UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

For the ended

OR

For the transition period from to

Commission File Number

(Exact Name of Registrant as Specified in its Charter)

| |

| |

| (State Other Jurisdiction of Incorporation or Organization) |

| (I.R.S. Employer Identification Number) |

(Address of principal executive offices) (Zip code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | |

|

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.01 Par Value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES NO ☐

Indicate by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large, accelerated filer,” “accelerated filer,” “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| | Smaller reporting company |

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. YES ☐ NO

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, was $

As of June 15, 2023, the registrant had outstanding

DOCUMENTS INCORPORATED BY REFERENCE: None

MITESCO, INC.

TABLE OF CONTENTS

|

|

|

|

|

|

|

PAGE |

|

PART I |

|

|

|

|

|

|

|

Item 1. |

8 | |

|

Item 1A. |

17 | |

|

Item 1B. |

33 | |

|

Item 2. |

33 | |

|

Item 3. |

34 | |

|

Item 4. |

35 | |

|

|

|

|

|

PART II |

|

|

|

|

|

|

|

Item 5. |

36 | |

|

Item 6. |

40 | |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

40 |

|

Item 7A. |

46 | |

|

Item 8. |

46 | |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

92 |

|

Item 9A. |

92 | |

|

Item 9B. |

93 | |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

93 |

|

PART III |

|

|

|

|

|

|

|

Item 10. |

94 | |

|

Item 11. |

100 | |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

102 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

104 |

|

Item 14. |

106 | |

|

|

|

|

|

PART IV |

|

|

|

|

|

|

|

Item 15. |

107 | |

|

Item 16. |

112 |

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

As used in this Annual Report on Form 10-K (this “Annual Report”), unless indicated or the context requires otherwise, the terms the “Company”, “Mitesco” or “MITI” refer to Mitesco, Inc.

In addition to historical information, this Annual Report contains forward looking statements. The forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in the sections entitled “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date hereof. We undertake no obligation to revise or release the results of any revision of these forward-looking statements. Readers should carefully review the risk factors described in this Annual Report and in other documents that we file from time to time with the Securities and Exchange Commission (the “SEC” or the “Commission”).

You can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “proposed,” “intended,” or “continue” or the negative of these terms or other comparable terminology. You should read statements that contain these words carefully, because they discuss our expectations about our future operating results or our future financial condition or state other “forward-looking” information. There may be events in the future that we are not able to accurately predict or control. You should be aware that the occurrence of any of the events described in these risk factors and elsewhere in this Annual Report could harm our business, results of operations and financial condition, and that upon the occurrence of any of these events, the trading price of our securities could decline. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, growth rates, levels of activity, performance, or achievements.

Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere in this Annual Report.

We cannot give any guarantee that these plans, intentions, or expectations will be achieved. All forward-looking statements involve risks and uncertainties, and actual results may differ materially from those discussed in the forward-looking statements as a result of various factors, including those factors described in the “Risk Factors” section of this Annual Report. Moreover, new risks emerge from time to time, and it is not possible for our management to predict all risks, nor can we assess the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking statements. All forward-looking statements included in this Annual Report are based on information available to us on the date of this Annual Report. Except to the extent required by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this Annual Report.

Special Notice Regarding the Worldwide Covid-19 Crisis

During the fiscal year ended December 31, 2022, there were many uncertainties regarding the current Novel Coronavirus (“COVID-19”) pandemic, including the scope of scientific and health issues, the anticipated duration of the pandemic, and the extent of local and worldwide social, political, and economic disruption. The COVID-19 pandemic has had far-reaching impacts on many aspects of the operations of the Company, directly and indirectly, including on consumer behavior, customer store traffic, our people, and the market generally. During the year ended December 31, 2022, we made the determination that COVID-19 possessed no continued serious risk to our employees and our business, and we returned to operating under pre-COVID-19 protocols.

Summary Risk Factors

Our business and our ability to execute our business strategy are subject to a number of risks of which you should be aware of before you decide to invest in our Company. The following is a summary of our key risks. A more detailed description of each of the risks can be found below in Item 1A. Risk Factors.

Risks Related to our Financial Condition

|

|

● |

Effective December 8, 2022, we closed all of our clinic locations due to a lack of funding. Subsequent to that date we have entered into negotiations to terminate our obligations for all except one clinic location. Due to difficulty in securing financing, we are uncertain of when or even if we will be able to resume operations at any clinic location. |

|

|

● |

We are in the initial stages of our business plan and have limited or no historical performance on which to base an investment decision and may never become profitable. |

|

|

|

|

|

|

● |

There is substantial doubt about our ability to continue as a going concern. |

|

|

|

|

|

|

● |

If we are unable to generate significant revenue, we may need to raise additional capital which may not be available to us on acceptable terms or at all. |

|

|

|

|

|

|

● |

We may incur additional debt in the future which may contain restrictive covenants. |

|

|

|

|

|

|

● |

We have identified weaknesses in our internal controls, and we cannot provide assurances that these weaknesses will be effectively remediated or that additional material weaknesses will not occur in the future. |

|

|

|

|

|

|

● |

The issuance of additional shares of our Common Stock, or securities convertible into shares of our Common Stock, may dilute the percentage ownership of our existing stockholders and may make it more difficult to raise additional capital. |

|

|

|

|

|

|

● |

Our operating results and liquidity needs could be negatively affected by market fluctuations and economic downturns |

Risks Related to our Business

|

|

● |

We are currently focused on a new business model and have extremely limited operating history and limited information and therefore our business may be difficult to evaluate. |

|

|

|

|

|

|

● |

Our business expansion is dependent upon us finding suitable locations for additional clients. |

|

|

|

|

|

|

● |

We may be unable to attract and retain sufficient numbers of qualified personnel. |

|

|

|

|

|

|

● |

We may become involved in legal proceedings. |

|

|

|

|

|

|

● |

Our business is also dependent upon the various insurance companies agreeing to reimburse patients for our services. |

|

|

|

|

|

|

● |

Our industry is highly competitive and there is no assurance we will successfully compete with our competitors who may have greater resources and experience than us. |

|

|

|

|

|

|

● |

We do not have any registered trademarks or trade names. |

|

|

|

|

|

|

● |

We are dependent on the successful development, marketing and advertising efforts of our clinics and telehealth services. |

|

|

|

|

|

|

● |

The telehealth market is immature and volatile and may never develop, or may develop more slowly than we expect, may encounter negative publicity or we may be unable to compete effectively. |

|

|

|

|

|

|

● |

Rapid technological change in our industry present us with significant risks and challenges. |

|

|

|

|

|

|

● |

We may not manage our strategy effectively. |

|

|

|

|

|

|

● |

Any damage to our reputation may materially and adversely affect our business, financial condition, and results of operations. |

