UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04707

Fidelity Advisor Series II

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

|

Date of fiscal year end: |

December 31 |

|

|

|

|

Date of reporting period: |

December 31, 2022 |

Item 1.

Reports to Stockholders

Contents

| Board Approval of Investment Advisory Contracts and Management Fees |

|

Average Annual Total Returns

|

|||

|

Periods ended December 31, 2022

|

Past 1

year

|

Past 5

years

|

Past 10

years

|

|

Class A

(incl.4.00% sales charge)

|

-14.84%

|

0.32%

|

1.91%

|

|

Class M

(incl.4.00% sales charge)

|

-14.91%

|

0.33%

|

1.92%

|

|

Class C

(incl. contingent deferred sales charge)

|

-12.85%

|

0.40%

|

1.73%

|

|

Fidelity® Strategic Income Fund

|

-11.14%

|

1.42%

|

2.60%

|

|

Class I

|

-11.18%

|

1.39%

|

2.58%

|

|

Class Z

|

-11.00%

|

1.49%

|

2.63%

|

|

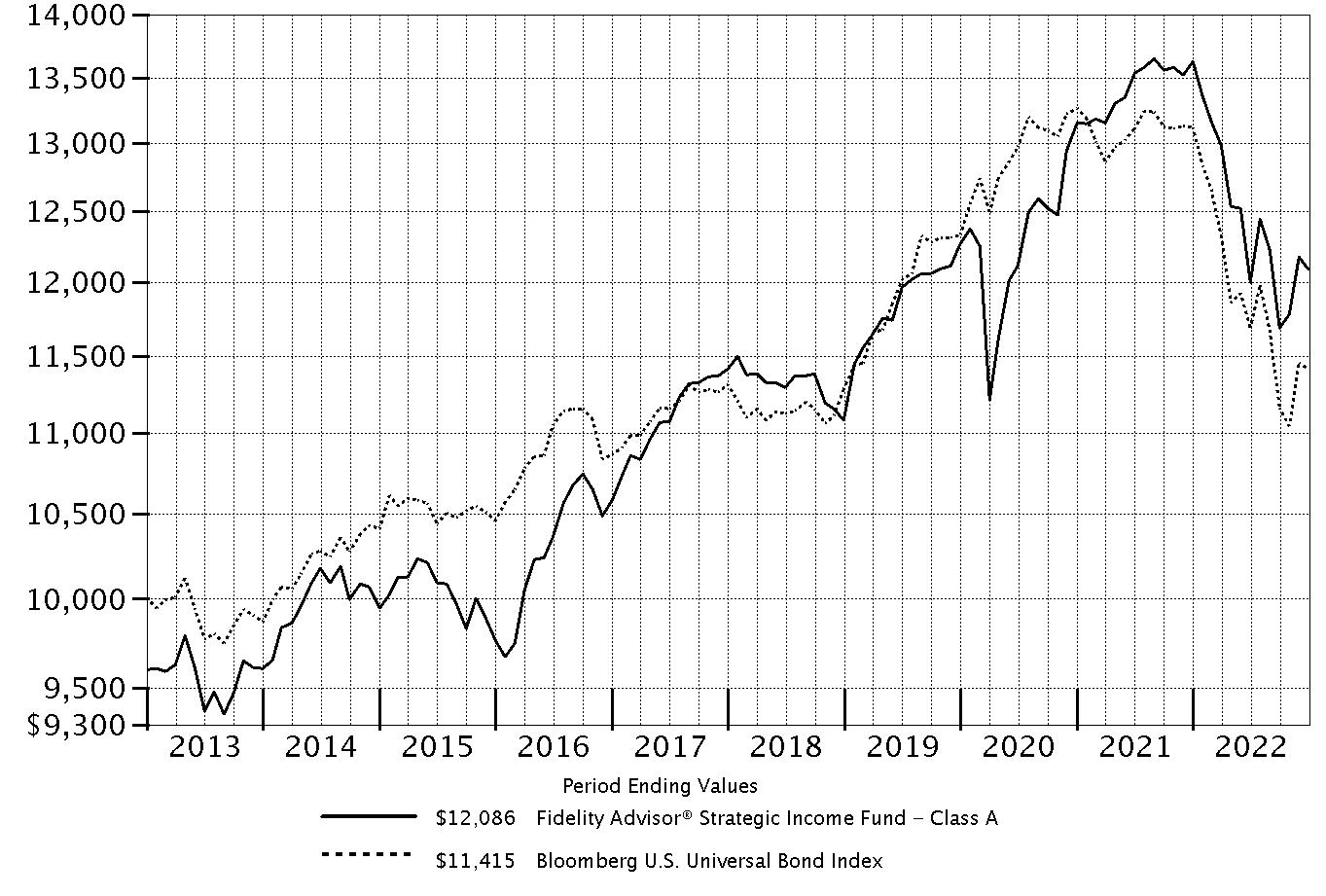

$10,000 Over 10 Years

|

|

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Strategic Income Fund - Class A, a class of the fund, on December 31, 2012, and the current 4.00% sales charge was paid.

The chart shows how the value of your investment would have changed, and also shows how the Bloomberg U.S. Universal Bond Index performed over the same period.

|

|

|

Top Bond Issuers (% of Fund's net assets)

|

||

|

(with maturities greater than one year)

|

||

|

U.S. Treasury Obligations

|

27.1

|

|

|

Freddie Mac

|

1.2

|

|

|

CCO Holdings LLC/CCO Holdings Capital Corp.

|

1.2

|

|

|

TransDigm, Inc.

|

1.2

|

|

|

JPMorgan Chase & Co.

|

0.9

|

|

|

Bank of America Corp.

|

0.9

|

|

|

Citigroup, Inc.

|

0.9

|

|

|

Fannie Mae

|

0.8

|

|

|

United Kingdom, Great Britain and Northern Ireland

|

0.8

|

|

|

German Federal Republic

|

0.7

|

|

|

35.7

|

||

|

Market Sectors (% of Fund's net assets)

|

||

|

Financials

|

9.5

|

|

|

Energy

|

9.3

|

|

|

Consumer Discretionary

|

8.1

|

|

|

Communication Services

|

7.7

|

|

|

Industrials

|

6.4

|

|

|

Materials

|

4.9

|

|

|

Information Technology

|

3.9

|

|

|

Health Care

|

3.2

|

|

|

Utilities

|

3.0

|

|

|

Consumer Staples

|

2.5

|

|

|

Real Estate

|

1.4

|

|

|

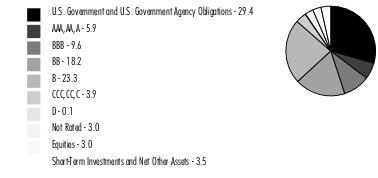

Quality Diversification (% of Fund's net assets)

|

|

|

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

|

|

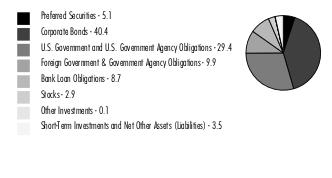

Asset Allocation (% of Fund's net assets)

|

|

|

Foreign investments - 25.8%

|

|

Futures and Swaps - 8.6%

|

|

Forward Currency Contracts - (5.1)%

|

|

Percentages in the above tables are adjusted for the effect of TBA Sale Commitments.

|

|

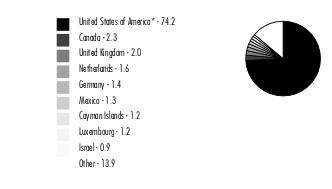

Geographic Diversification (% of Fund's net assets)

|

|

|

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and are adjusted for the effect of derivatives, if applicable.

|

|

Corporate Bonds - 32.7%

|

|||

|

Principal

Amount (a)

(000s)

|

Value ($)

(000s)

|

||

|

Convertible Bonds - 0.2%

|

|||

|

ENERGY - 0.2%

|

|||

|

Oil, Gas & Consumable Fuels - 0.2%

|

|||

|

Mesquite Energy, Inc. 15% 7/15/23 (b)(c)

|

1,457

|

9,285

|

|

|

Mesquite Energy, Inc. 15% 7/15/23 (b)(c)

|

2,515

|

16,026

|

|

|

25,311

|

|||

|

FINANCIALS - 0.0%

|

|||

|

Diversified Financial Services - 0.0%

|

|||

|

New Cotai LLC 5% 2/24/27 (c)

|

2,620

|

4,216

|

|

|

TOTAL CONVERTIBLE BONDS

|

29,527

|

||

|

Nonconvertible Bonds - 32.5%

|

|||

|

COMMUNICATION SERVICES - 4.9%

|

|||

|

Diversified Telecommunication Services - 2.0%

|

|||

|

Altice France SA:

|

|||

|

5.125% 7/15/29(d)

|

38,465

|

28,839

|

|

|

5.5% 1/15/28(d)

|

13,345

|

10,451

|

|

|

5.5% 10/15/29(d)

|

28,170

|

21,480

|

|

|

8.125% 2/1/27(d)

|

4,495

|

4,094

|

|

|

C&W Senior Financing Designated Activity Co. 6.875% 9/15/27 (d)

|

21,480

|

19,893

|

|

|

Cablevision Lightpath LLC:

|

|||

|

3.875% 9/15/27(d)

|

3,300

|

2,720

|

|

|

5.625% 9/15/28(d)

