PNC

PNC

AVIATION FINANCE

February 1, 2021

Andrew Klaus Preformed Line, LLC 660 Beta Drive

Mayfield Village, OH 44143

Dear Andrew,

We would like to thank you for giving us the opportunity to serve your aircraft financing needs. Our goal is to provide superior financial products and an unsurpassed level of customer service to aircraft owners like you.

Copies of the loan documents are enclosed for your file. Again, PNC Aviation Finance appreciates the opportunity to service your new account and looks forward to building a great relationship.

|

|

With best regards, |

|

|

|

|

|

|

|

|

|

|

|

Mary Jo Dusel Senior Vice President, Aircraft Finance Officer |

|

Member of The PNC Financial Services Group

4355 Emerald Street #100 XX- A022- 01-1 Boise Idaho 83706

|

|

Page 1 of 1 |

Loan Documentation Schedule

•Promissory Note

•Aircraft Security Agreement & Exhibit A

•Form of Irrevocable De-Registration (IDERA)

•Closing Statement

•Invoice Statement

•PNCAF Resolution - Borrower

•Payment Authorization

•PNCAF Resolution - Guarantor

•Guaranty(s)

•Subordination Agreement

|

|

Page 1 of 1 |

E04

PROMISSORY NOTE

|

Borrower: Preformed Line, LLC |

|

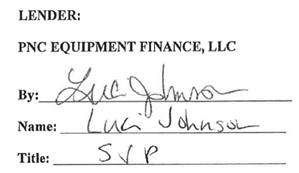

Lender: |

PNC Equipment Finance, LLC 4355 Emerald St. |

|

660 Beta Drive |

|

|

Suite 100 |

|

Mayfield Village, OH 44143 |

|

|

Boise, ID 83706 |

|

Principal Amount: $20,500,000.00 |

Date of Note: December 29, 2020 |

(1)PROMISE TO PAY. Preformed Line, LLC ("Borrower") promises to pay to PNC Equipment Finance, LLC ("Lender"), or order, in lawful money of the United States of America, the principal amount of Twenty Million Five Hundred Thousand & 00/100 Dollars ($20,500,000.00), together with interest on the unpaid principal balance from the Funding Date until paid in full.

(2)PAYMENT, AMORTIZATION, AND INTEREST. Borrower's first payment is due on the first calendar day of the second month following the month during which the loan is funded, and all subsequent payments are due on the first calendar day of each month after that. All outstanding principal and all accrued interest not yet paid shall be due on the final monthly payment. Unless otherwise agreed or required by applicable law, payments will be applied first to any unpaid collection costs and any late charges, then to any unpaid interest, and any remaining amount to principal. Borrower will pay Lender at such place as Lender may designate in writing.

(a)Repayment. Principal shall be due and payable in One Hundred Nineteen (119) equal consecutive monthly installments, each in the amount $170,833.33, with a final payment of any outstanding principal and accrued interest due and payable on the final monthly payment date. Interest shall be payable monthly at the same time as the principal payments at the rate provided for below. Borrower’s monthly principal payment will be calculated by dividing the principal amount of the Note by 120 months. All payment calculations will be determined by Lender in its sole discretion.

(b)Fixed Interest Period. The interest rate will be 2.744%. Interest on this Note during the Fixed Interest Period is computed on a 30/360 simple interest basis; that is, with the exception of odd days in the first payment period, monthly interest is calculated by applying the ratio of the annual interest rate over a year of360 days, multiplied by the outstanding principal balance, multiplied by a month of 30 days. Interest for the odd days is calculated on the basis of the actual days to the next full month and a 360-day year. Borrower understands that Lender may make loans based on other rates as well.

(c)Interest After Default. Upon an Event of Default, including failure to pay upon final maturity, Lender, at its option, may, if permitted under applicable law, increase the Fixed Interest Rate by an additional 4.00%. The interest rate will not exceed the maximum rate permitted by applicable law.

(3)TERM. The term of this loan is 120 months from February l, 2021 ("Term"). At the end of the Term, all amounts owing under this Note and the Related Documents (collectively the "Loan Documents") will be due and payable.

(4)RELATED DOCUMENTS. This Note is issued in connection with the Aircraft Security Agreement of even date herewith between Bo11'ower and Lender (the "Aircraft Security Agreement"), one or more Guaranty agreements, and such other agreements and documents executed and/or delivered in connection herewith or therewith (as amended, modified or renewed from time to time, collectively the "Related Documents"), and is secured by the property described in the Related Documents and by such other collateral as previously may have been or may in the future be granted to Lender to secure this Note.

(5)DEFAULT. Each of the following shall constitute an event of default ("Event of Default") under this Note : (i) the nonpayment of any principal, interest or other indebtedness when due under (1) this Note or (2) any and all obligations of the Borrower (or any of its affiliates) or Guarantor (or any of its affiliates) or any other direct or indirect subsidiary of Preformed Line Products Company to the Lender (the "PLPC Obligations"); (ii) the occm1•ence of any event of default or any default and the lapse of any notice or cure period, or any Obligor's failure to observe or perfom1 any covenant, representation, warranty or other agreement, under or contained in any Loan Document or any other document now or in the future evidencing or securing any debt, liability or obligation of any Obligor to Lender, including, without limitation, the occurrence of any "Event of Default" (as defined therein) under the PLPC Obligations, provided, however, that no such failure to observe or pe1form any such covenant or other agreement (excluding default under Clause (i) above, Defective Collateralization, False Statements, Death or Insolvency, Creditor or Forfeiture Proceedings, Events Affecting Guarantor, and Change of Control) shall constitute an Event of Default unless such failure continues for a period of thirty (30) days after the earlier to occur of (a) the date when Borrower becomes aware of such failure and (b) the date when the Lender gives written notice to the Borrower of such failure; (iii) the filing by or against any Obligor of any proceeding in bankruptcy, receivership, insolvency, reorganization, liquidation, conservatorship or similar proceeding (and, in the case of any such proceeding instituted against any Obligor, such proceeding is not dismissed or stayed within 30 days of the commencement thereof, provided that Lender shall not be obligated to advance additional funds hereunder during such period); (iv) any assignment by any Obligor for the benefit of creditors, or any levy, garnishment,

Page - 1 - of 5

attachment or similar proceeding is instituted against any property of any Obligor held by or deposited with Lender; (v) a default with respect to any other indebtedness of any Obligor for borrowed money in excess of $100,000 individually or in the aggregate, if the effect of such default is to cause or permit the acceleration of such debt; (vi) the commencement of any foreclosure or forfeiture proceeding, execution or attachment against any collateral securing the obligations of any Obligor to Lender; (vii) the entry of a final judgment against any Obligor and the failure of such Obligor to discharge the judgment within thirty (30) days of the entry thereof; (viii) any change in any Obligor's business, assets, operations, financial condition or results of operations that has or could reasonably be expected to have any material adverse effect on any Obligor, including a division into two or more entities; (ix) any Obligor ceases doing business as a going concern; (x) any representation or warranty made by any Obligor to Lender in any Loan Document or any other documents now or in the future evidencing or securing the obligations of any Obligor to Lender, is false, erroneous or misleading in any material respect; (xi) the• re vocation or attempted revocation, in whole or in part, of any guarantee by any Obligor; or (xii) the death, incarceration, indictment or legal incompetency of any individual Obligor. As used herein, the term "Obligor" means any Borrower and any guarantor of, or any pledgor, mortgagor or other person or entity providing collateral support for, Borrower's obligations to Lender existing on the date of this Note or arising in the future.

(6)RIGHTS. Upon an Event of Default, Lender may (1) declare the entire unpaid principal balance on this Note and all accrued unpaid interest immediately due, and then Borrower will pay that amount, and/or (2) exercise any rights and remedies set forth in the Aircraft Security Agreement and the Related Documents.

