|

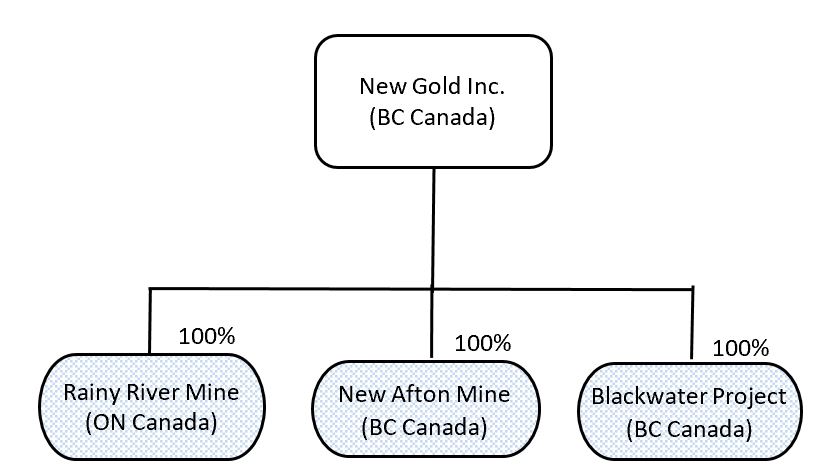

CORPORATE STRUCTURE

|

9

|

|

GENERAL DEVELOPMENT OF THE BUSINESS

|

10

|

|

Developments – Mines and Projects

|

10

|

|

Developments – Financial

|

11

|

|

DESCRIPTION OF THE BUSINESS

|

13

|

|

Principal Products

|

13

|

|

Specialized Skills and Knowledge

|

13

|

|

Competitive Conditions

|

13

|

|

Operations

|

14

|

|

Technical Information

|

15

|

|

Summary of Mineral Reserve and Mineral Resource Estimates

|

15

|

|

MINERAL PROPERTIES

|

19

|

|

Rainy River Mine, Canada

|

19

|

|

New Afton Mine, Canada

|

26

|

|

Blackwater Project, Canada

|

33

|

|

Cerro San Pedro Mine, Mexico

|

36

|

|

RISK FACTORS

|

36

|

|

NOTES

|

57

|

|

DIVIDENDS

|

58

|

|

DESCRIPTION OF CAPITAL STRUCTURE

|

58

|

|

MARKET FOR SECURITIES

|

60

|

|

DIRECTORS AND OFFICERS

|

60

|

|

LEGAL PROCEEDINGS AND REGULATORY ACTIONS

|

67

|

|

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

|

67

|

|

TRANSFER AGENT AND REGISTRAR

|

67

|

|

MATERIAL CONTRACTS

|

68

|

|

TECHNICAL REPORTS

|

68

|

|

SCHEDULE A Audit Committee Charter

|

1

|

|

SCHEDULE B DEFINITIONS

|

1

|

|

SCHEDULE C ABBREVIATIONS AND MEASUREMENT CONVERSION

|

1

|

|

SCHEDULE D EXCHANGE RATE AND METAL PRICE INFORMATION

|

1

|

FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2019

|

●

|

100% interest in the Rainy River gold-silver mine in Ontario, Canada (“Rainy River Mine”)

|

|

●

|

100% interest in the New Afton gold-copper mine British Columbia, Canada (“New Afton Mine”)

|

|

●

|

100% interest in the Blackwater gold-silver project in British Columbia, Canada (“Blackwater Project”)

|

|

Location

|

Employees

|

|

Corporate Office

|

33

|

|

Rainy River Mine

|

809

|

|

New Afton Mine

|

491

|

|

Cerro San Pedro Mine(1)

|

123

|

|

Blackwater Project

|

4

|

|

Total

|

1,337

|

| (1) |

As at December 31, 2019, 62 employees at the

Cerro San Pedro Mine belonged to a union.

|

|

MINERAL

RESERVES

|

|||||||

|

Metal grade

|

Contained metal

|

||||||

|

Tonnes

000s |

Gold

g/t |

Silver

g/t |

Copper

% |

Gold

Koz |

Silver

Koz |

Copper

Mlbs |

|

|

RAINY RIVER

|

|||||||

|

Open Pit Mineral Reserves

|

|||||||

|

Direct processing

|

|||||||

|

Proven

|

15,700

|

1.21

|

2.4

|

-

|

612

|

1,187

|

-

|

|

Probable

|

30,675

|

1.15

|

2.5

|

-

|

1,136

|

2,416

|

-

|

|

Open Pit P&P (direct

proc.)

|

46,375

|

1.17

|

2.4

|

-

|

1,748

|

3,602

|

-

|

|

Low grade

|

|||||||

|

Proven

|

5,702

|

0.35

|

1.9

|

-

|

65

|

341

|

-

|

|

Probable

|

15,470

|

0.35

|

2.2

|

-

|

172

|

1,076

|

-

|

|

Open Pit P&P (low grade)

|

21,172

|

0.35

|

2.1

|

-

|

237

|

1,417

|

-

|

|

Stockpile

|

|||||||

|

Proven

|

5,928

|

0.53

|

1.1

|

-

|

102

|

211

|

-

|

|

Probable

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Open Pit

P&P (stockpile)

|

5,928

|

0.53

|

1.1

|

-

|

102

|

211

|

-

|

|

Open Pit Total Mineral

Reserves

|

73,476

|

0.88

|

2.2

|

-

|

2,087

|

5,231

|

-

|

|

Underground

|

|||||||

|

Proven

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Probable

|

4,096

|

4.17

|

7.8

|

-

|

549

|

1,034

|

-

|

|

Underground P&P (direct

proc.)

|

4,096

|

4.17

|

7.8

|

-

|

549

|

1,034

|

-

|

|

Combined

Direct proc. & Low grade

|

|||||||

|

Proven

|

27,331

|

0.88

|

2.0

|

-

|

779

|

1,740

|

-

|

|

Probable

|

50,240

|

1.15

|

2.8

|

-

|

1,857

|

4,526

|

-

|

|

Total Rainy

River Mineral Reserves

|

77,572

|

1.06

|

2.5

|

-

|

2,636

|

6,265

|

-

|

|

NEW AFTON

|

|||||||

|

A&B Zones

|

|||||||

|

Proven

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Probable

|

20,213

|

0.55

|

1.9

|

0.73

|

357

|

1,234

|

323

|

|

C Zone

|

|||||||

|

Proven

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Probable

|

27,088

|

0.74

|

1.8

|

0.80

|

648

|

1,610

|

478

|

|

Total New

Afton Mineral Reserves

|

47,302

|

0.66

|

1.9

|

0.77

|

1,005

|

2,844

|

802

|

|

BLACKWATER

|

|||||||

|

Direct processing Reserves

|

|||||||

|

Proven

|

124,500

|

0.95

|

5.5

|

-

|

3,790

|

22,100

|

-

|

|

Probable

|

169,700

|

0.68

|

4.1

|

-

|

3,730

|

22,300

|

-

|

|

P&P (direct

proc.)

