|

|

1 Filed by Verint Systems Inc. Commission File No. 333-184628 Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Comverse Technology, Inc. Commission File No. 001-35303 Additional Information This presentation does not constitute an offer of any securities for sale. In connection with the proposed merger between Verint Systems Inc. (“Verint”) and Comverse Technology, Inc. (“CTI”), Verint and CTI expect to file with the Securities and Exchange Commission (“SEC”) a joint proxy statement/prospectus as part of a registration statement regarding the proposed transaction. Investors and security holders are urged to read the joint proxy statement/prospectus and any other relevant documents filed by Verint and/or CTI with the SEC because they will contain important information about Verint and CTI and the proposed transaction. Investors and security holders may obtain free copies of the definitive joint proxy statement/prospectus and other documents when filed by Verint and CTI with the SEC at www.sec.gov or www.verint.com or www.cmvt.com. Investors and security holders are urged to read the joint proxy statement/prospectus and other relevant material when they become available before making any voting or investment decisions with respect to the merger. This presentation is not a solicitation of a proxy from any security holder of Verint or CTI and shall not constitute an offer to sell or a solicitation of an offer to buy securities, nor shall there be any sale of securities in any jurisdiction in which such solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933. However, Verint, CTI and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders in connection with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of Verint may be found in its Annual Report on Form 10-K for the year ended January 31, 2012 and in its definitive proxy statement relating to its 2012 Annual Meeting of Stockholders filed with the Securities and Exchange Commission on May 14, 2012. Information about the directors and executive officers of CTI may be found in its Annual Report on Form 10-K for the year ended January 31, 2012 and in its definitive proxy statement on Schedule 14A filed with the SEC on September 6, 2012 and the preliminary information statement attached thereto. |

|

|

Verint Systems Inc. Making Big Data Actionable TM December 2012 |

|

|

Forward-Looking Statements This presentation contains "forward-looking statements," including statements regarding expectations, predictions, views, opportunities, plans, strategies, beliefs, and statements of similar effect relating to Verint Systems Inc. These forward-looking statements are not guarantees of future performance and they are based on management's expectations that involve a number of risks and uncertainties which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. Important risks, uncertainties, and other factors could cause actual results to differ materially from our forward-looking statements. The forward-looking statements contained in this presentation are made as of the date of this presentation and, except as required by law, Verint assumes no obligation to update or revise them or to provide reasons why actual results may differ. For a more detailed discussion of how these and other risks and uncertainties could cause Verint’s actual results to differ materially from those indicated in its forward-looking statements, see Verint’s prior filings with the Securities and Exchange Commission. |

|

|

Non-GAAP Financial Measures This presentation includes financial measures not prepared in accordance with generally accepted accounting principles (“GAAP”). For a description of these non-GAAP financial measures, including the reasons management uses each measure, and reconciliations of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with GAAP, please see the Appendix to this presentation, Verint’s press releases, as well as the GAAP to non-GAAP reconciliation found under the Investor Relations tab on Verint’s website. |

|

|

Intelligent organizations are differentiating themselves and driving competitive advantage through big data analytics The Big Data Analytics Opportunity |

|

|

Making Big Data Actionable – Collection and Applications Enterprise Applications Security Applications Higher Growth Collection |

|

|

Enterprise Case Study More than 50 million customer telephony interactions per year More 300 million customer text related interactions per year - emails, surveys and unstructured text Security Case Study Tens of millions of communications per day - phone, email, chat, SMS, web session, social media, etc. Requires multiple Petabytes of storage Objective: Extract intelligence from customer interactions for customer centric operations Objective: Extract intelligence from communications to fight crime and terrorism Enterprise Security Helping Customers Collect Big Data - Examples |

|

|

Large base of more than 10,000 customers provides Verint the opportunity to deliver analytical applications across multiple markets Large and Diversified Customer Base Note: % represent percentage of Global Fortune 500 companies that are Verint customers. Finance 90% Healthcare 80% Government Many countries around the world Retail 70% Communications 70% 70% 50% Strong Presence Across Global Fortune 500 Companies |

