| |

SUMMARY | |

PRXEX | |

October 1, 2015 | |

T. Rowe Price New Income Fund—I Class | |

A bond fund seeking the highest level of income consistent with the preservation of capital over time by investing primarily in marketable debt securities. This class is generally available only to financial intermediaries and other institutional investors. | |

Before you invest, you

may want to review the fund’s prospectus, which contains more information about the fund and its

risks. You can find the fund’s prospectus and other information about the fund online at troweprice.com/prospectus. You can

also get this information at no cost by calling The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense. | |

| |

Summary | 1 |

Investment Objective

The fund seeks the highest level of income consistent with the preservation of capital over time by investing primarily in marketable debt securities.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund.

Fees and Expenses of the Fund’s I Class

Annual fund operating expenses | |

Management fees | 0.44% |

Distribution and service (12b-1) fees | 0.00% |

Other expenses | 0.01% |

Acquired fund fees and expenses | 0.01% |

Total annual fund operating expenses | 0.46% |

Fee waiver/expense reimbursement | (0.01)%a |

Total annual fund operating expenses after fee waiver/expense reimbursement | 0.45% |

a T. Rowe Price Associates, Inc. is required to permanently waive a portion of its management fee charged to the fund in an amount sufficient to fully offset any acquired fund fees and expenses related to investments in other T. Rowe Price mutual funds. The amount of the waiver will vary each fiscal year in proportion to the amount invested in other T. Rowe Price mutual funds. The T. Rowe Price funds would be required to seek regulatory approval in order to terminate this arrangement.

Example This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

1 year | 3 years | 5 years | 10 years |

$46 | $144 | $252 | $567 |

Portfolio Turnover The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s performance. During the most recent fiscal year, the fund’s portfolio turnover rate (for existing classes) was 144.7% of the average value of its portfolio.

T. Rowe Price | 2 |

Investments, Risks, and Performance

Principal Investment Strategies The fund will invest at least 80% of its total assets in income-producing securities, which may include, but are not limited to, U.S. government and agency obligations, mortgage- and asset-backed securities, corporate bonds, foreign bonds, commercial mortgage-backed securities, and Treasury inflation protected securities.

Active management of the portfolio can result in bonds being sold at gains or losses. However, over the long term, the fund seeks to achieve its objective by investing primarily in income-producing securities that possess what the fund believes are favorable total return (income plus increases in principal value) characteristics.

Eighty percent (80%) of the debt securities purchased by the fund will be rated investment grade (i.e., rated in one of the four highest rating categories) by each of the major credit rating agencies (Standard & Poor’s, Moody’s, and Fitch) that have assigned a rating to the security or, if unrated, deemed to be of investment-grade quality by T. Rowe Price. Up to 15% of the fund’s total assets may be invested in “split-rated securities,” which are securities that have been rated investment grade by at least one rating agency but below investment grade by another rating agency. The fund may invest up to 20% of its total assets in non-U.S. dollar-denominated foreign debt securities (including securities of issuers in emerging markets) and take currency positions to hedge this exposure as well as to capture appreciation from favorable currency changes. In addition, the fund may invest up to 5% of its total assets in securities that have received below investment-grade ratings from each of the rating agencies that have assigned ratings to the securities or, if unrated, deemed to be below investment-grade quality by T. Rowe Price (high yield or “junk” bonds).

The fund has considerable flexibility in seeking high income. There are no maturity restrictions, so the fund can purchase longer-term bonds, which tend to have higher yields than shorter-term bonds. In addition, when there is a large yield difference between the various quality levels, the fund may move down the credit scale and purchase lower-rated bonds with higher yields. When the difference is small or the outlook warrants, the fund may concentrate investments in higher-rated issues.

While most assets will typically be invested in bonds, the fund also uses interest rate futures and forward currency exchange contracts in keeping with the fund’s objectives. Interest rate futures would typically be used to manage the fund’s exposure to interest rate changes or to adjust portfolio duration. Forward currency exchange contracts would be used to gain exposure to certain currencies expected to increase or decrease in value relative to other currencies or to protect the fund’s foreign bond holdings from adverse currency movements relative to the U.S. dollar.

