UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04861

Fidelity Garrison Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | December 31 |

Date of reporting period: | June 30, 2022 |

Item 1.

Reports to Stockholders

Fidelity® VIP Investment Grade Central Fund

Semi-Annual Report

June 30, 2022

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2022 FMR LLC. All rights reserved.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

Note to Shareholders:

Early in 2020, the outbreak and spread of COVID-19 emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and corporate earnings. On March 11, 2020, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread. The pandemic prompted a number of measures to limit the spread of COVID-19, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. To help stem the turmoil, the U.S. government took unprecedented action – in concert with the U.S. Federal Reserve and central banks around the world – to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

In general, the overall impact of the pandemic lessened in 2021, amid a resilient economy and widespread distribution of three COVID-19 vaccines granted emergency use authorization from the U.S. Food and Drug Administration (FDA) early in the year. Still, the situation remains dynamic, and the extent and duration of its influence on financial markets and the economy is highly uncertain, due in part to a recent spike in cases based on highly contagious variants of the coronavirus.

Extreme events such as the COVID-19 crisis are exogenous shocks that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets. Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we continue to take extra steps to be responsive to customer needs. We encourage you to visit us online, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Investment Summary (Unaudited)

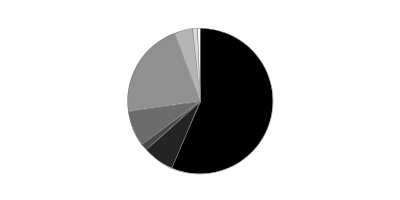

Quality Diversification (% of fund's net assets)

| As of June 30, 2022 | ||

| U.S. Government and U.S. Government Agency Obligations | 56.3% | |

| AAA | 7.0% | |

| AA | 1.5% | |

| A | 8.0% | |

| BBB | 21.4% | |

| BB and Below | 4.2% | |

| Not Rated | 1.1% | |

| Short-Term Investments and Net Other Assets | 0.5% | |

We have used ratings from Moody’s Investors Service, Inc. Where Moody’s® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. Securities rated BB or below were rated investment grade at the time of acquisition.

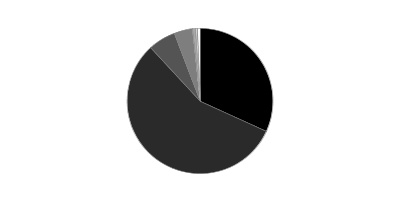

Asset Allocation (% of fund's net assets)

| As of June 30, 2022 * | ||

| Corporate Bonds | 31.8% | |

| U.S. Government and U.S. Government Agency Obligations | 56.3% | |

| Asset-Backed Securities | 6.1% | |

| CMOs and Other Mortgage Related Securities | 4.1% | |

| Municipal Bonds | 0.7% | |

| Other Investments | 0.5% | |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.5% | |

* Foreign investments - 11.9%

Percentages in the above tables are adjusted for the effect of TBA Sale Commitments.

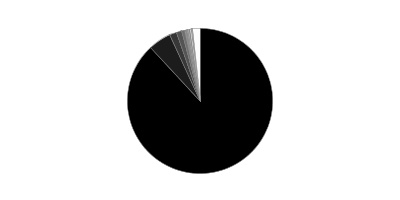

Geographic Diversification (% of fund's net assets)

| As of June 30, 2022 | ||

| United States of America* | 88.1% | |

| Cayman Islands | 5.1% | |

| United Kingdom | 1.5% | |

| Mexico | 1.2% | |

| Ireland | 0.7% | |

| Switzerland | 0.6% | |

| Canada | 0.6% | |

| France | 0.4% | |

| Other | 1.6% | |

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and include the effect of futures, if applicable.

Schedule of Investments June 30, 2022 (Unaudited)

Showing Percentage of Net Assets

| Nonconvertible Bonds - 31.8% | |||

| Principal Amount | Value | ||

| COMMUNICATION SERVICES - 3.1% | |||

| Diversified Telecommunication Services - 0.8% | |||

| AT&T, Inc.: | |||

| 2.55% 12/1/33 | $4,584,000 | $3,718,695 | |

| 3.8% 12/1/57 | 4,678,000 | 3,612,926 | |

| 4.3% 2/15/30 | 859,000 | 838,299 | |

| 4.75% 5/15/46 | 4,816,000 | 4,457,525 | |

| Verizon Communications, Inc.: | |||

| 2.1% 3/22/28 | 1,835,000 | 1,629,887 | |

| 2.55% 3/21/31 | 1,698,000 | 1,451,803 | |

| 3% 3/22/27 | 397,000 | 377,078 | |

| 4.862% 8/21/46 | 2,282,000 | 2,245,867 | |

| 5.012% 4/15/49 | 89,000 | 90,345 | |

| 18,422,425 | |||

| Entertainment - 0.4% | |||

| The Walt Disney Co.: | |||

| 3.8% 3/22/30 | 7,061,000 | 6,826,991 | |

| 4.7% 3/23/50 | 2,229,000 | 2,198,397 | |

| 9,025,388 | |||

| Media - 1.5% | |||

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp.: | |||

| 2.25% 1/15/29 | 1,100,000 | 903,834 | |

| 4.4% 4/1/33 | 1,073,000 | 958,015 | |

| 4.908% 7/23/25 | 1,184,000 | 1,186,747 | |

| 5.25% 4/1/53 | 1,073,000 | 906,699 | |

| 5.375% 5/1/47 | 5,574,000 | 4,746,046 | |

| 5.5% 4/1/63 | 1,073,000 | 911,405 | |

| 6.484% 10/23/45 | 842,000 | 818,567 | |

| Comcast Corp.: | |||

| 2.937% 11/1/56 | 2,100,000 | 1,459,279 | |

| 3.9% 3/1/38 | 329,000 | 297,543 | |

| 4.65% 7/15/42 | 779,000 | 744,465 | |

| Discovery Communications LLC: | |||

| 3.625% 5/15/30 | 1,066,000 | 947,817 | |

| 4.65% 5/15/50 | 2,883,000 | 2,267,080 | |

| Fox Corp.: | |||

| 4.03% 1/25/24 | 389,000 | 389,034 | |

| 4.709% 1/25/29 | 563,000 | 551,975 | |

| 5.476% 1/25/39 | 555,000 | 538,809 | |

| 5.576% 1/25/49 | 368,000 | 358,970 | |

| Magallanes, Inc.: | |||

| 3.428% 3/15/24 (a) | 1,267,000 | 1,242,081 | |

| 3.638% 3/15/25 (a) | 694,000 | 672,146 | |

| 3.755% 3/15/27 (a) | 1,357,000 | 1,272,855 | |

| 4.054% 3/15/29 (a) | 470,000 | 430,509 | |

| 4.279% 3/15/32 (a) | 1,970,000 | 1,760,673 | |

| 5.05% 3/15/42 (a) | 996,000 | 847,387 | |

| 5.141% 3/15/52 (a) | 1,583,000 | 1,328,691 | |

| Time Warner Cable LLC: | |||

| 4.5% 9/15/42 | 283,000 | 220,915 | |

| 5.5% 9/1/41 | 521,000 | 454,788 | |

| 5.875% 11/15/40 | 460,000 | 421,538 | |

| 6.55% 5/1/37 | 6,199,000 | 6,206,903 | |

| 7.3% 7/1/38 | 1,160,000 | 1,211,225 | |

| 34,055,996 | |||

| Wireless Telecommunication Services - 0.4% | |||

| Rogers Communications, Inc.: | |||

| 3.2% 3/15/27 (a) | 1,461,000 | 1,385,770 | |

| 3.8% 3/15/32 (a) | 1,275,000 | 1,165,873 | |

| T-Mobile U.S.A., Inc.: | |||

| 3.75% 4/15/27 | 1,871,000 | 1,801,623 | |

| 3.875% 4/15/30 | 2,705,000 | 2,524,458 | |

| 4.375% 4/15/40 | 404,000 | 360,621 | |

| 4.5% 4/15/50 | 793,000 | 703,632 | |

| 7,941,977 | |||

| TOTAL COMMUNICATION SERVICES | 69,445,786 | ||

| CONSUMER DISCRETIONARY - 0.7% | |||

| Automobiles - 0.1% | |||

| General Motors Financial Co., Inc. 4.25% 5/15/23 | 638,000 | 640,173 | |

| Volkswagen Group of America Finance LLC 3.125% 5/12/23 (a) | 1,531,000 | 1,520,037 | |

