UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒ |

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year Ended December 31, 2013

or

|

☐ |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from ________to________

Commission File No. 0-15057

P.A.M. TRANSPORTATION SERVICES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

71-0633135 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

297 West Henri De Tonti Blvd, Tontitown, Arkansas 72770

(Address of principal executive offices) (Zip Code)

(479) 361-9111

Registrant's telephone number, including area code

Securities registered pursuant to section 12(b) of the Act:

|

Title of each class |

Name of each exchange on which registered | |

|

Common Stock, $.01 par value |

NASDAQ Global Market |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes ☐ |

|

No ☑ |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

Yes ☐ |

|

No ☑ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes ☑ |

|

No ☐ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes ☑ |

|

No ☐ |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☑ |

||

|

Non-accelerated filer ☐ |

Smaller reporting company ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

|

Yes ☐ |

|

No ☑ |

The aggregate market value of the common stock of the registrant held by non-affiliates of the registrant computed by reference to the average of the closing bid and ask prices of the common stock as of the last business day of the registrant's most recently completed second quarter was $39,816,217. Solely for the purposes of this response, executive officers, directors and beneficial owners of more than five percent of the registrant’s common stock are considered the affiliates of the registrant at that date.

The number of shares outstanding of the registrant’s common stock, as of February 17, 2014: 7,984,589 shares of $.01 par value common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its Annual Meeting of Stockholders to be held on May 29, 2014, are incorporated by reference in answer to Part III of this report. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the Registrant’s fiscal year ended December 31, 2013.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) contains forward-looking statements, including statements about our operating and growth strategies, our expected financial position and operating results, industry trends, our capital expenditure and financing plans and similar matters. Such forward-looking statements are found throughout this Report, including under Item 1, Business, Item 1A, Risk Factors, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and Item 7A, Quantitative and Qualitative Disclosures About Market Risk. In those and other portions of this Report, the words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “project” and similar expressions, as they relate to us, our management, and our industry are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting our business. Actual results may differ materially. Some of the risks, uncertainties and assumptions that may cause actual results to differ from these forward-looking statements are described under the headings “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Quantitative and Qualitative Disclosures About Market Risk.”

All forward-looking statements attributable to us, or to persons acting on our behalf, are expressly qualified in their entirety by this cautionary statement.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this Report might not transpire.

P.A.M. TRANSPORTATION SERVICES, INC.

FORM 10-K

For the fiscal year ended December 31, 2013

TABLE OF CONTENTS

|

PART I |

Page | |

|

Item 1 |

Business |

1 |

|

Item 1A |

Risk Factors |

8 |

|

Item 1B |

Unresolved Staff Comments |

16 |

|

Item 2 |

Properties |

17 |

|

Item 3 |

Legal Proceedings |

17 |

|

Item 4 |

Mine Safety Disclosures |

18 |

|

PART II |

||

|

Item 5 |

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

18 |

|

Item 6 |

Selected Financial Data |

22 |

|

Item 7 |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

23 |

|

Item 7A |

Quantitative and Qualitative Disclosures About Market Risk |

36 |

|

Item 8 |

Financial Statements and Supplementary Data |

37 |

|

Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

67 |

|

Item 9A |

Controls and Procedures |

67 |

|

Item 9B |

Other Information |

69 |

|

PART III |

||

|

Item 10 |

Directors, Executive Officers and Corporate Governance |

69 |

|

Item 11 |

Executive Compensation |

69 |

|

Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

69 |

|

Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

70 |

|

Item 14 |

Principal Accounting Fees and Services |

70 |

|

PART IV |

||

|

Item 15 |

Exhibits, Financial Statement Schedules |

70 |

|

SIGNATURES |

73 | |

|

EXHIBIT INDEX |

74 |

PART I

Item 1. Business.

Unless the context otherwise requires, all references in this Annual Report on Form 10-K to “P.A.M.,” the “Company,” “we,” “our,” or “us” mean P.A.M. Transportation Services, Inc. and its subsidiaries.

We are a truckload dry van carrier transporting general commodities throughout the continental United States, as well as in certain Canadian provinces. We also provide transportation services in Mexico under agreements with Mexican carriers. Our freight consists primarily of automotive parts, expedited goods, consumer goods, such as general retail store merchandise, and manufactured goods, such as heating and air conditioning units.

P.A.M. Transportation Services, Inc. is a holding company incorporated under the laws of the State of Delaware in June 1986. We conduct operations through the following wholly owned subsidiaries: P.A.M. Transport, Inc., T.T.X., LLC, P.A.M. Cartage Carriers, LLC, Overdrive Leasing, LLC, P.A.M. Logistics Services, Inc., Choctaw Express, LLC, Choctaw Brokerage, Inc., Transcend Logistics, Inc., Decker Transport Co., LLC, East Coast Transport and Logistics, LLC, S & L Logistics, Inc., P.A.M. International, Inc. and P.A.M. Canada, Inc. Our operating authorities are held by P.A.M. Transport, Inc., P.A.M. Cartage Carriers, LLC, Choctaw Express, LLC, Choctaw Brokerage, Inc., T.T.X., LLC, Decker Transport Co., LLC, and East Coast Transport and Logistics, LLC. Effective on January 1, 2010, the operations of most of the Company’s operating subsidiaries were consolidated under the P.A.M. Transport, Inc. name in an effort to more clearly reflect the Company’s scope and available service offerings. Effective September 30, 2010, the Company sold the assets of East Coast Transport and Logistics, LLC which effectively closed the Company’s New Jersey based brokerage office.

We are headquartered and maintain our primary terminal and maintenance facilities and our corporate and administrative offices in Tontitown, Arkansas, which is located in northwest Arkansas, a major center for the trucking industry and where the support services (including warranty repair services) for most major truck and trailer equipment manufacturers are readily available.

In order to conform to industry practice, the Company began to classify payments to third-party owner operator drivers as purchased transportation rather than as salaries, wages and benefits as had been presented in reports prior to the period ended September 30, 2013. This reclassification has no effect on operating income, net income or earnings per share. The Company has made corresponding reclassifications to comparative periods shown.

Segment Financial Information

The Company's operations are all in the motor carrier segment and are aggregated into a single reporting segment in accordance with the aggregation criteria under Generally Accepted Accounting Principles (“GAAP”).

Operations

Our operations can generally be classified into truckload services or brokerage and logistics services. Truckload services include those transportation services in which we utilize company owned trucks or owner-operator owned trucks for the pickup and delivery of freight. The brokerage and logistics services consists of services such as transportation scheduling, routing, mode selection, transloading and other value added services related to the transportation of freight which may or may not involve the use of company owned or owner-operator owned equipment. Both our truckload operations and our brokerage and logistics operations have similar economic characteristics and are impacted by virtually the same economic factors as discussed elsewhere in this Report. Truckload services operating revenues, before fuel surcharges represented 92.6%, 91.8% and 93.5% of total operating revenues for the years ended December 31, 2013, 2012 and 2011, respectively. The remaining operating revenues, before fuel surcharge for the same periods were generated by brokerage and logistics services, representing 7.4%, 8.2%, and 6.5%, respectively.

Approximately 55% of the Company's revenues are derived from domestic shipments while approximately 45% of our revenues are derived from freight originating from or destined to locations in Mexico or Canada.

