EXHIBIT 99.4

BY ACCEPTING THIS OBLIGATION, THE HOLDER REPRESENTS AND WARRANTS THAT IT IS NOT A UNITED STATES PERSON (OTHER THAN AN EXEMPT RECIPIENT DESCRIBED IN SEC 6049(B)(4) OF THE INTERNAL REVENUE CODE AND REGULATIONS THEREUNDER) AND THAT IT IS NOT ACTING FOR OR ON BEHALF OF A UNITED STATES PERSON (OTHER THAN AN EXEMPT RECIPIENT DESCRIBED IN SEC. 6049(8)(4) OF THE INTERNAL REVENUE CODE AND THE REGULATIONS THEREUNDER).

SECOND REPLACEMENT PROMISSORY NOTE

Issuance and Effective Date: as of April 8, 2016

$2,113,008.53

FOR VALUE RECEIVED, ONCOLOGIX TECH, INC., a Nevada corporation (“Borrower”), whose address is P.O. Box 8832, Grand Rapids, Michigan 49518, hereby promises to pay to the order of TCA Global Credit Master Fund, LP, a Cayman Islands limited partnership, with an office located at 3960 Howard Hughes Parkway, Suite 500, Las Vegas, Nevada 89169, and its successors or assigns (collectively, the “Holder”), on or before the Extended Maturity Date (as defined in the Credit Agreement): (i) the principal amount of Two Million One Hundred Thirteen Thousand Eight and 53/100 Dollars ($2,113,008.53); together with (ii) interest on the unpaid principal balance hereof at the rate of eighteen percent (18%) per annum (the “Interest Rate”) commencing as of the effective date hereof; together with (iii) all other Obligations due, owing and payable under the terms of the Credit Agreement and all other Loan Documents, all in accordance with the terms hereof and the terms and provisions of that certain Credit Agreement between the Borrower and the Holder dated as of November 30, 2015, but made effective as of January 3, 2014 (the “Original Credit Agreement”), as amended by Amendment No. 1 to Credit Agreement, dated effective as of September 25, 2014 (the “First Amendment”), as amended by the Settlement Agreement dated as of February 5, 2016 (the “Original Settlement Agreement”), as amended by the First Amendment to Settlement Agreement dated as of February 23, 2016 (the “First Amended Settlement Agreement”), as amended by the Second Amendment to Settlement Agreement dated as of even date herewith (the “Second Amended Settlement Agreement”) (the Original Credit Agreement, the First Amendment, the Original Settlement Agreement, the First Amended Settlement Agreement, and the Second Amended Settlement Agreement, together with all other renewals, extensions, future advances, amendments, modifications, substitutions, or replacements thereof, sometimes collectively referred to as the “Credit Agreement”). This Second Replacement Promissory Note (this note, and all modifications, extensions, future advances, supplements, and renewals thereof, and any substitutions therefor, hereinafter referred to as the “Note) shall be payable in accordance with the terms of the Credit Agreement and the specific terms set forth below. Capitalized words and phrases not otherwise defined herein shall have the meanings assigned thereto in the Credit Agreement.

This Note is being executed in substitution for and to supersede the Amended and Restated Revolving Convertible Promissory Note issued and effective September 25, 2014, by Borrower to Lender (the “Amended and Restated Note”), in its entirety. It is the intention of the Borrower and Lender that while this Note replaces and supersedes the Amended and Restated Note, in its entirety, it is not in payment or satisfaction of the Amended and Restated Note, but rather is the substitute of one evidence of debt for another without any intent to extinguish the old. Nothing contained in this Note shall be deemed to extinguish the indebtedness and obligations evidenced by the Amended and Restated Note or constitute a novation of the indebtedness evidenced by the Amended and Restated Note.

1. Payments.

(a) Payment Premium. In addition to the interest at the Interest Rate accruing under this Note, there shall be due and payable under this Note a payment premium in accordance with the “Payment Schedule” (as hereinafter defined), which is for payment of accrued and unpaid interest, and certain other past due fees and charges due and payable under the Credit Agreement as of the date hereof and not included within the principal balance hereof, amortized over the term of this Note (the “Premium”), which Premium shall be due and payable as provided below.

(b) Monthly Payments. The Borrower shall make monthly payments of principal, interest, and a corresponding amount of Premium to the Holder, commencing on the thirtieth (30th) day of April, 2016 and on the thirtieth (30th) day of each consecutive calendar month thereafter (except for February which such payment will be due on the final day of the calendar month) while this Note is outstanding, until the Extended Maturity Date, based on the payment and amortization schedule attached hereto as Exhibit “A” (the “Payment Schedule”). In the event the thirtieth (30’’) day of any calendar month on which a payment is due hereunder is not a Business Day, then said payment shall be due on the first Business Day thereafter occurring.

(c) Prepayment Prior to Maturity. The Borrower, at its option, shall have the right to prepay this Note in full and for cash, at any time prior to the Extended Maturity Date, with three (3) Business Days advance written notice (the “Prepayment Notice”) to the Holder. The amount required to prepay this Note in full pursuant to this Section 1(c) shall be equal to: (i) the aggregate principal amount then outstanding under this Note; plus (ii) all accrued and unpaid interest due under this Note as of the prepayment date; plus (iii) all accrued and unpaid Premium due under this Note as of the prepayment date; plus (iv) all other costs, fees, charges, and all other Obligations due and payable hereunder or under any other “Loan Documents” (as hereinafter defined) (collectively, the “Prepayment Amount”). The Borrower shall deliver the Prepayment Amount to the Holder on the third (31d) Business Day after the date of the Prepayment Notice.

(d) Payment at Maturity. The principal amount of this Note, together with all accrued and unpaid interest, all accrued and unpaid Premium, and all other sums due and payable hereunder and/or under any other Loan Documents, are and shall be due and payable in full to the Holder by no later than 2:00 P.M., EST, on the Extended Maturity Date.

