UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended April 30, 2020

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-14939

AMERICA’S CAR-MART, INC.

(Exact name of registrant as specified in its charter)

| Texas | 63-0851141 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No) |

| 1805 North 2nd Street, Suite 401 Rogers, Arkansas |

72756 |

| (Address of principal executive offices) | (Zip Code) |

(479) 464-9944

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | CRMT | NASDAQ Global Select Market |

Securities registered pursuant to section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| ☐ Large accelerated filer | Accelerated filer ☒ | |||

| ☐ Non-accelerated filer | Smaller reporting company ☐ | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates on October 31, 2019 was $546,262,034 (6,003,539 shares), based on the closing price of the registrant’s common stock on October 31, 2019 of $90.99.

There were 6,632,819 shares of the registrant’s common stock outstanding as of June 15, 2020.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement to be furnished to stockholders in connection with its 2020 Annual Meeting of Stockholders are incorporated by reference in response to Part III of this report.

PART I

Forward-Looking Statements

This Annual Report on Form 10-K and the documents incorporated by reference in this Annual Report on Form 10-K contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements address the Company’s future objectives, plans and goals, as well as the Company’s intent, beliefs and current expectations regarding future operating performance, and can generally be identified by words such as “may”, “will”, “should”, “could”, “believe”, “expect”, “anticipate”, “intend”, “plan”, “foresee” and other similar words or phrases. Specific events addressed by these forward-looking statements include, but are not limited to:

| • | new dealership openings; | |

| • | performance of new dealerships; | |

| • | same dealership revenue growth; | |

| • | future revenue growth; | |

| • | receivables growth as related to revenue growth; | |

| • | gross margin percentages; | |

| • | interest rates; | |

| • | future credit losses; | |

| • | the Company’s collection results, including but not limited to collections during income tax refund periods; | |

| • | seasonality; | |

| • | compliance with tax regulations; | |

| • | the Company’s business and growth strategies; | |

| • | financing the majority of growth from profits; and | |

| • | having adequate liquidity to satisfy the Company’s capital needs. |

These forward-looking statements are based on the Company’s current estimates and assumptions and involve various risks and uncertainties. As a result, you are cautioned that these forward-looking statements are not guarantees of future performance, and that actual results could differ materially from those projected in these forward-looking statements. Factors that may cause actual results to differ materially from the Company’s projections include those risks described elsewhere in this report, as well as:

| • | business and economic disruptions and uncertainty resulting from the COVID-19 pandemic and efforts to mitigate the financial impact and health risks associated with the pandemic; | |

| • | general economic conditions in the markets in which the Company operates, including but not limited to fluctuations in gas prices, grocery prices and employment levels; | |

| • | the availability of credit facilities to support the Company’s business; | |

| • | the Company’s ability to underwrite and collect its contracts effectively; | |

| • | competition; | |

| • | dependence on existing management; | |

| • | ability to attract, develop and retain qualified general managers; | |

| • | availability of quality vehicles at prices that will be affordable to customers; | |

| • | changes in consumer finance laws or regulations, including but not limited to rules and regulations that have recently been enacted or could be enacted by federal and state governments; | |

| • | security breaches, cyber-attacks, or fraudulent activity; and | |

| • | the ability to successfully identify, complete and integrate new acquisitions. |

The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the dates on which they are made.

2

Item 1. Business

Business and Organization

America’s Car-Mart, Inc., a Texas corporation initially formed in 1981 (the “Company”), is one of the largest publicly held automotive retailers in the United States focused exclusively on the “Integrated Auto Sales and Finance” segment of the used car market. References to the “Company” include the Company’s consolidated subsidiaries. The Company’s operations are principally conducted through its two operating subsidiaries, America’s Car Mart, Inc., an Arkansas corporation (“Car-Mart of Arkansas”), and Colonial Auto Finance, Inc., an Arkansas corporation (“Colonial”). Collectively, Car-Mart of Arkansas and Colonial are referred to herein as “Car-Mart.” The Company primarily sells older model used vehicles and provides financing for substantially all of its customers. Many of the Company’s customers have limited financial resources and would not qualify for conventional financing as a result of limited credit histories or past credit problems. As of April 30, 2020, the Company operated 148 dealerships located primarily in small cities throughout the South-Central United States.

Impact of COVID-19

In March 2020, the World Health Organization declared the outbreak of COVID-19 as a global pandemic, and, in the following weeks, many U.S. states and localities issued lockdown orders impacting the operations of our stores and consumer demand. Since then, the COVID-19 situation within the U.S. has rapidly escalated with many businesses being closed or operating in limited capacities. While our dealerships have remained open and are operating under all CDC recommendations, the fluidity of the current environment leads to uncertainty in regard to consumer demand and ongoing changes in government mandates, as well as unpredictable risks and challenges stemming from COVID-19. We have taken measures to enhance our liquidity position and provide additional financial flexibility, including drawing down funds on our revolving credit facility and aligning operating expenses to the current state of the business. We continue to monitor the situation closely. Our top priority is ensuring the health and safety of our associates and customers. We have made process updates such as enhanced cleaning and social distancing measures and instituted new efforts like disinfectant spraying. We have distributed personal protective equipment, such as masks and gloves for our associates, and implemented disinfectant spraying and temperature checks across our operations. We have also supported associates impacted by COVID-19 by providing extra paid time off in addition to their other paid and unpaid time off options.

Business Strategy

In general, it is the Company’s objective to continue to expand its business using the same business model that has been developed and used by Car-Mart for over 38 years. This business strategy focuses on:

Collecting Customer Accounts. Collecting customer accounts is perhaps the single most important aspect of operating an Integrated Auto Sales and Finance used car business and is a focal point for dealership level and corporate office personnel on a daily basis. The Company measures and monitors the collection results of its dealerships using internally developed delinquency and account loss standards. Substantially all associate incentive compensation is tied directly or indirectly to collection results. The Company has a vice president of collection services and support staff at the corporate level to work with field operators to improve credit results. This team monitors efficiencies and the effectiveness of account representatives as they work to improve customer success rates. Over the last five fiscal years, the Company’s annual credit losses as a percentage of sales have ranged from a low of 24.8% in fiscal 2020 to a high of 28.7% in fiscal 2017 (average of 26.9%), with the fiscal year 2020 credit loss percentage reflecting a $9.1 million adjustment to the allowance for credit losses primarily as a result of COVID-19. See Item 1A. Risk Factors for further discussion.

3

Maintaining a Decentralized Operation. The Company’s dealerships operate on a decentralized basis. Each dealership is ultimately responsible for buying and selling its own vehicles, making credit decisions, and collecting the contracts it originates in accordance with established policies and procedures. Most customers make their payments in person at one of the Company’s dealerships. This decentralized structure is complemented by the oversight and involvement of corporate office management and the maintenance of centralized financial controls, including monitoring proprietary credit scoring, establishing standards for down-payments and contract terms, and an internal compliance function.