(7)ATTORNEYS' FEES; EXPENSES. Borrower agrees to pay upon demand all of Lender's costs and expenses, including Lender's reasonable attorneys' fees and legal expenses, incurred in connection with the enforcement of this. Note, the Aircraft Security Agreement, or the Related Documents. Lender may hire or pay someone else to help enforce this Note, and Borrower shall pay the costs and expenses of such enforcement. Costs and expenses include Lender's reasonable attorneys' fees and legal expenses whether or not there is a lawsuit, including reasonable attorneys' fees and legal expenses for bankruptcy proceedings (including efforts to modify or vacate any automatic stay or injunction), appeals, and any anticipated post-judgment collection services. Borrower also shall pay all court costs and such additional fees as may be directed by the court.

(8)LOAN ASSUMPTION. This Note and Related Documents are fully assumable by a qualified buyer provided that the buyer is approved by Lender in its sole discretion. Borrower or the buyer assuming this loan must pay an assumption fee equal to 0.75% of the unpaid principal balance plus any and all third-party expenses incurred in connection with the assumption.

(9)JURY WAIVER. Lender and Borrower hereby waive the right to any jury trial in any action, proceeding, or counterclaim brought by either Lender or Borrower against the other.

(10)INCORPORATION OF COVENANTS BY REFERENCE. The Lender and Borrower agree that any and all affirmative, negative and financial covenants which may be set forth in any credit agreement, loan agreement, promissory note, guaranty or other agreement, instrument or document entered into between either the Borrower (or any of its affiliates) or the Guarantor (or any of its affiliates), on the one hand, and the Lender or any of its affiliates, on the other hand (the "Other Loan Documents"), are hereby incorporated herein by this reference as if set forth herein at length, as any of the foregoing may be amended or supplemented from time to time (the "Incorporated Provisions"). Any amendments, modifications, waivers or other changes in the terms of any of the Incorporated Provisions shall automatically constitute an amendment to this Note without any need for further action or documentation. Notwithstanding the foregoing, any amendments, modifications, waivers or other such changes to any Incorporated Provisions which operate to waive or prevent the occurrence of a default or "Event of Default" under the related Other Loan Documents shall not be effective unless consented to in writing by the Lender in its sole discretion. If any Other Loan Documents terminates or otherwise ceases to be in full force and effect at any time and for any reason, whether by voluntary termination, upon default, acceleration, at maturity or otherwise (a "Termination"), all of the Incorporated Provisions of such Other Loan Documents shall survive the Termination and shall continue in full force and effect as a part of this Note, At any time after a Termination, Borrower shall promptly upon Lender's request execute and deliver to Lender an amendment to this Note, which amendment will expressly Incorporate into this Note all or any number of the Incorporated Provisions of the terminated Other Loan Documents as Lender in its sole discretion shall select, as such Incorporated Provisions are in effect immediately prior to the date of Termination. In addition, the Termination of any Other Loan Documents for any reason shall constitute an Event of Default under this Note and the Guaranty, entitling Lender at its option to exercise all of its rights and remedies under this Note, the Guaranty and the Related Documents.

(11)GENERAL PROVISIONS. Lender may delay or forgo enforcing any of its rights or remedies under this Note without losing them. Borrower and any other person who signs, guarantees or endorses this Note, to the extent allowed by law, waive presentment, demand for payment, and notice of dishonor. Upon any change in the terms of this Note, and unless otherwise expressly stated in writing, no party who signs this Note, whether as maker, guarantor, accommodation maker or endorser, shall be released from liability. All such parties agree that Lender may, in its sole discretion, renew or extend (repeatedly and for any length of time) this loan or release any party or guarantor or collateral; or impair, fail to realize upon or perfect Lender's security interest in the collateral. All such parties also agree that Lender may modify this loan without the consent of or notice to anyone other than the party with whom the modification is made. The obligations under this Note are joint and several. Capitalized terms not defined in this Note shall have the same definition given such terms in the Aircraft Security Agreement, the Related Documents, or other Joan documents executed by Borrower.

(12)PREPAYMENT. Borrower must give written notice at least forty-five (45) days prior to the day the loan is prepaid. Upon prepayment of this Note, Lender is entitled to interest on the outstanding loan balance through the date of early payment. Borrower may pay all but not less than all of the amount owed earlier than it is due. Early payments wilt not, unless agreed to by Lender in writing, relieve Borrower of Borrowers obligation to continue to make payments under the payment schedule. Rather, early payments will reduce the principal balance due and may result in Borrower's making fewer payments. Borrower agrees not to send Lender payments marked "paid in full", "without recourse", or similar language. If Borrower sends such a payment, Lender may accept it without losing any of Lender's rights under this Note, and Borrower will remain obligated to pay any further amount owed to Lender. All written communications concerning disputed amounts, including any check or other payment instrument that indicates that the payment constitutes "payment in full" of the amount owed or that is tendered with other conditions or limitations or as full satisfaction of a disputed amount must be mailed or delivered to: PNC Equipment Finance, LLC; 4355 Emerald St.; Suite 100; Boise, ID 83706. Lender is entitled to the following refundable premium payable at the time of prepayment, which may be refunded as set forth below (the "Refundable Premium"): (a) if such early payment occurs during months one

Page - 2 - of 5

through thirty-six of the Term, two percent of the unpaid principal balance; (b) if such early payment occurs during months thirty-seven through sixty of the Term, one percent of the unpaid principal balance; (c) if such early payment occurs during months sixty-one through eighty-four of the Term, one half of one percent of the unpaid principal balance. After the eighty- fourth• month of the Term, no early payment premium shall apply. Lender will refund the Refundable Premium if Lender makes a new loan against Borrower's replacement aircraft within six months of the early payment date provided that the amount of the new loan is equal to or greater than the outstanding balance of the Note. Except as provided in the previous sentence, Lender shall be entitled to retain the Refundable Premium. Notwithstanding anything to the contrary above, Lender will have no obligation to enter into a new loan or refund the Refundable Premium if the new loan is not approved by Lender in its sole discretion.

(13)LOAN PARTICIPATION. Borrower agrees and consents to Lender's sale or transfer, whether now or later, of the Note and Related Documents or of one or more participation interests in the Note and Related Documents to one or more purchasers, whether related or unrelated to Lender. Lender may provide, without any limitation whatsoever, to any one or more purchasers, or potential purchasers, any information or knowledge Lender may have about Borrower or about any other matter relating to the Note and Related Documents, and Borrower hereby waives any rights to privacy that Borrower may have with respect to such matters,

(14)LATE CHARGE. If the Borrower fails to make any payment of principal, interest or other amount coming due pursuant to the provisions of this Note when due and payable, then Borrower also shall pay to Lender a late charge equal to $1,500 but not more than the maximum amount allowed by law ("Late Charge"). Both the Late Charge and any additional interest charged upon a default are imposed as liquidated damages for the purpose of defraying Lender's expenses incident to the handling of delinquent payments, but are in addition to, and not in lieu of, Lender's exercise of any rights and remedies hereunder, under the other Loan Documents or under applicable law, and any fees and expenses of any agents or attorneys which Lender may employ, In addition, the additional interest charged upon a default reflects the increased credit risk to Lender of carrying a loan that is in default. The Borrower agrees that the Late Charge and any additional interest charged upon a default are reasonable forecasts of just compensation for anticipated and actual harm incurred by Lender, and that the actual harm incurred by Lender cannot be estimated with certainty and without difficulty.

(15)GOVERNING LAW AND JURISDICTION. This Note, the Aircraft Security Agreement, and the Related Documents have been delivered to Lender and accepted by Lender in the Commonwealth of Pennsylvania ("State"). THIS NOTE, THE AIRCRAFT SECURITY AGREEMENT, AND THE RELATED DOCUMENTS WILL BE INTERPRETED AND THE RIGHTS AND LIABILITIES OF THE LENDER AND TIIE BORROWER DETERMINED IN ACCORDANCE WITH THE LAWS OF THE STATE, EXCLUDING ITS CONFLICT OF LAWS RULES, INCLUDING WITHOUT LIMITATION THE ELECTRONIC TRANSACTIONS ACT (OR EQUNALENT) IN EFFECT IN THE STATE (OR, TO THE EXTENT CON1ROLLING, THE LAWS OF TI-IE UNITED STATES OF AMERICA, INCLUDING WITHOUT LIMITATION THE ELEC1RONIC SIGNATURES IN GLOBAL AND NATIONAL COMMERCE ACT). The Borrower hereby irrevocably consents to the exclusive jurisdiction of any state or federal court in the county or judicial district for Allegheny County, Commonwealth of Pennsylvania; provided that nothing contained in this Note will prevent the Lender from bringing any action, enforcing any-award or judgment or exercising any rights against the Borrower individually, against any security or against any property of the Borrower within any other county, state or other foreign or domestic jurisdiction. The Borrower acknowledges and agrees that the venue provided above is the most convenient forum for both the Lender and the Borrower. The Borrower waives any objection to venue and any objection based on a more convenient forum in any action instituted under this Note.

