Exhibit 13.1

Commission File No. 0-15261

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES AND EXCHANGE ACT OF 1934

For the Year Ended December 31, 2010

BRYN MAWR BANK CORPORATION

Investing for growth

A rich tradition of investing in our franchise and in our future.

Recent investments over the last five years have included:

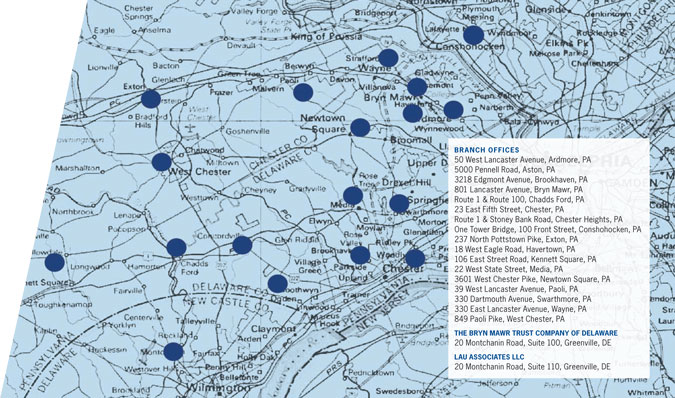

| • | JANUARY 2007 — Opened the Ardmore office. |

| • | MAY 2007 — Formed the Private Banking Group. |

| • | JUNE 2008 — Major renovations of the Wayne office. |

| • | JULY 2008 — Acquired Lau Associates LLC, Wilmington, DE. |

| • | NOVEMBER 2008 — Established The Bryn Mawr Trust Company of Delaware in Wilmington, DE. |

| • | JANUARY 2009 — Opened the West Chester Regional Banking Center. |

| • | MAY 2009 — Established BMT Asset Management. |

| • | NOVEMBER 2009 — Signed agreement to acquire First Keystone Financial. |

| • | DECEMBER 2009 — Major renovations of the Paoli office. |

| • | JULY 2010 — Acquired First Keystone Financial, Inc. |

| • | DECEMBER 2010 — Lau Associates LLC and The Bryn Mawr Trust Company of Delaware move to Greenville, Delaware. |

| • | FEBRUARY 2011 — Signed agreement to acquire the Private Wealth Management Group from Hershey Trust Company with approximately $1.1 billion of assets under management. |

ANNUAL MEETING — The Annual Meeting of Shareholders of Bryn Mawr Bank Corporation will be held at Saint Davids Golf Club, 845 Radnor Street Road, Wayne, PA 19087, on Wednesday, April 27, 2011, at 11:00 a.m.

STOCK LISTING — Bryn Mawr Bank Corporation common stock is listed on the NASDAQ Select Global Market under the symbol BMTC.

FORM 10-K — A copy of the Corporation’s Form 10-K, including financial statement schedules as filed with the Securities and Exchange Commission, is available on our website www.bmtc.com or upon written request to the Corporate Secretary, Bryn Mawr Bank Corporation, 801 Lancaster Avenue, Bryn Mawr, Pennsylvania 19010.

EQUAL EMPLOYMENT OPPORTUNITY — The Corporation continues its commitment to equal opportunity employment and does not discriminate against minorities or women with respect to recruitment, hiring, training, or promotion. It is the policy of the Corporation to comply voluntarily with the practices of Affirmative Action.

This discussion contains forward-looking statements. Please see the section entitled “Special Cautionary Notice Regarding Forward Looking Statements” in the enclosed Annual Report to Shareholders, and the section entitled “Risk Factors” in the enclosed Form 10-K, for discussions of the risks, uncertainties and assumptions associated with these statements.

2010 Annual Report

Consolidated financial highlights

The comparability of these Consolidated financial highlights are impacted by the July 1, 2010 merger of First Keystone Financial, Inc. into Bryn Mawr Bank Corporation.

| 2010 | 2009 | CHANGE | ||||||||||||||

| FOR THE YEAR |

||||||||||||||||

| Net interest income |

$ | 52,150 | $ | 40,793 | $ | 11,357 | 27.8 | % | ||||||||

| Net interest income after loan and lease loss provision |

42,296 | 33,909 | 8,387 | 24.7 | % | |||||||||||

| Non-interest income |

29,375 | 28,470 | 905 | 3.2 | % | |||||||||||

| Non-interest expenses |

57,985 | 46,542 | 11,443 | 24.6 | % | |||||||||||

| Income taxes |

4,512 | 5,500 | (988 | ) | -18.0 | % | ||||||||||

| Net income |

9,174 | 10,337 | (1,163 | ) | -11.3 | % | ||||||||||

| Net income, exclusive of merger-related expenses |

13,004 | 10,739 | 2,265 | 21.1 | % | |||||||||||

| (a non-GAAP measure)* |

||||||||||||||||

| AT YEAR-END |

||||||||||||||||

| Total assets |

$ | 1,731,768 | $ | 1,238,821 | $ | 492,947 | 39.8 | % | ||||||||

| Total portfolio loans and leases |

1,196,717 | 885,739 | 310,978 | 35.1 | % | |||||||||||

| Total deposits |

1,341,432 | 937,887 | 403,545 | 43.0 | % | |||||||||||

| Shareholders’ equity |

161,418 | 103,936 | 57,482 | 55.3 | % | |||||||||||

| Tangible common equity |

136,695 | 92,214 | 44,480 | 48.2 | % | |||||||||||

| Wealth assets under management, administration |

3,412,890 | 2,871,143 | 541,747 | 18.9 | % | |||||||||||

| and supervision |

||||||||||||||||

| PER COMMON SHARE |

||||||||||||||||

| Basic earnings per common share |

$ | 0.85 | $ | 1.18 | $ | (0.33 | ) | -28.0 | % | |||||||

| Diluted earnings per common share |

0.85 | 1.18 | (0.33 | ) | -28.0 | % | ||||||||||

| Dividends declared |

0.56 | 0.56 | 0.00 | 0.0 | % | |||||||||||

| Book value |

13.24 | 11.72 | 1.52 | 13.0 | % | |||||||||||

| Tangible book value |

11.21 | 10.40 | 0.81 | 7.8 | % | |||||||||||

| Closing price |

17.45 | 15.09 | 2.36 | 15.6 | % | |||||||||||

| SELECTED RATIOS |

||||||||||||||||

| Return on average assets |

0.61 | % | 0.88 | % | ||||||||||||

| Return on average shareholders’ equity |

6.76 | % | 10.55 | % | ||||||||||||

| Tax equivalent net interest margin |

3.79 | % | 3.70 | % | ||||||||||||

| Tangible common equity |

8.01 | % | 7.51 | % | ||||||||||||

dollars in thousands, except per share data

| * | Net income, exclusive of merger-related expenses, is calculated by adding back to reported net income, which is a GAAP measure, the tax-effected due diligence and merger-related expenses of $3.830 million (pre-tax of $5.714 million, effective tax rate of 33.0%) and $402 thousand (pre-tax of $616 thousand, effective tax rate of 33.7%), for the years ended December 31, 2010 and 2009, respectively. Our management uses these non-GAAP financial measures in their analysis of our performance and believes that they provide useful supplemental information that is essential to an investor’s understanding of Bryn Mawr Bank Corporation’s operating results. These non-GAAP financial measures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. |

2

Letter to shareholders

Dear Fellow Shareholders,

Although the recession has continued to batter many banks around the nation, I’m pleased to report that the Bryn Mawr Bank Corporation and our main subsidiary, The Bryn Mawr Trust Company, had an outstanding year.

Credit for this performance goes to our hardworking and dedicated staff, an excellent management team, and an engaged and active Board of Directors.

Here are the highlights:

| • | On July 1, we successfully completed the acquisition of First Keystone Bank. In doing so, we doubled the size of our branch system and geographical footprint, and increased our banking assets by $480 million. |

| • | Net income, exclusive of merger expenses, was $13 million, an increase of 21% over the prior year.* |

| • | Wealth assets under management and administration increased 19% during 2010 and finished the year at $3.4 billion. A strong contributor was our newly-formed BMT Asset Management group, which specializes in handling investment accounts from $500 thousand to $3 million. |

| • | We completed a “private placement” stock offering in May and raised over $24 million of new common equity to support current and future growth. Bryn Mawr Trust remains a “well-capitalized” bank per federal and state regulatory guidelines. |

| • | Our stock price increased from $15.09 on December 31, 2009 to $17.45 on December 31, 2010, an improvement of 15.6%. Including our dividends, the total return to our shareholders for the year was 19.4%. |

| • | Bryn Mawr Bank Corporation was ranked #56 in financial performance out of thousands of institutions on the US Banker’s “Annual List of Top Community Banks.” |

Despite such a strong year, challenges still remain. Many of our clients, especially small businesses, continue to be affected by the weak economy and, especially, by high unemployment. While the recently enacted Dodd-Frank

Act for financial reform bill mainly affects the very large banks, it still includes time-consuming and burdensome requirements on institutions such as ours.

However, we believe that we are very well positioned for another excellent year of profitability and growth in 2011.

Should you have any questions, please do not hesitate to call me at my direct line, 610-581-4800.

| Sincerely, |

|

| Ted Peters Chairman and Chief Executive Officer |

| * | See non-GAAP disclosure on page 1. |

4

Year in review

In 2010, we announced our 3-5-3 strategic vision. Our goal is to have $3 billion in banking assets and $5 billion in wealth assets within 3 years. This year, we made significant strides in achieving that strategic vision.