Business and Growth Strategy

Our strategy focuses on the following elements:

Providing a Full Suite of Complimentary Truckload Transportation Solutions. Our objective is to provide our customers with a comprehensive solution to their truckload transportation needs. Our asset-based service offerings consist of dedicated, expedited, regional, automotive, and long-haul truckload services with non-asset based supply chain management, logistics and brokerage solutions rounding out our service offerings. Our range of service offerings also include our complete range of asset-based and non-asset based services to Mexico and Canada.

Developing Customer Relationships within High Density Traffic Lanes. We strive to maximize utilization and increase revenue per truck while minimizing our time and empty miles between loads. In this regard, we seek to provide equipment to our customers in defined regions and disciplined traffic lanes. This strategy enables us to:

| · |

maintain more consistent equipment capacity; | |

| · |

provide a high level of service to our customers, including time-sensitive delivery schedules; | |

| · |

attract and retain drivers; and | |

| · |

maintain a sound safety record as drivers travel familiar routes. | |

Providing Superior and Flexible Customer Service. Our wide range of services includes expedited services, dedicated fleet services, logistics services, time-definite delivery, two-person driving teams, cross-docking and consolidation programs, specialized trailers, international services to Mexico and Canada, and Internet-based customer access to delivery status. These services allow us to quickly and reliably respond to the diverse needs of our customers, and provide an advantage in securing new business.

Many of our customers depend on us to make delivery on a time-definite basis, meaning that parts or raw materials are scheduled for delivery as they are needed on a manufacturer’s production line. The need for this service is a product of modern manufacturing and assembly methods that are designed to decrease inventory levels and handling costs. Such requirements place a premium on the freight carrier’s delivery performance and reliability.

Employing Stringent Cost Controls. Throughout our organization, emphasis is placed on gaining efficiency in our processes with the primary goals of decreasing costs and improving customer satisfaction. Maintaining a high level of efficiency and prioritizing our focus on improvements allows us to minimize the number of non-driving personnel we employ and positively influence other overhead costs. Expenses are intensely scrutinized for opportunities for elimination, reduction or to further leverage our purchasing power to achieve more favorable pricing.

Industry

According to the American Trucking Association’s “American Trucking Trends 2013” report, the trucking industry transported approximately 68.5% of the total volume of freight transported in the United States during 2012, which equates to 9.4 billion tons and approximately $642 billion in revenue. The truckload industry is highly fragmented and is impacted by several economic and business factors, many of which are beyond the control of individual carriers. The state of the economy, coupled with equipment capacity levels, can impact freight rates. Volatility of various operating expenses, such as fuel and insurance, make the predictability of profit levels uncertain. Availability, attraction, retention and compensation of drivers also affect operating costs, as well as equipment utilization. In addition, the capital requirements for equipment, coupled with potential uncertainty of used equipment values, impact the ability of many carriers to expand their operations. The current operating environment is characterized by the following:

|

· |

Intense competition for freight; |

|

· |

Price increases by truck and trailer equipment manufacturers; |

|

· |

Volatile fuel costs, generally trending higher, and |

|

· |

In recent years, many less profitable or undercapitalized carriers have been forced to consolidate or to exit the industry. |

Competition

The trucking industry is highly competitive and includes thousands of carriers, none of which dominates the market in which the Company operates. The Company's market share is less than 1% and we compete primarily with other irregular route medium- to long-haul truckload carriers, with private carriage conducted by our existing and potential customers, and, to a lesser extent, with the railroads. We compete on the basis of quality of service and delivery performance, as well as price. Many of the other irregular route long-haul truckload carriers have substantially greater financial resources, own more equipment or carry a larger total volume of freight as compared to the Company.

Marketing and Significant Customers

Our marketing emphasis is directed to that portion of the truckload market which is generally service-sensitive, as opposed to being solely price competitive. We seek to become a “core carrier” for our customers in order to maintain high utilization and capitalize on recurring revenue opportunities. Our marketing efforts are diversified and designed to gain access to dedicated, expedited, regional, automotive, and long-haul opportunities (including those in Mexico and Canada) and to expand supply chain solutions offerings.

Our marketing efforts are conducted by a sales staff of nine employees who are located in our major markets and supervised from our headquarters. These individuals work to improve profitability by maintaining an even flow of freight traffic (taking into account the balance between originations and destinations in a given geographical area), high utilization, and minimizing movement of empty equipment.

Our five largest customers, for which we provide carrier services covering a number of geographic locations, accounted for approximately 43%, 39% and 47% of our total revenues in 2013, 2012 and 2011, respectively. General Motors Corporation accounted for approximately 21%, 17% and 26% of our revenues in 2013, 2012 and 2011, respectively. Another large customer, Chrysler, accounted for approximately 12%, 12% and 5% of our revenues in 2013, 2012 and 2011, respectively.

We also provide transportation services to other manufacturers who are suppliers for automobile manufacturers. Approximately 46%, 37% and 38% of our revenues were derived from transportation services provided to the automobile industry during 2013, 2012 and 2011, respectively.

Revenue Equipment

At December 31, 2013, we operated a fleet of 1,837 trucks, which includes 357 owner-operator trucks, and 5,170 trailers, which includes 91 leased trailers. Our company-owned trucks are late model, well-maintained, premium trucks, which we believe help to attract and retain drivers, maximize fuel efficiency, promote safe operations, minimize maintenance and repair costs, and improve customer service by minimizing service interruptions caused by breakdowns. We evaluate our equipment purchasing decisions based on factors such as initial cost, useful life, warranty terms, expected maintenance costs, fuel economy, driver comfort, customer needs, manufacturer support, and resale value.

We contract with owner-operators to provide greater flexibility in responding to fluctuations in consumer demand. Owner-operators provide their own trucks and are contractually responsible for all associated expenses, including financing costs, fuel, maintenance, insurance, and taxes, among other things. They are also responsible for maintaining compliance with the Federal Motor Carrier Safety Administration regulations.

During 1999, the U.S. Environmental Protection Agency (“EPA”) mandated a three-phase strategy to reduce engine emissions from heavy-duty vehicles through a combination of advanced emissions control technologies and diesel fuel with a reduced sulfur content. The first phase (Phase I) mandated new engine emission standards for all model year 2004 heavy-duty trucks; however, through agreements with heavy-duty diesel engine manufacturers, the effective date was accelerated to October 1, 2002. Since October 1, 2002, all newly manufactured truck engines had to comply with the new engine emission standards. As of December 31, 2013, the Company-owned truck fleet does not contain any trucks with the older Phase I engines.

In the second phase (Phase II), effective January 1, 2007, the EPA mandated a new set of more stringent emission standards for vehicles powered by diesel fuel engines manufactured in 2007 through 2009. As of December 31, 2013, our Company-owned truck fleet consisted of fewer than 20 trucks with engines that comply with the Phase II emission standards (Phase II trucks) and are either leased to third parties or are in process of being sold. As compared to trucks powered by the Phase I engines, the trucks powered by the Phase II compliant diesel engines had a significantly higher purchase price and as a result, our depreciation expense increased over time as we replaced Phase I trucks with Phase II trucks.

