Condensed Interim Consolidated Financial Statements

For the quarter ended March 31, 2019

(In accordance with International Financial Reporting Standards (“IFRS”) and stated in thousands of Canadian dollars, unless otherwise indicated)

INDEX

Notice to Reader of the Unaudited Condensed Interim Financial Statements

Condensed Interim Consolidated Financial Statements

Notice to reader of the unaudited CONDENSED interim CONSOLIDATED financial statements

For the three months period ended March 31, 2019

In accordance with National Instrument 51-102, of the Canadian Securities Administrators, North American Nickel Inc. (the “Company” or “North American Nickel”) discloses that its auditors have not reviewed the unaudited condensed interim consolidated interim financial statements.

The unaudited condensed interim consolidated financial statements of the Company for the three months period ended March 31, 2019 (“Financial Statements”) have been prepared by management. The Financial Statements should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto of the Company for the fiscal year ended December 31, 2018, which are available at the SEDAR website under the Company’s profile (www.sedar.com). The Financial Statements are stated in thousands of Canadian dollars, unless otherwise indicated, and are prepared in accordance with International Financial Reporting Standards (“IFRS”).

1 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |

Condensed Interim Consolidated Statements of Financial Position

(Unaudited - Expressed in thousands of Canadian dollars)

| Notes | March 31, 2019 | December 31, 2018 | ||||||||

| ASSETS | ||||||||||

| CURRENT ASSETS | ||||||||||

| Cash and cash equivalents | 347 | 339 | ||||||||

| Short term investments | 4 | 1,500 | 2,500 | |||||||

| Receivables and other current assets | 5 | 137 | 133 | |||||||

| TOTAL CURRENT ASSETS | 1,984 | 2,972 | ||||||||

| NON-CURRENT ASSETS | ||||||||||

| Property, plant and equipment | 32 | 35 | ||||||||

| Exploration and evaluation assets | 6 | 64,738 | 64,479 | |||||||

| Reclamation of deposit | 6 | 14 | 14 | |||||||

| TOTAL NON-CURRENT ASSETS | 64,784 | 64,528 | ||||||||

| TOTAL ASSETS | 66,768 | 67,500 | ||||||||

| LIABILITIES | ||||||||||

| CURRENT LIABILITIES | ||||||||||

| Trade payables and accrued liabilities | 7, 9 | 384 | 556 | |||||||

| TOTAL CURRENT LIABILITIES | 384 | 556 | ||||||||

| TOTAL LIABILITIES | 384 | 556 | ||||||||

| EQUITY | ||||||||||

| Share capital - preferred | 8 | 591 | 591 | |||||||

| Share capital – common | 8 | 87,947 | 87,947 | |||||||

| Reserve | 8 | 7,749 | 7,749 | |||||||

| Deficit | (29,903 | ) | (29,343 | ) | ||||||

| TOTAL EQUITY | 66,384 | 66,944 | ||||||||

| TOTAL LIABILITIES AND EQUITY | 66,768 | 67,500 | ||||||||

Nature of Operations (Note 1)

The accompanying notes are an integral part of these Condensed Interim Consolidated Financial Statements.

Approved by the Board of Directors on May 24, 2019

| “signed” | “signed” |

Keith Morrison Director |

Doug Ford Audit Committee Chair |

2 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |

Condensed Interim Consolidated Statements of Comprehensive Loss

(Unaudited - Expressed in thousands of Canadian dollars)

| Three months ended | ||||||||||

| Notes | March 31, 2019 | March 31, 2018 | ||||||||

| EXPENSES | ||||||||||

| General and administrative expenses | 9, 13 | (535 | ) | (540 | ) | |||||

| Property investigation | (41 | ) | - | |||||||

| Amortization | (3 | ) | (4 | ) | ||||||

| Share-based payments | 8 | - | (287 | ) | ||||||

| (579 | ) | (831 | ) | |||||||

| OTHER ITEMS | ||||||||||

| Interest income | 18 | - | ||||||||

| Foreign exchange gain (loss) | 1 | (7 | ) | |||||||

| 19 | (7 | ) | ||||||||

| TOTAL COMPREHENSIVE LOSS FOR THE PERIOD | (560 | ) | (838 | ) | ||||||

| Basic and diluted weighted average number of common shares outstanding | 787,928,500 | 554,598,167 | ||||||||

| Basic and diluted loss per share | (0.00 | ) | (0.00 | ) | ||||||

The accompanying notes are an integral part of these Condensed Interim Consolidated Financial Statements.

3 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |

Condensed Interim Consolidated Statements of Changes in Equity

(Unaudited - Expressed in thousands of Canadian dollars)

| Notes | Number

Shares | Share

Capital | Preferred

Stock | Reserve | Deficit | Total

Equity | ||||||||||||||||||||

| BALANCE AT DECEMBER 31, 2017 | 554,595,167 | 73,598 | 591 | 5,089 | (26,550 | ) | 52,728 | |||||||||||||||||||

| Net and comprehensive loss for the period | - | - | - | - | (838 | ) | (838 | ) | ||||||||||||||||||

| Forfeited/expired options | - | - | - | (25 | ) | 25 | - | |||||||||||||||||||

| Share-based payments | 8 | - | - | - | 287 | - | 287 | |||||||||||||||||||

| BALANCE AT MARCH 31, 2018 | 554,595,167 | 73,598 | 591 | 5,351 | (27,363 | ) | 52,177 | |||||||||||||||||||

| BALANCE AT DECEMBER 31, 2018 | 787,928,500 | 87,947 | 591 | 7,749 | (29,343 | ) | 66,944 | |||||||||||||||||||

| Net and comprehensive loss for the period | (560 | ) | (560 | ) | ||||||||||||||||||||||

| Share-based payments | 8 | - | - | - | - | - | - | |||||||||||||||||||

| BALANCE AT MARCH 31, 2019 | 787,928,500 | 87,947 | 591 | 7,749 | (29,903 | ) | 66,384 | |||||||||||||||||||

The accompanying notes are an integral part of these Condensed Interim Consolidated Financial Statements.

