RENT-2014.3.31-10K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

_______________________________________

FORM 10-K

|

| | |

[X] | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the Fiscal Year Ended: March 31, 2014 |

OR |

[ ] | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 000‑15159

|

|

RENTRAK CORPORATION |

(Exact name of registrant as specified in its charter) |

|

| | | | |

Oregon | | 93-0780536 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

7700 NE Ambassador Place, Portland, Oregon | | 97220 |

(Address of principal executive offices) | | (Zip Code) |

| Registrant’s telephone number, including area code: 503‑284-7581 | |

| Securities Registered pursuant to Section 12(b) of the Act: | |

Title of each class | | Name of each exchange on which registered |

Common Stock, $0.001 par value per share | | The NASDAQ Stock Market LLC (NASDAQ Global Market) |

| Securities registered pursuant to Section 12(g) of the Act: None | |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes ¨ No ý

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: Yes ¨ No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K, or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | |

Large accelerated filer | ¨ | | | Accelerated filer | ý |

Non-accelerated filer | ¨ | (Do not check if a smaller reporting company) | | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates, computed by reference to the last sales price ($32.62) as reported by the NASDAQ Global Market, as of the last business day of the Registrant’s most recently completed second fiscal quarter (September 30, 2013), was $376,570,434.

The number of shares outstanding of the Registrant’s Common Stock as of June 2, 2014 was 12,286,801 shares.

Documents Incorporated by Reference

The Registrant has incorporated into Part III of Form 10‑K, by reference, portions of its Proxy Statement for its 2014 Annual Meeting of Shareholders.

RENTRAK CORPORATION

2014 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

|

| | | |

| | Page |

| |

| | |

| | |

| | |

Item 1. | | |

| | |

Item 1A. | | |

| | |

Item 1B. | | |

| | |

Item 2. | | |

| | |

Item 3. | | |

| | |

Item 4. | | |

| | |

| | |

| | |

Item 5. | | |

| | |

Item 6. | | |

| | |

Item 7. | | |

| | |

Item 7A. | | |

| | |

Item 8. | | |

| | |

Item 9. | | |

| | |

Item 9A. | | |

| | |

Item 9B. | | |

| | |

| | |

| | |

Item 10. | | |

| | |

Item 11. | | |

| | |

Item 12. | | |

| | |

Item 13. | | |

| | |

Item 14. | | |

| | |

| | |

| | |

Item 15. | | |

| | |

| | |

Forward-Looking Statements

Certain information included in this Annual Report on Form 10-K (including Management’s Discussion and Analysis of Financial Condition and Results of Operations regarding revenue growth, gross profit margin and liquidity) constitute forward-looking statements that involve a number of risks and uncertainties. Forward-looking statements may be identified by the use of forward-looking words such as “could,” “should,” “plan,” “depends on,” “predict,” “believe,” “potential,” “may,” “will,” “expects,” “intends,” “anticipate,” “estimates” or “continues” or the negative thereof or variations thereon or comparable terminology. Forward-looking statements in this Annual Report on Form 10-K include, in particular, statements regarding:

| |

• | the future growth prospects for our business as a whole and individual business lines in particular, including adding new clients, adjusting rates and increasing business activity, and using funds in our foreign bank accounts to fund our international expansion and growth; |

| |

• | increases in our costs over the next twelve months; |

| |

• | future acquisitions, investments or divestitures; |

| |

• | our plans or requirements to hold or sell our marketable securities; |

| |

• | our relationships with our customers and suppliers; |

| |

• | our ability to attract new customers; |

| |

• | market response to our products and services; |

| |

• | increased spending on property and equipment in Fiscal 2015 for the capitalization of internally developed software, computer equipment, and other purposes; |

| |

• | expected amortization of our deferred rent; and |

| |

• | the sufficiency of our available sources of liquidity to fund our current operations, the continued current development of our business information services and other cash requirements through at least March 31, 2015. |

These forward-looking statements involve known and unknown risks and uncertainties that may cause our results to be materially different from results implied by such forward-looking statements. These risks and uncertainties include, in no particular order, whether we will be able to:

| |

• | successfully develop, expand and/or market new services to new and existing customers, including our media measurement services, in order to increase revenue and/or create new revenue streams; |

| |

• | timely acquire and integrate into our systems various third party databases; |

| |

• | compete with companies that may have financial, marketing, sales, technical or other advantages over us; |

| |

• | successfully deal with our data providers, who are much larger than us and have significant financial leverage over us; |

| |

• | successfully manage the impact on our business of the economic environment generally, both domestic and international, and in the markets in which we operate, including the financial condition of any of our suppliers or customers or the impact of the economic environment on our suppliers’ or customers’ ability to continue their services with us and/or fulfill their payment obligations to us; |

| |

• | effectively respond to rapidly changing technology and consumer demand for entertainment content in various media formats; |

| |

• | manage and/or offset any cost increases; |

| |

• | add new clients or adjust rates for our services; |

| |

• | adapt to government restrictions; |

| |

• | leverage our investments in our systems and generate revenue and earnings streams that contribute to our overall success; |

| |

• | enhance and expand the services we provide in our foreign locations and enter into additional foreign locations; and |

| |

• | successfully integrate business acquisitions or other investments in other companies, products or technologies into our operations and use those acquisitions or investments to enhance our technical capabilities, expand our operations into new markets or otherwise grow our business. |

Please refer to Item 1A. Risk Factors in this Annual Report on Form 10-K for a discussion of reasons why our actual results may differ materially from our forward-looking statements. Although we may elect to update forward-looking statements in the future, we specifically disclaim any obligation to do so, even if our expectations change.

PART I

Overview

We are a global media measurement and information company serving the entertainment, television, video and advertising industries. Our Software as a Service (“SaaS”) technology merges census-based television viewership information from over 100 million TVs and devices with consumer behavior and purchase information (“Advanced Demographics”) across multiple platforms, devices and distribution channels. We also measure box office results from more than 100,000 movie screens in 36 countries throughout the world. We process and aggregate hundreds of billions of data transactions from multiple screens wherever entertainment content is viewed, whether at the box office, on a television screen, over the internet, on a smart phone or other portable device. Rentrak measures live TV, recorded TV (“DVR”), Video-On-Demand (“VOD”), and whether the content is free, purchased, rented, recorded, downloaded or streamed from multiple channels. These massive content databases provide stable and granular viewership information across every screen (“multiscreen”) and are anonymously matched with third-party consumer segmentation and purchase databases using privacy compliant methodologies. By linking multiscreen viewership information with information about the products viewers consume and prefer, we provide our clients, such as content producers, distributors, advertisers and advertising agencies, with the knowledge necessary to more effectively manage their businesses, program and market their networks and more precisely target and sell their advertising inventory. The benefits to the advertising community are improvements in profitability while effectively targeting specific TV shows against the demographics of the products viewers buy, the cars they drive and how they are likely to vote in elections. The benefits to the movie industry and video (TV) content owners are they can manage their businesses in real time or near real time and also improve their profitability. Additionally, certain clients use our databases to populate programmatic buying systems. These systems automate the buying process and introduce efficiencies for both advertising agencies and their clients.

Rentrak Corporation is an Oregon corporation and was incorporated in 1977, and is headquartered in Portland, Oregon, with additional offices in the United States and around the world.

