Investment Company Act Registration No. 811-4852

U.S. SECURITIES AND EXCHANGE COMMISSION

REGISTRATION STATEMENT

|

Charles Booth

Citi Fund Services Ohio, Inc.

4400 Easton Commons, Suite 200

Columbus, Ohio 43219 |

Christopher K. Dyer

Victory Portfolios

4900 Tiedeman Road, 4th Floor

Brooklyn, OH 44144 |

Jay G. Baris

Sidley Austin LLP

787 Seventh Avenue

New York, New York 10019 |

|

Victory INCORE Total Return Bond Fund | ||||||

|

|

Class A |

Class C |

Class I |

Class R |

Class R6 |

Class Y |

|

|

MUCAX |

MUCCX |

— |

— |

MUCRX |

MUCYX |

800-539-FUND (800-539-3863)

|

|

Class A |

Class C |

Class R6 |

Class Y |

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price) |

|

|

|

|

|

Maximum Deferred Sales Charge (Load)

(as a percentage of the lower of purchase or sale price) |

|

|

|

|

|

Management Fees |

|

|

|

|

|

Distribution and/or Service (12b-1) Fees |

|

|

|

|

|

Other Expenses |

|

|

|

|

|

Total Annual Fund Operating Expenses |

|

|

|

|

|

Fee Waiver/Expense Reimbursement3 |

( |

( |

( |

( |

|

Total Annual Fund Operating Expenses After Fee Waiver

and/or Expense Reimbursement3 |

|

|

|

|

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Class A |

$ |

$ |

$ |

$ |

|

Class C |

$ |

$ |

$ |

$ |

|

Class R6 |

$ |

$ |

$ |

$ |

|

Class Y |

$ |

$ |

$ |

$ |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Class C |

$ |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Annual Total Returns

(For the Periods Ended December 31, 2020) |

1 Year |

5 Years |

10 Years

(or Life

of Class) |

|

CLASS Y Before Taxes |

8.10% |

4.53% |

4.02% |

|

CLASS Y After Taxes on Distributions |

6.92% |

3.12% |

2.60% |

|

CLASS Y After Taxes on Distributions and Sale of Fund Shares |

4.77% |

2.84% |

2.47% |

|

CLASS A Before Taxes |

5.43% |

3.80% |

3.53% |

|

CLASS C Before Taxes |

5.91% |

3.49% |

2.99% |

|

CLASS R6 Before Taxes |

8.01% |

4.56% |

3.41%1

|

|

Index | |||

|

Bloomberg Barclays U.S. Aggregate Bond Index

reflects no deduction for fees, expenses or taxes. |

7.51% |

4.44% |

3.84% |

|

|

Title |

Tenure with the Fund |

|

Edward D. Goard, CFA |

Chief Investment Officer |

Since 2009 |

|

Richard A. Consul, CFA |

Senior Portfolio Manager |

Since 2012 |

|

James R. Kelts, CFA |

Senior Portfolio Manager |

Since 2012 |

|

Investment Minimums |

Class A |

Class C |

Class R6 |

Class Y |

|

Minimum Initial Investment |

$2,500 |

$2,500 |

None |

$1,000,000 |

|

Minimum Subsequent Investments |

$50 |

$50 |

None |

None |

|

Victory Capital Management Inc., which we refer to as the “Adviser”

throughout the Prospectus, manages the Fund. |

|

If you would like to receive additional copies of any materials, please call the Victory Funds

at 800-539-FUND (800-539-3863) or please visit VictoryFunds.com. |

|

By matching your investment objective with an acceptable level of risk,

you can create your own customized investment plan. |

|

An investment in the

Fund is not a complete

investment program. |

|

All you need to do to get started is to fill out an application. |

|

An Investment Professional is an investment consultant, salesperson, financial planner,

investment adviser, or trust officer who provides you with investment information.

Your Investment Professional also can help you decide which share class is best for you.

Investment Professionals and other financial intermediaries may charge fees for their services. |

|

The daily NAV is useful to you as a shareholder because the NAV,

multiplied by the number of Fund shares you own, gives you the value of your investment. |

|

NAV= |

Total Assets - Liabilities |

|

Number of Shares Outstanding |

|

For historical expense information, see the “Financial Highlights”

at the end of this Prospectus. |

|

Your Investment in the Fund |

Sales

Charge

as a % of

Offering

Price |

Sales

Charge

as a % of

Your

Investment |

|

Up to $99,999 |

2.25% |

2.30% |

|

$100,000 up to $249,999 |

1.75% |

1.78% |

|

Your Investment in the Fund |

Sales

Charge

as a % of

Offering

Price |

Sales

Charge

as a % of

Your

Investment |

|

$250,000 and above* |

0.00% |

0.00% |

|

There are several ways you can combine multiple purchases of Class A shares of the Victory

Funds to take advantage of reduced sales charges and, in some cases, eliminate sales charges. |

|

The Fund reserves the right to change the criteria for eligible investors and

the investment minimums. |

P.O. Box 182593

Columbus, OH 43218-2593

|

Keep these addresses handy for purchases, exchanges, or redemptions. |

|

BY REGULAR U.S. MAIL |

Victory Funds

P.O. Box 182593

Columbus, OH 43218-2593 |

|

BY OVERNIGHT MAIL |

Use the following address ONLY for overnight packages:

Victory Funds

c/o FIS TA Operations

4249 Easton Way, Suite 400

Columbus, OH 43219

PHONE: 800-539-FUND (800-539-3863) |

|

BY WIRE |

Call 800-539-FUND (800-539-3863) BEFORE wiring money to notify the

Fund that you intend to purchase shares by wire and to verify wire

instructions. |

|

BY TELEPHONE |

800-539-FUND (800-539-3863) |

|

ON THE INTERNET |

www.VictoryFunds.com |

|

There may be limits on the ability to exchange between certain Victory Funds. You can

obtain a list of Victory Funds available for exchange by calling 800-539-FUND (800-539-3863) or by visiting

VictoryFunds.com |

|

There are a number of convenient ways to sell your shares. You can use the same mailing

addresses listed for purchases. |

|

BY TELEPHONE |

|

BY MAIL |

|

BY WIRE |

|

BY ACH |

|

Buying a dividend. You should check the Fund's distribution schedule before you invest.

If you buy shares of the Fund shortly before it makes a distribution,

some of your investment may come back to you as a taxable distribution. |

|

Your choice of distribution should be set up on the original Account Application.