Expanding Through Controlled Organic Growth and Strategic Acquisitions. The Company grows by increasing revenues at existing dealerships and opening or acquiring new dealerships. The Company will continue to view organic growth as its primary source for growth. The Company continues to make infrastructure investments in order to improve performance of existing dealerships and to support growth of its customer count. The Company added five new dealerships during the year and closed one, ending fiscal 2020 with 148 locations. The Company intends to continue to add new dealerships, subject to favorable operating performance and available general manager talent to run these dealerships, and to consider and pursue strategic acquisition opportunities that we believe will enhance our franchise and maximize the return to our shareholders. These plans, of course, are subject to change based on both internal and external factors.

Selling Basic Transportation. The Company focuses on selling basic and affordable transportation to its customers. The Company’s average retail sales price was $11,793 per unit in fiscal 2020. By selling vehicles at this price point, the Company is able to keep the terms of its installment sales contracts relatively short (overall portfolio weighted average of 33.3 months), while requiring relatively low payments.

Operating in Smaller Communities. The majority of the Company’s dealerships are located in cities and towns with a population of 50,000 or less. The Company believes that by operating in smaller communities it develops strong personal relationships, resulting in better collection results. Further, the Company believes that operating costs, such as salaries, rent and advertising, are lower in smaller communities than in major metropolitan areas.

Enhanced Management Talent and Experience. The Company seeks to hire honest and hardworking individuals to fill entry level positions, nurture and develop these associates, and promote them to managerial positions from within the Company. By promoting from within, the Company believes it is able to train its associates in the Car-Mart way of doing business, maintain the Company’s unique culture and develop the loyalty of its associates by providing opportunity for advancement. The Company has recently focused, however, to a larger extent on looking outside of the Company for associates possessing requisite skills and who share the values and appreciate the unique culture the Company has developed over the years. The Company has been able to attract quality individuals via its General Manager Recruitment and Advancement team as well as other key areas. Management has determined that it will be increasingly difficult to grow the Company without looking for outside talent. The Company’s operating success has been a benefit for recruiting outside talent; however, the Company expects the hiring environment going forward to be challenging as a result of wage rates, competition for qualified workers and the impact of COVID-19 on our business and operations.

Cultivating Customer Relationships. The Company believes that developing and maintaining a relationship with its customers is critical to the success of the Company. A large percentage of sales at mature dealerships are made to repeat customers, and the Company estimates an additional 10% to 15% of sales result from customer referrals. By developing a personal relationship with its customers, the Company believes it is in a better position to assist a customer, and the customer is more likely to cooperate with the Company should the customer experience financial difficulty during the term of his or her installment contract. The Company is able to cultivate these relationships through a variety of communication channels and the fact that a high percentage of customers make their payments in person at one of the Company’s dealerships on a weekly or bi-weekly basis.

4

Business Strengths

The Company believes it possesses a number of strengths or advantages that distinguish it from most of its competitors. These business strengths include:

Experienced and Motivated Management. The Company’s senior management team has significant experience in the industry and an average tenure of nearly 20 years. Several of Car-Mart’s dealership managers have been with the Company for more than 10 years. Each dealership manager is compensated, at least in part, based upon the dealership’s profitability. A significant portion of the compensation of senior management is incentive based and tied to operating profits or stock performance.

Proven Business Practices. The Company’s operations are highly structured. While dealerships operate on a decentralized basis, the Company has established policies, procedures, and business practices for virtually every aspect of a dealership’s operations. Detailed online operating manuals are available to assist the dealership manager and office, sales and collections personnel in performing their daily tasks. As a result, each dealership is operated in a uniform manner. Further, corporate office personnel monitor the dealerships’ operations through weekly visits and a number of daily, weekly and monthly communications and reports.

Low Cost Operator. The Company has structured its dealership and corporate office operations to minimize operating costs. The number of associates employed at the dealership level is dictated by the number of active customer accounts each dealership services. Associate compensation is standardized for each dealership position. Other operating costs are closely monitored and scrutinized. Technology is utilized to maximize efficiency. The Company believes its operating costs as a percentage of revenues, and per unit sold, are among the lowest in the industry.

Well-Capitalized / Limited External Capital Required for Growth. As of April 30, 2020, the Company’s debt to equity ratio (Revolving credit facilities and notes payable divided by Total equity on the Consolidated Balance Sheet) was 0.71 to 1.0, which reflects the Company’s decision in March 2020 to borrow an additional $30 million under its existing credit facilities in order to increase its cash position and preserve financial flexibility in light of the uncertainty due to the COVID-19 pandemic. Excluding the amount of debt equal to cash, the Company’s adjusted debt to equity ratio (a non-GAAP measure) as of April 30, 2020 was 0.52 to 1.0, which the Company believes is lower than many of its competitors. Further, the Company believes it can fund a significant amount of its planned growth from net income generated from operations. Of the external capital that will be needed to fund growth, the Company plans to draw on its existing credit facilities, or renewals or replacements of those facilities. For a reconciliation of adjusted debt to equity ratio to the most directly comparable GAAP financial measure, see “Reconciliation of Adjusted Debt to Equity Ratio” included in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Significant Expansion Opportunities. The Company historically targets smaller communities in which to locate its dealerships (i.e., populations from 20,000 to 50,000), but is also operating in larger cities such as Tulsa, Oklahoma; Lexington, Kentucky; Springfield, Missouri and Little Rock, Arkansas. The Company believes there are numerous suitable communities of various sizes within the twelve states in which the Company currently operates and other contiguous states to satisfy anticipated dealership growth for the next several years.

Operations

Operating Segment. Each dealership is an operating segment with its results regularly reviewed by the Company’s chief operating decision maker in an effort to make decisions about resources to be allocated to the segment and to assess its performance. Individual dealerships meet the aggregation criteria for reporting purposes under the current accounting guidance. The Company operates in the Integrated Auto Sales and Finance segment of the used car market. In this industry, the nature of the sale and the financing of the transaction, financing processes, the type of customer and the methods used to distribute the Company’s products and services, including the actual servicing of the contracts as well as the regulatory environment in which the Company operates, all have similar characteristics. Each dealership is similar in nature and only engages in the selling and financing of used vehicles. All individual dealerships have similar operating characteristics. As such, individual dealerships have been aggregated into one reportable segment.

5

Dealership Organization. Dealerships operate on a decentralized basis. Each dealership is responsible for buying and selling vehicles, making credit decisions, and servicing and collecting the installment contracts it originates. Dealerships also maintain their own records and make daily deposits. Dealership-level financial statements are prepared by the corporate office on a monthly basis. Depending on the number of active customer accounts, a dealership may have as few as three or as many as twenty-five full-time associates employed at that location. Associate positions at a large dealership may include a general manager, assistant manager(s), office manager, office clerk(s), service manager, purchasing agent, collections personnel, sales personnel, inventory associates (detailers), and on-call drivers. Dealerships are generally open Monday through Saturday from 9:00 a.m. to 6:00 p.m.

