UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

OF THE SECURITIES EXCHANGE ACT OF 1934

OR

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

Commission file number

MARTEN TRANSPORT, LTD.

(Exact name of registrant as specified in its charter)

| |

| |

| (State of incorporation) |

| (I.R.S. Employer Identification no.) |

| |

|

|

| | | ( |

| (Address of principal executive offices) | (Zip Code) | (Registrant’s telephone number) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Trading symbol: | Name of each exchange on which registered: |

| | | THE |

| $.01 PER SHARE | (NASDAQ GLOBAL SELECT MARKET) |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Smaller reporting company

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the Registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes

As of June 30, 2021 (the last business day of the Registrant’s most recently completed second fiscal quarter), the aggregate market value of the Common Stock of the Registrant (based upon the closing price of the Common Stock at that date as reported by the NASDAQ Global Select Market), excluding outstanding shares beneficially owned by directors and executive officers, was $

As of February 14, 2022,

Part III of this Annual Report on Form 10-K incorporates by reference information (to the extent specific sections are referred to in this Report) from the Registrant’s Proxy Statement for the annual meeting to be held May 3, 2022, or 2022 Proxy Statement.

TABLE OF CONTENTS

Page

| PART I |

||

| ITEM 1. |

BUSINESS |

1 |

| ITEM 1A. |

RISK FACTORS |

6 |

| ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

11 |

| ITEM 2. |

PROPERTIES |

11 |

| ITEM 3. |

LEGAL PROCEEDINGS |

11 |

| ITEM 4. |

MINE SAFETY DISCLOSURES |

12 |

| ITEM 4A. |

INFORMATION ABOUT OUR EXECUTIVE OFFICERS |

12 |

| PART II |

||

| ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

13 |

| ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

15 |

| ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

26 |

| ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

27 |

| ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

49 |

| ITEM 9A. |

CONTROLS AND PROCEDURES |

49 |

| ITEM 9B. |

OTHER INFORMATION |

49 |

| PART III |

||

| ITEM 10. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

50 |

| ITEM 11. |

EXECUTIVE COMPENSATION |

50 |

| ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

50 |

| ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

50 |

| ITEM 14. |

PRINCIPAL ACCOUNTANT FEES AND SERVICES |

50 |

| PART IV |

||

| ITEM 15. |

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES |

51 |

| ITEM 16. |

FORM 10-K SUMMARY |

55 |

| OTHER |

||

| Signature Page |

56 |

|

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains certain forward-looking statements. Such statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Any statements not of historical fact may be considered forward-looking statements. Written words such as “may” “expect,” “believe,” “anticipate,” “plan,” “goal,” or “estimate,” or other variations of these or similar words, identify such statements. These statements by their nature involve substantial risks and uncertainties, and actual results may differ materially from those expressed in such forward-looking statements. Important factors known to us that could cause such material differences are identified in this Annual Report on Form 10-K under the heading “Risk Factors” beginning on page 6. We undertake no obligation to correct or update any forward-looking statements, whether as a result of new information, future events, or otherwise. You are advised, however, to consult any future disclosures we make on related subjects in future filings with the Securities and Exchange Commission.

References in this Annual Report to “we,” “us,” “our,” or the “Company” or similar terms refer to Marten Transport, Ltd. and its consolidated subsidiaries unless the context otherwise requires.

PART I

| ITEM 1. |

BUSINESS |

Overview

We have strategically transitioned from a refrigerated long-haul carrier to a multifaceted business offering a network of refrigerated and dry truck-based transportation capabilities across our five distinct business platforms – Truckload, Dedicated, Intermodal, Brokerage and MRTN de Mexico. We are one of the leading temperature-sensitive truckload carriers in the United States, specializing in transporting and distributing food and other consumer packaged goods that require a temperature-controlled or insulated environment. In 2021, we generated $973.6 million in operating revenue. Approximately 58% of our Truckload and Dedicated revenue in 2021 resulted from hauling temperature-sensitive products and 42% from hauling dry freight. We operate throughout the United States and in parts of Canada and Mexico, with substantially all of our revenue generated from within the United States. We provide regional truckload carrier services in the Southeast, West Coast, Midwest, South Central and Northeast regions. Our primary medium-to-long-haul traffic lanes are between the Midwest and the West Coast, Southwest, Southeast, and the East Coast, as well as from California to the Pacific Northwest. In 2021, our average length of haul was 403 miles.

Our growth strategy is to expand our business organically by offering shippers a high level of service and significant freight capacity. We market primarily to shippers that offer consistent volumes of freight in the lanes we prefer and are willing to compensate us for a high level of service. With our fleet of 3,204 company and independent contractor tractors, we offer service levels that include up to 99% on-time performance and delivery within the narrow time windows often required when shipping perishable commodities.

We have four reporting segments – Truckload, Dedicated, Intermodal and Brokerage. Financial information regarding these segments can be found in Footnote 16 to the Notes to Consolidated Financial Statements under Item 8 of this Form 10-K.

The primary source of our operating revenue is provided by our Truckload segment through a combination of regional short-haul and medium-to-long-haul full-load transportation services. We transport food and other consumer packaged goods that require a temperature-controlled or insulated environment, along with dry freight, across the United States and into and out of Mexico and Canada. Our agreements with customers are typically for one year.

Our Dedicated segment provides customized transportation solutions tailored to meet each individual customer’s requirements, utilizing temperature-controlled trailers, dry vans and other specialized equipment within the United States. Our agreements with customers range from three to five years and are subject to annual rate reviews.

Our Intermodal segment transports our customers’ freight within the United States utilizing our refrigerated containers and our temperature-controlled trailers, each on railroad flatcars for portions of trips, with the balance of the trips using our tractors or, to a lesser extent, contracted carriers.

Our Brokerage segment develops contractual relationships with and arranges for third-party carriers to transport freight for our customers in temperature-controlled trailers and dry vans within the United States and into and out of Mexico through Marten Transport Logistics, LLC, which was established in 2007 and operates pursuant to brokerage authority granted by the United States Department of Transportation, or DOT. We retain the billing, collection and customer management responsibilities.

Operating results of our MRTN de Mexico business which offers our customers door-to-door service between the United States and Mexico with our Mexican partner carriers is reported within our Truckload and Brokerage segments.

Organized under Wisconsin law in 1970, we are a successor to a sole proprietorship Roger R. Marten founded in 1946. In 1988, we reincorporated under Delaware law. Our executive offices are located at 129 Marten Street, Mondovi, Wisconsin 54755. Our telephone number is (715) 926-4216.

We maintain a website at www.marten.com. We are not including the information contained on our website as a part of, nor incorporating it by reference into, this Annual Report on Form 10-K. We post on our website, free of charge, documents that we file with or furnish to the Securities and Exchange Commission, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and proxy statements, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission. We also provide a link on our website to Forms 3, 4 and 5 that our officers, directors and 10% stockholders file with the Securities and Exchange Commission pursuant to Section 16(a) of the Securities Exchange Act of 1934.

Marketing and Operations

We approach our business as an integrated effort of marketing and operations. We target food and consumer packaged goods companies whose products require temperature-sensitive services and who ship multiple truckloads per week. By emphasizing high-quality service, we seek to become a core carrier for our customers. In 2021, our largest customer was Walmart.