| 2,160,210 | |||

| Diversified Consumer Services - 0.0% | |||

| Ingersoll-Rand Global Holding Co. Ltd. 4.25% 6/15/23 | 899,000 | 900,808 | |

| Hotels, Restaurants & Leisure - 0.1% | |||

| McDonald's Corp.: | |||

| 3.5% 7/1/27 | 517,000 | 506,568 | |

| 3.6% 7/1/30 | 615,000 | 585,444 | |

| 1,092,012 | |||

| Household Durables - 0.0% | |||

| Toll Brothers Finance Corp. 4.875% 3/15/27 | 1,135,000 | 1,074,021 | |

| Leisure Products - 0.1% | |||

| Hasbro, Inc. 3% 11/19/24 | 1,348,000 | 1,312,337 | |

| Specialty Retail - 0.4% | |||

| AutoNation, Inc. 4.75% 6/1/30 | 234,000 | 220,121 | |

| AutoZone, Inc.: | |||

| 3.625% 4/15/25 | 350,000 | 345,646 | |

| 4% 4/15/30 | 1,629,000 | 1,546,728 | |

| Lowe's Companies, Inc.: | |||

| 3.35% 4/1/27 | 211,000 | 203,051 | |

| 3.75% 4/1/32 | 649,000 | 602,120 | |

| 4.25% 4/1/52 | 2,647,000 | 2,292,164 | |

| 4.45% 4/1/62 | 2,720,000 | 2,323,448 | |

| 4.5% 4/15/30 | 1,170,000 | 1,155,963 | |

| O'Reilly Automotive, Inc. 4.2% 4/1/30 | 361,000 | 348,534 | |

| 9,037,775 | |||

| TOTAL CONSUMER DISCRETIONARY | 15,577,163 | ||

| CONSUMER STAPLES - 2.3% | |||

| Beverages - 1.3% | |||

| Anheuser-Busch InBev Finance, Inc.: | |||

| 4.7% 2/1/36 | 2,842,000 | 2,722,713 | |

| 4.9% 2/1/46 | 3,531,000 | 3,318,751 | |

| Anheuser-Busch InBev Worldwide, Inc.: | |||

| 3.5% 6/1/30 | 1,135,000 | 1,063,907 | |

| 4.35% 6/1/40 | 1,082,000 | 968,220 | |

| 4.5% 6/1/50 | 1,534,000 | 1,379,029 | |

| 4.6% 6/1/60 | 1,135,000 | 992,122 | |

| 4.75% 4/15/58 | 1,764,000 | 1,578,625 | |

| 5.45% 1/23/39 | 1,439,000 | 1,463,028 | |

| 5.55% 1/23/49 | 3,287,000 | 3,357,081 | |

| 5.8% 1/23/59 (Reg. S) | 3,472,000 | 3,611,175 | |

| Molson Coors Beverage Co.: | |||

| 3% 7/15/26 | 2,300,000 | 2,160,288 | |

| 5% 5/1/42 | 4,016,000 | 3,712,532 | |

| The Coca-Cola Co.: | |||

| 3.375% 3/25/27 | 1,742,000 | 1,727,175 | |

| 3.45% 3/25/30 | 1,064,000 | 1,034,951 | |

| 29,089,597 | |||

| Food Products - 0.5% | |||

| General Mills, Inc. 2.875% 4/15/30 | 220,000 | 194,877 | |

| JBS Finance Luxembourg SARL: | |||

| 2.5% 1/15/27 (a) | 4,189,000 | 3,634,963 | |

| 3.625% 1/15/32 (a) | 320,000 | 258,400 | |

| JBS U.S.A. Lux SA / JBS Food Co.: | |||

| 3% 5/15/32 (a) | 3,400,000 | 2,611,067 | |

| 5.125% 2/1/28 (a) | 1,340,000 | 1,308,537 | |

| 5.5% 1/15/30 (a) | 380,000 | 359,594 | |

| 5.75% 4/1/33 (a) | 2,700,000 | 2,571,183 | |

| 6.5% 4/15/29 (a) | 49,000 | 49,294 | |

| 10,987,915 | |||

| Tobacco - 0.5% | |||

| Altria Group, Inc.: | |||

| 4.25% 8/9/42 | 1,696,000 | 1,266,285 | |

| 4.5% 5/2/43 | 1,137,000 | 853,092 | |

| 4.8% 2/14/29 | 311,000 | 295,504 | |

| 5.375% 1/31/44 | 1,030,000 | 875,629 | |

| 5.95% 2/14/49 | 407,000 | 356,637 | |

| Imperial Tobacco Finance PLC 4.25% 7/21/25 (a) | 4,751,000 | 4,652,202 | |

| Reynolds American, Inc.: | |||

| 4.45% 6/12/25 | 718,000 | 713,677 | |

| 5.7% 8/15/35 | 373,000 | 353,772 | |

| 6.15% 9/15/43 | 1,227,000 | 1,135,711 | |

| 7.25% 6/15/37 | 909,000 | 945,347 | |

| 11,447,856 | |||

| TOTAL CONSUMER STAPLES | 51,525,368 | ||

| ENERGY - 3.7% | |||

| Energy Equipment & Services - 0.0% | |||

| Halliburton Co.: | |||

| 3.8% 11/15/25 | 18,000 | 17,821 | |

| 4.85% 11/15/35 | 661,000 | 635,585 | |

| 653,406 | |||

| Oil, Gas & Consumable Fuels - 3.7% | |||

| Canadian Natural Resources Ltd.: | |||

| 3.8% 4/15/24 | 2,081,000 | 2,066,546 | |

| 5.85% 2/1/35 | 766,000 | 777,060 | |

| Cenovus Energy, Inc.: | |||

| 3.75% 2/15/52 | 2,600,000 | 1,975,088 | |

| 4.25% 4/15/27 | 1,963,000 | 1,924,022 | |

| Columbia Pipeline Group, Inc. 4.5% 6/1/25 | 410,000 | 413,375 | |

| DCP Midstream Operating LP: | |||

| 3.875% 3/15/23 | 543,000 | 537,825 | |

| 5.6% 4/1/44 | 376,000 | 303,851 | |

| 6.45% 11/3/36 (a) | 760,000 | 744,800 | |

| Empresa Nacional de Petroleo 4.375% 10/30/24 (a) | 1,086,000 | 1,080,774 | |

| Enbridge, Inc.: | |||

| 4% 10/1/23 | 863,000 | 866,379 | |

| 4.25% 12/1/26 | 544,000 | 538,372 | |

| Energy Transfer LP: | |||

| 3.75% 5/15/30 | 710,000 | 639,865 | |

| 3.9% 5/15/24 (b) | 405,000 | 401,855 | |

| 4.2% 9/15/23 | 364,000 | 364,541 | |

| 4.25% 3/15/23 | 312,000 | 311,839 | |

| 4.5% 4/15/24 | 387,000 | 387,177 | |

| 4.95% 6/15/28 | 1,242,000 | 1,223,849 | |

| 5% 5/15/50 | 2,045,000 | 1,740,181 | |

| 5.25% 4/15/29 | 629,000 | 622,997 | |

| 5.4% 10/1/47 | 414,000 | 363,233 | |

| 5.8% 6/15/38 | 692,000 | 648,181 | |

| 6% 6/15/48 | 451,000 | 423,673 | |

| 6.25% 4/15/49 | 432,000 | 418,744 | |

| Enterprise Products Operating LP 3.7% 2/15/26 | 1,472,000 | 1,446,657 | |

| Exxon Mobil Corp. 3.482% 3/19/30 | 4,122,000 | 3,953,226 | |

| Hess Corp.: | |||

| 4.3% 4/1/27 | 1,500,000 | 1,462,182 | |

| 5.6% 2/15/41 | 3,671,000 | 3,576,628 | |

| 7.125% 3/15/33 | 308,000 | 342,803 | |

| 7.3% 8/15/31 | 411,000 | 459,979 | |

| 7.875% 10/1/29 | 1,346,000 | 1,547,636 | |

| Kinder Morgan Energy Partners LP: | |||

| 3.45% 2/15/23 | 521,000 | 521,528 | |

| 6.55% 9/15/40 | 141,000 | 146,559 | |

| Kinder Morgan, Inc. 5.55% 6/1/45 | 747,000 | 703,520 | |

| MPLX LP: | |||

| 4.5% 7/15/23 | 606,000 | 607,723 | |

| 4.8% 2/15/29 | 345,000 | 339,246 | |

| 4.875% 12/1/24 | 839,000 | 844,722 | |

| 5.5% 2/15/49 | 1,036,000 | 960,915 | |

| Occidental Petroleum Corp.: | |||

| 5.55% 3/15/26 | 1,587,000 | 1,575,939 | |

| 6.2% 3/15/40 | 521,000 | 513,185 | |

| 6.45% 9/15/36 | 1,412,000 | 1,447,300 | |

| 6.6% 3/15/46 | 1,751,000 | 1,859,562 | |

| 7.5% 5/1/31 | 2,356,000 | 2,532,700 | |

| Petroleos Mexicanos: | |||

| 4.5% 1/23/26 | 1,632,000 | 1,414,128 | |

| 5.95% 1/28/31 | 1,097,000 | 800,371 | |

| 6.35% 2/12/48 | 4,049,000 | 2,352,469 | |

| 6.49% 1/23/27 | 1,175,000 | 1,006,270 | |

| 6.5% 3/13/27 | 1,481,000 | 1,278,473 | |

| 6.5% 1/23/29 | 1,705,000 | 1,386,591 | |

| 6.7% 2/16/32 | 1,810,000 | 1,371,075 | |

| 6.75% 9/21/47 | 3,713,000 | 2,274,213 | |

| 6.84% 1/23/30 | 5,684,000 | 4,476,150 | |

| 6.95% 1/28/60 | 2,417,000 | 1,487,664 | |

| 7.69% 1/23/50 | 4,972,000 | 3,318,810 | |

| Phillips 66 Co.: | |||

| 3.7% 4/6/23 | 146,000 | 145,989 | |

| 3.85% 4/9/25 | 188,000 | 186,837 | |

| Plains All American Pipeline LP/PAA Finance Corp.: | |||

| 3.55% 12/15/29 | 405,000 | 356,829 | |

| 3.6% 11/1/24 | 426,000 | 416,661 | |

| Sabine Pass Liquefaction LLC 4.5% 5/15/30 | 2,447,000 | 2,345,004 | |

| The Williams Companies, Inc.: | |||

| 3.5% 11/15/30 | 2,609,000 | 2,351,412 | |

| 3.7% 1/15/23 | 371,000 | 371,594 | |

| 3.9% 1/15/25 | 373,000 | 368,482 | |

| 4.3% 3/4/24 | 1,671,000 | 1,678,230 | |

| 4.5% 11/15/23 | 537,000 | 540,730 | |

| 4.55% 6/24/24 | 4,091,000 | 4,123,410 | |

| Transcontinental Gas Pipe Line Co. LLC: | |||

| 3.25% 5/15/30 | 312,000 | 280,189 | |

| 3.95% 5/15/50 | 1,007,000 | 835,853 | |

| Valero Energy Corp. 2.85% 4/15/25 | 72,000 | 69,582 | |

| Western Gas Partners LP: | |||

| 3.95% 6/1/25 | 266,000 | 251,038 | |

| 4.5% 3/1/28 | 613,000 | 554,765 | |

| 4.65% 7/1/26 | 2,778,000 | 2,618,265 | |

| 4.75% 8/15/28 | 354,000 | 323,421 | |

| 82,600,742 | |||

| TOTAL ENERGY | 83,254,148 | ||

| FINANCIALS - 14.8% | |||

| Banks - 6.1% | |||

| Bank of America Corp.: | |||

| 2.299% 7/21/32 (b) | 4,656,000 | 3,762,497 | |

| 3.3% 1/11/23 | 1,332,000 | 1,334,130 | |

| 3.419% 12/20/28 (b) | 5,817,000 | 5,417,128 | |

| 3.5% 4/19/26 | 1,541,000 | 1,501,314 | |

| 3.864% 7/23/24 (b) | 1,340,000 | 1,334,115 | |

| 3.95% 4/21/25 | 1,265,000 | 1,247,673 | |

| 4.2% 8/26/24 | 6,127,000 | 6,138,716 | |

| 4.25% 10/22/26 | 1,307,000 | 1,288,583 | |

| 4.45% 3/3/26 | 465,000 | 462,751 | |

| Barclays PLC: | |||

| 2.852% 5/7/26 (b) | 2,482,000 | 2,343,742 | |

| 4.375% 1/12/26 | 1,908,000 | 1,888,356 | |

| 5.088% 6/20/30 (b) | 2,253,000 | 2,126,601 | |

| 5.2% 5/12/26 | 1,908,000 | 1,899,857 | |

| BNP Paribas SA 2.219% 6/9/26 (a)(b) | 2,313,000 | 2,135,298 | |

| Citigroup, Inc.: | |||

| 2.7% 10/27/22 | 3,067,000 | 3,069,524 | |

| 3.352% 4/24/25 (b) | 1,521,000 | 1,489,743 | |

| 3.875% 3/26/25 | 2,914,000 | 2,873,307 | |

| 4.05% 7/30/22 | 552,000 | 552,527 | |

| 4.3% 11/20/26 | 532,000 | 524,337 | |

| 4.412% 3/31/31 (b) | 3,258,000 | 3,111,614 | |

| 4.45% 9/29/27 | 5,245,000 | 5,136,594 | |

| 4.6% 3/9/26 | 673,000 | 673,851 | |

| 4.91% 5/24/33 (b) | 3,286,000 | 3,242,380 | |

| 5.5% 9/13/25 | 1,694,000 | 1,740,359 | |

| Citizens Financial Group, Inc. 2.638% 9/30/32 | 1,490,000 | 1,188,469 | |

| Commonwealth Bank of Australia 3.61% 9/12/34 (a)(b) | 802,000 | 713,705 | |

| Credit Suisse Group Funding Guernsey Ltd. 3.8% 9/15/22 | 2,221,000 | 2,222,776 | |