(e) Payment of Default Interest. Any amount of principal, interest, Premium, or other sums due on this Note or any other Loan Documents which are not paid when due shall bear interest from the date due until such past due amount is paid in full at the Default Rate.

(f) Late Fee. If all or any portion of the payments of principal, interest, Premium, or other charges due hereunder are not received by the Holder within five (5) days of the date such payment is due, then the Borrower shall pay to the Holder a late charge (in addition to any other remedies that Holder may have) equal to five percent (5%) of each such unpaid payment or sum. Any payments returned to Holder for any reason must be covered by wire transfer of immediately available funds to an account designated by Holder, plus a $100.00 administrative fee charge. Holder shall have no responsibility or liability for payments purportedly made hereunder but not actually received by Holder, and the Borrower shall not be discharged from the obligation to make such payments due to loss of same in the mails or due to any other excuse or justification ultimately involving facts where such payments were not actually received by Holder.

| 2 |

(g) General Payment Provisions. Interest shall be calculated on the basis of a 360-day year, and shall accrue daily on the outstanding principal amount outstanding from time to time for the actual number of days elapsed, commencing as of the effective date hereof until payment in full of the outstanding principal, together with all accrued and unpaid interest, Premium, and other amounts which may become due hereunder or under any Loan Documents, has been received and cleared to the Holder. All payments received and actually collected by Holder hereunder shall be applied first to any costs, fees and expenses due or incurred hereunder or under any other Loan Documents, second to payment of the Premium due hereunder, third to accrued and unpaid interest hereunder, and last to reduce the outstanding principal balance of this Note. All payments on this Note shall be made in lawful money of the United States of America in the manner required by the Credit Agreement.

2. Secured Nature of Note. This Note is being issued in connection with the Credit Agreement. The indebtedness evidenced by this Note is also secured by all of the Collateral of the Borrower and various other instruments and documents referred to in the Credit Agreement as the “Loan Documents” (which term shall have the same meaning in this Note as such term is given in the Credit Agreement). All of the agreements, conditions, covenants, provisions, representations, warranties and stipulations contained in any of the Loan Documents which are to be kept and performed by the Borrower are hereby made a part of this Note to the same extent and with the same force and effect as if they were fully set forth herein, and the Borrower covenants and agrees to keep and perform them, or cause them to be kept or performed, strictly in accordance with their terms.

3. Defaults and Remedies.

(a) Events of Default. The occurrence of any of the following events shall constitute an “Event of Default” hereunder: (i) the Borrower shall fail to pay any installment of interest, principal, Premium, or other sums due under this Note or any other Loan Documents when any such payment shall be due and payable; (ii) the Borrower or any of its Subsidiaries makes an assignment for the benefit of creditors; (iii) any order or decree is rendered by a court which appoints or requires the appointment of a receiver, liquidator or trustee for the Borrower or any of its Subsidiaries, and the order or decree is not vacated within thirty (30) days from the date of entry thereof; (iv) any order or decree is rendered by a court adjudicating the Borrower or any of its Subsidiaries, insolvent, and the order or decree is not vacated within thirty (30) days from the date of entry thereof; (v) the Borrower or any of its Subsidiaries files a petition in bankruptcy under the provisions of any bankruptcy law or any insolvency act; (vi) the Borrower or any of its Subsidiaries admits, in writing, its inability to pay its debts as they become due; (vii) a proceeding or petition in bankruptcy is filed against the Borrower or any of its Subsidiaries, and such proceeding or petition is not dismissed within thirty (30) days from the date it is filed; (viii) the Borrower or any of its Subsidiaries files a petition or answer seeking reorganization or arrangement under the bankruptcy laws or any law or statute of the United States or any other foreign country or state; (ix) the occurrence of any breach, default, “Event of Default” (as such term may be defined in any of the other Loan Documents), or “Future Default” (as such term is defined in the Second Amended Settlement Agreement) under the Credit Agreement or any other Loan Documents; or (x) the Borrower shall fail to perform, comply with or abide by any of the material stipulations, agreements, conditions and/or covenants contained in this Note or any other Loan Documents on the part of the Borrower to be performed, complied with, or abided by, and such failure is not cured within ten (10) days after written notice of such failure is delivered by Holder to the Borrower (provided that if the failure to perform or default in performance is not capable of being cured, in Holder’s sole discretion, then the cure period set forth herein shall not be applicable and the failure or default shall be an immediate Event of Default hereunder).

| 3 |

(b) Remedies. Upon the occurrence of an Event of Default, the interest on this Note shall immediately accrue at the Default Rate, and, in addition to all other rights or remedies the Holder may have, at law or in equity, the Holder may, in its sole discretion, accelerate full repayment of all principal amounts outstanding hereunder, together with accrued interest thereon, together with all Premium amounts due thereon, together with all other fees, charges and amounts due under any Loan Documents, together with all attorneys’ fees, paralegals’ fees and costs and expenses incurred by the Holder in collecting or enforcing payment hereof (whether such fees, costs or expenses are incurred in negotiations, all trial and appellate levels, administrative proceedings, bankruptcy proceedings or otherwise), and together with all other Obligations due by the Borrower hereunder and under the Loan Documents, and all such amounts shall thereafter accrue interest at the Default Rate, all without any relief whatsoever from any valuation or appraisement laws, and payment thereof may be enforced and recovered in whole or in part at any time by one or more of the remedies provided to the Holder at law, in equity, or under this Note or any of the other Loan Documents. In connection with the Holder’s rights hereunder upon an Event of Default, the Holder need not provide, and the Borrower hereby waives, any presentment, demand, protest or other notice of any kind, and the Holder may immediately enforce any and all of its rights and remedies hereunder and all other remedies available to it in equity or under applicable law.

