UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-04719

The TETON Westwood Funds

(Exact name of registrant as specified in charter)

One Corporate Center

Rye, New York 10580-1422

(Address of principal executive offices) (Zip code)

Bruce N. Alpert

Teton Advisors, Inc.

One Corporate Center

Rye, New York 10580-1422

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-422-3554

Date of fiscal year end: September 30

Date of reporting period: September 30, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

|

TETON WESTWOOD FUNDS

|

||||

|

Mighty MitesSM Fund

|

||||

|

SmallCap Equity Fund

|

||||

|

Convertible Securities Fund

|

||||

|

Equity Fund

|

||||

|

Balanced Fund

|

||||

| Annual Report | ||||

| September 30, 2020 | ||||

| Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.tetonadv.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. To elect to receive all future reports on paper free of charge, please contact your financial intermediary, or, if you invest directly with the Funds, you may call 800-937-8966 or send an email request to info@tetonadv.com. |

TETON WESTWOOD FUNDS

(Unaudited)

| Class AAA Shares | Class A Shares | |||||||||||||||||||||||||||||

| Average Annual Returns – September 30, 2020 (a) | Average Annual Returns – September 30, 2020 (a)(b)(c) | |||||||||||||||||||||||||||||

| 1 Year | 5 Year | 10 Year | 15 Year | Since Inception |

Gross Expense Ratio |

Expense Ratio after Adviser |

1 Year | 5 Year | 10 Year | 15 Year | Since Inception |

Gross Expense Ratio |

Expense Ratio after Adviser | |||||||||||||||||

| Mighty Mites |

(8.68)% | 4.64% | 7.35% | 7.33% | 9.50% | 1.43% | 1.43% | (12.55)% | 3.52% | 6.65% | 6.79% | 9.08% | 1.68% | 1.68% | ||||||||||||||||

| SmallCap Equity |

(10.08) | 6.78 | 7.89 | 6.46 | 6.66 | 2.05 | 1.66 | (13.93) | 5.66 | 7.19 | 5.92 | 6.30 | 2.30 | 1.91 | ||||||||||||||||

| Convertible Securities |

15.80 | 11.89 | 9.94 | 6.08 | 7.90 | 1.66 | 1.15 | 10.82 | 10.70 | 9.22 | 5.53 | 7.49 | 1.91 | 1.40 | ||||||||||||||||

| Equity |

(4.32) | 8.47 | 9.85 | 6.69 | 9.57 | 1.64 | 1.64 | (8.38) | 7.32 | 9.14 | 6.14 | 9.21 | 1.89 | 1.89 | ||||||||||||||||

| Balanced |

(0.17) | 6.83 | 7.25 | 5.75 | 8.03 | 1.37 | 1.37 | (4.41) | 5.70 | 6.55 | 5.20 | 7.61 | 1.62 | 1.62 | ||||||||||||||||

| Class C Shares | Class I Shares | |||||||||||||||||||||||||||||

| Average Annual Returns – September 30, 2020 (a)(c)(d) | Average Annual Returns – September 30, 2020 (a)(c) | |||||||||||||||||||||||||||||

| 1 Year | 5 Year | 10 Year | 15 Year | Since Inception |

Gross Expense Ratio |

Expense after |

1 Year | 5 Year | 10 Year | 15 Year | Since Inception |

Gross Expense Ratio |

Expense after | |||||||||||||||||

| Mighty Mites |

(10.30)% | 3.85% | 6.55% | 6.54% | 8.81% | 2.18% | 2.18% | (8.43)% | 4.90% | 7.62% | 7.56% | 9.66% | 1.18% | 1.18% | ||||||||||||||||

| SmallCap Equity |

(11.71) | 5.99 | 7.09 | 5.68 | 5.99 | 2.80 | 2.41 | (9.87) | 7.06 | 8.17 | 6.69 | 6.81 | 1.80 | 1.41 | ||||||||||||||||

| Convertible Securities |

13.93 | 11.05 | 9.12 | 5.29 | 7.30 | 2.41 | 1.90 | 16.03 | 12.17 | 10.23 | 6.31 | 8.05 | 1.41 | 0.90 | ||||||||||||||||

| Equity |

(5.99) | 7.65 | 9.04 | 5.89 | 9.04 | 2.39 | 2.39 | (4.09) | 8.73 | 10.09 | 6.90 | 9.67 | 1.39 | 1.39 | ||||||||||||||||

| Balanced |

(1.94) | 6.05 | 6.46 | 4.96 | 7.43 | 2.12 | 2.12 | 0.09 | 7.11 | 7.52 | 5.97 | 8.15 | 1.12 | 1.12 | ||||||||||||||||

| (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. For the SmallCap Equity and Convertible Securities Funds (and for the Mighty Mites Fund through September 30, 2005), Teton Advisors, Inc. (the Adviser) reimbursed expenses to limit the expense ratio. Had such limitations not been in place, returns would have been lower. The contractual expense limitations are in effect through January 31, 2021 and are renewable annually by the Adviser. The Funds, except for the Equity and Balanced Funds, impose a 2.00% redemption fee on shares sold or exchanged within seven days after the date of purchase. Investors should carefully consider the investment objectives, risks, charges, and expenses of a Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com. The gross expense ratios and expense ratios after Adviser reimbursements are from the current prospectus dated January 28, 2020. |

| (b) | Includes the effect of the maximum 4.00% sales charge at the beginning of the period. |

| (c) | The performance of the Class AAA Shares is used to calculate performance for the periods prior to the issuance of Class A Shares, Class C Shares, and Class I Shares. The performance for the Class A Shares and Class C Shares would have been lower due to the additional fees and expenses associated with these classes of shares. The performance for the Class I Shares would have been higher due to the lower expenses associated with this class of shares. The inception dates for the Class AAA Shares and the initial issuance dates for the Class A Shares, Class C Shares, and Class I Shares after which shares remained continuously outstanding are listed below. |

| (d) | Assuming payment of the 1.00% maximum contingent deferred sales charge imposed on redemptions made within one year of purchase. |

| Inception Dates | ||||||||

| Class AAA Shares | Class A Shares | Class C Shares | Class I Shares | |||||

| Mighty Mites |

05/11/98 | 11/26/01 | 08/03/01 | 01/11/08 | ||||

| SmallCap Equity |

04/15/97 | 11/26/01 | 11/26/01 | 01/11/08 | ||||

| Convertible Securities |

09/30/97 | 05/09/01 | 11/26/01 | 01/11/08 | ||||

| Equity |

01/02/87 | 01/28/94 | 02/13/01 | 01/11/08 | ||||

| Balanced |

10/01/91 | 04/06/93 | 09/25/01 | 01/11/08 | ||||

The TETON Westwood Funds file complete schedules of portfolio holdings with the Securities and Exchange Commission (the SEC) for the first and third quarters of each fiscal year on Form N-PORT. Shareholders may obtain this information at www.tetonadv.com or by calling the Funds at 800-WESTWOOD (800-937-8966). The Funds’ Form N-PORT is available on the SEC’s website at www.sec.gov and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Proxy Voting

Each Fund files Form N-PX with its complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. A description of the Funds’ proxy voting policies, procedures, and how the Funds voted proxies relating to portfolio securities are available without charge, upon request, by (i) calling 800-WESTWOOD (800-937-8966); (ii) writing to The TETON Westwood Funds at One Corporate Center, Rye, NY 10580-1422; and (iii) visiting the SEC’s website at www.sec.gov.

2

Performance Discussion (Unaudited)

Mighty Mites Fund

For the fiscal year ended September 30, 2020, the net asset value (NAV) total return per Class AAA Share of the TETON Westwood Mighty Mites Fund was (8.7)% compared with a total return of 0.4% for the Russell 2000 Index. See the next page for additional performance information.

The Fund primarily invests in small and micro-cap equity securities that have a market capitalization of $500 million or less at time of initial investment. The portfolio management team focuses on bottom up stock selection, seeking bite sized companies with excellent management teams, strong balance sheets, and superior long term fundamentals. As bottom up, fundamental, research driven investors, the team seeks to purchase the inefficiently priced stocks of excellent companies selling at a discount to their Private Market Value (PMV), and possess a catalyst that can unlock hidden value within the enterprise. As such, (y)our portfolio is diversified across a broad cross section of companies sharing these valuation characteristics.

