UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-04526 | |

|

Name of Registrant: |

Vanguard Quantitative Funds | |

|

Address of Registrant: |

P.O. Box 2600 | |

| Valley Forge, PA 19482 | ||

|

Name and address of agent for service: |

Heidi Stam, Esquire | |

| P.O. Box 876 | ||

| Valley Forge, PA 19482 | ||

|

Registrant’s telephone number, including area code: (610) 669-1000 | ||

|

Date of fiscal year end: September 30 |

||

|

Date of reporting period: October 1, 2012 – March 31, 2013 | ||

|

Item 1: Reports to Shareholders |

||

Semiannual Report | March 31, 2013

Vanguard Growth and Income Fund

> Vanguard Growth and Income Fund returned more than 10% for the six months

ended March 31, 2013.

> For the period, the fund edged ahead of its benchmark, the S&P 500 Index, but

was a step behind the average return of its large-capitalization core fund peers.

> Stock selection in energy, consumer discretionary, and materials boosted the

fund’s relative performance.

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisors’ Report. | 7 |

| Fund Profile. | 12 |

| Performance Summary. | 13 |

| Financial Statements. | 14 |

| About Your Fund’s Expenses. | 32 |

| Glossary. | 34 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the

risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Our cover photograph shows rigging on the HMSSurprise, a replica of an 18th-century Royal Navy frigate. It

was featured in the 2003 movie Master and Commander: The Far Side of the World, which was based on Patrick O’Brian’s sea

novels, set amid the Napoleonic Wars. Vanguard was named for another ship of that era, the HMSVanguard, which was the

flagship of British Admiral Horatio Nelson at the Battle of the Nile.

Your Fund’s Total Returns

| Six Months Ended March 31, 2013 | |

| Total | |

| Returns | |

| Vanguard Growth and Income Fund | |

| Investor Shares | 10.31% |

| Admiral™ Shares | 10.37 |

| S&P 500 Index | 10.19 |

| Large-Cap Core Funds Average | 10.57 |

| Large-Cap Core Funds Average: Derived from data provided by Lipper Inc. | |

| Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements. | |

| Your Fund’s Performance at a Glance | ||||

| September 30, 2012, Through March 31, 2013 | ||||

| Distributions Per Share | ||||

| Starting | Ending | Income | Capital | |

| Share Price | Share Price | Dividends | Gains | |

| Vanguard Growth and Income Fund | ||||

| Investor Shares | $30.73 | $33.50 | $0.359 | $0.000 |

| Admiral Shares | 50.18 | 54.70 | 0.617 | 0.000 |

Chairman’s Letter

Dear Shareholder,

As the six-month period progressed, investor anxieties about corporate profits, the fiscal deficit, and fresh troubles in Europe gave way to greater optimism about the strength of the U.S. economy, especially with regard to the labor and housing markets. Vanguard Growth and Income Fund finished the half year ended March 31, 2013, with a return of a little more than 10%. The fund outpaced its benchmark, the Standard & Poor’s 500 Index, but lagged the average return of its large-cap core fund peers.

The fund’s gains were broad-based. Returns from seven out of ten market sectors topped 10%, with financials and health care leading the way. Stock selection, notably in energy, consumer discretionary, and materials, boosted the fund’s performance relative to its benchmark.

Global equity markets delivered a powerful rally

Global stocks advanced for the fifth straight month to finish the half year ended March 31 with impressive gains. The Standard & Poor’s 500 Index closed at a record high on the period’s final business day after global financial markets in recent months shrugged off the U.S. “fiscal cliff” crisis, the unsettled Italian national elections, and a controversial bailout package for Cyprus.

2

Peter Westaway, Vanguard’s chief European economist, said that the latest developments in Europe had been “rather bad,” but that the market had for the most part already priced in these events. “As always,” he said, “we think investors should assess their portfolios carefully and avoid making impulsive moves.”

U.S. equities returned more than 11% as the economic recovery slowly built momentum, the housing market rebounded further, and the labor market improved. International equities were up more than 9%. Returns were about 16% in the Pacific region, where Japan’s

accommodative monetary policy has helped spark the nation’s stock market, and nearly 10% in Europe. Emerging markets stocks rose about 4%.

Bond returns barely budged as yields lingered near lows

The broad U.S. taxable bond market scraped out a minuscule gain of 0.09% for the half year as U.S. Treasury yields remained just slightly above their all-time lows. Although the yield of the benchmark 10-year Treasury note increased during the six months and topped 2.00% at various times, it closed the period at about 1.85%. (Bond prices and yields move in opposite directions.)

| Market Barometer | |||

| Total Returns | |||

| Periods Ended March 31, 2013 | |||

| Six | One | Five Years | |

| Months | Year | (Annualized) | |

| Stocks | |||

| Russell 1000 Index (Large-caps) | 11.10% | 14.43% | 6.15% |

| Russell 2000 Index (Small-caps) | 14.48 | 16.30 | 8.24 |

| Russell 3000 Index (Broad U.S. market) | 11.35 | 14.56 | 6.32 |

| MSCI All Country World Index ex USA (International) | 9.20 | 8.36 | -0.39 |

| Bonds | |||

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | 0.09% | 3.77% | 5.47% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 0.96 | 5.25 | 6.10 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.05 | 0.08 | 0.30 |

| CPI | |||

| Consumer Price Index | 0.59% | 1.47% | 1.74% |

3

Municipal bonds returned almost 1% for the six months despite price declines in March. And returns of money market funds and savings accounts barely registered as short-term interest rates remained between 0% and 0.25%, under the Federal Reserve’s four-year-old policy.

Robert Auwaerter, head of Vanguard’s Fixed Income Group, doesn’t anticipate abrupt policy changes from the central bank. “We don’t see the Fed changing course in the near term,” he said, “and when the Fed does, we expect it’ll go slowly so as not to undo the efforts made to keep interest rates low and to stimulate the economy.”

Good stock selection added to a strong stock market upturn

Each of the three advisors to Vanguard Growth and Income Fund uses its own quantitative approach to stock selection, but they all have the same aim of delivering a higher return than that of the S&P 500 Index without taking on significantly more risk. For the six-month period, many large-cap market sectors reported strong gains, which were largely captured by the fund. Financials stood out, rising about 18% for the index and a little less for the fund because of significant cost-cutting measures through layoffs and branch closures, a pickup in lending

| Expense Ratios | |||

| Your Fund Compared With Its Peer Group | |||

| Investor | Admiral | Peer Group | |

| Shares | Shares | Average | |

| Growth and Income Fund | 0.36% | 0.25% | 1.15% |

The fund expense ratios shown are from the prospectus dated January 28, 2013, and represent estimated costs for the current fiscal year. For the six months ended March 31, 2013, the fund’s annualized expense ratios were 0.36% for Investor Shares and 0.25% for Admiral Shares. The peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2012.

Peer group: Large-Cap Core Funds.

4

activity, and greater investor appetite for stocks more sensitive to the economic cycle.

Health care was another strong performer, gaining about 16% for the index and a little more for the fund. Investor sentiment toward this sector improved as patent losses peaked in 2012, competition from generics weakened, and product pipelines looked more promising. The business outlook brightened also, as falling unemployment led to higher expected demand and the number of insured was set to rise.

At the other end of the spectrum was information technology. Lackluster corporate profits and a struggling PC market contributed to a slightly negative return for the sector in both the index and the fund.

Although most sector returns for the fund were more or less in line with those of the benchmark, the fund was ahead for the period thanks to strong stock selection in a few areas. In the energy sector, the fund’s advisors found value among oil refiners. Margins in this business traditionally tend to be quite low, but recent expansion in domestic oil production gave inland refiners a cost advantage that translated into higher profits. In materials, a tilt toward chemical stocks and away from mining stocks enhanced performance. So, too, did consumer discretionary holdings focused on hotels, household goods, consumer services, and retailers.

More information about the advisors’ management of the fund can be found in the Advisors’ Report that follows this letter.

Low cost and talent drive successful active management

Investors sometimes ask whether it’s a contradiction that Vanguard, a champion of index investing, offers actively managed mutual funds. To understand how active funds fit into our philosophy, consider for a moment why indexing has proved its mettle: It’s a generally low-cost, tax-efficient way to build a diversified portfolio that lets you keep more of your fund’s returns. Because index funds seek to track the overall market or a segment of it, they typically cost much less to run than funds that are actively managed in an effort to outperform the market. And the less you pay for a fund, the more of its returns come back to you.

The same principle—low cost—drives our approach to active funds. The other essential ingredient is talent. Some wonder how we can afford to hire top active managers when we place such importance on keeping investing costs low. The answer lies in five key characteristics of Vanguard’s structure and culture—our mutual ownership, our large scale, performance incentives aligned with investors’ interests, a long-term perspective, and a rigorous oversight process, which I lead. (You can read more about our approach in The Case for Vanguard Active Management: Solving the Low-Cost/Top-Talent Paradox? at vanguard.com/research.)

5

These enduring advantages don’t guarantee outperformance, of course. Even in those cases when an active stock fund outperforms over long periods, it doesn’t necessarily mean that investors earn more than the index results every year—or even every decade. And investors have no way of knowing beforehand which funds will outperform.

But for those willing to accept the greater risks that come with active investing, we believe Vanguard’s combination of talented advisors and low costs can improve the odds.

As always, thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

April 12, 2013

6

Advisors’ Report

Vanguard Growth and Income Fund’s Investor Shares returned 10.31% for the six months ended March 31. The Admiral Shares returned 10.37%. The S&P 500 Index returned 10.19%, and the average return of large-cap core funds was 10.57%.

Your fund is managed by three independent advisors, a strategy that enhances the fund’s diversification by providing exposure to distinct, yet complementary, investment approaches. It is not uncommon for different advisors to have different views about individual securities or the broader investment environment.