Previously, we had two operating divisions within our corporate structure and we reported certain financial information by individual segment under this structure. Those two operating divisions were our Advanced Media and Information (“AMI”) operating division, which included our media measurement services, and our Home Entertainment operating division, which included our distribution services as well as services that measure, aggregate and report consumer rental activity on film product from traditional “brick and mortar,” online and kiosk retailers.

During the fourth quarter of the fiscal year ended March 31, 2014 (“Fiscal 2014”), we initiated our plan to sell our Pay Per Transaction® (“PPT®”) business, which has been a longstanding legacy business of Rentrak and a significant component of the Home Entertainment operating division. The PPT® business represented 42.5%, 48.3% and 58.4% of our total revenue for our fiscal years ended March 31, 2013, 2012 and 2011. For Fiscal 2014, it would have represented 37.4% of our total revenue if we had decided to retain the line. Our PPT® business has been in a state of decline due to the decline of physical DVD rentals from retail stores. This strategic decision to sell PPT® will enable us to focus more fully on the growth of our media measurement business and advanced consumer targeting business. Accordingly, we have restated our financial results and the PPT® business is reported as discontinued operations for all periods presented.

As a result of our plan to divest our PPT® business, we will operate in a single business segment encompassing our media measurement services which are primarily delivered through scalable, SaaS products within our Entertainment Essentials™ lines of business. These syndicated big data services, offered primarily on a recurring subscription basis, provide consumer viewership information integrated with consumer segmentation and purchase behavior databases. We provide film studios, television networks and local stations, cable, satellite and telecommunications company (“telco”) operators, advertisers and advertising agencies unique insights into consumer viewing and purchasing patterns through our comprehensive and expansive information on local, national, VOD and “Over the Top” television performance and worldwide box office results. Our movie measurement business is a global business measuring more than 90% of the ticket sales globally in real or near real time, allowing for decisions to be made to market, promote and manage the industry for maximum profitability.

Our Products and Services

Our media measurement services are distributed to clients through patent pending software systems and business processes into two broad areas within the entertainment industry, which we refer to as Movies Everywhere™ and TV Everywhere™. We refer to our approach as the “census-based (or census-like) currency.” The results for TV Everywhere™ are from nearly every zip code in America, projected to all 210 local TV markets and to a national level across multiple distribution platforms. This method results in granular levels of processing from billions of transactions and establishes us as the only company that provides a television ratings census-like currency with Advanced Demographics (the products we buy and the “lifestyles” we lead). We are the only source of worldwide movie box office results, trends and insights. Our business growth of Movies Everywhere™ is due to our continued expansion of our global footprint, as well as the introduction of new products to help studios and content creators better monetize their content for maximum profitability. We also believe there is significant opportunity for continued growth within our TV Everywhere™ service offerings. As the TV, video and advertising sectors continue to evolve, they are becoming increasingly more fragmented, and consumers can view a wide variety of entertainment content wherever and whenever they choose via an expanding array of devices and technologies. We have invested heavily in our systems, processes and databases in order to address the evolving needs of the industry and help our clients maximize the efficiency and effectiveness of their advertising programs. Our systems capture total television audience information by providing the largest coverage from multiple screens and providers and merge that information with Advanced Demographics and information relating to actual consumer purchase behavior. We are the only company who can offer a census-like currency to our clients.

Our services are designed to help our clients understand consumer viewing, reaction and purchase behavior everywhere content and advertising are consumed to allow both sellers and buyers to more precisely target the most relevant viewing audience. This precise targeting enables our clients to optimize their marketing, sales and advertising strategies. The majority of our service offerings are related to four major types of content: 1) ad supported content, specifically linear television which can be viewed as a scheduled program, in a time-shifted manner, on VOD, streamed or downloaded from the internet or via a mobile device, 2) subscription- or transactional-based programming content, 3) advanced media and analytics, which provides audience targets, measurement and marketing mix optimization for television and digital viewing content combined and 4) theatrical box office content. Typical customers utilizing our services include content producers, studios, distributors, national networks, local stations, satellite and cable operators, agencies, and a wide spectrum of advertisers, ranging from traditional consumer brands to various political groups. We also provide many of our clients tailored research and analytical solutions unique to their needs and specifications.

Our most significant lines of business, which we refer to as Entertainment Essentials™ services, are:

| |

• | TV Everywhere™, which includes TV Essentials® and StationView Essentials™; |

| |

• | OnDemand Everywhere®, which includes OnDemand Essentials®, Over the Top measurement products and related products; |

| |

• | Movies Everywhere™, which includes domestic and international Box Office Essentials®, PostTrak® and PreAct™; and |

| |

• | Other Services, which includes our Studio Direct Revenue Sharing (“DRS”) and other products relating to content in the home video rental industry. |

In August 2013, we acquired iTVX, a provider of branded entertainment analytics, insight and research. Going beyond traditional product placement, branded entertainment is the creation and integration of original branded content into television, movie and other digital entertainment content types. Successful branded entertainment spurs consumers to engage and interact with a brand through the strategic placement of marketing messages across every screen. Our branded entertainment services provide our clients with the impact brand integration has on consumers across movie and television content on all screens, which enables users to assess the total media value of their campaigns. The financial results of iTVX from the date of acquisition are included within our TV Everywhere™ line of business.

Our revenue increased $18.6 million, or 32.6%, in Fiscal 2014 compared to the fiscal year ended March 31, 2013 (“Fiscal 2013”). Our current spending, investments and long-term strategic planning are heavily focused on the innovation, development, growth and expansion of our services and product lines, both domestically and internationally. As such, we continue to allocate significant resources towards innovation and the expansion of our data assets and technology as well as our research, analytics and sales groups. These strategic investments, many of which are expensed as incurred, have lowered our overall operating performance and, as a result, we had operating losses from continuing operations of $9.5 million and $26.5 million for Fiscal 2014 and Fiscal 2013, respectively.

TV Everywhere™

We provide our customers with second-by-second performance metrics that deliver consumer viewing behavior for scheduled, interactive, and digital video recorder (“DVR”) television content. We aggregate transaction-level data across all 210 designated local television markets in the United States, which are projected to the complete footprint of television households resulting in massive amounts of viewing behavior from every market. We currently have multi-year contracts with a number of data providers including DISH Network L.L.C. (“DISH”), AT&T Services, Inc. (“AT&T), Charter Communications, Inc., and FourthWall Media, Inc. and will soon be integrating data from DIRECTV LLC and Cox Communications, Inc. (“Cox”), expanding our measurement footprint even further. Our viewership information, which integrates satellite, telco, cable and projects Over the Air viewing, provides our customers with a deep level of granularity and stability, and thus the competitive advantage of a more informed understanding of the viewing audience. We provide our customers with access to information from hundreds of networks, which is more than twice as much available elsewhere. Our technology includes web-based reporting systems, which provide clients with instant access to the measurement metrics and detailed analytics key to tracking content and consumer behavior across multiple platforms and devices. We also provide Advanced Demographics, which allow our customers to more accurately pinpoint audiences they want to reach, by combining our massive viewership information with third party consumer behavior information from a variety of industry-leading sources, enabling our customers to develop more targeted approaches to ad selling and buying. As an example of our census-like currency, our roster of political advertisers continues to quickly expand because we help candidates target the audiences they want to reach and more efficiently and effectively utilize their campaign funds. Our most significant products for measurement of national and local television audiences within our TV Everywhere™ services include TV Essentials® and StationView Essentials™.