Dealership Locations and Facilities. Below is a summary of dealerships operating during the fiscal years ended April 30, 2020, 2019 and 2018:

| Years Ended April 30, | ||||||||||||

| 2020 | 2019 | 2018 | ||||||||||

| Dealerships at beginning of year | 144 | 139 | 140 | |||||||||

| Dealerships opened or acquired | 5 | 5 | 3 | |||||||||

| Dealerships closed | (1 | ) | - | (4 | ) | |||||||

| Dealerships at end of year | 148 | 144 | 139 | |||||||||

Below is a summary of dealership locations by state as of April 30, 2020, 2019 and 2018:

| As of April 30, | ||||||

| Dealerships by State | 2020 | 2019 | 2018 | |||

| Arkansas | 37 | 36 | 35 | |||

| Oklahoma | 27 | 27 | 25 | |||

| Missouri | 18 | 18 | 18 | |||

| Alabama | 16 | 16 | 15 | |||

| Texas | 13 | 13 | 12 | |||

| Kentucky | 12 | 12 | 12 | |||

| Georgia | 9 | 9 | 9 | |||

| Tennessee | 6 | 6 | 6 | |||

| Mississippi | 5 | 5 | 5 | |||

| Illinois | 3 | - | - | |||

| Indiana | 1 | 1 | 1 | |||

| Iowa | 1 | 1 | 1 | |||

| Total | 148 | 144 | 139 | |||

Dealerships are typically located in smaller communities. As of April 30, 2020, approximately 73% of the Company’s dealerships were located in cities with populations of less than 50,000. Dealerships are located on leased or owned property between one and three acres in size. When opening a new dealership, the Company will typically use an existing structure on the property to conduct business or purchase a modular facility while business at the new location develops. Dealership facilities typically range in size from 1,500 to 5,000 square feet.

Purchasing. The Company purchases vehicles primarily from wholesalers, new car dealers, individuals and auctions. The majority of vehicle purchasing is performed by the Company’s purchasing agents, although dealership managers are authorized to purchase vehicles as needed. A purchasing agent will purchase vehicles for one to three dealerships depending on the size of the dealerships. Purchasing agents report to the dealership manager, or managers, for whom they make purchases. The Company centrally monitors the quantity and quality of vehicles purchased and continuously compares the cost of vehicles purchased to outside valuation sources and holds responsible parties accountable for results. The Company has recently started to make some corporate level purchases and form relationships with national vendors that can supply a large quantity of high-quality vehicles.

6

Generally, the Company’s purchasing agents purchase vehicles between 5 and 12 years of age with 70,000 to 150,000 miles and pay between $4,000 and $12,000 per vehicle. The Company focuses on providing basic transportation to its customers. The Company typically does not purchase sports cars or luxury cars. The Company sells a significant number of trucks and sport utility vehicles. Some of the more popular vehicles the Company sells include the Chevrolet Impala, Chevrolet Malibu, Dodge Charger, Chrysler Mini-Van, Ford Focus, Ford Taurus, Ford Fusion, Dodge Ram Pickup and the Ford F-150 Pickup. The Company’s purchasing agents or general managers inspect and test-drive almost every vehicle prior to a sale. Purchasing agents strive to purchase vehicles that require little or no repair as the Company has limited facilities to repair or recondition vehicles.

Selling, Marketing and Advertising. Dealerships generally maintain an inventory of 20 to 90 vehicles depending on the size and maturity of the dealership and the time of the year. Inventory turns over approximately 9 to 10 times each year. Selling is done predominantly by the dealership manager, assistant manager, manager trainee or sales associate. Sales associates are paid a commission for sales that they make in addition to an hourly wage. Sales are made on an “as is” basis; however, customers are given an option to purchase a service contract which covers certain vehicle components and assemblies. For covered components and assemblies, the Company coordinates service with third-party service centers with which the Company typically has previously negotiated labor rates. The vast majority of the Company’s customers elect to purchase a service contract when purchasing a vehicle. Additionally, the Company offers its customers to whom financing is extended a payment protection plan product. This product contractually obligates the Company to cancel the remaining amount owed on a contract where the vehicle has been totaled, as defined in the plan, or the vehicle has been stolen. This product is available in most of the states in which the Company operates and the vast majority of financed customers elect to purchase this product when purchasing a vehicle in those states.

The Company’s objective is to offer its customers basic transportation at a fair price and treat each customer in such a manner as to earn his or her repeat business. The Company attempts to build a positive reputation in each community where it operates and generate new business from such reputation as well as from customer referrals. The Company estimates that approximately 10% to 15% of the Company’s sales result from customer referrals. For mature dealerships, a large percentage of sales are to repeat customers.

The Company primarily advertises using local newspapers, radio, internet and social media. In addition, the Company periodically conducts promotional sales campaigns in an effort to increase sales. The Company uses an outside marketing firm and has recently hired a director of digital experience in order to broaden and increase the Company’s usage of digital and social media channels as a part of its marketing strategy.

Underwriting and Finance. The Company provides financing to substantially all of its customers who purchase a vehicle at one of its dealerships. The Company only provides financing to its customers for the purchase of its vehicles, and the Company does not provide any type of financing to non-customers. The Company’s installment sales contracts as of April 30, 2020 typically include down payments ranging from 0% to 20% (average of 6.4%), terms ranging from 18 months to 48 months (average of 33.3 months), and a fixed annual interest rate of 16.5% (19.5% to 21.5% in Illinois) for contracts originating after fiscal 2016 (weighted average of 16.4%).

The Company requires that payments be made on a weekly, bi-weekly, semi-monthly or monthly basis, scheduled to coincide with the day the customer is paid by his or her employer. Upon the customer and the Company reaching a preliminary agreement as to financing terms, the Company obtains a credit application from the customer which includes information regarding employment, residence and credit history, personal references and a detailed budget itemizing the customer’s monthly income and expenses. Certain information is then verified by Company personnel. After the verification process, the dealership manager makes the decision to accept, reject or modify (perhaps obtain a greater down payment or suggest a lower priced vehicle) the proposed transaction. In general, the dealership manager attempts to assess the stability and character of the applicant. The dealership manager who makes the credit decision is ultimately responsible for collecting the contract, and his or her compensation is directly related to the collection results of his or her dealership. The Company provides centralized support to the dealership manager in the form of a proprietary credit scoring system used for monitoring and other supervisory assistance to assist with the credit decision. Credit quality is monitored centrally by corporate office personnel on a daily, weekly and monthly basis.

7

Collections. All of the Company’s retail installment contracts are serviced by Company personnel at the dealership level. A high percentage of the Company’s customers make their payments in person at the dealership where they purchased their vehicle; however, in an effort to make paying convenient for its customers, the Company offers a variety of payment options. Customers can send their payments through the mail, set up ACH auto draft, make mobile and online payments, and make payments at certain money service centers. Each dealership closely monitors its customer accounts using the Company’s proprietary receivables and collections software that stratifies past due accounts by the number of days past due. The vice presidents of operations and the area operations managers routinely review and monitor the status of customer collections to ensure collection activities are conducted in compliance with applicable policies and procedures. In addition, the vice president of collections services oversees the collections department and provides timely oversight and additional accountability on a consistent basis. The Company believes that the timely response to past due accounts is critical to its collections success.

The Company has established standards with respect to the percentage of accounts one and two weeks past due, 15 or more days past due and 30 or more days past due (delinquency standards), and the percentage of accounts where the vehicle was repossessed or the account was charged off that month (account loss standard).