|

294,300

|

0.79

|

4.7

|

-

|

7,510

|

44,400

|

-

|

|

Low grade Reserves

|

|||||||

|

Proven

|

20,100

|

0.50

|

3.6

|

-

|

330

|

2,300

|

-

|

|

Probable

|

30,100

|

0.34

|

14.6

|

-

|

330

|

14,100

|

-

|

|

P&P (low

grade)

|

50,200

|

0.40

|

10.2

|

-

|

650

|

16,400

|

-

|

|

Combined Direct proc. &

Low grade

|

|||||||

|

Proven

|

144,600

|

0.88

|

5.3

|

-

|

4,110

|

24,400

|

-

|

|

Probable

|

199,800

|

0.63

|

5.7

|

-

|

4,050

|

36,400

|

-

|

|

Total

Blackwater Mineral Reserves

|

344,400

|

0.74

|

5.5

|

-

|

8,170

|

60,800

|

-

|

|

TOTAL PROVEN

& PROBABLE MINERAL RESERVES

|

|

|

|

11,811

|

69,909

|

802

|

|

|

Measured and Indicated Mineral Resources

Mineral Resource estimates as at December 31, 2019 are presented in the following tables:

MEASURED & INDICATED MINERAL RESOURCES (Exclusive of Mineral Reserves)

|

|||||||

|

Metal grade

|

Contained metal

|

||||||

|

|

Tonnes

000s |

Gold

g/t |

Silver

g/t |

Copper

% |

Gold

Koz |

Silver

Koz |

Copper

Mlbs |

|

RAINY RIVER

|

|

|

|

|

|

|

|

|

High and Medium grade Mineral Resources

|

|||||||

|

Open Pit

|

|||||||

|

Measured

|

695

|

1.46

|

2.9

|

-

|

33

|

64

|

-

|

|

Indicated

|

4,813

|

1.18

|

3.4

|

-

|

182

|

531

|

-

|

|

Open Pit M&I (High and medium grade)

|

5,508

|

1.21

|

3.4

|

-

|

214

|

596

|

-

|

|

Underground

|

|||||||

|

Measured

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Indicated

|

14,866

|

3.49

|

9.1

|

-

|

1,669

|

4,331

|

-

|

|

Underground M&I

|

14,866

|

3.49

|

9.1

|

-

|

1,669

|

4,331

|

-

|

|

Low grade Mineral Resources

|

|||||||

|

Open Pit

|

|||||||

|

Measured

|

293

|

0.34

|

1.9

|

-

|

3

|

18

|

-

|

|

Indicated

|

2,460

|

0.34

|

2.2

|

-

|

27

|

175

|

-

|

|

Open Pit M&I (High, medium and low grade)

|

2,753

|

0.34

|

2.2

|

-

|

30

|

193

|

-

|

|

Combined M&I

|

|||||||

|

Measured

|

988

|

1.13

|

2.6

|

-

|

36

|

82

|

-

|

|

Indicated

|

22,139

|

2.64

|

7.1

|

-

|

1,878

|

5,037

|

-

|

|

Total Rainy River M&I

|

23,127

|

2.57

|

6.9

|

-

|

1,914

|

5,120

|

-

|

|

NEW AFTON

|

|

|

|

|

|

|

|

|

A&B Zones

|

|

|

|

|

|

|

|

|

Measured

|

17,013

|

0.63

|

1.7

|

0.83

|

346

|

940

|

312

|

|

Indicated

|

9,759

|

0.44

|

2.6

|

0.71

|

138

|

825

|

154

|

|

A&B Zone M&I

|

26,773

|

0.56

|

2.1

|

0.79

|

484

|

1,765

|

466

|

|

C-zone

|

|||||||

|

Measured

|

6,116

|

0.78

|

2.0

|

0.94

|

154

|

401

|

126

|

|

Indicated

|

12,727

|

0.71

|

2.1

|

0.83

|

292

|

852

|

233

|

|

C-zone M&I

|

18,843

|

0.74

|

2.1

|

0.86

|

446

|

1,254

|

359

|

|

HW Lens

|

|||||||

|

Measured

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Indicated

|

11,362

|

0.51

|

2.0

|

0.44

|

187

|

738

|

109

|

|

HW Lens M&I

|

11,362

|

0.51

|

2.0

|

0.44

|

187

|

738

|

109

|

|

Combined M&I

|

|||||||

|

Measured

|

23,154

|

0.67

|

1.8

|

0.86

|

500

|

1,345

|

438

|

|

Indicated

|

33,854

|

0.57

|

2.2

|

0.66

|

617

|

2,409

|

495

|

|

Total New Afton M&I

|

57,008

|

0.61

|

2.1

|

0.74

|

1,118

|

3,754

|

933

|

|

BLACKWATER

|

|

|

|

|

|

|

|

|

Direct processing Mineral Resources

|

|||||||

|

Measured

|

288

|

1.39

|

6.6

|

-

|

13

|

61

|

-

|

|

Indicated

|

45,440

|

0.84

|

4.7

|

-

|

1,227

|

6,866

|

-

|

|

M&I (direct proc.)

|

45,728

|

0.84

|

4.7

|

-

|

1,240

|

6,927

|

-

|

|

Low grade Mineral Resources

|

|||||||

|

Measured

|

11

|

0.29

|

7.4

|

-

|

-

|

3

|

-

|

|

Indicated

|

15,831

|

0.32

|

3.9

|

-

|

162

|

1,985

|

-

|

|

M&I (low grade)

|

15,842

|

0.32

|

3.9

|

-

|

162

|

1,988

|

-

|

|

Total Blackwater M&I

|

61,570

|

0.71

|

4.5

|

-

|

1,402

|

8,915

|

-

|

|

TOTAL M&I MINERAL RESOURCES

|

|

|

|

|

4,434

|

17,788

|

933

|

|

INFERRED MINERAL RESOURCES

|

||||||||

|

Metal grade

|

Contained metal

|

|||||||

|

|

Tonnes

000s |

Gold

g/t |

Silver

g/t |

Copper

% |

Gold

Koz |

Silver

Koz |

Copper

Mlbs |

|

|

RAINY RIVER

|

|

|

|

|

|

|

|

|

|

High and Medium grade Resources

|

||||||||

|

Open Pit

|

2,015

|

0.61

|

1.8

|

-

|

39

|

114

|

-

|

|

|

Underground

|

1,297

|

3.76

|

3.5

|

-

|

157

|

146

|

-

|

|

|

Total Direct Processing

|

3,312

|

1.84

|

2.4

|

-

|

196

|

260

|

-

|

|

|

Low grade Resources

|

||||||||

|

Open Pit

|

167

|

0.35

|

1.4

|

-

|

2

|

8

|

-

|

|

|

Rainy River Inferred

|

3,479

|

1.77

|

2.4

|

-

|

198

|

268

|

-

|

|

|

NEW AFTON

|

|

|

|

|

|

|

|

|

|

A&B Zones

|

6,367

|

0.34

|

1.3

|

0.35

|

70

|

272

|

49

|

|

|

C-zone

|

7,650

|

0.41

|

1.3

|

0.47

|

101

|

316

|

71

|

|

|

HW Lens

|

3

|

0.49

|

0.6

|

0.19

|

-

|

-

|

-

|

|

|

New Afton Inferred

|

14,022

|

0.38

|

1.3

|

0.42

|

172

|

589

|

121

|

|

|

BLACKWATER

|

|

|

|

|

|

|

|

|

|

Direct processing

|

13,933

|

0.76

|

4.0

|

-

|

341

|

1,792

|

-

|

|

|

Low grade Resources

|

4,225

|

0.32

|

3.5

|

-

|

44

|

475

|

-

|

|

|

Blackwater Inferred

|

18,158

|

0.66

|

3.9

|

-

|

385

|

2,267

|

-

|

|

|

TOTAL INFERRED MINERAL RESOURCES

|

|

|

|

|

754

|

3,124

|

121

|

|

| 1. |

New Gold’s Mineral Reserves and Mineral Resources have been estimated in accordance with the CIM Standards (2014), which are incorporated by reference in NI 43-101.

