NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

AND PROXY STATEMENT

Wednesday, April 24, 2024

3:00 p.m. Eastern Time

Virtual Meeting; Please visit www.virtualshareholdermeeting.com/WBS2024

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material Pursuant to §240.14a-12 |

☒ |

No fee required |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

AND PROXY STATEMENT

Wednesday, April 24, 2024

3:00 p.m. Eastern Time

Virtual Meeting; Please visit www.virtualshareholdermeeting.com/WBS2024

To the Stockholders of Webster Financial Corporation:

You are cordially invited to attend the Webster Financial Corporation (“Webster”) Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Wednesday, April 24, 2024 at 3:00 p.m., Eastern Time. The Annual Meeting will be held virtually via the Internet to allow us to facilitate participation for more stockholders, regardless of their geographic location, and provides us with another opportunity to reduce our environmental impact.

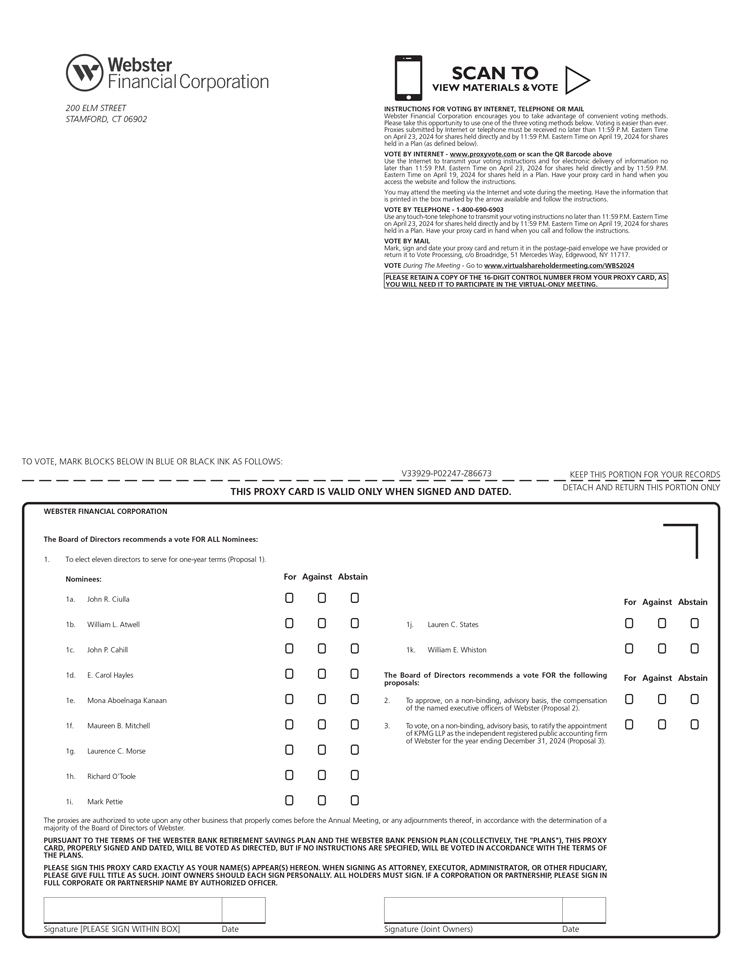

You will be able to participate in the virtual Annual Meeting, vote your shares electronically and submit live questions by visiting www.virtualshareholdermeeting.com/WBS2024. At the Annual Meeting, you will be asked to (i) elect eleven directors to serve for one-year terms; (ii) approve, on a non-binding, advisory basis, the compensation of the named executive officers of Webster; (iii) vote, on a non-binding basis, to ratify the appointment of KPMG LLP as the independent registered public accounting firm of Webster for the year ending December 31, 2024; and (iv) transact any other business that properly comes before the Annual Meeting or any adjournments thereof.

We encourage you to read the accompanying Proxy Statement, which provides information regarding Webster and the matters to be voted on at the Annual Meeting. It is important that your share(s) be represented at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, you may vote your shares via the Internet, by phone or by mail. If you attend the meeting and prefer to vote during the meeting, you may do so. Stockholders who attend the Annual Meeting by following the instructions in the Proxy Statement will be considered to be attending the meeting “in person.”

Sincerely,

|

||||

|

|

||||

| John R. Ciulla | ||||

| Chairman of the Board and Chief Executive Officer | ||||

|

200 Elm Street Stamford, Connecticut 06902 | ||

| Notice of 2024 Annual Meeting of Stockholders |

When April 24, 2024 3:00 p.m. Eastern Time |

Where Virtual meeting; please visit www.virtualshareholdermeeting.com/WBS2024 |

Record Date Close of business on March 5, 2024 | |||

To the Stockholders of

Webster Financial Corporation:

You are cordially invited to attend the Webster Financial Corporation (the “Company”, “we”, “us,” “our”, or “Webster”) Annual Meeting of Stockholders (the “Annual Meeting”) to be held virtually on Wednesday, April 24, 2024 at 3:00 p.m., Eastern Time. We believe that a virtual meeting allows us to facilitate participation for more stockholders, regardless of their geographic location, and provides us with another opportunity to reduce our environmental impact.

The Board of Directors of the Company fixed the close of business on March 5, 2024 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting. Only stockholders of record at the close of business on that date will be entitled to notice of and to vote at the Annual Meeting or any adjournments thereof. This Notice of Internet Availability of Proxy Materials or Proxy Statement are first being sent to stockholders on or about March 15, 2024.

You will be able to participate in the virtual Annual Meeting, vote your shares electronically, and submit questions by visiting www.virtualshareholdermeeting.com/WBS2024.

At the Annual Meeting, you will be asked to vote on the following matters:

| Proposal | Description | |||

| Proposal 1. | Election of Directors - To elect eleven directors to serve for one-year terms | |||

| Proposal 2. | Say-on-Pay - To approve, on a non-binding, advisory basis, the compensation of the named executive officers (“NEOs”) of Webster | |||

| Proposal 3. | Auditor Ratification - To vote, on a non-binding basis, to ratify the appointment of KPMG LLP as the independent registered public accounting firm of Webster for the year ending December 31, 2024 | |||

| Proposal 4. | Other Business - To transact any other business that properly comes before the Annual Meeting, or any adjournments thereof | |||

The Annual Meeting will be held in a virtual meeting format only, via the Internet, with no physical in-person meeting. If you plan to attend the virtual Annual Meeting, please see “Attending the Annual Meeting” on page 1. Stockholders will be able to attend, vote and submit questions from any location via the Internet. Stockholders who attend the Annual Meeting by following the instructions in this Proxy Statement will be considered to be attending the meeting “in person.”

| VOTING OPTIONS | ||||

| IT IS IMPORTANT THAT YOU VOTE PROMPTLY. THEREFORE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE VOTE YOUR COMMON SHARES VIA: | ||||

|

|

|

| ||

| Important notice regarding the availability of proxy materials for the annual meeting of stockholders to be held April 24, 2024: The Proxy Statement, along with our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and our 2023 Annual Report, are available free of charge on the Investor Relations section of our website at https://investors.websterbank.com. | ||||

Whether or not you expect to attend the Annual Meeting, we encourage you to read the accompanying Proxy Statement, which provides information regarding Webster and the matters to be voted on at the Annual Meeting, and our 2023 Annual Report.

It is important that your shares be represented at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, you may vote your shares via the Internet at the website printed on your proxy card, by dialing the toll-free telephone number printed on your proxy card, or you may complete, date, sign and return the enclosed proxy card in the enclosed postage-paid envelope. If you attend the virtual meeting and prefer to vote during the meeting, you may do so. If your common stock is held by a bank, broker, or other nominee (i.e., in “street name”), you should receive instructions from that person or entity that you must follow in order to have your shares of common stock voted.

For a printed copy of the Proxy Statement, please send a written request to: Webster Financial Corporation, 200 Elm Street, Stamford, Connecticut 06902, Attention: Corporate Secretary.

If you have any questions or need assistance voting your shares, please contact Morrow Sodali LLC, our proxy solicitor, by calling (800) 662-5200 (or banks, brokers, and other nominees can call collect at (203) 658-9400), or by emailing WBSinfo@investor.morrowsodali.com.