If you would like to change the option you selected, please call 800-539-FUND (800-539-3863). |

|

The tax information in this Prospectus is provided as general information. You should

consult your own tax adviser about the tax consequences of an investment in the Fund. |

|

|

Notary

Public |

SVP |

MSG |

|

Change of name |

x |

x |

x |

|

Add/change banking instructions |

|

x |

x |

|

Add/change beneficiaries |

x |

x |

x |

|

|

Notary

Public |

SVP |

MSG |

|

Add/change authorized account traders |

|

x |

x |

|

Adding a Power of Attorney |

x |

x |

x |

|

Add/change Trustee |

x |

x |

x |

|

Uniform Transfers to Minors Act/Uniform Gifts to Minors Act custodian

change |

x |

x |

x |

|

|

Class A | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$9.91 |

$9.46 |

$9.21 |

$9.54 |

$ 9.79 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

0.15 |

0.20 |

0.21 |

0.20 |

0.23 |

|

Net Realized and Unrealized Gains (Losses) on

Investments |

0.01 |

0.50 |

0.32 |

(0.24) |

(0.14) |

|

Total from Investment Activities |

0.16 |

0.70 |

0.53 |

(0.04) |

0.09 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Investment Income |

(0.23) |

(0.25) |

(0.28) |

(0.29) |

(0.34) |

|

Total Distributions |

(0.23) |

(0.25) |

(0.28) |

(0.29) |

(0.34) |

|

Net Asset Value, End of Period |

$9.84 |

$9.91 |

$9.46 |

$9.21 |

$9.54 |

|

Total Return (Excludes Sales Charge) |

1.67% |

7.57% |

5.77% |

(0.49)% |

0.97% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses |

0.85% |

0.85% |

0.85% |

0.85% |

0.85% |

|

Net Investment Income (Loss) |

1.51% |

2.03% |

2.32% |

2.15% |

2.35% |

|

Gross Expenses |

1.16% |

1.11% |

1.09% |

1.11% |

1.07% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$9,380 |

$11,472 |

$12,248 |

$12,592 |

$14,569 |

|

Portfolio Turnover(b)(c) |

79% |

74% |

150% |

110% |

210% |

|

|

Class C | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$9.99 |

$9.53 |

$9.28 |

$9.60 |

$9.86 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

0.08 |

0.12 |

0.15 |

0.14 |

0.15 |

|

Net Realized and Unrealized Gains (Losses) on

Investments |

0.01 |

0.52 |

0.31 |

(0.25) |

(0.14) |

|

Total from Investment Activities |

0.09 |

0.64 |

0.46 |

(0.11) |

0.01 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Investment Income |

(0.16) |

(0.18) |

(0.21) |

(0.21) |

(0.27) |

|

Total Distributions |

(0.16) |

(0.18) |

(0.21) |

(0.21) |

(0.27) |

|

Net Asset Value, End of Period |

$9.92 |

$9.99 |

$9.53 |

$9.28 |

$9.60 |

|

Total Return (Excludes Sales Charge) |

0.91% |

6.76% |

5.05% |

(1.12)% |

0.13% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses |

1.60% |

1.60% |

1.60% |

1.60% |

1.60% |

|

Net Investment Income (Loss) |

0.80% |

1.27% |

1.67% |

1.43% |

1.60% |

|

Gross Expenses |

3.68% |

3.54% |

3.12% |

2.31% |

1.61% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$451 |

$727 |

$574 |

$973 |

$2,073 |

|

Portfolio Turnover(b)(c) |

79% |

74% |

150% |

110% |

210% |

|

|

Class R6 | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$9.94 |

$9.48 |

$9.23 |

$9.55 |

$9.81 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

0.17 |

0.22 |

0.24 |

0.22 |

0.25 |

|

Net Realized and Unrealized Gains (Losses) on

Investments |

0.02 |

0.51 |

0.31 |

(0.23) |

(0.14) |

|

Total from Investment Activities |

0.19 |

0.73 |

0.55 |

(0.01) |

0.11 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Investment Income |

(0.26) |

(0.27) |

(0.30) |

(0.31) |

(0.37) |

|

Total Distributions |

(0.26) |

(0.27) |

(0.30) |

(0.31) |

(0.37) |

|

Net Asset Value, End of Period |

$9.87 |

$9.94 |

$9.48 |

$9.23 |

$9.55 |

|

Total Return (Excludes Sales Charge) |

1.93% |

7.94% |

6.05% |

(0.12)% |

1.19% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses |

0.58% |

0.58% |

0.57% |

0.58% |

0.58% |

|

Net Investment Income (Loss) |

1.73% |

2.30% |

2.61% |

2.37% |

2.63% |

|

Gross Expenses |

0.61% |

0.59% |

0.57% |

0.62% |

0.91% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$26,970 |

$25,999 |

$24,929 |

$25,438 |

$6,698 |

|

Portfolio Turnover(b)(c) |

79% |

74% |

150% |

110% |

210% |

|

|

Class Y | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$9.94 |

$9.47 |

$9.23 |

$9.55 |

$9.81 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

0.17 |

0.22 |

0.24 |

0.23 |

0.25 |

|

Net Realized and Unrealized Gains (Losses) on

Investments |

0.02 |

0.52 |

0.30 |

(0.24) |

(0.14) |

|

Total from Investment Activities |

0.19 |

0.74 |

0.54 |

(0.01) |

0.11 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Investment Income |

(0.26) |

(0.27) |

(0.30) |

(0.31) |

(0.37) |

|

Total Distributions |

(0.26) |

(0.27) |

(0.30) |

(0.31) |

(0.37) |

|

Net Asset Value, End of Period |

$9.87 |

$9.94 |

$9.47 |

$9.23 |

$9.55 |

|

Total Return (Excludes Sales Charge) |

1.91% |

7.92% |

5.99% |

(0.13)% |

1.17% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses |

0.60% |

0.60% |

0.60% |

0.59% |

0.60% |

|

Net Investment Income (Loss) |

1.74% |

2.28% |

2.63% |

2.43% |

2.61% |

|

Gross Expenses |

0.64% |

0.62% |

0.63% |

0.59% |

0.62% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$31,032 |

$33,455 |

$31,026 |

$52,633 |

$76,263 |

|

Portfolio Turnover(b)(c) |

79% |

74% |

150% |

110% |

210% |

Victory Funds

P.O. Box 182593

Columbus, OH 43218-2593

Columbus, OH 43218-2593

Call Victory Funds at

800-539-FUND (800-539-3863)

EDGAR database at sec.gov or by email request at

publicinfo@sec.gov

|

Victory Integrity Discovery Fund | ||||||

|

|

Class A |

Class C |

Class I |

Class R |

Class R6 |

Class Y |

|

|

MMEAX |

MMECX |

— |

MMERX |

— |

MMEYX |

|

Victory Integrity Mid-Cap Value Fund | ||||||

|

|

Class A |

Class C |

Class I |

Class R |

Class R6 |

Class Y |

|

|

MAIMX |

MCIMX |

— |

— |

MRIMX |

MYIMX |

|

Victory Integrity Small-Cap Value Fund | ||||||

|

|

Class A |

Class C |

Class I |

Class R |

Class R6 |

Class Y |

|

|

VSCVX |

MCVSX |

— |

MRVSX |

MVSSX |

VSVIX |

|

Victory Integrity Small/Mid-Cap Value Fund | ||||||

|

|

Class A |

Class C |

Class I |

Class R |

Class R6 |

Class Y |

|

|

MAISX |

— |

— |

— |

MIRSX |

MYISX |

800-539-FUND (800-539-3863)

|

|

Class A |

Class C |

Class R |

Class Y |

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price) |

|

|

|

|

|

Maximum Deferred Sales Charge (Load)