|

| 2. |

All Mineral Reserve and Mineral Resource estimates for New Gold’s properties and projects are effective as at December 31, 2019.

|

| 3. |

New Gold’s year-end 2019 Mineral Reserves and Mineral Resources have been estimated based on the following metal prices and foreign exchange (FX) rate criteria:

|

|

Gold

$/ounce

|

Silver

$/ounce

|

Copper

$/pound

|

FX

CAD:USD

|

|

|

Mineral Reserves

|

$1,275

|

$17.00

|

$3.00

|

$1.30

|

|

Mineral Resources

|

$1,375

|

$19.00

|

$3.25

|

$1.30

|

| 4. |

Cut-offs for the Company’s Mineral Reserves and Mineral Resources are outlined in the following table:

|

|

Mineral Property

|

Mineral Reserves

Lower cut-off

|

Mineral Resources

Lower Cut-off

|

|

|

Rainy River

|

O/P direct processing:

|

0.46 – 0.49 g/t AuEq

|

0.44 – 0.45 g/t AuEq

|

|

O/P low grade material:

|

0.30 g/t AuEq

|

0.30 g/t AuEq

|

|

|

U/G direct processing:

|

2.20 g/t AuEq

|

2.00 g/t AuEq

|

|

|

New Afton

|

Main Zone – B1 & B2 Blocks:

|

USD$ 21.00/t

|

All Resources: 0.40% CuEq

|

|

B3 Block & C-zone:

|

USD$ 24.00/t

|

||

|

Blackwater

|

O/P direct processing:

|

0.26 – 0.38 g/t AuEq

|

All Resources: 0.40 g/t AuEq

|

|

O/P low grade material:

|

0.32 g/t AuEq

|

||

| 5. |

New Gold reports its Measured and Indicated Mineral Resources exclusive of Mineral Reserves. Measured and Indicated Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability. Inferred Mineral Resources have a greater amount of uncertainty as to their existence and technical feasibility, do not have demonstrated economic viability, and are likewise exclusive of Mineral

Reserves. Numbers may not add due to rounding.

|

| 6. |

Mineral Resources are classified as Measured, Indicated and Inferred based on relative levels of confidence in their estimation and on technical and economic parameters consistent with

the methods considered to be most suitable to their potential commercial extraction. The designators ‘open pit’ and ‘underground’ may be used to indicate the envisioned mining method for different portions of a Resource. Similarly,

the designators ‘direct processing’ and ‘lower grade material’ may be applied to differentiate material envisioned to be mined and processed directly from material to be mined and stored separately for future processing. Mineral

Reserves and Mineral Resources may be materially affected by metallurgical, environmental, permitting, legal, title, taxation, sociopolitical, marketing and other risks and relevant issues. Additional details regarding mineral

reserve and mineral resource estimation, classification, reporting parameters, key assumptions and associated risks for each of New Gold’s material properties are provided in the respective NI 43-101 Technical Reports, which are

available on the Company’s SEDAR profile available at www.sedar.com.

|

| 7. |

The preparation of New Gold's consolidated statement and estimation of Mineral Reserves has been completed under the oversight and review of Mr. Andrew Croal, Director of Technical

Services for the Company. Mr. Croal is a Professional Engineer and member of the Association of Professional Engineers Ontario. Preparation of New Gold’s consolidated statement and estimation of Mineral Resources has been completed

under the oversight and review of Mr. Michele Della Libera, Director, Exploration for the Company. Mr. Della Libera is a Professional Geoscientist and member of the Association of Professional Geoscientists of Ontario and of the

Engineers and Geoscientists of British Columbia. Mr. Croal and Mr. Della Libera are "Qualified Persons" as defined by NI 43-101.

|

|

2020 Expected Capital Expenditures(1)

|

2020 Expected All-in Sustaining Costs/ gold eq oz sold

|

|||

|

Sustaining Capital and Sustaining Leases(2)

|

$128 – $162

|

Operating Expense

|

$875 – $955

|

|

|

Growth Capital(2)

|

$3 – $9

|

+ sustaining expenditures(3)

|

~$595

|

|

|

Total

|

$131 – $171

|

Total All-in Sustaining Costs

|

$1,470 - $1,550

|

|

|

(1) In millions.

(2) Based on the Company’s 2020 estimated capital

expenditures. Includes sustaining leases. Sustaining capital excludes expenditures related to growth-related initiatives. Growth capital excludes sustaining capital.

(3) Includes sustaining capital expenditures, capitalized

mining, capitalized and expensed exploration that is sustaining in nature, environmental reclamation costs and sustaining capital leases. See “Non-GAAP Financial Performance

Measures” in New Gold’s MD&A.

|

||||

|

2020 Expected Capital Expenditures(1)

|

2020 Expected All-in Sustaining Costs/ gold eq oz

sold

|

|||

|

Sustaining Capital and Sustaining Leases (2)

|

$50 – $70

|

Operating Expense

|

$550 – $630

|

|

|

Growth Capital(2)

|

$85 – $105

|

+ treatment and refining charges

|

~$115

|

|

|

Total

|

$135 – $175

|

+ sustaining expenditures(4)

|

~$275

|

|

|

Total All-in Sustaining Costs

|

$940 – $1020

|

|||

|

(1) In

millions.

(2) Based

on the Company’s 2020 estimated capital expenditures. Sustaining capital excludes expenditures related to growth-related

initiatives. Growth capital excludes sustaining capital.

(3) Includes

sustaining capital expenditures, capitalized mining, capitalized and expensed exploration that is sustaining in nature,

environmental reclamation costs and sustaining capital leases. See “Non-GAAP Financial Performance Measures” in New Gold’s MD&A.

|

||||

|

●

|

the strength of the United States economy and

the economies of other industrialized and developing nations;

|

|

●

|

global and regional political and economic

conditions;

|

|

●

|

the relative strength of the United States

dollar and other currencies;

|

|

●

|

expectations with respect to the rate of

inflation;

|

|

●

|

interest rates;

|

|

●

|

purchases and sales of gold by central banks

and other large holders, including speculators;

|

|

●

|

demand for jewellery containing gold;

|

|

●

|

investment activity, including speculation, in

gold as a commodity; and

|

|

●

|

worldwide production.

|

|

●

|

the

Company has been or will be

at all times in complete

compliance with such laws,

regulations and permitting

requirements, or with any

new or amended laws,

regulations and permitting

requirements that may be

imposed from time to time;

|

|

●

|

the Company’s

compliance will not be

challenged; or

|

|

●

|

the

costs of compliance will be

economic and will not

materially or adversely

affect the Company’s future

cash flow, results of

operations and financial

condition.

|

|

●

|

monetary

penalties (including

fines);

|

|

●

|

restrictions

on or suspension of its

activities;

|

|

●

|

loss

of its rights, permits

and property;

|

|

●

|

completion

of extensive remedial

cleanup or paying for

government or

third-party remedial

cleanup;

|

|

●

|

premature

reclamation of our

operating sites; and

|

|

●

|

seizure

of funds or forfeiture

of bonds.

|

|

●

|

transaction

exposure: New Gold’s operations sell commodities and incur costs in

different currencies. Specifically, the Company’s revenues are denominated in United

States dollars while most of the Company’s expenses are currently denominated in

Canadian dollars and, to a lesser extent, Mexican pesos. This creates exposure at

the operational level, which may affect its profitability as exchange rates

fluctuate. The appreciation of non-United States dollar currencies against the

United States dollar can increase the costs of production at New Gold’s mines,

making those mines less profitable;

|

|

●

|

exposure

to currency risk: New Gold is exposed to currency risk through a portion of

the following assets and liabilities denominated in currencies other than the United

States dollar: cash and cash equivalents, investments, accounts receivable,

reclamation deposits, accounts payable and accruals, reclamation and closure cost

obligations and long-term debt; and

|

|

●

|

translation

exposure: New Gold’s functional and reporting currency is United States

dollars. Certain of the Company’s operations have assets and liabilities denominated

in currencies other than the United States dollar, with translation foreign exchange

gains and losses included in these balances in the determination of profit or loss.