The fiscal year started in October 2019 with the U.S. economy on solid footing, accommodative monetary policy coupled with a strong U.S. consumer and historically low unemployment levels. However, this stability was suddenly disrupted by the outbreak of COVID-19, which escalated into a global health crisis in February 2020. Accordingly, global equity markets fell sharply from record highs through the end of March attributable to the economic shock and uncertainty caused by lockdowns implemented to contain the spread of the virus. In response to the crisis, the U.S. initiated several monetary and fiscal policy actions. In March, the Federal Open Market Committee slashed the federal funds rate to 0%-0.25% and extended lending, at the same time Congress passed the Coronavirus Aid, Relief and Economic Security (CARES). These actions along with the gradual easing of restrictions through the spring supported a faster economic recovery than initially predicted, accordingly, U.S. equity markets substantially improved during the June quarter. But after continued strong performance in July and August, markets declined in September as concerns grew around a resurgence of virus cases in Europe, as well as the potential implications of the upcoming U.S. election cycle.

While markets rebounded from the lows of March, small and micro-capitalization companies have lagged the large cap recovery – through September the S&P 500 Index appreciated 13% compared to only 0.4% for the Russell 2000 Index. This disparity is even more pronounced when considering traditional “value” vs. “growth” sectors, particularly among smaller market capitalization issuers. The Russell 2000 Growth Index exited September up 15.7% for the year, whereas the Russell 2000 Value Index declined 14.9%. The Mighty Mites Fund, which remains overweight businesses with more exposure to cyclical end-markets, experienced similar dynamics.

As bottom up, fundamental, research driven investors, the team seeks to purchase inefficiently priced stocks of excellent companies selling at a discount to their Private Market Value (PMV), where a catalyst has been identified that can unlock shareholder value. The fund’s mandate is to primarily invest in companies with market capitalizations of $500 million or less at the time of initial purchase. During market volatility over the past year, we used this opportunity to increase existing positions buying at wider discounts to our estimated Private Market Value (PMV) and to add new micro-cap ideas to the portfolio where we believe the intrinsic value of the underlying business remains intact.

Among the Fund’s top contributors to performance for the year was Astec Industries Inc. (2.7% of net assets as of September 30, 2020), a manufacturer of asphalt and other road building equipment, has benefitted from new management’s efforts to simplify its historically complex operating structure and refocus the company on growth and operating improvement. The company also stands to benefit significantly from government stimulus directed towards infrastructure. InfuSystem Holdings, Inc. (0.7%) is a leading distributor and servicer of infusion pumps, both in the hospital and in ambulatory care settings. These are critical products for treating COVID-19 patients, which provided a significant boost to demand. Longer-term management is looking to leverage the company’s nationwide distribution network by entering adjacent markets for non-opioid pain management (nerve blocks) and negative pressure wound therapy with partner Cardinal Health. Cardlytics Inc. (0.5%) operates a purchase intelligence platform that connects marketers and financial institutions via cash-back advertisements in banks’ mobile and web applications. Its unique value proposition is its ability to aggregate financial institutions’ data and directly attribute customers’ spending to served advertising. It participates in the secular shift to digital advertising, a $90 billion market that has grown 15%-20% per year, and its scale and proprietary bank relationships provide a wide competitive moat.

Some of the detractors to performance included the fund’s largest position, Aerojet Rocketdyne (6.2%), a leading manufacturer of propulsion systems for space and military applications. Additionally, Aerojet owns a sizeable real estate portfolio with large holdings in the Sacramento, California area. Flushing Financial (0.8%), a bank holding company operating in the New York City area, declined as coronavirus lockdowns disproportionately impacted the local New York economy, raising credit concerns for the bank. Nathan’s Famous Inc. (2.0%), a branded food company and restaurant franchisor and operator, benefitted from increased at-home consumption of its iconic hotdogs and other products, which was partially offset by COVID-19 related closures and reduced traffic in its restaurant business.

We appreciate your continued confidence and trust.

3

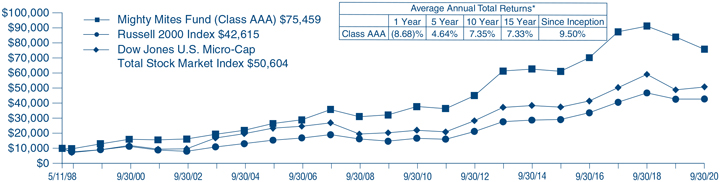

| Average Annual Returns through September 30, 2020 (a) (Unaudited) | ||||||||||||

| 1 Year | 5 Year | 10 Year | 15 Year | Since Inception (5/11/98) | ||||||||

| Mighty Mites Fund Class AAA |

(8.68) | % | 4.64% | 7.35% | 7.33% | 9.50% | ||||||

| Dow Jones U.S. Micro-Cap Total Stock Market Index |

3.95 | 6.29 | 8.69 | 5.32 | 7.50(b) | |||||||

| Russell 2000 Index |

0.39 | 8.00 | 9.85 | 7.03 | 6.69 | |||||||

| Lipper Small Cap Value Fund Average |

(15.18) | 2.81 | 6.31 | 4.84 | 6.38(b) | |||||||

In the current prospectuses dated January 28, 2020, the expense ratio for Class AAA Shares is 1.43%. See page 34 for the expense ratios for the year ended September 30, 2020. Class AAA Shares do not have a sales charge.

| (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. Teton Advisors, Inc., (the Adviser) reimbursed expenses through September 30, 2005 to limit the expense ratios. Had such limitations not been in place, returns would have been lower. The Fund imposes a 2% redemption fee on shares sold or exchanged within seven days after purchase. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com. Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The Dow Jones U.S. Micro-Cap Total Stock Market Index is designed to provide a comprehensive measure of the micro-cap segment of the U.S. stock market. The Russell 2000 Index is an unmanaged indicator which measures the performance of the small cap segment of the U.S. equity market. The Lipper Small Cap Value Fund Average reflects the average performance of mutual funds classified in this particular category. Investing in small capitalization securities involves special challenges because these securities may trade less frequently and experience more abrupt price movements than large capitalization securities. Dividends are considered reinvested. You cannot invest directly in an index. |

| (b) | Dow Jones U.S. Micro-Cap Total Stock Market Index and Lipper Small Cap Value Fund Average since inception performance is as of April 30, 1998. |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN

THE MIGHTY MITES FUND CLASS AAA, THE RUSSELL 2000 INDEX,

AND THE DOW JONES U.S. MICRO-CAP TOTAL STOCK MARKET INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

4

SmallCap Equity Fund (Unaudited)

For the fiscal year ended September 30, 2020, the net asset value (NAV) total return per Class AAA Share of the TETON Westwood SmallCap Equity Fund was (10.1)% compared with a total return of 0.4% for the Russell 2000 Index. See the next page for additional performance information.

The Fund invests primarily in small cap companies that, through bottom-up fundamental research, the portfolio manager believes are attractively priced relative to their earnings growth potential or Private Market Value. The Fund characterizes small capitalization companies as those companies with a market capitalization between $100 million and $2.5 billion at the time of the Fund’s initial investment.

Following strong stock market gains in 2019, the first quarter of 2020 presaged an event-driven bear market, brought on by the rapid spread of a lethal pandemic. As we entered 2020, investors dumped stocks in a sharp global correction reminiscent of the market crashes of 1987, 2001, and the great recession of 2008. Fueling investor panic was the rapid spread in the U.S. of the coronavirus (COVID-19) pandemic, forcing hospital emergency rooms to the brink of capacity. President Trump declared a U.S. National Emergency as the contagion forced a virtual shutdown of the U.S. economy, forcing closure of factories, schools, restaurants, sporting events, hotels, entertainment, and air travel. California and New York, among other states, ordered residents to stay at home except for essential services. The impact has rippled broadly throughout the U.S. economy, disrupting supply chains, shuttering thousands of businesses and leading to a surge of more than six million jobless claims.

The second quarter 2020 exhibited a juggernaut of volatility as v-shaped recovery investor optimism faded amid fears of renewed COVID-19 virus outbreaks. Fueling investor optimism was the unexpected rise of 2.5 million in May non-farm payrolls following a 20.7 million tumble the prior month, which was the largest decline in records going back to 1939. The May jobless rate fell to 13.3% from 14.7%, signaling the economy is picking up faster than anticipated from the COVID-19-inflicted recession. Nearly all U.S. states added jobs in May, as businesses reopen in most areas of the country, recovering from huge employment losses. In June, Private Non-Farm payrolls grew 4.8 million, double the consensus expectation, and the unemployment rate declined to 11.1% from 12.5% in May.

