UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2012 |

||

Or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Commission file number 001-11499

WATTS WATER TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

04-2916536 (I.R.S. Employer Identification No.) |

|

815 Chestnut Street, North Andover, MA (Address of Principal Executive Offices) |

01845 (Zip Code) |

Registrant's telephone number, including area code: (978) 688-1811

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

|---|---|---|

| Class A Common Stock, par value $0.10 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of July 1, 2012, the aggregate market value of the registrant's common stock held by non-affiliates of the registrant was approximately $924,049,140 based on the closing sale price as reported on the New York Stock Exchange.

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

| Class | Outstanding at January 31, 2013 | |

|---|---|---|

| Class A Common Stock, $0.10 par value per share | 28,661,416 shares | |

| Class B Common Stock, $0.10 par value per share | 6,588,680 shares |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's Proxy Statement for its Annual Meeting of Stockholders to be held on May 15, 2013, are incorporated by reference into Part III of this Annual Report on Form 10-K.

This Annual Report on Form 10-K contains statements that are not historical facts and are considered forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements contain projections of our future results of operations or our financial position or state other forward-looking information. In some cases you can identify these forward-looking statements by words such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "should," and "would" or similar words. You should not rely on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. These risks, uncertainties and other factors may cause our actual results, performance or achievements to differ materially from the anticipated future results, performance or achievements expressed or implied by the forward-looking statements. Some of the factors that might cause these differences are described under Item 1A—"Risk Factors." You should carefully review all of these factors, and you should be aware that there may be other factors that could cause these differences. These forward-looking statements were based on information, plans and estimates at the date of this report, and, except as required by law, we undertake no obligation to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes.

In this Annual Report on Form 10-K, references to "the Company," "Watts Water," "we," "us" or "our" refer to Watts Water Technologies, Inc. and its consolidated subsidiaries.

Overview

Watts Regulator Co. was founded by Joseph E. Watts in 1874 in Lawrence, Massachusetts. Watts Regulator Co. started as a small machine shop supplying parts to the New England textile mills of the 19th century and grew into a global manufacturer of products and systems focused on the control, conservation and quality of water and the comfort and safety of the people using it. Watts Water Technologies, Inc. was incorporated in Delaware in 1985 and became the parent company of Watts Regulator Co.

Our strategy is to be the leading provider of water quality, water conservation, water safety and water flow control products for the residential and commercial markets in North America and EMEA (Europe, Middle East and Africa) and to expand our presence in Asia. Our primary objective is to grow earnings by increasing sales within existing markets, expanding into new markets, leveraging our distribution channels and customer base, making selected acquisitions, reducing manufacturing costs and advocating for the development and enforcement of industry standards.

We intend to continue to expand organically by introducing products in existing markets, by enhancing our preferred brands, by developing new complementary products, by promoting plumbing code development to drive sales of safety and water quality products and by continually improving merchandising in both the do-it-yourself (DIY) and wholesale distribution channels. We continually target selected new product and geographic markets based on growth potential, including our ability to leverage our existing distribution channels. Additionally, we continually leverage our distribution channels through the introduction of new products, as well as the integration of products of our acquired companies.

We intend to continue to generate incremental growth by targeting selected acquisitions, both in our core markets as well as new complementary markets. We have completed 36 acquisitions since divesting our industrial and oil and gas business in 1999. Our acquisition strategy focuses on businesses that manufacture preferred brand name products that address our themes of water quality, water conservation, water safety, water flow control and comfort and related complementary markets. We target businesses that will provide us with one or more of the following: an entry into new markets, an increase in shelf space with existing customers, strong brand names, a new or improved technology or an expansion of the breadth of our product offerings.

2

We are committed to reducing our manufacturing and operating costs through a combination of manufacturing in lower-cost countries, using Lean and Six Sigma to drive continuous improvement across all key processes, and consolidating our diverse manufacturing operations in North America, EMEA and Asia. We have a number of manufacturing facilities in lower-cost regions such as Mexico, China, Bulgaria and Tunisia. In recent years, we have announced several global restructuring plans to reduce our manufacturing footprint in order to reduce our costs and to realize additional operating efficiencies.

