UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ¨ | Definitive Proxy Statement | |||

| x | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

COMVERSE TECHNOLOGY, INC. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

|

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| (5) | Total fee paid: | |||

|

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

|

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| (3) | Filing Party:

| |||

|

| ||||

| (4) | Date Filed:

| |||

|

| ||||

Comverse

Technology, Inc. Investor Presentation

October 28, 2011

NASDAQ: CMVT

1 |

Forward Looking

Statements and Segment Performance

2

Forward-Looking Statements

This investor presentation contains “forward-looking statements.”

Forward-looking statements include financial projections, statements of plans and objectives

for future operations, statements of future economic performance, and statements of

assumptions relating thereto. In some cases, forward-looking statements can be

identified by the use of terminology such as “may,” “expects,” “plans,” “anticipates,” “estimates,” “believes,” “potential,” “projects,” “forecasts,”

“intends,” or the negative thereof or other comparable terminology. By their very

nature, forward-looking statements involve known and unknown risks, uncertainties

and other important factors that could cause actual results, performance and the timing of events to differ materially from those anticipated,

expressed or implied by the forward-looking statements in this investor

presentation. Such risks or uncertainties may give rise to future claims and increase

exposure to contingent liabilities.

The risks and uncertainties discussed above, as well as others, are discussed in greater

detail in Item 1A, “Risk Factors” of Comverse Technology, Inc.’s Annual

Report on Form 10-K for the fiscal year ended January 31, 2011 and our other filings with

the SEC. The documents and reports we file with the SEC are available through the

Company, or its website, www.cmvt.com, or through the SEC’s Electronic Data Gathering, Analysis, and Retrieval system (EDGAR) at

The Company undertakes no commitment to update or revise any forward-looking statements

except as required by law. Segment Performance

•

The Company uses segment performance, as defined below, as the primary basis for assessing the

financial results of its segments and for the allocation of resources. Segment

performance, as defined by the Company’s management in accordance with the Financial Accounting Standards Board’s (“FASB”) guidance

relating to segment reporting, is not necessarily comparable to other similarly titled

captions of other companies. Segment performance, as defined by management, represents

operating results of a segment without the impact of significant expenditures incurred by the segment in connection with the efforts

to become current in periodic reporting obligations under the federal securities laws, certain

non-cash charges, and certain other insignificant gains and charges.

•

Segment performance is computed by management as income (loss) from operations adjusted for

the following: (i) stock-based compensation expense; (ii) amortization of

acquisition-related intangibles; (iii) compliance-related professional fees; (iv) compliance-related compensation and other expenses;

(v) impairment charges; (vi) litigation settlements and related costs; (vii)

acquisition-related charges; (viii) restructuring and integration charges; and (ix) certain

other insignificant gains and charges. Compliance-related professional fees and

compliance-related compensation and other expenses relate to fees and expenses

incurred in connection with (a) the Company’s efforts to complete current and previously issued financial statements and audits of such financial

statements and (b) the Company’s efforts to become and remain current in its periodic

reporting obligations under the federal securities laws. •

In evaluating each segment’s performance, management uses segment revenue, which consists

of revenue generated by the segment, including intercompany revenue. Certain segment

performance adjustments relate to expenses included in the calculation of income (loss) from operations, while, from time to time,

certain segment performance adjustments may be presented as adjustments to revenue. www.sec.gov.

|

Agenda

•

Company Overview

•

Company Structure

•

Company Timeline

•

Enhanced Governance Measures and Accomplishments

•

Conclusion-

Vote FOR

all of the Company’s director nominees

3 |

Company

Overview Comverse Technology, Inc. -

holding company conducting business through

•

Comverse, Inc.

The leading provider of software-based products, systems, and related services that

¯

provide prepaid, postpaid and converged billing and active customer management for wireless,

wireline and cable networks operators

¯

enable wireless and wireline network-based Value-Added Services (VAS)

¯

provides

wireless

users

with

optimized

access

to

mobile

Internet

websites

•

Verint Systems Inc.

