Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS 2

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the Fiscal Year Ended December 31, 2015 |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the Transition Period From to |

||

Commission File No. 001-32472

DAWSON GEOPHYSICAL COMPANY

(Exact name of registrant as specified in its charter)

| Texas (State or other jurisdiction of incorporation or organization) |

74-2095844 (I.R.S. Employer Identification No.) |

508 West Wall, Suite 800, Midland, Texas 79701

(Address of Principal Executive Office) (Zip Code)

Registrant's Telephone Number, including area code: 432-684-3000

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Exchange on Which Registered | |

|---|---|---|

| Common Stock, $0.01 par value | The NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232 405 of the chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

As of June 30, 2015, the aggregate market value of Dawson Geophysical Company common stock, par value $0.01 per share, held by non-affiliates (based upon the closing transaction price on Nasdaq) was approximately $94,238,000.

On March 11, 2016, there were 21,629,310 shares of Dawson Geophysical Company common stock, $0.01 par value outstanding.

As used in this report, the terms "we," "our," "us," "Dawson" and the "Company" refer to Dawson Geophysical Company unless the context indicates otherwise.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's Proxy Statement for its 2016 Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

1

DAWSON GEOPHYSICAL COMPANY

FORM 10-K

For the Fiscal Year Ended December 31, 2015

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

Statements other than statements of historical fact included in this Form 10-K that relate to forecasts, estimates or other expectations regarding future events, including without limitation, statements under "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business" regarding technological advancements and our financial position, business strategy and plans and objectives of our management for future operations, may be deemed to be forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). When used in this Form 10-K, words such as "anticipate," "believe," "estimate," "expect," "intend" and similar expressions, as they relate to us or our management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of our management, as well as assumptions made by and information currently available to management. Actual results could differ materially from those contemplated by the forward-looking statements as a result of certain factors, including but not limited to the volatility of oil and natural gas prices, dependence upon energy industry spending, industry competition, delays, reductions or cancellations of service contracts, reduced utilization, crew productivity, the type of contracts we enter into, external factors affecting our crews such as weather interruptions and inability to obtain land access rights of way, high fixed costs of our operations and our high capital requirements, limited number of clients, credit risk related to our clients, the availability of capital resources, operational disruptions, the risk that the benefits from the business combination pursuant to the Merger (as defined below) may not be fully realized or may take longer to realize than expected, the ability to promptly and effectively integrate our combined business and the diversion of management time on transaction-related issues. See "Risk Factors" for more information on these and other factors. These forward-looking statements reflect our current views with respect to future events and are subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations, growth strategies and liquidity. The cautionary statements made in this Form 10-K should be read as applying to all related forward-looking statements wherever they appear in this Form 10-K. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this paragraph. We assume no obligation to update any such forward-looking statements.

General

Dawson Geophysical Company, a Texas corporation (the "Company"), is a leading provider of North America onshore seismic data acquisition services with operations throughout the continental United States and Canada. We acquire and process 2-D, 3-D and multi-component seismic data for our clients, ranging from major oil and gas companies to independent oil and gas operators as well as providers of multi-client data libraries. Our principal business office is located at 508 West Wall, Suite 800, Midland, Texas 79701 (Telephone: 432-684-3000), and our internet address is www.dawson3d.com. We make available free of charge on our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K as soon as reasonably practicable after filing or furnishing such information with the Securities and Exchange Commission.

On February 11, 2015, the Company, which was formerly known as TGC Industries, Inc. ("Legacy TGC"), consummated a strategic business combination with Dawson Operating Company, which was formerly known as Dawson Geophysical Company ("Legacy Dawson"), pursuant to which a wholly-owned

2

subsidiary of Legacy TGC merged with and into Legacy Dawson, with Legacy Dawson continuing after the merger as the surviving entity and a wholly-owned subsidiary of Legacy TGC (the "Merger"). In connection with the Merger, Legacy Dawson changed its name to "Dawson Operating Company" and Legacy TGC changed its name to "Dawson Geophysical Company." Legacy TGC was formed in 1980. Legacy Dawson was formed in 1952.

Except as otherwise specifically noted herein, references herein to the "Company," "we," "us" or "our" refer to post-combination Dawson Geophysical Company and its consolidated subsidiaries, including Legacy Dawson.

We provide our seismic data acquisition services primarily to onshore oil and natural gas exploration and development companies for use in the onshore drilling and production of oil and natural gas in the continental United States and Canada as well as providers of multi-client data libraries. The main factors influencing demand for seismic data acquisition services in our industry are the level of drilling activity by oil and natural gas companies and the sizes of such companies' exploration and development budgets, which, in turn, depend largely on current and anticipated future crude oil and natural gas prices and depletion rates of the companies' oil and natural gas reserves.

As of December 31, 2015, we operated ten seismic crews, consisting of eight crews in the United States and two crews in Canada, and one seismic data processing center. During the three months ended December 31, 2015, we operated a maximum of ten crews in the United States and two in Canada. We are currently operating five crews in the United States with limited activity in Canada as the Canadian winter operating season comes to an end. We anticipate operating between four and six crews in the United States with limited activity in Canada into the second quarter of 2016. Visibility for active crew count beyond the second quarter is limited due to uncertainty in oil prices and demand levels. Demand for our services is likely to be at reduced levels in North America in response to the reduced expenditures by our clients related to the recent drop in crude oil prices. Our seismic crews supply seismic data primarily to companies engaged in the exploration and development of oil and natural gas on land and in land-to-water transition areas. Seismic acquisition services of our wholly-owned subsidiary, Eagle Canada, Inc. ("Eagle Canada"), are also used by the potash mining industry in Canada, and Eagle Canada has particular expertise through its heliportable capabilities. Our clients rely on seismic data to identify areas where subsurface conditions are favorable for the accumulation of existing hydrocarbons, to optimize the development and production of hydrocarbon reservoirs, to better delineate existing oil and natural gas fields, and to augment reservoir management techniques.

We acquire geophysical data using the latest in 3-D seismic survey techniques. We introduce acoustic energy into the ground by using vibration equipment or dynamite detonation, depending on the surface terrain, area of operation, and subsurface requirements. The reflected energy, or echoes, is received through geophones, converted into a digital signal at a multi-channel recording unit, and then transmitted to a central recording vehicle. Subsurface requirements dictate the number of channels necessary to perform our services. We generally use thousands of recording channels in our seismic surveys. Additional recording channels enhance the resolution of the seismic survey through increased imaging analysis and provide improved operational efficiencies for our clients. With our state-of-the-art seismic equipment, including computer technology and multiple channels, we acquire, on a cost effective basis, immense volumes of seismic data that, when processed and interpreted, produce precise images of the earth's subsurface. Our clients then use our seismic data to generate 3-D geologic models that help reduce drilling risks, finding and development costs and improve recovery rates from existing fields.