|

2,610

|

1,939

|

|

|

Cogent Communications Group, Inc. 7% 6/15/27 (d)

|

2,785

|

2,729

|

|

|

Frontier Communications Holdings LLC:

|

|||

|

5% 5/1/28(d)

|

11,730

|

10,229

|

|

|

5.875% 10/15/27(d)

|

6,300

|

5,850

|

|

|

8.75% 5/15/30(d)

|

2,785

|

2,832

|

|

|

Northwest Fiber LLC/Northwest Fiber Finance Sub, Inc.:

|

|||

|

4.75% 4/30/27(d)

|

2,800

|

2,464

|

|

|

6% 2/15/28(d)

|

2,355

|

1,823

|

|

|

Qwest Corp. 7.25% 9/15/25

|

955

|

961

|

|

|

Sable International Finance Ltd. 5.75% 9/7/27 (d)

|

11,004

|

10,165

|

|

|

Sprint Capital Corp.:

|

|||

|

6.875% 11/15/28

|

53,897

|

55,942

|

|

|

8.75% 3/15/32

|

15,023

|

17,879

|

|

|

Telenet Finance Luxembourg Notes SARL 5.5% 3/1/28 (d)

|

9,200

|

8,280

|

|

|

Verizon Communications, Inc. 4.75% 10/31/34

|

EUR

|

11,734

|

12,957

|

|

Virgin Media Finance PLC 5% 7/15/30 (d)

|

14,025

|

11,237

|

|

|

Windstream Escrow LLC 7.75% 8/15/28 (d)

|

24,965

|

20,342

|

|

|

Zayo Group Holdings, Inc. 4% 3/1/27 (d)

|

9,545

|

7,050

|

|

|

260,156

|

|||

|

Entertainment - 0.0%

|

|||

|

Roblox Corp. 3.875% 5/1/30 (d)

|

4,175

|

3,291

|

|

|

Media - 2.8%

|

|||

|

Altice Financing SA:

|

|||

|

5% 1/15/28(d)

|

8,025

|

6,460

|

|

|

5.75% 8/15/29(d)

|

11,895

|

9,356

|

|

|

Block Communications, Inc. 4.875% 3/1/28 (d)

|

4,405

|

3,843

|

|

|

CCO Holdings LLC/CCO Holdings Capital Corp.:

|

|||

|

4.25% 2/1/31(d)

|

10,205

|

8,186

|

|

|

4.5% 8/15/30(d)

|

16,805

|

13,884

|

|

|

4.5% 5/1/32

|

6,745

|

5,369

|

|

|

4.75% 3/1/30(d)

|

51,010

|

43,992

|

|

|

5% 2/1/28(d)

|

22,835

|

20,734

|

|

|

5.375% 6/1/29(d)

|

34,085

|

30,822

|

|

|

6.375% 9/1/29(d)

|

5,815

|

5,465

|

|

|

Clear Channel International BV 6.625% 8/1/25 (d)

|

9,800

|

9,351

|

|

|

Clear Channel Outdoor Holdings, Inc. 7.5% 6/1/29 (d)

|

5,745

|

4,218

|

|

|

CSC Holdings LLC:

|

|||

|

4.5% 11/15/31(d)

|

14,440

|

10,019

|

|

|

5.375% 2/1/28(d)

|

13,855

|

11,171

|

|

|

6.5% 2/1/29(d)

|

15,380

|

12,573

|

|

|

Diamond Sports Group LLC/Diamond Sports Finance Co. 5.375% 8/15/26 (d)

|

24,690

|

2,901

|

|

|

DISH DBS Corp.:

|

|||

|

5.25% 12/1/26(d)

|

6,925

|

5,833

|

|

|

5.75% 12/1/28(d)

|

6,925

|

5,527

|

|

|

DISH Network Corp. 11.75% 11/15/27 (d)

|

5,670

|

5,840

|

|

|

Gannett Holdings LLC 6% 11/1/26 (d)

|

4,000

|

3,260

|

|

|

Gray Escrow II, Inc. 5.375% 11/15/31 (d)

|

8,145

|

5,870

|

|

|

LCPR Senior Secured Financing DAC:

|

|||

|

5.125% 7/15/29(d)

|

7,310

|

6,056

|

|

|

6.75% 10/15/27(d)

|

6,107

|

5,710

|

|

|

Nexstar Broadcasting, Inc.:

|

|||

|

4.75% 11/1/28(d)

|

13,395

|

11,587

|

|

|

5.625% 7/15/27(d)

|

14,270

|

13,091

|

|

|

Quebecor Media, Inc. 5.75% 1/15/23

|

14,205

|

14,171

|

|

|

Radiate Holdco LLC/Radiate Financial Service Ltd. 4.5% 9/15/26 (d)

|

4,205

|

3,089

|

|

|

Scripps Escrow II, Inc. 3.875% 1/15/29 (d)

|

1,655

|

1,328

|

|

|

Sirius XM Radio, Inc.:

|

|||

|

3.125% 9/1/26(d)

|

4,235

|

3,760

|

|

|

3.875% 9/1/31(d)

|

5,645

|

4,404

|

|

|

4% 7/15/28(d)

|

11,260

|

9,800

|

|

|

5% 8/1/27(d)

|

8,740

|

8,079

|

|

|

Townsquare Media, Inc. 6.875% 2/1/26 (d)

|

3,305

|

2,933

|

|

|

Univision Communications, Inc.:

|

|||

|

4.5% 5/1/29(d)

|

5,760

|

4,817

|

|

|

7.375% 6/30/30(d)

|

8,200

|

7,837

|

|

|

Videotron Ltd. 5.125% 4/15/27 (d)

|

7,325

|

6,919

|

|

|

VZ Secured Financing BV 5% 1/15/32 (d)

|

11,130

|

9,044

|

|

|

Ziggo Bond Co. BV:

|

|||

|

5.125% 2/28/30(d)

|

3,375

|

2,725

|

|

|

6% 1/15/27(d)

|

7,930

|

7,378

|

|

|

Ziggo BV 4.875% 1/15/30 (d)

|

4,805

|

4,021

|

|

|

351,423

|

|||

|

Wireless Telecommunication Services - 0.1%

|

|||

|

Intelsat Jackson Holdings SA 6.5% 3/15/30 (d)

|

11,675

|

10,437

|

|

|

Millicom International Cellular SA 4.5% 4/27/31 (d)

|

1,040

|

873

|

|

|

Sprint Corp. 7.625% 3/1/26

|

3,615

|

3,804

|

|

|

T-Mobile U.S.A., Inc. 3.5% 4/15/31

|

2,215

|

1,913

|

|

|

17,027

|

|||

|

TOTAL COMMUNICATION SERVICES

|

631,897

|

||

|

CONSUMER DISCRETIONARY - 5.0%

|

|||

|

Auto Components - 0.1%

|

|||

|

Allison Transmission, Inc. 5.875% 6/1/29 (d)

|

4,830

|

4,536

|

|

|

Dana, Inc. 4.5% 2/15/32

|

4,150

|

3,319

|

|

|

Exide Technologies:

|

|||

|

11% 10/31/24 pay-in-kind(c)(d)(e)(f)

|

1,280

|

0

|

|

|

11% 10/31/24 pay-in-kind(c)(d)(e)(f)

|

632

|

285

|

|

|

Nesco Holdings II, Inc. 5.5% 4/15/29 (d)

|

7,155

|

6,261

|

|

|

PECF USS Intermediate Holding III Corp. 8% 11/15/29 (d)

|

2,515

|

1,634

|

|

|

16,035

|

|||

|

Automobiles - 0.2%

|

|||

|

Ford Motor Co.:

|

|||

|

3.25% 2/12/32

|

12,660

|

9,496

|

|

|

6.1% 8/19/32

|

5,815

|

5,380

|

|

|

McLaren Finance PLC 7.5% 8/1/26 (d)

|

3,860

|

2,837

|

|

|

Rivian Holdco & Rivian LLC & Rivian Automotive LLC 6 month U.S. LIBOR + 5.620% 10.1636% 10/15/26 (d)(f)(g)

|

14,000

|

13,510

|

|

|

31,223

|

|||

|

Diversified Consumer Services - 0.2%

|

|||

|

Adtalem Global Education, Inc. 5.5% 3/1/28 (d)

|

4,235

|

3,843

|

|

|

GEMS MENASA Cayman Ltd. 7.125% 7/31/26 (d)

|

5,300

|

5,066

|

|

|

Service Corp. International 4% 5/15/31

|

5,750

|

4,845

|

|

|

Sotheby's 7.375% 10/15/27 (d)

|

2,970

|

2,785

|

|

|

Sotheby's/Bidfair Holdings, Inc. 5.875% 6/1/29 (d)

|

4,315

|

3,623

|

|

|

TKC Holdings, Inc. 6.875% 5/15/28 (d)

|

6,393

|

4,995

|

|

|

WASH Multifamily Acquisition, Inc. 5.75% 4/15/26 (d)

|

4,750

|

4,477

|

|

|

29,634

|

|||

|

Hotels, Restaurants & Leisure - 2.7%

|

|||

|

1011778 BC Unlimited Liability Co./New Red Finance, Inc.:

|

|||

|

3.875% 1/15/28(d)

|

5,685

|

5,085

|

|

|

4% 10/15/30(d)

