As

filed with the Securities and Exchange Commission on

Registration No. 33-7190

Investment Company Act File No. 811-4750

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 ☒

POST-EFFECTIVE AMENDMENT NO. 72 ☒

and

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 ☒

AMENDMENT NO. 75 ☒

(Exact Name of Registrant as Specified in Charter)

384 North Grand Street

P.O. Box 399

Cobleskill, New York 12043

(Address of Principal Executive Offices)

Registrant’s Telephone Number: 800-453-4392

Patrick W.D. Turley, Esq.

Dechert LLP

1900 K Street, N.W.

Washington, D.C. 20006

(Name and Address of Agent for Service)

Copies to:

Michael F. Balboa

384 North Grand Street

Cobleskill, New York 12043

It is proposed that this filing will become effective: (check appropriate box)

| ☐ | immediately upon filing pursuant to paragraph (b) | |

| ☒ | on

| |

| ☐ | 60 days after filing pursuant to paragraph (a)(1) | |

| ☐ | on (date) pursuant to paragraph (a)(1) | |

| ☐ | 75 days after filing pursuant to paragraph (a)(2) | |

| ☐ | on (date) pursuant to paragraph (a)(2) of Rule 485 |

If appropriate, check the following box:

| ☐ | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

| TABLE OF CONTENTS |

| SUMMARY SECTION | |

| FAM Value Fund | 1 |

| FAM Dividend Focus Fund | 5 |

| FAM Small Cap Fund | 9 |

| More About Investment Objectives, Principal Investment Strategies and Risks | |

| More About Investment Objectives | 13 |

| More About Principal Investment Strategies | 13 |

| More About Other Investment Strategies | 13 |

| More About Principal Risks | 13 |

| Fund Management | |

| The Investment Advisor | 15 |

| Portfolio Managers | 15 |

| Shareholder Information | |

| Pricing Fund Shares | 17 |

| Householding of Shareholder Mailings | 17 |

| Purchasing and Adding to Your Shares | 17 |

| Important Information About Procedures for Opening an Account | 17 |

| Account Minimums | 18 |

| Converting from Investor Shares to Institutional Shares | 18 |

| Automatic Investment Plan | 18 |

| Managing Your Account Online | 18 |

| Wire Instructions | 19 |

| IRA and Retirement Accounts | 19 |

| Purchases Through Selected Dealers | 19 |

| Shareholder Administrative Servicing Arrangements | 19 |

| Payments to Third Parties by the Advisor | 21 |

| Instructions for Redemption of Shares | 21 |

| Definition of Good Order | 21 |

| Signature Guarantees | 22 |

| Systematic Withdrawal Plan | 22 |

| Information on Distributions and Taxes | 23 |

| Tax Information | 23 |

| Financial Highlights | |

| FAM Value Fund | 25 |

| FAM Dividend Focus Fund | 26 |

| FAM Small Cap Fund | 27 |

| TO OBTAIN ADDITIONAL INFORMATION | 28 |

| FAM Value Fund – Investor Shares | SUMMARY SECTION |

FAM Value Fund’s investment objective is to maximize long-term return on capital.

The tables below describe the fees and expenses that you may pay if you buy and hold shares of the Fund.

(fees paid directly from your investment) |

Investor

Shares | |

| Maximum sales charge (load) on purchase | ||

| Maximum deferred sales charge (load) | ||

| Redemption fee |

(expenses that you pay each year as a percentage of the value of your investment) |

Investor

Shares | |

| Management Fees | ||

| Distribution and Service (12b-1) Fees | ||

| Other Expenses | ||

| Total Fund Operating Expenses1 | ||

| Fee Waiver/Expense Reimbursement1 | ||

| Net Fund Operating Expenses1 |

| 1 |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

| Expense Example | ||||||

| 1-Year | 3-Year | 5-Year | 10-Year | |||

| $ |

$ |

$ |

$ | |||

The

Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher

portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account.

These costs, which are not reflected in the annual fund operating expenses or in the Example, affect the Fund’s performance. During

the most recent fiscal year, the Fund’s portfolio turnover rate was

1

| FAM Value Fund – Investor Shares | SUMMARY SECTION |

Fenimore Asset Management, Inc. (“Fenimore”), the investment advisor to the Fund, employs a “value approach” in making its common stock selections. This approach is based on Fenimore’s belief that at any given point in time the stock price of a company may sell below the company’s “true business worth”. Factors considered in evaluating the true business worth include the company’s current earnings and Fenimore’s opinion as to its future earnings potential. After identifying a company whose securities are determined to have a favorable price-to-earnings relationship, Fenimore plans to invest in such securities until the “true business worth” nears the market price of the company’s securities.

Generally, the Fund will attempt to remain fully invested in common stocks and securities that are convertible into common stocks, such as convertible bonds and convertible preferred stocks. The Fund may invest in the securities of issuers of all sizes and market capitalizations. The Fund may also invest in the securities of both domestic and foreign issuers and it may invest in shares of other investment companies, including exchange-traded funds (“ETFs”).

| ● | Stock Market Risk - the value of stocks fluctuates in response to the activities of individual companies and general stock market and economic conditions. Stock prices may decline over short or extended periods of time. Stocks are more volatile and riskier than some other forms of investments. |

| ● | Stock Selection Risk - the value stocks chosen for the Fund are subject to the risk that the market may never realize their intrinsic value or their prices may go down. |

| ● | Small-Cap Risk - small capitalization companies may not have the size, resources or other assets of large capitalization companies. |

| ● | Market Risk - the value of your investment will go up and down, which means that you could lose money. Market risk includes political, regulatory, economic, social and health risks (including the risks presented by the spread of infectious diseases) which can lead to increased market volatility and negative impacts on local and global financial markets, and the duration and severity of the impact of these risks on markets cannot be reasonably estimated. |

| ● | Foreign Investment Risk - the Fund may invest in securities of foreign issuers that are traded in foreign markets or may be represented by American Depositary Receipts that are traded in the United States. Investments in non-U.S. securities may involve additional risk including exchange rate fluctuation, political or economic instability, the imposition of exchange controls, expropriation, limited disclosure and illiquid markets. |

| ● | Investment in Other Investment Companies Risk - the Fund may invest in shares of other investment companies, including ETFs. Shareholders of the Fund will indirectly be subject to the fees and expenses of the other investment companies in which the Fund invests. In addition, shareholders will be exposed to the investment risks associated with investments in other investment companies. |

2

| FAM Value Fund – Investor Shares | SUMMARY SECTION |

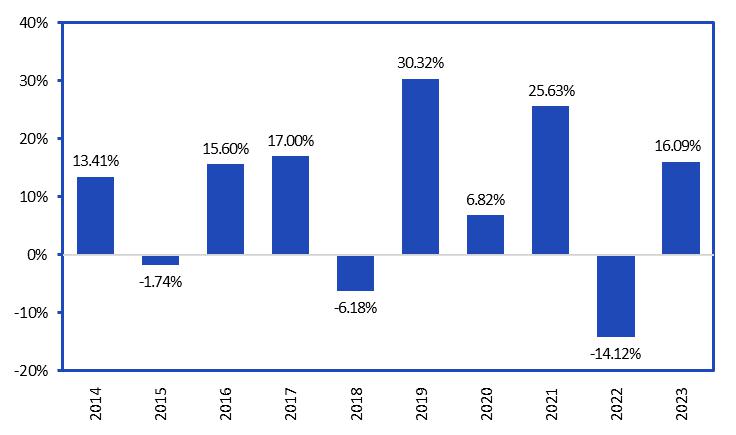

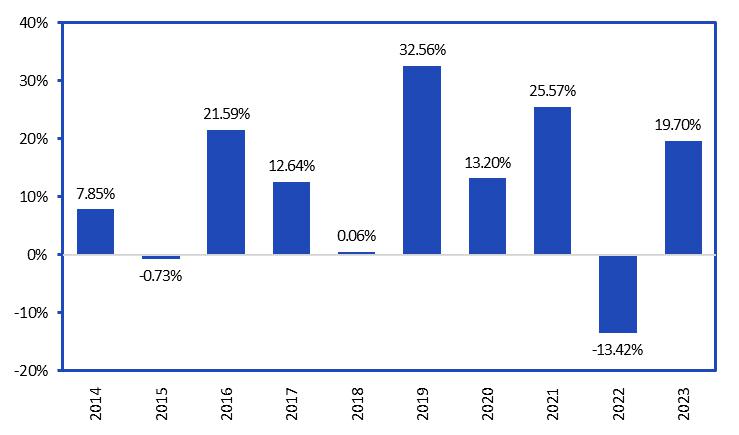

Investor Shares |

-

| Investor Shares | |||||

| 1 YEAR | 5 YEARS | 10 YEARS | ||||

| Return after taxes on distributions | ||||||

| Return after taxes on distributions and sale of fund shares | ||||||

| Russell MidCap Total Return Index | ||||||

3

| FAM Value Fund – Investor Shares | SUMMARY SECTION |

Investment Advisor

Fenimore Asset Management, Inc.