INVESTING IN OUR FUTU RE

On July 1, 2010, we completed our acquisition of First Keystone Financial, Inc., and its main operating subsidiary, First Keystone Bank. With this acquisition, we added eight full-service branches to our network and $480 million in assets. Closing on the acquisition marked an important milestone for us. However, we still had a tremendous amount of work ahead of us converting all former First Keystone Bank client accounts to Bryn Mawr Trust’s computer systems. Our primary goal for conversion was to develop and implement a “client focused” plan that would effectively communicate any changes in products or services, anticipate customer questions, identify new opportunities for customers and guide them through the transition to Bryn Mawr Trust.

On August 25, 2010, we announced the successful conversion of all First Keystone Bank client accounts to Bryn Mawr Trust’s computer systems. Our conversion team did a wonderful job on this project, and we experienced relatively few issues or complaints. In fact, client and account retention has been very high, and we are excited about the growth opportunities for the combined organizations.

In September, following our successful conversion, we launched a major multimedia campaign to improve brand awareness, particularly in our newly-acquired markets. The campaign promoted our capabilities in wealth management, commercial banking, retail banking and mortgage banking, using radio, cable TV, newspapers, internet and outdoor advertising. We received a tremendous amount of positive feedback about the campaign and generated many new client relationships.

OUR CORE BUSINESSES

Once again, each of our four core businesses performed well in 2010. There was certainly the potential for getting distracted as we worked through the First Keystone acquisition. However, our team didn’t let that effort interfere with their primary goal of growing the Bank.

The Wealth Management Division acquired many new clients and made progress in growing some of our newer services, including philanthropic and escrow services. Our Wealth Management professionals are recognized financial management experts. Major news organizations sought their opinions and interviewed them on a variety of wealth and financial management topics. They have been seen on CNBC Closing Bell, CNBC Squawk on the Street, Fox Business News and Fox 29 News, and quoted in The Wall Street Journal, New York Times, Philadelphia Business Journal, Wilmington News Journal and The Philadelphia Inquirer, to name a few.

The Retail Banking staff personnel kept very busy growing new consumer and business account relationships. In addition to their normal sales and customer service activities, they were responsible for training the former First Keystone staff on our products, services, computer systems and procedures. As a result of their hard work, account retention and new client growth has been excellent. Our clients are receiving the excellent service they have come to expect!

| 5 |

2010 Annual Report |

With a disciplined approach to loan underwriting and risk management, our Commercial Banking group was able to avoid the significant loan problems that many other banks have encountered over the last few years. Credit quality of our loan portfolio is good and, with the addition of several new experienced lenders to our staff, we are poised for growth in 2011.

Many consumers were motivated to refinance residential mortgages due to the continued low rate environment in 2010. The BMT Mortgage Company closed over $239 million in new mortgages.

BUILDING STRONGER COMMUNITIES

Bryn Mawr Trust has always had a strong commitment to supporting the communities we serve. As we grow larger, we feel it is even more important to maintain close ties with residents, business leaders and community leaders. In 2009, we began to formalize our commitment by establishing a Chester County Advisory Board. In 2010, we expanded the program by establishing a Delaware County Advisory Board, a Wealth Management Advisory Board and The Bryn Mawr Trust Company of Delaware Advisory Board. Advisory Board members meet with Bryn Mawr Trust’s senior managers on emerging trends, issues, and opportunities to enhance our well-established role as a business and community partner. We are fortunate to have assembled a prestigious group of leaders to serve on our Advisory Boards. The members of our Advisory Boards are:

CHESTER COUNTY ADVISORY BOARD

Anthony Giannascoli, Attorney at Law, Giannascoli & Associates, P.C.

Kevin Holleran, Attorney at Law, Gawthrop Greenwood, P.C.

Senya D. Isayeff, Alliance Environmental Systems, Inc.

Valerie Jester, Brandywine Capital Associates, Inc.

James MacFadden,Century 21 Alliance

Mary Ellen “Mell” Josephs, Executive Director, Student Services, Inc., West Chester University

Eugene Steger, Attorney at Law, and CPA, Steger Gowie & Company, Inc.

Hon. Richard B. Yoder, Former Mayor of West Chester, Pennsylvania

DELAWARE COUNTY ADVISORY BOARD

Donald S. Guthrie, Attorney at Law and former Chairman of First Keystone Bank

Bruce Hendrixson, Owner, Garnet Ford

Donald G. Hosier, Jr., Executive, Montgomery Insurance Services, Inc.

Edmund Jones, Attorney at Law

Bruce E. Miller, President, Open MRI Centers

William J. O’Donnell, Executive, Wawa, Inc.

Lawrence G. Strohm, Jr., Attorney at Law

Thomas Broadt, Attorney at Law

Margaret Kuo, Restaurateur

Photos, left to right: J. Duncan Smith, Executive Vice President and Chief Financial Officer; Marie D. Connolly, Senior Vice President, Comptrollers; Mame O. Skelly, Senior Vice President, Comptrollers; Geoffrey L. Halberstadt, Executive Vice President, Chief Credit Policy Officer and Corporate Secretary. Stephen P. Novak, Senior Vice President, Retail Banking; Robin G. Otto, Group Vice President, Retail Banking; Sigal Silverman, Group Vice President, Retail Banking; Amy K. Groff, Vice President, Retail Banking. Joseph G. Keefer, Executive Vice President and Chief Lending Officer; Britton H. Murdoch, Lead Board Director; Martin F. Gallagher, Jr., Senior Vice President, Commercial Banking Division Head.

6

WEALTH MANAGEMENT ADVISORY BOARD

Brett Senior, Senior Partner of Brett Senior & Associates, P.C. Denean Williams, Managing Director of Cameron Capital Management LLC

Joseph Sidelarz, Senior Associate at Raffaele & Puppio, LLP

Virginia Sikes, Partner at Montgomery, McCracken, Walker & Rhodes, LLP

Joseph Lundy, Founding Partner of Lundy & Flynn, LLP

THE BRYN MAWR TRUST COMPANY OF DELAWARE ADVISORY BOARD

F. Peter Conaty, Jr., Attorney at Law, Richard, Layton & Finger, P.A.

Frances Gauthier, Attorney at Law, Stradley Ronan Stevens & Young, LLP

Michael M. Gordon, Attorney at Law, Gordon, Fournaris & Mammarella, P.A.

Harold W. T. Purnell, II, Attorney at Law, Archer & Greiner, P.C.

James W. Whalen, Jr., CEBS, Belfint, Lyons & Shuman, P.A.

In 2010, we continued our tradition of contributing generously to a wide variety of charitable, educational, cultural and civic organizations. In addition to our continued financial support, many members of our staff donate their personal time to many different community organizations.

RECOGNITION AND AWARDS

It’s always nice to receive recognition for a special achievement or a job well done. Thanks to our dedicated team members, Bryn Mawr Trust was honored on several different occasions this year.

In May 2010, we were notified that we had been ranked 56th in the US Banker’s annual ranking of the top community banks in the United States. The rankings are based on the financial institution’s performance as compiled by SNL Financial LC.

On August 2, 2010, in recognition of our 25th anniversary of being listed on the NASDAQ exchange, we were invited to ring the closing bell at the market. When first listed on NASDAQ, our market capitalization was $64.3 million and it has grown to over $240 million during the first quarter of 2011.

Ringing the closing bell on August 2, 2010. Photo ©NASDAQ OMX Group.

| 7 | 2010 Annual Report |

In December 2010, we received the Community Service Award from The Pennsylvania Association of Community Bankers for our support of The Radnor High School Scholarship Fund. In addition to our financial support, many of our staff members volunteer their time to work on various fundraising activities for this and other organizations.

We are honored to have received this award and recognition.

INVESTING IN OUR FRANCHISE

In December 2010, two of our subsidiaries, The Bryn Mawr Trust Company of Delaware and Lau Associates LLC, moved to a beautiful new location at 20 Montchanin Road, Greenville, Delaware 19807. This new location is ideally situated to serve our growing client base in the state of Delaware.

We are also in the process of making major renovations at our Havertown branch located at 18 West Eagle Road, Havertown, Pennsylvania 19083. We expect to have renovations completed in the first quarter of 2011.

Photos, left to right: Elizabeth Roberts, Esq., Senior Vice President, Chief Fiduciary Officer and Director of Trust; Gilbert B. Mateer, Senior Vice President, Retirement Services; Anrita McGinn, Group Vice President, Custody Services; F. Peter Brodie, Senior Vice President, Chief Investment Officer; Francis J. Leto, Executive Vice President, Wealth Management Division; Ellen T. Jordan, Senior Vice President, Wealth Management Division; Richard K. Cobb, Jr., Senior Vice President, BMT Asset Management; Mary T. Martin, Senior Vice President and Tax Manager. June M. Falcone, Senior Vice President, Operations; Kevin L. O’Connor, Chief Technology Officer, Information Services; Alison E. Gers, Executive Vice President, Retail Banking, Operations, IT and Marketing.

FUTURE OPPORTUNITIES

We will continue to seek out new and profitable opportunities for growth in the future. Because we are a Strong, Stable, Secure organization, we expect to have the financial strength to take advantage of new opportunities. We will carefully evaluate new opportunities as we have in the past, using a thoughtful, disciplined approach focused on risk management. We are very excited by opportunities for growth.