4 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |

Condensed Interim Consolidated Statements of Cash Flows

(Unaudited - Expressed in thousands of Canadian dollars)

| Three months ended | ||||||||||

| Notes | March 31, 2019 | March 31, 2018 | ||||||||

| OPERATING ACTIVITIES | ||||||||||

| Loss for the period | (560 | ) | (838 | ) | ||||||

| Items not affecting cash: | ||||||||||

| Amortization | 3 | 4 | ||||||||

| Share based payments | - | 287 | ||||||||

| Interest income | (18 | ) | - | |||||||

| Changes in working capital | 10 | (33 | ) | (379 | ) | |||||

| Other: | ||||||||||

| Interest received | 11 | 16 | ||||||||

| Net cash used in operating activities | (597 | ) | (910 | ) | ||||||

| INVESTING ACTIVITIES | ||||||||||

| Expenditures on exploration and evaluation assets (includes changes in working capital) | (395 | ) | (1,129 | ) | ||||||

| Short-term investments | 1,000 | 2,000 | ||||||||

| Net cash used in investing activities | 605 | 871 | ||||||||

| FINANCING ACTIVITIES | ||||||||||

| Net cash provided by financing activities | - | - | ||||||||

| Change in cash equivalents for the period | 8 | (39 | ) | |||||||

| Cash and cash equivalents, beginning of the period | 339 | 398 | ||||||||

| Cash and cash equivalents, end of the period | 347 | 359 | ||||||||

The accompanying notes are an integral part of these Condensed Interim Consolidated Financial Statements.

5 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019

(Unaudited - Expressed in thousands of Canadian dollars)

| 1. | NATURE AND CONTINUANCE OF OPERATIONS |

North American Nickel Inc. (the “Company” or “NA Nickel”) was incorporated on September 23, 1983, under the laws of the Province of British Columbia, Canada. The head office and principal address is located at 3400 – 100 King Street West, PO Box 130, Toronto, Ontario, M5X 1A4 and the records office of the Company is located at Suite 2200, 1055 West Hastings Street, Vancouver, British Columbia, Canada, V6E 2E9. The Company’s common shares trade on the TSX Venture Exchange (“TSXV”) under the symbol “NAN”.

The Company’s principal business activity is the exploration and development of mineral properties in Greenland, Canada and United States. The Company has not yet determined whether any of these properties contain ore reserves that are economically recoverable. The recoverability of carrying amounts shown for exploration and evaluation assets is dependent upon a number of factors including environmental risk, legal and political risk, the existence of economically recoverable mineral reserves, confirmation of the Company’s interests in the underlying mineral claims, the ability of the Company to obtain necessary financing to complete exploration and development, and to attain sufficient net cash flow from future profitable production or disposition proceeds.

These condensed interim consolidated financial statements have been prepared on the assumption that the Company will continue as a going concern, meaning it will continue in operation for the foreseeable future and will be able to realize assets and discharge liabilities in the ordinary course of operations. The ability of the Company to continue operations as a going concern is ultimately dependent upon achieving profitable operations. To date, the Company has not generated profitable operations from its resource activities and will need to invest additional funds in carrying out its planned exploration, development and operational activities. These uncertainties cast substantial doubt about the Company’s ability to continue as a going concern. These condensed interim consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

The exploration and evaluation properties in which the Company currently has an interest are in the exploration stage. As such, the Company is dependent on external financing to fund its activities. In order to carry out the planned exploration and cover administrative costs, the Company will use its existing working capital and raise additional amounts as needed. Although the Company has been successful in its past fundraising activities, there is no assurance as to the success of future fundraising efforts or as to the sufficiency of funds raised in the future. The Company will continue to assess new properties and seek to acquire interests in additional properties if there is sufficient geologic or economic potential and if adequate financial resources are available to do so.

The condensed interim consolidated financial statements were approved and authorized for issuance by the Board of Directors of the Company on May 24, 2019.

| 2. | BASIS OF PREPARATION AND SIGNIFICANT ACCOUNTING POLICIES |

(a) Statement of Compliance

These condensed interim consolidated financial statements were prepared in accordance with International Financial Reporting Standards (“IFRS”), including IAS 34 Interim Financial Statements. The condensed interim consolidated financial statements do not include all of the information and disclosures required in the annual financial statements, and should be read in conjunction with the Company’s audited annual financial statements for the year ended December 31, 2018. Any subsequent changes to IFRS that are reflected in the Company’s consolidated financial statements for the year ended December 31, 2019 could result in restatement of these condensed interim consolidated financial statements.

(b) Basis of Preparation

These condensed interim consolidated financial statements have been prepared under the historical cost convention, modified by the revaluation of any financial assets and financial liabilities where applicable. The preparation of financial statements in conformity with IFRS requires the use of certain critical accounting estimates. It also requires management to exercise judgment in the process of applying the Company’s accounting policies.

6 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019

(Unaudited - Expressed in thousands of Canadian dollars)

The significant accounting policies used in the preparation of these condensed interim consolidated financial statements are consistent with those used in the preparation of the annual consolidated financial statements for the year ended December 31, 2018.

(c) Basis of consolidation

These condensed interim consolidated financial statements include the financial statements of the Company and its wholly-owned subsidiary, North American Nickel (US) Inc. which was incorporated in the State of Delaware on May 22, 2015. Consolidation is required when the Company is exposed, or has rights to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee. All intercompany transactions, balances, income and expenses are eliminated upon consolidation.

| 3. | CHANGES IN ACCOUNTING POLICIES |

New standards adopted during the three months period ended March 31, 2019:

IFRS 16 - “Leases”

IFRS 16 replaces current guidance in IAS 17. Under IAS 17, lessees were required to make a distinction between a finance lease (on the balance sheet) and an operating lease (off balance sheet). IFRS 16 now requires lessees to recognize a lease liability reflecting future lease payments and a “right-of-use asset” for virtually all lease contracts. The IASB has included an optional exemption for certain short-term leases and leases of low value assets, however this exemption can only be applied by lessees. The standard applies to annual periods beginning on or after January 1, 2019, with earlier application permitted. The adoption of this standard did not result in any impact to the Company’s financial statements.

