UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-04764 | |||||

| BNY Mellon Opportunistic Municipal Securities Fund | ||||||

| (Exact name of Registrant as specified in charter) | ||||||

|

c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street New York, New York 10286 |

||||||

| (Address of principal executive offices) (Zip code) | ||||||

|

Deirdre Cunnane, Esq. 240 Greenwich Street New York, New York 10286 |

||||||

| (Name and address of agent for service) | ||||||

| Registrant's telephone number, including area code: | (212) 922-6400 | |||||

|

Date of fiscal year end:

|

04/30 | |||||

| Date of reporting period: |

04/30/23

|

|||||

FORM N-CSR

Item 1. Reports to Stockholders.

BNY Mellon Opportunistic Municipal Securities Fund

ANNUAL REPORT April 30, 2023 |

|

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.im.bnymellon.com and sign up for eCommunications. It’s simple and only takes a few minutes. |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

FOR MORE INFORMATION

Back Cover

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from May 1, 2022, through April 30, 2023, as provided by Daniel Rabasco and Jeffrey Burger, Portfolio Managers employed by the fund’s sub-adviser, Insight North America LLC

Market and Fund Performance Overview

For the 12-month period ended April 30, 2023, BNY Mellon Opportunistic Municipal Securities Fund (the “fund”) produced a total return of 1.40% for Class A shares, 0.61% for Class C shares, 1.64% for Class I shares 1.65% for Class Y shares and 1.36% for Class Z shares.1 In comparison, the Bloomberg U.S. Municipal Bond Index (the “Index”), the fund’s benchmark index, achieved a total return of 2.87% for the same period.2

Municipal bonds posted gains during the reporting period largely as a result of easing inflation and investor anticipation of an end to the Federal Reserve’s (the “Fed”) rate hikes. The fund lagged the Index mainly due to unfavorable security selection, especially in certain portions of the revenue bond market.

The Fund’s Investment Approach

The fund seeks to maximize current income exempt from federal income tax to the extent consistent with the preservation of capital. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in municipal bonds that provide income exempt from federal income tax. Typically, the fund invests substantially all of its assets in such municipal bonds. The fund invests at least 70% of its assets in municipal bonds rated, at the time of purchase, investment grade (Baa/BBB or higher) or the unrated equivalent as determined by the fund’s sub-adviser, Insight North America LLC (“INA”). For additional yield, the fund may invest up to 30% of its assets in municipal bonds rated below investment grade (“high yield” or “junk” bonds) or the unrated equivalent as determined by INA. The dollar-weighted, average maturity of the fund’s portfolio normally exceeds 10 years, but the fund may invest without regard to maturity or duration.

The portfolio managers focus on identifying undervalued sectors and securities and minimize the use of interest-rate forecasting. The portfolio managers select municipal bonds for the fund’s portfolio by using fundamental credit analysis to estimate the relative value and attractiveness of various sectors and securities, and to exploit pricing inefficiencies in the municipal bond market, and by actively trading among various sectors, and securities, including pre-refunded, general obligation and revenue bonds, based on their apparent relative values. The fund seeks to invest in several different sectors, and does not seek to overweight any particular sector but may do so depending on each sector’s relative value at any given time.

Market Rebounds as Inflation Retreats, Rate Hikes Ease

During the reporting period, the municipal bond market experienced volatility driven by economic uncertainty, rising inflation and geopolitical risk. While employment remained strong, the outcome of the Fed’s tightening policy was uncertain, with investors fearing that an economic slowdown was becoming more likely. But toward the end of the period, inflation began to ease, and investors began to anticipate the end of the Fed’s rate hikes.

Inflation measures stayed near multidecade highs during the first part of the reporting period. The Fed continued increasing the federal funds rate, which began in March 2022, raising it eight times by April 30, 2023. Toward the end of the period, the Fed began to moderate these increases, hiking by just 25 basis points in February and March 2023. By the end of the period, the federal funds target rate was 4.75–5.00%, up from 0.25–0.50% at the start of the period.

Fears that the economy could slow were realized when the first quarter GDP figures were released in April 2022. A still-strong labor market, however, suggested that the economy could rebound, but second quarter data showed that economic growth slowed again, making for two-consecutive quarters of decline, a rough indicator of recession. Nevertheless, the economy rebounded in the third and fourth quarter, posting gains of 3.2% and 2.6%, respectively. Growth continued in the first quarter of 2023, with the economy expanding 1.1%.

For much of the period, the persistence of higher-than-expected inflation, combined with measures from the Fed to combat it, led to significant to higher interest rates and outflows from municipal bond mutual funds. The need for fund managers to meet redemptions only added to the downward momentum.

2

While headwinds prevailed over most of the period, credit fundamentals in the municipal market remained strong. In addition, turmoil resulted in more attractive valuations in many segments of the market, creating the potential for outperformance in the future.

Late in 2022 and into 2023, municipal bonds began to rebound as inflation abated, and investors began to anticipate a recession could be on the horizon, and an end to the Fed’s rate-hiking cycle. A perception that the stress on regional banks resulting from the banking crisis would help slow the economy also supported the market. In addition, the normal seasonal decline in supply, combined with the seasonal reinvestment of maturing bonds, buoyed the market.

Security Selection Weighed on Fund Results

The fund’s performance was hindered primarily by security selection. Selections were especially unfavorable in state general obligation bonds as well as in certain portions of the revenue bond segment, including appropriation bonds, special tax, airports and transportation. The fund’s overweight to revenue bonds, more broadly, also hindered relative performance. An overweight position in continuing care/retirement centers hampered returns as well; these operators continued to experience pricing pressures due to higher labor costs, among other challenges. Finally, the fund’s curve positioning versus the Index also detracted. Although the fund was neutral on duration, positions at the long end of the curve were hurt slightly by the rise in rates during the period. The fund did not make use of derivatives.

On the other hand, security selections in certain segments added to the fund’s relative performance. Selections in the hospital, industrial development and prepaid gas segments in particular were especially helpful. In addition, an overweighting of public power and education bonds was beneficial.

Anticipating Easing Inflation and an End to Monetary Tightening

Although volatility could continue in the short term as the market responds to continued Fed tightening, we remain sanguine about the market. It appears that inflation has begun to ease, and we believe it may have peaked, allowing the Fed to ease up on its tightening policy. Nevertheless, we expect to have more clarity on inflation and monetary policy as the year progresses. Municipal bonds typically perform well at the end of a monetary tightening cycle, and we are beginning to see more interest from retail investors, given the attractive yields.

With a possible recession on the horizon, we will remain cautious on credit quality. Nevertheless, municipalities’ fundamentals remain healthy and we will take advantage of in situations where credit quality remains sound.

May 15, 2023

1 Total return includes reinvestment of dividends and any capital gains paid and does not take into consideration the maximum initial sales charge in the case of Class A shares or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Class I, Class Y and Class Z are not subject to any initial or deferred sales charge. Past performance is no guarantee of future results. Share price, yield and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. Income may be subject to state and local taxes, and some income may be subject to the federal alternative minimum tax (AMT) for certain investors. Capital gains, if any, are taxable.

2 Source: Lipper Inc. — The Bloomberg U.S. Municipal Bond Index covers the U.S. dollar-denominated, long-term, tax-exempt bond market. Investors cannot invest directly in any index.

Bonds are subject generally to interest-rate, credit, liquidity and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause price declines.

High yield bonds involve increased credit and liquidity risk than higher-rated bonds and are considered speculative in terms of the issuer’s ability to pay interest and repay principal on a timely basis.

The amount of public information available about municipal bonds is generally less than that for corporate equities or bonds. Special factors, such as legislative changes, and state and local economic and business developments, may adversely affect the yield and/or value of the fund’s investments in municipal bonds. Other factors include the general conditions of the municipal bond market, the size of the particular offering, the maturity of the obligation and the rating of the issue. Changes in economic, business or political conditions relating to a particular municipal project, municipality or state in which the fund invests may have an impact on the fund’s share price.

References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations.

3

FUND PERFORMANCE (Unaudited)

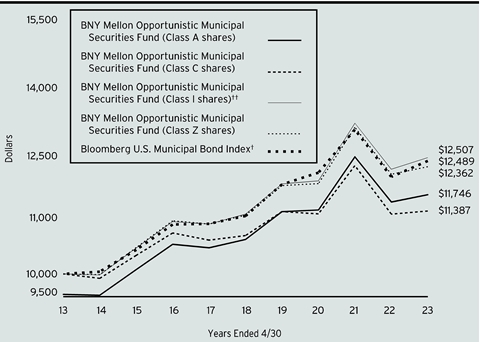

Comparison

of change in value of a $10,000 investment in Class A shares, Class C shares, Class I shares and Class

Z shares of BNY Mellon Opportunistic Municipal Securities Fund with a hypothetical investment of $10,000

in the Bloomberg U.S. Municipal Bond Index (the “Index”).

† Source: Lipper Inc.

†† The total return figures presented for Class I shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 8/31/16 (the inception date for Class I shares), not reflecting the applicable sales load for Class A shares.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in each of the Class A shares, Class C shares, Class I shares and Class Z shares of BNY Mellon Opportunistic Municipal Securities Fund on 4/30/13 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on Class A shares, Class C shares, Class I shares and Class Z shares. The Index, unlike the fund, covers the U.S. dollar-denominated long-term tax-exempt bond market. These factors can contribute to the Index potentially outperforming or underperforming the fund. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

4

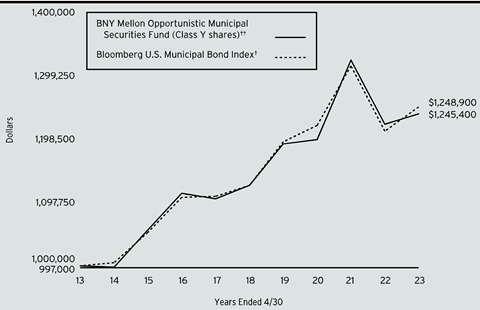

Comparison of change in value of a $1,000,000 investment in Class Y shares of BNY Mellon Opportunistic Municipal Securities Fund with a hypothetical investment of $1,000,000 in the Bloomberg U.S. Municipal Bond Index (the “Index”).