Our marketing efforts are conducted by a staff of 261 sales, customer service and support personnel under the supervision of our senior management team. Marketing personnel travel within their regions to solicit new customers and maintain contact with existing customers. Customer service managers regularly contact customers to solicit additional business on a load-by-load basis.

Our operations and sales personnel strive to improve our asset productivity by seeking freight that allows for rapid turnaround times, minimizes non-revenue miles between loads, and carries a favorable rate structure. Once we have established a customer relationship, customer service managers work closely with our fleet managers to match customer needs with our capacity and the location of revenue equipment. Fleet managers use our optimization system to assign loads to satisfy customer and operational requirements, as well as to meet the routing needs of our drivers. We attempt to route most of our trucks over selected operating lanes, which we believe assists us in meeting customer requirements, balancing traffic, reducing non-revenue miles, and improving the reliability of delivery schedules.

We employ technology in our operations when we believe that it will allow us to operate more efficiently and the investment is cost-justified. Examples of the technologies we employ include:

| ● |

Terrestrial based tracking and messaging that allows us to communicate with our drivers, obtain load position updates, provide our customers with freight visibility, and download operating information such as fuel mileage and idling time for the tractor engines and temperature setting and run time for the temperature-control units on our trailers. |

| ● |

Electronic data interchange and internet communication with customers concerning freight tendering, invoices, shipment status, and other information. |

| ● |

Electronic logging devices in our tractors to monitor drivers’ hours of service. |

| ● |

Auxiliary power units installed on our company-owned tractors that allow us to decrease fuel costs associated with idling our tractors. |

| ● |

Fuel-routing software that optimizes the fuel stops for each trip to take advantage of volume discounts available in our fuel network. |

We believe this integrated approach to our marketing and operations, coupled with our use of technology, has allowed us to provide our customers with a high level of service and support our revenue growth in an efficient manner. For example, we produced a non-revenue mile percentage of 5.9% during 2021, which points to the efficiency of our operations and we believe compares favorably to other temperature-sensitive and dry van trucking companies.

Major Customers

A significant portion of our revenue is generated from our major customers. In 2021, our top 30 customers accounted for approximately 68% of our revenue, and our top ten customers accounted for 50% of our revenue. We have emphasized increasing our customer diversity which is shown by the decrease in the portion of our revenue with our top customers. In 2010, our top 30 customers accounted for approximately 78% of our revenue. Seven of our top ten customers have been significant customers of ours for the last ten years. We believe we are the largest or second largest temperature-sensitive carrier for six of our top ten customers. We believe our relationships with these key customers are sound, but we are dependent upon them and the loss of some or all of their business could have a materially adverse effect on our results.

Human Capital

As of December 31, 2021, we had 4,007 employees. This total consists of 3,108 drivers, 292 mechanics and maintenance personnel, and 607 support personnel, which includes management and administration. As of that date, we also contracted with 93 independent contractors. None of our employees are represented by a collective bargaining unit. We consider relations with our employees to be good.

We believe our employees are a critical part to the continued success of our operations. Our business model depends on the efforts of our support personnel to efficiently and effectively coordinate transportation services for our customers and on the efforts of our drivers to timely and safely execute the delivery of our customers’ cargo. Competition in the trucking industry for qualified drivers is normally intense and has increased. Our operations have been impacted, and from time-to-time we have experienced under-utilization and increased expense, as a result of a shortage of qualified drivers. As such, we dedicate significant attention to hiring and retaining talented employees to manage, support and execute our operations and place a high priority on the recruitment and retention of an adequate supply of qualified drivers. As part of those efforts, we are also committed to hiring, developing and supporting a diverse and inclusive workplace.

We believe we provide our employees with compensation and benefits that are competitive with or exceed our industry peers. We primarily pay company-employed drivers a fixed rate per mile. The rate increases based on length of service. We also compensate drivers for all detention time, for inclement weather and for road service delays. Total weekly compensation is also subject to a guaranteed minimum amount. Drivers also are eligible for bonuses based upon safe, efficient driving. We pay independent contractors a fixed rate per mile. Independent contractors pay for their own fuel, insurance, maintenance, and repairs.

The health and well-being of our employees is paramount to our success. We sponsor a wellness program designed to enhance the well-being of all our employees. The COVID-19 pandemic has also heightened our responsibility of ensuring our employees have a safe work environment and we have implemented numerous efforts to keep our valued employees safe, healthy and informed. We believe that maintaining a healthy, safe and productive professional driver group is essential to providing excellent customer service and achieving profitability. We select drivers, including independent contractors, using our specific guidelines for safety records, including drivers’ Compliance, Safety, Accountability, or CSA, scores, driving experience, and personal evaluations. We maintain stringent screening, training, and testing procedures for our drivers to reduce the potential for accidents and the corresponding costs of insurance and claims. We train new drivers at a number of our terminals in all phases of our policies and operations, as well as in safety techniques and fuel-efficient operation of the equipment. All new drivers also must pass DOT required tests prior to assignment to a vehicle.

For a more detailed discussion of the impact of the COVID-19 pandemic on our human capital resources and certain risks related to driver recruitment and retention, see “Risk Factors” in Item 1A of this Form 10-K.

Revenue Equipment

Our revenue equipment programs are an important part of our overall goal of profitable growth. We evaluate our equipment decisions based on factors such as initial cost, useful life, warranty terms, expected maintenance costs, fuel economy, driver comfort, customer needs, manufacturer support, and resale value. We generally operate newer, well-maintained equipment with uniform specifications to minimize our spare parts inventory, streamline our maintenance program, and simplify driver training.

As of December 31, 2021, we operated a fleet of 3,204 tractors, including 3,111 company-owned tractors and 93 tractors supplied by independent contractors. The average age of our company-owned tractor fleet at December 31, 2021 was approximately 1.4 years. In 2021, we replaced our company-owned tractors within an average of 4.3 years after purchase.

Kenworth and Freightliner manufacture most of our company-owned tractors. Maintaining a relatively new and standardized fleet allows us to operate most miles while the tractors are under warranty to minimize repair and maintenance costs. It also enhances our ability to attract drivers, increases fuel economy, and improves customer acceptance by minimizing service interruptions caused by breakdowns. We adhere to a comprehensive maintenance program during the life of our equipment. We perform most routine servicing and repairs at our terminal facilities to reduce costly on-road repairs and out-of-route trips. We do not have any agreements with tractor manufacturers pursuant to which they agree to repurchase the tractors or guarantee a residual value, and we therefore could incur losses upon disposition if resale values of used tractors decline.

We historically have contracted with independent contractors to provide and operate a portion of our tractor fleet. Independent contractors own their own tractors and are responsible for all associated expenses, including financing costs, fuel, maintenance, insurance, and taxes. The percentage of our fleet provided by independent contractors was 2.9% at December 31, 2021, 4.3% at December 31, 2020 and 2.9% at December 31, 2019.