During the September quarter 2020, the global economic recovery continued to gather momentum. In the U.S., extraordinary policy accommodation by the Federal Reserve, coupled with trillions in fiscal stimulus appropriated by Congress, appears to have stabilized both the equity and credit markets. The real economy, meanwhile, remains bifurcated as airline travel and leisure, restaurant and retail sectors struggle under the weight of COVID-19, while the working from home phenomenon has bolstered corporate capex investment in such verticals as personal computing, 5G, datacom connectivity, and cloud computing. Likewise, the market’s recovery has not been uniform.

Among our stronger performing stocks for the year were Darling Ingredients Inc. (3.4% of net assets as of September 30, 2020), is a global leader in creating sustainable food, feed and fuel ingredients; Entegris Inc. (2.8%) is a global leader in advanced materials science, including filtration products, gas delivery systems, and specialty coatings and; Marvel Technology Group Ltd. (2.0%), designs, develops, and sells analog, mixed-signal, digital signal processing, and embedded and standalone integrated circuits.

Some of the weaker holdings in the portfolio included Patterson-UTI Energy Inc. (0.9), which provides drilling and pressure pumping services, directional drilling, and rental equipment for oil fields; Plantronics Inc. (0.4%), designs, manufactures, markets, and sells integrated communications and collaborations solutions for corporate customers; and Meredith Corp. (0.3%), operates as a diversified media company primarily in the United States.

We thank you for your continued confidence and trust.

5

| Average Annual Returns through September 30, 2020 (a) (Unaudited) | Since | |||||||||||||||||||

| Inception | ||||||||||||||||||||

| 1 Year | 5 Year | 10 Year | 15 Year | (4/15/97) | ||||||||||||||||

| SmallCap Equity Fund Class AAA |

(10.08) | % | 6.78% | 7.89% | 6.46% | 6.66% | ||||||||||||||

| Russell 2000 Index |

0.39 | 8.00 | 9.85 | 7.03 | 7.97 | |||||||||||||||

| Russell 2000 Value Index |

(14.88) | 4.11 | 7.09 | 4.93 | 7.76 | |||||||||||||||

In the current prospectuses dated January 28, 2020, the gross expense ratio for Class AAA Shares is 2.05%, and the net expense ratio is 1.66% after contractual reimbursements by Teton Advisors, Inc. (the Adviser) in place through January 31, 2021. See page 35 for the expense ratios for the year ended September 30, 2020. Class AAA Shares do not have a sales charge.

| (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. The Adviser reimbursed expenses to limit the expense ratio. Had such limitation not been in place, returns would have been lower. The Fund imposes a 2% redemption fee on shares sold or exchanged within seven days after purchase. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com. Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The Russell 2000 Index is an unmanaged indicator which measures the performance of the small cap segment of the U.S. equity market. The Russell 2000 Value Index measures the performance of the small capitalization sector of the U.S. equity market and is a subset of the Russell 2000 Index. Investing in small capitalization securities involves special challenges because these securities may trade less frequently and experience more abrupt price movements than large capitalization securities. Dividends are considered reinvested. You cannot invest directly in an index. |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE SMALLCAP EQUITY FUND

CLASS AAA AND THE RUSSELL 2000 INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

6

Convertible Securities Fund (Unaudited)

For the fiscal year ended September 30, 2020, the net asset value (NAV) total return per Class AAA Share of the TETON Convertible Securities Fund was 15.8% compared with a total return of 15.2% and 31.2% for the Standard & Poor’s (S&P) 500 Index and the ICE Bank of America Merrill Lynch U.S. Convertibles Index, respectively. See the next page for additional performance information.

The Fund invests in convertible securities. By investing in convertible securities, the portfolio managers seek the opportunity to participate in the capital appreciation of underlying stocks, while at the same time relying on the fixed income aspect of the convertible securities to provide current income and reduced price volatility, which can limit the risk of loss in a down equity market. The Fund may invest in securities of any market capitalization or credit quality, and may from time to time invest a significant amount of its assets in securities of smaller companies.

There were three distinct periods affecting returns this fiscal year. From October 2019 through February 2020 convertibles moved higher with strong performance from their underlying equities as the market reached all-time highs in mid-February. February through March saw significant volatility as markets crashed trying to price in the unknown of a global pandemic. Markets rebounded quickly beginning in April and we saw significant convertible issuance such that we are on pace for the most issuance in over twenty years. This issuance was beneficial to investors and issuers. Issuers were able to raise money to bridge an unknown gap of zero or uncertain revenues, and investors were able to participate in the recovery trade as the economy started to reopen. With equity markets rebounding back to new highs, converts have performed very well. In addition to the recovery trade, the convertible market has many issuers that benefit from social distancing and the movement of our work and social lives online.

In the first quarter of 2020, we experienced an exogenous shock with the COVID-19 virus pandemic. This is an event that the economy and the financial markets were not ready for. It is our opinion that such an event is almost impossible to predict or truly prepare for. The Federal Reserve Board and the U.S. Government have both done much to cushion the blow, but it is clear that significant economic and human damage has occurred. It is also clear that our economy will not bounce right back, but is likely to return to health only gradually.

In the second quarter of 2020 convertibles had their best quarter as an asset class since Barclays has been tracking data, going back to 2003. This was driven by three specific factors – the social distancing trade, the recovery trade, and Tesla. The convertible market came into the quarter with significant exposure to companies that benefit from social distancing. Software companies that enable telehealth, remote learning, security, communications, and collaboration abound in our market, and many have seen significant demand growth as companies and consumers are quickly shifting to an online environment. We expect this demand to continue, and the new customers to be a great source of recurring revenues for many of these companies for years to come. We also saw record new convertible issuance in the quarter as companies staring down an unknown period of zero revenues looked to extend liquidity and shore up balance sheets.

Among our stronger performing positions for the year were: DexCom Inc. 0.750%, 12/01/23 (1.7% of net assets as of September 30, 2020), makes medical devices for continuous glucose monitoring that can be used remotely; Twilio Inc. 0.250%, 6/01/23 (1.2%), allows developers to integrate communication into their product to improve customer experience; and Teladoc Health Inc. 1.250%, 6/01/27 (0.9%), is a leader in telehealth, a service that has become indispensable through the pandemic.

Some of the weaker holdings in the portfolio included GOL Equity Finance. 3.750%, 7/15/24 (0.3%), which provides air passenger transportation services in Brazil; PROS Holdings Inc. 1.000%, 5/15/24 (0.3%), which provides dynamic pricing to businesses with large exposure to travel; and; Centerpoint Energy (no longer held as of September 30, 2020), an electric and natural gas utility with pipeline exposure.

We appreciate your continued confidence and trust.

7

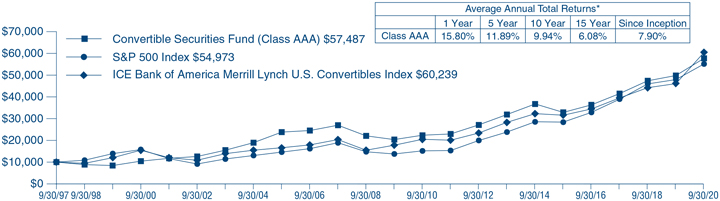

| Average Annual Returns through September 30, 2020 (a) (Unaudited) | ||||||||||||||||||||

| Since | ||||||||||||||||||||

| Inception | ||||||||||||||||||||

| 1 Year | 5 Year | 10 Year | 15 Year | (9/30/97) | ||||||||||||||||

| Convertible Securities Fund Class AAA |

15.80 | % | 11.89% | 9.94% | 6.08% | 7.90% | ||||||||||||||

| S&P 500 Index |

15.15 | 14.15 | 13.74 | 9.19 | 7.68 | |||||||||||||||

| ICE Bank of America Merrill Lynch U.S. Convertibles Index |

31.20 | 13.79 | 11.38 | 8.97 | 8.11 | |||||||||||||||

In the current prospectuses dated January 28, 2020, the gross expense ratio for Class AAA Shares is 1.66%, and the net expense ratio is 1.15%, after contractual reimbursements by Teton Advisors, Inc. (the Adviser) in place through January 31, 2021. See page 36 for the expense ratios for the year ended September 30, 2020. Class AAA Shares do not have a sales charge.

| (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. The Adviser reimbursed expenses to limit the expense ratio. Had such limitation not been in place, returns would have been lower. The Fund imposes a 2% redemption fee on shares sold or exchanged within seven days after purchase. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com. Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The S&P 500 Index is a market capitalization weighted index of 500 large capitalization stocks commonly used to represent the U.S. equity market. The ICE Bank of America Merrill Lynch U.S. Convertibles Index is a market value weighted index of all dollar denominated convertible securities that are exchangeable into U.S. equities that have a market value of more than $50 million. Dividends are considered reinvested. You cannot invest directly in an index. |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE CONVERTIBLE SECURITIES FUND

CLASS AAA, THE S&P 500 INDEX AND

THE ICE BANK OF AMERICA MERRILL LYNCH U.S. CONVERTIBLES INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

8

Equity Fund (Unaudited)

For the fiscal year ended September 30, 2020, the net asset value (NAV) total return per Class AAA Share of the Equity Fund was (4.3)% compared with a total return of 15.2% for the S&P 500 Index. See the next page for additional performance information.