(as a percentage of the lower of purchase or sale price) |

|

|

|

|

|

Management Fees |

|

|

|

|

|

Distribution and/or Service (12b-1) Fees |

|

|

|

|

|

Other Expenses |

|

|

|

|

|

Total Annual Fund Operating Expenses |

|

|

|

|

|

Fee Waiver/Expense Reimbursement |

|

( |

( |

|

|

Total Annual Fund Operating Expenses After Fee Waiver

and/or Expense Reimbursement3 |

|

|

|

|

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Class A |

$ |

$ |

$ |

$ |

|

Class C |

$ |

$ |

$ |

$ |

|

Class R |

$ |

$ |

$ |

$ |

|

Class Y |

$ |

$ |

$ |

$ |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Class C |

$ |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

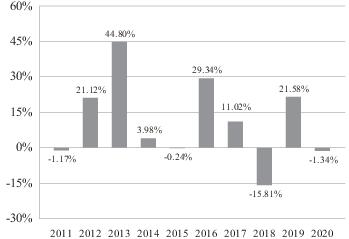

Average Annual Total Returns

(For the Periods Ended December 31, 2020) |

1 Year |

5 Years |

10 Years |

|

CLASS Y Before Taxes |

-1.34% |

7.72% |

10.06% |

|

CLASS Y After Taxes on Distributions |

-1.34% |

6.15% |

8.29% |

|

CLASS Y After Taxes on Distributions and Sale of Fund Shares |

-0.79% |

5.84% |

7.95% |

|

CLASS A Before Taxes |

-7.17% |

6.21% |

9.15% |

|

CLASS C Before Taxes |

-3.29% |

6.63% |

8.94% |

|

CLASS R Before Taxes |

-1.93% |

6.94% |

9.36% |

|

Index | |||

|

Russell Microcap® Value Index

reflects no deduction for fees, expenses or taxes. |

6.34% |

10.50% |

9.47% |

|

|

Title |

Tenure with the Fund |

|

Daniel J. DeMonica, CFA |

Senior Portfolio Manager |

Since 2011 |

|

Mirsat Nikovic |

Portfolio Manager |

Since 2011 |

|

Sean A. Burke |

Portfolio Manager |

Since 2015 |

|

Michael P. Wayton |

Portfolio Manager |

Since 2018 |

|

Investment Minimums |

Class A |

Class C |

Class R |

Class Y |

|

Minimum Initial Investment |

$2,500 |

$2,500 |

None |

$1,000,000 |

|

Minimum Subsequent Investments |

$50 |

$50 |

None |

None |

|

|

Class A |

Class C |

Class R6 |

Class Y |

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price) |

|

|

|

|

|

Maximum Deferred Sales Charge (Load)

(as a percentage of the lower of purchase or sale price) |

|

|

|

|

|

Management Fees |

|

|

|

|

|

Distribution and/or Service (12b-1) Fees |

|

|

|

|

|

Other Expenses |

|

|

|

|

|

Total Annual Fund Operating Expenses |

|

|

|

|

|

Fee Waiver/Expense Reimbursement3 |

( |

( |

( |

( |

|

Total Annual Fund Operating Expenses After Fee Waiver

and/or Expense Reimbursement3 |

|

|

|

|

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Class A |

$ |

$ |

$ |

$ |

|

Class C |

$ |

$ |

$ |

$ |

|

Class R6 |

$ |

$ |

$ |

$ |

|

Class Y |

$ |

$ |

$ |

$ |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Class C |

$ |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

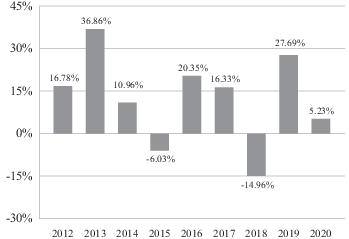

Average Annual Total Returns

(For the Periods Ended December 31, 2020) |

1 Year |

5 Years

(or Life

of Class) |

Life of

Fund |

|

CLASS Y Before Taxes |

5.23% |

9.85% |

9.98%1

|

|

CLASS Y After Taxes on Distributions |

4.51% |

8.98% |

9.33%1

|

|

CLASS Y After Taxes on Distributions and Sale of Fund Shares |

3.42% |

7.62% |

8.05%1

|

|

CLASS A Before Taxes |

-1.08% |

8.26% |

9.01%1

|

|

CLASS C Before Taxes |

3.16% |

6.92%2

|

N/A |

|

CLASS R6 Before Taxes |

5.39% |

9.93% |

10.24%3

|

|

Index | |||

|

Russell Midcap® Value Index

reflects no deduction for fees, expenses or taxes. |

4.96% |

9.73% |

10.12% |

|

|

Title |

Tenure with the Fund |

|

Daniel G. Bandi, CFA |

Chief Investment Officer |

Since 2011 |

|

Daniel J. DeMonica, CFA |

Senior Portfolio Manager |

Since 2011 |

|

Adam I. Friedman |

Senior Portfolio Manager |

Since 2011 |

|

Joe A. Gilbert, CFA |

Portfolio Manager |

Since 2011 |

|

J. Bryan Tinsley, CFA |

Portfolio Manager |

Since 2011 |

|

Michael P. Wayton |

Portfolio Manager |

Since 2018 |

|

Investment Minimums |

Class A |

Class C |

Class R6 |

Class Y |

|

Minimum Initial Investment |

$2,500 |

$2,500 |

None |

$1,000,000 |

|

Minimum Subsequent Investments |

$50 |

$50 |

None |

None |

|

|

Class A |

Class C |

Class R |

Class R6 |

Class Y |

|

Maximum Sales Charge (Load) Imposed on

Purchases

(as a percentage of offering price) |

|

|

|

|

|

|

Maximum Deferred Sales Charge (Load)