As of December 31, 2021, we operated a fleet of 5,299 trailers, consisting of 3,337 refrigerated trailers and 1,962 dry vans. Most of our refrigerated trailers are equipped with Thermo-King refrigeration units, air ride suspensions, and anti-lock brakes. The average age of our trailer fleet at December 31, 2021 was approximately 3.3 years. In 2021, we replaced our company-owned trailers within an average of 6.4 years after purchase.

As of December 31, 2021, we operated a fleet of 634 refrigerated containers for use on railroad flatcars as compared to a fleet of 433 refrigerated containers as of December 31, 2020.

Insurance and Claims

We self-insure for a portion of our claims exposure resulting from workers’ compensation, auto liability, general liability, cargo and property damage claims, as well as employees’ health insurance. We are responsible for our proportionate share of the legal expenses relating to such claims as well. We reserve currently for anticipated losses and expenses. We periodically evaluate and adjust our insurance and claims reserves to reflect our experience. We have $18.5 million in standby letters of credit to guarantee settlement of claims under agreements with our insurance carriers and regulatory authorities. We maintain insurance coverage for per-incident and total losses in excess of the amounts for which we self-insure up to specified policy limits with licensed insurance carriers. Insurance carriers have significantly raised premiums for trucking companies, which increases our insurance and claims expense, along with other factors. We believe that our policy of self-insuring up to set limits, together with our safety and loss prevention programs, are effective means of managing insurance costs.

Fuel

Our operations are heavily dependent upon the use of diesel fuel. The price and availability of diesel fuel can vary and are subject to political, economic, and market factors that are beyond our control. Fuel prices fluctuated dramatically and quickly at various times during the last three years. We actively manage our fuel costs by purchasing fuel in bulk in Mondovi, Wisconsin and at a number of our other maintenance facilities throughout the country and have volume purchasing arrangements with national fuel centers that allow our drivers to purchase fuel at a discount while in transit. During 2021, nearly 100% of our fuel purchases were made at these designated locations. To help further reduce fuel consumption, we have equipped our company-owned tractors with auxiliary power units since 2007. These units reduce fuel consumption by providing quiet climate control and electrical power for our drivers without idling the tractor engine. We have also invested in satellite tracking equipment for the temperature-control units on our trailers that has improved fuel usage through management of required temperature settings and run time of the units.

We further manage our exposure to changes in fuel prices through fuel surcharge programs with our customers and other measures that we have implemented. We have historically been able to pass through a significant portion of long-term increases in fuel prices and related taxes to customers in the form of fuel surcharges. These fuel surcharges, which adjust with the cost of fuel, enable us to recover a substantial portion of the higher cost of fuel as prices increase, except for non-revenue miles, out-of-route miles or fuel used while the tractor is idling. As of December 31, 2021, we had no derivative financial instruments to reduce our exposure to fuel price fluctuations.

Competition

We are one of the leading carriers operating in the temperature-sensitive segment of the truckload market, and our dry freight services are expanding. These markets are highly competitive, and we compete with many other truckload carriers of varying sizes and, to a lesser extent, with less-than-truckload carriers, railroads, and other transportation companies, many of which have more equipment, a wider range of services, and greater capital resources than we do or have other competitive advantages. We also compete with other motor carriers for the services of drivers, independent contractors, and management employees. We believe that the principal competitive factors in our business are service, freight rates, capacity, use of technology and financial stability, which positions us well to compete in these segments.

Regulation

The DOT and various state and local agencies exercise broad powers over our business, generally governing such activities as authorization to engage in motor carrier operations, safety and insurance requirements. Our company drivers and independent contractors also must comply with the safety and fitness regulations promulgated by the DOT, including those relating to drug and alcohol testing, medical and continuous training qualification and hours-of-service.

The DOT, through the Federal Motor Carrier Safety Administration, or FMCSA, imposes safety and fitness regulations on us and our drivers. In December 2010, the FMCSA introduced the Compliance, Safety, Accountability, or CSA, system to measure and evaluate the on-road safety performance of commercial carriers and individual drivers. CSA’s Motor Carrier Safety Measurement System replaced the former SafeStat system and has removed a number of drivers from the industry as carriers are less willing to hire and retain drivers with marginal ratings, which has increased competition for qualified drivers. The FMCSA is currently evaluating a new statistical model known as the Item Response Theory, or IRT, model to replace the current system utilizing CSA scores in order to better evaluate the safety of motor carriers.

The FMCSA issued final revisions to the hours-of-service requirements for drivers in September 2020. The revisions allow drivers more flexibility with their 30-minute rest breaks and with dividing their time in the sleeper berth. Additionally, the new regulations increase by two hours the duty time for drivers encountering adverse weather and expand the short haul exemption radius from 100 to 150 miles.

In January 2011, the FMCSA issued a regulatory proposal requiring commercial carriers to track compliance with hours-of-service regulations using electronic logging devices, or ELD’s, which was vacated and sent back to the FMCSA for further analysis and review in September 2011 by the 7th U.S. Circuit Court of Appeals. The Moving Ahead for Progress in the 21st Century Act, or MAP-21 Act, included a provision directing the FMCSA to develop a final ELD rule in 2013, which was delayed until its issuance in December 2015. The final rule required compliance beginning in December 2017 which was strictly enforced beginning in April 2018. Carriers using automatic on-board recording devices, or AOBRD’s, which were installed and in use prior to December 2017 were allowed until December 2019 to convert to ELD’s. Our entire fleet has been equipped with AOBRD’s since early 2011 and converted to ELD’s prior to December 2019.

The FMCSA has established a Commercial Driver’s License Drug and Alcohol Clearinghouse, which is a database of drivers who have violations including failed or refused drug and alcohol tests. Beginning in January 2020, all carriers are required to run queries in the clearinghouse for all prospective drivers and annually for all drivers currently employed. All testing violations must also be reported to the clearinghouse. Also effective in January 2020, all carriers must perform random drug tests at a rate of at least 50% of the average number of driver positions. The rate was at least 25% previously. We have been testing at a rate in excess of 50%, including when the requirement was at least 25%, and tested 55% in each of 2020 and 2021. The impact of the clearinghouse has been significant, with a total of approximately 81,000 drivers removed from the trucking industry in 2020 and 2021.

In September 2020, the United States Department of Health and Human Services proposed mandatory guidelines for federal workplace drug testing programs using hair follicles, which is a more strenuous test than current requirements. The FMCSA has not yet issued proposed regulations.

We are also subject to various environmental laws and regulations dealing with the handling of hazardous materials, fuel storage tanks, air emissions from our facilities, engine idling, and discharge and retention of storm water. These regulations did not have a significant impact on our operations or financial results in 2019 through 2021.

ITEM 1A. RISK FACTORS

The following factors are important and should be considered carefully in connection with any evaluation of our business, financial condition, results of operations, prospects, or an investment in our common stock. The risks and uncertainties described below are those that we currently believe may materially affect our company or our financial results. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations or affect our financial results.

Risks Related to Company’s Industry and Operations

Our business is subject to general economic and business factors that are largely beyond our control, any of which could have a materially adverse effect on our operating results. Our business is dependent on a number of general economic and business factors that may have a materially adverse effect on our results of operations, many of which are beyond our control. These factors include excess capacity in the trucking industry, strikes or other work stoppages, and significant increases or fluctuations in interest rates, fuel taxes, fuel prices, and license and registration fees. We are affected by recessionary economic cycles and downturns in customers’ business cycles, particularly in market segments and industries where we have a significant concentration of customers. Economic conditions may adversely affect our customers and their ability to pay for our services.