In addition to conventional 2-D and 3-D seismic surveys, we provide what the industry refers to as multi-component seismic data surveys. Multi-component surveys involve the recording of alternative seismic waves known as shear waves. Shear waves can be recorded as wave conversion of conventional energy sources (3-C converted waves) or from horizontal vibrator energy source units (shear wave vibrators). Multi-component data are utilized in further analysis of subsurface rock type, fabric and

3

reservoir characterization. We own equipment required for onshore multi-component surveys. The majority of the projects in Canada require multi-component recording equipment. We have operated one to two multi-component equipped crews in the United States routinely over the past few years. The use of multi-component seismic data could increase in North America over the next few years if industry conditions improve and potentially require capital expenditures for additional equipment.

In recent years, we have begun providing surface-recorded microseismic services utilizing equipment we currently own. Microseismic monitoring is used by clients who use hydraulic fracturing to extract hydrocarbon deposits to monitor their hydraulic fracturing operations.

We market and supplement our services in the continental United States from our headquarters in Midland, Texas and from additional offices in three other cities in Texas (Denison, Houston and Plano) as well as two additional states, Oklahoma (Oklahoma City) and Colorado (Denver). In addition, we market and supplement our services in Canada from our facilities in Calgary, Alberta.

The Industry

Technological advances in seismic equipment and computing allow the seismic industry to acquire and process, on a cost-effective basis, immense volumes of seismic data which produce precise images of the earth's subsurface. The latest accepted method of seismic data acquisition, processing, and the subsequent interpretation of the processed data is the 3-D seismic method. Geophysicists use computer workstations to interpret 3-D data volumes, identify subsurface anomalies, and generate a geologic model of subsurface features. In contrast with the 3-D method, the 2-D method involves the collection of seismic data in a linear fashion, thus generating a single plane of subsurface seismic data.

3-D seismic data are used in the exploration and development of new reserves and enable oil and natural gas companies to better delineate existing fields and to augment their reservoir management techniques. Benefits of incorporating high resolution 3-D seismic surveys into exploration and development programs include reducing drilling risk, decreasing oil and natural gas finding costs, and increasing the efficiencies of reservoir location, delineation, and management. In order to meet the requirements necessary to fully realize the benefits of 3-D seismic data, there is an increasing demand for improved data quality with greater subsurface resolution.

Currently, the North American seismic data acquisition industry is made up of a number of companies divided into two groups. The first group is made up of publicly-traded companies. This group includes us, SAExploration Holdings, Inc. ("SAE") and Tesla Exploration, Ltd. ("Tesla"). The second group is made up of Geokinetics, Inc. ("Geokinetics"), Global Geophysical Services, Inc. ("Global Geophysical"), Breckenridge Geophysical Inc. ("Breckenridge"), Paragon Geophysical Services, Inc. ("Paragon"), LoneStar Geophysical Surveys ("LoneStar"), and smaller companies which generally run one or two seismic crews and often specialize in specific regions or types of operations.

Equipment and Crews

In recent years, we have experienced continued increases in recording channel capacity on a per crew or project basis. This increase in channel count demand is driven by client needs and is necessary in order to produce higher resolution images, increase crew efficiencies and undertake larger scale projects. Due to the increase in demand for higher channel counts, we have continued our investments in additional channels. In response to project-based channel requirements, we routinely deploy a variable number of channels on a variable number of crews in an effort to maximize asset utilization and meet client needs. While the number of recording systems we own may exceed the number utilized in the field at any given time, we maintain the excess equipment to provide additional operational flexibility and to allow us to quickly deploy additional recording channels and energy source units as needed to respond to client demand and desire for improved data quality with greater subsurface images. We believe we will realize the

4

benefit of increased channel counts and flexibility of deployment through increased crew efficiencies, higher revenues and margins in improved conditions.

In addition, since 2011, we have purchased or leased a significant number of cable-less recording channels. We have utilized this equipment primarily as stand-alone recording systems, but on occasion we have utilized it in conjunction with our cable-based systems. As a result of the introduction of cable-less recording systems, we have realized increased crew efficiencies and increased revenue on projects using this equipment. We believe we will experience continued demand for cable-less recording systems in the future. While we have replaced cable-based recording equipment with cable-less equipment on certain crews, the cable-based recording equipment continues to be deployed on existing crews.

As of December 31, 2015, we owned equipment for 22 land-based seismic data acquisition crews, 217 vibrator energy source units, approximately 248,000 recording channels and 22 central recording systems. Of the 22 recording systems we owned at December 31, 2015, 12 were Geospace Technologies GSR cable-less recording systems, eight were ARAM ARIES cable-based recording systems, one was a Wireless Seismic RT System 2 system, and one was a cable-less INOVA Hawk system. Each crew consists of approximately 40 to 100 technicians with associated vehicles, geophones, a seismic recording system, energy sources, cables, and a variety of other equipment. Each ARAM crew has one central recording vehicle which captures seismic data. The GSR, GSX and INOVA Hawk crews utilize a recorder to manage the data acquisition while the individual system captures and holds the data until they are placed in the Data Transfer Module. The data is then transferred to various data storage media, which are delivered to a data processing center selected by the client.

Equipment Acquisition and Capital Expenditures

We monitor and evaluate advances in geophysical technology and commit capital funds to purchase the equipment we deem most effective to maintain our competitive position cost-effectively. Purchasing and updating seismic equipment and technology involves a commitment to capital spending. We also tie our capital expenditures closely to demand for our services. As a result of the continuing softening in demand for seismic services beginning in early 2014 and the Company's belief that its current equipment base is sufficient to meet current demand, the Company has adopted a maintenance capital expenditures program and has generally curtailed large equipment purchases.

Clients

Our services are marketed by supervisory and executive personnel who contact clients to determine geophysical needs and respond to client inquiries regarding the availability of crews or processing schedules. These contacts are based principally upon professional relationships developed over a number of years.

Our clients range from major oil and gas companies to small independent oil and gas operators and also providers of multi-client data libraries. The services we provide to our clients vary according to the size and needs of each client. During the twelve months ended December 31, 2015, sales to two clients represented more than 36% of our revenue. The remaining balance of our revenue was derived from varied clients and none represented 10% or more of our revenues. We anticipate that sales to these two clients will represent a smaller percentage of our overall revenues during 2016.

We do not acquire seismic data for our own account or for future sale, maintain multi-client seismic data libraries or participate in oil and gas ventures. The results of seismic surveys conducted for a client belong to that client. It is also our policy that none of our officers, directors or employees actively participate in oil and natural gas ventures. All of our clients' information is maintained in the strictest confidence.

5

Domestic and Foreign Operations

We derive our revenue from domestic and foreign sources. Total revenues for the twelve months ended December 31, 2015 were approximately $234,685,000, of which $222,154,000 were earned in the United States and $12,531,000 were earned in Canada. Total revenue for the twelve months ended December 31, 2014 were approximately $244,304,000, of which $240,751,000 were earned in the United Stated and $3,553,000 were earned in Canada.

Long lived assets as of December 31, 2015 were approximately $345,619,000, with $329,467,000 owned in the United States and $16,152,000 owned in Canada. Long lived assets as of December 31, 2014 were approximately $339,245,000, with $337,945,000 owned in the United States and $1,300,000 owned in Canada.