During the third phase (Phase III), which was effective in 2010, final emission standards became effective. During 2013, the Company took delivery of approximately 550 trucks, all of which contained engines compliant with the Phase III emission standards. As of December 31, 2013, substantially all of our Company-owned truck fleet consisted of trucks with engines that comply with the Phase III emission standards (Phase III trucks). During 2014, the Company expects to take delivery of 300 additional Phase III trucks. To date, the Company-owned Phase III trucks have shown increased fuel efficiency as compared to either the Phase I or Phase II truck fuel efficiency, however, Phase III trucks have a significant purchase price premium as compared to the purchase price of the Phase I and Phase II trucks and as a result, our depreciation expense per truck has increased. We expect that the costs to replace older trucks will continue to increase due to both an increase in new truck purchase prices and in maintenance costs as the engines become more complex to meet future EPA regulations. To the extent we are unable to offset these anticipated increased costs with rate increases charged to customers or offsetting cost savings in other areas, our results of operations will be adversely affected.

Technology

We have installed Qualcomm display units in all of our trucks. The Qualcomm system is a satellite-based global positioning and communications system that allows fleet managers to communicate directly with drivers. Drivers can provide location, status and updates directly to our computer system which increases productivity and convenience. This system provides us with accurate estimated time of arrival information, which optimizes load selection and service levels to our customers.

Our information systems manage the data provided by the Qualcomm devices to provide us with real-time information regarding the location, status and load assignment of our trucks, which permits us to better meet delivery schedules, respond to customer inquiries and match equipment with the next available load. Our system also provides real-time information electronically to our customers regarding the status of freight shipments and anticipated arrival times. This system provides our customers flexibility and convenience by extending supply chain visibility through electronic data interchange, the Internet and e-mail.

Maintenance

We have a strictly enforced comprehensive preventive maintenance program for our trucks and trailers. Inspections and various levels of preventive maintenance are performed at set intervals on both trucks and trailers. A maintenance and safety inspection is performed on all vehicles each time they return to a terminal.

Our trucks carry full warranty coverage for at least three years or 375,000 miles. Extended truck warranties can be negotiated with the truck manufacturer and manufacturers of major components, such as engine, transmission and differential manufacturers, for up to four years or 500,000 miles. Our trailers carry full warranties by the manufacturer for up to 5 years with certain components covered for up to ten years.

Employees

At December 31, 2013, we employed 3,034 persons, of whom 2,477 were drivers, 185 were employed in maintenance, 171 were employed in operations, 38 were employed in marketing, 95 were employed in safety and personnel, and 68 were employed in general administration and accounting. None of our employees is represented by a collective bargaining unit and we believe that our employee relations are good.

Drivers

At December 31, 2013, we utilized 2,477 company drivers in our operations. We also had 357 owner-operators under contract compensated on a per mile basis. Our drivers are compensated on the basis of miles driven, loading and unloading, extra stops, and layovers in transit. Drivers can earn bonuses by recruiting other qualified drivers who become employed by us and both cash and non-cash prizes are awarded for achieving certain miles per gallon goals. All of our drivers are recruited, screened, drug tested and participate in our driver training program. Our driver training program stresses the importance of safety and reliable, on-time delivery. Drivers are required to report to their driver managers daily and at the earliest possible moment when any condition en route occurs that might delay their scheduled delivery time.

Owner-operators are utilized through a contact with us to supply one or more tractors and drivers for our use. Owner-operators must pay their own tractor expenses, fuel, maintenance, insurance, and driver costs. They must meet and operate within our guidelines with respect to safety. We have a lease-purchase program whereby we offer owner-operators the opportunity to lease a tractor, with the option to purchase the tractor at the end of the lease term. We believe our lease-purchase program has contributed to our ability to attract and retain owner operators. At December 31, 2013, approximately 40 owner-operators were participating in this program.

In addition to strict application screening and drug testing, before being permitted to operate a vehicle, our drivers must undergo classroom instruction on our policies and procedures, safety techniques as taught by the Smith System of Defensive Driving, and the proper operation of equipment, and must pass both written and road tests. Instruction in defensive driving and safety techniques continues after hiring, with seminars at several of our terminals. At December 31, 2013, we employed 77 persons on a full-time basis in our driver recruiting, training and safety instruction programs.

Intense competition in the trucking industry for qualified drivers has resulted in additional expense to recruit and retain an adequate supply of drivers, and has had a negative impact on the industry. Our operations have also been impacted and from time to time we have experienced under-utilization and increased expenses due to a shortage of qualified drivers. We place a high priority on the recruitment and retention of an adequate supply of qualified drivers.

Available Information

The Company maintains a website where additional information concerning its business can be found. The address of that website is www.pamtransport.com. The Company makes available free of charge on its Internet website its Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) as soon as reasonably practicable after it electronically files or furnishes such materials to the Securities and Exchange Commission.

Seasonality

Our revenues do not exhibit a significant seasonal pattern due primarily to our varied customer mix. Operating expenses can be somewhat higher in the winter months primarily due to decreased fuel efficiency and increased maintenance costs associated with inclement weather. In addition, the automobile plants for which we transport a large amount of freight typically utilize scheduled shutdowns in July and December and the volume of automotive freight we ship is reduced during such scheduled plant shutdowns.

Regulation

We are a common and contract motor carrier regulated by various United States federal and state, Canadian provincial, and Mexican federal agencies. These regulatory agencies have broad powers, generally governing matters such as authority to engage in motor carrier operations, motor carrier registration, driver hours-of-service (“HOS”), drug and alcohol testing of drivers, and safety, size, and weight of transportation equipment. The primary regulatory agencies affecting the Company’s operations include the Federal Motor Carrier Safety Administration (“FMCSA”), the Pipeline and Hazardous Materials Safety Agency, and the Surface Transportation Board, which are all agencies within the U.S. Department of Transportation (“DOT”). We believe that we are in compliance in all material respects with applicable regulatory requirements relating to our business and operate with a “satisfactory” rating (the highest of three rating categories) from the DOT. In addition, we are subject to compliance with cargo-security and transportation regulations issued by the Transportation Security Administration, a component department within the U.S. Department of Homeland Security. To the extent that we conduct operations outside the United States, we are subject to the Foreign Corrupt Practices Act, which generally prohibits U.S. companies and their intermediaries from offering bribes to foreign officials for the purpose of obtaining or retaining favorable treatment.

In 2004, the FMCSA issued updated rules related to driver HOS limits that became effective October 1, 2005 (the "2005 Rules"). In July 2007, a federal appeals court vacated certain provisions of the 2005 Rules relating to the expansion of the daily driving limit from 10 hours to 11 hours, and the "34-hour restart," which allowed drivers to restart calculations of the weekly on-duty time limits after the driver had at least 34 consecutive hours off duty. The court indicated that, in addition to other reasons, it vacated these two provisions because the FMCSA failed to provide adequate data supporting its decision to increase the daily driving limit and provide for the 34-hour restart provision. In November 2008, following the submission of additional data by FMCSA and a series of appeals and related court rulings, the FMCSA published its final rule, which retained the 11 hour daily driving limit and the 34-hour restart provision. Safety advocacy groups continued to challenge the final rule and in an effort to end litigation by these groups, the FMCSA agreed to propose new rules by July 26, 2011. During December 2010, the FMCSA released the proposed new rules for public comment which included provisions that would shorten allowable daily driving time from 11 hours to 10 hours and also require that drivers take two nights of rest during the 34-hour restart provision. The proposed rules, which were generally not well received by either safety advocacy groups or by the trucking industry, were finalized and published by the FMCSA in December 2011. The final rule, effective July 1, 2013, retained the 11 hour daily driving limit but restricted the use of the 34-hour restart provision to once every seven days and the 34-hour period must include two periods between 1:00 a.m. and 5:00 a.m. and requires drivers to take a 30-minute off duty break after driving 8 hours. During 2012, both the American Trucking Association and safety advocacy groups had filed petitions with the D.C. U.S. Circuit Court of Appeals requesting the court to review the FMCSA’s final rule. Oral arguments began on March 15, 2013 and a final ruling was issued August 2, 2013. The final ruling upheld the HOS rules effective July 1, 2013 with the exception of vacating the 30-minute off duty break for short haul truck drivers. Although the final HOS rules have made an impact on the utilization of our equipment and our drivers’ productivity, they have not had a significant negative impact on our operations.