It is not possible to predict the effects of actual or threatened armed conflicts or terrorist attacks, efforts to combat terrorism, military action against any foreign state, heightened security requirements, or other related events and the subsequent effects on the economy or on consumer confidence in the United States, or the impact, if any, on our future results of operations.

The COVID-19 pandemic could negatively impact our business and results of operations. Our business may face risks related to the outbreak of the COVID-19 pandemic, which has been declared a “pandemic” by the World Health Organization. The full impact of the pandemic is unknown and evolving. Although transportation services are generally considered essential services and the overall demand for our services has continued, we have experienced significant changes in demand from certain customers in certain freight lanes. We are unable to predict if overall demand for our services will continue at current levels or decrease as a result of the pandemic and its ongoing impact to the economy going forward. We continue to monitor the pandemic’s impact on the health and safety of our employees, but any widespread outbreak among our employees may negatively impact our business. Some of our customers are encountering significant disruptions to their business and may represent a greater risk for collection of amounts owed, and we may be required to increase our allowance for credit losses. The extent to which the pandemic impacts our business and operating results will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the pandemic and the actions taken to contain the virus or treat its impact as well as the long-term economic impact of the virus, among others.

We operate in a highly competitive and fragmented industry, and numerous competitive factors could impair our ability to maintain our current profitability. We compete with many other truckload carriers that provide temperature-sensitive service and dry freight of varying sizes and, to a lesser extent, with less-than-truckload carriers, railroads and other transportation companies, many of which have more equipment, a wider range of services and greater capital resources than we do or have other competitive advantages. Many of our competitors periodically reduce their freight rates to gain business, especially during times of reduced growth rates in the economy, which may limit our ability to maintain or increase freight rates or maintain significant growth in our business. In addition, many customers reduce the number of carriers they use by selecting so-called “core carriers” as approved service providers or conduct bids from multiple carriers for their shipping needs, and in some instances, we may not be selected as a core carrier or to provide service under such bids.

In addition, the trend toward consolidation in the trucking industry may create other large carriers with greater financial resources and other competitive advantages relating to their size. Competition from freight logistics and brokerage companies may negatively impact our customer relationships and freight rates. Furthermore, economies of scale that may be passed on to smaller carriers by procurement aggregation providers may improve such carriers’ ability to compete with us.

If the growth in our regional operations declines, or if we expand into a market with insufficient economic activity, our results of operations could be adversely affected. We operate regional service centers which are located in a number of cities within the United States. In order to support future growth, these regional operations require the commitment of additional capital, revenue equipment and facilities along with qualified management, drivers and other personnel. Should the growth in our regional operations decline, the results of our operations could be adversely affected. It may become more difficult to identify additional cities that can support service centers, and we may expand into cities where there is insufficient economic activity, reduced capacity for growth or less driver and non-driver personnel to support our operations. We may encounter operating conditions in these new markets that materially differ from our current operations and customer relationships may be difficult to obtain at appropriate freight rates. Also, we may not be able to apply our regional operating strategy successfully in additional cities, and it might take longer than expected or require a more substantial financial commitment than anticipated to establish our operations in the additional cities.

Increased prices and restricted availability of new revenue equipment could cause our financial condition, results of operations and cash flows to suffer. We have experienced higher prices for new tractors and trailers over the past few years, primarily as a result of higher commodity prices and government regulations applicable to newly manufactured tractors and trailers. We expect to continue to pay increased prices for revenue equipment for the foreseeable future. Our business could be harmed if we are unable to continue to obtain an adequate supply of new tractors and trailers or if we are required to pay increased prices for new revenue equipment.

We derive a significant portion of our revenue from our major customers, the loss of one or more of which could have a materially adverse effect on our business. A significant portion of our revenue is generated from our major customers. For 2021 our top 30 customers, based on revenue, accounted for approximately 68% of our revenue; our top ten customers accounted for approximately 50% of our revenue; our top five customers accounted for approximately 41% of our revenue; our top two customers accounted for approximately 31% of our revenue; and our largest customer accounted for approximately 23% of our revenue. Generally, other than for our Dedicated operations, we enter into one-year contracts with our major customers, the majority of which do not contain any firm obligations to ship with us. We cannot ensure that, upon expiration of existing contracts, these customers will continue to use our services or that, if they do, they will continue at the same levels. Many of our customers periodically solicit bids from multiple carriers for their shipping needs, and this process may depress freight rates or result in loss of business to our competitors. Some of our customers also operate their own private trucking fleets, and they may decide to transport more of their own freight. A reduction in or termination of our services by one or more of our major customers could have a materially adverse effect on our business and operating results.

Ongoing insurance and claims expenses could significantly affect our earnings. Our future insurance and claims expense might exceed historical levels, which could reduce our earnings. We self-insure for a portion of our claims exposure resulting from workers’ compensation, auto liability, general liability, cargo and property damage claims, as well as employees’ health insurance. We also are responsible for our legal expenses relating to such claims. We reserve currently for anticipated losses and expenses. We periodically evaluate and adjust our claims reserves to reflect our experience. However, ultimate results may differ from our estimates, which could result in losses over our reserved amounts.

We maintain insurance above the amounts for which we self-insure with licensed insurance carriers. Although we believe the aggregate insurance limits should be sufficient to cover reasonably expected claims, it is possible that one or more claims could exceed our aggregate coverage limits. Insurance carriers have significantly raised premiums for trucking companies. As a result, our insurance and claims expense has increased. If these expenses increase, or if we experience a claim in excess of our coverage limits, or we experience a claim for which coverage is not provided, results of our operations and financial condition could be materially and adversely affected.

If demand declines for our used revenue equipment, it could result in decreased equipment sales, resale values, and gains on sales of assets. The market for used revenue equipment is subject to a number of factors, including fluctuations in demand and prices. We do not have any agreements with tractor manufacturers pursuant to which they agree to repurchase our tractors or guarantee a residual value. As such, we are sensitive to changes in used equipment prices and demand, especially with respect to tractors. Reduced demand for used equipment could result in a lower volume of sales or lower sales prices, either of which could negatively affect our gains on sales of assets.

We depend on the stability, availability and security of the technology related to our management information and communication systems, which are subject to certain cyber risks and other events beyond our control. We depend upon our management information and communication systems for the efficient operation of our business. Our systems are used for receiving, planning and optimizing loads, communicating with and monitoring our drivers, tractors and trailers, billing customers and financial reporting. In addition, some of our key software has been developed internally by our programmers or by adapting purchased software to our needs and this software may not be easily modified or integrated with other software and systems. Our operations are potentially vulnerable to interruption by natural disasters, power loss, telecommunications failure, terrorist attacks, internet failures, computer viruses, malware, hacking, and other events beyond our control. Although we have taken steps to prevent and mitigate service interruptions and data security threats, the operational and security risks associated with information technology systems have increased in recent years because of the complexity of the systems and the sophistication and increasing volume of cyberattacks. We have been subject to cyberattacks, which have yet to have a material impact on our business or results of operations, but this might not always be the case in the future. For example, as previously reported, in October 2021, we detected a cyberattack that accessed and encrypted files utilized by us in the provision of our business. Based on our assessment and on the information currently known, we do not believe the incident will have a material impact on our business, operations or financial results. Nonetheless, the investigation indicates that certain employee data was at risk during the event. Our business could be materially and adversely affected if our management information and communication systems are materially compromised or disrupted by a failure or security breach or if we are unable to improve, upgrade, integrate or expand our systems as we continue to execute our growth strategy.