Contracts

Our contracts are obtained either through competitive bidding or as a result of client negotiations. Our services are conducted under general service agreements for seismic data acquisition services which define certain obligations for us and for our clients. A supplemental agreement setting forth the terms of a specific project, which may be canceled by either party on short notice, is entered into for every project. We currently operate under supplemental agreements that are either "turnkey" agreements providing for a fixed fee to be paid to us for each unit of data acquired or "term" agreements providing for a fixed hourly, daily, or monthly fee during the term of the project or projects.

Currently, as in recent years, most of our projects are operated under turnkey agreements. Turnkey agreements generally provide us more profit potential, but involve more risks because of the potential of crew downtime or operational delays. We attempt to negotiate on a project-by-project basis some level of weather downtime protection within the turnkey agreements. Under the term agreements, we forego an increased profit potential in exchange for a more consistent revenue stream with improved protection from crew downtime or operational delays.

Competition

The acquisition of seismic data for the oil and natural gas industry is a highly competitive business. Contracts for such services generally are awarded on the basis of price quotations, crew experience, and the availability of crews to perform in a timely manner, although factors other than price, such as crew safety, performance history, and technological and operational expertise, are often determinative. Our competition includes publicly traded competitors, such as Tesla and SAE. Our other major competitors include Geokinetics, Global Geophysical, Breckenridge, Paragon and LoneStar. In addition to these previously named companies, we also compete for projects from time to time with smaller seismic companies which operate in local markets with only one or two crews. Further, the barriers to entry in the seismic industry are not prohibitive, and it would not be difficult for seismic companies outside of the United States to enter the United States market and compete with us.

Employees

As of December 31, 2015, we employed over 1,125 full-time employees, of which approximately 150 consisted of management, sales, and administrative personnel with the remainder being crew and crew support personnel. Our employees are not represented by a labor union. We believe we have good relations with our employees.

See "Item 2. Properties" for a description of our material properties utilized in our business.

6

An investment in our common stock is subject to a number of risks, including those discussed below. You should carefully consider these discussions of risk and the other information included in this Form 10-K. These risk factors could affect our actual results and should be considered carefully when evaluating us. Although the risks described below are the risks that we believe are material, they are not the only risks relating to our business, our industry and our common stock. Additional risks and uncertainties, including those that are not yet identified or that we currently believe are immaterial, may also adversely affect our business, financial condition or results of operations. If any of the events described below occur, our business, financial condition or results of operations could be materially adversely affected.

We derive substantially all of our revenues from companies in the oil and natural gas exploration and development industry, as well as providers of multi-client data libraries which serve common clients in the industry. The oil and natural gas industry is a historically cyclical industry which is currently experiencing a severe downturn, with levels of activity that are significantly affected by the levels and volatility of oil and natural gas prices.

Demand for our services depends upon the level of expenditures by oil and natural gas companies for exploration, production, development and field management activities, which depend primarily on oil and natural gas prices. The oil and natural gas industry is currently experiencing a severe downturn. Significant declines in oil and natural gas exploration activities and oil and natural gas prices have adversely affected the demand for our services and our results of operations in the past as well as currently and will continue to do so if the level of such exploration activities and the prices for oil and natural gas were to decline in the future or if the current downturn is extended or becomes more severe. In addition to the market prices of oil and natural gas, the willingness of our clients to explore, develop and produce depends largely upon prevailing industry conditions that are influenced by numerous factors over which our management has no control, including general economic conditions and the availability of credit. Any prolonged reduction in the overall level of exploration and development activities, whether resulting from changes in oil and natural gas prices or otherwise, could adversely impact us in many ways by negatively affecting:

- •

- our revenues, cash flows, and profitability;

- •

- our ability to maintain or increase our borrowing capacity;

- •

- our ability to obtain additional capital to finance our business and the cost of that capital; and

- •

- our ability to attract and retain skilled personnel whom we would need in the event of an upturn in the demand for our services.

Worldwide political, economic, and military events have contributed to oil and natural gas price volatility and are likely to continue to do so in the future. Depending on the market prices of oil and natural gas, oil and natural gas exploration and development companies may cancel or curtail their capital expenditure and drilling programs, thereby reducing demand for our services, or may become unable to pay, or have to delay payment of, amounts owed to us for our services. Oil and natural gas prices have been highly volatile historically and, we believe, will continue to be so in the future. Many factors beyond our control affect oil and natural gas prices, including:

- •

- the cost of exploring for, producing, and delivering oil and natural gas;

- •

- the discovery rate of new oil and natural gas reserves;

- •

- the rate of decline of existing and new oil and natural gas reserves;

- •

- available pipeline and other oil and natural gas transportation capacity;

- •

- the ability of oil and natural gas companies to raise capital and debt financing;

7

- •

- actions by OPEC (the Organization of Petroleum Exporting Countries);

- •

- political instability in the Middle East and other major oil and natural gas producing regions;

- •

- economic conditions in the United States and elsewhere;

- •

- domestic and foreign tax policy;

- •

- domestic and foreign energy policy including increased emphasis on alternative sources of energy;

- •

- weather conditions in the United States, Canada and elsewhere;

- •

- the pace adopted by foreign governments for the exploration, development, and production of their national reserves;

- •

- the price of foreign imports of oil and natural gas; and

- •

- the overall supply and demand for oil and natural gas.

We and our clients may be adversely affected by an economic downturn.

An economic downturn could have a material adverse effect on our financial results and proposed plan of operations and could lead to further significant fluctuations in the demand for and pricing of oil and gas. Reduced demand and pricing pressures could adversely affect the financial condition and results of operations of our clients and their ability to purchase our services. We are not able to predict the timing, extent, and duration of the economic cycles in the markets in which we operate. The oil and natural gas industry is currently experiencing a severe downturn and prices for oil and natural gas have been in decline since the fourth quarter of 2014. If the current downturn continues for an extended period of time, or if it becomes more extreme, it may have material adverse effects on our planned operations, level of capital expenditures and financial condition.

A limited number of clients operating in a single industry account for a significant portion of our revenues, and the loss of one of these clients could adversely affect our results of operations.

We derive a significant amount of our revenues from a relatively small number of oil and gas exploration and development companies and providers of multi-client data libraries. During the twelve months ended December 31, 2015, our two largest clients accounted for approximately 36% of our revenues. If either of these clients, or any of our other significant clients, were to terminate their contracts or fail to contract for our services in the future because they are acquired, alter their exploration or development strategy, experience financial difficulties or for any other reason, our results of operations could be adversely affected.

Our clients could delay, reduce or cancel their service contracts with us on short notice, which may lead to lower than expected demand and revenues.

Our order book reflects client commitments at levels we believe are sufficient to maintain operations on our existing crews for the indicated periods. However, our clients can delay, reduce or cancel their service contracts with us on short notice. If the current downturn in the oil and natural gas industry continues for an extended period of time, or if it becomes more extreme, it may result in an increase in delays, reductions or cancellations by our clients. In addition, the timing of the origination and completion of projects and when projects are awarded and contracted for is also uncertain. As a result, our order book as of any particular date may not be indicative of actual demand and revenues for any succeeding fiscal period.

8

Our revenues, operating results and cash flows can be expected to fluctuate from period to period.