The advisors, the percentage of fund assets each manages, and brief descriptions of their investment strategies are presented in the table below. The advisors have also prepared a discussion of the investment environment that existed during the fiscal half year and of how the portfolio’s positioning reflects this assessment. (Please note that Los Angeles Capital’s discussion refers to industry sectors as defined by Russell classifications, rather than by the Global Industry Classification Standard used elsewhere in this report.) These comments were prepared on April 18, 2013.

| Vanguard Growth and Income Fund Investment Advisors | |||

| Fund Assets Managed | |||

| Investment Advisor | % | $ Million | Investment Strategy |

| Los Angeles Capital | 32 | 1,529 | Employs a quantitative model that emphasizes stocks |

| with characteristics investors are currently seeking and | |||

| underweights stocks with characteristics investors are | |||

| currently avoiding. The portfolio’s sector weights, size, | |||

| and style characteristics may differ modestly from the | |||

| benchmark in a risk-controlled manner. | |||

| Vanguard Equity Investment | 32 | 1,528 | Employs a quantitative, fundamental management |

| Group | approach, using models that assess valuation, growth | ||

| prospects, management decisions, market sentiment, | |||

| and earnings quality of companies versus their peers. | |||

| D. E. Shaw Investment | 32 | 1,523 | Employs quantitative models that seek to capture |

| Management, L.L.C. | predominantly “bottom up” stock-specific return | ||

| opportunities while aiming to keep the portfolio’s | |||

| sector weights, size, and style characteristics similar to | |||

| the benchmark. | |||

| Cash Investments | 4 | 125 | These short-term reserves are invested by Vanguard in |

| equity index products to simulate investments in | |||

| stocks. Each advisor also may maintain a modest cash | |||

| position. | |||

7

D. E. Shaw Investment

Management, L.L.C.

Portfolio Manager:

Anne Dinning, Ph.D., Managing Director and

Chief Investment Officer

The primary themes driving equity market valuations for the period were national elections in the United States and Japan, macroeconomic developments in emerging markets and the United States (including the “fiscal cliff” negotiations), and the European debt crisis. The U.S. Federal Reserve maintained its expansionary policy, and, significantly, the first quarter of 2013 saw the Bank of Japan unveil an even larger quantitative easing program (as a percentage of GDP). Negative economic news from Brazil, China, and India raised investor fears about slowing growth and rising inflation in emerging markets.

Corporate profits were strong in the United States, but overwhelmingly negative earnings guidance raised concerns about their sustainability. The fourth quarter of 2012 was notable for a lack of headlines from Europe, but the inconclusive results of the Italian national election and the banking crisis in Cyprus rekindled investor fears about the stability of the Eurozone in 2013.

The portfolio’s relative performance was strong during the fourth quarter of 2012 but weakened in the subsequent quarter. We attribute these results to three major sources: bottom-up stock selection; common risk factors such as value, growth, and capitalization; and sector and industry group exposures.

Stock selection was the primary detractor from the portfolio’s relative return during the period. Overweight positions in Apple and Occidental Petroleum and an underweight position in Citigroup were the top three single-stock laggards. The three leaders were overweight positions in Marathon Petroleum, Visa, and American International Group.

Our management of common risk factors made an overall positive contribution to relative performance. The biggest boosts came from modest tilts toward high-momentum and small-capitalization stocks, although higher-volatility stocks detracted. Sector and industry exposures helped slightly.

Despite the recent turmoil caused by the banking crisis in Cyprus, correlations among individual stocks and short-term volatility in U.S. equity markets remain low. All else being equal, low correlations generally increase the potential for diversified bottom-up stock selection strategies to outperform. The Federal Reserve’s quantitative easing program, strong corporate profits, and signs of improvements in the U.S. housing market helped the Dow Jones Industrial Average close at an all-time high in early March; the S&P 500 Index approached that milestone later in the month. Disappointing U.S. economic growth, renewed concerns about Europe’s debt crisis, and changes in the Fed’s monetary policy constitute clear risks in the current environment.

8

Los Angeles Capital

Portfolio Managers:

Thomas D. Stevens, CFA,

Chairman and Principal

Hal W. Reynolds, CFA,

Chief Investment Officer and Principal

The S&P 500 Index generated strong first-quarter returns (+10.6%) for a second consecutive calendar year. Driving results was a falling equity risk premium as market risk (as measured by the Chicago Board Options Exchange Market Volatility Index) fell 29% to its lowest level in five years. Although economic data remain weak, continued monetary stimulus, the housing recovery, and low real interest rates have led investors back into U.S. equities with the best positive flows since the financial crisis unfolded in 2008.

Despite sentiment that financial risks in the United States have subsided as a result of the aggressive monetary actions taken by the Federal Reserve, the risks of lower growth rates and higher inflation rates remain. Analysts expect U.S. revenue and profit growth to be relatively flat on a year-over-year basis. The Bank of Japan’s recent announcement that it plans to double the size of its balance sheet indicates that major central banks worldwide now believe it is necessary to fight deflation and stimulate real growth through aggressive monetary actions. As we know from experience, aggressive actions, while good for asset prices over the short term, increase the risks of unwanted levels of inflation, significantly raising discount rates and lowering asset values. Although strong equity returns

suggest a “risk on” environment, a closer look reveals that investors remain cautious and are cognizant of these risks.

With the exception of technology and basic materials, two economically sensitive sectors that lagged, sector returns were remarkably similar. Transportation, consumer staples, and utilities were the top value performers, and health care and biotechnology led in the growth category. Investors continued to prefer higher-quality companies with favorable earnings yields and the ability to increase their return on equity by borrowing at low interest rates. Interestingly, after strong returns in January, companies with volatile stock prices and favorable book-to-price ratios underperformed for the remainder of the quarter, another indication of investor caution.

Over the past six months, the portfolio outperformed the S&P 500 Index by maintaining a bias toward higher-quality companies with above-average earnings yields and higher-quality earnings. Its higher dividend-yielding holdings detracted as investors began to look more broadly at earnings growth and less at payout ratios.

Reduced concerns about financial risks as well as the deteriorating financial situation in Europe caused U.S. investors to move away from the cash-rich mega-cap companies that derive a significant portion of their profits from overseas operations and look instead to domestically focused mid-caps. Prospects for ongoing low interest rates combined with high-quality earnings and peak profit margins continue to make leverage attractive. An analysis of

9

the companies with the highest alphas (or risk-adjusted returns) shows that they are most highly correlated with both higher leverage and their appraisal factor, which measures a company’s break-up value relative to its market capitalization. Our largest overweight positions currently are in finance, consumer cyclicals, and capital goods, and our most underweight position is in technology.

Vanguard Equity Investment Group

Portfolio Managers:

James D. Troyer, CFA, Principal

James P. Stetler, Principal

Michael R. Roach, CFA

For the six months ended March 31, 2013, equities in general experienced above-average returns. The large-cap stocks in the fund’s benchmark, the S&P 500 Index (+10.19%), slightly underperformed the broader market (Russell 3000 Index, +11.35%). Globally, developed markets both in the United States and abroad, were the place to be, with returns of more than 11%; emerging markets were up less than 4%. Gains in the benchmark index were broad-based. Nine out of ten sectors generated positive returns; financials, health care, and industrials did best. Information technology was the sole negative performer.

Returns for the past two quarters differed greatly. For the fourth quarter of 2012, the benchmark index was down 0.38% as investors digested the election results and Hurricane Sandy and contemplated the potential repercussions of the looming

“fiscal cliff.” Fortunately, Congress and the president finally reached an agreement early in the new year, averting tax hikes that would likely have put the anemic recovery at risk. Investor fears seemed to abate and new money entered the U.S. equity market, helping to push large-cap stocks up 10.6% in the first quarter of 2013.

In the past six months, volatility in equity returns declined relative to most of 2012, when it was driven in large part by macroeconomic events, including lackluster global economic growth, European and U.S. central bank actions, and the concern about a fiscal cliff. Although the United States is not without its problems, we expect its modest economic recovery to continue. Corporate balance sheets remain strong, there is ample liquidity in the economy, housing data continue to improve, and unemployment statistics are moving in the right direction, although at a snail’s pace.

The recent market fluctuations have reinforced our conviction that attempting to time investments is not profitable. Our aim, instead, is to identify individual stocks with characteristics that will help them outperform over the long run.

We select them by using a model with five components: valuation, growth, management decisions, market sentiment, and quality. We then construct our portfolio using a risk-control process that neutralizes our exposure to market capitalization, volatility, and industry risks relative to our benchmark. In our view, such exposures are not justified by the potential rewards they offer.

10

Our stock selection model’s results were encouraging over the last six months as four of our five components made positive contributions. Our quality measure was the strongest performer, while growth was relatively neutral.

The model’s effectiveness across sectors was mixed. Our stock selection was positive in five of the benchmark index’s ten sectors, with the strongest results in energy and consumer discretionary. Results were neutral in three sectors, and we underperformed in consumer staples and financials.

At the individual stock level, the largest contributions came from overweight positions in Marathon Petroleum, Phillips 66, and H&R Block. Relative to the benchmark index, we benefited from underweighting or avoiding poorly performing stocks such as Apple and Caterpillar.

Unfortunately, we were not able to avoid all laggards. Overweight positions in CF Industries, Advanced Micro Devices, and Yahoo detracted. And our underweighting of companies including Gilead Sciences and Ford Motor hurt our performance relative to the benchmark.