During February 2012, the FMCSA announced its intent to continue to pursue a rule that would require all interstate motor carriers to install electronic on-board recorders (“EOBRs”) to monitor compliance with HOS regulations. The FMCSA’s previous efforts in 2011 to implement a rule requiring EOBRs were successfully challenged in court and the rule was vacated in August 2011 as the court ruled that the FMCSA failed to directly address the potential for harassment of vehicle operators. The vacated rule applied to phase one of a two-phase rule implementation process whereby implementation of phase one would require EOBR use only by habitual HOS regulation violators while phase two would require EOBR use by all motor carriers. The FMCSA refers to these two-phases as EOBR 1 and EOBR 2, respectively. Under EOBR 1, any motor carrier found to have a HOS regulation violation rate of 10% or greater would be required to install EOBRs on all of its commercial motor vehicles for a period of two years. The final rule related to EOBR 1 was published in April 2010 and, prior to being vacated, was to be effective for any single compliance review completed on or after June 4, 2012. Under EOBR 2, all motor carriers required to maintain HOS record keeping would be required to use EOBRs to monitor their drivers' compliance with HOS requirements. Motor carriers would have three years after the effective date of the EOBR 2 final rule to comply with these requirements. As of December 31, 2013, the Company is not subject to any requirement that EOBRs be installed on any of its trucks, however all the Company’s trucks currently have EOBRs installed.

During 2010, the FMCSA also implemented its “Compliance, Safety, Accountability” program (“CSA”), formerly known as “Comprehensive Safety Analysis 2010” or “CSA 2010”. The stated goal under CSA is to achieve a greater reduction in large truck and bus crashes, injuries and fatalities, while maximizing the resources of the FMCSA and its state partners. Since the 1970s, federal and state enforcement agencies, in partnership with the motor carrier industry, have progressively reduced the commercial vehicle related fatality crash rate. Under CSA, the FMCSA uses a comprehensive measurement system of all safety-based violations found during roadside inspections, weighing such violations by their relationship to crash risk. CSA data analysis expands on the previous system utilized by the FMCSA and covers more behavioral areas specifically linked to crash risk such as unsafe or fatigued driving, driver fitness, controlled substances, crash history, vehicle maintenance, and improper loading. Safety performance information is accumulated to assess the safety performance of both carriers and drivers. This expanded methodology for determining a carrier's DOT safety rating may have an adverse effect on our DOT safety rating. We currently have a satisfactory DOT rating, which is the highest available rating. A conditional or unsatisfactory DOT safety rating could adversely affect our business because some of our customer contracts may require a satisfactory DOT safety rating, and a conditional or unsatisfactory rating could negatively impact or restrict our operations.

Our motor carrier operations are also subject to environmental laws and regulations, including laws and regulations dealing with underground fuel storage tanks, the transportation of hazardous materials and other environmental matters, and our operations involve certain inherent environmental risks. We maintain one bulk fuel storage above ground tank and fuel island. Our operations involve the risks of fuel spillage or seepage, environmental damage, and hazardous waste disposal, among others. We have instituted programs to monitor and control environmental risks and assure compliance with applicable environmental laws. As part of our safety and risk management program, we periodically perform internal environmental reviews so that we can achieve environmental compliance and avoid environmental risk. We transport a minimum amount of environmentally hazardous substances and, to date, have experienced no significant claims for hazardous materials shipments. If we should fail to comply with applicable regulations, we could be subject to substantial fines or penalties and to civil and criminal liability.

Company operations conducted in industrial areas, where truck terminals and other industrial activities are conducted, and where groundwater or other forms of environmental contamination have occurred, potentially expose us to claims that we contributed to the environmental contamination.

We believe we are currently in material compliance with applicable laws and regulations and that the cost of compliance has not materially affected results of operations.

In addition to environmental regulations directly affecting our business, we are also subject to the effects of the new truck engine design requirements implemented by the EPA. See "Revenue Equipment" above.

Item 1A. Risk Factors.

Set forth below, and elsewhere in this Report and in other documents we file with the SEC, are risks and uncertainties that could cause our actual results to differ materially from the results contemplated by the forward-looking statements contained in this Report.

Our business is subject to general economic and business factors that are largely beyond our control, any of which could have a material adverse effect on our operating results.

Our business is dependent upon a number of general economic and business factors that may adversely affect our results of operations. These factors include significant increases or rapid fluctuations in fuel prices, excess capacity in the trucking industry, surpluses in the market for used equipment, interest rates, fuel taxes, license and registration fees, insurance premiums, self-insurance levels, and difficulty in attracting and retaining qualified drivers and independent contractors.

We operate in a highly competitive and fragmented industry, and our business may suffer if we are unable to adequately address any downward pricing pressures or other factors that may adversely affect our ability to compete with other carriers.

Further, we are affected by recessionary economic cycles and downturns in customers’ business cycles, particularly in market segments and industries, such as the automotive industry, where we have a significant concentration of customers. Economic conditions may also adversely affect our customers and their ability to pay for our services.

Deterioration in the United States and world economies could exacerbate any difficulties experienced by our customers and suppliers in obtaining financing, which, in turn, could materially and adversely impact our business, financial condition, results of operations and cash flows.

Numerous competitive factors could impair our ability to operate at an acceptable profit. These factors include, but are not limited to, the following:

|

· |

we compete with many other truckload carriers of varying sizes and, to a lesser extent, with less-than-truckload carriers and railroads, some of which have more equipment and greater capital resources than we do; |

|

· |

some of our competitors periodically reduce their freight rates to gain business, especially during times of reduced growth rates in the economy, which may limit our ability to maintain or increase freight rates, maintain our margins or maintain significant growth in our business; |

|

· |

many customers reduce the number of carriers they use by selecting so-called “core carriers” as approved service providers, and in some instances we may not be selected; |

|

· |

many customers periodically accept bids from multiple carriers for their shipping needs, and this process may depress freight rates or result in the loss of some of our business to competitors; |

|

· |

the trend toward consolidation in the trucking industry may create other large carriers with greater financial resources and other competitive advantages relating to their size and with whom we may have difficulty competing; |

|

· |

advances in technology require increased investments to remain competitive, and our customers may not be willing to accept higher freight rates to cover the cost of these investments; |

|

· |

competition from Internet-based and other logistics and freight brokerage companies may adversely affect our customer relationships and freight rates; and |

|

· |

economies of scale that may be passed on to smaller carriers by procurement aggregation providers may improve their ability to compete with us. |

We are highly dependent on our major customers, the loss of one or more of which could have a material adverse effect on our business.