† Source: Lipper Inc.

†† The total return figures presented for Class Y shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 8/31/16 (the inception date for Class Y shares), not reflecting the applicable sales load for Class A shares.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $1,000,000 investment made in Class Y shares of BNY Mellon Opportunistic Municipal Securities Fund on 4/30/13 to a hypothetical investment of $1,000,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the graph above takes into account all applicable fees and expenses of the fund’s Class Y shares. The Index, unlike the fund, covers the U.S. dollar-denominated long-term tax-exempt bond market. These factors can contribute to the Index potentially outperforming or underperforming the fund. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

5

FUND PERFORMANCE (Unaudited) (continued)

Average Annual Total Returns as of 4/30/2023 |

|

|

| |

| Inception | 1 Year | 5 Years | 10 Years |

Class A shares | ||||

with maximum sales charge (4.50%) | 11/26/86 | -3.14% | .84% | 1.62% |

without sales charge | 11/26/86 | 1.40% | 1.77% | 2.09% |

Class C shares | ||||

with applicable redemption charge † | 7/13/95 | -.38% | .98% | 1.31% |

without redemption | 7/13/95 | .61% | .98% | 1.31% |

Class I shares | 8/31/16 | 1.64% | 2.02% | 2.26%†† |

Class Y shares | 8/31/16 | 1.65% | 2.00% | 2.22%†† |

Class Z shares | 10/14/04 | 1.36% | 1.82% | 2.14% |

Bloomberg U.S. Municipal Bond Index | 2.87% | 2.06% | 2.25% | |

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

†† The total return performance figures presented for Class I shares and Class Y shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 8/31/16 (the inception date for Class I shares and Class Y shares), not reflecting the applicable sales load for Class A shares.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to www.im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graphs and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

6

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in BNY Mellon Opportunistic Municipal Securities Fund from November 1, 2022 to April 30, 2023. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment |

| ||||||

Assume actual returns for the six months ended April 30, 2023 |

| ||||||

|

|

|

|

|

|

|

|

|

| Class A | Class C | Class I | Class Y | Class Z |

|

Expenses paid per $1,000† | $3.65 | $7.69 | $2.47 | $2.42 | $3.44 |

| |

Ending value (after expenses) | $1,073.10 | $1,068.80 | $1,074.20 | $1,074.40 | $1,073.30 |

| |

COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment |

| ||||||

Assuming a hypothetical 5% annualized return for the six months ended April 30, 2023 |

| ||||||

|

|

|

|

|

|

|

|

|

| Class A | Class C | Class I | Class Y | Class Z |

|

Expenses paid per $1,000† | $3.56 | $7.50 | $2.41 | $2.36 | $3.36 |

| |

Ending value (after expenses) | $1,021.27 | $1,017.36 | $1,022.41 | $1,022.46 | $1,021.47 |

| |

† | Expenses are equal to the fund’s annualized expense ratio of .71% for Class A, 1.50% for Class C, .48% for Class I, .47% for Class Y and .67% for Class Z, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). | ||||||

7

STATEMENT OF INVESTMENTS

April

30, 2023

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Bonds and Notes - .2% | |||||||||

Collateralized Municipal-Backed Securities - .2% | |||||||||

Arizona

Industrial Development Authority, Revenue Bonds, Ser. 2019-2 | 3.63 | 5/20/2033 | 984,715 | 921,382 | |||||

| |||||||||

Long-Term Municipal Investments - 99.3% | |||||||||

Alabama - 4.3% | |||||||||

Birmingham-Jefferson Civic Center Authority, Special Tax Bonds, Ser. B | 5.00 | 7/1/2043 | 2,500,000 | 2,620,255 | |||||

Black Belt Energy Gas District, Revenue Bonds (Project No. 4) Ser. A1 | 4.00 | 12/1/2025 | 1,250,000 | a | 1,251,952 | ||||

Black Belt Energy Gas District, Revenue Bonds, Refunding, Ser. D1 | 4.00 | 6/1/2027 | 1,000,000 | a | 1,005,327 | ||||

Black Belt Energy Gas District, Revenue Bonds, Ser. B1, 1 Month LIBOR +0.90% | 4.15 | 12/1/2023 | 1,405,000 | a,b | 1,403,497 | ||||

Jefferson County, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal Corp.) Ser. C | 6.60 | 10/1/2042 | 7,835,000 | c | 8,071,681 | ||||

The Lower Alabama Gas District, Revenue Bonds (Gas Project) | 4.00 | 12/1/2025 | 1,750,000 | a | 1,750,188 | ||||

The Southeast Alabama Gas Supply District, Revenue Bonds (Project No. 2) Ser. A | 4.00 | 6/1/2024 | 2,240,000 | a | 2,242,179 | ||||

University of Alabama at Birmingham, Revenue Bonds, Ser. B | 4.00 | 10/1/2035 | 2,000,000 | 2,073,376 | |||||

20,418,455 | |||||||||

Arizona - 3.1% | |||||||||

Arizona Industrial Development Authority, Revenue Bonds (Equitable School Revolving Fund Obligated Group) Ser. A | 4.00 | 11/1/2038 | 3,065,000 | 2,974,140 | |||||

Arizona Industrial Development Authority, Revenue Bonds, Refunding (BASIS Schools Project) Ser. A | 5.38 | 7/1/2050 | 2,500,000 | d | 2,394,869 | ||||

Glendale Industrial Development Authority, Revenue Bonds, Refunding (Sun Health Services Obligated Group) Ser. A | 5.00 | 11/15/2054 | 1,500,000 | 1,355,054 | |||||

8

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Long-Term Municipal Investments - 99.3% (continued) | |||||||||

Arizona - 3.1% (continued) | |||||||||

La Paz County Industrial Development Authority, Revenue Bonds (Harmony Public Schools) Ser. A | 5.00 | 2/15/2048 | 1,000,000 | 982,210 | |||||

La Paz County Industrial Development Authority, Revenue Bonds (Harmony Public Schools) Ser. A | 5.00 | 2/15/2046 | 2,000,000 | d | 1,979,203 | ||||

Maricopa County Industrial Development Authority, Revenue Bonds (Banner Health Obligated Group) Ser. A | 5.00 | 1/1/2041 | 1,175,000 | 1,234,281 | |||||

Maricopa County Industrial Development Authority, Revenue Bonds (Benjamin Franklin Charter School Obligated Group) | 6.00 | 7/1/2038 | 2,750,000 | d | 2,883,772 | ||||

The Phoenix Arizona Industrial Development Authority, Revenue Bonds, Refunding (BASIS Schools Projects) Ser. A | 5.00 | 7/1/2046 | 1,000,000 | d | 923,809 | ||||

14,727,338 | |||||||||

California - 4.2% | |||||||||

Alameda Corridor Transportation Authority, Revenue Bonds (Insured; Assured Guaranty Municipal Corp.) Ser. C | 5.00 | 10/1/2052 | 2,500,000 | 2,719,596 | |||||

California, GO, Refunding | 5.00 | 4/1/2042 | 1,400,000 | 1,584,577 | |||||

California, GO, Refunding | 5.25 | 9/1/2047 | 1,000,000 | 1,144,731 | |||||

California Community Choice Financing Authority, Revenue Bonds (Green Bond) | 5.25 | 10/1/2031 | 2,000,000 | a | 2,089,327 | ||||

California County Tobacco Securitization Agency, Revenue Bonds, Refunding, Ser. A | 4.00 | 6/1/2040 | 400,000 | 394,735 | |||||

California Health Facilities Financing Authority, Revenue Bonds, Refunding (Sutter Health Obligated Group) Ser. B | 5.00 | 11/15/2046 | 1,480,000 | 1,519,635 | |||||

California Housing Finance Agency, Revenue Bonds, Ser. 2021-1 | 3.50 | 11/20/2035 | 1,453,953 | 1,377,744 | |||||

California Municipal Finance Authority, Revenue Bonds (Green Bond) (Insured; Build America Mutual) | 5.00 | 5/15/2027 | 450,000 | 479,866 | |||||

California Municipal Finance Authority, Revenue Bonds, Refunding (HumanGood California Obligated Group) Ser. A | 5.00 | 10/1/2044 | 2,500,000 | 2,555,005 | |||||

9

STATEMENT OF INVESTMENTS (continued)

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Long-Term Municipal Investments - 99.3% (continued) | |||||||||

California - 4.2% (continued) | |||||||||

California University, Revenue Bonds, Refunding, Ser. B2 | 0.55 | 11/1/2026 | 1,000,000 | a | 889,972 | ||||

Orange County Community Facilities District, Special Tax Bonds, Ser. A | 5.00 | 8/15/2047 | 1,000,000 | 1,025,010 | |||||

San Diego County Regional Airport Authority, Revenue Bonds, Ser. B | 4.00 | 7/1/2046 | 1,750,000 | 1,652,047 | |||||

San Francisco City & County Airport Commission, Revenue Bonds, Refunding, Ser. B | 5.00 | 5/1/2041 | 1,500,000 | 1,533,554 | |||||

San Jose Evergreen Community College District, GO, Ser. C | 4.00 | 9/1/2045 | 1,000,000 | 1,012,565 | |||||

19,978,364 | |||||||||

Colorado - 6.0% | |||||||||

Colorado Health Facilities Authority, Revenue Bonds (Children's Hospital Colorado Obligated Group) Ser. A | 5.00 | 12/1/2041 | 2,500,000 | 2,558,023 | |||||

Colorado Health Facilities Authority, Revenue Bonds (Covenant Retirement Communities & Services Obligated Group) | 5.00 | 12/1/2043 | 3,280,000 | 3,292,584 | |||||

Colorado Health Facilities Authority, Revenue Bonds, Refunding | 5.00 | 11/19/2026 | 2,270,000 | a | 2,419,880 | ||||