Risks Related to Government Regulation

|

|

● |

If the statutes and regulations in our industry change, we could be negatively impacted. |

|

|

|

|

|

|

● |

The impact on our planned operations by recent and future healthcare legislation and other changes in the healthcare industry and in healthcare spending is unpredictable and volatile. |

|

|

|

|

|

|

● |

We are subject to federal Anti-Kickback Statutes and Federal Stark Law. |

|

|

|

|

|

|

● |

We must comply with Health Information Privacy and Security Standards. |

|

|

|

|

|

|

● |

A breach in our cyber security could cause a violation of our obligations under HIPAA, a breach of customer and patient privacy or may have other negative consequences. |

|

|

|

|

|

|

● |

We are subject to Environmental and Occupational Safety and Health Administration Regulations and other federal and state healthcare laws. |

|

|

|

|

|

|

● |

Changes in healthcare laws could create an uncertain environment. |

|

|

|

|

|

|

● |

Our operations are subject to the nation’s healthcare laws, as amended, repealed, or replaced from time to time. |

|

|

|

|

|

|

● |

Our revenues may depend on our patients’ receipt of adequate reimbursement from private issuers and government sponsored healthcare programs. |

|

|

|

|

|

|

● |

Future regulatory programs remain uncertain. |

Risks Related to Acquisitions

|

|

● |

Acquisitions may subject us to liability with regard to the creditors, customers, and shareholders of the sellers. |

|

|

|

|

|

|

● |

We may be unable to implement our strategy of acquiring companies. |

|

|

|

|

|

|

● |

Future acquisitions may result in potentially dilutive issuances of equity securities, incurrence of additional indebtedness and increased amortization expenses. |

|

|

|

|

|

|

● |

We face risks arising from acquisitions that we may pursue in the future. |

Risks Related to our Management

|

|

● |

Our success is dependent, in part, on the performance and continued service of certain of our officers and directors. |

|

|

|

|

|

|

● |

A sizable portion of our voting securities is owned and controlled by our executive officer and certain key stockholders, and they therefore maintain significant control over the company and the outcome of matters put to a stockholder vote. |

Risks Related to Ownership of our Common Stock

|

|

● |

Shares eligible for future sale may have adverse effects on our share price. |

|

|

|

|

|

|

● |

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline. |

|

|

|

|

|

|

● |

Our stock price has fluctuated in the past, has recently been volatile and may be volatile in the future, and as a result, investors in our Common Stock could incur substantial losses. |

|

|

|

|

|

|

● |

There can be no assurances that our Common Stock once listed on the Nasdaq will not be subject to potential delisting if we do not continue to maintain the listing requirements of the Nasdaq Capital Market. |

|

|

|

|

|

|

● |

Our reverse stock split may not result in a proportional increase in the per share price of our Common Stock. |

|

|

|

|

|

|

● |

Because we may issue preferred stock without the approval of our shareholders and have other anti-takeover defenses, it may be more difficult for a third party to acquire us and could depress our stock price. |

|

|

|

|

|

|

● |

Offers or availability for sale of a substantial number of shares of our Common Stock may cause the price of our Common Stock to decline. |

|

|

|

|

|

|

● |

We do not intend to pay any cash dividends on our Common Stock in the near future therefore investors will not be able to receive a return on their shares unless they sell the shares at a higher price than their purchase price. |

|

|

|

|

|

|

● |

Until recently, our Common Stock was thinly traded and may prevent you from selling at or near asking prices, if at all. |

PART I

ITEM 1. BUSINESS

Company Overview

The following discussion and analysis should be read in conjunction with the financial statements and notes thereto appearing elsewhere herein.

Mitesco, Inc. (the “Company,” “we,” “us,” or “our”), previously known as True Nature Holding, Inc., which was previously known as Trunity Holdings, Inc., a Delaware corporation, incorporated on January 18, 2012. Effective April 22, 2020, we changed our name to Mitesco, Inc.

We are a holding company with current operating plans to participate in the healthcare industry through the development of healthcare services, and with a view toward additional services and technology that may find a ready market in the healthcare industry. During early 2022 we continued on our plan to open primary care clinics around the United States in select markets, utilizing the experience, expertise, and training of licensed, advanced degreed nurse practitioners (“Nurse Practitioners”). During 2022 our clinics provided complete primary care, as well as a limited set of offerings addressing more specific needs for the general public. The medical practice focuses on whole person health and prevention. During late 2022 we decided to close our clinics due to a lack of funding for their operations and growth plans.

We have always had a view toward additional healthcare technology and services offerings and are committing more time to that effort going forward. We have a number of near-term opportunities that we hope to pursue, assuming the capital markets make sufficient funding available at reasonable rates.

Our operations are subject to comprehensive federal, state, and local laws and regulations in the jurisdictions in which it does business. There also continues to be a heightened level of review and/or audit by federal and state regulators of the health and related benefits industry’s business and reporting practices. As of the date of this filing, we are not subject any actual or anticipated regulatory reviews or audits relating to our operations.

The laws and rules governing our businesses and interpretations of those laws and rules continue to evolve each year and are subject to frequent change. The application of these complex legal and regulatory requirements to the detailed operation of our businesses creates areas of uncertainty. Further, there are numerous proposed health care, financial services and other laws and regulations at the federal and state level some of which could adversely affect our businesses if they are enacted. We cannot predict whether pending or future federal or state legislation will have an adverse effect on our business.

We can give no assurance that its businesses, financial condition, operating results and/or cash flows will not be materially adversely affected, or that we will not be required to materially change its business practices, based on: (i) future enactment of new health care or other laws or regulations; (ii) the interpretation or application of existing laws or regulations, including the laws and regulations described in this Government Regulation section, as they may relate to one or more of our businesses, one or more of the industries in which we compete and/or the health care industry generally; (iii) our pending or future federal or state governmental investigations.