|

|

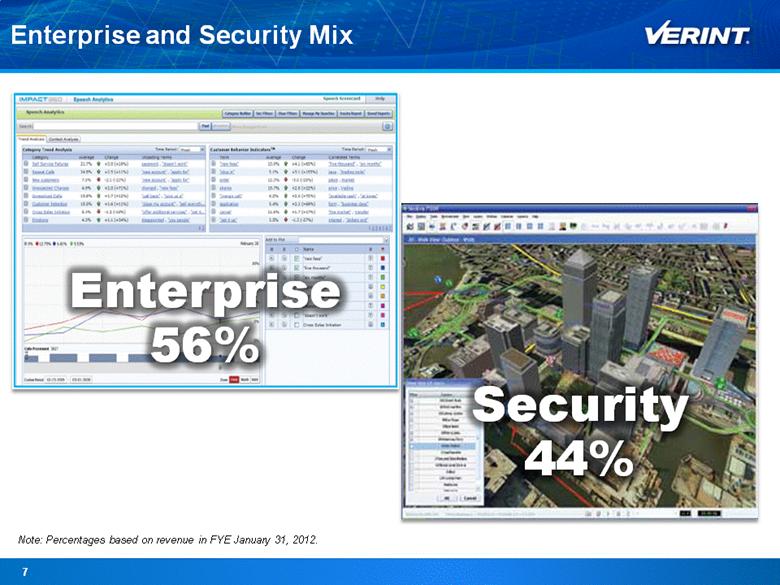

Enterprise and Security Mix Note: Percentages based on revenue in FYE January 31, 2012. |

|

|

Discover Business Trends Optimize the Workforce Our solutions enable customer service operations to enhance the customer experience while increasing revenue and improving profitability Enterprise Intelligence We are expanding from our strong position in the contact center into branch, back-office and customer experience functions Understand Customer Sentiment |

|

|

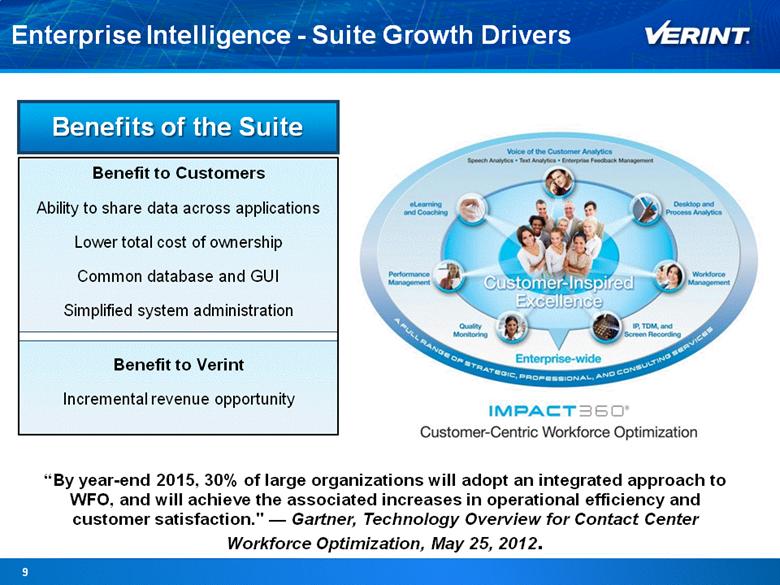

Benefit to Customers Ability to share data across applications Lower total cost of ownership Common database and GUI Simplified system administration Benefit to Verint Incremental revenue opportunity “By year-end 2015, 30% of large organizations will adopt an integrated approach to WFO, and will achieve the associated increases in operational efficiency and customer satisfaction." — Gartner, Technology Overview for Contact Center Workforce Optimization, May 25, 2012. Benefits of the Suite Enterprise Intelligence - Suite Growth Drivers |

|

|

Benefit to Customers Common tools and methodologies across customer operations Holistic view of customer experience Ability to share workload across enterprise Benefit to Verint Increases Verint’s addressable market “As enterprises seek to make more sense of complex customer interactions they come to recognize the limits of their siloed legacy data capture systems” — Ovum, Contact Center Analytics Look a Lot Like Big Data, February 9, 2012 Contact Center Branch Chief Customer Officer Back Office Enterprise Intelligence - Silos Growth Drivers Benefits of Breaking Down the Silos |