Our products are sold to wholesale distributors and dealers, major DIY chains and original equipment manufacturers (OEMs). Most of our sales are for products that have been approved under regulatory standards incorporated into state and municipal plumbing, heating, building and fire protection codes in North America and Europe. We have consistently advocated for the development and enforcement of plumbing codes and are committed to providing products to meet these standards, particularly for safety and control valve products.

Additionally, a majority of our manufacturing facilities are ISO 9000, 9001 or 9002 certified by the International Organization for Standardization.

Our business is reported in three geographic segments: North America, EMEA and Asia. The contributions of each segment to net sales, operating income and the presentation of certain other financial information by segment are reported in Note 16 of the Notes to Consolidated Financial Statements and in "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this report.

Products

We have a broad range of products in terms of design distinction, size and configuration. We classify our many products into four universal product lines. These product lines are:

- •

- Residential & commercial flow control products—includes products typically sold into plumbing and hot

water applications such as backflow preventers, water pressure regulators, temperature and pressure relief valves, and thermostatic mixing valves. In 2012, 2011 and 2010, residential &

commercial flow control products accounted for approximately 54%, 53% and 51%, respectively, of our total sales.

- •

- HVAC & gas products—includes hydronic and electric heating systems for under-floor radiant

applications, hydronic pump groups for boiler manufacturers and alternative energy control packages, and flexible stainless steel connectors for natural and liquid propane gas in commercial food

service and residential applications. In 2012, 2011 and 2010, HVAC & gas products accounted for approximately 31%, 33% and 34%, respectively, of our total sales. HVAC is an acronym for heating,

ventilation and air conditioning.

- •

- Drains & water re-use products—includes drainage products and engineered rain water

harvesting solutions for commercial, industrial, marine and residential applications. In 2012, 2011 and 2010, drains & water re-use products accounted for approximately 10%, 9% and

10%, respectively, of our total sales.

- •

- Water quality products—includes point-of-use and point-of-entry water filtration, conditioning and scale prevention systems for both commercial and residential applications. Water quality products accounted for approximately 5% of our total sales in each of 2012, 2011 and 2010.

Customers and Markets

We sell our products to plumbing, heating and mechanical wholesale distributors, major DIY chains and OEMs.

Wholesalers. Approximately 63%, 63% and 64% of our sales in 2012, 2011 and 2010, respectively, were to wholesale distributors for commercial and residential applications. We rely on commissioned

3

manufacturers' representatives, some of which maintain a consigned inventory of our products, to market our product lines. Additionally, various water quality products are sold to independent dealers throughout North America.

DIY Chains. Approximately 13%, 13% and 16% of our sales in 2012, 2011 and 2010, respectively, were to DIY chains. Our DIY chains demand less technical products, but are highly receptive to innovative designs and new product ideas.

OEMs. Approximately 24%, 24% and 20% of our sales in 2012, 2011 and 2010, respectively, were to OEMs. In North America, our typical OEM customers are water heater manufacturers and equipment and water systems manufacturers needing flow control devices and other products. Our sales to OEMs in EMEA are primarily to boiler manufacturers and radiant system manufacturers. Our sales to OEMs in Asia are primarily to boiler, water heaters and bath manufacturers including manufacturers of faucet and shower products.

In 2012, 2011 and 2010, no customer accounted for more than 10% of our total net sales. Our top ten customers accounted for approximately $309.3 million, or 21%, of our total net sales in 2012; $290.4 million, or 20%, of our total net sales in 2011; and $273.6 million, or 22%, of our total net sales in 2010. Thousands of other customers constituted the balance of our net sales in each of those years.

Marketing and Sales

For product sales, we rely primarily on commissioned manufacturers' representatives, some of which maintain a consigned inventory of our products. These representatives sell primarily to plumbing and heating wholesalers or service DIY stores in North America. We also sell products for the residential construction and home repair and remodeling industries through DIY plumbing retailers, national catalog distribution companies, hardware stores, building material outlets and retail home center chains and through plumbing and heating wholesalers. In addition, we sell products directly to wholesalers, OEMs and private label accounts in EMEA and to a lesser extent in North America.