Fluctuations in the price or availability of fuel may increase our cost of operation, which could materially and adversely affect our profitability. We require large amounts of diesel fuel to operate our tractors and to power the temperature-control units on our trailers. Fuel is one of our largest operating expenses. Fuel prices tend to fluctuate, and prices and availability of all petroleum products are subject to political, economic and market factors that are beyond our control. We depend primarily on fuel surcharges, auxiliary power units for our tractors, satellite tracking equipment for the temperature-control units on our trailers, volume purchasing arrangements with truck stop chains and bulk purchases of fuel at our terminals to control and recover our fuel expenses. There can be no assurance that we will be able to collect fuel surcharges, enter into volume purchase agreements, or execute successful hedges in the future. Additionally, we may encounter decreases in productivity that may offset or eliminate savings from auxiliary power units or satellite tracking equipment, or we may incur unexpected maintenance or other costs associated with such units. The absence of meaningful fuel price protection through these measures, fluctuations in fuel prices, or a shortage of diesel fuel, could materially and adversely affect our results of operations.

We may be adversely affected by the physical effects of climate change as well as legal, regulatory, or market responses to climate change concerns. Risks associated with climate change are subject to increasing societal, regulatory and political focus. Shifts in weather patterns caused by climate change may lead to an increase in the frequency, severity or duration of certain adverse weather conditions and natural disasters, such as hurricanes, tornadoes, earthquakes, wildfires, droughts, extreme temperatures or flooding, which could cause more significant business interruptions, damage to our revenue equipment and facilities, reduced workforce availability, increased costs, increased liabilities, and decreased revenue than what we have experienced in the past from such events. In addition, increased public and political concern over climate change could result in new legal or regulatory requirements designed to mitigate the effects of climate change and greenhouse gas emissions such as carbon dioxide, a by-product of burning fossil fuels such as those used in our tractors and in the refrigeration units on our trailers and containers, which could include the adoption of more stringent environmental laws and regulations or stricter enforcement of existing laws and regulations. Due to such increased concerns, there could be an increase in regulation from federal, state and local governments related to our carbon footprint, including with respect to vehicle engine emissions. This increase in regulation could result in increased direct costs, such as taxes, fees, fuel, or capital costs, or changes to our operations in order to comply. There is also a focus from regulators and our customers on sustainability issues. This focus may result in new legislation or customer requirements, such as limits on vehicle weight and size or energy source. Costs associated with future climate change concerns or environmental laws and regulations and sustainability requirements could have a material adverse effect on our operations and operating results.

Seasonality and the impact of weather can affect our profitability. Our tractor productivity generally decreases during the winter season because inclement weather impedes operations and some shippers reduce their shipments. At the same time, operating expenses generally increase, with harsh weather creating higher accident frequency, increased claims and more equipment repairs. We can also suffer short-term impacts from weather-related events such as hurricanes, blizzards, ice-storms, and floods that could harm our results or make our results more volatile.

Lack of capacity, changes in equipment requirements and service instability in the railroad industry could increase our operating costs and reduce our ability to offer intermodal services, which could adversely affect our revenue, results of operations, and customer relationships. Our Intermodal segment is dependent on railroad services and their capacity to transport freight for our customers. We expect our dependence on railroads will continue to increase as we expand our Intermodal services. We compete for the availability of railroad services with other intermodal operators as well as certain industries reliant on the use of rail cars, such as oil and agricultural, whose consumption of railroad capacity has significantly fluctuated over the past several years. In most markets, rail service is limited to a few railroads or even a single railroad. Any capacity constraints, changes in equipment requirements, service problems or reduction in service by the railroads with which we have, or in the future may have, relationships is likely to increase the cost of the rail-based services we provide and reduce the reliability, timeliness, and overall attractiveness of our rail-based services, which could adversely affect our revenue, results of operations and customer relationships. Furthermore, railroads are relatively free to adjust shipping rates up or down as market conditions permit. Price increases could result in higher costs to our customers and reduce or eliminate our ability to offer Intermodal services. In addition, we cannot assure you that we will be able to negotiate additional contracts with railroads to expand our capacity, add additional routes, or obtain multiple providers, which could limit our ability to provide this service.

Risks Related to Company’s Capital Requirements and Financing

We have significant ongoing capital requirements that could harm our financial condition, results of operations and cash flows if we are unable to generate sufficient cash from our operations. The truckload industry is capital intensive, and our policy of operating newer equipment requires us to expend significant amounts annually. If we elect to expand our fleet in future periods, our capital needs would increase. We expect to pay for projected capital expenditures with cash flows from operations and borrowings under our revolving credit facility. If we are unable to generate sufficient cash from operations and obtain financing on favorable terms in the future, we may have to limit our growth, enter into less favorable financing arrangements, or operate our revenue equipment for longer periods, any of which could have a materially adverse effect on our profitability.

Instability of the credit markets and the resulting effects on the economy could have a material adverse effect on our operating results. If the credit markets and the economy weaken, our business, financial results, and results of operations could be materially and adversely affected, especially if consumer confidence declines and domestic spending decreases. We may need to incur indebtedness, which may include drawing on our credit facility, or issue debt securities in the future to fund working capital requirements, make investments, or for general corporate purposes. Additionally, stresses in the credit market causes uncertainty in the equity markets, which may result in volatility of the market price for our securities.

Risks Related to Regulation of Company’s Operations

We operate in a highly regulated industry and increased costs of compliance with, or liability for violation of, existing or future regulations could have a materially adverse effect on our business. The DOT and various state and local agencies exercise broad powers over our business, generally governing such activities as authorization to engage in motor carrier operations, safety and insurance requirements. Our company drivers and independent contractors also must comply with the safety and fitness regulations promulgated by the DOT, including those relating to drug and alcohol testing, medical and continuous training qualification and hours-of-service. We also may become subject to new or more restrictive regulations relating to fuel emissions, ergonomics, or other matters affecting safety or operating methods. Other agencies, such as the United States Environmental Protection Agency, or EPA, and the United States Department of Homeland Security, or DHS, also regulate our equipment, operations, and drivers. Future laws and regulations may be more stringent and require changes in our operating practices, influence the demand for transportation services, or require us to incur significant additional costs. Higher costs incurred by us or by our suppliers who pass the costs onto us through higher prices could adversely affect our results of operations.

The DOT, through the Federal Motor Carrier Safety Administration, or FMCSA, imposes safety and fitness regulations on us and our drivers. In December 2010, the FMCSA introduced the Compliance, Safety, Accountability, or CSA, system to measure and evaluate the on-road safety performance of commercial carriers and individual drivers. CSA’s Motor Carrier Safety Measurement System replaced the former SafeStat system and has removed a number of drivers from the industry as carriers are less willing to hire and retain drivers with marginal ratings, which has increased competition for qualified drivers. The FMCSA is currently evaluating a new statistical model known as the Item Response Theory, or IRT, model to replace the current system utilizing CSA scores in order to better evaluate the safety of motor carriers.