(16)SUCCESSOR INTERESTS. The terms of this Note, the Aircraft Security Agreement, and the Related Documents shall be binding upon Borrower, and upon Borrower's heirs, personal representatives, successors and assigns, and shall inure to the benefit of Lender and Lender's successors and assigns.

(17)IMPORTANT INFORMATION ABOUT PHONE CALLS. By providing telephone number(s) to Lender, now or at any later time, Borrower authorizes Lender and its affiliates and designees to contact Borrower regarding Borrower account(s) with Lender or its affiliates, whether such accounts are Borrower individual accounts or business accounts for which Borrower is a contact, at such numbers using any means, including but not limited to placing calls using an automated dialing system to cell, VoIP or other wireless phone number, or leaving prerecorded messages or sending text messages, even if charges may be incurred for the calls or text messages. Borrower consents that any phone call with Lender may be monitored or recorded by Lender.

(18)ANTI-MONEY LAUNDERING/INTERNATIONAL TRADE LAW COMPLIANCE. Borrower represents and warrants to Lender, as of the date of this Note, the date of each advance of proceeds under the Note, the date of any renewal, extension or modification of the Note, and at all times until the Note has been terminated and all amounts thereunder have been indefeasibly paid in full, that: (a) no Covered Entity (i) is a Sanctioned Person; (ii) has any of its assets in a Sanctioned Country or in the possession, custody or control of a Sanctioned Person; or (iii) does business in or with, or derives any of its operating income from investments in or transactions with, any Sanctioned Country or Sanctioned Person in violation of any law, regulation, order or directive enforced by any Compliance Authority; (b) the proceeds of the Note will not be used to fund any operations in, finance any investments or activities in, or, make any payments to, a Sanctioned Country or Sanctioned Person in violation of any law, regulation, order or directive enforced by any Compliance Authority; (c) the funds used to repay the Note are not derived from any unlawful activity; and (d) each Covered Entity is in compliance with, and no Covered Entity engages in any dealings or transactions prohibited by, any laws of the United States, including but not limited to any Anti-Terrorism Laws. Borrower covenants and agrees that it shall immediately notify Lender in writing upon the occurrence of a Reportable Compliance Event.

Page - 3 - of 5

As used herein: "Anti-Terrorism Laws" means any laws relating to terrorism, trade sanctions programs and embargoes, import/export licensing, money laundering, or bribery, all as amended, supplemented or replaced from time to time; "Compliance Authority" means each and all of the (a) U.S. Treasury Department/Office of Foreign Assets Control, (b) U.S. Treasury Department/Financial Crimes Enforcement Network, (c) U.S. State Department/Directorate of Defense Trade Controls, (d) U.S. Commerce Deportment/Bureau of Industry and Security, (e) U.S. Internal Revenue Service, (f) U.S. Justice Department, and (g) U.S. Securities and Exchange Commission; "Covered Entity" means Borrower, its affiliates and subsidiaries, all guarantors, pledgors of collateral, all owners of the foregoing, and all brokers or other agents of Borrower acting in any capacity in connection with the Note; "Reportable Compliance Event" means that any Covered Entity becomes a Sanctioned Person, or is indicted, arraigned, investigated or custodially detained, or receives an inquiry from regulatory or law enforcement officials, in connection with any Anti-Terrorism Law or any predicate crime to any Anti-Terrorism Law, or self-discovers facts or circumstances implicating any aspect of its operations with the actual or possible violation of any Anti-Terrorism Law; "Sanctioned Country" means a country subject to a sanctions program maintained by any Compliance Authority; and "Sanctioned Person" means any individual person, group, regime, entity or thing listed or otherwise recognized as a specially designated, prohibited, sanctioned or debarred person or entity, or subject to any limitations or prohibitions (including but not limited to the blocking of property or rejection of transactions), under any order or directive of any Compliance Authority or otherwise subject to, or specially designated under, any sanctions program maintained by any Compliance Authority.

(19)INDEMNITY. Borrower agrees to indemnify each of Lender, each legal entity, if any, who controls, is controlled by or is under common control with Lender, and each of their respective directors, officers and employees ("Indemnified Parties"), and to defend and hold each Indemnified Party harmless from and against any and all claims, damages, losses, liabilities and expenses (including all fees and charges of internal or external counsel with whom any Indemnified Party may consult and all expenses of litigation and preparation therefor) which any Indemnified Party may incur or which may be asserted against any Indemnified Party by any person, entity or governmental authority (including any person or entity claiming derivatively on behalf of Borrower), in connection with or arising out of or relating to the matters referred to in this Note or in the other Loan Documents or the use of any advance hereunder, whether (a) arising from or incurred in connection with any breach of a representation, warranty or covenant by Borrower, or (b) arising out of or resulting from any suit, action, claim, proceeding or governmental investigation, pending or threatened, whether based on statute, regulation or order, or tort, or contract or otherwise, before any court or governmental authority; provided, however, that the foregoing indemnity agreement shall not apply to any claims, damages, losses, liabilities and expenses solely attributable to an Indemnified Party's gross negligence or willful misconduct. The indemnity agreement contained in this section shall survive the termination of this Note, payment of any advance hereunder and the assignment of any rights hereunder. Borrower may participate at its expense in the defense of any such action or claim.

(20)COUNTERPARTS; ELECTRONIC SIGNATURES AND RECORDS. This Note and any other Loan Document may be signed in any number of counterpart copies and by the parties hereto on separate counterparts, but all such copies shall constitute one and the same instrument. Notwithstanding any other provision herein. the Borrower agrees that this Note, the Loan Documents, any amendments thereto, and any other information, notice, signature card, agreement or authorization 1elated thereto (each, a "Communication") may, at the Lender's option, be in the form of an electronic record, Any Communication may, at the Lender's option, be signed or executed using electronic signatures. For the avoidance of doubt, the authorization under this paragraph may include, without limitation, use or acceptance by the Lender of a manually signed paper Communication which has been converted into electronic form (such as scanned into PDF format) for transmission, delive1y and/or retention.

(21)BENEFICIAL OWNERSHIP CERTIFICATION, Borrower represents and warrants, as of the date hereof, and as of the date of execution of this Note, that the information in the Certification of Beneficial Owner(s) ("Certification of Beneficial Owners") executed and delivered to Lender on or prior to the date of this Note, if any, as updated from time to time in accordance with this Note, is true, complete and correct as of the date hereof and as of the date any such update is delivered. Borrower agrees that from the date of execution of this Note until this Note has been terminated, Borrower will provide: (i) confirmation of the accuracy of the information set forth in the most recent Certification of Beneficial Owners provided to Lender, as and when requested by Lender; (ii) a new Certification of Beneficial Owners in form and substance acceptable to Lender when the individual(s) identified as a controlling party and/or a direct or indirect individual owner on the most recent Certification of Beneficial Owners provided to Lender have changed; and (iii) such other information and documentation as may reasonably be requested by Lender from time to time for purposes of compliance by Lender with applicable laws (including without limitation the USA Patriot Act and other "know your customer" and anti-money laundering rules and regulations), and any policy or procedure implemented by Lender to comply therewith.