(c) Exercise of Remedies. The remedies of the Holder as provided herein and in any of the other Loan Documents shall be cumulative and concurrent and may be pursued singly, successively or together, at the sole discretion of the Holder, and may be exercised as often as occasion therefor shall occur; and the failure to exercise any such right or remedy shall in no event be construed as a waiver or release thereof.

4. Lost or Stolen Note. Upon notice to the Borrower of the loss, theft, destruction or mutilation of this Note, and, in the case of loss, theft or destruction, of an indemnification undertaking by the Holder to the Borrower in a form reasonably acceptable to the Borrower and customary for similar circumstances in commercial lender/borrower circumstances, and, in the case of mutilation, upon surrender and cancellation of the mutilated Note, the Borrower shall promptly execute and deliver a new Note of like tenor and date and in substantially the same form as this Note.

5. Cancellation. After all principal, accrued interest, Premium, and all other Obligations at any time owed on this Note or any other Loan Documents have been indefeasibly paid in full, and there are no existing or outstanding commitments for Holder to make any loans or other advances of credit to Borrower under the Credit Agreement or otherwise, this Note shall be canceled by Holder.

6. Waivers. Borrower hereby waives and releases all benefit that might accrue to the Borrower by virtue of any present or future laws exempting any property that may serve as security for this Note, or any other property or Collateral, real or personal, or any part of the proceeds arising from any sale of any such property or Collateral, from attachment, levy, or sale under execution, exemption from civil process, or extension of time for payment, including, without limitation, any and all homestead exemption rights of the Borrower; and the Borrower agrees that any property that may be levied upon pursuant to a judgment obtained by virtue hereof, on any writ of execution issued thereon, may be sold upon any such writ in whole or in part in any order or manner desired by Holder. In addition, the Borrower and all others who are, or may become liable for the payment hereof: (i) severally waive presentment for payment, demand, notice of nonpayment or dishonor, protest and notice of protest of this Note or the other Loan Documents, and all other notices in connection with the delivery, acceptance, performance, default, or enforcement of the payment of this Note or the other Loan Documents; (ii) expressly consent to all extensions of time, renewals or postponements of time of payment of this Note or the other Loan Documents from time to time prior to or after the maturity of this Note without notice, consent or further consideration to any of the foregoing; (iii) expressly agree that the Holder shall not be required first to institute any suit, or to exhaust its remedies against the Borrower, or any other Person or party to become liable hereunder or against any Collateral that may secure this Note in order to enforce the payment of this Note; and (iv) expressly agree that, notwithstanding the occurrence of any of the foregoing (except the express written release by the Holder of any such Person), the undersigned shall be and remain, directly and primarily liable for all sums due under this Note.

| 4 |

7. Governing Law; Venue. The Borrower irrevocably agrees that any dispute arising under, relating to, or in connection with, directly or indirectly, this Note or related to any matter which is the subject of or incidental to this Note (whether or not such claim is based upon breach of contract or tort) shall be subject to the exclusive jurisdiction and venue of the state and/or federal courts located in Broward County, Florida. This provision is intended to be a “mandatory” forum selection clause and governed by and interpreted consistent with Florida law. Borrower hereby consents to the exclusive jurisdiction and venue of any state or federal court having its situs in said county (or to any other jurisdiction or venue, if Holder so elects), and waives any objection based on forum non conveniens. Borrower hereby waives personal service of any and all process and consents that all such service of process may be made by certified mail, return receipt requested, directed to Borrower, as applicable, as set forth herein or in the manner provided by applicable statute, law, rule of court or otherwise. Except for the foregoing mandatory forum selection clause, all terms and provisions hereof and the rights and obligations of the Borrower and Holder hereunder shall be governed, construed and interpreted in accordance with the laws of the State of Nevada, without reference to conflict of laws principles.

8. Expenses. The Borrower agrees to pay and reimburse the Holder upon demand for all costs and expenses (including, without limitation, attorneys’ fees and expenses) that the Holder may incur in connection with (i) the exercise or enforcement of any rights or remedies (including, but not limited to, collection) granted hereunder or otherwise available to it (whether at law, in equity or otherwise); or (ii) the failure by the Borrower to perform or observe any of the provisions hereof. The provisions of this Section 8 shall survive the execution and delivery of this Note, the repayment of any or all of the Obligations, and the termination of this Note.

9. Waiver of Jury Trail. THE BORROWER HEREBY KNOWINGLY, VOLUNTARILY, INTENTIONALLY AND IRREVOCABLY WAIVES ALL RIGHT TO A TRIAL BY JURY WITH RESPECT TO ANY LITIGATION BASED ON THIS NOTE, OR ARISING OUT OF, UNDER OR IN CONNECTION WITH, THIS NOTE OR ANY OTHER LOAN DOCUMENTS, OR ANY COURSE OF CONDUCT, COURSE OF DEALING, STATEMENTS (WHETHER VERBAL OR WRITTEN) OR ACTIONS OF OR BETWEEN ANY PARTY HERETO, AND THE BORROWER AGREES AND CONSENTS TO THE GRANTING TO HOLDER OF RELIEF FROM ANY STAY ORDER WHICH MIGHT BE ENTERED BY ANY COURT AGAINST HOLDER AND TO ASSIST HOLDER IN OBTAINING SUCH RELIEF. THIS PROVISION IS A MATERIAL INDUCEMENT FOR HOLDER ACCEPTING THIS NOTE FROM THE BORROWER. THE BORROWER’S REASONABLE RELIANCE UPON SUCH INDUCEMENT IS HEREBY ACKNOWLEDGED.

10. Specific Shall Not Limit General; Construction. No specific provision contained in this Note shall limit or modify any more general provision contained herein. This Note shall be deemed to be jointly drafted by the Borrower and the Holder and shall not be construed against any person as the drafter hereof.