The FMCSA issued final revisions to the hours-of-service requirements for drivers in September 2020. The revisions allow drivers more flexibility with their 30-minute rest breaks and with dividing their time in the sleeper berth. Additionally, the new regulations increase by two hours the duty time for drivers encountering adverse weather and expand the short haul exemption radius from 100 to 150 miles.

In January 2011, the FMCSA issued a regulatory proposal requiring commercial carriers to track compliance with hours-of-service regulations using electronic logging devices, or ELD’s, which was vacated and sent back to the FMCSA for further analysis and review in September 2011 by the 7th U.S. Circuit Court of Appeals. The Moving Ahead for Progress in the 21st Century Act, or MAP-21 Act, included a provision directing the FMCSA to develop a final ELD rule in 2013, which was delayed until its issuance in December 2015. The final rule required compliance beginning in December 2017 which was strictly enforced beginning in April 2018. Carriers using automatic on-board recording devices, or AOBRD’s, which were installed and in use prior to December 2017 were allowed until December 2019 to convert to ELD’s. Our entire fleet has been equipped with AOBRD’s since early 2011 and converted to ELD’s prior to December 2019.

The FMCSA has established a Commercial Driver’s License Drug and Alcohol Clearinghouse, which is a database of drivers who have violations including failed or refused drug and alcohol tests. Beginning in January 2020, all carriers are required to run queries in the clearinghouse for all prospective drivers and annually for all drivers currently employed. All testing violations must also be reported to the clearinghouse. Also effective in January 2020, all carriers must perform random drug tests at a rate of at least 50% of the average number of driver positions. The rate was at least 25% previously. We have been testing at a rate in excess of 50%, including when the requirement was at least 25%, and tested 55% in each of 2020 and 2021. The impact of the clearinghouse has been significant, with a total of approximately 81,000 drivers removed from the trucking industry in 2020 and 2021.

In September 2020, the United States Department of Health and Human Services proposed mandatory guidelines for federal workplace drug testing programs using hair follicles, which is a more strenuous test than the current requirements. The FMCSA has not yet issued proposed regulations.

From time to time, various federal, state, or local taxes are increased, including taxes on fuels. We cannot predict whether, or in what form, any such increase applicable to us will be enacted, but such an increase could adversely affect our profitability.

Our operations are subject to various environmental laws and regulations, the violation of which could result in substantial fines or penalties. We are subject to various environmental laws and regulations dealing with the handling of hazardous materials, fuel storage tanks, air emissions from our vehicles and facilities, engine idling, and discharge and retention of storm water. We operate in industrial areas, where truck terminals and other industrial activities are located, and where groundwater or other forms of environmental contamination have occurred. Our operations involve the risks of fuel spillage or seepage, environmental damage, and hazardous waste disposal, among others. Although we have instituted programs to monitor and control environmental risks and promote compliance with applicable environmental laws and regulations, if we are involved in a spill or other accident involving hazardous substances or if we are found to be in violation of applicable laws or regulations, we could be subject to liabilities, including substantial fines or penalties or civil and criminal liability, any of which could have a materially adverse effect on our business and operating results.

Risks Related to Company’s Human Capital

Increases in compensation or difficulty in attracting drivers could affect our profitability and ability to grow. The transportation industry has historically experienced substantial difficulty in attracting and retaining qualified drivers, including independent contractors. With the current increased competition for drivers, including the impact that regulatory changes have had on the number of drivers in the transportation industry, we could experience greater difficulty in attracting sufficient numbers of qualified drivers. In addition, the available pool of independent contractor drivers is smaller than it has been historically. Accordingly, we may face difficulty in attracting and retaining drivers for all of our current tractors and for those we may add. Additionally, we may face difficulty in increasing the number of our independent contractor drivers. In addition, our industry suffers from high turnover rates of drivers. Our turnover rate requires us to recruit a substantial number of drivers. Moreover, our turnover rate could increase. If we are unable to continue to attract drivers and contract with independent contractors, we could be required to continue adjusting our driver compensation package or let trucks sit idle. An increase in our expenses or in the number of tractors without drivers could materially and adversely affect our growth and profitability.

If we are unable to retain our executive officers and key management employees, our business, financial condition and results of operations could be adversely affected. We are highly dependent upon the services of our executive officers and key management employees, including our Chief Executive Officer. Currently, we do not have employment agreements with these employees and the loss of their services for any reason could have a materially adverse effect on our operations and future profitability. We have entered into agreements with our executive officers that require us to provide compensation to them in the event of termination of their employment without cause in connection with or within a certain period of time after a “change in control” of our Company. In addition, we must continue to develop and retain a core group of managers if we are to realize our goal of expanding our operations and continuing our growth. While our Board regularly engages in succession planning for our Chief Executive Officer and executive leadership team, there is no guarantee that a candidate or plan will be successful. Although we strive to reduce the potential negative impact of any such changes, the loss of any executive officers or key management employees could result in disruptions to our operations. In addition, hiring, training, and successfully integrating replacement personnel, whether internal or external, could be time consuming, may cause additional disruptions to our operations, and may be unsuccessful, which could negatively impact our business, financial condition and results of operations.

| ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. |

PROPERTIES |

Our executive offices and principal terminal are located on approximately seven acres in Mondovi, Wisconsin. This facility consists of 39,000 square feet of office space and 21,000 square feet of equipment repair and maintenance space. We added additional equipment repair and maintenance facilities in 2007 and in 2009 in Mondovi, Wisconsin which consist of 15,000 square feet of space located on approximately 11 acres and 50,000 square feet of space located on approximately three acres, respectively. We operate facilities in or near the following cities at which we primarily perform operations and maintenance activities:

| ● Mondovi, Wisconsin |

● Atlanta, Georgia |

● Memphis, Tennessee |

| ● Phoenix, Arizona |

● Indianapolis, Indiana |

● Desoto, Texas |

| ● Jurupa Valley, California |

● Kansas City, Kansas |

● Laredo, Texas |

| ● Otay Mesa, California |

● Portland, Oregon |

● Colonial Heights, Virginia |

| ● Tampa, Florida |

● Carlisle, Pennsylvania |

● Rio Grande Valley, Texas |

Our Truckload, Dedicated and Brokerage segments operate out of a majority of our facilities while our Intermodal segment operates out of a small number of our locations. We believe the nature, size and location of our properties are suitable and adequate for our current business needs.

| ITEM 3. |

LEGAL PROCEEDINGS |

We are involved in ordinary routine litigation incidental to our operations. These lawsuits primarily involve claims for workers’ compensation, personal injury, or property damage incurred in the transportation of freight.

| ITEM 4. |

MINE SAFETY DISCLOSURES |

Not Applicable.

| ITEM 4A. |

INFORMATION ABOUT OUR EXECUTIVE OFFICERS |

Our executive officers, with their ages and the offices held as of February 14, 2022, are as follows:

| Name |

Age |

Position |

| Randolph L. Marten |

69 |

Executive Chairman of the Board and Director |

|

|

|

|

| Timothy M. Kohl |

74 |

Chief Executive Officer |

| Douglas P. Petit |

55 |

President |

|

|

|

|

| James J. Hinnendael |

58 |

Executive Vice President and Chief Financial Officer |

|

|

|

|

| John H. Turner |

60 |

Executive Vice President of Sales and Marketing |

Randolph L. Marten has been a full-time employee of ours since 1974. Mr. Marten has been a Director since October 1980 and our Executive Chairman of the Board since May 2021. Mr. Marten also served as our Chairman of the Board from August 1993 to May 2021, our Chief Executive Officer from January 2005 to May 2021, our President from June 1986 to June 2008, our Chief Operating Officer from June 1986 to August 1998 and as a Vice President from October 1980 to June 1986.

