UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

|

Investment Company Act file number |

811-04813 | |||||

|

|

| |||||

|

|

Dreyfus Investment Funds |

| ||||

|

|

(Exact name of Registrant as specified in charter) |

| ||||

|

|

|

| ||||

|

|

c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 |

| ||||

|

|

(Address of principal executive offices) (Zip code) |

| ||||

|

|

|

| ||||

|

|

Janette Farragher, Esq. 200 Park Avenue New York, New York 10166 |

| ||||

|

|

(Name and address of agent for service) |

| ||||

|

| ||||||

|

Registrant's telephone number, including area code: |

(212) 922-6000 | |||||

|

|

| |||||

|

Date of fiscal year end:

|

12/31 |

| ||||

|

Date of reporting period: |

12/31/11 |

| ||||

The following N-CSR relates only to the Registrant’s series listed below and does not affect the other series of the Registrant, which have a different fiscal year end and, therefore, different N-CSR reporting requirements. Separate N-CSR Forms will be filed for those series, as appropriate.

Dreyfus/Standish Fixed Income Fund

Dreyfus/Standish Global Fixed Income Fund

Dreyfus/Standish International Fixed Income Fund

| Dreyfus/Standish |

| Fixed Income Fund |

ANNUAL REPORT December 31, 2011

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

|

Contents | |

|

THE FUND | |

| 2 |

A Letter from the Chairman and CEO |

| 3 |

Discussion of Fund Performance |

| 6 |

Fund Performance |

| 7 |

Understanding Your Fund’s Expenses |

| 7 |

Comparing Your Fund’s Expenses With Those of Other Funds |

| 8 |

Statement of Investments |

| 20 |

Statement of Financial Futures |

| 20 |

Statement of Options Written |

| 21 |

Statement of Assets and Liabilities |

| 22 |

Statement of Operations |

| 23 |

Statement of Changes in Net Assets |

| 24 |

Financial Highlights |

| 25 |

Notes to Financial Statements |

| 44 |

Report of Independent Registered Public Accounting Firm |

| 45 |

Important Tax Information |

| 46 |

Board Members Information |

| 48 |

Officers of the Fund |

|

FOR MORE INFORMATION | |

|

Back Cover |

Dreyfus/Standish

Fixed Income Fund

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We are pleased to present this annual report for Dreyfus/Standish Fixed Income Fund, covering the 12-month period from January 1, 2011, through December 31, 2011. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

U.S. bond markets in 2011 were primarily driven by a “flight to quality” in which investors fled riskier assets due to adverse macroeconomic developments ranging from natural disasters in Japan to an unprecedented downgrade of long-term U.S. debt securities and the resurgence of a sovereign debt crisis in Europe. Ironically, despite the rating downgrade, long-term U.S.Treasury securities ended the year with double-digit total returns as investors flocked to traditional safe havens. Corporate-backed bonds also fared well, but to a lesser degree thanTreasuries, as investors sought competitive yields in a low interest-rate environment.

Our economic forecast calls for a mild acceleration of the U.S. recovery as the domestic banking system regains strength, credit conditions loosen and housing markets begin a long-awaited convalescence. In addition, we believe that long-term fundamentals currently appear to favor U.S. non-financial corporate credit, as well as emerging-markets local currency-denominated debt. Of course, we encourage you to talk with your financial adviser to help ensure that your investment objectives are properly aligned with your risk tolerance in pursuing potential market opportunities in 2012.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

January 17, 2012

2

DISCUSSION OF FUND PERFORMANCE

For the period of January 1, 2011, through December 31, 2011, as provided by David Bowser, CFA, and Peter Vaream, Portfolio Managers

Fund and Market Performance Overview

For the 12-month period ended December 31, 2011, Dreyfus/Standish Fixed Income Fund’s Class I shares achieved a total return of 7.10%.1 In comparison, the Barclays Capital U.S. Aggregate Bond Index (the “Index”), the fund’s benchmark, achieved a total return of 7.84% for the same period.2

U.S. government securities rallied strongly over much of 2011 when economic uncertainty intensified amid a subpar U.S. economic recovery and a sovereign debt crisis in Europe, sparking a flight to traditional safe havens among investors. In contrast, higher yielding sectors of the bond market produced more modest returns. The fund produced a lower return than its benchmark, primarily due to allocations to higher yielding bonds and a relatively short average duration at times during the year.

The Fund’s Investment Approach

The fund seeks to achieve a high level of current income, consistent with conserving principal and liquidity, and secondarily seeks capital appreciation when changes in interest rates and economic conditions indicate that capital appreciation may be available without significant risk to principal. To achieve this, the fund invests, under normal circumstances, at least 80% of net assets in fixed-income securities issued by U.S. and foreign governments and companies.

The fund invests primarily in investment-grade securities, but may invest up to 15% of assets in below investment-grade securities, sometimes referred to as junk bonds. The fund will not invest in securities rated lower than B at the time of purchase. In this instance, we will attempt to select fixed-income securities that have the potential to be upgraded.

Government Securities Rallied Amid Economic Uncertainty

Improvements in U.S. economic data supported prices of higher yielding bonds at the start of 2011, but investor confidence deteriorated in the spring when Greece appeared headed for default on its sovereign debt

| The Fund | 3 |

DISCUSSION OF FUND PERFORMANCE (continued)

and the crisis spread to other European nations. In addition, U.S. economic data proved more disappointing than expected, and investors reacted cautiously to a contentious political debate regarding U.S. government spending and borrowing.These developments sparked a shift away from riskier assets and toward traditional safe havens, causing U.S. government bond prices to rise and yields to fall. Market volatility proved especially severe in August and September after a major credit-rating agency reduced its assessment of long-term U.S. government debt. Ironically, U.S. government bonds gained considerable value during the ensuing flight to quality. In contrast, investment-grade and high yield corporate bonds suffered declines, erasing their earlier gains.

Economic data and investor confidence seemed to improve from October through December, when it became more apparent that the subpar U.S. economic expansion remained intact and the European Union seemed to make some progress in addressing the region’s problems. As a result, U.S. government securities gave back some of their previous gains. Corporate-backed securities rallied to a degree over the final months of the reporting period, enabling them to end the year with positive total returns, on average.

Constructive Investment Posture Dampened Relative Results

The fund’s results compared to the benchmark were undermined by our expectations of a more robust U.S. economy, which led us to establish overweighted positions in riskier market sectors, including high yield securities and dollar-denominated bonds issued by governments in the emerging markets. These securities generally lagged the strong returns provided by long-term U.S. government securities during the flight to quality. In addition, we had set the fund’s average duration in a position we considered slightly shorter than market averages in anticipation of potentially higher interest rates. However, this strategy prevented the fund from participating more fully in the remarkable gains of U.S. Treasury securities and, to a lesser extent, U.S. government agency securities.

The fund achieved better results from commercial mortgage-backed securities and asset-backed securities, which fared quite well during 2011. The fund also benefited from our security selection strategy among residential mortgage-backed securities, which favored higher coupon mortgages in an environment where prepayment activity remained low due to depressed home prices and tight lending standards.

4

Positioned for a Slow-Growth Environment

We currently expect the U.S. economic recovery to persist, but at a more sluggish pace than historical norms, as the concerns that weighed on investor sentiment in 2011 may be slow to recede. Nonetheless, we have maintained a mild emphasis on higher yielding securities, particularly residential mortgage-backed securities that are likely to benefit from the Federal Reserve Board’s efforts to stimulate the U.S. economy.We also have favored commercial mortgages, asset-backed securities and corporate credits that have little exposure to Europe’s troubles.The fund’s high yield holdings are concentrated among shorter-term securities toward the upper end of the sector’s credit-quality spectrum. In our view, these are prudent strategies until the economic outlook becomes clearer.