Portfolio Co-Managers

John D. Fox, CFA, Andrew P. Wilson, CFA and Marc Roberts, CFA of Fenimore Asset Management, Inc. serve as co-managers of the Fund. Mr. Fox has co-managed the Fund since 2000, Mr. Wilson has co-managed the Fund since 2017 and Mr. Roberts has co-managed the Fund since 2021.

Purchase and Sale of Fund Shares

The minimum initial purchase is $500 for a regular account and $100 for an individual retirement account. The minimum subsequent investment is $50. You may redeem shares by mail or fax (877.513.0756). Redemption proceeds will be sent by check to the address of record or by electronic bank transfer.

Tax Information

Fund distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Such tax-deferred arrangements may be taxed upon withdrawals made from these arrangements.

Financial Intermediary Compensation

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend Fund shares over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

4

| FAM Dividend Focus Fund – Investor Shares | SUMMARY SECTION |

FAM Dividend Focus Fund’s investment objective is to provide current income as well as long-term capital appreciation by investing primarily (at least 80% of its total assets) in income-producing stocks that pay dividends.

The tables below describe the fees and expenses that you may pay if you buy and hold shares of the Fund.

(fees paid directly from your investment) |

Investor Shares | |

| Maximum sales charge (load) on purchase | ||

| Maximum deferred sales charge (load) | ||

| Redemption fee |

(expenses that you pay each year as a percentage of the value of your investment) |

Investor

Shares | |

| Management Fees | ||

| Distribution and Service (12b-1) Fees | ||

| Other Expenses | ||

| Acquired Fund Fees and Expenses | ||

| Total Fund Operating Expenses1 |

| 1 |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

| Expense Example | ||||||

| 1-Year | 3-Year | 5-Year | 10-Year | |||

| $ |

$ |

$ |

$ | |||

The

Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher

portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account.

These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During

the most recent fiscal year, the Fund’s portfolio turnover rate was

5

| FAM Dividend Focus Fund – Investor Shares | SUMMARY SECTION |

Fenimore Asset Management, Inc. (“Fenimore”), the investment advisor to the Fund employs a “value approach” in making its common stock selections. This approach is based on Fenimore’s belief that at any given point in time the stock price of a company may sell below the company’s “true business worth”. Factors considered in evaluating the true business worth include the company’s current earnings and Fenimore’s opinion as to its future earnings potential. After identifying a company whose securities are determined to have a favorable price-to-earnings relationship, Fenimore plans to invest in such securities until the “true business worth” nears the market price of the company’s securities.

Generally, the Fund will attempt to remain fully invested in common stocks and securities that are convertible into common stocks, such as convertible bonds and convertible preferred stocks. The Fund may invest in the securities of issuers of all sizes and market capitalizations. The Fund may also invest in the securities of both domestic and foreign issuers and it may invest in shares of other investment companies, including exchange-traded funds (“ETFs”).

| ● | Stock Market Risk - the value of stocks fluctuates in response to the activities of individual companies and general stock market and economic conditions. Stock prices may decline over short or extended periods of time. Stocks are more volatile and riskier than some other forms of investments. |

| ● | Stock Selection Risk - the value stocks chosen for the Fund are subject to the risk that the market may never realize their intrinsic value or their prices may go down. |

| ● | Small-Cap Risk - small capitalization companies may not have the size, resources or other assets of large capitalization companies. |

| ● | Market Risk - the value of your investment will go up and down, which means that you could lose money. Market risk includes political, regulatory, economic, social and health risks (including the risks presented by the spread of infectious diseases) which can lead to increased market volatility and negative impacts on local and global financial markets, and the duration and severity of the impact of these risks on markets cannot be reasonably estimated. |

| ● | Foreign Investment Risk - the Fund may invest in securities of foreign issuers that are traded in foreign markets or may be represented by American Depositary Receipts that are traded in the United States. Investments in non-U.S. securities may involve additional risk including exchange rate fluctuation, political or economic instability, the imposition of exchange controls, expropriation, limited disclosure and illiquid markets. |

| ● | Investment in Other Investment Companies Risk - the Fund may invest in shares of other investment companies, including ETFs. Shareholders of the Fund will indirectly be subject to the fees and expenses of the other investment companies in which the Fund invests. In addition, shareholders will be exposed to the investment risks associated with investments in other investment companies. |

6

| FAM Dividend Focus Fund – Investor Shares | SUMMARY SECTION |

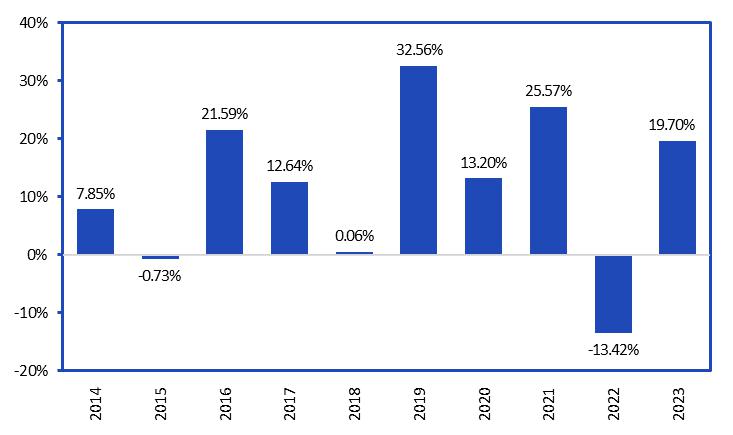

Investor Shares |

-

(for the periods ended December 31, 2023) | Investor Shares | |||||

| 1 YEAR | 5 YEARS | 10 YEARS | ||||

| Return after taxes on distributions | ||||||

| Return after taxes on distributions and sale of fund shares | ||||||

| Russell MidCap Total Return Index | ||||||

7

| FAM Dividend Focus Fund – Investor Shares | SUMMARY SECTION |

Investment Advisor

Fenimore Asset Management, Inc.

Portfolio Co-Managers

Paul C. Hogan, CFA and William W. Preston, CFA, of Fenimore Asset Management, Inc. serve as co-managers of the Fund. Mr. Hogan has co-managed the Fund since the Fund’s inception in 1996 and Mr. Preston has co-managed the Fund since 2020.

Purchase and Sale of Fund Shares

The minimum initial purchase is $500 for a regular account and $100 for an individual retirement account. The minimum subsequent investment is $50. You may redeem shares by mail or fax (877.513.0756). Redemption proceeds will be sent by check to the address of record or by electronic bank transfer.

Tax Information

Fund distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Such tax-deferred arrangements may be taxed upon withdrawals made from these arrangements.

Financial Intermediary Compensation

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend Fund shares over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

8

| FAM Small Cap Fund – Investor Shares | SUMMARY SECTION |

FAM Small Cap Fund’s investment objective is to maximize long-term return on capital.

The tables below describe the fees and expenses that you may pay if you buy and hold shares of the Fund.

(fees paid directly from your investment) |

Investor Shares | |

| Maximum sales charge (load) on purchase | ||

| Maximum deferred sales charge (load) | ||

| Redemption fee |

(expenses that you pay each year as a percentage of the value of your investment) |

Investor

Shares | |

| Management Fees | ||

| Distribution and Service (12b-1) Fees | ||

| Other Expenses | ||

| Acquired Fund Fees and Expenses | ||

| Total Fund Operating Expenses1 |

| 1 |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

| Expense Example | ||||||

| 1-Year | 3-Year | 5-Year | 10-Year | |||

| $ |

$ |

$ |

$ | |||

The

Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher

portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account.

These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During

the most recent fiscal year, the Fund’s portfolio turnover rate was

9

| FAM Small Cap Fund – Investor Shares | SUMMARY SECTION |

Fenimore Asset Management, Inc. (“Fenimore”), the investment advisor to the Fund, employs a “value approach” in making its common stock selections. This approach is based on Fenimore’s belief that at any given point in time the stock price of a company may sell below the company’s “true business worth”. Factors considered in evaluating the true business worth include the company’s current earnings, and Fenimore’s opinion as to its future potential. After identifying a company whose securities are determined to have a favorable price-to-earnings relationship, Fenimore plans to invest in such securities until the “true business worth” nears the market price of the company’s securities.