|

|

Optimize Public Safety Call Centers Improve Physical Security Cost Effectively Generate Intelligence and Collect Evidence Security Intelligence Our solutions enable security organizations to leverage big data from a wide range of communications, video and data sources to enhance security and prevent crime and terrorism Migration to IP networks create new challenges and new opportunities for law enforcement and security organizations |

|

|

Security Intelligence Growth Drivers Communications Intelligence Transition to IP networks Web and cyber security Physical Security Continue transition from analog to IP video Effective management of disparate systems Public Safety Improved emergency response Growth Trends Ongoing crime and terrorism is primarily being addressed by legacy technology The market is seeking innovative solutions for collection, fusion and analysis |

|

|

Go-to-Market Strategy Growing sales force and channel partners Verticalized direct sales force with subject matter expertise ~700 professionals in sales and marketing Partner strategy broadens market coverage 50% of business through channel partners: OEMs, SIs and regional resellers Flexible business models Perpetual, software-as-a-service, managed services Business models reflect customer preferences Enterprise, typical software model Security, prefer turnkey solutions |

|

|

Financial Highlights |

|

|

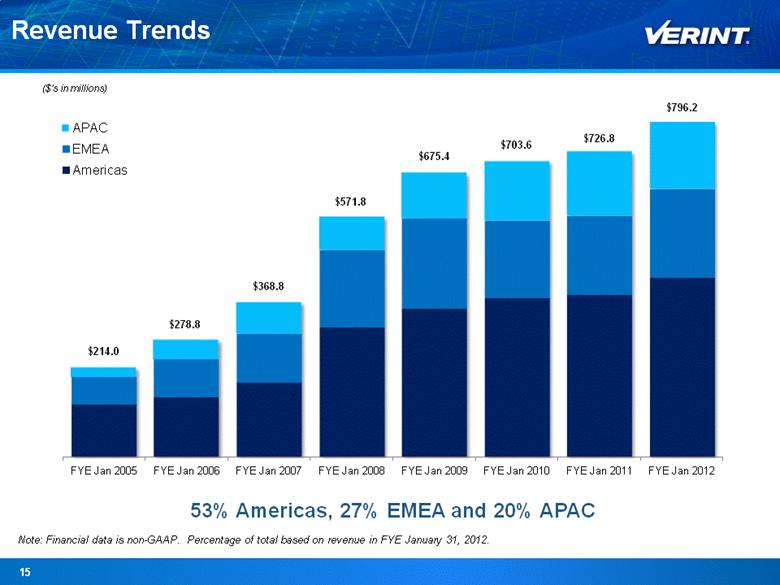

Revenue Trends 53% Americas, 27% EMEA and 20% APAC Note: Financial data is non-GAAP. Percentage of total based on revenue in FYE January 31, 2012. ($’s in millions) |