IFRIC 23 – “Uncertainty over Income Tax Treatments”

In June 2017, the IFRS Interpretations Committee of the IASB issued IFRIC 23, Uncertainty over Income Tax Treatments (IFRIC 23). The interpretation provides guidance on the accounting for current and deferred tax liabilities and assets in circumstances in which there is uncertainty over income tax treatments. The Interpretation is applicable for annual periods beginning on or after January 1, 2019. Earlier application is permitted. The Interpretation requires: (a) an entity to contemplate whether uncertain tax treatments should be considered separately, or together as a group, based on which approach provides better predictions of the resolution; (b) an entity to determine if it is probable that the tax authorities will accept the uncertain tax treatment; and (c) if it is not probable that the uncertain tax treatment will be accepted, measure the tax uncertainty based on the most likely amount or expected value, depending on whichever method better predicts the resolution of the uncertainty. The adoption of this interpretation did not result in any impact to the Company’s financial statements.

Standards, Interpretations and Amendments Not Yet Effective:

Amendments to References to the Conceptual Framework in IFRS Standards

On March 29, 2018 the International Accounting Standards Board (“IASB”) issued a revised version of its Conceptual Framework for Financial Reporting (the Framework), that underpins IFRS Standards. The IASB also issued Amendments to References to the Conceptual Framework in IFRS Standards (the Amendments) to update references in IFRS Standards to previous versions of the Conceptual Framework. Both documents are effective from January 1, 2020 with earlier application permitted.

7 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019

(Unaudited - Expressed in thousands of Canadian dollars)

Some Standards include references to the 1989 and 2010 versions of the Framework. The IASB has published a separate document which contains consequential amendments to affected Standards so that they refer to the new Framework, with the exception of IFRS 3 Business Combinations which continues to refer to both the 1989 and 2010 Frameworks. The Company does not intend to adopt the Amendments in its financial statements before the annual period beginning on January 1, 2020. The extent of the impact of the change has not yet been determined.

IAS 1 - Presentation of Financial Statements and IAS 8 - Accounting Policies, Changes in Accounting Estimates and Errors

In October 2018, the IASB issued amendments to International Accounting Standard (“IAS”) 1, Presentation of Financial Statements and IAS 8, Accounting Policies, Changes in Accounting Estimates and Errors. The amendments are to clarify the definition of ‘material’ and to align the definition used in the Conceptual Framework and the standards themselves. The amendments are effective January 1, 2020. The Company is evaluating the impact of the adoption of these amendments.

| 4. | SHORT-TERM INVESTMENTS |

Short-term investments are comprised of a highly liquid Canadian dollar denominated guaranteed investment certificate with an initial term to maturity greater than ninety days, but not more than one year, that is readily convertible to a contracted amount of cash. The counter-party is a Canadian financial institution. During the period ended March 31, 2019, the instrument was yielding an annual interest rate range of 1.40% (March 31, 2018 - 1.30%).

| 5. | RECEIVABLES AND OTHER CURRENT ASSETS |

A summary of the receivables and other current assets as of March 31, 2019 is detailed in the table below:

| March 31, 2019 | December 31, 2018 | |||||||

| Sales taxes receivable | 52 | 75 | ||||||

| Interest receivable | 17 | 10 | ||||||

| Other current assets | 68 | 48 | ||||||

| 137 | 133 | |||||||

Other current assets is comprised of prepaid expenses.

8 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019

(Unaudited - Expressed in thousands of Canadian dollars)

| 6. | EXPLORATION AND EVALUATION ASSETS |

| Canada | US | Greenland | ||||||||||||||||||||||

| Post Creek Property | Halcyon Property | Quetico Claims | Section 35 Property | Maniitsoq Property | Total | |||||||||||||||||||

| Acquisition | ||||||||||||||||||||||||

| Balance, December 31, 2018 | 288 | 222 | 42 | 8 | 42 | 602 | ||||||||||||||||||

| Acquisition costs – cash | 5 | 4 | - | 1 | - | 10 | ||||||||||||||||||

| Balance, March 31, 2019 | 293 | 226 | 42 | 9 | 42 | 612 | ||||||||||||||||||

| Exploration | ||||||||||||||||||||||||

| Balance, December 31, 2018 | 1,431 | 209 | 22 | - | 62,215 | 63,877 | ||||||||||||||||||

| Administration | 1 | - | - | - | - | 1 | ||||||||||||||||||

| Corporate social responsibility | 1 | - | - | - | 1 | |||||||||||||||||||

| Drilling | 7 | - | - | - | 120 | 127 | ||||||||||||||||||

| Environmental, health and safety | - | - | - | - | 8 | 8 | ||||||||||||||||||

| Geology | 4 | 3 | - | 2 | 76 | 85 | ||||||||||||||||||

| Geophysics | - | - | - | - | 27 | 27 | ||||||||||||||||||

| 13 | 3 | - | 2 | 231 | 249 | |||||||||||||||||||

| Balance, March 31,2019 | 1,444 | 212 | 22 | 2 | 62,446 | 64,126 | ||||||||||||||||||

| Total, March 31, 2019 | 1,737 | 438 | 64 | 11 | 62,488 | 64,738 | ||||||||||||||||||

| Canada | US | Greenland | ||||||||||||||||||

| Post Creek Property | Halcyon Property | Section 35 Property | Maniitsoq Property | Total | ||||||||||||||||