Manufacturing

We have integrated and automated manufacturing capabilities, including a brass and bronze foundry, machining, plastic extrusion and injection molding and assembly operations. Our foundry operations include metal pouring systems, automatic core making, brass forging and brass and bronze die-castings. Our machining operations feature computer-controlled machine tools, high-speed chucking machines with robotics and automatic screw machines for machining bronze, brass and steel components. We have invested in recent years to expand our manufacturing capabilities to ensure the availability of the most efficient and productive equipment. In response to the federal Reduction of Lead in Drinking Water Act (see Item 1A. Risk Factors), we expect to commit approximately $20.0 million in capital spending ($7.0 million spent in 2012 and $13.0 million expected to be spent in 2013) for a new foundry and machinery in the U.S. to produce lead free products. The foundry cost and related equipment are expected to be commissioned during the second quarter of 2013. We are committed to maintaining our manufacturing equipment at a level consistent with current technology in order to maintain high levels of quality and manufacturing efficiencies.

Capital expenditures and depreciation for each of the last three years were as follows:

| |

Years Ended December 31, |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2012 | 2011 | 2010 | |||||||

| |

(in millions) |

|||||||||

Capital expenditures |

$ | 30.6 | $ | 22.6 | $ | 24.6 | ||||

Depreciation |

$ | 33.8 | $ | 33.0 | $ | 30.5 | ||||

4

Raw Materials

We require substantial amounts of raw materials to produce our products, including bronze, brass, cast iron, stainless steel, steel, plastic, and components used in products, and substantially all of the raw materials we require are purchased from outside sources. The commodity markets have experienced tremendous volatility over the past several years, particularly with respect to copper. The market prices of many commodities increased throughout 2010. During 2011, spot copper prices increased to historic highs early in the year, and then trended downward in the second half of 2011. The average monthly copper spot price decreased approximately 17.7% from December 2010 to December 2011. In 2012, increases in the first quarter and third quarter were offset by more moderate pricing in the second quarter and fourth quarter. Bronze and brass are copper-based alloys. The fact that we source internationally a significant amount of raw materials means that several months of raw materials and work in process are moving through our business at any point in time. We are not able to predict whether commodity costs, including copper, will significantly increase or decrease in the future. If commodity costs increase in the future and we are not able to reduce or eliminate the effect of the cost increases by reducing production costs or implementing price increases, our profit margins could decrease. If commodity costs were to decline, we may experience pressures from customers to reduce our selling prices. The timing of any price reductions and decreases in commodity costs may not align. As a result, our margins could be affected.

With limited exceptions, we have multiple suppliers for our commodities and other raw materials. We believe our relationships with our key suppliers are good and that an interruption in supply from any one supplier would not materially affect our ability to meet our immediate demands while another supplier is qualified. We regularly review our suppliers to evaluate their strengths. If a supplier is unable to meet our demands, we believe that in most cases our inventory of raw materials will allow for sufficient time to identify and obtain the necessary commodities and other raw materials from an alternate source. We believe that the nature of the commodities and other raw materials used in our business are such that multiple sources are generally available in the market.

Code Compliance

Products representing a majority of our sales are subject to regulatory standards and code enforcement, which typically require that these products meet stringent performance criteria. Standards are established by such industry test and certification organizations as the American Society of Mechanical Engineers (A.S.M.E.), the Canadian Standards Association (C.S.A.), the American Society of Sanitary Engineers (A.S.S.E.), the University of Southern California Foundation for Cross-Connection Control (USC FCC), the International Association of Plumbing and Mechanical Officials (I.A.P.M.O.), Factory Mutual (F.M.), the National Sanitation Foundation (N.S.F.) and Underwriters Laboratory (U.L.). Many of these standards are incorporated into state and municipal plumbing and heating, building and fire protection codes.

National regulatory standards in Europe vary by country. The major standards and/or guidelines that our products must meet are AFNOR (France), DVGW (Germany), UNI/ICIN (Italy), KIWA (Netherlands), SVGW (Switzerland), SITAC (Sweden) and WRAS (United Kingdom). Further, there are local regulatory standards requiring compliance as well.

Together with our commissioned manufacturers' representatives, we have consistently advocated for the development and enforcement of plumbing codes. We maintain stringent quality control and testing procedures at each of our manufacturing facilities in order to manufacture products that comply with code requirements. We believe that product-testing capability and investment in plant and equipment is needed to manufacture products that comply with code requirements. Additionally, a majority of our manufacturing facilities are ISO 9000, 9001 or 9002 certified by the International Organization for Standardization.