|

|

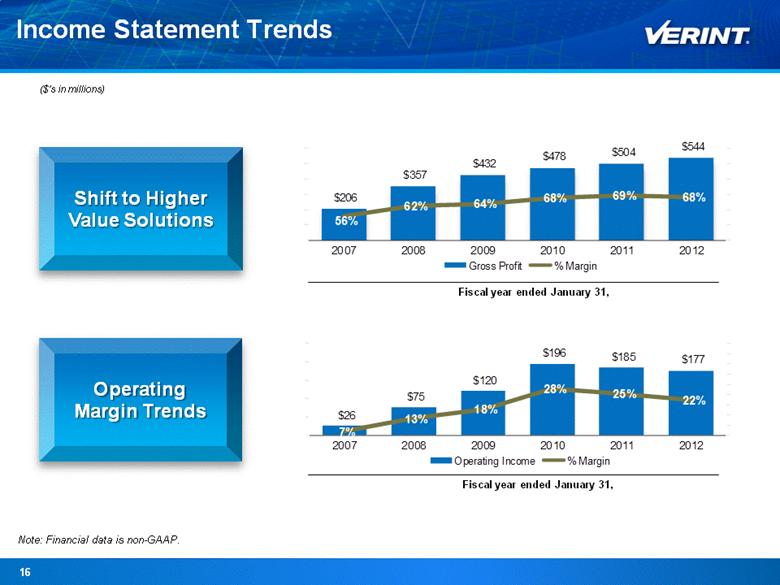

Income Statement Trends Operating Margin Trends Shift to Higher Value Solutions Fiscal year ended January 31, Fiscal year ended January 31, Note: Financial data is non-GAAP. ($’s in millions) $26 $75 $120 $196 $185 $177 7% 13% 18% 28% 25% 22% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% – $50 $100 $150 $200 $250 2007 2008 2009 2010 2011 2012 Operating Income % Margin $206 $357 $432 $478 $504 $544 56% 62% 64% 68% 69% 68% 40% 50% 60% 70% 80% 90% 100% – $100 $200 $300 $400 $500 $600 2007 2008 2009 2010 2011 2012 Gross Profit % Margin |

|

|

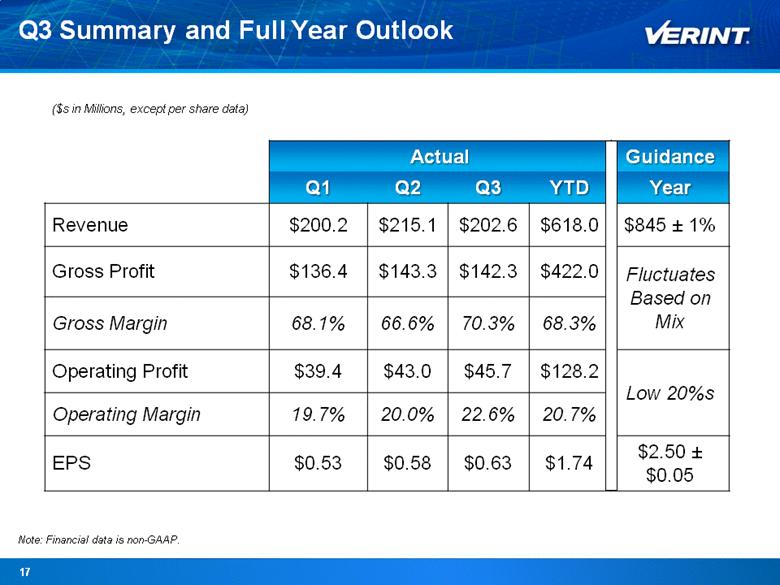

Q3 Summary and Full Year Outlook Note: Financial data is non-GAAP. ($s in Millions, except per share data) Actual Guidance Q1 Q2 Q3 YTD Year Revenue $200.2 $215.1 $202.6 $618.0 $845 ± 1% Gross Profit $136.4 $143.3 $142.3 $422.0 Fluctuates Based on Mix Gross Margin 68.1% 66.6% 70.3% 68.3% Operating Profit $39.4 $43.0 $45.7 $128.2 Low 20%s Operating Margin 19.7% 20.0% 22.6% 20.7% EPS $0.53 $0.58 $0.63 $1.74 $2.50 ± $0.05 |