11

Growth and Income Fund

Fund Profile

As of March 31, 2013

| Share-Class Characteristics | ||

| Investor | Admiral | |

| Shares | Shares | |

| Ticker Symbol | VQNPX | VGIAX |

| Expense Ratio1 | 0.36% | 0.25% |

| 30-Day SEC Yield | 1.77% | 1.88% |

| Portfolio Characteristics | |||

| DJ U.S. | |||

| Total | |||

| Market | |||

| S&P 500 | FA | ||

| Fund | Index | Index | |

| Number of Stocks | 765 | 500 | 3,586 |

| Median Market Cap | $59.4B | $58.7B | $40.0B |

| Price/Earnings Ratio | 16.4x | 17.0x | 18.1x |

| Price/Book Ratio | 2.3x | 2.3x | 2.3x |

| Return on Equity | 17.0% | 18.1% | 16.6% |

| Earnings Growth Rate | 9.9% | 9.6% | 9.6% |

| Dividend Yield | 2.2% | 2.1% | 2.0% |

| Foreign Holdings | 0.1% | 0.0% | 0.0% |

| Turnover Rate | |||

| (Annualized) | 106% | — | — |

| Short-Term Reserves | 0.3% | — | — |

| Sector Diversification (% of equity exposure) | |||

| DJ U.S. | |||

| Total | |||

| Market | |||

| S&P 500 | FA | ||

| Fund | Index | Index | |

| Consumer Discretionary | 12.5% | 11.6% | 12.4% |

| Consumer Staples | 10.0 | 11.0 | 9.5 |

| Energy | 10.5 | 10.9 | 10.1 |

| Financials | 17.3 | 15.9 | 17.3 |

| Health Care | 12.4 | 12.6 | 12.2 |

| Industrials | 11.1 | 10.1 | 11.1 |

| Information Technology | 16.5 | 18.0 | 17.4 |

| Materials | 4.1 | 3.4 | 3.8 |

| Telecommunication | |||

| Services | 3.0 | 3.0 | 2.6 |

| Utilities | 2.6 | 3.5 | 3.6 |

| Volatility Measures | ||

| DJ U.S. | ||

| Total | ||

| Market | ||

| S&P 500 | FA | |

| Index | Index | |

| R-Squared | 0.99 | 0.99 |

| Beta | 1.00 | 0.96 |

| These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months. | ||

| Ten Largest Holdings (% of total net assets) | ||

| Exxon Mobil Corp. | Integrated Oil & Gas | 3.0% |

| Apple Inc. | Computer Hardware | 2.6 |

| General Electric Co. | Industrial | |

| Conglomerates | 2.5 | |

| Pfizer Inc. | Pharmaceuticals | 1.8 |

| Chevron Corp. | Integrated Oil & Gas | 1.7 |

| Philip Morris | ||

| International Inc. | Tobacco | 1.7 |

| Procter & Gamble Co. | Household Products | 1.7 |

| Wells Fargo & Co. | Diversified Banks | 1.6 |

| AT&T Inc. | Integrated | |

| Telecommunication | ||

| Services | 1.6 | |

| International Business | IT Consulting & | |

| Machines Corp. | Other Services | 1.6 |

| Top Ten | 19.8% | |

| The holdings listed exclude any temporary cash investments and equity index products. | ||

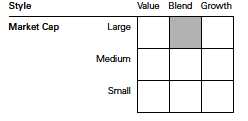

Investment Focus

1 The expense ratios shown are from the prospectus dated January 28, 2013, and represent estimated costs for the current fiscal year. For

the six months ended March 31, 2013, the annualized expense ratios were 0.36% for Investor Shares and 0.25% for Admiral Shares.

12

Growth and Income Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

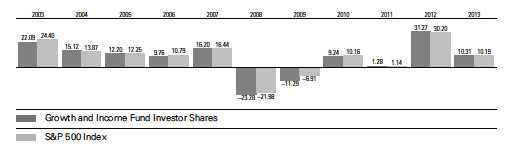

Fiscal-Year Total Returns (%): September 30, 2002, Through March 31, 2013

| Average Annual Total Returns: Periods Ended March 31, 2013 | ||||

| Inception | One | Five | Ten | |

| Date | Year | Years | Years | |

| Investor Shares | 12/10/1986 | 14.18% | 4.94% | 7.88% |

| Admiral Shares | 5/14/2001 | 14.28 | 5.07 | 8.03 |

See Financial Highlights for dividend and capital gains information.

13

Growth and Income Fund

Financial Statements (unaudited)

Statement of Net Assets

As of March 31, 2013

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Common Stocks (97.1%)1 | |||

| Consumer Discretionary (12.1%) | |||

| Home Depot Inc. | 628,392 | 43,849 | |

| Comcast Corp. Class A | 987,905 | 41,502 | |

| * | Amazon.com Inc. | 102,056 | 27,197 |

| Wyndham Worldwide | |||

| Corp. | 397,040 | 25,601 | |

| * | DIRECTV | 432,507 | 24,484 |

| News Corp. Class A | 739,656 | 22,574 | |

| Time Warner Cable Inc. | 228,600 | 21,959 | |

| Time Warner Inc. | 372,205 | 21,446 | |

| TJX Cos. Inc. | 420,770 | 19,671 | |

| Ford Motor Co. | 1,233,165 | 16,216 | |

| Walt Disney Co. | 265,075 | 15,056 | |

| McDonald’s Corp. | 144,284 | 14,384 | |

| * | Goodyear Tire & | ||

| Rubber Co. | 1,135,253 | 14,316 | |

| * | priceline.com Inc. | 19,700 | 13,552 |

| Viacom Inc. Class B | 208,195 | 12,819 | |

| Lowe’s Cos. Inc. | 334,150 | 12,671 | |

| Cablevision Systems | |||

| Corp. Class A | 832,224 | 12,450 | |

| Newell Rubbermaid Inc. | 451,350 | 11,780 | |

| Starbucks Corp. | 193,950 | 11,047 | |

| * | O’Reilly Automotive Inc. | 106,000 | 10,870 |

| * | PulteGroup Inc. | 497,950 | 10,079 |

| Macy’s Inc. | 235,380 | 9,848 | |

| Gap Inc. | 268,100 | 9,491 | |

| Whirlpool Corp. | 76,600 | 9,074 | |

| Mattel Inc. | 187,389 | 8,206 | |

| * | NVR Inc. | 6,200 | 6,697 |

| NIKE Inc. Class B | 107,600 | 6,349 | |

| Carnival Corp. | 172,070 | 5,902 | |

| H&R Block Inc. | 194,200 | 5,713 | |

| Wynn Resorts Ltd. | 44,215 | 5,534 | |

| Omnicom Group Inc. | 92,450 | 5,445 | |

| Expedia Inc. | 90,540 | 5,433 | |

| Target Corp. | 75,870 | 5,193 | |

| Marriott International Inc. | |||

| Class A | 121,720 | 5,140 | |

| * | TripAdvisor Inc. | 97,600 | 5,126 |

| Gannett Co. Inc. | 222,400 | 4,864 | |

| Darden Restaurants Inc. | 89,430 | 4,622 | |

| Washington Post Co. | |||

| Class B | 10,100 | 4,515 | |

| * | Apollo Group Inc. Class A | 201,160 | 3,498 |

| * | Discovery Communications | ||

| Inc. Class A | 40,710 | 3,205 | |

| Starwood Hotels & Resorts | |||

| Worldwide Inc. | 48,620 | 3,099 | |

| Yum! Brands Inc. | 42,860 | 3,083 | |

| * | Bed Bath & Beyond Inc. | 44,371 | 2,858 |

| Scripps Networks | |||

| Interactive Inc. Class A | 43,400 | 2,792 | |

| Interpublic Group of | |||

| Cos. Inc. | 198,015 | 2,580 | |

| Lennar Corp. Class A | 61,320 | 2,544 | |

| * | Fossil Inc. | 25,400 | 2,454 |

| Nordstrom Inc. | 40,930 | 2,261 | |

| * | Charter Communications | ||

| Inc. Class A | 20,000 | 2,084 | |

| VF Corp. | 11,670 | 1,958 | |

| L Brands Inc. | 42,500 | 1,898 | |

| D.R. Horton Inc. | 76,340 | 1,855 | |

| Harman International | |||

| Industries Inc. | 40,042 | 1,787 | |

| PVH Corp. | 16,012 | 1,710 | |

| Delphi Automotive plc | 38,450 | 1,707 | |

| * | Discovery | ||

| Communications Inc. | 24,500 | 1,704 | |

| GameStop Corp. Class A | 54,060 | 1,512 | |

| Domino’s Pizza Inc. | 22,900 | 1,178 | |

| Hasbro Inc. | 25,537 | 1,122 | |

| * | Fifth & Pacific Cos. Inc. | 58,300 | 1,101 |

| * | Orbitz Worldwide Inc. | 187,800 | 1,072 |

| PetSmart Inc. | 16,410 | 1,019 | |

| * | Liberty Media Corp. | 8,100 | 904 |

| Family Dollar Stores Inc. | 12,700 | 750 |

14

Growth and Income Fund

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Harley-Davidson Inc. | 10,800 | 576 | |