Under normal market conditions the Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in securities of small-cap companies. The Fund considers small-cap companies to be those issuers that, at the time of initial purchase, have a market capitalization that is within or below the range of companies in the Russell 2000 Total Return Index as of the latest reconstitution. As of April 28, 2023, the market capitalization range for the Russell 2000 Total Return Index was approximately $159.5 million to $6.0 billion.

The Fund may invest in securities of both domestic and foreign issuers and it may invest in shares of other investment companies, including exchange-traded funds (“ETFs”). The Fund’s policy of investing at least 80% of its net assets in small-cap companies may only be changed upon 60 days prior notice to shareholders.

| ● | Small-Cap Risk - small capitalization companies may not have the size, resources or other assets of large capitalization companies. |

| ● | Stock Market Risk - the value of stocks fluctuates in response to the activities of individual companies and general stock market and economic conditions. Stock prices may decline over short or extended periods of time. Stocks are more volatile and riskier than some other forms of investments. |

| ● | Stock Selection Risk - the value stocks chosen for the Fund are subject to the risk that the market may never realize their intrinsic value or their prices may go down. |

| ● | Market Risk - the value of your investment will go up and down, which means that you could lose money. Market risk includes political, regulatory, economic, social and health risks (including the risks presented by the spread of infectious diseases) which can lead to increased market volatility and negative impacts on local and global financial markets, and the duration and severity of the impact of these risks on markets cannot be reasonably estimated. |

| ● | Foreign Investment Risk - the Fund may invest in securities of foreign issuers that are traded in foreign markets or may be represented by American Depositary Receipts that are traded in the United States. Investments in non-U.S. securities may involve additional risk including exchange rate fluctuation, political or economic instability, the imposition of exchange controls, expropriation, limited disclosure and illiquid markets. |

| ● | Investment in Other Investment Companies Risk - the Fund may invest in shares of other investment companies, including ETFs. Shareholders of the Fund will indirectly be subject to the fees and expenses of the other investment companies in which the Fund invests. In addition, shareholders will be exposed to the investment risks associated with investments in other investment companies. |

10

| FAM Small Cap Fund – Investor Shares | SUMMARY SECTION |

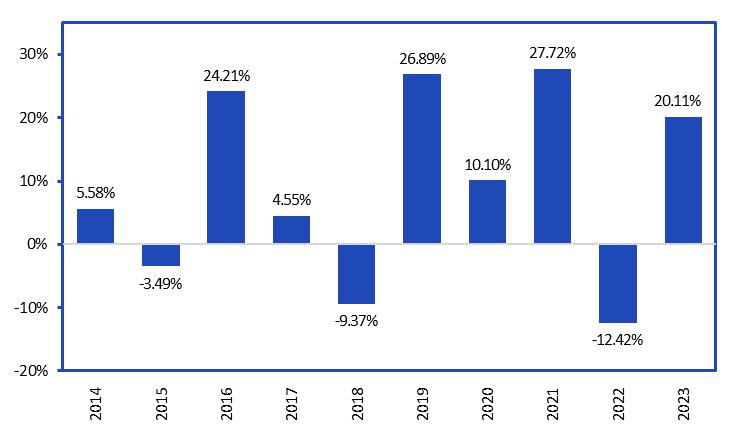

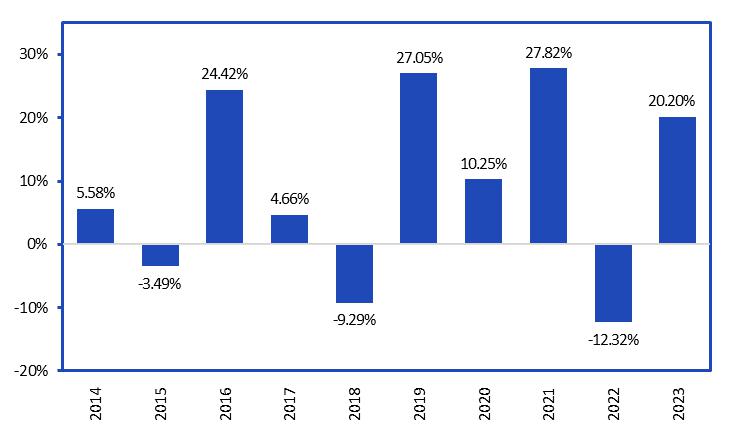

Investor Shares |

-

| Investor Shares | |||||

| 1 YEAR | 5 YEARS | 10 YEARS | ||||

| Return after taxes on distributions | ||||||

| Return after taxes on distributions and sale of fund shares | ||||||

| Russell 2000 Total Return Index | ||||||

11

| FAM Small Cap Fund – Investor Shares | SUMMARY SECTION |

Investment Advisor

Fenimore Asset Management, Inc.

Portfolio Co-Managers

Andrew F. Boord and Kevin D. Gioia, CFA of Fenimore Asset Management, Inc. serve as co-managers of the Fund. Mr. Boord has co-managed the Fund since January 2016 and Mr. Gioia has co-managed the Fund since October 2019.

Purchase and Sale of Fund Shares

The minimum initial purchase is $500 for a regular account and $100 for an individual retirement account. The minimum subsequent investment is $50. You may redeem shares by mail or fax (877.513.0756). Redemption proceeds will be sent by check to the address of record or by electronic bank transfer.

Tax Information

Fund distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Such tax-deferred arrangements may be taxed upon withdrawals made from these arrangements.

Financial Intermediary Compensation

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend Fund shares over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

12

| More About Investment Objectives, |

| Principal Investment Strategies and Risks |

More About Investment Objectives

FAM Value Fund seeks to maximize long-term return on capital.

FAM Dividend Focus Fund seeks to provide current income as well as long-term capital appreciation by investing primarily (at least 80% of its total assets) in income-producing equity securities.

FAM Small Cap Fund seeks to maximize long-term return on capital.

The investment objective of each Fund is a fundamental policy which may not be changed without a majority vote of a Fund’s shareholders.

More About Principal Investment Strategies

Fenimore’s investment philosophy is to seek out well-managed, financially sound companies that it considers to be undervalued in the marketplace. Utilizing investment principles based on the teachings of Benjamin Graham and David Dodd, whose book Security Analysis provides the foundation for value investing, Fenimore is categorized as a bottom-up manager. As such, Fenimore focuses on identifying, analyzing, and selecting individual companies that meet Fenimore’s long-term growth expectation.

FAM Value Fund. Under normal market conditions the FAM Value Fund will attempt to remain fully invested in common stocks and securities that are convertible into common stocks, such as convertible bonds and convertible preferred stocks.

FAM Dividend Focus Fund. Under normal market conditions the FAM Dividend Focus Fund will attempt to remain fully invested in common stocks and securities that are convertible into common stocks, such as convertible bonds and convertible preferred stocks. The Fund invests primarily in income-producing stocks that pay dividends. The Fund distributes its income on a quarterly basis.

FAM Small Cap Fund. Under normal market conditions the Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in securities of small-cap companies. The Fund considers small-cap companies to be those issuers that, at the time of initial purchase, have a market capitalization that is within or below the range of companies in the Russell 2000 Total Return Index as of the latest reconstitution. As of April 28, 2023, the market capitalization range for the Russell 2000 Total Return Index was approximately $159.5 million to $6.0 billion. The Fund may invest in securities of both domestic and foreign issuers. The Fund’s policy of investing at least 80% of its net assets in small cap companies may only be changed upon 60 days prior notice to shareholders. Under normal market conditions, the Fund will attempt to remain fully invested in common stocks and securities that are convertible into common stocks, such as convertible bonds and convertible preferred stocks.

More About Other Investment Strategies

For temporary defensive purposes, the Funds may invest all of their assets in investment grade fixed-income securities or cash equivalents. Generally, the Funds intend to invest in investment grade fixed-income securities or cash equivalents when, in Fenimore’s opinion, common stocks are too risky in relationship to their anticipated rewards and investment grade fixed-income securities or cash equivalents are considered a good alternative. During such temporary periods, the Funds might not achieve their stated investment objectives.

The Funds may also engage in certain investment techniques to a limited extent that are not part of their principal investment strategies. For example, each of the Funds are permitted to utilize options, futures contracts and options on futures contracts. The Funds may engage in short-sale transactions, lend portfolio securities, invest in securities which have relatively short operating histories and invest in securities of issuers that do not have quoted markets. However, our investment decisions will always be guided by prudent choices dictated by our thoughtful and disciplined value investing methodology. Additional information concerning these investment techniques, including their risks, are set forth in the Funds’ Statement of Additional Information.