| Discover Bank 4.2% 8/8/23 | 874,000 | 877,014 | |

| First Citizens Bank & Trust Co. 3.929% 6/19/24 (b) | 512,000 | 508,712 | |

| HSBC Holdings PLC: | |||

| 4.25% 3/14/24 | 675,000 | 671,789 | |

| 4.95% 3/31/30 | 437,000 | 431,741 | |

| Intesa Sanpaolo SpA: | |||

| 5.017% 6/26/24 (a) | 1,330,000 | 1,270,037 | |

| 5.71% 1/15/26 (a) | 3,922,000 | 3,735,895 | |

| JPMorgan Chase & Co.: | |||

| 2.956% 5/13/31 (b) | 1,324,000 | 1,143,120 | |

| 3.797% 7/23/24 (b) | 1,754,000 | 1,747,470 | |

| 3.875% 9/10/24 | 13,419,000 | 13,392,643 | |

| 4.125% 12/15/26 | 4,319,000 | 4,280,200 | |

| 4.493% 3/24/31 (b) | 3,926,000 | 3,834,184 | |

| NatWest Group PLC: | |||

| 3.073% 5/22/28 (b) | 1,427,000 | 1,297,215 | |

| 5.125% 5/28/24 | 6,295,000 | 6,307,879 | |

| 6% 12/19/23 | 3,200,000 | 3,256,819 | |

| 6.1% 6/10/23 | 4,101,000 | 4,153,560 | |

| 6.125% 12/15/22 | 2,527,000 | 2,538,156 | |

| NatWest Markets PLC 2.375% 5/21/23 (a) | 2,667,000 | 2,629,153 | |

| Rabobank Nederland 4.375% 8/4/25 | 2,285,000 | 2,265,821 | |

| Santander Holdings U.S.A., Inc. 2.49% 1/6/28 (b) | 1,754,000 | 1,548,064 | |

| Societe Generale: | |||

| 1.038% 6/18/25 (a)(b) | 4,852,000 | 4,537,647 | |

| 1.488% 12/14/26 (a)(b) | 2,986,000 | 2,633,734 | |

| Wells Fargo & Co.: | |||

| 2.406% 10/30/25 (b) | 1,400,000 | 1,332,805 | |

| 3.526% 3/24/28 (b) | 2,893,000 | 2,740,097 | |

| 4.478% 4/4/31 (b) | 4,386,000 | 4,289,297 | |

| 5.013% 4/4/51 (b) | 6,470,000 | 6,345,767 | |

| Westpac Banking Corp. 4.11% 7/24/34 (b) | 1,139,000 | 1,041,050 | |

| 138,229,816 | |||

| Capital Markets - 3.8% | |||

| Affiliated Managers Group, Inc.: | |||

| 3.5% 8/1/25 | 1,700,000 | 1,677,214 | |

| 4.25% 2/15/24 | 1,315,000 | 1,323,197 | |

| Ares Capital Corp.: | |||

| 3.875% 1/15/26 | 3,822,000 | 3,509,895 | |

| 4.2% 6/10/24 | 2,732,000 | 2,682,363 | |

| Credit Suisse Group AG: | |||

| 2.593% 9/11/25 (a)(b) | 3,245,000 | 3,052,977 | |

| 3.75% 3/26/25 | 1,429,000 | 1,384,185 | |

| 3.8% 6/9/23 | 2,632,000 | 2,607,010 | |

| 3.869% 1/12/29 (a)(b) | 1,233,000 | 1,107,994 | |

| 4.194% 4/1/31 (a)(b) | 2,950,000 | 2,610,276 | |

| 4.55% 4/17/26 | 790,000 | 772,117 | |

| Deutsche Bank AG 4.5% 4/1/25 | 3,669,000 | 3,492,861 | |

| Deutsche Bank AG New York Branch 3.3% 11/16/22 | 2,856,000 | 2,855,167 | |

| Goldman Sachs Group, Inc.: | |||

| 2.383% 7/21/32 (b) | 2,893,000 | 2,339,443 | |

| 3.2% 2/23/23 | 2,193,000 | 2,193,763 | |

| 3.691% 6/5/28 (b) | 12,774,000 | 12,113,357 | |

| 3.8% 3/15/30 | 4,751,000 | 4,405,459 | |

| 4.25% 10/21/25 | 696,000 | 690,627 | |

| 6.75% 10/1/37 | 689,000 | 763,014 | |

| Moody's Corp.: | |||

| 3.25% 1/15/28 | 732,000 | 692,863 | |

| 3.75% 3/24/25 | 1,557,000 | 1,555,887 | |

| 4.875% 2/15/24 | 687,000 | 700,199 | |

| Morgan Stanley: | |||

| 3.125% 1/23/23 | 7,975,000 | 7,972,254 | |

| 3.125% 7/27/26 | 6,737,000 | 6,426,730 | |

| 3.622% 4/1/31 (b) | 3,078,000 | 2,827,280 | |

| 3.625% 1/20/27 | 3,374,000 | 3,267,917 | |

| 3.737% 4/24/24 (b) | 1,534,000 | 1,528,659 | |

| 4.431% 1/23/30 (b) | 1,348,000 | 1,309,749 | |

| 4.875% 11/1/22 | 2,377,000 | 2,393,722 | |

| 5% 11/24/25 | 4,489,000 | 4,561,009 | |

| Peachtree Corners Funding Trust 3.976% 2/15/25 (a) | 1,534,000 | 1,517,515 | |

| UBS Group AG: | |||

| 1.494% 8/10/27 (a)(b) | 1,788,000 | 1,564,648 | |

| 4.125% 9/24/25 (a) | 1,614,000 | 1,601,148 | |

| 87,500,499 | |||

| Consumer Finance - 2.6% | |||

| AerCap Ireland Capital Ltd./AerCap Global Aviation Trust: | |||

| 1.65% 10/29/24 | 3,388,000 | 3,128,248 | |

| 2.45% 10/29/26 | 1,236,000 | 1,076,263 | |

| 2.875% 8/14/24 | 1,839,000 | 1,751,828 | |

| 3% 10/29/28 | 1,295,000 | 1,090,803 | |

| 3.3% 1/30/32 | 1,385,000 | 1,108,681 | |

| 3.5% 1/15/25 | 2,546,000 | 2,431,522 | |

| 4.125% 7/3/23 | 1,286,000 | 1,273,187 | |

| 4.45% 4/3/26 | 959,000 | 915,771 | |

| 4.875% 1/16/24 | 1,538,000 | 1,529,961 | |

| 6.5% 7/15/25 | 1,112,000 | 1,137,774 | |

| Ally Financial, Inc.: | |||

| 1.45% 10/2/23 | 678,000 | 655,368 | |

| 3.05% 6/5/23 | 2,954,000 | 2,922,382 | |

| 5.125% 9/30/24 | 656,000 | 662,365 | |

| 5.8% 5/1/25 | 1,606,000 | 1,640,237 | |

| 8% 11/1/31 | 829,000 | 921,570 | |

| Capital One Financial Corp.: | |||

| 2.6% 5/11/23 | 2,292,000 | 2,276,020 | |

| 2.636% 3/3/26 (b) | 1,495,000 | 1,411,535 | |

| 3.273% 3/1/30 (b) | 1,912,000 | 1,692,035 | |

| 3.65% 5/11/27 | 4,134,000 | 3,937,439 | |

| 3.8% 1/31/28 | 2,165,000 | 2,036,351 | |

| 4.927% 5/10/28 (b) | 2,300,000 | 2,277,879 | |

| Discover Financial Services: | |||

| 3.85% 11/21/22 | 1,546,000 | 1,549,783 | |

| 3.95% 11/6/24 | 873,000 | 860,216 | |

| 4.1% 2/9/27 | 875,000 | 839,170 | |

| 4.5% 1/30/26 | 1,437,000 | 1,408,012 | |

| Ford Motor Credit Co. LLC: | |||

| 4.063% 11/1/24 | 5,400,000 | 5,122,941 | |

| 5.584% 3/18/24 | 1,916,000 | 1,906,420 | |

| Synchrony Financial: | |||

| 3.95% 12/1/27 | 2,356,000 | 2,147,718 | |

| 4.25% 8/15/24 | 2,051,000 | 2,038,264 | |

| 4.375% 3/19/24 | 1,677,000 | 1,666,791 | |

| 5.15% 3/19/29 | 2,576,000 | 2,410,009 | |

| Toyota Motor Credit Corp. 2.9% 3/30/23 | 2,377,000 | 2,377,283 | |

| 58,203,826 | |||

| Diversified Financial Services - 0.8% | |||

| Blackstone Private Credit Fund 4.7% 3/24/25 (a) | 5,035,000 | 4,836,871 | |

| Brixmor Operating Partnership LP: | |||

| 4.05% 7/1/30 | 1,554,000 | 1,402,126 | |

| 4.125% 6/15/26 | 1,425,000 | 1,391,099 | |

| 4.125% 5/15/29 | 1,549,000 | 1,443,014 | |

| Equitable Holdings, Inc.: | |||

| 3.9% 4/20/23 | 208,000 | 209,034 | |

| 4.35% 4/20/28 | 1,304,000 | 1,257,909 | |

| Jackson Financial, Inc.: | |||

| 5.17% 6/8/27 | 1,014,000 | 1,005,214 | |

| 5.67% 6/8/32 | 1,281,000 | 1,237,556 | |

| Park Aerospace Holdings Ltd. 5.5% 2/15/24 (a) | 1,871,000 | 1,855,809 | |

| Pine Street Trust I 4.572% 2/15/29 (a) | 1,750,000 | 1,690,266 | |

| Pine Street Trust II 5.568% 2/15/49 (a) | 1,748,000 | 1,712,375 | |

| 18,041,273 | |||

| Insurance - 1.5% | |||

| AIA Group Ltd.: | |||

| 3.2% 9/16/40 (a) | 1,070,000 | 854,732 | |

| 3.375% 4/7/30 (a) | 2,257,000 | 2,112,064 | |

| American International Group, Inc. 2.5% 6/30/25 | 3,650,000 | 3,478,624 | |

| Five Corners Funding Trust II 2.85% 5/15/30 (a) | 3,419,000 | 2,974,322 | |

| Liberty Mutual Group, Inc. 4.569% 2/1/29 (a) | 1,255,000 | 1,233,988 | |

| Marsh & McLennan Companies, Inc.: | |||

| 4.375% 3/15/29 | 1,220,000 | 1,205,745 | |

| 4.75% 3/15/39 | 560,000 | 547,915 | |

| Massachusetts Mutual Life Insurance Co. 3.729% 10/15/70 (a) | 1,782,000 | 1,299,185 | |

| MetLife, Inc. 4.55% 3/23/30 | 3,527,000 | 3,556,290 | |

| Metropolitan Life Global Funding I 3% 1/10/23 (a) | 809,000 | 808,527 | |

| Pacific LifeCorp 5.125% 1/30/43 (a) | 1,611,000 | 1,546,189 | |

| SunAmerica, Inc.: | |||

| 3.5% 4/4/25 (a) | 646,000 | 627,643 | |

| 3.65% 4/5/27 (a) | 2,280,000 | 2,143,269 | |

| 3.85% 4/5/29 (a) | 904,000 | 835,414 | |

| 3.9% 4/5/32 (a) | 1,076,000 | 965,302 | |

| 4.35% 4/5/42 (a) | 245,000 | 208,932 | |

| 4.4% 4/5/52 (a) | 724,000 | 603,571 | |

| Swiss Re Finance Luxembourg SA 5% 4/2/49 (a)(b) | 600,000 | 567,750 | |

| Teachers Insurance & Annuity Association of America 4.9% 9/15/44 (a) | 1,640,000 | 1,572,398 | |

| TIAA Asset Management Finance LLC 4.125% 11/1/24 (a) | 543,000 | 539,039 | |

| Unum Group: | |||

| 3.875% 11/5/25 | 1,491,000 | 1,465,117 | |

| 4% 3/15/24 | 1,819,000 | 1,818,537 | |

| 4% 6/15/29 | 1,353,000 | 1,274,932 | |

| 5.75% 8/15/42 | 2,232,000 | 2,086,459 | |

| 34,325,944 | |||

| TOTAL FINANCIALS | 336,301,358 | ||

| HEALTH CARE - 1.3% | |||

| Health Care Providers & Services - 1.0% | |||

| Centene Corp.: | |||

| 2.45% 7/15/28 | 3,009,000 | 2,511,341 | |

| 2.625% 8/1/31 | 1,403,000 | 1,116,087 | |

| 3.375% 2/15/30 | 1,564,000 | 1,326,350 | |

| 4.25% 12/15/27 | 1,762,000 | 1,644,774 | |

| 4.625% 12/15/29 | 2,738,000 | 2,553,185 | |

| Cigna Corp.: | |||

| 3.05% 10/15/27 | 982,000 | 922,551 | |

| 4.375% 10/15/28 | 1,860,000 | 1,845,646 | |

| 4.8% 8/15/38 | 1,158,000 | 1,126,360 | |

| 4.9% 12/15/48 | 1,157,000 | 1,110,545 | |

| CVS Health Corp.: | |||

| 3% 8/15/26 | 192,000 | 183,627 | |

| 3.625% 4/1/27 | 551,000 | 536,748 | |

| 4.78% 3/25/38 | 1,830,000 | 1,732,197 | |

| HCA Holdings, Inc.: | |||

| 3.5% 9/1/30 | 1,046,000 | 889,843 | |

| 5.625% 9/1/28 | 1,311,000 | 1,289,624 | |

| 5.875% 2/1/29 | 1,020,000 | 1,020,780 | |

| Humana, Inc. 3.7% 3/23/29 | 827,000 | 782,875 | |

| Sabra Health Care LP 3.2% 12/1/31 | 2,870,000 | 2,277,677 | |

| Toledo Hospital 5.325% 11/15/28 | 647,000 | 611,796 | |

| 23,482,006 | |||

| Pharmaceuticals - 0.3% | |||

| Bayer U.S. Finance II LLC 4.25% 12/15/25 (a) | 1,338,000 | 1,320,521 | |

| Elanco Animal Health, Inc. 6.4% 8/28/28 (b) | 409,000 | 389,327 | |

| Mylan NV 4.55% 4/15/28 | 1,227,000 | 1,169,694 | |

| Utah Acquisition Sub, Inc. 3.95% 6/15/26 | 782,000 | 736,717 | |

| Viatris, Inc.: | |||

| 1.65% 6/22/25 | 302,000 | 273,388 | |

| 2.7% 6/22/30 | 1,533,000 | 1,230,326 | |

| 3.85% 6/22/40 | 668,000 | 473,148 | |

| 4% 6/22/50 | 1,153,000 | 772,034 | |

| Zoetis, Inc. 3.25% 2/1/23 | 506,000 | 504,206 | |

| 6,869,361 | |||

| TOTAL HEALTH CARE | 30,351,367 | ||

| INDUSTRIALS - 0.7% | |||

| Aerospace & Defense - 0.2% | |||

| BAE Systems PLC 3.4% 4/15/30 (a) | 696,000 | 635,345 | |

| The Boeing Co.: | |||

| 5.04% 5/1/27 | 909,000 | 897,881 | |

| 5.15% 5/1/30 | 909,000 | 872,529 | |

| 5.705% 5/1/40 | 920,000 | 858,145 | |

| 5.805% 5/1/50 | 920,000 | 844,994 | |

| 5.93% 5/1/60 | 908,000 | 826,661 | |

| 4,935,555 | |||

| Professional Services - 0.0% | |||

| Thomson Reuters Corp. 3.85% 9/29/24 | 317,000 | 314,707 | |

| Trading Companies & Distributors - 0.3% | |||

| Air Lease Corp.: | |||

| 2.25% 1/15/23 | 407,000 | 402,866 | |

| 3% 9/15/23 | 269,000 | 262,982 | |

| 3.375% 7/1/25 | 1,977,000 | 1,861,696 | |

| 3.875% 7/3/23 | 1,712,000 | 1,696,886 | |

| 4.25% 2/1/24 | 1,761,000 | 1,739,695 | |

| 4.25% 9/15/24 | 1,093,000 | 1,072,522 | |

| 7,036,647 | |||

| Transportation Infrastructure - 0.2% | |||

| Avolon Holdings Funding Ltd.: | |||

| 3.95% 7/1/24 (a) | 640,000 | 612,752 | |

| 4.25% 4/15/26 (a) | 485,000 | 449,133 | |

| 4.375% 5/1/26 (a) | 1,433,000 | 1,327,503 | |

| 5.25% 5/15/24 (a) | 1,170,000 | 1,149,486 | |

| 3,538,874 | |||

| TOTAL INDUSTRIALS | 15,825,783 | ||

| INFORMATION TECHNOLOGY - 1.0% | |||

| Electronic Equipment & Components - 0.1% | |||

| Dell International LLC/EMC Corp.: | |||

| 5.85% 7/15/25 | 397,000 | 409,429 | |

| 6.02% 6/15/26 | 480,000 | 498,219 | |

| 6.1% 7/15/27 | 729,000 | 764,325 | |

| 6.2% 7/15/30 | 631,000 | 656,679 | |

| 2,328,652 | |||

| Semiconductors & Semiconductor Equipment - 0.5% | |||

| Broadcom, Inc.: | |||

| 1.95% 2/15/28 (a) | 510,000 | 434,259 | |

| 2.45% 2/15/31 (a) | 4,340,000 | 3,486,923 | |

| 2.6% 2/15/33 (a) | 4,340,000 | 3,337,060 | |

| 3.5% 2/15/41 (a) | 3,505,000 | 2,643,190 | |

| 3.75% 2/15/51 (a) | 1,645,000 | 1,218,725 | |

| 11,120,157 | |||

| Software - 0.4% | |||

| Oracle Corp.: | |||

| 1.65% 3/25/26 | 1,992,000 | 1,784,351 | |

| 2.3% 3/25/28 | 3,147,000 | 2,707,648 | |

| 2.8% 4/1/27 | 1,797,000 | 1,638,877 | |

| 2.875% 3/25/31 | 3,303,000 | 2,721,384 | |

| 3.6% 4/1/40 | 1,797,000 | 1,342,898 | |

| 10,195,158 | |||

| TOTAL INFORMATION TECHNOLOGY | 23,643,967 | ||

| REAL ESTATE - 2.9% | |||

| Equity Real Estate Investment Trusts (REITs) - 2.4% | |||

| Alexandria Real Estate Equities, Inc. 4.9% 12/15/30 | 1,278,000 | 1,268,502 | |