TV Essentials® is a comprehensive suite of research and analytical tools that reports network television audience viewership patterns across all facets of television programming and advertising, including linear and DVR television viewing. By providing transaction-level performance metrics from millions of televisions across the United States, TV Essentials® helps our national network, agency and advertiser clients make better decisions by giving them a greater and more relevant and reliable understanding of the true value of their viewing audiences. We provide insight into programming effectiveness, enabling networks and network operators to optimize their TV advertising inventory. Developed with the potential capacity to handle data from all of the nation’s television households, the system can isolate individual market, network, series or telecast performances, administer national and local estimates and provide an evaluation of influencing factors such as purchase behaviors and Advanced Demographics for competitive, in-depth intelligence. One of the biggest advantages of TV Essentials® is that it combines the stability and granularity of TV viewing information with marketing segmentation and advertiser databases, resulting in robust targeted TV viewership intelligence. Our advanced television targeting enables our customers to spend their advertising dollars more efficiently and effectively since they are able to target consumers who they believe will purchase their products. In addition, with TV Essentials® Exact Commercial Ratings®, we are able to provide our national clients with the ability to determine the performance of a specific commercial on their network campaigns so they can plan, buy and sell advertising more strategically.

StationView Essentials™ is a local market television measurement and analytical service specifically designed to meet the unique needs of local television station and cable sales, news and management teams, as well as local agency media directors, planners and buyers. StationView Essentials™ allows clients to better understand consumer viewing patterns across local TV stations and cable channels in their market(s), monitor and maximize daily program performance by evaluating viewing trends down to the minute, and identify how similar audiences view programming across multiple stations and local cable channels to (a) more efficiently and effectively promote viewership to a particular station and (b) negotiate inventory pricing. With our stable and reliable ratings information and our highly targeted Advanced Demographics, clients can isolate and reach the customers most likely to purchase a given product and sell or buy their advertising far more effectively and profitably. Our local market services provide insights which stations and agencies can use to accurately pinpoint the audiences they want to reach, which increases the value of the inventory and, ultimately, enables our customers to either sell their inventory for a higher price or buy their schedules more effectively, thereby increasing the advertisers’ sales volume.

Technology has evolved in terms of how television advertising is bought and sold. Systems have been developed to automate the TV ad buying and selling processes, which is referred to as programmatic buying/selling for television advertising (“Programmatic TV”). Programmatic TV is different from current sales methods because it enables sellers and buyers to use computer software to automatically sell/buy inventory based on the relevance of the audience and efficiency of the pricing. With our Advanced Demographics and granular census currency, used by several companies utilizing Programmatic TV systems, we can help our clients target their desired audiences far more effectively. For example, local cable and satellite providers are embracing Programmatic TV because the technology allows them to use audience viewing information to more effectively understand the type of people who are watching their ads. Our services would show our clients that viewers of a particular network at a particular time are more likely to be in the market for a particular product. This knowledge enables them to increase the value of their

advertising inventory and increase the likelihood that specific targeted audiences are exposed to specific ads, thereby adding to our client’s profitability.

OnDemand Everywhere®

The VOD market continues to evolve and change and the amount of time spent with on demand broadcast prime-time content increased by 24% in calendar 2013. Innovation and technological advances continue to provide improved viewer experiences across a growing number of distribution platforms. Consumers are demonstrating increased control over what entertainment content they watch, when they watch it and on what device, whether from a television, on a DVR, on VOD, or from a wide variety of Over the Top (“OTT”) platforms, such as Netflix, Hulu, VUDU and iTunes, and TV Everywhere™ platforms such as Xfinity, FiOS, and AT&T U-Verse, which continues to increase the breadth of entertainment content available to the consumer. Another significant shift continues to occur as consumers move away from paid VOD content to what is known as “Free on Demand,” or ad supported, content. Currently, more than 78% of all VOD content viewed is Free on Demand and over half of the viewing happens after the seventh day that it is aired. These trends are also changing the way TV operators perceive the advertising opportunity, how advertisers look at viewership information and how content providers monetize their content. We are uniquely positioned as the only company with full census measurement of VOD. We currently collect 100% of all VOD television viewing data in the United States from more than 110 million television sets and report information relating to how consumers interact with this content.

Our information includes VOD, broadband, video and mobile device content transactions, and we currently receive our data from all multi-system operators, including Comcast Corp, Time Warner Cable, Inc., AT&T, Cox and Charter Communications, Inc., as well as network-owned sites and apps, mobile content providers such as AT&T, Cox, T-Mobile and Mobi.tv, iTunes, Xbox, VUDU, PlayStation, Google and Amazon. Our OnDemand Everywhere® products include OnDemand Essentials®, AdEssentials®, Internet TV Essentials®, Digital Download Essentials®, VOD Monitor™ and Mobile OnDemand Essentials™. The most significant service is OnDemand Essentials®.

OnDemand Essentials® (“ODE”) provides multichannel video programming distributors (“MVPDs”) and content providers (including broadcast/cable networks and studios) with a transactional tracking and reporting system to view and analyze the performance of VOD content. This web-based system provides clients throughout the United States, Canada and Spain with access to the tools needed to track on demand content, trends and consumer behavior and represents information from over 110 million televisions from every operator that offers VOD programming. Our system includes daily, census-level data of current and historical market- and title-level content performance from 43 MVPDs.

Rentrak is the planning currency for VOD advertising today. Our other services within OnDemand Everywhere® currently include the measurement of VOD advertising across our national footprint of operators as well as tracking and reporting on the availability of VOD content. We also provide an auditing service which contains performance intelligence on purchased and rented movie and television content downloaded or streamed via the internet, including royalty report tracking. Additionally, our systems process online usage data to help clients manage their ad-supported and subscription-based television programming content streamed online.

There are also some significant advances in the industry relating to television advertising technology which will allow our clients to better monetize their content and capture more of the growing number of people who watch television on a time-shifted basis, often days or weeks after a show airs. This newer technology, Dynamic Ad Insertion (“DAI”), enables TV networks to switch out and replace ads on programs that air on VOD in as little as 24 hours, instead of having to wait weeks which has been the case previously. DAI will make it much easier for networks to remove ads that can become stale or irrelevant after a few days, thus making VOD a more attractive medium for advertisers. VOD content providers will be able to use our OnDemand Essentials® systems to better understand viewership, make more informed advertising decisions using our Advanced Demographics and more precisely target the right consumers at the right time. Dynamic advertising represents a great opportunity for growth for Rentrak as we expand our services to include ad measurement in addition to content measurement.

Our arrangements with our clients and the information we provide them are also changing and expanding. Historically, our content providers could only access information relating to how their own content performed across all MVPDs. They were not able to see the performance of the content of other providers. Now, we are able to show how a title performs compared to all other titles. We believe our title-level transparency capabilities, which extend across many networks, including all our major networks, will create value for our clients and will enable us to expand our product offerings relating to VOD advertising and content performance. We are also working on initiatives to apply the same Advanced Demographics to VOD as we have in our TV Essentials® service, which will help our clients understand the quality of the VOD audience and not just the size.

We are currently beta testing a new service, Multiscreen Essentials™, which expands the capability of our ODE service to provide cross-platform reporting for VOD content viewed beyond the television set (e.g., internet streaming, portable and mobile devices). We currently have all the data from major MVPDs for multiple platforms, totaling approximately eight million households. We intend to sign more data providers to expand our household coverage and create a large amount of cross-platform information, similar to how we use our large amount of information in linear TV.