More About Principal Risks

The principal risks of investing in the Funds are as follows:

Stock Market Risk. The value of stocks fluctuates in response to the activities of individual companies and general stock market and economic conditions. Stock prices may decline over short or extended periods of time. Stocks are

13

| More About Investment Objectives, |

| Principal Investment Strategies and Risks |

more volatile and riskier than some other forms of investments, such as short-term, high grade fixed-income securities.

Stock Selection Risk. The value stocks chosen for the Funds are subject to the risk that the market may never realize their intrinsic value or their prices may go down. While the Funds’ investments in value stocks may limit their downside risk over time, the Funds may produce more modest gains than riskier stock funds as a trade off for this potentially lower risk.

Small-Cap Risk. Small capitalization companies may not have the size, resources or other assets of large capitalization companies. These small capitalization companies may be subject to greater market risks and fluctuations in value than large capitalization companies and may not correspond to changes in the stock market in general.

Market Risk. The value of your investment will go up and down, which means that you could lose money. Market risk includes political, regulatory, economic, social and health risks (including the risks presented by the spread of infectious diseases) which can lead to increased market volatility and negative impacts on local and global financial markets, and the duration and severity of the impact of these risks on markets cannot be reasonably estimated. Financial markets have become increasingly interconnected on a global basis and, as a result, the occurrence of events related to any of these market risks in various global regions can thus cause volatility to occur in the domestic and global markets and can cause declines in the value of assets held by the Funds in response. Changes in the value of portfolio assets could be short-term or long-term, depending on the applicable circumstances. You should consider an investment in the FAM Funds as a long-term investment.

Foreign Investment Risk. The Funds may invest in securities of foreign issuers that are traded in foreign markets or may be represented by American Depositary Receipts that are traded in the United States. Investments in non-U.S. securities may involve additional risks including exchange rate fluctuation, political or economic instability, the imposition of exchange controls, expropriation, limited disclosure and illiquid markets.

Other Investment Company Investment Risk. The Funds may invest in shares of other investment companies, including ETFs. Investments in other investment companies may involve duplication of certain fees and expenses. By investing in other investment companies, a Fund becomes the shareholder of that company. As a result, Fund shareholders indirectly bear their proportionate share of the other investment company’s fees and expenses which are paid by the Fund as a shareholder of the other investment company. These fees and expenses are in addition to the fees and expenses that Fund shareholders bear directly in connection with each Fund’s own operations. If the other investment company fails to achieve its investment objective, a Fund’s investment in the other investment company may adversely affect that Fund’s performance.

An investment in FAM Funds is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

14

| FUND MANAGEMENT |

The Investment Advisor

The Investment Advisor to FAM Funds is Fenimore Asset Management, Inc., (“Fenimore” or the “Advisor”), which is a New York corporation majority-owned by its founder, Mr. Thomas O. Putnam, and located at 384 N. Grand Street, Cobleskill, NY 12043. Fenimore has been continuously offering investment advisory and consulting services since 1974 to individuals, pension, profit sharing, IRA and Keogh plans, corporations, and non-profit organizations generally located in a service area that includes the continental United States. Mr. Putnam currently serves as Executive Chairman of Fenimore and as the President of the Funds and he previously served for many years as a portfolio manager of the Funds and he oversaw Fenimore’s investment management and research activities. Mr. Putnam is the sole shareholder of Fenimore Securities, Inc., the Funds’ principal underwriter. Ms. Anne Putnam is Fenimore’s Chief Executive Officer and she serves as a Trustee of the Funds.

Portfolio Managers

The co-managers are jointly and primarily responsible for the day-to-day management of each respective Fund’s investment portfolio.

John D. Fox, CFA, serves as co-manager of FAM Value Fund with Mr. Wilson and Mr. Roberts. Mr. Fox is employed by Fenimore as Chief Investment Officer and has been actively involved in investment research activities since he joined the firm in 1996.

Andrew P. Wilson, CFA, serves as co-manager of FAM Value Fund with Mr. Fox and Mr. Roberts. Mr. Wilson is employed by Fenimore as an Investment Research Analyst and joined the firm in 2011. He has been actively involved in portfolio management and investment research activities since 1996.

Marc Roberts, CFA, serves as co-manager of the FAM Value Fund with Mr. Fox and Mr. Wilson. Mr. Roberts is employed by Fenimore as an Investment Research Analyst and he rejoined the firm in March 2020. From January 2016 to January 2020 Mr. Roberts was employed by Port Capital LLC, a registered investment adviser. From June 2007 to December 2015, Mr. Roberts was employed by Fenimore as an Investment Research Analyst and co-portfolio manager. He has been actively involved in investment research activities since 2007 and he has assisted with the FAM Value Fund since March 2020.

Paul C. Hogan, CFA, serves as co-manager of FAM Dividend Focus Fund with Mr. Preston. Mr. Hogan is employed by Fenimore as an Investment Research Analyst and has been actively involved in investment research activities since he joined the firm in 1991.

William W. Preston, CFA, serves as co-manager of the FAM Dividend Focus Fund with Mr. Hogan. Mr. Preston is employed by Fenimore as an Investment Research Analyst and he joined the firm in 2016. He previously worked at Renaissance Capital in Greenwich, Connecticut as a Senior Research Analyst and he has been actively involved in investment research activities since 2011.

Andrew F. Boord, serves as co-manager of the FAM Small Cap Fund with Mr. Gioia. Mr. Boord is employed by Fenimore as an Investment Research Analyst and he joined the firm in 2005. He has been actively involved in investment research activities since 1995.

Kevin D. Gioia, CFA, serves as co-manager of the FAM Small Cap Fund with Mr. Boord. Mr. Gioia is employed by Fenimore as an Investment Research Analyst and he joined the firm in 2010. He has been actively involved in investment research activities since 2010 and has assisted with the FAM Small Cap Fund since 2015.

15

| FUND MANAGEMENT |

Additional information about the portfolio managers’ compensation arrangements, other accounts managed by the portfolio managers, and the portfolio managers’ ownership of securities of the Funds is available in the Funds’ Statement of Additional Information.

Fenimore employs a staff of experienced investment professionals to manage assets for other corporate and individual clients.

Under the terms of the investment advisory contract, Fenimore receives a monthly fee from each Fund equal to 0.90% per annum of the average daily market value of its net assets. Fenimore has entered into contractual expense limitation agreements with FAM Value Fund, FAM Dividend Focus Fund and FAM Small Cap Fund pursuant to which it has agreed to limit the total operating expenses (excluding acquired fund fees and expenses and certain other expenses) of each Fund’s Investor Shares to 1.18%, 1.26% and 1.42% respectively, through May 1, 2025. These expense limitation agreements may only be amended by the Funds’ Board. A discussion regarding the basis for the Trustees’ approval of each investment advisory contract is available in the Funds’ Annual Report to Shareholders dated December 31, 2023.

The Advisor also provides and/or procures, as applicable, certain types of non-advisory services for each of the Funds, including business management services, shareholder services and fund accounting services, and the Advisor receives fees from the Funds for providing these services. The Advisor has retained Ultimus Fund Solutions, LLC (“Ultimus”) to provide certain of these services to the Funds, and the Advisor, not the Funds, is responsible for the fees that are payable to Ultimus for these services.

FAM Funds, the Advisor and Fenimore Securities, Inc. have jointly adopted a Code of Ethics which places certain express restrictions on the personal trading practices of personnel of both the Funds and Fenimore. In addition, FAM Funds and Fenimore have developed procedures that provide for the administration and enforcement of the Code through the continuous monitoring of personal trading practices.

16

| SHAREHOLDER INFORMATION |

Pricing Fund Shares

The share price (also called “Net Asset Value” or “NAV” per share) is calculated each day at the close of regular trading on the New York Stock Exchange (generally 4:00 p.m. Eastern Time) and on such days as there is sufficient trading in a Fund’s portfolio of securities. The New York Stock Exchange is closed on weekends and on the following holidays: New Year’s Day, Martin Luther King, Jr. Day, President’s Day, Good Friday, Memorial Day, Juneteenth National Independence Day, Independence Day, Labor Day, Thanksgiving and Christmas. Securities in each Fund’s portfolio will ordinarily be valued based upon market quotes. If market quotations are not readily available, securities or other assets held by each Fund are determined pursuant to the valuation procedures adopted by the Board. Pursuant to Rule 2a-5 under the 1940 Act, the Board designated the Advisor as the “Valuation Designee”. The Valuation Designee fair value securities pursuant to the Funds’ Valuation Procedures to accurately reflect fair value. To calculate the NAV, a Fund’s assets are valued and totaled, liabilities are subtracted, and the balance, called net assets, is divided by the number of shares outstanding.