|

|

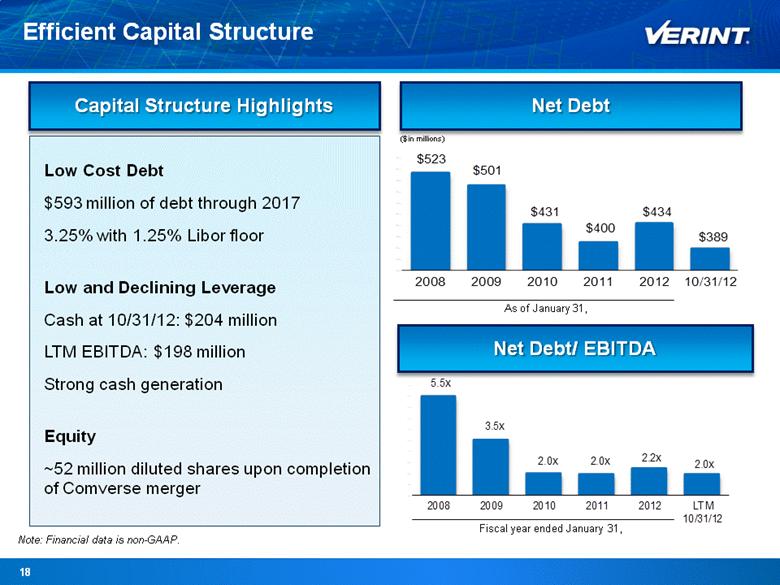

Efficient Capital Structure ($ in millions) Net Debt Capital Structure Highlights Net Debt/ EBITDA As of January 31, Low Cost Debt $593 million of debt through 2017 3.25% with 1.25% Libor floor Low and Declining Leverage Cash at 10/31/12: $204 million LTM EBITDA: $198 million Strong cash generation Equity ~52 million diluted shares upon completion of Comverse merger Fiscal year ended January 31, Note: Financial data is non-GAAP. $523 $501 $431 $400 $434 $389 $350 $370 $390 $410 $430 $450 $470 $490 $510 $530 $550 2008 2009 2010 2011 2012 10/31/12 5.5x 3.5x 2.0x 2.0x 2.2x 2.0x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x 4.5x 5.0x 5.5x 6.0x 2008 2009 2010 2011 2012 LTM 10/31/12 |

|

|

Summary Verint’s strong market presence in big data collection provides a solid foundation for delivering applications and growth Large installed base provides stability and recurring revenue Strong economy: Opportunity to accelerate adoption of applications Weak economy: Maintenance stream, compliance and high value ROI Strong cash generation Free cash flow used for technology M&A or debt reduction Long-term Model Opportunity to accelerate growth as mix shifts Opportunity to expand margins with scale |

|

|

Appendix |

|

|

About Non-GAAP Financial Measures The following tables include a reconciliation of certain financial measures prepared in accordance with Generally Accepted Accounting Principles (“GAAP”) to the most directly comparable financial measures not prepared in accordance with GAAP (“non-GAAP”). Non-GAAP financial measures should not be considered in isolation or as a substitute for comparable GAAP financial measures. The non-GAAP financial measures we present in the following tables have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP, and these non-GAAP financial measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP financial measures. These non-GAAP financial measures do not represent discretionary cash available to us to invest in the growth of our business, and we may in the future incur expenses similar to the adjustments made in these non-GAAP financial measures. We believe that the non-GAAP financial measures we present in the following tables provide meaningful supplemental information regarding our operating results primarily because they exclude certain non-cash charges or items that we do not believe are reflective of our ongoing operating results when budgeting, planning and forecasting, determining compensation and when assessing the performance of our business with our individual operating segments or our senior management. We believe that these non-GAAP financial measures also facilitate the comparison by management and investors of results between periods and among our peer companies. However, those companies may calculate similar non-GAAP financial measures differently than we do, limiting their usefulness as comparative measures. Our non-GAAP financial measures reflect adjustments to the corresponding GAAP financial measure based on the items set forth below. The purpose of these adjustments is to give an indication of our performance exclusive of certain non-cash charges and other items that are considered by our senior management to be outside of our ongoing operating results. |