The Fund seeks to provide capital appreciation. The Fund’s secondary goal is to produce current income.

The S&P 500 rallied sharply in the fourth quarter 2019, particularly into year-end, where the more secular growth-oriented Information Technology and Health Care led the way as the top two highest returning sectors. Some of the more speculative areas within each, like Biotechnology, were strong gainers during the quarter. Conversely, Real Estate and Utilities performed poorly as investors rotated away from the more defensive areas of the market. Falling rates have bolstered both sectors for several years given their attractive yield profiles. However, their valuations remained relatively elevated versus their historical trading ranges and investors took profits to reinvest elsewhere during the quarter.

The first quarter of 2020 was one for the record books. After a strong start with improving corporate outlooks and an initial U.S.-China trade deal, however, markets took a nasty turn. The outbreak of COVID-19 swept across the globe, sending returns sharply negative, with much of the pain felt during March. The S&P 500 suffered the worst first quarter since 1928, while fixed income markets were equally battered, as both investment grade and high yield indices suffered their worst monthly sell-offs in history, down over 10 percent each. As governments around the world implemented quarantining and shelter-in-place orders to try and “flatten the curve”, the effect on business was overwhelming as many companies shut their doors with revenues falling to zero. Employees quickly found themselves without jobs and the world braced for the expected recession to come. The response by governments and central banks was swift as both worked to deliver trillions of dollars of stimulus via their respective channels. The Federal Reserve slashed interest rates to zero and announced an unprecedented move for open-ended expansion of their balance sheet to support markets. The U.S. Government passed the largest economic relief bill in history, the CARES Act, worth over $2.2 trillion to try to protect paychecks and help fund businesses impacted by the virus.

The second quarter of 2020 was again a record setter as markets rallied and the S&P 500 Index posted the strongest quarterly gain since 1998. This also marked the first back-to-back decline and then rally of such magnitude since the 1930s. Investor optimism rose as COVID-19 trends moderated from their worst levels, raising the prospects for a snapback in the economic landscape. Massive amounts of fiscal and monetary stimulus began to be disbursed, helping drive a similar snapback to the markets. Despite dire unemployment numbers, consumer spending rebounded sharply as people spent their government stimulus checks. Individuals reemerged as reopening began across various states.

The third quarter saw equity markets climb once more, with the S&P 500 moving into positive territory for the year. Small caps remained challenged, still down nearly 8%, as navigating through the COVID-19 disruptions has been more difficult for smaller businesses. Interest rates were relatively unchanged, with the yield on the 10-year Treasury bond ending the quarter at 69 basis points, and credit spreads continued to tighten. The Federal Reserve continued to provide qualitative forward commentary around supporting markets with low rates and additional quantitative easing should it be needed. However, additional fiscal stimulus that had been hoped for now appeared to be delayed indefinitely amidst the emergence of the partisan debate over nominating a replacement to the Supreme Court. Volatility began to pick up in earnest in tandem with the election rhetoric on both sides of the aisle. The health of the consumer remained a key question for investors as consumer spending remained strong juxtaposed against the unemployment rate still above 8%. COVID-19 cases, which had spiked during the summer, have come down and remained elevated into the fall. Recovery and reopening efforts continued to progress, and with them, earnings estimates continued to rise from their troughs.

Among our stronger performing positions for the year were: Microsoft, Corp. (2.9% of net assets as of September 30, 2020), which develops, licenses, and supports software, services, devices, and solutions worldwide; Activision Blizzard, Inc. (2.1%), which together with its subsidiaries, develops and distributes content and services on video game consoles, personal computers, and mobile devices; and Apple, Inc. (1.9%), a designer and manufacturer of smartphones, personal computers, tablets, wearables, and accessories worldwide.

Some of the weaker holdings in the portfolio included: Wells Fargo & Co. (1.8%), a diversified financial services company, provides banking, investment, mortgage, and consumer and commercial finance products and services to individuals, businesses, and institutions in the United States and internationally; EOG Resources, Inc. (0.9%), a crude oil and natural gas exploration and production company with reserves in the U.S., Trinidad, and China; and Boeing (no longer held) which together with its subsidiaries designs, develops, manufactures, sells, and services commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems.

We appreciate your continued confidence and trust.

9

| Average Annual Returns through September 30, 2020 (a) (Unaudited) | ||||||||||||||||||||

| Since | ||||||||||||||||||||

| Inception | ||||||||||||||||||||

| 1 Year | 5 Year | 10 Year | 15 Year | (1/2/87) | ||||||||||||||||

| Equity Fund Class AAA |

(4.32 | )% | 8.47% | 9.85% | 6.69% | 9.57% | ||||||||||||||

| S&P 500 Index |

15.15 | 14.15 | 13.74 | 9.19 | 10.54(b) | |||||||||||||||

In the current prospectuses dated January 28, 2020, the expense ratio for Class AAA Shares is 1.64%. See page 37 for the expense ratios for the year ended September 30, 2020. Class AAA Shares do not have a sales charge.

| (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com. Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The S&P 500 Index is a market capitalization weighted index of 500 large capitalization stocks commonly used to represent the U.S. equity market. Dividends are considered reinvested. You cannot invest directly in an index. |

| (b) | S&P 500 Index since inception performance is as of December 31, 1986. |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN

THE EQUITY FUND CLASS AAA AND THE S&P 500 INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

10

Balanced Fund (Unaudited)

For fiscal year ended September 30, 2020, the net asset value (NAV) total return per Class AAA Share of the TETON Westwood Balanced Fund was (0.2)% compared with total return of 8.0% and 12.3% for the Bloomberg Barclays Government/Credit Bond Index and the common balanced benchmark comprised of 60% S&P 500 Index and 40% of the Bloomberg Barclays Capital Government/Credit Bond Index, respectively. See the next page for additional performance information.

The Fund invests in a combination of equity and debt securities. The Fund is primarily equity-oriented, and uses a top-down approach in seeking to provide equity-like returns but with lower volatility than a fully invested equity portfolio. Westwood Management Corp., the Fund’s sub-adviser (the “Westwood Sub-Adviser”) will typically invest 30% to 70% of the Fund’s assets in equity securities and 70% to 30% in debt securities, and the balance of the Fund’s assets in cash or cash equivalents. The actual mix of assets will vary depending on the Westwood Sub-Adviser’s analysis of market and economic conditions.

The Fund invests in stocks of seasoned companies. Seasoned companies generally have market capitalizations of $1 billion or more and have been operating for at least three years. The Westwood Sub-Adviser chooses stocks of seasoned companies with proven records and above-average earnings growth potential. The Westwood Sub-Adviser has disciplines in place that serve as sell signals such as a security reaching a predetermined price target, a change to a company’s fundamentals that make the risk/reward profile unattractive, or a need to improve the overall risk/reward profile of the Fund.

The debt securities held by the Fund are investment grade securities of corporate and government issuers and commercial paper and mortgage- and asset-backed securities. Investment grade debt securities are securities rated in one of the four highest ratings categories by a Nationally Recognized Statistical Rating Organization (“NRSRO”). The Fund may invest in fixed income securities of any maturity.

The Fund may also invest up to 25% of its total assets in foreign equity securities and in European Depositary Receipts (“EDRs”) or American Depositary Receipts (“ADRs”), including in those of companies located in emerging markets. The Fund may also invest in foreign debt securities.

Equity markets ended the fourth quarter 2019 in positive territory despite continued concerns over the ongoing trade dispute and future economic growth given the deterioration of economic data. The U.S. market outperformed international equities and large caps fared far better than small caps. GDP growth for the second quarter remained steady at 2%, though several economic indicators such as the ISM’s PMI for the manufacturing segment fell into contraction. Investors continue to look for additional clues regarding the health of the economy given the longevity of the business cycle. The Federal Reserve cut rates twice during the quarter, marking the first time for such actions in over a decade. The market remains optimistic regarding additional future rate cuts in order to help bolster the economy. Interest rates fell sharply during the quarter, notably the yield on the 10-year U.S. treasury declined to 1.66%, falling 34 basis points over increasing demand for safe-haven assets amidst the uncertainty.