5

New Product Development and Engineering

We maintain our own product development staff, design teams, and testing laboratories in North America, EMEA and Asia that work to enhance our existing products and develop new products. We maintain sophisticated product development and testing laboratories. Research and development costs included in selling, general, and administrative expense amounted to $20.7 million, $20.9 million and $18.6 million for the years ended December 31, 2012, 2011 and 2010, respectively.

California, Louisiana, Maryland and Vermont have recently implemented laws that require all pipes, pipe and plumbing fittings and plumbing fixtures sold in those states that convey or dispense water for human consumption to contain no more than 0.25% lead content, which is generally referred to as lead free. On January 4, 2011, the federal government enacted a similar law that will take effect nationwide in January 2014. We have invested considerable resources over the past several years to develop lead free versions of our plumbing products to comply with the new laws, and we have successfully introduced our lead free product offerings in Maryland, California, Louisiana and Vermont. We expect to commit approximately $13 million in capital through the second quarter of 2013 to complete the construction of our new lead free foundry to meet expected lead free demand for our products sold in the U.S.

Complying with these new requirements on a nationwide basis will pose a significant challenge for us. The transition to comply with the expected requirements may cause our material costs to increase as suppliers of alternative lead free metals are currently limited. We may not succeed in passing through these cost increases to our customers. We may also experience technical challenges in our manufacturing process in converting our present manufacturing operations to 100% lead free products. In addition, we could have difficulty providing sufficient quantities of our lead free compliant products to meet nationwide demand and we could be left with potentially obsolete traditional leaded product inventories if customers convert to lead free offerings faster than anticipated.

Competition

The domestic and international markets for water safety and flow control devices are intensely competitive and require us to compete against some companies possessing greater financial, marketing and other resources than ours. Due to the breadth of our product offerings, the number and identities of our competitors vary by product line and market. We consider quality, brand preference, delivery times, engineering specifications, plumbing code requirements, price, technological expertise and breadth of product offerings to be the primary competitive factors. We believe that new product development and product engineering are also important to success in the water industry and that our position in the industry is attributable in part to our ability to develop new and innovative products quickly and to adapt and enhance existing products. We continue to develop new and innovative products to enhance our market position and are continuing to implement manufacturing and design programs to reduce costs. We cannot be certain that our efforts to develop new products will be successful or that our customers will accept our new products. Although we own certain patents and trademarks that we consider to be of importance, we do not believe that our business and competitiveness as a whole are dependent on any one of our patents or trademarks or on patent or trademark protection generally.

Backlog

Backlog was approximately $84.5 million at February 8, 2013. We do not believe that our backlog at any point in time is indicative of future operating results and we expect our entire current backlog to be converted to sales in 2013.

Employees

As of December 31, 2012, we employed approximately 5,900 people worldwide. With the exception of our tekmar subsidiary in Canada, none of our employees in North America or Asia are covered by

6

collective bargaining agreements. In some European countries, our employees are subject to traditional national collective bargaining agreements. We believe that our employee relations are good.

Available Information

We maintain a website with the address www.wattswater.com. The information contained on our website is not included as a part of, or incorporated by reference into, this Annual Report on Form 10-K. Other than an investor's own internet access charges, we make available free of charge through our website our Annual Report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable after we have electronically filed such material with, or furnished such material to, the Securities and Exchange Commission.

Executive Officers and Directors

Set forth below in alphabetical order are the names of our executive officers and directors, their respective ages and positions with our Company and a brief summary of their business experience for at least the past five years:

Executive Officers

|

Age | Position | |||

|---|---|---|---|---|---|

Srinivas K. Bagepalli |

46 | President, North America | |||

J. Dennis Cawte |

62 | Group Managing Director, EMEA | |||

David J. Coghlan |

53 | Chief Executive Officer, President and Director | |||

Dean P. Freeman |

49 | Executive Vice President and Chief Financial Officer | |||

Kenneth R. Lepage |

42 | General Counsel, Executive Vice President of Administration and Secretary | |||

Elie Melhem |

50 | President, Asia | |||

Non-Employee Directors

|

|||||

Robert L. Ayers(2)(3) |

67 | Director | |||

Bernard Baert(1)(3) |

63 | Director | |||

Kennett F. Burnes(1)(3) |

70 | Director | |||

Richard J. Cathcart(2)(3) |

68 | Director | |||

W. Craig Kissel(2)(3) |

62 | Director | |||

John K. McGillicuddy(1)(3) |

69 | Chairman of the Board and Director | |||

Merilee Raines(1)(3) |

57 | Director | |||

- (1)