Timothy M. Kohl has been our Chief Executive Officer since May 2021. Mr. Kohl also served as our President from June 2008 to August 2021 after joining the company in November 2007. Mr. Kohl served as Knight Transportation Inc.’s President from 2004 to 2007 and as its Secretary from 2000 to 2007. Mr. Kohl served as a director on Knight’s Board of Directors from 2001 to 2006, and he served as its Chief Financial Officer from 2000 to 2004. Mr. Kohl also served as Knight’s Vice President of Human Resources from 1996 to 1999. From 1999 to 2000, Mr. Kohl served as Vice President of Knight’s southeast region. Prior to his employment with Knight, Mr. Kohl was employed by Burlington Motor Carriers as a Vice President. Prior to his employment with Burlington Motor Carriers, Mr. Kohl served as a Vice President for J.B. Hunt.

Douglas P. Petit has been our President since August 2021. Mr. Petit also served as our Chief Operating Officer from August 2019 to August 2021, our Senior Vice President of Operations from January 2014 to August 2019 and our Vice President of Operations from December 2011 to January 2014. Mr. Petit advanced through various professional capacities in our operations area from June 1992 to December 2011 and from February 1990 to June 1991. From June 1991 to June 1992 Mr. Petit served as a fleet manager for Transport America, Inc.

James J. Hinnendael has been our Executive Vice President since May 2015 and our Chief Financial Officer since January 2006 and served as our Controller from January 1992 to December 2005. Mr. Hinnendael served in various professional capacities with Ernst & Young LLP, a public accounting firm, from January 1987 to December 1991. Mr. Hinnendael is a certified public accountant.

John H. Turner has been our Executive Vice President of Sales and Marketing since December 2019, Senior Vice President of Sales from December 2013 to December 2019, our Vice President of Sales from January 2007 to December 2013 and an executive officer since August 2007. He also served as our Vice President of Sales from October 2000 to February 2005, and as an executive officer from January 2002 to February 2005. Mr. Turner also served as our Director of Sales from July 1999 to October 2000 and in various professional capacities in our sales and marketing area from August 1991 to July 1999 and as our Operations Manager-West from October 1990 to August 1991. Previously, Mr. Turner served as a vice president for Naterra Land, Inc., a recreational land developer, from 2005 to 2006 and as the western fleet general manager and area sales manager for Munson Transportation, Inc., a long-haul truckload carrier, from 1986 to 1990.

PART II

| ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock is listed on the NASDAQ Global Select Market under the symbol “MRTN.” On February 14, 2022, we had 162 record stockholders and approximately 17,505 beneficial stockholders of our common stock. On August 13, 2020, we effected a three-for-two stock split of our common stock, $.01 par value, in the form of a 50% stock dividend. The following cash dividends and share amounts have been adjusted to give retroactive effect to the stock split for all periods presented.

Dividend Policy

In 2010, we announced a regular cash dividend program to our stockholders, subject to approval each quarter. We paid cash dividends totaling $54.7 million in 2021 which consisted of a special dividend of $0.50 per share of common stock in October, along with quarterly cash dividends of $0.04 per share of common stock in March, June, October and December. We paid cash dividends totaling $52.4 million in 2020 which consisted of a special dividend of $0.50 per share of common stock in December, along with quarterly cash dividends of $0.04 per share of common stock in the third and fourth quarters and of $0.027 per share of common stock in the first and second quarters. We paid cash dividends totaling $42.1 million in 2019 which consisted of a special dividend of $0.433 per share of common stock in September, along with quarterly cash dividends of $0.02 per share of common stock in each quarter of 2019. We currently expect to continue to pay quarterly cash dividends in the future. The payment of cash dividends in the future, and the amount of any such dividends, will depend upon our financial condition, results of operations, cash requirements, and certain corporate law requirements, as well as other factors deemed relevant by our Board of Directors.

Our ability to pay cash dividends is currently limited by restrictions contained in our revolving credit facility, which prohibits us from paying, in any fiscal year, stock redemptions and dividends in excess of 25% of our net income from the prior fiscal year. Waivers allowing stock redemptions and dividends in excess of the 25% limitation in total amounts of up to $80 million in 2021, of up to $60 million in 2020 and of up to $65 million in 2019 were obtained from the lender in August 2021, November 2020 and August 2019, respectively.

Share Repurchase Program

In August 2019, our Board of Directors approved and we announced an increase from current availability in our existing share repurchase program providing for the repurchase of up to $34 million, or approximately 1.8 million shares, of our common stock, which was increased by our Board of Directors to 2.7 million shares in August 2020 to reflect the three-for-two stock split effected in the form of a stock dividend on August 13, 2020. The share repurchase program allows purchases on the open market or through private transactions in accordance with Rule 10b-18 of the Exchange Act. The timing and extent to which we repurchase shares depends on market conditions and other corporate considerations. The repurchase program does not have an expiration date.

We repurchased and retired 53,064 shares of common stock for $597,000 in the first quarter of 2020. We did not repurchase any shares in 2019, in the rest of 2020 or in 2021. As of December 31, 2021, future repurchases of up to $33.4 million, or approximately 2.6 million shares, were available in the share repurchase program.

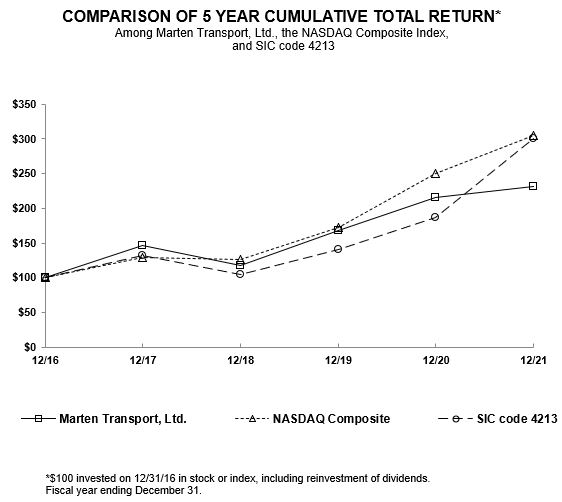

Comparative Stock Performance

The graph below compares the cumulative total stockholder return on our common stock with the NASDAQ Market index and the SIC code 4213 (trucking, except local) line-of-business index for the last five years. Research Data Group, Inc. prepared the line-of-business index. The graph assumes $100 is invested in our common stock, the NASDAQ Stock Market index and the line-of-business index on December 31, 2016, with reinvestment of dividends. The comparisons in the graph below are based on historical data and are not intended to forecast the possible future performance of our common stock. The information in the graph below shall be deemed “furnished” and not “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section.

| ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis of our financial condition and results of operations should be read together with the selected consolidated financial data and our consolidated financial statements and the related notes appearing elsewhere in this report. This discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including but not limited to those under the heading “Risk Factors” beginning on page 6. We do not assume, and specifically disclaim, any obligation to update any forward-looking statement contained in this report.