|

|

About Non-GAAP Financial Measures Revenue adjustments related to acquisitions. We exclude from our non-GAAP revenue the impact of fair value adjustments required under GAAP relating to acquired customer support contracts which would have otherwise been recognized on a standalone basis. We exclude these adjustments from our non-GAAP financial measures because these are not reflective of our ongoing operations. Amortization of acquired intangible assets, including acquired technology. When we acquire an entity, we are required under GAAP to record the fair values of the intangible assets of the acquired entity and amortize those assets over their useful lives. We exclude the amortization of acquired intangible assets, including acquired technology, from our non-GAAP financial measures. These expenses are excluded from our non-GAAP financial measures because they are non-cash charges. In addition, these amounts are inconsistent in amount and frequency and are significantly impacted by the timing and size of acquisitions. Thus, we also exclude these amounts to provide better comparability of pre- and post-acquisition operating results. Stock-based compensation expenses. We exclude stock-based compensation expenses related to stock options, restricted stock awards and units, stock bonus plans and phantom stock from our non-GAAP financial measures. These expenses are excluded from our non-GAAP financial measures because they are primarily non-cash charges. In prior periods, we also incurred (and excluded from our non-GAAP financial measures) significant cash-settled stock compensation expense due to our previous extended filing delay and restrictions on our ability to issue new shares of common stock to our employees. M&A and other adjustments. We exclude from our non-GAAP financial measures legal, other professional fees and certain other expenses associated with acquisitions, whether or not consummated, and certain extraordinary transactions, including reorganizations, restructurings and expenses associated with our merger with CTI. Also excluded are changes in the fair value of contingent consideration liabilities associated with business combinations, and expenses related to our restatement of previously filed financial statements and our previous extended filing delay. These expenses are excluded from our non-GAAP financial measures because we believe that they are not reflective of our ongoing operations. |

|

|

About Non-GAAP Financial Measures Unrealized (gains) losses on derivatives, net. We exclude from our non-GAAP financial measures unrealized gains and losses on interest rate swaps and foreign currency derivatives. These gains and losses are excluded from our non-GAAP financial measures because they are non-cash transactions which are highly variable from period to period and which we believe are not reflective of our ongoing operations. Loss on extinguishment of debt. We exclude from our non-GAAP financial measures loss on extinguishment of debt attributable to refinancing of our debt because we believe it is not reflective of our ongoing operations. Non-cash tax adjustments. We exclude from our non-GAAP financial measures non-cash tax adjustments, which represent the difference between the amount of taxes we actually paid and our GAAP tax provision on an annual basis. On a quarterly basis, this adjustment reflects our expected annual effective tax rate on a cash basis. Integration costs. We exclude from our non-GAAP financial measures expenses directly related to the integration of Witness. These expenses are excluded from our non-GAAP financial measures because they are not reflective of our ongoing operations. In-process research and development. We exclude from our non-GAAP financial measures the fair value of incomplete in-process research and development projects that had not yet reached technological feasibility and have no known alternative future use as of the date of the acquisition. These expenses are excluded from our non-GAAP financial measures because they are non-cash charges that we do not believe are reflective of our ongoing operations. Impairments of goodwill and other acquired intangible assets. Goodwill represents the excess of the purchase price in a business combination over the fair value of net tangible and identifiable intangible assets acquired. We exclude from our non-GAAP financial measures charges relating to impairment of goodwill and acquired identifiable intangible assets. These expenses are excluded from our non-GAAP financial measures because they are non-cash charges. |

|

|

About Non-GAAP Financial Measures Other legal expenses (recoveries). We exclude from our non-GAAP financial measures other legal fees and settlements associated with certain intellectual property litigations assumed in connection with the Witness acquisition. We excluded these items from our non-GAAP financial measures because they are not reflective of our ongoing operations. Expenses related to our previous extended filing delay. We exclude from our non-GAAP financial measures expenses related to our restatement of previously filed financial statements and our extended filing delay. These expenses included professional fees and related expenses as well as expenses associated with a special cash retention program. These expenses are excluded from our non-GAAP financial measures because they are not reflective of our ongoing operations. Restructuring costs. We exclude from our non-GAAP financial measures expense associated with the restructuring of our operations due to internal or external market factors. These expenses are excluded from our non-GAAP financial measures because we believe they are not reflective of our ongoing operations. Settlement with OCS. In the year ended January 31, 2007, we recorded a charge related to our July 31, 2006 settlement with the Office of Chief Scientist in Israel (“OCS”), pursuant to which we exited a royalty-bearing program and the OCS accepted a settlement of our royalty obligations under this program. We exclude from our non-GAAP financial measures expenses associated with exiting this program because they are not reflective of our ongoing operations. Gain on sale of land. We exclude from our non-GAAP financial measures the gain from the sale of a parcel of land. This gain is excluded from our non-GAAP financial measures because it is not reflective of our ongoing operations. |