Therefore, exchange rate movements in the Canadian dollar and, to a lesser extent,

Mexican peso can have a significant impact on the Company’s consolidated operating

results.

|

|

●

|

Standard & Poor’s Ratings Services: B (Recovery Rating: 3)

|

|

●

|

Moody’s Investors Service: B3 (SGL-3)

|

|

2019

|

High (C$)

|

Low (C$)

|

Volume

|

|

January

|

1.65

|

1.05

|

32,894,120

|

|

February

|

1.75

|

1.11

|

35,116,861

|

|

March

|

1.21

|

1.09

|

32,168,694

|

|

April

|

1.28

|

1.11

|

11,463,626

|

|

May

|

1.18

|

0.82

|

20,503,576

|

|

June

|

1.28

|

0.86

|

47,523,165

|

|

July

|

2.03

|

1.15

|

49,583,016

|

|

August

|

1.84

|

1.44

|

53,056,878

|

|

September

|

1.78

|

1.32

|

57,313,038

|

|

October

|

1.44

|

1.21

|

21,445,513

|

|

November

|

1.43

|

1.03

|

17,439,945

|

|

December

|

1.22

|

1.01

|

18,183,493

|

|

RENAUD ADAMS

Ontario, Canada

Director since:

September 12, 2018

Non-Independent Director President and Chief Executive Officer

Securities on March 25, 2020

Common Shares: 600,000

PSUs: 1,397,721

RSUs: 456,081

|

Renaud Adams has more than 25 years of experience in the mining industry. He was the

President and Chief Executive Officer of Richmont Mines Inc. from 2014 until the sale of the company to Alamos Gold in November

2017. During Mr. Adams’ time at Richmont Mines, production at the company’s principal mine more than doubled, Mineral Reserves more

than tripled, and costs were reduced to make the Island Gold Mine in Ontario one of the lowest cost operating underground mines in

the Americas. From 2011 to 2014, Mr. Adams was the Chief Operating Officer at Primero Mining Corporation, and prior to that he was

with IAMGOLD Corporation from 2007 to 2011 as the General Manager of the Rosebel mine in Suriname and then the Senior Vice

President, Americas Operations. Prior to IAMGOLD, Mr. Adams held various senior operations positions at mining operations located in

the Americas. Mr. Adams is also a director of GT Gold Corp. Mr. Adams holds a Bachelor of Engineering degree in Mining and Mineral

Processing from Laval University in Quebec, Canada.

|

|

NICHOLAS CHIREKOS

Colorado, United States

Director since: May 27, 2019

Independent Director

Securities on March 25, 2020

DSUs: 107,698

|

Nick Chirekos was appointed to the board on May 27, 2019 and has more than 25 years of

experience in investment banking and capital markets, with a focus on the mining industry. He served in various investment banking

roles at J.P. Morgan Securities Inc. from 1987 until his retirement in 2016. His roles included Managing Director, North American

Head of Mining from 2002 to 2016, and Global Head of Mining and Metals from 2000 to 2002. Mr. Chirekos brings extensive expertise in

mergers and acquisitions, equity, equity linked and fixed income transactions and was formerly a member of J.P. Morgan’s Investment

Banking North American Reputational Risk Committee. Mr. Chirekos is also a director of Peabody Energy Corporation and the Reiman

School of Finance Advisory Board at the University of Denver’s Daniels College of Business. He holds a Bachelor of Science degree

from the University of Denver and a Master of Business Administration degree from New York University. Mr. Chirekos ’s principal

occupation is as a corporate director.

|

|

GILLIAN DAVIDSON

Edinburgh, United Kingdom

Director since:

April 25, 2018

Independent Director

Securities on March 25, 2020

DSUs: 209,396

|

Gillian Davidson has 20 years of experience as an internal and external advisor to

companies and other organizations regarding sustainability, social license and community relations. Most recently, Dr. Davidson was

the Head of Mining and Metals for the World Economic Forum from 2014 to 2017, where she led global and regional engagement and

multi-stakeholder initiatives to advance responsible and sustainable mining. From 2008 to 2014, she was Director of Social

Responsibility at Teck Resources Limited, supporting social and environmental commitments and performance across the mining

lifecycle. Before joining Teck, Dr. Davidson held roles related to community development, environment and natural resources as a

consultant and in government. Dr. Davidson presently serves as a director on the board of Lydian International Limited as well as a

director on the board of Central Asia Metal Limited and Chair of the Sustainability Committee. Dr. Davidson has an Honours Master of

Arts in Geography from the University of Glasglow, a PhD in Development Economics and Economic Geography from the University of

Liverpool and is an alumnus of the Governor General of Canada’s Leadership Conference. Dr. Davidson is also chair of International

Women in Mining. Dr. Davidson’s principal occupation is as a consultant.

|

|

JAMES GOWANS

British Columbia, Canada

Director since:

July 9, 2018

Independent Director

Securities on March 25, 2020

Common Shares: 30,000

DSUs: 214,963

|

James Gowans has more than 30 years of experience in mineral exploration, mine

feasibility studies, mine construction and commissioning and the development of best practices in mine safety, operations and

economic performance improvement. From January 2016 to August 2018, he was the President and Chief Executive Officer of Arizona

Mining Inc. Previously, he was with Barrick Gold Corporation as Senior Advisor to the Chairman from August to December 2015,

Co-President from July 2014 to August 2015, and Executive Vice President and Chief Operating Officer from January to July 2014. From

2011 to 2014, Mr. Gowans was the Managing Director of Debswana Diamond Company (Pty) Ltd., and prior to that he held executive

positions at various companies including De Beers SA, De Beers Canada Inc., PT Inco Indonesia tbk and Placer Dome Inc. Mr. Gowans

previously served as the President of the Canadian Institute of Mining, Metallurgy and Petroleum, the Chair of the Board of the

Mining Association of Canada, and a director of the Conference Board of Canada. He currently serves on the boards of directors of

Cameco Ltd., Titan Mining Corporation and Trilogy Metals Inc. He is also the interim President and Chief Executive Officer of

Trilogy Metals Inc. Mr. Gowans is a Professional Engineer, holds a Bachelor of Applied Science degree in mineral engineering from

the University of British Columbia, and attended the Banff School of Advanced Management. Mr. Gowans’s principal occupation is as a

corporate director.

|

|

MARGARET MULLIGAN

Ontario, Canada

Director since:

April 25, 2018

Independent Director

Securities on March 25, 2020

DSUs: 200,380

|

Margaret (Peggy) Mulligan has over 35 years of experience in audit and finance. From