| * | Christopher & Banks Corp. | 77,985 | 501 |

| Ameristar Casinos Inc. | 18,300 | 480 | |

| * | Liberty Global Inc. Class A | 6,500 | 477 |

| Service Corp. International | 27,600 | 462 | |

| Hillenbrand Inc. | 18,000 | 455 | |

| * | Sally Beauty Holdings Inc. | 13,600 | 400 |

| * | Beazer Homes USA Inc. | 23,900 | 379 |

| Lear Corp. | 5,900 | 324 | |

| ^ | Blyth Inc. | 17,800 | 309 |

| Leggett & Platt Inc. | 9,140 | 309 | |

| * | Live Nation Entertainment | ||

| Inc. | 22,100 | 273 | |

| * | Ascent Capital Group Inc. | ||

| Class A | 3,600 | 268 | |

| * | Starz - Liberty Capital | 10,900 | 241 |

| Coach Inc. | 3,790 | 189 | |

| * | Dollar Tree Inc. | 2,700 | 131 |

| * | Biglari Holdings Inc. | 343 | 128 |

| * | Carmike Cinemas Inc. | 6,300 | 114 |

| Churchill Downs Inc. | 1,400 | 98 | |

| * | Body Central Corp. | 9,800 | 92 |

| Sears Canada Inc. | 9,422 | 91 | |

| Movado Group Inc. | 2,400 | 80 | |

| *,^ | Boyd Gaming Corp. | 9,200 | 76 |

| * | American Apparel Inc. | 33,497 | 73 |

| * | Media General Inc. | ||

| Class A | 11,900 | 71 | |

| * | ITT Educational Services | ||

| Inc. | 5,000 | 69 | |

| * | Corinthian Colleges Inc. | 31,500 | 66 |

| Universal Technical | |||

| Institute Inc. | 5,200 | 66 | |

| * | New York & Co. Inc. | 15,823 | 65 |

| * | Unifi Inc. | 3,100 | 59 |

| Harte-Hanks Inc. | 7,043 | 55 | |

| * | Liberty Ventures Class A | 600 | 45 |

| * | Pandora Media Inc. | 3,100 | 44 |

| Hooker Furniture Corp. | 2,484 | 40 | |

| Ambassadors Group Inc. | 5,104 | 22 | |

| * | Build-A-Bear | ||

| Workshop Inc. | 3,780 | 20 | |

| * | Isle of Capri Casinos Inc. | 3,200 | 20 |

| Signet Jewelers Ltd. | 300 | 20 | |

| * | Cumulus Media Inc. | ||

| Class A | 5,900 | 20 | |

| * | Lee Enterprises Inc. | 14,075 | 18 |

| * | hhgregg Inc. | 1,400 | 15 |

| * | Zale Corp. | 3,394 | 13 |

| GNC Holdings Inc. | |||

| Class A | 300 | 12 | |

| International Game | |||

| Technology | 709 | 12 | |

| AH Belo Corp. Class A | 1,900 | 11 | |

| * | Career Education Corp. | 4,216 | 10 |

| * | Tuesday Morning Corp. | 1,100 | 9 |

| * | Valuevision Media Inc. | ||

| Class A | 2,463 | 9 | |

| Sirius XM Radio Inc. | 2,400 | 7 | |

| Six Flags Entertainment | |||

| Corp. | 100 | 7 | |

| * | Exide Technologies | 2,220 | 6 |

| * | Pacific Sunwear of | ||

| California Inc. | 2,500 | 5 | |

| * | Education Management | ||

| Corp. | 1,300 | 5 | |

| * | Furniture Brands | ||

| International Inc. | 4,200 | 4 | |

| * | Sears Hometown and | ||

| Outlet Stores Inc. | 100 | 4 | |

| * | Reading International Inc. | ||

| Class A | 700 | 4 | |

| * | Express Inc. | 200 | 4 |

| Lincoln Educational | |||

| Services Corp. | 600 | 4 | |

| * | MTR Gaming Group Inc. | 500 | 2 |

| * | School Specialty Inc. | 7,119 | 1 |

| 569,780 | |||

| Consumer Staples (9.6%) | |||

| Philip Morris International | |||

| Inc. | 841,489 | 78,014 | |

| Procter & Gamble Co. | 1,010,372 | 77,859 | |

| PepsiCo Inc. | 606,531 | 47,983 | |

| Wal-Mart Stores Inc. | 527,539 | 39,476 | |

| Coca-Cola Co. | 672,434 | 27,193 | |

| Costco Wholesale Corp. | 218,930 | 23,231 | |

| Kraft Foods Group Inc. | 426,935 | 22,000 | |

| Altria Group Inc. | 483,368 | 16,623 | |

| CVS Caremark Corp. | 299,740 | 16,483 | |

| * | Dean Foods Co. | 627,120 | 11,370 |

| Kroger Co. | 316,222 | 10,480 | |

| JM Smucker Co. | 89,900 | 8,914 | |

| Reynolds American Inc. | 197,372 | 8,781 | |

| Hershey Co. | 89,338 | 7,820 | |

| Walgreen Co. | 140,400 | 6,694 | |

| Kimberly-Clark Corp. | 65,441 | 6,412 | |

| ConAgra Foods Inc. | 177,400 | 6,353 | |

| Mondelez International | |||

| Inc. Class A | 200,974 | 6,152 | |

| Colgate-Palmolive Co. | 44,548 | 5,258 | |

| Dr Pepper Snapple Group | |||

| Inc. | 87,591 | 4,112 | |

| Estee Lauder Cos. Inc. | |||

| Class A | 61,200 | 3,919 | |

| General Mills Inc. | 59,710 | 2,944 | |

| Sysco Corp. | 69,949 | 2,460 | |

| HJ Heinz Co. | 33,800 | 2,443 | |

| Avon Products Inc. | 110,400 | 2,289 | |

| Tyson Foods Inc. Class A | 79,300 | 1,968 | |

| Clorox Co. | 19,010 | 1,683 | |

15

Growth and Income Fund

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Kellogg Co. | 21,320 | 1,374 | |