A significant portion of our revenue is generated from our major customers. For 2013, our top five customers, based on revenue, accounted for approximately 43% of our revenue, and our two largest customers, General Motors Corporation and Chrysler, accounted for approximately 21% and 12% of our revenue, respectively. We also provide transportation services to other manufacturers who are suppliers for automobile manufacturers. As a result, the concentration of our business within the automobile industry is greater than the concentration in a single customer. Approximately 46% of our revenues for 2013 were derived from transportation services provided to the automobile industry.

Generally, we do not have long-term contractual relationships with our major customers, and we cannot assure that our customer relationships will continue as presently in effect. A reduction in or termination of our services by our major customers could have a material adverse effect on our business and operating results.

We may be adversely impacted by fluctuations in the price and availability of diesel fuel.

Diesel fuel represents a significant operating expense for the Company and we do not currently hedge against the risk of diesel fuel price increases. An increase in diesel fuel prices or diesel fuel taxes, or any change in federal or state regulations that results in such an increase, could have a material adverse effect on our operating results to the extent we are unable to recoup such increases from customers in the form of increased freight rates or through fuel surcharges. Historically, we have been able to offset, to a certain extent, diesel fuel price increases through fuel surcharges to our customers but we cannot be certain that we will be able to do so in the future. We continuously monitor the components of our pricing, including base freight rates and fuel surcharges, and address individual account profitability issues with our customers when necessary. While we have historically been able to adjust our pricing to help offset changes to the cost of diesel fuel, through changes to base rates and/or fuel surcharges, we cannot be certain that we will be able to do so in the future.

Difficulty in attracting drivers could affect our profitability and ability to grow.

Periodically, the transportation industry experiences difficulty in attracting and retaining qualified drivers, including independent contractors, resulting in intense competition for drivers. We have from time to time experienced under-utilization and increased expenses due to a shortage of qualified drivers. If we are unable to attract drivers when needed or contract with independent contractors when needed, we could be required to further adjust our driver compensation packages or let trucks sit idle, which could adversely affect our growth and profitability.

If we are unable to retain our key employees, our business, financial condition and results of operations could be harmed.

We are highly dependent upon the services of our key employees and executive officers. The loss of any of their services could have a material adverse effect on our operations and future profitability. We must continue to develop and retain a core group of managers if we are to realize our goal of expanding our operations and continuing our growth. We cannot assure that we will be able to do so.

Ongoing insurance and claims expenses could significantly reduce our earnings.

Our future insurance and claims expenses might exceed historical levels, which could reduce our earnings. The Company is self insured for health and workers’ compensation insurance coverage up to certain limits. If medical costs continue to increase, or if the severity or number of claims increase, and if we are unable to offset the resulting increases in expenses with higher freight rates, our earnings could be materially and adversely affected.

Purchase price increases for new revenue equipment and/or decreases in the value of used revenue equipment could have an adverse effect on our results of operations, cash flows and financial condition.

During the last decade, the purchase price of new revenue equipment has increased significantly as equipment manufacturers recover increased materials costs and engine design costs resulting from compliance with increasingly stringent EPA engine emission standards. The final phase of the new EPA engine design requirements were effective in 2010; however, additional EPA emission mandates in the future could result in higher purchase prices of revenue equipment which could result in higher than anticipated depreciation expenses. If we were unable to offset any such increase in expenses with freight rate increases, our cash flows and results of operations could be adversely affected. If the market prices for used revenue equipment declines, we could incur substantial losses upon disposition of our revenue equipment which could adversely affect our results of operations and financial condition.

We have significant ongoing capital requirements that could affect our liquidity and profitability if we are unable to generate sufficient cash from operations or obtain sufficient financing on favorable terms.

The trucking industry is capital intensive. If we are unable to generate sufficient cash from operations in the future, we may have to limit our growth, enter into unfavorable financing arrangements, or operate our revenue equipment for longer periods, any of which could have a material adverse effect on our profitability.

We have a substantial amount of debt, which could restrict our growth, place us at a competitive disadvantage or otherwise materially adversely affect our financial health. Our substantial debt levels could have important consequences such as the following:

|

· |

impair our ability to obtain additional future financing for working capital, capital expenditures, acquisitions or general corporate expenses; |

|

· |

limit our ability to use operating cash flow in other areas of our business due to the necessity of dedicating a substantial portion of these funds for payments on our indebtedness; |

|

· |

limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

|

· |

make it more difficult for us to satisfy our obligations; |

|

· |

increase our vulnerability to general adverse economic and industry conditions; and |

|

· |

place us at a competitive disadvantage compared to our competitors. |

Our ability to make scheduled payments on, or to refinance, our debt and other obligations will depend on our financial and operating performance, which, in turn, is subject to our ability to implement our strategic initiatives, prevailing economic conditions and certain financial, business and other factors beyond our control. If our cash flow and capital resources are insufficient to fund our debt service and other obligations, we may be forced to reduce or delay expansion plans and capital expenditures, sell material assets or operations, obtain additional capital or restructure our debt. We cannot provide any assurance that our operating performance, cash flow and capital resources will be sufficient to pay our debt obligations when they become due. We also cannot provide assurance that we would be able to dispose of material assets or operations or restructure our debt or other obligations if necessary or, even if we were able to take such actions, that we could do so on terms that are acceptable to us.

Disruptions in the credit markets may adversely affect our business, including the availability and cost of short-term funds for liquidity requirements and our ability to meet long-term commitments, which could adversely affect our results of operations, cash flows and financial condition.

If cash from operations is not sufficient, we may be required to rely on the capital and credit markets to meet our financial commitments and short-term liquidity needs. Disruptions in the capital and credit markets, as have been experienced during recent years, could adversely affect our ability to draw on our bank revolving credit facility. Our access to funds under the credit facility is dependent on the ability of banks to meet their funding commitments. A bank may not be able to meet their funding commitments if they experience shortages of capital and liquidity or if they experience excessive volumes of borrowing requests from other borrowers within a short period of time.

Longer term disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation, reduced alternatives, or failures of significant financial institutions could adversely affect our access to liquidity needed for our business. Any disruption could require us to take measures to conserve cash until the markets stabilize or until alternative credit arrangements or other funding for our business needs can be arranged, which could adversely affect our growth and profitability.

We operate in a highly regulated industry and increased costs of compliance with, or liability for violation of, existing or future regulations could have a material adverse effect on our business.

The DOT and various state agencies exercise broad powers over our business, generally governing such activities as authorization to engage in motor carrier operations, safety, and financial reporting. We may also become subject to new or more restrictive regulations relating to fuel emissions, drivers’ hours of service, and ergonomics. Compliance with such regulations could substantially impair equipment productivity and increase our operating expenses.

The EPA adopted new emission control regulations, which required progressive reductions in exhaust emissions from diesel engines through 2010. In order to partially offset the costs of compliance with the new EPA engine design requirements, manufacturers have increased new equipment prices and eliminated or sharply reduced the price of repurchase or trade-in commitments. If new equipment prices continue to increase, or if the price of repurchase commitments by equipment manufacturers were to decrease more than anticipated, we may be required to increase our depreciation and financing costs and/or retain some of our equipment longer, which may result in an increase in maintenance expenses. To the extent we are unable to offset any such increases in expenses with rate increases or cost savings, our results of operations would be adversely affected. If our fuel or maintenance expenses were to increase as a result of our use of the new, EPA-compliant engines, and we are unable to offset such increases with fuel surcharges or higher freight rates, our results of operations would be adversely affected. Further, our business and operations could be adversely impacted if we experience problems with the reliability of the new engines. Although we have not experienced any significant reliability issues with these engines to date, the expenses associated with the trucks containing these engines have been slightly elevated, primarily as a result of higher depreciation expense due to increased purchase prices.