Colorado Health Facilities Authority, Revenue Bonds, Refunding (CommonSpirit Health Obligated Group) Ser. A | 5.00 | 8/1/2044 | 1,250,000 | 1,291,255 | |||||

Colorado Health Facilities Authority, Revenue Bonds, Refunding (Intermountain Healthcare Obligated Group) Ser. A | 4.00 | 5/15/2052 | 2,000,000 | 1,911,563 | |||||

Colorado Health Facilities Authority, Revenue Bonds, Refunding, Ser. A | 4.00 | 1/1/2036 | 2,000,000 | 2,056,913 | |||||

Denver City & County Airport System, Revenue Bonds, Refunding, Ser. A | 5.00 | 12/1/2048 | 3,000,000 | 3,079,586 | |||||

Denver City & County Airport System, Revenue Bonds, Refunding, Ser. A | 5.50 | 11/15/2053 | 3,000,000 | 3,288,879 | |||||

Denver City & County Airport System, Revenue Bonds, Refunding, Ser. D | 5.00 | 11/15/2024 | 2,400,000 | 2,453,065 | |||||

Denver City & County Airport System, Revenue Bonds, Ser. A | 5.50 | 11/15/2027 | 3,065,000 | 3,092,300 | |||||

Regional Transportation District, Revenue Bonds, Refunding (Denver Transit Partners) Ser. A | 5.00 | 1/15/2031 | 950,000 | 1,033,737 | |||||

10

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Long-Term Municipal Investments - 99.3% (continued) | |||||||||

Colorado - 6.0% (continued) | |||||||||

Weld County School District No. RE-4, GO (Insured; State Aid Withholding) | 5.00 | 12/1/2042 | 2,000,000 | 2,257,692 | |||||

28,735,477 | |||||||||

Connecticut - .8% | |||||||||

Connecticut, GO, Ser. F | 5.00 | 11/15/2041 | 2,500,000 | 2,810,880 | |||||

Connecticut Health & Educational Facilities Authority, Revenue Bonds, Refunding (Fairfield University) Ser. T | 4.00 | 7/1/2055 | 1,000,000 | 900,819 | |||||

3,711,699 | |||||||||

District of Columbia - 2.7% | |||||||||

District of Columbia, Revenue Bonds, Ser. A | 5.50 | 7/1/2047 | 3,000,000 | 3,453,016 | |||||

Metropolitan Washington Airports Authority, Revenue Bonds, Refunding | 5.00 | 10/1/2035 | 1,500,000 | 1,580,631 | |||||

Metropolitan Washington Airports Authority, Revenue Bonds, Refunding, Ser. A | 5.00 | 10/1/2035 | 1,000,000 | 1,041,009 | |||||

Metropolitan Washington Airports Authority, Revenue Bonds, Refunding, Ser. A | 5.00 | 10/1/2027 | 3,340,000 | 3,393,981 | |||||

Metropolitan Washington Airports Authority, Revenue Bonds, Refunding, Ser. B | 4.00 | 10/1/2049 | 2,500,000 | 2,350,342 | |||||

Washington Metropolitan Area Transit Authority, Revenue Bonds (Green Bond) Ser. A | 4.13 | 7/15/2047 | 1,000,000 | 988,562 | |||||

12,807,541 | |||||||||

Florida - 3.7% | |||||||||

Broward County Airport System, Revenue Bonds | 5.00 | 10/1/2037 | 1,560,000 | 1,624,958 | |||||

Escambia County, Revenue Bonds | 5.00 | 10/1/2046 | 2,000,000 | 2,112,686 | |||||

Florida Municipal Power Agency, Revenue Bonds, Ser. A | 3.00 | 10/1/2032 | 1,000,000 | 958,963 | |||||

Hillsborough County Aviation Authority, Revenue Bonds | 5.00 | 10/1/2034 | 1,000,000 | 1,117,142 | |||||

Jacksonville, Revenue Bonds, Refunding (Brooks Rehabilitation Project) | 4.00 | 11/1/2045 | 1,500,000 | 1,372,701 | |||||

JEA Water & Sewer System, Revenue Bonds, Refunding, Ser. A | 4.00 | 10/1/2040 | 800,000 | 797,882 | |||||

Miami Beach Redevelopment Agency, Tax Allocation Bonds, Refunding | 5.00 | 2/1/2033 | 1,000,000 | 1,009,168 | |||||

11

STATEMENT OF INVESTMENTS (continued)

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Long-Term Municipal Investments - 99.3% (continued) | |||||||||

Florida - 3.7% (continued) | |||||||||

Miami Beach Stormwater, Revenue Bonds, Refunding | 5.00 | 9/1/2047 | 2,500,000 | 2,500,021 | |||||

Mid-Bay Bridge Authority, Revenue Bonds, Refunding, Ser. A | 5.00 | 10/1/2040 | 1,000,000 | 1,009,002 | |||||

Orange County Health Facilities Authority, Revenue Bonds (Orlando Health Obligated Group) Ser. A | 5.00 | 10/1/2053 | 2,000,000 | 2,120,182 | |||||

Palm Beach County Health Facilities Authority, Revenue Bonds, Refunding (Baptist Health South Florida Obligated Group) | 4.00 | 8/15/2049 | 3,305,000 | 3,023,525 | |||||

17,646,230 | |||||||||

Georgia - 4.3% | |||||||||

Atlanta Water & Wastewater, Revenue Bonds, Refunding | 5.00 | 11/1/2041 | 1,000,000 | 1,068,446 | |||||

Georgia Municipal Electric Authority, Revenue Bonds (Plant Vogtle Units 3&4 Project) | 5.00 | 1/1/2037 | 1,100,000 | 1,164,481 | |||||

Georgia Municipal Electric Authority, Revenue Bonds (Plant Vogtle Units 3&4 Project) (Insured; Assured Guaranty Municipal Corp.) Ser. A | 5.00 | 7/1/2055 | 1,000,000 | 1,047,528 | |||||

Georgia Municipal Electric Authority, Revenue Bonds (Plant Vogtle Units 3&4 Project) Ser. A | 5.00 | 7/1/2052 | 3,250,000 | 3,361,607 | |||||

Georgia Municipal Electric Authority, Revenue Bonds, Refunding (Project No. 1) Ser. A | 5.00 | 1/1/2028 | 2,500,000 | 2,627,148 | |||||

Georgia Ports Authority, Revenue Bonds | 4.00 | 7/1/2052 | 1,250,000 | 1,216,961 | |||||

Main Street Natural Gas, Revenue Bonds, Ser. A | 5.00 | 6/1/2030 | 2,500,000 | a | 2,637,918 | ||||

Main Street Natural Gas, Revenue Bonds, Ser. B | 5.00 | 6/1/2029 | 2,000,000 | a | 2,099,567 | ||||

Main Street Natural Gas, Revenue Bonds, Ser. C | 4.00 | 9/1/2026 | 3,750,000 | a | 3,746,998 | ||||

Private Colleges & Universities Authority, Revenue Bonds, Refunding (Emory University) Ser. A | 5.00 | 10/1/2043 | 1,700,000 | 1,704,413 | |||||

20,675,067 | |||||||||

Hawaii - .3% | |||||||||

Hawaii Airports System, Revenue Bonds, Ser. A | 5.00 | 7/1/2047 | 1,250,000 | 1,312,326 | |||||

12

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Long-Term Municipal Investments - 99.3% (continued) | |||||||||

Illinois - 9.9% | |||||||||

Chicago Board of Education, GO, Refunding (Insured; Assured Guaranty Municipal Corp.) Ser. A | 5.00 | 12/1/2033 | 1,000,000 | 1,072,971 | |||||

Chicago Board of Education, GO, Refunding (Insured; Assured Guaranty Municipal Corp.) Ser. C | 5.00 | 12/1/2030 | 1,500,000 | 1,614,335 | |||||

Chicago Board of Education Dedicated Capital Improvement Tax, Revenue Bonds | 5.00 | 4/1/2042 | 1,000,000 | 1,016,305 | |||||

Chicago II Wastewater Transmission, Revenue Bonds (Insured; Assured Guaranty Municipal Corp.) | 5.00 | 1/1/2033 | 2,490,000 | 2,524,542 | |||||

Chicago II Waterworks, Revenue Bonds (2nd Lien Project) | 5.00 | 11/1/2025 | 1,925,000 | 1,960,634 | |||||

Chicago O'Hare International Airport, Revenue Bonds, Refunding, Ser. A | 5.00 | 1/1/2034 | 2,100,000 | 2,137,740 | |||||

Chicago O'Hare International Airport, Revenue Bonds, Ser. A | 5.50 | 1/1/2055 | 1,500,000 | 1,618,776 | |||||

Chicago Park District, GO, Refunding, Ser. C | 5.00 | 1/1/2027 | 2,030,000 | 2,050,142 | |||||

Cook County II, GO, Refunding, Ser. A | 5.00 | 11/15/2025 | 2,000,000 | 2,085,451 | |||||

Cook County II, Revenue Bonds, Refunding | 5.00 | 11/15/2035 | 2,500,000 | 2,670,293 | |||||

Illinois, GO, Refunding, Ser. D | 4.00 | 7/1/2037 | 1,750,000 | 1,728,879 | |||||

Illinois, Revenue Bonds (Insured; Build America Mutual) Ser. A | 5.00 | 6/15/2030 | 2,000,000 | 2,170,287 | |||||

Illinois Finance Authority, Revenue Bonds (Advocate Health Care Obligated Group) | 5.00 | 6/1/2027 | 270,000 | 270,297 | |||||

Illinois Finance Authority, Revenue Bonds, Refunding (OSF Healthcare System Obligated Group) Ser. A | 5.00 | 11/15/2045 | 1,000,000 | 1,010,217 | |||||

Illinois Finance Authority, Revenue Bonds, Refunding (Rush University Medical Center Obligated Group) Ser. A | 5.00 | 11/15/2033 | 3,000,000 | 3,095,743 | |||||