| Acquisition | ||||||||||||||||||||

| Balance, December 31, 2017 | 278 | 214 | 6 | 36 | 534 | |||||||||||||||

| Acquisition costs – cash | 5 | 4 | 2 | 14 | 25 | |||||||||||||||

| Balance, March 31, 2018 | 283 | 218 | 8 | 50 | 559 | |||||||||||||||

| Exploration | ||||||||||||||||||||

| Balance, December 31, 2017 | 1,138 | 187 | - | 48,635 | 49,960 | |||||||||||||||

| Administration | - | - | - | 15 | 15 | |||||||||||||||

| Drilling expenses | 5 | - | - | 204 | 209 | |||||||||||||||

| Geology | 10 | 7 | - | 91 | 108 | |||||||||||||||

| Geophysics | - | - | - | 40 | 40 | |||||||||||||||

| Helicopter charter aircraft | - | - | - | 3 | 3 | |||||||||||||||

| Infrastructure | - | - | - | 13 | 13 | |||||||||||||||

| 15 | 7 | - | 366 | 388 | ||||||||||||||||

| Balance, March 31, 2018 | 1,153 | 194 | - | 49,001 | 50,348 | |||||||||||||||

| Total, March 31, 2018 | 1,436 | 412 | 8 | 49,051 | 50,907 | |||||||||||||||

The following is a description of the Company’s exploration and evaluation assets and the related spending commitments:

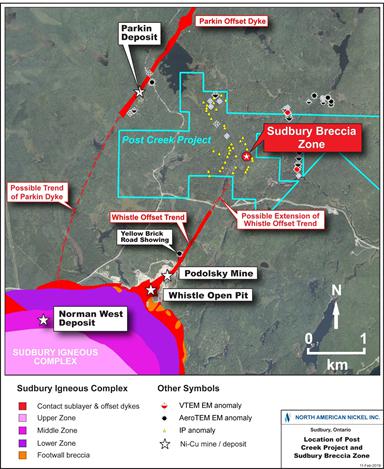

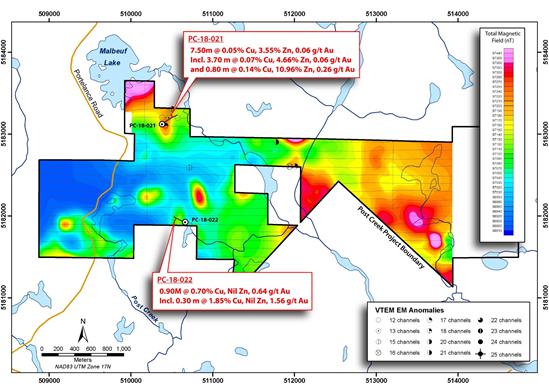

Post Creek

On December 23, 2009, the Company executed a letter of intent whereby the Company has an option to acquire a mineral claim known as the Post Creek Property located within the Sudbury Mining District of Ontario.

9 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019

(Unaudited - Expressed in thousands of Canadian dollars)

On April 5, 2010 and as amended on March 12, 2013, the Company entered into an option agreement to acquire a 100% interest in the Post Creek Property, subject to certain net smelter return royalties (“NSR”) and advance royalty payments. To December 31, 2015, the Company has completed the required consideration and acquired its interest in the Post Creek Property. Commencing August 1, 2015, the Company is obligated to pay advances on the NSR of $10 per annum, totalling $10 during the year ended December 31, 2018, the total of which will be deducted from any payments to be made under the NSR. The total advances paid during the three months period ended March 31, 2019 were $5, (March 31, 2018 - $5).

During the three months period ended March 31, 2019, the Company incurred exploration expenditures totalling $13 (March 31, 2018 - $15) on the Post Creek Property.

Halcyon

On April 5, 2010 and as amended on March 12, 2013, the Company entered into an option agreement to acquire rights to Halcyon Property, subject to certain NSR and advance royalty payments. To December 31, 2015, the Company has completed the required consideration and acquired its interest in the Halcyon Property. Commencing August 1, 2015, the Company is obligated to pay advances on the NSR of $8 per annum, totalling $8 during the year ended December 31, 2018, the total of which will be deducted from any payments to be made under the NSR.

During the three months period ended March 31, 2019, the Company incurred $7 (March 31, 2018 - $11) in exploration and license related expenditures on the Halcyon Property.

Quetico

on April 26, 2018, the Company acquired certain claims known as Quetico located within the Sudbury Mining District of Ontario. The Company incurred total acquisition and exploration related costs of $64 during the year ended December 31, 2018.

The Company had no minimum required exploration commitment for the year ended December 31, 2018 as it is not required to file any geoscience assessment work between the initial recording of a mining claim and the first anniversary date of the mining claim.

By the second anniversary of the recording of a claim and by each anniversary thereafter, a minimum of $400 worth of exploration activity per claim unit must be reported to the Provincial Recording Office. The company could maintain mining claims by filing an Application to Distribute Banked Assessment Work Credits form before any due date. Payments in place of reporting assessment work may also be used to meet yearly assessment work requirements, provided the payments are not used for the first unit of assessment work and consecutively thereafter. Payments cannot be banked to be carried forward for future use. The total annual work requirement for Quetico project after April 26, 2020 is $324 should the Company maintain the current size of the claims.

There were no exploration related costs incurred during the three months period ended March 31, 2019.

Section 35 Property

On January 4, 2016, the Company entered into a 10 year Metallic Minerals Lease (the “Lease”) with the Michigan Department of Natural Resources for an area covering approximately 320 acres. The terms of the Lease require an annual rental fee at a rate of US $3.00 per acre for years 1-5 and at a rate of US $6.00 per acre for years 6-10. The Company shall pay a minimum royalty at a rate of US $10.00 per acre for the 11th year onwards, with an increase of an additional US $5.00 per acre per year up to a maximum of US $55.00 per acre per year. A production royalty of between 2% - 2.5% is payable from production of minerals and/or mineral products from an established mining operation area. The Company paid the first year rental fee and the required reclamation deposit of $14 (US $10). The Department of Natural Resources shall annually review the level of the reclamation deposit and shall require the amount to be increased or decreased to reflect changes in the cost of future reclamation of the leased premises.