See below for a discussion within the “Innovation, Research, Development and Technology” section for more information on a comprehensive product solution which combines both our TV and OnDemand Everywhere® data assets. We continue to work to obtain and/or incorporate data from new and existing providers relating to online, mobile and OTT content. We are well positioned to continue to grow this business by adding new clients and adjusting rates as business activity increases and as advanced advertising technology is rolled out by the industry.

Movies Everywhere™

As the global movie currency, precisely measuring movie viewership from more than 90% of the worldwide box offices, Rentrak goes beyond simply reporting what movies people saw to answer three key questions: Will they go? How much did they spend? And, what did they think? Our most significant products for measurement of box office results, as well as audience sentiment, within our Movies Everywhere™ services include Box Office Essentials®, PostTrak® and PreAct™.

Box Office Essentials® provides a full census measurement of domestic and international theatrical gross receipts and attendance information combined with detailed analytics to motion picture studios and movie theater owners in 36 countries. Rentrak is the only provider of this key information to the motion picture industry. We provide studios with access to box office performance information pertaining to specific motion pictures and movie theater circuits, including real-time, geographic-specific and historical information. Data is obtained via internet or phone connectivity to theater box offices and is collected for an aggregate of more than 90% of all movie theaters in the United States, Canada, Russia, China, Hong Kong, the United Kingdom, Ireland, Italy, Australia, New Zealand, Japan, South Korea, Taiwan, Germany, Austria, the Netherlands, France, Mexico, Colombia, Venezuela, Argentina, Brazil, Spain, Portugal, Chile, Bolivia, Costa Rica, El Salvador, Guatemala, Honduras, Malaysia, Singapore, Nicaragua, Panama, Paraguay, and Peru. Box Office Essentials® delivers box office results from more than 100,000 movie screens in 36 countries throughout the world. We are also currently expanding into other locations, such as India and South Africa, and plan to report on these areas in the coming months.

PostTrak® is our exit polling service, which delivers additional real-time insights relating to a movie’s performance, such as audience reaction about the film, as well as specific demographic information relating to attendance, such as gender, ethnicity and age.

PreAct™, which was launched during the fourth quarter of Fiscal 2014, is a long-lead measurement tool that helps clients gauge the performance of a theatrical marketing campaign. PreAct™ allows users to effectively monitor the strength of a film’s marketing campaign up to a year in advance of its release by monitoring audience sentiment from social media. PreAct™ quantifies these insights, allowing users the opportunity to modify their campaigns accordingly during the critical marketing stage of a film.

Box Office Essentials® information is used around the world by major news channels, such as CNBC, as well as major internet sites, such as Yahoo and in major news publications around the world, like Bloomberg News, The Wall Street Journal, the Hollywood Reporter, USA Today, and The New York Times, to name a few. We are the source for box office reporting globally.

We have long-term relationships with each of the major Hollywood studios (“Global Clients”) in the United States and abroad. Currently, there are no competitors who provide this service, and we believe that the barriers to entry are quite high because the Global Clients prefer a single system with world-wide reporting capabilities. In particular, our service provides these Global Clients with access to information relating to all other market participants.

Other Services

Our Other Services include products relating to physical content in the home video rental industry, the most significant of which is Studio Direct Revenue Sharing (“DRS”).

Studio Direct Revenue Sharing (DRS) is a service that grants content providers timely and consistent insights, plus valuable checks and balances, regarding how both their video products and their retail customers are performing. Data

relating to rented entertainment content is received on physical product under established agreements on a fee-for-service basis.

These services include entertainment content relating to units rented and/or sold by large online retailers, kiosk operators, and “brick-and-mortar” retailers, such as Netflix, Redbox and Hastings Entertainment (“DRS Retailers”). Our services are tailored to meet the needs of content providers, which include major studios and independent program suppliers, such as Twentieth Century Fox Home Entertainment, Inc., Warner Home Video, and Sony Pictures Home Entertainment, Inc. For each DRS client, we collect, process, audit, summarize and report the number of transactions and corresponding revenue generated on each title distributed to DRS Retailers on a revenue sharing basis. We also provide in-depth inventory tracking by title, retailer and location. Additionally, we conduct numerous periodic physical and electronic audits of DRS Retailers, combined with actual testing of transactions processed through their POS systems, to ensure all DRS inventory is utilized in a manner consistent with the terms of the DRS Retailer’s revenue sharing arrangement with our DRS clients.

Innovation, Research, Development and Technology

We are making significant investments in our systems which support our existing service lines. We continue to integrate various third-party databases with our products, which we believe will help advertisers deliver the right message at the right time to the right consumer group. We continue to build our analytic capabilities, which enable us to move our products from data-based to more comprehensive and applicable knowledge-based products and services. These expenditures will likely increase our costs over the next twelve months. We believe we will be able to leverage these investments and generate revenue and earnings streams that contribute to our overall success.

We are also investing significant resources in, and continue to develop and expand, our comprehensive services that provide business insights, research and analytics across multiple media platforms to provide our clients with insight into movies and TV from every viewing device. Our comprehensive services will include TV, DVR, internet TV, mobile, digital and VOD. This system is being designed to compile usage data, using common metrics, to illustrate each platform’s individual contribution and compare it against other media platforms. With the ability to track records across various media, this new multiscreen service will be designed to allow users to comprehend how content is being consumed by end users, interpret the effect such consumption has on other media platforms, understand consumer adoption of new platforms, visualize cross-platform consumption and support more complex advertising models by targeting audiences on every platform.

Competition

Our primary competitors in these markets are Nielsen, Kantar (a subsidiary of WPP Group) and TiVo, which are companies with significantly greater resources than Rentrak. Nielsen’s, Tivo’s and Kantar’s services are largely based on a sampling methodology with a small sample in each market which is used to measure television viewing behaviors, and are currently the television industry’s standard measurement of television ratings behavior for advertising purposes, referred to as the sample currency.

We compete in these markets primarily on the basis of product performance. Our services and systems differ from a sample service in that we offer a measurement system based on a massive amount of passively-collected viewing activity, which results in far more granular, reliable and predictable solutions as compared to the small, compensated sample approach used by most of our competitors. We refer to our approach as the “census-like currency” and project the results to local and national levels across multiple platforms. This method results in granular levels of processing from billions of transactions and establishes us as the only company that provides television ratings in a census-like currency. We believe this positions us to offer a more comprehensive, representative, targeted, and relevant system that networks, stations, agencies and advertisers are demanding and, consequently, that the market will continue to purchase our measurement products.

Trademarks, Copyrights, Proprietary Rights and Patents

In the United States, we have registered our RENTRAK®, PPT®, Pay Per Transaction®, Essentials®, Box Office Essentials®, PostTrak®, Home Video Essentials®, OnDemand Everywhere®, OnDemand Essentials®, AdEssentials®, TV Essentials®, Digital Download Essentials®, Exact Commercial Ratings®, Internet TV Essentials®, Multiscreen Essentials® trademarks, among others, and applied to register other marks under federal trademark laws. We have applied to register and obtained registered status in several foreign countries for many of our trademarks. We believe our Entertainment Essentials™ software is entitled to copyright protection. We believe that our intellectual property is important to our marketing efforts and the competitive value of our services, and we intend to take appropriate action to halt infringement and protect against improper usage.

We own two patents directed to techniques for extracting revenue information from point-of-sale terminals, three patents for various aspects of linear television data collection, projections and analysis, and a number of patent pending applications covering various aspects of our technology. We have applied for additional patents related to certain of our proprietary technologies, primarily for our Entertainment Essentials™ Suite of products. We believe our proprietary technologies, in combination with our ability to innovate and our personnel, provide us with advantages over our competitors’ technologies. There is no assurance, however, that we will be able to obtain patents covering such proprietary technologies.