(as a percentage of the lower of purchase or

sale price) |

|

|

|

|

|

|

Management Fees |

|

|

|

|

|

|

Distribution and/or Service (12b-1) Fees |

|

|

|

|

|

|

Other Expenses |

|

|

|

|

|

|

Total Annual Fund Operating Expenses |

|

|

|

|

|

|

Fee Waiver/Expense Reimbursement3 |

|

|

( |

|

|

|

Total Annual Fund Operating Expenses After

Fee Waiver and/or Expense Reimbursement3 |

|

|

|

|

|

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Class A |

$ |

$ |

$ |

$ |

|

Class C |

$ |

$ |

$ |

$ |

|

Class R |

$ |

$ |

$ |

$ |

|

Class R6 |

$ |

$ |

$ |

$ |

|

Class Y |

$ |

$ |

$ |

$ |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Class C |

$ |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Annual Total Returns

(For the Periods Ended December 31, 2020) |

1 Year |

5 Years |

10 Years

(or Life

of Class) |

|

CLASS A Before Taxes |

-4.95% |

5.58% |

7.33% |

|

CLASS A After Taxes on Distributions |

-4.97% |

4.61% |

5.74% |

|

CLASS A After Taxes on Distributions and Sale of Fund Shares |

-2.91% |

4.25% |

5.26% |

|

CLASS C Before Taxes |

-1.00% |

6.09% |

7.20% |

|

CLASS R Before Taxes |

0.54% |

6.56% |

7.71% |

|

CLASS R6 Before Taxes |

1.33% |

7.40% |

10.68%1

|

|

CLASS Y Before Taxes |

1.21% |

7.23% |

8.32% |

|

Index | |||

|

Russell 2000® Value Index

reflects no deduction for fees, expenses or taxes. |

4.63% |

9.65% |

8.66% |

|

|

Title |

Tenure with the Fund |

|

Daniel G. Bandi, CFA |

Chief Investment Officer |

Since 2011 |

|

Daniel J. DeMonica, CFA |

Senior Portfolio Manager |

Since 2011 |

|

Adam I. Friedman |

Senior Portfolio Manager |

Since 2011 |

|

Joe A. Gilbert, CFA |

Portfolio Manager |

Since 2011 |

|

J. Bryan Tinsley, CFA |

Portfolio Manager |

Since 2011 |

|

Michael P. Wayton |

Portfolio Manager |

Since 2018 |

|

Investment Minimums |

Class A |

Class C |

Class R |

Class R6 |

Class Y |

|

Minimum Initial Investment |

$2,500 |

$2,500 |

None |

None |

$1,000,000 |

|

Minimum Subsequent Investments |

$50 |

$50 |

None |

None |

None |

|

|

Class A |

Class R6 |

Class Y |

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price) |

|

|

|

|

Maximum Deferred Sales Charge (Load)

(as a percentage of the lower of purchase or sale price) |

|

|

|

|

Management Fees |

|

|

|

|

Distribution and/or Service (12b-1) Fees |

|

|

|

|

Other Expenses |

|

|

|

|

Total Annual Fund Operating Expenses |

|

|

|

|

Fee Waiver/Expense Reimbursement2 |

( |

( |

( |

|

Total Annual Fund Operating Expenses After Fee Waiver and/or

Expense Reimbursement2 |

|

|

|

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Class A |

$ |

$ |

$ |

$ |

|

Class R6 |

$ |

$ |

$ |

$ |

|

Class Y |

$ |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Annual Total Returns

(For the Periods Ended December 31, 2020) |

1 Year |

5 Years |

Life of

Fund |

|

CLASS Y Before Taxes |

4.93% |

9.40% |

8.62%1

|

|

CLASS Y After Taxes on Distributions |

4.44% |

8.94% |

8.12%1

|

|

CLASS Y After Taxes on Distributions and Sale of Fund Shares |

3.10% |

7.37% |

6.92%1

|

|

CLASS A Before Taxes |

-1.30% |

7.84% |

7.68%1

|

|

CLASS R6 Before Taxes |

5.02% |

9.46% |

6.03%2

|

|

Index | |||

|

Russell 2500™ Value Index

reflects no deduction for fees, expenses or taxes. |

4.88% |

9.43% |

8.97% |

|

|

Title |

Tenure with the Fund |

|

Daniel G. Bandi, CFA |

Chief Investment Officer |

Since 2011 |

|

Daniel J. DeMonica, CFA |

Senior Portfolio Manager |

Since 2011 |

|

Adam I. Friedman |

Senior Portfolio Manager |

Since 2011 |

|

Joe A. Gilbert, CFA |

Portfolio Manager |

Since 2011 |

|

J. Bryan Tinsley, CFA |

Portfolio Manager |

Since 2011 |

|

Michael P. Wayton |

Portfolio Manager |

Since 2018 |

|

Investment Minimums |

Class A |

Class R6 |

Class Y |

|

Minimum Initial Investment |

$2,500 |

None |

$1,000,000 |

|

Minimum Subsequent Investments |

$50 |

None |

None |

|

Victory Capital Management Inc., which we refer to as the “Adviser”

throughout the Prospectus, manages each Fund. |

|

If you would like to receive additional copies of any materials, please call the Victory Funds

at 800-539-FUND (800-539-3863) or please visit VictoryFunds.com. |

|

|

Integrity Discovery |

Integrity Mid-Cap Value |

Integrity Small-Cap Value |

Integrity Small/Mid-Cap Value |

|

Equity Securities Risk |

X |

X |

X |

X |

|

Foreign Securities Risk |

X |

X |

X |

X |

|

Investment Style Risk |

X |

X |

X |

X |

|

Large Shareholder Risk |

|

X |

|

|

|

Liquidity Risk |

X |

X |

X |

X |

|

Management Risk |

X |

X |

X |

X |

|

Sector Focus Risk |

X |

X |

X |

X |

|

Smaller-Company Stock Risk |

X |

X |

X |

X |

|

Stock Market Risk |

X |

X |

X |

X |

|

An investment in the

Fund is not a complete

investment program. |

|

Fund |

Advisory Fee |

|

Victory Integrity Discovery Fund |

1.00% |

|

Victory Integrity Mid-Cap Value Fund |

0.75% |

|

Victory Integrity Small-Cap Value Fund |

0.86% |

|

Victory Integrity Small/Mid-Cap Value Fund |

0.80% |

|

All you need to do to get started is to fill out an application. |

|

An Investment Professional is an investment consultant, salesperson, financial planner,

investment adviser, or trust officer who provides you with investment information.

Your Investment Professional also can help you decide which share class is best for you.

Investment Professionals and other financial intermediaries may charge fees for their services. |

|

The daily NAV is useful to you as a shareholder because the NAV,

multiplied by the number of Fund shares you own, gives you the value of your investment. |

|

NAV= |

Total Assets - Liabilities |

|

Number of Shares Outstanding |

|

For historical expense information, see the “Financial Highlights”

at the end of this Prospectus. |

|

Your Investment in the Fund |

Sales

Charge

as a % of

Offering

Price |

Sales

Charge

as a % of

Your

Investment |

|

Up to $49,999 |

5.75% |

6.10% |

|

$50,000 up to $99,999 |

4.50% |

4.71% |

|

$100,000 up to $249,999 |

3.50% |

3.63% |

|

$250,000 up to $499,999 |

2.50% |

2.56% |

|

$500,000 up to $999,999 |

2.00% |

2.04% |

|

Your Investment in the Fund |

Sales

Charge

as a % of

Offering

Price |

Sales

Charge

as a % of

Your

Investment |

|

$1,000,000 and above1 |

0.00% |

0.00% |

|

There are several ways you can combine multiple purchases of Class A shares of the Victory

Funds to take advantage of reduced sales charges and, in some cases, eliminate sales charges. |

|

A Fund reserves the right to change the criteria for eligible investors and

the investment minimums. |

P.O. Box 182593

Columbus, OH 43218-2593

|

Keep these addresses handy for purchases, exchanges, or redemptions. |

|

BY REGULAR U.S. MAIL |

Victory Funds

P.O. Box 182593

Columbus, OH 43218-2593 |

|

BY OVERNIGHT MAIL |

Use the following address ONLY for overnight packages:

Victory Funds

c/o FIS TA Operations

4249 Easton Way, Suite 400

Columbus, OH 43219

PHONE: 800-539-FUND (800-539-3863) |

|

BY WIRE |

Call 800-539-FUND (800-539-3863) BEFORE wiring money to notify the

Fund that you intend to purchase shares by wire and to verify wire

instructions. |

|

BY TELEPHONE |

800-539-FUND (800-539-3863) |

|

ON THE INTERNET |

www.VictoryFunds.com |

|

There may be limits on the ability to exchange between certain Victory Funds. You can

obtain a list of Victory Funds available for exchange by calling 800-539-FUND (800-539-3863) or by visiting

VictoryFunds.com |

|

There are a number of convenient ways to sell your shares. You can use the same mailing

addresses listed for purchases. |

|

BY TELEPHONE |

|

BY MAIL |

|

BY WIRE |

|

BY ACH |

|

Buying a dividend. You should check the Funds' distribution schedule before you invest.