| American Homes 4 Rent LP: | |||

| 2.375% 7/15/31 | 231,000 | 184,196 | |

| 3.625% 4/15/32 | 989,000 | 866,945 | |

| Boston Properties, Inc.: | |||

| 3.25% 1/30/31 | 1,190,000 | 1,020,670 | |

| 4.5% 12/1/28 | 1,193,000 | 1,159,898 | |

| Corporate Office Properties LP: | |||

| 2.25% 3/15/26 | 510,000 | 462,223 | |

| 2.75% 4/15/31 | 373,000 | 301,582 | |

| Healthcare Trust of America Holdings LP: | |||

| 3.1% 2/15/30 | 402,000 | 346,366 | |

| 3.5% 8/1/26 | 419,000 | 398,722 | |

| Healthpeak Properties, Inc.: | |||

| 3.25% 7/15/26 | 176,000 | 169,443 | |

| 3.5% 7/15/29 | 201,000 | 185,277 | |

| Hudson Pacific Properties LP 4.65% 4/1/29 | 2,374,000 | 2,278,069 | |

| Invitation Homes Operating Partnership LP 4.15% 4/15/32 | 1,453,000 | 1,319,226 | |

| Kimco Realty Corp. 3.375% 10/15/22 | 249,000 | 249,039 | |

| Kite Realty Group Trust: | |||

| 4% 3/15/25 | 1,912,000 | 1,872,413 | |

| 4.75% 9/15/30 | 2,980,000 | 2,774,352 | |

| LXP Industrial Trust (REIT): | |||

| 2.7% 9/15/30 | 560,000 | 459,647 | |

| 4.4% 6/15/24 | 442,000 | 440,156 | |

| Omega Healthcare Investors, Inc.: | |||

| 3.25% 4/15/33 | 1,945,000 | 1,472,984 | |

| 3.375% 2/1/31 | 1,027,000 | 833,877 | |

| 3.625% 10/1/29 | 1,814,000 | 1,539,458 | |

| 4.375% 8/1/23 | 381,000 | 382,172 | |

| 4.5% 1/15/25 | 821,000 | 813,698 | |

| 4.5% 4/1/27 | 4,967,000 | 4,708,645 | |

| 4.75% 1/15/28 | 1,958,000 | 1,854,909 | |

| 4.95% 4/1/24 | 415,000 | 416,419 | |

| 5.25% 1/15/26 | 1,744,000 | 1,726,861 | |

| Piedmont Operating Partnership LP 2.75% 4/1/32 | 451,000 | 348,416 | |

| Realty Income Corp.: | |||

| 2.2% 6/15/28 | 244,000 | 213,945 | |

| 2.85% 12/15/32 | 301,000 | 258,721 | |

| 3.25% 1/15/31 | 313,000 | 284,539 | |

| 3.4% 1/15/28 | 489,000 | 461,939 | |

| Retail Opportunity Investments Partnership LP: | |||

| 4% 12/15/24 | 300,000 | 291,604 | |

| 5% 12/15/23 | 226,000 | 227,436 | |

| Simon Property Group LP 2.45% 9/13/29 | 499,000 | 423,937 | |

| SITE Centers Corp.: | |||

| 3.625% 2/1/25 | 694,000 | 674,534 | |

| 4.25% 2/1/26 | 906,000 | 889,777 | |

| Store Capital Corp.: | |||

| 2.75% 11/18/30 | 2,676,000 | 2,180,933 | |

| 4.625% 3/15/29 | 550,000 | 536,611 | |

| Sun Communities Operating LP: | |||

| 2.3% 11/1/28 | 512,000 | 437,969 | |

| 2.7% 7/15/31 | 1,323,000 | 1,066,162 | |

| Ventas Realty LP: | |||

| 3% 1/15/30 | 2,340,000 | 2,047,312 | |

| 3.5% 2/1/25 | 1,976,000 | 1,927,577 | |

| 4% 3/1/28 | 688,000 | 656,983 | |

| 4.125% 1/15/26 | 478,000 | 472,870 | |

| 4.375% 2/1/45 | 234,000 | 199,505 | |

| 4.75% 11/15/30 | 3,072,000 | 3,004,607 | |

| VICI Properties LP: | |||

| 4.375% 5/15/25 | 256,000 | 250,030 | |

| 4.75% 2/15/28 | 2,029,000 | 1,936,620 | |

| 4.95% 2/15/30 | 2,648,000 | 2,509,536 | |

| 5.125% 5/15/32 | 280,000 | 263,855 | |

| Vornado Realty LP 2.15% 6/1/26 | 578,000 | 514,926 | |

| WP Carey, Inc.: | |||

| 2.4% 2/1/31 | 1,166,000 | 952,280 | |

| 3.85% 7/15/29 | 391,000 | 363,996 | |

| 4% 2/1/25 | 1,644,000 | 1,632,977 | |

| 54,535,346 | |||

| Real Estate Management & Development - 0.5% | |||

| Brandywine Operating Partnership LP: | |||

| 3.95% 2/15/23 | 1,690,000 | 1,685,914 | |

| 3.95% 11/15/27 | 1,415,000 | 1,334,725 | |

| 4.1% 10/1/24 | 1,555,000 | 1,540,096 | |

| 4.55% 10/1/29 | 1,792,000 | 1,709,260 | |

| CBRE Group, Inc. 2.5% 4/1/31 | 1,708,000 | 1,389,538 | |

| Post Apartment Homes LP 3.375% 12/1/22 | 121,000 | 121,037 | |

| Tanger Properties LP: | |||

| 2.75% 9/1/31 | 1,346,000 | 1,053,561 | |

| 3.125% 9/1/26 | 1,874,000 | 1,758,988 | |

| 10,593,119 | |||

| TOTAL REAL ESTATE | 65,128,465 | ||

| UTILITIES - 1.3% | |||

| Electric Utilities - 0.7% | |||

| Alabama Power Co. 3.05% 3/15/32 | 2,030,000 | 1,854,770 | |

| Cleco Corporate Holdings LLC: | |||

| 3.375% 9/15/29 | 1,057,000 | 943,097 | |

| 3.743% 5/1/26 | 4,043,000 | 3,900,227 | |

| Duke Energy Corp. 2.45% 6/1/30 | 854,000 | 719,824 | |

| Duquesne Light Holdings, Inc.: | |||

| 2.532% 10/1/30 (a) | 405,000 | 332,758 | |

| 2.775% 1/7/32 (a) | 1,402,000 | 1,148,960 | |

| Entergy Corp. 2.8% 6/15/30 | 876,000 | 751,314 | |

| Eversource Energy 2.8% 5/1/23 | 1,567,000 | 1,557,280 | |

| Exelon Corp.: | |||

| 2.75% 3/15/27 (a) | 449,000 | 419,719 | |

| 3.35% 3/15/32 (a) | 546,000 | 489,361 | |

| 4.05% 4/15/30 | 534,000 | 512,419 | |

| 4.1% 3/15/52 (a) | 404,000 | 348,278 | |

| 4.7% 4/15/50 | 238,000 | 223,006 | |

| FirstEnergy Corp. 7.375% 11/15/31 | 1,645,000 | 1,846,513 | |

| IPALCO Enterprises, Inc. 3.7% 9/1/24 | 662,000 | 654,559 | |

| 15,702,085 | |||

| Gas Utilities - 0.0% | |||

| Nakilat, Inc. 6.067% 12/31/33 (a) | 510,645 | 542,497 | |

| Independent Power and Renewable Electricity Producers - 0.2% | |||

| Emera U.S. Finance LP 3.55% 6/15/26 | 580,000 | 555,105 | |

| The AES Corp.: | |||

| 3.3% 7/15/25 (a) | 2,635,000 | 2,471,577 | |

| 3.95% 7/15/30 (a) | 2,298,000 | 2,072,107 | |

| 5,098,789 | |||

| Multi-Utilities - 0.4% | |||

| Berkshire Hathaway Energy Co. 4.05% 4/15/25 | 3,813,000 | 3,836,296 | |

| Consolidated Edison Co. of New York, Inc. 3.35% 4/1/30 | 242,000 | 225,440 | |

| NiSource, Inc. 2.95% 9/1/29 | 2,624,000 | 2,324,223 | |

| Puget Energy, Inc.: | |||

| 4.1% 6/15/30 | 1,032,000 | 959,221 | |

| 4.224% 3/15/32 | 1,875,000 | 1,728,495 | |

| WEC Energy Group, Inc. 3 month U.S. LIBOR + 2.610% 3.5238% 5/15/67 (b)(c) | 437,000 | 337,333 | |