Sincerely,

|

|

||||

|

|

||||

| John R. Ciulla |

||||

| Chairman of the Board and Chief Executive Officer |

||||

| Webster Financial Corporation |

|

Webster Financial Corporation |

TABLE OF CONTENTS

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This Proxy Statement contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements can be identified by words such as “believes,” “anticipates,” “expects,” “intends,” “targets,” “continues,” “remains,” “will,” “should,” “may,” “plans,” “estimates,” and similar references to future periods; however, such words are not the exclusive means of identifying such statements. Any forward-looking statement made in this Proxy Statement speaks only as of the date on which it is made. Webster Financial Corporation (“Webster”, “we”, “our”, “us” or the “Company”) undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

For additional information, please see the other reports filed with the U.S. Securities and Exchange Commission (the “SEC”), including discussions under the “Forward-Looking Statements” and “Risk Factors” sections of Webster’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC and available on its website at www.sec.gov.

|

| PROXY STATEMENT SUMMARY |

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all the information that you should consider, and you should read this entire Proxy Statement carefully before you vote your shares.

| 2024 ANNUAL MEETING OF STOCKHOLDERS OF WEBSTER FINANCIAL CORPORATION (THE “ANNUAL MEETING”) |

When April 24, 2024 3:00 p.m. Eastern Time |

Where Virtual meeting; please visit www.virtualshareholdermeeting.com/WBS2024 |

Record Date Close of business on March 5, 2024 | |||

Agenda and Recommendations

| Proposal | Board Recommendation | |||

| Proposal 1 |

Election of Directors |

✓ FOR each nominee See page 8 | ||

| Proposal 2 |

Say-on-Pay |

✓ FOR See page 51 | ||

| Proposal 3 |

Auditor Ratification |

✓ FOR See page 52 | ||

Attending the Annual Meeting

Our Annual Meeting this year will be held entirely online via live webcast. You may log into and attend the virtual Annual Meeting beginning at 2:45 p.m. Eastern Time on April 24, 2024. The Annual Meeting will begin promptly at 3:00 p.m. Eastern Time.

If you are a registered stockholder or beneficial owner of common stock holding shares at the close of business on the record date, you may attend the Annual Meeting by going to www.virtualshareholdermeeting.com/WBS2024 and logging in by entering your name, a valid email address and the 16-digit control number found on your proxy card, Notice of Internet Availability, or voting instruction form, as applicable. Attendance at the Annual Meeting is subject to capacity limits set by the virtual meeting platform provider. To submit questions in advance of the Annual Meeting, visit www.proxyvote.com before 11:59 p.m. Eastern Time on April 23, 2024 and enter your 16-digit control number.

For additional information on voting, attendance and submitting questions for the Annual Meeting, please see the sections entitled “How do I attend the virtual Annual Meeting?”, “Will I be able to participate in the virtual Annual Meeting on the same basis I would be able to participate in a live annual meeting?” and “How do I vote my shares?”, beginning on page 56 of this Proxy Statement.

Even if you plan to attend the Annual Meeting, we encourage you to vote your shares in advance online, or, if you requested printed copies of the proxy materials, by phone or by mail to ensure that your vote will be represented at the Annual Meeting.

No recording of the Annual Meeting is permitted, including audio and video recording.

Voting Your Shares

Your Vote is Important to Us

Regardless of whether you are planning to attend this year’s Annual Meeting, please submit your vote over the Internet, by phone or by mail by completing, signing, and returning your proxy card as soon as you can so that we can be assured of obtaining a quorum. A proxy that is signed and dated, but which does not contain voting instructions, will be voted as recommended by our Board of Directors (the “Board”) on each proposal.

Who Can Vote

The securities that can be voted at the Annual Meeting consist of shares of common stock of Webster with each share entitling its owner to one vote on all matters properly presented at the Annual Meeting. There is no cumulative voting of shares.

The Board fixed the close of business on March 5, 2024 as the record date for the determination of stockholders of Webster entitled to notice of and to vote at the Annual Meeting. On the record date, there were 8,357 holders of record of the 171,554,840 shares of common stock then outstanding and eligible to be voted at the Annual Meeting.

How to Vote

For shares held in “street name”. If your common stock is held by a bank, broker, or other nominee (i.e., in “street name”), you should receive instructions from that person or entity that you must follow in order to have your shares of common stock voted.

Webster Financial Corporation - 2024 Proxy Statement | 1

|

For shares held in your own name. If you hold your common stock in your own name and not through a bank, broker, or other nominee, you may vote your shares of common stock:

| • | By Telephone – You can vote your shares of common stock by telephone by dialing the toll-free telephone number printed on your proxy card. Telephone voting is available 24 hours a day until 11:59 p.m., Eastern Time, on April 23, 2024. Easy-to-follow voice prompts allow you to vote your shares of common stock and confirm that your instructions have been properly recorded. If you vote by telephone, you do not need to return your proxy card. |

| • | By Internet - The website for Internet voting is printed on your proxy card. Internet voting is available 24 hours a day until 11:59 p.m., Eastern Time, on April 23, 2024. As with telephone voting, you will be given the opportunity to confirm that your instructions have been properly recorded. If you vote via the Internet, you do not need to return your proxy card. |

| • | By Proxy Card – You can sign, date, and mail the proxy card in the enclosed postage-paid envelope. |

| • | In Person - You can attend the Annual Meeting virtually and vote during the meeting. |

Whichever of these methods you select to transmit your instructions, the proxy holders will vote your common stock in accordance with your instructions. If you give a proxy without specific voting instructions, your proxy will be voted by the proxy holders as recommended by the Board.

Quorum and Vote Requirements

The presence, in person or by proxy, of at least one-third of the total number of outstanding shares of common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting.

Stockholders’ votes will be tabulated by the person or persons appointed by the Board to act as inspectors of election for the Annual Meeting. Stockholders who attend the Annual Meeting by following the instructions in this Proxy Statement will be considered to be attending the meeting “in person.”

If you do not give instructions, whether the broker or other nominee can vote your shares depends on whether the proposal is considered “routine” or “non-routine” under New York Stock Exchange (“NYSE”) rules. If a proposal is routine, a broker or other entity holding shares for an owner in street name may vote on the proposal without voting instructions from the owner. If a proposal is non-routine, the broker or other nominee may vote on the proposal only if the owner provided voting instructions. A “broker non-vote” occurs when the broker or other nominee is unable to vote on a proposal because the proposal is non-routine and the owner does not provide instructions.

Both abstentions and broker non-votes will be treated as shares present for purposes of determining the presence of a quorum at the Annual Meeting.

Abstentions and broker non-votes will not be counted for purposes of determining the number of votes cast on Proposals 1 and 2 and therefore, will have no effect on the outcome of the votes for those proposals. Abstentions will not be counted for purposes of determining the number of votes cast on Proposal 3 and, therefore, will have no effect on the outcome of the vote for that proposal. Brokerage firms or other nominees have authority to vote customers’ unvoted shares held by such firms in street name on Proposal 3; however, if a broker or other nominee does not exercise this authority, such broker non-votes will have no effect on the results of this vote.

| Proposal |

Vote Required for Approval(1) | Effect of Abstentions |

Effect of Broker Non-Votes | |||||

| Proposal 1 |

Election of Directors | “FOR” votes of the holders of a majority of the votes cast at the Annual Meeting | None; not counted as a “vote cast” | None; not counted as a “vote cast” | ||||

| Proposal 2 |

Say-on-Pay | “FOR” votes of the holders of a majority of the votes cast at the Annual Meeting | None; not counted as a “vote cast” | None; not counted as a “vote cast” | ||||

| Proposal 3 |

Auditor Ratification | “FOR” votes of the holders of a majority of the votes cast at the Annual Meeting | None; not counted as a “vote cast” | Brokers and other nominees may vote(2); Broker non-votes are not expected | ||||

| (1) | Assuming the presence of a quorum at the Annual Meeting. |

| (2) | If a broker or other nominee does not exercise this authority, such broker non-votes will have no effect on the results of this vote. |

Solicitation

The Board is soliciting proxies for use at the Annual Meeting. We will bear the entire cost of proxy solicitation, including the costs of preparing, assembling, printing and mailing this Proxy Statement, the Notice of Internet Availability of Proxy Materials, the proxy card and any additional solicitation materials furnished to our stockholders. Copies of these materials will be furnished to banks, brokers, or other nominees holding shares in their names that are beneficially owned by others so they may forward these materials to such beneficial owners. In addition, we may reimburse such persons for their reasonable expenses in forwarding the solicitation materials to the beneficial owners. The original solicitation of proxies by mail may be supplemented by a solicitation by personal contact, telephone, facsimile, email or any other means by our directors, officers or colleagues. No additional compensation will be paid to these individuals for any such services. In addition, we engaged Morrow Sodali LLC to assist in the solicitation of proxies and provide related advice and informational support. For additional information about this engagement, please see “Additional Information—Method of Proxy Solicitation” below.

