Exhibit

99.CODEETH

|

Access Person Code of Conduct

Effective

Date: 01 March 2022 | Contact: Code_of_Ethics@vanguard.com

|

Background – Why This Access Person Code of Conduct Matters

Vanguard was founded with a singular focus

on clients and serving their best interests, and this has been the foundation of our strong ethical culture. One way in which we consistently

seek to earn and maintain the trust and loyalty of our clients is by adhering to the highest standards of ethical behavior. Acting with

integrity and complying with applicable laws and regulations necessarily extends to your conduct in general and to your personal investing

and trading activities in particular.

Some crew and contingent workers at Vanguard, by virtue of their

role or department, are designated as an “Access Person” (i.e., an Advisor Access Person, Fund Access Person, or Investment

Access Person) because they or their department are authorized to know about present or future transactions by Vanguard funds, or have

the authority to influence those transactions, or otherwise have access to sensitive market or client activity. Because of that knowledge,

authority, and access, Access Persons are subject to additional standards of business conduct, stricter personal investment rules, and

greater oversight, among other things. These standards and rules, as set forth in this Access Person Code of Conduct (APCC)1,

have been adopted with the goals of ensuring we comply with applicable law and avoiding conflicts of interest or the appearance of conflicts

of interest. This is especially true regarding any potential conflicts of interest that could arise between the securities trading that

Vanguard undertakes on behalf of the Vanguard funds or our clients and the personal securities trading by crew, contingent workers, and

their household or family members.

Policy Coverage

To Whom Does the APCC Apply?

This policy2 applies to all crew members and contingent

workers globally who are in a role that has been designated as an “Access Person” role. Certain provisions of this

policy also apply to Associated Persons.

Are you an Access Person? Visit Appendix A to learn

whether the role you’re in is an Access Person role, and if so, which Access Person “designation” applies.

What

about Non-Access Persons? Any crew member or contingent worker who is not in a role that has been designated as an Access

Person role is a “Non-Access Person” and must comply with the Personal Investment Activity Policy for Non-Access Persons,

not this policy.

Are you a contingent worker? A “contingent

worker” is any person other than a crew member who provides services to or on behalf of Vanguard through staffing firms, consulting

1 The APCC constitutes

the code of ethics that the Vanguard funds have adopted in compliance with U.S. SEC Rules 17j-1 and 204A-1.

2 The APCC is a policy

that has been created and approved, and is governed, similar to other policies at Vanguard. As used herein, references to “this

policy” mean the APCC.

firms,

service providers, or as independent contractors. Like crew, a contingent worker can be in either an Access Person or Non-Access Person

role.

What

about Associated Persons? For U.S. crew and contingent workers who are Associated Persons (to reiterate, not Access Persons, but Associated

Persons) under FINRA rules and regulations, please note you have additional investment-related obligations under the FINRA Licensing

Policy, including the Securities Account Reporting Obligations

for Associated Persons. Please review and comply with those

documents, as well.

Policy Overview

There are four primary sections to this policy:

Section 1

– Standards of Business Conduct, sets forth rules and expectations regarding your behavior and conduct.

Section 2

– Personal Investment Activities, contains rules on how you and your Household or Family Members may own and trade securities

for your own personal benefit. Note that some of these rules differ based on your Access Person designation. While the details are set

forth in Section 2, at a high level there are four subsections applicable to you and your personal investment activities:

A – Reminders on who is covered

B – Brokerage firms you may use

C – Disclosure obligations

D – Investment and trading restrictions

Section 3

– Penalties and Sanctions, describes how violations of this policy are addressed and enforced.

Section 4

– Defined terms, provides definitions for the capitalized terms used in this policy.

Please carefully read the rest of this policy and ensure you understand

and comply with its terms. Understanding and following this policy is one of the most important ways we can ensure our clients’

interests always come first.

Be sure you are familiar with the following other Vanguard policies

that relate to your ethical conduct and personal investment activities:

·

Standards of Conduct Policy

·

Conflicts of Interest Policy

·

Insider Trading Policy

·

Outside Business Activity Policy

Please

also ensure you are familiar with Vanguard’s Code of Ethical Conduct.

Policy Requirements

Section 1 – Standards of Business Conduct

Everyone at Vanguard is expected to promote high standards of integrity

and manage the company’s affairs honestly and ethically. We all have a personal responsibility to conduct ourselves

in a manner that reflects a commitment to ethics and compliance with

all applicable laws and regulations. Doing so is part and parcel of Vanguard’s mission to “take a stand for all investors,

to treat them fairly, and to give them the best chance for investment success.”

Putting

these values into practice means having and adhering to expected standards of business conduct. The Vanguard policy that explains

these standards is the Standards of Conduct Policy,

which is incorporated herein by reference. You must comply with that policy, including the following standards of conduct that are

explained therein:

| 1. | Always put Vanguard clients’ interests first and

treat them fairly. |

| 2. | Avoid conflicts of interest. |

| 3. | Be candid and clear with clients and provide them with

accurate information. |

| 4. | Comply with applicable laws, rules, regulations, and policies. |

| 5. | Comply with applicable professional standards. |

| 6. | Complete mandatory training and regularly certify that

you are compliant with our policies. |

| 7. | Maintain accurate, timely, and complete business records. |

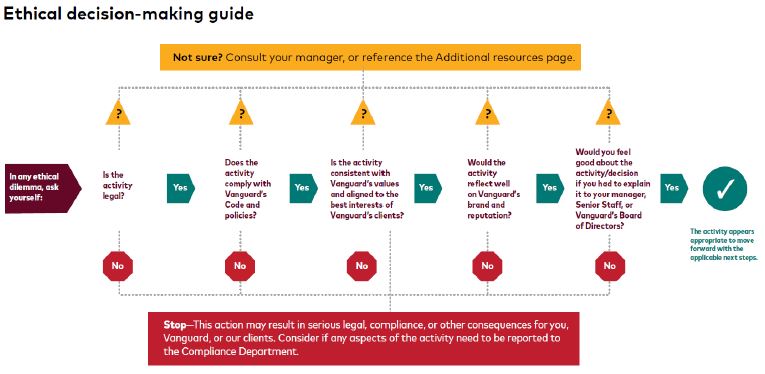

At Vanguard, you are expected to always do

the right thing. It sounds simple and it’s usually very clear what doing the right thing entails. But sometimes it isn’t.

How do you make the best choice when facing difficult or unclear circumstances? How do you navigate an ethical dilemma?

In those situations, you should pause and

reflect, and then work through the following “ethical decision-making guide.” This guide will help you consider important

questions before deciding whether or how to proceed with an action. It is not a substitute for this or any policy, and it may not tell

you exactly what to do in every situation, but it can be used as a tool to help guide you when you face an ethical dilemma or a complex

situation where the answer might not be clear.

If you’re still in doubt as you work through the decision-making

guide, err on the side of caution—ask questions, elevate the issue, and enlist the help of others to ensure we reach the right

answer every time for Vanguard and our clients.

Speaking Up – As mentioned above, you are encouraged

to help protect our clients, crew, and Vanguard by reporting concerns about ethics, financial or business integrity, information security

and privacy, workplace practices, or alleged violations of policy, regulation, or law. Indeed, speaking up is one of the most effective

ways to help ensure Vanguard maintains its high standards for ethics and compliance. To that end, if you become aware that you or anyone

else violated any of the terms of this policy, you must contact Compliance immediately.

Likewise, it is your responsibility to know whether the role you are

in is designated as an Access Person, and if so, which Access Person designation applies to you (visit the Appendix A to learn more).