Our revenues, operating results, and profitability may fluctuate from period to period. These fluctuations are attributable to the level of new business in a particular period, the timing of the initiation, progress or cancellation of significant projects, higher revenues and expenses on our dynamite contracts, and costs we incur to train new crews we may add in the future to meet increased client demand. Fluctuations in our operating results may also be affected by other factors that are outside of our control such as permit delays, weather delays and crew productivity. Oil and natural gas prices have continued to be volatile, and have resulted in significant demand fluctuations for our services. The current downturn in the oil and natural gas industry and the related sustained declines in oil and natural gas commodity prices have resulted in declines in the demand for our services. There can be no assurance of future oil and gas price levels or stability. Our operations in Canada are also seasonal as a result of the thawing season and we have historically experienced limited Canadian activity for the second and third quarters of each year. The demand for our services will be adversely affected by a significant reduction in oil and natural gas prices and by climate change legislation or material changes to U.S. energy policy. Because our business has high fixed costs, the negative effect of one or more of these factors could trigger wide variations in our operating revenues, cash flows, EBITDA margin, and profitability from quarter-to-quarter, rendering quarter-to-quarter comparisons unreliable as an indicator of performance. Due to the factors discussed above, you should not expect sequential growth in our quarterly revenues and profitability.

We extend credit to our clients without requiring collateral and a default by a client could have a material adverse effect on our operating revenues.

We perform ongoing credit evaluations of our clients' financial conditions and, generally, require no collateral from our clients. It is possible that one or more of our clients will become financially distressed, especially in light of the current downturn in the oil and natural gas industry and low commodity prices, which could cause them to default on their obligations to us and could reduce the client's future need for seismic services provided by us. Our concentration of clients may also increase our overall exposure to these credit risks. A default in payment from one of our large clients could have a material adverse effect on our operating revenues for the period involved.

We incur losses.

We incurred net losses of $26,279,000 and $14,714,000 for the twelve months ended December 31, 2015 and 2014, respectively.

Our ability to be profitable in the future will depend on many factors beyond our control, but primarily on the level of demand for land-based seismic data acquisition services by oil and natural gas exploration and development companies. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis.

We have indebtedness under credit facilities with commercial banks, and certain of our core assets and our accounts receivable are pledged as collateral for these obligations. Our ability to borrow may be limited if our accounts receivable decrease.

We have indebtedness under credit facilities with commercial banks, and certain of our core assets as well as our accounts receivable are pledged as collateral for these borrowings. If we are unable to repay all secured borrowings when due, whether at maturity or if declared due and payable following a default, our lenders have the right to proceed against the assets pledged to secure the indebtedness and may sell these assets in order to repay those borrowings, which could materially harm our business, financial condition and results of operations. Our ability to borrow funds under our revolving line of credit is tied to the amount of our eligible accounts receivable. If our accounts receivable decrease materially for any reason,

9

including due to delays, reductions or cancellations by clients or decreased demand for our services, our ability to borrow to fund operations or other obligations may be limited.

Our financial results could be adversely affected by asset impairments.

We periodically review our portfolio of equipment and our intangible assets for impairment. In connection with the Merger, we recorded intangibles associated with the combination of Legacy TGC and Legacy Dawson that are an asset on our consolidated balance sheet. Future events, including our financial performance, sustained decreases in oil and natural gas prices, reduced demand for our services, our market valuation or the market valuation of comparable companies, loss of a significant client's business, failure to realize the benefits of the Merger, or strategic decisions, could cause us to conclude that impairment indicators exist and ultimately that the asset values associated with our equipment or our intangibles, if any, were to be impaired. If we were to impair our equipment or intangibles, these noncash asset impairments could negatively affect our financial results in a material manner in the period in which they are recorded, and the larger the amount of any impairment that may be taken, the greater the impact such impairment may have on our financial results.

Our profitability is determined, in part, by the utilization level and productivity of our crews and is affected by numerous external factors that are beyond our control.

Our revenue is determined, in part, by the contract price we receive for our services, the level of utilization of our data acquisition crews and the productivity of these crews. Crew utilization and productivity is partly a function of external factors, such as client cancellation or delay of projects, operating delays from inclement weather, obtaining land access rights and other factors, over which we have no control. If our crews encounter operational difficulties or delays on any data acquisition survey, our results of operations may vary, and in some cases, may be adversely affected.

In recent years, most of our projects have been performed on a turnkey basis for which we were paid a fixed price for a defined scope of work or unit of data acquired. The revenue, cost and gross profit realized under our turnkey contracts can vary from our estimates because of changes in job conditions, variations in labor and equipment productivity or because of the performance of our subcontractors. Turnkey contracts may also cause us to bear substantially all of the risks of business interruption caused by external factors over which we may have no control, such as weather, obtaining land access rights, crew downtime or operational delays. These variations, delays and risks inherent in turnkey contracts may result in reducing our profitability.

We face intense competition in our business that could result in downward pricing pressure and the loss of market share.

The seismic data acquisition services industry is a highly competitive business in the continental U.S. and Canada. Our competitors include companies with financial resources that are significantly greater than our own as well as companies of comparable and smaller size. Additionally, the seismic data acquisition business is extremely price competitive and has a history of periods in which seismic contractors bid jobs below cost and therefore adversely affect industry pricing. Many contracts are awarded on a bid basis, which may further increase competition based primarily on price. Further, the barriers to entry in the seismic industry are not prohibitive, and it would not be difficult for seismic companies outside of the U.S. to enter the U.S. market and compete with us.

Inclement weather may adversely affect our ability to complete projects and could therefore adversely affect our results of operations.

Our seismic data acquisition operations could be adversely affected by inclement weather conditions. Delays associated with weather conditions could adversely affect our results of operations. For example,

10

weather delays could affect our operations on a particular project or an entire region and could lengthen the time to complete data acquisition projects. In addition, even if we negotiate weather protection provisions in our contracts, we may not be fully compensated by our clients for the delay caused by the inclement weather.

Our operations are subject to delays related to obtaining land access rights of way from third parties which could affect our results of operations.

Our seismic data acquisition operations could be adversely affected by our inability to obtain timely right of way usage from both public and private land and/or mineral owners. We cannot begin surveys on property without obtaining permits from governmental entities as well as the permission of the private landowners who own the land being surveyed. In recent years, it has become more difficult, costly and time-consuming to obtain access rights of way as drilling activities have expanded into more populated areas. Additionally, while landowners generally are cooperative in granting access rights, some have become more resistant to seismic and drilling activities occurring on their property. In addition, governmental entities do not always grant permits within the time periods expected. Delays associated with obtaining such rights of way could negatively affect our results of operations.

Capital requirements for our operations are large. If we are unable to finance these requirements, we may not be able to maintain our competitive advantage.