January 17, 2012

| Bond funds are subject generally to interest rate, credit, liquidity and market risks, to varying | |

| degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors | |

| being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause | |

| price declines. | |

| Foreign bonds are subject to special risks including exposure to currency fluctuations, changing | |

| political and economic conditions, and potentially less liquidity.The fixed income securities of | |

| issuers located in emerging markets can be more volatile and less liquid than those of issuers in | |

| more mature economies. | |

| High yield bonds are subject to increased credit risk and are considered speculative in terms of the | |

| issuer’s perceived ability to continue making interest payments on a timely basis and to repay | |

| principal upon maturity. | |

| Investments in foreign currencies are subject to the risk that those currencies will decline in value | |

| relative to the U.S. dollar, or, in the case of hedged positions, that the U.S. dollar will decline | |

| relative to the currency being hedged. Each of these risks could increase the fund’s volatility. | |

| The fund may use derivative instruments, such as options, futures and options on futures, forward | |

| contracts, swaps (including credit default swaps on corporate bonds and asset-backed securities), | |

| options on swaps and other credit derivatives.A small investment in derivatives could have a | |

| potentially large impact on the fund’s performance. | |

| 1 | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| guarantee of future results. Share price, yield and investment return fluctuate such that upon | |

| redemption fund shares may be worth more or less than their original cost. Return figure provided | |

| reflects the absorption of certain fund expenses by The Dreyfus Corporation pursuant to a | |

| voluntary undertaking in effect has been terminated since the end of the reporting period. Had | |

| these expenses not been absorbed, the fund’s return would have been lower. | |

| 2 | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital |

| gain distributions.The Barclays Capital U.S.Aggregate Bond (Hedged) Index is a widely | |

| accepted, unmanaged total return index of corporate, U.S. government and U.S. government | |

| agency debt instruments, mortgage-backed securities and asset-backed securities with an average | |

| maturity of 1-10 years.The Index does not include fees and expenses to which the fund is | |

| subject. Investors cannot invest directly in any index. |

| The Fund | 5 |

FUND PERFORMANCE

| Average Annual Total Returns as of 12/31/11 | ||||||

| 1Year | 5 Years | 10 Years | ||||

| Class I shares | 7.10% | 6.34% | 5.88% | |||

| Barclays Capital U.S. Aggregate Bond Index | 7.84% | 6.50% | 5.78% | |||

| † Source: Lipper Inc. |

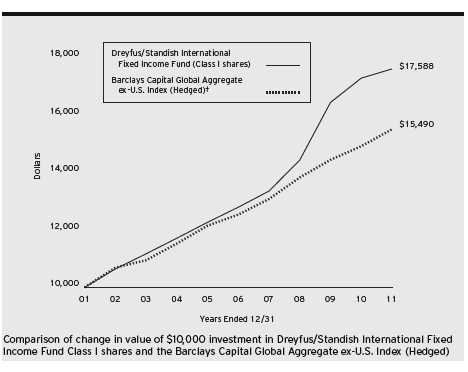

| Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not |

| reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| The above graph compares a $10,000 investment made in Class I shares of Dreyfus/Standish Fixed Income Fund on |

| 12/31/01 to a $10,000 investment made in the Barclays Capital U.S.Aggregate Bond Index (the “Index”) on that |

| date.All dividends and capital gain distributions are reinvested. |

| The fund’s performance shown in the line graph above takes into account all applicable fees and expenses.The Index is a |

| widely accepted, unmanaged total return index of corporate, U.S. government and U.S. government agency debt |

| instruments, mortgage-backed securities and asset-backed securities with an average maturity of 1-10 years. Unlike a |

| mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. |

| These factors can contribute to the Index potentially outperforming the fund. Further information relating to fund |

| performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the |

| prospectus and elsewhere in this report. |

6

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus/Standish Fixed Income Fund from July 1, 2011 to December 31, 2011. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended December 31, 2011

| Expenses paid per $1,000† | $2.67 | |

| Ending value (after expenses) | $1,038.80 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended December 31, 2011

| Expenses paid per $1,000† | $2.65 | |

| Ending value (after expenses) | $1,022.58 |

| † Expenses are equal to the fund’s annualized expense ratio of .52% for Class I, multiplied by the average account |