| * | Monster Beverage Corp. | 15,610 | 745 |

| Molson Coors Brewing Co. | |||

| Class B | 15,200 | 744 | |

| Beam Inc. | 10,377 | 659 | |

| Lorillard Inc. | 14,927 | 602 | |

| Coca-Cola Enterprises Inc. | 2,800 | 103 | |

| * | Crimson Wine Group Ltd. | 6,540 | 61 |

| Cott Corp. | 2,280 | 23 | |

| * | Rite Aid Corp. | 4,900 | 9 |

| * | Synutra International Inc. | 800 | 4 |

| 453,238 | |||

| Energy (10.2%) | |||

| Exxon Mobil Corp. | 1,551,804 | 139,833 | |

| Chevron Corp. | 690,025 | 81,989 | |

| ConocoPhillips | 421,534 | 25,334 | |

| Anadarko Petroleum Corp. | 278,575 | 24,361 | |

| Occidental Petroleum Corp. | 309,535 | 24,258 | |

| Marathon Petroleum Corp. | 264,200 | 23,672 | |

| Schlumberger Ltd. | 294,989 | 22,092 | |

| Phillips 66 | 297,977 | 20,849 | |

| Ensco plc Class A | 240,335 | 14,420 | |

| EOG Resources Inc. | 97,350 | 12,468 | |

| Valero Energy Corp. | 258,800 | 11,773 | |

| Spectra Energy Corp. | 247,140 | 7,600 | |

| * | WPX Energy Inc. | 463,570 | 7,426 |

| Tesoro Corp. | 115,906 | 6,786 | |

| Williams Cos. Inc. | 156,890 | 5,877 | |

| Marathon Oil Corp. | 170,700 | 5,756 | |

| Noble Energy Inc. | 47,600 | 5,505 | |

| Halliburton Co. | 133,200 | 5,383 | |

| Kinder Morgan Inc. | 100,430 | 3,885 | |

| Murphy Oil Corp. | 58,200 | 3,709 | |

| * | Southwestern Energy Co. | 95,450 | 3,556 |

| National Oilwell Varco Inc. | 42,224 | 2,987 | |

| Helmerich & Payne Inc. | 46,300 | 2,810 | |

| EQT Corp. | 38,650 | 2,619 | |

| Devon Energy Corp. | 40,181 | 2,267 | |

| Peabody Energy Corp. | 100,600 | 2,128 | |

| Cabot Oil & Gas Corp. | 28,160 | 1,904 | |

| * | Newfield Exploration Co. | 69,500 | 1,558 |

| CONSOL Energy Inc. | 45,320 | 1,525 | |

| QEP Resources Inc. | 34,380 | 1,095 | |

| Apache Corp. | 14,110 | 1,089 | |

| * | Denbury Resources Inc. | 55,095 | 1,028 |

| * | Hercules Offshore Inc. | 71,100 | 528 |

| * | SemGroup Corp. Class A | 10,100 | 522 |

| * | Renewable Energy | ||

| Group Inc. | 30,200 | 232 | |

| * | TETRA Technologies Inc. | 12,700 | 130 |

| Range Resources Corp. | 1,500 | 122 | |

| * | Lone Pine Resources Inc. | 74,348 | 89 |

| * | Overseas Shipholding | ||

| Group Inc. | 26,800 | 88 | |

| * | Endeavour International | ||

| Corp. | 24,900 | 73 | |

| * | Forest Oil Corp. | 13,300 | 70 |

| * | Cal Dive International Inc. | 29,700 | 53 |

| * | Harvest Natural | ||

| Resources Inc. | 10,500 | 37 | |

| Tsakos Energy | |||

| Navigation Ltd. | 8,061 | 35 | |

| DHT Holdings Inc. | 7,000 | 33 | |

| * | Hyperdynamics Corp. | 36,100 | 22 |

| * | Oil States International Inc. | 200 | 16 |

| * | SandRidge Energy Inc. | 2,000 | 11 |

| * | Quicksilver Resources Inc. | 4,300 | 10 |

| * | Willbros Group Inc. | 800 | 8 |

| W&T Offshore Inc. | 548 | 8 | |

| * | Uranium Resources Inc. | 2,970 | 8 |

| * | Halcon Resources Corp. | 700 | 5 |

| *,^ | GMX Resources Inc. | 2,300 | 5 |

| * | C&J Energy Services Inc. | 200 | 5 |

| * | EPL Oil & Gas Inc. | 100 | 3 |

| * | Scorpio Tankers Inc. | 300 | 3 |

| * | Midstates Petroleum | ||

| Co. Inc. | 282 | 2 | |

| * | ZaZa Energy Corp. | 364 | 1 |

| 479,661 | |||

| Exchange-Traded Fund (0.3%) | |||

| SPDR S&P 500 ETF Trust | 74,800 | 11,710 | |

| Financials (16.6%) | |||

| Wells Fargo & Co. | 2,096,017 | 77,532 | |

| JPMorgan Chase & Co. | 1,499,831 | 71,182 | |

| * | American International | ||

| Group Inc. | 1,361,956 | 52,871 | |

| Bank of America Corp. | 3,960,300 | 48,236 | |

| Citigroup Inc. | 882,293 | 39,033 | |

| US Bancorp | 1,136,274 | 38,554 | |

| * | Berkshire Hathaway Inc. | ||

| Class B | 357,695 | 37,272 | |

| Goldman Sachs Group Inc. | 157,030 | 23,107 | |

| State Street Corp. | 354,071 | 20,922 | |

| Simon Property Group Inc. | 116,931 | 18,541 | |

| SLM Corp. | 856,376 | 17,539 | |

| Discover Financial | |||

| Services | 384,450 | 17,239 | |

| Equity Residential | 281,339 | 15,491 | |

| Fifth Third Bancorp | 894,020 | 14,581 | |

| Aflac Inc. | 277,570 | 14,439 | |

| Marsh & McLennan | |||

| Cos. Inc. | 378,366 | 14,367 | |

| Aon plc | 221,610 | 13,629 | |

| American Express Co. | 200,437 | 13,521 | |

| Allstate Corp. | 266,140 | 13,059 | |

| HCP Inc. | 215,799 | 10,760 | |

| Ventas Inc. | 134,570 | 9,851 | |

16

Growth and Income Fund

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Bank of New York | |||

| Mellon Corp. | 329,829 | 9,232 | |

| Travelers Cos. Inc. | 109,016 | 9,178 | |

| Morgan Stanley | 399,560 | 8,782 | |

| American Tower | |||

| Corporation | 103,115 | 7,932 | |

| Loews Corp. | 179,065 | 7,891 | |

| Health Care REIT Inc. | 107,080 | 7,272 | |

| Prologis Inc. | 181,680 | 7,264 | |

| Kimco Realty Corp. | 316,630 | 7,092 | |

| Torchmark Corp. | 114,560 | 6,851 | |

| * | IntercontinentalExchange | ||

| Inc. | 40,430 | 6,593 | |

| Ameriprise Financial Inc. | 87,144 | 6,418 | |

| Invesco Ltd. | 218,258 | 6,321 | |

| Progressive Corp. | 229,403 | 5,797 | |

| Weyerhaeuser Co. | 183,700 | 5,764 | |

| XL Group plc Class A | 164,910 | 4,997 | |

| Equity Lifestyle | |||

| Properties Inc. | 57,300 | 4,401 | |

| Assurant Inc. | 96,400 | 4,339 | |

| Capital One Financial | |||

| Corp. | 76,778 | 4,219 | |

| * | E*TRADE Financial | ||

| Corp. | 388,240 | 4,158 | |

| Plum Creek Timber | |||

| Co. Inc. | 78,386 | 4,092 | |

| Chubb Corp. | 44,009 | 3,852 | |

| Unum Group | 133,392 | 3,768 | |

| Lincoln National Corp. | 114,500 | 3,734 | |

| AvalonBay | |||

| Communities Inc. | 28,891 | 3,660 | |

| Public Storage | 23,683 | 3,607 | |

| First Horizon National | |||

| Corp. | 296,160 | 3,163 | |

| PNC Financial Services | |||

| Group Inc. | 44,739 | 2,975 | |

| BB&T Corp. | 93,920 | 2,948 | |

| CME Group Inc. | 47,300 | 2,904 | |

| MetLife Inc. | 73,580 | 2,797 | |

| ACE Ltd. | 29,392 | 2,615 | |

| Boston Properties Inc. | 25,580 | 2,585 | |

| People’s United | |||

| Financial Inc. | 178,492 | 2,399 | |

| Prudential Financial Inc. | 34,900 | 2,059 | |

| Northern Trust Corp. | 37,682 | 2,056 | |

| * | Genworth Financial Inc. | ||

| Class A | 199,749 | 1,997 | |

| ^ | Granite REIT | 47,800 | 1,825 |

| SunTrust Banks Inc. | 62,190 | 1,792 | |

| M&T Bank Corp. | 16,959 | 1,749 | |

| Vornado Realty Trust | 18,320 | 1,532 | |

| Cincinnati Financial Corp. | 26,650 | 1,258 | |

| Apartment Investment & | |||

| Management Co. Class A | 40,886 | 1,254 |

| Erie Indemnity Co. Class A | 15,399 | 1,163 | |

| Franklin Resources Inc. | 7,200 | 1,086 | |

| NYSE Euronext | 27,500 | 1,063 | |

| KeyCorp | 103,280 | 1,029 | |

| Principal Financial | |||

| Group Inc. | 26,150 | 890 | |

| Old Republic | |||

| International Corp. | 68,350 | 869 | |

| * | Flagstar Bancorp Inc. | 53,800 | 749 |

| McGraw-Hill Cos. Inc. | 14,283 | 744 | |

| Leucadia National Corp. | 24,800 | 680 | |

| * | CIT Group Inc. | 14,900 | 648 |

| * | Ocwen Financial Corp. | 13,000 | 493 |

| Oriental Financial | |||

| Group Inc. | 29,900 | 464 | |

| Hudson City Bancorp Inc. | 51,800 | 448 | |

| Hartford Financial | |||

| Services Group Inc. | 16,960 | 438 | |

| Huntington | |||