- Member

of the Audit Committee

- (2)

- Member

of the Compensation Committee

- (3)

- Member of the Nominating and Corporate Governance Committee

Srinivas K. Bagepalli joined our Company in October 2011 and was appointed President, North America. From 2006 to September 2011, Mr. Bagepalli was the President and General Manager of three global companies within Danaher Corporation's Industrial Technologies Group, including Setra Systems, Inc., Sonix, Inc. and Portescap. During his time with Danaher, Mr. Bagepalli also served as the President of Sensors & Controls, Asia. Danaher Corporation is a global business that designs, manufactures and markets professional, medical, industrial, and commercial products and services. Mr. Bagepalli worked for General Electric Company from 1994 to 2006. While with General Electric, Mr. Bagepalli served as the Executive Vice President and Segment Manager at GE Infrastructure Sensing and Inspection Technologies from 2003 to 2006, Manager, Mergers and Acquisitions at GE Industrial Systems from 2001 to 2003, Manager, Business Development: Strategy and Growth at GE Corporate from 2000 to 2001 and Process Integration & Manufacturing Group Leader at GE Corporate Technology Center from 1994 to 1999.

7

J. Dennis Cawte joined our Company in 2001 and was appointed Group Managing Director, EMEA. Prior to joining our Company, he was European President of PCC Valve and Controls, a division of Precision Castparts Corp., a manufacturer of components and castings to the aeronautical industry, from 1999 to 2001. He had also worked for approximately 20 years for Keystone Valve International, a manufacturer and distributor of industrial valves, where his most recent position was the Managing Director Northern Europe, Middle East, Africa and India.

David J. Coghlan was appointed Chief Executive Officer, President and Director in January 2011. He previously served as our Chief Operating Officer from January 2010 to January 2011 and as President of North America and Asia from June 2008 to January 2010. Prior to joining our Company, Mr. Coghlan served as Vice President, Global Parts for Trane Inc., a global manufacturer of commercial and residential heating, ventilation and air conditioning equipment, from April 2004 through May 2008. He also held several management positions within the Climate Control Technologies segment of Ingersoll-Rand Company Limited, a manufacturer of transport temperature control units and refrigerated display merchandisers, from 1995 to December 2003. Before joining Ingersoll-Rand, Mr. Coghlan worked for several years with the management consulting firm of McKinsey & Co. in both the United Kingdom and United States.

Dean P. Freeman joined our Company in October 2012 and was appointed Executive Vice President and Chief Financial Officer in November 2012. Mr. Freeman previously served as Senior Vice President of Finance and Treasurer of Flowserve Corporation from October 2009 to October 2011. Also while at Flowserve, Mr. Freeman served as Vice President, Finance and Chief Financial Officer of the Flowserve Pump Division from 2006 to October 2009. Flowserve is a leading global provider of fluid motion and control products and services, producing engineered and industrial pumps, seals and valves as well as a range of related flow management services. Prior to Flowserve, Mr. Freeman served as Chief Financial Officer, Europe for The Stanley Works Corporation. Mr. Freeman also served in financial executive and management roles of progressive responsibility with United Technologies Corporation and SPX Corporation.

Kenneth R. Lepage was appointed General Counsel and Secretary of the Company in August 2008 and Executive Vice President of Administration in December 2009. Mr. Lepage originally joined our Company in September 2003 as Assistant General Counsel and Assistant Secretary. Prior to joining our Company, he was a junior partner at the law firm of Hale and Dorr LLP (now Wilmer Cutler Pickering Hale and Dorr LLP).

Elie Melhem joined our Company in July 2011 as President, Asia. Mr. Melhem was previously the Managing Director of China for Ariston Thermo Group, a global manufacturer of heating and hot water products, from 2008 to July 2011. Prior to joining Ariston, Mr. Melhem spent eleven years with ITT Industries in China where he held several management positions, including serving as President of ITT's Residential and Commercial Water Group in China and President of ITT's Water Technology Group in Asia.