| value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| The Fund | 7 |

| STATEMENT OF INVESTMENTS |

| December 31, 2011 |

| Coupon | Maturity | Principal | |||

| Bonds and Notes—122.9% | Rate (%) | Date | Amount ($)a | Value ($) | |

| Asset-Backed Certificates—.5% | |||||

| Santander Drive Auto Receivables | |||||

| Trust, Ser. 2011-1, Cl. C | 3.11 | 5/16/16 | 1,065,000 | 1,050,549 | |

| Asset-Backed Ctfs./ | |||||

| Auto Receivables—3.2% | |||||

| Americredit Automobile Receivables | |||||

| Trust, Ser. 2011-5, Cl. D | 5.05 | 12/8/17 | 1,095,000 | 1,101,298 | |

| Americredit Automobile Receivables | |||||

| Trust, Ser. 2010-1, Cl. C | 5.19 | 8/17/15 | 280,000 | 289,871 | |

| Americredit Prime Automobile | |||||

| Receivable, Ser. 2007-1, Cl. E | 6.96 | 3/8/16 | 894,110 | b | 895,095 |

| Carmax Auto Owner Trust, | |||||

| Ser. 2010-1, Cl. B | 3.75 | 12/15/15 | 200,000 | 205,992 | |

| Carmax Auto Owner Trust, | |||||

| Ser. 2010-2, Cl. B | 3.96 | 6/15/16 | 140,000 | 145,617 | |

| Chrysler Financial Auto | |||||

| Securitization Trust, | |||||

| Ser. 2010-A, Cl. C | 2.00 | 1/8/14 | 465,000 | 465,309 | |

| Ford Credit Floorplan Master Owner | |||||

| Trust, Ser. 2011-1, Cl. A2 | 0.88 | 2/15/16 | 425,000 | c | 424,769 |

| Franklin Auto Trust, | |||||

| Ser. 2008-A, Cl. B | 6.10 | 5/20/16 | 569,055 | b | 572,041 |

| JPMorgan Auto Receivables Trust, | |||||

| Ser. 2008-A, Cl. CFTS | 5.22 | 7/15/15 | 250,826 | b | 248,856 |

| Santander Drive Auto Receivables | |||||

| Trust, Ser. 2010-2, Cl. B | 2.24 | 12/15/14 | 280,000 | 279,363 | |

| Santander Drive Auto Receivables | |||||

| Trust, Ser. 2010-B, Cl. C | 3.02 | 10/17/16 | 835,000 | b | 827,125 |

| Santander Drive Auto Receivables | |||||

| Trust, Ser. 2010-3, Cl. C | 3.06 | 11/15/17 | 405,000 | 405,024 | |

| Smart Trust, | |||||

| Ser. 2011-1USA, Cl. A3B | 1.13 | 10/14/14 | 825,000 | b,c | 823,777 |

| 6,684,137 | |||||

| Asset-Backed Ctfs./Credit Cards—.5% | |||||

| Citibank Omni Master Trust, | |||||

| Ser. 2009-A14A, Cl. A14 | 3.03 | 8/15/18 | 1,000,000 | b,c | 1,049,719 |

| Asset-Backed Ctfs./ | |||||

| Home Equity Loans—.3% | |||||

| Bayview Financial Acquisition | |||||

| Trust, Ser. 2005-B, Cl. 1A6 | 5.21 | 4/28/39 | 116,492 | c | 111,453 |

8

| Coupon | Maturity | Principal | |||

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)a | Value ($) | |

| Asset-Backed Ctfs./ | |||||

| Home Equity Loans (continued) | |||||

| Carrington Mortgage Loan Trust, | |||||

| Ser. 2005-NC5, Cl. A2 | 0.61 | 10/25/35 | 253,932 | c | 234,047 |

| Citicorp Residential Mortgage | |||||

| Securities, Ser. 2006-1, Cl. A3 | 5.71 | 7/25/36 | 135,215 | c | 135,469 |

| Citicorp Residential Mortgage | |||||

| Securities, Ser. 2007-2, Cl. A2 | 5.98 | 6/25/37 | 103,596 | c | 103,703 |

| First Franklin Mortgage Loan Asset | |||||

| Backed Certificates, | |||||

| Ser. 2005-FF2, Cl. M1 | 0.69 | 3/25/35 | 66,125 | c | 65,805 |

| JP Morgan Mortgage Acquisition, | |||||

| Ser. 2006-CH2, Cl. AV2 | 0.34 | 10/25/36 | 19,405 | c | 19,249 |

| 669,726 | |||||

| Asset-Backed Ctfs./ | |||||

| Manufactured Housing—.5% | |||||

| Vanderbilt Mortgage Finance, | |||||

| Ser. 1999-A, Cl. 1A6 | 6.75 | 3/7/29 | 1,030,000 | c | 1,029,203 |

| Auto Loan—.4% | |||||

| Ford Motor Credit, | |||||

| Sr. Unscd. Notes | 5.00 | 5/15/18 | 780,000 | 783,973 | |

| Banks—3.4% | |||||

| Bank of America, | |||||

| Sr. Unscd. Notes, Ser. 1 | 3.75 | 7/12/16 | 400,000 | 370,745 | |

| Bank of America, | |||||

| Sr. Unscd. Notes | 5.00 | 5/13/21 | 1,225,000 | 1,117,800 | |

| Citigroup, | |||||

| Sr. Unscd. Notes | 4.50 | 1/14/22 | 505,000 | 486,788 | |

| Citigroup, | |||||

| Sr. Unscd. Notes | 5.38 | 8/9/20 | 520,000 | 535,618 | |

| Citigroup, | |||||

| Sr. Unscd. Notes | 5.50 | 4/11/13 | 1,040,000 | 1,062,084 | |

| Goldman Sachs Group, | |||||

| Sr. Unscd. Notes | 5.25 | 7/27/21 | 560,000 | 547,315 | |

| JPMorgan Chase & Co., | |||||

| Sr. Unscd. Notes | 6.00 | 1/15/18 | 425,000 | 474,770 | |

| JPMorgan Chase Bank, | |||||

| Sr. Unscd. Notes | 4.35 | 8/15/21 | 1,340,000 | 1,355,919 | |

| Morgan Stanley, | |||||

| Sr. Unscd. Notes | 5.50 | 7/28/21 | 435,000 | 402,944 | |

| The Fund | 9 |

STATEMENT OF INVESTMENTS (continued)

| Coupon | Maturity | Principal | |||

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)a | Value ($) | |

| Banks (continued) | |||||

| Morgan Stanley, | |||||

| Sr. Unscd. Notes | 5.55 | 4/27/17 | 840,000 | 811,359 | |

| 7,165,342 | |||||

| Commercial Mortgage | |||||

| Pass-Through Ctfs.—4.5% | |||||

| American Tower Trust, | |||||

| Ser. 2007-1A, Cl. D | 5.96 | 4/15/37 | 630,000 | b | 669,326 |

| American Tower Trust, | |||||

| Ser. 2007-1A, Cl. F | 6.64 | 4/15/37 | 1,280,000 | b | 1,363,467 |

| Bear Stearns Commercial Mortgage | |||||

| Securities, Ser. 2003-T12, Cl. A3 | 4.24 | 8/13/39 | 525,477 | c | 529,168 |

| CS First Boston Mortgage | |||||

| Securities, Ser. 2005-C4, Cl. AAB | 5.07 | 8/15/38 | 681,310 | c | 693,882 |

| Extended Stay America Trust, | |||||

| Ser. 2010-ESHA, Cl. A | 2.95 | 11/5/27 | 308,692 | b | 310,236 |

| GS Mortgage Securities Corporation | |||||

| II, Ser. 2007-EOP, Cl. B | 1.84 | 3/6/20 | 2,965,000 | b,c | 2,887,477 |

| GS Mortgage Securities Corporation | |||||

| II, Ser. 2007-EOP, Cl. E | 2.67 | 3/6/20 | 1,120,000 | b,c | 1,085,111 |

| GS Mortgage Securities Corporation | |||||

| II, Ser. 2007-EOP, Cl. K | 5.33 | 3/6/20 | 650,000 | b,c | 639,574 |

| JP Morgan Chase Commercial | |||||

| Mortgage Securities, | |||||

| Ser. 2011-C3, Cl. A4 | 4.72 | 2/15/46 | 1,185,000 | b | 1,307,070 |

| Merrill Lynch Mortgage Trust, | |||||

| Ser. 2005-LC1, Cl. A2 | 5.20 | 1/12/44 | 97,851 | c | 97,808 |

| Wachovia Bank Commercial Mortgage | |||||

| Trust, Ser. 2005-C16, Cl. A2 | 4.38 | 10/15/41 | 62,870 | 62,835 | |

| 9,645,954 | |||||

| Diversified Financial Services—4.6% | |||||

| American Express, | |||||

| Sr. Unscd. Notes | 7.25 | 5/20/14 | 240,000 | 268,175 | |

| Ameriprise Financial, | |||||

| Jr. Sub. Notes | 7.52 | 6/1/66 | 610,000 | c | 619,150 |

| Discover Financial Services, | |||||

| Sr. Unscd. Notes | 10.25 | 7/15/19 | 998,000 | 1,218,184 | |

| ERAC USA Finance, | |||||

| Gtd. Notes | 6.38 | 10/15/17 | 460,000 | b | 532,208 |

10

| Coupon | Maturity | Principal | |||

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)a | Value ($) | |

| Diversified Financial | |||||

| Services (continued) | |||||

| FUEL Trust, | |||||

| Scd. Notes | 4.21 | 4/15/16 | 660,000 | b | 666,250 |

| General Electric Capital, | |||||

| Sr. Unscd. Notes | 1.01 | 4/7/14 | 930,000 | c | 909,546 |

| General Electric Capital, | |||||

| Sr. Unscd. Notes | 4.38 | 9/21/15 | 360,000 | 387,593 | |

| General Electric Capital, | |||||

| Sr. Unscd. Notes | 6.88 | 1/10/39 | 965,000 | 1,159,989 | |

| Harley-Davidson Funding, | |||||

| Gtd. Notes | 5.75 | 12/15/14 | 1,145,000 | b | 1,236,961 |

| Hyundai Capital Services, | |||||

| Sr. Unscd. Notes | 4.38 | 7/27/16 | 400,000 | b | 408,363 |

| International Lease Finance, | |||||

| Sr. Unscd. Notes | 6.63 | 11/15/13 | 565,000 | e | 565,000 |

| Invesco, | |||||

| Gtd. Notes | 5.38 | 2/27/13 | 595,000 | 618,574 | |

| Merrill Lynch & Co., | |||||

| Sub. Notes | 5.70 | 5/2/17 | 1,205,000 | 1,107,894 | |

| 9,697,887 | |||||

| Electric Utilities—1.6% | |||||

| AES, | |||||

| Sr. Unscd. Notes | 8.00 | 10/15/17 | 490,000 | 541,450 | |

| Exelon Generation, | |||||

| Sr. Unscd. Notes | 5.20 | 10/1/19 | 660,000 | 726,170 | |

| National Grid, | |||||

| Sr. Unscd. Notes | 6.30 | 8/1/16 | 548,000 | 629,480 | |

| Nevada Power, | |||||

| Mortgage Notes | 6.50 | 8/1/18 | 240,000 | 289,812 | |

| Nisource Finance, | |||||

| Sr. Unscd. Notes | 4.45 | 12/1/21 | 555,000 | 568,221 | |

| Sempra Energy, | |||||

| Sr. Unscd. Notes | 6.50 | 6/1/16 | 565,000 | 659,715 | |

| 3,414,848 | |||||

| Environmental Control—.4% | |||||

| Waste Management, | |||||

| Sr. Unscd. Notes | 7.00 | 7/15/28 | 596,000 | 749,238 | |

| The Fund | 11 |

STATEMENT OF INVESTMENTS (continued)