| Bancshares Inc. | 53,200 | 393 | |

| Charles Schwab Corp. | 18,410 | 326 | |

| * | NewStar Financial Inc. | 23,000 | 304 |

| Regency Centers Corp. | 5,300 | 280 | |

| Healthcare Trust of | |||

| America Inc. Class A | 21,300 | 250 | |

| * | Popular Inc. | 8,900 | 246 |

| First Industrial Realty | |||

| Trust Inc. | 13,600 | 233 | |

| * | Central Pacific Financial | ||

| Corp. | 14,100 | 221 | |

| BlackRock Inc. | 850 | 218 | |

| * | Alleghany Corp. | 500 | 198 |

| Newcastle Investment | |||

| Corp. | 16,900 | 189 | |

| Columbia Banking | |||

| System Inc. | 8,500 | 187 | |

| Apollo Residential | |||

| Mortgage Inc. | 8,200 | 183 | |

| White Mountains | |||

| Insurance Group Ltd. | 300 | 170 | |

| PacWest Bancorp | 4,300 | 125 | |

| American Assets | |||

| Trust Inc. | 3,497 | 112 | |

| * | Knight Capital Group Inc. | ||

| Class A | 28,400 | 106 | |

| Symetra Financial Corp. | 7,600 | 102 | |

| * | First BanCorp | 14,836 | 92 |

| Geo Group Inc. | 2,100 | 79 | |

| Parkway Properties Inc. | 4,195 | 78 | |

| * | United Community | ||

| Banks Inc. | 6,800 | 77 | |

| Summit Hotel | |||

| Properties Inc. | 7,184 | 75 | |

| Retail Properties of | |||

| America Inc. | 5,000 | 74 |

17

Growth and Income Fund

| Market | ||||

| Value | ||||

| Shares | ($000) | |||

| T. Rowe Price Group Inc. | 960 | 72 | ||

| Sterling Financial Corp. | 2,880 | 62 | ||

| ProAssurance Corp. | 1,262 | 60 | ||

| * | ZAIS Financial Corp. | 2,100 | 43 | |

| * | Southwest Bancorp Inc. | 3,342 | 42 | |

| * | Hilltop Holdings Inc. | 2,600 | 35 | |

| * | FelCor Lodging Trust Inc. | 5,603 | 33 | |

| CyrusOne Inc. | 1,406 | 32 | ||

| Medley Capital Corp. | 1,700 | 27 | ||

| Rouse Properties Inc. | 1,200 | 22 | ||

| Western Asset Mortgage | ||||

| Capital Corp. | 800 | 19 | ||

| PrivateBancorp Inc. | 700 | 13 | ||

| Silver Bay Realty Trust Corp. | 600 | 12 | ||

| Hospitality Properties Trust | 400 | 11 | ||

| * | FBR & Co. | 515 | 10 | |

| RLJ Lodging Trust | 400 | 9 | ||

| * | Cowen Group Inc. Class A | 2,900 | 8 | |

| Terreno Realty Corp. | 436 | 8 | ||

| United Fire Group Inc. | 300 | 8 | ||

| Cohen & Steers Inc. | 200 | 7 | ||

| * | Altisource Portfolio | |||

| Solutions SA | 100 | 7 | ||

| * | Phoenix Cos. Inc. | 226 | 7 | |

| Primerica Inc. | 200 | 7 | ||

| * | Ezcorp Inc. Class A | 300 | 6 | |

| Chatham Lodging Trust | 300 | 5 | ||

| Government Properties | ||||

| Income Trust | 200 | 5 | ||

| * | Doral Financial Corp. | 6,695 | 5 | |

| Piedmont Office Realty | ||||

| Trust Inc. Class A | 200 | 4 | ||

| CNO Financial Group Inc. | 300 | 3 | ||

| WhiteHorse Finance Inc. | 200 | 3 | ||

| * | Preferred Bank | 196 | 3 | |

| * | Global Indemnity plc | 100 | 2 | |

| * | Seacoast Banking Corp. | |||

| of Florida | 1,100 | 2 | ||

| * | Altisource Asset | |||

| Management Corp. | 10 | 1 | ||

| SI Financial Group Inc. | 100 | 1 | ||

| MidSouth Bancorp Inc. | 6 | — | ||

| 782,524 | ||||

| Health Care (12.1%) | ||||

| Pfizer Inc. | 2,973,819 | 85,824 | ||

| Johnson & Johnson | 853,456 | 69,582 | ||

| Merck & Co. Inc. | 1,230,796 | 54,438 | ||

| Amgen Inc. | 335,634 | 34,406 | ||

| AbbVie Inc. | 727,327 | 29,660 | ||

| Eli Lilly & Co. | 475,698 | 27,015 | ||

| UnitedHealth Group Inc. | 463,014 | 26,489 | ||

| Abbott Laboratories | 561,623 | 19,837 | ||

| * | Mylan Inc. | 534,410 | 15,466 | |

| Medtronic Inc. | 316,893 | 14,881 | ||

| Covidien plc | 191,500 | 12,991 | ||

| * | CareFusion Corp. | 319,300 | 11,172 |

| Cigna Corp. | 163,120 | 10,174 | |

| Allergan Inc. | 86,353 | 9,640 | |

| * | Express Scripts | ||

| Holding Co. | 167,170 | 9,637 | |

| Zimmer Holdings Inc. | 124,700 | 9,380 | |

| * | Biogen Idec Inc. | 40,359 | 7,786 |

| * | Gilead Sciences Inc. | 157,740 | 7,718 |

| McKesson Corp. | 68,510 | 7,396 | |

| Cardinal Health Inc. | 176,290 | 7,337 | |

| * | DaVita HealthCare | ||

| Partners Inc. | 59,700 | 7,080 | |

| AmerisourceBergen | |||

| Corp. Class A | 134,641 | 6,927 | |

| Becton Dickinson and Co. | 71,852 | 6,870 | |

| Bristol-Myers Squibb Co. | 164,432 | 6,773 | |

| * | Hospira Inc. | 199,775 | 6,559 |

| * | Edwards Lifesciences | ||

| Corp. | 75,200 | 6,178 | |

| Aetna Inc. | 115,466 | 5,903 | |

| * | Tenet Healthcare Corp. | 122,646 | 5,836 |

| Humana Inc. | 79,000 | 5,460 | |

| * | Celgene Corp. | 41,400 | 4,799 |

| * | Life Technologies Corp. | 73,100 | 4,724 |

| * | Alexion Pharmaceuticals | ||

| Inc. | 36,620 | 3,374 | |

| Baxter International Inc. | 43,237 | 3,141 | |

| * | Forest Laboratories Inc. | 71,897 | 2,735 |

| Quest Diagnostics Inc. | 39,779 | 2,246 | |

| Thermo Fisher | |||

| Scientific Inc. | 28,850 | 2,207 | |

| * | Boston Scientific Corp. | 223,250 | 1,744 |

| * | Actavis Inc. | 16,500 | 1,520 |

| PerkinElmer Inc. | 35,820 | 1,205 | |

| * | XenoPort Inc. | 102,401 | 732 |

| Teleflex Inc. | 8,600 | 727 | |

| * | Laboratory Corp. of | ||

| America Holdings | 7,000 | 631 | |

| Patterson Cos. Inc. | 16,490 | 627 | |

| Stryker Corp. | 9,033 | 589 | |

| * | Health Net Inc. | 20,500 | 587 |

| DENTSPLY International | |||

| Inc. | 12,880 | 546 | |

| * | Keryx Biopharmaceuticals | ||

| Inc. | 54,500 | 384 | |

| * | Sarepta Therapeutics Inc. | 10,300 | 381 |

| * | NuVasive Inc. | 15,829 | 337 |

| * | Arqule Inc. | 122,434 | 317 |

| * | Rigel Pharmaceuticals Inc. | 46,408 | 315 |

| * | Array BioPharma Inc. | 60,500 | 298 |

| * | Idenix Pharmaceuticals Inc. | 71,714 | 255 |

| * | Cell Therapeutics Inc. | 206,300 | 237 |

| * | Progenics | ||

| Pharmaceuticals Inc. | 40,900 | 220 | |

| * | Amicus Therapeutics Inc. | 64,600 | 205 |

18

Growth and Income Fund

| Market | |||

| Value | |||

| Shares | ($000) | ||

| * | Sirona Dental Systems Inc. | 2,601 | 192 |

| * | PharMerica Corp. | 13,118 | 184 |

| * | Auxilium | ||

| Pharmaceuticals Inc. | 9,100 | 157 | |

| * | Accretive Health Inc. | 15,200 | 154 |

| * | MedAssets Inc. | 7,800 | 150 |

| * | Sequenom Inc. | 32,610 | 135 |

| * | Oncothyreon Inc. | 63,500 | 132 |

| *,^ | Arena Pharmaceuticals Inc. | 14,700 | 121 |

| * | AVEO Pharmaceuticals Inc. | 15,400 | 113 |

| Pain Therapeutics Inc. | 31,833 | 109 | |

| St. Jude Medical Inc. | 2,400 | 97 | |

| * | Alnylam Pharmaceuticals | ||

| Inc. | 3,400 | 83 | |

| * | GTx Inc. | 18,900 | 78 |

| * | Accuray Inc. | 16,800 | 78 |

| * | Aegerion Pharmaceuticals | ||

| Inc. | 1,700 | 69 | |

| * | LCA-Vision Inc. | 20,300 | 68 |

| * | Orexigen Therapeutics Inc. | 10,100 | 63 |

| * | Medivation Inc. | 1,300 | 61 |

| * | Emergent Biosolutions Inc. | 4,186 | 59 |

| * | AMAG Pharmaceuticals Inc. | 2,300 | 55 |

| * | Theravance Inc. | 2,300 | 54 |

| Quality Systems Inc. | 2,536 | 46 | |

| * | BioDelivery Sciences | ||

| International Inc. | 8,989 | 38 | |

| Agilent Technologies Inc. | 890 | 37 | |

| * | Sunesis Pharmaceuticals | ||

| Inc. | 6,600 | 36 | |

| * | Albany Molecular | ||

| Research Inc. | 3,400 | 36 | |

| * | Bruker Corp. | 1,700 | 32 |

| * | Staar Surgical Co. | 5,347 | 30 |

| * | Nordion Inc. | 4,263 | 28 |