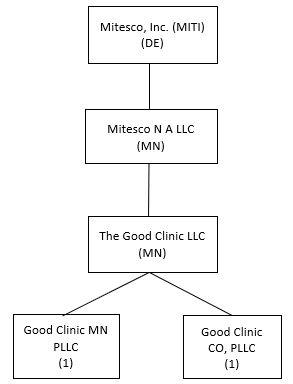

Corporate Organizational Chart

|

(1) |

Due to the prohibition of corporate medicine in Minnesota and Colorado, these entities are owned by licensed nurse practitioners and are managed and controlled under contract by The Good Clinic LLC using a variable interest entity structure. A prohibition on the corporate practice of medicine by statute, regulation, board of medicine or attorney general guidance, or case law, exists in certain of the U.S. states in which we operate. These laws generally prohibit the practice of medicine by lay persons or entities and are intended to prevent unlicensed persons or entities from interfering with or inappropriately influencing providers’ professional judgment. We do not own the Good Clinic MN PLLC or the Good Clinic CO PLLC (together, the “Good Clinic PLLCs”). The Good Clinic LLC manages all administrative services. All clinical decisions are the purview of the Good Clinic PLLCs. |

Competition

The market for healthcare solutions including walk in clinics and telehealth services is competitive. We compete in a fragmented primary care market with direct and indirect competitors that offer varying levels of impact to our stakeholders such as insurance companies, patients, and employers. Our competitive success is contingent on our ability to simultaneously address the needs of key stakeholders efficiently and with superior outcomes at scale compared with competitors. We expect to compete with walk-in clinics, traditional healthcare providers, and primary care medical practices, care management and coordination, digital health, and telehealth companies. Competition in our market involves rapidly changing technologies, evolving regulatory requirements and industry expectations, frequent new product and service introductions and changes in customer and patient requirements. If we are unable to keep pace with the evolving needs of our clients, members and partners and continue to develop and introduce new applications and services in a timely and efficient manner, demand for our solutions and services may be reduced and our business and results of operations would be harmed.

Our business is dependent on completing our clinics and gaining patients and customers in our target markets. However, the healthcare market is competitive, which could make it difficult for us to succeed. We face competition in the healthcare industry for our solutions and services from a range of companies and providers, including traditional healthcare providers and medical practices that offer similar services. These competitors primarily include primary care providers who are employed by or affiliated with health networks. Our indirect competitors also include episodic consumer-driven point solutions such as telemedicine as well as urgent care providers. Generally, urgent care providers in the local communities will provide services similar to those we intend to offer, and our competitors (1) are more established than we are, (2) may offer a broader array of services or more desirable facilities to patients and providers than ours, and (3) may have larger or more specialized medical staffs to admit and refer patients, among other things. Our competition varies by state but generally includes local health systems, primary care physician offices and urgent care centers.

Our competitors may have greater name recognition, longer operating histories and significantly greater financial and other resources than we do. Further, our competitors may be acquired by third parties with greater available resources. As a result, our competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards, or patient requirements and may have the ability to initiate or withstand substantial price competition. In addition, our competitors have established, and may in the future establish, cooperative relationships with vendors of complementary technologies or services to increase the availability of their solutions in the marketplace. Accordingly, new competitors or alliances may emerge that have greater market share, a larger member or patient base, more widely adopted proprietary technologies, greater marketing expertise, greater financial resources, and larger sales forces than we have, which could put us at a competitive disadvantage. Our competitors could also be better positioned to serve certain segments of the healthcare market, which would limit our member and patient growth. In light of these factors, even if our solution is more effective than those of our competitors, current members, health network partners and enterprise clients may accept alternative competitive solutions in lieu of purchasing our solution. If we are unable to compete in the healthcare market, our business would be harmed.

We may encounter increased competition from system-affiliated hospitals and healthcare companies, health insurers and private equity companies seeking to acquire providers in specific geographic markets. We also may face competition from primary care providers, and outpatient centers for market share and for providers and personnel. Furthermore, some of the clinics and medical offices that compete with us may be government agencies or not-for-profit organizations supported by endowments and charitable contributions and can finance capital expenditures and operations on a tax-exempt basis. Competitors may also be better positioned to contract with leading health network partners in our target markets. If our competitors are better able to attract patients, contract with health network partners, recruit providers, expand services or obtain favorable managed care contracts at their facilities than we are, we may experience an overall decline in member volumes and net revenue. We cannot assure we will be able to compete in the markets in which we operate which could cause you to lose your investment.

Our Competitive Strengths

We believe the following strengths and market dynamics provide us a competitive advantage. As additional capital is available to the Company, we will pursue the acquisition of existing healthcare services and technology business, and we may consider opening new clinics using our revised and less capital-intensive approach going forward:

|

|

● |

Experienced management team - with a proven track record of growing healthcare services companies. |

|

|

● |

Experienced Board of Directors - that have been recruited for their specific expertise in business strategy, operations, healthcare, business development, accounting, public company management, information systems and technology, investment banking, merger & acquisitions, regulatory affairs, state, federal, and international law, political process lobbying, |

|

|

● |

Cost Advantage - Based on Bureau of Labor Statistics for Physician providers, the 2022 median annual pay for a Nurse Practitioner (NP) was $121,610 compared to the median annual pay for Family Medicine Physicians was $225,190. CMS established NP reimbursement at 85% of physician reimbursement for the same medical, surgical, and diagnostic procedure or service. Based on these considerations we believe we will have approximately a forty percent (40%) labor cost advantage over the traditional primary care service provider by employing Nurse Practitioners as the primary healthcare professional as compared to a traditional physician-employed care models. |

|

|

● |

Diversified product line including |

|

|

o |

Insurance paid (Commercial, Medicare and Medicaid) and cash paid primary care and behavioral services |

|

|

o |

Urgent care |

|

|

o |

Preventative care |

|

|

o |

Wellness care |

|

|

o |

Nutrition coaching |

|

|

o |

Population health services management |

|

|

o |

Telehealth care |

|

|

o |

Department of Transportation annual exams and First Responder Exams |

|

|

o |

In-clinic product sales of books, vitamins, supplements, and essential oils |

|

|

● |

Large healthcare market opportunity |

|

|

o |

U.S.’s total spending on healthcare equaled 19.7% of GDP at about $4.1 Trillion in 2020 according to the Centers for Medicare & Medicaid Services. Assuming that consumers want to lower their health care costs, we believe we can provide lower health care costs to consumers by utilizing primary care and Nurse Practitioners versus specialists. |

|

|

o |

Grandview Research values the US primary care market at $260.1 billion in 2021 and expects it to expand at a compound rate (CAGR) of 3.2% from 2022 to 2030. The WHO calls primary health care “the most inclusive, equitable, cost-effective and efficient approach to enhance people’s physical and mental health, as well as their social well-being.” CMS in their Primary Care First Model brief notes, “Primary care is central to a high-functioning healthcare system and thus, there is an urgent need to preserve and strengthen primary care.” The Advisory Board noted in their February 24, 2022, daily briefing that “investors are also pouring billions into primary care companies, amounting to $16 billion in 2021 alone.” The Good Clinic locations provide net new primary care access for the US healthcare consumer. |

|

|

o |

U.S. skin care market is large and growing. According to an October 2021 report by Statista, the U.S. skin care market was estimated at $17.5 billion in 2020. |

|

|

o |

The North America dietary supplements market is estimated $48.4 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2022 to 2030 according to a report from Grand View Research. |

|

|

● |

Shortage of primary care providers – We believe there is a primary care physician shortage in America. The Association of American Medical Colleges in a June 21, 2021 report, states that there is a 17,800 to as much as 48,000 shortfall of primary care physicians by 2034. The Good Clinic is just one of a few organizations providing net new capacity to serve the people impacted by the shortage. |