2 | Webster Financial Corporation - 2024 Proxy Statement

|

| Webster’s Mission, Values and Culture |

At Webster, we deliver financial solutions to help businesses, individuals, families and partners achieve their financial goals. Our values are reflected in our sustained dedication to serving our customers and our communities. Our culture is centered around delivering for our clients; strong risk management; responsible corporate citizenship; diversity, equity, inclusion and belonging and transparent governance. This is made possible thanks to the dedication, teamwork and commitment to our values demonstrated by Webster colleagues every day.

| Business Highlights |

Overcoming Difficult Industry Conditions

Beginning in March of 2023, the banking industry experienced significant volatility with multiple high-profile bank failures and industry-wide concerns related to unrealized losses on securities, deposit outflows, and available liquidity in the banking system. Despite these industry headwinds, Webster Bank N.A.’s (“Webster Bank”) diverse funding sources overcame these trends with total deposits at December 31, 2023 of $60.8 billion, representing a net $6.8 billion increase as compared to its total deposits at December 31, 2022, and Webster Bank’s loans to deposits ratio decreased to 83% as compared to 92% at December 31, 2022.

interLINK Acquisition

On January 11, 2023, Webster Bank acquired interLINK, a technology-enabled deposit management platform that administers over $9 billion of deposits from FDIC-insured cash sweep programs between banks and broker/dealers and clearing firms. The acquisition expanded Webster Bank’s deposit funding sources and scalable liquidity and added another technology-enabled channel to its already differentiated, omnichannel deposit gathering capabilities. At December 31, 2023, interLINK provided $5.7 billion of core deposit funding.

Sterling Integration Update

In July 2023, the Company executed and completed its transition to a unified core operating system (the “core conversion”) with Sterling Bancorp (“Sterling”), which marked a significant milestone in the Company’s overall integration process. The core conversion unified the majority of legacy Webster and Sterling technology platforms used to support Webster Bank’s daily operating activities. The core conversion and other actions taken in 2023 substantially completed the integration process.

Ametros Acquisition

On January 24, 2024, Webster Bank acquired Ametros Financial Corporation (“Ametros”), a custodian and administrator of medical funds from insurance claims’ settlements. Ametros managed their ongoing medical care through its CareGuard service and proprietary technology platform. The Company believes that the acquisition will provide a fast-growing source of low-cost and long-duration deposits, new sources of non-interest income, and will enhance the Company’s employee benefit/healthcare financial services expertise.

| Corporate Governance Highlights |

We believe in the importance of sound and effective corporate governance. Over the years, we forged an explicit link between our corporate culture and corporate governance by identifying our core values, communicating them and living them every day. With uncompromising commitment to our core principles, we continue to add value for our customers, stockholders, colleagues and the communities we serve. The Board has adopted corporate governance practices and policies that the Board and senior management believe promote this philosophy. Certain of such practices and policies are listed below and certain of those listed are discussed in greater detail elsewhere in this Proxy Statement.

Independent leadership

| • | During 2023, 13 of our 15 directors were independent, and following this Annual Meeting, 10 of our 11 directors will be independent |

| • | Our Lead Independent Director is appointed in accordance with Webster’s Corporate Governance Policy |

| • | Independent directors comprise 100% of each of the Board’s Audit, Compensation, Nominating and Corporate Governance, Risk, and Technology Committees |

| • | Regular Board and committee executive sessions of independent directors are held without management present |

Director accountability

| • | All directors stand for election annually |

| • | Directors are elected by majority vote |

| • | Any incumbent director must, as a condition to nomination for re-election to the Board, submit a conditional (and generally irrevocable) letter of resignation to the Chairman of the Board; If an incumbent director is not elected, the Nominating and Corporate Governance Committee of the Board will consider the conditional resignation and recommend to the Board whether to accept or reject the resignation |

| • | All directors attended more than 75% of the aggregate of (i) the total number of meetings of the Board and (ii) the total number of meetings held by all committees of the Board on which they served during 2023 |

Measures to Support Board Effectiveness

| • | Annual Board and committee self-assessment |

| • | Code of Business Conduct & Ethics applies to directors |

| • | Board orientation / education program |

| • | Director overboarding policy |

Webster Financial Corporation - 2024 Proxy Statement | 3

|

Alignment with stockholder interests

| • | Annual equity grant to non-employee directors |

| • | Stock ownership guidelines for directors and executive officers |

| • | Anti-hedging and anti-pledging policy |

| • | No supermajority voting provisions |

| • | No poison pill |

Environmental, Social and Governance (“ESG”) practices

| • | Our Corporate Responsibility Committee is comprised of senior executive leadership, overseeing the ESG Council and reporting on ESG and Corporate Responsibility efforts to the Nominating and Corporate Governance Committee |

| • | Robust enterprise risk management and corporate compliance functions, including cybersecurity and privacy policies |

| • | Regular engagement with stockholders and other stakeholders, including regulators |

| • | Implements a Community Investment Strategy, with a focus on affordable housing, community development and small business lending to minority and women-owned businesses and community support |

| • | Publishes Annual Corporate Responsibility Report detailing ESG efforts |

Share Repurchase Program

Webster maintains a common stock repurchase program, approved by the Board on October 24, 2017, that authorizes management to purchase shares of Webster common stock in open market or privately negotiated transactions, through block trades, and pursuant to any adopted predetermined trading plan subject to the availability and trading price of stock, general market conditions, alternative uses for capital, regulatory considerations, and the Company’s financial performance. On April 27, 2022, the Board increased the Company’s authority to repurchase shares of Webster common stock under the repurchase program by $600.0 million. During the year ended December 31, 2023, the Company repurchased 2,667,149 shares under the repurchase program at a weighted-average price of $40.49 per share, totaling $108.0 million. At December 31, 2023, the Company’s remaining purchase authority was $293.4 million.

In addition, the Company periodically acquires Webster common stock outside of the repurchase program related to employee stock compensation plan activity. During the year ended December 31, 2023, the Company repurchased 315,729 shares at a weighted-average price of $51.48 per share, totaling $16.3 million for this purpose.

4 | Webster Financial Corporation - 2024 Proxy Statement

|

COMMITMENT TO CORPORATE RESPONSIBILITY |

| COMMITMENT TO CORPORATE RESPONSIBILITY |

Webster is a values-based, leading commercial bank focused on delivering financial solutions to businesses, individuals, families and partners. We offer differentiated lines of business, including Commercial Banking, Consumer Banking and our HSA Bank division, one of the country’s largest providers of employee benefits. Our culture is centered around delivering for our clients; strong risk management; responsible corporate citizenship; diversity, equity, inclusion and belonging; and transparent governance.

Board Oversight of Corporate Responsibility

In 2023, we continued to enhance our Corporate Responsibility program. The Board and its committees ensure that corporate responsibility principles, including ESG activities, are integrated into our business strategy in ways that optimize opportunities to make positive impacts while advancing long-term goals. We are committed to conducting our business in a safe, environmentally responsible, and sustainable manner and in a way that reflects our responsibilities to our stakeholders.

Our Board of Directors oversees Webster’s corporate responsibility efforts, led by the Nominating and Corporate Governance Committee. Our Corporate Responsibility Committee is comprised of senior executive leadership, overseeing the ESG Council activities and reporting on corporate responsibility and ESG efforts to the Nominating and Corporate Governance Committee. Our management-level ESG Council includes a cross-functional team with representatives from the Lines of Business, Audit, Compliance, Corporate Responsibility, Investor Relations, Legal, Operations and Risk. The ESG Council meets on a quarterly basis.