The fund may sell holdings for a variety of reasons, such as to adjust the portfolio’s average maturity, duration, or credit quality or to shift assets into and out of higher-yielding or lower-yielding securities or different sectors.

Summary | 3 |

Principal Risks As with any mutual fund, there is no guarantee that the fund will achieve its objective. The fund’s share price fluctuates, which means you could lose money by investing in the fund. The principal risks of investing in this fund are summarized as follows:

Active management risk The fund is subject to the risk that the investment adviser’s judgments about the attractiveness, value, or potential appreciation of the fund’s investments may prove to be incorrect. If the investments selected and strategies employed by the fund fail to produce the intended results, the fund could underperform other funds with similar objectives and investment strategies.

Fixed income markets risk Economic and other market developments can adversely affect fixed income securities markets. At times, participants in these markets may develop concerns about the ability of certain issuers of debt securities to make timely principal and interest payments, or they may develop concerns about the ability of financial institutions that make markets in certain debt securities to facilitate an orderly market. Those concerns could cause increased volatility and reduced liquidity in particular securities or in the overall fixed income markets and the related derivatives markets. A lack of liquidity or other adverse credit market conditions may hamper the fund’s ability to sell the debt securities in which it invests or to find and purchase suitable debt instruments.

Interest rate risk This is the risk that a rise in interest rates will cause the price of a fixed rate debt security to fall. Generally, securities with longer maturities or durations and funds with longer weighted average maturities or durations carry greater interest rate risk. The fund may be subject to a greater risk of rising interest rates due to the current period of historically low rates and the effect of potential government fiscal policy initiatives and resulting market reaction to those initiatives.

Credit risk This is the risk that an issuer of a debt security could suffer an adverse change in financial condition that results in a payment default, security downgrade, or inability to meet a financial obligation. Junk bonds carry a higher risk of default and should be considered speculative. The fund’s exposure to credit risk is increased to the extent it invests in securities that are rated noninvestment grade.

Prepayment risk and extension risk Prepayment risk is the risk that the principal on mortgage-backed securities, other asset-backed securities or any debt security with an embedded call option may be prepaid at any time, which could reduce the security’s yield and market value. The rate of prepayments tends to increase as interest rates fall, which could cause the average maturity of the portfolio to shorten. Extension risk may result from a rise in interest rates, which tends to make mortgage-backed securities, asset-backed securities, and other callable debt securities more volatile.

Liquidity risk This is the risk that the fund may not be able to sell a holding in a timely manner at a desired price. Reduced liquidity in the bond markets can result from a number of events, such as significant trading activity, reductions in bond inventory, and rapid or unexpected changes in interest rates. Less liquid markets

T. Rowe Price | 4 |

could lead to greater price volatility and limit the fund’s ability to sell a holding at a suitable price.

Foreign investing risk This is the risk that the fund’s investments in foreign securities may be adversely affected by local, political, social, and economic conditions overseas, greater volatility, reduced liquidity, or decreases in foreign currency values relative to the U.S. dollar. These risks are heightened for the fund’s investments in emerging markets.

Currency risk Because the fund may invest in securities issued in foreign currencies, the fund is subject to the risk that it could experience losses based solely on the weakness of foreign currencies versus the U.S. dollar and changes in the exchange rates between such currencies and the U.S. dollar. Any attempts at currency hedging may not be successful and could cause the fund to lose money.

Derivatives risk The fund uses interest rate futures and forward currency exchange contracts and is therefore exposed to additional volatility in comparison to investing directly in bonds and other debt securities. These instruments can be illiquid and difficult to value, may involve leverage so that small changes produce disproportionate losses for the fund and, if not traded on an exchange, are subject to the risk that a counterparty to the transaction will fail to meet its obligations under the derivatives contract. The fund’s principal use of derivatives involves the risk that anticipated interest rate movements and changes in currency values and currency exchange rates will not be accurately predicted, which could significantly harm the fund’s performance.