Illinois Finance Authority, Revenue Bonds, Refunding (The University of Chicago) Ser. A | 4.00 | 4/1/2050 | 3,760,000 | 3,543,614 | |||||

Illinois Finance Authority, Revenue Bonds, Refunding, Ser. A | 6.00 | 7/1/2043 | 2,500,000 | 2,510,672 | |||||

Illinois Housing Development Authority, Revenue Bonds (Insured; GNMA, FNMA, FHLMC) Ser. A | 3.00 | 4/1/2051 | 1,865,000 | 1,807,884 | |||||

13

STATEMENT OF INVESTMENTS (continued)

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Long-Term Municipal Investments - 99.3% (continued) | |||||||||

Illinois - 9.9% (continued) | |||||||||

Illinois Municipal Electric Agency, Revenue Bonds, Refunding, Ser. A | 5.00 | 2/1/2032 | 1,500,000 | 1,552,267 | |||||

Northern Illinois University, Revenue Bonds, Refunding (Insured; Build America Mutual) Ser. B | 4.00 | 4/1/2040 | 1,475,000 | 1,383,008 | |||||

Regional Transportation Authority, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal Corp.) | 6.00 | 6/1/2025 | 1,000,000 | 1,033,067 | |||||

Sales Tax Securitization Corp., Revenue Bonds, Refunding, Ser. A | 4.00 | 1/1/2039 | 2,350,000 | 2,317,484 | |||||

Sales Tax Securitization Corp., Revenue Bonds, Refunding, Ser. A | 4.00 | 1/1/2038 | 1,000,000 | 994,102 | |||||

Sales Tax Securitization Corp., Revenue Bonds, Refunding, Ser. A | 5.00 | 1/1/2034 | 1,400,000 | 1,611,637 | |||||

Sales Tax Securitization Corp., Revenue Bonds, Refunding, Ser. A | 5.00 | 1/1/2036 | 3,500,000 | 3,786,433 | |||||

47,566,780 | |||||||||

Indiana - .6% | |||||||||

Indiana Finance Authority, Revenue Bonds, Refunding (CWA Authority Project) Ser. 1 | 4.00 | 10/1/2036 | 2,980,000 | 3,047,511 | |||||

Iowa - 2.0% | |||||||||

Iowa Finance Authority, Revenue Bonds, Refunding (Iowa Fertilizer Co. Project) | 5.00 | 12/1/2050 | 2,730,000 | 2,713,708 | |||||

Iowa Student Loan Liquidity Corp., Revenue Bonds, Ser. B | 5.00 | 12/1/2030 | 1,500,000 | 1,671,389 | |||||

Iowa Tobacco Settlement Authority, Revenue Bonds, Refunding, Ser. A2 | 4.00 | 6/1/2049 | 2,000,000 | 1,801,872 | |||||

Iowa Tobacco Settlement Authority, Revenue Bonds, Refunding, Ser. B1 | 4.00 | 6/1/2049 | 1,420,000 | 1,406,107 | |||||

PEFA, Revenue Bonds (Gas Project) | 5.00 | 9/1/2026 | 2,000,000 | a | 2,060,125 | ||||

9,653,201 | |||||||||

Kansas - .0% | |||||||||

Kansas Development Finance Authority, Revenue Bonds, Ser. B | 4.00 | 11/15/2025 | 250,000 | 234,986 | |||||

Kentucky - 1.8% | |||||||||

Kentucky Economic Development Finance Authority, Revenue Bonds, Refunding (Louisville Arena Project) (Insured; Assured Guaranty Municipal Corp.) Ser. A | 5.00 | 12/1/2045 | 2,000,000 | 2,059,424 | |||||

14

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Long-Term Municipal Investments - 99.3% (continued) | |||||||||

Kentucky - 1.8% (continued) | |||||||||

Kentucky Public Energy Authority, Revenue Bonds, Ser. A | 4.00 | 4/1/2024 | 1,010,000 | a | 1,010,987 | ||||

Kentucky Public Energy Authority, Revenue Bonds, Ser. A1 | 4.00 | 8/1/2030 | 1,500,000 | a | 1,488,098 | ||||

Kentucky Public Energy Authority, Revenue Bonds, Ser. B | 4.00 | 1/1/2025 | 4,000,000 | a | 4,010,394 | ||||

8,568,903 | |||||||||

Louisiana - 1.8% | |||||||||

Louisiana Public Facilities Authority, Revenue Bonds (Franciscan Missionaries of Our Lady Health System Obligated Group) Ser. A | 5.00 | 7/1/2047 | 1,500,000 | 1,524,447 | |||||

New Orleans Aviation Board, Revenue Bonds (Parking Facilities Corp.) (Insured; Assured Guaranty Municipal Corp.) | 5.00 | 10/1/2048 | 1,250,000 | 1,309,829 | |||||

New Orleans Aviation Board, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal Corp.) | 5.00 | 1/1/2036 | 1,135,000 | 1,225,030 | |||||

New Orleans Aviation Board, Revenue Bonds, Ser. B | 5.00 | 1/1/2040 | 2,175,000 | 2,190,382 | |||||

St. John the Baptist Parish, Revenue Bonds, Refunding (Marathon Oil Corp.) | 2.20 | 7/1/2026 | 1,000,000 | a | 941,295 | ||||

Tobacco Settlement Financing Corp., Revenue Bonds, Refunding, Ser. A | 5.25 | 5/15/2035 | 1,500,000 | 1,510,092 | |||||

8,701,075 | |||||||||

Maryland - .3% | |||||||||

Maryland Economic Development Corp., Revenue Bonds (Green Bond) (Purple Line Transit Partners) Ser. B | 5.25 | 6/30/2052 | 1,590,000 | 1,614,500 | |||||

Massachusetts - 1.3% | |||||||||

Massachusetts Development Finance Agency, Revenue Bonds, Refunding (Boston Medical Center Corp. Obligated Group) | 4.38 | 7/1/2052 | 1,000,000 | 970,744 | |||||

Massachusetts Development Finance Agency, Revenue Bonds, Refunding (Suffolk University) | 5.00 | 7/1/2027 | 1,750,000 | 1,840,248 | |||||

Massachusetts Educational Financing Authority, Revenue Bonds, Ser. B | 5.00 | 7/1/2027 | 2,350,000 | 2,494,511 | |||||

15

STATEMENT OF INVESTMENTS (continued)

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Long-Term Municipal Investments - 99.3% (continued) | |||||||||

Massachusetts - 1.3% (continued) | |||||||||

Massachusetts Port Authority, Revenue Bonds (Green Bond) Ser. A | 5.00 | 7/1/2034 | 1,000,000 | 1,133,567 | |||||

6,439,070 | |||||||||

Michigan - 5.1% | |||||||||

Great Lakes Water Authority, Revenue Bonds, Ser. B | 5.00 | 7/1/2046 | 3,000,000 | 3,092,941 | |||||

Karegnondi Water Authority, Revenue Bonds, Refunding | 5.00 | 11/1/2041 | 1,000,000 | 1,040,041 | |||||

Lansing Board of Water & Light, Revenue Bonds, Ser. B | 2.00 | 7/1/2026 | 2,500,000 | a | 2,384,001 | ||||

Michigan Finance Authority, Revenue Bonds (Henry Ford Health System Obligated Group) Ser. A | 4.00 | 11/15/2050 | 1,665,000 | 1,510,037 | |||||

Michigan Finance Authority, Revenue Bonds, Refunding | 4.00 | 4/15/2042 | 2,425,000 | 2,364,578 | |||||

Michigan Finance Authority, Revenue Bonds, Refunding (Great Lakes Water Authority) (Insured; Assured Guaranty Municipal Corp.) Ser. C3 | 5.00 | 7/1/2031 | 2,500,000 | 2,545,710 | |||||

Michigan Finance Authority, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal Corp.) Ser. D1 | 5.00 | 7/1/2037 | 2,000,000 | 2,025,132 | |||||

Michigan Housing Development Authority, Revenue Bonds, Ser. A | 3.50 | 12/1/2050 | 1,605,000 | 1,581,980 | |||||

Michigan Strategic Fund, Revenue Bonds (I-75 Improvement Project) | 5.00 | 6/30/2033 | 3,900,000 | 4,092,752 | |||||

Michigan Trunk Line, Revenue Bonds | 4.00 | 11/15/2046 | 1,140,000 | 1,118,394 | |||||

Pontiac School District, GO | 4.00 | 5/1/2045 | 1,800,000 | 1,801,310 | |||||

Wayne County Airport Authority, Revenue Bonds, Ser. D | 5.00 | 12/1/2045 | 1,000,000 | 1,024,059 | |||||

24,580,935 | |||||||||

Missouri - .6% | |||||||||

Kansas City Industrial Development Authority, Revenue Bonds, Ser. B | 5.00 | 3/1/2054 | 3,060,000 | 3,135,868 | |||||

Multi-State - .2% | |||||||||

Federal Home Loan Mortgage Corp. Multifamily Variable Rate Certificates, Revenue Bonds, Ser. M048 | 3.15 | 1/15/2036 | 1,175,000 | d | 1,076,866 | ||||

16

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Long-Term Municipal Investments - 99.3% (continued) | |||||||||

Nebraska - .4% | |||||||||

Public Power Generation Agency, Revenue Bonds, Refunding | 5.00 | 1/1/2037 | 2,000,000 | 2,091,944 | |||||

Nevada - 1.4% | |||||||||

Clark County School District, GO, Ser. A | 5.00 | 6/15/2039 | 5,000,000 | 5,572,627 | |||||

Reno, Revenue Bonds, Refunding (Reno Transportation Rail Access Project) | 5.00 | 6/1/2048 | 1,070,000 | 1,111,775 | |||||

6,684,402 | |||||||||

New Jersey - 3.3% | |||||||||

New Jersey Economic Development Authority, Revenue Bonds, Refunding, Ser. XX | 5.25 | 6/15/2027 | 465,000 | 485,478 | |||||

New Jersey Educational Facilities Authority, Revenue Bonds, Refunding (Stockton University) Ser. A | 5.00 | 7/1/2041 | 1,000,000 | 1,016,954 | |||||