During the three months period ended March 31, 2019, the Company spent a total of $3 in exploration and license related expenditures, (March 31, 2018 - $2).

10 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019

(Unaudited - Expressed in thousands of Canadian dollars)

Maniitsoq

The Company has been granted certain exploration licenses, by the Bureau of Minerals and Petroleum (“BMP”) of Greenland for exclusive exploration rights of an area comprising the Maniitsoq Property, located near Ininngui, Greenland. The Property is subject to a 2.5% NSR. The Company can reduce the NSR to 1% by paying $2,000 on or before 60 days from the decision to commence commercial production.

At the expiration of the first license period, the Company may apply for a second licence period (years 6-10), and the Company may apply for a further 3-year licence for years 11 to 13. Thereafter, the Company may apply for additional 3-year licences for years 14 to 16, 17 to 19 and 20 to 22. The Company will be required to pay additional license fees and will be obligated to incur minimum eligible exploration expenses for such years.

The Company may terminate the licenses at any time; however any unfulfilled obligations according to the licenses will remain in force, regardless of the termination.

Future required minimum exploration expenditures will be adjusted each year on the basis of the change to the Danish Consumer Price Index.

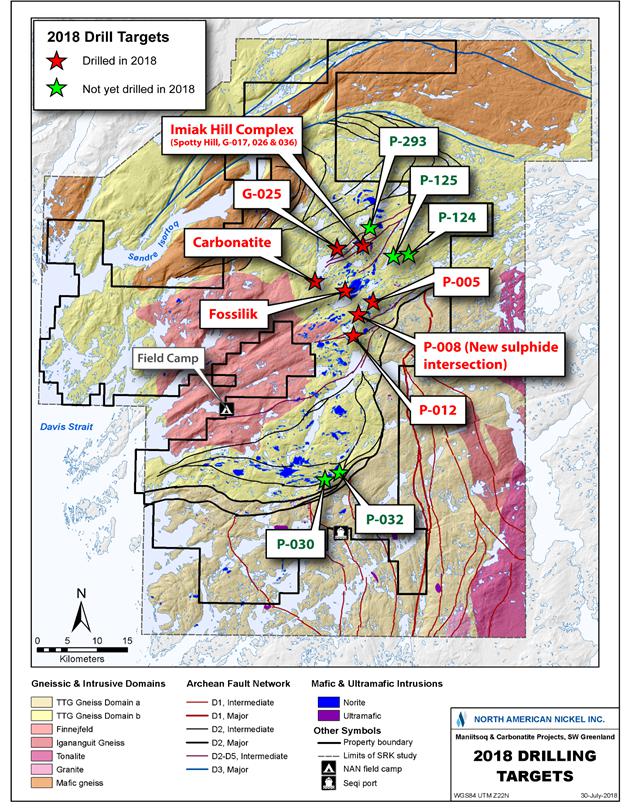

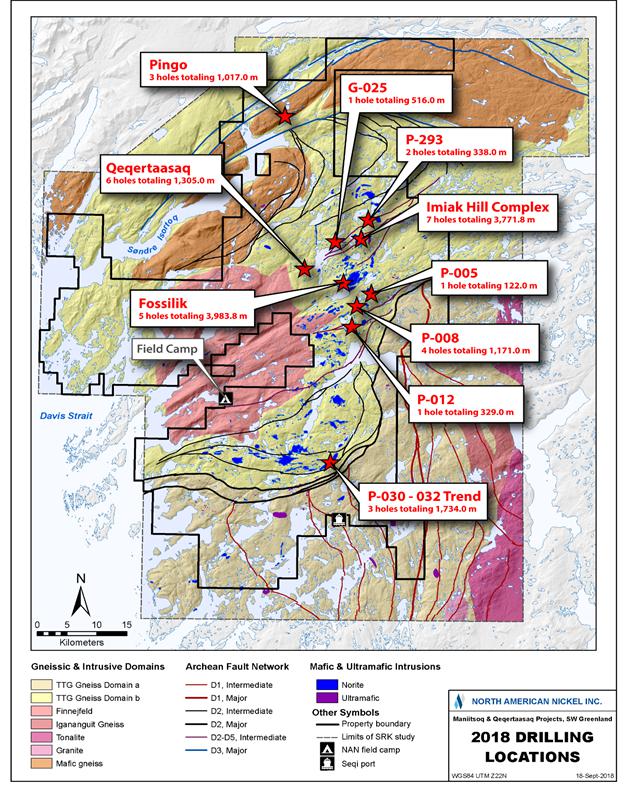

During the three months period ended March 31, 2019, the Company spent in aggregate of $231 (March 31, 2018 - $380) in exploration and license related expenditures on the Maniitsoq Property, which is comprised of the Sulussugut, Ininngui and Carbonatite Licenses. Further details on the licenses and related expenditures are outlined below.

Sulussugut License (2011/54)

(All references to amounts in Danish Kroners, “DKK” are in thousands of DKK)

Effective August 15, 2011, the Company was granted an exploration license (the “Sulussugut License”) by the BMP of Greenland for exclusive exploration rights of an area located near Sulussugut, Greenland. The Company paid a license fee of $6 (DKK 31) upon granting of the Sulussugut License. The application for another 5 year term on the Sulussugut License was submitted to the Greenland Mineral Licence & Safety Authority which was effective on April 11, 2016, with December 31, 2017 being the seventh year. During the year ended December 31, 2016, the Company paid a license fee of $8 (DKK 40) which provides for renewal of the Sulussugut License until 2020.

To December 31, 2015, under the terms of a preliminary license, the Company completed the exploration requirements of an estimated minimum of DKK 83,809 (approximately $15,808) between the years ended December 31, 2011 to 2015 by incurring $26,116 on the Sulussugut License. The accumulated exploration credits held at the end to December 31, 2015, of DKK 100,304 can be carried forward until 2019. Under the terms of the second license period, the required minimum exploration expenditures for the year ended December 31, 2017 was DKK 44,374 (approximately $8,955). As of December 31, 2018, the Company has spent $55,732 on exploration costs for the Sulussugut License.