(22)INCREASED COSTS; YIELD PROTECTION, On written demand, together with written evidence of the justification therefor, Borrower agrees to pay Lender all direct costs incurred, any losses suffered or payments made by Lender as a result of any Change in Law (hereinafter defined), imposing any reserve, deposit, allocation of capital or similar requirement (including without limitation, Regulation D of the Board of Governors of the Federal Reserve System) on Lender, its holding company or any of their respective assets relative to the Note. "Change in Law" means the occurrence, after the date of this Agreement, of any of the following: (a) the adoption or taking effect of any law, rule, regulation or treaty, (b) any change in any law, rule, regulation or treaty or in the administration, interpretation, implementation or application thereof by any governmental authority or (c) the making or issuance of any request, rule, guideline or directive (whether or not having the force of law) by any governmental authority; provided that notwithstanding anything herein to the contrary, (x) the Dodd-Frank Wall Street Reform and Consumer Protection Act and all requests, rules, guidelines or directives thereunder or issued in connection therewith and (y) all requests, rules, guidelines or directives promulgated by Lender for International Settlements, the Basel Committee on Banking Supervision (or any successor or similar authority) or the United States or foreign regulatory authorities, in each case pursuant to Basel III, shall in each case be deemed to be a "Change in Law", regardless of the date enacted, adopted or issued.

PRIOR TO SIGNING THIS NOTE, BORROWER READ AND UNDERSTOOD ALL THE PROVISIONS OF THIS NOTE, INCLUDING THE PAYMENT, AMORTIZATION, AND INTEREST PROVISIONS. BORROWER AGREES TO THE TERMS OF THE NOTE.

Page - 4 - of 5

BORROWER ACKNOWLEDGES RECEIPT OF A COMPLETED COPY OF THIS PROMISSORY NOTE. BORROWER:

PREFORMED LINE, LLC

|

|

|

Andrew Klaus, Chief Financial Officer of Preformed Line, LLC |

Page - 5 - of 5

DEPARTMENT OF TRANSPORTATION

FEDERAL AVIATION ADMINISTRATION

FAA AIRCRAFT REGISTRY

P.O. Box 25504

Oklahoma City, Oklahoma 73125

AIRCRAFT SECURITY AGREEMENT

|

NAME & ADDRESS OF BORROWER: |

|

|

Preformed Line, LLC 660 Beta Drive Mayfield Village, OH 44143 |

|

|

NAME & ADDRESS OF SECURED PARTY/LENDER: |

|

|

PNC Equipment Finance, LLC 4355 Emerald St. Suite 100 Boise, ID 83706 |

|

|

NAME & ADDRESS OF GRANTOR: |

|

|

Preformed Line, LLC 660 Beta Drive Mayfield Village, OH 44143 |

ABOVE SPACE FOR FAA USE ONLY |

THIS AIRCRAFT SECURITY AGREEMENT dated December 31, 2020, is made and executed between Preformed Line, LLC ("Grantor") and PNC Equipment Finance, LLC (as more fully defined below, "Lender").

(1)GRANT OF SECURITY INTEREST. For valuable consideration, Grantor grants to Lender a continuing security Interest in the Collateral to secure the Obligations and agrees that Lender shall have the rights stated in this Agreement with respect to the Collateral, in addition to all other rights which Lender may have by law.

(2)COLLATERAL. The word "Collateral" as used in this Agreement means the following described Airframe, Engines and Contracts, as defined herein:

|

YEAR MFG |

AIRCRAFT MANUFACTURER |

MODEL NUMBER |

SERIAL NUMBER |

FAA REGISTRATION NUMBER |

|

2020 |

TEXTRON AVIATION INC. |

700 |

700-0040 |

N751PL |

|

ENGINE MAKE |

MODEL NUMBER (S) |

SERIAL NUMBER (S) |

|

|

|

HONEYWELL |

AS907-2-1S (aka AS907 Series on the International Registry drop down menu) |

P144189 |

|

|

|

HONEYWELL |

AS907-2-1S (aka AS907 Series on the |

P144190 |

||

|

|

International Registry drop down menu) |

|

||

|

PROPELLER MAKE |

MODEL NUMBER (S) |

SERIAL NUMBER (S) |

|

|

|

|

|

|

|

|

The word "Aircraft" also means and includes without limitation, (a) the Airframe, (b) the Engines, (c) any propellers, and (d) related Jog books, manuals, diagrams and records.

The word "Airframe" means the Aircraft's airframe, together with any and all parts, appliances, components, instruments, accessories, accessions, attachments, equipment, or avionics (including, without limitation, radio, radar, navigation systems, or other electronic equipment) installed in, appurtenant to, or delivered with or in respect of such airframe,

Page - 1 - of 12

The word "Engines". means any engines described above together with any other aircraft engines which either now or in the future are installed on, appurtenant to, or delivered with or in respect of the Airframe, together with any and all parts, appliances, components, accessories, accessions, attachments or equipment installed on, appurtenant to, or delivered with or in respect of such engines. The word "Engines" shall also refer to any replacement aircraft engine which, under this Agreement, is required or permitted to be installed upon the Airframe.

The word "Contracts" means any and all agreements, contracts, service contracts, repair contracts, maintenance contracts, including the Engine Maintenance Program, insurance contracts, leases, purchase agreements, bills of sale and assignments, and any other instruments, contracts, or agreements of any kind with respect to the Collateral.

(3)DURATION. This Agreement, including any representations, warranties and covenants contained herein, shall remain continuing, in full force and effect until such time as the Obligations secured hereby, including principal, interest, costs, expenses, attorneys' fees and other fees and charges, shall have been paid in full, together with all additional sums that Lender may pay or advance on Grantor's behalf and interest thereon as provided in this Agreement.

(4)REPRESENTATIONS, WARRANTIES, AND COVENANTS. Grantor represents, warrants and covenants to Lender at all times while this Agreement is in effect as follows:

(a)Title. Grantor warrants that Grantor is the lawful owner of the Collateral and holds good and marketable title to the Collateral, free and clear of all Encumbrances except the lien of this Agreement. Grantor is, or concurrent with the completion of the transactions contemplated by this Agreement will be, the registered owner of the Aircraft pursuant to a proper registration under the Transportation Code, and Grantor qualifies in all respects as a citizen of the United States as defined in the Transportation Code. If Grantor acquired its interest in the Aircraft on or after the effective date of the Convention, the ownership rights of Grantor shall be the subject of a valid and subsisting registered contract of sale at the International Registry. Grantor shall defend Lender's rights in the Collateral against the claims and demands of all other persons. The Collateral is not and will not be registered under the laws of any foreign country, and Grantor is and will remain a citizen of the United States as defined in the Transportation Code.•

(b)Authority; Binding Effect, etc. Grantor is a limited liability company which is, and at all times shall be, duly organized, validly existing, and in good standing under and by virtue of the laws of the State of Ohio. Grantor is duly authorized to transact business in all other states in which Grantor is doing business, having obtained all necessary filings, governmental licenses and approvals for each state in which Grantor is doing business. Grantor has the full right, power and authority to enter into the Note, the Related Documents, and this Agreement and to grant a security interest in the Collateral to Lender. The Note, the Related Documents, and this Agreement are binding upon Grantor as well as Grantor's successors and assigns, and are legal, valid and binding obligations of Grantor and are legally enforceable in accordance with their terms. Grantor's principal place of business is 660 Beta Drive, Mayfield Village, OH 44143, and unless Grantor has designated otherwise in writing, the Home Airport (as defined below) is the office at which Grantor keeps its complete logs, manuals, books and records including its complete logs, manuals, books and records concerning the Collateral. Grantor's exact legal name is: Preformed Line, LLC. Grantor has not used any trade, assumed or previous names within the past five years. Grantor's organizational identification number is i294794. Grantor has not merged with or into, or transferred all or substantially all of its assets to, any other entity within the past five years. Grantor was situated in the United States, State of Ohio at the time of the conclusion of this Agreement. Grantor has the power to dispose of the Aircraft, as contemplated in the Convention.

(c)Authorization. Grantor's execution, delivery, and performance of the Note, this Agreement and all the Related Documents have been duly authorized by all necessary action by Grantor and do not conflict with, result in a violation of, or constitute a default under (If any provision of Grantor's articles of organization or membership agreements, or bylaws or articles of incorporation, or any agreement or other instrument binding upon Grantor or (2) any law, governmental regulation, court decree, or order applicable to Grantor or to Grantor's properties.