The global leader in Actionable Intelligence solutions and value-added systems

•

Starhome BV

A provider of wireless service mobility solutions that enhance international roaming

4 |

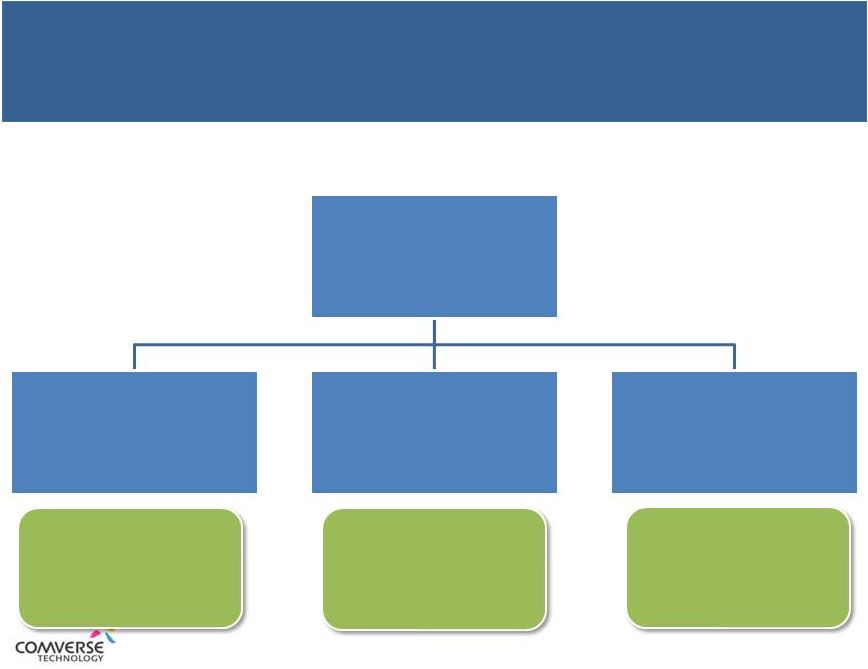

Company

Structure -FY ‘10 Revenue $860.2M

BSS $340.5M

VAS $519.7M

-FY ’10 Segment Performance $74.0M

-FY ‘10 Revenue $726.8M

-FY ’10 Segment Performance

$184.6M

*Approximately 16.2m shares of

Verint Common Stock and 100% of

Verint Series A Preferred Stock.

-FY ‘10 Revenue $36.4M

-FY ‘10 Operating Income $2.7M

100%

66.5%

52.9%*

5

Comverse

Technology, Inc.

Comverse,

Inc.

Verint Systems Inc.