It is also your responsibility to know the policies and trading restrictions that apply to you accordingly, and to ask questions if you

are unsure.

Section 2 – Personal Investment Activities

Introduction

Vanguard recognizes the importance to crew and contingent workers

of being able to manage and develop their own financial resources through long-term investments and strategies. With that in mind, the

rules and requirements set forth in this policy have been adopted with the goals of (1) ensuring we comply with all applicable laws and

regulations, and (2) avoiding any conflicts of interest, or any appearances of conflicts of interest, between the securities trading that

Vanguard undertakes on behalf of Vanguard funds or our clients and the personal securities trading or investing by crew, contingent workers,

or their Household or Family Members (defined in Section 4, below). Our industry and Vanguard have implemented certain standards and limitations

designed to minimize these conflicts and help ensure that we focus on meeting our duty to clients.

Granted, the rules in this policy are demanding and strict and they

may feel like an imposition. But at Vanguard, we take our ethical obligations very seriously, and the rules in this policy are intended

to ensure that trading on behalf of Vanguard funds and clients are given priority over trading for your personal accounts, and that trades

for your personal accounts do not adversely affect trades for our funds or clients.

Similarly, keep in mind that you must comply with applicable securities

laws and must avoid taking personal advantage of your knowledge of securities activity in Vanguard funds or client accounts.

This policy includes specific restrictions on personal investing but

cannot anticipate every fact pattern or situation. You should adhere to the spirit, and not just the letter, of this policy.

Compliance will keep all records relating to personal account trading

as confidential as necessary. Information will be accessible within Compliance and may be reported to senior management or HR. Records

may also need to be made available to Internal Audit and/or any regulator. All non-U.S. crew and contingent workers are required to sign

a data consent / data privacy notice.

The Compliance Department reserves the right to monitor any and all

investment or trading activity by you or by any Household or Family Member based on any information or system to which it has access.

Checklist

Given the complexity of this policy and the steps you must take to

ensure you remain in compliance with it, we have created this brief checklist to help you keep track of your obligations. This is merely

a summary, so be sure to comply with the full terms of this policy as well.

| Checklist item |

Where this topic is covered in this policy |

| ¨ I

know my Access Person “designation,” and I am aware that this policy applies not only to me but also to my Household

or Family Members |

Subsection

2-A – Who Is Covered Under this Policy |

| ¨ For the region where I work, I know what brokerage firm I and my Household or Family Members may use to maintain the accounts where I or they hold and trade Reportable Securities |

Subsection

2-B – Brokerage Firms You May Use |

| ¨ For

my Access Person designation, I know the initial and ongoing account and holdings disclosure obligations that apply to me and

my Household or Family Members |

Subsection

2-C – Disclosure Obligations |

| ¨ For

my Access Person designation, I know the rules and limitations for transacting securities in my personal accounts and

those of my Household or Family Members |

Subsections

2-D-1 and 2-D-2 – Investment and Trading Restrictions |

| ¨ For Fund Access Person and Investment Access Person designations, I know how to seek trade preclearance |

Subsection

2-D-3 – How to Seek and Abide by Preclearance

Requirements |

| ¨ I know the penalties and sanctions that may apply for violations of any of the requirements under this policy |

Section

3 – Penalties and Sanctions |

| ¨ I understand the meaning of the defined terms used in this policy |

Section

4 – Defined Terms |

|

Quick Tip:

The rules in this policy cover most of the personal investing situations

you are likely to find. Yet it’s always possible you will encounter a situation that isn’t fully addressed by the rules. If

that happens, you need to know what to do. The easiest way to make sure you are making the right decision is to follow these three principles:

1. Know the policy. If you think your situation isn’t

covered, check again. It never hurts to take a second look at the rules.

2.

Seek guidance. Asking questions is always appropriate. Talk with your manager or contact Compliance if

you’re not sure about the policy requirements or how they apply to your situation.

3. Use sound judgment. Analyze the situation and weigh the

options. Think about how your decision would look to someone outside of Vanguard.

|

Note

for crew in China:

Because

you may not have access to MCO, different systems and procedures are in place for you to disclose accounts and holdings. Please consult

with your manager or the China Compliance team to learn more. |

Subsection

2-A – Who Is Covered Under this Policy

As

stated in the introduction to this policy, above, this policy applies to all crew members and contingent workers globally who are in

a role that has been designated as an “Access Person” role.

Access

Persons are covered – This policy applies to crew and contingent worker Access Persons and, in certain instances, to their

Household or Family Members.

| o | Access

Persons – Please note that the specific trading prohibitions and reporting requirements

vary depending on your Access Person “designation,” meaning Advisor Access

Person, Fund Access Person, or Investment Access Person. To learn the Access

Person designation that applies to your role, visit Appendix A. Note further that, regardless

of your designation, the Compliance Department has the authority, with appropriate notice

to you, to apply to you any or all of the trading restrictions within this policy |

| o | Household

or Family Members – Certain aspects of this policy apply not only to you but to

your Household or Family Members, as well. Why? Doing so is required by applicable law and

regulations in many jurisdictions. It is also consistent with industry best practices and

helps Vanguard ensure we are effectively monitoring and guarding against conflicts of interest

and other issues. See Section 4, below, for the definition of Household or Family Members

in the region where you work. |

Non-Access

Persons are not covered – If the role you are in is not an Access Person role, you do not need to comply with this policy;

instead, with regard to your personal investments, you must comply with the Personal Investment Activity Policy for Non-Access Persons

(and other applicable policies). Note, however, that in the event a Non-Access Person is a Household or Family Member of an Access Person,

then the terms of this policy will apply to the Non-Access Person as a Household or Family Member hereunder and any conflicting terms

of this policy will take precedence over the Personal Investment Activity Policy for Non-Access Persons.

Associated

Persons also have obligations under other policies and documents – For U.S. crew and contingent workers who are deemed to be

Associated Persons (to reiterate, not Access Persons, but Associated Persons) under the FINRA Licensing Policy, you have certain

obligations under this policy and have additional investment-related obligations under the FINRA Licensing Policy and the Securities

Account Reporting Obligations for Associated Persons.

Your

designation may change – Keep in mind that your Access Person designation may change over time, for instance if you change

roles, if there are changes made in your department, or if the Compliance Department determines a designation change is appropriate.

You are advised to regularly consult the My Ethics and Compliance Resource Center available on CrewNet to check your designation.

Subsection

2-B – Brokerage Firms You May Use

The

terms of Subsection 2-B apply to all Access Person designations.

The

following requirements and restrictions on which brokerage firms you may use to hold and transact Reportable Securities apply to you

based on whether you are a crew member or contingent worker and where you work:

| U.S. Crew: |

Crew who are Access Persons employed in the U.S., and their Household or Family Members (parts (a) and (b) of that defined term only), must maintain and trade all Reportable Securities in a Vanguard Brokerage Account (VBA). This obligation does not apply to any Household or Family Members covered under part (c) of that defined term. See the Defined Terms in Section 4, below, for all definitions. Securities or investments that are not “Reportable Securities” may be held in a brokerage account at the firm of your choice. Employer-sponsored retirement accounts (e.g., 401(k) and 403(b)), 529 college savings plans, and Compliance-approved accounts (e.g., Approved Managed Accounts) may be held in a brokerage account at the firm of your choice. However, if you hold any Reportable Securities through any of those accounts, then such accounts are considered Covered Accounts under this policy and you are required to disclose them to Compliance under Subsection 2-C of this policy. Newly hired U.S. crew who are Access Persons, and their Household or Family Members (parts (a) and (b) of that defined term only), must transfer any existing applicable Reportable Securities to a VBA by submitting a request or other applicable paperwork with Vanguard and each firm at which you have an existing applicable brokerage account within 60 days of your joining Vanguard. Visit Vanguard.com > Personal Investors > Open an Account to transfer assets from another firm to Vanguard. For a more detailed list of Securities that must be held in a VBA, as well as Securities that may be held elsewhere, visit the Appendices C-F. |

| Ex-U.S. Crew: |

Crew who are Access Persons employed outside the U.S., and their Household or Family Members, may maintain Reportable Securities (as well as Securities or investments that are not Reportable Securities) in a brokerage account or other type of account at the firm of their choice.

|

| Contingent Workers, Globally |

Contingent workers who are Access Persons may maintain Reportable Securities (as well as Securities or investments that are not Reportable Securities) in a brokerage account at the firm of their choice. |

Subsection

2-C – Disclosure Obligations

The

terms of this Subsection 2-C apply to all Access Person designations and to all Associated Persons.