| 9,411,008 | |||

| TOTAL UTILITIES | 30,754,379 | ||

| TOTAL NONCONVERTIBLE BONDS | |||

| (Cost $783,008,627) | 721,807,784 | ||

| U.S. Treasury Obligations - 40.4% | |||

| U.S. Treasury Bonds: | |||

| 1.125% 5/15/40 | $12,353,900 | $8,599,473 | |

| 1.75% 8/15/41 | 43,542,800 | 33,121,443 | |

| 1.875% 11/15/51 | 21,856,800 | 16,399,430 | |

| 2% 11/15/41 | 16,500,000 | 13,104,609 | |

| 2% 8/15/51 | 108,411,200 | 83,785,765 | |

| 2.25% 2/15/52 (d) | 36,300,000 | 29,873,766 | |

| 2.875% 5/15/52 | 17,100,000 | 16,151,484 | |

| 3% 2/15/47 | 25,251,500 | 23,579,574 | |

| U.S. Treasury Notes: | |||

| 0.125% 8/15/23 | 35,017,700 | 33,912,454 | |

| 0.125% 8/31/23 | 35,211,900 | 34,066,138 | |

| 0.25% 7/31/25 | 83,520,600 | 76,685,613 | |

| 0.375% 12/31/25 | 17,431,400 | 15,886,406 | |

| 0.75% 3/31/26 | 52,072,200 | 47,827,095 | |

| 0.75% 4/30/26 | 41,407,700 | 37,959,215 | |

| 0.75% 8/31/26 | 15,336,200 | 13,959,537 | |

| 1.125% 10/31/26 | 18,403,400 | 16,963,478 | |

| 1.125% 8/31/28 | 38,104,900 | 33,911,873 | |

| 1.125% 2/15/31 | 73,821,600 | 63,434,671 | |

| 1.25% 5/31/28 | 118,957,700 | 107,154,847 | |

| 1.375% 11/15/31 | 26,562,900 | 23,039,165 | |

| 1.625% 9/30/26 | 31,567,200 | 29,777,981 | |

| 1.75% 1/31/29 | 24,900,000 | 22,957,606 | |

| 1.875% 2/28/27 | 10,000,000 | 9,492,188 | |

| 1.875% 2/15/32 | 40,000,000 | 36,190,624 | |

| 2.25% 4/30/24 (d) | 17,808,000 | 17,575,661 | |

| 2.375% 3/31/29 | 20,000,000 | 19,144,531 | |

| 2.5% 1/31/24 | 23,709,700 | 23,531,877 | |

| 2.5% 3/31/27 | 25,000,000 | 24,391,602 | |

| 2.875% 5/15/32 (d) | 5,400,000 | 5,339,250 | |

| TOTAL U.S. TREASURY OBLIGATIONS | |||

| (Cost $1,039,165,463) | 917,817,356 | ||

| U.S. Government Agency - Mortgage Securities - 19.0% | |||

| Fannie Mae - 4.5% | |||

| 12 month U.S. LIBOR + 1.480% 1.855% 7/1/34 (b)(c) | 2,214 | 2,267 | |

| 12 month U.S. LIBOR + 1.550% 1.803% 6/1/36 (b)(c) | 2,274 | 2,344 | |

| 12 month U.S. LIBOR + 1.630% 2.24% 11/1/36 (b)(c) | 29,197 | 29,877 | |

| 12 month U.S. LIBOR + 1.700% 3.183% 6/1/42 (b)(c) | 17,751 | 18,297 | |

| 12 month U.S. LIBOR + 1.730% 3.105% 5/1/36 (b)(c) | 17,726 | 18,235 | |

| 12 month U.S. LIBOR + 1.750% 2.281% 7/1/35 (b)(c) | 1,988 | 2,027 | |

| 12 month U.S. LIBOR + 1.780% 2.163% 2/1/36 (b)(c) | 11,759 | 11,995 | |

| 12 month U.S. LIBOR + 1.800% 2.05% 7/1/41 (b)(c) | 11,768 | 12,166 | |

| 12 month U.S. LIBOR + 1.810% 2.068% 9/1/41 (b)(c) | 6,192 | 6,395 | |

| 12 month U.S. LIBOR + 1.810% 2.245% 7/1/41 (b)(c) | 14,966 | 15,530 | |

| 12 month U.S. LIBOR + 1.820% 2.195% 12/1/35 (b)(c) | 7,154 | 7,329 | |

| 12 month U.S. LIBOR + 1.830% 2.08% 10/1/41 (b)(c) | 5,738 | 5,805 | |

| 12 month U.S. LIBOR + 1.950% 2.401% 9/1/36 (b)(c) | 13,161 | 13,433 | |

| 12 month U.S. LIBOR + 1.950% 3.496% 7/1/37 (b)(c) | 4,951 | 5,132 | |

| 6 month U.S. LIBOR + 1.310% 2.438% 5/1/34 (b)(c) | 11,081 | 11,261 | |

| 6 month U.S. LIBOR + 1.420% 1.571% 9/1/33 (b)(c) | 18,986 | 19,224 | |

| 6 month U.S. LIBOR + 1.550% 2.002% 10/1/33 (b)(c) | 1,385 | 1,422 | |

| 6 month U.S. LIBOR + 1.560% 1.815% 7/1/35 (b)(c) | 2,089 | 2,158 | |

| U.S. TREASURY 1 YEAR INDEX + 1.940% 1.87% 10/1/33 (b)(c) | 23,472 | 24,383 | |

| U.S. TREASURY 1 YEAR INDEX + 2.200% 2.583% 3/1/35 (b)(c) | 1,742 | 1,801 | |

| U.S. TREASURY 1 YEAR INDEX + 2.220% 2.571% 8/1/36 (b)(c) | 24,515 | 25,376 | |

| U.S. TREASURY 1 YEAR INDEX + 2.280% 2.408% 10/1/33 (b)(c) | 3,511 | 3,638 | |

| U.S. TREASURY 1 YEAR INDEX + 2.420% 2.75% 5/1/35 (b)(c) | 5,282 | 5,468 | |

| 1.5% 11/1/40 to 11/1/51 | 2,899,491 | 2,492,533 | |

| 2% 11/1/40 to 2/1/52 | 30,654,281 | 26,772,841 | |

| 2.5% 7/1/31 to 3/1/52 | 25,628,526 | 23,475,362 | |

| 3% 8/1/32 to 7/1/50 | 14,763,331 | 14,190,181 | |

| 3.5% 8/1/37 to 1/1/52 | 15,844,086 | 15,456,842 | |

| 4% 7/1/39 to 11/1/49 | 10,249,129 | 10,294,385 | |

| 4.5% to 4.5% 5/1/25 to 9/1/49 | 6,660,842 | 6,837,797 | |

| 5% 3/1/23 to 5/1/44 | 280,967 | 294,265 | |

| 6% 10/1/34 to 1/1/42 | 1,072,303 | 1,167,506 | |

| 6.5% 12/1/23 to 8/1/36 | 196,636 | 214,467 | |

| 7% to 7% 11/1/23 to 2/1/32 | 31,179 | 32,972 | |

| 7.5% to 7.5% 9/1/25 to 11/1/31 | 37,847 | 40,845 | |

| 8.5% 6/1/25 | 113 | 120 | |

| TOTAL FANNIE MAE | 101,515,679 | ||

| Freddie Mac - 3.4% | |||

| 12 month U.S. LIBOR + 1.370% 1.684% 3/1/36 (b)(c) | 16,406 | 16,559 | |

| 12 month U.S. LIBOR + 1.880% 2.13% 9/1/41 (b)(c) | 8,885 | 9,124 | |

| 12 month U.S. LIBOR + 1.880% 3.255% 4/1/41 (b)(c) | 2,232 | 2,297 | |

| 12 month U.S. LIBOR + 1.910% 2.16% 6/1/41 (b)(c) | 5,939 | 6,160 | |

| 12 month U.S. LIBOR + 1.910% 3.131% 6/1/41 (b)(c) | 23,208 | 24,010 | |

| 12 month U.S. LIBOR + 1.910% 3.22% 5/1/41 (b)(c) | 17,815 | 18,340 | |

| 12 month U.S. LIBOR + 1.910% 3.568% 5/1/41 (b)(c) | 18,691 | 19,311 | |

| 12 month U.S. LIBOR + 2.030% 2.271% 3/1/33 (b)(c) | 256 | 261 | |

| 12 month U.S. LIBOR + 2.160% 2.41% 11/1/35 (b)(c) | 4,450 | 4,546 | |

| 6 month U.S. LIBOR + 1.650% 2.184% 4/1/35 (b)(c) | 15,001 | 15,409 | |

| 6 month U.S. LIBOR + 2.680% 3.239% 10/1/35 (b)(c) | 3,035 | 3,153 | |

| U.S. TREASURY 1 YEAR INDEX + 2.240% 2.372% 1/1/35 (b)(c) | 1,917 | 1,978 | |

| 1.5% 12/1/40 to 4/1/41 | 461,015 | 397,505 | |

| 2% 4/1/41 to 2/1/52 | 21,186,634 | 18,464,678 | |

| 2.5% 8/1/32 to 1/1/52 | 16,536,306 | 15,024,190 | |

| 3% 6/1/31 to 6/1/50 | 7,946,139 | 7,555,202 | |

| 3.5% 3/1/32 to 3/1/52 | 23,269,713 | 22,817,194 | |

| 4% 5/1/37 to 6/1/48 | 7,439,835 | 7,506,173 | |

| 4.5% 7/1/25 to 10/1/48 | 4,512,394 | 4,642,498 | |

| 5% 1/1/40 to 6/1/41 | 379,990 | 399,526 | |

| 6% 4/1/32 to 8/1/37 | 110,558 | 119,122 | |

| 7.5% 8/1/26 to 11/1/31 | 4,256 | 4,669 | |

| 8% 4/1/27 to 5/1/27 | 330 | 353 | |

| 8.5% 5/1/27 to 1/1/28 | 690 | 737 | |

| TOTAL FREDDIE MAC | 77,052,995 | ||

| Ginnie Mae - 4.4% | |||

| 3% 12/20/42 to 10/20/51 | 7,491,518 | 7,118,408 | |

| 3.5% 12/20/40 to 6/20/50 | 7,140,273 | 6,990,036 | |

| 4% 3/15/40 to 4/20/48 | 7,006,381 | 7,062,598 | |

| 4.5% 5/15/39 to 5/20/41 | 1,401,743 | 1,447,269 | |

| 5% 3/15/39 to 4/20/48 | 818,957 | 861,453 | |

| 6.5% 4/15/35 to 11/15/35 | 15,680 | 17,149 | |

| 7% 1/15/28 to 7/15/32 | 106,374 | 114,379 | |

| 7.5% to 7.5% 10/15/22 to 10/15/28 | 19,073 | 20,235 | |

| 8% 3/15/30 to 9/15/30 | 2,280 | 2,498 | |

| 2% 7/1/52 (e) | 6,000,000 | 5,327,079 | |

| 2% 7/1/52 (e) | 1,600,000 | 1,420,554 | |

| 2% 7/1/52 (e) | 1,600,000 | 1,420,554 | |

| 2% 7/1/52 (e) | 1,600,000 | 1,420,554 | |

| 2% 7/1/52 (e) | 3,150,000 | 2,796,716 | |

| 2% 7/1/52 (e) | 1,600,000 | 1,420,554 | |

| 2% 7/1/52 (e) | 1,600,000 | 1,420,554 | |

| 2% 7/1/52 (e) | 3,150,000 | 2,796,716 | |

| 2% 7/1/52 (e) | 700,000 | 621,493 | |

| 2% 7/1/52 (e) | 1,850,000 | 1,642,516 | |

| 2% 7/1/52 (e) | 3,000,000 | 2,663,540 | |

| 2% 8/1/52 (e) | 7,850,000 | 6,962,542 | |

| 2% 8/1/52 (e) | 2,950,000 | 2,616,497 | |

| 2% 8/1/52 (e) | 3,000,000 | 2,660,844 | |

| 2.5% 12/20/51 | 96,668 | 88,681 | |

| 2.5% 7/1/52 (e) | 4,200,000 | 3,841,383 | |

| 2.5% 7/1/52 (e) | 4,050,000 | 3,704,191 | |

| 2.5% 7/1/52 (e) | 2,025,000 | 1,852,096 | |

| 2.5% 7/1/52 (e) | 2,050,000 | 1,874,961 | |

| 2.5% 7/1/52 (e) | 2,050,000 | 1,874,961 | |

| 2.5% 7/1/52 (e) | 4,350,000 | 3,978,576 | |

| 2.5% 7/1/52 (e) | 2,450,000 | 2,240,807 | |

| 2.5% 7/1/52 (e) | 1,625,000 | 1,486,250 | |

| 3% 7/1/52 (e) | 3,350,000 | 3,156,458 | |

| 3% 7/1/52 (e) | 1,350,000 | 1,272,005 | |

| 3% 7/1/52 (e) | 1,350,000 | 1,272,005 | |

| 3.5% 7/1/52 (e) | 6,150,000 | 5,973,170 | |

| 4% 7/1/52 (e) | 3,400,000 | 3,383,582 | |

| 4.5% 7/1/52 (e) | 4,800,000 | 4,869,769 | |

| TOTAL GINNIE MAE | 99,693,633 | ||

| Uniform Mortgage Backed Securities - 6.7% | |||

| 1.5% 7/1/37 (e) | 2,700,000 | 2,456,718 | |

| 1.5% 7/1/52 (e) | 1,650,000 | 1,368,289 | |

| 1.5% 7/1/52 (e) | 4,550,000 | 3,773,160 | |

| 1.5% 7/1/52 (e) | 2,750,000 | 2,280,482 | |

| 1.5% 7/1/52 (e) | 1,675,000 | 1,389,021 | |

| 2% 7/1/37 (e) | 6,850,000 | 6,393,434 | |

| 2% 7/1/37 (e) | 3,350,000 | 3,126,716 | |

| 2% 7/1/37 (e) | 5,050,000 | 4,713,407 | |

| 2% 7/1/52 (e) | 5,450,000 | 4,729,067 | |

| 2% 7/1/52 (e) | 400,000 | 347,088 | |

| 2% 7/1/52 (e) | 200,000 | 173,544 | |

| 2% 7/1/52 (e) | 3,300,000 | 2,863,472 | |

| 2% 7/1/52 (e) | 4,000,000 | 3,470,875 | |

| 2% 7/1/52 (e) | 3,450,000 | 2,993,630 | |

| 2% 7/1/52 (e) | 2,900,000 | 2,516,385 | |

| 2% 7/1/52 (e) | 2,100,000 | 1,822,209 | |

| 2% 7/1/52 (e) | 2,100,000 | 1,822,209 | |

| 2% 7/1/52 (e) | 6,150,000 | 5,336,471 | |

| 2% 8/1/52 (e) | 4,500,000 | 3,900,164 | |

| 2% 8/1/52 (e) | 4,400,000 | 3,813,494 | |

| 2% 8/1/52 (e) | 3,850,000 | 3,336,807 | |

| 2% 8/1/52 (e) | 3,100,000 | 2,686,780 | |

| 2.5% 7/1/52 (e) | 12,100,000 | 10,874,869 | |

| 2.5% 7/1/52 (e) | 4,400,000 | 3,954,498 | |

| 2.5% 7/1/52 (e) | 5,650,000 | 5,077,935 | |

| 2.5% 7/1/52 (e) | 10,375,000 | 9,324,526 | |

| 2.5% 7/1/52 (e) | 14,000,000 | 12,582,493 | |

| 2.5% 7/1/52 (e) | 1,500,000 | 1,348,124 | |

| 2.5% 8/1/52 (e) | 9,650,000 | 8,661,624 | |

| 2.5% 8/1/52 (e) | 4,350,000 | 3,904,463 | |

| 3% 7/1/52 (e) | 10,650,000 | 9,911,982 | |

| 3% 7/1/52 (e) | 11,250,000 | 10,470,403 | |

| 3% 8/1/52 (e) | 7,900,000 | 7,343,292 | |

| 3.5% 7/1/52 (e) | 50,000 | 48,068 | |

| 3.5% 7/1/52 (e) | 250,000 | 240,342 | |

| 4% 7/1/52 (e) | 2,300,000 | 2,267,296 | |

| 4% 7/1/52 (e) | 1,250,000 | 1,232,226 | |

| 4% 7/1/52 (e) | 1,150,000 | 1,133,648 | |

| TOTAL UNIFORM MORTGAGE BACKED SECURITIES | 153,689,211 | ||

| TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES | |||

| (Cost $449,970,702) | 431,951,518 | ||

| Asset-Backed Securities - 6.1% | |||

| AASET Trust: | |||

| Series 2018-1A Class A, 3.844% 1/16/38 (a) | $859,034 | $578,463 | |

| Series 2019-1 Class A, 3.844% 5/15/39 (a) | 818,872 | 562,657 | |

| Series 2019-2: | |||

| Class A, 3.376% 10/16/39 (a) | 1,635,187 | 1,243,267 | |

| Class B, 4.458% 10/16/39 (a) | 315,410 | 200,409 | |

| Series 2021-1A Class A, 2.95% 11/16/41 (a) | 1,888,692 | 1,581,751 | |

| Series 2021-2A Class A, 2.798% 1/15/47 (a) | 3,501,902 | 2,990,820 | |

| Aimco Series 2021-BA Class AR, 3 month U.S. LIBOR + 1.100% 2.1443% 1/15/32 (a)(b)(c) | 529,405 | 515,287 | |