2008 to 2010, Ms. Mulligan was the Executive Vice President and Chief Financial Officer of Biovail Corporation and from 2005 to 2007

she was the Executive Vice President and Chief Financial Officer of Linamar Corporation. From 1994 to 2004, Ms. Mulligan was the

Senior Vice President, Audit and Chief Inspector and then the Executive Vice President, Systems and Operations of The Bank of Nova

Scotia. Before joining Scotiabank, she was an Audit Partner with PricewaterhouseCoopers. She holds a Bachelor of Math (Honours) from

the University of Waterloo and is a Chartered Professional Accountant, FCPA, CA. Ms. Mulligan also serves as a director on the board

of Canadian Western Bank. Ms. Mulligan’s principal occupation is as a corporate director.

|

|

IAN PEARCE

Ontario, Canada

Director since:

April 27, 2016

Independent Director

Securities on March 25, 2020

Common Shares: 27,200

DSUs: 378,834

|

Ian Pearce is the Chair of the Board of New Gold. Mr. Pearce has over 35 years of

experience in the mining industry. From 1993 to 2003, Mr. Pearce held progressively more senior engineering and project management

roles with Fluor Inc., including managing numerous significant development projects in the extractive sector. From 2003 to 2006, Mr.

Pearce held executive roles at Falconbridge Limited, including Chief Operating Officer, and he subsequently served as Chief

Executive Officer of Xstrata Nickel, a subsidiary of Xstrata plc, from 2006 to 2013. From 2013 to 2017, Mr. Pearce was a partner of

X2 Resources, a private partnership focused on building a mid-tier diversified mining and metals group. Mr. Pearce currently serves

as the Chair of the Board of MineSense Technologies Ltd., a technology company seeking to improve the ore extraction and recovery

process, and as a Senior Advisor at KoBold Metals, a company that deploys digital tools to discover new cobalt deposits. He is a

director of Nexa Resources S.A.as well as Vice Chair and Director of Outotec Oyj. He served as the Chair of the Board of Nevsun

Resources Ltd. up to its acquisition by Zijin Mining Group Co. Ltd. in December 2018. Mr. Pearce holds a Higher National Diploma in

Engineering (Mineral Processing) and a Bachelor of Science degree from the University of the Witwatersrand in South Africa. Mr.

Pearce’s principal occupation is as a Corporate Director.

|

|

MARILYN SCHONBERNER

Alberta, Canada

Director since:

June 26, 2017

Independent Director

Securities on March 25, 2020

DSUs: 256,520

|

Marilyn Schonberner served as the Chief Financial Officer and Senior Vice President,

and an Executive Director, of Nexen Energy ULC from January 2016 to June 2018. She joined Nexen in 1997 and over her 21 year career

with the company held positions of increasing responsibility including General Manager of Human Resources Services; Director of

Corporate Audit; Director of Business Services U.K.; and Treasurer and Vice President of Corporate Planning. Prior to joining Nexen,

Ms. Schonberner spent over 15 years in finance, strategic planning and organization development in the energy sector and as a

consultant. Ms. Schonberner currently serves on the board of directors of Wheaton Precious Metals Corp. and she is a member of the

Executive Committee of the Calgary Chapter of the Institute of Corporate Directors. Ms. Schonberner holds a Bachelor of Commerce

from the University of Alberta and a Master of Business Administration from the University of Calgary. She is a CPA, CMA and a

Certified Internal Auditor. Ms. Schonberner completed the Senior Executive Development Programme at the London Business School and

has obtained the ICD.D designation from the Institute of Corporate Directors. Ms. Schonberner’s principal occupation is as a

Corporate Director.

|

|

ROBERT CHAUSSE

Ontario, Canada

Executive Vice President and Chief Financial Officer

Securities on March 25, 2020

Common Shares: 500,000

PSUs: 646,653

RSUs: 186,655

|

Robert Chausse has an extensive background of more than 25 years of international

finance and mining experience. Most recently, he was Chief Financial Officer of Richmont Mines Inc., prior to which he was Chief

Financial Officer at Stornoway Diamonds. From 2013 to 2015, Mr. Chausse was Executive Vice President and Chief Financial Officer of

AuRico Gold, and from 2009 to 2013, he served as Vice President of Finance, Operations and Projects for Kinross Gold. He also served

as Chief Financial Officer for Baffinland Iron Mines Corporation from 2006 to 2009 and held increasingly senior positions with

Barrick Gold from 1998 to 2006. Rob received his Chartered Accountant designation in 1990.

|

|

ANNE DAY

Ontario, Canada

Vice President, Investor Relations

Securities on March 25, 2020

Common Shares: 135,000

PSUs: 189,060

RSUs: 76,408

|

Anne Day is a senior executive with more than 20 years of capital market experience

that includes the development and implementation of effective global investor relations strategies, primarily in the mining sector.

From 2015 to 2017, Anne was Senior Vice President, Investor Relations for Richmont Mines, where she was part of the senior executive

team that led the transformation of Richmont to be one of the top junior mining companies in the Americas. From 2007 to 2015, she

was Vice President, Investor Relations for AuRico Gold. Anne also served on the Board of Directors of AuRico Metals from 2015 to

2017. Anne holds a B. Comm degree (Marketing), an MBA (Finance) from the Sobeys School of Business and an ICD.D designation from the

Rotman School of Management.

|

|

SEAN KEATING

Ontario, Canada

Vice President, General Counsel and Corporate Secretary

Securities on March 25, 2020

Common Shares: 1,480

PSUs: 144,485

RSUs: 51,802

|

Sean Keating has over 15 years’ experience in corporate and securities law and mergers

and acquisitions, primarily in the mining industry. Sean joined New Gold in 2016 and was Assistant General Counsel prior to his

appointment as Vice President, General Counsel and Corporate Secretary in November 2019. Prior to joining New Gold, Sean was

corporate counsel to Barrick Gold Corporation from 2010 to 2015 where he was involved in mergers and acquisitions, financings,

commercial transactions, corporate governance, regulatory compliance and capital project development. From 2005 to 2010, Sean

practiced law at Torys LLP in the capital markets and mergers and acquisitions groups. Sean holds a J.D. and M.B.A. from the

University of Toronto and a B.Sc. (Chemistry) from St. Francis Xavier University.

|

|

ANKIT SHAH

Ontario, Canada

Vice President, Strategy and Business Development

Securities on March 25, 2020

Common Shares: 21,033

PSUs: 146,794

RSUs: 57,568

|

Ankit Shah is a mining finance executive with fifteen years of experience in strategy,

corporate development, capital allocation and investor relations, primarily within the mining industry. Ankit joined New Gold in

2010 with the primary focus of working with the corporate development and investor relations teams. Since that time, Ankit has

taken on progressively more responsibility for many facets of the business, including working with both the operations and

exploration groups of the company. Prior to joining New Gold, Ankit worked for both Ernst & Young and KPMG within their

Assurance and Financial Advisory practices. Ankit is both a Chartered Accountant and Chartered Professional Accountant.

|

|

ERIC VINET

Quebec, Canada

Vice President, General

Manager, Rainy River

Securities on March 25, 2020

PSUs: 246,269

RSUs: 99,550

|

Eric Vinet has over 29 years of experience in the mining industry and brings with him a

wealth of knowledge in numerous areas of mining production, including with various types of deposits: precious metals (Au, Ag), base

metals (Cu, Zn, Ni), as well as with both underground and open pit mining operations. Mr. Vinet has been involved at various stages

of mine construction and optimization, general site layout, and water and tailings facilities. Underground project experience

includes backfill/pastefill systems, alimak/raisebore, ventilation, production methods and others to optimize the operations. He was