This

policy requires the disclosure of a variety of account and holdings information to the Compliance Department for monitoring and oversight.

This policy requires (1) an initial disclosure of information, and (2) periodic ongoing disclosures. Even if you do not have any personal

brokerage

account

holdings or do not trade in Reportable Securities, you are still required to complete the necessary initial and periodic disclosures.

1.

Initial Disclosure of Accounts and Holdings

Within

ten (10) calendar days of joining Vanguard, or if applicable within ten (10) calendar days of moving from a Non-Access Person role at

Vanguard into an Access Person role, all Access Persons and Associated Persons must disclose the following to Compliance:

(a)

All Covered Accounts and all Reportable Securities held by you or a Household or Family Member;

(b)

All Covered Accounts in which you exercise Investment Discretion;

(c)

All Covered Accounts over which you exercise control (e.g., agent authority (full or limited), trustee, power of attorney authority,

etc.);

(d)

All accounts in which you have, or will acquire, Beneficial Ownership of Securities; and

(e)

All accounts held by you and any Household or Family Member in which there are college saving plan products (including, in the U.S.,

529 plans), annuity products, or other insurance products that, in turn, hold or invest in Vanguard Funds.

This

includes Brokerage Accounts held at Vanguard, as well as those held at another financial institution. For clarity, you do not need to

disclose an account or submit transaction confirmations or statements if the account does not have the ability to hold Securities –

for example, a traditional checking, savings, or deposit account with a bank, credit union, or building society for holding cash would

not need to be disclosed.

This

information must be current as of no more than 45 calendar days before joining Vanguard.

To

make this initial disclosure, you will receive an Initial Certification assignment by email to complete which will include a section

to disclose Covered Accounts and all Reportable Securities by including account information in the “Account Attestation”

section of the assignment and uploading corresponding account statements via MCO. You must

complete and submit the Initial Certification within ten (10) calendar days of receiving it; the failure to do so may be considered a

violation of this policy.

| Note: We

use an application called MyComplianceOffice, or MCO, to help manage this policy. You may use MCO to disclose accounts and holdings,

and to secure trading permissions, if those obligations apply to you. Visit My Ethics and Compliance Resource Center on CrewNet for

resources on how to access and use MCO |

2.

Ongoing Disclosure of Accounts, Transactions, and Duplicate Statements

After

the Initial Disclosure, Access Persons and Associated Persons may need to disclose account and transaction information to Compliance

on a periodic basis regarding Covered Accounts and any transactions in Reportable Securities made by you and your Household or Family

Members.

Further,

if at any time you or a Household or Family Member subsequently:

| · | open,

or intend to open, a Covered Account with a financial institution (e.g., broker, dealer,

advisor, or any other professional money manager), or |

| · | acquire

holdings in Reportable Securities, or |

| · | have

a preexisting Covered Account (including a Vanguard Brokerage Account) that becomes associated

with you or a Household or Family Member (such as through marriage or inheritance or some

other life event), |

or

there becomes an account in which you acquire Beneficial Ownership of Securities, then you must notify Compliance as soon as possible

(and in any event within 10 calendar days) and disclose these Covered Accounts and Reportable Securities by listing them and including

associated information in the Accounts tab in MCO.

For

U.S. crew, keep in mind that, as explained in Section 2-B of this policy above, you and your Household or Family Members (parts (a) and

(b) of that defined term only) must maintain Reportable Securities in a VBA.

What

and how to disclose this information:

| · | For

VBAs disclosed by U.S. crew as required under this policy, Compliance will receive transaction

confirmations automatically. No additional action by you is needed to disclose transactions

of Reportable Securities in VBAs you have disclosed. |

| · | For

Covered Accounts and holdings of Reportable Securities held outside of Vanguard (including

in any account that would require disclosure under Section 2-C(1) of this policy), it is

your responsibility to ensure that duplicate statements and transaction confirmations

are available to or delivered to Compliance: |

| o | Because

Vanguard has file feed contracts in place with many brokerage firms worldwide, for many Covered

Accounts you disclose the holdings and transactions information will be sent to Compliance

electronically with no additional action needed by you. |

| o | For

Covered Accounts held at firms where Vanguard does not have a file feed in place, you must

do the following: |

| § | Contact

the firm where your Covered Account is held and take steps to send duplicate statements and

daily transaction confirmations (electronic or paper) to Vanguard. You do this often by making

Vanguard Compliance an interested party and having duplicate statements and confirmations

sent to the third party scanning service Vanguard uses, called “Earth Class Mail”

at this address: Vanguard, c/o TerraNua, 9450 SW Gemini Drive #37880, Beaverton, OR, 97008-7105. |

| § | If

the firm where your Covered Account is held is not able to send statements and daily transaction

confirmations (electronic or paper) to Vanguard, you are required to scan and upload copies

into the Trading Documents folder in MCO immediately after you receive them, unless you receive

an exemption from this requirement from Compliance. You must ensure the documents you upload

clearly show the firm/institution at which the account is held, the account number or ID,

the account owner, and the account type. |

| · | If

Compliance does not receive the information automatically via a file feed, you will receive

email notifications on a calendar quarterly basis to complete a Quarterly Securities Transaction

Report and thereby disclose Covered Accounts and Reportable Securities, via MCO. You must

complete and submit that assignment within 30 calendar days; the failure to do so may be

considered a violation of this policy. |

| · | On

an annual basis (usually in January or February), you will receive an assignment from Compliance

in which you must certify, among other things, that all Covered Accounts and Reportable Securities

are recorded accurately in MCO. |

3.

Additional notes related to disclosures under this policy:

| · | For

clarity, you do not need to disclose an account or submit transaction confirmations or statements

if the account does not have the ability to hold Securities (for example, a traditional checking,

savings, or deposit account with a bank, credit union, or building society for holding cash

would not need to be disclosed). |

| · | As

stated above, U.S. crew and contingent workers who are Associated Persons are also required

to comply with and are subject to the FINRA Licensing Policy and Securities Account Reporting

Obligations. |

| · | The

Compliance Department will keep personal trading information confidential, but please note

that such information may be accessible to authorized personnel within Compliance and may

be reported to or summarized for senior management, HR, or the OGC for investigative purposes.

Applicable records may also be provided to internal or external auditors and/or to any regulator

if required. All ex-U.S. crew and contingent workers are required to sign a data consent

/ data privacy notice. |

| · | Please

note that crew and contingent workers in Australia are required to disclose all transactions

in VIA funds in MCO in the same manner as is required for Reportable Securities. |

Subsection

2-D – Investment and Trading Restrictions

This

Subsection 2-D contains three segments:

Segment

2-D-1 applies to all Access Person designations.