The First quarter 2020 was one for the record books. After a strong start with improving corporate outlooks and an initial U.S.-China trade deal, however, markets took a nasty turn. The outbreak of COVID-19 swept across the globe, sending returns sharply negative, with much of the pain felt during March. The S&P 500 suffered the worst first quarter since 1928, while fixed income markets were equally battered, as both investment grade and high yield indices suffered their worst monthly sell-offs in history, down over 10 percent each. As governments around the world implemented quarantining and shelter-in-place orders to try and “flatten the curve”, the effect on business was overwhelming as many companies shut their doors with revenues falling to zero. Employees quickly found themselves without jobs and the world braced for the expected recession to come. The response by governments and central banks was swift as both worked to deliver trillions of dollars of stimulus via their respective channels. The Federal Reserve slashed interest rates to zero and announced an unprecedented move for open-ended expansion of their balance sheet to support markets. The U.S. Government passed the largest economic relief bill in history, the CARES Act, worth over $2.2 trillion dollars, to try to protect paychecks and help fund businesses impacted by the virus.

The second quarter 2020 was again a record-setter as markets rallied and the S&P 500 Index posted the strongest quarterly gain since 1998. This also marked the first time for a back-to-back decline and rally of such magnitude since the 1930s. Investors optimism rose as COVID-19 trends moderated from their worst levels, raising the prospects for a snapback in the economic landscape. Massive amounts of fiscal and monetary stimulus began to be disbursed, helping drive a similar snapback to the markets. Despite dire unemployment numbers, greater than 11 percent at present, consumer spending rebounded sharply as people spent their government stimulus checks. Individuals reemerged as reopening began across various states. However, as businesses started this process across the country, key states like Texas and Florida saw infection trends worsen. This raised the possibility of a second wave and remains front of mind for investors heading into the upcoming earnings season. Earnings growth estimates have begun to moderate their declines and improve on the margin, after falling sharply last quarter. The trajectory for future corporate profits will serve as a guide for markets going forward.

The third quarter saw equity markets climb once more, with the S&P 500 now with a positive return for the year. Small caps remained challenged, down nearly 8% still, as navigating through the COVID-19 disruptions has been more difficult for smaller businesses. Interest rates were relatively unchanged, with the yield on the 10-year Treasury bond relatively unchanged to end the quarter at 69 basis points and credit spreads have continued to tighten. The Federal Reserve continued to provide qualitative forward commentary around supporting markets with low rates and additional quantitative easing should it be needed. However, additional fiscal stimulus that had been hoped for now appears to be delayed indefinitely amidst the emergence of the partisan debate over nominating a replacement to the Supreme Court. Volatility has begun to pick up in earnest in tandem with the election rhetoric on both sides of the aisle. The health of the consumer remains a key question for investors as consumer spending has remained strong juxtaposed against the unemployment rate still above 8% with further increases expected as temporary furloughs become permanent. COVID cases, which had spiked during the summer, have come down and remain elevated into the fall. Recovery and reopening efforts continue to progress, and with them, earnings estimates have continued to rise from their troughs.

We appreciate your confidence and trust.

11

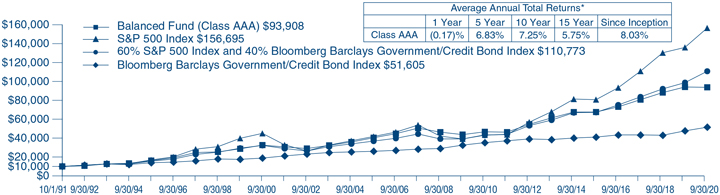

|

Average Annual Returns through September 30, 2020 (a) (Unaudited) |

||||||||||||||||||||

| 1 Year | 5 Year | 10 Year | 15 Year | Since Inception (10/1/91) |

||||||||||||||||

| Balanced Fund Class AAA |

(0.17 | )% | 6.83% | 7.25% | 5.75% | 8.03% | ||||||||||||||

| 60% S&P 500 Index and 40% Bloomberg Barclays Government/Credit Bond Index (b) |

12.30 | 12.25 | 11.21 | 9.63 | 8.64 | |||||||||||||||

| S&P 500 Index |

15.15 | 14.15 | 13.74 | 9.19 | 9.95(c) | |||||||||||||||

| Bloomberg Barclays Government/Credit Bond Index |

8.03 | 4.66 | 3.87 | 4.63 | 5.82(c) | |||||||||||||||

In the current prospectuses dated January 28, 2020, the expense ratio for Class AAA Shares is 1.37%. See page 38 for the expense ratios for the year ended September 30, 2020. Class AAA Shares do not have a sales charge.

| (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.tetonadv.com for performance information as of the most recent month end. Teton Advisors, Inc. (the Adviser) reimbursed expenses in years prior to 1998 to limit the expense ratio. Had such limitation not been in place, returns would have been lower. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.tetonadv.com. Other share classes are available and have different performance characteristics. See page 2 for performance of other classes of shares. The Bloomberg Barclays Government/Credit Bond Index is a market value weighted index that tracks the performance of fixed rate, publicly placed, dollar denominated obligations. The S&P 500 Index is a market capitalization weighted index of 500 large capitalization stocks commonly used to represent the U.S. equity market. Dividends are considered reinvested. You cannot invest directly in an index. |

| (b) | The Blended Index consists of a blend of 60% the S&P 500 Index and 40% Bloomberg Barclays Government/Credit Bond Index. (c) S&P 500 Index and Bloomberg Barclays Government/Credit Bond Index since inception performances are as of September 30, 1991. |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE BALANCED FUND CLASS AAA,

THE S&P 500 INDEX, AND A COMPOSITE OF 60% OF THE S&P 500 INDEX AND 40% OF

THE BLOOMBERG BARCLAYS GOVERNMENT/CREDIT BOND INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

12

TETON Westwood Funds

Disclosure of Fund Expenses (Unaudited)

For the Six Month Period from April 1, 2020 through September 30, 2020

| 13 |

TETON Westwood Funds

Disclosure of Fund Expenses (Unaudited) (Continued)

For the Six Month Period from April 1, 2020 through September 30, 2020

Expense Table

| Actual Fund Return | Hypothetical 5% Return | ||||||||||||||||||||||||||||||||||||||||||||

| Beginning | Ending | Annualized | Expenses | Beginning | Ending | Annualized | Expenses | ||||||||||||||||||||||||||||||||||||||

| Account Value | Account Value | Expense | Paid During | Account Value | Account Value | Expense | Paid During | ||||||||||||||||||||||||||||||||||||||

| 04/01/20 | 09/30/20 | Ratio | Period* | 04/01/20 | 09/30/20 | Ratio | Period* | ||||||||||||||||||||||||||||||||||||||

|

TETON Westwood Mighty Mites Fund |

|||||||||||||||||||||||||||||||||||||||||||||

| Class AAA |

$1,000.00 | $1,233.20 | 1.44% | $ | 8.04 | $1,000.00 | $1,017.80 | 1.44% | $ | 7.26 | |||||||||||||||||||||||||||||||||||

| Class A |

$1,000.00 | $1,231.70 | 1.69% | $ | 9.43 | $1,000.00 | $1,016.55 | 1.69% | $ | 8.52 | |||||||||||||||||||||||||||||||||||

| Class C |

$1,000.00 | $1,228.90 | 2.19% | $ | 12.20 | $1,000.00 | $1,014.05 | 2.19% | $ | 11.03 | |||||||||||||||||||||||||||||||||||

| Class I |

$1,000.00 | $1,234.90 | 1.19% | $ | 6.65 | $1,000.00 | $1,019.05 | 1.19% | $ | 6.01 | |||||||||||||||||||||||||||||||||||

|

TETON Westwood SmallCap Equity Fund |

|||||||||||||||||||||||||||||||||||||||||||||

| Class AAA |

$1,000.00 | $1,257.10 | 1.25% | $ | 7.05 | $1,000.00 | $1,018.75 | 1.25% | $ | 6.31 | |||||||||||||||||||||||||||||||||||

| Class A |

$1,000.00 | $1,255.40 | 1.50% | $ | 8.46 | $1,000.00 | $1,017.50 | 1.50% | $ | 7.57 | |||||||||||||||||||||||||||||||||||

| Class C |

$1,000.00 | $1,251.60 | 2.00% | $ | 11.26 | $1,000.00 | $1,015.00 | 2.00% | $ | 10.08 | |||||||||||||||||||||||||||||||||||

| Class I |

$1,000.00 | $1,259.00 | 1.00% | $ | 5.65 | $1,000.00 | $1,020.00 | 1.00% | $ | 5.05 | |||||||||||||||||||||||||||||||||||