|

|

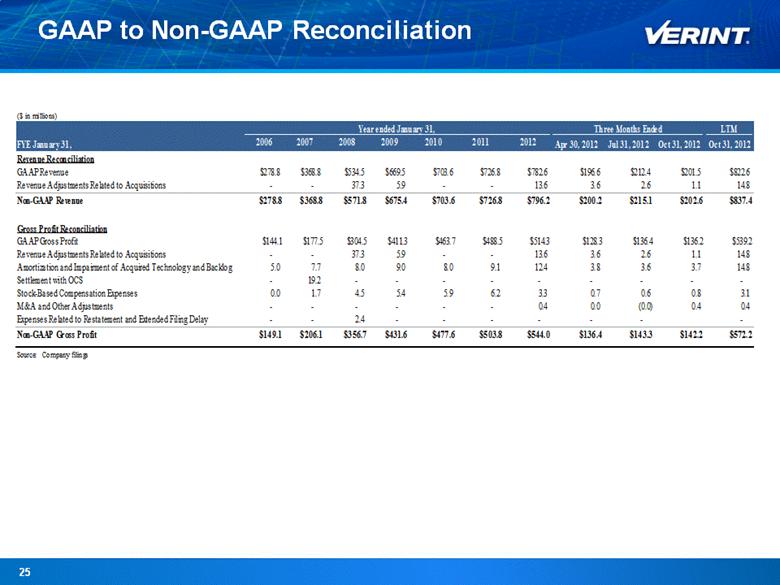

GAAP to Non-GAAP Reconciliation ($ in millions) LTM FYE January 31, 2006 2007 2008 2009 2010 2011 2012 Apr 30, 2012 Jul 31, 2012 Oct 31, 2012 Oct 31, 2012 Revenue Reconciliation GAAP Revenue $278.8 $368.8 $534.5 $669.5 $703.6 $726.8 $782.6 $196.6 $212.4 $201.5 $822.6 Revenue Adjustments Related to Acquisitions - - 37.3 5.9 - - 13.6 3.6 2.6 1.1 14.8 Non-GAAP Revenue $278.8 $368.8 $571.8 $675.4 $703.6 $726.8 $796.2 $200.2 $215.1 $202.6 $837.4 Gross Profit Reconciliation GAAP Gross Profit $144.1 $177.5 $304.5 $411.3 $463.7 $488.5 $514.3 $128.3 $136.4 $136.2 $539.2 Revenue Adjustments Related to Acquisitions - - 37.3 5.9 - - 13.6 3.6 2.6 1.1 14.8 Amortization and Impairment of Acquired Technology and Backlog 5.0 7.7 8.0 9.0 8.0 9.1 12.4 3.8 3.6 3.7 14.8 Settlement with OCS - 19.2 - - - - - - - - - Stock-Based Compensation Expenses 0.0 1.7 4.5 5.4 5.9 6.2 3.3 0.7 0.6 0.8 3.1 M&A and Other Adjustments - - - - - - 0.4 0.0 (0.0) 0.4 0.4 Expenses Related to Restatement and Extended Filing Delay - - 2.4 - - - - - - - Non-GAAP Gross Profit $149.1 $206.1 $356.7 $431.6 $477.6 $503.8 $544.0 $136.4 $143.3 $142.2 $572.2 Source: Company filings Year ended January 31, Three Months Ended |