Operational Overview

During the year ended December 31, 2022, we have focused on establishing medical clinics utilizing nurse practitioners and telemedicine technology under “The Good Clinic” name. Our strategy is to utilize a mix of nurse practitioners and telemedicine technology in clinics to improve patient experiences and outcomes and reduce healthcare costs as compared to other available treatment options. As previously noted, we made a strategic decision to reduce our capital needs by closing our clinic operations in the fourth quarter of 2022, and releasing a significant portion of our staff. As we redevelop our new strategy for lower cost operations, we expect to focus on acquisition of existing healthcare technology and services businesses.

Serving the Market

We believe there is a looming shortage of primary care providers in the United States. Approximately 27 States in the U.S. allow Nurse Practitioners to operate as fully independent primary care providers. Another 13 allow Nurse Practitioners broad autonomy in providing primary care services. By using Nurse Practitioners, we plan to focus on direct patient care, patient education and helping people to manage their health more effectively. The Good Clinics are designed to improve access to basic affordable primary care and empower Nurse Practitioners to function as healthcare providers. According to an American Association of Colleges of Nursing report from April 2022, there are more than 355,000 Nurse practitioners practicing in the US making the necessary expertise readily available. This is a significant increase from the approximately 91,000 practicing in 2010. According to the Bureau of Labor Statistics 2021 data, Nurse Practitioners median annual pay was 48% less than their physician counterparts.

Like any consumer-focused business, locating a clinic is one-part art and one-part science. We evaluate concentration of primary care practices within the zip code and examine average wait-times for appointments and ensure the local markets are already using Nurse Practitioners as primary care providers. We focus on convenience that includes locations near residential centers, adequate parking, good retail visibility in higher traffic areas and the presence of other retail businesses close by.

Billing and Payment

The Good Clinics bills health insurance companies for allowed medical services and accepts payment in cash or credit cards for client selected and non-covered services. We will also explore partnering with local small to mid-size businesses of all types to provide near-site employer clinics for wellness exams, chronic disease management, department of transportation exams, physicals, virus testing, occupational health services and other healthcare related services traditionally offered by primary care providers.

Marketing

We plan to generate business for The Good Clinics through a combination of partnerships with residential developers and local marketing and advertising, direct sales of occupational medical services to companies (flu shots, workers injury treatment services, drug testing, and health promotion programs), public relations efforts with local charities, city and county organizations, hospitals and medical providers, networking and promotional events and open houses. We have used internal marketing including brochures, posters, magazines, health promotion articles, and educational materials that point to our services. Upon having a new patient, we plan to initiate client follow-up and schedule return visits. To assure broad access of insured clients in the medical service area, we plan to participate in contracts with health insurance providers, and the Medicare program, making The Good Clinics services fully reimbursable for its clients.

The Good Clinic is about delivering a convenient individualized care experience built on education, expertise, and empathy. We are the patient’s partner in obtaining quality and affordable medical care. The Good Clinic supports patient care with both in-clinic and telehealth visits.

Healthcare Industry Insight

According to a recent report published by Centers for Medicare and Medicaid Services (“CMS”) which examined the market for 2020, health care expenditures continue to consume an increasing portion of most economies. In the U.S., health care spending increased 9.7 percent to $4.1 trillion in 2020, and now represents 19.7 percent of the U.S.’ Gross Domestic Product (“GDP”). An aging population and high levels of chronic conditions are contributing to expectations that health care expenditures will continue growing faster than the economy. The CMS estimates annual U.S. healthcare spending will grow at an average rate of 5.1 percent through 2030 and reach $6.8 trillion, or 19.6 percent of U.S. GDP, by 2030. We believe this trajectory is unsustainable and support the widespread call for investment in expanding access to primary care. Establishing a longitudinal primary care relationship has significant value to the individual and the overall healthcare system as detailed in an Eden Health May 2021 posting.

|

|

● |

Adults in the U.S. who have a primary care provider have 19% lower odds of premature death than those who only see specialists for their care. |

|

|

● |

Patients with a primary care provider save 33% on healthcare costs compared to those who only see specialists. |

|

|

● |

Access to primary care helps avoid unnecessary trips to the emergency room, where care can cost as much as 4x that of other outpatient care. |

|

|

● |

Catching and treating problems during regular check-ups is far less expensive than treating an advanced illness — in fact, if everyone saw a primary care provider first for their care, it would save the U.S. an estimated $67 billion every year. |

|

|

● |

Patients report a 10% increase in patient satisfaction with healthcare when they have a primary care provider. |

Management/Human Capital

We believe that the Company’s management team will remain relatively small in the near term and should consist of a team with experience in 1) public company accounting and finance, 2) software and systems, 3) brand marketing, and 4) public equities financing.

We also use the services of additional advisors and consultants on an as needed basis to perform outsourced tasks including accounting, SEC reporting, corporate finance and investor relations. As of December 31, 2022, none of our employees were represented by a union or covered by a collective bargaining agreement. We have not experienced any work stoppages and we consider our relationship with our employees to be good.

Intellectual Property

In August 2020, we applied for trademark protection of “The Good Clinic”, with the United States Patent & Trademark Office (USPTO). Our federal trademark registration for the mark THE GOOD CLINIC is on the Supplemental Register, not the Principal Register. The Supplemental Register does not confer the same rights and benefits as the Principal Register. After a period of five years of use, or sooner based upon our marketing resources and our use of the name, we intend to apply to have the name transferred to the Principle Register.