The Company works very hard to keep its delinquency percentages low and not to repossess vehicles. Accounts three days late are contacted by telephone. Notes from each telephone contact are electronically maintained in the Company’s computer system. The Company also utilizes text messaging notifications which allows customers to elect to receive payment reminders and late notices via text message.

The Company attempts to resolve payment delinquencies amicably prior to repossessing a vehicle. If a customer becomes severely delinquent in his or her payments, and management determines that timely collection of future payments is not probable, the Company will take steps to repossess the vehicle. Periodically, the Company enters into contract modifications with its customers to extend or modify the payment terms. The Company only enters into a contract modification or extension if it believes such action will increase the amount of monies the Company will ultimately realize on the customer’s account and will increase the likelihood of the customer being able to pay off the vehicle contract. At the time of modification, the Company expects to collect amounts due including accrued interest at the contractual interest rate for the period of delay. No other concessions are granted to customers, beyond the extension of additional time, at the time of modification. Modifications are minor and are made for pay day changes, minor vehicle repairs and other reasons. For those vehicles that are repossessed, the majority are returned or surrendered by the customer on a voluntary basis. Other repossessions are performed by Company personnel or third-party repossession agents. Depending on the condition of a repossessed vehicle, it is either resold on a retail basis through a Company dealership or sold for cash on a wholesale basis, primarily through physical or online auctions.

New Dealership Openings. Senior management, with the assistance of the corporate office staff, will make decisions with respect to the communities in which to locate a new dealership and the specific sites within those communities. New dealerships have historically been located in the general proximity of existing dealerships to facilitate the corporate office’s oversight of the Company’s dealerships. The Company intends to add new dealerships, subject to favorable operating performance of existing dealerships and availability of qualified managers. Recently, the Company has opened new dealerships under experienced top performing general managers and may continue to do so in order to grow and leverage the talents of these experienced managers.

8

The Company’s approach with respect to new dealership openings has been one of gradual development. The manager in charge of a new dealership is normally a recently promoted associate who was an assistant manager at a larger dealership and in most cases participated in the formal manager-in-training program. The corporate office provides significant resources and support with pre-opening and initial operations of new dealerships. Historically, new dealerships have operated with a low level of inventory and personnel. As a result of the modest staffing level, the new dealership manager performs a variety of duties (i.e., selling, collecting and administrative tasks) during the early stages of his or her dealership’s operations. As the dealership develops and the customer base grows, additional staff are hired.

Monthly sales levels at new dealerships are typically substantially less than sales levels at mature dealerships. Over time, new dealerships gain recognition in their communities, and a combination of customer referrals and repeat business generally facilitates sales growth. Historically, sales growth at new dealerships could exceed 10% per year for a number of years, whereas mature dealerships typically experience annual sales growth but at a lower percentage than new dealerships. Due to continual operational initiatives, the Company is able to support higher sales levels, and recently the Company has raised its volume expectation level of new locations somewhat as infrastructure improvements related to new dealership openings have improved.

New dealerships are generally provided with approximately $1.5 million to $2.5 million in capital from the corporate office during the first few years of operation. These funds are used principally to fund receivables growth. After this start-up period, new dealerships can typically begin generating positive cash flow, allowing for some continuing growth in receivables without additional capital from the corporate office. As these dealerships become cash flow positive, a decision is made by senior management to either increase the investment due to favorable return rates on the invested capital, or to deploy capital elsewhere. This limitation of capital to new, as well as existing, dealerships serves as an important operating discipline. Dealerships must be profitable in order to grow and typically new dealerships can be profitable within the first year of opening.

In addition to opening new dealerships, the Company believes that strategic acquisitions of existing dealerships can complement the Company’s business and increase its profitability. The Company recently completed the acquisition of the ongoing dealership assets of Taylor Motor Company and Auto Credit of Southern Illinois (collectively, “Taylor Motors”) based in Benton, Illinois, through which the Company acquired three dealerships located in Illinois and will continue to evaluate other acquisition opportunities. These dealerships are established businesses with an expectation of sales levels similar to mature dealerships. As part of its growth strategy, the Company intends to consider and pursue future strategic acquisition opportunities that the Company believes will enhance our franchise and maximize the return to our shareholders.

Corporate Office Oversight and Management. The corporate office, based in Rogers, Arkansas, consists of regional vice presidents, area operations managers, regional inventory purchasing directors, a sales director, a vice president of collection services, a vice president inventory operations, a director of audit and compliance and compliance auditors, a vice president of human resources, a director of general manager recruitment and development, associate and management development personnel, accounting and management information systems personnel, administrative personnel and senior management. The corporate office monitors and oversees dealership operations. The corporate office has access to operating and financial information and reports on each dealership on a daily, weekly and monthly basis. This information includes cash receipts and disbursements, inventory and receivables levels and statistics, receivables aging and sales and account loss data. The corporate office uses this information to compile Company-wide reports, plan dealership visits and prepare monthly financial statements.

Periodically, area operations managers, regional vice presidents, compliance auditors and senior management visit the Company’s dealerships to inspect, review and comment on operations. The corporate office assists in training new managers and other dealership level associates. Compliance auditors visit dealerships to ensure policies and procedures are being followed and that the Company’s assets are being safe-guarded. In addition to financial results, the corporate office uses delinquency and account loss standards and a point system to evaluate a dealership’s performance. Also, bankrupt and legal action accounts and other accounts that have been written off at dealerships are handled by the corporate office in an effort to allow dealership personnel time to focus on more current accounts.

9

The Company’s dealership managers meet monthly on an area, regional or Company-wide basis. At these meetings, corporate office personnel provide training and recognize achievements of dealership managers. Near the end of every fiscal year, the respective area operations manager, regional vice president and senior management conduct “projection” meetings with each dealership manager. At these meetings, the year’s results are reviewed and ranked relative to other dealerships, and both quantitative and qualitative goals are established for the upcoming year. The qualitative goals may focus on staff development, effective delegation, and leadership and organization skills. Quantitatively, the Company establishes unit sales goals and profit goals based on invested capital and, depending on the circumstances, may establish delinquency, account loss or expense goals.

The corporate office is also responsible for establishing policy, maintaining the Company’s management information systems, conducting compliance audits, orchestrating new dealership openings and setting the strategic direction for the Company.

Industry

Used Car Sales. The market for used car sales in the United States is significant. Used car retail sales typically occur through franchised new car dealerships that sell used cars or independent used car dealerships. The Company operates in the Integrated Auto Sales and Finance segment of the independent used car sales and finance market. Integrated Auto Sales and Finance dealers sell and finance used cars to individuals with limited credit histories or past credit problems. Integrated Auto Sales and Finance dealers typically offer their customers certain advantages over more traditional financing sources, such as less restrictive underwriting guidelines, flexible payment terms (including scheduling payments on a weekly or bi-weekly basis to coincide with a customer’s payday), and the ability to make payments in person, an important feature to individuals who may not have a checking account.