Employees

As of March 31, 2014, we employed 414 full-time associates and 110 part-time associates. We consider our relations with our associates to be good.

Financial Information About Industry Segments, Enterprise-Wide Data and Geographic Information

See Note 17 of Notes to the Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K.

Available Information

We file annual, quarterly and other reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”) under the Securities Exchange Act of 1934, as amended (“Exchange Act”). We also make available, free of charge on our website at www.rentrak.com, our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after they are filed electronically with the SEC. Information on our website does not constitute part of this report or of any other report we file or furnish with the SEC. You can inspect and copy our reports, proxy statements and other information filed with the SEC at the offices of the SEC’s Public Reference Room located at 100 F Street, NE, Washington D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of Public Reference Rooms. The SEC also maintains an internet website at http://www.sec.gov/ where you can obtain most of our SEC filings. You can also obtain paper copies of these reports, without charge, by contacting Investor Relations at (503) 284-7581.

Certain Entertainment Essentials™ services face various obstacles to widespread market adoption, including competition from companies with significantly greater resources than ours.

Our Entertainment Essentials™ services are dependent on several factors for long-term success, including our ability to compete with larger and more seasoned competitors in this market. Our primary competitors currently are Nielsen, Kantar and TiVo. Each of these competitors has significantly greater resources than we do, which could allow them to become more formidable competitors with enhanced technology service solutions. Additionally, we face other obstacles. For instance, we may be unable to reasonably obtain data and/or data providers may be reluctant or ultimately decide not to grant us adequate access to their digital transaction data, which is a key component of our systems. The owners of data may also impose greater restrictions on the use and reporting of such data, which may make it difficult to fully realize the opportunities we anticipate for our products and related services. Further, the marketplace (such as advertisers, advertising agencies and television networks) may be reluctant to adopt a new standard of viewership measurement. These factors could have an adverse effect on our ability to grow these services, which could lead to a material adverse effect on our results of operations, financial condition and cash flows.

We may be unable to obtain requisite data and other content to source our systems which provide our Entertainment Essentials™ services.

Our Entertainment Essentials™ services rely on data collected from a wide variety of sources. Once received, the data must be reviewed, processed, integrated and, at times, converted to our required file format. If we are unable to obtain quality data feeds and process that data in a timely manner, we may not be able to meet the needs of our clients, and we could lose clients. The loss of a significant number of Entertainment Essentials™ clients would have an adverse impact on our ability to grow our Entertainment Essentials™ lines of business, which could result in a material adverse effect on our results of operations, financial condition and cash flows.

We have operations outside of the United States that subject us to legal, business, political, cultural and other risks of international operations.

We operate globally, which subjects us to a number of risks and burdens, including:

| |

• | staffing and managing international operations across different geographic areas; |

| |

• | multiple, conflicting and changing governmental laws and regulations; |

| |

• | the possibility of protectionist laws and business practices that favor local companies; |

| |

• | price and currency exchange rates and controls; |

| |

• | different business practices and legal standards, particularly with respect to intellectual property; |

| |

• | difficulties in collecting accounts receivable, including longer payment cycles; |

| |

• | political, social, and economic instability; |

| |

• | designing and maintaining effective operating and financial controls; |

| |

• | the possibility of failure of internal controls, including any failure to detect unauthorized transactions; and |

| |

• | increased costs relating to personnel management as a result of government and other regulations. |

In addition, economic conditions in our overseas markets may negatively impact the demand for our products abroad and benefits we receive from those operations.

We may acquire or invest in other companies, products or technologies, which may be costly, dilutive to stockholders and, in the event we experience difficulties in assimilating and integrating the personnel, technologies, operating systems and products and services of acquired businesses, less beneficial than we anticipate.

As part of our business strategy, we may acquire or invest in other companies, products or technologies that complement our current product offerings, enhance our technical capabilities, expand our operations into new markets or offer other growth opportunities. Such acquisitions may be costly and potentially dilutive to existing shareholders in the event we offer capital stock as consideration in an acquisition. Acquisitions could also pose risks to our operations and operating results, including the possibilities of:

| |

• | increased costs relating to the integration of acquired businesses or technologies; |

| |

• | difficulties assimilating the acquired operations, personnel, technologies or products into our company; |

| |

• | loss of key personnel at an acquired business who decide not to work for us; |

| |

• | diversion of management’s attention from our existing operations; |

| |

• | adverse effects on relationships with our existing suppliers, customers or partners; |

| |

• | a need for additional capital or debt financing to complete acquisitions; and |

| |

• | the impairment of intangible assets acquired. |

The described risks would be magnified as the size of an acquisition increases or if the acquisitions are in geographic or business markets in which we have little or no prior experience. As a result of these and other challenges, we may not realize any anticipated

benefits from acquisitions even if we can find suitable acquisition opportunities at what we believe to be attractive valuations, which we do not assure.

Economic conditions could negatively impact our business.

We primarily operate within the media, advertising and entertainment industry. Our overall success depends on the success of national networks and local stations, studios, cable operators, data providers, advertisers, and advertising agencies. The success of these businesses is dependent on consumer economic activity. For example, our Box Office Essentials® clients depend on consumers being interested in, and financially able to attend, movies in theaters. Changes in the economic climate and consumer spending could impact the financial condition of our clients. Such changes that affect our clients could, in turn, decrease the demand for our products, which could have a material adverse effect on our results of operations, financial condition and cash flows.

Additionally, if our clients experience financial difficulties, they may be unable to continue to purchase our services or pay for services in a timely manner, if at all. This could have a material adverse effect on our results of operations, financial condition and cash flows.

We face intense competition in the markets in which we operate and those in which we are currently developing new service offerings.

Some of our competitors have extensive distribution networks, long-standing relationships with our suppliers and customers, stronger brand name recognition and significantly greater financial resources than we do. These factors may enable our competition to have increased bargaining and purchasing power relating to resources that could enable them to operate in a more cost effective manner and/or to surpass our technological advancements. This could have a material adverse effect on our ability to grow our lines of business.

Our DRS business is dependent on studios maintaining direct revenue sharing relationships with “brick-and-mortar,” kiosks and online retailers.

We currently collect, process, audit, summarize and report transactional data relating to rental and sales activity of home entertainment content at large traditional and online retailers and kiosk locations that have revenue sharing agreements directly with major studios. There are a number of risks that may adversely affect the size and profitability of this DRS business. First and foremost, our business is dependent on the DRS clients maintaining DRS relationships with the DRS Retailers. Should these clients end those relationships, they would have no need for our services. Second, our clients could decide to invest the resources necessary to provide these services internally. Lastly, if the overall size of the home entertainment rental market contracts significantly, or the large “brick-and-mortar” and online retailers’ share of the overall rental market declines substantially, the amount of data we process and audit on behalf of our clients would also be reduced, resulting in a corresponding decrease in our revenue. These and other factors could potentially reduce the demand for our DRS services and the quantity of data we process, which would negatively affect our results of operations, financial condition and cash flows.

The future success of our company is highly dependent on our ability to maintain and grow our base of clients who subscribe to our Entertainment Essentials™ suite of services.

Our success depends on effective software solutions, marketing, sales and customer relations for our Entertainment Essentials™ services, as well as acceptance of future enhancements and new services by our existing and prospective clients. If we are unable to both retain existing clients and secure new clients for our Entertainment Essentials™ services, our results of operations, financial condition and cash flows will be adversely affected.

