale price (or the last reported bid price), and there is no guarantee that a fair valued security will be sold at the price at which the Fund is carrying the security.

The Fund may use a fair valuation model provided by an independent pricing service, which is intended to reflect fair value when a security’s value or a meaningful portion of the Fund’s portfolio is believed to have been materially affected by a significant event that has occurred between the close of the exchange or market on which the security is principally traded and the close of the New York Stock Exchange (“NYSE”) or on a day when the foreign exchange is closed and the NYSE is open. The Fund’s valuation policies set forth certain triggers which instruct when to use the valuation model. The value assigned to a security by the fair valuation model is a determination of fair value made under the Funds’ valuation policies. In such a case, the Fund’s value for a security is likely to be different from the last quoted price.

Foreign currency exchange rates are determined at the close of trading on the NYSE. Occasionally, events affecting the value of foreign investments occur between the time at which they are determined and the close of trading on the NYSE. Such events would not normally be reflected in a calculation of the Fund’s NAV on that day. If events that materially affect the value of the Fund’s foreign investments occur during such period, the investments will be valued at their fair value as described above.

Foreign securities held by the Fund may be traded on days and at times when the NYSE is closed. Accordingly, the value of the Fund’s investments may be significantly affected on days when shareholders have no access to the Fund. For valuation purposes, quotations of foreign portfolio securities, other assets and liabilities, and forward contracts stated in foreign currency are translated into U.S.-dollar equivalents at the prevailing market rates.

If your order in proper form is received (see “How to Purchase Shares” and “How to Redeem Shares”) by the Transfer Agent or OSI by the close of trading on the NYSE on a given day (currently 3:00 p.m., Central Time), or by a securities broker/dealer or its designated agent, a bank or other institution having a sales agreement with OSI by the close of trading on the NYSE, Fund shares will be purchased or sold at the next computed NAV. The NAV of the shares of the Fund is computed once daily, as of the later of the close of regular trading on the NYSE or the Chicago Board Options Exchange (“CBOE”), on each day the NYSE is open for trading. For purposes of computing the NAV, all securities in the Fund other than options are priced as of the close of trading on the NYSE. The options in the Fund are priced as of the close of trading on the CBOE.

14

Each Fund’s distributions are generally taxable as ordinary income or capital gains, unless your investment is made through an IRA, 401(k) or other tax-advantaged investment plan (in which case, amounts may be taxable upon withdrawal).

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Funds through a broker-dealer or other financial intermediary (such as a bank), the Funds and their related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Funds over another investment. Ask your salesperson or visit your financial intermediary’s Web site for more information.

Additional information concerning the Acquiring Fund and Target Fund is contained in this Proxy Statement/Prospectus. The cover page of this Proxy Statement/Prospectus describes how you may obtain further information.

The proposed Reorganization will be governed by the Agreement, a form of which is attached as Appendix II. The Agreement provides that the Target Fund will transfer all of its assets to the Acquiring Fund solely in exchange for the issuance of full and fractional Acquiring Fund Shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund. The closing of the Reorganization will take place at the close of business on the Closing Date. The following discussion of the Agreement is qualified in its entirety by the full text of the Agreement.

The Target Fund will transfer all of its assets to the Acquiring Fund, and in exchange, the Acquiring Fund will assume all the liabilities of the Target Fund and deliver to the Target Fund a number of full and fractional Acquiring Fund Shares having a net asset value as of the Valuation Time (as defined in the Agreement) equal to the value of the assets of the Target Fund less the liabilities of the Target Fund assumed by the Acquiring Fund as of such time. At the designated time on the Closing Date as set forth in the Agreement, the Target Fund will distribute in complete liquidation and termination of the Target Fund, pro rata to its shareholders of record, all Acquiring Fund Shares received by the Target Fund. This distribution will be accomplished by the transfer of the Acquiring Fund Shares credited to the account of the Target Fund on the books of the Acquiring Fund to open accounts on the share records of the Acquiring Fund in the name of the Target Fund shareholders, and representing the respective pro rata number of Acquiring Fund shares due such shareholders. All issued and outstanding shares of the Target Fund will be canceled on the books of the Target Fund.

15

The consummation of the Reorganization is subject to the terms and conditions of, and the representations and warranties being true as set forth in, the Agreement. The Agreement may be terminated by mutual agreement of the Funds. In addition, either Fund may at its option terminate the Agreement at or before the Closing due to (1) a breach by any other party of any representation, warranty, or agreement to be performed at or before the Closing, if not cured within 30 days and prior to Closing, (2) a condition precedent to the obligations of the terminating party that has not been met and it reasonably appears that it will not or cannot be met, or (3) a determination by the Board that the consummation of the transactions contemplated by the Agreement is not in the best interests of a Fund.