|

23,490

|

19,022

|

|

|

4.375% 1/15/28(d)

|

6,265

|

5,610

|

|

|

Affinity Gaming LLC 6.875% 12/15/27 (d)

|

2,520

|

2,137

|

|

|

Bloomin Brands, Inc. / OSI Restaurant Partners LLC 5.125% 4/15/29 (d)

|

2,720

|

2,288

|

|

|

Booking Holdings, Inc. 4.75% 11/15/34

|

EUR

|

9,706

|

10,561

|

|

Boyd Gaming Corp. 4.75% 6/15/31 (d)

|

7,140

|

6,212

|

|

|

Caesars Entertainment, Inc.:

|

|||

|

4.625% 10/15/29(d)

|

8,375

|

6,816

|

|

|

6.25% 7/1/25(d)

|

25,535

|

24,812

|

|

|

8.125% 7/1/27(d)

|

34,045

|

33,451

|

|

|

Caesars Resort Collection LLC 5.75% 7/1/25 (d)

|

8,510

|

8,330

|

|

|

Carnival Corp.:

|

|||

|

4% 8/1/28(d)

|

14,305

|

11,664

|

|

|

7.625% 3/1/26(d)

|

10,595

|

8,398

|

|

|

9.875% 8/1/27(d)

|

10,150

|

9,592

|

|

|

10.5% 2/1/26(d)

|

7,395

|

7,385

|

|

|

Carnival Holdings (Bermuda) Ltd. 10.375% 5/1/28 (d)

|

8,655

|

8,885

|

|

|

CDI Escrow Issuer, Inc. 5.75% 4/1/30 (d)

|

2,790

|

2,501

|

|

|

Fertitta Entertainment LLC / Fertitta Entertainment Finance Co., Inc.:

|

|||

|

4.625% 1/15/29(d)

|

11,750

|

9,943

|

|

|

6.75% 1/15/30(d)

|

15,885

|

12,813

|

|

|

Garden SpinCo Corp. 8.625% 7/20/30 (d)

|

2,545

|

2,698

|

|

|

Hilton Domestic Operating Co., Inc.:

|

|||

|

3.75% 5/1/29(d)

|

3,350

|

2,898

|

|

|

4% 5/1/31(d)

|

5,020

|

4,200

|

|

|

4.875% 1/15/30

|

11,025

|

9,991

|

|

|

Hilton Worldwide Finance LLC/Hilton Worldwide Finance Corp. 4.875% 4/1/27

|

5,210

|

4,959

|

|

|

Jacobs Entertainment, Inc. 6.75% 2/15/29 (d)

|

3,955

|

3,570

|

|

|

Melco Resorts Finance Ltd.:

|

|||

|

5.25% 4/26/26(d)

|

5,440

|

4,786

|

|

|

5.75% 7/21/28(d)

|

2,710

|

2,257

|

|

|

Merlin Entertainments PLC 5.75% 6/15/26 (d)

|

4,580

|

4,288

|

|

|

MGM Resorts International 4.75% 10/15/28

|

6,740

|

5,883

|

|

|

NCL Corp. Ltd. 5.875% 2/15/27 (d)

|

5,580

|

4,834

|

|

|

Papa John's International, Inc. 3.875% 9/15/29 (d)

|

2,555

|

2,133

|

|

|

Premier Entertainment Sub LLC:

|

|||

|

5.625% 9/1/29(d)

|

10,245

|

7,555

|

|

|

5.875% 9/1/31(d)

|

5,385

|

3,809

|

|

|

Royal Caribbean Cruises Ltd.:

|

|||

|

5.375% 7/15/27(d)

|

4,165

|

3,372

|

|

|

8.25% 1/15/29(d)

|

12,500

|

12,561

|

|

|

9.25% 1/15/29(d)

|

16,510

|

16,966

|

|

|

11.5% 6/1/25(d)

|

13,222

|

14,181

|

|

|

11.625% 8/15/27(d)

|

5,815

|

5,830

|

|

|

SeaWorld Parks & Entertainment, Inc. 5.25% 8/15/29 (d)

|

5,630

|

4,902

|

|

|

Station Casinos LLC 4.625% 12/1/31 (d)

|

4,155

|

3,333

|

|

|

Studio City Finance Ltd. 5% 1/15/29 (d)

|

3,255

|

2,405

|

|

|

Vail Resorts, Inc. 6.25% 5/15/25 (d)

|

3,855

|

3,855

|

|

|

Viking Cruises Ltd. 13% 5/15/25 (d)

|

5,740

|

6,056

|

|

|

Voc Escrow Ltd. 5% 2/15/28 (d)

|

6,285

|

5,406

|

|

|

Yum! Brands, Inc. 4.625% 1/31/32

|

5,905

|

5,220

|

|

|

343,453

|

|||

|

Household Durables - 0.4%

|

|||

|

Ashton Woods U.S.A. LLC/Ashton Woods Finance Co. 4.625% 4/1/30 (d)

|

4,105

|

3,295

|

|

|

Brookfield Residential Properties, Inc./Brookfield Residential U.S. Corp. 4.875% 2/15/30 (d)

|

4,370

|

3,407

|

|

|

Century Communities, Inc. 3.875% 8/15/29 (d)

|

4,225

|

3,322

|

|

|

Taylor Morrison Communities, Inc./Monarch Communities, Inc. 5.625% 3/1/24 (d)

|

775

|

769

|

|

|

Tempur Sealy International, Inc.:

|

|||

|

3.875% 10/15/31(d)

|

7,360

|

5,778

|

|

|

4% 4/15/29(d)

|

7,905

|

6,641

|

|

|

TopBuild Corp. 3.625% 3/15/29 (d)

|

3,030

|

2,484

|

|

|

TRI Pointe Group, Inc./TRI Pointe Holdings, Inc. 5.875% 6/15/24

|

11,770

|

11,712

|

|

|

TRI Pointe Homes, Inc. 5.7% 6/15/28

|

8,715

|

7,894

|

|

|

45,302

|

|||

|

Internet & Direct Marketing Retail - 0.8%

|

|||

|

Angi Group LLC 3.875% 8/15/28 (d)

|

3,385

|

2,512

|

|

|

Millennium Escrow Corp. 6.625% 8/1/26 (d)

|

5,650

|

3,616

|

|

|

Terrier Media Buyer, Inc. 8.875% 12/15/27 (d)

|

23,835

|

17,941

|

|

|

Uber Technologies, Inc.:

|

|||

|

4.5% 8/15/29(d)

|

12,675

|

11,043

|

|

|

6.25% 1/15/28(d)

|

5,520

|

5,299

|

|

|

7.5% 9/15/27(d)

|

31,625

|

31,647

|

|

|

8% 11/1/26(d)

|

29,170

|

29,270

|

|

|

101,328

|

|||

|

Multiline Retail - 0.1%

|

|||

|

Macy's Retail Holdings LLC:

|

|||

|

5.875% 3/15/30(d)

|

2,925

|

2,538

|

|

|

6.125% 3/15/32(d)

|

2,820

|

2,370

|

|

|

Nordstrom, Inc.:

|

|||

|

4.25% 8/1/31

|

11,600

|

8,295

|

|

|

4.375% 4/1/30

|

1,745

|

1,312

|

|

|

5% 1/15/44

|

825

|

501

|

|

|

6.95% 3/15/28

|

250

|

231

|

|

|

15,247

|

|||

|

Specialty Retail - 0.4%

|

|||

|

Arko Corp. 5.125% 11/15/29 (d)

|

4,190

|

3,290

|

|

|

Asbury Automotive Group, Inc.:

|

|||

|

4.5% 3/1/28

|

1,987

|

1,749

|

|

|

4.625% 11/15/29(d)

|

4,555

|

3,838

|

|

|

4.75% 3/1/30

|

1,980

|

1,656

|

|

|

5% 2/15/32(d)

|

4,915

|

4,044

|

|

|

Bath & Body Works, Inc.:

|

|||

|

6.625% 10/1/30(d)

|

3,355

|

3,148

|

|

|

6.75% 7/1/36

|

8,920

|

7,840

|

|

|

7.5% 6/15/29

|

5,030

|

4,966

|

|

|

Carvana Co.:

|

|||

|

4.875% 9/1/29(d)

|

10,830

|

4,172

|

|

|

5.875% 10/1/28(d)

|

680

|

265

|

|

|

Foot Locker, Inc. 4% 10/1/29 (d)

|

2,800

|

2,181

|

|

|

LCM Investments Holdings 4.875% 5/1/29 (d)

|

3,120

|

2,498

|

|

|

Michaels Companies, Inc. 5.25% 5/1/28 (d)

|

6,875

|

5,531

|

|

|

Victoria's Secret & Co. 4.625% 7/15/29 (d)

|

10,565

|

8,295

|

|

|

53,473

|

|||

|

Textiles, Apparel & Luxury Goods - 0.1%

|

|||

|

Crocs, Inc.:

|

|||

|

4.125% 8/15/31(d)

|

2,820

|

2,298

|

|

|

4.25% 3/15/29(d)

|

4,325

|

3,664

|

|

|

Kontoor Brands, Inc. 4.125% 11/15/29 (d)

|

2,420

|

1,975

|

|

|

7,937

|

|||

|

TOTAL CONSUMER DISCRETIONARY

|

643,632

|

||

|

CONSUMER STAPLES - 1.2%

|

|||

|

Beverages - 0.0%

|

|||

|

Triton Water Holdings, Inc. 6.25% 4/1/29 (d)