During 2010, the FMCSA implemented its “Compliance, Safety, Accountability” program (“CSA”), formerly known as “Comprehensive Safety Analysis 2010” or “CSA 2010”. CSA is an enforcement and compliance initiative that provides for driver standards in addition to the carrier standards previously in place. Under CSA, the methodology for determining a carrier's DOT safety rating has been expanded to include the on-road safety performance of the carrier's drivers. As a result of these new regulations, including the expanded methodology for determining a carrier's DOT safety rating, there may be an adverse effect on our DOT safety rating. We currently have a satisfactory DOT rating, which is the highest available rating. A conditional or unsatisfactory DOT safety rating could adversely affect our business because some of our customer contracts may require a satisfactory DOT safety rating, and a conditional or unsatisfactory rating could negatively impact or restrict our operations.

During December 2011, the FMCSA published final HOS rules which included changes that placed limits on the 34-hour restart provision and added required driver breaks. These final HOS rules have made an impact on the utilization of our equipment and our drivers’ productivity however, they have not had a significant negative impact on our operations.

We are subject to certain risks arising from doing business in Mexico.

As we continue to grow our business in Mexico, we are subject to greater risks of doing business internationally, including fluctuations in foreign currencies, changes in the economic strength of Mexico, difficulties in enforcing contractual obligations and intellectual property rights, burdens of complying with a wide variety of international and U.S. export and import laws, and social, political, and economic instability. We also face additional risks associated with our Mexico business, including potential restrictive trade policies and imposition of duties, taxes, or government royalties imposed by the Mexican government. If we are unable to address business concerns related to our international operations in a timely and cost efficient manner, our financial position, results of operations or cash flows could be adversely affected.

A determination by regulators that owner-operators are employees, rather than independent contractors, could expose us to various liabilities and additional costs.

Tax and other regulatory authorities often seek to assert that independent contractors in the transportation service industry, such as our owner-operators, are employees rather than independent contractors. There can be no assurance that these interpretations and tax laws that consider these persons independent contractors will not change or that these authorities will not successfully assert this position. If our owner-operators are determined to be our employees, that determination could materially increase our exposure under a variety of federal and state tax, workers’ compensation, unemployment benefits, labor, employment and tort laws, as well as our potential liability for employee benefits. In addition, such changes may be applied retroactively, and if so, we may be required to pay additional amounts to compensate for prior periods. Any of the above increased costs would adversely affect our business and operating results.

Our results of operations may be affected by seasonal factors.

Our productivity may decrease during the winter season when severe winter weather impedes operations. Also, some shippers may reduce their shipments after the winter holiday season. At the same time, operating expenses may increase and fuel efficiency may decline due to engine idling during periods of inclement weather. Harsh weather conditions generally also result in higher accident frequency, increased freight claims, and higher equipment repair expenditures.

Our business may be disrupted by natural disasters and severe weather conditions causing supply chain disruptions.

Natural disasters such as earthquakes, tsunamis, hurricanes, tornadoes, floods or other adverse weather and climate conditions, whether occurring in the United States or abroad, could disrupt our operations or the operations of our customers or could damage or destroy infrastructure necessary to transport products as part of the supply chain. Specifically, these events may damage or destroy or assets, disrupt fuel supplies, increase fuel costs, disrupt freight shipments or routes, and affect regional economies. As a result, these events could make it difficult or impossible for us to provide logistics and transportation services; disrupt or prevent our ability to perform functions at the corporate level; and/or otherwise impede our ability to continue business operations in a continuous manner consistent with the level and extent of business activities prior to the occurrence of the unexpected event, which could adversely affect our business and results of operations or make our results more volatile.

We may incur additional operating expenses or liabilities as a result of potential future requirements to address climate change issues.

As global warming issues become more prevalent, federal, state and local governments as well as some of our customers, are beginning to respond to these issues. This increased focus on sustainability may result in new legislation or regulations and customer requirements that could negatively affect us as we may incur additional costs or be required to make changes to our operations in order to comply with any new regulations or customer requirements. Legislation or regulations that potentially impose restrictions, caps, taxes, or other controls on emissions of greenhouse gases such as carbon dioxide, a by-product of burning fossil fuels such as those used in the Company’s trucks, could adversely affect our operations and financial results. More specifically, legislative or regulatory actions related to climate change could adversely impact the Company by increasing our fuel costs and reducing fuel efficiency and could result in the creation of substantial additional capital expenditures and operating costs in the form of taxes, emissions allowances, or required equipment upgrades. Any of these factors could impair our operating efficiency and productivity and result in higher operating costs. In addition, revenues could decrease if we are unable to meet regulatory or customer sustainability requirements. These additional costs, changes in operations, or loss of revenues could have a material adverse effect on our business, financial condition and results of operations.

Our operations are subject to various environmental laws and regulations, the violation of which could result in substantial fines or penalties.

We are subject to various environmental laws and regulations dealing with the handling of hazardous materials, underground fuel storage tanks, and discharge and retention of storm-water. We operate in industrial areas, where truck terminals and other industrial activities are located, and where groundwater or other forms of environmental contamination could occur. In prior years, we also maintained bulk fuel storage and fuel islands at two of our facilities. Our operations may involve the risks of fuel spillage or seepage, environmental damage, and hazardous waste disposal, among others. If we are involved in a spill or other accident involving hazardous substances, or if we are found to be in violation of applicable laws or regulations, it could have a materially adverse effect on our business and operating results. If we should fail to comply with applicable environmental regulations, we could be subject to substantial fines or penalties and to civil and criminal liability.

If our employees were to unionize, our operating costs would increase and our ability to compete would be impaired.

None of our employees is currently represented by a collective bargaining agreement. However, we can offer no assurance that our employees will not unionize in the future, particularly if legislation is passed that facilitates unionization. If our employees were to unionize, our operating costs would increase and our profitability could be adversely affected.

Our information technology systems are subject to certain risks that are beyond our control.

We depend on the proper functioning and availability of our information systems, including communications and data processing systems, in operating our business. Although we have implemented redundant systems and network security measures, our information technology remains susceptible to outages, computer viruses, break-ins and similar disruptions that may inhibit our ability to provide services to our customers and the ability of our customers to access our systems. This may result in the loss of customers or a reduction in demand for our services, which could adversely affect our growth and profitability.

We have substantial fixed costs and, as a result, our operating income fluctuates disproportionately with changes in our net sales.

A significant portion of our expenses are fixed costs that that neither increase nor decrease proportionately with sales. There can be no assurance that we would be able to reduce our fixed costs proportionately in response to a decline in our sales and therefore our competitiveness could be significantly impacted. As a result, a decline in our sales would result in a higher percentage decline in our income from operations and net income.

Our financial results may be adversely impacted by potential future changes in accounting practices.

Future changes in accounting standards or practices, and related legal and regulatory interpretations of those changes, may adversely impact public companies in general, the transportation industry or our operations specifically. New accounting standards or requirements, such as a conversion from U.S. Generally Accepted Accounting Principles to International Financial Reporting Standards, could change the way we account for, disclose and present various aspects of our financial position, results of operations or cash flows and could be costly to implement.