Our senior leadership team is tasked with driving results in these areas given the strategic importance of corporate responsibility. Against this backdrop, we engaged with internal and external stakeholders on our corporate responsibility strategy to help further inform our future direction and priorities. The four areas of focus for our corporate responsibility reporting are:

|

Economic Vitality |

Webster believes strongly in empowering people and strengthening communities by expanding access to capital. Our Office of Corporate Responsibility (“OCR”) manages all community-facing activities across the Company, including Supplier Diversity; Community Reinvestment Act and Fair and Responsible Banking; Community Investment, Engagement and Philanthropy; Government Relations and Public Affairs; and all ESG efforts. This structure allows us to plan more strategically, support enterprise goals more effectively and use our resources more efficiently. The OCR also oversees Webster’s multi-year Community Investment Strategy, driving economic vitality in the communities we serve.

In developing the Community Investment Strategy, Webster worked with more than 100 community groups across our footprint, listening to their needs and concerns. The strategy has four key focus areas:

| Small Business Lending

|

Affordable Housing

|

Community Development

|

Community Support

|

Notably in 2023, we:

| • | Introduced our Special Purpose Credit Program, Webster You’re Home. The new program is aimed at expanding homeownership opportunities for low- to moderate-income first-time homebuyers, providing access to credit in economically-disadvantaged communities and helping to build generational wealth. |

| • | Launched our Minority and Women-owned Business Enterprise banking team, which works to support the growth and development of minority and women-owned small businesses across the footprint. |

| • | Expanded our signature Webster Finance Labs initiative. The Finance Labs are designed to help nonprofit partners in communities create opportunities for students to gain the skills needed for economic empowerment and financial success. |

| • | Continued to grow our Supplier Diversity program launching our Supplier Diversity portal to allow vendors to submit their company information for entry into Webster’s supplier database. Our Supplier Diversity program continues to be an enterprise-wide effort, partnering with Strategic Sourcing, Accounts Payable and our lines of business. |

Additionally, we work to build vibrant and healthy communities through a variety of regional and local initiatives, along with key partnerships. Our colleagues have opportunities to make an impact as they share their time and skills in our communities. Webster provides all colleagues with 16 hours of paid time to volunteer at the organizations of their choice.

Webster Financial Corporation - 2024 Proxy Statement | 5

|

COMMITMENT TO CORPORATE RESPONSIBILITY |

|

Valuing Our People |

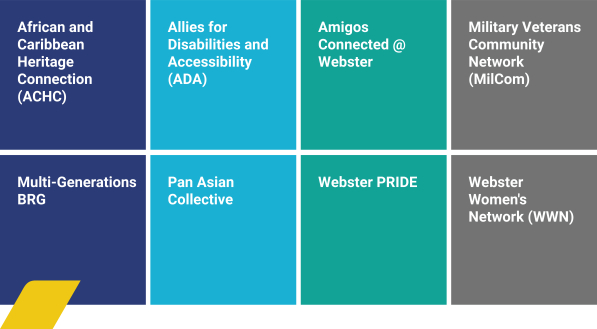

Webster’s core values are the foundation of our efforts to attract, acquire and retain talented colleagues for our business. As a values-driven organization, our colleagues are the cornerstone of our success. We believe that Diversity, Equity, Inclusion and Belonging (“DEIB”) is critical to our growth as a leading commercial bank. This commitment starts with Webster’s senior leadership team, who work to ensure that our commitment to DEIB is integrated with the way we do business. Our DEIB Council serves as a platform where senior leaders and representatives of our various business resource groups (“BRGs”) shape the strategy and actions of our DEIB efforts. The DEIB Council reports quarterly to the Corporate Responsibility Committee, providing an additional level of accountability. This Committee in turn reports to the Nominating and Governance Committee of the Board.

Webster proudly supports a host of BRGs that provide our colleagues with an authentic experience of diversity, equity, inclusion and belonging. Our BRGs connect with our colleagues and community stakeholders through innovative programs, community outreach and partnerships.

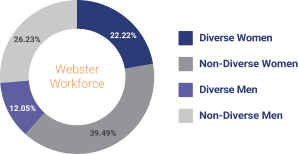

As of December 31, 2023, as a percentage of Webster’s workforce, diverse women were 22.22%, non-diverse women were 39.49%, diverse men were 12.05% and non-diverse men were 26.23%. As part of our efforts to have an inclusive workforce, we strive to offer competitive total rewards programs, promote colleague development and foster a diverse environment. We offer medical, dental and vision plans, prescription benefits, life insurance and disability benefits, Health Savings Accounts, wellness incentives, health coaching, paid parental leave, paid time off, matching 401(k) retirement savings plan, colleague stock purchase plan, backup child and elder care, and wellness programs.

Webster is also committed to investing in our workforce with training and career development. Our colleagues have access to more than 490 courses offered through Webster Bank University, our internal learning resource that offers on-demand webinars, e-learning and in-person learning programs. Webster also provides unlimited access to self-directed e-learning courses taught by industry experts with curated learning paths designed for specific professional interests.

In 2023, we conducted our first colleague engagement survey as a combined company. The results showed that the majority of our colleagues view Webster’s greatest strengths as “our sense of purpose” and “inclusion.” This feedback makes us a stronger organization and ensures that Company decisions align with the success of our colleagues.

6 | Webster Financial Corporation - 2024 Proxy Statement

|

COMMITMENT TO CORPORATE RESPONSIBILITY |

|

Our Environment |

We believe that our focus on environmental sustainability, with the objective of reducing costs and improving sustainability of our operations, provides a strategic benefit. We continue to advance plans to create further efficiencies in our operations and reduce our emissions, including increasing the amount of green energy used for our facilities. Across our footprint, we seek to maintain low-emission and energy-efficient working environments.

We recognize the importance of the transition to renewable energy and have been working to increase our use of renewable energy. We purchased multi-year renewable energy certificates, known as RECs, to offset our energy consumption in our New York market. RECs are certificates that represent the environmental attributes related to generating one megawatt-hour (MWh) of electricity from renewable sources and guarantee that equivalent energy was produced using renewable sources and added to the electricity grid. We further extended our commitment by financing commercial loans with companies involved in renewable energy, environmental remediation and energy-efficient components.

With a view to increasing efficiency and reducing waste, we are also continuing to digitize financial center functions. In 2023, we:

| • | Continued to migrate technology infrastructure to a cloud environment, reducing energy usage and our carbon footprint |

| • | Onboarded software tools to help us track and manage emissions more effectively |

| • | Retrofitted interior and exterior branches with energy efficient lighting fixtures |

Co-led by our Chief Risk Officer and Chief Credit Officer, we continue to develop and refine our risk management framework for measuring and managing climate-related physical and transition risks that could impact Webster Bank’s operations and loan portfolio.

|

Responsible Governance |

Webster is committed to achieving excellence in our corporate governance practices.

This commitment starts with comprehensive governance structures, policies, management committees and practices designed to ensure transparency in reporting and accountability for our Board of Directors and senior management. Our governance policies and procedures ensure that we maintain the highest levels of ethics and integrity, as well as data security and client privacy safeguards. We also maintain robust programs to manage operational risks and uphold compliance with all applicable laws, regulations and rules governing ethical business conduct.

Webster Financial Corporation - 2024 Proxy Statement | 7

|

ELECTION OF DIRECTORS |

| ELECTION OF DIRECTORS (Proposal 1) |

Our Board currently consists of 14 members. Upon recommendation of the Nominating and Corporate Governance Committee of the Board, the Board nominated 11 of the 14 current directors, reducing our Board size to 11, with no new nominees for the election as directors at the Annual Meeting. Each director elected at the Annual Meeting will hold office for a one-year term until the 2025 Annual Meeting of stockholders and will serve until his or her successor is duly elected and qualified.

Each director brings a strong and unique background and set of skills to the Board, giving the Board as a whole competence and experience in a wide variety of areas, including corporate governance, board service, executive management, business, finance, technology and marketing. In addition, with regard to the overall composition of the Board, the Nominating and Corporate Governance Committee and the Board seek to achieve an overall balance of backgrounds and diversity of experience with a complementary mix of skills and professional experience in areas relevant to the Company’s business and strategy. The biographies of each of the nominees set forth below contain certain information about his or her principal occupation and business experience, and also highlight certain of the nominee’s particular attributes that the Board believes the nominee brings to the Board.