We have voluntarily applied for accreditation from the Media Rating Council (“MRC”) for certain TV Essentials® products and services within our Entertainment Essentials™ lines of business and we cannot predict when we will receive such accreditation, if at all.

We have voluntarily applied for accreditation from the MRC for our TV Essentials® products and services. The MRC is a third party nonprofit industry association whose members consist of companies within our industry, including television broadcasters, cable casters, advertisers, internet organizations, advertising agencies and industry trade associations. The MRC’s goal is to ensure measurement services are valid, reliable and effective. While we believe we will be successful in achieving this accreditation, and we have made significant investments and progress towards this initiative, there is no assurance we will receive this accreditation in the near future, if at all, and we cannot predict the impact this accreditation would have on our business.

Our Entertainment Essentials™ services are highly dependent on employees who are skilled and experienced in information technologies.

If we are unable to attract, hire and retain high quality information technology personnel at a reasonable cost, we may not be able to meet the needs of existing clients, enhance existing services, or develop new lines of business. This inability could have a material adverse effect on our results of operations, financial condition and cash flows.

The market for on demand advertising has been slow to develop and may grow slowly or not at all.

We have made significant investments in developing our tracking module for advertisements in on demand programming. The success of our on demand ad tracking module is dependent on several uncertain factors, including market adoption of on demand advertising, rollout of dynamic ad insertion technologies, and the automation of files regarding the location of advertising in on demand content. If the market does not develop, we may be unable to recoup our investments.

Measurement services are receiving a high level of consumer group and government scrutiny relating to the privacy issues around the methodologies used in targeted advertising.

Although we are confident that our anonymous data aggregation methodologies are compliant with all current privacy laws, it is possible that privacy trends and market perceptions of the transparency of data could result in additional government restrictions or limitations on the use of that data, which would adversely affect many of our products. We believe it is unlikely that we will be required to change or limit our products. Nonetheless, if additional government restrictions are imposed, such restrictions could slow our ability to realize a return on our investments in new data-driven products or result in additional costs not currently anticipated.

Our services are highly dependent on the effective and efficient use of technology and our overall information management infrastructure.

If we are unable to acquire, establish and maintain our information management systems to ensure accurate, reliable and timely data processed in an efficient and cost effective manner, we may not be able to meet the needs of existing clients, enhance existing services or develop new lines of business. This inability could have an adverse effect on our business and long-term growth prospects.

Interruption or failure of our information technology and communications systems could hurt our ability to effectively provide our products and services, which could damage our reputation and harm our operating results.

The availability of our products and services depends on the continuing operation of our information technology and communications systems. Our systems are vulnerable to damage or interruption from earthquakes, floods, fires, power loss, telecommunications failures, computer viruses, computer denial of service attacks, terrorist attacks, or other attempts to harm our systems. Our data centers are located in areas with potential risk of earthquakes. Our data centers are also subject to break-ins, sabotage, and intentional acts of vandalism, and to potential disruptions if the operators of these facilities have financial difficulties. Some of our systems are not fully redundant, and our disaster recovery planning cannot account for all eventualities. The occurrence of a natural disaster, a decision to close a facility we are using without adequate notice for financial reasons, or other unanticipated problems at our data centers could result in lengthy interruptions in our service. In addition, our products and services are highly technical and complex and may contain errors or vulnerabilities. Any errors or vulnerabilities in our products and services, or damage to or failure of our systems, could result in interruptions in our services, which could reduce our revenue and results of operations.

The loss of our executive officers and key employees could have an adverse impact on our business and development initiatives.

We believe that the development of our business has been, and will continue to be, dependent on certain key executives and employees of Rentrak. The loss of any of these individuals could have a material adverse effect upon our business and development, and there is no assurance that adequate replacements could be found in the event of their unavailability.

Our stock is subject to price and volume fluctuations due to a number of factors, many of which are beyond our control and may prevent our shareholders from reselling our common stock at a profit.

The trading price of our common stock has, at times, experienced substantial price volatility and may continue to be volatile. For example, our common stock price has fluctuated from a high of $66.95 to a low of $19.92 for the 52 weeks ended March 31, 2014. This market volatility, as well as general economic, market or political conditions, could reduce the market price of our common

stock. The trading price of our common stock may fluctuate widely in response to various factors, some of which are beyond our control. These factors include:

| |

• | quarterly variations in our results of operations or those of our competitors; |

| |

• | announcements by us or our competitors of acquisitions, new products, significant contracts, commercial relationships, or capital commitments; |

| |

• | recommendations by securities analysts or changes in earnings estimates; |

| |

• | announcements about our earnings that are not in line with analyst expectations; |

| |

• | announcements by our competitors of their earnings that are not in line with analyst expectations; |

| |

• | the volume of shares of our common stock available for public sale; |

| |

• | sales of stock by us or by our shareholders (including sales by our directors, executive officers and other employees); and |

| |

• | short sales, hedging and other derivative transactions on shares of our common stock. |

Oregon law and our shareholder rights plan may have anti-takeover effects.

The Oregon Control Share Act and the Business Combination Act limit the ability of parties who acquire a significant amount of voting stock to exercise control over us. These provisions may have the effect of lengthening the time required to acquire control of us through a proxy contest or the election of a majority of the Board of Directors. In May 2005, we adopted a shareholder rights plan, which has the effect of making it more difficult for a person to acquire control of us in a transaction not approved by our Board of Directors. The provisions of the Oregon Control Share Act and the Business Combination Act and our shareholder rights plan could have the effect of delaying, deferring or preventing a change of control of us, could discourage bids for our common stock at a premium over the market price of our common stock and could materially adversely impact the market price of, and the voting and other rights of the holders of, our common stock.

| |

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

Our most significant locations, all of which are leased under operating leases, include the following:

|

| | |

Location | | Use |

Portland, Oregon | | Corporate headquarters |

Los Angeles, California | | Sales and Operations |

New York, New York | | Sales and Operations |

Munich, Germany | | Sales and Operations |

Madrid, Spain | | Sales and Operations |

London, England | | Sales and Operations |

Paris, France | | Sales and Operations |

Sydney, Australia | | Sales and Operations |

Mexico City, Mexico | | Sales and Operations |

Buenos Aires, Argentina | | Sales and Operations |

Rio de Janeiro, Brazil | | Sales and Operations |

See Note 14 of Notes to Consolidated Financial Statements for additional information.

We currently have no material outstanding litigation.

| |

ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

PART II

| |

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Stock Price and Dividends

Our common stock, $0.001 par value, is traded on the NASDAQ Global Market, where its prices are quoted under the symbol “RENT.” The closing price of our common stock on the NASDAQ Global Market on June 2, 2014 was $49.55. As of June 2, 2014 there were 178 holders of record of our common stock.

The following table sets forth the reported high and low closing sales prices of our common stock for each of the quarters in the last two fiscal years as regularly quoted on the NASDAQ Global Market:

|

| | | | | | | | |

Fiscal 2014 | | High | | Low |

Quarter 1 | | $ | 24.68 |

| | $ | 19.92 |

|

Quarter 2 | | 34.29 |

| | 19.96 |

|

Quarter 3 | | 40.50 |

| | 32.73 |

|

Quarter 4 | | 66.95 |

| | 36.44 |

|

|

| | | | | | | | |

Fiscal 2013 | | High | | Low |

Quarter 1 | | $ | 22.05 |

| | $ | 15.56 |

|

Quarter 2 | | 21.40 |

| | 16.73 |

|

Quarter 3 | | 21.03 |

| | 16.67 |

|

Quarter 4 | | 22.09 |

| | 19.30 |

|

Holders of our common stock are entitled to receive dividends if, as, and when declared by the Board of Directors out of funds legally available therefor, subject to the dividend and liquidation rights of any preferred stock that may be issued.