(d)Litigation and CI11ims. No litigation, claim, investigation, administrative proceeding or similar action (including those for unpaid taxes) against Grantor is pending or threatened, and no other event has occurred which may materially adversely affect Grantor's financial condition or properties, other than litigation, claims, or other events, if any, that have been disclosed to and acknowledged by Lender in writing.

(e)Taxes. All of Grantor's tax returns and reports that are or were required to be filed, have been filed, and all taxes, assessments and other governmental charges in connection with the Aircraft and the Collateral have been paid in full, except those presently being or to be contested by Grantor in good faith in the ordinary course of business and for which adequate reserves have been provided.

(f)Information. All written information heretofore or contemporaneously herewith furnished by Grantor to Lender for the purposes of or in connection with this Agreement or any transaction contemplated hereby (including without limitation the description of the Aircraft) is, and all information hereafter furnished by or on behalf of Grantor to Lender will be, true and accurate in every material respect on the date as of which such information is dated or certified; and none of such information is or will be incomplete by omitting to state any material fact necessary to make such information not materially misleading.

(g)Aircraft and Log Books. Grantor will keep accurate and complete logs, manuals, books, and records relating to the Collateral, and will provide Lender with copies of such reports and information relating to the Collateral as Lender may reasonably require from time to time.

(h)Airframe and Engines. The Airframe is type certified to transport at least eight persons including crew, or goods in excess of 2750 kilograms and each of the Engines has at least 1750 pounds of thrust or at least 550 rated take off shaft horsepower.

(3)Perfection of Security Interest. The security interest granted herein constitutes a valid and subsisting International Interest in the Aircraft under the Convention. Grantor grants and covenants to continue a first priority perfected security interest (including an International Interest) in and to the Collateral in favor of Lender. Upon request of Lender, Grantor agrees to prepare and file financing statements and to take whatever other actions are requested by Lender to perfect and continue Lender's security interests in the Collateral. Upon request of Lender, Grantor will deliver to Lender any and all of the documents evidencing or constituting the Collateral, and Granter will note Lender's interest upon any and all chattel paper if not delivered to Lender for possession by Lender. In particular, Grantor will perform, or will cause to be performed, upon Lender's request, each and all of the

Page - 2 - of 12

following: (1) Record, register and file this Agreement (and the IDERA, as defined below), together with such notices, financing statements or other documents or instruments as Lender may request from time to time to carry out fully the intent of this Agreement, with the FM in Oklahoma City, Oklahoma, United States of America and other governmental agencies, either concurrent with the delivery and acceptance of the Collateral or promptly after the execution and delivery of this Agreement; (2) Take all actions necessary to initiate or consent to the registration of an International Interest in the Aircraft (or at Lender's option, a Prospective International Interest) with the International Registry; Take all actions necessary to initiate or consent to the registration of any other interests or rights pertaining to the Collateral with the International Registry, as requested in the sole discretion of Lender; (4) Furnish to Lender evidence of every such recording, registering, and filing; and (5) Execute and deliver or perform any and all acts and things which may be reasonably requested by Lender with respect to complying with or remaining subject to the Geneva Convention, the Convention, the International Registry, the laws and regulations of the FM, the laws of the United States and the laws and regulation of any of the various states or countries in which the Collateral is or may fly over, operate in, or become located in. Grantor hereby appoints Lender as Grantor's irrevocable attorney-in-fact for the sole purposes of preparing, executing, and/or filing any documents necessary to perfect, amend or to continue the security interests granted in this Agreement or to demand termination of filings of other secured parties. Lender may at any time, and without further authorization from Grantor, file a carbon, photographic or other reproduction of any financing statement or of this Agreement for use as a financing statement. Grantor will reimburse Lender for all expenses for the perfection and the continuation of the perfection of Lender's security interest in the Collateral.

(i)Convention Requirements. Prior to funding by Lender, (a) Grantor shall establish a valid and existing account with the International Registry, appoint an Administrator and/or a Professional User acceptable to Lender to initiate or consent to registrations at the International Registry with regard to the Collateral, and initiate the registration of an International Interest (or, at Lender's option, a Prospective International Interest) in the Collateral, with all such steps being completed except for the consent of Lender, (b) Grantor's initiation of such registration at the International Registry shall not have expired or lapsed, (c) Grantor shall execute and Lender shall have received a fully completed and originally executed Irrevocable De-Registration and Export Request Authorization ("IDERA"), in the form attached hereto as Exhibit A and acceptable to the FM and Lender, and (d) Grantor's Contract of Sale shall be registered and searchable in the International Registry.

(j)Performance of Contracts. Grantor hereby undertakes to perform all of its obligations under the Note, this Agreement, any Related Documents and any Contracts and to procure the performance of third parties (other than Lender) under the Related Documents and any Contracts.

(4)Notices to Lender. Grantor will promptly notify Lender in writing at Lender's address shown above (or such other addresses as Lender may designate from time to time) prior to any (1) change in Grantor's name; (2) change in Grantor's assumed business name(s); (3) (if Grantor is a business) change in the ownership of the Grantor or management of the Grantor; change in the authorized signer(s); (5) change in Grantor's principal office address; (6) change in Grantor's state of organization; (7) conversion of Grantor to a new or different type of business entity; (8) merger of Grantor with or into, transfer by Grantor of all or substantially all of its assets to, or acquisition by Grantor of all or substantially all of the assets of, any other entity; or (9) change in any other aspect of Grantor that directly or indirectly relates to any agreements between Grantor and Lender. No change in Grantor's name or state of organization will take effect until after Lender has received notice.

(m)Location of the Collateral. Grantor will hangar or keep the Collateral at its home airport or base location (the "Home Airport"), which Is:

Cuyahoga County Airport (CGF)

(n)Maintenance, Use, Repairs, Inspections, and Licenses. Grantor, at its expense, shall do, or cause to be done, in a timely manner with respect to the Collateral each and all of the following:

(I)Guarantor shall maintain and keep the Collateral in as good condition and repair as it is on the date of this Agreement, ordinary wear and tear excepted.

(2)Grantor shall maintain and keep the Aircraft in good order and repair and in airworthy condition in accordance with the requirements of the FAA and each of the manufacturers' manuals and mandatory service bulletins and each of the manufacturers' non-mandatory service bulletins which relate to airworthiness, and as recommended or required by any rules, regulations, or guidelines of the FAA and/or the manufacturer.

(3)Grantor shall replace in or on the Airframe, any and all Engines, parts, appliances, instruments or accessories which may be worn out, lost, destroyed or otherwise rendered unfit for use,

(4)Grantor shall cause to be performed, on all parts of the Aircraft, all applicable mandatory airworthiness directives, Federal Aviation Regulations, special Federal Aviation Regulations, and manufacturers' service bulletins relating to airworthiness, the compliance date of which shall occur while this Agreement is in effect,

(5)Grantor shall be responsible for all required inspections of the Aircraft and licensing or re-licensing of the Aircraft in accordance with all applicable FAA and other governmental requirements. Granter shall at all times cause the Aircraft to have on board and in a conspicuous location a current Certificate of Airworthiness issued by the FAA.

(6)All inspections, maintenance, modifications, repairs, and overhauls of the Aircraft (including those performed on the Airframe, the Engines or any components, appliances, accessories, instruments, or equipment) shall be performed by personnel authorized by the FAA to perform such services.