The following table sets forth certain information as of March 5, 2024 with respect to our director nominees and their current committee memberships.

| Director Nominees: |

Age | Director Since |

Expiration of Term |

Positions Held with Webster and Webster Bank |

Committee Membership | |||||

| John R. Ciulla |

58 | 2018 | 2024 | Chairman of the Board and Chief Executive Officer |

Executive (Chair) | |||||

| William L. Atwell◆ |

73 | 2014 | 2024 | Director | Compensation; Nominating & Corporate Governance | |||||

| John P. Cahill |

65 | 2022 | 2024 | Director | Compensation; Nominating & Corporate Governance | |||||

| E. Carol Hayles |

63 | 2018 | 2024 | Director | Audit (Chair); Executive; Technology | |||||

| Mona Aboelnaga Kanaan |

56 | 2022 | 2024 | Director | Technology (Chair); Executive; Risk | |||||

| Maureen B. Mitchell |

72 | 2022 | 2024 | Director | Audit; Technology | |||||

| Laurence C. Morse |

72 | 2004 | 2024 | Director | Compensation (Chair); Executive; Nominating & Corporate Governance | |||||

| Richard O’Toole◆ |

67 | 2022 | 2024 | Lead Independent Director | Nominating & Corporate Governance (Chair); Compensation; Executive | |||||

| Mark Pettie |

67 | 2009 | 2024 | Director | Risk (Chair); Executive; Technology | |||||

| Lauren C. States |

67 | 2016 | 2024 | Director | Risk; Technology | |||||

| William E. Whiston |

70 | 2022 | 2024 | Director | Audit; Risk |

| ◆ | Mr. O’Toole serves as our Lead Independent Director replacing our prior Lead Independent Director, William Atwell, effective February 1, 2024. |

Current Board Composition, Diversity and Refreshment

| • | Majority Independent Board: Mr. O’Toole serves as the Lead Independent Director of the Board (replacing our prior Lead Independent Director, William Atwell, effective February 1, 2024), and 10 of our 11 director nominees are independent, as defined by the rules of the NYSE. Of the four directors who are not standing for re-election, all are independent, except for our former Executive Chairman, Mr. Kopnisky, who retired effective January 31, 2024. In addition, independent directors comprise 100% of each of the Board’s Audit, Compensation, Nominating and Corporate Governance, Risk and Technology Committees. |

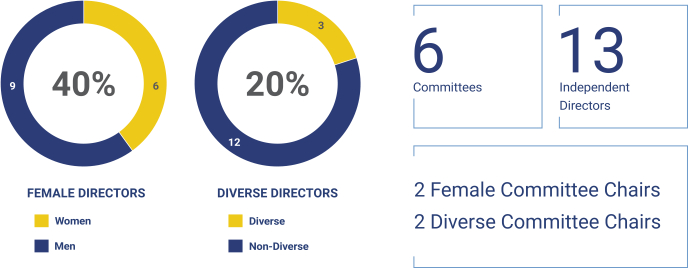

| • | Diversity of Backgrounds, Skills and Experience: The Board believes different points of view brought through diverse representation lead to better business performance, decision making, and understanding of the needs of our diverse customers, colleagues, stockholders, business partners, and other stakeholders. Consistent with those values, the Board adopted a set of Qualification Guidelines for Board Members (the “Board Qualification Guidelines”), which provide that the Nominating and Corporate Governance Committee will consider diversity, among other qualifications, when deciding on nominations for the Board. Among the nominees for election to the Board, four self-identify as female and three self-identify as diverse based on race or religion. The Board believes that the nominees for election offer a diverse range of backgrounds, skills and experience in relevant areas that contribute to overall effective leadership and exercise of oversight responsibilities by the Board. |

8 | Webster Financial Corporation - 2024 Proxy Statement

|

ELECTION OF DIRECTORS |

The charts below show our Board composition as of December 31, 2023:

| • | New Board Structure and Strong Board Refreshment Practices: The Board believes it is critical to maintain a mix of experienced, longer-tenured directors to ensure continuity and institutional knowledge through economic cycles and an evolving competitive landscape, along with newer directors who have different expertise, backgrounds and fresh perspectives. The director nominees range in age from 56 to 73, and the average age is approximately 66. In addition, our Board Qualification Guidelines provide that the Nominating and Corporate Governance Committee will not renominate a prospective director for a new term after such director reaches the age of 75. |

Webster Financial Corporation - 2024 Proxy Statement | 9

|

ELECTION OF DIRECTORS |

Director Nominee Skills and Experiences

| Director |

Other Public Co. Board Service |

Audit / Financial Reporting |

Financial Services Industry |

C-Suite Leadership |

Risk Mgt. | Technology, Info. Security |

Strategic Planning/ M&A |

Non-Profit/ Other Leadership | ||||||||

| John R. Ciulla |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

||||||||||

| William L. Atwell

|

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | |||||||||

| John P. Cahill |

✓ |

✓ |

✓ |

✓ |

✓ | |||||||||||

| E. Carol Hayles |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

||||||||||

| Mona Aboelnaga Kanaan |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | ||||||||

| Maureen B. Mitchell |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

||||||||||

| Laurence C. Morse |

✓ |

✓ |

✓ |

✓ | ||||||||||||

| Richard O’Toole

|

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

||||||||||

| Mark Pettie |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | |||||||||

| Lauren C. States |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | ||||||||||

| William E. Whiston |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ | ||||||||||

| Total of 11 Directors |

8 |

8 |

9 |

8 |

11 |

4 |

11 |

7 | ||||||||

| 73% |

73% |

82% |

73% |

100% |

17% |

100% |

64% | |||||||||

|

Lead Independent Director (Mr. O’Toole serves as our Lead Independent Director replacing our prior Lead Independent Director, William Atwell, effective February 1, 2024) |

The following are descriptions of the skills that the Board believes are critical in effective oversight of the Company:

|

Other Public Company Board Service

Experience as either a current or prior board member of another publicly-traded company (including those in the financial services industry). |

|

Risk Management

Experience assessing and mitigating significant competitive, regulatory, and technological risks across an enterprise. | |||

|

Audit / Financial Reporting

Experience or expertise in financial accounting and reporting or the financial management of a major organization. |

|

Technology, Cybersecurity, Information Security

Expertise in cybersecurity and information technology systems and developments, either through academia or industry experience. | |||

|

Financial Services Industry

Experience in the financial services industry, including experience as a fund trustee, with financial market products and services, or proven knowledge of key customers and/or associated risks. |

|

Strategic Planning / M&A

Experience leading strategic planning initiatives and complex mergers, acquisitions, or divestitures, including direct involvement in the integration of people, systems, data, and operations. | |||

|

C-Suite Leadership

Experience as a Chief Executive Officer, Chief Financial Officer, or a Chief Operating Officer of a major organization. |

|

Non-Profit / Other Leadership

Experience as a current or prior board member or executive of a major not-for-profit organization or a significant leadership role in a major non-profit organization. | |||

The Board has no reason to believe that any of its nominees will be unable or unwilling to serve if elected. If a nominee becomes unable or unwilling to accept nomination or election, either the number of the Company’s directors will be reduced or the persons acting under the Proxy will vote for the election of a substitute nominee that the Board recommends.

As required by Webster’s Bylaws, as amended (the “Bylaws”), directors must be elected by a majority of the votes cast with respect to such director in uncontested elections (meaning the number of shares voted “for” a director must exceed the number of votes cast “against” that director). There are no cumulative voting rights in the election of directors. In addition, under the Bylaws, incumbent directors nominated for re-election are required, as a condition to such nomination, to submit a conditional letter of resignation. In the event an incumbent nominee for director fails to receive a majority of the votes cast at an annual meeting, the Nominating and Corporate Governance Committee will consider the resignation and make a recommendation to the Board as to whether to accept or reject the resignation, or whether other action should be taken. The Board will act on the Nominating and Corporate Governance Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date the election results are certified. The director who failed to receive a majority of the votes cast will not participate in the Board’s decision.

10 | Webster Financial Corporation - 2024 Proxy Statement

|

ELECTION OF DIRECTORS |

Director Nominees

The following provides biographical information regarding each of the nominees, including the specific business experience, qualifications, attributes, and skills that were considered, in addition to prior service on the Board. Each nominee brings significant experience to the Board and the committees on which he or she serves, and the Board believes that each of the nominees is well qualified to serve as a Director on Webster’s Board.

Several of our directors served on the Board of Directors of Sterling until Sterling was acquired by Webster in 2022 and, previously, served on the Board of Hudson Valley Holding Corp. (“Hudson Valley”) until Hudson Valley was acquired by Sterling in 2015.