Segment

2-D-2 has terms and requirements that differ based on your Access Person designation.

| o | Segment

2-D-2(a): Advisor Access Person requirements |

| o | Segment

2-D-2(b): Fund Access Person requirements |

| o | Segment

2-D-2(c): Investment Access Person requirements |

Segment

2-D-3 explains how to seek and abide by preclearance requirements, if applicable to your activity.

Segment

2-D-1: Rules and Limitations applicable to all Access Person designations

The

terms of this Segment 2-D-1 apply to all Access Person designations.

| (1) | You

must comply with all applicable securities-related rules and laws. |

| (2) | You

may not engage in conduct that is deceitful, fraudulent, or manipulative, or that involves

false or misleading statements, in connection with the purchase or sale of a Security by

a Vanguard Fund or Vanguard Client account or otherwise. |

| (3) | You

may not intentionally, recklessly, or negligently circulate false information or rumors that

may affect the securities markets or may be perceived as market manipulation. |

| (1) | You

may not take personal advantage of knowledge of recent, impending, or planned Securities

activities of the Vanguard Funds or their investment advisors or any Vanguard Client. You

are prohibited from purchasing or selling—directly or indirectly—any Security

or Related Security when you know that the Security is being purchased or sold, or considered

for purchase or sale, by a Vanguard Fund (with the exception of an index fund) or by a Vanguard

Client. |

| (2) | You

are subject to and must comply with the Insider Trading Policy and/or any similar policy

of the Vanguard affiliate or region for which you work. Each of these policies is considered

an integral part of your obligations under this policy. Each policy prohibits you from buying

or selling any Security while in possession of material, nonpublic information about the

issuer of the Security. The policies also prohibit you from communicating any nonpublic information

about any Security or issuer of Securities to third parties. |

| (3) | You

must comply with the Confidential Information Policy, including that you may not share information

with any third party about any planned, upcoming, or recently executed trading activity by

any Vanguard Fund or Vanguard Client unless such information is publicly available through

no action by you. |

| iii) | Fund

policies and excessive trading: |

| (1) | When

purchasing, exchanging, or redeeming shares of a Vanguard Fund, you must adhere to the policies

and standards set forth in the fund’s prospectus, or offering document, including policies

on market-timing and frequent trading. |

| (2) | Excessive

trading in Covered Accounts is strongly discouraged. The Compliance Department reserves the

right to monitor trading across all of your Covered Accounts, and may conduct scrutiny of

any trades in your Covered Accounts where such trading may appear excessive in nature (including,

but not limited to, if the number of trades is so frequent as to potentially impact your

ability to carry out your assigned responsibilities or the trades involve positions that

are disproportionate to your net assets). If Compliance in its sole discretion determines

you have engaged in excessive trading, then Compliance may limit the number of trades allowed

in your Covered Accounts during a given period. This Section 2-D-1(a)(iii)(2) does not apply

to transactions in an Approved Managed Account. |

| iv) | Beneficial

ownership and discretion: |

| (1) | The

terms and restrictions of this policy apply to all Securities in which you have acquired

or will acquire Beneficial Ownership. |

| (2) | You

must comply with these investment and trading restrictions with respect to any account you

own as well as any account over which you have Investment Discretion or in which you have

the authority to transact. |

| v) | No

circumvention – You are not permitted to assist,

aid, or enable any other person in doing anything that you are prohibited from doing under

this policy. |

| (1) | The

Chief Compliance Officer may grant exceptions to this policy, including preclearance, other

trading restrictions, and certain reporting requirements on a case-by-case basis if it is

determined that (1) the proposed conduct involves no opportunity for abuse, (2) the proposed

conduct does not conflict with Vanguard’s interests, and (3) not granting an exception

would result in an unfair or unjust outcome. |

| (2) | The

Chief Compliance Officer may waive the applicability of this policy for a contingent worker

if the policy’s requirements are covered through the applicable service provider’s

contract with Vanguard. |

| (b) | Rules

regarding specific investments or investment types: |

| (1) | You

and your Household or Family Members may not use a derivative to avoid or circumvent a rule

or requirement set forth in this policy. If something is prohibited by these rules, then

it is also against these rules to effectively accomplish the same thing by using a derivative.

This includes futures, options, and other types of derivatives. |

| (2) | You

and your Household or Family Members are permitted to trade futures or options on commodities. |

| (1) | You

and your Household or Family Members are prohibited from acquiring Securities in an Initial

Public Offering (IPO) or Secondary Offering. |

| (2) | You

and your Household or Family Members are prohibited from participating in an Initial Coin

Offering (ICO). |

| (1) | You

and your Household or Family Members are not permitted to invest in securities offered to

potential investors in a Private Placement or other limited investment offering without first

obtaining preclearance from Compliance. |

| (2) | You

must provide documentation describing the investment (e.g., offering memorandum, subscription

documents, etc.) so as to enable Compliance to conduct a thorough review of the investment.

|

| (3) | Approval

by Compliance may be granted or denied after a review of the facts and circumstances, including

whether: |

| · | An

investment in the securities is likely to result in future conflicts with Vanguard Client

accounts. |

| · | You

are being offered the opportunity due to your employment at, or association with, Vanguard. |

| (4) | If

you or your Household or Family Members receive approval to purchase Securities in a Private

Placement, you must immediately inform Compliance if that Security goes to public offer or

is pending listing on an exchange. |

| (5) | To

initiate the process for obtaining preclearance of a Private Placement, complete the Outside

Business Activity request form (the form for U.S. crew is in LARS, and for ex-U.S. crew

is in MCO). |

iv)

SPACs – You and your Household or Family Members are prohibited from acquiring a SPAC at any

stage of its lifecycle (i.e., pre-IPO, IPO, pre-merger, post-merger).

v)

Short-Selling – You are prohibited from selling short any Security that you do not own or from

otherwise engaging in short-selling activities.

vi)

Limit Orders – Same-day limit orders are permitted; however, good 'til cancelled orders (such

as limit orders that stay open over the course of multiple trading days until a security reaches a specified market price) are not permitted.

vii)

Digital Currencies and Related Investments – Refer to the Trading and Reporting Requirements

for Digital Currency Investments and Activities for details on which digital currency account and product

types are permitted, and what must be disclosed, under this policy.

| (c) | Short

term trading in a Vanguard Fund (other than Vanguard ETFs): |

i)

Compliance may monitor trading in Vanguard Funds, other than Vanguard ETFs, and will review situations

where Vanguard Fund shares are redeemed within 30 calendar days of purchase (a “short-term trade”). You may be required to

relinquish to Vanguard any profit made on a short-term trade and will be subject to disciplinary action if Compliance determines the

short-term trade was detrimental to a Vanguard Fund or a Vanguard Client or that there is a history of frequent trading by you or your

Household or Family Members. For purposes of this paragraph:

| (1) | A

redemption includes a redemption by any means, including an exchange out of a Vanguard Fund. |

| (2) | This

policy does not cover purchases and redemptions/sales (i) into or out of Vanguard money market

funds, Vanguard short-term bond funds, or (ii) through an Automatic Investment Program. |

ii)

Nothing in this section is intended to replace, nullify, or modify any requirements imposed by a Vanguard

Fund.

Segment

2-D-2: Specific Limitations and Prohibitions that Apply Based on Access Person Designation

The

terms and requirements of this Segment 2-D-2 are in addition to the terms and requirement of Segment 2-D-1, and you must

comply with the portions of this Segment 2-D-2 that apply to your Access Person designation. Note, an Access Person designation can apply

to crew members or contingent workers.