|

TETON Convertible Securities Fund |

|||||||||||||||||||||||||||||||||||||||||||||

| Class AAA |

$1,000.00 | $1,260.70 | 1.15% | $ | 6.50 | $1,000.00 | $1,019.25 | 1.15% | $ | 5.81 | |||||||||||||||||||||||||||||||||||

| Class A |

$1,000.00 | $1,258.90 | 1.40% | $ | 7.91 | $1,000.00 | $1,018.00 | 1.40% | $ | 7.06 | |||||||||||||||||||||||||||||||||||

| Class C |

$1,000.00 | $1,256.40 | 1.90% | $ | 10.72 | $1,000.00 | $1,015.50 | 1.90% | $ | 9.57 | |||||||||||||||||||||||||||||||||||

| Class I |

$1,000.00 | $1,262.10 | 0.90% | $ | 5.09 | $1,000.00 | $1,020.50 | 0.90% | $ | 4.55 | |||||||||||||||||||||||||||||||||||

|

TETON Westwood Equity Fund |

|||||||||||||||||||||||||||||||||||||||||||||

| Class AAA |

$1,000.00 | $1,184.90 | 1.61% | $ | 8.79 | $1,000.00 | $1,016.95 | 1.61% | $ | 8.12 | |||||||||||||||||||||||||||||||||||

| Class A |

$1,000.00 | $1,183.00 | 1.86% | $ | 10.15 | $1,000.00 | $1,015.70 | 1.86% | $ | 9.37 | |||||||||||||||||||||||||||||||||||

| Class C |

$1,000.00 | $1,179.60 | 2.35% | $ | 12.81 | $1,000.00 | $1,013.25 | 2.35% | $ | 11.83 | |||||||||||||||||||||||||||||||||||

| Class I |

$1,000.00 | $1,185.70 | 1.36% | $ | 7.43 | $1,000.00 | $1,018.20 | 1.36% | $ | 6.86 | |||||||||||||||||||||||||||||||||||

|

TETON Westwood Balanced Fund |

|||||||||||||||||||||||||||||||||||||||||||||

| Class AAA |

$1,000.00 | $1,118.60 | 1.44% | $ | 7.63 | $1,000.00 | $1,017.80 | 1.44% | $ | 7.26 | |||||||||||||||||||||||||||||||||||

| Class A |

$1,000.00 | $1,117.40 | 1.69% | $ | 8.95 | $1,000.00 | $1,016.55 | 1.69% | $ | 8.52 | |||||||||||||||||||||||||||||||||||

| Class C |

$1,000.00 | $1,114.50 | 2.19% | $ | 11.58 | $1,000.00 | $1,014.05 | 2.19% | $ | 11.03 | |||||||||||||||||||||||||||||||||||

| Class I |

$1,000.00 | $1,120.30 | 1.19% | $ | 6.31 | $1,000.00 | $1,019.05 | 1.19% | $ | 6.01 | |||||||||||||||||||||||||||||||||||

| * | Expenses are equal to the Funds’ annualized expense ratio for the last six months multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183 days), then divided by 366. |

14

Summary of Portfolio Holdings (Unaudited)

The following tables present portfolio holdings as a percent of net assets as of September 30, 2020:

|

TETON Westwood Mighty Mites Fund |

|

TETON Westwood SmallCap Equity Fund | ||

|

TETON Convertible Securities Fund | ||

| 15 |

Summary of Portfolio Holdings (Unaudited) (Continued)

TETON Westwood Equity Fund

|

TETON Westwood Balanced Fund | ||

| 16 |

TETON Westwood Mighty Mites Fund

Summary Schedule of Investments — September 30, 2020

| See accompanying notes to financial statements. |

| 17 |

TETON Westwood Mighty Mites Fund

Summary Schedule of Investments (Continued) — September 30, 2020

| See accompanying notes to financial statements. |

| 18 |

TETON Westwood Mighty Mites Fund

Summary Schedule of Investments (Continued) — September 30, 2020

| See accompanying notes to financial statements. |

| 19 |

TETON Westwood SmallCap Equity Fund

Schedule of Investments — September 30, 2020

| See accompanying notes to financial statements. |

| 20 |

TETON Westwood SmallCap Equity Fund

Schedule of Investments (Continued) — September 30, 2020

| See accompanying notes to financial statements. |

| 21 |

TETON Convertible Securities Fund

Schedule of Investments — September 30, 2020

| See accompanying notes to financial statements. |

| 22 |

TETON Convertible Securities Fund

Schedule of Investments (Continued) — September 30, 2020

| See accompanying notes to financial statements. |

| 23 |

TETON Convertible Securities Fund

Schedule of Investments (Continued) — September 30, 2020

| See accompanying notes to financial statements. |

| 24 |

TETON Westwood Equity Fund

Schedule of Investments — September 30, 2020

| See accompanying notes to financial statements. |

| 25 |

TETON Westwood Balanced Fund

Schedule of Investments — September 30, 2020

| See accompanying notes to financial statements. |

| 26 |

TETON Westwood Balanced Fund

Schedule of Investments (Continued) — September 30, 2020

| See accompanying notes to financial statements. |

| 27 |

TETON Westwood Funds

Statements of Assets and Liabilities

September 30, 2020

| Mighty Mites Fund |

SmallCap |

Convertible Securities Fund | ||||||||||||||||||||||||

| Assets: |

||||||||||||||||||||||||||

| Investments, at value (cost $328,223,142, $26,556,265, and $63,530,386, respectively) |

$509,259,727 | $29,140,863 | $73,580,363 | |||||||||||||||||||||||

| Investments in affiliates, at value (cost $26,182,327) |

40,033,010 | — | — | |||||||||||||||||||||||

| Cash |

20,508 | 4,506 | 1,931 | |||||||||||||||||||||||

| Receivable for Fund shares sold |

173,866 | 326 | 46,984 | |||||||||||||||||||||||

| Receivable for investments sold |

36,255 | — | 547,737 | |||||||||||||||||||||||

| Receivable from Adviser |

— | 10,014 | 32,274 | |||||||||||||||||||||||

| Dividends and interest receivable |

476,576 | 19,933 | 248,528 | |||||||||||||||||||||||

| Prepaid expenses |

22,498 |

13,494 |

23,267 | |||||||||||||||||||||||

| Total Assets |

550,022,440 |

29,189,136 |

74,481,084 | |||||||||||||||||||||||

| Liabilities: |

||||||||||||||||||||||||||

| Payable to custodian |

3 | — | — | |||||||||||||||||||||||

| Payable for investments purchased |

— | 724,646 | 1,819,767 | |||||||||||||||||||||||

| Payable for Fund shares redeemed |

2,021,436 | 23,276 | 18,930 | |||||||||||||||||||||||

| Payable for investment advisory fees |

458,396 | 23,719 | 58,773 | |||||||||||||||||||||||

| Payable for distribution fees. |

90,146 | 3,957 | 8,949 | |||||||||||||||||||||||

| Payable for accounting fees |

3,750 | — | 3,750 | |||||||||||||||||||||||

| Payable for custodian fees |

63,793 | 4,258 | 7,430 | |||||||||||||||||||||||

| Payable for legal and audit fees |

66,719 | 37,249 | 31,204 | |||||||||||||||||||||||

| Payable for shareholder communications expenses |

133,042 | 13,681 | 15,550 | |||||||||||||||||||||||

| Payable for shareholder services fees |

111,570 | 2,892 | 4,415 | |||||||||||||||||||||||

| Other accrued expenses |

18,924 |

5,259 |

5,387 | |||||||||||||||||||||||

| Total Liabilities |

2,967,779 |

838,937 |

1,974,155 | |||||||||||||||||||||||

| Net Assets |

$547,054,661 |

$28,350,199 |

$72,506,929 | |||||||||||||||||||||||

| Net Assets Consist of: |

||||||||||||||||||||||||||

| Paid-in capital |

$301,811,413 | $26,875,303 | $61,246,704 | |||||||||||||||||||||||

| Total distributable earnings |

245,243,248 |

1,474,896 |

11,260,225 | |||||||||||||||||||||||

| Net Assets |

$547,054,661 |

$28,350,199 |

$72,506,929 | |||||||||||||||||||||||

| Shares of Beneficial Interest, each at $0.001 par value; |

||||||||||||||||||||||||||

| Class AAA: |

||||||||||||||||||||||||||

| Net assets |

$103,109,086 |

$6,146,444 |

$7,391,627 | |||||||||||||||||||||||

| Shares of beneficial interest outstanding |

4,599,266 |

399,207 |

474,165 | |||||||||||||||||||||||

| Net Asset Value, offering, and redemption price per share |

$22.42 |

$15.40 |

$15.59 | |||||||||||||||||||||||

| Class A: |

||||||||||||||||||||||||||

| Net assets |

$68,250,025 |

$3,171,979 |

$6,143,372 | |||||||||||||||||||||||

| Shares of beneficial interest outstanding |

3,193,728 |

218,797 |

380,840 | |||||||||||||||||||||||

| Net Asset Value and redemption price per share. |

$21.37 |

$14.50 |

$16.13 | |||||||||||||||||||||||

| Maximum offering price per share (NAV ÷ 0.96, based on maximum sales charge of 4.00% of the offering price) |