Government Regulation

The healthcare industry is a highly regulated industry by both federal and state governments. We are subject to other federal and state healthcare laws that could have a material adverse effect on our business, financial condition, or results of operations. We operate in a highly regulated and evolving environment with rigorous regulatory enforcement. Any legal or regulatory action could be time-consuming and costly. If we or the manufacturers or distributors that supply our products fail to comply with all applicable laws, standards, and regulations, action by regulatory agencies could result in significant restrictions. Any regulatory action could have a negative impact on us and materially affect our reputation, business, and operations. The U.S. healthcare industry has undergone significant changes designed to improve patient safety, improve clinical outcomes, and increase access to medical care. These changes include enactments and repeals of various healthcare related laws and regulation. Our operations and economic viability may be adversely affected by the changes in such regulations, including: (i) federal and state fraud and abuse laws; (ii) federal and state anti-kickback statutes; (iii) federal and state false claims laws; (iv) federal and state self-referral laws; (v) state restrictions on fee splitting; (vi) laws regarding the privacy and confidentiality of patient information; and (vii) other laws and government regulations.

If there are changes in laws, regulations, or administrative or judicial interpretations, we may have to change our future business practices, or our business practices could be challenged as unlawful, which could have a material adverse effect on our business, financial condition, and results of operations. See the description below for certain of the laws, regulations, or administrative or judicial interpretations that we are currently subject to and the “Risk Factors” section.

The Affordable Care Act

The Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act (the “Affordable Care Act” or the “ACA”) in 2010 made major changes in how healthcare is delivered and reimbursed and increased access to health insurance benefits to the uninsured and underinsured population of the United States.

Since its enactment, there have been judicial and Congressional challenges to certain aspects of the ACA as well as recent efforts by the current administration to repeal or replace certain aspects of the ACA. For example, the Tax Cuts and Jobs Act of 2017 was enacted, which includes a provision repealing, effective January 1, 2019, the tax-based shared responsibility payment imposed by the ACA on certain individuals who fail to maintain qualifying health coverage for all or part of a year that is commonly referred to as the “individual mandate.” Since the enactment of the Tax Cuts and Jobs Act of 2017, there have been additional amendments to certain provisions of the ACA, and we expect the current administration and Congress will likely continue to seek to modify all, or certain provisions of, the ACA. It is uncertain the extent to which any such changes may impact our business or financial condition. Congress may consider other legislation to repeal and replace elements of the ACA. In December 2019, a federal appeals court held that the individual mandate portion of the ACA was unconstitutional and left open the question whether the remaining provisions of the ACA would be valid without the individual mandate. We continue to evaluate the effect that the ACA and its possible modification or repeal and replacement has on our business. It is uncertain the extent to which any such changes may impact our business or financial condition.

Other legislative changes have been proposed and adopted since the ACA was enacted. These changes include aggregate reductions to Medicare payments to providers of up to 2% per fiscal year pursuant to the Budget Control Act of 2011 and subsequent laws, which began in 2013 and will remain in effect through 2029 unless additional Congressional action is taken. In January 2013, the American Taxpayer Relief Act of 2012 was signed into law, which, among other things, further reduced Medicare payments to several types of providers, including hospitals, imaging centers and cancer treatment centers, and increased the statute of limitations period for the government to recover overpayments to providers from three to five years. New laws may result in additional reductions in Medicare and other healthcare funding, which may materially adversely affect customer demand and affordability for our products and services and, accordingly, the results of our financial operations. Additional changes that may affect our business include the expansion of new programs such as Medicare payment for performance initiatives for physicians under the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) which first affected physician payment in 2019. At this time, it is unclear how the introduction of the Medicare quality payment program will impact overall physician reimbursement.

Such changes in the regulatory environment may also result in changes to our payor mix that may affect our operations and revenue. In addition, certain provisions of the ACA authorize voluntary demonstration projects, which include the development of bundling payments for acute, inpatient hospital services, physician services and post-acute services for episodes of hospital care. Further, the ACA may adversely affect payors by increasing medical costs generally, which could have an effect on the industry and potentially impact our business and revenue as payors seek to offset these increases by reducing costs in other areas. Certain of these provisions are still being implemented and the full impact of these changes on us cannot be determined at this time.

Uncertainty regarding future amendments to the ACA as well as new legislative proposals to reform healthcare and government insurance programs, along with the trend toward managed healthcare in the United States, could result in reduced demand and prices for our services. We expect that additional state and federal healthcare reform measures will be adopted in the future, any of which could limit the amounts that federal and state governments and other third-party payors will pay for healthcare products and services, which could adversely affect our business, financial condition, and results of operations.

Federal Anti-Kickback Statutes

The federal Anti-Kickback Statute is a provision of the Social Security Act of 1972 that prohibits as a felony offense the knowing and willful offer, payment, solicitation or receipt of any form of remuneration in return for, or to induce, (1) the referral of a patient for items or services for which payment may be made in whole or part under Medicare, Medicaid, or other federal healthcare programs, (2) the furnishing or arranging for the furnishing of items or services reimbursable under Medicare, Medicaid, or other federal healthcare programs or (3) the purchase, lease, or order or arranging or recommending the purchasing, leasing or ordering of any item or service reimbursable under Medicare, Medicaid or other federal healthcare programs. The Patient Protection and Affordable Care Act (“ACA”) amended section 1128B of the Social Security Act to make it clear that a person need not have actual knowledge of the statute, or specific intent to violate the statute, as a predicate for a violation. The OIG, which has the authority to impose administrative sanctions for violation of the statute, has adopted as its standard for review a judicial interpretation which concludes that the statute prohibits any arrangement where even one purpose of the remuneration is to induce or reward referrals. A violation of the Anti-Kickback Statute is a felony punishable by imprisonment, criminal fines of up to $25,000, civil fines of up to $50,000 per violation, and three times the amount of the unlawful remuneration. A violation also can result in exclusion from Medicare, Medicaid, or other federal healthcare programs. In addition, pursuant to the changes of the ACA, a claim that includes items or services resulting from a violation of the Anti-Kickback Statute is a false claim for purposes of the False Claims Act.

Federal Stark Law

The federal Stark Law, 42 U.S.C. 1395nn, also known as the physician self-referral law, generally prohibits a provider from referring Medicare and Medicaid patients to an entity (including hospitals) providing ‘‘designated health services,’’ if the physician or a member of the physician’s immediate family has a ‘‘financial relationship’’ with the entity, unless a specific exception applies. Designated health services include, among other services, inpatient hospital services, outpatient prescription drug services, clinical laboratory services, certain imaging services (e.g., MRI, CT, ultrasound), and other services that our affiliated physicians may order for their patients. The prohibition applies regardless of the reasons for the financial relationship and the referral; and therefore, unlike the federal Anti-Kickback Statute, intent to violate the law is not required. Like the Anti-Kickback Statute, the Stark Law contains statutory and regulatory exceptions intended to protect certain types of transactions and arrangements. Unlike safe harbors under the Anti-Kickback Statute with which compliance is voluntary, an arrangement must comply with every requirement of a Stark Law exception, or the arrangement is in violation of the Stark Law.