| Coupon | Maturity | Principal | ||||

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)a | Value ($) | ||

| Food & Beverages—.2% | ||||||

| Kraft Foods, | ||||||

| Sr. Unscd. Notes | 6.88 | 2/1/38 | 325,000 | 431,849 | ||

| Foreign/Governmental—2.8% | ||||||

| Corp Andina De Formento, | ||||||

| Sr. Unscd. Notes | 3.75 | 1/15/16 | 590,000 | 602,041 | ||

| Mexican Government, | ||||||

| Bonds | MXN | 6.50 | 6/10/21 | 59,545,000 | 4,282,165 | |

| Province of Quebec Canada, | ||||||

| Unscd. Notes | 4.60 | 5/26/15 | 585,000 | e | 651,517 | |

| Republic of Korea, | ||||||

| Sr. Unscd. Notes | 7.13 | 4/16/19 | 360,000 | 450,993 | ||

| 5,986,716 | ||||||

| Health Care—1.4% | ||||||

| Amgen, | ||||||

| Sr. Unscd. Notes | 3.88 | 11/15/21 | 850,000 | 859,497 | ||

| Aristotle Holding, | ||||||

| Gtd. Notes | 4.75 | 11/15/21 | 570,000 | b | 590,979 | |

| Biomet, | ||||||

| Gtd. Notes | 10.00 | 10/15/17 | 390,000 | 423,150 | ||

| Gilead Sciences, | ||||||

| Sr. Unscd. Notes | 4.40 | 12/1/21 | 465,000 | 493,263 | ||

| HCA, | ||||||

| Notes | 6.25 | 2/15/13 | 550,000 | 563,750 | ||

| 2,930,639 | ||||||

| Materials—2.2% | ||||||

| Dow Chemical, | ||||||

| Sr. Unscd. Notes | 4.13 | 11/15/21 | 1,260,000 | 1,294,965 | ||

| Dow Chemical, | ||||||

| Sr. Unscd. Notes | 5.25 | 11/15/41 | 420,000 | 443,476 | ||

| Ecolab, | ||||||

| Sr. Unscd. Notes | 4.35 | 12/8/21 | 210,000 | 224,711 | ||

| Freeport-McMoRan Copper & Gold, | ||||||

| Sr. Unscd. Notes | 8.38 | 4/1/17 | 590,000 | 627,539 | ||

| Georgia-Pacific, | ||||||

| Gtd. Notes | 8.25 | 5/1/16 | 485,000 | b | 538,987 | |

| Holcim US Finance Sarl & Cie, | ||||||

| Gtd. Notes | 6.00 | 12/30/19 | 490,000 | b | 505,728 | |

| Peabody Energy, | ||||||

| Sr. Notes | 6.25 | 11/15/21 | 475,000 | b | 494,000 | |

12

| Coupon | Maturity | Principal | |||

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)a | Value ($) | |

| Materials (continued) | |||||

| Teck Resources, | |||||

| Gtd. Notes | 6.25 | 7/15/41 | 410,000 | 475,355 | |

| 4,604,761 | |||||

| Media—2.9% | |||||

| Cox Communications, | |||||

| Sr. Unscd. Notes | 6.25 | 6/1/18 | 575,000 | b | 670,502 |

| DirecTV Holdings, | |||||

| Gtd. Notes | 6.00 | 8/15/40 | 80,000 | 87,581 | |

| Dish DBS, | |||||

| Gtd. Notes | 6.75 | 6/1/21 | 295,000 | 319,337 | |

| Dish DBS, | |||||

| Gtd. Notes | 7.13 | 2/1/16 | 230,000 | 248,975 | |

| NBC Universal Media, | |||||

| Sr. Unscd. Notes | 4.38 | 4/1/21 | 600,000 | 634,414 | |

| NBC Universal Media, | |||||

| Sr. Unscd. Notes | 5.15 | 4/30/20 | 635,000 | 708,203 | |

| News America, | |||||

| Gtd. Notes | 6.15 | 3/1/37 | 720,000 | 789,659 | |

| News America, | |||||

| Gtd. Notes | 6.90 | 8/15/39 | 545,000 | 632,095 | |

| Pearson Dollar Finance Two, | |||||

| Gtd. Notes | 6.25 | 5/6/18 | 150,000 | b | 174,436 |

| TCI Communications, | |||||

| Sr. Unscd. Debs | 7.88 | 2/15/26 | 355,000 | 471,263 | |

| Time Warner, | |||||

| Gtd. Debs | 6.10 | 7/15/40 | 220,000 | 258,855 | |

| Time Warner, | |||||

| Gtd. Debs | 6.20 | 3/15/40 | 370,000 | 437,397 | |

| Time Warner Cable, | |||||

| Gtd. Notes | 5.50 | 9/1/41 | 535,000 | 565,894 | |

| Time Warner Cable, | |||||

| Gtd. Notes | 6.75 | 7/1/18 | 205,000 | 243,809 | |

| 6,242,420 | |||||

| Multi-Line Insurance—.4% | |||||

| American International Group, | |||||

| Sr. Unscd. Notes | 3.65 | 1/15/14 | 185,000 | e | 179,763 |

| American International Group, | |||||

| Sr. Unscd. Notes | 6.40 | 12/15/20 | 675,000 | 682,380 | |

| 862,143 | |||||

| The Fund | 13 |

STATEMENT OF INVESTMENTS (continued)

| Coupon | Maturity | Principal | ||

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)a | Value ($) |

| Municipal Bonds—.9% | ||||

| California, | ||||

| GO (Build America Bonds) | 7.30 | 10/1/39 | 610,000 | 721,892 |

| Illinois, | ||||

| GO | 4.42 | 1/1/15 | 350,000 | 363,303 |

| New York City, | ||||

| GO (Build America Bonds) | 5.99 | 12/1/36 | 630,000 | 754,249 |

| 1,839,444 | ||||

| Office And Business Equipment—.3% | ||||

| Xerox, | ||||

| Sr. Unscd. Notes | 5.50 | 5/15/12 | 235,000 | 238,918 |

| Xerox, | ||||

| Sr. Unscd. Notes | 5.65 | 5/15/13 | 335,000 | 351,798 |

| 590,716 | ||||

| Oil & Gas—2.4% | ||||

| Anadarko Petroleum, | ||||

| Sr. Unscd. Notes | 6.38 | 9/15/17 | 985,000 | 1,143,135 |

| Chesapeake Energy, | ||||

| Gtd. Notes | 6.63 | 8/15/20 | 760,000 | 818,900 |

| EQT, | ||||

| Sr. Unscd. Notes | 8.13 | 6/1/19 | 550,000 | 646,054 |

| Hess, | ||||

| Sr. Unscd. Notes | 5.60 | 2/15/41 | 310,000 | 347,663 |

| Pemex Project Funding Master | ||||

| Trust, Gtd. Bonds | 6.63 | 6/15/35 | 610,000 | 697,687 |

| Petrobras International Finance, | ||||

| Gtd. Notes | 5.38 | 1/27/21 | 305,000 | 321,958 |

| Petrobras International Finance, | ||||

| Gtd. Notes | 6.75 | 1/27/41 | 260,000 | 300,075 |

| Petro-Canada, | ||||

| Sr. Unscd. Notes | 6.80 | 5/15/38 | 210,000 | 272,087 |

| Valero Energy, | ||||

| Gtd. Notes | 6.13 | 2/1/20 | 500,000 | 557,060 |

| 5,104,619 | ||||

| Paper & Paper Related—.3% | ||||

| International Paper, | ||||

| Sr. Unscd. Notes | 4.75 | 2/15/22 | 500,000 | 532,526 |

14

| Coupon | Maturity | Principal | ||

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)a | Value ($) |

| Pipelines—1.7% | ||||

| El Paso, | ||||

| Sr. Unscd. Notes | 7.25 | 6/1/18 | 500,000 | 549,949 |

| Enterprise Products Operating, | ||||

| Gtd. Notes | 5.95 | 2/1/41 | 905,000 | 1,018,079 |

| Kinder Morgan Energy Partners, | ||||

| Sr. Unscd. Notes | 6.55 | 9/15/40 | 605,000 | 680,052 |

| Plains All American Pipeline, | ||||

| Gtd. Notes | 5.00 | 2/1/21 | 550,000 | 606,995 |

| Plains All American Pipeline, | ||||

| Gtd. Notes | 5.75 | 1/15/20 | 610,000 | 681,897 |

| 3,536,972 | ||||

| Property & Casualty Insurance—2.8% | ||||

| AON, | ||||

| Sr. Unscd. Notes | 3.50 | 9/30/15 | 460,000 | 472,446 |

| Cincinnati Financial, | ||||

| Sr. Unscd. Notes | 6.13 | 11/1/34 | 563,000 | 561,980 |

| Cincinnati Financial, | ||||

| Sr. Unscd. Debs | 6.92 | 5/15/28 | 789,000 | 863,139 |

| MetLife, | ||||

| Sr. Unscd. Notes | 5.00 | 6/15/15 | 235,000 | 256,211 |

| Principal Financial Group, | ||||

| Gtd. Notes | 8.88 | 5/15/19 | 575,000 | 716,910 |

| Prudential Financial, | ||||

| Sr. Unscd. Notes | 5.38 | 6/21/20 | 1,040,000 | 1,114,941 |

| Willis North America, | ||||

| Gtd. Notes | 6.20 | 3/28/17 | 810,000 | 891,608 |

| Willis North America, | ||||

| Gtd. Notes | 7.00 | 9/29/19 | 910,000 | 1,014,514 |

| 5,891,749 | ||||

| Real Estate—2.0% | ||||

| DDR, | ||||

| Sr. Unscd. Notes | 4.75 | 4/15/18 | 545,000 | 522,156 |

| Duke Realty, | ||||

| Sr. Unscd. Notes | 6.75 | 3/15/20 | 55,000 | 60,441 |

| Duke Realty, | ||||

| Sr. Unscd. Notes | 8.25 | 8/15/19 | 510,000 | 600,133 |

| The Fund | 15 |

STATEMENT OF INVESTMENTS (continued)