Seismic data acquisition and data processing technologies historically have progressed steadily, and we expect this trend to continue. In order to remain competitive, we must continue to invest additional capital to maintain, upgrade and expand our seismic data acquisition capabilities. Our working capital requirements remain high, primarily due to the expansion of our infrastructure in response to client demand for cable-less recording systems and more recording channels, which has increased as the industry strives for improved data quality with greater subsurface resolution images. Our sources of working capital are limited. We have historically funded our working capital requirements primarily with cash generated from operations, cash reserves and from time to time borrowings from commercial banks. In recent years we have funded some of our capital expenditures through equipment term loans and capital leases. In the past, we have also funded our capital expenditures and other financing needs through public equity offerings. If we were to expand our operations at a rate exceeding operating cash flow, if current demand or pricing of geophysical services were to decrease substantially or if technical advances or competitive pressures required us to acquire new equipment faster than our cash flow could sustain, additional financing could be required. If we were not able to obtain such financing or renew our existing revolving line of credit when needed, our failure could have a negative impact on our ability to pursue expansion and maintain our competitive advantage.

Technological change in our business creates risks of technological obsolescence and requirements for future capital expenditures. If we are unable to keep up with these technological advances, we may not be able to compete effectively.

Seismic data acquisition technologies historically have steadily improved and progressed, and we expect this progression to continue. We are in a capital intensive industry, and in order to remain competitive, we must continue to invest additional capital to maintain, upgrade and expand our seismic data acquisition capabilities. However, we may have limitations on our ability to obtain the financing necessary to enable us to purchase state-of-the-art equipment, and certain of our competitors may be able to purchase newer equipment when we may not be able to do so, thus affecting our ability to compete.

We rely on a limited number of key suppliers for specific seismic services and equipment.

We depend on a limited number of third parties to supply us with specific seismic services and equipment. From time to time, increased demand for seismic data acquisition services has decreased the

11

available supply of new seismic equipment, resulting in extended delivery dates on orders of new equipment. Any delay in obtaining equipment could delay our deployment of additional crews and restrict the productivity of existing crews, adversely affecting our business and results of operations. In addition, any adverse change in the terms of our suppliers' arrangements could affect our results of operations.

Some of our suppliers may also be our competitors. If competitive pressures were to become such that our suppliers would no longer sell to us, we would not be able to easily replace the technology with equipment that communicates effectively with our existing technology, thereby impairing our ability to conduct our business.

We are dependent on our management team and key employees, and our inability to retain our current team or attract new employees could harm our business.

Our continued success depends upon attracting and retaining highly skilled professionals and other technical personnel. A number of our employees are highly skilled scientists and highly trained technicians. The loss, whether by death, departure or illness, of our senior executives or other key employees or our failure to continue to attract and retain skilled and technically knowledgeable personnel could adversely affect our ability to compete in the seismic services industry. We may experience significant competition for such personnel, particularly during periods of increased demand for seismic services. A limited number of our employees are under employment contracts, and we have no key man insurance.

We may fail to realize the anticipated benefits of the Merger, which could adversely affect the value of our common stock.

The success of the Merger will depend, in part, on our ability to manage effectively the businesses of Legacy TGC and Legacy Dawson and realize the anticipated benefits from the combination of Legacy TGC and Legacy Dawson. We believe that these anticipated benefits, which include the expansion of our geographic diversity, an increase in seismic crew utilization rates due to an expanded order book and the ability to enhance efficiencies because of logistical improvements and expanded support services capabilities, are achievable. However, it is possible that we will not be able to achieve these benefits fully, or at all, or will not be able to achieve them within the anticipated timeframe.

We are subject to Canadian foreign currency exchange rate risk.

We conduct business in Canada which subjects us to foreign currency exchange rate risk. Currently, we do not hold or issue foreign currency forward contracts, option contracts or other derivative financial instruments to mitigate the currency exchange rate risk. Our results of operations and our cash flows could be impacted by changes in foreign currency exchange rates.

Our common stock has experienced, and may continue to experience, price volatility and low trading volume.

Our stock price is subject to significant volatility. Overall market conditions, including a decline in oil and natural gas prices and other risks and uncertainties described in this "Risk Factors" section and in our other filings with the Securities and Exchange Commission, could cause the market price of our common stock to fall. Our high and low sales price following the Merger through December 31, 2015 was $7.31 and $2.93, respectively.

Our common stock is listed on the Nasdaq Global Select Market under the symbol "DWSN." However, daily trading volumes for our common stock are, and may continue to be, relatively small compared to many other publicly traded securities. It may be difficult for shares to be sold in the public market at any given time at prevailing prices, and the price of our common stock may, therefore, be volatile.

12

Our common stock currently trades below $5.00 per share, and as a result it may be considered a low-priced stock and may be subject to regulations that limit or restrict the potential market for the stock.

Our common stock may be considered a low-priced stock pursuant to rules promulgated under Section 15(g) of the Securities Exchange Act of 1934, as amended. The rules apply to non-NASDAQ listed companies whose stock trades below a price of $5.00 per share or that have tangible net worth of less than $5,000,000. These rules require, among other things, that broker-dealers participating in transactions in low-priced securities with persons other than "established customers" complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Broker-dealers must also disclose these restrictions in writing and provide monthly account statements to the client, and obtain specific written consent of the client. Many brokers have decided not to trade low-priced stock because of the requirements of the rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. With these restrictions, the likely effect of a designation as a low-price stock would be to decrease the willingness of broker-dealers to make a market for our common stock, to decrease the liquidity of the stock and to increase the transaction costs of sales and purchase of such stocks compared to other securities. As of December 31, 2015, our common stock was quoted at a closing sales price of $3.46 per share, and as of March 11, 2016, our common stock was quoted at a closing sales price of $4.34 per share. We cannot guarantee that our common stock will trade at a price greater than $5.00 per share in the future.

We do not expect to pay cash dividends on our common stock for the foreseeable future, and therefore only appreciation of the price of our common stock may provide a return to shareholders.

While there are currently no restrictions prohibiting us from paying dividends to our shareholders, our board of directors, after consideration of general economic and market conditions affecting the energy industry in general, and the oilfield services business in particular, determined that we would not pay a dividend in respect of our common stock for the foreseeable future. Payment of any dividends in the future will be at the discretion of our board and will depend on our financial condition, results of operations, capital and legal requirements, and other factors deemed relevant by the board.

Certain provisions of our amended and restated certificate of formation may make it difficult for a third party to acquire us in the future or may adversely impact your ability to obtain a premium in connection with a future change of control transaction.

Our amended restated certificate of formation, as amended, contains provisions that require the approval of holders of 80% of our issued and outstanding shares before we may merge or consolidate with or into another corporation or entity or sell all or substantially all of our assets to another corporation or entity. Additionally, if we increase the size of our board from the current eight directors to nine directors, we could by resolution of the board of directors stagger the directors' terms, and our directors could not be removed without approval of holders of 80% of our issued and outstanding shares. These provisions could discourage or impede a tender offer, proxy contest or other similar transaction involving control of us.

In addition, our board of directors has the right to issue preferred stock upon such terms and conditions as it deems to be in our best interest. The terms of such preferred stock may adversely impact the dividend and liquidation rights of our common shareholders without the approval of our common shareholders.

We may be subject to liability claims that are not covered by our insurance.

Our business is subject to the general risks inherent in land-based seismic data acquisition activities. Our activities are often conducted in remote areas under dangerous conditions, including the detonation of dynamite. These operations are subject to risks of injury to personnel and damage to equipment. Our

13

crews are mobile, and equipment and personnel are subject to vehicular accidents. These risks could cause us to experience equipment losses, injuries to our personnel, and interruptions in our business.