Management, staff and the Board of Directors are pleased with our 2010 accomplishments and thank you for your continued support.

| Bryn Mawr Trust |

| Strong. Stable. Secure. |

“This year was filled with more exciting opportunities and challenges than any other year in recent memory. It was a pleasure to see how our team took advantage of the opportunities and responded to the challenges.” — TED PETERS

8

Corporate information

CORPORATE H EADQUARTERS

801 Lancaster Ave., Bryn Mawr, PA 19010 Ÿ 610-525-1700 Ÿ www.bmtc.com

DIRECTORS

Thomas L. Bennett,

Private Investor, Director and Trustee of the Delaware Investments Family of Funds

Andrea F. Gilbert,

President, Bryn Mawr Hospital

Donald S. Guthrie,

Attorney at Law

Wendell F. Holland,

Partner, Saul Ewing LLP

Scott M. Jenkins,

President, S. M. Jenkins & Co.

David E. Lees,

Senior Partner, myCIO Wealth Partners, LLC

Francis J. Leto,

Executive Vice President, Wealth Management

Britton H. Murdoch,

CEO, City Line Motors;

Managing Director, Strattech Partners

Frederick C. “Ted” Peters II,

Chairman, President & Chief Executive Officer,

Bryn Mawr Bank Corporation and The Bryn Mawr Trust Company

B. Loyall Taylor, Jr.,

President, Taylor Gifts, Inc.

MARKET MAKERS

Boenning & Scattergood, Inc.

Credit Suisse Securities USA

Deutsche Bank Securities Inc.

Goldman, Sachs & Co.

Janney Montgomery Scott LLC

Keefe, Bruyette & Woods, Inc.

Morgan Stanley & Co., Inc.

Ryan Beck & Co., Inc.

Sandler O’Neill & Partners, LP

Sterne, Agee & Leach, Inc.

Stifel, Nicolaus & Co.

UBS Securities LLC

For a complete list, visit our website at www.bmtc.com

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

KPMG LLP, 1601 Market Street,

Philadelphia, PA 19103

LEGAL COUNSEL

McElroy, Deutsch, Mulvaney & Carpenter, LLP

One Penn Center at Suburban Station

1617 John F. Kennedy Boulevard,

Suite 1500,

Philadelphia, PA 19103

Stradley Ronon Stevens & Young, LLP

2005 Market Street,

Suite 2600,

Philadelphia, PA 19103-7098

BRYN MAWR BANK CORPORATION

Frederick C. “Ted” Peters II,

Chairman, President & Chief Executive Officer

Geoffrey L. Halberstadt,

Corporate Secretary

J. Duncan Smith, CPA,

Treasurer and Assistant Secretary

Francis J. Leto,

Vice President

PRINCIPAL SUBSIDIARY

The Bryn Mawr Trust Company

A Subsidiary of Bryn Mawr Bank Corporation

EXECUTIVE MANAGEMENT

Frederick C. “Ted” Peters II,

Chairman, President & Chief Executive Officer

Alison E. Gers,

Executive Vice President, Retail Banking,

Central Sales, Marketing,

Information Systems & Operations

Geoffrey L. Halberstadt,

Executive Vice President, Chief Credit Policy Officer and Corporate Secretary

Joseph G. Keefer,

Executive Vice President and Chief Lending Officer

Francis J. Leto,

Executive Vice President, Wealth Management

J. Duncan Smith, CPA,

Executive Vice President and Chief Financial Officer

WEALTH MANAGEMENT DIVI SION

10 South Bryn Mawr Avenue, Bryn Mawr, PA 19010

LIFE CARE COMMUNITY OFFICES

Beaumont at Bryn Mawr Retirement Community,

Bryn Mawr, PA

Bellingham Retirement Living,

West Chester, PA

Martins Run Life Care Community,

Media, PA

Rosemont Presbyterian Village,

Rosemont, PA The Quadrangle,

Haverford, PA

Waverly Heights, Gladwyne, PA

White Horse Village, Newtown Square, PA

OTHER SUBSIDIARIES AND FINANCIAL SERVICES

BMT Leasing, Inc.

Subsidiary of The Bryn Mawr Trust Company,

Bryn Mawr, PA

James A. Zelinskie, Jr., President

BMT Mortgage Company

A Division of The Bryn Mawr Trust Company,

Bryn Mawr, PA

Myron H. Headen, President

BMT Mortgage Services, Inc.

Subsidiary of The Bryn Mawr Trust Company,

Bryn Mawr, PA Myron H. Headen, President

BMT Settlement Services, Inc.

Subsidiary of The Bryn Mawr Trust Company,

Bryn Mawr, PA Myron H. Headen, President

The Bryn Mawr Trust Company of Delaware

A Subsidiary of Bryn Mawr Bank Corporation,

Greenville, DE Karen A. Fahrner, Esq., President

Insurance Counsellors of Bryn Mawr, Inc.

A Subsidiary of The Bryn Mawr Trust Company,

Bryn Mawr,PA

Thomas F. Drennan, President

Lau Associates LLC

A Subsidiary of Bryn Mawr Bank Corporation,

Greenville, DE Judith W. Lau, CFP®, President

REGISTRAR & TRANSFER AGENT

BNY Mellon Shareowner Services

PO Box 358015, Pittsburgh, PA 15252-8015 www.bnymellon.com/shareowner/isd

INVESTOR RELATIONS

Aaron F. Strenkoski,

Vice President

9

Exhibit 13.1

Selected Financial Data(1)

| For the years ended December 31, | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||

| (dollars in thousands, except for per share data) | ||||||||||||||||||||

| Interest income |

$ | 64,796 | $ | 56,892 | $ | 57,934 | $ | 54,218 | $ | 45,906 | ||||||||||

| Interest expense |

12,646 | 16,099 | 20,796 | 19,976 | 12,607 | |||||||||||||||

| Net interest income |

52,150 | 40,793 | 37,138 | 34,242 | 33,299 | |||||||||||||||

| Provision for loan and lease losses |

9,854 | 6,884 | 5,596 | 891 | 832 | |||||||||||||||

| Net interest income after provision for loan and lease losses |

42,296 | 33,909 | 31,542 | 33,351 | 32,467 | |||||||||||||||

| Non-interest income |

29,375 | 28,470 | 21,472 | 21,781 | 18,361 | |||||||||||||||

| Non-interest expense |

57,985 | 46,542 | 38,676 | 34,959 | 31,423 | |||||||||||||||

| Income before income taxes |

13,686 | 15,837 | 14,338 | 20,173 | 19,405 | |||||||||||||||

| Income taxes |

4,512 | 5,500 | 5,013 | 6,573 | 6,689 | |||||||||||||||

| Net Income |

$ | 9,174 | $ | 10,337 | $ | 9,325 | $ | 13,600 | $ | 12,716 | ||||||||||

| Per share data: |

||||||||||||||||||||

| Earnings per common share: |

||||||||||||||||||||

| Basic |

$ | 0.85 | $ | 1.18 | $ | 1.09 | $ | 1.59 | $ | 1.48 | ||||||||||

| Diluted |

$ | 0.85 | $ | 1.18 | $ | 1.08 | $ | 1.58 | $ | 1.46 | ||||||||||

| Dividends declared |

$ | 0.56 | $ | 0.56 | $ | 0.54 | $ | 0.50 | $ | 0.46 | ||||||||||

| Weighted-average shares outstanding |

10,765,657 | 8,732,004 | 8,566,938 | 8,539,904 | 8,578,050 | |||||||||||||||

| Dilutive potential common shares |

12,312 | 16,719 | 34,233 | 93,638 | 113,579 | |||||||||||||||

| Adjusted weighted-average shares |

10,777,969 | 8,748,723 | 8,601,171 | 8,633,542 | 8,691,629 | |||||||||||||||

| Selected financial ratios: |

||||||||||||||||||||

| Tax equivalent net interest margin |

3.79 | % | 3.70 | % | 3.84 | % | 4.37 | % | 4.90 | % | ||||||||||

| Net income/average total assets (“ROA”) |

0.61 | % | 0.88 | % | 0.89 | % | 1.59 | % | 1.72 | % | ||||||||||

| Net income/average shareholders’ equity (“ROE”) |

6.76 | % | 10.55 | % | 10.01 | % | 15.87 | % | 15.71 | % | ||||||||||

| Dividends declared per share to net income per basic common share |

65.9 | % | 47.5 | % | 49.5 | % | 31.4 | % | 31.1 | % | ||||||||||

| Average equity/average total assets |

9.02 | % | 8.34 | % | 8.89 | % | 10.02 | % | 10.95 | % | ||||||||||

| Non-interest expense / net-interest income and non-interest income |

71.1 | % | 67.2 | % | 66.0 | % | 62.4 | % | 60.8 | % | ||||||||||

| Non-interest income / net-interest income and non-interest income |

36.0 | % | 41.1 | % | 36.6 | % | 38.9 | % | 35.5 | % | ||||||||||

| At or for the year ended December 31, | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||

| Total assets |

$ | 1,731,768 | $ | 1,238,821 | $ | 1,151,346 | $ | 1,002,096 | $ | 826,817 | ||||||||||