|

3,135

|

2,515

|

|

|

Food & Staples Retailing - 0.5%

|

|||

|

Albertsons Companies LLC/Safeway, Inc./New Albertson's, Inc./Albertson's LLC:

|

|||

|

3.5% 3/15/29(d)

|

5,285

|

4,434

|

|

|

4.625% 1/15/27(d)

|

13,797

|

12,816

|

|

|

4.875% 2/15/30(d)

|

23,423

|

20,904

|

|

|

C&S Group Enterprises LLC 5% 12/15/28 (d)

|

5,155

|

3,892

|

|

|

KeHE Distributors LLC / KeHE Finance Corp. 8.625% 10/15/26 (d)

|

4,698

|

4,592

|

|

|

Performance Food Group, Inc.:

|

|||

|

4.25% 8/1/29(d)

|

3,955

|

3,427

|

|

|

5.5% 10/15/27(d)

|

5,345

|

5,041

|

|

|

SEG Holding LLC/SEG Finance Corp. 5.625% 10/15/28 (d)

|

6,735

|

6,331

|

|

|

United Natural Foods, Inc. 6.75% 10/15/28 (d)

|

4,680

|

4,497

|

|

|

65,934

|

|||

|

Food Products - 0.6%

|

|||

|

Chobani LLC/Finance Corp., Inc. 4.625% 11/15/28 (d)

|

3,790

|

3,300

|

|

|

Darling Ingredients, Inc. 6% 6/15/30 (d)

|

6,615

|

6,466

|

|

|

JBS U.S.A. Lux SA / JBS Food Co. 5.5% 1/15/30 (d)

|

12,225

|

11,632

|

|

|

Lamb Weston Holdings, Inc.:

|

|||

|

4.125% 1/31/30(d)

|

5,575

|

4,924

|

|

|

4.375% 1/31/32(d)

|

2,790

|

2,438

|

|

|

Pilgrim's Pride Corp. 4.25% 4/15/31 (d)

|

10,220

|

8,693

|

|

|

Post Holdings, Inc.:

|

|||

|

4.5% 9/15/31(d)

|

12,110

|

10,180

|

|

|

4.625% 4/15/30(d)

|

6,415

|

5,534

|

|

|

5.5% 12/15/29(d)

|

11,940

|

10,805

|

|

|

5.75% 3/1/27(d)

|

1,713

|

1,657

|

|

|

Simmons Foods, Inc. 4.625% 3/1/29 (d)

|

4,295

|

3,496

|

|

|

TreeHouse Foods, Inc. 4% 9/1/28

|

2,250

|

1,913

|

|

|

71,038

|

|||

|

Household Products - 0.0%

|

|||

|

Diamond BC BV 4.625% 10/1/29 (d)

|

3,360

|

2,696

|

|

|

Spectrum Brands Holdings, Inc. 3.875% 3/15/31 (d)

|

4,310

|

3,352

|

|

|

6,048

|

|||

|

Personal Products - 0.1%

|

|||

|

BellRing Brands, Inc. 7% 3/15/30 (d)

|

6,925

|

6,664

|

|

|

TOTAL CONSUMER STAPLES

|

152,199

|

||

|

ENERGY - 4.1%

|

|||

|

Energy Equipment & Services - 0.3%

|

|||

|

CGG SA 8.75% 4/1/27 (d)

|

5,895

|

4,761

|

|

|

Nabors Industries Ltd.:

|

|||

|

7.25% 1/15/26(d)

|

6,565

|

6,187

|

|

|

7.5% 1/15/28(d)

|

5,660

|

5,178

|

|

|

Nine Energy Service, Inc. 8.75% 11/1/23 (d)

|

3,620

|

3,548

|

|

|

NuStar Logistics LP 6% 6/1/26

|

7,285

|

7,015

|

|

|

Summit Midstream Holdings LLC:

|

|||

|

5.75% 4/15/25

|

3,405

|

2,882

|

|

|

8.5%(d)(h)

|

4,185

|

3,986

|

|

|

Vier Gas Transport GmbH 4.625% 9/26/32 (Reg. S)

|

EUR

|

4,000

|

4,302

|

|

37,859

|

|||

|

Multi Industry Energy - 0.0%

|

|||

|

Enviva Partners LP / Enviva Partners Finance Corp. 6.5% 1/15/26 (d)

|

6,600

|

6,216

|

|

|

Oil, Gas & Consumable Fuels - 3.8%

|

|||

|

Antero Midstream Partners LP/Antero Midstream Finance Corp.:

|

|||

|

5.375% 6/15/29(d)

|

4,305

|

3,936

|

|

|

5.75% 1/15/28(d)

|

10,640

|

9,870

|

|

|

Cheniere Energy Partners LP:

|

|||

|

3.25% 1/31/32

|

4,200

|

3,338

|

|

|

4% 3/1/31

|

9,070

|

7,722

|

|

|

Cheniere Energy, Inc. 4.625% 10/15/28

|

9,375

|

8,474

|

|

|

Chesapeake Energy Corp.:

|

|||

|

5.875% 2/1/29(d)

|

3,115

|

2,951

|

|

|

6.75% 4/15/29(d)

|

4,415

|

4,298

|

|

|

7% 10/1/24(c)(e)

|

3,985

|

0

|

|

|

8% 1/15/25(c)(e)

|

1,955

|

0

|

|

|

8% 6/15/27(c)(e)

|

1,240

|

0

|

|

|

Citgo Holding, Inc. 9.25% 8/1/24 (d)

|

16,430

|

16,392

|

|

|

Citgo Petroleum Corp.:

|

|||

|

6.375% 6/15/26(d)

|

4,665

|

4,496

|

|

|

7% 6/15/25(d)

|

13,580

|

13,245

|

|

|

CNX Midstream Partners LP 4.75% 4/15/30 (d)

|

2,970

|

2,437

|

|

|

CNX Resources Corp.:

|

|||

|

6% 1/15/29(d)

|

3,200

|

2,944

|

|

|

7.375% 1/15/31(d)

|

2,885

|

2,765

|

|

|

Colgate Energy Partners III LLC 5.875% 7/1/29 (d)

|

4,055

|

3,477

|

|

|

Comstock Resources, Inc.:

|

|||

|

5.875% 1/15/30(d)

|

15,170

|

13,042

|

|

|

6.75% 3/1/29(d)

|

8,110

|

7,319

|

|

|

CQP Holdco LP / BIP-V Chinook Holdco LLC 5.5% 6/15/31 (d)

|

12,715

|

11,107

|

|

|

Crestwood Midstream Partners LP/Crestwood Midstream Finance Corp.:

|

|||

|

5.625% 5/1/27(d)

|

11,025

|

10,253

|

|

|

5.75% 4/1/25

|

2,960

|

2,879

|

|

|

6% 2/1/29(d)

|

23,985

|

22,006

|

|

|

CrownRock LP/CrownRock Finance, Inc. 5% 5/1/29 (d)

|

2,450

|

2,201

|

|

|

CVR Energy, Inc.:

|

|||

|

5.25% 2/15/25(d)

|

9,740

|

8,961

|

|

|

5.75% 2/15/28(d)

|

24,505

|

21,332

|

|

|

DCP Midstream Operating LP 5.85% 5/21/43 (d)(f)

|

10,780

|

10,516

|

|

|

DT Midstream, Inc.:

|

|||

|

4.125% 6/15/29(d)

|

4,285

|

3,681

|

|

|

4.375% 6/15/31(d)

|

4,285

|

3,595

|

|

|

EG Global Finance PLC 8.5% 10/30/25 (d)

|

9,545

|

8,892

|

|

|

Endeavor Energy Resources LP/EER Finance, Inc. 5.75% 1/30/28 (d)

|

10,149

|

9,718

|

|

|

Energy Transfer LP 5.5% 6/1/27

|

12,065

|

11,744

|

|

|

EnLink Midstream LLC 6.5% 9/1/30 (d)

|

5,815

|

5,755

|

|

|

Hess Midstream Partners LP:

|

|||

|

4.25% 2/15/30(d)

|

4,590

|

3,924

|

|

|

5.125% 6/15/28(d)

|

6,600

|

6,103

|

|

|

5.5% 10/15/30(d)

|

2,775

|

2,539

|

|

|

5.625% 2/15/26(d)

|

9,140

|

8,903

|

|

|

Hilcorp Energy I LP/Hilcorp Finance Co. 6.25% 11/1/28 (d)

|

7,130

|

6,453

|

|

|

Holly Energy Partners LP/Holly Energy Finance Corp.:

|

|||

|

5% 2/1/28(d)

|

4,350

|

3,961

|

|

|

6.375% 4/15/27(d)

|

2,780

|

2,731

|

|

|

MEG Energy Corp. 7.125% 2/1/27 (d)

|

6,490

|

6,619

|

|

|

Mesquite Energy, Inc. 7.25% 2/15/23 (c)(d)(e)

|

12,834

|

0

|

|

|

Murphy Oil U.S.A., Inc.:

|

|||

|

4.75% 9/15/29

|

4,155

|

3,802

|

|

|

5.625% 5/1/27

|

3,665

|

3,559

|

|

|

New Fortress Energy, Inc.:

|

|||

|

6.5% 9/30/26(d)

|

11,785

|

10,945

|

|

|

6.75% 9/15/25(d)

|

12,840

|

12,144

|

|

|

NGPL PipeCo LLC 4.875% 8/15/27 (d)

|

1,800

|

1,710

|

|

|

Occidental Petroleum Corp.:

|

|||

|

3.5% 8/15/29

|

3,820

|

3,420

|

|

|

5.875% 9/1/25

|

6,775

|

6,750

|

|

|

6.2% 3/15/40

|

3,565

|

3,489

|

|

|

6.375% 9/1/28

|

6,775

|

6,841

|

|

|

6.45% 9/15/36

|

11,875

|

12,113

|

|

|

6.6% 3/15/46

|

7,130

|

7,337

|

|

|

6.625% 9/1/30

|

13,550

|

14,002

|

|

|

7.2% 3/15/29

|

2,440

|

2,525

|

|

|

7.5% 5/1/31

|

680

|

727

|

|

|

Parkland Corp.:

|

|||

|

4.5% 10/1/29(d)

|

4,420

|

3,683

|

|

|

4.625% 5/1/30(d)

|

5,540

|

4,584

|

|

|

PBF Holding Co. LLC/PBF Finance Corp.:

|

|||

|

6% 2/15/28

|

15,760

|

14,066

|

|

|

7.25% 6/15/25

|

13,580

|

13,419

|

|

|

PBF Logistics LP/PBF Logistics Finance, Inc. 6.875% 5/15/23

|

6,110

|

6,102

|

|

|

PDC Energy, Inc. 6.125% 9/15/24

|

1,240

|

1,233

|

|

|

SM Energy Co.:

|

|||

|

5.625% 6/1/25

|

4,400

|

4,224

|

|

|

6.625% 1/15/27

|

12,830

|

12,358

|

|

|

6.75% 9/15/26

|

3,175

|

3,082

|

|

|

Southwestern Energy Co.:

|

|||

|

5.375% 3/15/30

|

5,630

|

5,135

|

|

|

5.7% 1/23/25(i)

|

149

|

146

|

|

|

7.75% 10/1/27

|

7,830

|

7,980

|

|

|

Sunoco LP/Sunoco Finance Corp.:

|

|||

|

4.5% 5/15/29

|

5,515

|

4,824

|

|

|

4.5% 4/30/30

|

5,550

|

4,818

|

|

|

Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp.:

|

|||

|

6% 9/1/31(d)

|

4,225

|

3,633

|

|

|

7.5% 10/1/25(d)

|

5,035

|

5,080

|

|

|

Targa Resources Partners LP/Targa Resources Partners Finance Corp. 4.875% 2/1/31

|

6,345

|

5,729

|

|

|

Teine Energy Ltd. 6.875% 4/15/29 (d)

|

4,420

|

3,967

|

|

|

Tennessee Gas Pipeline Co. 7.625% 4/1/37

|

2,585

|

2,811

|

|

|

Unit Corp. 0% 12/1/29 (c)

|

1,660

|

0

|

|

|

Venture Global Calcasieu Pass LLC:

|

|||

|

3.875% 8/15/29(d)

|

3,525

|

3,084

|

|

|

4.125% 8/15/31(d)

|

3,525

|

3,003

|

|

|

482,904

|

|||

|

TOTAL ENERGY

|

526,979

|

||

|

FINANCIALS - 4.1%

|

|||

|

Banks - 0.5%

|

|||

|

ABN AMRO Bank NV 4.5% 11/21/34 (Reg. S)

|

EUR

|

7,200

|

7,614

|

|

AIB Group PLC 2.875% 5/30/31 (Reg. S) (f)

|

EUR

|

5,810

|

5,580

|

|

Barclays PLC 5.262% 1/29/34 (Reg. S) (f)

|

EUR

|

12,316

|

13,017

|

|

CaixaBank SA 6.25% 2/23/33 (Reg. S) (f)

|

EUR

|

9,500

|

10,178

|

|

HSBC Holdings PLC Eur Swap Annual 5Y Index + 3.300% 6.364% 11/16/32 (Reg. S) (f)(g)

|

EUR

|

9,791

|

10,632

|

|

Svenska Handelsbanken AB 3.25% 6/1/33 (Reg. S) (f)

|

EUR

|

9,304

|

9,180

|

|

UniCredit SpA 2.731% 1/15/32 (Reg. S) (f)

|

EUR

|

1,676

|

1,507

|

|

57,708

|

|||

|

Capital Markets - 0.4%

|

|||

|

AssuredPartners, Inc.:

|

|||

|

5.625% 1/15/29(d)

|

3,905

|

3,214

|

|

|

7% 8/15/25(d)

|

2,930

|

2,834

|

|

|

Broadstreet Partners, Inc. 5.875% 4/15/29 (d)

|

7,265

|

6,183

|

|

|

Coinbase Global, Inc.:

|

|||

|

3.375% 10/1/28(d)

|

4,060

|

2,146

|

|

|

3.625% 10/1/31(d)

|

4,200

|

2,023

|

|

|

Deutsche Bank AG 4% 6/24/32 (Reg. S) (f)

|

EUR

|

17,100

|

16,195

|

|

Hightower Holding LLC 6.75% 4/15/29 (d)

|

2,870

|

2,397

|

|

|

Jane Street Group LLC/JSG Finance, Inc. 4.5% 11/15/29 (d)

|

3,985

|

3,427

|

|

|

Lions Gate Capital Holdings LLC 5.5% 4/15/29 (d)

|

4,420

|

2,563

|

|

|

MSCI, Inc.:

|

|||

|

3.25% 8/15/33(d)

|

4,225

|

3,263

|

|

|

4% 11/15/29(d)

|

3,780

|

3,293

|

|

|

47,538

|

|||

|

Consumer Finance - 1.6%

|

|||

|

Ally Financial, Inc.:

|

|||

|

8% 11/1/31

|

53,672

|

55,408

|

|

|

8% 11/1/31

|

16,761

|

17,426

|

|

|

Ford Motor Credit Co. LLC:

|

|||

|

3.375% 11/13/25

|

11,600

|

10,487

|

|

|

3.625% 6/17/31

|

7,380

|

5,803

|

|

|

4% 11/13/30

|

25,360

|

20,817

|

|

|

5.113% 5/3/29

|

6,160

|

5,578

|

|

|

7.35% 11/4/27

|

5,690

|

5,831

|

|

|

OneMain Finance Corp.:

|

|||

|

4% 9/15/30

|

3,340

|

2,492

|

|

|

5.375% 11/15/29

|

5,560

|

4,548

|

|

|

6.625% 1/15/28

|

4,415

|

4,065

|

|

|

6.875% 3/15/25

|

30,605

|

29,401

|

|

|

7.125% 3/15/26

|

41,215

|

39,191

|

|

|

201,047

|

|||

|

Diversified Financial Services - 0.6%

|

|||

|

Altus Midstream LP 5.875% 6/15/30 (d)

|

4,180

|

3,920

|

|

|

Compass Group Diversified Holdings LLC 5% 1/15/32 (d)

|

2,765

|

2,185

|

|

|

Icahn Enterprises LP/Icahn Enterprises Finance Corp.:

|

|||

|

4.375% 2/1/29

|

6,375

|

5,391

|

|

|

5.25% 5/15/27

|

23,175

|

21,234

|

|

|

6.25% 5/15/26

|

14,625

|

14,053

|

|

|

6.375% 12/15/25

|

18,820

|

18,252

|

|

|

James Hardie International Finance Ltd. 5% 1/15/28 (d)

|

5,270

|

4,835

|

|

|

OEC Finance Ltd.:

|

|||

|

4.375% 10/25/29 pay-in-kind(d)

|

4,302

|

99

|

|

|

5.25% 12/27/33 pay-in-kind(d)

|

2,180

|

49

|

|

|

Shift4 Payments LLC / Shift4 Payments Finance Sub, Inc. 4.625% 11/1/26 (d)

|

2,265

|

2,140

|

|

|

VMED O2 UK Financing I PLC 4.75% 7/15/31 (d)

|

9,930

|

8,067

|

|

|

80,225

|

|||

|

Insurance - 1.0%

|

|||

|

Acrisure LLC / Acrisure Finance, Inc.:

|

|||

|

6% 8/1/29(d)

|

4,230

|

3,457

|

|

|

7% 11/15/25(d)

|

20,290

|

18,643

|

|

|

10.125% 8/1/26(d)

|

6,810

|

6,623

|

|

|

Alliant Holdings Intermediate LLC:

|

|||

|

4.25% 10/15/27(d)

|

6,740

|

6,037

|

|

|

5.875% 11/1/29(d)

|

4,180

|

3,438

|

|

|

6.75% 10/15/27(d)

|

10,080

|

9,061

|

|

|

Allianz SE 4.252% 7/5/52 (Reg. S) (f)

|

EUR

|

17,200

|

16,897

|

|

AmWINS Group, Inc. 4.875% 6/30/29 (d)

|

4,105

|

3,482

|

|

|

ASR Nederland NV 7% 12/7/43 (Reg. S) (f)

|

EUR

|

15,040

|

16,104

|

|

AXA SA 4.25% 3/10/43 (Reg. S) (f)