In addition, we could be subject to personal injury or real property damage claims in the normal operation of our business. Such claims may not be covered under the indemnification provisions contained in our general service agreements to the extent that the damage is due to our negligence or intentional misconduct.

Our general service agreements require us to have specific amounts of insurance. However, we do not carry insurance against certain risks that could cause losses, including business interruption resulting from equipment maintenance or weather delays. Further, there can be no assurance, however, that any insurance obtained by us will be adequate to cover all losses or liabilities or that this insurance will continue to be available or available on terms which are acceptable to us. Liabilities for which we are not insured, or which exceed the policy limits of our applicable insurance, could have a materially adverse effect on us.

We may be held liable for the actions of our subcontractors.

We often work as the general contractor on seismic data acquisition surveys and, consequently, engage a number of subcontractors to perform services and provide products. While we obtain contractual indemnification and insurance covering the acts of these subcontractors and require the subcontractors to obtain insurance for our benefit, we could be held liable for the actions of these subcontractors. In addition, subcontractors may cause injury to our personnel or damage to our property that is not fully covered by insurance.

The high fixed costs of our operations could result in operating losses.

Companies within our industry are typically subject to high fixed costs which consist primarily of depreciation (a non-cash item) and maintenance expenses associated with seismic data acquisition and equipment and crew costs. In addition, ongoing maintenance capital expenditures, as well as new equipment investment, can be significant. As a result, any extended periods of significant downtime or low productivity caused by reduced demand, weather interruptions, equipment failures, permit delays, or other causes could result in operating losses.

We operate under hazardous conditions that subject us to risk of damage to property or personnel injuries and may interrupt our business.

Our business is subject to the general risks inherent in land-based seismic data acquisition activities. Our activities are often conducted in remote areas under extreme weather and other dangerous conditions, including the use of dynamite as an energy source. These operations are subject to risks of injury to our personnel and third parties and damage to our equipment and improvements in the areas in which we operate. In addition, our crews often operate in areas where the risk of wildfires is present and may be increased by our activities. Our crews are mobile, and equipment and personnel are subject to vehicular accidents. We use diesel fuel which is classified by the U.S. Department of Transportation as a hazardous material. These risks could cause us to experience equipment losses, injuries to our personnel and interruptions in our business. Delays due to operational disruptions such as equipment losses, personnel injuries and business interruptions could adversely affect our profitability and results of operations.

Loss of our information and computer systems could adversely affect our business.

We are heavily dependent on our information systems and computer-based programs, including our seismic information, electronic data processing and accounting data. If any of such programs or systems were to fail or create erroneous information in our hardware or software network infrastructure, or if we were subject to cyberspace breaches or attacks, possible consequences include our loss of communication

14

links, loss of seismic data and inability to automatically process commercial transactions or engage in similar automated or computerized business activities. Any such consequence could have a material adverse effect on our business.

Our business could be negatively impacted by security threats, including cyber-security threats and other disruptions.

We face various security threats, including cyber-security threats to gain unauthorized access to sensitive information or to render data or systems unusable, threats to the safety of our employees, threats to the security of our facilities and infrastructure and threats from terrorist acts. Cyber-security attacks in particular are evolving and include, but are not limited to, malicious software, attempts to gain unauthorized access to data and other electronic security breaches that could lead to disruptions in critical systems, unauthorized release of confidential or otherwise protected information and corruption of data. Although we utilize various procedures and controls to monitor and protect against these threats and to mitigate our exposure to such threats, there can be no assurance that these procedures and controls will be sufficient in preventing security threats from materializing. If any of these events were to materialize, they could lead to losses of sensitive information, critical infrastructure, personnel or capabilities essential to our operations and could have a material adverse effect on our reputation, financial position, results of operations or cash flows.

Our business is subject to government regulation that may adversely affect our future operations.

Our operations are subject to a variety of federal, state, and provincial and local laws and regulations, including laws and regulations relating to the protection of the environment and archeological sites and those that may result from climate change legislation. Canadian operations have been historically cyclical due to governmental restrictions on seismic acquisition during certain periods. As a result, there is a risk that there will be a significant amount of unused equipment during those periods. We are required to expend financial and managerial resources to comply with such laws and related permit requirements in our operations, and we anticipate that we will continue to be required to do so in the future. Although such expenditures historically have not been material to us, the fact that such laws or regulations change frequently makes it impossible for us to predict the cost or impact of such laws and regulations on our future operations. The adoption of laws and regulations that have the effect of reducing or curtailing exploration and development activities by energy companies could also adversely affect our operations by reducing the demand for our services.

Current and future legislation or regulation relating to climate change or hydraulic fracturing could negatively affect the exploration and production of oil and gas and adversely affect demand for our services.

In response to concerns suggesting that emissions of certain gases, commonly referred to as "greenhouse gases" (GHG) (including carbon dioxide and methane) may be contributing to global climate change, legislative and regulatory measures to address the concerns are in various phases of discussion or implementation at the national and state levels. At least one-half of the states, either individually or through multi-state regional initiatives, have already taken legal measures intended to reduce GHG emissions, primarily through the planned development of GHG emission inventories and/or GHG cap and trade programs. Although various climate change legislative measures have been under consideration by the U.S. Congress, it is not possible at this time to predict whether or when Congress may act on climate change legislation. The U.S. Environmental Protection Agency (the "EPA") has promulgated a series of rulemakings and taken other actions that the EPA states will result in the regulation of GHG as "air pollutants" under the existing federal Clean Air Act. Furthermore, in 2010, EPA regulations became effective that require monitoring and reporting of GHG emissions on an annual basis, including extensive GHG monitoring and reporting requirements. While this new rule does not control GHG emission levels from any facilities, it will cause covered facilities to incur monitoring and reporting costs. Moreover,

15

lawsuits have been filed seeking to require individual companies to reduce GHG emissions from their operations. These and other lawsuits relating to GHG emissions may result in decisions by state and federal courts and agencies that could impact our operations.

This increasing governmental focus on global warming may result in new environmental laws or regulations that may negatively affect us, our suppliers and our clients. This could cause us to incur additional direct costs in complying with any new environmental regulations, as well as increased indirect costs resulting from our clients, suppliers or both incurring additional compliance costs that get passed on to us. Moreover, passage of climate change legislation or other federal or state legislative or regulatory initiatives that regulate or restrict emissions of GHG may curtail production and demand for fossil fuels such as oil and gas in areas where our clients operate and thus adversely affect future demand for our services. Reductions in our revenues or increases in our expenses as a result of climate control initiatives could have adverse effects on our business, financial position, results of operations and prospects.