| Earning assets |

1,597,130 | 1,164,617 | 1,061,139 | 874,661 | 733,781 | |||||||||||||||

| Portfolio loans and leases |

1,196,717 | 885,739 | 899,577 | 802,925 | 681,291 | |||||||||||||||

| Deposits |

1,341,432 | 937,887 | 869,490 | 849,528 | 714,489 | |||||||||||||||

| Shareholders’ equity |

161,418 | 103,936 | 92,413 | 90,351 | 82,092 | |||||||||||||||

| Wealth assets under management, administration & supervision(2) |

3,412,890 | 2,871,143 | 2,146,399 | 2,277,091 | 2,178,777 | |||||||||||||||

| Ratio of tangible common equity to tangible assets |

8.01 | % | 7.51 | % | 7.13 | % | 9.02 | % | 9.97 | % | ||||||||||

| Tier 1 Capital to Risk Weighted Assets |

11.30 | % | 9.41 | % | 8.81 | % | 10.40 | % | 11.38 | % | ||||||||||

| Total Regulatory Capital to Risk Weighted Assets |

13.71 | % | 12.53 | % | 11.29 | % | 11.31 | % | 12.46 | % | ||||||||||

| Loans serviced for others |

605,485 | 514,875 | 350,199 | 357,363 | 382,141 | |||||||||||||||

| Book value per share |

$ | 13.24 | $ | 11.72 | $ | 10.76 | $ | 10.60 | $ | 9.59 | ||||||||||

| Tangible book value per share |

$ | 11.21 | $ | 10.40 | $ | 9.55 | $ | 10.60 | $ | 9.59 | ||||||||||

| Allowance as a percentage of portfolio loans and leases |

0.86 | % | 1.18 | % | 1.15 | % | 1.01 | % | 1.19 | % | ||||||||||

| Allowance as a percentage of originated portfolio loans and leases(3) |

1.08 | % | 1.18 | % | 1.15 | % | 1.01 | % | 1.19 | % | ||||||||||

| Non-performing loans and leases as a percentage of loans and leases |

0.79 | % | 0.78 | % | 0.65 | % | 0.25 | % | 0.12 | % | ||||||||||

| (1) | The comparability of the Selected Financial Data is impacted by the July 1, 2010 merger of First Keystone Financial, Inc. into Bryn Mawr Bank Corporation. |

| (2) | Excludes assets under management from an institutional client for 2007, and 2006. |

| (3) | A non-GAAP measure that excludes loans and leases acquired in the Merger as detailed on page 23 of Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

1

Management’s Discussion and Analysis of Financial Condition and Results of Operations

BRIEF HISTORY OF THE CORPORATION

The Bryn Mawr Trust Company (the “Bank”) received its Pennsylvania banking charter in 1889 and is a member of the Federal Reserve System. In 1986, Bryn Mawr Bank Corporation (the “Corporation”) was formed and on January 2, 1987, the Bank became a wholly-owned subsidiary of the Corporation. The Bank and Corporation are headquartered in Bryn Mawr, Pennsylvania, a western suburb of Philadelphia. The Corporation and its subsidiaries offer a full range of personal and business banking services, consumer and commercial loans, equipment leasing, mortgages, insurance and wealth management services, including investment management, trust and estate administration, retirement planning, custody services, and tax planning and preparation from 17 full-service branches and seven limited-hour, retirement community offices throughout Montgomery, Delaware and Chester counties of Pennsylvania. The common stock of the Corporation trades on the NASDAQ Stock Market (“NASDAQ”) under the symbol BMTC.

The goal of the Corporation is to become the preeminent community bank and wealth management organization in the Philadelphia area.

The Corporation operates in a highly competitive market area that includes local, national and regional banks as competitors along with savings banks, credit unions, insurance companies, trust companies, registered investment advisors and mutual fund families. The Corporation and its subsidiaries are regulated by many agencies including the Securities and Exchange Commission (“SEC”), NASDAQ, Federal Deposit Insurance Corporation (“FDIC”), the Federal Reserve and the Pennsylvania Department of Banking.

FIRST KEYSTONE FINANCIAL, INC.

On July 1, 2010, the merger of First Keystone Financial, Inc. (“FKF”) with and into the Corporation (the “Merger”), and the two step merger of FKF’s wholly-owned subsidiary, First Keystone Bank (“FKB”) with and into the Bank, were completed. In accordance with the terms of the Agreement and Plan of Merger, dated November 3, 2009, by and between the Corporation and FKF (the “Merger Agreement”), shareholders of FKF received 0.6973 shares of the Corporation’s common stock plus $2.06 per share cash consideration for each share of FKF common stock they owned as of the effective date of the Merger. The 85% stock and 15% cash transaction is valued at $31.3 million, based on FKF’s June 30, 2010 closing share price of $13.35 as listed on NASDAQ.

The aggregate consideration paid to FKF shareholders consisted of approximately 1.6 million shares of the Corporation’s common stock, valued at approximately $26.4 million, and approximately $4.8 million in cash. FKF employee stock options, valued at approximately $102 thousand, which were fully vested and converted to options to purchase the Corporation’s common stock upon the closing of the Merger, were also included in the total consideration paid.

The acquisition of FKF, a federally chartered thrift institution with assets of approximately $480 million, enabled the Corporation to increase its regional footprint with the addition of eight full service branch locations, primarily in Delaware County, Pennsylvania. The geographic locations of the acquired branches were such that it was not necessary to close any of the former FKF branches. By expanding into these new areas within Delaware County, Pennsylvania, the Corporation will be able to extend its successful sales culture as well as offer its reputable wealth management products and other value-added services to a wider segment of the region’s population.

RESULTS OF OPERATIONS

The following is Management’s discussion and analysis of the significant changes in the results of operations, capital resources and liquidity presented in the accompanying consolidated financial statements. The Corporation’s consolidated financial condition and results of operations are comprised primarily of the Bank’s financial condition and results of operations. Current performance does not guarantee, and may not be indicative of similar performance in the future. For more information on the factors that could affect performance, see “Special Cautionary Notice Regarding Forward Looking Statements” on page 24 of this Annual Report.

CRITICAL ACCOUNTING POLICIES, JUDGMENTS AND ESTIMATES

The accounting and reporting policies of the Corporation and its subsidiaries conform with accounting principles generally accepted in the United States of America applicable to the financial services industry (“GAAP”). All inter-company transactions are eliminated in consolidation and certain reclassifications are made when necessary in order to conform the previous years’ financial statements to the current year’s presentation. In preparing the consolidated financial statements, Management is required to make estimates and assumptions that affect the reported amount of assets and

2

liabilities as of the dates of the balance sheets and revenues and expenditures for the periods presented. Therefore, actual results could differ from these estimates.

The allowance for loan and lease losses (the “Allowance”) involves a higher degree of judgment and complexity than other significant accounting policies. The allowance for loan and lease losses is calculated with the objective of maintaining a reserve level believed by the Corporation to be sufficient to absorb estimated probable credit losses. The Corporation’s determination of the adequacy of the allowance is based on periodic evaluations of the loan and lease portfolio and other relevant factors. However, this evaluation is inherently subjective as it requires material estimates, including, among others, expected default probabilities, expected loan commitment usage, the amounts and timing of expected future cash flows on impaired loans and leases, value of collateral, estimated losses on consumer loans and residential mortgages and general amounts for historical loss experience. The process also considers economic conditions and inherent risks in the loan and lease portfolio. All of these factors may be susceptible to significant change. To the extent actual outcomes differ from the Corporation’s estimates, additional provisions for loan and lease losses may be required that would adversely impact earnings in future periods. See the section of this document titled Asset Quality and Analysis of Credit Risk for additional information.

Other significant accounting policies are presented in Note 1 in the accompanying financial statements. The Corporation’s Summary of Significant Accounting Policies has not substantively changed any aspect of its overall approach in the application of the foregoing policies.

OVERVIEW OF GENERAL ECONOMIC, REGULATORY AND GOVERNMENTAL ENVIRONMENT

During 2010, the global and U.S. economies began to stabilize from the severe recessionary environment of 2008 and 2009. According to the National Bureau of Economic Research, a private, non-profit research group, the recession began in December 2007 and ended in June 2009. The decline in the housing market during the past year began to slow and the unemployment rate retreated from a high of 10% during the first part of 2010.

The drop in real estate values negatively impacted residential home builder and development business nationwide. In addition, investment securities backed by residential and commercial real estate reflected substantial unrealized losses due to a lack of liquidity in the financial markets and anticipated credit losses. Some financial institutions were forced into liquidation or were merged with stronger institutions as losses increased and the amounts of available funding and capital levels decreased. As of December 31, 2010, the Corporation and the Bank are “well capitalized” by regulatory standards and are in a position to acquire new customers from weaker financial institutions.

As the economic recovery was not as robust as the Federal Reserve anticipated, a second round of quantitative easing, known as “QE2,” was announced in November 2010. To further stimulate the economy, the Federal Reserve announced it would purchase $600 billion of Treasury securities by the end of the second quarter of 2011. There has been much debate as to whether QE2 was needed, the inflationary impact it may ultimately have and whether the program should be stopped early.

In July 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), a sweeping overhaul to financial regulation within the U.S. was signed into law. The main goals of the Dodd-Frank Act were to promote financial stability within the U.S. by improving accountability and transparency in the financial system, to end the “too big to fail” theory pertaining to financial institutions, to protect consumers from abusive financial service practices and to protect American taxpayers by ending bailouts of institutions. Implementation of the various provisions of the Dodd-Frank Act represents a significant change in the U.S. financial regulatory environment and will impact the entire financial services industry, including the Corporation.