Segment

2-D-2(a): Advisor Access Person requirements

The

following terms and requirements apply to Advisor Access Persons only and are in addition to the terms and requirements of Segment

2-D-1:

| Securities transactions for which you must obtain preclearance (meaning, approval from Compliance before transacting) |

None.

You are not required to obtain preclearance of any Covered Securities transactions by you or your Household or Family Members,

except Private Placements as described above. |

| Prohibited Securities transactions |

In addition to Segment 2-D-1, you are subject to the following restrictions with respect to any transaction in which you will acquire any direct or indirect Beneficial Ownership: · Short-Term Trading. You are prohibited from purchasing and then selling any Covered Security at a profit, as well as selling and then repurchasing a Covered Security at a lower price, within 60 calendar days. A last-in/first-out accounting methodology will be applied to a series of Security purchases when applying this rule. (Note, as stated, this is based on last-in/first-out accounting regardless of how you placed the trade or plan to report it for tax purposes.) If you realize profits on short-term trades, you will be required to relinquish the profits to Vanguard (exclusive of commissions). In addition, the trade will be recorded as a violation of this policy. For example: you would not be permitted to sell a Covered Security at $12 that you purchased within the prior 60 days for $10. Similarly, you would not be permitted to purchase a Covered Security at $10 that you had sold within the prior 60 days for $12. ·

Short-term trading on options. You may hold options on a Covered Security until you exercise the options or the options expire.

However, you may not otherwise close any open positions within 60 calendar days. If you realize profits on such short-term trades, you

must relinquish such profits to Vanguard (exclusive of commissions). In addition, the trade will be recorded as a violation of this policy. Note:

These types of transactions can have unintended consequences. |

| |

For example, your call option could be assigned, causing the underlying Security to be called away within sixty (60) calendar days following the purchase of the Covered Security.

|

| |

Visit

the Appendix C for a table summarizing the trading and reporting requirements for Advisor Access Persons. |

Segment

2-D-2(b): Fund Access Person requirements

The

following terms and requirements apply to Fund Access Persons only and are in addition to the terms and requirements of Segment

2-D-1:

| Securities transactions for which you must obtain preclearance (meaning, approval from Compliance before transacting) |

Yes, you must obtain, for yourself and on behalf of your Household or Family Members, preclearance for any transaction of a Covered Security by you or any Household or Family Member. See

Segment 2-D-3, below, for instructions on how to seek preclearance. |

| Securities transactions that do not require preclearance |

You are not required to obtain preclearance for the following:

·

Purchases or sales of Vanguard Funds.

·

Purchases or sales where the person requesting preclearance has no direct or indirect influence or control over the account (e.g., you

have a trust in your name but you are not the trustee who places the transaction, provided you have granted Investment Discretion to

the trustee and there has been no prior communication between you and the trustee regarding the transaction).

·

Corporate actions in Covered Securities such as stock dividends, stock splits, mergers, consolidations, spin-offs, or other similar corporate

reorganizations or distributions.

·

Purchases or sales made as a part of an Automatic Investment Program.

·

Purchases effected upon the exercise of Rights which were issued by an issuer pro rata to all holders of a class of its Securities, to

the extent such Rights were acquired from such issuer.

· Acquisitions of Covered Securities

through gifts or bequests.

Visit the Appendix D for a table summarizing the trading and reporting requirements for Fund

Access Persons. |

| Is preclearance required for trades in an Approved Managed Account? |

No, you are not required to seek preclearance of a transaction in a Covered Security in an Approved Managed Account so long as you have no prior communication with the portfolio manager of that account in connection with that transaction. Note,

Vanguard PAS accounts generally do not qualify as Approved Managed Accounts because PAS account owners generally retain some level

of investment discretion. Further, any |

| |

trades of Covered Securities in a PAS account must be precleared under this policy. |

“Blackout

period” restrictions that may apply to personal trading in Covered Securities

|

You may be subject to certain restrictions if you purchase or sell a Covered Security within seven (7) days before or after a Vanguard Fund purchases or sells the same Covered Security or a Related Security (the “blackout period”). Purchasing or selling before a Vanguard Fund: · If you purchase a Covered Security within seven days before a Vanguard Fund purchases the same Covered Security or a Related Security, you may be required to hold the Covered Security for 6 months before being permitted to sell the Covered Security for a profit. · If you sell a Covered Security within seven days before a Vanguard Fund sells the same Covered Security or a Related Security, you may be required to relinquish to Vanguard any profits earned from your sale of the Covered Security (exclusive of commissions), where profits are calculated based on the price that the Vanguard Fund received for selling the Covered Security or a Related Security. Note: Compliance will review your sale to determine if the relinquishment is required. This decision will be based on several factors, such as your role, access to fund trades, and the Covered Security sold. Purchasing or selling after a Vanguard Fund: · In general, you will not receive preclearance to purchase a Covered Security within seven days after a Vanguard Fund trades the same Covered Security or a Related Security. If you execute the transaction without receiving preclearance, you will have violated this policy and must immediately sell the Covered Security and relinquish all profits received from the sale to Vanguard (exclusive of commissions). · In general, you will not receive preclearance to sell a Covered Security within seven days after a Vanguard Fund trades the same Covered Security or a Related Security. If you execute the transaction without receiving preclearance, you will have violated this policy and must relinquish to Vanguard the difference (exclusive of commissions) between the sale price you received and the Vanguard Fund's sale price (as long as your sales price is higher), multiplied by the number of shares you sold. In addition to these restrictions, local law may dictate the extent to which any gains must be relinquished. Compliance

may exempt from these restrictions certain trades during blackout periods that coincide with trading by certain Vanguard Funds (e.g.,

index funds). |

| |

The

blackout period restrictions set forth above will not apply

to a Fund Access Person’s sale of stock of any issuer which has a market capitalization

that exceeds US$5 billion (or local currency equivalent), provided that the total value of

any sales of the Security by the Fund Access Person do not exceed US$10,000 (or local currency

equivalent) in any 30-day rolling period. Sales of securities of issuers with market capitalizations

below US$5 billion, or that exceed US$10,000 in any 30-day rolling period, will continue

to be subject to the blackout periods unless Compliance grants a waiver.

Compliance may waive

the blackout period as it applies to the sale of a Covered Security if the Chief Compliance

Officer determines its application creates a significant hardship to you (e.g., you need

cash for a home purchase or to cover a major medical expense) and, in the opinion of the

Chief Compliance Officer, satisfies the requirements for a waiver in the Waivers paragraph

of Segment 2-D-1, above. Request and complete a Hardship Waiver Request Form. |

| Prohibited

Securities transactions |

In

addition to Segment 2-D-1, you are subject to the following restrictions with respect to

any transaction in which you will acquire any direct or indirect Beneficial Ownership: ·

Futures and Options. You are prohibited from entering into, acquiring, or selling

any Futures contract (including single stock futures) or any Option on any Security (including

Options on ETFs, Digital Utility Tokens, Digital Security Tokens, and Digital Currencies). ·

Short-Term Trading. You are prohibited from purchasing and then selling any Covered

Security at a profit, as well as selling and then repurchasing a Covered Security at a lower

price, within 60 calendar days. A last-in/first-out accounting methodology will be applied

to a series of Security purchases when applying this rule. (Note, as stated, this is based

on last-in/first-out accounting regardless of how you placed the trade or plan to report

it for tax purposes.) If you realize profits on short-term trades, you will be required to

relinquish the profits to Vanguard (exclusive of commissions). In addition, the trade will

be recorded as a violation of this policy. Example: You are not permitted to sell

a security at $12 that you purchased within the prior 60 days for $10. Similarly, you are

not permitted to purchase a security at $10 that you sold within the prior 60 days for $12. ·

Spread Bets. You are prohibited from participating in Spread Betting on Securities,

indexes, interest rates, currencies, or commodities. |

Segment 2-D-2(c): Investment Access Person requirements

The following terms and requirements apply to Investment

Access Persons only and are in addition to the terms and requirements of Segment 2-D-1:

| Securities transactions for which you must obtain preclearance (meaning, approval from Compliance before transacting) |

Yes, you must obtain, for yourself and on behalf

of your Household or Family Members, preclearance for any transaction of (i) a Covered Security, or (ii) a Vanguard ETF, by you or

any Household or Family Member.