Because the Stark Law and implementing regulations continue to evolve and are detailed and complex, while we attempt to structure our relationships to meet an exception to the Stark Law, there can be no assurance that the arrangements entered into by us with affiliated physicians and facilities will be found to be in compliance with the Stark Law, as it ultimately may be implemented or interpreted. The penalties for violating the Stark Law can include the denial of payment for services ordered in violation of the statute, mandatory refunds of any sums paid for such services, and civil penalties of up to $15,000 for each violation, double damages, and possible exclusion from future participation in the governmental healthcare programs. A person who engages in a scheme to circumvent the Stark Law’s prohibitions may be fined up to $100,000 for each applicable arrangement or scheme.

Some states have enacted statutes and regulations against self-referral arrangements similar to the federal Stark Law, but which may be applicable to the referral of patients regardless of their payor source and which may apply to different types of services. These state laws may contain statutory and regulatory exceptions that are different from those of the federal law and that may vary from state to state. An adverse determination under these state laws and/or the federal Stark Law could subject us to different liabilities, including criminal penalties, civil monetary penalties, and exclusion from participation in Medicare, Medicaid, or other health care programs, any of which could have a material adverse effect on our business, financial condition, or results of operations.

Health Information Privacy and Security Standards

The Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), as amended, contain detailed requirements concerning the use and disclosure of individually identifiable patient health information (“PHI”) by various healthcare providers, such as medical groups. HIPAA covered entities must implement certain administrative, physical, and technical security standards to protect the integrity, confidentiality and availability of certain electronic health information received, maintained, or transmitted. HIPAA also implemented standard transaction code sets and standard identifiers that covered entities must use when submitting or receiving certain electronic healthcare transactions, including billing and claim collection activities. Violations of the HIPAA privacy and security rules may result in civil and criminal penalties, including a tiered system of civil money penalties that range from $100 to $50,000 per violation, with a cap of $1.5 million per year for identical violations. A HIPAA covered entity must also promptly notify affected individuals where a breach affects more than 500 individuals and report breaches affecting fewer than 500 individuals annually. State attorneys general may bring civil actions on behalf of state residents for violations of the HIPAA privacy and security rules, obtain damages on behalf of state residents, and enjoin further violations.

Many states also have laws that protect the privacy and security of confidential, personal information, which may be similar to or even more stringent than HIPAA. Some of these state laws may impose fines and penalties on violators and may afford private rights of action to individuals who believe their personal information has been misused. We expect increased federal and state privacy and security enforcement efforts.

Environmental and Occupational Safety and Health Administration Regulations

We are subject to federal, state, and local regulations governing the storage, use and disposal of waste materials and products. Although we believe that our safety procedures for storing, handling, and disposing of these materials and products comply with the standards prescribed by law and regulation, we cannot eliminate the risk of accidental contamination or injury from those hazardous materials. In the event of an accident, we could be held liable for any damages that result and any liability could exceed the limits or fall outside the coverage of our insurance coverage, which we may not be able to maintain on acceptable terms, or at all. We could incur significant costs and attention of our management could be diverted to comply with current or future environmental laws and regulations. Federal regulations promulgated by the Occupational Safety and Health Administration impose additional requirements on us, including those protecting employees from exposure to elements such as blood-borne pathogens. We cannot predict the frequency of compliance, monitoring, or enforcement actions to which we may be subject as those regulations are being implemented, which could adversely affect our operations.

Federal and State Healthcare Laws

We are subject to other federal and state healthcare laws that could have a material adverse effect on our business, financial condition, or results of operations. The Health Care Fraud Statute prohibits any person from knowingly and willfully executing, or attempting to execute, a scheme to defraud any healthcare benefit program, which can be either a government or private payor plan. Violation of this statute, even in the absence of actual knowledge of or specific intent to violate the statute, may be charged as a felony offense and may result in fines, imprisonment, or both. The Health Care False Statement Statute prohibits, in any matter involving a federal health care program, anyone from knowingly and willfully falsifying, concealing, or covering up, by any trick, scheme or device, a material fact, or making any materially false, fictitious, or fraudulent statement or representation, or making or using any materially false writing or document knowing that it contains a materially false or fraudulent statement. A violation of this statute may be charged as a felony offense and may result in fines, imprisonment, or both. Under the Civil Monetary Penalties Law of the Social Security Act, a person (including an organization) is prohibited from knowingly presenting or causing to be presented to any United States officer, employee, agent, or department, or any state agency, a claim for payment for medical or other items or services where the person knows or should know (a) the items or services were not provided as described in the coding of the claim, (b) the claim is a false or fraudulent claim, (c) the claim is for a service furnished by an unlicensed physician, (d) the claim is for medical or other items or service furnished by a person or an entity that is in a period of exclusion from the program, or (e) the items or services are medically unnecessary items or services. Violations of the law may result in penalties of up to $10,000 per claim, treble damages, and exclusion from federal healthcare programs.

In addition, the office of inspector general (“OIG”) may impose civil monetary penalties against any physician who knowingly accepts payment from a hospital (as well as against the hospital making the payment) as an inducement to reduce or limit medically necessary services provided to Medicare or Medicaid program beneficiaries. Further, except as permitted under the Civil Monetary Penalties Law, a person who offers or transfers to a Medicare or Medicaid beneficiary any remuneration that the person knows or should know is likely to influence the beneficiary’s selection of a particular provider of Medicare or Medicaid payable items or services may be liable for civil money penalties of up to $10,000 for each wrongful act.

In addition to the laws previously described, we may also be subject to other state fraud and abuse statutes and regulations if we expand our operations nationally. For example, Minnesota imposes a provider tax on healthcare providers and Colorado mandates that all patient facing providers are COVID-19 vaccinated. Generally, we operationalize our policies and procedures to be uniform across all jurisdictions in a manner that also complies with all local and state requirements.

Many states have adopted a form of anti-kickback law, self-referral prohibition, and false claims and insurance fraud prohibition. The scope of these laws and the interpretations of them vary from state to state and are enforced by state courts and regulatory authorities, each with broad discretion. Generally, state laws reach to all healthcare services and not just those covered under a governmental healthcare program. A determination of liability under any of these laws could result in fines and penalties and restrictions on our ability to operate in these states. We cannot assure that our arrangements or business practices will not be subject to government scrutiny or be found to violate applicable fraud and abuse laws.