In November 2010, the Federal Deposit Insurance Corporation, (“FDIC”) approved Section 343 of the Dodd-Frank Act providing temporary unlimited coverage for non-interest-bearing transaction accounts. This coverage became effective December 31, 2010 and will end on December 31, 2012. Excluded from this coverage are negotiable orders of withdrawal (“NOW”) accounts and interest on lawyer trust accounts (“IOLTA”).

In addition, on November 9, 2010, the FDIC approved proposed rules related to the calculation of the deposit insurance assessment. The proposal would shift the basis for the assessment away from an institution’s total domestic deposits, to its average total assets less tangible equity. The FDIC is also proposing that the new assessment method be implemented, effective April 1, 2011. This shift in assessment basis would benefit community banks by placing more of the burden on the large, multi-national banks, which, until now, were only assessed on their domestic deposit base.

The Federal Home Loan Bank of Pittsburgh (“FHLB”) has continued its voluntary suspension of dividend payments and the repurchase of excess capital stock originally announced on December 23, 2008. The FHLB expects that its ability to pay dividends and add to retained earnings will be significantly curtailed due to low short-term interest rates, an increased cost of maintaining liquidity and constrained access to debt markets at attractive rates. Capital stock repurchases from member banks will be reviewed on a quarterly basis, and only limited repurchases have taken place during the current fiscal year. As

3

of December 31, 2010, the Corporation held $14.2 million of FHLB capital stock. The FHLB is the primary source of liquidity for the Corporation, but alternatives are also available, including the Federal Reserve and wholesale certificates of deposit.

Since the financial crisis began in late 2008, there has been much debate on the future of two government sponsored enterprises: Fannie Mae and Freddie Mac. For decades, borrowers, lenders and investors benefited from the liquid markets these institutions helped establish. However, financial decisions were based on the faulty assumptions that housing prices could only rise. As credit and home demand catapulted to unseen levels, various financial instruments were created to shift risk away from the originators and mortgages became a tool for speculation. As the housing market collapsed, Fannie Mae and Freddie Mac did not have enough capital to support their investments and absorb losses. In September 2008, these two institutions were placed into conservatorship where they remain today. In February 2011, a report was issued by the Department of the Treasury and the U.S. Department of Housing entitled “Reforming America’s Housing Finance Market – A Report to Congress.” Though the report does not focus on one solution for Fannie Mae and Freddie Mac, it is clear that both organizations going forward will reduce their footprint in the housing market. It is unclear as of this writing how this will affect the Corporation, going forward.

Throughout 2010 the economy remained weak, but stabilized and there is reserved optimism for 2011. A continued anemic economic recovery could have an adverse effect on the Corporation’s revenues, capital, liquidity and profitability. However, the Corporation is confident that its disciplined strategies to maintain a strong financial position and build the brand name should put it in a good position to weather the financial downturn and take advantage of opportunities as they arise.

EXECUTIVE OVERVIEW

2010 Compared to 2009

As a result of the acquisition by merger of FKF on July 1, 2010, the primary cause of the changes in both the Corporation’s balance sheet and results of operations for the twelve months ended December 31, 2010, as compared to the same period in 2009 can be attributed to the Merger.

The Corporation reported net income of $9.2 million or $0.85 diluted earnings per share for the twelve months ended December 31, 2010, as compared to $10.3 million, or $1.18 diluted earnings per share, for the same period in 2009. Return on average equity (“ROE”) and return on average assets (“ROA”) for the twelve months ended December 31, 2010, were 6.76% and 0.61%, respectively, as compared to 10.55% and 0.88%, respectively, for the same period in 2009. Net income, ROE and ROA for the twelve months ended December 31, 2010, as compared to the same period in 2009, were reduced, primarily by the due diligence and merger-related expenses of $5.7 million associated with the Merger and $3.0 million increase in the provision for loan and lease losses (the “Provision”) for the twelve months ended December 31, 2010, as compared to the same period in 2009. ROE was also affected by the registered direct stock offering, completed in May 2010, which increased capital by $24.6 million.

The $11.6 million, or 28.1% increase in the Corporation’s tax-equivalent net interest income for the twelve months ended December 31, 2010, as compared to the same period in 2009, was attributed to a $3.5 million, or 21.4%, decrease in interest expense for the twelve months ended December 31, 2010, as compared to the same period in 2009. This decrease was primarily the result of a 71 basis point decrease in the rate paid on deposits between the periods. The decrease was partially offset by a 44 basis point decline in interest-earning asset yield for the twelve months ended December 31, 2010, as compared to the same period in 2009. The Corporation’s tax-equivalent net interest margin increased from 3.70% for the twelve months ended December 31, 2009 to 3.79% for the same period in 2010.

Asset quality remained stable as of December 31, 2010. The allowance for loan and lease losses of $10.3 million was 0.86% of portfolio loans and leases, as of December 31, 2010, as compared to $10.3 million, or 1.18%, of portfolio loans and leases, at December 31, 2009. The calculation of the Allowance, as a percentage of loans and leases in 2010, includes the acquired FKF loan portfolio which, in accordance with GAAP, was recorded at its fair value without its previously recorded Allowance.

Total portfolio loans and leases of $1.20 billion at December 31, 2010 increased $311.0 million, or 35.1%, as compared to $885.7 million at December 31, 2009. The growth was primarily attributable to the Merger and new business development efforts. Partially offsetting this increase was a decrease in the Bank’s lease portfolio of $12.3 million from $47.7 million as of December 31, 2009 to $35.4 million as of December 31, 2010, as repayments and charge-offs exceeded new production.

The Corporation’s investment portfolio at December 31, 2010 had a fair market value of $317.1 million, as compared to $208.2 million at December 31, 2009. This increase of $108.8 million, or 52.3%, was primarily the result of the Merger and the purchase of short-term securities, to utilize excess cash balances.

Deposits of $1.34 billion at December 31, 2010, increased $403.5 million, or 43.0%, from $937.9 million at December 31, 2009. This growth was largely due to the deposits acquired in the Merger, in addition to continued

4

strong branch activity, and the increase in balances of new accounts opened in previous quarters.

For the twelve months ended December 31, 2010, the Provision increased to $9.9 million, an increase of $3.0 million, or 43.1%, from the $6.9 million for the same period in 2009. This increase is related to $7.7 million in write-downs during the twelve months ended December 31, 2010, of two commercial loan relationships to their expected net realizable values based on updated analyses of the collateral supporting the loans and certain new valuation information. Partially offsetting this increase was a $2.7 million decrease in net charge-offs in the lease portfolio, for the twelve months ended December 31, 2010, as compared to the same period in 2009.

Non-interest income for the twelve months ended December 31, 2010 was $29.4 million, an increase of $905 thousand, or 3.2%, as compared to the same period in 2009. Contributing to the increase in non-interest income for the twelve months ended December 31, 2010, as compared to the same period in 2009, was a $239 thousand, or 17.2%, increase in loan servicing and late fees and a $356 thousand, or 18.2%, increase in service charges on deposits. These increases were largely attributable to the addition of the FKF branches during the third quarter of 2010. In addition to the effects of the Merger, fees for Wealth Management services increased $1.3 million, or 9.3%, from $14.2 million for the twelve months ended December 31, 2009 to $15.5 million, for the same period in 2010. Partially offsetting the increases in Wealth Management fees and other fee income was a $1.3 million decline in the gain on sale of mortgage loans for the twelve months ended December 31, 2010, as compared to the same period in 2009.

Non-interest expense for the twelve months ended December 31, 2010, was $58.0 million, an increase of $11.4 million, or 24.6%, as compared to the same period in 2009, partially due to the $5.7 million due diligence and merger-related expenses, as well as increased staffing and processing costs related to the addition of FKF’s eight full-service branch locations.

2009 Compared to 2008

The Corporation reported net income of $10.3 million or $1.18 diluted earnings per share for the twelve months ended December 31, 2009, as compared to $9.3 million, or $1.08 diluted earnings per share, for the same period in 2008. ROE and ROA for the twelve months ended December 31, 2009, were 10.22% and 0.87%, respectively, as compared to 10.01% and 0.89%, respectively, for the same period in 2008.

The Corporation’s portfolio of loans and leases as of December 31, 2009 of $885.7 million decreased $13.9 million, or 1.6%, from $899.6 million as of December 31, 2008. This decrease was primarily due to the $11.6 million, or 19.5% decline in the Bank’s lease portfolio to $47.8 million as of December 31, 2009, from the December 31, 2008 balance of $59.4 million. The decline in the loan portfolio, which related primarily to its construction segment, as well as the decline in the leasing portfolio, resulted from Management’s decision to limit exposure to these sections of the portfolio.

As of December 31, 2009 credit quality on the overall loan and lease portfolio remained stable as total non-performing loans and leases totaled $6.9 million or 0.78% of portfolio loans and leases as compared to non-performing loans and leases of $5.8 million, or 0.65% of portfolio loans and leases as of December 31, 2008.

The Provision for the years ended December 31, 2009 and 2008 was $6.9 million and $5.6 million, respectively. At December 31, 2009, the Allowance of $10.4 million represented 1.18% of portfolio loans and leases, as compared $10.3 million as of December 31, 2008, which was 1.15% of portfolio loans and leases, at December 31, 2008.

The increase in the Corporation’s tax-equivalent net interest income of $3.7 million, or 9.8%, for the year ended December 31, 2009, as compared to the same period in 2008 was attributed to a $4.7 million, or 22.6% decrease in interest expense for the twelve months ended December 31, 2009, as compared to the same period in 2008, primarily resulting from a 106 basis point decrease in the rate paid on deposits. The Corporation’s tax-equivalent net interest margin decreased from 3.84% for the twelve months ended December 31, 2008 to 3.70% for the same period in 2009.