Used Car Financing. The used automobile financing industry is served by traditional lending sources such as banks, savings and loans, and captive finance subsidiaries of automobile manufacturers, as well as by independent finance companies and Integrated Auto Sales and Finance dealers. Many loans that flow through the more traditional sources have historically ended up packaged in the securitization markets. Despite significant opportunities, many of the traditional lending sources have not historically been consistent in providing financing to individuals with limited credit histories or past credit problems. Management believes traditional lenders have historically avoided this market because of its high credit risk and the associated collections efforts. Management believes that there was constriction in the financing sources that existed for the deep sub-prime automobile market after the financial crisis in 2008. Since the Company does not rely on securitizations as a financing source, it was largely unaffected by the credit constrictions during the crisis and was able to continue to grow its revenue level and receivable base. Beginning in 2012, funding for the deep subprime automobile market increased significantly. Management attributed the increase to the ultra-low interest rate environment combined with the historical credit performance of the used automobile financing market during and after the recession. At this time, it is unclear what impact COVID-19 will have on the availability of consumer credit; however management expects the availability of consumer credit within the automotive industry to continue to remain high when compared to historical trends.

Competition

The used automotive retail industry is fragmented and highly competitive. The Company competes principally with other independent Integrated Auto Sales and Finance dealers, as well as with (i) the used vehicle retail operations of franchised automobile dealerships, (ii) independent used vehicle dealers, and (iii) individuals who sell used vehicles in private transactions. The Company competes for both the purchase and resale of used vehicles. The increased funding to the used automobile industry has led to increased competitive pressures which have been the primary contributors to the Company’s decision in recent periods to allow longer term lengths and slightly lower down payments in connection with our customer financing contracts.

10

Management believes the principal competitive factors in the sale of its used vehicles include (i) the availability of financing to consumers with limited credit histories or past credit problems, (ii) the breadth and quality of vehicle selection, (iii) pricing, (iv) the convenience of a dealership’s location, (v) the option to purchase a service contract and a payment protection plan, and (vi) customer service. Management believes that its dealerships are not only competitive in each of these areas, but have some distinct advantages, specifically related to the provision of strong customer service. The Company’s local face-to-face presence allows it to serve customers at a higher level by forming strong personal relationships.

Seasonality

Historically, the Company’s third fiscal quarter (November through January) has been the slowest period for vehicle sales. Conversely, the Company’s first and fourth fiscal quarters (May through July and February through April) have historically been the busiest times for vehicle sales. Therefore, the Company generally realizes a higher proportion of its revenue and operating profit during the first and fourth fiscal quarters. The Company expects this pattern to continue in future years.

If conditions arise that impair vehicle sales during the first or fourth fiscal quarters, the adverse effect on the Company’s revenues and operating results for the year could be disproportionately large.

Regulation and Licensing

The Company is committed to a culture of compliance by promoting and supporting efforts to design, implement, manage, and maintain compliance initiatives. The Company’s operations are subject to various federal, state and local laws, ordinances and regulations pertaining to the sale and financing of vehicles. Under various state laws, the Company’s dealerships must obtain a license in order to operate or relocate. These laws also regulate advertising and sales practices. The Company’s financing activities are subject to federal laws such as truth-in-lending and equal credit opportunity laws and regulations as well as state and local motor vehicle finance laws, installment finance laws, usury laws and other installment sales laws. Among other things, these laws require that the Company limit or prescribe terms of the contracts it originates, require specified disclosures to customers, restrict collections practices, limit the Company’s right to repossess and sell collateral, and prohibit discrimination against customers on the basis of certain characteristics including age, race, gender and marital status.

The Company’s consumer financing and collection activities are also subject to oversight by the federal Consumer Financial Protection Bureau (“CFPB”), which has broad regulatory powers over consumer credit products and services such as those offered by the Company. Under a CFPB rule adopted in 2015, the Company’s finance subsidiary, Colonial, is deemed a “larger participant” in the automobile financing market and is therefore subject to examination and supervision by the CFPB.

The states in which the Company operates impose limits on interest rates the Company can charge on its installment contracts. These limits have generally been based on either (i) a specified margin above the federal primary credit rate, (ii) the age of the vehicle, or (iii) a fixed rate.

We are subject to a variety of federal, state and local laws and regulations that pertain to the environment, including compliance with regulations concerning the use, handing and disposal of hazardous substances and wastes.

Additionally, the Company is subject to various laws, regulations and other government mandates by state and local authorities adopted in response to the COVID-19 pandemic.

11

Management believes the Company is in compliance in all material respects with all applicable federal, state and local laws, ordinances and regulations; however, the adoption of additional laws, changes in the interpretation of existing laws, or the Company’s entrance into jurisdictions with more stringent regulatory requirements could have a material adverse effect on the Company’s used vehicle sales and finance business.

Employees

As of April 30, 2020, the Company, including its consolidated subsidiaries, employed a diverse associate base of approximately 1,750 full time associates. None of the Company's employees are covered by a collective bargaining agreement and the Company believes that its relations with its employees are positive.

Available Information

The Company’s website is located at www.car-mart.com. The Company makes available on this website, free of charge, access to its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports, as well as proxy statements and other information the Company files with, or furnishes to, the Securities and Exchange Commission (“SEC”) as soon as reasonably practicable after the Company electronically submits this material to the SEC. The information contained on the website or available by hyperlink from the website is not incorporated into this Annual Report on Form 10-K or other documents the Company files with, or furnishes to, the SEC.

Executive Officers of the Registrant

The following table provides information regarding the executive officers of the Company as of April 30, 2020:

| Name | Age | Position with the Company | |

| Jeffrey A. Williams | 57 | President, Chief Executive Officer and Director | |

| Vickie D. Judy | 54 |

Chief Financial Officer | |

| Leonard L. Walthall | 54 | Chief Operating Officer |

Jeffrey A. Williams has served as Chief Executive Officer of the Company since January 2018, President of the Company since March 2016, and as a director since 2011. Before becoming President in March 2016, Mr. Williams served as Chief Financial Officer, Secretary and Vice President Finance of the Company since October 2005. Mr. Williams is a Certified Public Accountant, inactive, and prior to joining the Company, his experience included approximately seven years in public accounting with Arthur Andersen & Co. and Coopers and Lybrand LLC in Tulsa, Oklahoma and Dallas, Texas. His experience also includes approximately five years as Chief Financial Officer and Vice President of Operations of Wynco, LLC, a nationwide distributor of animal health products.

Vickie D. Judy has served as Chief Financial Officer of the Company since January 2018 and served as Secretary of the Company from May 2018 to August 2019. Before becoming Chief Financial Officer, Ms. Judy served a Principal Accounting Officer since March 2016 and Vice President of Accounting since August 2015. She joined the Company in May 2010, serving as Controller and Director of Financial Reporting. Ms. Judy is a Certified Public Accountant and prior to joining the Company her experience included approximately five years in public accounting with Arthur Andersen & Co. and approximately 17 years at National Home Center, Inc., a home improvement products and building materials retailer, most recently as Vice President of Financial Reporting.

12

Leonard L. Walthall has served as Chief Operating Officer of the Company since August 2019. Before becoming Chief Operating Officer, Mr. Walthall served as the Company’s Field Operations Officer since March 2016, and previously served as the Company’s Vice President of Operations since March 2009 and as a store manager for approximately 20 years.