If you buy shares of a Fund shortly before it makes a distribution,

some of your investment may come back to you as a taxable distribution. |

|

Your choice of distribution should be set up on the original Account Application.

If you would like to change the option you selected, please call 800-539-FUND (800-539-3863). |

|

The tax information in this Prospectus is provided as general information. You should

consult your own tax adviser about the tax consequences of an investment in the Fund. |

|

|

Notary

Public |

SVP |

MSG |

|

Change of name |

x |

x |

x |

|

Add/change banking instructions |

|

x |

x |

|

Add/change beneficiaries |

x |

x |

x |

|

Add/change authorized account traders |

|

x |

x |

|

Adding a Power of Attorney |

x |

x |

x |

|

Add/change Trustee |

x |

x |

x |

|

Uniform Transfers to Minors Act/Uniform Gifts to Minors Act custodian

change |

x |

x |

x |

|

|

Class A | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$24.03 |

$32.28 |

$42.75 |

$41.01 |

$ 32.71 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

(0.07) |

(0.05) |

(0.11) |

(0.16) |

(0.19) |

|

Net Realized and Unrealized Gains

(Losses) on Investments |

21.57 |

(7.38) |

(5.61) |

6.40 |

10.10 |

|

Total from Investment Activities |

21.50 |

(7.43) |

(5.72) |

6.24 |

9.91 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Realized Gains from Investments |

— |

(0.82) |

(4.75) |

(4.50) |

(1.61) |

|

Total Distributions |

— |

(0.82) |

(4.75) |

(4.50) |

(1.61) |

|

Net Asset Value, End of Period |

$45.53 |

$24.03 |

$32.28 |

$42.75 |

$41.01 |

|

Total Return (Excludes Sales Charge)(b)* |

89.47% |

(23.78)% |

(12.02)% |

15.76% |

30.36% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses(c) |

1.62% |

1.59% |

1.55% |

1.54% |

1.55% |

|

Net Investment Income (Loss)(c) |

(0.20)% |

(0.18)% |

(0.29)% |

(0.39)% |

(0.50)% |

|

Gross Expenses(c) |

1.62% |

1.59% |

1.55% |

1.54% |

1.55% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$45,073 |

$30,614 |

$50,963 |

$67,840 |

$85,228 |

|

Portfolio Turnover(b)(d) |

41% |

40% |

40% |

45% |

110% |

|

|

Class C | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$16.32 |

$22.36 |

$31.69 |

$31.69 |

$ 25.76 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

(0.21) |

(0.22) |

(0.28) |

(0.34) |

(0.38) |

|

Net Realized and Unrealized Gains

(Losses) on Investments |

14.56 |

(5.00) |

(4.30) |

4.84 |

7.92 |

|

Total from Investment Activities |

14.35 |

(5.22) |

(4.58) |

4.50 |

7.54 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Realized Gains from Investments |

— |

(0.82) |

(4.75) |

(4.50) |

(1.61) |

|

Total Distributions |

— |

(0.82) |

(4.75) |

(4.50) |

(1.61) |

|

Net Asset Value, End of Period |

$30.67 |

$16.32 |

$22.36 |

$31.69 |

$31.69 |

|

Total Return (Excludes Sales Charge)(b)* |

87.93% |

(24.42)% |

(12.74)% |

14.88% |

29.33% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses(c) |

2.45% |

2.46% |

2.34% |

2.32% |

2.36% |

|

Net Investment Income (Loss)(c) |

(0.95)% |

(1.09)% |

(1.07)% |

(1.10)% |

(1.28)% |

|

Gross Expenses(c) |

2.87% |

2.52% |

2.34% |

2.32% |

2.36% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$2,079 |

$2,194 |

$6,633 |

$9,871 |

$15,796 |

|

Portfolio Turnover(b)(d) |

41% |

40% |

40% |

45% |

110% |

|

|

Class R | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$22.45 |

$30.36 |

$40.76 |

$39.49 |

$ 31.71 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

(0.18) |

(0.18) |

(0.28) |

(0.28) |

(0.37) |

|

Net Realized and Unrealized Gains

(Losses) on Investments |

20.08 |

(6.91) |

(5.37) |

6.05 |

9.76 |

|

Total from Investment Activities |

19.90 |

(7.09) |

(5.65) |

5.77 |

9.39 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Realized Gains from Investments |

— |

(0.82) |

(4.75) |

(4.50) |

(1.61) |

|

Total Distributions |

— |

(0.82) |

(4.75) |

(4.50) |

(1.61) |

|

Net Asset Value, End of Period |

$42.35 |

$22.45 |

$30.36 |

$40.76 |

$39.49 |

|

Total Return (Excludes Sales Charge)(b)* |

88.56% |

(24.10)% |

(12.49)% |

15.15% |

29.67% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses(c) |

2.08% |

2.08% |

2.08% |

2.08% |

2.08% |

|

Net Investment Income (Loss)(c) |

(0.58)% |

(0.65)% |

(0.84)% |

(0.70)% |

(0.99)% |

|

Gross Expenses(c) |

2.43% |

2.33% |

2.41% |

2.27% |

2.56% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$1,955 |

$1,990 |

$3,038 |

$3,465 |

$2,291 |

|

Portfolio Turnover(b)(d) |

41% |

40% |

40% |

45% |

110% |

|

|

Class Y | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$26.64 |

$35.65 |

$46.47 |

$44.11 |

$ 35.02 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

0.03 |

—(b) |

(0.03) |

(0.05) |

(0.13) |

|

Net Realized and Unrealized Gains

(Losses) on Investments |

23.96 |

(8.19) |

(6.04) |

6.91 |

10.83 |

|

Total from Investment Activities |

23.99 |

(8.19) |

(6.07) |

6.86 |

10.70 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Realized Gains from Investments |