General Manager for Semafo at the Mana Gold mine in Burkina Faso and also at the Samira Hill mine in Niger, both open pit mines. His

open pit experience includes supervisory roles at the Jeffrey mine and at McWatters Mines Inc., both in Canada. Prior to this, he

held a similar role with Scorpio Mining at the Nuestra Senora mine in Mexico, an underground mining operation. Additional

underground mining experience includes: Aur Resources (Mine Louvicourt) Quebec - Project Engineer and Supervisory roles; Kahama

Mining (Bulyanhulu Mine) Tanzania - Underground Production Supervisor; Canmet Laboratory - Research Engineer; Campbell Resources

Inc., Chibougamau Quebec– Superintendent; Breakwater Resources (El Mochito mine), Honduras - Mine Manager; and Les Mines Sigma ltd,

Val D’or Quebec - Project Engineer and Supervisory roles with narrow vein mining. In the last two years he has also worked on

several studies with DRA and InnovExplo. Mr. Vinet graduated from École Polytechnique de Montreal with a Bachelor's degree in Mining

Engineering in 1989.

|

|

Board Committee

|

Committee Members

|

Status

|

|

Audit Committee

|

Marilyn Schonberner (Chair)

|

Independent

|

|

Nicholas Chirekos

|

Independent

|

|

|

Margaret Mulligan

|

Independent

|

|

|

Human Resources and Compensation Committee

|

James Gowans (Chair)

|

Independent

|

|

Ian Pearce

|

Independent

|

|

|

Marilyn Schonberner

|

Independent

|

|

|

Corporate Governance and Nominating Committee

|

Margaret Mulligan (Chair)

Nicholas Chirekos

Gillian Davidson

|

Independent

Independent

Independent

|

|

Technical and Sustainability Committee

|

Gillian Davidson (Chair)

|

Independent

|

|

James Gowans

|

Independent

|

|

|

Ian Pearce

|

Independent

|

|

Marilyn Schonberner (Chair)

|

Independent (1)

|

Financially literate (2)

|

|

Nicholas Chirekos

|

Independent (1)

|

Financially literate (2)

|

|

Margaret Mulligan

|

Independent (1)

|

Financially literate (2)

|

| (1) |

A member of an Audit Committee is independent if the member has no direct or indirect material relationship with the Company which could, in the view of the

Company’s board of directors, reasonably interfere with the exercise of the member’s independent judgment.

|

| (2) |

An individual is financially literate if he or she has the ability to read and understand a set of financial statements that present a breadth of complexity of

accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Company’s financial statements.

|

|

Financial Years Ending

December 31

|

Audit Fees (1)

|

Audit Related Fees (2)

|

Tax Fees (3)

|

All Other Fees(4)

|

|

2019

|

C$1,176,500

|

C$266,956

|

C$55,106

|

C$240,000

|

|

2018

|

C$1,881,667

|

C$24,903

|

C$53,006

|

C$15,000

|

| (1) |

The aggregate fees billed for the performance of the audit or review of the Company’s financial statements.

|

| (2) |

The aggregate fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s

financial statements which are not included under the heading “Audit Fees”, including fees related work done related to the Company’s equity offering in August 2019.

|

| (3) |

The aggregate fees billed for professional services rendered for tax compliance, tax advice and tax planning.

|

| (4) |

In 2019, All Other Fees consists of a strategic planning workshop organized by Monitor Deloitte.

|

|

●

|

Indenture dated as of November 14, 2012 between New Gold Inc., the Guarantors (Metallica Resources Inc., Minera San Xavier S.A. de C.V., Peak Gold Ltd., Peak

Gold Mines Pty Ltd., Rockcliff Group Limited, Western Goldfields Inc. and Western Mesquite Mines, Inc.), and Computershare Trust Company, N.A. (as Trustee) relating to the 6.25% Senior Notes due 2022.

See “Notes” on page 57 for more information.

|

|

●

|

Indenture dated as of May 18, 2017 between New Gold Inc., the Guarantors (Minera San Xavier S.A. de C.V., New Gold Mesquite Inc., New Gold CSP Ltd., New Gold

Finance Inc., Western Goldfields (USA) Inc., New Gold Netherlands Cooperatie U.A., Peak Gold Asia Pacific Pty Ltd., Peak Gold Mines Pty Ltd. and Western Mesquite Mines, Inc.), and Computershare Trust

Company, N.A. (as Trustee) relating to the 6.375% Senior Notes due 2025. See “Notes” on page 57 for more information.

|

|

●

|

Amended and Restated Credit Agreement dated as of October 30, 2018 between New Gold Inc. (as borrower) and The Bank of Nova Scotia and RBC Capital Markets (as

Co-Lead Arrangers and Joint Book Runners) and The Bank of Nova Scotia (as Administrative Agent) and Royal Bank of Canada (as Syndication Agent) and The Bank of Nova Scotia, Royal Bank of Canada, JPMorgan

Chase Bank, N.A., The Toronto-Dominion Bank, Canadian Imperial Bank of Commerce, Bank of Montreal, Export Development Canada and Bank of America, N.A., Canada Branch (as Lenders) described under the

heading “General Development of the Business - Developments - Financial” on page 57.

|

|

●

|

New Afton PA dated February 24, 2020 between New Gold Inc. and 2742150 Ontario Limited, an affiliate of Ontario Teachers’ described under the heading “General

Development of the Business – Developments – Mines and Projects – New Afton Mine” on page 10.

|

|

●

|

The most recent technical report on the Rainy River Mine that is filed on SEDAR at www.sedar.com is titled “New Gold Rainy River NI 43-101 Technical Report”

dated March 12, 2020 by Mr. F. McCann, P.Eng., Mr. H. Smith, P.Eng., Mr. Mo Molavi, P.Eng., Dr. A Ross, P.Geo. and Ms. D. Nussipakynova, P.Geo. for AMC Mining Consultants (Canada) Ltd.; Mr. A. Millar,

MAusIMM, CP, for AMC Mining Consultants Pty Ltd.; Mr. K. Bocking, P. Eng., for Gold Associates Ltd.; Mr. E. Saunders, P. Eng., for SRK Consulting (Canada) Inc.; Mr. A. Zerwer, P.Eng., for BGC Engineering

Inc.; and Ms. T. Griffith, P.Eng., Senior Environmental Specialist, Rainy River Mine, New Gold Inc.

|

|

●

|

The most recent technical report on the New Afton Mine that is filed on SEDAR at www.sedar.com is titled “Technical Report on the New Afton Mine, British Columbia, Canada” dated

February 28, 2020 by Normand L. Lecuyer, P.Eng., David W. Rennie, P.Eng., Holger Krutzelmann, P. Eng., and Luis Vasquez, M.Sc., P.Eng., for Roscoe Postle Associates Inc.

|

AUDIT COMMITTEE CHARTER

| 1. |

Purpose and Authority

|

| 2. |

Membership and Composition

|

| 3. |

Meetings

|

| 4. |

Duties and Responsibilities

|

| 4.1 |

Financial Reporting and Disclosure

|

| a. |

Review and discuss with management and the external auditor at the completion of the annual examination:

|

| i. |

the Company's audited financial statements and related notes;

|

| ii. |

the external auditor's audit of the financial statements and their report;

|

| iii. |

any significant changes required in the external auditor's audit plan;

|

| iv. |

any serious difficulties or disputes with management encountered during the course of the audit; and

|

| v. |

other matters related to the conduct of the audit which are to be communicated to the Committee under IFRS.