Householding of Shareholder Mailings

To reduce the volume of mail you receive, each Fund will send a single copy of most financial reports, prospectuses, and regular communications to a shareholder with multiple accounts (single, retirement, joint, etc.) if such accounts have the same address and the Fund reasonably believes that the shareholders are members of the same family. You may request that additional copies be sent by notifying the Funds.

Purchasing and Adding to Your Shares

To establish an account, complete and sign the appropriate application and mail it, along with your check to FAM Funds, PO Box 46707, Cincinnati, OH 45246-0707. Checks should be made payable to the appropriate Fund. FAM Funds reserves the right to refuse third party checks and any “bank starter check.” Please be sure to provide your Social Security number, taxpayer identification number and/or a copy of your driver’s license. Foreign checks and cash will not be accepted. Any applications received not following the above guidelines will be returned.

You may also establish an account online at fenimoreasset.com by logging on to the Funds’ website and clicking on “Account Access”. You will be required to provide certain necessary information regarding your identity in order to establish your online account and you will need to create a User ID. Once you have provided the requested information and have accepted the terms and conditions of online access to your account, you will be able to directly make transactions in your account online.

The date on which your purchase is credited is your trade date. For purchases made by check, Federal Funds wire, or online and received by the close of regular trading on the New York Stock Exchange (generally 4:00 p.m. Eastern Time) the trade date is the date of receipt. For purchases received after the close of regular trading on the Exchange the trade date is the next business day. Shares are purchased at the NAV determined on your trade date.

FAM Funds reserves the right to reject purchase applications or to terminate the offering of shares made by this prospectus if, in the opinion of the Board, such termination and/or rejection would be in the best interest of existing shareholders. In the event that your check does not clear, your order(s) will be canceled and you may be liable for losses or fees incurred, or both. FAM Funds have a policy of waiving the minimum initial investment for Fund trustees, and employees and affiliated persons (including family members) of FAM Funds. If your check or electronic payment does not clear, you will be responsible for any loss incurred by the funds and charged a $10 fee to defray bank charges. All applications to purchase Fund shares are subject to acceptance by FAM Funds and are not binding until so accepted. FAM Funds do not accept telephone orders for the purchase of shares, and it reserves the right to reject applications in whole or in part. Note that you may not make an initial purchase payment via the Automated Clearing House (ACH) unless you are opening an account online.

Important Information About Procedures for Opening an Account

To help fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions, including the Funds, to obtain, verify and record information that identifies each person who opens an account, and to determine whether such person’s name appears on government lists of known or suspected terrorists and terrorist organizations.

What this means for you: the Funds must obtain the following information for each person who opens an account: (1) Name; (2) Date of birth (for individuals); (3) Physical residential address (although post office boxes are still permitted for mailing); and (4) Social Security Number, Taxpayer Identification Number and/or other identifying number.

17

| SHAREHOLDER INFORMATION |

You may also be asked to show your driver’s license, passport or other identifying documents in order to verify your identity. Additional information may be required to open accounts for corporations and other nonnatural persons.

Federal law prohibits the Funds and other financial institutions from opening accounts unless the minimum identifying information listed above is received. The Funds may also be required to close your account if we are unable to verify your identity.

Account Minimums

To begin an investment in the Investor Shares of the FAM Funds the following minimum initial investments must be met. All subsequent investments to an existing account require a minimum of $50. FAM Funds, in its discretion, reserves the right to close accounts that have balances that fall below the minimum investment balance.

| MINIMUM INITIAL INVESTMENTS INVESTOR SHARES | ||||||

| FAM VALUE FUND |

FAM DIVIDEND FOCUS FUND |

FAM SMALL CAP FUND | ||||

| To open a new account | $500 | $500 | $500 | |||

| To open a new retirement account IRA, Roth IRA, SEP, SIMPLE IRA, 403(b)(7), Coverdell ESA or Individual (k) | $100 | $100 | $100 | |||

| To open a Uniform Transfer to Minors (UTMA) or Uniform Gift to Minors (UGMA) Account | $500 | $500 | $500 | |||

| To open a new account through our Automatic Investment Program* | $500 | $500 | $500 | |||

| * | FAM Funds’ Automatic Investment Plan requires the systematic addition of at least $50 per month. |

Converting from Investor Shares to Institutional Shares

In addition to the Investor Shares described in this Prospectus, the Funds also offer Institutional Shares which are offered in a different Prospectus. In order to convert an investor must meet the investment requirements of the Institutional Share Class. You may elect to convert that account from Investor Shares to Institutional Shares of the same Fund on the basis of relative NAVs. Converting from Investor Shares to Institutional Shares may not be available at certain financial intermediaries, or there may be additional costs associated with this exchange as charged by your financial intermediary. Because the NAV per share of the Institutional Shares may be higher or lower than that of the Investor Shares at the time of conversion, although the total dollar value will be the same, a shareholder may receive more or less Institutional Shares than the number of Investor Shares converted. You may convert from Investor Shares to Institutional Shares by calling us at (800) 932-3271 or by contacting your financial intermediary if you hold your investment in the Fund through a financial intermediary.

A conversion from Investor Shares to Institutional Shares of the same Fund, or from Institutional Shares to Investor Shares of the same Fund, pursuant to the preceding paragraphs, should generally not be a taxable exchange for Federal income tax purposes.

Automatic Investment Plan

FAM Funds offers an Automatic Investment Plan whereby authorization is granted and instructions are provided to charge the regular bank checking account of a shareholder on a regular basis to provide systematic additions to the shareholder’s account. The bank at which the shareholder checking account is maintained must be an ACH member. While there is no charge to shareholders for this service, a charge of $10.00 may be deducted from a shareholder’s Fund account in case of returned items. NOTE: Individual Retirement Account (IRA) contributions made through the Automatic Investment Plan are assumed to be current year contributions. A shareholder’s Automatic Investment Plan may be terminated at any time without charge or penalty by the shareholder or the Fund.

Managing Your Account Online

If you choose to manage your account online, you should be aware that the internet is an unsecured, unstable, unregulated and unpredictable environment. Your ability to use the website for transactions is dependent upon the internet and equipment, software, systems, data and services provided by various vendors and third parties. While the Funds and their service providers have established certain security procedures, the Funds, their distributor and transfer agent cannot assure you that trading information will be completely secure.

18

| SHAREHOLDER INFORMATION |

There may also be delays, malfunctions, or other inconveniences generally associated with the internet. There also may be times when the website is unavailable for Fund transactions or other purposes. Should this happen, you should consider purchasing or redeeming shares by another method. Neither the Funds nor their transfer agent, distributor or Advisor will be liable for any such delays, malfunctions, unauthorized interception or access to communications or account information.

Wire Instructions

If you wish to wire funds to establish a new account, please use the following instructions. Investors establishing new accounts by wire should first forward their completed Account Application to FAM Funds stating that the account will be established by wire transfer and the expected date and amount of the transfer. Further information regarding wire transfers is available by calling (800) 932-3271. FAM Funds must have receipt of a wire transfer no later than 4:00 p.m. Eastern Time in order for the purchase to be made that same business day. Neither the Funds, Ultimus, nor the Funds’ cash management or custodian banks are responsible for the consequences of delays resulting from the banking or Federal Reserve wire system, or incomplete wire instructions.

IRA and Retirement Accounts

An individual having earned income and her or his spouse may each have one or more IRAs, the number and amounts limited only by the maximum allowed contribution per year. Existing IRA accounts may be rolled over or transferred at any time into a new IRA, which may be invested in Fund shares. Monies deposited into an IRA may be invested in shares of one of the Funds upon the filing of the appropriate forms. Forms establishing IRAs, Roth IRAs, SEP Accounts, SIMPLE IRAs, 403(b)(7) Plans, Coverdell ESAs and Individual 401(k) Plans are available by calling FAM Funds at (800) 932-3271. There is no annual maintenance fee. Investors are urged to consult with a tax advisor in connection with the establishment of retirement plans.

Monies or deposits into other types of retirement plans and/or Keogh accounts may also be invested in FAM Fund shares. However, the qualification and certification of such plans must first be prearranged by the investor’s own tax specialists who would assist and oversee all plan compliance requirements. Although FAM Funds endeavors to provide assistance to those investors interested in such plans, it neither offers nor possesses the necessary professional skills or knowledge regarding the establishment or compliance maintenance of retirement plans. Therefore, it is recommended that professional counsel be retained by the investor before investing such monies in shares of FAM Funds.

No signature guarantee is required if a shareholder elects to transfer an IRA, Roth IRA, SEP Account, SIMPLE IRA, 403(b)(7) Plan, Coverdell ESA or Individual 401(k) Plan to another custodian or in the event of a mandatory distribution.