Recent Developments

We are a holding company with current operating plans to participate in the healthcare industry through the development of healthcare services, and with a view toward additional services and technology that may find a ready market in the healthcare industry. We have made a strategic decision to reduce our capital needs by closing our clinic operations in the fourth quarter of 2022, and releasing a significant portion of our staff. As we redevelop our new strategy for lower cost operations, we hope to slowly open clinics, using the same staffing approach, but with a wider range of services for a broader portion of the population with healthcare needs.

The clinics closed and leases lost include the clinic in 1) Eagan, MN, 2) St. Paul MN, 3) St. Louis Park, MN, 4) Maple Grove, MN, 5) NE Minneapolis, 6) Wayzata, MN (under construction), and 7) two clinics in Denver, CO (under construction).

Reverse Stock Split

On December 12, 2022, the Company effected one-for-fifty reverse-split of its common stock. The number of shares of common stock outstanding immediately before the reverse-split was 231,427,580; the number of shares of common stock immediately following the reverse-split was 4,631,437, a decrease of 226,796,143 shares. This reverse stock split was effected as of December 12, 2022.

Gardner Debt for Equity Agreement

The Company entered into a debt-for-equity exchange agreement with Gardner Builders Holdings, LLC (the “Creditor”) on January 7, 2022 (the “Agreement”). Pursuant to the Agreement, the Company issued shares of restricted common stock, par value $0.01 per share, of MITI (the “Restricted Shares”) to the Creditor in exchange for the Company Debt Obligations, as defined below.

The Agreement settled certain accounts payable amounts owed by the Company to the Creditor (the “Accounts Payable Amount”) as well as then upcoming amounts that would become due between the date of the Agreement and April 1, 2022. The Agreement also settled incurred interest and penalties on the amounts due through January 5, 2022, as well as future interest payments on amounts to be incurred in the first quarter of 2022 (collectively, the “Additional Costs”, and combined with the Accounts Payable Amount, the “Company Debt Obligations”). The Accounts Payable Amount was $500,000, the Additional Costs were $294,912 and the conversion price was $12.50. As a result, 63,593 Restricted Shares were authorized to be issued. The Company’s Board of Directors approved the Agreement on January 5, 2022. As of the date of this filing the Company has begun an effort to negotiate the remaining obligations with Gardner and hopes to have a complete resolution during the third quarter of fiscal 2023.

Other Corporate Information

Our website is www.mitescoinc.com and our principal executive offices is located at 18202 Minnetonka Blvd, Suite 100, Deephaven, MN 55391. Our telephone number is (844) 383 8689. We make available free of charge on our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports, as soon as reasonably practicable after we electronically file or furnish such materials to the SEC. Our website and the information contained therein or connected thereto are not intended to be incorporated into this Form 10-K. Our filings are also available through the SEC website www.sec.gov.

ITEM 1A. RISK FACTORS

RISK FACTORS

Investing in our securities involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this Form 10-K, including our financial statements and the related notes and the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Form 10-K, before deciding whether to invest in our securities. The occurrence of any of the events or developments described below could harm our business, financial condition, results of operations and growth prospects. In such an event, the market price of our securities could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. Some statements in this Form 10-K, including such statements in the following risk factors, constitute forward-looking statements. See the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

Special Notice Regarding the Worldwide Covid-19 Crisis

The world economy is facing significant uncertainties as a result of the worldwide COVID-19 crisis. While we are a small company and have a limited workforce, it is likely we will face increased risk in the case that our financing needs are delayed; our acquisition targets face liquidity issues; or if our professional relationships are challenged from limited staff availability or access. We cannot predict with any certainty whether and to what degree the disruption caused by the COVID-19 pandemic and reactions thereto will continue and expect to face difficulty in developing our business and building our planned clinics. It is not possible for us to accurately predict the duration or magnitude of the adverse results of the outbreak and its effects on our business, results of operations or financial condition at this time, but such effects may be material. The COVID-19 pandemic may also have the effect of heightening many of the other risks identified elsewhere in this section.

Risks Related to our Financial Condition

We are in the initial stages of our present business plan and have a limited historical performance for you to base an investment decision upon, and we may never become profitable.

We have only a limited history and a new business plan upon which an evaluation of our prospects and future performance can be made. Our planned operations are subject to all business risks associated with new companies. The likelihood of our success must be considered considering the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the establishment of a new business, operation in a competitive industry. There is a possibility that we could sustain losses in the future. There can be no assurances that we will ever operate profitably.

There is substantial doubt about our ability to continue as a going concern because of our limited operating history, history of losses and financial resources, and if we are unable to generate significant revenue or secure financing, we may be required to cease or curtail our operations.

We have a history of losses. We have nominal revenues from our operations. The Report of our Independent Registered Public Accounting Firm issued in connection with our audited financial statements for the calendar year ended December 31, 2022, expressed substantial doubt about our ability to continue as a going concern, since we have had recurring operating losses and our lack of liquidity and working capital. The Company’s continuance is dependent on raising capital and generating revenues sufficient to sustain operations. We have generated only minimal revenues from our present business plan. If we generate revenue more slowly than we anticipate, or if our operating expenses are higher than we expect, we may not be able to pay our operating expenses or achieve profitability and our financial condition could suffer. Whether we can achieve cash flow levels sufficient to support our operations cannot be accurately predicted. Unless such cash flow levels are achieved, we will need to borrow additional funds or sell debt or equity securities, or some combination thereof, to obtain funding for our operations. Such additional funding may not be available on commercially reasonable terms, or at all.

We need additional capital to fund our operations and cannot assure you that we will be able to obtain sufficient capital on reasonable terms or at all, and we may be forced to limit the scope of our operations.

We need additional capital to implement and fund our operations. The extent of our capital needs will depend on numerous factors, including (i) the availability and terms of any financing available to us; (ii) the opening of medical clinics by our competitors in the geographic areas where we plan to operate; (iii) the level of our investment in research and development; (iv) the amount of our capital expenditures, including acquisitions; and (v) regulations applicable to our operations. We cannot assure you that we will be able to obtain capital in the future to meet our needs. Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are acceptable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing stockholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences, and privileges senior to our Common Stock. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

We may incur additional debt in the future which may contain restrictive covenants and impair our operating flexibility.

Because we currently have no significant revenue and limited cash on hand, we must seek funds for our operational plans. If we incur additional indebtedness in the future, a portion of the cash flow we generate, if any, will be dedicated to the payment of principal and interest on outstanding indebtedness. Typical loan agreements also might contain restrictive covenants, which may impair our operating flexibility. Such loan agreements would also provide for default under certain circumstances, such as failure to meet certain financial covenants. A default under a loan agreement could result in the loan becoming immediately due and payable and, if unpaid, a judgment in favor of such lender which would be senior to the rights of our stockholders. A judgment creditor would have the right to foreclose on our limited assets resulting in a material adverse effect on our business, operating results, and financial condition.