| Coupon | Maturity | Principal | |||

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)a | Value ($) | |

| Real Estate (continued) | |||||

| Federal Realty Investment Trust, | |||||

| Sr. Unscd. Notes | 6.00 | 7/15/12 | 380,000 | 386,649 | |

| Mack-Cali Realty, | |||||

| Sr. Unscd. Notes | 5.13 | 1/15/15 | 196,000 | 205,754 | |

| Mack-Cali Realty, | |||||

| Sr. Unscd. Notes | 5.25 | 1/15/12 | 340,000 | 340,256 | |

| Regency Centers, | |||||

| Gtd. Notes | 5.25 | 8/1/15 | 187,000 | 199,438 | |

| Regency Centers, | |||||

| Gtd. Notes | 5.88 | 6/15/17 | 330,000 | 359,790 | |

| Simon Property Group, | |||||

| Sr. Unscd. Notes | 6.75 | 2/1/40 | 745,000 | 976,224 | |

| WEA Finance, | |||||

| Gtd. Notes | 7.13 | 4/15/18 | 445,000 | b | 497,979 |

| WEA Finance, | |||||

| Gtd. Notes | 7.50 | 6/2/14 | 245,000 | b | 268,728 |

| 4,417,548 | |||||

| Residential Mortgage | |||||

| Pass-Through Ctfs.—.8% | |||||

| Banc of America Mortgage | |||||

| Securities, Ser. 2005-2, Cl. 2A1 | 5.00 | 3/25/20 | 307,017 | 307,394 | |

| Countrywide Alternative Loan | |||||

| Trust, Ser. 2004-16CB, Cl. 2A2 | 5.00 | 8/25/19 | 901,483 | 912,862 | |

| CS First Boston Mortgage | |||||

| Securities, Ser. 2004-7, Cl. 6A1 | 5.25 | 10/25/19 | 366,972 | 370,976 | |

| 1,591,232 | |||||

| Retail—1.7% | |||||

| Autozone, | |||||

| Sr. Unscd. Notes | 5.75 | 1/15/15 | 560,000 | 620,351 | |

| CVS Pass-Through Trust, | |||||

| Pass Thru Certificates Notes | 8.35 | 7/10/31 | 1,411,677 | b | 1,732,205 |

| Home Depot, | |||||

| Sr. Unscd. Notes | 5.95 | 4/1/41 | 415,000 | 537,523 | |

| Staples, | |||||

| Gtd. Notes | 9.75 | 1/15/14 | 570,000 | 652,085 | |

| 3,542,164 | |||||

| Telecommunications—.8% | |||||

| Cellco Partnership/Verizon | |||||

| Wireless Capital, Sr. Unscd. Notes | 5.55 | 2/1/14 | 565,000 | 614,154 | |

16

| Coupon | Maturity | Principal | ||||

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)a | Value ($) | ||

| Telecommunications (continued) | ||||||

| Verizon Communications, | ||||||

| Sr. Unscd. Notes | 3.50 | 11/1/21 | 395,000 | 412,098 | ||

| Verizon Communications, | ||||||

| Sr. Unscd. Notes | 4.75 | 11/1/41 | 350,000 | 378,229 | ||

| Verizon Communications, | ||||||

| Sr. Unscd. Notes | 7.35 | 4/1/39 | 280,000 | 392,814 | ||

| 1,797,295 | ||||||

| Tobacco—.9% | ||||||

| Altria Group, | ||||||

| Gtd. Notes | 10.20 | 2/6/39 | 1,185,000 | 1,849,602 | ||

| Transportation-Rail—.2% | ||||||

| CSX, | ||||||

| Sr. Unscd. Notes | 4.75 | 5/30/42 | 510,000 | 528,368 | ||

| U.S. Government Agencies/ | ||||||

| Mortgage-Backed—34.4% | ||||||

| Federal Home Loan Mortgage Corp.: | ||||||

| 4.00% | 10,325,000f,g | 10,831,570 | ||||

| 5.00%, 1/1/40—9/1/40 | 1,525,918f | 1,663,837 | ||||

| 5.50%, 1/1/34—9/1/40 | 1,137,754f | 1,242,092 | ||||

| 7.00%, 11/1/31 | 116,640f | 134,013 | ||||

| Federal National Mortgage Association: | ||||||

| 3.50% | 1,090,000f,g | 1,121,338 | ||||

| 4.00% | 17,925,000f,g | 18,835,255 | ||||

| 4.50% | 835,000f,g | 888,753 | ||||

| 5.00% | 10,235,000f,g | 11,051,300 | ||||

| 5.50% | 10,350,000f,g | 11,234,780 | ||||

| 6.00% | 4,750,000f,g | 5,230,939 | ||||

| 4.50%, 11/1/14 | 3,856f | 4,113 | ||||

| 5.00%, 1/1/19—9/1/40 | 798,723f | 870,181 | ||||

| 5.50%, 2/1/33—8/1/40 | 6,040,934f | 6,631,366 | ||||

| 6.00%, 1/1/38 | 837,066f | 925,699 | ||||

| 7.00%, 11/1/31—6/1/32 | 16,361f | 18,985 | ||||

| 7.50%, 2/1/29—11/1/29 | 3,389f | 3,981 | ||||

| Government National | ||||||

| Mortgage Association I: | ||||||

| 4.00% | 2,115,000g | 2,262,719 | ||||

| 6.00%, 1/15/32 | 1,420 | 1,616 | ||||

| 6.50%, 7/15/32 | 2,147 | 2,490 | ||||

| 8.00%, 5/15/26 | 1,945 | 2,241 | ||||

| 72,957,268 | ||||||

| The Fund | 17 |

STATEMENT OF INVESTMENTS (continued)

| Principal | ||||

| Bonds and Notes (continued) | Amount ($)a | Value ($) | ||

| U.S. Government Securities—43.9% | ||||

| U.S. Treasury Bonds: | ||||

| 3.88%, 8/15/40 | 4,915,000 | e | 5,892,623 | |

| 6.13%, 11/15/27 | 445,000 | 661,451 | ||

| U.S. Treasury Notes: | ||||

| 1.00%, 4/30/12 | 6,875,000 | e | 6,897,557 | |

| 1.13%, 1/15/12 | 29,770,000 | e | 29,785,123 | |

| 1.38%, 9/15/12 | 18,725,000 | e | 18,892,514 | |

| 1.75%, 4/15/13 | 625,000 | e | 637,500 | |

| 2.13%, 5/31/15 | 12,870,000 | e | 13,588,918 | |

| 3.63%, 5/15/13 | 15,940,000 | e | 16,682,214 | |

| 93,037,900 | ||||

| Total Bonds and Notes | ||||

| (cost $254,381,364) | 260,216,507 | |||

| Face Amount | ||||

| Covered by | ||||

| Options Purchased—.0% | Contracts ($) | Value ($) | ||

| Call Options; | ||||

| 5-Year USD LIBOR-BBA, | ||||

| February 2012 @ $1.43 | ||||

| (cost $86,284) | 11,660,000 | h | 111,429 | |

| Principal | ||||

| Short-Term Investments—3.4% | Amount ($) | Value ($) | ||

| U.S. Treasury Bills: | ||||

| 0.03%, 1/12/12 | 7,105,000 | 7,104,979 | ||

| 0.02%, 5/17/12 | 40,000 | d | 39,995 | |

| Total Short-Term Investments | ||||

| (cost $7,145,061) | 7,144,974 | |||

| Other Investment—1.8% | Shares | Value ($) | ||

| Registered Investment Company; | ||||

| Dreyfus Institutional Preferred | ||||

| Plus Money Market Fund | ||||

| (cost $3,759,606) | 3,759,606 | i | 3,759,606 | |

18

| Investment of Cash Collateral | ||||

| for Securities Loaned—5.1% | Shares | Value ($) | ||

| Registered Investment Company; | ||||

| Dreyfus Institutional Cash Advantage Fund | ||||

| (cost $10,733,429) | 10,733,429i | 10,733,429 | ||

| Total Investments (cost $276,105,744) | 133.2% | 281,965,945 | ||

| Liabilities, Less Cash and Receivables | (33.2%) | (70,249,493) | ||

| Net Assets | 100.0% | 211,716,452 | ||

| BBA—British Bankers Association |

| LIBOR—London Interbank Offered Rate |

| USD—U.S. Dollar |

| a Principal amount stated in U.S. Dollars unless otherwise noted. |

| MXN—Mexican New Peso |

| b Securities exempt from registration under Rule 144A of the Securities Act of 1933.These securities may be resold in |