Overview

We have strategically transitioned from a refrigerated long-haul carrier to a multifaceted business offering a network of refrigerated and dry truck-based transportation capabilities across our five distinct business platforms – Truckload, Dedicated, Intermodal, Brokerage and MRTN de Mexico.

The primary source of our operating revenue is provided by our Truckload segment through a combination of regional short-haul and medium-to-long-haul full-load transportation services. We transport food and other consumer packaged goods that require a temperature-controlled or insulated environment, along with dry freight, across the United States and into and out of Mexico and Canada. Our agreements with customers are typically for one year.

Our Dedicated segment provides customized transportation solutions tailored to meet each individual customer’s requirements, utilizing temperature-controlled trailers, dry vans and other specialized equipment within the United States. Our agreements with customers range from three to five years and are subject to annual rate reviews.

Generally, we are paid by the mile for our Truckload and Dedicated services. We also derive Truckload and Dedicated revenue from fuel surcharges, loading and unloading activities, equipment detention and other accessorial services. The main factors that affect our Truckload and Dedicated revenue are the rate per mile we receive from our customers, the percentage of miles for which we are compensated, the number of miles we generate with our equipment and changes in fuel prices. We monitor our revenue production primarily through average Truckload and Dedicated revenue, net of fuel surcharges, per tractor per week. We also analyze our average Truckload and Dedicated revenue, net of fuel surcharges, per total mile, non-revenue miles percentage, the miles per tractor we generate, our fuel surcharge revenue, our accessorial revenue and our other sources of operating revenue.

Our Intermodal segment transports our customers’ freight within the United States utilizing our refrigerated containers and our temperature-controlled trailers, each on railroad flatcars for portions of trips, with the balance of the trips using our tractors or, to a lesser extent, contracted carriers. The main factors that affect our Intermodal revenue are the rate per mile and other charges we receive from our customers.

Our Brokerage segment develops contractual relationships with and arranges for third-party carriers to transport freight for our customers in temperature-controlled trailers and dry vans within the United States and into and out of Mexico through Marten Transport Logistics, LLC, which was established in 2007 and operates pursuant to brokerage authority granted by the DOT. We retain the billing, collection and customer management responsibilities. The main factors that affect our Brokerage revenue are the rate per mile and other charges that we receive from our customers.

Operating results of our MRTN de Mexico business which offers our customers door-to-door service between the United States and Mexico with our Mexican partner carriers is reported within our Truckload and Brokerage segments.

In addition to the factors discussed above, our operating revenue is also affected by, among other things, the United States economy, inventory levels, the level of truck and rail capacity in the transportation market, a contracting driver market, severe weather conditions and specific customer demand.

Our operating revenue increased $99.3 million, or 11.4%, in 2021 from 2020. Our operating revenue, net of fuel surcharges, increased $65.4 million, or 8.3%, compared with 2020. Truckload segment revenue, net of fuel surcharges, increased 1.1% from 2020 due to an increase in our average revenue per tractor, despite a reduction in our average number of tractors. Dedicated segment revenue, net of fuel surcharges, increased 2.0% from 2020 primarily due to an increase in our average revenue per tractor. Intermodal segment revenue, net of fuel surcharges, increased 9.4% from 2020 primarily due to an increase in revenue per load. Brokerage segment revenue increased 50.2% primarily due to increases in both the number of loads and in revenue per load in 2021. Fuel surcharge revenue increased to $117.7 million in 2021 from $83.8 million in 2020, primarily due to higher fuel costs.

Our profitability is impacted by the variable costs of transporting freight for our customers, fixed costs, and expenses containing both fixed and variable components. The variable costs include fuel expense, driver-related expenses, such as wages, benefits, training, and recruitment, and independent contractor costs, which are recorded under purchased transportation. Expenses that have both fixed and variable components include maintenance and tire expense and our cost of insurance and claims. These expenses generally vary with the miles we travel, but also have a controllable component based on safety, fleet age, efficiency and other factors. Our main fixed costs relate to the acquisition and subsequent depreciation of long-term assets, such as revenue equipment and operating terminals. We expect our annual cost of tractor and trailer ownership will increase in future periods as a result of higher prices of new equipment, along with any increases in fleet size. Although certain factors affecting our expenses are beyond our control, we monitor them closely and attempt to anticipate changes in these factors in managing our business. For example, fuel prices have significantly fluctuated over the past several years. We manage our exposure to changes in fuel prices primarily through fuel surcharge programs with our customers, as well as through volume fuel purchasing arrangements with national fuel centers and bulk purchases of fuel at our terminals. To help further reduce fuel expense, we have installed and tightly manage the use of auxiliary power units in our tractors to provide climate control and electrical power for our drivers without idling the tractor engine, and also have improved the fuel usage in the temperature-control units on our trailers. For our Intermodal and Brokerage segments, our profitability is impacted by the percentage of revenue which is payable to the providers of the transportation services we arrange. This expense is included within purchased transportation in our consolidated statements of operations.

Our operating income improved 19.8% to $111.7 million in 2021 from $93.2 million in 2020. Our operating expenses as a percentage of operating revenue, or “operating ratio,” improved to 88.5% in 2021 from 89.3% in 2020. Operating expenses as a percentage of operating revenue, with both amounts net of fuel surcharges, improved to 87.0% in 2021 from 88.2% in 2020. Our net income improved 22.9% to $85.4 million, or $1.02 per diluted share, in 2021 from $69.5 million, or $0.84 per diluted share, in 2020.

Our business requires substantial, ongoing capital investments, particularly for new tractors and trailers. At December 31, 2021, we had $57.0 million of cash and cash equivalents, $651.7 million in stockholders’ equity and no long-term debt outstanding. In 2021, net cash flows provided by operating activities of $171.2 million were primarily used to purchase new revenue equipment, net of proceeds from dispositions, in the amount of $118.3 million, to pay cash dividends of $54.7 million, and to construct and upgrade regional operating facilities in the amount of $4.3 million, resulting in a $9.1 million decrease in cash and cash equivalents. We estimate that capital expenditures, net of proceeds from dispositions, will be approximately $143 million in 2022. We paid cash dividends totaling $54.7 million in 2021 which consisted of a special dividend of $0.50 per share of common stock in October, along with quarterly cash dividends of $0.04 per share of common stock in March, June, October and December. We believe our sources of liquidity are adequate to meet our current and anticipated needs for at least the next twelve months. Based upon anticipated cash flows, existing cash and cash equivalents balances, current borrowing availability and other sources of financing we expect to be available to us, we do not anticipate any significant liquidity constraints in the foreseeable future.