The Target Fund will, within a reasonable period of time before the Closing Date, furnish the Acquiring Fund with a list of the Target Fund’s portfolio securities and other investments. The Acquiring Fund will, within a reasonable period of time before the Closing Date, furnish the Target Fund with a list of the securities, if any, on the Target Fund’s list referred to above that do not conform to the Acquiring Fund’s investment objective, policies and restrictions. Since the Funds’ investment objective, policies and restrictions are the same, the Acquiring Fund does not expect that any securities will be included on such list. The Target Fund, if requested by the Acquiring Fund, will dispose of securities on the Acquiring Fund’s list before the Closing Date. In addition, if it is determined that the portfolios of the Target Fund and Acquiring Fund, when aggregated, would contain investments exceeding certain percentage limitations imposed upon the Acquiring Fund with respect to such investments, the Target Fund, if requested by the Acquiring Fund, will dispose of a sufficient amount of such investments as may be necessary to avoid violating such limitations as of the Closing. The sale of such investments could result in taxable distributions to shareholders of the Target Fund prior to the Reorganization. Notwithstanding the foregoing, nothing in the Agreement will require the Target Fund to dispose of any investments or securities if, in the reasonable judgment of the Board or the Adviser, such disposition would adversely affect the tax-free nature of the Reorganization for federal income tax purposes or would otherwise not be in the best interests of the Target Fund.

Description of Securities to be Issued

Voting Shares of Beneficial Interest. Pursuant to the Trust’s Amended and Restated Agreement and Declaration of Trust (the “Declaration of Trust”), the Trust may issue an unlimited number of shares of beneficial interest in one or more series of “Funds,” all having no par value. Shares of each Fund have equal non-cumulative voting rights and equal rights with respect to dividends, assets and liquidation of such Fund. Shares are fully paid and non-assessable by the Trust when issued, are transferable without restriction and have no preemptive or conversion rights.

Voting Rights of Shareholders. Holders of shares of the Acquiring Fund are entitled to one vote per share on matters as to which they are entitled to vote, with fractional shares voting proportionally. The Acquiring Fund operates as a series of the Trust, an open-end management investment company registered with the SEC under the 1940 Act. The Trust currently has eight series, including the Acquiring Fund, and the Board may, in its sole discretion, create additional series from time to time. Separate votes generally are taken by each series on matters affecting an individual series. In addition to the specific voting rights described above, shareholders of the Acquiring Fund are entitled, under current law, to vote with respect to certain other matters, including changes in fundamental investment policies and restrictions. Moreover, shareholders owning at least 25% of the outstanding shares of the Trust may request that the Board call a shareholders’ meeting (10% if the purpose is voting on the removal of one or more Trustees).

16

Continuation of Shareholder Accounts; Share Certificates

If the Reorganization is approved, the Acquiring Fund will establish an account for each Target Fund shareholder containing the appropriate number of shares of the Acquiring Fund. The shareholder services of the Funds are substantially the same. No certificates for Acquiring Fund shares will be issued as part of the Reorganization.

UMB Bank, N.A. serves as the custodian for the assets of each Fund. UMB Fund Services, Inc. serves as the Funds’ transfer agent. Oberweis Securities, Inc. serves as the distributor for each Fund. Cohen & Company, Ltd. serves as the Independent Registered Public Accounting Firm for each Fund.

Material Federal Income Tax Consequences

As a condition to each Fund’s obligation to consummate the Reorganization, each Fund will receive a tax opinion from Vedder Price P.C. (which opinion will be based on certain factual representations and certain customary assumptions and exclusions) substantially to the effect that, on the basis of the existing provisions of the Code, current administrative rules and court decisions, for federal income tax purposes:

| 1. | The transfer of all the Target Fund’s assets to the Acquiring Fund in exchange solely for Acquiring Fund Shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund immediately followed by the pro rata distribution by the Target Fund of all the Acquiring Fund Shares received to the Target Fund’s shareholders of record in complete liquidation of the Target Fund will constitute a “reorganization” within the meaning of Section 368(a)(1) of the Code and the Acquiring Fund and the Target Fund will each be a “party to a reorganization,” within the meaning of Section 368(b) of the Code, with respect to the Reorganization. |

| 2. | No gain or loss will be recognized by the Acquiring Fund upon the receipt of all the assets of the Target Fund solely in exchange for Acquiring Fund Shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund. |

| 3. | No gain or loss will be recognized by the Target Fund upon the transfer of all the Target Fund’s assets to the Acquiring Fund solely in exchange for Acquiring Fund Shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund or upon the distribution (whether actual or constructive) of such Acquiring Fund Shares to the Target Fund’s shareholders solely in exchange for such shareholders’ shares of the Target Fund in complete liquidation of the Target Fund. |

| 4. | No gain or loss will be recognized by the Target Fund’s shareholders upon the exchange of their Target Fund shares solely for Acquiring Fund Shares in the Reorganization. |

| 5. | The aggregate basis of the Acquiring Fund Shares received by each Target Fund shareholder pursuant to the Reorganization will be the same as the aggregate basis of the Target Fund shares exchanged therefor by such shareholder. The holding period of the Acquiring Fund Shares received by each Target Fund shareholder will include the period during which the Target Fund shares exchanged therefor were held by such shareholder, provided such Target Fund shares are held as capital assets at the effective time of the Reorganization. |