Hydraulic fracturing is an important and commonly used process in the completion of oil and gas wells. Hydraulic fracturing involves the injection of water, sand and chemical additives under pressure into rock formations to stimulate gas production. Due to public concerns raised regarding potential impacts of hydraulic fracturing on groundwater quality, legislative and regulatory efforts at the federal level and in some states have been initiated to require or make more stringent the permitting and compliance requirements for hydraulic fracturing operations. At the federal level, a bill was introduced in Congress in March 2011 entitled, the "Fracturing Responsibility and Awareness of Chemicals Act," or the "FRAC Act," that would amend the federal Safe Drinking Water Act, or the "SDWA," to repeal an exemption from regulation for hydraulic fracturing. If the FRAC Act or similar legislation in the next Congress were enacted, the definition of "underground injection" in the SDWA would be amended to encompass hydraulic fracturing activities. Such a provision could require hydraulic fracturing operations to meet permitting and financial assurance requirements, adhere to certain construction specifications, fulfill monitoring, reporting, and recordkeeping obligations and meet plugging and abandonment requirements. The FRAC Act also proposes to require the reporting and public disclosure of chemicals used in the fracturing process, which could make it easier for third parties opposing the hydraulic fracturing process to initiate legal proceedings based on allegations that specific chemicals used in the fracturing process could adversely affect groundwater. In early 2010, the EPA indicated in a website posting that it intended to regulate hydraulic fracturing under the SDWA and require permitting for any well where hydraulic fracturing was conducted with the use of diesel as an additive. While industry groups have challenged the EPA's website posting as improper rulemaking, the Agency's position, if upheld, could require additional permitting. In addition, in March 2010 the EPA commenced a study of the potential adverse effects that hydraulic fracturing may have on water quality and public health, and a committee of the U.S. House of Representatives has commenced its own investigation into hydraulic fracturing practices. The EPA released a progress report in December 2012, but it did not include results of the research. In May 2014, the EPA indicated it would convene a stakeholder process to develop an approach to obtain information on chemical substances and mixtures used in hydraulic fracturing. The EPA issued a draft report in June 2015, concluding that, although hydraulic fracturing activities have the potential to impact drinking water resources through water withdrawals, spills, fracturing directly into such resources, underground migration of liquids and gases, and inadequate treatment and discharge of wastewater, EPA did not find evidence that these mechanisms have led to widespread, systemic impacts on drinking water resources. However, the draft report did identify important vulnerabilities to drinking water. The draft report has not yet been finalized. These legislative and regulatory initiatives imposing additional reporting obligations on, or otherwise limiting, the hydraulic fracturing process could make it more difficult or costly to complete natural gas wells. Shale gas cannot be economically produced without extensive fracturing. In the event such legislation is enacted, demand for our seismic acquisition services may be adversely affected.

16

We are subject to the requirements of Section 404 of the Sarbanes-Oxley Act. If we are unable to maintain compliance with Section 404, or if the costs related to maintaining compliance are significant, our profitability, stock price, and results of operations and financial condition could be materially adversely affected.

If we are unable to maintain adequate internal controls in accordance with Section 404, as such standards are amended, supplemented, or modified from time to time, we may not be able to ensure that we have effective internal controls over financial reporting on an ongoing basis in accordance with Section 404. Failure to achieve and maintain effective internal controls could have a material adverse effect on our stock price. In addition, a material weakness in the effectiveness of our internal control over financial reporting could result in an increased chance of fraud and the loss of clients, reduce our ability to obtain financing, and/or require additional expenditures to comply with these requirements, each of which could negatively impact our business, profitability, and financial condition.

Item 1B. UNRESOLVED STAFF COMMENTS

None.

Our headquarters are located in a 34,570 square foot leased property in Midland, Texas. We have two other properties in Midland, including a 61,402 square foot property that we own and use as a field office, equipment and fabrication facility and maintenance and repair shop. We also own a 6,600 square foot property that we use as an inventory field office and storage facility.

We also have additional offices in three other cities in Texas: Denison, Houston and Plano. Our Denison warehouse facility consists of one 5,000-square foot building, three 10,000-square foot adjacent buildings, and an outdoor storage area of approximately 60,500 square feet. Our Houston sales office is in a 10,041-square foot facility. Our office in Plano, Texas consists of 10,137 square feet of office space.

We also lease a 3,443-square foot facility in Denver, Colorado, as a sales office. We lease a 7,480 and 1,094-square foot facility in Oklahoma City, Oklahoma, as sales offices.

We lease 3,030 square feet of office space located in Calgary, Alberta. In addition, Eagle Canada leases a 7,423-square foot facility, also located in Calgary, Alberta, that is used as a shop and warehouse. We also lease a storage and parking area near the Eagle Canada shop and warehouse.

We believe that our existing facilities are being appropriately utilized in line with past experience and are well maintained, suitable for their intended use and adequate to meet our current and future operating requirements.

From time to time, we are a party to various legal proceedings arising in the ordinary course of business. Although we cannot predict the outcomes of any such legal proceedings, our management believes that the resolution of pending legal actions will not have a material adverse effect on our financial condition, results of operations or liquidity.

For a discussion of certain contingencies affecting the Company, please refer to Note 16, "Commitments and Contingencies" to the Consolidated Financial Statements included herein, which is incorporated by reference herein.

Item 4. MINE SAFETY DISCLOSURES

Not applicable.

17

Item 5. MARKET FOR OUR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Our common stock trades on the Nasdaq Stock Market® under the symbol "DWSN." The table below represents the high and low sales prices per share for the period shown for Legacy TGC prior to the Merger and for the combined Company after the Merger.

Three Months Ended

|

High(1) | Low(1) | |||||

|---|---|---|---|---|---|---|---|

March 31, 2014 |

$ | 7.45 | $ | 5.66 | |||

June 30, 2014 |

$ | 6.12 | $ | 4.24 | |||

September 30, 2014 |

$ | 5.76 | $ | 3.69 | |||

December 31, 2014 |

$ | 3.92 | $ | 1.93 | |||

March 31, 2015 |

$ | 7.31 | $ | 1.90 | |||

June 30, 2015 |

$ | 6.11 | $ | 4.22 | |||

September 30, 2015 |

$ | 5.38 | $ | 3.34 | |||

December 31, 2015 |

$ | 4.63 | $ | 2.93 | |||

- (1)

- The high and low stock price provided for periods prior to February 11, 2015 was calculated by dividing the historical Legacy TGC high or low price by three to account for the 1-for-3 reverse stock split undertaken by Legacy TGC in connection with the Merger. The high and low stock price provided for periods after February 11, 2015 reflect the stock price of the combined Company following the Merger as reported on the Nasdaq Stock Market under the symbol "DWSN".

The table below represents the high and low sales prices per share for the period shown for Legacy Dawson prior to the Merger.

Three Months Ended

|

High(2) | Low(2) | |||||

|---|---|---|---|---|---|---|---|

March 31, 2014 |

$ | 19.83 | $ | 15.66 | |||

June 30, 2014 |

$ | 17.55 | $ | 14.47 | |||

September 30, 2014 |

$ | 16.59 | $ | 10.32 | |||

December 31, 2014 |

$ | 10.66 | $ | 5.91 | |||

February 11, 2015 |

$ | 7.13 | $ | 5.86 | |||

- (2)

- The high and low stock price provided for periods prior to February 11, 2015 was calculated by dividing the historical Legacy Dawson high or low price by the merger conversion factor of 1.76.

As of March 11, 2016, the market price for our common stock was $4.34 per share, and we had 103 common stockholders of record, as reported by our transfer agent.