| AIMCO CLO Ltd. Series 2021-11A Class AR, 3 month U.S. LIBOR + 1.130% 2.1743% 10/17/34 (a)(b)(c) | 1,280,878 | 1,231,220 | |

| AIMCO CLO Ltd. / AIMCO CLO LLC Series 2021-14A Class A, 3 month U.S. LIBOR + 0.990% 2.0527% 4/20/34 (a)(b)(c) | 3,132,569 | 2,991,155 | |

| Allegro CLO XV, Ltd. / Allegro CLO VX LLC Series 2022-1A Class A, CME TERM SOFR 3 MONTH INDEX + 1.500% 3.1807% 7/20/35 (a)(b)(c) | 1,736,000 | 1,691,826 | |

| Allegro CLO, Ltd. Series 2021-1A Class A, 3 month U.S. LIBOR + 1.140% 2.2027% 7/20/34 (a)(b)(c) | 1,532,085 | 1,473,898 | |

| Apollo Aviation Securitization Equity Trust Series 2020-1A Class A, 3.351% 1/16/40 (a) | 505,094 | 423,663 | |

| Ares CLO Series 2019-54A Class A, 3 month U.S. LIBOR + 1.320% 2.3643% 10/15/32 (a)(b)(c) | 1,676,859 | 1,637,927 | |

| Ares LIX CLO Ltd. Series 2021-59A Class A, 3 month U.S. LIBOR + 1.030% 2.214% 4/25/34 (a)(b)(c) | 1,039,487 | 998,312 | |

| Ares LV CLO Ltd. Series 2021-55A Class A1R, 3 month U.S. LIBOR + 1.130% 2.1743% 7/15/34 (a)(b)(c) | 1,931,133 | 1,870,453 | |

| Ares LVIII CLO LLC Series 2022-58A Class AR, U.S. 90-Day Avg. Secured Overnight Fin. Rate (SOFR) Indx + 1.330% 2.1764% 1/15/35 (a)(b)(c) | 2,545,000 | 2,439,794 | |

| Ares XLI CLO Ltd. / Ares XLI CLO LLC Series 2021-41A Class AR2, 3 month U.S. LIBOR + 1.070% 2.1143% 4/15/34 (a)(b)(c) | 2,173,138 | 2,091,724 | |

| Ares XXXIV CLO Ltd. Series 2020-2A Class AR2, 3 month U.S. LIBOR + 1.250% 2.2943% 4/17/33 (a)(b)(c) | 665,897 | 649,326 | |

| Babson CLO Ltd. Series 2021-1A Class AR, 3 month U.S. LIBOR + 1.150% 2.1943% 10/15/36 (a)(b)(c) | 1,292,534 | 1,247,554 | |

| Barings CLO Ltd.: | |||

| Series 2021-1A Class A, 3 month U.S. LIBOR + 1.020% 2.204% 4/25/34 (a)(b)(c) | 2,282,638 | 2,200,470 | |

| Series 2021-4A Class A, 3 month U.S. LIBOR + 1.220% 2.2827% 1/20/32 (a)(b)(c) | 2,070,385 | 2,026,429 | |

| Beechwood Park CLO Ltd. Series 2022-1A Class A1R, CME TERM SOFR 3 MONTH INDEX + 1.300% 2.1464% 1/17/35 (a)(b)(c) | 2,560,000 | 2,469,940 | |

| BETHP Series 2021-1A Class A, 3 month U.S. LIBOR + 1.130% 2.1743% 1/15/35 (a)(b)(c) | 1,953,217 | 1,880,907 | |

| Blackbird Capital Aircraft: | |||

| Series 2016-1A: | |||

| Class A, 4.213% 12/16/41 (a) | 2,034,759 | 1,798,023 | |

| Class AA, 2.487% 12/16/41 (a)(b) | 245,807 | 229,536 | |

| Series 2021-1A Class A, 2.443% 7/15/46 (a) | 2,552,194 | 2,184,645 | |

| Bristol Park CLO, Ltd. Series 2020-1A Class AR, 3 month U.S. LIBOR + 0.990% 2.0343% 4/15/29 (a)(b)(c) | 1,983,909 | 1,953,000 | |

| Castlelake Aircraft Securitization Trust Series 2019-1A: | |||

| Class A, 3.967% 4/15/39 (a) | 1,253,805 | 1,106,055 | |

| Class B, 5.095% 4/15/39 (a) | 666,261 | 527,739 | |

| Castlelake Aircraft Structured Trust: | |||

| Series 2018-1 Class A, 4.125% 6/15/43 (a) | 917,138 | 824,277 | |

| Series 2021-1A Class A, 3.474% 1/15/46 (a) | 528,889 | 471,075 | |

| Cedar Funding Ltd.: | |||

| Series 2021-10A Class AR, 3 month U.S. LIBOR + 1.100% 2.1627% 10/20/32 (a)(b)(c) | 1,561,530 | 1,515,265 | |

| Series 2022-15A Class A, CME TERM SOFR 3 MONTH INDEX + 1.320% 2.0327% 4/20/35 (a)(b)(c) | 2,429,000 | 2,324,176 | |

| Cedar Funding XII CLO Ltd. / Cedar Funding XII CLO LLC Series 2021-12A Class A1R, 3 month U.S. LIBOR + 1.130% 2.314% 10/25/34 (a)(b)(c) | 1,198,676 | 1,153,235 | |

| CEDF Series 2021-6A Class ARR, 3 month U.S. LIBOR + 1.050% 2.1127% 4/20/34 (a)(b)(c) | 1,887,884 | 1,805,838 | |

| Cent CLO Ltd. / Cent CLO Series 2021-29A Class AR, 3 month U.S. LIBOR + 1.170% 2.2327% 10/20/34 (a)(b)(c) | 1,944,015 | 1,868,360 | |

| Columbia Cent CLO 31 Ltd. Series 2021-31A Class A1, 3 month U.S. LIBOR + 1.200% 2.2627% 4/20/34 (a)(b)(c) | 2,085,721 | 2,009,486 | |

| Columbia Cent Clo 32 Ltd. / Coliseum Series 2022-32A Class A1, CME TERM SOFR 3 MONTH INDEX + 1.700% 1.75% 7/24/34 (b)(c)(e) | 2,607,000 | 2,583,292 | |

| Columbia Cent CLO Ltd. / Columbia Cent CLO Corp. Series 2021-30A Class A1, 3 month U.S. LIBOR + 1.310% 2.3727% 1/20/34 (a)(b)(c) | 2,729,841 | 2,658,150 | |

| DB Master Finance LLC Series 2017-1A Class A2II, 4.03% 11/20/47 (a) | 1,770,418 | 1,694,371 | |

| Dryden 98 CLO Ltd. Series 2022-98A Class A, CME TERM SOFR 3 MONTH INDEX + 1.300% 2.204% 4/20/35 (a)(b)(c) | 1,361,000 | 1,307,928 | |

| Dryden CLO, Ltd.: | |||

| Series 2021-76A Class A1R, 3 month U.S. LIBOR + 1.150% 2.2127% 10/20/34 (a)(b)(c) | 1,290,693 | 1,246,107 | |

| Series 2021-83A Class A, 3 month U.S. LIBOR + 1.220% 2.2643% 1/18/32 (a)(b)(c) | 1,582,694 | 1,548,351 | |

| Dryden Senior Loan Fund: | |||

| Series 2020-78A Class A, 3 month U.S. LIBOR + 1.180% 2.2243% 4/17/33 (a)(b)(c) | 1,318,912 | 1,281,286 | |

| Series 2021-85A Class AR, 3 month U.S. LIBOR + 1.150% 2.1943% 10/15/35 (a)(b)(c) | 1,717,039 | 1,654,213 | |

| Series 2021-90A Class A1A, 3 month U.S. LIBOR + 1.130% 2.608% 2/20/35 (a)(b)(c) | 1,021,083 | 982,506 | |

| Eaton Vance CLO, Ltd.: | |||

| Series 2021-1A Class AR, 3 month U.S. LIBOR + 1.100% 2.1443% 4/15/31 (a)(b)(c) | 885,205 | 863,192 | |

| Series 2021-2A Class AR, 3 month U.S. LIBOR + 1.150% 2.1943% 1/15/35 (a)(b)(c) | 2,283,000 | 2,207,928 | |

| Eaton Vance CLO, Ltd. / Eaton Vance CLO LLC Series 2021-1A Class A13R, 3 month U.S. LIBOR + 1.250% 2.2943% 1/15/34 (a)(b)(c) | 444,749 | 432,233 | |

| Flatiron CLO Ltd. Series 2021-1A: | |||

| Class A1, 3 month U.S. LIBOR + 1.110% 2.1543% 7/19/34 (a)(b)(c) | 1,392,832 | 1,342,966 | |

| Class AR, 3 month U.S. LIBOR + 1.080% 2.4913% 11/16/34 (a)(b)(c) | 1,993,704 | 1,931,367 | |

| Flatiron CLO Ltd. / Flatiron CLO LLC Series 2020-1A Class A, 3 month U.S. LIBOR + 1.300% 2.778% 11/20/33 (a)(b)(c) | 2,529,561 | 2,459,254 | |

| Horizon Aircraft Finance I Ltd. Series 2018-1 Class A, 4.458% 12/15/38 (a) | 750,922 | 653,339 | |

| Horizon Aircraft Finance Ltd. Series 2019-1 Class A, 3.721% 7/15/39 (a) | 754,917 | 667,988 | |

| Invesco CLO Ltd. Series 2021-3A Class A, 3 month U.S. LIBOR + 1.130% 2.2663% 10/22/34 (a)(b)(c) | 1,367,988 | 1,313,910 | |

| KKR CLO Ltd. Series 2022-41A Class A1, CME TERM SOFR 3 MONTH INDEX + 1.330% 2.0223% 4/15/35 (a)(b)(c) | 3,167,000 | 3,039,522 | |

| Lucali CLO Ltd. Series 2021-1A Class A, 3 month U.S. LIBOR + 1.210% 2.2543% 1/15/33 (a)(b)(c) | 981,516 | 957,705 | |

| Madison Park Funding Series 2020-19A Class A1R2, 3 month U.S. LIBOR + 0.920% 2.0563% 1/22/28 (a)(b)(c) | 1,337,195 | 1,317,617 | |

| Madison Park Funding L Ltd. / Madison Park Funding L LLC Series 2021-50A Class A, 3 month U.S. LIBOR + 1.140% 2.1843% 4/19/34 (a)(b)(c) | 2,186,940 | 2,121,428 | |

| Madison Park Funding LII Ltd. / Madison Park Funding LII LLC Series 2021-52A Class A, 3 month U.S. LIBOR + 1.100% 2.2363% 1/22/35 (a)(b)(c) | 2,223,747 | 2,131,844 | |

| Madison Park Funding XLV Ltd./Madison Park Funding XLV LLC Series 2021-45A Class AR, 3 month U.S. LIBOR + 1.120% 2.1643% 7/15/34 (a)(b)(c) | 1,390,072 | 1,347,190 | |

| Madison Park Funding XXXII, Ltd. / Madison Park Funding XXXII LLC Series 2021-32A Class A2R, 3 month U.S. LIBOR + 1.200% 2.3363% 1/22/31 (a)(b)(c) | 573,573 | 549,523 | |

| Magnetite CLO Ltd. Series 2021-27A Class AR, 3 month U.S. LIBOR + 1.140% 2.2027% 10/20/34 (a)(b)(c) | 461,006 | 444,667 | |

| Magnetite IX, Ltd. / Magnetite IX LLC Series 2021-30A Class A, 3 month U.S. LIBOR + 1.130% 2.314% 10/25/34 (a)(b)(c) | 2,357,478 | 2,275,791 | |

| Magnetite XXI Ltd. Series 2021-21A Class AR, 3 month U.S. LIBOR + 1.020% 2.0827% 4/20/34 (a)(b)(c) | 1,823,166 | 1,757,950 | |

| Magnetite XXIII, Ltd. Series 2021-23A Class AR, 3 month U.S. LIBOR + 1.130% 2.314% 1/25/35 (a)(b)(c) | 5,340,000 | 5,139,948 | |

| Magnetite XXIX, Ltd. / Magnetite XXIX LLC Series 2021-29A Class A, 3 month U.S. LIBOR + 0.990% 2.0343% 1/15/34 (a)(b)(c) | 1,904,754 | 1,855,943 | |

| Milos CLO, Ltd. Series 2020-1A Class AR, 3 month U.S. LIBOR + 1.070% 2.1327% 10/20/30 (a)(b)(c) | 1,997,385 | 1,959,571 | |

| Park Place Securities, Inc. Series 2005-WCH1 Class M4, 1 month U.S. LIBOR + 1.240% 2.8686% 1/25/36 (b)(c) | 58,955 | 58,529 | |

| Peace Park CLO, Ltd. Series 2021-1A Class A, 3 month U.S. LIBOR + 1.130% 2.1927% 10/20/34 (a)(b)(c) | 760,982 | 736,956 | |

| Planet Fitness Master Issuer LLC: | |||

| Series 2019-1A Class A2, 3.858% 12/5/49 (a) | 1,448,850 | 1,288,074 | |

| Series 2022-1A: | |||

| Class A2I, 3.251% 12/5/51 (a) | 1,570,065 | 1,406,607 | |

| Class A2II, 4.008% 12/5/51 (a) | 1,402,485 | 1,250,709 | |

| Project Silver Series 2019-1 Class A, 3.967% 7/15/44 (a) | 1,410,409 | 1,210,436 | |