| * | Furiex Pharmaceuticals Inc. | 736 | 28 |

| * | Cleveland Biolabs Inc. | 12,300 | 24 |

| * | Momenta Pharmaceuticals | ||

| Inc. | 1,800 | 24 | |

| * | Nektar Therapeutics | 2,179 | 24 |

| * | Allscripts Healthcare | ||

| Solutions Inc. | 1,700 | 23 | |

| * | TranS1 Inc. | 10,180 | 23 |

| * | Halozyme Therapeutics Inc. | 3,600 | 21 |

| * | Celsion Corp. | 19,300 | 20 |

| *,^ | Neuralstem Inc. | 17,669 | 20 |

| * | Nymox Pharmaceutical | ||

| Corp. | 2,800 | 15 | |

| Computer Programs & | |||

| Systems Inc. | 268 | 15 | |

| * | Vivus Inc. | 1,300 | 14 |

| * | Hansen Medical Inc. | 7,000 | 14 |

| * | StemCells Inc. | 6,698 | 12 |

| * | Insmed Inc. | 1,500 | 11 |

| * | Synta Pharmaceuticals | ||

| Corp. | 1,025 | 9 | |

| * | Threshold | ||

| Pharmaceuticals Inc. | 1,800 | 8 | |

| * | Five Star Quality Care Inc. | 1,200 | 8 |

| * | Ligand Pharmaceuticals | ||

| Inc. Class B | 300 | 8 | |

| * | Zalicus Inc. | 11,700 | 8 |

| * | ABIOMED Inc. | 300 | 6 |

| * | Providence Service Corp. | 300 | 6 |

| * | Pacific Biosciences of | ||

| California Inc. | 2,000 | 5 | |

| * | Biosante Pharmaceuticals | ||

| Inc. | 4,189 | 5 | |

| * | ACADIA Pharmaceuticals | ||

| Inc. | 500 | 4 | |

| * | Rockwell Medical | ||

| Technologies Inc. | 1,000 | 4 | |

| * | Merrimack | ||

| Pharmaceuticals Inc. | 500 | 3 | |

| * | Cutera Inc. | 200 | 3 |

| * | Alimera Sciences Inc. | 400 | 1 |

| * | Ventrus Biosciences Inc. | 400 | 1 |

| Myrexis Inc. | 1,550 | — | |

| 566,360 | |||

| Industrials (10.8%) | |||

| General Electric Co. | 5,039,350 | 116,510 | |

| Union Pacific Corp. | 227,635 | 32,417 | |

| Boeing Co. | 277,890 | 23,857 | |

| United Parcel Service | |||

| Inc. Class B | 276,927 | 23,788 | |

| Honeywell | |||

| International Inc. | 298,042 | 22,457 | |

| Ingersoll-Rand plc | 406,660 | 22,370 | |

| General Dynamics Corp. | 266,371 | 18,782 | |

| Raytheon Co. | 285,686 | 16,795 | |

| Emerson Electric Co. | 293,509 | 16,398 | |

| Northrop Grumman Corp. | 225,846 | 15,843 | |

| Tyco International Ltd. | 469,860 | 15,036 | |

| Danaher Corp. | 240,480 | 14,946 | |

| Illinois Tool Works Inc. | 231,620 | 14,115 | |

| Lockheed Martin Corp. | 126,152 | 12,176 | |

| ADT Corp. | 234,177 | 11,461 | |

| United Technologies Corp. | 104,110 | 9,727 | |

| Textron Inc. | 313,630 | 9,349 | |

| 3M Co. | 82,390 | 8,759 | |

| Republic Services Inc. | |||

| Class A | 208,220 | 6,871 | |

| Caterpillar Inc. | 75,511 | 6,567 | |

| Dun & Bradstreet Corp. | 77,645 | 6,495 | |

| Ryder System Inc. | 102,430 | 6,120 | |

| Southwest Airlines Co. | 437,151 | 5,893 | |

| L-3 Communications | |||

| Holdings Inc. | 71,045 | 5,749 | |

| Iron Mountain Inc. | 148,550 | 5,394 | |

19

Growth and Income Fund

| Market | |||

| Value | |||

| Shares | ($000) | ||

| CSX Corp. | 192,318 | 4,737 | |

| Pentair Ltd. | 86,300 | 4,552 | |

| Deere & Co. | 51,070 | 4,391 | |

| Cintas Corp. | 89,920 | 3,968 | |

| Xylem Inc. | 134,500 | 3,707 | |

| Precision Castparts Corp. | 19,327 | 3,665 | |

| Waste Management Inc. | 79,900 | 3,133 | |

| ^ | Pitney Bowes Inc. | 210,090 | 3,122 |

| Roper Industries Inc. | 23,030 | 2,932 | |

| C.H. Robinson | |||

| Worldwide Inc. | 45,920 | 2,730 | |

| Equifax Inc. | 47,080 | 2,711 | |

| Masco Corp. | 117,840 | 2,386 | |

| FedEx Corp. | 22,660 | 2,225 | |

| Expeditors International | |||

| of Washington Inc. | 47,000 | 1,678 | |

| * | Stericycle Inc. | 15,130 | 1,607 |

| Rockwell Collins Inc. | 19,740 | 1,246 | |

| Snap-on Inc. | 13,680 | 1,131 | |

| * | Verisk Analytics Inc. | ||

| Class A | 18,100 | 1,116 | |

| Joy Global Inc. | 18,500 | 1,101 | |

| Flowserve Corp. | 5,740 | 963 | |

| Rockwell Automation Inc. | 9,633 | 832 | |

| Parker Hannifin Corp. | 8,620 | 789 | |

| Babcock & Wilcox Co. | 26,900 | 764 | |

| * | EnerNOC Inc. | 33,600 | 584 |

| Pall Corp. | 7,980 | 546 | |

| Stanley Black & Decker Inc. | 5,300 | 429 | |

| * | Jacobs Engineering | ||

| Group Inc. | 7,223 | 406 | |

| * | Engility Holdings Inc. | 14,297 | 343 |

| * | AerCap Holdings NV | 21,600 | 334 |

| Cummins Inc. | 2,620 | 303 | |

| Covanta Holding Corp. | 13,100 | 264 | |

| * | Spirit Aerosystems | ||

| Holdings Inc. Class A | 12,900 | 245 | |

| Dover Corp. | 3,100 | 226 | |

| Fluor Corp. | 3,400 | 226 | |

| Albany International Corp. | 7,800 | 225 | |

| Huntington Ingalls | |||

| Industries Inc. | 3,600 | 192 | |

| * | Acacia Research Corp. | 4,700 | 142 |

| HEICO Corp. | 3,208 | 139 | |

| * | Nortek Inc. | 1,800 | 128 |

| * | Old Dominion Freight | ||

| Line Inc. | 3,300 | 126 | |

| Sauer-Danfoss Inc. | 2,045 | 119 | |

| * | Colfax Corp. | 2,500 | 116 |

| Nielsen Holdings NV | 2,800 | 100 | |

| * | Fuel Tech Inc. | 19,600 | 85 |

| * | Sensata Technologies | ||

| Holding NV | 1,918 | 63 | |

| * | FuelCell Energy Inc. | 62,218 | 59 |

| * | Swift Transportation Co. | 4,100 | 58 |

| * | Republic Airways | ||

| Holdings Inc. | 3,300 | 38 | |

| * | Federal Signal Corp. | 4,400 | 36 |

| Towers Watson & Co. | |||

| Class A | 500 | 35 | |

| Brink’s Co. | 1,200 | 34 | |

| * | Xerium Technologies Inc. | 4,427 | 24 |

| * | Pendrell Corp. | 13,200 | 22 |

| * | CRA International Inc. | 900 | 20 |

| Chicago Bridge & Iron | |||

| Co. NV | 300 | 19 | |

| * | Cenveo Inc. | 8,655 | 19 |

| * | Genco Shipping & | ||

| Trading Ltd. | 5,600 | 16 | |

| Tennant Co. | 300 | 15 | |

| * | Star Bulk Carriers Corp. | 1,809 | 13 |

| * | Casella Waste Systems | ||

| Inc. Class A | 2,633 | 12 | |

| * | ARC Document | ||

| Solutions Inc. | 3,710 | 11 | |

| * | Odyssey Marine | ||

| Exploration Inc. | 2,958 | 10 | |

| * | Greenbrier Cos. Inc. | 400 | 9 |

| Aircastle Ltd. | 500 | 7 | |

| * | EnergySolutions Inc. | 1,500 | 6 |

| * | USG Corp. | 200 | 5 |

| * | Spirit Airlines Inc. | 200 | 5 |

| * | Quality Distribution Inc. | 600 | 5 |

| Harsco Corp. | 200 | 5 | |

| * | Tecumseh Products Co. | ||

| Class A | 568 | 5 | |

| * | NCI Building Systems Inc. | 200 | 3 |

| * | CPI Aerostructures Inc. | 300 | 3 |

| 509,196 | |||

| Information Technology (16.0%) | |||

| Apple Inc. | 273,863 | 121,220 | |

| International Business | |||

| Machines Corp. | 358,394 | 76,445 | |

| Microsoft Corp. | 2,429,208 | 69,500 | |

| Oracle Corp. | 1,526,655 | 49,372 | |

| * | Google Inc. Class A | 60,646 | 48,155 |

| Cisco Systems Inc. | 2,018,537 | 42,208 | |

| Visa Inc. Class A | 192,347 | 32,668 | |

| Mastercard Inc. Class A | 53,594 | 29,001 | |

| QUALCOMM Inc. | 306,996 | 20,553 | |

| Accenture plc Class A | 270,450 | 20,546 | |

| Texas Instruments Inc. | 413,652 | 14,676 | |

| Fidelity National | |||

| Information Services Inc. | 367,220 | 14,549 | |

| Hewlett-Packard Co. | 597,860 | 14,253 | |

| * | Symantec Corp. | 575,600 | 14,206 |

| Intel Corp. | 616,479 | 13,470 | |

| Motorola Solutions Inc. | 202,200 | 12,947 | |

| * | eBay Inc. | 218,356 | 11,839 |

| * | LSI Corp. | 1,655,720 | 11,226 |

20

Growth and Income Fund

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Western Digital Corp. | 215,805 | 10,851 | |