New Jersey Health Care Facilities Financing Authority, Revenue Bonds (Inspira Health Obligated Group) | 5.00 | 7/1/2037 | 1,600,000 | 1,673,631 | |||||

New Jersey Higher Education Student Assistance Authority, Revenue Bonds, Ser. B | 5.00 | 12/1/2024 | 570,000 | 580,419 | |||||

New Jersey Transportation Trust Fund Authority, Revenue Bonds | 5.50 | 6/15/2050 | 1,000,000 | 1,109,102 | |||||

New Jersey Transportation Trust Fund Authority, Revenue Bonds, Ser. BB | 5.00 | 6/15/2044 | 2,000,000 | 2,098,755 | |||||

New Jersey Turnpike Authority, Revenue Bonds, Refunding, Ser. D | 5.00 | 1/1/2028 | 1,000,000 | 1,065,641 | |||||

South Jersey Transportation Authority, Revenue Bonds | 4.63 | 11/1/2047 | 1,000,000 | 1,016,991 | |||||

Tobacco Settlement Financing Corp., Revenue Bonds, Refunding, Ser. A | 5.00 | 6/1/2046 | 3,880,000 | 3,997,247 | |||||

Tobacco Settlement Financing Corp., Revenue Bonds, Refunding, Ser. A | 5.00 | 6/1/2036 | 2,000,000 | 2,127,742 | |||||

Tobacco Settlement Financing Corp., Revenue Bonds, Refunding, Ser. A | 5.25 | 6/1/2046 | 620,000 | 648,618 | |||||

15,820,578 | |||||||||

New Mexico - 1.0% | |||||||||

New Mexico Educational Assistance Foundation, Revenue Bonds, Refunding, Ser. 1A | 5.00 | 9/1/2025 | 2,080,000 | 2,148,105 | |||||

17

STATEMENT OF INVESTMENTS (continued)

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Long-Term Municipal Investments - 99.3% (continued) | |||||||||

New Mexico - 1.0% (continued) | |||||||||

New Mexico Mortgage Finance Authority, Revenue Bonds (Insured; GNMA, FNMA, FHLMC) Ser. C | 3.00 | 1/1/2052 | 2,645,000 | 2,560,148 | |||||

4,708,253 | |||||||||

New York - 6.4% | |||||||||

Metropolitan Transportation Authority, Revenue Bonds, Refunding (Green Bond) Ser. C1 | 5.00 | 11/15/2050 | 3,000,000 | 3,104,186 | |||||

New York City, GO, Ser. F1 | 4.00 | 3/1/2047 | 200,000 | 195,662 | |||||

New York City Housing Development Corp., Revenue Bonds (Insured; Federal Housing Administration) Ser. F2 | 0.60 | 7/1/2025 | 1,000,000 | a | 923,988 | ||||

New York Liberty Development Corp., Revenue Bonds, Refunding (Class 1-3 World Trade Center Project) | 5.00 | 11/15/2044 | 2,500,000 | d | 2,429,314 | ||||

New York Liberty Development Corp., Revenue Bonds, Refunding (Goldman Sachs Headquarters) | 5.25 | 10/1/2035 | 1,000,000 | 1,148,940 | |||||

New York State Dormitory Authority, Revenue Bonds, Refunding, Ser. E | 4.00 | 3/15/2038 | 1,400,000 | 1,431,106 | |||||

New York State Mortgage Agency, Revenue Bonds, Refunding, Ser. 232 | 5.00 | 4/1/2026 | 1,180,000 | 1,227,409 | |||||

New York Transportation Development Corp., Revenue Bonds (Delta Air Lines) | 4.38 | 10/1/2045 | 2,500,000 | 2,384,729 | |||||

New York Transportation Development Corp., Revenue Bonds (Delta Air Lines) | 5.00 | 1/1/2032 | 1,500,000 | 1,572,661 | |||||

New York Transportation Development Corp., Revenue Bonds (JFK International Air Terminal) | 5.00 | 12/1/2040 | 2,000,000 | 2,091,332 | |||||

New York Transportation Development Corp., Revenue Bonds (LaGuardia Airport Terminal B Redevelopment Project) Ser. A | 5.25 | 1/1/2050 | 2,500,000 | 2,503,039 | |||||

Triborough Bridge & Tunnel Authority, Revenue Bonds, Refunding, Ser. C | 5.25 | 5/15/2052 | 5,000,000 | 5,575,555 | |||||

Triborough Bridge & Tunnel Authority, Revenue Bonds, Refunding, Ser. C2 | 5.00 | 11/15/2042 | 1,500,000 | 1,607,138 | |||||

18

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Long-Term Municipal Investments - 99.3% (continued) | |||||||||

New York - 6.4% (continued) | |||||||||

Triborough Bridge & Tunnel Authority, Revenue Bonds, Ser. A | 5.25 | 5/15/2057 | 2,500,000 | 2,764,404 | |||||

TSASC, Revenue Bonds, Refunding, Ser. B | 5.00 | 6/1/2045 | 815,000 | 766,205 | |||||

Westchester County Local Development Corp., Revenue Bonds, Refunding (Purchase Senior Learning Community Obligated Group) | 5.00 | 7/1/2046 | 1,000,000 | d | 771,295 | ||||

30,496,963 | |||||||||

North Carolina - 1.5% | |||||||||

Charlotte Airport, Revenue Bonds, Refunding, Ser. B | 5.00 | 7/1/2038 | 1,000,000 | 1,091,810 | |||||

North Carolina Medical Care Commission, Revenue Bonds (Twin Lakes Community) Ser. A | 5.00 | 1/1/2038 | 1,000,000 | 996,846 | |||||

The Charlotte-Mecklenburg Hospital Authority, Revenue Bonds (Atrium Health Obligated Group) | 5.00 | 12/1/2028 | 1,500,000 | a | 1,671,753 | ||||

The Charlotte-Mecklenburg Hospital Authority, Revenue Bonds (Atrium Health Obligated Group) Ser. B | 5.00 | 12/2/2024 | 3,500,000 | a | 3,598,944 | ||||

7,359,353 | |||||||||

North Dakota - .3% | |||||||||

University of North Dakota, COP (Insured; Assured Guaranty Municipal Corp.) Ser. A | 4.00 | 6/1/2046 | 1,470,000 | 1,394,436 | |||||

Ohio - 1.8% | |||||||||

Buckeye Tobacco Settlement Financing Authority, Revenue Bonds, Refunding, Ser. A2 | 4.00 | 6/1/2048 | 6,000,000 | 5,312,137 | |||||

Cuyahoga County, Revenue Bonds, Refunding (The MetroHealth System) | 5.25 | 2/15/2047 | 1,000,000 | 1,012,776 | |||||

Ohio, Revenue Bonds (Cleveland Clinic Health System Obligated Group) | 2.75 | 5/1/2028 | 1,000,000 | a | 984,991 | ||||

Ohio, Revenue Bonds, Refunding (Lease Appropriations-Adult Correctional Building Fund Projects) Ser. A | 5.00 | 10/1/2037 | 1,430,000 | 1,541,700 | |||||

8,851,604 | |||||||||

Oregon - 1.2% | |||||||||

Port of Portland, Revenue Bonds, Refunding (Green Bond) Ser. 29 | 5.50 | 7/1/2053 | 3,250,000 | 3,579,329 | |||||

19

STATEMENT OF INVESTMENTS (continued)

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Long-Term Municipal Investments - 99.3% (continued) | |||||||||

Oregon - 1.2% (continued) | |||||||||

Port of Portland, Revenue Bonds, Refunding, Ser. 28 | 4.00 | 7/1/2047 | 2,250,000 | 2,137,985 | |||||

5,717,314 | |||||||||

Pennsylvania - 7.7% | |||||||||

Allentown Neighborhood Improvement Zone Development Authority, Revenue Bonds (City Center Project) | 5.00 | 5/1/2033 | 2,750,000 | d | 2,800,944 | ||||

Allentown School District, GO, Refunding (Insured; Build America Mutual) Ser. B | 5.00 | 2/1/2030 | 1,000,000 | 1,127,441 | |||||

Commonwealth Financing Authority, Revenue Bonds | 5.00 | 6/1/2030 | 2,000,000 | 2,187,775 | |||||

Geisinger Authority, Revenue Bonds, Refunding (Geisinger Health System Obligated Group) | 5.00 | 2/15/2027 | 1,350,000 | a | 1,417,574 | ||||

Luzerne County Industrial Development Authority, Revenue Bonds, Refunding (Pennsylvania-American Water Co.) | 2.45 | 12/3/2029 | 1,750,000 | a | 1,610,652 | ||||

Montgomery County Industrial Development Authority, Revenue Bonds, Refunding (ACTS Retirement-Life Communities Obligated Group) | 5.00 | 11/15/2036 | 3,500,000 | 3,489,708 | |||||

Pennsylvania Economic Development Financing Authority, Revenue Bonds (Insured; Assured Guaranteed Municipal Corp.) | 5.00 | 12/31/2057 | 2,000,000 | 2,092,803 | |||||

Pennsylvania Higher Education Assistance Agency, Revenue Bonds, Ser. A | 5.00 | 6/1/2029 | 1,400,000 | 1,505,682 | |||||

Pennsylvania Turnpike Commission, Revenue Bonds, Ser. A1 | 5.00 | 12/1/2036 | 1,250,000 | 1,315,865 | |||||

Pennsylvania Turnpike Commission Oil Franchise, Revenue Bonds, Refunding, Ser. A | 5.00 | 12/1/2046 | 3,000,000 | 3,257,525 | |||||

Pennsylvania Turnpike Commission Oil Franchise, Revenue Bonds, Ser. B | 5.25 | 12/1/2048 | 4,000,000 | 4,246,287 | |||||

Philadelphia, GO, Ser. A | 5.00 | 5/1/2033 | 4,000,000 | 4,612,424 | |||||

The Philadelphia Redevelopment Authority, Revenue Bonds, Refunding, Ser. B | 5.00 | 4/15/2024 | 1,500,000 | 1,519,101 | |||||