If you own an IRA or other retirement plan, you must indicate on your redemption request whether the Funds should withhold state and federal income tax. Unless you elect in your redemption request that you do not want to have federal tax withheld, the redemption will be subject to withholding.

Purchases Through Selected Dealers

Certain Selected Dealers may affect transactions of the FAM Funds. FAM Funds may accept orders from broker-dealers who have been previously approved by the Funds. It is the responsibility of such broker-dealers to promptly forward purchase or redemption orders to the Funds. If the broker-dealer submits trades to the Funds, the Funds will use the time of day when such entity or its designee receives the order to determine the time of purchase or redemption and will process the order at the next closing price computed after acceptance. Broker-dealers may charge the investor a transaction-based fee for their services at either the time of purchase or the time of redemption. Such charges may vary among broker-dealers, but in all cases will be retained by the broker-dealer and not remitted to FAM Funds or the Advisor. The Advisor makes payments to such companies out of its own resources to compensate these companies for certain shareholder administrative services provided in connection with the Funds. Shareholders who wish to transact through a broker-dealer should contact FAM Funds at (800) 932-3271 for further information.

Shareholder Administrative Servicing Arrangements

The Funds have adopted a Shareholder Administrative Services Plan for Investor Shares (the “Shareholder Services Plan”) under which the Investor Shares of each Fund may pay shareholder administrative servicing fees to the Advisor and to financial institutions which may include banks, broker-dealers, trust companies and other similar

19

| SHAREHOLDER INFORMATION |

types of financial intermediaries (collectively, “Service Organizations”), for providing, or arranging for the provision of, certain types of shareholder administrative services to Investor Class shareholders serviced by the Advisor, affiliates of the Advisor or the Service Organization. The types of services which may be compensated for under the terms of the Shareholder Services Plan include various types of shareholder administrative support services such as assisting shareholders with their fund accounts and records, their fund purchase and redemption orders and other similar types of non-distribution related services involving the administrative servicing of shareholder accounts. Pursuant to the Shareholder Services Plan, the Investor Shares of the Funds may pay shareholder administrative servicing fees of up to 0.25% of the average daily net assets of the Investor Shares of each respective Fund.

20

| SHAREHOLDER INFORMATION |

Payments to Third Parties by the Advisor

The Advisor and its affiliates, including the Distributor, out of their own resources, and without additional direct cost to the Funds or their shareholders, provide compensation to certain financial intermediaries, such as broker-dealers and financial advisers, in connection with sales of shares of the Funds (“revenue sharing”). This compensation is generally made to those intermediaries that provide shareholder servicing, marketing support, broker education, and/or access to sales meetings, sales representatives and management representatives of the intermediary. Compensation may also be paid to intermediaries for inclusion of the Funds on a sales list, including a preferred or select sales list, mutual fund “supermarket” platforms and other formal sales programs, or as an expense reimbursement in cases where the intermediary provides shareholder services to shareholders of the Funds. Revenue sharing payments are in addition to any distribution or servicing fees payable under Rule 12b-1 or service plan of the Funds or any record keeping or sub-transfer agency fees payable by the Funds. You should note that if one mutual fund sponsor makes greater distribution assistance payments than another, your broker or financial adviser and his or her firm may have an incentive to recommend one fund complex over another.

Instructions for Redemption of Shares

Shareholders wishing to redeem shares may tender them to FAM Funds any business day by executing a written request for redemption, in good order as described below, and delivering the request by mail, fax, or by hand to the Funds, FAM Funds, PO Box 46707, Cincinnati, OH 45246-0707. For further information on redemption requests call (800) 932-3271.

Definition of Good Order

Good order means that the written redemption request includes the following:

| 1. | The Fund account number, name, and Social Security or Tax I.D. number. |

| 2. | The amount of the transaction (specified in dollars or shares). |

| 3. | Signatures of all owners exactly as they are registered on the account. |

| 4. | Signature guarantees are required if: the value of shares being redeemed exceeds $50,000; payment is to be sent to an address other than the address of record; payment is to be made payable to a payee other than the shareholder; there has been an address change in the last 30 days. Shareholder bank accounts, when accompanied by a voided check, shall constitute the address of record for this signature guarantee requirement. |

| 5. | Other supporting legal documentation that might be required, in the case of retirement plans, corporations, trusts, estates and certain other accounts. |

Shareholders requesting redemption proceeds to be wired from FAM Funds will incur a $10 wire fee for domestic wires. Shareholders may also elect to have their proceeds sent by ACH directly to their bank account, there is no fee for this.

Shareholders may sell all or any portion of their shares on any such business day that NAV is calculated. Such shares will be redeemed by FAM Funds at the next such calculation after such redemption request is received in good order. When a redemption occurs shortly after a recent purchase made by check, FAM Funds may hold the redemption proceeds beyond 7 days but only until the purchase check clears, which may take up to 15 days.

21

| SHAREHOLDER INFORMATION |

FAM Funds reserve the right, however, to withhold payment up to seven (7) days if necessary to protect the interests and assets of the Funds and their shareholders. In the event the New York Stock Exchange is closed for any reason other than normal weekend or holiday closing or if trading on that exchange is restricted for any reason, or in the event of any emergency circumstances as determined by the Securities and Exchange Commission, the Board shall have the authority and may suspend redemptions or postpone payment dates accordingly.

Redemption of shares may result in the shareholder realizing a taxable capital gain or loss.

Signature Guarantees

For our mutual protection, signature guarantees may be required on certain written transaction requests. A signature guarantee verifies the authenticity of your signature and may be obtained from “eligible guarantor institutions.”

Eligible guarantor institutions include: (1) national or state banks, savings associations, savings and loan associations, trust companies, savings banks, industrial loan companies and credit unions; (2) national securities exchanges, registered securities associations and clearing agencies; (3) securities broker-dealers which are members of a national securities exchange or a clearing agency or which have minimum net capital of $100,000; (4) institutions that participate in the Securities Transfer Agent Medallion Program (“STAMP”) or other recognized signature medallion program.

A signature guarantee cannot be provided by a notary public.

Signature guarantees will be required under the following circumstances:

| 1. | Redemption of Shares IF: |

| ● | the value of shares being redeemed exceeds $50,000 per fund |

| ● | payment is requested payable to a payee other than the shareholder of record Exception: You may request that a distribution be made payable to a charity as a Qualified Charitable Distribution if the redemption is $10,000 or less per account, per transaction. The check must be mailed to the shareholder’s address of record. | |

| ● | payment is to be sent to an address other than the address of record |

| ● | an address change accompanies the redemption request or there has been a change of address on the account during the last 30 days |

| ● | payment is to be sent to a bank account other than the account of record | |

| 2. | Transferring of Ownership and/or Account Name Changes (call (800) 932-3271 before getting the signature guarantee). |

The requirement for a signature guarantee based on the above circumstances may be waived on a case by case basis.

Systematic Withdrawal Plan

For your convenience you may elect to have automatic periodic redemptions from your account. Shareholders who wish to participate in the systematic withdrawal plan must complete the appropriate form and return to FAM Funds 30 days prior to the first scheduled redemption.

22

| SHAREHOLDER INFORMATION |

Information on Distributions and Taxes

All net investment income and net realized capital gains generated as a result of portfolio management activities are distributed to shareholders.

A capital gain or loss is the difference between the purchase and sale price of a security. If a Fund has net capital gains for the year they are usually declared and paid in December to shareholders of record in the month of December.

Dividend and capital gain distributions are reinvested in additional Fund shares in your account, unless you select another option on your account application form. Investors who want dividends and/or capital gains distributions sent to them in cash rather than invested in additional shares must arrange this by making a request to FAM Funds. The request must be in written form acceptable to FAM Funds. Unless investors request cash distributions in writing at least 7 business days prior to the distribution, or on the Account Application, all dividends and other distributions will be reinvested automatically in additional shares of the Funds. Capital gains, if any, will be distributed in December.

The value of your shares will be reduced by the amount of dividends and/or capital gains. If you purchase shares shortly before the record date for a dividend or the distribution of capital gains, you will pay the full price for the shares and receive some portion of the price back as a taxable dividend or distribution.