| Seagate Technology plc | 262,860 | 9,610 | |

| Total System | |||

| Services Inc. | 372,500 | 9,231 | |

| * | Facebook Inc. Class A | 310,585 | 7,945 |

| * | Yahoo! Inc. | 279,495 | 6,576 |

| * | BMC Software Inc. | 125,560 | 5,817 |

| * | Juniper Networks Inc. | 299,000 | 5,543 |

| * | EMC Corp. | 224,300 | 5,358 |

| Intuit Inc. | 76,890 | 5,048 | |

| * | Autodesk Inc. | 118,000 | 4,866 |

| Computer Sciences Corp. | 92,800 | 4,569 | |

| Harris Corp. | 90,670 | 4,202 | |

| * | VeriSign Inc. | 88,553 | 4,187 |

| Automatic Data | |||

| Processing Inc. | 59,970 | 3,899 | |

| * | F5 Networks Inc. | 41,988 | 3,740 |

| CA Inc. | 145,586 | 3,664 | |

| * | Zebra Technologies Corp. | 72,200 | 3,403 |

| * | Citrix Systems Inc. | 44,520 | 3,213 |

| * | LinkedIn Corp. Class A | 16,600 | 2,923 |

| * | Cognizant Technology | ||

| Solutions Corp. Class A | 35,000 | 2,681 | |

| * | First Solar Inc. | 95,960 | 2,587 |

| AOL Inc. | 67,100 | 2,583 | |

| Analog Devices Inc. | 48,698 | 2,264 | |

| * | NetApp Inc. | 61,200 | 2,091 |

| * | Salesforce.com Inc. | 10,239 | 1,831 |

| * | JDS Uniphase Corp. | 129,440 | 1,731 |

| Paychex Inc. | 42,870 | 1,503 | |

| * | Red Hat Inc. | 26,500 | 1,340 |

| * | Fiserv Inc. | 15,200 | 1,335 |

| * | Advanced Micro | ||

| Devices Inc. | 419,186 | 1,069 | |

| Linear Technology Corp. | 27,101 | 1,040 | |

| TE Connectivity Ltd. | 21,962 | 921 | |

| * | NCR Corp. | 32,400 | 893 |

| Altera Corp. | 23,300 | 826 | |

| * | CoreLogic Inc. | 29,420 | 761 |

| * | SanDisk Corp. | 13,300 | 731 |

| * | Electronic Arts Inc. | 19,100 | 338 |

| * | PMC - Sierra Inc. | 48,100 | 327 |

| * | Sonus Networks Inc. | 122,300 | 317 |

| Tessera Technologies Inc. | 13,391 | 251 | |

| * | Agilysys Inc. | 21,400 | 213 |

| * | Silicon Image Inc. | 34,593 | 168 |

| * | Aspen Technology Inc. | 4,600 | 148 |

| * | FleetCor Technologies Inc. | 1,600 | 123 |

| * | Vocus Inc. | 8,104 | 115 |

| FLIR Systems Inc. | 4,000 | 104 | |

| Broadridge Financial | |||

| Solutions Inc. | 3,900 | 97 | |

| * | STEC Inc. | 20,585 | 91 |

| * | Integrated Device | ||

| Technology Inc. | 9,500 | 71 |

| Marvell Technology | |||

| Group Ltd. | 6,700 | 71 | |

| * | Amkor Technology Inc. | 17,700 | 71 |

| * | SunPower Corp. Class A | 5,600 | 65 |

| * | MoneyGram | ||

| International Inc. | 3,400 | 61 | |

| * | Carbonite Inc. | 5,095 | 56 |

| * | ViaSat Inc. | 936 | 45 |

| * | Seachange | ||

| International Inc. | 3,300 | 39 | |

| * | Quantum Corp. | 29,000 | 37 |

| * | Entropic | ||

| Communications Inc. | 8,589 | 35 | |

| * | Novatel Wireless Inc. | 17,100 | 34 |

| * | Allot Communications Ltd. | 2,800 | 33 |

| * | Acxiom Corp. | 1,444 | 29 |

| * | Identive Group Inc. | 17,600 | 26 |

| * | InterXion Holding NV | 1,000 | 24 |

| * | Mattson Technology Inc. | 15,200 | 21 |

| Jack Henry & | |||

| Associates Inc. | 400 | 18 | |

| * | Immersion Corp. | 1,503 | 18 |

| * | NCI Inc. Class A | 3,244 | 16 |

| * | Checkpoint Systems Inc. | 1,200 | 16 |

| * | TeleCommunication | ||

| Systems Inc. Class A | 6,510 | 14 | |

| * | Aeroflex Holding Corp. | 1,624 | 13 |

| KLA-Tencor Corp. | 219 | 12 | |

| * | PLX Technology Inc. | 2,239 | 10 |

| * | MicroStrategy Inc. | ||

| Class A | 97 | 10 | |

| Maxim Integrated | |||

| Products Inc. | 300 | 10 | |

| * | Adobe Systems Inc. | 200 | 9 |

| * | MaxLinear Inc. | 1,108 | 7 |

| * | Riverbed Technology Inc. | 400 | 6 |

| Xerox Corp. | 563 | 5 | |

| * | UTStarcom Holdings Corp. | 1,453 | 4 |

| Micrel Inc. | 344 | 4 | |

| * | Constant Contact Inc. | 200 | 3 |

| * | IntraLinks Holdings Inc. | 400 | 3 |

| * | Calix Inc. | 300 | 2 |

| Digimarc Corp. | 100 | 2 | |

| * | Pulse Electronics Corp. | 5,401 | 2 |

| Black Box Corp. | 100 | 2 | |

| * | Amtech Systems Inc. | 500 | 2 |

| * | Dynamics Research Corp. | 300 | 2 |

| * | Smith Micro Software Inc. | 969 | 1 |

| * | FriendFinder Networks Inc. | 1,250 | 1 |

| * | Powerwave | ||

| Technologies Inc. | 15,776 | — | |

| 750,868 |

21

Growth and Income Fund

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Materials (4.0%) | |||

| Monsanto Co. | 333,870 | 35,267 | |

| LyondellBasell Industries | |||

| NV Class A | 298,640 | 18,901 | |

| EI du Pont de | |||

| Nemours & Co. | 353,980 | 17,402 | |

| CF Industries Holdings Inc. | 68,466 | 13,034 | |

| Ball Corp. | 257,536 | 12,254 | |

| Praxair Inc. | 100,995 | 11,265 | |

| PPG Industries Inc. | 79,869 | 10,698 | |

| Freeport-McMoRan | |||

| Copper & Gold Inc. | 292,243 | 9,673 | |

| Dow Chemical Co. | 261,063 | 8,312 | |

| Sherwin-Williams Co. | 44,240 | 7,472 | |

| Sealed Air Corp. | 297,530 | 7,173 | |

| Eastman Chemical Co. | 85,200 | 5,953 | |

| Vulcan Materials Co. | 90,880 | 4,698 | |

| ^ | United States Steel Corp. | 167,480 | 3,266 |

| Alcoa Inc. | 335,030 | 2,854 | |

| Ecolab Inc. | 32,400 | 2,598 | |

| Air Products & | |||

| Chemicals Inc. | 28,710 | 2,501 | |

| Newmont Mining Corp. | 49,400 | 2,069 | |

| Nucor Corp. | 43,120 | 1,990 | |

| Valspar Corp. | 27,268 | 1,697 | |

| International Flavors & | |||

| Fragrances Inc. | 22,043 | 1,690 | |

| MeadWestvaco Corp. | 41,793 | 1,517 | |

| Airgas Inc. | 11,740 | 1,164 | |

| Allegheny Technologies Inc. | 33,970 | 1,077 | |

| Sigma-Aldrich Corp. | 11,560 | 898 | |

| * | Resolute Forest Products | 32,000 | 518 |

| Mosaic Co. | 8,300 | 495 | |

| Rockwood Holdings Inc. | 6,412 | 420 | |

| * | Owens-Illinois Inc. | 15,629 | 416 |

| * | Mercer International Inc. | 50,341 | 348 |

| * | Flotek Industries Inc. | 16,400 | 268 |

| * | Clearwater Paper Corp. | 4,200 | 221 |

| Packaging Corp. of America | 3,900 | 175 | |

| FutureFuel Corp. | 8,800 | 107 | |

| * | Louisiana-Pacific Corp. | 4,000 | 86 |

| Silgan Holdings Inc. | 900 | 43 | |

| * | Boise Cascade Co. | 1,100 | 37 |

| Innospec Inc. | 700 | 31 | |

| Myers Industries Inc. | 1,600 | 22 | |

| * | Rare Element | ||

| Resources Ltd. | 7,172 | 16 | |

| * | GSE Holding Inc. | 1,768 | 15 |

| * | General Moly Inc. | 5,793 | 13 |

| Mesabi Trust | 470 | 11 | |

| PolyOne Corp. | 400 | 10 | |

| * | Ferro Corp. | 704 | 5 |

| 188,680 | |||

| Telecommunication Services (2.9%) | |||

| AT&T Inc. | 2,096,928 | 76,936 | |

| Verizon Communications | |||

| Inc. | 698,674 | 34,340 | |

| * | Sprint Nextel Corp. | 1,755,030 | 10,899 |

| CenturyLink Inc. | 286,510 | 10,065 | |

| * | Crown Castle | ||

| International Corp. | 33,890 | 2,360 | |

| * | MetroPCS | ||

| Communications Inc. | 121,900 | 1,329 | |

| Windstream Corp. | 72,700 | 578 | |

| * | Clearwire Corp. Class A | 36,600 | 118 |

| Neutral Tandem Inc. | 19,291 | 63 | |

| * | Leap Wireless | ||

| International Inc. | 8,500 | 50 | |

| Frontier Communications | |||

| Corp. | 5,303 | 21 | |

| * | Cincinnati Bell Inc. | 3,900 | 13 |

| 136,772 | |||

| Utilities (2.5%) | |||

| CMS Energy Corp. | 593,704 | 16,588 | |

| DTE Energy Co. | 212,600 | 14,529 | |

| Northeast Utilities | 302,600 | 13,151 | |

| PG&E Corp. | 289,500 | 12,891 | |

| Edison International | 229,700 | 11,559 | |

| American Electric Power | |||

| Co. Inc. | 210,630 | 10,243 | |

| NiSource Inc. | 183,900 | 5,396 | |

| Public Service Enterprise | |||

| Group Inc. | 153,909 | 5,285 | |

| Ameren Corp. | 148,470 | 5,199 | |

| Wisconsin Energy Corp. | 99,337 | 4,261 | |

| Pinnacle West Capital | |||

| Corp. | 64,700 | 3,746 | |

| Duke Energy Corp. | 41,470 | 3,010 | |

| NextEra Energy Inc. | 38,280 | 2,974 | |

| Southern Co. | 61,750 | 2,897 | |

| Dominion Resources Inc. | 36,864 | 2,145 | |

| PPL Corp. | 48,750 | 1,526 | |

| AES Corp. | 89,000 | 1,119 | |

| CenterPoint Energy Inc. | 35,990 | 862 | |

| Xcel Energy Inc. | 24,490 | 727 | |

| Consolidated Edison Inc. | 10,077 | 615 | |

| Pepco Holdings Inc. | 5,036 | 108 | |

| IDACORP Inc. | 1,800 | 87 | |

| MGE Energy Inc. | 1,212 | 67 | |

| NorthWestern Corp. | 1,200 | 48 | |

| Chesapeake Utilities Corp. | 267 | 13 | |

| * | Calpine Corp. | 600 | 12 |

| Southwest Gas Corp. | 169 | 8 | |

| El Paso Electric Co. | 199 | 7 | |

| 119,073 | |||

| Total Common Stocks | |||

| (Cost $3,834,835) | 4,567,862 | ||

22

Growth and Income Fund

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Temporary Cash Investments (3.2%)1 | |||

| Money Market Fund (3.1%) | |||

| 2,3 | Vanguard Market | ||

| Liquidity Fund, | |||

| 0.147% | 146,037,741 | 146,038 | |

| Face | |||

| Amount | |||

| ($000) | |||

| U.S. Government and Agency Obligations (0.1%) | |||

| 4,5 | Fannie Mae | ||

| Discount Notes, | |||

| 0.120%, 6/5/13 | 1,500 | 1,499 | |

| 5,6 | Federal Home Loan | ||

| Bank Discount Notes, | |||

| 0.085%, 4/19/13 | 5,000 | 5,000 | |

| 4,5 | Freddie Mac | ||

| Discount Notes, | |||

| 0.130%, 9/16/13 | 300 | 300 | |

| 6,799 | |||

| Total Temporary Cash Investments | |||

| (Cost $152,837) | 152,837 | ||

| Total Investments (100.3%) | |||

| (Cost $3,987,672) | 4,720,699 | ||

| Other Assets and Liabilities (-0.3%) | |||

| Other Assets | 50,973 | ||

| Liabilities3 | (66,600) | ||

| (15,627) | |||

| Net Assets (100%) | 4,705,072 | ||

| At March 31, 2013, net assets consisted of: | |

| Amount | |

| ($000) | |

| Paid-in Capital | 4,657,226 |

| Undistributed Net Investment Income | 5,560 |

| Accumulated Net Realized Losses | (692,466) |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 733,027 |

| Futures Contracts | 1,725 |

| Net Assets | 4,705,072 |

| Investor Shares—Net Assets | |

| Applicable to 86,305,392 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 2,890,875 |

| Net Asset Value Per Share— | |

| Investor Shares | $33.50 |

| Admiral Shares—Net Assets | |

| Applicable to 33,169,310 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 1,814,197 |

| Net Asset Value Per Share— | |

| Admiral Shares | $54.70 |

See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Part of security position is on loan to broker-dealers. The total value of securities on loan is $8,048,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures

investments, the fund’s effective common stock and temporary cash investment positions represent 99.8% and 0.5%, respectively, of net

assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the

7-day yield.

3 Includes $8,580,000 of collateral received for securities on loan.

4 The issuer was placed under federal conservatorship in September 2008; since that time, its daily operations have been managed by the

Federal Housing Finance Agency and it receives capital from the U.S. Treasury, as needed to maintain a positive net worth, in exchange for

senior preferred stock.

5 Securities with a value of $6,203,000 have been segregated as initial margin for open futures contracts.

6 The issuer operates under a congressional charter; its securities are generally neither guaranteed by the U.S. Treasury nor backed by the full

faith and credit of the U.S. government.

REIT—Real Estate Investment Trust.

See accompanying Notes, which are an integral part of the Financial Statements.

23

Growth and Income Fund

Statement of Operations

| Six Months Ended | |

| March 31, 2013 | |

| ($000) | |

| Investment Income | |

| Income | |

| Dividends1 | 53,599 |

| Interest2 | 98 |

| Security Lending | 155 |

| Total Income | 53,852 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 2,530 |

| Performance Adjustment | 180 |

| The Vanguard Group—Note C | |

| Management and Administrative—Investor Shares | 2,923 |

| Management and Administrative—Admiral Shares | 911 |

| Marketing and Distribution—Investor Shares | 217 |

| Marketing and Distribution—Admiral Shares | 115 |

| Custodian Fees | 115 |

| Shareholders’ Reports—Investor Shares | 42 |

| Shareholders’ Reports—Admiral Shares | 5 |

| Trustees’ Fees and Expenses | 8 |

| Total Expenses | 7,046 |

| Net Investment Income | 46,806 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold | 236,498 |

| Futures Contracts | 7,596 |

| Realized Net Gain (Loss) | 244,094 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | 146,956 |

| Futures Contracts | 2,739 |

| Change in Unrealized Appreciation (Depreciation) | 149,695 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 440,595 |

| 1 Dividends are net of foreign withholding taxes of $152,000. | |

| 2 Interest income from an affiliated company of the fund was $92,000. | |

See accompanying Notes, which are an integral part of the Financial Statements.

24

Growth and Income Fund

Statement of Changes in Net Assets

| Six Months Ended | Year Ended | |

| March 31, | September 30, | |

| 2013 | 2012 | |

| ($000) | ($000) | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net Investment Income | 46,806 | 81,914 |

| Realized Net Gain (Loss) | 244,094 | 463,150 |

| Change in Unrealized Appreciation (Depreciation) | 149,695 | 558,291 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 440,595 | 1,103,355 |

| Distributions | ||

| Net Investment Income | ||

| Investor Shares | (31,155) | (51,327) |

| Admiral Shares | (20,083) | (27,485) |

| Realized Capital Gain | ||

| Investor Shares | — | — |

| Admiral Shares | — | — |

| Total Distributions | (51,238) | (78,812) |

| Capital Share Transactions | ||

| Investor Shares | (145,396) | (437,673) |

| Admiral Shares | 72,231 | 122,956 |

| Net Increase (Decrease) from Capital Share Transactions | (73,165) | (314,717) |

| Total Increase (Decrease) | 316,192 | 709,826 |

| Net Assets | ||

| Beginning of Period | 4,388,880 | 3,679,054 |

| End of Period1 | 4,705,072 | 4,388,880 |

| 1 Net Assets—End of Period includes undistributed net investment income of $5,560,000 and $9,985,000. | ||

See accompanying Notes, which are an integral part of the Financial Statements.

25

Growth and Income Fund

Financial Highlights

| Investor Shares | |||||||

| Six Months | |||||||

| Ended | |||||||

| For a Share Outstanding | March 31, | Year Ended September 30, | |||||

| Throughout Each Period | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | |

| Net Asset Value, Beginning of Period | $30.73 | $23.86 | $23.98 | $22.34 | $25.84 | $38.62 | |

| Investment Operations | |||||||

| Net Investment Income | .328 | .549 | .482 | .418 | .447 | .546 | |

| Net Realized and Unrealized Gain (Loss) | |||||||

| on Investments | 2.801 | 6.846 | (.124) | 1.630 | (3.453) | (8.758) | |

| Total from Investment Operations | 3.129 | 7.395 | .358 | 2.048 | (3.006) | (8.212) | |

| Distributions | |||||||

| Dividends from Net Investment Income | (.359) | (.525) | (.478) | (.408) | (.494) | (.560) | |

| Distributions from Realized Capital Gains | — | — | — | — | — | (4.008) | |