For the twelve months ended December 31, 2009, non-interest income was $28.5 million, an increase of $7.0 million or 32.6% from $21.5 million for the same period in 2008. Contributing to this improvement was a $4.7 million increase in gain on sale of residential mortgage loans and a $1.9 million increase in gain on sale of available for sale and trading investment securities, for the twelve months ended December 31, 2009, as compared to the same period in 2008.

For the twelve months ended December 31, 2009, non-interest expense was $46.5 million, an increase of $7.9 million or 20.3% over the $38.7 million for the same period in 2008. Contributing to this increase was a $4.7 million increase in salary and benefits expense, which included commissions on mortgage originations associated with new business initiatives. In addition, FDIC insurance for the twelve months ended December 31, 2009 increased $1.3 million, to $1.8 million, which included a one-time special assessment of $540 thousand, as compared to the same period in 2008.

5

COMPONENTS OF NET INCOME

Net income is affected by five major elements: Net Interest Income, or the difference between interest income and loan fees earned on loans and investments and interest expense paid on deposits and borrowed funds; Provision For Loan and Lease Losses, or the amount added to the allowance for loan and lease losses to provide for estimated inherent losses on loans and leases; Non-Interest Income which is made up primarily of certain fees, wealth management revenue, residential mortgage activities and gains and losses from the sale of loans, securities and other assets; Non-Interest Expense, which consists primarily of salaries, employee benefits and other operating expenses; and Income Taxes. Each of these major elements will be reviewed in more detail in the following discussion.

NET INTEREST INCOME

Rate/Volume Analyses (Tax-equivalent Basis)(1)

The rate volume analysis in the table below analyzes dollar changes in the components of interest income and interest expense as they relate to the change in balances (volume) and the change in interest rates (rate) of tax-equivalent net interest income for the years 2010 as compared 2009 and 2009 as compared to 2008, allocated by rate and volume. The change in interest income / expense due to both volume and rate has been allocated to changes in volume.

| Year Ended December 31, | ||||||||||||||||||||||||||||

| (dollars in thousands) | 2010 Compared to 2009 | 2009 Compared to 2008 | ||||||||||||||||||||||||||

| increase/(decrease) | Volume | Rate | Total | Volume | Rate | Total | ||||||||||||||||||||||

| Interest Income: |

||||||||||||||||||||||||||||

| Interest-bearing deposits with banks |

$ | 82 | $ | 22 | $ | 104 | $ | 127 | $ | (198 | ) | $ | (71 | ) | ||||||||||||||

| Money market funds |

(195 | ) | (1 | ) | (196 | ) | (123 | ) | (12 | ) | (135 | ) | ||||||||||||||||

| Federal funds sold |

(1 | ) | — | (1 | ) | 193 | (15 | ) | 178 | |||||||||||||||||||

| Investment securities |

4,479 | (4,004 | ) | 475 | 2,531 | (1,848 | ) | 683 | ||||||||||||||||||||

| Loans and leases |

8,676 | (932 | ) | 7,744 | 2,546 | (4,121 | ) | (1,575 | ) | |||||||||||||||||||

| Total interest income |

13,041 | (4,915 | ) | 8,126 | 5,274 | (6,194 | ) | (920 | ) | |||||||||||||||||||

| Interest expense: |

||||||||||||||||||||||||||||

| Savings, NOW and market rate accounts |

1,413 | (1,550 | ) | (137 | ) | 1,084 | (1,632 | ) | (548 | ) | ||||||||||||||||||

| Other wholesale deposits |

128 | 25 | 153 | 27 | 10 | 37 | ||||||||||||||||||||||

| Wholesale time deposits |

(1,125 | ) | (308 | ) | (1,433 | ) | (2,076 | ) | (1,338 | ) | (3,414 | ) | ||||||||||||||||

| Time deposits |

288 | (2,740 | ) | (2,452 | ) | (162 | ) | (1,985 | ) | (2,147 | ) | |||||||||||||||||

| Borrowed funds |

1,534 | (1,118 | ) | 416 | 1,221 | 154 | 1,375 | |||||||||||||||||||||

| Total interest expense |

2,238 | (5,691 | ) | (3,453 | ) | 94 | (4,791 | ) | (4,697 | ) | ||||||||||||||||||

| Interest differential |

$ | 10,803 | $ | 776 | $ | 11,579 | $ | 5,180 | $ | (1,403 | ) | $ | 3,777 | |||||||||||||||

| (1) | The tax rate used in the calculation of the tax-equivalent income is 35%. |

6

Analysis of Interest Rates and Interest Differential

The table below presents the major asset and liability categories on an average daily basis for the periods presented, along with tax-equivalent interest income and expense and key rates and yields:

| For the Year Ended December 31, | ||||||||||||||||||||||||||||||||||||||||||||

| 2010 | 2009 | 2008 | ||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | Average Balance |

Interest Income/ Expense |

Average Rates Earned/ Paid |

Average Balance |

Interest Income/ Expense |

Average Rates Earned/ Paid |

Average Balance |

Interest Income/ Expense |

Average Rates Earned/ Paid |

|||||||||||||||||||||||||||||||||||

| Assets: |

||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks |

$ | 73,046 | $ | 178 | 0.24 | % | $ | 34,946 | $ | 74 | 0.21 | % | $ | 18,678 | $ | 145 | 0.78 | % | ||||||||||||||||||||||||||

| Federal funds sold |

— | — | — | 548 | 1 | 0.18 | % | 5,616 | 136 | 2.42 | % | |||||||||||||||||||||||||||||||||

| Money market funds |

475 | 1 | 0.21 | % | 38,662 | 197 | 0.51 | % | 3,445 | 19 | 0.55 | % | ||||||||||||||||||||||||||||||||

| Investment securities: |

||||||||||||||||||||||||||||||||||||||||||||

| Taxable |

249,714 | 4,555 | 1.82 | % | 129,780 | 4,398 | 3.39 | % | 86,940 | 4,127 | 4.75 | % | ||||||||||||||||||||||||||||||||

| Tax - Exempt |

27,173 | 1,094 | 4.03 | % | 17,818 | 776 | 4.36 | % | 7,538 | 364 | 4.83 | % | ||||||||||||||||||||||||||||||||

| Total investment securities (3) |

276,887 | 5,649 | 2.04 | % | 147,598 | 5,174 | 3.51 | % | 94,478 | 4,491 | 4.75 | % | ||||||||||||||||||||||||||||||||

| Loans and leases(1)(2) |

1,041,109 | 59,579 | 5.72 | % | 892,518 | 51,835 | 5.81 | % | 851,752 | 53,410 | 6.27 | % | ||||||||||||||||||||||||||||||||

| Total interest-earning assets |

1,391,517 | 65,407 | 4.70 | % | 1,114,272 | 57,281 | 5.14 | % | 973,969 | 58,201 | 5.98 | % | ||||||||||||||||||||||||||||||||

| Cash and due from banks |

11,750 | 11,249 | 15,780 | |||||||||||||||||||||||||||||||||||||||||

| Allowance for loan and lease losses |

(10,248 | ) | (10,421 | ) | (8,613 | |||||||||||||||||||||||||||||||||||||||

| Other assets |

100,351 | 65,395 | 64,542 | |||||||||||||||||||||||||||||||||||||||||

| Total assets |

$ | 1,493,370 | $ | 1,180,495 | $ | 1,045,678 | ||||||||||||||||||||||||||||||||||||||

| Liabilities: |

||||||||||||||||||||||||||||||||||||||||||||

| Savings, NOW, and market rate accounts |

$ | 594,756 | 2,957 | 0.50 | % | $ | 408,523 | $ | 3,094 | 0.76 | % | $ | 325,291 | $ | 3,753 | 1.15 | % | |||||||||||||||||||||||||||

| Other wholesale deposits |

62,875 | 301 | 0.48 | % | 33,988 | 148 | 0.44 | % | 10,088 | 111 | 1.10 | % | ||||||||||||||||||||||||||||||||

| Wholesale time deposits |

38,379 | 651 | 1.70 | % | 83,277 | 2,084 | 2.50 | % | 123,794 | 5,498 | 4.11 | % | ||||||||||||||||||||||||||||||||

| Time deposits |

201,947 | 2,192 | 1.09 | % | 190,071 | 4,644 | 2.44 | % | 194,739 | 6,791 | 3.49 | % | ||||||||||||||||||||||||||||||||

| Total interest-bearing deposits |

897,957 | 6,101 | 0.68 | % | 715,859 | 9,970 | 1.39 | % | 653,912 | 16,042 | 2.45 | % | ||||||||||||||||||||||||||||||||

| Subordinated debentures |

22,500 | 1,129 | 5.02 | % | 20,260 | 1,108 | 5.47 | % | 5,934 | 408 | 6.88 | % | ||||||||||||||||||||||||||||||||

| Junior subordinated debentures |

6,076 | 494 | 8.13 | % | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Short-term borrowings |

5,838 | 16 | 0.28 | % | 159 | 1 | 0.61 | % | — | — | — | |||||||||||||||||||||||||||||||||

| FHLB advances and other borrowings |

177,882 | 4,906 | 2.76 | % | 151,228 | 5,020 | 3.32 | % | 130,490 | 4,346 | 3.33 | % | ||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities |

1,110,253 | 12,646 | 1.14 | % | 887,506 | 16,099 | 1.81 | % | 790,336 | 20,796 | 2.63 | % | ||||||||||||||||||||||||||||||||

| Non-interest-bearing deposits |

222,715 | 172,468 | 143,924 | |||||||||||||||||||||||||||||||||||||||||

| Other liabilities |

24,601 | 22,502 | 18,243 | |||||||||||||||||||||||||||||||||||||||||

| Total non-interest-bearing liabilities |

247,316 | 194,970 | 162,167 | |||||||||||||||||||||||||||||||||||||||||

| Total liabilities |

1,357,569 | 1,082,476 | 952,503 | |||||||||||||||||||||||||||||||||||||||||

| Shareholders’ equity |

135,801 | 98,019 | 93,175 | |||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity |

$ | 1,493,370 | $ | 1,180,495 | $ | 1,045,678 | ||||||||||||||||||||||||||||||||||||||

| Net interest spread |

3.56 | % | 3.33 | % | 3.35 | % | ||||||||||||||||||||||||||||||||||||||

| Effect of non-interest-bearing sources |

0.23 | % | 0.37 | % | 0.49 | % | ||||||||||||||||||||||||||||||||||||||

| Net interest income/margin on earning assets |

$ | 52,761 | 3.79 | % | $ | 41,182 | 3.70 | % | $ | 37,405 | 3.84 | % | ||||||||||||||||||||||||||||||||

| Tax-equivalent adjustment (tax rate 35%) |

$ | 611 | 0.04 | % | $ | 389 | 0.04 | % | $ | 267 | 0.03 | % | ||||||||||||||||||||||||||||||||

| (1) | Non-accrual loans have been included in average loan balances, but interest on non-accrual loans has not been included for purposes of determining interest income. |

| (2) | Includes portfolio loans and leases and loans held for sale. |

| (3) | Investment securities include trading and available for sale. |

7

Net Interest Income and Net Interest Margin 2010 Compared to 2009

The tax-equivalent net interest margin increased 9 basis points to 3.79% for the twelve months ended December 31, 2010, as compared to 3.70%, for the same period in 2009.

The tax-equivalent net interest income for the twelve months ended December 31, 2010, of $52.8 million, was $11.6 million, or 28.1%, higher than the tax-equivalent net interest income of $41.2 million for the same period in 2009. This increase was primarily driven by the effects of larger asset and liability balances resulting from the Merger as well as a 71 basis point decrease in weighted average rate paid on deposits from 1.39% for the twelve months ended December 31, 2009 to 0.68% for the same period in 2010.

The tax-equivalent net interest income increased as a result of the $148.6 million, or 16.6%, increase in average loans and leases for the twelve month period ended December 31, 2010, as compared to the same period in 2009, primarily due to loans acquired in the Merger as well as new business development initiatives. The yield on loans declined 9 basis points to 5.72% from 5.81% for the twelve months ended December 31, 2010, as compared to the same period in 2009. In addition, the average balance of investment securities grew by $129.3 million, or 87.6%, to $276.9 for the twelve months ended December 31, 2010 from the same period in 2009, primarily due to investments acquired in the Merger, and, to a lesser extent, the investment of cash resulting from strong deposit inflows as well as cash acquired in the Merger. The tax-equivalent yield on investment securities for the twelve months ended December 31, 2010 decreased 147 basis points to 2.04% from 3.51% for the same period in 2009, as more short-term liquid investments were purchased, replacing the higher-yielding investments that were called and the continued decline in interest rates.

Average interest-bearing liabilities increased $222.7 million, or 25.1%, to $1.1 billion during the twelve months ended December 31, 2010, as compared to $887.5 million for the same period in 2009. The rate paid on interest-bearing liabilities dropped 67 basis points to 1.14%, for the twelve months ended December 31, 2010 from 1.81%, for the same period in 2009. This was primarily due to the maturing of higher-rate wholesale deposits, the increase in lower-costing money market and savings account balances and reduced deposit rates.

Net Interest Income and Net Interest Margin 2009 Compared to 2008

Net interest income on a tax-equivalent basis for the year ended December 31, 2009 of $41.2 million was $3.8 million or 10.1% higher than the $37.4 million recorded for the twelve months ended December 31, 2008. This increase was primarily due to the $4.7 million, or 22.6% reduction in interest expense for the twelve months ended December 31, 2009, as compared to the same period in 2008. The average balance of interest-earning assets, for the twelve months ended December 31, 2009, increased $140.3 million, or 14.4%, to $1.11 billion, from $974.0 million for the same period in 2008. However, the tax-equivalent yield on interest-earning assets decreased by 84 basis points from 5.98% for the twelve months ended December 31, 2008 to 5.14% for the same period in 2009. This was the result of decreases in the tax-equivalent yields on investment securities and loans and leases of 124 basis points and 46 basis points, respectively, for the twelve months ended December 31, 2009, as compared to the same period in 2008. The yields on loans decreased largely due to the current rate environment and competitive pricing pressures, while the yield on investments decreased as more short-term liquid investments were purchased.

Average interest-bearing liabilities increased $97.2 million, or 12.3%, from $790.3 million for the twelve months ended December 31, 2008 to $887.5 million for the same period in 2009. This increase was mainly due to the increase in core deposits, as wholesale deposits that matured were not replaced. Additionally, the Corporation increased subordinated debt by $14.3 million during the twelve months ended December 31, 2009. The tax-equivalent rate on interest-bearing liabilities declined 82 basis points from 2.63% for the twelve months ended December 31, 2008 to 1.81% for the same period in 2009, primarily due to aggressive management of deposit pricing and the maturities of higher-rate wholesale deposits during 2009. Despite the increase in tax-equivalent net interest income, tax-equivalent net interest margin on interest-earning assets decreased 14 basis points to 3.70% for the twelve months ended December 31, 2009, from 3.84% for the same period in 2008.

Net Interest Margin

The interest-bearing liability cost decreased 41 basis points to 1.04% for the three months ended December 31, 2010, from 1.45% for the same period in 2009. This reduction was due primarily to aggressive management of deposit pricing and the maturity of higher-rate wholesale deposits during the fourth quarter of 2010. At the same time, the yield on interest-earning assets for the three months ended December 31, 2010 declined 43 basis points to 4.56% from 4.99% for the same period in 2009.

The interest-bearing liability cost for the twelve months ended December 31, 2010 decreased 67 basis points, to 1.14%, from 1.81% for the same period in 2009. This reduction was due primarily to the aggressive management of deposit pricing and the maturity of higher-rate wholesale deposits during 2010.

8

The tax-equivalent net interest margin and related components, for the past five quarters and the past three years are shown in the table below:

| Year | Earning Asset Yield |

Interest- Bearing Liability Cost |

Net Interest Spread |

Effect

of Non-Interest Bearing Sources |

Net Interest Margin |

|||||||||||||||||||

| Tax-equivalent Net Interest Margin Last Five Quarters |

|

|||||||||||||||||||||||

|

4th Quarter |

2010 | 4.56 | % | 1.04 | % | 3.52 | % | 0.21 | % | 3.73 | % | |||||||||||||

|

3rdQuarter |

2010 | 4.57 | % | 1.09 | % | 3.48 | % | 0.18 | % | 3.66 | % | |||||||||||||

|

2nd Quarter |

2010 | 4.74 | % | 1.22 | % | 3.52 | % | 0.32 | % | 3.84 | % | |||||||||||||

|

1st Quarter |

2010 | 5.06 | % | 1.28 | % | 3.78 | % | 0.28 | % | 4.06 | % | |||||||||||||

|

4th Quarter |

2009 | 4.99 | % | 1.45 | % | 3.54 | % | 0.31 | % | 3.85 | % | |||||||||||||

| Tax-equivalent Net Interest Margin Last Three Years |

|

|||||||||||||||||||||||

| 2010 | 4.70 | % | 1.14 | % | 3.56 | % | 0.23 | % | 3.79 | % | ||||||||||||||

| 2009 | 5.14 | % | 1.81 | % | 3.33 | % | 0.37 | % | 3.70 | % | ||||||||||||||

| 2008 | 5.98 | % | 2.63 | % | 3.35 | % | 0.49 | % | 3.84 | % | ||||||||||||||

Interest Rate Sensitivity

The Corporation actively manages its interest rate sensitivity position. The objectives of interest rate risk management are to control exposure of net interest income to risks associated with interest rate movements and to achieve sustainable growth in net interest income. The Corporation’s Asset Liability Committee (“ALCO”), using policies and procedures approved by the Corporation’s Board of Directors, is responsible for the management of the Corporation’s interest rate sensitivity position. The Corporation manages interest rate sensitivity by changing the mix, pricing and re-pricing characteristics of its assets and liabilities, through the management of its investment portfolio, its offerings of loan and selected deposit terms and through wholesale funding. Wholesale funding consists of multiple sources including borrowings from the FHLB, the Federal Reserve Bank of Philadelphia’s discount window, certificates of deposit from institutional brokers, Certificate of Deposit Account Registry Service (“CDARS”), Insured Network Deposit (“IND”) Program, Institutional Deposit Corporation (“IDC”) and Pennsylvania Local Government Investment Trust (“PLGIT”).