|

EUR

|

14,867

|

14,492

|

|

Berkshire Hathaway Finance Corp. 2% 3/18/34

|

EUR

|

12,912

|

11,101

|

|

Hannover Reuck SE 5.875% 8/26/43 (Reg. S) (f)

|

EUR

|

7,100

|

7,761

|

|

HUB International Ltd.:

|

|||

|

5.625% 12/1/29(d)

|

6,030

|

5,266

|

|

|

7% 5/1/26(d)

|

6,980

|

6,833

|

|

|

MAPFRE SA 2.875% 4/13/30 (Reg. S)

|

EUR

|

1,700

|

1,499

|

|

Sampo Oyj 2.5% 9/3/52 (Reg. S) (f)

|

EUR

|

2,579

|

2,065

|

|

132,759

|

|||

|

Thrifts & Mortgage Finance - 0.0%

|

|||

|

MGIC Investment Corp. 5.25% 8/15/28

|

4,725

|

4,357

|

|

|

TOTAL FINANCIALS

|

523,634

|

||

|

HEALTH CARE - 2.2%

|

|||

|

Biotechnology - 0.0%

|

|||

|

Grifols Escrow Issuer SA 4.75% 10/15/28 (d)

|

2,795

|

2,413

|

|

|

Health Care Equipment & Supplies - 0.0%

|

|||

|

Avantor Funding, Inc. 3.875% 11/1/29 (d)

|

2,790

|

2,343

|

|

|

Hologic, Inc. 4.625% 2/1/28 (d)

|

2,505

|

2,360

|

|

|

4,703

|

|||

|

Health Care Providers & Services - 1.7%

|

|||

|

180 Medical, Inc. 3.875% 10/15/29 (d)

|

2,995

|

2,575

|

|

|

Cano Health, Inc. 6.25% 10/1/28 (d)

|

1,865

|

1,128

|

|

|

Centene Corp.:

|

|||

|

4.25% 12/15/27

|

6,820

|

6,396

|

|

|

4.625% 12/15/29

|

23,795

|

21,745

|

|

|

Community Health Systems, Inc.:

|

|||

|

4.75% 2/15/31(d)

|

11,430

|

8,298

|

|

|

5.25% 5/15/30(d)

|

8,305

|

6,262

|

|

|

5.625% 3/15/27(d)

|

4,015

|

3,443

|

|

|

6% 1/15/29(d)

|

4,940

|

4,132

|

|

|

6.125% 4/1/30(d)

|

10,425

|

5,162

|

|

|

8% 3/15/26(d)

|

37,390

|

34,040

|

|

|

DaVita HealthCare Partners, Inc.:

|

|||

|

3.75% 2/15/31(d)

|

2,075

|

1,549

|

|

|

4.625% 6/1/30(d)

|

15,850

|

12,750

|

|

|

HealthEquity, Inc. 4.5% 10/1/29 (d)

|

2,950

|

2,578

|

|

|

Horizon Pharma U.S.A., Inc. 5.5% 8/1/27 (d)

|

7,300

|

7,493

|

|

|

ModivCare Escrow Issuer, Inc. 5% 10/1/29 (d)

|

3,250

|

2,741

|

|

|

Molina Healthcare, Inc.:

|

|||

|

3.875% 11/15/30(d)

|

6,345

|

5,377

|

|

|

3.875% 5/15/32(d)

|

5,560

|

4,617

|

|

|

4.375% 6/15/28(d)

|

4,690

|

4,280

|

|

|

Option Care Health, Inc. 4.375% 10/31/29 (d)

|

3,060

|

2,677

|

|

|

Radiology Partners, Inc. 9.25% 2/1/28 (d)

|

9,515

|

5,341

|

|

|

RP Escrow Issuer LLC 5.25% 12/15/25 (d)

|

6,200

|

4,735

|

|

|

Tenet Healthcare Corp.:

|

|||

|

4.625% 7/15/24

|

1,500

|

1,463

|

|

|

4.625% 9/1/24(d)

|

7,305

|

7,095

|

|

|

4.875% 1/1/26(d)

|

18,260

|

17,267

|

|

|

5.125% 11/1/27(d)

|

10,955

|

10,191

|

|

|

6.125% 10/1/28(d)

|

6,535

|

5,851

|

|

|

6.125% 6/15/30(d)

|

11,235

|

10,705

|

|

|

6.25% 2/1/27(d)

|

20,050

|

19,258

|

|

|

219,149

|

|||

|

Health Care Technology - 0.1%

|

|||

|

IQVIA, Inc. 5% 5/15/27 (d)

|

5,660

|

5,396

|

|

|

Life Sciences Tools & Services - 0.1%

|

|||

|

Charles River Laboratories International, Inc.:

|

|||

|

3.75% 3/15/29(d)

|

5,245

|

4,639

|

|

|

4% 3/15/31(d)

|

6,035

|

5,220

|

|

|

4.25% 5/1/28(d)

|

2,045

|

1,883

|

|

|

Syneos Health, Inc. 3.625% 1/15/29 (d)

|

5,025

|

4,002

|

|

|

15,744

|

|||

|

Pharmaceuticals - 0.3%

|

|||

|

Bayer AG 5.375% 3/25/82 (Reg. S) (f)

|

EUR

|

8,400

|

7,868

|

|

Catalent Pharma Solutions:

|

|||

|

3.5% 4/1/30(d)

|

2,800

|

2,211

|

|

|

5% 7/15/27(d)

|

2,295

|

2,136

|

|

|

Organon & Co. / Organon Foreign Debt Co-Issuer BV:

|

|||

|

4.125% 4/30/28(d)

|

10,200

|

9,031

|

|

|

5.125% 4/30/31(d)

|

8,890

|

7,698

|

|

|

Teva Pharmaceutical Finance Netherlands III BV:

|

|||

|

4.75% 5/9/27

|

2,775

|

2,508

|

|

|

5.125% 5/9/29

|

2,775

|

2,471

|

|

|

33,923

|

|||

|

TOTAL HEALTH CARE

|

281,328

|

||

|

INDUSTRIALS - 3.8%

|

|||

|

Aerospace & Defense - 1.4%

|

|||

|

Bombardier, Inc.:

|

|||

|

6% 2/15/28(d)

|

2,815

|

2,603

|

|

|

7.125% 6/15/26(d)

|

5,695

|

5,525

|

|

|

7.5% 3/15/25(d)

|

5,202

|

5,152

|

|

|

7.875% 4/15/27(d)

|

13,015

|

12,624

|

|

|

BWX Technologies, Inc. 4.125% 6/30/28 (d)

|

6,400

|

5,752

|

|

|

Moog, Inc. 4.25% 12/15/27 (d)

|

2,025

|

1,873

|

|

|

Rolls-Royce PLC 5.75% 10/15/27 (d)

|

6,560

|

6,248

|

|

|

Spirit Aerosystems, Inc. 7.5% 4/15/25 (d)

|

9,205

|

9,096

|

|

|

TransDigm UK Holdings PLC 6.875% 5/15/26

|

21,085

|

20,590

|

|

|

TransDigm, Inc.:

|

|||

|

4.625% 1/15/29

|

9,290

|

8,168

|

|

|

5.5% 11/15/27

|

68,140

|

63,370

|

|

|

6.25% 3/15/26(d)

|

11,120

|

10,966

|

|

|

6.375% 6/15/26

|

20,230

|

19,683

|

|

|

7.5% 3/15/27

|

11,028

|

10,911

|

|

|

182,561

|

|||

|

Air Freight & Logistics - 0.0%

|

|||

|

Cargo Aircraft Management, Inc. 4.75% 2/1/28 (d)

|

3,960

|

3,564

|

|

|

Airlines - 0.4%

|

|||

|

Air Canada 3.875% 8/15/26 (d)

|

4,230

|

3,747

|

|

|

Allegiant Travel Co. 7.25% 8/15/27 (d)

|

4,365

|

4,152

|

|

|

Delta Air Lines, Inc. 7% 5/1/25 (d)

|

1,671

|

1,708

|

|

|

Mileage Plus Holdings LLC 6.5% 6/20/27 (d)

|

18,595

|

18,487

|

|

|

Spirit Loyalty Cayman Ltd. / Spirit IP Cayman Ltd.:

|

|||

|

8% 9/20/25(d)

|

1,420

|

1,427

|

|

|

8% 9/20/25(d)

|

4,670

|

4,686

|

|

|

United Airlines, Inc.:

|

|||

|

4.375% 4/15/26(d)

|

14,560

|

13,496

|

|

|

4.625% 4/15/29(d)

|

8,725

|

7,597

|

|

|

55,300

|

|||

|

Building Products - 0.1%

|

|||

|

Advanced Drain Systems, Inc.:

|

|||

|

5% 9/30/27(d)

|

1,400

|

1,306

|

|

|

6.375% 6/15/30(d)

|

2,780

|

2,701

|

|

|

CP Atlas Buyer, Inc. 7% 12/1/28 (d)

|

3,280

|

2,436

|

|

|

MIWD Holdco II LLC / MIWD Finance Corp. 5.5% 2/1/30 (d)

|

1,865

|

1,485

|

|

|

Oscar Acquisition Co. LLC / Oscar Finance, Inc. 9.5% 4/15/30 (d)