We have identified weaknesses in our internal controls, and we cannot provide assurances that these weaknesses will be effectively remediated, or that additional material weaknesses will not occur in the future.

As a public company, we are subject to the reporting requirements of the Exchange Act, and the Sarbanes-Oxley Act. We expect that the requirements of these rules and regulations will continue to increase our legal, accounting, and financial compliance costs, make some activities more difficult, time consuming and costly, and place significant strain on our personnel, systems, and resources.

The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures, and internal control over financial reporting.

We do not yet have effective disclosure controls and procedures, or internal controls over all aspects of our financial reporting. We are continuing to develop and refine our disclosure controls and other procedures that are designed to ensure that information required to be disclosed by us in the reports that we will file with the SEC is recorded, processed, summarized, and reported within the time periods specified in SEC rules and forms. Our management is responsible for establishing and maintaining adequate internal control over our financial reporting, as defined in Rule 13a-15(f) under the Exchange Act.

We have identified material weaknesses in our internal control over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our financial statements will not be prevented or detected on a timely basis. The material weaknesses identified to date include (i) lack of segregation of duties, (ii) lack of sufficient resources to ensure that information required to be disclosed by us in the reports that we file or submit to the SEC are recorded, processed, summarized, and reported, within the time periods specified in the SEC’s rules and forms, and (iii) lack of formal control procedures related to the approval of related party transactions. As such, our internal controls over financial reporting were not designed or operating effectively.

We will be required to expend time and resources to further improve our internal controls over financial reporting, including by expanding our staff. However, we cannot assure you that our internal control over financial reporting, as modified, will enable us to identify or avoid material weaknesses in the future.

We have not yet retained sufficient staff or engaged sufficient outside consultants with appropriate experience in GAAP presentation to devise and implement effective disclosure controls and procedures, or internal controls. We will be required to expend time and resources hiring and engaging additional staff and outside consultants with the appropriate experience to remedy these weaknesses. We cannot assure you that management will be successful in locating and retaining appropriate candidates; that newly engaged staff or outside consultants will be successful in remedying material weaknesses thus far identified or identifying material weaknesses in the future; or that appropriate candidates will be located and retained prior to these deficiencies resulting in material and adverse effects on our business. Our ability to retain staff with appropriate experience in GAAP presentation will also be dependent upon the revenue we generate from operations and our ability to raise sufficient funding.

Our current controls and any new controls that we develop may become inadequate because of changes in conditions in our business. Further, weaknesses in our disclosure controls or our internal controls over financial reporting may be discovered in the future. Any failure to develop or maintain effective controls, or any difficulties encountered in their implementation or improvement, could harm our operating results, or cause us to fail to meet our reporting obligations and may result in a restatement of our financial statements for prior periods. Any failure to implement and maintain effective internal controls over financial reporting could also adversely affect the results of management reports and independent registered public accounting firm audits of our internal controls over financial reporting that we will eventually be required to include in our periodic reports that will be filed with the SEC. Ineffective disclosure controls and procedures, and ineffective internal controls over financial reporting could also cause investors to lose confidence in our reported financial and other information, which would likely have a negative effect on the market price of our Common Stock and Warrants.

Our independent registered public accounting firm is not required to audit the effectiveness of our internal control over financial reporting until after we are no longer a “smaller reporting company” as defined in the Jumpstart Our Business Startups (JOBS) Act of 2012. At such time, our independent registered public accounting firm may issue a report that is adverse in the event it is not satisfied with the level at which our internal control over financial reporting is documented, designed, or operating. Any failure to maintain effective disclosure controls and internal control over financial reporting could have a material and adverse effect on our business and operating results and cause a decline in the market price of our Common Stock and Warrants.

The issuance of additional shares of our Common Stock, Warrants, convertible Preferred Stock and other convertible securities may dilute the percentage ownership of the then-existing stockholders and may make it more difficult to raise additional equity capital.

As of June 8, 2023, there were outstanding options and warrants to purchase 310,692 and 672,334 shares of Common Stock, respectively. The exercise of such options and warrants and conversion of convertible securities would dilute the then-existing stockholders’ percentage ownership of our stock, and any sales in the public market of Common Stock underlying such securities could adversely affect prevailing market prices for the Common Stock. Moreover, the terms upon which we would be able to obtain additional equity capital could be adversely affected because the holders of our options and warrants could exercise them at a time when we would likely be able to obtain any needed capital on terms more favorable to us than those provided by such securities.

Our operating results and liquidity needs could be negatively affected by market fluctuations and economic downturn.

Our operating results and liquidity could be negatively affected by economic conditions generally, both in the United States and elsewhere around the world. The market for clinics and services we provide may be particularly vulnerable to unfavorable economic conditions. Some customers may consider certain of our services to be discretionary, and if full reimbursement for such services is not available, demand for these services may be tied to the discretionary spending levels of our targeted patient populations. Domestic and international equity and debt markets have experienced and may continue to experience heightened volatility and turmoil based on domestic and international economic conditions and concerns. In the event these economic conditions and concerns continue or worsen, and the markets continue to remain volatile, our operating results and liquidity could be adversely affected by those factors in many ways, including weakening demand for certain of our services and making it more difficult for us to raise funds if necessary, and our stock price may decline.

Mechanic’s liens were placed on six of our clinics that could have a material adverse impact on our business, results of operations, and financial condition.

In 2022, nine mechanic’s liens for an approximate total of $3.9 million were filed by several contractors against 7 of our 9 clinics. In 2023, the landlord for the Eagan clinic and the landlord for the St. Paul clinic reached confidential settlements with the contractors related to the liens. The other landlords are continuing to negotiate with the contractors to resolve the liens. We are currently in negotiations with landlords to settle the impact of the liens and the ongoing lease obligations related to the clinic properties. There are no filed liens on the NE Minneapolis or Eden Prairie locations. We are negotiating with the NE Minneapolis a settlement regarding our lease obligations that still remain after we relinquished possession of the property. We are currently paying rent on the Eden Prairie clinic location with the intent to either reopen as capital comes available or to sell the location with The Good Clinic brand and assets.

All liens were filed pursuant to Minnesota’s and Colorado’s Mechanic’s statutes and relate to past due obligations for construction and related work on certain of our clinics. Pursuant to Minnesota’s and Colorado’s Mechanic’s statutes, the contractor-creditors may have the ability to commence a mechanic’s lien foreclosure action against the real properties in question to recover amounts due, costs, legal fees, and interest.