— |

(0.82) |

(4.75) |

(4.50) |

(1.61) |

|

Total Distributions |

— |

(0.82) |

(4.75) |

(4.50) |

(1.61) |

|

Net Asset Value, End of Period |

$50.63 |

$26.64 |

$35.65 |

$46.47 |

$44.11 |

|

Total Return (Excludes Sales Charge)(c)* |

90.05% |

(23.64)% |

(11.81)% |

16.08% |

30.62% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses(d) |

1.31% |

1.38% |

1.30% |

1.28% |

1.38% |

|

Net Investment Income (Loss)(d) |

0.07% |

—%(e) |

(0.06)% |

(0.12)% |

(0.30)% |

|

Gross Expenses(d) |

1.31% |

1.38% |

1.30% |

1.28% |

1.38% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$40,600 |

$27,519 |

$71,708 |

$78,079 |

$49,468 |

|

Portfolio Turnover(c)(f) |

41% |

40% |

40% |

45% |

110% |

|

|

Class A | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$15.30 |

$17.86 |

$19.17 |

$17.91 |

$ 15.43 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

0.13 |

0.24 |

0.19 |

0.19 |

0.03 |

|

Net Realized and Unrealized Gains (Losses)

on Investments |

8.74 |

(2.70) |

(0.32) |

1.84 |

2.45 |

|

Total from Investment Activities |

8.87 |

(2.46) |

(0.13) |

2.03 |

2.48 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Investment Income |

(0.37) |

(0.10) |

(0.19) |

(0.15) |

— |

|

Net Realized Gains from Investments |

— |

— |

(0.99) |

(0.62) |

— |

|

Return of Capital |

(0.08) |

— |

— |

— |

— |

|

Total Distributions |

(0.45) |

(0.10) |

(1.18) |

(0.77) |

— |

|

Net Asset Value, End of Period |

$23.72 |

$15.30 |

$17.86 |

$19.17 |

$17.91 |

|

Total Return (Excludes Sales Charge)(b) |

58.66% |

(13.90)% |

0.36% |

11.32% |

16.07% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses(c) |

1.00% |

1.00% |

1.00% |

1.09% |

1.35% |

|

Net Investment Income (Loss)(c) |

0.64% |

1.40% |

1.05% |

1.01% |

0.19% |

|

Gross Expenses(c) |

1.37% |

1.43% |

1.51% |

1.67% |

1.94% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$12,542 |

$8,574 |

$7,567 |

$4,255 |

$2,864 |

|

Portfolio Turnover(b)(d) |

67% |

82% |

73% |

73% |

68% |

|

|

Class C | |

|

|

Year

Ended

6/30/21 |

11/4/19(a)

through

6/30/20 |

|

Net Asset Value, Beginning of Period |

$15.37 |

$18.75 |

|

Investment Activities |

|

|

|

Net Investment Income (Loss)(b) |

(0.05) |

0.11 |

|

Net Realized and Unrealized Gains (Losses) on Investments |

8.82 |

(3.39) |

|

Total from Investment Activities |

8.77 |

(3.28) |

|

Distributions to Shareholders From |

|

|

|

Net Investment Income |

(0.27) |

(0.10) |

|

Net Realized Gains from Investments |

— |

— |

|

Return of Capital |

(0.06) |

— |

|

Total Distributions |

(0.33) |

(0.10) |

|

Net Asset Value, End of Period |

$23.81 |

$15.37 |

|

Total Return (Excludes Sales Charge)(c) |

57.43% |

(17.55)% |

|

Ratios to Average Net Assets |

|

|

|

Net Expenses(d) |

1.75% |

1.75% |

|

Net Investment Income (Loss)(d) |

(0.25)% |

1.02% |

|

Gross Expenses(d) |

16.27% |

43.95% |

|

Supplemental Data |

|

|

|

Net Assets, End of Period (000's) |

$78 |

$44 |

|

Portfolio Turnover(c)(e) |

67% |

82% |

|

|

Class R6 | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$15.47 |

$18.02 |

$19.30 |

$18.02 |

$15.53 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

0.19 |

0.33 |

0.26 |

0.22 |

0.12 |

|

Net Realized and Unrealized Gains (Losses)

on Investments |

8.85 |

(2.74) |

(0.32) |

1.87 |

2.43 |

|

Total from Investment Activities |

9.04 |

(2.41) |

(0.06) |

2.09 |

2.55 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Investment Income |

(0.43) |

(0.14) |

(0.23) |

(0.19) |

(0.06) |

|

Net Realized Gains from Investments |

— |

— |

(0.99) |

(0.62) |

— |

|

Return of Capital |

(0.09) |

— |

— |

— |

— |

|

Total Distributions |

(0.52) |

(0.14) |

(1.22) |

(0.81) |

(0.06) |

|

Net Asset Value, End of Period |

$23.99 |

$15.47 |

$18.02 |

$19.30 |

$18.02 |

|

Total Return (Excludes Sales Charge)(b) |

59.24% |

(13.53)% |

0.72% |

11.68% |

16.42% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses(c) |

0.60% |

0.60% |

0.60% |

0.77% |

0.89% |

|

Net Investment Income (Loss)(c) |

0.94% |

1.93% |

1.43% |

1.14% |

0.71% |

|

Gross Expenses(c) |

0.88% |

0.88% |

0.94% |

1.17% |

3.01% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$226,652 |

$184,503 |

$56,232 |

$6,750 |

$1,375 |

|

Portfolio Turnover(b)(d) |

67% |

82% |

73% |

73% |

68% |

|

|

Class Y | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$15.44 |

$18.02 |

$19.34 |

$18.06 |

$15.58 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

0.06 |

0.25 |

0.28 |

0.24 |

0.13 |

|

Net Realized and Unrealized Gains (Losses)

on Investments |

8.94 |

(2.68) |

(0.37) |

1.85 |

2.43 |

|

Total from Investment Activities |

9.00 |

(2.43) |

(0.09) |

2.09 |

2.56 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Investment Income |

(0.41) |

(0.15) |

(0.24) |

(0.19) |

(0.08) |

|

Net Realized Gains from Investments |

— |

— |

(0.99) |

(0.62) |

— |

|

Return of Capital |

(0.08) |

— |

— |

— |

— |

|

Total Distributions |

(0.49) |

(0.15) |

(1.23) |

(0.81) |

(0.08) |

|

Net Asset Value, End of Period |

$23.95 |

$15.44 |

$18.02 |

$19.34 |

$18.06 |

|

Total Return (Excludes Sales Charge)(b) |

59.03% |

(13.67)% |

0.58% |

11.58% |

16.43% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses(c) |

0.75% |

0.75% |

0.75% |

0.84% |

0.89% |

|

Net Investment Income (Loss)(c) |

0.29% |

1.46% |

1.52% |

1.25% |

0.74% |

|

Gross Expenses(c) |

1.08% |

1.21% |

1.17% |

1.13% |

1.18% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$25,003 |

$9,352 |

$21,486 |

$59,866 |

$47,989 |

|

Portfolio Turnover(b)(d) |

67% |

82% |

73% |

73% |

68% |

|

|

Class A | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$24.40 |

$32.37 |

$40.06 |

$37.70 |

$ 30.72 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

(0.01)(b) |

0.03 |

0.09 |

(0.04) |

(0.08) |

|

Net Realized and Unrealized Gains

(Losses) on Investments |

19.61 |

(7.86) |

(3.59) |

4.76 |

7.06 |

|

Total from Investment Activities |

19.60 |

(7.83) |

(3.50) |

4.72 |

6.98 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Investment Income |

(0.03) |

— |

— |

— |

— |

|

Net Realized Gains from Investments |

— |

(0.14) |

(4.19) |

(2.36) |

— |

|

Total Distributions |

(0.03) |

(0.14) |

(4.19) |

(2.36) |

— |

|

Net Asset Value, End of Period |

$43.97 |

$24.40 |

$32.37 |

$40.06 |

$37.70 |

|

Total Return (Excludes Sales Charge)* |

80.37% |

(24.33)% |

(7.16)% |

12.55% |

22.72% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses |

1.50% |

1.48% |

1.50% |

1.50% |

1.50% |

|

Net Investment Income (Loss) |

(0.02)%(c) |

0.10% |

0.25% |

(0.10)% |

(0.22)% |

|

Gross Expenses |

1.50% |

1.48% |

1.58% |

1.54% |

1.52% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$91,203 |

$79,429 |

$140,439 |

$221,775 |

$219,113 |

|

Portfolio Turnover(d) |

56% |

80% |

72% |

70% |

58% |

|

|

Class C | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$20.81 |

$27.85 |

$35.40 |

$33.76 |

$ 27.69 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

(0.26) |

(0.17) |

(0.13) |

(0.24) |

(0.28) |

|

Net Realized and Unrealized Gains (Losses)