Our business may be harmed by terrorist attacks, future war or anti-terrorism measures.

In order to prevent terrorist attacks, federal, state and municipal authorities have implemented and continue to follow various security measures, including checkpoints and travel restrictions on large trucks. Our international operations in Canada and Mexico may be affected significantly if there are any disruptions or closures of border traffic due to security measures. Such measures may have costs associated with them, which, in connection with the transportation services we provide, we or our owner-operators could be forced to bear. In addition, war or risk of war also may have an adverse effect on the economy. A decline in economic activity could adversely affect our revenue or restrict our future growth. Instability in the financial markets as a result of terrorism or war also could affect our ability to raise capital. In addition, the insurance premiums charged for some or all of the coverage currently maintained by us could increase dramatically or such coverage could be unavailable in the future.

We may be unable to successfully integrate businesses we acquire into our operations.

Integrating businesses we acquire may involve unanticipated delays, costs or other operational or financial problems. Successful integration of the businesses we acquire depends on a number of factors, including our ability to transition acquired companies to our management information systems. In integrating businesses we acquire, we may not achieve expected economies of scale or profitability or realize sufficient revenues to justify our investment. We also face the risk that an unexpected problem at one of the companies we acquire will require substantial time and attention from senior management, diverting management’s attention from other aspects of our business. We cannot be certain that our management and operational controls will be able to support us as we grow.

The Chairman of our board of directors holds a controlling interest in us; therefore, the influence of our public shareholders over significant corporate actions is limited, and we are not subject to certain corporate governance standards that apply to other publicly traded companies.

Matthew T. Moroun, the Chairman of our Board of Directors, and a trust of which Mr. Moroun is a co-trustee together, own approximately 59.3% of our outstanding common stock. As a result, Mr. Moroun has the power to:

|

· |

control all matters submitted to our shareholders; |

|

· |

elect our directors; |

|

· |

adopt, extend or remove any anti-takeover provisions that are available to us; and |

|

· |

exercise control over our business, policies and affairs. |

This concentration of ownership could limit the price that some investors might be willing to pay for shares of our common stock, and our ability to engage in significant transactions, such as a merger, acquisition or liquidation, will require the consent of Mr. Moroun. Conflicts of interest could arise between us and Mr. Moroun, and any conflict of interest may be resolved in a manner that does not favor us. Accordingly, Mr. Moroun could cause us to enter into transactions or agreements of which our other shareholders would not approve or make decisions with which they may disagree. Because of Mr. Moroun’s level of ownership, we have elected to be treated as a controlled company in accordance with the rules of the NASDAQ Stock Market. Accordingly, we are not required to comply with NASDAQ Stock Market rules which would otherwise require a majority of our Board to be comprised of independent directors and require our Board to have a compensation committee and a nominating and corporate governance committee comprised of independent directors.

Mr. Moroun may continue to retain control of us for the foreseeable future and may decide not to enter into a transaction in which shareholders would receive consideration for our common stock that is much higher than the then-current market price of our common stock. In addition, Mr. Moroun could elect to sell a controlling interest in us to a third-party and our other shareholders may not be able to participate in such transaction or, if they are able to participate in such a transaction, such shareholders may receive less than the then current fair market value of their shares. Any decision regarding ownership of us that Mr. Moroun may make at some future time will be in his absolute discretion, subject to applicable laws and fiduciary duties.

Our stock trading volume may not provide adequate liquidity for investors.

Although shares of our common stock are traded on the NASDAQ Global Market, the average daily trading volume in our common stock is less than that of other larger transportation and logistics companies. A public trading market having the desired characteristics of depth, liquidity and orderliness depends on the presence in the marketplace of a sufficient number of willing buyers and sellers of the common stock at any given time. This presence depends on the individual decisions of investors and general economic and market conditions over which we have no control. Given the daily average trading volume of our common stock, significant sales of the common stock in a brief period of time, or the expectation of these sales, could cause a decline in the price of our common stock. Additionally, low trading volumes may limit a stockholder’s ability to sell shares of our common stock.

We currently do not intend to pay future dividends on our common stock.

We currently do not anticipate paying future cash dividends on our common stock. We anticipate that we will retain all of our future earnings, if any, for use in the development and expansion of our business and for general corporate purposes. Any determination to pay future dividends and other distributions in cash, stock, or property by the Company in the future will be at the discretion of our Board of Directors and will be dependent on then-existing conditions, including our financial condition and results of operations and contractual restrictions. Therefore, you should not rely on future dividend income from shares of our common stock.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

Our executive offices and primary terminal facilities, which we own, are located in Tontitown, Arkansas. These facilities are located on approximately 49.3 acres and consist of 114,403 square feet of office space and maintenance and storage facilities.

Our subsidiaries lease facilities in Indianapolis, Indiana; Romulus, Michigan; North Jackson, Ohio; Tahlequah, Oklahoma; Bath, Pennsylvania; El Paso, Texas; and Monterrey, Mexico. Our terminal facilities in Columbia, Mississippi; Irving and Laredo, Texas; North Little Rock, Arkansas; and Willard, Ohio are owned. The leased facilities are leased primarily on contractual terms typically ranging from one to five years. As of December 31, 2013, the following table provides a summary of the ownership and types of activities conducted at each location:

|

Location |

Own/ Lease |

Dispatch Office |

Maintenance Facility |

Safety Training |

|

Tontitown, Arkansas |

Own |

Yes |

Yes |

Yes |

|

North Little Rock, Arkansas |

Own |

No |

Yes |

Yes |

|

Indianapolis, Indiana |

Lease |

No |

Yes |

No |

|

Romulus, Michigan |

Lease |

No |

Yes |

No |

|

Columbia, Mississippi |

Own |

No |

No |

No |

|

North Jackson, Ohio |

Lease |

Yes |

Yes |

Yes |

|

Willard, Ohio |

Own |

Yes |

Yes |

No |

|

Tahlequah, Oklahoma |

Lease |

No |

No |

No |

|

Bath, Pennsylvania |

Lease |

No |

Yes |

No |

|

El Paso, Texas |

Lease |

No |

No |

No |

|

Irving, Texas |

Own |

Yes |

Yes |

Yes |

|

Laredo, Texas |

Own |

Yes |

Yes |

Yes |

|

Monterrey, Mexico |

Lease |

No |

No |

No |

We also have access to trailer drop and relay stations in various other locations across the country. We lease certain of these facilities on a month-to-month basis from affiliates of our largest stockholder.

We believe that all of the properties that we own or lease are suitable for their purposes and adequate to meet our needs.

Item 3. Legal Proceedings.

The nature of our business routinely results in litigation, primarily involving claims for personal injuries and property damage incurred in the transportation of freight. We believe that all such routine litigation is adequately covered by insurance and that adverse results in one or more of those cases would not have a material adverse effect on our financial statements.