|

| b. |

Review and discuss with management and the external auditor at the completion of any review engagement or other examination, the Company's quarterly financial statements.

|

| c. |

Review and discuss with management, prior to their public disclosure, the annual reports, quarterly reports, Management’s Discussion and Analysis (“MD&A”),

earnings press releases and any other material disclosure documents containing or incorporating by reference audited or unaudited financial statements of the Company and, if thought advisable, provide their recommendations on such

documents to the Board.

|

| d. |

Review and discuss with management any guidance being provided to shareholders on the expected earnings of the Company and, if thought advisable, provide their recommendations on such

documents to the Board.

|

| e. |

Inquire of the auditors regarding the quality and acceptability of the Company's accounting principles and estimates, including the clarity of financial disclosure and the degree of

conservatism or aggressiveness of the accounting policies and estimates.

|

| f. |

Review the Company's compliance with any policies and reports received from regulators. Discuss with management and the external auditor the effect on the Company's financial statements

of significant regulatory initiatives.

|

| g. |

Meet with the external auditor and management in separate executive sessions, as necessary or appropriate, to discuss any matters that the Committee or any of these groups believe should

be discussed privately with the Committee.

|

| h. |

Ensure that management has the proper and adequate systems and procedures in place for the review of the Company's financial statements, financial reports and other financial information

including all Company disclosure of financial information extracted or derived from the Company’s financial statements, and that they satisfy all legal and regulatory requirements. The Committee shall periodically assess the

adequacy of such procedures.

|

| i. |

Review with the Company's counsel, management and the external auditor any legal or regulatory matter, including reports or correspondence, which could have a material impact on the Company's financial statements or

compliance policies.

|

| j. |

Based on discussions with the external auditor concerning the audit, the financial statement review and such other matters as the Committee deems appropriate, recommend to the Board the filing of the audited annual and

unaudited quarterly financial statements and MD&A on SEDAR and the inclusion of the audited financial statements in the Annual Report on Form 40-F.

|

| 4.2 |

External Auditor

|

| a. |

Be responsible for recommending to the Board the appointment of the Company's external auditor and for the compensation, retention and oversight of the work of the external auditor

engaged by the Company. The external auditor shall report directly to the Committee. The Committee shall be responsible to resolve disagreements, if any, between management and the external auditor regarding financial reporting.

|

| b. |

Consider, in consultation with the external auditor, the audit scope and plan of the external auditor and the related engagement letter and recommend approval of same to the Board.

|

| c. |

Confirm with the external auditor and receive written confirmation at least once per year as to the external auditor's internal processes and quality control and disclosure of any

investigations or government enquiries, reviews or investigations of the external auditor.

|

| d. |

Take reasonable steps to confirm at least annually the independence of the external auditor, which shall include:

|

| i. |

ensuring receipt from the external auditor of a formal written statement delineating all relationships between the external auditor and the Company, consistent with IFRS, and determine

that they satisfy the requirements of all applicable securities laws,

|

| ii. |

considering and discussing with the external auditor any disclosed relationships or services, including non-audit services, that may impact the objectivity and independence of the

external auditor, and

|

| iii. |

approving in advance any audit or permissible non-audit related services provided by the external auditor to the Company with a view to ensuring independence of the external auditor, and in accordance with any applicable

regulatory requirements, including the requirements of all applicable securities laws with respect to approval of non-audit related services performed by the external auditor. Non-audit services of up to US$25,000 (and up to a

cumulative amount of $75,000 in a calendar year) may be pre-approved by the Chair of the Committee and ratified at the next Committee meeting.

|

| e. |

Approve the lead audit partner for the Company's external auditor, confirm that such lead partner has not performed audit services for the Company for more than five previous fiscal

years, and otherwise ensure the rotation of the lead partner and other partners in accordance with all applicable securities laws.

|

| f. |

Periodically review the performance of the Company’s external auditor and provide feedback to the extent deemed appropriate.

|

| g. |

Review and approve the Company's hiring policies regarding partners, employees and former employees of the present and former external auditors of the Company.

|

| 4.3 |

Internal Controls and Audit

|

| a. |

Review and assess the adequacy and effectiveness of the Company's systems of internal control and management information systems through discussion with management and the external

auditor to ensure that the Company maintains appropriate systems, is able to assess the pertinent risks of the Company and that the risk of a material misstatement in the financial disclosures can be detected.

|

| b. |

Assess the requirement for the appointment of an internal auditor for the Company and, if the appointment of an internal auditor is deemed appropriate, be responsible for (i) approving

the appointment and removal of such internal auditor, and (ii) if deemed appropriate, establishing a position description for such internal auditor.

|

| c. |

Review and approve the annual internal audit plan, and review on a periodic basis progress in executing the plan, significant changes to the plan, significant internal audit findings

(including related to the adequacy of internal controls over financial reporting) and any significant internal fraud issues.

|

| d. |

Review disclosures made to the Committee by the Company's CEO and CFO during their certification process required under applicable Canadian and United States securities laws. Review any

significant deficiencies in the design and operation of internal controls over financial reporting or disclosure controls and procedures and any fraud involving management or other employees who have a significant role in the

Company's internal controls.

|

| 4.4 |

Financial Risk Management

|

|

a.

|

Ensure that principal areas of financial risk are identified and that plans and processes are in place to manage or mitigate these risks.

|

|

b.

|

Review and report to the Board regarding the structure and adequacy of the Company’s insurance program, having regard to the Company’s business and insurable risks.

|

| 4.5 |

General

|

|

a.

|

Unless otherwise delegated to another committee by the Board, conduct an ongoing review of any transaction now in effect, and review and approve in advance any proposed transaction, that could be within the scope of "related

party transactions" as such term is defined in applicable securities laws, and establish appropriate procedures to receive material information about and prior notice of any such transaction.

|

|

b.

|

Establish procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters; and for the confidential, anonymous submission by

employees of the Company of concerns regarding questionable accounting or auditing matters.

|

|

c.

|

Conduct or authorize investigations into any matter within the scope of this Charter. The Committee may request that any officer or employee of the Company, its external legal counsel or its external auditor attend a meeting

of the Committee or meet with any member(s) of the Committee.

|

|

d.

|

Review the qualifications of the senior accounting and financial personnel.

|

|

e.

|

Provide oversight of the Company’s policies, procedures and practices with respect to the maintenance of the books, records and accounts, and the filing of reports, by the Company with respect to third party payments in

compliance with the Foreign Corrupt Practices Act (United States), Corruption of Foreign Public Officials Act (Canada), the Extractive Sector Transparency Measures Act (Canada) and similar applicable laws.

|

|

f.

|

Perform any other activities consistent with this Charter, the Company's Articles and governing law, as the Committee or the Board deems necessary or appropriate.

|

| 4.6 |

Oversight Function

|

| 5. |

Chair of the Committee

|

DEFINITIONS

|

Term

|

Definition

|

|

atomic absorption (AA)

|

A spectroanalytical procedure for the quantitative determination of chemical elements employing the absorption of optical radiation (light) by free atoms in the gaseous state.

|

|

andesite

|

An extrusive igneous, volcanic rock of intermediate composition, with aphanitic to porphyritic texture.

|

|

assay

|

Analysis to determine the amount or proportion of the element of interest contained within a sample.