on Investments |

16.67 |

(6.73) |

(3.23) |

4.24 |

6.35 |

|

Total from Investment Activities |

16.41 |

(6.90) |

(3.36) |

4.00 |

6.07 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Investment Income |

— |

— |

— |

— |

— |

|

Net Realized Gains from Investments |

— |

(0.14) |

(4.19) |

(2.36) |

— |

|

Total Distributions |

— |

(0.14) |

(4.19) |

(2.36) |

— |

|

Net Asset Value, End of Period |

$37.22 |

$20.81 |

$27.85 |

$35.40 |

$33.76 |

|

Total Return (Excludes Sales Charge)* |

78.86% |

(24.91)% |

(7.79)% |

11.86% |

21.92% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses |

2.34% |

2.25% |

2.16% |

2.13% |

2.16% |

|

Net Investment Income (Loss) |

(0.89)% |

(0.69)% |

(0.42)% |

(0.70)% |

(0.89)% |

|

Gross Expenses |

2.34% |

2.25% |

2.16% |

2.13% |

2.16% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$7,578 |

$5,796 |

$11,083 |

$16,746 |

$27,015 |

|

Portfolio Turnover(b) |

56% |

80% |

72% |

70% |

58% |

|

|

Class R | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$23.53 |

$31.32 |

$39.02 |

$36.86 |

$30.11 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

(0.10) |

(0.05) |

(0.01) |

(0.13) |

(0.16) |

|

Net Realized and Unrealized Gains (Losses)

on Investments |

18.92 |

(7.60) |

(3.50) |

4.65 |

6.91 |

|

Total from Investment Activities |

18.82 |

(7.65) |

(3.51) |

4.52 |

6.75 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Investment Income |

— |

— |

— |

— |

— |

|

Net Realized Gains from Investments |

— |

(0.14) |

(4.19) |

(2.36) |

— |

|

Total Distributions |

— |

(0.14) |

(4.19) |

(2.36) |

— |

|

Net Asset Value, End of Period |

$42.35 |

$23.53 |

$31.32 |

$39.02 |

$36.86 |

|

Total Return (Excludes Sales Charge)* |

79.91% |

(24.54)% |

(7.39)% |

12.29% |

22.42% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses |

1.75% |

1.75% |

1.75% |

1.75% |

1.75% |

|

Net Investment Income (Loss) |

(0.29)% |

(0.19)% |

(0.03)% |

(0.35)% |

(0.46)% |

|

Gross Expenses |

1.95% |

1.86% |

1.99% |

1.89% |

2.06% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$7,099 |

$5,303 |

$10,451 |

$14,952 |

$15,317 |

|

Portfolio Turnover(b) |

56% |

80% |

72% |

70% |

58% |

|

|

Class R6 | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$25.43 |

$33.70 |

$41.51 |

$38.86 |

$31.60 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

0.18 |

0.19 |

0.24 |

0.18 |

0.12 |

|

Net Realized and Unrealized Gains

(Losses) on Investments |

20.47 |

(8.18) |

(3.67) |

4.92 |

7.28 |

|

Total from Investment Activities |

20.65 |

(7.99) |

(3.43) |

5.10 |

7.40 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Investment Income |

(0.17) |

(0.14) |

(0.19) |

(0.09) |

(0.14) |

|

Net Realized Gains from Investments |

— |

(0.14) |

(4.19) |

(2.36) |

— |

|

Total Distributions |

(0.17) |

(0.28) |

(4.38) |

(2.45) |

(0.14) |

|

Net Asset Value, End of Period |

$45.91 |

$25.43 |

$33.70 |

$41.51 |

$38.86 |

|

Total Return (Excludes Sales Charge)* |

81.42% |

(23.95)% |

(6.67)% |

13.17% |

23.40% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses |

0.96% |

0.97% |

0.96% |

0.95% |

0.96% |

|

Net Investment Income (Loss) |

0.52% |

0.64% |

0.65% |

0.45% |

0.33% |

|

Gross Expenses |

0.96% |

0.97% |

0.96% |

0.95% |

0.96% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$1,145,953 |

$984,938 |

$1,179,915 |

$938,831 |

$871,150 |

|

Portfolio Turnover(b) |

56% |

80% |

72% |

70% |

58% |

|

|

Class Y | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$25.27 |

$33.49 |

$41.25 |

$38.63 |

$31.45 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

0.13 |

0.14 |

0.21 |

0.11 |

0.05 |

|

Net Realized and Unrealized Gains

(Losses) on Investments |

20.34 |

(8.13) |

(3.67) |

4.89 |

7.23 |

|

Total from Investment Activities |

20.47 |

(7.99) |

(3.46) |

5.00 |

7.28 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Investment Income |

(0.12) |

(0.09) |

(0.11) |

(0.02) |

(0.10) |

|

Net Realized Gains from Investments |

— |

(0.14) |

(4.19) |

(2.36) |

— |

|

Total Distributions |

(0.12) |

(0.23) |

(4.30) |

(2.38) |

(0.10) |

|

Net Asset Value, End of Period |

$45.62 |

$25.27 |

$33.49 |

$41.25 |

$38.63 |

|

Total Return (Excludes Sales Charge)* |

81.13% |

(24.04)% |

(6.83)% |

13.01% |

23.14% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses |

1.08% |

1.11% |

1.12% |

1.12% |

1.15% |

|

Net Investment Income (Loss) |

0.36% |

0.47% |

0.58% |

0.28% |

0.13% |

|

Gross Expenses |

1.08% |

1.11% |

1.12% |

1.12% |

1.15% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$765,951 |

$491,836 |

$981,688 |

$1,467,901 |

$1,329,435 |

|

Portfolio Turnover(b) |

56% |

80% |

72% |

70% |

58% |

|

|

Class A | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$13.46 |

$16.70 |

$17.75 |

$16.04 |

$ 13.26 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

0.05 |

0.10 |

0.12 |

0.07 |

0.02 |

|

Net Realized and Unrealized Gains (Losses)