See Segment 2-D-3, below, for instructions on how to seek

preclearance.

|

| Securities transactions that do not require preclearance |

You are not required to obtain preclearance for the following:

· Purchases

or sales of Vanguard Funds. (Reminder: The purchase or sale of Vanguard ETFs does require preclearance.)

·

Purchases or sales where the person requesting preclearance

has no direct or indirect influence or control over the Covered Security (e.g., you have a trust in your name but you are not the trustee

who places the transaction, provided you have granted Investment Discretion to the trustee and there has been no prior communication between

you and the trustee regarding the transaction).

·

Corporate actions in Covered Securities such as stock

dividends, stock splits, mergers, consolidations, spin-offs, or other similar corporate reorganizations or distributions.

·

Purchases or sales made as a part of an Automatic Investment

Program.

·

Purchases effected upon the exercise of Rights which

were issued by an issuer pro rata to all holders of a class of its Securities, to the extent such Rights were acquired from such issuer.

·

Acquisitions of Covered Securities through gifts or

bequests.

Visit the Appendix for a table summarizing the trading and

reporting requirements for Investment Access Persons.

|

| Is preclearance required for trades in an Approved Managed Account? |

No, you are not required to seek preclearance of a transaction

in a Covered Security in an Approved Managed Account so long as you have no prior communication with the portfolio manager of that account

in connection with that transaction.

Note, Vanguard PAS accounts generally do not qualify

as Approved Managed Accounts because PAS account owners generally retain some level of investment discretion. Further, any trades of Covered

Securities (but not trades of Vanguard ETFs) in a PAS account must be precleared under this policy.

|

|

“Blackout period” restrictions that may apply to

personal trading in Covered Securities |

You may be subject to certain restrictions if you purchase

or sell a Covered Security within seven (7) days before or after a Vanguard Fund purchases or sells the same Covered Security or a Related

Security (the “blackout period”).

Purchasing or selling before a Vanguard Fund:

·

If you purchase a Covered Security

within seven days before a Vanguard Fund purchases the same Covered Security or a Related Security, you may be required to hold the Covered

Security for 6 months before being permitted to sell the Covered Security for a profit.

·

If you sell a Covered Security within

seven days before a Vanguard Fund sells the same Covered Security or a Related Security, you may be required to relinquish to Vanguard

any profits earned from your sale of the Covered Security (exclusive of commissions), where profits are calculated based on the price

that the Vanguard Fund received for selling the Covered Security or a Related Security.

Purchasing or selling after a Vanguard Fund:

·

In general, you will not receive preclearance to purchase a

Covered Security within seven days after a Vanguard Fund trades the same Covered Security or a Related Security. If you execute the transaction

without receiving preclearance, you will have violated this policy and must immediately sell the Covered Security and relinquish all profits

received from the sale to Vanguard (exclusive of commissions).

·

In general, you will not receive preclearance to sell a

Covered Security within seven days after a Vanguard Fund trades the same Covered Security or a Related Security. If you execute the transaction

without receiving preclearance, you will have violated this policy and must relinquish to Vanguard the difference (exclusive of commissions)

between the sale price you received and the Vanguard Fund’s sale price (as long as your sales price is higher), multiplied by the

number of shares you sold.

In addition to these restrictions, local law may dictate

the extent to which any gains must be relinquished.

Compliance may exempt from these restrictions certain trades

during blackout periods that coincide with trading by certain Vanguard Funds (e.g., index funds).

Compliance may waive

the blackout period as it applies to the sale of a Covered Security if the Chief Compliance Officer determines its application creates

a significant hardship to you (e.g., you need cash for a home purchase or to cover a major medical expense) and, in the opinion of the

Chief Compliance Officer, satisfies the requirements for a waiver in the Waivers |

| |

paragraph of Segment D-1, above. Request and complete a Hardship Waiver Request Form.

|

| Prohibited Securities transactions |

In addition to Segment 2-D-1, you are subject to the

following restrictions with respect to any transaction in which you will acquire any direct or indirect Beneficial Ownership:

Futures

and Options. You are prohibited from entering into, acquiring, or selling any Futures contract (including single stock futures)

or any Option on any Security (including Options on ETFs, Digital Utility Tokens, Digital Security Tokens, and Digital Currencies).

Short-Term

Trading. You are prohibited from purchasing and then selling any Covered Security or a Vanguard ETF at a profit, as well

as selling and then repurchasing a Covered Security or a Vanguard ETF at a lower price, within 60 calendar days. A last-in/first-out

accounting methodology will be applied to a series of Security purchases when applying this rule. (Note, as stated, this is based

on last-in/first-out accounting regardless of how you placed the trade or plan to report it for tax purposes.) If you realize profits

on short-term trades, you will be required to relinquish the profits to Vanguard (exclusive of commissions). In addition, the trade

will be recorded as a violation of this policy. Example: You are not permitted to sell a security at $12 that you purchased

within the prior 60 days for $10. Similarly, you are not permitted to purchase a security at $10 that you sold within the prior 60

days for $12.

Spread

Bets. You are prohibited from participating in Spread Betting on Securities, indexes, interest rates, currencies, or commodities.

|

Segment 2-D-3: How to Seek and Abide by Preclearance

Requirements

If you are required to obtain preclearance of any trade or transaction

under this policy, then the terms of this Segment 2-D-3 apply to that trade or transaction.

Preclearance representations.

By seeking preclearance, you will be deemed to be advising

and representing to Compliance that you:

| · | Do not possess any material, nonpublic information relating

to the security. |

| · | Do not use knowledge of any proposed trade or investment

program relating to the Vanguard Funds for personal benefit. |

| · | Believe the proposed trade is available to any market participant

on the same terms. |

How do I obtain preclearance?

Preclearance must be obtained via the “Personal Trade

Pre-Clearance” path in MCO. Once the required information is submitted, your preclearance request will usually be approved

or denied

immediately. Transactions in Covered Securities (including,

for Investment Access Persons, transactions in Vanguard ETFs) may not be executed before you receive approval.

As a reminder, preclearance of Private Placements is addressed

in Segment 2-D-1 of this policy, above.

Attempting to gain approval after the transaction has occurred

is not permitted. Completing a personal trade before receiving approval or after the approval window expires constitutes a violation of

this policy. See Section 3 of this policy for more information regarding the sanctions that may be imposed as a result of a violation.

How long is my preclearance approval valid?

In the U.S.: Preclearance approval will expire

at the end of the trading day on which it is issued (e.g., if you receive approval for a trade on Monday, it is effective until the market

closes on that Monday). Preclearance for permitted limit orders is good for transactions on the same day that approval is granted

only. If you receive approval for a limit order, it must be executed or expire at the close of regular trading on the same business

day for which approval was granted. If you wish to execute the limit order after the close of regular trading on the day you received

approval, you must submit a new preclearance request for the day you wish to execute the trade.