17

| 6. | The basis of the Target Fund’s assets transferred to the Acquiring Fund will be the same as the basis of such assets to the Target Fund immediately before the effective time of the Reorganization. The holding period of the assets of the Target Fund in the hands of the Acquiring Fund will include the period during which those assets were held by the Target Fund. |

No opinion will be expressed as to (1) the effect of the Reorganization on the Target Fund, the Acquiring Fund or any shareholder of the Target Fund with respect to any asset (including, without limitation, any stock held in a passive foreign investment company as defined in Section 1297(a) of the Code) as to which any gain or loss is required to be recognized under federal income tax principles (a) at the end of a taxable year (or on the termination thereof) or (b) upon the transfer of such asset regardless of whether such transfer would otherwise be a non-taxable transaction under the Code, (2) the effect of the Reorganization under the alternative minimum tax imposed under Section 55 of the Code on a direct or indirect shareholder of a Target Fund that is a corporation, and (3) any other federal tax issues (except those set forth above) and all state, local or foreign tax issues of any kind.

The opinion of counsel will be based on certain factual representations and customary assumptions. The opinion will rely on such representations and will assume the accuracy of such representations. If such representations and assumptions are incorrect, the Reorganization may not qualify as a “reorganization” within the meaning of Section 368(a) of the Code, and the Target Fund and Target Fund shareholders may recognize taxable gain or loss as a result of the Reorganization.

Opinions of counsel are not binding upon the Internal Revenue Service (“IRS”) or the courts and there can be no assurance that the IRS or a court will concur on all or any of the issues discussed above. If the Reorganization occurs, but the IRS or the courts determine that it does not qualify as a “reorganization” within the meaning of Section 368(a) of the Code, the Target Fund may recognize gain or loss on the transfer of its assets to the Acquiring Fund and/or the deemed distribution of Acquiring Fund shares to its shareholders and each shareholder of the Target Fund would recognize taxable gain or loss equal to the difference between its basis in its Target Fund shares and the fair market value of the shares of the Acquiring Fund it receives.

Prior to the Valuation Time, the Target Fund will declare a dividend or dividends which, together with all previous such dividends, shall have the effect of distributing to its shareholders at least all of the Target Fund’s investment company taxable income for all taxable periods ending on or before the Closing Date (computed without regard to any deduction for dividends paid), if any, plus the excess of its interest income excludible from gross income under Section 103(a) of the Code, if any, over its deductions disallowed under Sections 265 and 171(a)(2) of the Code for all taxable periods ending on or before the Closing Date and all of its net capital gains realized in all taxable periods ending on or before the Closing Date (after reduction for any available capital loss carryforward and excluding any net capital gain on which the Target Fund paid federal income tax). This distribution will be taxable to shareholders who are subject to federal income tax. Additional distributions may be made if necessary. All dividends and distributions will be reinvested in additional shares of the Target Fund unless a shareholder has made an election to receive dividends and distributions in cash. Dividends and distributions are treated the same for federal income tax purposes whether received in cash or additional shares.

After the Reorganization, the Acquiring Fund’s ability to use the Target Fund’s or the Acquiring Fund’s realized and unrealized pre-Reorganization capital losses, if any, may be limited under certain federal income tax rules applicable to reorganizations of this type. Therefore, in certain circumstances, shareholders may pay federal income tax sooner, or may pay more federal income taxes, than they would have had the Reorganization not occurred. The effect of these potential limitations will depend on a number of factors, including the amount of the losses, the amount of gains to be offset, the exact timing of the Reorganization and the amount of unrealized capital gains in the Funds at the time of the Reorganization. As of June 30, 2023, the Acquiring Fund had $46,909,614 in unused capital loss carryforwards available for federal income tax purposes to be applied against capital gains. As of June 30, 2023, the Target Fund had $169,317,215 unused in unsecured capital loss carryforwards available for federal income tax purposes to be applied against capital gains.

18

In addition, shareholders of the Target Fund will receive a proportionate share of any taxable income and gains (after the application of any available capital loss carryforwards) realized by the Acquiring Fund and not distributed to its shareholders prior to the Closing when such income and gains are eventually distributed by the Acquiring Fund. This may include any built-in gain in the portfolio investments of the Target Fund or the Acquiring Fund that was unrealized at the time of the Reorganization. As a result, shareholders of the Target Fund may receive a greater amount of taxable distributions than they would have had the Reorganization not occurred.