(7)If any Engine, component, appliance, accessory, instrument, equipment or part of the Aircraft shall reach such a condition as to require overhaul, repair or replacement, for any cause whatever, in order to comply with the standards for maintenance and other provisions set fo11h in this Agreement, Grantor may:

Page - 3 - of 12

(a)Install on or in the Aircraft such items of substantially the same type in temporary replacement of those then _ installed on the Aircraft, pending overhaul or repair of the unsatisfactory item; provided, however, that such replacement items must be in such a condition as to be permissible for use upon the Aircraft in accordance with the standards for maintenance and other provisions set forth in this Agreement; provided further, however, that Grantor at all times must retain unencumbered title to any and all items temporarily removed; or

(b)Install on or in the Aircraft such items of substantially the same type and value in permanent replacement of those then installed on the Aircraft; provided, however, that such replacement items must be in such condition as to be permissible for use upon the Aircraft in accordance with the standards for maintenance and other provisions set forth in this Agreement; provided further, however, that in the event Grantor shall be required or permitted to install upon the Airframe or any Engine, components, appliances, accessories, instruments, engines, equipment or parts in permanent replacement of those then installed on the Airframe or such Engine, Grantor may do so provided that, in addition to any other requirements of this Agreement:

(i)Lender is not divested of its security interest in and lien upon any item removed from the Aircraft and that no such removed item shall be or become subject to the lien or claim of any person, unless and until such item is replaced by an item of the type and condition required by this Agreement, title to which, upon its being installed or attached to the Airframe, is validly vested in Grantor, free and clear of all liens and claims, of every kind or nature, of all persons other than Lender;

(ii)Grantor's title to every substituted item shall immediately be and become subject to the security interests and liens of Lender and each of the provisions of this Agreement, and each such item shall remain so encumbered and so subject unless it is, in tum, replaced by a substitute item in the manner permitted in this Agreement;

(iii)If an item is removed from the Aircraft and replaced in accordance with the requirements of this Agreement, and if the substituted item satisfies the requirements of this Agreement, including the terms and conditions above, then the item which is removed shall thereupon be free and clear of the security interests and liens of Lender; and

(iv)Such items with and individual or aggregate purchase price in excess of$500,000.00 are approved in writing by Lender in its reasonable discretion.•

(8)In the event that any Engine, component, appliance, accessory, instrument, equipment or part is installed upon the Airframe, and ls not in substitution for or in replacement of an existing item, such additional item shall be considered as an accession to the Airframe.

(9)If the Engines are enrolled in or become enrolled in an "Engine Maintenance Program" at the time of loan application or anytime thereafter, Granter represents, warrants, and covenants that the Engines will continue to be enrolled in such Engine Maintenance Program while this Agreement is in effect and until all amounts owed to Lender are paid in full, "Engine Maintenance Program" means the engine maintenance program provided by or similar to, but not limited to, any of the following: Honeywell's MSP, Textron's ProAdvantage CFE Corp.'s CSP, Jet Support Services lnc.'s JSSI, Pratt & Whitney's ESP, Williams International's TAP, GE's OnPoint, Rolls Royce's Corporate Care, Honda's GHAE EMC and EMS.

(10)Grantor shall maintain all records, logs, and materials relating to the Aircraft required by, and in accordance with, the FAA and its rules and regulations, regardless of upon whom such requirements are, by their terms, normally imposed.

(11)The Aircraft shall be operated at all times by a currently certified pilot having the minimum total pilot hours and pilot-in-command hours required by FAA rules or regulations and applicable insurance policies.

(12)Grantor shall use, operate, maintain, and store the Aircraft, and every part thereof, carefully and in compliance with all applicable statutes, ordinances, and regulations of all jurisdictions in which the Aircraft is used, and with all applicable insurance policies, manufacturer's recommendations and operating and maintenance manuals, including, without limitation, FAR 91, 121, or 135, as applicable, and all applicable maintenance, service, repair and overhaul manuals and service bulletins published by manufacturers of the Aircraft or of the accessories, equipment and parts installed in the Aircraft,

(o)Taxes, Assessments and Liens. Grantor will pay when due all taxes, assessments and liens upon the Collateral, its use or operation, upon this Agreement, upon the Note, or upon any of the other Related Documents. Grantor may withhold any such payment or may elect to contest any lien if Grantor is in good faith conducting an appropriate proceeding to contest the obligation to pay and so long as Lender's interest in the Collateral is not jeopardized in Lender's sole opinion. If the Collateral is subjected to a lien which is not discharged within fifteen (15) days, if requested by Lender, Grantor shall deposit with Lender cash, a sufficient corporate surety bond or other security satisfactory to Lender in an amount adequate to provide for the discharge of the lien plus any interest, costs or other charges that could accrue as a result of foreclosure or sale of the Collateral. In any contest Grantor shall defend itself and Lender and shall satisfy any final adverse judgment before enforcement against the Collateral. Grantor shall name Lender as an additional obligee under any surety bond furnished in the contest proceedings.

(p)Compliance with Governmental Requirements. Grantor shall comply with all laws, ordinances and regulations of the FAA and all other governmental authorities applicable to the use, operation, maintenance, overhauling or condition of the Collateral. Grantor may contest in good faith any such law, ordinance or regulation and withhold compliance during any proceeding, including appropriate appeals, so long as Lender's interest in the Collateral, in Lender's opinion, is not jeopardized.

(q)Maintenance of Insurance. Grantor shall procure and maintain at all times all risks insurance on the Collateral, including without limitation, ground, taxiing and in flight coverage, loss, damage, destruction, fire, theft, liability and hull insurance, and such other insurance as Lender may require with respect to the Collateral, in form, amounts, coverages and basis reasonably acceptable to Lender and issued by a company or companies reasonably acceptable to Lender. Grantor shall further provide and maintain, at its sole cost and expense, comprehensive public liability insurance, naming both Grantor and Lender as parties insured, protecting against claims for bodily injury, death and/or property damage arising out of the use, ownership, possession, operation and condition of the Aircraft, and further containing a broad

Page - 4 - of 12

form contractual liability endorsement covering Grantor's obligations to indemnify Lender as provided under this Agreement. Lender's other requirements for insurance as of the date of this Agreement, subject to modification at Lender's reasonable discretion, include the following: (I) the Borrower must be the named insured; (2) the policy must provide coverage to the Engines while removed from the Airframe; (3) unless otherwise consented to by Lender in writing, the liability insurance policy must provide a minimum of $10 million liability coverage; (4) the all risks policy must be for the greater of(a) the amount of the Obligations or (b) the full insureable value of the Aircraft, and the basis must be the original cost of the Aircraft; (5) the policy must contain a breach of warranty endorsement up to 90% of the policy; (6) coverage must be maintained, in full force and effect, for the duration of the Note; (7) PNC Equipment Finance, LLC (or its assignee) must be named as lienholder and loss payee; (8) the policy must not prohibit the loss payee from making insurance payments upon Grantor's failure to make payments or upon Borrower's default; (9) the policy must include territorial limits; (10) the policy must include coverage for possible seizure and/or impoundment, and/or war risk perils; (11) if the Aircraft is to be operated by a charter operator or is party to a lease agreement with a charter operator, and Lender has consented to such use, the policy must include coverage for charter operation and for spare parts (engines); and (12) the policy must provide for notification of the loss payees upon termination of coverage. Such policies of insurance must also contain a provision, in form and substance acceptable to Lender, prohibiting cancellation or the alteration of such insurance without at least thirty (30) days prior written notice to Lender of such intended cancellation or alteration. Such insurance policies also shall include an endorsement providing that coverage in favor of Lender will not be impaired in any way by any act, omission or default of Grantor or any other person. Grantor agrees to provide Lender with originals or certified copies of such policies of insurance. Grantor, upon request of Lender, will deliver to Lender from time to time the policies or certificates of insurance in form satisfactory to Lender. In connection with all policies covering assets in which Lender holds or is offered a security interest for the Obligations, Grantor will provide Lender with such lender's loss payable or other endorsements as Lender may require. Grantor shall not use or permit the Collateral to be used in any manner or for any purpose excepted from or contrary to the requirements of any insurance policy or policies required to be carried and maintained under this Agreement or for any purpose excepted or exempted from or contrary to the insurance policies, nor shall Grantor do any other act or permit anything to be done which could reasonably be expected to invalidate or limit any such insurance policy or policies.

(r)Failure To Provide Insurance. Grantor acknowledges and agrees that if Grantor fails to provide any required insurance or fails to continue such insurance in force, Lender may do so at Grantor's expense. The cost of any such insurance, at the option of Lender, shall be added to the Obligations. Grantor acknowledges that if Lender so purchases any such insurance, the insurance will provide limited protection against physical damage to the Collateral, up to an amount equal to the unpaid balance of the debt. Grantor's equity in the Collateral may not be insured. In addition, the insurance may not provide any public liability or property damage indemnification and may not meet the requirements of any financial responsibility laws.