No cash dividends have been paid or declared during the last 15 fiscal years. The present policy of the Board of Directors is to retain earnings to provide funds for operation and expansion of our business. We do not intend to pay cash dividends in the foreseeable future.

Securities Authorized for Issuance

Information regarding securities authorized for issuance under equity compensation plans is included in Item 12 of this Annual Report on Form 10-K.

Stock Performance Graph

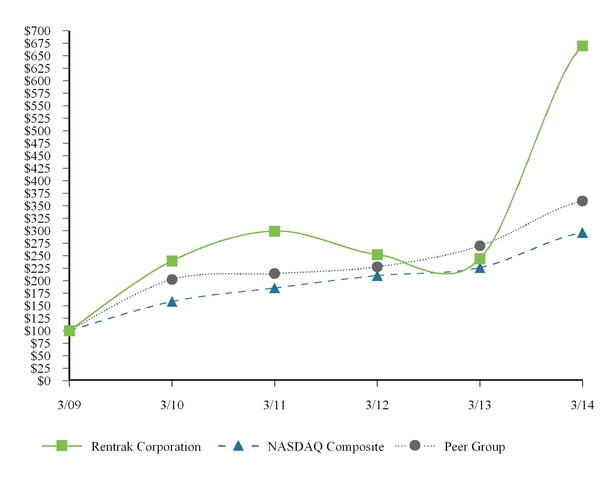

This chart compares the five-year cumulative total return on our common stock with that of the NASDAQ Composite index and a custom peer group, which was selected by us. The chart assumes $100 was invested on March 31, 2009, in our common stock, the NASDAQ Composite index and the peer group, and that any dividends were reinvested. The Peer Group is composed of: Acxiom Corp., comScore, Inc., Hastings Entertainment, Inc. and Nielsen Holdings N.V. The peer group index utilizes the same method of presentation and assumptions for the total return calculation as does Rentrak and the NASDAQ Composite index. All companies in the peer group index are weighted in accordance with their market capitalizations.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Base | | Indexed Returns |

| | Period | | Year Ended |

Company/Index | | 3/31/2009 | | 3/31/2010 | | 3/31/2011 | | 3/31/2012 | | 3/31/2013 | | 3/31/2014 |

Rentrak Corporation | | $ | 100.00 |

| | $ | 239.44 |

| | $ | 299.11 |

| | $ | 252.22 |

| | $ | 244.22 |

| | $ | 669.78 |

|

NASDAQ Composite | | 100.00 |

| | 158.32 |

| | 185.39 |

| | 210.13 |

| | 226.02 |

| | 296.17 |

|

Peer Group | | 100.00 |

| | 202.18 |

| | 213.98 |

| | 227.71 |

| | 269.42 |

| | 359.13 |

|

| |

ITEM 6. | SELECTED FINANCIAL DATA |

|

| | | | | | | | | | | | | | | | | | | |

(In thousands, except per share amounts) | Year Ended March 31, |

Statement of Operations Data(4) | 2014 | | 2013 | | 2012 | | 2011 | | 2010 |

Revenue | $ | 75,600 |

| | $ | 57,033 |

| | $ | 47,044 |

| | $ | 40,383 |

| | $ | 25,060 |

|

Cost of revenue(1) | 27,247 |

| | 21,347 |

| | 14,775 |

| | 11,276 |

| | 6,887 |

|

Gross margin | 48,353 |

| | 35,686 |

| | 32,269 |

| | 29,107 |

| | 18,173 |

|

Operating expenses: | | | | | | | | | |

Selling, general and administrative(1)(2) | 48,799 |

| | 55,998 |

| | 38,245 |

| | 33,545 |

| | 23,895 |

|

Research, technology and innovation(1)(2) | 9,014 |

| | 6,215 |

| | 4,662 |

| | 4,498 |

| | 2,937 |

|

Total operating expenses | 57,813 |

| | 62,213 |

| | 42,907 |

| | 38,043 |

| | 26,832 |

|

Loss from continuing operations | (9,460 | ) | | (26,527 | ) | | (10,638 | ) | | (8,936 | ) | | (8,659 | ) |

Other income: | | | | | | | | | |

Investment income, net | 125 |

| | 378 |

| | 477 |

| | 483 |

| | 1,148 |

|

Loss from continuing operations before income taxes | (9,335 | ) | | (26,149 | ) | | (10,161 | ) | | (8,453 | ) | | (7,511 | ) |

Income tax benefit | (2,183 | ) | | (980 | ) | | (982 | ) | | (3,956 | ) | | (3,617 | ) |

Loss from continuing operations, net of income taxes | (7,152 | ) | | (25,169 | ) | | (9,179 | ) | | (4,497 | ) | | (3,894 | ) |

Income from discontinued operations, net of income taxes(1)(2)(4) | 2,783 |

| | 2,491 |

| | 2,753 |

| | 3,730 |

| | 4,470 |

|

Net income (loss) | (4,369 | ) | | (22,678 | ) | | (6,426 | ) | | (767 | ) | | 576 |

|

Net loss attributable to noncontrolling interest | (115 | ) | | (61 | ) | | — |

| | — |

| | — |

|

Net income (loss) attributable to Rentrak Corporation | $ | (4,254 | ) | | $ | (22,617 | ) | | $ | (6,426 | ) | | $ | (767 | ) | | $ | 576 |

|

Loss per share from continuing operations attributable to Rentrak Corporation common stockholders: | | | | | | | | | |

Basic | $ | (0.59 | ) | | $ | (2.14 | ) | | $ | (0.82 | ) | | $ | (0.41 | ) | | $ | (0.37 | ) |

Diluted | $ | (0.59 | ) | | $ | (2.14 | ) | | $ | (0.82 | ) | | $ | (0.41 | ) | | $ | (0.35 | ) |

Income per share from discontinued operations attributable to Rentrak Corporation common stockholders: | | | | | | | | | |

Basic | $ | 0.24 |

| | $ | 0.21 |

| | $ | 0.25 |

| | $ | 0.34 |

| | $ | 0.42 |

|

Diluted | $ | 0.24 |

| | $ | 0.21 |

| | $ | 0.25 |

| | $ | 0.34 |

| | $ | 0.41 |

|

Net income (loss) per share attributable to Rentrak Corporation common stockholders: | | | | | | | | | |

Basic | $ | (0.35 | ) | | $ | (1.93 | ) | | $ | (0.57 | ) | | $ | (0.07 | ) | | $ | 0.05 |

|

Diluted | $ | (0.35 | ) | | $ | (1.93 | ) | | $ | (0.57 | ) | | $ | (0.07 | ) | | $ | 0.05 |

|

Shares used in per share calculations: | | | | | | | | | |

Basic | 12,177 |

| | 11,733 |

| | 11,197 |

| | 10,962 |

| | 10,527 |

|

Diluted | 12,177 |

| | 11,733 |

| | 11,197 |

| | 10,962 |

| | 11,013 |

|

| | | | | | | | | |

(1) Depreciation and amortization expense is included in the line items above as follows: | | | | |