Outside the U.S.: If you receive approval,

transactions must be executed no later than the end of trading on the next business day after the preclearance is granted. If the transaction

is not placed within that time, you must submit a new request for approval before placing the transaction. If you preclear a limit order,

that limit order must either be executed or expire at the end of the next business day. If you want to execute the order after the next

business day period expires, you must resubmit your preclearance request.

Section 3 – Penalties and Sanctions

How we enforce this policy

The Compliance Department regularly reviews the forms, reports, and

other information it receives. If these reviews turn up information that is incomplete, questionable, or potentially in violation of this

policy, the Compliance Department will investigate the matter and may contact you. If it is determined that you or any of your Household

or Family Members have violated this policy, the Compliance Department or another appropriate party may take action.

Violations

If

the Compliance Department determines that there has been a violation, you may be subject to penalties and sanctions as described in this

policy and otherwise as described in the Disciplinary Action Policy and,

for crew and contingent workers in Australia, the Managing Misconduct Policy. The Compliance Department will generally utilize a rolling

24-month period when evaluating whether and how to sanction a violation. Any violation of this policy may result in disciplinary

action up to and including termination of employment.

Vanguard takes all policy violations seriously and at times provides

the Vanguard Funds’ board with a summary of actions taken in response to material violations of this policy and other policies.

You should be aware that other securities laws and regulations not addressed by this policy may also apply to you, depending upon your

role at Vanguard.

Exceptions

The Chief Compliance Officer or designee retains the discretion to

interpret and grant exceptions to this policy and to decide how the rules apply to any given situation for the purpose of protecting the

funds and being consistent with the general principles of this policy and the Code of Ethical Conduct.

In cases where exceptions to this policy are noted and you may qualify

for them, you need to get prior written approval from the Compliance Department. If you believe that you have a situation that warrants

an exception that is not discussed in this policy, you may submit a written request to the Compliance Department, which will consider

your request and notify you of the outcome.

Section 4 – Defined Terms

The following definitions apply throughout this policy:

| Access Person |

Any person designated as an Investment Access Person, Fund Access Person, or Advisor Access Person. |

| Approved Managed Account |

An investment account where (i) the account is owned by an investor and overseen by a hired professional money manager, (ii) the investor has no trading discretion on the account, and (iii) Compliance has approved it as an Approved Managed Account. |

| Associated Person |

Any person who conducts securities business on behalf of Vanguard Marketing Corporation (VMC). This includes all FINRA-licensed contingent workers, as well as non-licensed contingent workers who perform certain operational and administrative functions for VMC. |

| Automatic Investment Program |

A program in which regular periodic purchases (or withdrawals) are made automatically in (or from) Investment accounts, according to a predetermined schedule and allocation. An Automatic Investment Program includes a dividend reinvestment plan. |

| Bankers’ Acceptance |

A time draft drawn on a commercial bank by a borrower usually in connection with an international commercial transaction. Bankers’ Acceptances are usually guaranteed by the bank. |

| Beneficial Ownership |

The opportunity to directly or indirectly—through

any contract, arrangement, understanding, relationship, or otherwise—share at any time in any economic interest or profit derived

from an ownership of or a transaction in a Security. For clarity, what you are deemed to have Beneficial Ownership of includes the following:

·

Any Security owned individually by you.

·

Any Security owned by a Household or Family Member.

·

Any Security owned in joint tenancy, as tenants in common,

or in other joint ownership arrangements.

·

Any Security in which a Household or Family Member has

Beneficial Ownership if the Security is held in a Covered Account over which you have decision making authority (for example, you act

as a trustee, executor, or guardian or you provide Investment advice).

·

Your interest as a general partner or manager/member

in Securities held by a general or limited partnership or limited liability company.

|

| |

· Your interest as a member of an Investment club or an organization that is formed for the purpose of investing in a pool of monies or Securities.

· Your ownership of Securities as a trustee of a trust in which either you or a Household or Family Member has a vested interest in the principal or income of the trust or your ownership of a vested interest in a trust.

· Securities owned by a corporation which is directly or indirectly controlled by, or under common control with, such person. |

| Bond |

A debt obligation issued by a corporation, government, or government agency that entails repayment of the principal amount of the obligation at a future date, usually with interest. |

| Certificate |

In Germany, a right or obligation issued by a bank where the payout profile or benefit of ownership depends upon or is tied to the performance of an agreed-upon underlying asset or security. |

| Certificate of Deposit (CD) |

An insured, interest-bearing deposit at a bank that requires the depositor to keep the money invested for a specified period. |

| Commercial Paper |

A promissory note issued by a large company in need of short-term financing. |

| Covered Account |

Any Vanguard Fund account, any brokerage account, and any other type of account that holds, or is capable of holding, Reportable Securities. |

| Covered Security |

Any Security (including through an IPO), but not

including any:

·

Direct Obligations of a Government;

·

Bankers' Acceptances, Certificates of Deposit (CD),

Commercial Paper, and High-Quality Short-Term Debt Instruments, including Repurchase Agreements;

·

Shares issued by Open-End Funds (although for European

subsidiaries, this is limited to UCITS schemes, a non-UCITS retail scheme, or another fund subject to supervision under the law of an

European Economic Area (EEA) state which is an index fund or which requires an equivalent level of risk spreading in their assets);

·

Life policies;

·

ETFs;

·

ETNs; or

·

Digital Currencies. |

| Debenture |

An unsecured debt obligation backed only by the general credit of the borrower. |

| Digital Currency |

A digital asset that: (1) serves solely as a store of value, a medium of exchange, or a unit of account; (2) is not issued or guaranteed by any jurisdiction, central bank, or public authority; (3) relies on algorithmic techniques to regulate the generation of new units of the digital asset; and (4) has transactions involving the digital asset recorded on a decentralized network or distributed ledger (e.g., blockchain). Common examples of a Digital Currency are Bitcoin and Ether. A Digital Currency is distinguishable from a Digital Security Token or a Digital Utility Token. |

| Digital Security Token |

Any digital asset that is not a Digital Currency or

Digital Utility Token. In general, a Digital Security Token may: (1) derive its value primarily from, or represent an interest in, a

separate asset or pool of assets; or (2) represent an interest in an enterprise or venture. A Digital Security Token may provide owners

or holders with voting rights, rights to distributions, or other rights associated with ownership. Digital Security |

| |

Tokens

are generally held for speculative investment purposes and not to provide holders with access to a particular network, product, or service.

Digital Security Tokens, like other investments, are generally not used as a medium of exchange.

Note, whether or not an asset is a Digital Security Token depends on specific facts and circumstances. Merely referring to an asset as a Digital Currency or Digital Utility Token does not prevent the asset from being a Digital Security Token. Furthermore, an asset may be a Digital Security Token even if it has some purported utility. Please contact Compliance if you have any questions regarding whether an asset is a Digital Security Token. |

| Digital Utility Token |

A digital asset that (1) provides access to a particular network, product, or service; (2) derives its value primarily from providing access to a particular network, product, or service; and (3) does not function as a Digital Currency or Digital Security Token. |

| Direct Obligation of a Government |

A debt that is backed by the full taxing power of any government. These Securities are generally considered to be of the very highest quality. |

| ETF or Exchange-Traded Fund |

An investment with characteristics of both mutual funds and individual stocks. Many ETFs track an index, a commodity, or a basket of assets. Unlike mutual funds, ETFs can be traded throughout the day. ETFs often have lower expense ratios but must be purchased and sold through a broker, which means you may incur commissions. |

| ETN or Exchange-Traded Note |

A senior, unsecured, unsubordinated debt Security issued by a financial institution, whose returns are based on the performance of an underlying index and backed only by the credit of the issuer. ETNs have a maturity date, but typically pay no periodic coupon interest and offer no principal protection. At maturity an ETN investor receives a cash payment linked to the performance of the corresponding index, less fees. |

| Futures / Futures Contract |

A contract to buy or sell specific amounts of a commodity or financial instrument (such as grain, a currency, including foreign currencies and Digital Currencies (e.g., Bitcoin), a Digital Security Token, or an index) for an agreed-upon price at a certain time in the future. Sometimes the arrangements in a contract prescribe that settlements are made through cash payments, rather than the delivery of physical goods or Securities; this is called Contract for Difference. |

| High-Quality Short-Term Debt Instrument |

An instrument that has a maturity at issuance of less than 366 days and is rated in one of the two highest ratings categories by a nationally recognized statistical rating organization, or an instrument that is unrated but determined by Vanguard to be of comparable quality. |

| Household or Family Member (U.S., Australia, Canada, China, Hong Kong, and Mexico) |