11. Failure or Indulgence Not Waiver. Holder shall not be deemed, by any act of omission or commission, to have waived any of its rights or remedies hereunder or under any Loan Documents, unless such waiver is in writing and signed by Holder, and then only to the extent specifically set forth in the writing. A waiver on one event shall not be construed as continuing or as a bar to or waiver of any right or remedy to a subsequent event.

| 5 |

12. Notice. Notice shall be given to each party at the address for such party set forth in the Credit Agreement, and such notice shall be deemed properly given in accordance with the notice provisions set forth in the Credit Agreement.

13. Usury Savings Clause. Notwithstanding any provision in this Note or the other Loan Documents, the total liability for payments of interest and payments in the nature of interest, including, without limitation, all charges, fees, exactions, or other sums which may at any time be deemed to be interest, shall not exceed the limit imposed by the usury laws of the jurisdiction governing this Note or any other applicable law. In the event the total liability of payments of interest and payments in the nature of interest, including, without limitation, all charges, fees, exactions or other sums which may at any time be deemed to be interest, shall, for any reason whatsoever, result in an effective rate of interest, which for any month or other interest payment period exceeds the limit imposed by the usury laws of the jurisdiction governing this Note, all sums in excess of those lawfully collectible as interest for the period in question shall, without further agreement or notice by, between, or to any party hereto, be applied to the reduction of the outstanding principal balance of this Note immediately upon receipt of such sums by the Holder hereof, with the same force and effect as though the Borrower had specifically designated such excess sums to be so applied to the reduction of such outstanding principal balance and the Holder hereof had agreed to accept such sums as a penalty-free payment of principal; provided, however, that the Holder of this Note may, at any time and from time to time, elect, by notice in writing to the Borrower, to waive, reduce, or limit the collection of any sums in excess of those lawfully collectible as interest rather than accept such sums as a prepayment of the outstanding principal balance. It is the intention of the parties that the Borrower do not intend or expect to pay nor does the Holder intend or expect to charge or collect any interest under this Note greater than the highest non-usurious rate of interest which may be charged under applicable law.

14. Binding Effect. This Note shall be binding upon the Borrower and the successors and assigns of the Borrower and shall inure to the benefit of Holder and the successors and assigns of Holder.

15. Severability. In the event any one or more of the provisions of this Note shall for any reason be held to be invalid, illegal, or unenforceable, in whole or in part, in any respect, or in the event that any one or more of the provisions of this Note operates or would prospectively operate to invalidate this Note, then and in any of those events, only such provision or provisions shall be deemed null and void and shall not affect any other provision of this Note. The remaining provisions of this Note shall remain operative and in full force and effect and shall in no way be affected, prejudiced, or disturbed thereby.

16. Participations. Holder may from time to time sell or assign, in whole or in part, or grant participations in this Note and/or the obligations evidenced hereby, without any requirement to obtain the Borrower’s written consent or approval. The holder of any such sale, assignment or participation, if the applicable agreement between Holder and such holder so provides, shall be: (a) entitled to all of the rights, obligations and benefits of Holder (to the extent of such holder’s interest or participation); and (b) deemed to hold and may exercise the rights of setoff or banker’s lien with respect to any and all obligations of such holder to the Borrower (to the extent of such holder’s interest or participation), in each case as fully as though the Borrower was directly indebted to such holder. Holder may in its discretion give notice to the Borrower of such sale, assignment or participation; however, the failure to give such notice shall not affect any of Holder’s or such holder’s rights hereunder.

17. Amendments. The provisions of this Note may be changed only by a written agreement executed by the Borrower and Holder.

| 6 |

18. Conversion of Note. At any time and from time to time while this Note is outstanding, but only upon: (i) the occurrence of an Event of Default under any of the Loan Documents; or (ii) mutual agreement between the Borrower and the Holder, this Note may be, at the sole option of the Holder, convertible into shares of the common stock, which has a par value of $0.001 per share (the “Common Stock”) of the Borrower, in accordance with the terms and conditions set forth below.

(d) Voluntary Conversion. At any time while this Note is outstanding, but only upon: (i) the occurrence of an Event of Default under any of the Loan Documents; or (ii) mutual agreement between the Borrower and the Holder, the Holder may convert all or any portion of the outstanding principal, accrued and unpaid interest, Premium, if applicable, and any other sums due and payable hereunder or under any other Loan Documents (such total amount, the “Conversion Amount”) into shares of Common Stock of the Borrower (the “Conversion Shares”) at a price equal to: (i) the Conversion Amount (the numerator); divided by (ii) eighty-five percent (85%) of the lowest of the daily volume weighted average price of the Borrower’s Common Stock during the five (5) Business Days immediately prior to the Conversion Date, which price shall be indicated in the conversion notice (in the form attached hereto as Exhibit “B”, the “Conversion Notice”) (the denominator) (the “Conversion Price”). The Holder shall submit a Conversion Notice indicating the Conversion Amount, the number of Conversion Shares issuable upon such conversion, and where the Conversion Shares should be delivered.

(e) The Holder’s Conversion Limitations. The Borrower shall not effect any conversion of this Note, and the Holder shall not have the right to convert any portion of this Note, to the extent that after giving effect to the conversion set forth on the Conversion Notice submitted by the Holder, the Holder (together with the Holder’s Affiliates and any Persons acting as a group together with the Holder or any of the Holder’s Affiliates) would beneficially own shares of Common Stock in excess of the Beneficial Ownership Limitation (as defined herein). To ensure compliance with this restriction, prior to delivery of any Conversion Notice, the Holder shall have the right to request that the Borrower provide to the Holder a written statement of the percentage ownership of the Borrower’s Common Stock that would be beneficially owned by the Holder and its Affiliates in the Borrower if the Holder converted such portion of this Note then intended to be converted by Holder. The Borrower shall, within two (2) Business Days of such request, provide Holder with the requested information in a written statement, and the Holder shall be entitled to rely on such written statement from the Borrower in issuing its Conversion Notice and ensuring that its ownership of the Borrower’s Common Stock is not in excess of the Beneficial Ownership Limitation. The restriction described in this Section may be waived by Holder, in whole or in part, upon notice not less than sixty-one (61) days prior written notice from the Holder to the Borrower to increase such percentage.