To December 31, 2018, the Company has completed all obligations with respect to required reduction of the area of the license.

During the year ended December 31, 2018, the Company had approved exploration expenditures of DKK 79,604 (approximately $16,342) which results in the total cumulative surplus credits of DKK 326,111 (approximately $66,951). The credits may be carried forward until December 31, 2021.

The Company had no minimum required exploration for the year ended December 31, 2018. During the year ended December 31, 2018, the Company spent a total of $10,795 (December 31, 2017 - $11,079) in exploration and license related expenditures on the Sulussugut License.

During the three months period ended March 31, 2019, the Company spent a total of $116 in exploration and license related expenditures, (March 31, 2018 - $337).

11 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019

(Unaudited - Expressed in thousands of Canadian dollars)

Ininngui License (2012/28)

Effective March 4, 2012, the Company was granted an exploration license (the “Ininngui License”) by the BMP of Greenland for exclusive exploration rights of an area located near Ininngui, Greenland. The Company paid a license fee of $6 (DKK 32) upon granting of the Ininngui License. The Ininngui License was valid for 5 years until December 31, 2016, with December 31, 2012 being the first year. The Ininngui License is contiguous with the Sulussugut License.

To December 31, 2018, the Company’s expenditures exceeded the minimum requirement and the Company has a total cumulative surplus credits of DKK 35,509 (approximately $7,290). The credits may be carried forward until December 31, 2021.

The Company had no minimum required exploration for the year ended December 31, 2018. As of December 31, 2018, the Company has spent $5,121 on exploration costs for the Ininngui License.

Should the Company not incur the minimum exploration expenditures on the license in any one year from years 2-5, the Company may pay 50% of the difference in cash to BMP as full compensation for that year. This procedure may not be used for more than 2 consecutive calendar years and as at December 31, 2018, the Company has not used the procedure for the license.

During the year ended December 31, 2018, the Company spent a total of $1,423 (December 31, 2017 - $985) in exploration and license related expenditures on the Ininngui License.

During the three months period ended March 31, 2019, the Company spent a total of $22 in exploration and license related expenditures, (March 31, 2018 - $23).

Carbonatite License (2018/21)

Effective May 4, 2018, the Company was granted an exploration license (the “Carbonatite License”) by the BMP of Greenland for exclusive exploration rights of an area located near Maniitsoq in West Greenland. The Company paid a license fee of $7 (DKK 31) upon granting of the Carbonatite License. The Carbonatite License is valid for 5 years until December 31, 2022, with December 31, 2018 being the first year. As of December 31, 2018, the Company has spent $1,362 on exploration costs for the Carbonatite License.

During the year ended December 31, 2018, the Company spent a total of $1,369 in exploration and license related expenditures (December 31, 2017 - $Nil) for the Carbonatite License.

The Company had a minimum required exploration obligation of DKK 269 (approximately $55) for the year ended December 31, 2018. To December 31, 2018, the Company’s expenditures exceeded the minimum requirement and the Company has a total surplus credit of DKK 9,830 (approximately $2,018). The credit may be carried forward until December 31, 2021.

During the three months periods ended March 31, 2019, the Company spent a total of $93 in exploration and license related expenditures, (March 31, 2018 - $9).

| 7. | TRADE PAYABLES AND ACCRUED LIABILITIES |

March 31, 2019 | December 31, 2018 | |||||||

| Trade payables | 344 | 477 | ||||||

| Amounts due to related parties (Note 9) | 13 | 1 | ||||||

| Accrued liabilities | 27 | 78 | ||||||

| 384 | 556 | |||||||

12 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019

(Unaudited - Expressed in thousands of Canadian dollars)

| 8. | SHARE CAPITAL, WARRANTS AND OPTIONS |

The authorized capital of the Company comprises an unlimited number of common shares without par value and 100,000,000 Series 1 convertible preferred shares without par value.

| a) | Common shares issued and outstanding |

There were no common shares issued during the three months period ended March 31, 2019 and March 31, 2018.

As at March 31, 2019, the Company has 787,928,500 common shares issued and outstanding, (March 31, 2018 – 554,598,167).

2018

On April 19, 2018, the Company closed a non-brokered private placement equity financing of 233,333,333 units at a price of $0.075 per unit and raised aggregate gross proceeds of $17,500. Each unit consists of one common share and one-half of one common share purchase warrant of the Company. Each warrant will entitle the holder to acquire one common share of the Company at an exercise price of $0.12 for a period of 24 months from its date of issuance. The Company incurred total share issuance costs of $579, of which $250 is recorded in trade payables at December 31, 2018. The Company allocated a $2,572 fair value to the warrants issued in conjunction with the private placement. The fair value of warrants was determined on a pro-rata basis using the Black-Scholes Option Pricing Model with the following assumptions; expected life of 2 years, expected dividend yield of 0%, a risk-free interest rate of 1.91% and an expected volatility of 94.26%.

Contemporary Amperex Technology Limited (“CATL”) subscribed for 200,000,000 units of the aforementioned private placement for a total purchase price of $15,000. At December 31, 2018, CATL beneficially owns, or exercises control or direction over approximately 25.38% of the currently issued and outstanding shares of the Company. As per the subscription agreement, CATL has pre-emptive rights and the right to nominate one director to the board of directors of the Company.

Sentient subscribed for 13,333,333 units of the aforementioned private placement for a total purchase price of $1,000. At December 31, 2018, Sentient beneficially owns, or exercises control or direction over 369,809,820 common shares constituting approximately 46.93% of the currently issued and outstanding shares of the Company.

As at December 31, 2018, the Company had 787,928,500 common shares issued and outstanding.

| b) | Preferred shares issued and outstanding |

As at March 31, 2019 and March 31, 2018, there are 590,931 series 1 preferred shares outstanding.