The Philadelphia School District, GO (Insured; State Aid Withholding) Ser. A | 4.00 | 9/1/2036 | 1,420,000 | 1,426,678 | |||||

20

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Long-Term Municipal Investments - 99.3% (continued) | |||||||||

Pennsylvania - 7.7% (continued) | |||||||||

The Philadelphia School District, GO (Insured; State Aid Withholding) Ser. A | 5.00 | 9/1/2038 | 1,000,000 | 1,069,642 | |||||

The Philadelphia School District, GO (Insured; State Aid Withholding) Ser. A | 5.00 | 9/1/2044 | 3,000,000 | 3,193,950 | |||||

36,874,051 | |||||||||

Rhode Island - .4% | |||||||||

Providence Public Building Authority, Revenue Bonds (Insured; Assured Guaranty Municipal Corp.) Ser. A | 5.00 | 9/15/2037 | 1,695,000 | 1,823,076 | |||||

South Carolina - 2.3% | |||||||||

Piedmont Municipal Power Agency, Revenue Bonds, Refunding, Ser. B | 5.00 | 1/1/2029 | 1,000,000 | 1,104,752 | |||||

Piedmont Municipal Power Agency, Revenue Bonds, Refunding, Ser. D | 4.00 | 1/1/2033 | 3,000,000 | 3,093,936 | |||||

South Carolina Public Service Authority, Revenue Bonds (Santee Cooper) Ser. A | 4.00 | 12/1/2055 | 2,000,000 | 1,767,587 | |||||

South Carolina Public Service Authority, Revenue Bonds, Refunding (Santee Cooper) | 5.13 | 12/1/2043 | 5,000,000 | 5,016,673 | |||||

10,982,948 | |||||||||

Tennessee - 1.0% | |||||||||

Tennergy Corp., Revenue Bonds, Ser. A | 4.00 | 9/1/2028 | 2,000,000 | a | 2,000,568 | ||||

Tennessee Energy Acquisition Corp., Revenue Bonds | 4.00 | 11/1/2025 | 1,000,000 | a | 1,000,360 | ||||

The Metropolitan Nashville Airport Authority, Revenue Bonds, Ser. B | 5.50 | 7/1/2052 | 1,500,000 | 1,625,951 | |||||

4,626,879 | |||||||||

Texas - 9.3% | |||||||||

Argyle Independent School District, GO (Insured; Permanent School Fund Guarantee Program) | 5.00 | 8/15/2035 | 1,100,000 | 1,297,624 | |||||

Clifton Higher Education Finance Corp., Revenue Bonds (International Leadership of Texas) Ser. D | 5.75 | 8/15/2033 | 4,500,000 | 4,578,477 | |||||

Clifton Higher Education Finance Corp., Revenue Bonds, Refunding (IDEA Public Schools) (Insured; Permanent School Fund Guarantee Program) | 5.00 | 8/15/2031 | 3,825,000 | 3,908,294 | |||||

Corpus Christi Utility System, Revenue Bonds, Refunding, Ser. A | 4.00 | 7/15/2035 | 1,000,000 | 1,032,895 | |||||

21

STATEMENT OF INVESTMENTS (continued)

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Long-Term Municipal Investments - 99.3% (continued) | |||||||||

Texas - 9.3% (continued) | |||||||||

Dallas Area Rapid Transit, Revenue Bonds, Refunding, Ser. B | 4.00 | 12/1/2051 | 1,925,000 | 1,869,621 | |||||

Dallas Fort Worth International Airport, Revenue Bonds, Refunding, Ser. B | 5.00 | 11/1/2040 | 2,500,000 | 2,792,232 | |||||

Garland Electric Utility System, Revenue Bonds, Refunding | 5.00 | 3/1/2044 | 1,500,000 | 1,591,740 | |||||

Georgetown Utility System, Revenue Bonds (Insured; Assured Guaranteed Municipal Corp.) | 5.25 | 8/15/2052 | 3,000,000 | 3,273,809 | |||||

Houston Airport System, Revenue Bonds (United Airlines) Ser. C | 5.00 | 7/15/2028 | 1,000,000 | 1,015,182 | |||||

Lamar Consolidated Independent School District, GO | 4.00 | 2/15/2053 | 1,225,000 | 1,154,934 | |||||

Love Field Airport Modernization Corp., Revenue Bonds | 5.00 | 11/1/2034 | 3,500,000 | 3,586,780 | |||||

Lower Colorado River Authority, Revenue Bonds, Refunding | 5.00 | 5/15/2039 | 3,000,000 | 2,999,843 | |||||

Lower Colorado River Authority, Revenue Bonds, Refunding (LCRA Transmission Services Corp.) Ser. A | 4.00 | 5/15/2049 | 1,000,000 | 894,692 | |||||

Lubbock Electric Light & Power System, Revenue Bonds | 5.00 | 4/15/2048 | 2,475,000 | 2,555,167 | |||||

Mission Economic Development Corp., Revenue Bonds, Refunding (Natgasoline Project) | 4.63 | 10/1/2031 | 2,800,000 | d | 2,735,999 | ||||

North Texas Tollway Authority, Revenue Bonds, Refunding, Ser. A | 5.00 | 1/1/2039 | 4,000,000 | 4,130,527 | |||||

Plano Independent School District, GO | 5.00 | 2/15/2043 | 1,000,000 | 1,115,503 | |||||

Tarrant County Cultural Education Facilities Finance Corp., Revenue Bonds (Baylor Scott & White Health Obligated Group) Ser. F | 5.00 | 11/15/2030 | 2,000,000 | a | 2,247,829 | ||||

Tarrant County Cultural Education Facilities Finance Corp., Revenue Bonds (CHRISTUS Health Obligated Group) Ser. A | 5.00 | 7/1/2032 | 1,500,000 | a | 1,694,296 | ||||

44,475,444 | |||||||||

U.S. Related - 2.3% | |||||||||

Puerto Rico, GO, Ser. A1 | 5.63 | 7/1/2029 | 3,000,000 | 3,176,405 | |||||

Puerto Rico, GO, Ser. A1 | 5.63 | 7/1/2027 | 7,500,000 | 7,825,304 | |||||

11,001,709 | |||||||||

Utah - .9% | |||||||||

Salt Lake City Airport, Revenue Bonds, Ser. A | 5.00 | 7/1/2034 | 3,000,000 | 3,167,025 | |||||

22

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Long-Term Municipal Investments - 99.3% (continued) | |||||||||

Utah - .9% (continued) | |||||||||

Utah Telecommunication Open Infrastructure Agency, Revenue Bonds, Refunding | 5.50 | 6/1/2040 | 1,200,000 | 1,375,237 | |||||

4,542,262 | |||||||||

Virginia - 1.5% | |||||||||

Virginia Public Building Authority, Revenue Bonds, Ser. A | 4.00 | 8/1/2039 | 2,500,000 | 2,566,335 | |||||

Virginia Public Building Authority, Revenue Bonds, Ser. C | 5.00 | 8/1/2030 | 1,275,000 | 1,349,067 | |||||

Virginia Small Business Financing Authority, Revenue Bonds, Refunding | 5.00 | 12/31/2047 | 1,500,000 | 1,513,163 | |||||

Winchester Economic Development Authority, Revenue Bonds, Refunding (Valley Health System Obligated Group) | 5.00 | 1/1/2035 | 1,560,000 | 1,620,683 | |||||

7,049,248 | |||||||||

Washington - 2.2% | |||||||||

Port of Seattle, Revenue Bonds | 5.00 | 4/1/2029 | 2,380,000 | 2,594,281 | |||||

Port of Seattle, Revenue Bonds, Refunding | 4.00 | 8/1/2047 | 1,500,000 | 1,380,088 | |||||

Washington, GO, Ser. B | 5.00 | 2/1/2043 | 2,710,000 | 3,055,131 | |||||

Washington Convention Center Public Facilities District, Revenue Bonds | 5.00 | 7/1/2058 | 2,450,000 | 2,464,178 | |||||

Washington Housing Finance Commission, Revenue Bonds, Ser. A1 | 3.50 | 12/20/2035 | 972,161 | 913,146 | |||||

10,406,824 | |||||||||

Wisconsin - 1.4% | |||||||||

Public Finance Authority, Revenue Bonds, Refunding (Duke Energy Progress) Ser. B | 4.00 | 10/1/2030 | 2,855,000 | a | 2,931,603 | ||||

Public Finance Authority, Revenue Bonds, Refunding (Renown Regional Medical Center) Ser. A | 5.00 | 6/1/2040 | 2,000,000 | 2,037,034 | |||||

23

STATEMENT OF INVESTMENTS (continued)

Description | Coupon | Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Long-Term Municipal Investments - 99.3% (continued) | |||||||||

Wisconsin - 1.4% (continued) | |||||||||

Public Finance Authority, Revenue Bonds, Ser. A | 5.00 | 10/1/2052 | 1,500,000 | 1,572,597 | |||||

6,541,234 | |||||||||

Total Long-Term

Municipal Investments | 476,080,714 | ||||||||

Total Investments (cost $489,149,463) | 99.5% | 477,002,096 | |||||||

Cash and Receivables (Net) | 0.5% | 2,230,818 | |||||||

Net Assets | 100.0% | 479,232,914 | |||||||

a These securities have a put feature; the date shown represents the put date and the bond holder can take a specific action to retain the bond after the put date.

b Variable rate security—interest rate resets periodically and rate shown is the interest rate in effect at period end. Security description also includes the reference rate and spread if published and available.

c Zero coupon until a specified date at which time the stated coupon rate becomes effective until maturity.

d Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At April 30, 2023, these securities were valued at $17,996,071 or 3.76% of net assets.