Jack Kopnisky retired as Executive Chairman of the Company and Webster Bank on January 31, 2024.

As of the date of the Annual Meeting, we will decrease the size of the Board for each of Webster and Webster Bank to 11 directors. Linda Ianieri, James Landy and Karen Osar will not stand for re-election. We thank each of them for their service to the Company and Webster Bank.

|

|

JOHN R. CIULLA Chairman of the Board and Chief Executive

Age: 58

Director since: 2018

|

Current Committees:

Executive |

Committees pending re-election at Executive | |||

CAREER HIGHLIGHTS

| • | Chief Executive Officer and a director of Webster and Webster Bank since January 2018 |

| • | Chairman of the Board from April 2020 to January 2022 and again effective February 1, 2024 |

| • | Joined Webster in 2004 and served in a variety of management positions, including Chief Credit Risk Officer and Senior Vice President, Commercial Banking, responsible for several lines of business |

| • | Promoted from Executive Vice President and Head of Middle Market Banking to lead Commercial Banking of Webster Bank in 2014 and to President in 2015 |

| • | Managing Director of The Bank of New York (1997-2004) |

| • | Board member, American Bankers Association |

| • | Serves on the Mid-Size Bank Coalition of America’s (MBCA) Executive Committee |

| • | Served as former Chair and board member of the Connecticut Business Roundtable |

SELECTED DIRECTOR QUALIFICATIONS:

| • | Over 20 years of leadership experience in financial services industry |

| • | Extensive experience as President and Chief Executive Officer of Webster, providing a thorough understanding of Webster’s opportunities, challenges and operations |

|

|

WILLIAM L. ATWELL Director

Age: 73

Director since: 2014

Former President of Cigna International |

Current Committees:

Compensation Nominating & Corporate Governance |

Committees pending re-election at Compensation Nominating & Corporate Governance Executive | |||

CAREER HIGHLIGHTS

| • | Former Consulting and Managing Director of Atwell Partners, LLC, which provided consulting services and market insights to the financial services industry (2012-2019) |

| • | President of Cigna International at Cigna Corporation (2008-2012) and served as Senior Vice President (1996-2000) |

| • | Held senior executive positions with The Charles Schwab Corporation, including President of Individual Investor Enterprise and Charles Schwab Bank (2000-2005) |

| • | Career at Citibank, holding various senior executive roles both domestically and internationally over the course of 23 years |

| • | Former Chairman of the Board of Avantax, Inc. (f/k/a Blucora, Inc.) (NASDAQ: AVTA), a provider of technology-enabled financial solutions (2017-2019) |

| • | Chairman of AQR Mutual Funds (AQR Capital Management LLC) since 2023 and a member of its Board since 2011 serving on its Audit and Nominating & Governance committees |

SELECTED DIRECTOR QUALIFICATIONS:

| • | Over 40 years of executive experience in the financial services industry, including banking, brokerage, healthcare and insurance |

| • | Provides insight into the financial sector as a result of his extensive and broad industry experience |

Webster Financial Corporation - 2024 Proxy Statement | 11

|

ELECTION OF DIRECTORS |

|

|

JOHN P. CAHILL Director

Age: 65

Director since: 2022 Director of Sterling since 2015 and prior to

Chancellor to the Archdiocese of New York |

Current Committees:

Compensation Nominating & Corporate Governance |

Committees pending re-election at Risk Technology | |||

CAREER HIGHLIGHTS

| • | Chancellor to Archdiocese of New York, overseeing the temporal matters of the Archdiocese of New York (2019-present) |

| • | Co-founded the Pataki-Cahill Group LLC in 2007, a strategic consulting firm focusing on the economic and policy implications of domestic energy needs, and continues as a Principal |

| • | Former Senior Counsel at Norton Rose Fulbright LLP (formerly Chadbourne & Parke LLP) (2007-2019) |

| • | Served in various capacities in the administration of Governor of New York, George E. Pataki, including Secretary and Chief of Staff to the Governor (2002-2006) |

| • | Former Director of Ecoark Holdings, Inc. (NASDAQ: ZEST), serving on its Nominating and Corporate Governance Committee (Chair) and on the Compensation Committee (2016-2021) |

| • | Trustee of the National September 11th Memorial & Museum at the World Trade Center Foundation, Inc. |

| • | Trustee of the Open Space Institute and Archbishop Stepinac High School |

SELECTED DIRECTOR QUALIFICATIONS:

| • | Distinguished career as an attorney in government and in the private sector |

| • | Extensive knowledge of the financial services industry and the banking community, as well as knowledge of, and advocate for, environmental and energy preservation efforts |

|

|

E. CAROL HAYLES Director

Age: 63

Director since: 2018

Former Executive Vice President and Chief |

Current Committees:

Audit (Chair) Executive Technology |

Committees pending re-election at Annual Meeting: Audit (Chair) Executive Risk | |||

CAREER HIGHLIGHTS

| • | Former Executive Vice President and Chief Financial Officer of CIT Group Inc., a financial services company (2015-2017), responsible for overseeing all financial operations |

| • | Served as Controller and Principal Accounting Officer (2010-2015) of CIT Group Inc., responsible for managing the financial accounting and reporting functions, including SEC and regulatory reporting (2010-2015) |

| • | Spent 24 years in various finance roles at Citigroup, Inc., most recently as Deputy Controller |

| • | Began career at PricewaterhouseCoopers LLP and held Canadian Chartered Accountant Designation (1985-2009) |

| • | Served on the board and audit committee of Avantax, Inc. (f/k/a Blucora, Inc.) (NASDAQ: AVTA), a provider of technology-enabled financial solutions (2018-2023) |

| • | Serves on the board and is Chair of the Audit Committee and a member the Governance and Nominating Committee of eBay, Inc. (NASDAQ: EBAY), a global commerce corporation, since 2022 |

SELECTED DIRECTOR QUALIFICATIONS:

| • | Extensive financial reporting and accounting experience, including as the Chief Financial Officer of a large financial institution and Chair of two public company audit committees which qualifies her as an “audit committee financial expert” |

| • | As an executive in the financial services industry for over 30 years, has leadership, capital allocation, operations, regulatory compliance, strategy and mergers and acquisitions experience |

12 | Webster Financial Corporation - 2024 Proxy Statement

|

ELECTION OF DIRECTORS |

|

|

MONA ABOELNAGA KANAAN Director

Age: 56

Director since: 2022 Director of Sterling since 2019

Managing Partner at K6 Investments LLC |

Current Committees:

Technology (Chair) Executive Risk |

Committees pending re-election at Annual Meeting: Technology (Chair) Executive Nominating & Corporate Governance | |||

CAREER HIGHLIGHTS

| • | Founder and Managing Partner of K6 Investments LLC (“K6”), a private investment firm that invests globally in the financial services, technology, media and consumer products industries (2011-present) |

| • | Founded Proctor Investment Managers LLC (“Proctor”), which was sold to National Bank of Canada in 2006 and continued as Proctor’s President and Chief Executive Officer until 2013 |

| • | Serves as the first US-based member of the Board of Directors of Perpetual Limited (ASX: PPT), an Australian-based diversified global financial services company and leading private wealth and trust business and serves on its Investment and People Committees since June 2021 and Chairs its Technology and Cybersecurity Committee |

| • | Serves as a Director of Mondee Holdings, Inc. (NASDAQ: MOND), an innovative TravelTech company and is Chair of its Nominating and Corporate Governance Committee and is a member of its Audit Committee since July 2022 |

| • | Former director and audit committee member of FinTech Acquisition Corp. VI (Symbol: FTVI), (2021-2022) |

| • | Serves on the Advisory Board of Dubai-based VC Fund, Global Ventures and Investcorp Strategic Capital Group; |

| • | Trustee of the Fashion Institute of Technology of the State University of New York and a member of the Council on Foreign Relations |

SELECTED DIRECTOR QUALIFICATIONS:

| • | Experienced Chief Executive Officer, entrepreneur, private equity investor and corporate director with over 30 years of experience in the financial services sector |

| • | Invested, divested and managed transformative strategic transactions in a broad range of asset classes, investment strategies, product areas and distribution channels, and brings a unique perspective on the financial services market to the Board |