Item 1A. Risk Factors

The Company is subject to various risks. The following is a discussion of risks that could materially and adversely affect the Company’s business, operating results, and financial condition.

The recent outbreak of COVID-19 could have a significant negative impact on our business, sales, results of operations and financial condition.

The global outbreak of COVID-19 has led to severe disruptions in general economic activities, particularly retail operations, as businesses and federal, state, and local governments implement mandates to mitigate this public health crisis. The pandemic has affected consumer demand and the overall health of the US economy. These conditions could negatively impact all aspects of our business, including used vehicle sales and financing, finance receivable collections, repossession activity and inventory acquisition. Our business is also dependent on the continued health and productivity of our associates, including management teams, throughout this crisis. The consequences of the COVID-19 outbreak could have a material adverse effect on our business, sales, results of operations and financial condition.

Additionally, our liquidity could be negatively impacted if these conditions continue for a significant period of time and we may be required to pursue additional sources of financing to obtain working capital, maintain appropriate inventory levels, support the origination of vehicle financing, and meet our financial obligations. Currently capital and credit markets have been disrupted by the crisis and our ability to obtain any new or additional financing is not guaranteed and largely dependent upon evolving market conditions and other factors.

The extent to which the COVID-19 outbreak ultimately impacts our business, sales, results of operations and financial condition will depend on future developments, which are highly uncertain and cannot be predicted, including, but not limited to, the duration and spread of the outbreak, the development of testing and a vaccine, and how quickly and to what extent normal economic and operating conditions can resume.

The Company may have a higher risk of delinquency and default than traditional lenders because it finances its sales of used vehicles to credit-impaired borrowers.

Substantially all of the Company’s automobile contracts involve financing to individuals with impaired or limited credit histories, or higher debt-to-income ratios than permitted by traditional lenders. Financing made to borrowers who are restricted in their ability to obtain financing from traditional lenders generally entails a higher risk of delinquency, default and repossession, and higher losses than financing made to borrowers with better credit. Delinquency interrupts the flow of projected interest income and repayment of principal from a contract, and a default can ultimately lead to a loss if the net realizable value of the automobile securing the contract is insufficient to cover the principal and interest due on the contract or if the vehicle cannot be recovered. The Company’s profitability depends, in part, upon its ability to properly evaluate the creditworthiness of non-prime borrowers and efficiently service such contracts. Although the Company believes that its underwriting criteria and collection methods enable it to manage the higher risks inherent in financing made to non-prime borrowers, no assurance can be given that such criteria or methods will afford adequate protection against such risks. If the Company experiences higher losses than anticipated, its financial condition, results of operations and business prospects could be materially and adversely affected.

13

The Company’s allowance for credit losses may not be sufficient to cover actual credit losses, which could adversely affect its financial condition and operating results.

When applicable, the Company has to recognize losses resulting from the inability of certain borrowers to pay contracts and the insufficient realizable value of the collateral securing contracts. The Company maintains an allowance for credit losses in an attempt to cover credit losses inherent in its contract portfolio. Additional credit losses will likely occur in the future and may occur at a rate greater than the Company has experienced to date. The allowance for credit losses is based primarily upon historical credit loss experience, with consideration given to delinquency levels, collateral values, economic conditions and underwriting and collections practices. This evaluation is inherently subjective as it requires estimates of material factors that may be susceptible to significant change. If the Company’s assumptions and judgments prove to be incorrect, its current allowance may not be sufficient and adjustments may be necessary to allow for different economic conditions or adverse developments in its contract portfolio which could adversely affect the Company’s financial condition and results of operations. In the first quarter of fiscal 2020, the Company reduced its allowance for credit losses from 25.0% to 24.5% as a result of improvements in net chargeoffs as a percentage of average receivables, the quality of the portfolio and the allowance analysis. During the fourth quarter of fiscal 2020, the Company increased its allowance for credit losses from 24.5% to 26.5% of the principal balance in our finance receivables due to the impact of COVID-19. However, the deterioration in economic conditions as a result of COVID-19 may result in additional future credit losses that may not be fully reflected in the allowance for credit losses.

A reduction in the availability or access to sources of inventory could adversely affect the Company’s business by increasing the costs of vehicles purchased.

The Company acquires vehicles primarily through wholesalers, new car dealers, individuals and auctions. There can be no assurance that sufficient inventory will continue to be available to the Company or will be available at comparable costs. Any reduction in the availability of inventory or increases in the cost of vehicles could adversely affect gross margin percentages as the Company focuses on keeping payments affordable to its customer base. The Company could have to absorb a portion of cost increases. The overall new car sales volumes in the United States decreased dramatically from peak sales years during the economic recession of 2008 and did not return back to pre-recession levels until fiscal 2016. The reduction in new car sales had a significant negative effect on the supply of vehicles at appropriate prices available to the Company in recent years. Any future decline in new car sales could further adversely affect the Company’s access to and costs of inventory. Our ability to source vehicles could also be impacted by the closure of auctions and wholesalers as a result of COVID-19 or other factors.

The used automotive retail industry is fragmented and highly competitive, which could result in increased costs to the Company for vehicles and adverse price competition. Increased competition on the financing side of the business could result in increased credit losses.

The Company competes principally with other independent Integrated Auto Sales and Finance dealers, and with (i) the used vehicle retail operations of franchised automobile dealerships, (ii) independent used vehicle dealers, and (iii) individuals who sell used vehicles in private transactions. The Company competes for both the purchase and resale, which includes, in most cases, financing for the customer, of used vehicles. The Company’s competitors may sell the same or similar makes of vehicles that Car-Mart offers in the same or similar markets at competitive prices. Increased competition in the market, including new entrants to the market, could result in increased wholesale costs for used vehicles and lower-than-expected vehicle sales and margins. Further, if any of the Company’s competitors seek to gain or retain market share by reducing prices for used vehicles, the Company would likely reduce its prices in order to remain competitive, which may result in a decrease in its sales and profitability and require a change in its operating strategies. Increased competition on the financing side puts pressure on contract structures and increases the risk for higher credit losses. More qualified applicants have more financing options on the front-end, and if events adversely affecting the borrower occur after the sale, the increased competition may tempt the borrower to default on their contract with the Company in favor of other financing options, which in turn increases the likelihood of the Company not being able to save that account.

The used automotive retail industry operates in a highly regulated environment with significant attendant compliance costs and penalties for non-compliance.

The used automotive retail industry is subject to a wide range of federal, state, and local laws and regulations, such as local licensing requirements and laws regarding advertising, vehicle sales, financing, and employment practices. Facilities and operations are also subject to federal, state, and local laws and regulations relating to environmental protection and human health and safety. The violation of these laws and regulations could result in administrative, civil, or criminal penalties against the Company or in a cease and desist order. As a result, the Company has incurred, and will continue to incur, capital and operating expenditures, and other costs of complying with these laws and regulations. Further, over the past several years, private plaintiffs and federal, state, and local regulatory and law enforcement authorities have increased their scrutiny of advertising, sales and finance activities in the sale of motor vehicles. Additionally, the Company’s finance subsidiary, Colonial, is deemed a “larger participant” in the automobile finance market and is therefore subject to examination and supervision by the CFPB, which has broad regulatory powers over consumer credit products and services such as those offered by the Company.