For purposes of this Note, the “Beneficial Ownership Limitation” shall be 4.99% of the number of shares of Common Stock outstanding immediately after giving effect to the issuance of shares of Common Stock issuable upon conversion of this Note. The limitations contained in this Section shall apply to a successor holder of this Note.

Mechanics of Conversion. The conversion of this Note shall be conducted in the

following manner:

(i) To convert this Note into shares of Common Stock on any date set forth in the Conversion Notice by the Holder (the “Conversion Date”), the Holder shall transmit by facsimile or electronic mail (or otherwise deliver) a copy of the fully executed Conversion Notice to the Borrower (or, under certain circumstances as set forth below, by delivery of the Conversion Notice to the Borrower’s transfer agent).

| 7 |

(ii) Borrower’s Response. Upon receipt by the Borrower of a copy of a Conversion Notice, the Borrower shall as soon as practicable, but in no event later than two (2) Business Days after receipt of such Conversion Notice, send, via facsimile or electronic mail (or otherwise deliver) a confirmation of receipt of such Conversion Notice (the “Conversion Confirmation”) to the Holder indicating that the Borrower will process such Conversion Notice in accordance with the terms herein. In the event the Borrower fails to issue its Conversion Confirmation within said two (2) Business Day time period, the Holder shall have the absolute and irrevocable right and authority to deliver the fully executed Conversion Notice to the Borrower’s transfer agent, and pursuant to the terms of the Loan Documents, the Borrower’s transfer agent shall issue the applicable Conversion Shares to Holder as hereby provided. Within five (5) Business Days after the date of the Conversion Confirmation (or the date of the Conversion Notice, if the Borrower fails to issue the Conversion Confirmation), provided that the Borrower’s transfer agent is participating in the Depository Trust Borrower (“DTC”) Fast Automated Securities Transfer (“FAST”) program, the Borrower shall cause the transfer agent to (or, if for any reason the Borrower fails to instruct or cause its transfer agent to so act, then pursuant to the Loan Documents, the Holder may request and require the Borrower’s transfer agent to) electronically transmit the applicable Conversion Shares to which the Holder shall be entitled by crediting the account of the Holder’s prime broker with DTC through its Deposit Withdrawal Agent Commission (“DWAC”) system, and provide proof satisfactory to the Holder of such delivery. In the event that the Borrower’s transfer agent is not participating in the DTC FAST program and is not otherwise DWAC eligible, within five (5) Business Days after the date of the Conversion Confirmation (or the date of the Conversion Notice, if the Borrower fails to issue the Conversion Confirmation), the Borrower shall instruct and cause its transfer agent to (or, if for any reason the Borrower fails to instruct or cause its transfer agent to so act, then pursuant to the Loan Documents, the Holder may request and require the Borrower’s transfer agent to) issue and surrender to a nationally recognized overnight courier for delivery to the address specified in the Conversion Notice, a certificate, registered in the name of the Holder, or its designees, for the number of Conversion Shares to which the Holder shall be entitled. To effect conversions hereunder, the Holder shall not be required to physically surrender this Note to the Borrower unless the entire principal amount of this Note, plus all accrued and unpaid interest, Premium, if applicable, and other sums due hereunder, has been so converted. Subject to the make-whole rights below, conversions hereunder shall have the effect of lowering the outstanding principal amount of this Note in an amount equal to the applicable conversion. The Holder and the Borrower shall maintain records showing the principal amount(s) converted and the date of such conversion(s). The Holder, and any assignee by acceptance of this Note, acknowledge and agree that, by reason of the provisions of this paragraph, following conversion of a portion of this Note, the unpaid and unconverted principal amount of this Note may be less than the amount stated on the face hereof.

(iii) Record Holder. The Person(s) entitled to receive the shares of Common Stock issuable upon a conversion of this Note shall be treated for all purposes as the record holder(s) of such shares of Common Stock as of the Conversion Date.

(iv) Failure to Deliver Certificates. If in the case of any Conversion Notice, the certificate or certificates are not delivered to or as directed by the Holder by the date required hereby, the Holder shall be entitled to elect by written notice to the Borrower at any time on or before its receipt of such certificate or certificates, to rescind such Conversion Notice, in which event the Borrower shall promptly return to the Holder any original Note delivered to the Borrower and the Holder shall promptly return to the Borrower the Common Stock certificates representing the principal amount of this Note unsuccessfully tendered for conversion to the Borrower.