| Rockland Park CLO Ltd. Series 2021-1A Class A, 3 month U.S. LIBOR + 1.120% 2.1827% 4/20/34 (a)(b)(c) | 2,604,698 | 2,526,474 | |

| RR 7 Ltd. Series 2022-7A Class A1AB, 3 month U.S. LIBOR + 1.340% 1.5203% 1/15/37 (a)(b)(c) | 2,626,000 | 2,530,183 | |

| Sapphire Aviation Finance Series 2020-1A Class A, 3.228% 3/15/40 (a) | 1,468,823 | 1,285,742 | |

| SBA Tower Trust: | |||

| Series 2019, 2.836% 1/15/50 (a) | 1,902,000 | 1,837,249 | |

| 1.884% 7/15/50 (a) | 733,000 | 677,634 | |

| 2.328% 7/15/52 (a) | 560,000 | 497,353 | |

| Stratus CLO, Ltd. Series 2022-1A Class A, CME TERM SOFR 3 MONTH INDEX + 1.750% 1.75% 7/20/30 (a)(b)(c)(e) | 417,000 | 413,208 | |

| SYMP Series 2022-32A Class A1, CME TERM SOFR 3 MONTH INDEX + 1.320% 1.6326% 4/23/35 (a)(b)(c) | 2,727,000 | 2,607,398 | |

| Symphony CLO XXI, Ltd. Series 2021-21A Class AR, 3 month U.S. LIBOR + 1.060% 2.1043% 7/15/32 (a)(b)(c) | 256,728 | 249,738 | |

| Symphony CLO XXV Ltd. / Symphony CLO XXV LLC Series 2021-25A Class A, 3 month U.S. LIBOR + 0.980% 2.0243% 4/19/34 (a)(b)(c) | 2,313,924 | 2,223,329 | |

| Symphony CLO XXVI Ltd. / Symphony CLO XXVI LLC Series 2021-26A Class AR, 3 month U.S. LIBOR + 1.080% 2.1427% 4/20/33 (a)(b)(c) | 2,177,375 | 2,106,151 | |

| Terwin Mortgage Trust Series 2003-4HE Class A1, 1 month U.S. LIBOR + 0.860% 2.4836% 9/25/34 (b)(c) | 2,297 | 2,247 | |

| Thunderbolt Aircraft Lease Ltd. Series 2018-A Class A, 4.147% 9/15/38 (a)(b) | 1,739,912 | 1,534,437 | |

| Thunderbolt III Aircraft Lease Ltd. Series 2019-1 Class A, 3.671% 11/15/39 (a) | 2,169,402 | 1,860,514 | |

| Voya CLO Ltd. Series 2019-2A Class A, 3 month U.S. LIBOR + 1.270% 2.3327% 7/20/32 (a)(b)(c) | 2,009,654 | 1,964,897 | |

| Voya CLO Ltd./Voya CLO LLC: | |||

| Series 2021-2A Class A1R, 3 month U.S. LIBOR + 1.160% 2.2043% 7/19/34 (a)(b)(c) | 1,277,198 | 1,235,800 | |

| Series 2021-3A Class AR, 3 month U.S. LIBOR + 1.150% 2.2127% 10/20/34 (a)(b)(c) | 2,613,900 | 2,520,155 | |

| Voya CLO, Ltd. Series 2021-1A Class AR, 3 month U.S. LIBOR + 1.150% 2.1943% 7/16/34 (a)(b)(c) | 1,289,773 | 1,246,172 | |

| TOTAL ASSET-BACKED SECURITIES | |||

| (Cost $148,238,416) | 139,765,034 | ||

| Collateralized Mortgage Obligations - 0.0% | |||

| Private Sponsor - 0.0% | |||

| Cascade Funding Mortgage Trust Series 2021-HB6 Class A, 0.8983% 6/25/36 (a) | 1,200,621 | 1,177,145 | |

| Sequoia Mortgage Trust floater Series 2004-6 Class A3B, 6 month U.S. LIBOR + 0.880% 3.6276% 7/20/34 (b)(c) | 537 | 492 | |

| TOTAL PRIVATE SPONSOR | 1,177,637 | ||

| U.S. Government Agency - 0.0% | |||

| Fannie Mae planned amortization class: | |||

| Series 1999-54 Class PH, 6.5% 11/18/29 | 12,575 | 12,874 | |

| Series 1999-57 Class PH, 6.5% 12/25/29 | 25,842 | 27,012 | |

| Ginnie Mae guaranteed REMIC pass-thru certificates sequential payer Series 2013-H06 Class HA, 1.65% 1/20/63 (f) | 8,572 | 8,556 | |

| TOTAL U.S. GOVERNMENT AGENCY | 48,442 | ||

| TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS | |||

| (Cost $1,246,245) | 1,226,079 | ||

| Commercial Mortgage Securities - 4.1% | |||

| BAMLL Commercial Mortgage Securities Trust: | |||

| floater Series 2022-DKLX: | |||

| Class A, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Indx + 1.150% 2.429% 1/15/39 (a)(b)(c) | 1,415,000 | 1,374,671 | |

| Class B, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Indx + 1.550% 2.829% 1/15/39 (a)(b)(c) | 267,000 | 258,353 | |

| Class C, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Indx + 2.150% 3.429% 1/15/39 (a)(b)(c) | 191,000 | 183,579 | |

| sequential payer Series 2019-BPR Class ANM, 3.112% 11/5/32 (a) | 1,183,000 | 1,126,070 | |

| Series 2019-BPR: | |||

| Class BNM, 3.465% 11/5/32 (a) | 265,000 | 244,163 | |

| Class CNM, 3.8425% 11/5/32 (a)(b) | 110,000 | 94,180 | |

| BANK sequential payer: | |||

| Series 2018-BN10 Class A5, 3.688% 2/15/61 | 118,089 | 114,878 | |

| Series 2019-BN21 Class A5, 2.851% 10/17/52 | 201,824 | 184,171 | |

| Benchmark Mortgage Trust: | |||

| sequential payer: | |||

| Series 2018-B4 Class A5, 4.121% 7/15/51 | 420,518 | 417,506 | |

| Series 2019-B10 Class A4, 3.717% 3/15/62 | 389,846 | 376,423 | |

| Series 2018-B8 Class A5, 4.2317% 1/15/52 | 2,882,896 | 2,873,075 | |

| BFLD Trust floater sequential payer Series 2020-OBRK Class A, 1 month U.S. LIBOR + 2.050% 3.374% 11/15/28 (a)(b)(c) | 1,079,000 | 1,064,872 | |

| BPR Trust floater Series 2022-OANA: | |||

| Class A, CME TERM SOFR 1 MONTH INDEX + 1.890% 3.1767% 4/15/37 (a)(b)(c) | 5,047,000 | 4,943,744 | |

| Class B, CME TERM SOFR 1 MONTH INDEX + 2.440% 3.7257% 4/15/37 (a)(b)(c) | 1,341,000 | 1,311,677 | |

| BX Commercial Mortgage Trust floater: | |||

| Series 2021-PAC: | |||

| Class A, 1 month U.S. LIBOR + 0.680% 2.0141% 10/15/36 (a)(b)(c) | 2,648,253 | 2,513,900 | |

| Class B, 1 month U.S. LIBOR + 0.890% 2.2238% 10/15/36 (a)(b)(c) | 396,287 | 373,381 | |

| Class C, 1 month U.S. LIBOR + 1.090% 2.4236% 10/15/36 (a)(b)(c) | 530,325 | 493,546 | |

| Class D, 1 month U.S. LIBOR + 1.290% 2.6233% 10/15/36 (a)(b)(c) | 514,682 | 474,382 | |

| Class E, 1 month U.S. LIBOR + 1.940% 3.2725% 10/15/36 (a)(b)(c) | 1,789,733 | 1,661,149 | |

| Series 2022-LP2: | |||

| Class A, CME TERM SOFR 1 MONTH INDEX + 1.010% 2.3469% 2/15/39 (a)(b)(c) | 3,356,167 | 3,222,064 | |

| Class B, CME TERM SOFR 1 MONTH INDEX + 1.310% 2.6463% 2/15/39 (a)(b)(c) | 1,011,333 | 960,820 | |

| Class C, CME TERM SOFR 1 MONTH INDEX + 1.560% 2.8957% 2/15/39 (a)(b)(c) | 1,011,333 | 950,718 | |

| Class D, CME TERM SOFR 1 MONTH INDEX + 1.960% 3.2948% 2/15/39 (a)(b)(c) | 1,011,333 | 940,619 | |

| BX Trust: | |||

| floater: | |||

| Series 2018-EXCL Class D, 1 month U.S. LIBOR + 2.620% 3.949% 9/15/37 (a)(b)(c) | 455,393 | 379,309 | |

| Series 2019-IMC: | |||

| Class B, 1 month U.S. LIBOR + 1.300% 2.624% 4/15/34 (a)(b)(c) | 1,007,281 | 966,683 | |

| Class C, 1 month U.S. LIBOR + 1.600% 2.924% 4/15/34 (a)(b)(c) | 665,897 | 637,383 | |

| Class D, 1 month U.S. LIBOR + 1.900% 3.224% 4/15/34 (a)(b)(c) | 699,023 | 663,809 | |

| Series 2019-XL: | |||

| Class B, 1 month U.S. LIBOR + 1.080% 2.404% 10/15/36 (a)(b)(c) | 806,653 | 786,361 | |

| Class C, 1 month U.S. LIBOR + 1.250% 2.574% 10/15/36 (a)(b)(c) | 1,014,182 | 983,568 | |

| Class D, 1 month U.S. LIBOR + 1.450% 2.774% 10/15/36 (a)(b)(c) | 1,436,280 | 1,389,314 | |

| Class E, 1 month U.S. LIBOR + 1.800% 3.124% 10/15/36 (a)(b)(c) | 2,018,196 | 1,947,125 | |

| Series 2022-IND: | |||

| Class A, CME TERM SOFR 1 MONTH INDEX + 1.490% 2.8248% 4/15/37 (a)(b)(c) | 2,719,000 | 2,645,656 | |

| Class B, CME TERM SOFR 1 MONTH INDEX + 1.940% 3.2738% 4/15/37 (a)(b)(c) | 1,386,000 | 1,343,109 | |

| Class C, CME TERM SOFR 1 MONTH INDEX + 2.290% 3.6238% 4/15/37 (a)(b)(c) | 313,000 | 299,991 | |

| Class D, CME TERM SOFR 1 MONTH INDEX + 2.830% 4.1728% 4/15/37 (a)(b)(c) | 262,000 | 249,654 | |

| floater, sequential payer Series 2019-IMC Class A, 1 month U.S. LIBOR + 1.000% 2.324% 4/15/34 (a)(b)(c) | 1,656,308 | 1,614,583 | |

| CF Hippolyta Issuer LLC sequential payer Series 2021-1A Class A1, 1.53% 3/15/61 (a) | 2,986,767 | 2,635,978 | |

| CHC Commercial Mortgage Trust floater Series 2019-CHC: | |||

| Class A, 1 month U.S. LIBOR + 1.120% 2.444% 6/15/34 (a)(b)(c) | 2,419,570 | 2,363,539 | |

| Class B, 1 month U.S. LIBOR + 1.500% 2.824% 6/15/34 (a)(b)(c) | 476,425 | 460,645 | |

| Class C, 1 month U.S. LIBOR + 1.750% 3.074% 6/15/34 (a)(b)(c) | 538,224 | 517,785 | |

| CIM Retail Portfolio Trust floater Series 2021-RETL: | |||

| Class C, 1 month U.S. LIBOR + 2.300% 3.625% 8/15/36 (a)(b)(c) | 105,628 | 99,983 | |

| Class D, 1 month U.S. LIBOR + 3.050% 4.375% 8/15/36 (a)(b)(c) | 352,500 | 330,334 | |

| COMM Mortgage Trust sequential payer Series 2014-CR18 Class A5, 3.828% 7/15/47 | 387,699 | 385,008 | |

| Credit Suisse Mortgage Trust: | |||

| floater Series 2019-ICE4: | |||

| Class B, 1 month U.S. LIBOR + 1.230% 2.554% 5/15/36 (a)(b)(c) | 1,290,000 | 1,261,276 | |

| Class C, 1 month U.S. LIBOR + 1.430% 2.754% 5/15/36 (a)(b)(c) | 243,000 | 237,028 | |

| sequential payer Series 2020-NET Class A, 2.2569% 8/15/37 (a) | 592,056 | 546,535 | |

| Series 2018-SITE: | |||

| Class A, 4.284% 4/15/36 (a) | 1,129,357 | 1,096,612 | |

| Class B, 4.5349% 4/15/36 (a) | 347,211 | 333,752 | |

| Class C, 4.9414% 4/15/36 (a)(b) | 233,110 | 222,892 | |

| Class D, 4.9414% 4/15/36 (a)(b) | 465,913 | 435,873 | |

| ELP Commercial Mortgage Trust floater Series 2021-ELP Class A, 1 month U.S. LIBOR + 0.700% 2.026% 11/15/38 (a)(b)(c) | 3,658,294 | 3,492,930 | |

| Extended Stay America Trust floater Series 2021-ESH: | |||

| Class A, 1 month U.S. LIBOR + 1.080% 2.405% 7/15/38 (a)(b)(c) | 1,204,586 | 1,174,336 | |