We are a defendant in a collective-action lawsuit which was filed on August 22, 2013, in the United States District Court for the Western District of Arkansas. The plaintiffs, who are current and former drivers and who worked for the Company during the period of August 22, 2010, through the date of the filing, allege claims for unpaid wages under the Fair Labor Standards Act and the Arkansas Minimum Wage Law. The complaint alleges that the Company failed to pay newly hired drivers minimum wage during orientation, training, and while traveling during normal business hours and that the Company failed to pay all drivers when working on assignment for more than 24 hours. The plaintiffs seek to enjoin the Company from continuing its current pay practices related to the allegations. They also seek actual damages, liquidated damages equal to accrual damages, court costs, and legal fees. The lawsuit is currently in the discovery stage. We cannot reasonably estimate at this time the possible loss or range of loss, if any, that may arise from this lawsuit. Management has determined that any losses under this claim would not be covered by exisiting insurance policies.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is traded on the NASDAQ Global Market under the symbol PTSI. The following table sets forth, for the quarters indicated, the range of the high and low sales prices per share for our common stock as reported on the NASDAQ Global Market and our dividends declared per common share.

Fiscal Year Ended December 31, 2013

|

High |

Low |

Dividends Declared Per Common Share |

||||||||||

|

First Quarter |

$ | 11.57 | $ | 9.30 | $ | - | ||||||

|

Second Quarter |

11.74 | 8.85 | - | |||||||||

|

Third Quarter |

17.82 | 10.00 | - | |||||||||

|

Fourth Quarter |

20.99 | 15.59 | - | |||||||||

Fiscal Year Ended December 31, 2012

|

High |

Low |

Dividends Declared Per Common Share |

||||||||||

|

First Quarter |

$ | 12.58 | $ | 9.45 | $ | 1.00 | ||||||

|

Second Quarter |

11.75 | 9.32 | - | |||||||||

|

Third Quarter |

10.18 | 8.95 | - | |||||||||

|

Fourth Quarter |

10.89 | 8.81 | 1.00 | |||||||||

As of February 17, 2013, there were approximately 105 holders of record of our common stock.

Dividends

The Company paid cash dividends of $1.00 per common share during each of the months of April 2012 and December 2012. No other dividends have been paid during any year prior to 2012 or during 2013. Future dividend policy and the payment of dividends, if any, will be determined by the Board of Directors in light of circumstances then existing, including our earnings, financial condition and other factors deemed relevant by the Board of Directors. Currently, the Company does not intend to pay dividends in the foreseeable future.

Repurchases of Equity Securities by the Issuer

The Company’s stock repurchase program has been extended and expanded several times, most recently in September 2011, when the Board of Directors announced that it had authorized the Company to repurchase up to 500,000 additional shares of its common stock. The Company repurchased 224,000 shares of its common stock during the fourth quarter of 2011 but did not repurchase any shares of its common stock during 2012 under the program. The Company did however, repurchase 50,325 shares of its common stock under the program during 2013.

On December 2, 2013, the Company announced a Dutch auction tender offer (the “tender offer”) to repurchase up to 600,000 shares of its common stock, par value $0.01 per share, subject to the terms and conditions described in the tender offer pursuant to the Board of Directors approval on November 27, 2013. Subject to certain limitations and legal requirements, the Company could purchase up to an additional 2% of its outstanding shares which totaled 173,000 shares. The tender offer began on the date of the announcement, December 2, 2013 and expired on December 30, 2013.

Through the tender offer, the Company’s shareholders had the opportunity to tender some or all of their shares at a price within the range of $19.00 to 21.00 per share. Upon expiration of the offer, the Company accepted for purchase a total of 675,000 shares at a price of $20.50 per share, for a total purchase price of approximately $13.9 million, including fees and commission. The purchases were settled on January 6, 2014. The Company accounted for the repurchase of these shares as treasury stock on the Company’s consolidated balance sheet as of December 31, 2013.

The following table summarizes the Company's common stock repurchases during the fourth quarter of 2013. No shares were purchased during the quarter other than through the repurchase program and the tender offer described above. All purchases were made by or on behalf of the Company and not by any “affiliated purchaser”.

|

Period |

Total number of shares purchased |

Average price paid per share |

Total number of shares purchased as part of publicly announced plans or programs |

Maximum number of shares that may yet be purchased under the plans or programs |

||||||||||||

|

October 1-31, 2013 |

2,100 | $ | 16.98 | 2,100 | 225,675 | |||||||||||

|

November 1-30, 2013 |

- | - | - | 225,675 | ||||||||||||

|

December 1-31, 2013 |

675,000 | 20.50 | 675,000 | 225,675 | ||||||||||||

|

Total |

677,100 | $ | 20.49 | 677,100 | ||||||||||||

Securities Authorized for Issuance Under Equity Compensation Plans

See Part III, Item 12, “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” of this Annual Report for a presentation of compensation plans under which equity securities of the Company are authorized for issuance.

Recent Sales of Unregistered Securities

See Part III, Item 12, “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” of this Annual Report for information regarding recent sales by the Company of unregistered securities.

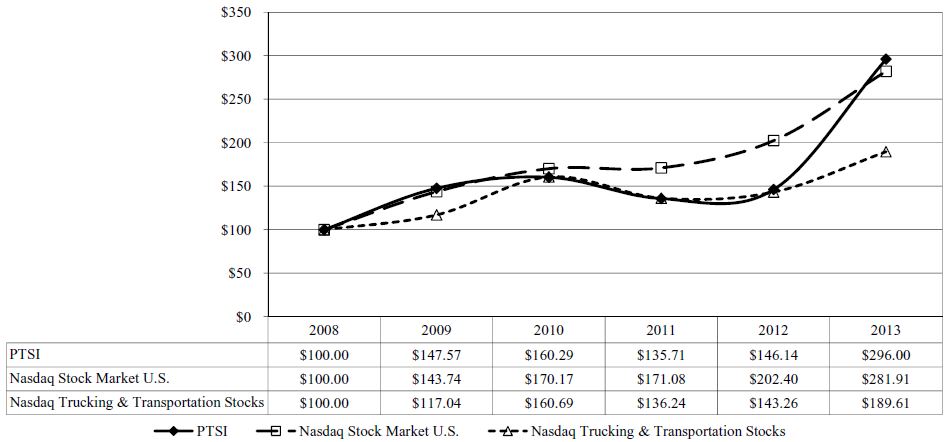

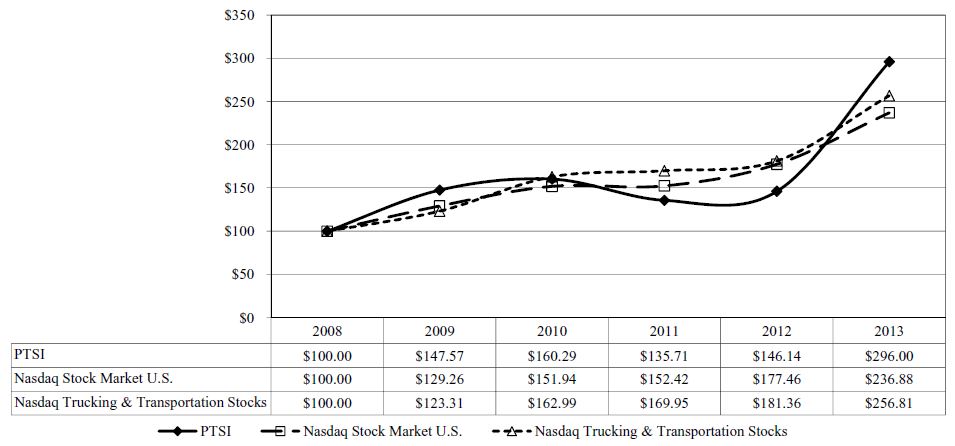

Performance Graph