The rights and restrictions of the preferred shares are as follows:

| i) | dividends shall be paid at the discretion of the directors; | |

| ii) | the holders of the preferred shares are not entitled to vote except at meetings of the holders of the preferred shares, where they are entitled to one vote for each preferred share held; | |

| iii) | the shares are convertible at any time after 6 months from the date of issuance, upon the holder serving the Company with 10 days written notice; and | |

| iv) | the number of the common shares to be received on conversion of the preferred shares is to be determined by dividing the conversion value of the share, $1 per share, by $0.90. |

13 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019

(Unaudited - Expressed in thousands of Canadian dollars)

| c) | Warrants |

A summary of common share purchase warrants activity during the three months period ended March 31, 2019 is as follows:

| March 31, 2019 | December 31, 2018 | |||||||||||||||

| Number Outstanding | Weighted Average Exercise Price | Number Outstanding | Weighted Average Exercise Price | |||||||||||||

| Outstanding, beginning of the period | 257,972,836 | 0.12 | 176,175,413 | 0.12 | ||||||||||||

| Issued | - | - | 116,666,664 | 0.12 | ||||||||||||

| Cancelled / Expired | - | - | (34,869,241 | ) | 0.12 | |||||||||||

| Outstanding, end of the period | 257,972,836 | 0.12 | 257,972,836 | 0.12 | ||||||||||||

At March 31, 2019, the Company had outstanding common share purchase warrants exercisable to acquire common shares of the Company as follows:

| Warrants Outstanding | Expiry Date | Exercise Price ($) | Weighted Average remaining contractual life (years) | |||||||||

| 72,515,414 | June 8, 20191 | 0.12 | 0.05 | |||||||||

| 1,965,083 | June 8, 2019 | 0.075 | 0.00 | |||||||||

| 46,334,451 | July 21, 20191,2 | 0.12 | 0.06 | |||||||||

| 20,491,224 | August 15, 2019 | 0.12 | 0.03 | |||||||||

| 116,666,664 | April 19, 2020 | 0.12 | 0.48 | |||||||||

| 257,972,836 | 0.62 | |||||||||||

1 The warrants are subject to an acceleration clause such that if the volume-weighted average trading price of the Company’s common shares on the TSX-V exceeds $0.18 per common share for a period of 10 consecutive trading days at any date before the expiration date of such warrants, the Company may, at its option, accelerate the warrant expiry date to within 30 days. To December 31, 2018, the Company’s common shares have not met the criterion for acceleration.

2 On September 1, 2018, the TSXV approved an extension of the term of the warrants from July 21, 2018 to July 21, 2019. All other terms, including the exercise price, remain the same.

| d) | Stock options |

The Company adopted a Stock Option Plan (the “Plan”), providing the authority to grant options to directors, officers, employees and consultants enabling them to acquire up to 10% of the issued and outstanding common stock of the Company. Under the Plan, the exercise price of each option equals the market price or a discounted price of the Company’s stock as calculated on the date of grant. The options can be granted for a maximum term of 10 years.

14 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019

(Unaudited - Expressed in thousands of Canadian dollars)

A summary of option activity under the Plan during the three months period ended March 31, 2019 is as follows:

| March 31, 2019 | December 31, 2018 | |||||||||||||||

| Number Outstanding | Weighted Average Exercise Price | Number Outstanding | Weighted Average Exercise Price | |||||||||||||

| Outstanding, beginning of the period | 25,945,500 | 0.18 | 20,720,500 | 0.23 | ||||||||||||

| Issued | - | - | 6,425,000 | 0.12 | ||||||||||||

| Cancelled / Expired | - | - | (1,200,000 | ) | 0.18 | |||||||||||

| Outstanding, end of the period | 25,945,500 | 0.18 | 25,945,500 | 0.18 | ||||||||||||

There no incentive stock options granted during the period ended March 31, 2019.

During the period ended March 31, 2018, the Company granted 5,725,000 incentive stock options to employees, directors and consultants with a maximum term of 5 years. All stock options vest immediately and are exercisable at $0.12 per common share. The Company calculates the fair value of all stock options using the Black-Scholes Option Pricing Model. The fair value of this grant amounted to $287 and was recorded as a share-based payments expense.

The fair value of stock options granted and vested during the period ended March 31, 2018 was calculated using the following assumptions:

| March 31, 2019 | March 31, 2018 | |||||||

| Expected dividend yield | - | 0 | % | |||||

| Expected share price volatility | - | 96.9 | % | |||||

| Risk free interest rate | - | 2.04 | % | |||||

| Expected life of options | - | 5 years | ||||||

Details of options outstanding as at March 31, 2019 are as follows:

| Options Outstanding | Options Exercisable | Expiry Date | Exercise Price | Weighted average remaining contractual life (years) | ||||||||||||

| 2,440,000 | 2,440,000 | Jul 9, 2019 | 0.62 | 0.03 | ||||||||||||

| 200,000 | 200,000 | Aug 27, 2019 | 0.37 | 0.00 | ||||||||||||

| 100,000 | 100,000 | Sep 26, 2019 | 0.26 | 0.00 | ||||||||||||

| 350,000 | 350,000 | Nov 5, 2019 | 0.21 | 0.01 | ||||||||||||

| 1,000,000 | 1,000,000 | Dec 19, 2019 | 0.22 | 0.03 | ||||||||||||

| 900,000 | 900,000 | Feb 3, 2020 | 0.275 | 0.03 | ||||||||||||

| 450,000 | 450,000 | Oct 5, 2020 | 0.20 | 0.03 | ||||||||||||

| 5,443,000 | 5,443,000 | Jan 28, 2021 | 0.21 | 0.38 | ||||||||||||

| 7,637,500 | 7,637,500 | Feb 21, 2022 | 0.12 | 0.85 | ||||||||||||

| 1,000,000 | 1,000,000 | Dec 20, 2022 | 0.12 | 0.14 | ||||||||||||

| 5,725,000 | 5,725,000 | Feb 28, 2023 | 0.12 | 0.86 | ||||||||||||

| 500,000 | 500,000 | May 1, 2023 | 0.12 | 0.08 | ||||||||||||

| 200,000 | 200,000 | May 4, 2023 | 0.12 | 0.03 | ||||||||||||

| 25,945,500 | 25,945,500 | 2.47 | ||||||||||||||

15 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019

(Unaudited - Expressed in thousands of Canadian dollars)

| e) | Reserve |

The reserve records items recognized as stock-based compensation expense and other share-based payments until such time that the stock options or warrants are exercised, at which time the corresponding amount will be transferred to share capital. Amounts recorded for forfeited or expired unexercised options and warrants are transferred to deficit. During the year ended December 31, 2018 the Company recorded $317 of share-based payments and transferred $229 to deficit for expired options and warrants.