| Class B, 1 month U.S. LIBOR + 1.380% 2.705% 7/15/38 (a)(b)(c) | 685,779 | 665,112 | |

| Class C, 1 month U.S. LIBOR + 1.700% 3.025% 7/15/38 (a)(b)(c) | 505,887 | 489,371 | |

| Class D, 1 month U.S. LIBOR + 2.250% 3.575% 7/15/38 (a)(b)(c) | 1,019,724 | 983,875 | |

| GS Mortgage Securities Trust floater Series 2021-IP: | |||

| Class A, 1 month U.S. LIBOR + 0.950% 2.274% 10/15/36 (a)(b)(c) | 1,559,690 | 1,502,572 | |

| Class B, 1 month U.S. LIBOR + 1.150% 2.474% 10/15/36 (a)(b)(c) | 241,085 | 227,427 | |

| Class C, 1 month U.S. LIBOR + 1.550% 2.874% 10/15/36 (a)(b)(c) | 198,757 | 186,063 | |

| JPMorgan Chase Commercial Mortgage Securities Trust Series 2018-WPT: | |||

| Class CFX, 4.9498% 7/5/33 (a) | 223,602 | 220,330 | |

| Class DFX, 5.3503% 7/5/33 (a) | 386,779 | 380,609 | |

| Class EFX, 5.5422% 7/5/33 (a) | 470,207 | 456,107 | |

| Life Financial Services Trust floater Series 2022-BMR2: | |||

| Class A1, CME TERM SOFR 1 MONTH INDEX + 1.290% 2.5739% 5/15/39 (a)(b)(c) | 3,430,000 | 3,344,201 | |

| Class B, CME TERM SOFR 1 MONTH INDEX + 1.790% 3.0726% 5/15/39 (a)(b)(c) | 2,383,000 | 2,311,465 | |

| Class C, CME TERM SOFR 1 MONTH INDEX + 2.090% 3.3718% 5/15/39 (a)(b)(c) | 1,335,000 | 1,288,248 | |

| Class D, CME TERM SOFR 1 MONTH INDEX + 2.540% 3.8206% 5/15/39 (a)(b)(c) | 1,187,000 | 1,133,557 | |

| LIFE Mortgage Trust floater Series 2021-BMR: | |||

| Class A, 1 month U.S. LIBOR + 0.700% 2.024% 3/15/38 (a)(b)(c) | 2,199,143 | 2,128,397 | |

| Class B, 1 month U.S. LIBOR + 0.880% 2.204% 3/15/38 (a)(b)(c) | 530,641 | 507,984 | |

| Class C, 1 month U.S. LIBOR + 1.100% 2.424% 3/15/38 (a)(b)(c) | 333,761 | 318,671 | |

| Class D, 1 month U.S. LIBOR + 1.400% 2.724% 3/15/38 (a)(b)(c) | 464,311 | 440,988 | |

| Class E, 1 month U.S. LIBOR + 1.750% 3.074% 3/15/38 (a)(b)(c) | 405,819 | 378,302 | |

| Morgan Stanley Capital I Trust: | |||

| floater Series 2018-BOP: | |||

| Class B, 1 month U.S. LIBOR + 1.250% 2.574% 8/15/33 (a)(b)(c) | 1,071,355 | 1,057,744 | |

| Class C, 1 month U.S. LIBOR + 1.500% 2.824% 8/15/33 (a)(b)(c) | 2,580,383 | 2,539,468 | |

| sequential payer Series 2019-MEAD Class A, 3.17% 11/10/36 (a) | 2,570,651 | 2,423,550 | |

| Series 2018-H4 Class A4, 4.31% 12/15/51 | 1,895,246 | 1,875,028 | |

| Series 2019-MEAD: | |||

| Class B, 3.283% 11/10/36 (a)(b) | 371,442 | 344,535 | |

| Class C, 3.283% 11/10/36 (a)(b) | 356,413 | 323,273 | |

| Prima Capital Ltd. floater sequential payer Series 2021-9A Class A, 1 month U.S. LIBOR + 1.450% 2.3773% 12/15/37 (a)(b)(c) | 139,306 | 139,306 | |

| Providence Place Group Ltd. Partnership Series 2000-C1 Class A2, 7.75% 7/20/28 (a) | 959,667 | 1,038,985 | |

| SPGN Mortgage Trust floater Series 2022-TFLM: | |||

| Class B, CME TERM SOFR 1 MONTH INDEX + 2.000% 3.2787% 2/15/39 (a)(b)(c) | 642,000 | 612,332 | |

| Class C, CME TERM SOFR 1 MONTH INDEX + 2.650% 3.9287% 2/15/39 (a)(b)(c) | 334,000 | 318,254 | |

| SREIT Trust floater Series 2021-MFP: | |||

| Class A, 1 month U.S. LIBOR + 0.730% 2.0548% 11/15/38 (a)(b)(c) | 2,470,353 | 2,346,285 | |

| Class B, 1 month U.S. LIBOR + 1.070% 2.4038% 11/15/38 (a)(b)(c) | 1,414,917 | 1,333,199 | |

| Class C, 1 month U.S. LIBOR + 1.320% 2.653% 11/15/38 (a)(b)(c) | 878,763 | 823,600 | |

| Class D, 1 month U.S. LIBOR + 1.570% 2.9022% 11/15/38 (a)(b)(c) | 577,561 | 539,857 | |

| VLS Commercial Mortgage Trust: | |||

| sequential payer Series 2020-LAB Class A, 2.13% 10/10/42 (a) | 1,766,729 | 1,453,921 | |

| Series 2020-LAB Class B, 2.453% 10/10/42 (a) | 113,488 | 92,159 | |

| Wells Fargo Commercial Mortgage Trust: | |||

| floater Series 2021-FCMT Class A, 1 month U.S. LIBOR + 1.200% 2.524% 5/15/31 (a)(b)(c) | 1,349,000 | 1,288,206 | |

| sequential payer Series 2015-C26 Class A4, 3.166% 2/15/48 | 1,026,911 | 1,002,969 | |

| Series 2018-C48 Class A5, 4.302% 1/15/52 | 850,545 | 849,055 | |

| TOTAL COMMERCIAL MORTGAGE SECURITIES | |||

| (Cost $98,032,593) | 93,023,997 | ||

| Municipal Securities - 0.7% | |||

| California Gen. Oblig. Series 2009: | |||

| 7.35% 11/1/39 | $245,000 | $319,146 | |

| 7.55% 4/1/39 | 1,100,000 | 1,492,137 | |

| Chicago Gen. Oblig. (Taxable Proj.) Series 2010 C1, 7.781% 1/1/35 | 900,000 | 1,062,942 | |

| Illinois Gen. Oblig.: | |||

| Series 2003: | |||

| 4.95% 6/1/23 | 414,545 | 417,604 | |

| 5.1% 6/1/33 | 1,475,000 | 1,483,982 | |

| Series 2010-1, 6.63% 2/1/35 | 3,770,000 | 4,014,698 | |

| Series 2010-3: | |||

| 6.725% 4/1/35 | 2,910,000 | 3,083,328 | |

| 7.35% 7/1/35 | 1,700,000 | 1,854,356 | |

| New Jersey Econ. Dev. Auth. State Pension Fdg. Rev. Series 1997, 7.425% 2/15/29 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 2,221,000 | 2,495,225 | |

| TOTAL MUNICIPAL SECURITIES | |||

| (Cost $16,639,540) | 16,223,418 | ||

| Foreign Government and Government Agency Obligations - 0.2% | |||

| Emirate of Abu Dhabi 3.875% 4/16/50 (a) | $1,748,000 | $1,554,955 | |

| Kingdom of Saudi Arabia: | |||

| 3.25% 10/22/30 (a) | 966,000 | 908,040 | |

| 4.5% 4/22/60 (a) | 736,000 | 677,120 | |

| State of Qatar 4.4% 4/16/50 (a) | 2,181,000 | 2,091,034 | |

| TOTAL FOREIGN GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS | |||

| (Cost $5,813,757) | 5,231,149 | ||

| Supranational Obligations - 0.1% | |||

| Corporacion Andina de Fomento 2.375% 5/12/23 (Cost $1,808,818) | 1,810,000 | 1,797,638 | |

| Bank Notes - 0.2% | |||

| Discover Bank: | |||

| 3.35% 2/6/23 | $983,000 | $983,036 | |

| 4.682% 8/9/28 (b) | 847,000 | 823,411 | |

| Regions Bank 6.45% 6/26/37 | 2,368,000 | 2,632,107 | |

| TOTAL BANK NOTES | |||

| (Cost $4,271,530) | 4,438,554 | ||

| Shares | Value | ||

| Money Market Funds - 9.2% | |||

| Fidelity Cash Central Fund 1.58% (g) | 157,747,348 | $157,778,897 | |

| Fidelity Securities Lending Cash Central Fund 1.58% (g)(h) | 51,202,255 | 51,207,375 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $208,985,878) | 208,986,272 | ||

| TOTAL INVESTMENT IN SECURITIES - 111.8% | |||

| (Cost $2,757,181,569) | 2,542,268,799 | ||

| NET OTHER ASSETS (LIABILITIES) - (11.8)% | (269,280,481) | ||

| NET ASSETS - 100% | $2,272,988,318 |

| TBA Sale Commitments | ||

| Principal Amount | Value | |

| Ginnie Mae | ||

| 2% 7/1/52 | $(7,850,000) | $(6,969,594) |

| 2% 7/1/52 | (3,000,000) | (2,663,540) |

| 2% 7/1/52 | (1,850,000) | (1,642,516) |

| 2% 7/1/52 | (3,000,000) | (2,663,540) |

| TOTAL GINNIE MAE | (13,939,190) | |

| Uniform Mortgage Backed Securities | ||

| 2% 7/1/52 | (4,500,000) | (3,904,735) |

| 2% 7/1/52 | (4,400,000) | (3,817,963) |

| 2% 7/1/52 | (3,850,000) | (3,340,717) |

| 2% 7/1/52 | (6,150,000) | (5,336,471) |

| 2% 7/1/52 | (3,100,000) | (2,689,928) |

| 2.5% 7/1/52 | (9,650,000) | (8,672,933) |

| 2.5% 7/1/52 | (4,350,000) | (3,909,560) |

| 2.5% 7/1/52 | (1,500,000) | (1,348,124) |

| 2.5% 7/1/52 | (14,000,000) | (12,582,493) |

| 2.5% 7/1/52 | (1,500,000) | (1,348,124) |

| 3% 7/1/52 | (7,900,000) | (7,352,550) |

| 3.5% 7/1/52 | (50,000) | (48,068) |

| TOTAL UNIFORM MORTGAGE BACKED SECURITIES | (54,351,666) | |

| TOTAL TBA SALE COMMITMENTS | ||

| (Proceeds $67,926,755) | $(68,290,856) |

Legend

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $339,909,807 or 15.0% of net assets.

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(c) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(d) Security or a portion of the security is on loan at period end.

(e) Security or a portion of the security purchased on a delayed delivery or when-issued basis.

(f) Represents an investment in an underlying pool of reverse mortgages which typically do not require regular principal and interest payments as repayment is deferred until a maturity event.

(g) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(h) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Fund | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Realized Gain/Loss | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Cash Central Fund 1.58% | $231,714,564 | $190,462,945 | $264,398,613 | $383,985 | $-- | $1 | $157,778,897 | 0.3% |

| Fidelity Securities Lending Cash Central Fund 1.58% | 25,486,340 | 375,458,514 | 349,737,479 | 32,362 | -- | -- | 51,207,375 | 0.1% |

| Total | $257,200,904 | $565,921,459 | $614,136,092 | $416,347 | $-- | $1 | $208,986,272 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Investment Valuation

The following is a summary of the inputs used, as of June 30, 2022, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Corporate Bonds | $721,807,784 | $-- | $721,807,784 | $-- |

| U.S. Government and Government Agency Obligations | 917,817,356 | -- | 917,817,356 | -- |

| U.S. Government Agency - Mortgage Securities | 431,951,518 | -- | 431,951,518 | -- |

| Asset-Backed Securities | 139,765,034 | -- | 139,765,034 | -- |

| Collateralized Mortgage Obligations | 1,226,079 | -- | 1,226,079 | -- |

| Commercial Mortgage Securities | 93,023,997 | -- | 93,023,997 | -- |

| Municipal Securities | 16,223,418 | -- | 16,223,418 | -- |

| Foreign Government and Government Agency Obligations | 5,231,149 | -- | 5,231,149 | -- |

| Supranational Obligations | 1,797,638 | -- | 1,797,638 | -- |

| Bank Notes | 4,438,554 | -- | 4,438,554 | -- |

| Money Market Funds | 208,986,272 | 208,986,272 | -- | -- |

| Total Investments in Securities: | $2,542,268,799 | $208,986,272 | $2,333,282,527 | $-- |

| Other Financial Instruments: | ||||

| TBA Sale Commitments | $(68,290,856) | $-- | $(68,290,856) | $-- |

| Total Other Financial Instruments: | $(68,290,856) | $-- | $(68,290,856) | $-- |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| June 30, 2022 (Unaudited) | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $50,417,680) — See accompanying schedule: Unaffiliated issuers (cost $2,548,195,691) | $2,333,282,527 | |

| Fidelity Central Funds (cost $208,985,878) | 208,986,272 | |