on Investments |

9.73 |

(3.24) |

(0.53) |

1.89 |

2.76 |

|

Total from Investment Activities |

9.78 |

(3.14) |

(0.41) |

1.96 |

2.78 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Investment Income |

(0.26) |

(0.10) |

(0.12) |

(0.05) |

— |

|

Net Realized Gains from Investments |

— |

— |

(0.52) |

(0.20) |

— |

|

Total Distributions |

(0.26) |

(0.10) |

(0.64) |

(0.25) |

— |

|

Net Asset Value, End of Period |

$22.98 |

$13.46 |

$16.70 |

$17.75 |

$ 16.04 |

|

Total Return (Excludes Sales Charge)(b) |

73.21% |

(18.97)% |

(1.66)% |

12.16% |

20.97% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses(c) |

1.13% |

1.13% |

1.13% |

1.13% |

1.21% |

|

Net Investment Income (Loss)(c) |

0.27% |

0.67% |

0.70% |

0.42% |

0.13% |

|

Gross Expenses(c) |

1.68% |

1.65% |

1.71% |

1.74% |

2.40% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$6,589 |

$3,241 |

$3,626 |

$2,996 |

$ 2,304 |

|

Portfolio Turnover(b)(d) |

61% |

72% |

67% |

77% |

65% |

|

|

Class R6 | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$13.64 |

$16.91 |

$17.96 |

$16.20 |

$ 13.35 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

0.14 |

0.15 |

0.14 |

0.05 |

0.03 |

|

Net Realized and Unrealized Gains (Losses)

on Investments |

9.82 |

(3.28) |

(0.51) |

1.99 |

2.82 |

|

Total from Investment Activities |

9.96 |

(3.13) |

(0.37) |

2.04 |

2.85 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Investment Income |

(0.30) |

(0.14) |

(0.16) |

(0.08) |

— |

|

Net Realized Gains from Investments |

— |

— |

(0.52) |

(0.20) |

— |

|

Total Distributions |

(0.30) |

(0.14) |

(0.68) |

(0.28) |

— |

|

Net Asset Value, End of Period |

$23.30 |

$13.64 |

$16.91 |

$17.96 |

$ 16.20 |

|

Total Return (Excludes Sales Charge)(b) |

73.68% |

(18.70)% |

(1.39)% |

12.54% |

21.35% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses(c) |

0.83% |

0.83% |

0.83% |

0.83% |

1.09% |

|

Net Investment Income (Loss)(c) |

0.72% |

0.97% |

0.86% |

0.28% |

0.20% |

|

Gross Expenses(c) |

0.94% |

0.97% |

0.96% |

1.26% |

1.96% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$143,273 |

$80,284 |

$95,286 |

$24,926 |

$ 18 |

|

Portfolio Turnover(b)(d) |

61% |

72% |

67% |

77% |

65% |

|

|

Class Y | ||||

|

|

Year

Ended

6/30/21 |

Year

Ended

6/30/20 |

Year

Ended

6/30/19 |

Year

Ended

6/30/18 |

Year

Ended

6/30/17 |

|

Net Asset Value, Beginning of Period |

$13.60 |

$16.86 |

$17.92 |

$16.17 |

$ 13.35 |

|

Investment Activities |

|

|

|

|

|

|

Net Investment Income (Loss)(a) |

0.12 |

0.14 |

0.22 |

0.12 |

0.06 |

|

Net Realized and Unrealized Gains (Losses)

on Investments |

9.81 |

(3.27) |

(0.60) |

1.91 |

2.78 |

|

Total from Investment Activities |

9.93 |

(3.13) |

(0.38) |

2.03 |

2.84 |

|

Distributions to Shareholders From |

|

|

|

|

|

|

Net Investment Income |

(0.30) |

(0.13) |

(0.16) |

(0.08) |

(0.02) |

|

Net Realized Gains from Investments |

— |

— |

(0.52) |

(0.20) |

— |

|

Total Distributions |

(0.30) |

(0.13) |

(0.68) |

(0.28) |

(0.02) |

|

Net Asset Value, End of Period |

$23.23 |

$13.60 |

$16.86 |

$17.92 |

$ 16.17 |

|

Total Return (Excludes Sales Charge)(b) |

73.61% |

(18.73)% |

(1.45)% |

12.51% |

21.25% |

|

Ratios to Average Net Assets |

|

|

|

|

|

|

Net Expenses(c) |

0.88% |

0.88% |

0.88% |

0.88% |

0.96% |

|

Net Investment Income (Loss)(c) |

0.66% |

0.92% |

1.30% |

0.67% |

0.38% |

|

Gross Expenses(c) |

0.98% |

1.01% |

1.03% |

1.13% |

1.21% |

|

Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (000's) |

$56,537 |

$32,572 |

$35,927 |

$92,019 |

$ 53,509 |

|

Portfolio Turnover(b)(d) |

61% |

72% |

67% |

77% |

65% |

Victory Funds

P.O. Box 182593

Columbus, OH 43218-2593

Columbus, OH 43218-2593

Call Victory Funds at

800-539-FUND (800-539-3863)

EDGAR database at sec.gov or by email request at

publicinfo@sec.gov

|

Victory Integrity Discovery Fund | ||||||

|

|

Member Class |

|

|

|

|

|

|

|

MMMMX |

|

|

|

|

|

|

Victory Integrity Mid-Cap Value Fund | ||||||

|

|

Member Class |

|

|

|

|

|

|

|

MMIJX |

|

|

|

|

|

|

Victory Integrity Small/Mid-Cap Value Fund | ||||||

|

|

Member Class |

|

|

|

|

|

|

|

MMMSX |

|

|

|

|

|

800-235-8396

|

|

Member

Class |

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price) |

|

|

Maximum Deferred Sales Charge (Load)

(as a percentage of the lower of purchase or sale price) |

|

|

Management Fees |

|

|

Distribution and/or Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver/Expense Reimbursement |

( |

|

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement1 |

|

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Member Class |

$ |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Annual Total Returns

(For the Periods Ended December 31, 2020) |

1 Year |

5 Years |

10 Years |

|

CLASS Y Before Taxes |

-1.34% |

7.72% |

10.06% |

|

CLASS Y After Taxes on Distributions |

-1.34% |

6.15% |

8.29% |

|

CLASS Y After Taxes on Distributions and Sale of Fund Shares |

-0.79% |

5.84% |

7.95% |

|

Index | |||

|

Russell Microcap® Value Index

reflects no deduction for fees, expenses or taxes. |

6.34% |

10.50% |

9.47% |

|

|

Title |

Tenure with the Fund |

|

Daniel J. DeMonica, CFA |

Senior Portfolio Manager |

Since 2011 |

|

Mirsat Nikovic |

Portfolio Manager |

Since 2011 |

|

Sean A. Burke |

Portfolio Manager |

Since 2015 |

|

Michael P. Wayton |

Portfolio Manager |

Since 2018 |

|

Investment Minimums |

Member

Class |

|

Minimum Initial Investment |

$3,000 |

|

Minimum Subsequent Investments |

$50 |

|

|

Member

Class |

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price) |

|

|

Maximum Deferred Sales Charge (Load)

(as a percentage of the lower of purchase or sale price) |

|

|

Management Fees |

|

|

Distribution and/or Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver/Expense Reimbursement |

( |

|

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement1 |

|

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Member Class |

$ |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Annual Total Returns

(For the Periods Ended December 31, 2020) |

1 Year |

5 Years |

Life of

Fund |

|

CLASS Y Before Taxes |

5.23% |

9.85% |

9.98%1

|

|

CLASS Y After Taxes on Distributions |

4.51% |

8.98% |

9.33%1

|

|

CLASS Y After Taxes on Distributions and Sale of Fund Shares |

3.42% |

7.62% |

8.05%1

|

|

Index | |||