Portfolio Summary (Unaudited) † | Value (%) |

General | 19.6 |

Airport | 12.2 |

Medical | 10.9 |

Education | 7.4 |

Transportation | 7.1 |

Power | 6.7 |

General Obligation | 6.3 |

Water | 5.6 |

School District | 4.7 |

Tobacco Settlement | 4.2 |

Development | 3.8 |

Nursing Homes | 2.6 |

Utilities | 2.5 |

Student Loan | 1.7 |

Single Family Housing | 1.5 |

Multifamily Housing | 1.1 |

Special Tax | .8 |

Facilities | .7 |

Housing | .1 |

99.5 |

† Based on net assets.

See notes to financial statements.

24

Summary of Abbreviations (Unaudited) | |||

ABAG | Association of Bay Area Governments | AGC | ACE Guaranty Corporation |

AGIC | Asset Guaranty Insurance Company | AMBAC | American Municipal Bond Assurance Corporation |

BAN | Bond Anticipation Notes | BSBY | Bloomberg Short-Term Bank Yield Index |

CIFG | CDC Ixis Financial Guaranty | COP | Certificate of Participation |

CP | Commercial Paper | DRIVERS | Derivative Inverse Tax-Exempt Receipts |

EFFR | Effective Federal Funds Rate | FGIC | Financial Guaranty Insurance Company |

FHA | Federal Housing Administration | FHLB | Federal Home Loan Bank |

FHLMC | Federal Home Loan Mortgage Corporation | FNMA | Federal National Mortgage Association |

GAN | Grant Anticipation Notes | GIC | Guaranteed Investment Contract |

GNMA | Government National Mortgage Association | GO | General Obligation |

IDC | Industrial Development Corporation | LIBOR | London Interbank Offered Rate |

LOC | Letter of Credit | LR | Lease Revenue |

NAN | Note Anticipation Notes | MFHR | Multi-Family Housing Revenue |

MFMR | Multi-Family Mortgage Revenue | MUNIPSA | Securities Industry and Financial Markets Association Municipal Swap Index Yield |

OBFR | Overnight Bank Funding Rate | PILOT | Payment in Lieu of Taxes |

PRIME | Prime Lending Rate | PUTTERS | Puttable Tax-Exempt Receipts |

RAC | Revenue Anticipation Certificates | RAN | Revenue Anticipation Notes |

RIB | Residual Interest Bonds | SFHR | Single Family Housing Revenue |

SFMR | Single Family Mortgage Revenue | SOFR | Secured Overnight Financing Rate |

TAN | Tax Anticipation Notes | TRAN | Tax and Revenue Anticipation Notes |

U.S. T-BILL | U.S. Treasury Bill Money Market Yield | XLCA | XL Capital Assurance |

See notes to financial statements.

25

STATEMENT OF ASSETS AND LIABILITIES

April

30, 2023

|

|

|

|

|

|

|

|

|

| Cost |

| Value |

|

Assets ($): |

|

|

|

| ||

Investments in securities—See Statement of Investments | 489,149,463 |

| 477,002,096 |

| ||

Cash |

|

|

|

| 1,907,427 |

|

Interest receivable |

| 6,701,434 |

| |||

Receivable for shares of Beneficial Interest subscribed |

| 201,329 |

| |||

Prepaid expenses |

|

|

|

| 57,409 |

|

|

|

|

|

| 485,869,695 |

|

Liabilities ($): |

|

|

|

| ||

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(c) |

| 217,788 |

| |||

Payable for shares of Beneficial Interest redeemed |

| 3,606,380 |

| |||

Payable for investment securities purchased |

| 2,703,765 |

| |||

Trustees’ fees and expenses payable |

| 4,554 |

| |||

Other accrued expenses |

|

|

|

| 104,294 |

|

|

|

|

|

| 6,636,781 |

|

Net Assets ($) |

|

| 479,232,914 |

| ||

Composition of Net Assets ($): |

|

|

|

| ||

Paid-in capital |

|

|

|

| 498,636,163 |

|

Total distributable earnings (loss) |

|

|

|

| (19,403,249) |

|

Net Assets ($) |

|

| 479,232,914 |

| ||

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | Class Z |

|

Net Assets ($) | 154,319,528 | 4,607,580 | 187,298,574 | 37,743 | 132,969,489 |

|

Shares Outstanding | 12,866,704 | 383,249 | 15,610,446 | 3,147 | 11,085,777 |

|

Net Asset Value Per Share ($) | 11.99 | 12.02 | 12.00 | 11.99 | 11.99 |

|

|

|

|

|

|

|

|

See notes to financial statements. |

|

|

|

|

|

|

26

STATEMENT OF OPERATIONS

Year

Ended April 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Income ($): |

|

|

|

| ||

Interest Income |

|

| 15,715,902 |

| ||

Expenses: |

|

|

|

| ||

Management fee—Note 3(a) |

|

| 1,678,143 |

| ||

Shareholder servicing costs—Note 3(c) |

|

| 904,542 |

| ||

Registration fees |

|

| 157,604 |

| ||

Professional fees |

|

| 87,437 |

| ||

Trustees’ fees and expenses—Note 3(d) |

|

| 55,831 |

| ||

Distribution fees—Note 3(b) |

|

| 33,695 |

| ||

Prospectus and shareholders’ reports |

|

| 20,820 |

| ||

Chief Compliance Officer fees—Note 3(c) |

|

| 15,519 |

| ||

Loan commitment fees—Note 2 |

|

| 10,959 |

| ||

Custodian fees—Note 3(c) |

|

| 7,785 |

| ||

Miscellaneous |

|

| 37,478 |

| ||

Total Expenses |

|

| 3,009,813 |

| ||

Less—reduction in fees due to earnings credits—Note 3(c) |

|

| (25,122) |

| ||

Net Expenses |

|

| 2,984,691 |

| ||

Net Investment Income |

|

| 12,731,211 |

| ||

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

|

| ||||

Net realized gain (loss) on investments | (7,832,079) |

| ||||

Net change in unrealized appreciation (depreciation) on investments | 2,808,746 |

| ||||

Net Realized and Unrealized Gain (Loss) on Investments |

|

| (5,023,333) |

| ||

Net Increase in Net Assets Resulting from Operations |

| 7,707,878 |

| |||

|

|

|

|

|

|

|

See notes to financial statements. | ||||||

27

STATEMENT OF CHANGES IN NET ASSETS

|

|

|

| Year Ended April 30, | |||||

|

|

|

| 2023 |

| 2022 |

| ||

Operations ($): |

|

|

|

|

|

|

|

| |

Net investment income |

|

| 12,731,211 |

|

|

| 9,785,258 |

| |

Net realized gain (loss) on investments |

| (7,832,079) |

|

|

| 1,230,248 |

| ||

Net

change in unrealized appreciation |

| 2,808,746 |

|

|

| (46,204,537) |

| ||

Net Increase

(Decrease) in Net Assets | 7,707,878 |

|

|

| (35,189,031) |

| |||

Distributions ($): |

| ||||||||

Distributions to shareholders: |

|

|

|

|

|

|

|

| |

Class A |

|

| (4,413,191) |

|

|

| (4,775,936) |

| |

Class C |

|

| (90,724) |

|

|

| (98,691) |

| |

Class I |

|

| (5,509,053) |

|

|

| (2,611,194) |

| |

Class Y |

|

| (1,140) |

|

|

| (1,180) |

| |

Class Z |

|

| (3,833,610) |

|

|

| (4,177,283) |

| |

Total Distributions |

|

| (13,847,718) |

|

|

| (11,664,284) |

| |

Beneficial Interest Transactions ($): |

| ||||||||

Net proceeds from shares sold: |

|

|

|

|

|

|

|

| |

Class A |

|

| 44,202,389 |

|

|

| 26,042,955 |

| |

Class C |

|

| 1,177,878 |

|

|

| 718,021 |

| |

Class I |

|

| 207,421,428 |

|

|

| 99,571,830 |

| |

Class Z |

|

| 904,549 |

|

|

| 2,400,380 |

| |

Distributions reinvested: |

|

|

|

|

|

|

|

| |

Class A |

|

| 3,912,381 |

|

|

| 4,226,313 |

| |

Class C |

|

| 90,724 |

|

|

| 97,919 |

| |

Class I |

|

| 5,482,981 |

|

|

| 2,577,270 |

| |

Class Z |

|

| 3,170,521 |

|

|

| 3,442,707 |

| |

Cost of shares redeemed: |

|

|

|

|

|

|

|

| |

Class A |

|

| (51,993,308) |

|

|

| (36,144,145) |

| |

Class C |

|

| (1,297,793) |

|

|

| (1,496,345) |

| |

Class I |

|

| (147,641,083) |

|

|

| (40,433,858) |

| |

Class Z |

|

| (12,497,483) |

|

|

| (15,430,865) |

| |

Increase

(Decrease) in Net Assets | 52,933,184 |

|

|

| 45,572,182 |

| |||

Total Increase (Decrease) in Net Assets | 46,793,344 |

|

|

| (1,281,133) |

| |||

Net Assets ($): |

| ||||||||

Beginning of Period |

|

| 432,439,570 |

|

|

| 433,720,703 |

| |

End of Period |

|

| 479,232,914 |

|

|

| 432,439,570 |

| |

28

|

|

|

| Year Ended April 30, | |||||

|

|

|

| 2023 |

| 2022 |

| ||

Capital Share Transactions (Shares): |

| ||||||||

Class Aa |

|

|

|

|

|

|

|

| |

Shares sold |

|

| 3,717,469 |

|

|

| 1,949,303 |

| |

Shares issued for distributions reinvested |

|

| 328,961 |

|

|

| 318,201 |

| |

Shares redeemed |

|

| (4,369,471) |

|

|

| (2,764,226) |

| |

Net Increase (Decrease) in Shares Outstanding | (323,041) |

|

|

| (496,722) |

| |||

Class C |

|

|

|

|

|

|

|

| |

Shares sold |

|

| 99,982 |

|

|

| 53,185 |

| |

Shares issued for distributions reinvested |

|

| 7,612 |

|

|

| 7,347 |

| |

Shares redeemed |

|

| (108,804) |

|

|

| (112,780) |

| |

Net Increase (Decrease) in Shares Outstanding | (1,210) |

|

|

| (52,248) |

| |||

Class Ia,b |

|

|

|

|

|

|

|

| |

Shares sold |

|

| 17,338,674 |

|

|

| 7,690,890 |

| |

Shares issued for distributions reinvested |

|

| 461,008 |

|

|

| 194,528 |

| |

Shares redeemed |

|

| (12,363,537) |

|

|

| (3,091,236) |

| |

Net Increase (Decrease) in Shares Outstanding | 5,436,145 |

|

|

| 4,794,182 |

| |||

Class Zb |

|

|

|

|

|

|

|

| |

Shares sold |

|

| 75,614 |

|

|

| 181,237 |

| |

Shares issued for distributions reinvested |

|

| 266,515 |

|

|

| 259,221 |

| |

Shares redeemed |

|

| (1,047,280) |

|

|

| (1,158,702) |

| |

Net Increase (Decrease) in Shares Outstanding | (705,151) |

|

|

| (718,244) |

| |||

|

|

|

|

|

|

|

|

|

|

a | During the period ended April 30, 2023, 45,328 Class A shares representing $525,906 were exchanged for 45,289 Class I shares. | ||||||||

b | During the period ended April 30, 2023, 5,913 Class Z shares representing $72,611 were exchanged for 5,908 Class I shares. | ||||||||

See notes to financial statements. | |||||||||

29

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. These figures have been derived from the fund’s financial statements.