(s)Application of Insurance Proceeds. Granter shall promptly (not to exceed seven (7) days) notify Lender of any loss or damage to the Collateral in excess of$5,000, whether or not such casualty or loss is covered by insurance. Lender may make proof of loss if Grantor fails to do so within fifteen (15) days of the casualty. Lender shall have the right to receive directly the proceeds of any insurance payable to Grantor on the Collateral; and the insurance proceeds shall be paid directly to Lender. If Lender consents to repair or replacement of the damaged or destroyed Collateral, Lender shall, upon satisfactory proof of expenditure, pay or reimburse Grantor from the proceeds for the reasonable cost of repair or restoration. If Lender does not consent to repair or replacement of the Collateral, Lender shall retain a sufficient amount of the proceeds to pay all of the Obligations, and shall pay the balance to Grantor. Any proceeds which have not been disbursed within six (6) months after their receipt and which Grantor has not committed to the repair or restoration of the Collateral shall be used to prepay the Obligations.

(t)Insurance Reports. Grantor, upon reasonable request of Lender, shall furnish to Lender reports on each existing policy of insurance showing such information as Lender may reasonably request including, but not limited to, the following: (1) the name of the insurer; (2) the risks insured; (3) the amount of the policy; (4) the proper(y insured; (5) the then current value on the basis of which insurance has been obtained and the manner of determining that value; and (6) the expiration date of the policy. In addition, Granter shall upon request by Lender (however not more often than annually) have an independent appraiser satisfactory to Lender determine, as applicable, the cash value or replacement cost of the Collateral at PNC's expense, unless an Event of Default has occurred or is continuing then at Grantor's expense.

(u)Notice of Encumbrances and Events of Default, Grantor shall immediately notify Lender in writing upon obtaining knowledge of the tiling of any attachment, lien, judicial process, or claim relating to the Collateral. Granter additionally agrees to immediately notify Lender in writing upon the occurrence of any Event of Default, or event that with the passage of time, failure to cure, or giving of notice, may result in an Event of Default under any of Grantor's obligations that may be secured by any presently existing or future Encumbrance, or that may result in an Encumbrance affecting the Collateral, or should the Collateral be seized or attached or levied upon, or threatened by seizure or attachment or levy, by any person other than Lender.

(i)Notices of Claims and Litigation. Grantor will promptly inform Lender in writing of (1) all material adverse changes in Grantor's financial condition, (2) all existing and all threatened in writing litigation, claims, investigations, administrative proceedings or similar actions affecting or concerning in any manner the Collateral, and (3) all existing and all threatened litigation, claims., investigations, administrative proceedings or similar actions affecting or concerning in any manner the Grantor or any guarantor which could materially affect the financial condition of Grantor or the financial condition of any guarantor.•

(w)Inspection. Granter shall permit employees or agents of Lender at any reasonable time to inspect any and all Collateral (including the logs, books, manuals and records comprising or related to the Collateral) for the Obligations and to examine financial statements and to make copies and memoranda of Grantor's financial statements. Unless compliance is waived in writing by Lender or until all of the Obligations have been paid In full, Grantor shall promptly submit to Lender such information relating to the Borrower's, Grantor's or principal equity owners' of Borrower and Granter affairs (including but not limited to annual financial statements and tax returns for Borrower, Grantor or principal equity owner of Borrower and Grantor) as the Lender may reasonably request. If Granter now or at any time hereafter maintains any records including but not limited to records related to the Collateral (including without limitation computer generated records and computer software programs for the generation of such records) in the possession of a third par(y, Grantor by execution of this Agreement authorizes such party to permit Lender free access (either in paper form or on-line via the internet) to such records at all reasonable times and to provide Lender with copies of any records it may request, all at Grantor's expense.

Page - 5 - of 12

(x)Compliance Certificates. Unless waived in writing by Lender, Grantor shall provide Lender within thirty (30) days after the end of the nine month period following the Funding Date (the "Compliance Due Day") and within thirty (30) days annually of the Compliance Due Day thereafter, with a certificate executed by Grantor's chief financial officer and pilot, or other officer or person acceptable to Lender, certifying that or providing (a) the representations and warranties set forth in this Agreement are true and correct as of the date of the certificate; (b) as of the date of the certificate, no Event of Default exists under this Agreement; (c) the Grantor has maintained and kept the Collateral in good order and repair and in airworthy condition in accordance with the requirements of each of the manufacturers' manuals and mandatory service bulletins and each of the manufacturers' non-mandatory service bulletins which relate to airworthiness; (d) the Grantor has performed, on all parts of the Collateral, all applicable mandatory airworthiness directives, and regulation of the Federal Aviation Administration; (e) the total number of hours and landings on the Airframe; (f) the total number of hours on the Engines since their last major overhaul or core; (g) verification that the Engines are enrolled in an Engine Maintenance Program if they were enrolled in an Engine Maintenance Program at the time of loan application; (h) the Engine serial numbers; (i) contact information (name and phone number) for the maintenance facility that performed the last annual inspection or phase inspection; and G) the insurance report identified above.

(y)Additional Assurances. Grantor will make, execute and deliver to Lender such promissory notes, mortgages, security agreements, assignments, financing statements, instruments, documents and other agreements as Lender or its attorneys may reasonably request to evidence and secure the Note and/or the Obligations.

(z)Continuation. The foregoing representations and warranties, and all other representations and warranties contained in the Note, the Related Documents, and this Agreement are and shall be continuing in nature and shall remain in full force and effect until such time as the Note and all other obligations of Grantor to the Lender are paid in full and until this Agreement is terminated or cancelled as provided herein.

(5)PROHIBITIONS REGARDING COLLATERAL. Grantor represents, warrants and covenants to Lender while this Agreement remains in effect as follows:

(a)Transactions Involving Collateral, Without the prior written consent by Lender, (i) Grantor shall not sell, offer to sell, or otherwise transfer or dispose of the Collateral, and (ii) Grantor shall not lease, pledge, mortgage, encumber or otherwise permit the Collateral to be subject to any lien, security interest, encumbrance, or charge, other than the security interest provided for in this Agreement. This includes security interests even if junior in right to the security interests granted under this Agreement. Unless waived by Lender, all proceeds from any disposition of the Collateral (for whatever reason) shall be held in trust for Lender,and shall not be commingled with any other funds; provided however, this requirement shall not constitute consent by Lender to any sale or other disposition, Upon receipt, Granter shall immediately deliver any such proceeds to Lender.

(b)No Commercial Use. Grantor shall use the Collateral solely for business purposes. Granter shall not, without the prior written consent of Lender, (i) use the Collateral, or permit the Collateral to be used, in Commercial Operations, or (ii) use the Collateral under a Part 135 Certificate.

(c)Removal of the Collateral. Except for routine use, Grantor shall not change the Home Airport or remove the Collateral from the Home Airport without Lender's prior written consent. Granter shall, whenever requested, advise Lender of the exact location of the Collateral. Grantor shall not base, or permit the Collateral to be based, outside the continental United States of America,

(d)Travel Restrictions. Granter shall not operate or locate the Collateral, or permit the Collateral to be operated, located, or flown (i) outside the continental United States without war risk coverage, (ii) in or over any country for which the U.S. State Department has issued travel restrictions, (iii) in or over any country or jurisdiction that does not maintain full diplomatic relations with the United States, (iv) in or over any area of hostilities, or (v) in or over any geographic area not covered by the insurance then in effect. Without limiting the foregoing, Granter agrees that at no time during the effectiveness of this Agreement shall the Collateral be operated in, flown over, or temporarily located in any jurisdiction, unless the Geneva Convention, together with its necessary enacting rules and regulations (or some comparable treaty and regulations satisfactory to Lender) shall be in effect in such jurisdiction and any notices, financing statements, documents, or instruments necessary or required, in the opinion of Lender, to be filed in such jurisdiction shall have been filed and file stamped copies thereof shall have been furnished to Lender. Notwithstanding the foregoing, at no time shall the Collateral be operated in or over any area which may expose Lender to any penalty, fine, sanction or other liability, whether civil or criminal, under any applicable law, rule, treaty or convention; nor may the Collateral be used in any manner which is or may be declared to be illegal and which may thereby render the Collateral liable to confiscation, seizure, detention or destruction.