There were no share-based payments or expired options and warrants during the three months period ended March 31, 2019. During the three months period ended March 31, 2018 the Company recorded $287 of share-based compensation to reserves and transferred $25 to deficit for expired options and warrants.

| 9. | RELATED PARTY TRANSACTIONS |

The following amounts due to related parties are included in trade payables and accrued liabilities (Note 7):

| March 31, 2019 | December 31, 2018 | |||||||

| Directors and officers of the Company | 13 | 1 | ||||||

| Total | 13 | 1 | ||||||

These amounts are unsecured, non-interest bearing and have no fixed terms of repayment.

(a) Related party transactions

As of March 31, 2019, Sentient beneficially owns 369,809,820 common shares constituting approximately 46.93% of the currently issued and outstanding common shares.

As of March 31, 2019, CATL beneficially owns 200,000,000 common shares constituting approximately 25.38% of the currently issued and outstanding shares of the Company. CATL has pre-emptive rights and the right to nominate one director to the board of directors of the Company.

During the three months period ended March 31, 2019, the Company recorded $9 (March 31, 2018 - $78) in fees charged by a legal firm in which the Company’s chairman is a consultant.

(b) Key management personnel are defined as members of the Board of Directors and senior officers.

Key management compensation was:

| March 31, 2019 | March 31, 2018 | |||||||

| Geological consulting fees – expensed | 26 | 26 | ||||||

| Geological consulting fees – capitalized | - | 18 | ||||||

| Management fees – expensed | 188 | 178 | ||||||

| Salaries - expensed | 47 | 29 | ||||||

| Share-based payments | - | 170 | ||||||

| Total | 261 | 421 | ||||||

16 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019

(Unaudited - Expressed in thousands of Canadian dollars)

| 10. | SUPPLEMENTAL CASH FLOW INFORMATION |

Changes in working capital for the three months period ended March 31, 2019 and 2018 are as follows:

| March 31, 2019 | March 31, 2018 | |||||||

| Decrease (increase) in accounts receivables | 23 | (59 | ) | |||||

| (Increase) in prepaid expenses | (20 | ) | (318 | ) | ||||

| Decrease in trade payables and accrued liabilities | (36 | ) | (2 | ) | ||||

| Total changes in working capital | (33 | ) | (379 | ) | ||||

During the period ended March 31, 2019, the Company:

i) recorded $135, the net change for accrued in exploration and evaluation expenditures.

During the period ended March 31, 2018, the Company:

ii) transferred $25 from reserve to deficit;

iii) recorded $716, the net change for accrued in exploration and evaluation expenditures.

| 11. | COMMITMENTS AND CONTINGENCIES |

The Company has certain commitments to meet the minimum expenditures requirements on its mineral exploration assets it has interest in.

Effective July 1, 2014, the Company had changes to management and entered into the following agreements for services with directors of the Company and a company in which a director has an interest:

| i) | Directors’ fees: $2 stipend per month for independent directors and $3 stipend per month for the chairman of the board, and $2.5 for committee chairman. | |

| ii) | Management fees: $31 per month effective June 2018. | |

| Effectively on June 1, 2018, the Company has changed the terms with Keith Morrison, the CEO, from direct employment to contracted consultant and entered into service agreement with his company. |

Each of the agreements shall be continuous and may only be terminated by mutual agreement of the parties, subject to the provisions that in the event there is a change of effective control of the Company, the party shall have the right to terminate the agreement, within sixty days from the date of such change of effective control, upon written notice to the Company. Within thirty days from the date of delivery of such notice, the Company shall forward to the party the amount of money due and owing to the party hereunder to the extent accrued to the effective date of termination.

| 12. | SEGMENTED INFORMATION |

The Company operates in one reportable operating segment being that of the acquisition, exploration and development of mineral properties in three geographic segments being Canada, Greenland and United States (Note 6). The Company’s geographic segments are as follows:

March 31, 2019 | December 31, 2018 | |||||||

| Equipment | ||||||||

| Canada | 10 | 11 | ||||||

| Greenland | 22 | 24 | ||||||

| Total | 32 | 35 | ||||||

March 31, 2019 | December 31, 2018 | |||||||

| Exploration and evaluation assets | ||||||||

| Canada | 2,239 | 2,214 | ||||||

| Greenland | 62,488 | 62,257 | ||||||

| United States | 11 | 8 | ||||||

| Total | 64,738 | 64,479 | ||||||

| 13. | GENERAL AND ADMINISTRATIVE EXPENSES |

Details of the general and administrative expenses by nature are presented in the following table:

| March 31, 2019 | March 31, 2018 | |||||||

| Consulting fees | 81 | 93 | ||||||

| Professional fees | 9 | 26 | ||||||

| Management fees | 188 | 178 | ||||||

| Investor relations | 16 | 34 | ||||||

| Filing fees | 11 | 19 | ||||||

| Salaries and benefits | 131 | 87 | ||||||

| General office expenses | 99 | 103 | ||||||

| Total | 535 | 540 | ||||||

17 | N o r t h A m e r i c a n N i c k e l / Q 1 2 0 1 9 |