| 8 |

(v) Obligation Absolute, Partial Liquidated Damages. The Borrower’s obligations to issue and deliver the Conversion Shares upon conversion of this Note in accordance with the terms hereof are absolute and unconditional, irrespective of any action or inaction by the Holder to enforce the same, any waiver or consent with respect to any provision hereof, the recovery of any judgment against any person or entity or any action to enforce the same, or any setoff, counterclaim, recoupment, limitation or termination, or any breach or alleged breach by the Holder or any other Person of any obligation to the Borrower or any violation or alleged violation of law by the Holder or any other Person, and irrespective of any other circumstance which might otherwise limit such obligation of the Borrower to the Holder in connection with the issuance of such Conversion Shares; provided, however, that such delivery shall not operate as a waiver by the Borrower of any such action the Borrower may have against the Holder. In the event the Holder of this Note shall elect to convert any or all of the outstanding principal amount hereof and accrued but unpaid interest and Premium, if applicable, thereon in accordance with the terms of this Note, the Borrower may not refuse conversion based on any claim that the Holder or anyone associated or affiliated with the Holder has been engaged in any violation of law, agreement or for any other reason, unless an injunction from a court, on notice to Holder, restraining and or enjoining conversion of all or part of this Note shall have been sought and obtained, and the Borrower posts a surety bond for the benefit of the Holder in the amount of 150% of the outstanding principal amount of this Note, which is subject to the injunction, which bond shall remain in effect until the completion of arbitration/litigation of the underlying dispute and the proceeds of which shall be payable to such Holder to the extent it obtains judgment. In the absence of such injunction, the Borrower shall issue Conversion Shares upon a properly noticed conversion. If the Borrower fails for any reason to deliver to the Holder such certificate or certificates representing Conversion Shares pursuant to timing and delivery requirements of this Note, the Borrower shall pay to such Holder, in cash, as liquidated damages and not as a penalty, for each $1,000 of principal amount being converted, $1.00 per day for each day after the date by which such certificates should have been delivered until such certificates are delivered. Nothing herein shall limit a Holder’s right to pursue actual damages or declare an Event of Default pursuant to this Note, the other Loan Documents, or any agreement securing the indebtedness under this Note for the Borrower’s failure to deliver Conversion Shares within the period specified herein and such Holder shall have the right to pursue all remedies available to it hereunder, at law or in equity, including, without limitation, a decree of specific performance and/or injunctive relief. The exercise of any such rights shall not prohibit the Holder from seeking to enforce damages pursuant to any other Section hereof or under applicable law. Nothing herein shall prevent the Holder from having the Conversion Shares issued directly by the Borrower’s transfer agent in accordance with the Loan Documents, in the event for any reason the Borrower fails to issue or deliver, or cause its transfer agent to issue and deliver, the Conversion Shares to the Holder upon exercise of Holder’s conversion rights hereunder.

(vi) Transfer Taxes. The issuance of certificates for shares of the Common Stock on conversion of this Note shall be made without charge to the Holder hereof for any documentary stamp or similar taxes, or any other issuance or transfer fees of any nature or kind that may be payable in respect of the issue or delivery of such certificates, any such taxes or fees, if payable, to be paid by the Borrower.

| 9 |

(g) Make-Whole Rights. Upon liquidation by the Holder of Conversion Shares issued pursuant to a Conversion Notice, provided that the Holder realizes a net amount from such liquidation equal to less than the Conversion Amount specified in the relevant Conversion Notice (such net realized amount, the “Realized Amount”), the Borrower shall issue to the Holder additional shares of the Borrower’s Common Stock equal to: (i) the Conversion Amount specified in the relevant Conversion Notice; minus (ii) the Realized Amount, as evidenced by a reconciliation statement from the Holder (a “Sale Reconciliation”) showing the Realized Amount from the sale of the Conversion Shares; divided by (iii) the average volume weighted average price of the Borrower’s Common Stock during the five (5) Business Days immediately prior to the date upon which the Holder delivers notice (the “Make-Whole Notice”) to the Borrower that such additional shares are requested by the Holder (the “Make-Whole Stock Price”) (such number of additional shares to be issued, the “Make-Whole Shares”). Upon receiving the Make-Whole Notice and Sale Reconciliation evidencing the number of Make-Whole Shares requested, the Borrower shall instruct its transfer agent to issue certificates representing the Make-Whole Shares, which Make Whole Shares shall be issued and delivered in the same manner and within the same time frames as set forth in Subsection (c)(ii) above. Subsections (cXiii), (c)(iv), (c)(v) and (c)(vi) above shall be applicable to the issuance of the Make-Whole Shares. The Make-Whole Shares, when issued, shall be deemed to be validly issued, fully paid, and non-assessable shares of the Borrower’s Common Stock. Following the sale of the Make-Whole Shares by the Holder: (i) in the event that the Holder receives net proceeds from such sale which, when added to the Realized Amount from the prior relevant Conversion Notice, is less than the Conversion Amount specified in the relevant Conversion Notice, the Holder shall deliver an additional Make-Whole Notice to the Borrower following the procedures provided previously in this paragraph, and such procedures and the delivery of Make-Whole Notices shall continue until the Conversion Amount has been fully satisfied; (ii) in the event that the Holder received net proceeds from the sale of Make-Whole Shares in excess of the Conversion Amount specified in the relevant Conversion Notice, such excess amount shall be applied to satisfy any and all amounts owed hereunder in excess of the Conversion Amount specified in the relevant Conversion Notice.

(h) Adjustments to Conversion Price. The adjustments set forth in Sections (e)(i) and (e)(ii) below shall be applicable only to the extent the Conversion Price of the Common Stock does not already reflect an adjustment for any of such events.

(i) Stock Dividends and Stock Splits. If the Borrower, at any time while this Note is outstanding: (i) pays a stock dividend or otherwise makes a distribution or distributions payable in shares of Common Stock on outstanding shares of Common Stock, (ii) subdivides outstanding shares of Common Stock into a larger number of shares, (iii) combines (including by way of a reverse stock split) outstanding shares of Common Stock into a smaller number of shares, or (iv) issues, in the event of a reclassification of shares of Common Stock, any shares of capital stock of the Borrower, then the Conversion Price shall be multiplied by a fraction, the numerator of which shall be the number of shares of Common Stock (excluding any treasury shares of the Borrower) outstanding immediately before such event, and the denominator of which shall be the number of shares of Common Stock outstanding immediately after such event. Any adjustment made pursuant to this Section shall become effective immediately after the record date for the determination of stockholders entitled to receive such dividend or distribution and shall become effective immediately after the effective date in the case of a subdivision, combination, or re-classification.