|

|

ball mill

|

A horizontal rotating steel cylinder which grinds ore to fine particles. The grinding is carried out by the pounding and rolling of a charge of steel balls carried within the cylinder.

|

|

batholith

|

A very large igneous intrusion extending deep in the earth's crust.

|

|

block cave

|

Used to mine massive, steeply-dipping ore bodies. An undercut with haulage access is driven under the ore body, with "drawbells" excavated between the top of the haulage level and the bottom

of the undercut. The drawbells serve as a place for caving rock to fall into. The ore body is drilled and blasted above the undercut, and the ore is removed via the haulage access.

|

|

block model

|

A three-dimensional model that forms the basic framework of a Mineral Resource estimate.

|

|

bornite

|

A brittle reddish-brown crystalline mineral with an iridescent purple tarnish, consisting of a sulphide of copper and iron.

|

|

breccia

|

A coarse-grained clastic rock, composed of angular broken rock fragments held together by a mineral cement or in a fine-grained matrix; it differs from conglomerate in that the fragments have

sharp edges and unworn corners.

|

|

bullion

|

Gold or silver in bulk before coining, or valued by weight.

|

|

by-product

|

A secondary metal or mineral product that is recovered along with the primary metal or mineral product during the ore concentration process.

|

|

calc-alkalic

|

Rocks are rich in alkaline earths (magnesia and calcium oxide) and alkali metals and make up a major part of the crust of the earth's continents.

|

|

Cenozoic

|

The current and most recent of the three Phanerozoic geological eras, following the Mesozoic Era and covering the period from about 65 million years ago to the present.

|

|

chalcocite

|

A dark gray mineral that is an important ore of copper.

|

|

chalcopyrite

|

A copper mineral composed of copper, iron and sulphur. It tarnishes easily; going from bronze or brassy yellow to yellowish or grayish brown, has a dark streak, and is lighter in weight and

harder than gold.

|

|

Term

|

Definition

|

|

concentrate

|

A processing product containing the valuable ore mineral from which most of the waste mineral has been eliminated.

|

|

core

|

Cylindrical rock cores produced by diamond drilling method that uses a rotating barrel and an annular-shaped, diamond-impregnated rock-cutting bit to produce cores and lift them to the

surface to be examined.

|

|

Cretaceous

|

A geologic period and system from circa 145 to 66 million years ago. The Cretaceous follows the Jurassic period and is followed by the Paleogene period of the Cenozoic era. It is the last

period of the Mesozoic Era, and, spanning 80 million years, the longest period of the Phanerozoic Eon.

|

|

crushing

|

Breaking of ore into smaller and more uniform fragments to be then fed to grinding mills or to a leach pad.

|

|

crust

|

The outermost solid shell of a rocky planet, which is chemically distinct from the underlying mantle.

|

|

cyanidation

|

A method of extracting exposed gold or silver grains from crushed or ground ore by dissolving the contained gold and silver in a weak cyanide solution.

|

|

decline

|

A downward inclined underground tunnel.

|

|

deformation

|

Change in the form or in the dimensions of a body produced by stress.

|

|

Devonian

|

A geologic period and system of the Paleozoic Era spanning from the end of the Silurian Period, about 419 million years ago, to the beginning of the Carboniferous Period, about 359 million

years ago.

|

|

dilution

|

The effect of waste or low-grade ore being included unavoidably in the mine ore, lowering the recovered grade.

|

|

doré

|

Unrefined gold and silver bullion bars, which will be further refined to almost pure metal.

|

|

electrowinning

|

Recovery of a metal from a solution by means of electro-chemical processes.

|

|

Eocene

|

A major division of the geologic timescale and the second epoch of the Paleogene Period in the Cenozoic Era. The Eocene spans the time from the end of the Palaeocene Epoch to the beginning of

the Oligocene Epoch. The start of the Eocene is marked by the emergence of the first modern mammals.

|

|

epithermal

|

A hydrothermal mineral deposit formed within about one kilometre of the Earth’s surface and in the temperature range of 50 to 200 degrees Celsius, occurring mainly as veins.

|

|

fault

|

A fracture in the earth’s crust accompanied by a displacement of one side of the fracture with respect to the other and in a direction parallel to the fracture.

|

|

Feasibility Study

|

A comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of applicable Modifying Factors together

with any other relevant operational factors and detailed financial analysis, that are necessary to demonstrate at the time of reporting that extraction is reasonably justified (economically mineable). The results of the study may

reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of a Pre-Feasibility

Study.

|

|

Term

|

Definition

|

|

felsic

|

Silicate minerals, magma, and rocks which are enriched in the lighter elements such as silicon, oxygen, aluminium, sodium, and potassium.

|

|

fire assay

|

Analysis to determine the amount or proportion of the element of interest contained within a sample alloy by removal of other metals. Also known as gravimetric analysis.

|

|

flotation

|

A separation process in which valuable mineral particles are induced to become attached to bubbles and float, while the non-valuable minerals sink.

|

|

formation

|

Unit of sedimentary rock of characteristic composition or genesis.

|

|

geophysical survey

|

Exploration activity mapping an area showing the physics of the earth.

|

|

grade

|

The amount of metal in each tonne of ore, expressed as grams per tonne for precious metals.

|

|

granite

|

A very hard, granular, crystalline, igneous rock consisting mainly of quartz, mica, and feldspar and often used as a building stone.

|

|

grinding (milling)

|

Powdering or pulverizing of ore, by pressure or abrasion, to liberate valuable minerals for further metallurgical processing.

|

|

hectares

|

A metric unit of area measuring 100 metres by 100 metres.

|

|

hedging

|

Taking a buy or sell position in a futures market opposite to a position held in the cash market to minimize the risk of financial loss from an adverse price change.

|

|

Indicated Mineral Resource*

|

The part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of

Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to

assume geological and grade or quality continuity between points of observation. An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable

Mineral Reserve.

|

|

Inferred Mineral Resource*

|

The part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but

not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably

expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

|

|

infill

|

The collection of additional samples between existing samples, used to provide greater geological detail and to provide more closely-spaced assay data.

|

|

intrusive

|

Igneous rock which, while molten, penetrated into or between other rocks and solidified before reaching the surface.

|

|

Term

|

Definition

|

|

lode

|

A mineral deposit, consisting of a zone of veins, veinlets or disseminations, in consolidated rock as opposed to a placer deposit.

|

|

low-grade

|

Descriptive of ores relatively poor in the metal they are mined for; lean ore.

|

|

mafic

|

A group of dark-colored minerals, composed chiefly of magnesium and iron, that occur in igneous rocks.

|

|

Measured Mineral Resource*

|

The part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of

Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm

geological and grade or quality continuity between points of observation. A Measured Mineral Resource has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource. It may be

converted to a Proven Mineral Reserve or to a Probable Mineral Reserve.

|

|

mill

|

A processing facility where ore is finely ground and then undergoes physical or chemical treatment to extract the valuable metals. Also, the device used to perform grinding (milling).

|

|

mineral claim / property / concession

|

Authorizes the holder to prospect and mine for minerals and to carry out works in connection with prospecting and mining.

|

|

Mineral Reserve*

|

The economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or

extracted and is defined by studies at Pre-Feasibility or Feasibility level as appropriate that include application of Modifying Factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified.

Mineral Reserves are sub-divided in order of increasing confidence into Probable Mineral Reserves and Proven Mineral Reserves. A Probable Mineral Reserve has a lower level of confidence than a Proven Mineral Reserve.

|

|

Mineral Resource*

|

A concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual

economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including