Year Ended April 30, | |||||||||

Class A Shares | 2023 | 2022 | 2021 | 2020 | 2019 | ||||

Per Share Data ($): | |||||||||

Net asset value, beginning of period | 12.17 | 13.55 | 12.62 | 12.93 | 12.60 | ||||

Investment Operations: | |||||||||

Net investment incomea | .31 | .29 | .33 | .36 | .37 | ||||

Net realized and unrealized | (.16) | (1.33) | .96 | (.31) | .34 | ||||

Total from Investment Operations | .15 | (1.04) | 1.29 | .05 | .71 | ||||

Distributions: | |||||||||

Dividends from net investment | (.30) | (.28) | (.33) | (.36) | (.37) | ||||

Dividends from net realized | (.03) | (.06) | (.03) | − | (.01) | ||||

Total Distributions | (.33) | (.34) | (.36) | (.36) | (.38) | ||||

Net asset value, end of period | 11.99 | 12.17 | 13.55 | 12.62 | 12.93 | ||||

Total Return (%)b | 1.40 | (7.92) | 10.27 | .32 | 5.70 | ||||

Ratios/Supplemental Data (%): | |||||||||

Ratio of total expenses | .72 | .72 | .72 | .73 | .86 | ||||

Ratio

of net expenses | .72 | .72 | .72 | .73 | .86 | ||||

Ratio of net investment income | 2.56 | 2.14 | 2.47 | 2.75 | 2.94 | ||||

Portfolio Turnover Rate | 21.69 | 9.69 | 9.40 | 21.90 | 27.39 | ||||

Net Assets, end of period ($ x 1,000) | 154,320 | 160,455 | 185,393 | 145,636 | 146,875 | ||||

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

30

Year Ended April 30, | ||||||||||

Class C Shares | 2023 | 2022 | 2021 | 2020 | 2019 | |||||

Per Share Data ($): | ||||||||||

Net asset value, beginning of period | 12.19 | 13.58 | 12.65 | 12.96 | 12.63 | |||||

Investment Operations: | ||||||||||

Net investment incomea | .21 | .18 | .23 | .26 | .27 | |||||

Net

realized and unrealized | (.14) | (1.33) | .96 | (.31) | .34 | |||||

Total from Investment Operations | .07 | (1.15) | 1.19 | (.05) | .61 | |||||

Distributions: | ||||||||||

Dividends from net investment | (.21) | (.18) | (.23) | (.26) | (.27) | |||||

Dividends

from net realized | (.03) | (.06) | (.03) | − | (.01) | |||||

Total Distributions | (.24) | (.24) | (.26) | (.26) | (.28) | |||||

Net asset value, end of period | 12.02 | 12.19 | 13.58 | 12.65 | 12.96 | |||||

Total Return (%)b | .61 | (8.62) | 9.39 | (.46) | 4.87 | |||||

Ratios/Supplemental Data (%): | ||||||||||

Ratio

of total expenses | 1.51 | 1.50 | 1.51 | 1.51 | 1.65 | |||||

Ratio

of net expenses | 1.50 | 1.50 | 1.51 | 1.51 | 1.65 | |||||

Ratio

of net investment income | 1.78 | 1.36 | 1.68 | 1.97 | 2.15 | |||||

Portfolio Turnover Rate | 21.69 | 9.69 | 9.40 | 21.90 | 27.39 | |||||

Net Assets, end of period ($ x 1,000) | 4,608 | 4,688 | 5,930 | 4,980 | 5,796 | |||||

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

31

FINANCIAL HIGHLIGHTS (continued)

Year Ended April 30, | ||||||||

Class I Shares | 2023 | 2022 | 2021 | 2020 | 2019 | |||

Per Share Data ($): | ||||||||

Net asset value, beginning of period | 12.17 | 13.55 | 12.62 | 12.93 | 12.61 | |||

Investment Operations: | ||||||||

Net investment incomea | .34 | .31 | .36 | .39 | .40 | |||

Net realized and unrealized | (.15) | (1.31) | .96 | (.30) | .33 | |||

Total from Investment Operations | .19 | (1.00) | 1.32 | .09 | .73 | |||

Distributions: | ||||||||

Dividends from net investment | (.33) | (.32) | (.36) | (.40) | (.40) | |||

Dividends from net realized | (.03) | (.06) | (.03) | − | (.01) | |||

Total Distributions | (.36) | (.38) | (.39) | (.40) | (.41) | |||

Net asset value, end of period | 12.00 | 12.17 | 13.55 | 12.62 | 12.93 | |||

Total Return (%) | 1.64 | (7.62) | 10.53 | .57 | 5.88 | |||

Ratios/Supplemental Data (%): | ||||||||

Ratio of total expenses | .49 | .48 | .49 | .48 | .62 | |||

Ratio

of net expenses | .48 | .48 | .49 | .48 | .62 | |||

Ratio of net investment income | 2.80 | 2.38 | 2.71 | 2.97 | 3.17 | |||

Portfolio Turnover Rate | 21.69 | 9.69 | 9.40 | 21.90 | 27.39 | |||

Net Assets, end of period ($ x 1,000) | 187,299 | 123,812 | 72,900 | 55,013 | 26,521 | |||

a Based on average shares outstanding.

See notes to financial statements.

32

Year Ended April 30, | ||||||||

Class Y Shares | 2023 | 2022 | 2021 | 2020 | 2019 | |||

Per Share Data ($): | ||||||||

Net asset value, beginning of period | 12.16 | 13.55 | 12.62 | 12.93 | 12.61 | |||

Investment Operations: | ||||||||

Net investment incomea | .34 | .32 | .36 | .40 | .42 | |||

Net realized and unrealized | (.15) | (1.33) | .96 | (.31) | .31 | |||

Total from Investment Operations | .19 | (1.01) | 1.32 | .09 | .73 | |||

Distributions: | ||||||||

Dividends from net investment | (.33) | (.32) | (.36) | (.40) | (.40) | |||

Dividends from net realized | (.03) | (.06) | (.03) | − | (.01) | |||

Total Distributions | (.36) | (.38) | (.39) | (.40) | (.41) | |||

Net asset value, end of period | 11.99 | 12.16 | 13.55 | 12.62 | 12.93 | |||

Total Return (%) | 1.65 | (7.69) | 10.54 | .57 | 5.85 | |||

Ratios/Supplemental Data (%): | ||||||||

Ratio of total expenses | .48 | .46 | .49 | .47 | .62 | |||

Ratio

of net expenses | .47 | .46 | .49 | .47 | .62 | |||

Ratio of net investment income | 2.81 | 2.40 | 2.72 | 3.00 | 3.22 | |||

Portfolio Turnover Rate | 21.69 | 9.69 | 9.40 | 21.90 | 27.39 | |||

Net Assets, end of period ($ x 1,000) | 38 | 38 | 43 | 40 | 41 | |||

a Based on average shares outstanding.

See notes to financial statements.

33

FINANCIAL HIGHLIGHTS (continued)

Year Ended April 30, | ||||||||||

Class Z Shares | 2023 | 2022 | 2021 | 2020 | 2019 | |||||

Per Share Data ($): | ||||||||||

Net asset value, beginning of period | 12.17 | 13.55 | 12.62 | 12.93 | 12.60 | |||||

Investment Operations: | ||||||||||

Net investment incomea | .31 | .29 | .34 | .37 | .38 | |||||

Net

realized and unrealized | (.15) | (1.32) | .96 | (.31) | .34 | |||||

Total from Investment Operations | .16 | (1.03) | 1.30 | .06 | .72 | |||||

Distributions: | ||||||||||

Dividends from net investment | (.31) | (.29) | (.34) | (.37) | (.38) | |||||

Dividends

from net realized | (.03) | (.06) | (.03) | − | (.01) | |||||

Total Distributions | (.34) | (.35) | (.37) | (.37) | (.39) | |||||

Net asset value, end of period | 11.99 | 12.17 | 13.55 | 12.62 | 12.93 | |||||

Total Return (%) | 1.36 | (7.80) | 10.32 | .37 | 5.75 | |||||

Ratios/Supplemental Data (%): | ||||||||||

Ratio

of total expenses | .68 | .67 | .67 | .67 | .81 | |||||

Ratio

of net expenses | .67 | .67 | .67 | .67 | .81 | |||||

Ratio

of net investment income | 2.60 | 2.19 | 2.52 | 2.81 | 2.99 | |||||

Portfolio Turnover Rate | 21.69 | 9.69 | 9.40 | 21.90 | 27.39 | |||||

Net Assets, end of period ($ x 1,000) | 132,969 | 143,446 | 169,455 | 164,045 | 175,252 | |||||

a Based on average shares outstanding.