| transactions exempt from registration, normally to qualified institutional buyers.At December 31, 2011, these |

| securities were valued at $20,996,200 or 9.9% of net assets. |

| c Variable rate security—interest rate subject to periodic change. |

| d Held by a broker as collateral for open financial futures positions. |

| e Security, or portion thereof, on loan.At December 31, 2011, the value of the fund’s securities on loan was |

| $35,044,502 and the market value of the collateral held by the fund was $35,951,807, consisting of cash collateral |

| of $10,733,429 and U.S. Government securities valued at $25,218,378. |

| f The Federal Housing Finance Agency (“FHFA”) placed Federal Home Loan Mortgage Corporation and Federal |

| National Mortgage Association into conservatorship with FHFA as the conservator.As such, the FHFA oversees the |

| continuing affairs of these companies. |

| g Purchased on a forward commitment basis. |

| h Non-income producing security. |

| i Investment in affiliated money market mutual fund. |

| Portfolio Summary (Unaudited)† | |||

| Value (%) | Value (%) | ||

| U.S. Government & Agencies | 78.3 | Foreign/Governmental | 2.8 |

| Corporate Bonds | 30.6 | Municipal Bonds | .9 |

| Asset/Mortgage-Backed | 10.3 | Options Purchased | .0 |

| Short-Term/ | |||

| Money Market Investments | 10.3 | 133.2 | |

| † Based on net assets. | |||

| See notes to financial statements. | |||

| The Fund | 19 |

| STATEMENT OF FINANCIAL FUTURES |

| December 31, 2011 |

| Market Value | Unrealized | |||||

| Covered by | (Depreciation) | |||||

| Contracts | Contracts ($) | Expiration | at 12/31/2011 | ($) | ||

| Financial Futures Short | ||||||

| U.S. Treasury 10 Year Notes | 20 | (2,622,500 | ) | March 2012 | (12,213 | ) |

| See notes to financial statements. | ||||||

| STATEMENT OF OPTIONS WRITTEN |

| December 31, 2011 |

| Face Amount | ||||

| Covered by | ||||

| Contracts ($) | Value ($) | |||

| Call Options: | ||||

| 10-Year USD LIBOR-BBA, | ||||

| February 2012 @ $2.15 | ||||

| (premiums received $86,284) | 6,115,000 | a | (108,243 | ) |

| BBA—British Bankers Association |

| LIBOR—London Interbank Offered Rate |

| USD—U.S. Dollar |

| a Non-income producing security. |

| See notes to financial statements. |

20

| STATEMENT OF ASSETS AND LIABILITIES |

| December 31, 2011 |

| Cost | Value | ||

| Assets ($): | |||

| Investments in securities—See Statement of Investments (including | |||

| securities on loan, valued at $35,044,502)—Note 1(c): | |||

| Unaffiliated issuers | 261,612,709 | 267,472,910 | |

| Affiliated issuers | 14,493,035 | 14,493,035 | |

| Cash | 39,791 | ||

| Cash denominated in foreign currencies | 141,573 | 140,219 | |

| Dividends, interest and securities lending income receivable | 1,588,345 | ||

| Prepaid expenses | 8,563 | ||

| 283,742,863 | |||

| Liabilities ($): | |||

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | 95,234 | ||

| Due to Administrator—Note 3(a) | 11,169 | ||

| Payable for investment securities purchased | 60,991,085 | ||

| Liability for securities on loan—Note 1(c) | 10,733,429 | ||

| Outstanding options written, at value (premiums received | |||

| $86,284)—See Statement of Options Written—Note 4 | 108,243 | ||

| Payable for shares of Beneficial Interest redeemed | 42,514 | ||

| Payable for futures variation margin—Note 4 | 5,625 | ||

| Accrued expenses | 39,112 | ||

| 72,026,411 | |||

| Net Assets ($) | 211,716,452 | ||

| Composition of Net Assets ($): | |||

| Paid-in capital | 214,099,732 | ||

| Accumulated undistributed investment income—net | 843,233 | ||

| Accumulated net realized gain (loss) on investments | (9,051,156) | ||

| Accumulated net unrealized appreciation (depreciation) on | |||

| investments [including ($12,213) net unrealized | |||

| (depreciation) on financial futures] | 5,824,643 | ||

| Net Assets ($) | 211,716,452 | ||

| Class I Shares Outstanding | |||

| (unlimited number of $.001 par value shares of Beneficial Interest authorized) | 9,837,744 | ||

| Net Asset Value, offering and redemption price per share ($) | 21.52 | ||

| See notes to financial statements. | |||

| The Fund | 21 |

| STATEMENT OF OPERATIONS |

| Year Ended December 31, 2011 |

| Investment Income ($): | ||

| Income: | ||

| Interest | 7,563,236 | |

| Dividends; | ||

| Affiliated issuers | 4,697 | |

| Income from securities lending—Note 1(c) | 13,125 | |

| Total Income | 7,581,058 | |

| Expenses: | ||

| Investment advisory fee—Note 3(a) | 909,886 | |

| Administration fees—Note 3(a) | 89,041 | |

| Professional fees | 62,545 | |

| Custodian fees—Note 3(c) | 50,842 | |

| Registration fees | 25,985 | |

| Shareholder servicing costs—Note 3(c) | 25,398 | |

| Administrative service fees—Note 3(b) | 19,251 | |

| Accounting and administration fees—Note 3(a) | 15,000 | |

| Prospectus and shareholders’ reports | 11,235 | |

| Trustees’ fees and expenses—Note 3(d) | 9,901 | |

| Loan commitment fees—Note 2 | 3,787 | |

| Miscellaneous | 59,386 | |

| Total Expenses | 1,282,257 | |

| Less—reduction in investment advisory fee | ||

| due to undertaking—Note 3(a) | (38,850) | |

| Less—reduction in fees due to earnings credits—Note 3(c) | (11) | |

| Net Expenses | 1,243,396 | |

| Investment Income—Net | 6,337,662 | |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | ||

| Net realized gain (loss) on investments and foreign currency transactions | 11,257,762 | |

| Net realized gain (loss) on options transactions | 99,058 | |

| Net realized gain (loss) on financial futures | (568,721) | |

| Net realized gain (loss) on forward foreign currency exchange contracts | 219,072 | |

| Net Realized Gain (Loss) | 11,007,171 | |

| Net unrealized appreciation (depreciation) on | ||

| investments and foreign currency transactions | (1,298,848) | |

| Net unrealized appreciation (depreciation) on options transactions | (29,445) | |

| Net unrealized appreciation (depreciation) on financial futures | (354,472) | |

| Net unrealized appreciation (depreciation) on | ||

| forward foreign currency exchange contracts | 11,678 | |

| Net Unrealized Appreciation (Depreciation) | (1,671,087) | |

| Net Realized and Unrealized Gain (Loss) on Investments | 9,336,084 | |

| Net Increase in Net Assets Resulting from Operations | 15,673,746 | |

| See notes to financial statements. | ||

22

STATEMENT OF CHANGES IN NET ASSETS

| Year Ended December 31, | ||||

| 2011 | 2010 | |||

| Operations ($): | ||||

| Investment income—net | 6,337,662 | 9,477,254 | ||

| Net realized gain (loss) on investments | 11,007,171 | 9,430,732 | ||

| Net unrealized appreciation | ||||

| (depreciation) on investments | (1,671,087) | 2,969,578 | ||

| Net Increase (Decrease) in Net Assets | ||||

| Resulting from Operations | 15,673,746 | 21,877,564 | ||

| Dividends to Shareholders from ($): | ||||

| Investment income—net | (6,666,113) | (10,023,757) | ||

| Beneficial Interest Transactions ($): | ||||

| Net proceeds from shares sold | 44,852,359 | 50,296,437 | ||

| Dividends reinvested | 6,083,801 | 8,875,032 | ||

| Cost of shares redeemed | (89,960,363) | (74,461,285) | ||

| Increase (Decrease) in Net Assets from | ||||

| Beneficial Interest Transactions | (39,024,203) | (15,289,816) | ||

| Total Increase (Decrease) in Net Assets | (30,016,570) | (3,436,009) | ||

| Net Assets ($): | ||||

| Beginning of Period | 241,733,022 | 245,169,031 | ||

| End of Period | 211,716,452 | 241,733,022 | ||

| Undistributed investment income—net | 843,233 | 1,057,913 | ||

| Capital Share Transactions (Shares): | ||||

| Shares sold | 2,113,586 | 2,434,833 | ||

| Shares issued for dividends reinvested | 288,276 | 430,086 | ||

| Shares redeemed | (4,234,315) | (3,582,058) | ||

| Net Increase (Decrease) in Shares Outstanding | (1,832,453) | (717,139) | ||

| See notes to financial statements. | ||||

| The Fund | 23 |

FINANCIAL HIGHLIGHTS

The following table describes the performance for the fiscal periods indicated. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| Year Ended December 31, | ||||||||||