Starhome |

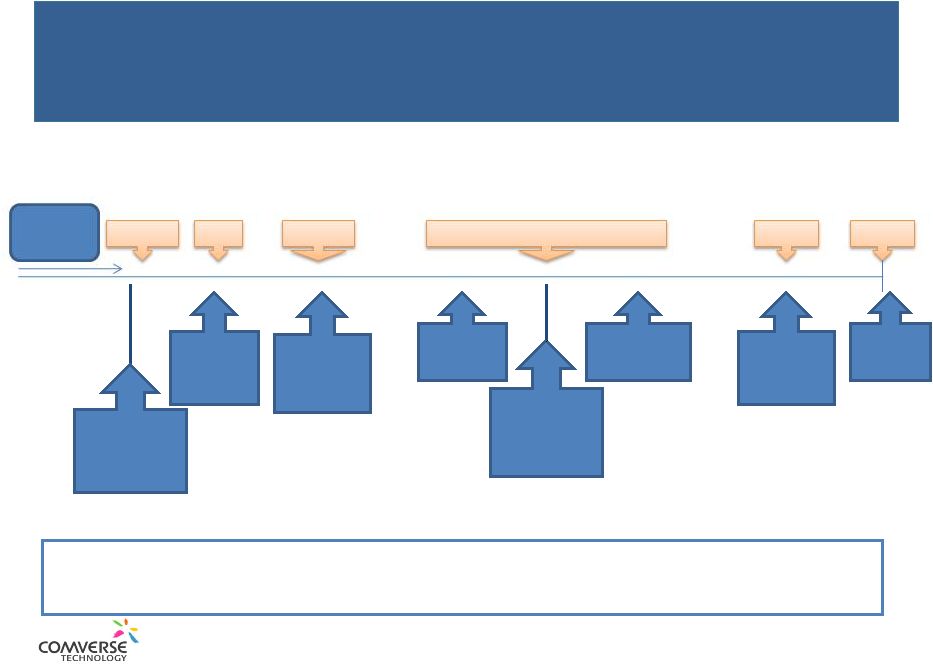

Prior Board

and Senior

Management

March 2006

Nov.

2006

2007-2008

July -Dec

2006

Sept 2011

Stock Options

Backdating

Uncovered and

Special Committee

Organized

Accounting

Fraud (reserve

manipulation)

uncovered

Board

reconstituted

with 6 new

directors

2 new

shareholder

directors

added

Revenue

Recognition Issues

Identified

1 new shareholder

director added

Current and

timely SEC filer

and listed on

NASDAQ

Nov 2011

A series of complex problems was inherited,

uncovered and resolved

6

Company Timeline

Annual

Shareholders’

Meeting |

Enhanced Governance

Measures and Accomplishments •

Special Committee Recommendations and Board Action

Majority Voting for Directors

If the number of shares voted “for”

a director does not exceed the number of votes cast “against,”

such

director to tender resignation

Shareholder Proxy Access

Enhanced

Rights

to

Call

Shareholders’

Meeting

10% holders may call shareholders’

meeting if no meeting is held by June 30, 2012

Enhanced controls and procedures

•

Settled Actions related to Historical Issues

FCPA Violations settled with SEC and DOJ for minimal fee and no other remedies

Shareholder Class and Derivative Actions

SEC Backdating Settlement without monetary penalty or other remedies

12(j) SEC Litigation

The

Board

managed

resolution

of

multiple

issues

and

developed

in

parallel

forward-looking governance initiatives.

7 |

Conclusion-

Vote FOR

Company Director Nominees

•

This Board has the right skill set in its entirety

•

The continuity and institutional knowledge of this Board are necessary at this time

•

Cadian has arbitrarily targeted 3 directors claiming they lack the requisite business

and transactional experience required for company oversight, when in fact, they

have extensive operational and financial backgrounds in telecommunications and

technology (see attached biographies)

•

This Board has guided the Company through a series of complex challenges that

were not of its own making

•

This Board is focused on value creation through operational improvements and

strategic initiatives

Next Annual General Meeting of Shareholders will provide an opportunity

to measure progress against these objectives.

8 |

Appendix A

Raz Alon

Mr. Alon, age 49, has served as a member of our Board since December 2003, and served as our

interim Chief Executive Officer from April to November 2006. Since November 2000, Mr.

Alon has served as Chairman of TopView Ventures LLC, an investment firm focused on

special situation investments in a broad range of industries. From 1998 to 2000, Mr. Alon

served as a Director in the mergers and acquisitions department of Merrill Lynch & Co.,

Inc. with a focus on private equity and financial sponsor clients. From 1996 to 1998,

Mr. Alon had served as a Director at SG Securities Inc., the U.S. based mergers and

acquisitions and merchant banking business unit of Société Générale

SA. From 1991 to 1996, Mr. Alon worked as an investment banker at Lehman Brothers Inc.

Mr. Alon served as the Chairman of the Board of Directors of Ulticom, Inc. during the

last five years. Mr. Alon received a B.S. in Computer Science and Engineering, magna

cum laude, from the University of California, Los Angeles in 1988 and an M.B.A.

from Harvard Business School in 1991. Mr. Alon is an

independent director. Mr. Alon’s qualifications to serve on the Board include his

investment and transactional experience at investment banking firms and as a private

investor. Mr. Alon also has public company board and corporate governance experience

attributable to his service as an independent director of a NASDAQ-listed company.