$22.26 |

$15.10 |

$16.80 | |||||||||||||||||||||||

| Class C: |

||||||||||||||||||||||||||

| Net assets |

$47,508,900 |

$1,596,981 |

$6,130,457 | |||||||||||||||||||||||

| Shares of beneficial interest outstanding |

2,594,249 |

132,635 |

355,161 | |||||||||||||||||||||||

| Net Asset Value and offering price per share(a) |

$18.31 |

$12.04 |

$17.26 | |||||||||||||||||||||||

| Class I: |

||||||||||||||||||||||||||

| Net assets |

$328,186,650 |

$17,434,795 |

$52,841,473 | |||||||||||||||||||||||

| Shares of beneficial interest outstanding |

14,191,045 |

1,083,852 |

3,377,736 | |||||||||||||||||||||||

| Net Asset Value, offering, and redemption price per share |

$23.13 |

$16.09 |

$15.64 | |||||||||||||||||||||||

| (a) | Redemption price varies based on the length of time held. |

| See accompanying notes to financial statements. |

| 28 |

TETON Westwood Funds

Statements of Assets and Liabilities (Continued)

September 30, 2020

| Equity Fund |

Balanced |

|||||||||||||||

| Assets: |

||||||||||||||||

| Investments, at value (cost $42,545,311 and $46,836,692, respectively) |

$47,823,445 | $52,058,555 | ||||||||||||||

| Investments in affiliates, at value |

— | — | ||||||||||||||

| Cash |

711 | — | ||||||||||||||

| Receivable for Fund shares sold |

1,033 | 2,326 | ||||||||||||||

| Receivable for investments sold |

— | — | ||||||||||||||

| Receivable from Adviser |

— | — | ||||||||||||||

| Dividends and interest receivable |

25,315 | 109,492 | ||||||||||||||

| Prepaid expenses |

14,539 | 16,736 | ||||||||||||||

|

|

|

|||||||||||||||

| Total Assets |

47,865,043 | 52,187,109 | ||||||||||||||

|

|

|

|||||||||||||||

| Liabilities: |

||||||||||||||||

| Payable to custodian |

— | 4,063 | ||||||||||||||

| Payable for investments purchased |

— | — | ||||||||||||||

| Payable for Fund shares redeemed |

1,000 | 28,973 | ||||||||||||||

| Payable for investment advisory fees |

39,497 | 32,312 | ||||||||||||||

| Payable for distribution fees |

9,576 | 12,287 | ||||||||||||||

| Payable for accounting fees |

— | 3,750 | ||||||||||||||

| Payable for custodian fees |

6,413 | 7,320 | ||||||||||||||

| Payable for legal and audit fees |

30,361 | 30,516 | ||||||||||||||

| Payable for shareholder communications expenses |

15,422 | 15,577 | ||||||||||||||

| Payable for shareholder services fees |

5,519 | 6,980 | ||||||||||||||

| Other accrued expenses |

5,433 | 5,572 | ||||||||||||||

|

|

|

|||||||||||||||

| Total Liabilities |

113,221 | 147,350 | ||||||||||||||

|

|

|

|||||||||||||||

| Net Assets |

$47,751,822 | $52,039,759 | ||||||||||||||

|

|

|

|||||||||||||||

| Net Assets Consist of: |

||||||||||||||||

| Paid-in capital |

$40,210,718 | $45,026,041 | ||||||||||||||

| Total distributable earnings |

7,541,104 | 7,013,718 | ||||||||||||||

|

|

|

|||||||||||||||

| Net Assets |

$47,751,822 | $52,039,759 | ||||||||||||||

|

|

|

|||||||||||||||

| Shares of Beneficial Interest, each at $0.001 par value; |

||||||||||||||||

| Class AAA: |

||||||||||||||||

| Net assets |

$44,108,915 | $38,713,318 | ||||||||||||||

|

|

|

|||||||||||||||

| Shares of beneficial interest outstanding |

4,003,510 |

3,567,983 |

||||||||||||||

| Net Asset Value, offering, and redemption price per share |

$11.02 |

$10.85 |

||||||||||||||

| Class A: |

||||||||||||||||

| Net assets |

$1,009,447 |

$7,981,267 |

||||||||||||||

| Shares of beneficial interest outstanding |

91,877 |

730,206 |

||||||||||||||

| Net Asset Value and redemption price per share |

$10.99 |

$10.93 |

||||||||||||||

| Maximum offering price per share (NAV ÷ 0.96, based on maximum sales charge of 4.00% of the offering price) |

$11.45 |

$11.39 |

||||||||||||||

| Class C: |

||||||||||||||||

| Net assets |

$38,410 |

$1,214,437 |

||||||||||||||

| Shares of beneficial interest outstanding |

3,773 |

108,880 |

||||||||||||||

| Net Asset Value and offering price per share(a) |

$10.18 |

$11.15 |

||||||||||||||

| Class I: |

||||||||||||||||

| Net assets |

$2,595,050 |

$4,130,737 |

||||||||||||||

| Shares of beneficial interest outstanding |

236,304 |

381,354 |

||||||||||||||

| Net Asset Value, offering, and redemption price per share |

$10.98 |

$10.83 |

||||||||||||||

| (a) | Redemption price varies based on the length of time held. |

| See accompanying notes to financial statements. |

| 29 |

TETON Westwood Funds

Statements of Operations

For the Year Ended September 30, 2020

| Mighty Mites Fund |

SmallCap Equity Fund |

Convertible Securities Fund |

||||||||||||||||||

| Investment Income: |

||||||||||||||||||||

| Dividends - unaffiliated (net of foreign withholding taxes of $48,669, $634, and $0, respectively) |