|

4,185

|

3,756

|

|

|

Shea Homes Ltd. Partnership/Corp. 4.75% 4/1/29

|

4,830

|

4,057

|

|

|

15,741

|

|||

|

Commercial Services & Supplies - 0.9%

|

|||

|

Allied Universal Holdco LLC / Allied Universal Finance Corp. 6% 6/1/29 (d)

|

3,995

|

2,899

|

|

|

Atlas Luxco 4 SARL / Allied Universal Holdco LLC / Allied Universal Finance Corp.:

|

|||

|

4.625% 6/1/28(d)

|

10,374

|

8,568

|

|

|

4.625% 6/1/28(d)

|

6,871

|

5,571

|

|

|

CoreCivic, Inc. 8.25% 4/15/26

|

14,975

|

15,357

|

|

|

Covanta Holding Corp.:

|

|||

|

4.875% 12/1/29(d)

|

4,300

|

3,523

|

|

|

5% 9/1/30

|

6,775

|

5,471

|

|

|

GFL Environmental, Inc.:

|

|||

|

4% 8/1/28(d)

|

4,200

|

3,591

|

|

|

4.75% 6/15/29(d)

|

5,705

|

4,993

|

|

|

IAA, Inc. 5.5% 6/15/27 (d)

|

2,830

|

2,761

|

|

|

KAR Auction Services, Inc. 5.125% 6/1/25 (d)

|

6,210

|

6,067

|

|

|

Madison IAQ LLC:

|

|||

|

4.125% 6/30/28(d)

|

5,345

|

4,470

|

|

|

5.875% 6/30/29(d)

|

4,265

|

2,923

|

|

|

Neptune BidCo U.S., Inc. 9.29% 4/15/29 (d)

|

14,145

|

13,332

|

|

|

Pitney Bowes, Inc. 7.25% 3/15/29 (d)

|

890

|

696

|

|

|

The Brink's Co. 4.625% 10/15/27 (d)

|

7,200

|

6,588

|

|

|

The GEO Group, Inc.:

|

|||

|

9.5% 12/31/28(d)

|

5,755

|

5,478

|

|

|

10.5% 6/30/28

|

16,764

|

16,928

|

|

|

109,216

|

|||

|

Construction & Engineering - 0.4%

|

|||

|

AECOM 5.125% 3/15/27

|

7,490

|

7,209

|

|

|

Arcosa, Inc. 4.375% 4/15/29 (d)

|

4,130

|

3,581

|

|

|

Bouygues SA 5.375% 6/30/42 (Reg. S)

|

EUR

|

14,100

|

15,520

|

|

Pike Corp. 5.5% 9/1/28 (d)

|

14,255

|

12,462

|

|

|

SRS Distribution, Inc.:

|

|||

|

4.625% 7/1/28(d)

|

5,520

|

4,893

|

|

|

6.125% 7/1/29(d)

|

2,315

|

1,872

|

|

|

45,537

|

|||

|

Electrical Equipment - 0.1%

|

|||

|

Sensata Technologies BV 4% 4/15/29 (d)

|

5,910

|

5,097

|

|

|

Industrial Conglomerates - 0.1%

|

|||

|

Honeywell International, Inc. 4.125% 11/2/34

|

EUR

|

12,154

|

12,843

|

|

Machinery - 0.1%

|

|||

|

ATS Automation Tooling System, Inc. 4.125% 12/15/28 (d)

|

4,630

|

3,995

|

|

|

Chart Industries, Inc. 7.5% 1/1/30 (d)

|

7,420

|

7,459

|

|

|

Stevens Holding Co., Inc. 6.125% 10/1/26 (d)

|

1,880

|

1,885

|

|

|

13,339

|

|||

|

Marine - 0.0%

|

|||

|

Seaspan Corp. 5.5% 8/1/29 (d)

|

4,240

|

3,213

|

|

|

Professional Services - 0.1%

|

|||

|

ASGN, Inc. 4.625% 5/15/28 (d)

|

5,670

|

5,132

|

|

|

Booz Allen Hamilton, Inc.:

|

|||

|

3.875% 9/1/28(d)

|

6,270

|

5,555

|

|

|

4% 7/1/29(d)

|

2,820

|

2,482

|

|

|

TriNet Group, Inc. 3.5% 3/1/29 (d)

|

4,545

|

3,737

|

|

|

16,906

|

|||

|

Road & Rail - 0.1%

|

|||

|

Hertz Corp.:

|

|||

|

4.625% 12/1/26(d)

|

2,350

|

1,968

|

|

|

5% 12/1/29(d)

|

4,560

|

3,459

|

|

|

5.5% 10/15/24(c)(d)(e)

|

6,540

|

147

|

|

|

6% 1/15/28(c)(d)(e)

|

5,785

|

340

|

|

|

6.25% 12/31/49(c)(e)

|

6,775

|

8

|

|

|

7.125% 8/1/26(c)(d)(e)

|

6,315

|

505

|

|

|

XPO, Inc. 6.25% 5/1/25 (d)

|

5,220

|

5,269

|

|

|

11,696

|

|||

|

Trading Companies & Distributors - 0.1%

|

|||

|

Foundation Building Materials, Inc. 6% 3/1/29 (d)

|

3,110

|

2,328

|

|

|

H&E Equipment Services, Inc. 3.875% 12/15/28 (d)

|

10,040

|

8,552

|

|

|

10,880

|

|||

|

Transportation Infrastructure - 0.0%

|

|||

|

First Student Bidco, Inc./First Transit Parent, Inc. 4% 7/31/29 (d)

|

4,235

|

3,503

|

|

|

TOTAL INDUSTRIALS

|

489,396

|

||

|

INFORMATION TECHNOLOGY - 1.2%

|

|||

|

Electronic Equipment & Components - 0.0%

|

|||

|

Coherent Corp. 5% 12/15/29 (d)

|

4,370

|

3,769

|

|

|

TTM Technologies, Inc. 4% 3/1/29 (d)

|

4,540

|

3,893

|

|

|

7,662

|

|||

|

IT Services - 0.3%

|

|||

|

Acuris Finance U.S. 5% 5/1/28 (d)

|

4,315

|

3,441

|

|

|

Block, Inc. 3.5% 6/1/31

|

5,745

|

4,584

|

|

|

CA Magnum Holdings 5.375% (d)(h)

|

2,230

|

2,018

|

|

|

Camelot Finance SA 4.5% 11/1/26 (d)

|

6,365

|

5,966

|

|

|

Gartner, Inc.:

|

|||

|

3.625% 6/15/29(d)

|

4,040

|

3,550

|

|

|

3.75% 10/1/30(d)

|

6,920

|

5,965

|

|

|

Go Daddy Operating Co. LLC / GD Finance Co., Inc.:

|

|||

|

3.5% 3/1/29(d)

|

6,060

|

5,073

|

|

|

5.25% 12/1/27(d)

|

5,665

|

5,362

|

|

|

Rackspace Hosting, Inc. 5.375% 12/1/28 (d)

|

3,845

|

1,676

|

|

|

Unisys Corp. 6.875% 11/1/27 (d)

|

3,685

|

2,828

|

|

|

40,463

|

|||

|

Semiconductors & Semiconductor Equipment - 0.1%

|

|||

|

onsemi 3.875% 9/1/28 (d)

|

6,765

|

5,903

|

|

|

Synaptics, Inc. 4% 6/15/29 (d)

|

3,500

|

2,949

|

|

|

8,852

|

|||

|

Software - 0.8%

|

|||

|

Black Knight InfoServ LLC 3.625% 9/1/28 (d)

|

6,975

|

6,051

|

|

|

Central Parent, Inc./Central Merger Sub, Inc. 7.25% 6/15/29 (d)

|

4,225

|

4,133

|

|

|

Clarivate Science Holdings Corp.:

|

|||

|

3.875% 7/1/28(d)

|

5,025

|

4,354

|

|

|

4.875% 7/1/29(d)

|

4,755

|

4,043

|

|

|

Elastic NV 4.125% 7/15/29 (d)

|

8,005

|

6,466

|

|

|

Fair Isaac Corp. 4% 6/15/28 (d)

|

6,420

|

5,826

|

|

|

Gen Digital, Inc. 5% 4/15/25 (d)

|

6,360

|

6,186

|

|

|

ION Trading Technologies Ltd. 5.75% 5/15/28 (d)

|

5,780

|

4,819

|

|

|

MicroStrategy, Inc. 6.125% 6/15/28 (d)

|

9,960

|

7,122

|

|

|

NCR Corp.:

|

|||

|

5% 10/1/28(d)

|

3,385

|

2,886

|

|

|

5.25% 10/1/30(d)

|

13,370

|

11,030

|

|

|

5.75% 9/1/27(d)

|

5,480

|

5,244

|

|

|

6.125% 9/1/29(d)

|

5,480

|

5,124

|

|

|

Open Text Corp.:

|

|||

|

3.875% 2/15/28(d)

|

3,220

|

2,763

|

|

|

3.875% 12/1/29(d)

|

3,045

|

2,449

|

|

|

6.9% 12/1/27(d)

|

5,000

|

5,000

|

|

|

Open Text Holdings, Inc.:

|

|||

|

4.125% 2/15/30(d)

|

3,220

|

2,583

|

|

|

4.125% 12/1/31(d)

|

2,490

|

1,935

|

|

|

PTC, Inc.:

|

|||

|

3.625% 2/15/25(d)

|

3,755

|

3,576

|

|

|

4% 2/15/28(d)