Legacy Dawson paid quarterly dividends in 2014, with its last quarterly dividend paid on December 8, 2014. Legacy Dawson did not pay any dividends to shareholders in 2015. Legacy TGC last paid cash dividends in 2012 and last paid stock dividends in 2013. Legacy TGC did not pay any dividends to shareholders in 2014 or 2015. While there are currently no restrictions prohibiting us from paying dividends to our shareholders, our board of directors, after consideration of general economic and market conditions affecting the energy industry in general, and the oilfield services business in particular, determined that we would not pay a dividend in respect of our common stock for the foreseeable future. Payment of any dividends in the future will be at the discretion of our board and will depend on our financial condition, results of operations, capital and legal requirements, and other factors deemed relevant by the board.

The following table summarizes certain information regarding securities authorized for issuance under our equity compensation plans as of December 31, 2015. See information regarding material

18

features of the plan in Note 8, "Stock-Based Compensation," to the Consolidated Financial Statements incorporated by reference herein.

Equity Compensation Plan Information

Plan Category

|

Number of Securities to be Issued Upon Exercise or Vesting of Outstanding Options, Warrants and Rights |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights |

Number of Securities Remaining Available for Future Issuance Under the Equity Compensation Plan (Excluding Securities Reflected in Column (a)) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

(a) |

|

|

|||||||

Legacy Dawson |

||||||||||

Equity compensation plan approved by security holders |

287,921 | (1) | $ | 10.74 | (2) | 456,708 | ||||

Equity compensation plans not approved by security holders |

— | — | — | |||||||

Legacy TGC |

||||||||||

Equity compensation plan approved by security holders |

269,756 | (3) | $ | 14.34 | (2) | 406,360 | ||||

Equity compensation plans not approved by security holders |

— | — | — | |||||||

| | | | | | | | | | | |

Total |

557,677 | $ | 12.48 | 863,068 | ||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

- (1)

- Number

of securities to be issued upon the exercise of outstanding options, warrants and rights include 158,674 options that have vested but have not yet

been exercised and 129,247 restricted stock units that have not yet vested.

- (2)

- Excludes

outstanding and unvested restricted stock unit awards, for which there is no exercise price.

- (3)

- Number of securities to be issued upon the exercise of outstanding options, warrants and rights include 269,756 options that have vested but have not yet been exercised.

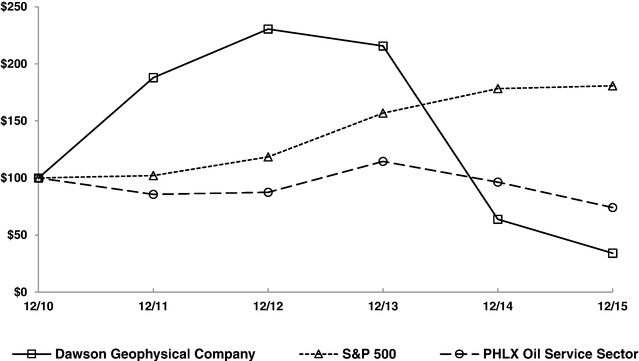

PERFORMANCE GRAPH

The graph below matches Dawson Geophysical Company's cumulative 5-Year total shareholder return on common stock with the cumulative total returns of the S&P 500 index and the PHLX Oil Service Sector index. The graph tracks the performance of a $100 investment in our common stock and in each index (with the reinvestment of all dividends) from 12/31/2010 to 12/31/2015.

The stock prices used in the computation of the graph below reflect those of Legacy TGC from December 31, 2010 to December 31, 2014 multiplied by three to account for the 1-for-3 reverse stock split undertaken by Legacy TGC in connection with the Merger. The stock price at December 31, 2015 reflects that of the combined Company following the Merger, as reported on the Nasdaq Stock Market under the symbol "DWSN".

19

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Dawson Geophysical Company, the S&P 500 Index

and the PHLX Oil Service Sector Index

- *

- $100

invested on 12/31/10 in stock or index, including reinvestment of dividends.

Fiscal year ended December 31.

Copyright© 2016 S&P, a division of McGraw Hill Financial. All rights reserved.

| |

12/10 | 12/11 | 12/12 | 12/13 | 12/14 | 12/15 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Dawson Geophysical Company |

100.00 | 187.89 | 230.45 | 215.67 | 63.82 | 34.07 | |||||||||||||

S&P 500 |

100.00 | 102.11 | 118.45 | 156.82 | 178.29 | 180.75 | |||||||||||||

PHLX Oil Service Sector |

100.00 | 85.62 | 87.44 | 114.50 | 96.36 | 74.08 | |||||||||||||

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

20

Item 6. SELECTED FINANCIAL DATA

The following selected financial data should be read in conjunction with Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations," and the Company's consolidated financial statements and related notes included in Item 8, "Financial Statements and Supplementary Data."

| |

Year Ended December 31, |

Three Months Ended December 31, |

Year Ended September 30, | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2014 | 2014 | 2013 | 2012 | 2011 | |||||||||||||

| |

(In thousands, except per share amounts) |

||||||||||||||||||

Operating revenues |

$ | 234,685 | $ | 50,802 | $ | 261,683 | $ | 305,299 | $ | 319,274 | $ | 333,279 | |||||||

Net (loss) income(1) |

$ | (26,279 | ) | $ | (4,991 | ) | $ | (12,620 | ) | $ | 10,480 | $ | 11,113 | $ | (3,246 | ) | |||

Basic (loss) income per share attributable to common stock(2)(3) |

$ | (1.27 | ) | $ | (0.36 | ) | $ | (0.90 | ) | $ | 0.75 | $ | 0.81 | $ | (0.24 | ) | |||

Cash dividends declared per share of common stock(4)(5) |

$ | — | $ | 0.05 | $ | 0.14 | $ | — | $ | — | $ | — | |||||||

Weighted average equivalent common shares outstanding |

20,688 | 14,020 | 14,009 | 13,868 | 13,801 | 13,745 | |||||||||||||

Total assets |

$ | 247,787 | $ | 244,022 | $ | 256,662 | $ | 289,027 | $ | 279,175 | $ | 264,824 | |||||||

Revolving line of credit |

$ | — | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||

Current maturities of notes payable and obligations under capital leases |

$ | 8,585 | $ | 6,018 | $ | 6,752 | $ | 9,258 | $ | 9,131 | $ | 5,290 | |||||||

Notes payable and obligations under capital leases less current maturities |

$ | 2,106 | $ | 4,209 | $ | 4,933 | $ | 3,697 | $ | 11,179 | $ | 10,281 | |||||||

Stockholders' equity |

$ | 209,718 | $ | 194,218 | $ | 199,530 | $ | 213,060 | $ | 200,949 | $ | 188,163 | |||||||

- (1)

- Net

loss for the year ended September 30, 2011 includes $3,866,000 of transaction costs associated with a previously proposed transaction with TGC.

Net loss for the year ended December 31, 2015, the three months ended December 31, 2014, and the year ended September 30, 2014 include transaction costs associated with the Merger

of $3,314,000, $1,492,000 and $950,000, respectively.

- (2)

- The