| Class I Shares | 2011 | 2010 | 2009a | 2008 | 2007 | |||||

| Per Share Data ($): | ||||||||||

| Net asset value, beginning of period | 20.71 | 19.79 | 17.52 | 19.31 | 19.61 | |||||

| Investment Operations: | ||||||||||

| Investment income—netb | .59 | .77 | .85 | .88 | .96 | |||||

| Net realized and unrealized | ||||||||||

| gain (loss) on investments | .86 | .99 | 2.29 | (1.81) | (.26) | |||||

| Total from Investment Operations | 1.45 | 1.76 | 3.14 | (.93) | .70 | |||||

| Distributions: | ||||||||||

| Dividends from investment income—net | (.64) | (.84) | (.87) | (.86) | (1.00) | |||||

| Net asset value, end of period | 21.52 | 20.71 | 19.79 | 17.52 | 19.31 | |||||

| Total Return (%) | 7.10 | 8.99 | 18.32 | (5.00) | 3.64 | |||||

| Ratios/Supplemental Data (%): | ||||||||||

| Ratio of total expenses | ||||||||||

| to average net assets | .56 | .54 | .60 | .52 | .51c | |||||

| Ratio of net expenses | ||||||||||

| to average net assets | .55 | .50 | .50 | .50 | .50 | |||||

| Ratio of net investment income | ||||||||||

| to average net assets | 2.79 | 3.74 | 4.62 | 4.72 | 4.93 | |||||

| Portfolio Turnover Rated | 400.34 | 328.76 | 361.73 | 443 | 430e | |||||

| Net Assets, end of period ($ x 1,000) | 211,716 | 241,733 | 245,169 | 310,742 | 565,572 | |||||

| a Effective September 1, 2009, the fund’s shares were redesignated as Class I shares. |

| b Based on average shares outstanding at each month end. |

| c Includes the fund’s share of the The Standish Mellon Fixed Income Portfolio’s (the Portfolio) allocated expenses. |

| d The portfolio turnover rates excluding mortgage dollar roll transactions for the periods ended December 31, 2011, |

| 2010, 2009, 2008 and 2007 were 281.77%, 130.16%, 93.83%, 72% and 166% , respectively. |

| e On October 25, 2007, the fund, which owned 100% of the Portfolio on such date, withdrew entirely from the |

| Portfolio and received the Portfolio’s securties and cash in exchange for its interest in the Portfolio. Effective October |

| 26, 2007, the fund began investing directly in the securities in which the Portfolio had invested. Portfolio turnover |

| represents activity of both the fund and the Portfolio for the year 2007. |

See notes to financial statements.

24

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus/Standish Fixed Income Fund (the “fund”) is a separate diversified series of Dreyfus Investment Funds (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company offering eleven series, including the fund. The fund’s investment objective is to achieve a high level of current incomes consistent with conserving principal liquidity. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares.

Class I shares are sold primarily to bank trust departments and other financial service providers, (including The Bank of NewYork Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus), acting on behalf of customers having a qualified trust or an investment account or relationship at such institution and bear no distribution or service fees. Class I shares are offered without a front end sales charge or contingent deferred sales charge.

The Trust accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

| The Fund | 25 |

NOTES TO FINANCIAL STATEMENTS (continued)

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Registered investment companies that are not traded on an exchange are valued at their net asset value and are categorized within Level 1 of the fair value hierarchy.

26

Investments in securities excluding short-term investments (other than U.S.Treasury Bills), financial futures, options and forward foreign currency exchange contracts (“forward contracts”) are valued each business day by an independent pricing service (the “Service”) approved by the Board of Trustees. Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of the Service are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service based upon its evaluation of the market for such securities). Other investments (which constitute a majority of the portfolio securities) are valued as determined by the Service, based on methods which include consideration of: yields or prices of securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions. These securities are generally categorized within Level 2 of the fair value hierarchy.

U.S. Treasury Bills are valued at the mean price between quoted bid prices and asked prices by the Service. These securities are generally categorized within Level 2 of the fair value hierarchy.

The Service’s procedures are reviewed by Dreyfus under the general supervision of the Board of Trustees.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Trustees. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public

| The Fund | 27 |

NOTES TO FINANCIAL STATEMENTS (continued)

trading in similar securities of the issuer or comparable issuers. These securities are either categorized as Level 2 or 3 depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are categorized within Level 3 of the fair value hierarchy.

Financial futures and options, which are traded on an exchange, are valued at the last sales price on the securities exchange on which such securities are primarily traded or at the last sales price on the national securities market on each business day. These securities are generally categorized within Level 1 of the fair value hierarchy. Options traded over-the-counter are valued at the mean between the bid and asked price.These securities are generally categorized within Level 2 of the fair value hierarchy. Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. Forward contracts are valued at the forward rate.These securities are generally categorized within Level 2 of the fair value hierarchy.

The following is a summary of the inputs used as of December 31, 2011 in valuing the fund’s investments:

| Level 2—Other | Level 3— | |||

| Level 1— | Significant | Significant | ||

| Unadjusted | Observable | Unobservable | ||

| Quoted Prices | Inputs | Inputs | Total | |

| Assets ($) | ||||

| Investments in Securities: | ||||

| Asset-Backed | — | 10,483,334 | — | 10,483,334 |

| Commercial | ||||

| Mortgage-Backed | — | 9,645,954 | — | 9,645,954 |

| Corporate Bonds† | — | 64,674,659 | — | 64,674,659 |

| Foreign Government | — | 5,986,716 | — | 5,986,716 |

| Municipal Bonds | — | 1,839,444 | — | 1,839,444 |

| Mutual Funds | 14,493,035 | — | — | 14,493,035 |

| Residential | ||||

| Mortgage-Backed | — | 1,591,232 | — | 1,591,232 |

28

| Level 2—Other | Level 3— | ||||||

| Level 1— | Significant | Significant | |||||

| Unadjusted | Observable | Unobservable | |||||

| Quoted Prices | Inputs | Inputs | Total | ||||

| Assets ($) (continued) | |||||||

| U.S. Government | |||||||

| Agencies/ | |||||||

| Mortgage-Backed | — | 72,957,268 | — | 72,957,268 | |||

| U.S. Treasury | — | 100,182,874 | — | 100,182,874 | |||

| Other Financial | |||||||

| Instruments: | |||||||

| Options Purchased | — | 111,429 | — | 111,429 | |||

| Liabilities ($) | |||||||

| Other Financial | |||||||

| Instruments: | |||||||

| Futures†† | (12,213 | ) | — | — | (12,213 | ) | |

| Options Written | — | (108,243 | ) | — | (108,243 | ) |

| † | See Statement of Investments for additional detailed categorizations. |

| †† | Amount shown represents unrealized (depreciation) at period end. |

In May 2011, FASB issued Accounting Standards Update (“ASU”) No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in GAAP and International Financial Reporting Standards (“IFRS”)” (“ASU 2011-04”). ASU 2011-04 includes common requirements for measurement of and disclosure about fair value between GAAP and IFRS. ASU 2011-04 will require reporting entities to disclose the following information for fair value measurements categorized within Level 3 of the fair value hierarchy: quantitative information about the unobservable inputs used in the fair value measurement, the valuation processes used by the reporting entity and a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs and the interrelationships between those unobservable inputs. In addition, ASU 2011-04 will require reporting entities to make disclosures about amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value measurements.The new and revised disclosures are effective for interim

| The Fund | 29 |

NOTES TO FINANCIAL STATEMENTS (continued)

and annual reporting periods beginning after December 15, 2011. At this time, management is evaluating the implications of ASU 2011-04 and its impact on the financial statements.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on investments are included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Investing in foreign markets may involve special risks and considerations not typically associated with investing in the U.S. These risks include revaluation of currencies, high rates of inflation, repatriation restrictions on income and capital, and adverse political and economic developments. Moreover, securities issued in these markets may be less liquid, subject to government ownership controls and delayed settlements, and their prices may be more volatile than those of comparable securities in the U.S.