Tax Information

The maximum tax rate for individual taxpayers applicable to long-term capital gains and income from certain qualifying dividends on certain corporate stock is generally either 15% or 20%, depending on whether the individual’s income exceeds certain threshold amounts. These rate reductions do not apply to corporate taxpayers. Distributions of earnings from dividends paid by certain “qualified foreign corporations” can also qualify for the lower tax rates on qualifying dividends. A shareholder will also have to satisfy a more than 60 day holding period for the Fund shares with respect to any distributions of qualifying dividends in order to obtain the benefit of the lower tax rate. Distributions of earnings from non-qualifying dividends, interest income, other types of ordinary income and short-term capital gains will be taxed at the ordinary income tax rate applicable to the taxpayer. Distributions reported by a Fund as long-term capital distributions will be taxable to you at your long-term capital gains rate, regardless of how long you have held your Fund shares. An exchange of Fund shares for shares of another fund is considered a sale, and gains from any sale or exchange may be subject to federal and state taxes. Dividends generally are taxable in the year in which they are accrued, even if they appear on your account statement the following year. Dividends and distributions are treated the same for federal tax purposes, whether you receive them in cash or in additional shares of the Fund. Depending on your residence for tax purposes, distributions may also be subject to state and local taxes.

A 3.8% Medicare tax is imposed on certain net investment income (including ordinary dividends and capital gain distributions received from a Fund and net gains from redemptions or other taxable dispositions of Fund shares) of U.S. individuals, estates and trusts to the extent that such person’s “modified adjusted gross income” (in the case of an individual) or “adjusted gross income” (in the case of an estate or trust) exceeds certain threshold amounts.

If you hold shares through a tax-deferred account, such as a retirement plan, income and gains will not be taxable each year. Instead, the taxable portion of amounts you hold in a tax-deferred account will generally be subject to tax only when they are distributed from the account.

You will be notified by February 15th each year through the appropriate tax form about the federal tax status of distributions made the previous year.

The Funds are required to withhold Federal income tax at the Federal back withholding rate on taxable dividends, capital gains distributions and redemptions paid to shareholders who have not provided the Funds with their certified taxpayer identification number in compliance with IRS rules. To avoid this, make sure you provide your correct tax identification number (Social Security Number for most investors) on your account application.

This tax discussion is meant only as a general summary. Because everyone’s tax situation is unique, you should consult your tax professional about particular consequences to you of investing in the Funds.

FAM Funds reports cost basis for all covered shares to both you and the IRS. When filing your tax return you will be required to use the cost basis reported on your Form 1099-B for your covered shares. FAM Funds has chosen the Average Cost method as its default cost account method. The cost basis method you elect may not be changed with

23

| SHAREHOLDER INFORMATION |

respect to a redemption of shares after the settlement date of the redemption. You should consult with your tax advisor to determine the best cost basis method for your tax situation. If you hold your shares through a financial intermediary, you should contact the financial intermediary with respect to reporting of cost basis and available elections for your account.

Frequent Trading Policy

The Funds are intended for long-term investors and not for those who wish to trade frequently in Fund shares. Frequent trading into and out of a Fund can have adverse consequences for that Fund and for long-term shareholders in the Fund. The Trust believes that frequent or excessive short-term trading activity by shareholders of a Fund may be detrimental to long-term shareholders because those activities may, among other things: (a) dilute the value of shares held by long-term shareholders; (b) cause the Funds to maintain larger cash positions than would otherwise be necessary; (c) increase brokerage commissions and related costs and expenses; (d) incur additional tax liability. The Trust therefore discourages frequent purchase and redemptions by shareholders and it does not make any effort to accommodate this practice. To protect against such activity, the Board has adopted policies and procedures that are intended to permit the Funds to curtail frequent or excessive short-term trading by shareholders. At the present time the Trust does not impose limits on the frequency of purchases and redemptions, nor does it limit the number of exchanges into any of the Funds. The Trust reserves the right, however, to impose certain limitations at any time with respect to trading in shares of the Funds, including suspending or terminating trading privileges in Fund shares, for any investor whom it believes has a history of abusive trading or whose trading, in the judgment of the Trust, has been or may be disruptive to the Funds. The Funds’ ability to detect and prevent any abusive or excessive short-term trading may be limited to the extent such trading involves Fund shares held through omnibus accounts of a financial intermediary.

Disclosure of Fund Portfolio Holdings

On a quarterly basis, the Funds disclose on their website, fenimoreasset.com, each Fund’s entire portfolio holdings and certain additional information regarding their portfolios (e.g., Top Ten holdings, asset allocation, sector breakdown). The information will generally be available no earlier than the 10th business day following the quarter-end and shall remain on the website until the next quarter’s information is made publicly available. A complete list of each Fund’s portfolio holdings is also publicly available on a quarterly basis through filings made with the SEC on Forms N-CSR and N-PORT. A description of the Funds’ policies and procedures with respect to the disclosure of the Funds’ portfolio securities is provided in the Statement of Additional Information (SAI).

24

| Financial Highlights |

The financial highlights provide information about each Fund’s financial history and are expressed in one share outstanding throughout each fiscal year. Each table is part of the Fund’s financial statements which are included in its annual report. The total returns in the table represent the rate that an Investor Class shareholder would have earned or lost on an investment in the Fund, assuming reinvestment of all dividends and capital gains. The financial highlights for the periods ended December 31, 2019 to December 31, 2022, were audited by BBD, LLP, the Funds’ former independent registered public accounting firm. The financial highlights for the period ended December 31, 2023 have been audited by Cohen & Company, Ltd. (“Cohen”), the Funds’ current independent registered public accounting firm (effective March 6, 2023). Cohen’s report on the Funds’ financial statements is included in the Funds’ annual report which is available upon request.

FAM Value Fund

(Investor Shares)

| Per share information | Years Ended December 31, | |||||||||||||||||||

| (For a share outstanding throughout each year) | 2023 | 2022 | 2021 | 2020 | 2019 | |||||||||||||||

| Net asset value, beginning of year | $ | 82.51 | $ | 99.58 | $ | 83.23 | $ | 80.83 | $ | 66.24 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (loss)(a) | 0.13 | 0.14 | 0.02 | (0.06 | ) | (0.02 | ) | |||||||||||||

| Net realized and unrealized gains (losses) on investments | 13.15 | (14.18 | ) | 21.30 | 5.53 | 20.11 | ||||||||||||||

| Total from investment operations | 13.28 | (14.04 | ) | 21.32 | 5.47 | 20.09 | ||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.14 | ) | (0.15 | ) | (0.02 | ) | — | — | ||||||||||||

| Net realized gains | (4.43 | ) | (2.88 | ) | (4.95 | ) | (3.07 | ) | (5.50 | ) | ||||||||||

| Return of capital | — | — | (0.00 | )(b) | — | — | ||||||||||||||

| Total distributions | (4.57 | ) | (3.03 | ) | (4.97 | ) | (3.07 | ) | (5.50 | ) | ||||||||||

| Change in net asset value for the year | 8.71 | (17.07 | ) | 16.35 | 2.40 | 14.59 | ||||||||||||||

| Net asset value, end of year | $ | 91.22 | $ | 82.51 | $ | 99.58 | $ | 83.23 | $ | 80.83 | ||||||||||

| Total return(c) | 16.09 | % | (14.12 | %) | 25.63 | % | 6.82 | % | 30.32 | % | ||||||||||

| Ratios/supplementary data | ||||||||||||||||||||

| Net assets, end of year (000) | $ | 1,561,631 | $ | 1,406,047 | $ | 1,681,118 | $ | 1,385,432 | $ | 1,377,473 | ||||||||||

| Ratios to average net assets of: | ||||||||||||||||||||

| Expenses, total | 1.17 | % | 1.18 | % | 1.18 | % | 1.19 | % | 1.19 | % | ||||||||||

| Expenses, net (includes fees reduced/recouped by Advisor) | 1.18 | % | 1.18 | % | 1.18 | % | 1.18 | % | 1.18 | % | ||||||||||

| Net investment income (loss) | 0.15 | % | 0.17 | % | 0.02 | % | (0.08 | %) | (0.03 | %) | ||||||||||

| Portfolio turnover rate | 10 | % | 9 | % | 6 | % | 14 | % | 7 | % | ||||||||||

| (a) | Based on average shares outstanding. |

| (b) | Amount rounds to less than $0.01 per share. |

| (c) | Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total returns would be lower/higher if the Advisor had not reduced and/or recouped advisory fees. |