(ii) Fundamental Transaction. If, at any time while this Note is outstanding: (i) the Borrower effects any merger or consolidation of the Borrower with or into another Person, (ii) the Borrower effects any sale of all or substantially all of its assets in one transaction or a series of related transactions, (iii) any tender offer or exchange offer (whether by the Borrower or another Person) is completed pursuant to which holders of Common Stock are permitted to tender or exchange their shares for other securities, cash or property, or (iv) the Borrower effects any reclassification of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other securities, cash or property (in any such case, a “Fundamental Transaction”), then upon any subsequent conversion of this Note, the Holder shall have the right to receive, for each Conversion Share that would have been issuable upon such conversion immediately prior to the occurrence of such Fundamental Transaction, the same kind and amount of securities, cash or property as it would have been entitled to receive upon the occurrence of such Fundamental Transaction if it had been, immediately prior to such Fundamental Transaction, the holder of one (1) share of Common Stock (the “Alternate Consideration”). For purposes of any such conversion, the determination of the Conversion Price shall be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one (1) share of Common Stock in such Fundamental Transaction, and the Borrower shall apportion the Conversion Price among the Alternate Consideration in a reasonable manner reflecting the relative value of any different components of the Alternate Consideration. If holders of Common Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holder shall be given the same choice as to the Alternate Consideration it receives upon any conversion of this Note following such Fundamental Transaction. To the extent necessary to effectuate the foregoing provisions, any successor to the Borrower or surviving entity in such Fundamental Transaction shall issue to the Holder a new note consistent with the foregoing provisions and evidencing the Holder’s right to convert such note into Alternate Consideration. The terms of any agreement pursuant to which a Fundamental Transaction is effected shall include terms requiring any such successor or surviving entity to comply with the provisions of this Section and insuring that this Note (or any such replacement security) will be similarly adjusted upon any subsequent transaction analogous to a Fundamental Transaction.

| 10 |

(iii) Adjustment to Conversion Price. Whenever the Conversion Price is adjusted pursuant to any provision of this Note, the Borrower shall promptly deliver to Holder a notice setting forth the Conversion Price after such adjustment and setting forth a brief statement of the facts requiring such adjustment.

(iv) Notice to Allow Conversion by Holder. If: (A) the Borrower shall declare a dividend (or any other distribution in whatever form) on the Common Stock, (B) the Borrower shall declare a special nonrecurring cash dividend on or a redemption of the Common Stock, (C) the Borrower shall authorize the granting to all holders of the Common Stock of rights or warrants to subscribe for or purchase any shares of capital stock of any class or of any rights, (D) the approval of any stockholders of the Borrower shall be required in connection with any reclassification of the Common Stock, any consolidation or merger to which the Borrower is a party, any sale or transfer of all or substantially all of the assets of the Borrower, of any compulsory share exchange whereby the Common Stock is converted into other securities, cash or property, or (E) the Borrower shall authorize the voluntary or involuntary dissolution, liquidation or winding up of the affairs of the Borrower, then, in each case, the Borrower shall cause to be filed at each office or agency maintained for the purpose of conversion of this Note, and shall cause to be delivered to the Holder at its last address as it shall appear upon the Borrower’s records, at least twenty (20) calendar days prior to the applicable record or effective date hereinafter specified, a notice stating: (x) the date on which a record is to be taken for the purpose of such dividend, distribution, redemption, rights or warrants, or if a record is not to be taken, the date as of which the holders of the Common Stock of record to be entitled to such dividend, distributions, redemption, rights or warrants are to be determined, or (y) the date on which such reclassification, consolidation, merger, sale, transfer or share exchange is expected to become effective or close, and the date as of which it is expected that holders of the Common Stock of record shall be entitled to exchange their shares of the Common Stock for securities, cash or other property deliverable upon such reclassification, consolidation, merger, sale, transfer or share exchange, provided that the failure to deliver such notice or any defect therein or in the delivery thereof shall not affect the validity of the corporate action required to be specified in such notice. The Holder is entitled to convert this Note during the 10-day period commencing on the date of such notice through the effective date of the event triggering such notice.

19. Non-U.S. Status. THE HOLDER IS A NON-U.S. PERSON AS THAT TERM IS DEFINED IN THE UNITED STATES INTERNAL REVENUE CODE. IT IS HEREBY AGREED AND UNDERSTOOD THAT THE OBLIGATIONS HEREUNDER MAY BE SOLD OR RESOLD ONLY TO NON-U.S. PERSONS. THE INTEREST PAYABLE HEREUNDER IS PAYABLE ONLY OUTSIDE THE UNITED STATES. ANY U.S. PERSON WHO HOLDS THIS OBLIGATION WILL BE SUBJECT TO LIMITATIONS UNDER THE UNITED STATES INCOME TAX LAW. BY ACCEPTING THIS OBLIGATION, THE HOLDER REPRESENTS AND WARRANTS THAT IT IS NOT A UNITED STATES PERSON (OTHER THAN AN EXEMPT RECIPIENT DESCRIBED IN SEC 6049(BX4) OF THE INTERNAL REVENUE CODE AND REGULATIONS THEREUNDER) AND THAT IT IS NOT ACTING FOR OR ON BEHALF OF A UNITED STATES PERSON (OTHER THAN AN EXEMPT RECIPIENT DESCRIBED IN SEC. 6049(8X4) OF THE INTERNAL REVENUE CODE AND THE REGULATIONS THEREUNDER).