$ | 7,483,005 | $ | 506,601 | $ | 790,088 | ||||||||||||||

| Dividends - affiliated |

868,758 | — | — | |||||||||||||||||

| Interest |

72,744 | 8,573 | 613,198 | |||||||||||||||||

| Total Investment Income |

8,424,507 | 515,174 | 1,403,286 | |||||||||||||||||

| Expenses: |

||||||||||||||||||||

| Investment advisory fees |

7,458,579 | 339,000 | 619,623 | |||||||||||||||||

| Distribution fees - Class AAA |

310,670 | 17,467 | 14,212 | |||||||||||||||||

| Distribution fees - Class A |

359,422 | 18,925 | 27,242 | |||||||||||||||||

| Distribution fees - Class C |

719,976 | 24,008 | 54,257 | |||||||||||||||||

| Accounting fees |

45,000 | — | 45,000 | |||||||||||||||||

| Custodian fees |

164,191 | 11,033 | 18,490 | |||||||||||||||||

| Interest expense |

3,307 | 667 | 455 | |||||||||||||||||

| Legal and audit fees |

80,750 | 34,277 | 28,695 | |||||||||||||||||

| Registration expenses |

66,268 | 52,372 | 57,527 | |||||||||||||||||

| Shareholder communications expenses |

208,517 | 25,286 | 32,017 | |||||||||||||||||

| Shareholder services fees |

669,080 | 14,009 | 24,920 | |||||||||||||||||

| Trustees’ fees |

116,645 | 5,319 | 9,611 | |||||||||||||||||

| Tax expense |

11,646 | — | — | |||||||||||||||||

| Miscellaneous expenses |

57,599 | 13,469 | 13,636 | |||||||||||||||||

| Total Expenses |

10,271,650 | 555,832 | 945,685 | |||||||||||||||||

| Less: |

||||||||||||||||||||

| Fees waived or expenses reimbursed by Adviser (See Note 3) |

— | (154,193 | ) | (291,369 | ) | |||||||||||||||

| Advisory fee reduction on unsupervised assets (See Note 3) |

(55,544 | ) | — | — | ||||||||||||||||

| Custodian fee credits |

(316 | ) | — | (238 | ) | |||||||||||||||

| Expenses paid by broker (See Note 6) |

(9,560 | ) | (1,573 | ) | (250 | ) | ||||||||||||||

| Total Reimbursements, Waivers, Reductions, and Credits |

(65,420 | ) | (155,766 | ) | (291,857 | ) | ||||||||||||||

| Net Expenses |

10,206,230 | 400,066 | 653,828 | |||||||||||||||||

| Net Investment Income/(Loss) |

(1,781,723 | ) | 115,108 | 749,458 | ||||||||||||||||

| Net Realized and Unrealized Gain/(Loss) on Investments and Foreign Currency: |

||||||||||||||||||||

| Net realized gain/(loss) on investments - unaffiliated |

71,775,781 | (81,846 | ) | 1,950,481 | ||||||||||||||||

| Net realized loss on investments - affiliated |

(4,476 | ) | — | — | ||||||||||||||||

| Net realized gain on foreign currency transactions |

2,900 | — | — | |||||||||||||||||

| Net realized gain/(loss) on investments and foreign currency transactions |

71,774,205 | (81,846 | ) | 1,950,481 | ||||||||||||||||

| Net change in unrealized appreciation/depreciation: |

||||||||||||||||||||

| on investments - unaffiliated |

(168,456,282 | ) | (3,957,562 | ) | 6,732,680 | |||||||||||||||

| on investments - affiliated |

(2,067,222 | ) | — | — | ||||||||||||||||

| on foreign currency translations |

1,480 | — | — | |||||||||||||||||

| Net change in unrealized appreciation/depreciation on investments and foreign currency translations |

(170,522,024 | ) | (3,957,562 | ) | 6,732,680 | |||||||||||||||

| Net Realized and Unrealized Gain/(Loss) on Investments and Foreign Currency |

(98,747,819 | ) | (4,039,408 | ) | 8,683,161 | |||||||||||||||

| Net Increase/(Decrease) in Net Assets Resulting from Operations |

$ | (100,529,542 | ) | $ | (3,924,300 | ) | $ | 9,432,619 | ||||||||||||

|

|

||||||||||||||||||||

| See accompanying notes to financial statements. |

| 30 |

TETON Westwood Funds

Statements of Operations (Continued)

For the Year Ended September 30, 2020

| Equity Fund |

Balanced Fund |

|||||||||||

| Investment Income: |

||||||||||||

| Dividends - unaffiliated (net of foreign withholding taxes of $1,568 and $1,124, respectively) |

$1,198,187 | $ | 809,689 | |||||||||

| Dividends - affiliated |

— | — | ||||||||||

| Interest |

5,700 | 488,719 | ||||||||||

|

|

|

|

||||||||||

| Total Investment Income |

1,203,887 | 1,298,408 | ||||||||||

|

|

|

|

||||||||||

| Expenses: |

||||||||||||

| Investment advisory fees |

515,780 | 411,571 | ||||||||||

| Distribution fees - Class AAA |

117,517 | 102,379 | ||||||||||

| Distribution fees - Class A |

5,920 | 42,937 | ||||||||||

| Distribution fees - Class C |

839 | 13,739 | ||||||||||

| Accounting fees |

18,750 | 41,250 | ||||||||||

| Custodian fees |

16,240 | 19,317 | ||||||||||

| Interest expense |

— | — | ||||||||||

| Legal and audit fees |

28,152 | 28,392 | ||||||||||

| Registration expenses |

55,413 | 56,951 | ||||||||||

| Shareholder communications expenses |

28,085 | 28,069 | ||||||||||

| Shareholder services fees |

30,885 | 35,312 | ||||||||||

| Trustees’ fees |

8,140 | 8,726 | ||||||||||

| Miscellaneous expenses |

13,909 | 14,561 | ||||||||||

|

|

|

|

||||||||||

| Total Expenses |

839,630 | 803,204 | ||||||||||

|

|

|

|

||||||||||

| Less: |

||||||||||||

| Fees waived or expenses reimbursed by Adviser (See Note 3) |

— | — | ||||||||||

| Advisory fee reduction on unsupervised assets (See Note 3) |

— | — | ||||||||||

| Custodian fee credits |

— | — | ||||||||||

| Expenses paid by broker (See Note 6) |

(1,331) | (1,729 | ) | |||||||||

|

|

|

|

||||||||||

| Total Reimbursements, Waivers, Reductions, and Credits |

(1,331) | (1,729 | ) | |||||||||

|

|

|

|

||||||||||

| Net Expenses. |

838,299 | 801,475 | ||||||||||

|

|

|

|

||||||||||

| Net Investment Income |

365,588 | 496,933 | ||||||||||

|

|

|

|

||||||||||

| Net Realized and Unrealized Gain/(Loss) on Investments and Foreign Currency: |

||||||||||||

| Net realized gain on investments - unaffiliated |

2,201,830 | 1,877,132 | ||||||||||

| Net realized loss on investments - affiliated |

— | — | ||||||||||

| Net realized gain/(loss) on foreign currency transactions |

— | — | ||||||||||

|

|

|

|

||||||||||

| Net realized gain on investments and foreign currency transactions |

2,201,830 | 1,877,132 | ||||||||||

|

|

|

|

||||||||||

| Net change in unrealized appreciation/depreciation: |

||||||||||||

| on investments |

(4,996,419) | (2,544,380 | ) | |||||||||

|

|

|

|

||||||||||

| Net change in unrealized appreciation/depreciation on investments |

(4,996,419) | (2,544,380 | ) | |||||||||

|

|

|

|

||||||||||

| Net Realized and Unrealized Loss on Investments and Foreign Currency |

(2,794,589) | (667,248 | ) | |||||||||

|

|

|

|

||||||||||

| Net Decrease in Net Assets Resulting from Operations |

$(2,429,001) | $ | (170,315 | ) | ||||||||

|

|

|

|

||||||||||

| See accompanying notes to financial statements. |

| 31 |

TETON Westwood Funds

Statements of Changes in Net Assets

For the Year Ended September 30,

| Mighty Mites Fund | ||||||||

| 2020 | 2019 | |||||||

| Operations: |

||||||||

| Net investment income/(loss) |

$ | (1,781,723 | ) | $ | (532,789 | ) | ||

| Net realized gain/(loss) on investments and foreign currency transactions |

71,774,205 | 35,912,231 | ||||||

| Net change in unrealized appreciation/depreciation on investments and foreign currency translations |

(170,522,024 | ) | (158,512,405 | ) | ||||

|

|

|

|

|

|||||

| Net Increase/(Decrease) in Net Assets Resulting from Operations |

(100,529,542 | ) | (123,132,963 | ) | ||||

|

|

|

|

|

|||||

| Distributions to Shareholders |

||||||||

| Accumulated earnings |

||||||||

| Class AAA |

(6,208,183 | ) | (7,361,282 | ) | ||||

| Class A |

(3,606,122 | ) | (3,810,847 | ) | ||||

| Class C |

(4,751,028 | ) | (6,494,377 | ) | ||||

| Class I |

(24,833,267 | ) | (29,681,828 | ) | ||||

|

|

|

|

|

|||||

| Distributions to Shareholders |

(39,398,600 | ) | (47,348,334 | ) | ||||

|

|

|

|

|

|||||

| Shares of Beneficial Interest Transactions: |

||||||||

| Proceeds from shares issued |

||||||||

| Class AAA |

6,998,306 | 10,468,795 | ||||||

| Class A |

28,659,192 | 14,953,915 | ||||||

| Class C |

3,705,823 | 6,646,050 | ||||||

| Class I |

76,093,456 | 118,030,977 | ||||||

|

|

|

|

|

|||||

| 115,456,777 | 150,099,737 | |||||||

|

|

|

|

|

|||||

| Proceeds from reinvestment of distributions |

||||||||

| Class AAA |

6,063,185 | 7,212,093 | ||||||

| Class A |

3,348,477 | 3,441,845 | ||||||

| Class C |

4,118,528 | 5,725,757 | ||||||

| Class I |

17,295,389 | 19,854,881 | ||||||

|

|

|

|

|

|||||

| 30,825,579 | 36,234,576 | |||||||

|

|

|

|

|

|||||

| Cost of shares redeemed |

||||||||

| Class AAA |

(46,554,600 | ) | (61,793,617 | ) | ||||

| Class A |

(28,494,755 | ) | (40,281,984 | ) | ||||

| Class C |

(54,901,918 | ) | (49,090,524 | ) | ||||

| Class I |

(295,064,423 | ) | (335,035,651 | ) | ||||

|

|

|

|

|

|||||

| (425,015,696 | ) | (486,201,776 | ) | |||||

|

|

|

|

|

|||||