Robert L. Ayers has served as a director of our Company since October 2006. He was Senior Vice President of ITT Industries and President of ITT Industries' Fluid Technology from October 1999 until September 2005. Mr. Ayers continued to be employed by ITT Industries from September 2005 until his retirement in September 2006, during which time he focused on special projects for the company. Mr. Ayers joined ITT Industries in 1998 as President of ITT Industries' Industrial Pump Group. Before joining ITT Industries, he was President of Sulzer Industrial USA and Chief Executive Officer of Sulzer Bingham, a pump manufacturer. Mr. Ayers served as a director of T-3 Energy Services, Inc. from August 2007 to January 2011.

Bernard Baert was elected as a member of our Board of Directors in August 2011. Mr. Baert has served as Senior Vice President and President, Europe and International of PolyOne Corporation since January 2010. Mr. Baert served as Senior Vice President and General Manager, Color and Engineered Materials—Europe and China for PolyOne Corporation from 2006 to December 2009 and as Vice President and General Manager, Color and Engineered Materials—Europe and China from 2000 to

8

2006. From 1995 to September 2000, Mr. Baert was General Manager, Color—Europe for M.A. Hanna Company, the predecessor to PolyOne Corporation. PolyOne Corporation is a worldwide provider of specialty polymer materials, services and solutions. Prior to joining M.A. Hanna, Mr. Baert was General Manager, Europe for Hexcel Corporation and spent 17 years with Owens Corning where he served as a plant manager and held various positions in the areas of cost control and production.

Kennett F. Burnes became a director of our Company in February 2009. Mr. Burnes is the retired Chairman, President and Chief Executive Officer of Cabot Corporation, a global specialty chemicals company. He was Chairman from 2001 to March 2008, President from 1995 to January 2008 and Chief Executive Officer from 2001 to January 2008. Prior to joining Cabot Corporation in 1987, Mr. Burnes was a partner at the Boston-based law firm of Choate, Hall & Stewart, where he specialized in corporate and business law for nearly 20 years. He is a director of State Street Corporation, a member of the Dana Farber Cancer Institute's Board of Trustees and a board member of the New England Conservatory. Mr. Burnes is also Chairman of the Board of Trustees of the Schepens Eye Research Institute.

Richard J. Cathcart has served as a director of our Company since October 2007. He was Vice Chairman and a member of the Board of Directors of Pentair, Inc. from February 2005 until his retirement in September 2007. Pentair is a diversified manufacturing company consisting of two operating segments: Water Technologies and Technical Products. He was appointed President and Chief Operating Officer of Pentair's Water Technologies Group in January 2001 and served in that capacity until his appointment as Vice Chairman in February 2005. He began his career at Pentair in March 1995 as Executive Vice President, Corporate Development, where he identified water as a strategic area of growth. In February 1996, he was named Executive Vice President and President of Pentair's Water Technologies Group. Prior to joining Pentair, he held several management and business development positions during his 20-year career with Honeywell International Inc. He is a director of Fluidra S.A.

W. Craig Kissel was elected as a member of our Board of Directors in November 2011. Mr. Kissel previously was employed by Trane Inc. (formerly known as American Standard Companies Inc.) from 1980 until his retirement in September 2008. During his time at Trane, Mr. Kissel served as President of Trane Commercial Systems from 2004 to June, 2008, President of WABCO Vehicle Control Systems from 1998 to 2003, President of Trane's North American Unitary Products Group from 1994 to 1997, Vice President of Marketing of Trane's North American Unitary Products Group from 1992 to 1994 and held various other management positions at Trane from 1980 to 1991. Trane is a leading worldwide supplier of air conditioning and heating systems, and WABCO is a leading worldwide supplier of commercial vehicle control systems. From 2001 to 2008, Mr. Kissel served as Chairman of Trane's Corporate Ethics and Integrity Council, which was responsible for developing the company's ethical business standards. Mr. Kissel also served in the U.S. Navy from 1973 to 1978. Mr. Kissel has served as a director of Chicago Bridge & Iron Company since May 2009. Chicago Bridge & Iron Company engineers and constructs some of the world's largest energy infrastructure projects.

John K. McGillicuddy has served as a director of our Company since 2003. He was employed by KPMG LLP, a public accounting firm, from 1965 until his retirement in 2000. He was elected into the Partnership at KPMG LLP in June 1975 where he served as Audit Partner, SEC Reviewing Partner, Partner-in-Charge of Professional Practice, Partner-in-Charge of College Recruiting and Partner-in-Charge of Staff Scheduling. He is a director of Brooks Automation, Inc. and Cabot Corporation.