25

| Financial Highlights |

FAM

Dividend Focus Fund

(Investor Shares)

| Per share information | Years Ended December 31, | |||||||||||||||||||

| (For a share outstanding throughout each year) | 2023 | 2022 | 2021 | 2020 | 2019 | |||||||||||||||

| Net asset value, beginning of year | $ | 44.83 | $ | 52.48 | $ | 42.35 | $ | 38.26 | $ | 29.73 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income(a) | 0.20 | 0.08 | 0.01 | 0.11 | 0.22 | |||||||||||||||

| Net realized and unrealized gains (losses) on investments | 8.62 | (7.12 | ) | 10.82 | 4.90 | 9.45 | ||||||||||||||

| Total from investment operations | 8.82 | (7.04 | ) | 10.83 | 5.01 | 9.67 | ||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.20 | ) | (0.09 | ) | — | (0.11 | ) | (0.21 | ) | |||||||||||

| Net realized gains | (0.16 | ) | (0.52 | ) | (0.70 | ) | (0.80 | ) | (0.93 | ) | ||||||||||

| Return of capital | — | — | — | (0.01 | ) | — | ||||||||||||||

| Total distributions | (0.36 | ) | (0.61 | ) | (0.70 | ) | (0.92 | ) | (1.14 | ) | ||||||||||

| Change in net asset value for the year | 8.46 | (7.65 | ) | 10.13 | 4.09 | 8.53 | ||||||||||||||

| Net asset value, end of year | $ | 53.29 | $ | 44.83 | $ | 52.48 | $ | 42.35 | $ | 38.26 | ||||||||||

| Total return(b) | 19.70 | % | (13.42 | %) | 25.57 | % | 13.20 | % | 32.56 | % | ||||||||||

| Ratios/supplementary data | ||||||||||||||||||||

| Net assets, end of year (000) | $ | 674,342 | $ | 559,126 | $ | 664,225 | $ | 509,666 | $ | 454,617 | ||||||||||

| Ratios to average net assets of: | ||||||||||||||||||||

| Expenses, total | 1.21 | % | 1.22 | % | 1.22 | % | 1.24 | % | 1.24 | % | ||||||||||

| Net investment income | 0.41 | % | 0.17 | % | 0.02 | % | 0.31 | % | 0.61 | % | ||||||||||

| Portfolio turnover rate | 10 | % | 4 | % | 4 | % | 25 | % | 10 | % | ||||||||||

| (a) | Based on average shares outstanding. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. |

26

| Financial Highlights |

FAM

Small Cap Fund

(Investor Shares)

| Per share information | Years Ended December 31, | |||||||||||||||||||

| (For a share outstanding throughout each year) | 2023 | 2022 | 2021 | 2020 | 2019 | |||||||||||||||

| Net asset value, beginning of year | $ | 21.79 | $ | 24.97 | $ | 20.83 | $ | 18.92 | $ | 14.98 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment loss(a) | (0.04 | ) | (0.12 | ) | (0.13 | ) | (0.09 | ) | (0.09 | ) | ||||||||||

| Net realized and unrealized gains (losses) on investments | 4.43 | (2.98 | ) | 5.90 | 2.00 | 4.12 | ||||||||||||||

| Total from investment operations | 4.39 | (3.10 | ) | 5.77 | 1.91 | 4.03 | ||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net realized gains | (1.58 | ) | (0.08 | ) | (1.63 | ) | — | (0.09 | ) | |||||||||||

| Change in net asset value for the year | 2.81 | (3.18 | ) | 4.14 | 1.91 | 3.94 | ||||||||||||||

| Net asset value, end of year | $ | 24.60 | $ | 21.79 | $ | 24.97 | $ | 20.83 | $ | 18.92 | ||||||||||

| Total return(b) | 20.11 | % | (12.42 | %) | 27.72 | % | 10.10 | % | 26.89 | % | ||||||||||

| Ratios/supplementary data | ||||||||||||||||||||

| Net assets, end of year (000) | $ | 220,594 | $ | 186,264 | $ | 213,588 | $ | 165,727 | $ | 139,788 | ||||||||||

| Ratios to average net assets of: | ||||||||||||||||||||

| Expenses, total | 1.24 | % | 1.25 | % | 1.26 | % | 1.28 | % | 1.28 | % | ||||||||||

| Net investment loss | (0.17 | %) | (0.52 | %) | (0.54 | %) | (0.55 | %) | (0.54 | %) | ||||||||||

| Portfolio turnover rate | 16 | % | 15 | % | 23 | % | 16 | % | 15 | % | ||||||||||

| (a) | Based on average shares outstanding. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. |

27

| To Obtain Additional Information |

If you would like additional information about the Funds, would like to obtain additional copies of the Funds’ Annual or Semi-Annual Reports or Statement of Additional Information (“SAI”), which are available without charge, or would like to make inquiries about any of the Funds, free reports on the Funds are available upon request and inquiries may be directed to:

FAM Funds

P.O. Box 46707

Cincinnati, Ohio 45246-0707

(800) 932-3271

fenimoreasset.com

Shareholder Reports

Each Fund’s Annual Report and Semi-Annual Report contains additional information about the Fund’s investments. The Fund’s Annual Report contains a discussion of the market conditions and investment strategies that significantly affected the performance of the Fund during the last fiscal year. Both the Annual Report and the Semi-Annual Report also contain Fund performance information, financial statements and portfolio holdings information.

Statement of Additional Information

The SAI for Investor Shares contains more comprehensive information on the Funds and the Investor Shares of the Funds. The SAI is incorporated by reference into this prospectus which makes it legally part of this prospectus.

Information about the Funds, including the SAI, may also be obtained from the Securities and Exchange Commission (“SEC”) for the cost of a duplicating fee. These documents are also available to view at the SEC’s public reference room in Washington, DC or by electronic request by e-mailing the SEC at the following address: publicinfo@sec.gov.

Investment Company Act

File No. 811-4750

| TABLE OF CONTENTS |

| SUMMARY SECTION | ||

| FAM Value Fund | 1 | |

| FAM Dividend Focus Fund | 4 | |

| FAM Small Cap Fund | 8 | |

| More About Investment Objectives, Principal Investment Strategies, and Risks | ||

| More About Investment Objectives | 12 | |

| More About Principal Investment Strategies | 12 | |

| More About Other Investment Strategies | 12 | |

| More About Principal Risks | 12 | |

| Fund Management | ||

| The Investment Advisor | 14 | |

| Portfolio Managers | 14 | |

| Shareholder Information | ||

| Pricing Fund Shares | 16 | |

| Householding of Shareholder Mailings | 16 | |

| Purchasing and Adding to Your Shares | 16 | |

| Important Information About Procedures for Opening an Account | 16 | |

| Converting from Institutional Shares to Investor Shares | 17 | |

| Automatic Investment Plan | 17 | |

| Managing Your Account Online | 18 | |

| Wire Instructions | 18 | |

| IRA and Retirement Accounts | 19 | |

| Purchases Through Selected Dealers | 19 | |

| Shareholder Administrative Servicing Arrangements | 19 | |

| Payments to Third Parties by the Advisor | 19 | |

| Instructions for Redemption of Shares | 20 | |

| Definition of Good Order | 20 | |

| Signature Guarantees | 21 | |

| Systematic Withdrawal Plan | 21 | |

| Information on Distributions and Taxes | 22 | |

| Tax Information | 22 | |

| Financial Highlights | ||

| FAM Value Fund | 24 | |

| FAM Dividend Focus Fund | 25 | |

| FAM Small Cap Fund | 26 | |

| TO OBTAIN ADDITIONAL INFORMATION | 27 |

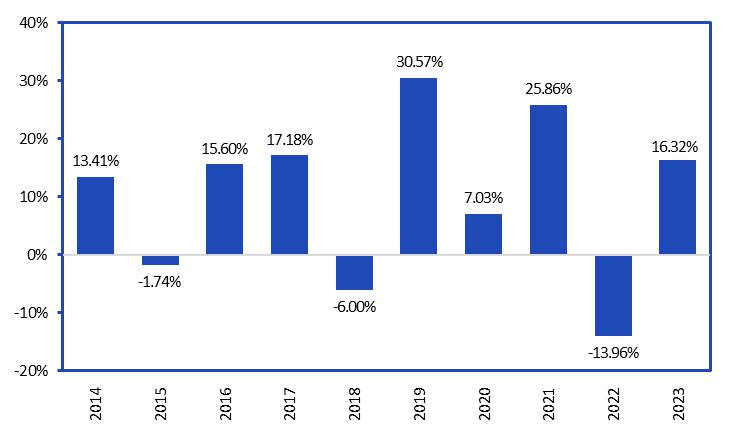

| FAM Value Fund – Institutional Shares | SUMMARY SECTION |

FAM Value Fund’s investment objective is to maximize long-term return on capital.

The tables below describe the fees and expenses that you may pay if you buy and hold shares of the Fund.

(fees paid directly from your investment) |

Institutional Shares | |

| Maximum sales charge (load) on purchase | ||

| Maximum deferred sales charge (load) | ||

| Redemption fee |

(expenses that you pay each year as a percentage of the value of your investment) |

Institutional Shares | |

| Management Fees | ||

| Distribution and Service (12b-1) Fees | ||

| Other Expenses | ||