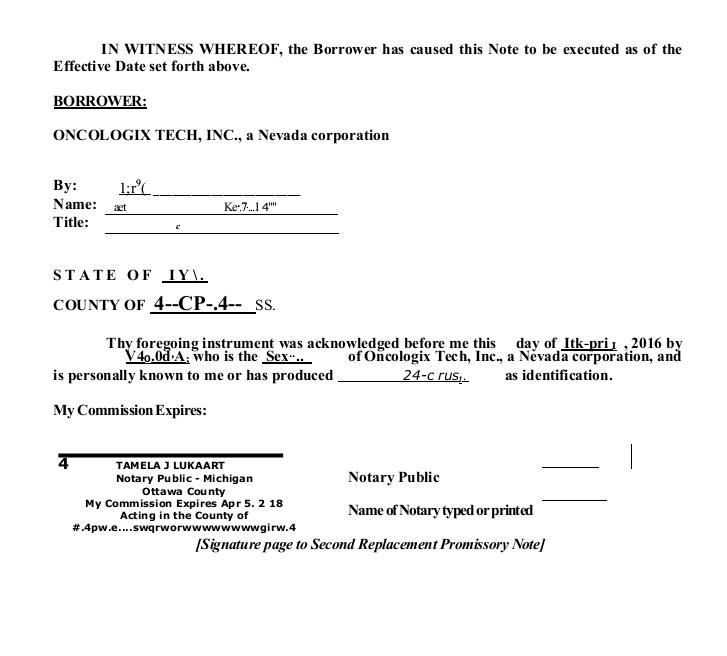

[Signature page follows]

| 11 |

| 12 |

VOMIT “A”

PAYMENT SCHEDULE

| Payment Date | Payment No. | Interest Payment | Prin. Payment | Redemption Premium | Total Payable | Balance Outstanding | ||||||||||||||||||

| 4/30/16 | 1 | $ | 31,695.13 | $ | 0 | $ | 0 | $ | 31,695.13 | $ | 2,113,008.53 | |||||||||||||

| 5/30/16 | 2 | $ | 31,695.13 | $ | 0 | $ | 0 | $ | 31,695.13 | $ | 2,113,008.53 | |||||||||||||

| 6/30/16 | 3 | $ | 31,695.13 | $ | 81,780.44 | $ | 11,785.54 | $ | 125,261.10 | $ | 2,031,228.09 | |||||||||||||

| 7/30/16 | 4 | $ | 30,468.42 | $ | 83,007.14 | $ | 11,785.54 | $ | 125,261.10 | $ | 1,948,220.95 | |||||||||||||

| 8/30/16 | 5 | $ | 29,223.31 | $ | 84,252.25 | $ | 11,785.54 | $ | 125,261.10 | $ | 1,863,968.70 | |||||||||||||

| 9/30/16 | 6 | $ | 27,959.53 | $ | 85,516.03 | $ | 11,785.54 | $ | 125,261.10 | $ | 1,778,452.67 | |||||||||||||

| 10/30/16 | 7 | $ | 26,676.79 | $ | 86,798.77 | $ | 11,785.54 | $ | 125,261.10 | $ | 1,691,653.90 | |||||||||||||

| 11/30/16 | 8 | $ | 25,374.81 | $ | 88,100.75 | $ | 11,785.54 | $ | 125,261.10 | $ | 1,603,553.14 | |||||||||||||

| 12/30/16 | 9 | $ | 24,053.30 | $ | 89,422.27 | $ | 11,785.54 | $ | 125,261.10 | $ | 1,514,130.88 | |||||||||||||

| 1/30/17 | 10 | $ | 22,711.96 | $ | 90,763.60 | $ | 11,785.54 | $ | 125,261.10 | $ | 1,423,367.28 | |||||||||||||

| 2/28/17 | 11 | $ | 21,350.51 | $ | 92,125.05 | $ | 11,785.54 | $ | 125,261.10 | $ | 1,331,242.22 | |||||||||||||

| 3/30/17 | 12 | $ | 19,968.63 | $ | 93,506.93 | $ | 11,785.54 | $ | 125,261.10 | $ | 1,237,735.30 | |||||||||||||

| 4/30/17 | 13 | $ | 18,566.03 | $ | 94,909.53 | $ | 11,785.54 | $ | 125,261.10 | $ | 1,142,825.76 | |||||||||||||

| 5/30/17 | 14 | $ | 17,142.39 | $ | 96,333.18 | $ | 11,785.54 | $ | 125,261.10 | $ | 1,046,492.58 | |||||||||||||

| 6/30/17 | 15 | $ | 15,697.39 | $ | 97,778.17 | $ | 11,785.54 | $ | 125,261.10 | $ | 948,714.41 | |||||||||||||

| 7/30/17 | 16 | $ | 14,230.72 | $ | 99,244.85 | $ | 11,785.54 | $ | 125,261.10 | $ | 849,469.56 | |||||||||||||

| 8/30/17 | 17 | $ | 12,742.04 | $ | 100,733.52 | $ | 11,785.54 | $ | 125,261.10 | $ | 748,736.04 | |||||||||||||

| 9/30/17 | 18 | $ | 11,231.04 | $ | 102,244.52 | $ | 11,785.54 | $ | 125,261.10 | $ | 646,491.52 | |||||||||||||

| 10/30/17 | 19 | $ | 9,697.37 | $ | 103,778.19 | $ | 11,785.54 | $ | 125,261.10 | $ | 542,713.33 | |||||||||||||

| 11/30/17 | 20 | $ | 8,140.70 | $ | 105,334.86 | $ | 11,785.54 | $ | 125,261.10 | $ | 437,378.47 | |||||||||||||

| 12/30/17 | 21 | $ | 6,560.68 | $ | 106,914.89 | $ | 11,785.54 | $ | 125,261.10 | $ | 330,463.58 | |||||||||||||

| 1/30/18 | 22 | $ | 4,956.95 | $ | 108,518.61 | $ | 11,785.54 | $ | 125,261.10 | $ | 221,944.97 | |||||||||||||

| 2/28/18 | 23 | $ | 3,329.17 | $ | 110,146.39 | $ | 11,785.54 | $ | 125,261.10 | $ | 111,798.58 | |||||||||||||

| 3/30/18 | 24 | $ | 1,676.98 | $ | 111,798.58 | $ | 11,785.54 | $ | 125,261.10 | $ | 0 | |||||||||||||

BORROWER INITIALS______________

| 13 |