Merilee Raines has served as a director of our Company since February 2011. Ms. Raines has served as Chief Financial Officer of IDEXX Laboratories, Inc. since October 2003. Prior to becoming Chief Financial Officer, Ms. Raines held several management positions with IDEXX Laboratories, including Corporate Vice President of Finance, Vice President and Treasurer of Finance, Director of Finance, and Controller. IDEXX Laboratories develops, manufactures and distributes diagnostic and information technology-based products and services for companion animals, livestock, poultry, water quality and food safety, and human point-of-care diagnostics. Ms. Raines recently announced that she will be retiring from IDEXX Laboratories in May 2013.

9

Product Liability, Environmental and Other Litigation Matters

We are subject to a variety of potential liabilities connected with our business operations, including potential liabilities and expenses associated with possible product defects or failures and compliance with environmental laws. We maintain product liability and other insurance coverage, which we believe to be generally in accordance with industry practices. Nonetheless, such insurance coverage may not be adequate to protect us fully against substantial damage claims.

Contingencies

Foreign Corrupt Practices Act Settlement

On October 13, 2011, we entered into a settlement with the Securities and Exchange Commission (SEC) to resolve allegations concerning potential violations of the U.S. Foreign Corrupt Practices Act (FCPA) at Watts Valve Changsha Co., Ltd., (CWV), a former indirect wholly-owned subsidiary of Watts Water in China. Under the terms of the settlement, without admitting or denying the SEC's allegations, we consented to entry of an administrative cease-and-desist order under the books and records and internal controls provisions of the FCPA. We also agreed to pay to the SEC $3.6 million in disgorgement and prejudgment interest, and $0.2 million in penalties.

The amounts paid by us in connection with the settlement were fully accrued as of December 31, 2010. We anticipate that this settlement resolves all government investigations concerning CWV's sales practices and potential FCPA violations.

Environmental Remediation

We have been named as a potentially responsible party with respect to a limited number of identified contaminated sites. The levels of contamination vary significantly from site to site as do the related levels of remediation efforts. Environmental liabilities are recorded based on the most probable cost, if known, or on the estimated minimum cost of remediation. Accruals are not discounted to their present value, unless the amount and timing of expenditures are fixed and reliably determinable. We accrue estimated environmental liabilities based on assumptions, which are subject to a number of factors and uncertainties. Circumstances that can affect the reliability and precision of these estimates include identification of additional sites, environmental regulations, level of cleanup required, technologies available, number and financial condition of other contributors to remediation and the time period over which remediation may occur. We recognize changes in estimates as new remediation requirements are defined or as new information becomes available.

Asbestos Litigation

We are defending approximately 42 lawsuits in different jurisdictions, alleging injury or death as a result of exposure to asbestos. The complaints in these cases typically name a large number of defendants and do not identify any particular Watts Water products as a source of asbestos exposure. To date, we have obtained a dismissal in every case before it has reached trial because discovery has failed to yield evidence of substantial exposure to any Watts Water products.

Other Litigation

Other lawsuits and proceedings or claims, arising from the ordinary course of operations, are also pending or threatened against us.

10

Current economic cycles, particularly those involving reduced levels of commercial and residential starts and remodeling, may continue to have an adverse effect on our revenues and operating results.

We have experienced and expect to continue to experience fluctuations in revenues and operating results due to economic and business cycles. The businesses of most of our customers, particularly plumbing and heating wholesalers and home improvement retailers, are cyclical. Therefore, the level of our business activity has been cyclical, fluctuating with economic cycles. The recent economic downturn may also affect the financial stability of our customers, which could affect their ability to pay amounts owed to their vendors, including us. We also believe our level of business activity is influenced by commercial and residential starts and renovation and remodeling, which are, in turn, heavily influenced by interest rates, consumer debt levels, changes in disposable income, employment growth and consumer confidence. The current credit market conditions may prevent commercial and residential builders or developers from obtaining the necessary capital to continue existing projects or to start new projects. This may result in the delay or cancellation of orders from our customers or potential customers and may adversely affect our revenues and our ability to manage inventory levels, collect customer receivables and maintain profitability. Recent conditions in the housing and debt markets caused a significant reduction in commercial and residential starts and renovation and remodeling. These conditions adversely impacted our revenue and profit over the last four to five years. In 2012, U.S. residential markets began to recover, with commercial construction still lagging. Further, sovereign debt concerns within the Euro Zone are negatively impacting the overall economic vitality of the region. If these conditions continue or worsen in the future or if the current U.S. residential recovery were to dissipate, our revenues and profits could decrease or trigger additional goodwill, indefinite-lived intangible assets, or long-lived asset impairments and could have a material effect on our financial condition and results of operations.