Cost of revenue | $ | 3,175 |

| | $ | 2,638 |

| | $ | 2,168 |

| | $ | 1,753 |

| | $ | 1,350 |

|

Selling, general and administrative | 2,037 |

| | 1,841 |

| | 1,842 |

| | 1,413 |

| | 721 |

|

Research, technology and innovation | 717 |

| | 311 |

| | 170 |

| | 110 |

| | 159 |

|

Net income from discontinued operations | 162 |

| | 161 |

| | 171 |

| | 155 |

| | 100 |

|

| $ | 6,091 |

| | $ | 4,951 |

| | $ | 4,351 |

| | $ | 3,431 |

| | $ | 2,330 |

|

| | | | | | | | | |

(2) Stock-based compensation expense is included in the line items above as follows: | | | |

Selling, general and administrative(3) | $ | 7,361 |

| | $ | 20,864 |

| | $ | 4,593 |

| | $ | 5,397 |

| | $ | 2,362 |

|

Research, technology and innovation | 697 |

| | 544 |

| | 359 |

| | 1,278 |

| | — |

|

Net income from discontinued operations | 397 |

| | 384 |

| | 166 |

| | 39 |

| | — |

|

| $ | 8,455 |

| | $ | 21,792 |

| | $ | 5,118 |

| | $ | 6,714 |

| | $ | 2,362 |

|

DISH & iTVX(3) | $ | 2,700 |

| | $ | 15,864 |

| | $ | 527 |

| | $ | 2,430 |

| | $ | 216 |

|

(3) Stock-based compensation in the year ended March 31, 2014 includes expense related to contingent consideration associated with our acquisition of iTVX. Stock-based compensation in the years ended March 31, 2013, 2012, 2011 and 2010 includes expense related to our agreement with DISH. |

(4) All prior periods presented have been restated as a result of reporting our PPT® business as discontinued operations. See Note 19 of Notes to Consolidated Financial Statements. |

|

| | | | | | | | | | | | | | | | | | | |

| March 31, |

| 2014 | | 2013 | | 2012 | | 2011 | | 2010 |

Balance Sheet Data | | | | | | | | | |

Cash and marketable securities | $ | 21,970 |

| | $ | 20,423 |

| | $ | 27,753 |

| | $ | 26,377 |

| | $ | 19,925 |

|

Working capital | 23,081 |

| | 20,919 |

| | 24,231 |

| | 28,947 |

| | 31,097 |

|

Net current assets of discontinued operations | 1,585 |

| | 4,019 |

| | 3,227 |

| | 4,302 |

| | 7,617 |

|

Total assets | 81,267 |

| | 71,781 |

| | 72,881 |

| | 76,175 |

| | 64,806 |

|

Long-term liabilities | 8,392 |

| | 4,075 |

| | 3,154 |

| | 2,203 |

| | 2,266 |

|

Stockholders’ Equity attributable to Rentrak Corporation | 52,160 |

| | 47,982 |

| | 50,525 |

| | 56,373 |

| | 51,228 |

|

| |

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Business Overview

We are a global media measurement and information company serving the entertainment, television, video and advertising industries. Our Software as a Service (“SaaS”) technology merges census-based television viewership information from over 100 million TVs and devices with consumer behavior and purchase information (“Advanced Demographics”) across multiple platforms, devices and distribution channels. We also measure box office results from more than 100,000 movie screens in 36 countries throughout the world. We process and aggregate hundreds of billions of data transactions from multiple screens wherever entertainment content is viewed, whether at the box office, on a television screen, over the internet, on a smart phone or other portable device. Rentrak measures live TV, recorded TV (“DVR”), Video-On-Demand (“VOD”), and whether the content is free, purchased, rented, recorded, downloaded or streamed from multiple channels. These massive content databases provide stable and granular viewership information across every screen (“multiscreen”) and are anonymously matched with third-party consumer segmentation and purchase databases using privacy compliant methodologies. By linking multiscreen viewership information with information about the products viewers consume and prefer, we provide our clients, such as content producers, distributors, advertisers and advertising agencies, with the knowledge necessary to more effectively manage their businesses, program and market their networks and more precisely target and sell their advertising inventory. The benefits to the advertising community are improvements in profitability while effectively targeting specific TV shows against the demographics of the products viewers buy, the cars they drive and how they are likely to vote in elections. The benefits to the movie industry and video (TV) content owners are they can manage their businesses in real time or near real time and also improve their profitability. Additionally, certain clients use our databases to populate programmatic buying systems. These systems automate the buying process and introduce efficiencies for both advertising agencies and their clients.

Previously, we had two operating divisions within our corporate structure and we reported certain financial information by individual segment under this structure. Those two operating divisions were our Advanced Media and Information (“AMI”) operating division, which included our media measurement services, and our Home Entertainment operating division, which included our distribution services as well as services that measure, aggregate and report consumer rental activity on film product from traditional “brick and mortar,” online and kiosk retailers.

During the fourth quarter of the fiscal year ended March 31, 2014 (“Fiscal 2014”), we initiated our plan to sell our Pay Per Transaction® (“PPT®”) business, which has been a longstanding legacy business of Rentrak and a significant component of the Home Entertainment operating division. The PPT® business represented 42.5%, 48.3% and 58.4% of our total revenue for our fiscal years ended March 31, 2013, 2012 and 2011. For Fiscal 2014, it would have represented 37.4% of our total revenue if we had decided to retain the line. Our PPT® business has been in a state of decline due to the decline of physical DVD rentals from retail stores. This strategic decision to sell PPT® will enable us to focus more fully on the growth of our media measurement business and advanced consumer targeting business. Accordingly, we have restated our financial results and the PPT® business is reported as discontinued operations for all periods presented.

As a result of our plan to divest our PPT® business, we will operate in a single business segment encompassing our media measurement services which are primarily delivered through scalable, SaaS products within our Entertainment Essentials™ lines of business. These syndicated big data services, offered primarily on a recurring subscription basis, provide consumer viewership information integrated with consumer segmentation and purchase behavior databases. We provide film studios, television networks and local stations, cable, satellite and telecommunications company (“telco”) operators, advertisers and advertising agencies unique insights into consumer viewing and purchasing patterns through our comprehensive and expansive information on local, national, VOD and “Over the Top” television performance and worldwide box office results. Our movie measurement business is a global business measuring more than 90% of the ticket sales globally in real or near real time allowing for decisions to be made to market, promote and manage the industry for maximum profitability.

See “Forward-Looking Statements” on page 2.

Our Products and Services

We provide media measurement business intelligence services across multiple screens and platforms delivered as SaaS. These services, offered primarily on a recurring subscription basis, are distributed to clients through patent pending software systems and business processes into two broad areas within the entertainment industry, which we refer to as TV Everywhere™ and Movies Everywhere™. Our systems capture total television audience information by providing the largest coverage from multiple screens and providers and merge that information with Advanced Demographics and information relating to actual consumer purchase behavior.

Typical customers utilizing our services include content producers, studios, distributors, national networks, local stations, satellite and cable operators, agencies, and a wide spectrum of advertisers, ranging from traditional consumer brands to various political groups. We also provide many of our clients tailored research and analytical solutions unique to their needs and specifications.

Our most significant lines of business, which we refer to as Entertainment Essentials™ services, are:

| |

• | TV Everywhere™, which includes TV Essentials® and StationView Essentials™; |

| |

• | OnDemand Everywhere®, which includes OnDemand Essentials® and Over the Top measurement products and related products; |

| |