The Corporation uses several tools to manage its interest rate risk including interest rate sensitivity analysis, or Gap Analysis, market value of portfolio equity analysis, interest rate simulations under various rate scenarios and tax-equivalent net interest margin reports. The results of these reports are compared to limits established by the Corporation’s ALCO policies and appropriate adjustments are made if the results are outside the established limits.

The following table demonstrates the annualized result of an interest rate simulation and the estimated effect that a parallel interest rate shift, or “shock”, in the yield curve and subjective adjustments in deposit pricing, might have on the Corporation’s projected net interest income over the next 12 months.

This simulation assumes that there is no growth in interest-earning assets or interest-bearing liabilities over the next twelve months. The changes to net interest income shown below are in compliance with the Corporation’s policy guidelines.

Summary of Interest Rate Simulation

| December 31, 2010 | ||||||||

| (dollars in thousands) | Estimated Change In Net Interest Income Over Next 12 Months |

|||||||

| Change in Interest Rates |

||||||||

| +300 basis points |

$ | 1,326 | 2.09 | % | ||||

| +200 basis points |

$ | 936 | 1.47 | % | ||||

| +100 basis points |

$ | 66 | 0.10 | % | ||||

| -100 basis points |

$ | (1,952 | ) | (3.08 | )% | |||

The interest rate simulation above demonstrates that the Corporation’s balance sheet as of December 31, 2010 is asset sensitive, indicating that an increase in interest rates will have a positive impact on net interest income over the next 12 months while a decrease in interest rates will negatively impact net interest income. In the above simulation, net interest income will increase if rates increase 100-, 200- or 300 basis points. However, the 100-basis point increase scenario indicates a minimal increase in net interest income over the next twelve months as the Corporation has interest rate floors on many of its portfolio loans. In addition, the Corporation’s internal prime loan rate is set, as of December 31, 2010, at 3.99%, or 74 basis points above the Wall Street Journal Prime Rate of 3.25%. The 100 basis point decrease scenario shows a $1.95 million, or (3.08)%, decrease in net interest income over the next twelve months as many of the Corporation’s liabilities bear rates of interest below 1.00% and therefore would not be able to sustain the entire decrease. The four scenarios are directionally consistent with the December 31, 2009 simulation (with the exception of the 100 basis point increase), but reflect a lower interest income increase and percentage change in net interest income due to the current rate environment.

The interest rate simulation is an estimate based on assumptions, which are based on past behavior of customers, along with expectations of future behavior relative to interest rate changes. In today’s uncertain economic environment and the current extended period of very low interest rates, the reliability of the Corporation’s interest rate simulation model is more uncertain than in other periods. Actual customer behavior may be significantly different than expected behavior, which could cause an unexpected outcome and may result in lower net interest income.

9

Gap Report

The interest sensitivity, or Gap report, identifies interest rate risk by showing repricing gaps in the Corporation’s balance sheet. All assets and liabilities are reflected based on behavioral sensitivity, which is usually the earliest of either: repricing, maturity, contractual amortization, prepayments or likely call dates. Non-maturity deposits, such as NOW, savings and money market accounts are spread over various time periods based on the expected sensitivity of these rates considering liquidity and the investment preferences of the bank. Non-rate-sensitive assets and liabilities are spread over time periods to reflect the Corporation’s view of the maturity of these funds.

Non-maturity deposits (demand deposits in particular), are recognized by the Bank’s regulatory agencies to have different sensitivities to interest rate environments. Consequently, it is an accepted practice to spread non-maturity deposits over defined time periods in order to capture that sensitivity. Commercial demand deposits are often in the form of compensating balances, and fluctuate inversely to the level of interest rates; the maturity of these deposits is reported as having a shorter life than typical retail demand deposits. Additionally, the Bank’s regulatory agencies have suggested distribution limits for non-maturity deposits. However, the Corporation has taken a more conservative approach than these limits would suggest by forecasting these deposit types with a shorter maturity. The following table presents the Corporation’s GAP Analysis as of December 31, 2010:

| (dollars in millions) | 0 to 90 Days |

91 to

365 Days |

1 - 5 Years |

Over 5 Years |

Non-Rate Sensitive |

Total | ||||||||||||||||||

| Assets: |

||||||||||||||||||||||||

| Interest-bearing deposits with banks |

$ | 78.4 | $ | — | $ | — | $ | — | $ | — | $ | 78.4 | ||||||||||||

| Money market funds |

0.1 | — | — | — | — | 0.1 | ||||||||||||||||||

| Investment securities |

86.4 | 97.7 | 108.8 | 24.1 | — | 317.0 | ||||||||||||||||||

| Loans and leases(1) |

428.8 | 157.4 | 510.1 | 105.3 | — | 1,201.6 | ||||||||||||||||||

| Allowance |

— | — | — | — | (10.3 | ) | (10.3 | ) | ||||||||||||||||

| Cash and due from banks |

— | — | — | — | 11.0 | 11.0 | ||||||||||||||||||

| Other assets |

— | — | — | — | 134.0 | 134.0 | ||||||||||||||||||

| Total assets |

$ | 593.7 | $ | 255.1 | $ | 618.9 | $ | 129.4 | $ | 134.7 | $ | 1,731.8 | ||||||||||||

| Liabilities and shareholders’ equity: |

||||||||||||||||||||||||

| Demand, non-interest-bearing |

$ | 54.4 | $ | 36.0 | $ | 192.0 | $ | — | $ | — | $ | 282.4 | ||||||||||||

| Savings, NOW and market rate |

121.0 | 105.2 | 375.2 | 94.7 | — | 696.1 | ||||||||||||||||||

| Time deposits |

66.6 | 123.2 | 55.8 | 0.1 | — | 245.7 | ||||||||||||||||||

| Other wholesale deposits |

80.1 | — | — | — | — | 80.1 | ||||||||||||||||||

| Wholesale time deposits |

30.9 | 6.3 | — | — | — | 37.2 | ||||||||||||||||||

| Short-term borrowings |

10.1 | — | — | — | — | 10.1 | ||||||||||||||||||

| Other borrowings |

39.3 | 26.0 | 73.8 | 21.0 | — | 160.1 | ||||||||||||||||||

| Subordinated debentures |

22.5 | — | — | — | — | 22.5 | ||||||||||||||||||

| Junior Subordinated debentures |

— | — | — | 12.0 | — | 12.0 | ||||||||||||||||||

| Other liabilities |

— | — | — | — | 24.2 | 24.2 | ||||||||||||||||||

| Shareholders’ equity |

5.8 | 17.3 | 92.2 | 46.1 | — | 161.4 | ||||||||||||||||||

| Total liabilities and shareholders’ equity |

$ | 430.7 | $ | 314.0 | $ | 789.0 | $ | 173.9 | $ | 24.2 | $ | 1,731.8 | ||||||||||||

| Interest-earning assets |

$ | 593.7 | $ | 255.1 | $ | 618.9 | $ | 129.4 | $ | — | $ | 1,597.1 | ||||||||||||

| Interest-bearing liabilities |

370.5 | 260.7 | 504.8 | 127.8 | — | 1,263.8 | ||||||||||||||||||

| Difference between interest-earning assets and interest-bearing liabilities |

$ | 223.2 | $ | (5.6 | ) | $ | 114.1 | $ | 1.6 | $ | — | $ | 333.3 | |||||||||||

| Cumulative difference between interest earning assets and interest-bearing liabilities |

$ | 223.2 | $ | 217.6 | $ | 331.7 | $ | 333.3 | $ | — | $ | 333.3 | ||||||||||||

| Cumulative earning assets as a % of cumulative interest bearing liabilities |

160 | % | 134 | % | 129 | % | 126 | % | ||||||||||||||||

| (1) | Loans include portfolio loans and leases and loans held for sale. |

The table above indicates that the Corporation is asset sensitive in the immediate to 90 day time frame and should experience an increase in net interest income in the near term, if interest rates rise. Accordingly, if rates decline, net interest income should decline. Actual results may differ from expected results for many reasons including market reactions, competitor responses, customer behavior and/or regulatory actions.

10

The following table summarizes the maturities of certificates of deposit of $100,000 or greater at December 31, 2010:

| (dollars in thousands) | Non- Wholesale |

Wholesale | ||||||

| Three months or less |

$ | 38,602 | $ | 30,422 | ||||

| Three to six months |

9,536 | 647 | ||||||

| Six to twelve months |

35,463 | 5,484 | ||||||

| Greater than twelve months |

17,658 | — | ||||||

| Total |

$ | 101,259 | $ | 36,553 | ||||

Fair Value Adjustments Impacting the Statement of Income

The following table details the actual effect for the six months ended December 31, 2010, and the projected effect for each of the five years ending December 31, 2015, and thereafter, of the accretable and amortizable fair value adjustments attributable to the Merger, on net interest income and pretax income. The projected accretion and amortization is subject to change in future periods related to, among other things, changes in the Corporation’s estimates of loan cash flows, investment sales and calls, deposit maturities, loan prepayments, and prepayments of FHLB advances and junior subordinated debentures.

| Income Statement Effect |

Accretable /Amortizable Balance July 1, 2010 |

For

the Six Months Ended Dec 31, 2010 |

For the Twelve Months Ending | Thereafter | ||||||||||||||||||||||||||||||||

| Dec 31, 2011 |

Dec 31, 2012 |

Dec 31, 2013 |

Dec 31, 2014 |

Dec 31, 2015 |

||||||||||||||||||||||||||||||||

| Interest income/expense: |

||||||||||||||||||||||||||||||||||||

| Loans |