14

Inclement weather can adversely impact the Company’s operating results.

The occurrence of weather events, such as rain, snow, wind, storms, hurricanes, or other natural disasters, which adversely affect consumer traffic at the Company’s automotive dealerships, could negatively impact the Company’s operating results.

Recent and future disruptions in domestic and global economic and market conditions could have adverse consequences for the used automotive retail industry in the future and may have greater consequences for the non-prime segment of the industry.

In the normal course of business, the used automotive retail industry is subject to changes in regional U.S. economic conditions, including, but not limited to, interest rates, gasoline prices, inflation, personal discretionary spending levels, and consumer sentiment about the economy in general. Recent and future disruptions in domestic and global economic and market conditions could adversely affect consumer demand or increase the Company’s costs, resulting in lower profitability for the Company. Due to the Company’s focus on non-prime customers, its actual rate of delinquencies, repossessions and credit losses on contracts could be higher under adverse economic conditions than those experienced in the automotive retail finance industry in general. The Company is unable to predict with certainty the future impact of the most recent global economic conditions on consumer demand in our markets or on the Company’s costs.

The Company’s business is geographically concentrated; therefore, the Company’s results of operations may be adversely affected by unfavorable conditions in its local markets.

The Company’s performance is subject to local economic, competitive, and other conditions prevailing in the twelve states where the Company operates. The Company provides financing in connection with the sale of substantially all of its vehicles. These sales are made primarily to customers residing in Alabama, Arkansas, Georgia, Illinois, Kentucky, Mississippi, Missouri, Oklahoma, Tennessee and Texas with approximately 29% of revenues resulting from sales to Arkansas customers. The Company’s current results of operations depend substantially on general economic conditions and consumer spending habits in these local markets. Any decline in the general economic conditions or decreased consumer spending in these markets may have a negative effect on the Company’s results of operations.

The Company’s success depends upon the continued contributions of its management teams and the ability to attract and retain qualified employees.

The Company is dependent upon the continued contributions of its management teams. Because the Company maintains a decentralized operation in which each dealership is responsible for buying and selling its own vehicles, making credit decisions and collecting contracts it originates, the key employees at each dealership are important factors in the Company’s ability to implement its business strategy. Consequently, the loss of the services of key employees could have a material adverse effect on the Company’s results of operations. In addition, when the Company decides to open new dealerships, the Company will need to hire additional personnel. The market for qualified employees in the industry and in the regions in which the Company operates is highly competitive and may subject the Company to increased labor costs during periods of low unemployment.

15

The Company’s business is dependent upon the efficient operation of its information systems.

The Company relies on its information systems in managing its sales, inventory, consumer financing, and customer information effectively. The failure of the Company’s information systems to perform as designed, or the failure to maintain and continually enhance or protect the integrity of these systems, could disrupt the Company’s business, impact sales and profitability, or expose the Company to customer or third-party claims.

Security breaches, cyber-attacks or fraudulent activity could result in damage to the Company's operations or lead to reputational damage.

Our information and technology systems are vulnerable to damage or interruption from computer viruses, network failures, computer and telecommunications failures, infiltration by unauthorized persons and security breaches, usage errors by our employees, power outages and catastrophic events such as fires, tornadoes, floods, hurricanes and earthquakes. A security breach of the Company's computer systems could also interrupt or damage its operations or harm its reputation. In addition, the Company could be subject to liability if confidential customer information is misappropriated from its computer systems. Any compromise of security, including security breaches perpetrated on persons with whom the Company has commercial relationships, that result in the unauthorized release of its users’ personal information, could result in a violation of applicable privacy and other laws, significant legal and financial exposure, damage to the Company's reputation, and a loss of confidence in the Company's security measures, which could harm its business. Any compromise of security could deter people from entering into transactions that involve transmitting confidential information to the Company's systems and could harm relationships with the Company's suppliers, which could have a material adverse effect on the Company's business. Actual or anticipated attacks may cause the Company to incur increasing costs, including costs to deploy additional personnel and protection technologies, train employees, and engage third-party experts and consultants. Despite the implementation of security measures, these systems may still be vulnerable to physical break-ins, computer viruses, programming errors, attacks by third parties or similar disruptive problems. The Company may not have the resources or technical sophistication to anticipate or prevent rapidly evolving types of cyber-attacks.

Most of the Company's customers provide personal information when applying for financing. The Company relies on encryption and authentication technology to provide security to effectively store and securely transmit confidential information. Advances in computer capabilities, new discoveries in the field of cryptography or other developments may result in the technology used by the Company to protect transaction data being breached or compromised.

In addition, many of the third parties who provide products, services, or support to the Company could also experience any of the above cyber risks or security breaches, which could impact the Company's customers and its business and could result in a loss of customers, suppliers, or revenue.

Changes in the availability or cost of capital and working capital financing could adversely affect the Company’s growth and business strategies, and volatility and disruption of the capital and credit markets and adverse changes in the global economy could have a negative impact on the Company’s ability to access the credit markets in the future and/or obtain credit on favorable terms.

The Company generates cash from income from continuing operations. The cash is primarily used to fund finance receivables growth. To the extent finance receivables growth exceeds income from continuing operations, generally the Company increases its borrowings under its revolving credit facilities to provide the cash necessary to fund operations. On a long-term basis, the Company expects its principal sources of liquidity to consist of income from continuing operations and borrowings under revolving credit facilities and/or fixed interest term loans. Any adverse changes in the Company’s ability to borrow under revolving credit facilities or fixed interest term loans, or any increase in the cost of such borrowings, would likely have a negative impact on the Company’s ability to finance receivables growth which would adversely affect the Company’s growth and business strategies. Further, the Company’s current credit facilities contain various reporting and financial performance covenants. Any failure of the Company to comply with these covenants could have a material adverse effect on the Company’s ability to implement its business strategy.

16

If the capital and credit markets experience disruptions and/or the availability of funds becomes restricted, it is possible that the Company’s ability to access the capital and credit markets may be limited or available on less favorable terms which could have an impact on the Company’s ability to refinance maturing debt or react to changing economic and business conditions. In addition, if negative global economic conditions persist for an extended period of time or worsen substantially, the Company’s business may suffer in a manner which could cause the Company to fail to satisfy the financial and other restrictive covenants under its credit facilities.