For the U.S., Australia, Canada, China, Hong Kong, and Mexico

regions, the term “Household or Family Member” includes:

a)

Your spouse or domestic partner (an unrelated adult

with whom you share your home and contribute to each other's support);

b)

Any child of yours or of your spouse or domestic partner,

provided that the child resides in the same household as or is financially dependent upon you; or

c)

Any other individual over whose accounts you have control

(e.g., agent authority (full or limited), trustee, power of attorney authority) and to whose financial support you materially contribute.

|

| |

For purposes of parts (a) and (b) of this definition, those

persons may not be deemed Household or Family Members under this policy if you demonstrate, to the satisfaction of the Compliance Department,

that you derive no economic benefit from, and exercise no control over, that person’s accounts. |

| Household or Family Member (Europe) |

For Europe crew members, the term “Household or Family Member” includes your spouse, domestic partner (an unrelated adult with whom you share your home and contribute to each other's support), and minor children, as well as relatives whether by blood, adoption, or marriage (e.g., children, grandchildren, siblings, parents, parents-in-law, stepchildren) residing in the same household for at least one year prior to the date of the personal transaction. |

| Initial Coin Offering (ICO) |

An initial offer or sale of Digital Currencies or Digital Security Tokens. Note, whether or not an offering is an ICO depends on specific facts and circumstances. Please contact Compliance before participating in an initial offering of a Digital Currency, Digital Security Token, or Digital Utility Token |

| Initial Public Offering (IPO) |

A corporation's first offering of common stock to the public. |

| Investment Contract |

Any contract, transaction, or scheme whereby a person invests money in a common enterprise and is led to expect profits solely from the efforts of the promoter or third party. |

| Investment Discretion |

The authority an individual may exercise, with respect to investment control or trading discretion, on another person's account (e.g., executor, trustee, power of attorney). |

| Non-Access Person |

Any person in a role that has not been designated as an Access Person role. |

| Note |

A financial security that generally has a longer term than a bill, but a shorter term than a Bond. However, the duration of a note can vary significantly and may not always fall neatly into this categorization. Notes are similar to Bonds in that they are sold at, above, or below face (par) value; make regular interest payments; and have a specified term until maturity. |

| Open-End Fund |

A mutual fund that has an unlimited number of shares available for purchase. |

| Option |

The right, but not the obligation, to buy (for a call option) or sell (for a put option) a specific amount of a given stock, commodity, currency, including foreign currencies and Digital Currencies (e.g., Bitcoin), index, or debt, at a specified price (the strike price) during a specified period or on one particular date. |

| Private Placement |

A Security that is not registered or required to be registered under applicable securities laws. Private Placements are generally sold to a relatively small number of select investors (as opposed to a public issue, in which Securities are made available for sale on the open market) in order to raise capital. Private Placements may include, among others, interests in hedge funds (including limited partnership interests) and shares of private companies. Investors in Private Placements are usually banks, mutual funds, insurance companies, pension funds, hedge funds, and high net worth individuals. Private Placements are typically held or maintained outside of Vanguard. |

| Related Security |

Any

Security or instrument that provides economic exposure to the same company or entity—provided, however, that equity instruments

will |

| |

generally not be considered related to fixed income instruments (other than convertible Bonds) and vice versa. For example, all of the following instruments would be related to the common Stock of Company X: Options, Futures, Rights, and Warrants on Company X common Stock; preferred Stock issued by Company X; and Bonds convertible into Company X common Stock. Similarly, different Bonds issued by Company X would be related to one another. |

| Reportable Security |

Any Covered Security, ETF, ETN, or Digital Security Token. |

| Repurchase Agreement |

An arrangement by which the seller of an asset agrees, at the time of the sale, to buy back the asset at a specific price and, typically, on a given date (normally the next day). |

| Right |

A Security giving stockholders entitlement to purchase new shares issued by the corporation issuer at a predetermined price (normally at a discount to the current market price) in proportion to the number of shares already owned. Rights are issued only for a short period of time, after which they expire. |

| Secondary Offering |

The sale of new or closely held shares by a company that has already made an Initial Public Offering. |

| Security |

Any Stock, Bond, money market instrument, Note, evidence of indebtedness, Debenture, Warrant, Option, Right, Investment Contract, ETF, ETN, Digital Currency that has been deemed to be a security by the US Securities and Exchange Commission, Certificate, or any other investment or interest commonly known as a Security. |

| SPAC (Special Purpose Acquisition Company) |

A shell company or company with no commercial operations that is formed strictly to raise capital through an Initial Public Offering (IPO) for the purpose of acquiring an existing company. |

| Spread Betting |

A way of trading that enables you to profit from movements in a wide range of markets from Securities to currencies, including foreign currencies and Digital Currencies, Digital Security Tokens, commodities, and interest rates. Spread betting allows you to trade on whether the price quoted for these financial instruments will go up or down. |

| Stock |

A Security that represents part ownership, or equity, in a corporation. Each share of stock is a proportional stake in the corporation's assets and profits, some of which could be paid out as dividends. |

| UCITS (Undertakings for the Collective Investment of Transferable Securities) |

A regulatory framework of the European Commission that creates a harmonized regime throughout Europe for the management and sale of mutual funds. UCITS funds can be registered in Europe and sold to investors worldwide using unified regulatory and investor protection requirements. |

| Vanguard Client |

The clients of VGI, or any of the International Subsidiaries, and investors in the Vanguard Funds, including the Vanguard Funds themselves. |

| Vanguard Fund |

Vanguard mutual funds, Vanguard managed funds, Vanguard UCITS funds, Vanguard ETFs, and any other accounts sponsored or managed by Vanguard. This includes, but is not limited to, separately managed accounts and collective trusts. |

| Warrant |

An entitlement to purchase a certain amount of common Stock at a set price (usually higher than the current price) during an extended period of time. Usually issued with a fixed-income security to enhance its marketability, a Warrant can be transferred, traded, or exercised by the holder. |

Policy Compliance

Questions regarding this policy may be submitted to Code_of_Ethics@vanguard.com.

Please be aware of and comply with any supplemental policies that

may apply to your role, department, or geographic region. Check with your manager for more information.

If you believe you may have breached this policy, you should immediately

report it to your manager, notify the policy contact for your region, and work with them to take swift corrective action. Alternatively,

you may report concerns regarding this policy via the Anonymous Reporting channel that Vanguard has arranged for your region. You are

expected to cooperate with any research or investigation into conduct regarding this policy.

The

Compliance Department is the owner of this policy. Any violations or potential violations of this policy may be investigated by the Compliance

Department, and if it is determined that there has been a violation, you may be subject to penalties and sanctions as described in the

Disciplinary Action Policy and, for crew and contingent workers