(e)No Removal of Parts. Except as permitted or required in the section of this Agreement titled "Maintenance, Use, Repairs, Inspections, and Licenses," Grantor shall not remove or permit the removal of any parts, engines, accessories, avionics or equipment from the Aircraft without replacing the same with comparable parts, engines, accessories, avionics and equipment acceptable to Lender and the Aircraft's manufacturer and insurer,

(I)Modifications, Grantor shall not, without the prior written consent of Lender, modify the Aircraft in any material way, Including but not limited to, the Aircraft's function or operating capability.

(6)FUTURE ENCUMBRANCES. Granter shall not, without the prior written consent of Lender, grant any Encumbrance that may affect the Collateral, or any part or parts thereof, nor shall Grantor permit or consent to any Encumbrance attaching to or being filed against the Collateral, or any part or parts thereof, in favor of anyone other than Lender. Grantor shall further promptly pay when due all statements and charges of airport authorities, mechanics, laborers, materialmen, suppliers and others incurred in connection with the use, operation, storage, maintenance and repair of the Aircraft so that no Encumbrance may attach to or be filed against the Aircraft or other Collateral. Grantor shall not file or register (or consent to the filing or registration at) any International Interest, Contract of Sale, or subordination, whether prospective or otherwise (or any amendment, assignment, modification, supplement, subordination or subrogation thereof) pertaining to the Aircraft, with the FAA or the International Registry without the prior written consent of Lender, which may be withheld in its sole discretion. Granter shall not execute or deliver an IDERA in favor of any party other than the Lender without the prior written consent of Lender, which may be withheld in its sole discretion. Granter additionally agrees to obtain, upon request by Lender, and in form and substance as may then be satisfactory to Lender, appropriate releases, terminations, discharges, waivers and/or subordinations of any Encumbrances that may affect the Collateral at any time and, at Lender's option cause same to be filed or registered with the FAA or International Registry as applicable.

Page - 6 - of 12

(7)GRANTOR'S RIGHT TO POSSESSION. Until an Event of Default, Grantor shall have the possession and beneficial use of the Collateral and may use it in any lawful manner not inconsistent with this Agreement or the Related Documents.

(8)LENDER'S EXPENDITURES. If any action or proceeding is commenced that would materially affect Lender's interest in the Collateral or if Grantor fails to comply with any provision of this Agreement or any Related Documents in any material respect, including but not limited to Grantor's failure to discharge or pay when due any amounts Grantor is required to discharge or pay under this Agreement or any Related Documents, Lender, on Grantor's behalf, may (but shall not be obligated to) take any action that Lender deems appropriate, including but not limited to discharging or paying all taxes, liens, security interests, International Interests, Contracts of Sale, encumbrances and other claims (including the filing of any interest with the FAA or the registration of any interest with the International Registry), at any time levied or placed on the Collateral and paying all costs for inspecting, repairing, operating, insuring, maintaining and preserving the Collateral. All such expenditures incurred or paid by Lender for such purposes will then bear interest at the rate charged under the Note from the date incurred or paid by Lender to the date of repayment by Grantor. All such expenses will become a part of the Obligations and, at Lender's option, will (A) be payable on demand; (B) be added to the balance of the Note and be apportioned among and be payable with any installment payments to become due during either ( 1) the terms of any applicable insurance policy; or (2) the remaining term of the Note; or (C) be treated as a balloon payment which will be due and payable at the Note's maturity. The Agreement also will secure payment of these amounts. Such right shall be in addition to all other rights and remedies to which Lender may be entitled upon an Event of Default.

(9)DEFAULT. The Grantor shall, at Lender's option, be in default under this Agreement upon the happening of any of the following events or conditions (each, an "Event of Default"): (a) any Event of Default (as defined in any of the Obligations); (b) any default under any of the Obligations that does not have a defined set of "Events of Default'' and the lapse of any notice or cure period provided in such Obligations with respect to such default; (c) demand by Lender under any of the Obligations that have a demand feature; (d) the failure by the Grantor to perform any of its obligations under this Agreement; (e) falsity, inaccuracy or material breach by the Grantor of any written warranty, representation or statement made or furnished to Lender by or on behalf of the Granter; (f) an uninsured material loss, theft, damage, or destruction to any of the Collateral, or the entry of any judgment against the Grantor or any lien against or the making of any levy, seizure or attachment of or on the Collateral that is not otherwise permitted hereunder; (g) the failure of Lender to have a perfected first priority security interest in the Collateral except as otherwise permitted hereunder; (h) any indication or evidence received by Lender that the Grantor may have directly or indirectly been engaged in any type of activity which, in Lender's discretion, might result in the forfeiture of any property of the Grantor to any governmental entity, federal, state or local; or (i) any change in ownership of Grantor, whether voluntary or involuntary, including, but not limited to, a division of Grantor into two or more entities.

(10)RIGHTS AND REMEDIES ON DEFAULT. If an Event of Default occurs and is continuing under this Agreement, Lender shall have all the rights of a secured party under the UCC and a creditor under the Convention, and Lender shall have and may exercise any or all other rights and remedies it may have available at law, in equity, or otherwise. In addition and without limitation, Lender may exercise any one or more of the following rights and remedies:

(a)Accelerate Obligations. Lender may declare the entire Obligations, including any prepayment premium which Grantor would be required to pay, immediately due and payable, without notice of any kind to Grantor.

(b)Assemble Collateral. Lender may require Grantor to deliver to Lender all or any portion of the Collateral and any and all certificates of title and other documents relating to the Collateral. Lender may require Grantor to assemble the Collateral and make it available to Lender at a place to be designated by Lender. Lender also shall have full power to enter upon the property of Grantor to take possession of and remove the Collateral. If the Collateral contains other goods not covered by this Agreement at the time of repossession, Grantor agrees Lender may take such other goods, provided that Lender makes reasonable efforts to return them to Grantor after repossession.

(c)Sale of the Collateral. Lender shall have full power to sell, lease, transfer, or otherwise deal with the Collateral or proceeds thereof in Lender's own name or that of Grantor. Lender may sell the Collateral at public auction or private sale. Unless the Collateral threatens to decline speedily in value or is of a type customarily sold on a recognized market, Lender will give Grantor, and other persons as required by law, reasonable notice of the time and place of any public sale, or the time after which any private sale or any other disposition of the Collateral is to be made. However, no notice need be provided to any person who, after Event of Default occurs, enters into and authenticates an agreement waiving that person's right to notification of sale. The requirements of reasonable notice shall be met if such notice is given at least ten ( I 0) business days before the time of the sale or disposition. All expenses relating to the disposition of the Collateral, including without limitation the expenses of retaking, inspecting, repairing, operating, holding, insuring, preparing for sale and selling the Collateral, shall become a part of the Obligations secured by this Agreement and shall be payable on demand, with interest at the Note rate from date of expenditure until repaid.

(d)Appoint Receiver. Lender shall have the right to have a receiver appointed to take possession of all or any part of the Collateral, with the power to protect and preserve the Collateral, to operate the Collateral preceding foreclosure or sale, and to collect the rents from the Collateral and apply the proceeds, over and above the cost of the receivership, against the Obligations. The receiver may serve without bond if permitted by law. Lender's right to the appointment of a receiver shall exist whether or not the apparent value of the Collateral exceeds the Obligations by a substantial amount. Employment by Lender shall not disqualify a person from serving as a receiver.

(e)Obtain Deficiency. If Lender chooses to sell any or all of the Collateral, Lender may obtain a judgment against Grantor for any deficiency remaining on the Obligations due to Lender after application of all amounts received from the exercise of the rights provided in this Agreement.

(f)Election of Remedies. Except as may be prohibited by applicable law, all of Lender's rights and remedies, whether evidenced by this Agreement, the Related Documents, or by any other writing, shall be cumulative and may be exercised singularly or concurrently. Election by Lender to pursue any remedy shall not exclude pursuit of any other remedy, and an election to make expenditures or to take action to perform an obligation of Grantor under this Agreement, after Grantor's failure to perform, shall not affect Lender's right to declare a default and exercise its remedies.

Page - 7 - of 12