|

3,715

|

3,344

|

|

|

Veritas U.S., Inc./Veritas Bermuda Ltd. 7.5% 9/1/25 (d)

|

7,100

|

4,900

|

|

|

99,834

|

|||

|

TOTAL INFORMATION TECHNOLOGY

|

156,811

|

||

|

MATERIALS - 2.6%

|

|||

|

Chemicals - 0.9%

|

|||

|

BASF AG 3.75% 6/29/32 (Reg. S)

|

EUR

|

6,100

|

6,431

|

|

Gpd Companies, Inc. 10.125% 4/1/26 (d)

|

8,860

|

7,553

|

|

|

Ingevity Corp. 3.875% 11/1/28 (d)

|

6,715

|

5,774

|

|

|

Kronos Acquisition Holdings, Inc. / KIK Custom Products, Inc. 5% 12/31/26 (d)

|

2,100

|

1,817

|

|

|

Lanxess AG 1.75% 3/22/28 (Reg. S)

|

EUR

|

13,300

|

12,499

|

|

Linde PLC 1.625% 3/31/35 (Reg. S)

|

EUR

|

12,600

|

10,864

|

|

LSB Industries, Inc. 6.25% 10/15/28 (d)

|

9,723

|

8,896

|

|

|

Olympus Water U.S. Holding Corp.:

|

|||

|

4.25% 10/1/28(d)

|

5,600

|

4,546

|

|

|

7.125% 10/1/27(d)

|

2,905

|

2,767

|

|

|

SCIH Salt Holdings, Inc. 4.875% 5/1/28 (d)

|

3,770

|

3,235

|

|

|

SCIL IV LLC / SCIL U.S.A. Holdings LLC 5.375% 11/1/26 (d)

|

6,435

|

5,454

|

|

|

The Chemours Co. LLC:

|

|||

|

5.375% 5/15/27

|

18,470

|

17,056

|

|

|

5.75% 11/15/28(d)

|

10,075

|

9,050

|

|

|

The Scotts Miracle-Gro Co. 4% 4/1/31

|

5,930

|

4,530

|

|

|

Valvoline, Inc. 4.25% 2/15/30 (d)

|

4,680

|

4,540

|

|

|

W.R. Grace Holding LLC 5.625% 8/15/29 (d)

|

13,095

|

10,571

|

|

|

115,583

|

|||

|

Construction Materials - 0.0%

|

|||

|

Summit Materials LLC/Summit Materials Finance Corp. 5.25% 1/15/29 (d)

|

6,525

|

6,075

|

|

|

Containers & Packaging - 0.6%

|

|||

|

Ardagh Metal Packaging Finance U.S.A. LLC/Ardagh Metal Packaging Finance PLC:

|

|||

|

3.25% 9/1/28(d)

|

3,025

|

2,571

|

|

|

4% 9/1/29(d)

|

6,050

|

4,795

|

|

|

6% 6/15/27(d)

|

2,785

|

2,727

|

|

|

Cascades, Inc.:

|

|||

|

5.125% 1/15/26(d)

|

3,310

|

3,011

|

|

|

5.375% 1/15/28(d)

|

3,310

|

2,898

|

|

|

Clydesdale Acquisition Holdings, Inc.:

|

|||

|

6.625% 4/15/29(d)

|

3,315

|

3,152

|

|

|

8.75% 4/15/30(d)

|

19,065

|

16,319

|

|

|

Crown Cork & Seal, Inc.:

|

|||

|

7.375% 12/15/26

|

16,535

|

17,023

|

|

|

7.5% 12/15/96

|

7,695

|

7,787

|

|

|

Graham Packaging Co., Inc. 7.125% 8/15/28 (d)

|

3,720

|

3,104

|

|

|

Graphic Packaging International, Inc. 3.75% 2/1/30 (d)

|

3,585

|

3,050

|

|

|

Intelligent Packaging Ltd. Finco, Inc. 6% 9/15/28 (d)

|

2,570

|

2,071

|

|

|

Trivium Packaging Finance BV 5.5% 8/15/26 (d)

|

4,195

|

3,845

|

|

|

72,353

|

|||

|

Metals & Mining - 1.0%

|

|||

|

Alcoa Nederland Holding BV:

|

|||

|

4.125% 3/31/29(d)

|

7,735

|

6,862

|

|

|

6.125% 5/15/28(d)

|

2,110

|

2,079

|

|

|

Algoma Steel SCA 0% 12/31/23 (c)

|

1,518

|

0

|

|

|

Arconic Corp.:

|

|||

|

6% 5/15/25(d)

|

4,090

|

4,021

|

|

|

6.125% 2/15/28(d)

|

9,123

|

8,560

|

|

|

ATI, Inc.:

|

|||

|

4.875% 10/1/29

|

2,795

|

2,470

|

|

|

5.125% 10/1/31

|

2,480

|

2,184

|

|

|

Cleveland-Cliffs, Inc.:

|

|||

|

4.625% 3/1/29(d)

|

4,615

|

4,096

|

|

|

4.875% 3/1/31(d)

|

4,615

|

4,075

|

|

|

5.875% 6/1/27

|

11,010

|

10,518

|

|

|

Compass Minerals International, Inc. 6.75% 12/1/27 (d)

|

9,315

|

8,942

|

|

|

Eldorado Gold Corp. 6.25% 9/1/29 (d)

|

4,225

|

3,709

|

|

|

ERO Copper Corp. 6.5% 2/15/30 (d)

|

4,180

|

3,368

|

|

|

First Quantum Minerals Ltd.:

|

|||

|

6.5% 3/1/24(d)

|

6,560

|

6,431

|

|

|

6.875% 3/1/26(d)

|

14,330

|

13,549

|

|

|

7.5% 4/1/25(d)

|

12,105

|

11,778

|

|

|

FMG Resources Pty Ltd.:

|

|||

|

4.375% 4/1/31(d)

|

4,420

|

3,676

|

|

|

4.5% 9/15/27(d)

|

5,450

|

5,028

|

|

|

HudBay Minerals, Inc. 4.5% 4/1/26 (d)

|

3,600

|

3,270

|

|

|

Infrabuild Australia Pty Ltd. 12% 10/1/24 (d)

|

6,320

|

6,130

|

|

|

Kaiser Aluminum Corp. 4.625% 3/1/28 (d)

|

6,615

|

5,772

|

|

|

Mineral Resources Ltd.:

|

|||

|

8% 11/1/27(d)

|

2,785

|

2,848

|

|

|

8.125% 5/1/27(d)

|

11,025

|

11,101

|

|

|

8.5% 5/1/30(d)

|

2,065

|

2,093

|

|

|

Murray Energy Corp.:

|

|||

|

11.25% 12/31/49(c)(d)(e)

|

5,925

|

0

|

|

|

12% 4/15/24 pay-in-kind(c)(d)(e)(f)

|

6,364

|

0

|

|

|

Roller Bearing Co. of America, Inc. 4.375% 10/15/29 (d)

|

2,015

|

1,742

|

|

|

134,302

|

|||

|

Paper & Forest Products - 0.1%

|

|||

|

Glatfelter Corp. 4.75% 11/15/29 (d)

|

4,190

|

2,519

|

|

|

LABL, Inc. 5.875% 11/1/28 (d)

|

6,750

|

5,881

|

|

|

8,400

|

|||

|

TOTAL MATERIALS

|

336,713

|

||

|

REAL ESTATE - 1.4%

|

|||

|

Equity Real Estate Investment Trusts (REITs) - 1.0%

|

|||

|

Iron Mountain Information Management Services, Inc. 5% 7/15/32 (d)

|

4,190

|

3,481

|

|

|

Iron Mountain, Inc.:

|

|||

|

4.875% 9/15/29(d)

|

14,590

|

12,725

|

|

|

5% 7/15/28(d)

|

6,370

|

5,721

|

|

|

5.25% 7/15/30(d)

|

5,915

|

5,140

|

|

|

5.625% 7/15/32(d)

|

5,915

|

5,126

|

|

|

MPT Operating Partnership LP/MPT Finance Corp.:

|

|||

|

3.5% 3/15/31

|

6,700

|

4,593

|

|

|

4.625% 8/1/29

|

10,950

|

8,350

|

|

|

5% 10/15/27

|

21,010

|

17,660

|

|

|

SBA Communications Corp. 3.875% 2/15/27

|

9,720

|

8,782

|

|

|

Uniti Group LP / Uniti Group Finance, Inc.:

|

|||

|

4.75% 4/15/28(d)

|

9,350

|

7,480

|

|

|

6.5% 2/15/29(d)

|

19,535

|

12,942

|

|

|

Uniti Group, Inc.:

|

|||

|

6% 1/15/30(d)

|

6,990

|

4,423

|

|

|

7.875% 2/15/25(d)

|

9,940

|

9,621

|

|

|

VICI Properties LP / VICI Note Co.:

|

|||

|

3.875% 2/15/29(d)

|

6,695

|

5,868

|

|

|

4.25% 12/1/26(d)

|

12,650

|

11,801

|

|

|

4.625% 12/1/29(d)

|

7,220

|

6,570

|

|

|

130,283

|

|||

|

Real Estate Management & Development - 0.4%

|

|||

|

DTZ U.S. Borrower LLC 6.75% 5/15/28 (d)

|

6,575

|