The Company’s growth strategy is dependent upon the following factors:

| • | Favorable operating performance. Our ability to expand our business through additional dealership openings or strategic acquisitions is dependent on a sufficiently favorable level of operating performance to support the management, personnel and capital resources necessary to successfully open and operate or acquire new locations. |

| • | Availability of suitable dealership sites. Our ability to open new dealerships is subject to the availability of suitable dealership sites in locations and on terms favorable to the Company. If and when the Company decides to open new dealerships, the inability to acquire suitable real estate, either through lease or purchase, at favorable terms could limit the expansion of the Company’s dealership base. In addition, if a new dealership is unsuccessful and we are forced to close the dealership, we could incur additional costs if we are unable to dispose of the property in a timely manner or on terms favorable to the Company. Any of these circumstances could have a material adverse effect on the Company’s expansion strategy and future operating results. |

| • | Ability to attract and retain management for new dealerships. The success of new dealerships is dependent upon the Company being able to hire and retain additional competent personnel. The market for qualified employees in the industry and in the regions in which the Company operates is highly competitive. If we are unable to hire and retain qualified and competent personnel to operate our new dealerships, these dealerships may not be profitable, which could have a material adverse effect on our future financial condition and operating results. |

| • | Availability and cost of vehicles. The cost and availability of sources of inventory could affect the Company’s ability to open new dealerships. The overall new car sales volumes in the United States decreased dramatically from peak sales years during the economic recession of 2008 and did not return back to pre-recession levels until fiscal 2016. The long-term impacts of the current downturn due to COVID-19 on new car sales volumes and the ability of auctions and wholesalers to continue to operate is uncertain. Any of these factors could potentially have a significant negative effect on the supply of vehicles at appropriate prices available to the Company in future periods. This could also make it difficult for the Company to supply appropriate levels of inventory for an increasing number of dealerships without significant additional costs, which could limit our future sales or reduce future profit margins if we are required to incur substantially higher costs to maintain appropriate inventory levels. |

| • | Acceptable levels of credit losses at new dealerships. Credit losses tend to be higher at new dealerships due to fewer repeat customers and less experienced associates; therefore, the opening of new dealerships tends to increase the Company’s overall credit losses. In addition, new dealerships may experience higher than anticipated credit losses, which may require the Company to incur additional costs to reduce future credit losses or to close the underperforming locations altogether. Any of these circumstances could have a material adverse effect on the Company’s future financial condition and operating results. |

17

| • | Ability to successfully identify, complete and integrate new acquisitions. Part of our current growth strategy includes strategic acquisitions of dealerships. We could have difficulty identifying attractive target dealerships, completing the acquisition or integrating the acquired business’ assets, personnel and operations with our own. Acquisitions are accompanied by a number of inherent risks, including, without limitation, the difficulty of integrating acquired companies and operations; potential disruption of our ongoing business and distraction of our management or the management of the target company; difficulties in maintaining controls, procedures and policies; potential impairment of relationships with associates and partners as a result of any integration of new personnel; potential inability to manage an increased number of locations and associates; failure to realize expected efficiencies, synergies and cost savings; or the effect of any government regulations which relate to the businesses acquired. |

The Company’s business is subject to seasonal fluctuations.

Historically, the Company’s third fiscal quarter (November through January) has been the slowest period for vehicle sales. Conversely, the Company’s first and fourth fiscal quarters (May through July and February through April) have historically been the busiest times for vehicle sales. Therefore, the Company generally realizes a higher proportion of its revenue and operating profit during the first and fourth fiscal quarters. The Company expects this pattern to continue in future years.

If conditions arise that impair vehicle sales during the first or fourth fiscal quarters, the adverse effect on the Company’s revenues and operating results for the year could be disproportionately large.

Item 1B. Unresolved Staff Comments

Not applicable.

18

Item 2. Properties

As of April 30, 2020, the Company leased approximately 87% of its facilities, including dealerships and the Company’s corporate offices. These facilities are located principally in the states of Alabama, Arkansas, Georgia, Illinois, Kentucky, Mississippi, Missouri, Oklahoma, Tennessee and Texas. The Company’s corporate offices are located in approximately 34,000 square feet of leased space in Rogers, Arkansas. For additional information regarding the Company’s properties, see “Operations-Dealership Locations and Facilities” under Item 1 above and “Contractual Payment Obligations” and “Off-Balance Sheet Arrangements” under Item 7 of Part II.

Item 3. Legal Proceedings

In the ordinary course of business, the Company has become a defendant in various types of legal proceedings. While the outcome of these proceedings cannot be predicted with certainty, the Company does not expect the final outcome of any of these proceedings, individually or in the aggregate, to have a material adverse effect on the Company’s financial position, results of operations or cash flows.

Item 4. Mine Safety Disclosure

Not applicable.

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

General

The Company’s common stock is traded on the NASDAQ Global Select Market under the symbol CRMT. As of June 15, 2020, there were approximately 885 shareholders of record. This number excludes stockholders holding the Company’s common stock as “beneficial owners” under nominee security position listings.

19

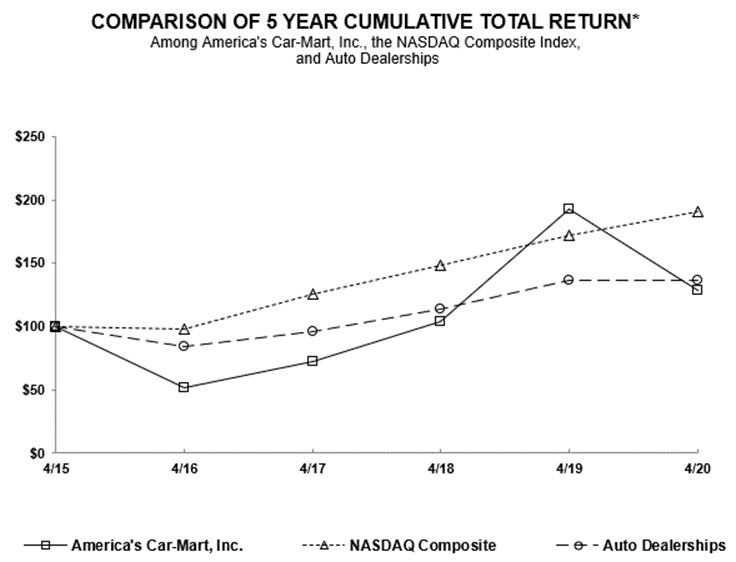

Stockholder Return Performance Graph

Set forth below is a line graph comparing the fiscal year end percentage change in the cumulative total stockholder return on the Company’s common stock to (i) the cumulative total return of the NASDAQ Market Index (U.S. companies), and (ii) the Hemscott Group 744 Index – Auto Dealerships (“Automobile Index”), for the period of five fiscal years commencing on May 1, 2015 and ending on April 30, 2020.

The graph assumes that the value of the investment in the Company’s common stock and each index was $100 on April 30, 2015.

* $100 invested on 4/30/2015 in stock or index, including reinvestment of dividends.

Fiscal year ending April 30.

The dollar value at April 30, 2020 of $100 invested in the Company’s common stock on April 30, 2015 was $128.46, compared to $136.56 for the automobile index described above and $190.32 for the NASDAQ Market Index (U.S. Companies).

Dividend Policy

Since its inception, the Company has paid no cash dividends on its common stock. The Company currently intends for the foreseeable future to continue its policy of retaining earnings to finance future growth. Payment of cash dividends in the future will be determined by the Company's Board of Directors and will depend upon, among other things, the Company's future earnings, operations, capital requirements and surplus, general financial condition, contractual restrictions that may exist, and such other factors as the Board of Directors may deem relevant. The Company is also limited in its ability to pay dividends or make other distributions to its shareholders without the consent of its lender. Please see “Liquidity and Capital Resources” under Item 7 of Part II for more information regarding this limitation.

20

Issuer Purchases of Equity Securities