9 |

Appendix B

Joseph O’Donnell

Mr. O’Donnell, age 65, has served as a member of our Board since December 2006. From

March 2008 to April 2009, Mr. O’Donnell served as the Chief Executive Officer of

Inmar Inc., a provider of technology-driven logistics management solutions to

retailers, wholesalers, and manufacturers in the consumer goods and healthcare markets. Mr. O’Donnell served

as Chief Executive Officer, President and Chairman of the Board of Artesyn Technologies, Inc.,

a supplier of power conversion equipment and real-time embedded computing solutions

to telecommunications equipment suppliers, from 1994 to 2006. Prior thereto, Mr.

O’Donnell served as the Chief Executive Officer of Savin Corporation and as President and

Chief Executive Officer of Go/Dan Industries. Mr. O’Donnell serves as a director and

Chairman of the Nominating and Corporate Governance Committee of Comverge, Inc., a

provider of demand management solutions to the electricity markets, and as a director

and member of the Audit Committee and Nominating and Corporate Governance Committee of

ModusLink Global Solutions, Inc., a provider of global supply chain business process

management serving technology-based clients. Mr. O’Donnell also serves as a

member of the University of Tennessee School of Business Advisory Board. In addition,

Mr. O’Donnell served as a director of Parametric Technology Corporation, MTS Systems Corporation and Superior

Essex Inc. during the last five years. Mr. O’Donnell holds a B.S. and M.B.A. from the

University of Tennessee. Mr. O’Donnell is an independent director. Mr.

O’Donnell’s qualifications to serve on the Board include his leadership and operational

experience attributable to his service as a chief executive officer of several

technology-related companies, including a telecommunications equipment vendor. Mr.

O’Donnell also has public company board and corporate governance experience

attributable to his service as a director of publicly-traded companies. 10

|

Appendix C

Theodore Schell

Mr. Schell, age 67, has served as a member of our Board since December 2006. Mr. Schell is

currently a Managing Director at Associated Partners LP, a private equity firm focusing

on media and telecommunications and prior to which, he held the position of Managing

Director at Apax Partners where he oversaw U.S. investments in telecommunications and related

technology companies. From 1989 to 2000, Mr. Schell served as Senior Vice President of

Strategy and Corporate Development and as a member of the Management Committee at

Sprint Corporation. From 1983 to 1988, he served as President and Chief Executive

Officer of Realcom Communications Corporation, an integrated provider of voice and data

services to corporate clients, which he founded. Mr. Schell also

held the position of Counselor and Chief of Staff to the U.S.

Secretary of Commerce where he served from 1977 to 1981. Mr. Schell is currently a member of

the Board of Directors, the Audit Committee and the Strategy Committee of Clearwire

Corporation, a wireless broadband networks operator. Mr. Schell also served as a

director of RCN Corporation during the last five years. Mr. Schell is a graduate of the Johns Hopkins

University and of the Johns Hopkins School of Advanced International Studies, and is a member

of the Council of Foreign Relations. Mr. Schell is an independent director. Mr.

Schell’s qualifications to serve on the Board include his leadership, industry,

operational, global and investment and transactional experience attributable to his senior positions with

investment firms and in companies engaged in the telecommunications and technology industries.

At Sprint, Mr. Schell developed and oversaw Sprint’s wireless strategy and served

on the Board of Sprint’s call center business. In connection with his

private equity experience, Mr. Schell invested extensively in a wide range of wireless application companies. Mr.

Schell serves as an advisor to various wireless and cable TV companies and hedge funds and

serves as Time Warner Cable’s representative on the Board of Clearwire

Corporation. Mr. Schell also has public company board and corporate governance

experience attributable to his service as a director of publicly-traded companies

11 |