|

|

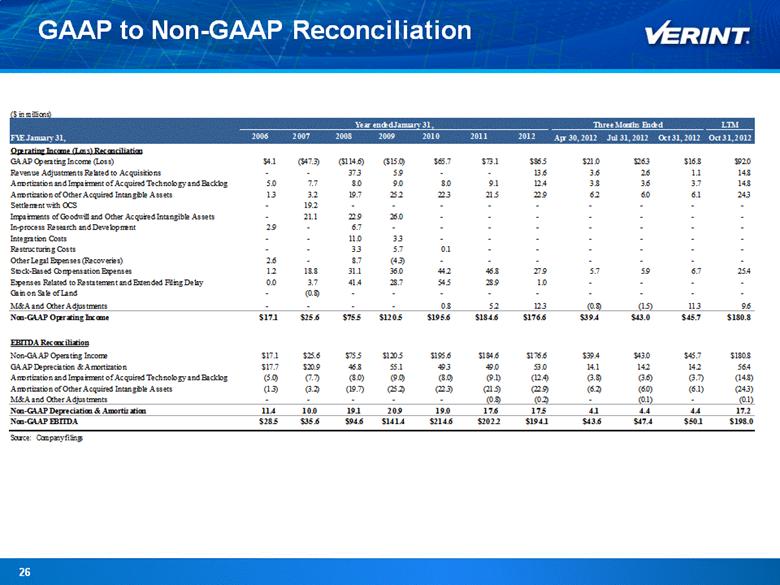

GAAP to Non-GAAP Reconciliation ($ in millions) LTM FYE January 31, 2006 2007 2008 2009 2010 2011 2012 Apr 30, 2012 Jul 31, 2012 Oct 31, 2012 Oct 31, 2012 Operating Income (Loss) Reconciliation GAAP Operating Income (Loss) $4.1 ($47.3) ($114.6) ($15.0) $65.7 $73.1 $86.5 $21.0 $26.3 $16.8 $92.0 Revenue Adjustments Related to Acquisitions - - 37.3 5.9 - - 13.6 3.6 2.6 1.1 14.8 Amortization and Impairment of Acquired Technology and Backlog 5.0 7.7 8.0 9.0 8.0 9.1 12.4 3.8 3.6 3.7 14.8 Amortization of Other Acquired Intangible Assets 1.3 3.2 19.7 25.2 22.3 21.5 22.9 6.2 6.0 6.1 24.3 Settlement with OCS - 19.2 - - - - - - - - - Impairments of Goodwill and Other Acquired Intangible Assets - 21.1 22.9 26.0 - - - - - - - In-process Research and Development 2.9 - 6.7 - - - - - - - - Integration Costs - - 11.0 3.3 - - - - - - - Restructuring Costs - - 3.3 5.7 0.1 - - - - - - Other Legal Expenses (Recoveries) 2.6 - 8.7 (4.3) - - - - - - - Stock-Based Compensation Expenses 1.2 18.8 31.1 36.0 44.2 46.8 27.9 5.7 5.9 6.7 25.4 Expenses Related to Restatement and Extended Filing Delay 0.0 3.7 41.4 28.7 54.5 28.9 1.0 - - - - Gain on Sale of Land - (0.8) - - - - - - - - - M&A and Other Adjustments - - - - 0.8 5.2 12.3 (0.8) (1.5) 11.3 9.6 Non-GAAP Operating Income $17.1 $25.6 $75.5 $120.5 $195.6 $184.6 $176.6 $39.4 $43.0 $45.7 $180.8 EBITDA Reconciliation Non-GAAP Operating Income $17.1 $25.6 $75.5 $120.5 $195.6 $184.6 $176.6 $39.4 $43.0 $45.7 $180.8 GAAP Depreciation & Amortization $17.7 $20.9 46.8 55.1 49.3 49.0 53.0 14.1 14.2 14.2 56.4 Amortization and Impairment of Acquired Technology and Backlog (5.0) (7.7) (8.0) (9.0) (8.0) (9.1) (12.4) (3.8) (3.6) (3.7) (14.8) Amortization of Other Acquired Intangible Assets (1.3) (3.2) (19.7) (25.2) (22.3) (21.5) (22.9) (6.2) (6.0) (6.1) (24.3) M&A and Other Adjustments - - - - - (0.8) (0.2) - (0.1) - (0.1) Non-GAAP Depreciation & Amortization 11.4 10.0 19.1 20.9 19.0 17.6 17.5 4.1 4.4 4.4 17.2 Non-GAAP EBITDA $28.5 $35.6 $94.6 $141.4 $214.6 $202.2 $194.1 $43.6 $47.4 $50.1 $198.0 Source: Company filings Year ended January 31, Three Months Ended |