Webster Financial Corporation - 2024 Proxy Statement | 13

|

ELECTION OF DIRECTORS |

|

|

MAUREEN B. MITCHELL Director

Age: 72

Director since: 2022 Director of Sterling since 2018

Senior Advisor at The Boston Consulting Group |

Current Committees:

Audit Technology |

Committees pending re-election at Annual Meeting: Audit Technology | |||

CAREER HIGHLIGHTS

| • | Senior Advisor at The Boston Consulting Group, a position held since 2017, providing advice on issues of strategy transformation, product development and digital execution |

| • | Provides consulting services to KRW International, a global leadership firm |

| • | President of Global Sales and Marketing and a director of GE Asset Management, Inc. (2009-2016) |

| • | Global Head of Distribution at Highland Capital Management, LP (2008-2009) |

| • | Previous experience includes ten years at Bear Stearns Asset Management, where she was a Senior Managing Director and Global Head of Institutional Sales and Client Services, leading the multi-billion asset management business |

| • | Serves as a member of the Board of Trustees of Natixis/Loomis Sayles Mutual Funds since 2017, and Chairs the Contracts Committee |

| • | Serves on the Advisory Board of Investcorp Strategic Capital Group since 2023 |

| • | Director of Fieldpoint Private Bank and Trust (2017-2018), Director of Investment Company Institute (ICI Board of Governors) (2015-2016), Director of GE Asset Management, Inc. (2009-2016), GE Investment Distributors, Inc. (2014-2016), GE Asset Management (2012-2016) and GE Asset Management Funds II PLC (2012-2014) |

| • | Serves as a Board member and on the Investment and Budget Committees of the Foundation for City College |

SELECTED DIRECTOR QUALIFICATIONS:

| • | Experienced corporate board director and C-Suite executive for global companies with more than 30 years of experience in the financial services sector |

| • | Broad experience in the areas of banking, asset management, insurance and private equity with a strong history of driving growth and transforming organizations through the lens of strategic vision |

|

|

LAURENCE C. MORSE Director

Age: 72

Director since: 2004

Managing Partner of Fairview Capital Partners, |

Committees:

Compensation (Chair) Executive Nominating & Corporate Governance |

Committees pending re-election at Annual Meeting: Compensation (Chair) Executive Nominating & Corporate Governance | |||

CAREER HIGHLIGHTS

| • | Managing Partner of Fairview Capital Partners, Inc., an investment management firm established in 1994 that oversees venture capital funds, some of which invest capital in venture capital partnerships and similar investment vehicles that provide capital primarily to minority-controlled companies |

| • | Serves as a member of the Board of Trustees of Harris Associates Investment Trust (which oversees the Oakmark Family of Mutual Funds) since 2013 |

| • | Chair of the Board of Trustees of Howard University |

| • | Former director of the Institute of International Education |

| • | Former director of Princeton University Investment Company and a former trustee of Princeton University |

| • | Former director and chairman of the National Association of Investment Companies |

SELECTED DIRECTOR QUALIFICATIONS:

| • | Entire career in the investment management field, including as the co-founder and Managing Partner of an investment management firm, which provides the Board with deep knowledge of capital markets and the financial services industry |

| • | Extensive experience has made him adept at performing rigorous risk assessments of managers and management teams, and assessing new technologies, products and services, business strategies, markets and industries |

14 | Webster Financial Corporation - 2024 Proxy Statement

|

ELECTION OF DIRECTORS |

|

|

RICHARD O’TOOLE Lead Independent Director

Age: 67

Director since: 2022 Director of Sterling since 2011 and Chair

Executive Vice President of The Related |

Current Committees:

Nominating & Corporate Governance Compensation Executive |

Committees pending re-election at Annual Meeting: Nominating & Corporate Governance Risk Executive | |||

CAREER HIGHLIGHTS

| • | Executive Vice President of The Related Companies, a position held since 2008, supporting the leadership to drive extraordinary growth through development and management of residential and commercial projects across the country |

| • | Former General Counsel of The Related Companies, responsible for tax structuring and origination of new business opportunities (2014-2022) |

| • | Former Partner in the Tax Department with Paul Hastings LLP (formerly Paul Hastings Janofsky & Walker LLP) (2000-2005) |

| • | Serves on the board of Equinox Holding Inc., a privately held company, and on its Compensation Committee |

| • | Serves on the board of Motivate, the operator of Citi Bike, a privately held company, and on the Compensation Committee |

| • | Served on the board of Ladder Capital Corp. (NYSE: LADR) (2017-2019) |

SELECTED DIRECTOR QUALIFICATIONS:

| • | Over 40 years of legal, merger and acquisition experience and expertise in real estate and tax matters |

| • | Strong leadership skills and corporate governance oversight experience |

|

|

MARK PETTIE Director

Age: 67

Director since: 2009

President of Blackthorne Associates, LLC |

Current Committees:

Risk (Chair) Executive Technology |

Committees pending re-election at Annual Meeting: Risk (Chair) Compensation Executive | |||

CAREER HIGHLIGHTS

| • | President of Blackthorne Associates, LLC, which provides consulting services to firms investing in a wide range of consumer-oriented businesses |

| • | Former Chairman and Chief Executive Officer of Prestige Brands Holdings, Inc. (NYSE: PBH), which developed, sold, distributed and marketed over-the-counter drugs, household cleaning products and personal care items (2007-2009) |

| • | Former President of the Dairy Foods Group with ConAgra (2005-2006) |

| • | Held various positions of increasing responsibility in general management, marketing and finance at Kraft Foods (1981-2004) and was named Executive Vice President and General Manager of Kraft Foods’ Coffee Division in 2002 |

| • | Serves as a member of the Board of Darigold as well as Chair of its Audit Committee and Member of its Compensation and Finance and Risk Committees since 2017 |

| • | Serves as director of Bear Down Brands since 2017 |

| • | Serves as director of Gehl Foods, LLC as well as Audit Committee Chair since 2015 |

SELECTED DIRECTOR QUALIFICATIONS:

| • | Experience as the former Chief Executive Officer and Chairman of a public company brings strong executive experience to the Board, along with his expertise in finance and marketing |

| • | Extensive business, corporate governance and risk management experience as a director for both public and private companies, with continued educational certification in FinTech and Financial Services |

Webster Financial Corporation - 2024 Proxy Statement | 15

|

ELECTION OF DIRECTORS |

|

|

LAUREN C. STATES Director

Age: 67

Director since: 2016

Former Vice President, Strategy and |

Current Committees:

Risk Technology |

Committees pending re-election at Annual Meeting: Risk Technology Audit | |||

CAREER HIGHLIGHTS

| • | Former Vice President, Strategy and Transformation for IBM Corporation’s Software Group (NYSE: IBM), having a career of more than 36 years in roles of increasing responsibility across the company, including as a leader in the company’s transformation to cloud computing, also serving as Chief Technology Officer in the corporate strategy function and in a broad variety of leadership roles including technology, strategy, transformation, sales and talent development |

| • | Serves as a member of the board of Clean Harbors, Inc. (NYSE: CLH), an environmental, energy and industrial services company, a position held since 2016, and serves on its Human Capital Committee and Chairs its Environmental Health and Safety Committee |

| • | Served as a member of the board of Diebold Nixdorf, Inc. (NYSE: DBD), a global financial and retail technology company, from 2020 to 2023, and served on its Nominating and Governance and Technology Committee |

| • | Serves on the board of NetBase Quid, a privately held marketing research company, a position held since 2020, and is Chair of its Audit Committee |

| • | Independent Director of Code Nation (a technology non-profit organization), serving on its Nominating and Governance Committee |

| • | Trustee for International House, New York (a graduate student housing non-profit organization), serving on its Development Committee |

| • | Served until April 2023 as an independent Director for the New England Science & Sailing Foundation, Stonington, Connecticut (a non-profit that provides an experiential STEM-based curriculum) |

SELECTED DIRECTOR QUALIFICATIONS:

| • | Experience as a former Chief Technology Officer of a public company, with a broad background in technology, strategy and transformation, provides the Board with strong executive and technology experience |

| • | Holds several Cybersecurity Certifications, including, CERT Certification in Cybersecurity Oversight (Software Engineering Institute at Carnegie Mellon University issued in conjunction with NACD), Cyber for Executives Certification (National Cybersecurity Center), Cybersecurity: The Intersection of Policy and Technology (Harvard Kennedy School) and Systemic Cyber Risk Governance for U.S. Public Company Corporate Directors (Digital Directors Network) |

|

|

WILLIAM E. WHISTON Director

Age: 70

Director since: 2022 Director of Sterling since 2014 and prior to that

Senior Advisor for the Archdiocese of New York |

Current Committees:

Audit Risk |

Committees pending re-election at Annual Meeting: Audit Compensation | |||

CAREER HIGHLIGHTS

| • | Senior Advisor and former Chief Financial Officer (2002-2023) for the Archdiocese of New York, a religious not-for-profit organization |

| • | Acting Chief Executive Officer of New York Catholic Healthcare Plan, Inc. (Legacy Fidelis Care) since 2018 |

| • | Former Executive Vice President and Member of U.S. Management Committee of Allied Irish Bank (1972-2002), responsible for a number of key functions, including Head of Acquisitions and Brand Development, Head of e-Commerce and Information Technology, Head of Church/Not-for-Profit Lending Group, Head of Financial Consulting Services and Head of Operations |

| • | Serves as a Trustee of St. Patrick’s Cathedral, St. Patrick’s Landmark Foundation and St. Joseph’s Seminary |

| • | Member of Board of Provident Healthcare, the member of Archcare, the healthcare arm of the Archdiocese of New York |

| • | Serves on the boards of Mutual of America Investment Corporation and Mutual of America Variable Life Insurance Portfolios, Inc. since 2011, and serves on the Audit Committee |

| • | President of Catholic Indemnity Insurance Company |

SELECTED DIRECTOR QUALIFICATIONS:

| • | Over 45 years of business experience in the areas of finance, financial services and e-commerce |

| • | As a former bank executive, has experience in a wide range of roles and provides the Board with a unique perspective on business management matters |

|

✓ THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF EACH OF THE NOMINEES LISTED ABOVE.

| ||

16 | Webster Financial Corporation - 2024 Proxy Statement

|

BOARD MEETINGS, COMMITTEES OF THE BOARD AND RELATED MATTERS |

| BOARD MEETINGS, COMMITTEES OF THE BOARD AND RELATED MATTERS |

Commitment to Good Governance Practices

The business and affairs of Webster are managed under the direction of the Board. Members of the Board are kept informed of Webster’s business through discussions with the Chairman of the Board and Chief Executive Officer and Webster’s other executive officers, by reviewing materials provided to the directors and by participating in meetings and strategic planning sessions of the Board and its committees. The Board is also kept apprised by the Chairman of the Board and Chief Executive Officer, senior management, and Webster’s legal department of continuing education programs on corporate governance and fiduciary duties and responsibilities. In addition, new directors of Webster participate in an orientation program, which is designed to familiarize them with Webster’s business and operations and with their duties as directors under applicable laws and regulations. Each member of the Board also serves as a director of Webster Bank.

Board Leadership Structure and Function

CHAIRMAN AND CHIEF EXECUTIVE OFFICER AND LEAD INDEPENDENT DIRECTOR ROLES

The Board determined that having Mr. Ciulla as Chairman and Chief Executive Officer and Mr. O’Toole as Lead Independent Director is the best leadership structure for the Company at this time, based on present needs and circumstances. Mr. O’Toole replaced Mr. Atwell as Lead Independent Director effective as of February 1, 2024. This structure, among other things, allows for Mr. Ciulla to preside at meetings of the Company’s stockholders and the Board and set the overall strategy and tone for the Company and lead its operations and strategic priorities. Mr. O’Toole provides additional and independent leadership for the Board, including presiding over executive sessions of independent directors and other clearly defined duties and responsibilities. Mr. O’Toole is a seasoned leader who possesses the characteristics and qualities critical for a Lead Independent Director.

Our Lead Independent Director is appointed in accordance with Webster’s Corporate Governance Policy, which provides that the Board will appoint an independent director to serve as the Lead Independent Director for a one-year term, or until a successor is appointed. The Lead Independent Director presides over the executive sessions of the independent directors and assists and advises the Chairman of the Board and has other robust and well-defined duties as described below.

| The responsibilities of our Lead Independent Director include the following:

| ||||||

| ✓ |

Preside over executive sessions of independent directors and other meetings where the Chairman is not present

|

✓ | Review and approve matters such as schedule sufficiency and information provided to Board members

| |||

| ✓ |

Has authority to call meetings of the independent directors

|

✓ | Assist with promoting corporate governance best practices

| |||

| ✓ |

Review and approve agenda items for Board meetings

|

✓ | Involved in selection and interviewing of new board members

| |||

| ✓ |

Facilitate Board focus on key issues and tasks

|

✓ | Facilitate the function of an efficient & effective Board

| |||

| ✓ |

Serve as a liaison among the Chairman and Chief Executive Officer and independent directors

|

✓ | Consult with directors on annual Board and committee assessment processes

| |||

| ✓ |

Contribute to the annual performance review of the Chief Executive Officer and participate in the Chief Executive Officer succession planning

|

✓ | Preside over the independent directors’ annual meeting with Webster’s primary bank regulators to discuss Board oversight of management | |||

DIRECTOR INDEPENDENCE

Pursuant to the NYSE listing standards, Webster is required to have a majority of “independent directors” on its Board. In addition, each of the Board’s Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee must be composed solely of independent directors. The NYSE listing standards define specific relationships that would disqualify a director from being independent and further require that for a director to qualify as “independent,” the board of directors must affirmatively determine that the director has no material relationship with the Company.

The Board, with the assistance of the Nominating and Corporate Governance Committee, conducted an evaluation of director independence, based primarily on a review of the responses of the directors to questions regarding employment and compensation history, affiliations and family and other commercial, industrial, banking, consulting, legal, accounting, charitable and legal relationships with Webster, including those relationships described under “Compensation Committee Interlocks and Insider Participation” on page 48 and “Transactions with Related Persons” on page 54 of this Proxy Statement, and on discussions with the Board. As a result of this evaluation, the Board affirmatively determined that each of Messrs. Atwell, Cahill, Morse, O’Toole, Pettie, and Whiston and Mses. Hayles, Aboelnaga Kanaan, Mitchell and States is an “independent director” for purposes of Section 303A of the Listed Company Manual of the NYSE and applicable SEC rules and regulations. In connection with its evaluation of director independence, the Board considered that Webster provides lending and other financial services to directors, their immediate family members, and their affiliated organizations in the ordinary course of business and without preferential terms or rates.

Mr. Ciulla is not considered independent because he is an executive officer of Webster and Webster Bank.

2023 BOARD AND COMMITTEE MEETINGS

During the year, Webster held 18 regular and special meetings of its Board. All directors attended at least 75% of the aggregate of (i) the total number of meetings held by the Board during the period that the individual served and (ii) the total number of meetings held by all committees of the Board on which the individual served during the period that the individual served. In 2023, Jack Kopnisky served as our Executive Chairman.

EXECUTIVE SESSIONS OF INDEPENDENT DIRECTORS

In keeping with Webster’s Corporate Governance Policy, in 2023, the Board held four meetings that were limited to independent directors. The Lead Independent Director presides over the executive sessions of independent directors.

Webster Financial Corporation - 2024 Proxy Statement | 17

|

BOARD MEETINGS, COMMITTEES OF THE BOARD AND RELATED MATTERS |

ORIENTATION TRAINING AND CONTINUING EDUCATION

Our Board believes that director education is essential to the ability of our directors to provide oversight and fulfill their roles. New directors are required to participate in an orientation program, which includes the introduction of the new directors to the Company’s principal officers and presentations by senior management to familiarize new directors with the Company’s strategic plans and business efforts. Throughout the year, our directors participate in continuing education activities and receive educational materials on a wide variety of topics (including corporate governance, ESG, the financial services industry, cybersecurity, technology, BSA / AML, executive compensation, risk management, finance, and accounting). These educational opportunities provide our directors with timely updates on industry changes and best practices among our peers and in the general marketplace and further supplement our directors’ significant business and leadership experiences.

DIRECTOR OVERBOARDING POLICY

Webster limits the number of other public company boards our directors may join to ensure that a director is not “overboarded” and is able to devote the appropriate amount of time and attention to the oversight of the Company, including attendance at Board and committee meetings. Our Board Qualification Guidelines provide that no director may serve on the board of more than three public companies (including Webster and its subsidiaries).

RISK OVERSIGHT