30

Pursuant to a securities lending agreement withThe Bank of NewYork Mellon, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Manager, U.S. Government and Agency securities or letters of credit.The fund is entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction.Although each security loaned is fully collateralized, the fund bears the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner. During the period ended December 31, 2011,The Bank of NewYork Mellon earned $7,067 from lending portfolio securities, pursuant to the securities lending agreement.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” in the Act.

The fund may invest in shares of certain affiliated investment companies also advised or managed by Dreyfus. Investments in affiliated investment companies for the period ended December 31, 2011 were as follows:

| Affiliated | |||||||

| Investment | Value | Value | Net | ||||

| Company | 12/31/2010 | ($) | Purchases ($) | Sales ($) | 12/31/2011 | ($) | Assets (%) |

| Dreyfus | |||||||

| Institutional | |||||||

| Preferred | |||||||

| Plus Money | |||||||

| Market | |||||||

| Fund | 8,529,422 | 208,575,215 | 213,345,031 | 3,759,606 | 1.8 | ||

| Dreyfus | |||||||

| Institutional | |||||||

| Cash | |||||||

| Advantage | |||||||

| Fund | 3,318,329 | 41,730,506 | 34,315,406 | 10,733,429 | 5.1 | ||

| Total | 11,847,751 | 250,305,721 | 247,660,437 | 14,493,035 | 6.9 |

| The Fund | 31 |

NOTES TO FINANCIAL STATEMENTS (continued)

(e) Concentration of Risk: The fund invests primarily in debt securities. Failure of an issuer of the debt securities to make timely interest or principal payments, or a decline or the perception of a decline in the credit quality of a debt security, can cause the debt security’s price to fall, potentially lowering the fund’s share price. In addition, the value of debt securities may decline due to general market conditions that are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment.They may also decline because of factors that affect a particular industry or country.

(f) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net are declared and paid quarterly. Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(g) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended December 31, 2011, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

Each of the tax years in the four-year period ended December 31, 2011 remains subject to examination by the Internal Revenue Service and state taxing authorities.

32

At December 31, 2011, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $843,233, accumulated capital losses $8,520,833 and unrealized appreciation $5,332,315. In addition, the fund had $37,995 of capital losses realized after October 31, 2011, which were deferred for tax purposes to the first day of the following fiscal year.

Under the Regulated Investment Company Modernization Act of 2010 (the “2010 Act”), the fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 (“post-enactment losses”) for an unlimited period. Furthermore, post-enactment capital loss carryovers will retain their character as either short-term or long-term capital losses rather than short-term as they were under previous statute. The 2010 Act requires post-enactment losses to be utilized before the utilization of losses incurred in taxable years prior to the effective date of the 2010 Act (“pre-enactment losses”). As a result of this ordering rule, pre-enactment losses may be more likely to expire unused.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net securities profits, if any, realized subsequent to December 31, 2011. If not applied, the carryover expires in fiscal 2017.

The tax character of distributions paid to shareholders during the fiscal periods ended December 31, 2011 and December 31, 2010 were as follows: ordinary income $6,666,113 and $10,023,757, respectively.

During the period ended December 31, 2011, as a result of permanent book to tax differences, primarily due to the tax treatment for paydown gains and losses on mortgage-backed securities, amortization of premiums, consent feees and foreign currency transactions, the fund increased accumulated undistributed investment income-net by $113,771 and decreased accumulated net realized gain (loss) on investments by the same amount. Net assets and net asset value per share were not affected by this reclassification.

| The Fund | 33 |

NOTES TO FINANCIAL STATEMENTS (continued)

(h) New Accounting Pronouncement: In April 2011, FASB issued ASU No. 2011-03“Transfers and Servicing (Topic 860) Reconsideration of Effective Control for Repurchase Agreements (“ASU 2011-03”) which relates to the accounting for repurchase agreements and similar agreements including mortgage dollar rolls, that both entitle and obligate a transferor to repurchase or redeem financial assets before their maturity. ASU 2011-03 modifies the criteria for determining effective control of transferred assets and as a result certain agreements may now be accounted for as secured borrowings.ASU 2011-03 is effective prospectively for new transfers and existing transactions that are modified in the first interim or annual period beginning on or after December 15, 2011. Management is currently evaluating the implications of this change and its impact on the financial statements.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $225 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing. During the period ended December 31, 2011, the fund did not borrow under the Facilities.

NOTE 3—Investment Advisory Fee and Other Transactions With Affiliates:

(a) Pursuant to an investment advisory agreement with the Manager, the investment advisory fee is based on the value of the fund’s average daily net assets and is computed at the following annual rates: .40% of the first $250 million; .35% of the next $250 million and .30% in excess of $500 million. The Manager had undertaken from January 1, 2011 through May 1, 2011 to reduce the investment advisory fee paid by the fund, to the extent that the fund’s aggregate annual expenses (exclusive

34

of taxes, brokerage fees, interest on borrowings, commitment fees and extraordinary expenses) did not exceed an annual rate of .50% of the value of the fund’s average daily net assets.The reduction in investment advisory fee, pursuant to the undertaking, amounted to $38,850 during the period ended December 31, 2011.

From January 1, 2011 through April 30, 2011,The Trust had an agreement with The Bank of New York Mellon, pursuant to which The Bank of NewYork Mellon provided administration and fund accounting services for the fund. For these services, the fund paid The Bank of New York Mellon a fixed fee plus asset and transaction based fees, as well as out-of-pocket expenses. Pursuant to this agreement, the fund was charged $15,000 during the period January 1, 2011 through April 30, 2011 for administration and fund accounting services.

At Board Meetings of the Trust held on February 15-16, 2011, the Board of Trustees of the Trust terminated the agreement with The Bank of New York Mellon and, on behalf of the Trust, entered into a Fund Accounting and Administration Agreement (the “Administration Agreement”) with Dreyfus, effective May 1, 2011, whereby Dreyfus performs administrative, accounting and recordkeeping services for the fund. The fund has agreed to compensate Dreyfus for providing accounting services, administration, compliance monitoring, regulatory and shareholder reporting, as well as related facilities, equipment and clerical help.The fee is based on the fund’s average daily net assets and computed at the following annual rates: .06% of the first $500 million, .04% of the next $500 million and .02% in excess of $1 billion.

In addition, after applying any expense limitations or fee waivers that reduce the fees paid to Dreyfus for this service, Dreyfus has contractually agreed in writing to waive any remaining fees for this service to the extent that they exceed both Dreyfus’ costs in providing these services and a reasonable allocation of the costs incurred by Dreyfus and its affiliates related to the support and oversight of these services.The fund also reimburses Dreyfus for the out-of-pocket expenses Dreyfus incurs

| The Fund | 35 |

NOTES TO FINANCIAL STATEMENTS (continued)

in performing this service for the fund. Pursuant to the Administration Agreement, the fund was charged $89,041 during the period May 1, 2011 through December 31, 2011.

(b) The fund may pay administrative service fees.These fees are paid to affiliated or unaffiliated retirement plans, omnibus accounts and platform administrators and other entities (“Plan Administrators”) that provide record keeping and/or other administrative support services to accounts, retirement plans and their participants. As compensation for such services, the fund may pay each Plan Administrator an administrative service fee in an amount of up to .15% (on an annualized basis) of the fund’s average daily net assets attributable to fund shares that are held in accounts serviced by such Plan Administrator. During the period ended December 31, 2011, the fund was charged $19,251.The fund’s adviser or its affiliates may pay additional compensation from their own resources to Plan Administrators and other entities for administrative services, as well as in consideration of marketing or other distribution related services. These payments may provide an incentive for these entities to actively promote the fund or cooperate with the distributor’s promotional efforts.

(c) The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of the Manager under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended December 31, 2011, the fund was charged $2,975 pursuant to the transfer agency agreement, which is included in Shareholder servicing costs in the Statement of Operations.

The fund has arrangements with the custodian and cash management bank whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody and cash management fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates The Bank of New York Mellon under cash management agreements for performing cash management services related to fund subscriptions and redemptions. During the period

36

ended December 31, 2011, the fund was charged $397 pursuant to the cash management agreements, which is included in Shareholder servicing costs in the Statement of Operations.These fees were partially offset by earnings credits of $11.

The fund also compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. During the period ended December 31, 2011, the fund was charged $50,842 pursuant to the custody agreement.

During the period ended December 31, 2011, the fund was charged $6,402 for services performed by the Chief Compliance Officer.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: investment advisory fees $74,458, custodian fees $15,041, chief compliance officer fees $5,295 and transfer agency per account fees $440.