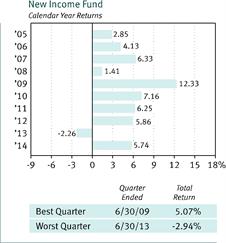

Performance The New Income Fund—I Class incepted on August 28, 2015, and does not have a full calendar year of performance history. Performance for the class will be presented after the class has been in operation for one full calendar year. As a point of comparison, however, the following bar chart and table show calendar year returns and average annual total returns for the existing Investor Class of the New Income Fund (“Investor Class”). Because the New Income Fund—I Class is expected to have lower expenses than the Investor Class, its performance, had it existed over the periods shown, would have been higher. The Investor Class and the New Income Fund—I Class share the same portfolio. The bar chart and table provide some indication of the risks of investing in the fund by showing changes in the performance from year to year and how the Investor Class’ average annual returns for certain periods compare with the returns of a relevant broad-based market index, as well as with the returns of other comparative indexes that have investment characteristics similar to those of the fund.

The fund can also experience short-term performance swings, as shown by the best and worst calendar quarter returns during the years depicted for the Investor Class.

Performance information represents only past performance (before and after taxes) and does not necessarily indicate future results.

Summary | 5 |

The fund’s return for the six months ended 6/30/15 was -0.08%.

In addition, the average annual total returns table shows hypothetical after-tax returns to demonstrate how taxes paid by a shareholder may influence returns. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as a 401(k) account or individual retirement account. In some cases, the figure shown for “returns after taxes on distributions and sale of fund shares” may be higher than the figure shown for “returns before taxes” because the calculations assume the investor received a tax deduction for any loss incurred on the sale of shares.

Average Annual Total Returns | ||||||||||||

|

|

| Periods ended |

| ||||||||

| December 31, 2014 |

| ||||||||||

| 1 Year | 5 Years | 10 Years |

| ||||||||

| New Income Fund |

| ||||||||||

| Returns before taxes | 5.74 | % | 4.49 | % | 4.92 | % |

| ||||

| Returns after taxes on distributions | 4.55 |

|

| 3.12 |

|

| 3.34 |

|

|

| |

| Returns after taxes on distributions |

|

|

|

|

|

|

|

|

|

| |

| and sale of fund shares | 3.24 |

|

| 2.98 |

|

| 3.40 |

|

|

| |

| Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | 5.97 |

|

| 4.45 |

|

| 4.71 |

|

|

| |

| Lipper Core Bond Funds Average | 5.33 |

|

| 4.68 |

|

| 4.24 |

|

|

| |

T. Rowe Price | 6 |

Current performance information may be obtained through troweprice.com or by calling 1-800-638-8790.

Management

Investment Adviser T. Rowe Price Associates, Inc. (T. Rowe Price)

Portfolio Manager | Title | Managed Fund Since | Joined Investment |

Daniel O. Shackelford | Chairman of Investment Advisory Committee | 2002 | 1999 |

Purchase and Sale of Fund Shares

The fund’s I Class generally requires a $1,000,000 minimum initial investment, although the minimum may be waived for certain accounts, such as retirement plans and financial intermediaries maintaining omnibus accounts. There is no minimum for subsequent purchases. If you hold shares through a retirement plan or financial intermediary, different investment minimums may apply to your account.

You may purchase, redeem, or exchange shares of the fund at any time by written request or by calling 1-800-638-8790 on any day the New York Stock Exchange is open for business. If you hold shares through a financial intermediary, you must purchase, redeem, and exchange shares through your intermediary.

Tax Information

The fund declares dividends daily and pays them on the first business day of each month. Any capital gains are declared and paid annually, usually in December. Redemptions or exchanges of fund shares and distributions by the fund, whether or not you reinvest these amounts in additional fund shares, may be taxed as ordinary income or capital gains unless you invest through a tax-deferred account (although you may be taxed upon withdrawal from such account).

Payments to Broker-Dealers and Other Financial Intermediaries

The fund and its investment adviser do not pay broker-dealers or other financial intermediaries for sales or related services of the fund’s I Class shares.

T. Rowe Price

Associates, Inc. | R533-045 10/1/15 |