We face intense competition and, if we are not able to respond to competition in our markets, our revenues may decrease.

Competitive pressures in our markets could adversely affect our competitive position, leading to a possible loss of market share or a decrease in prices, either of which could result in decreased revenues and profits. We encounter intense competition in all areas of our business. Additionally, we believe our customers are attempting to reduce the number of vendors from which they purchase in order to reduce the size and diversity of their inventories and their transaction costs. To remain competitive, we will need to invest continually in manufacturing, product development, marketing, customer service and support and our distribution networks. We may not have sufficient resources to continue to make such investments and we may be unable to maintain our competitive position. In addition, we anticipate that we may have to reduce the prices of some of our products to stay competitive, potentially resulting in a reduction in the profit margin for, and inventory valuation of, these products. Some of our competitors are based in foreign countries and have cost structures and prices in foreign currencies. Accordingly, currency fluctuations could cause our U.S. dollar costed products to be less competitive than our competitors' products which are priced in other currencies.

Changes in the costs of raw materials could reduce our profit margins. Reductions or interruptions in the supply of components or finished goods from international sources could adversely affect our ability to meet our customer delivery commitments.

We require substantial amounts of raw materials, including bronze, brass, cast iron, steel and plastic, and substantially all of the raw materials we require are purchased from outside sources. The costs of raw materials may be subject to change due to, among other things, interruptions in production by suppliers and changes in exchange rates and worldwide price and demand levels. We typically do not enter into long-term supply agreements. Our inability to obtain supplies of raw materials for our products at favorable costs could have a material adverse effect on our business, financial condition or results of operations by decreasing our profit margins. The commodity markets have experienced

11

tremendous volatility over the past several years, particularly copper. Should commodity costs increase substantially, we may not be able to recover such costs, through selling price increases to our customers or other product cost reductions, which would have a negative effect on our financial results. If commodity costs decline, we may experience pressure from customers to reduce our selling prices. Additionally, we continue to purchase increased levels of components and finished goods from international sources. In limited cases, these components or finished goods are single-sourced. The availability of components and finished goods from international sources could be adversely impacted by, among other things, interruptions in production by suppliers, suppliers' allocations to other purchasers and new laws or regulations.

Government regulations could limit or delay our ability to market or sell our products and could affect raw material sourcing and/or increase our raw material costs.

In January 2011, the President of the United States signed the Reduction of Lead in Drinking Water Act, which will reduce the permissible weighted average lead content in faucets, fittings and valves used in potable water applications from 8% to 0.25% nationwide beginning in January 2014. The new law is consistent with laws that recently went into effect in California, Vermont, Maryland and Louisiana. We have introduced lead free products for sale in California, Vermont, Maryland and Louisiana, and offer a large selection of lead free compliant valves and fittings. Complying with these new requirements on a nationwide basis will pose a significant challenge for us. The transition to comply with the requirements may cause our material costs to increase as suppliers of alternative lead free metals are currently limited. We may not succeed in passing through these cost increases to our customers. We may also experience technical challenges in converting our present manufacturing operations to produce more lead free products. Further, we may experience delays in the expected timing for commissioning our new lead free foundry. In addition, we could have difficulty providing sufficient quantities of our lead free compliant products to meet nationwide demand and we could be left with potentially obsolete traditional leaded product inventories if customers convert to lead free offerings faster than anticipated. These requirements could have a material effect on our financial condition and results of operation.

Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the Dodd-Frank Act) requires the SEC to establish new disclosure and reporting requirements regarding specified minerals originating in the Democratic Republic of the Congo or an adjoining country that are necessary to the functionality or production of products manufactured by companies required to file reports with the SEC. The final rules implementing these requirements, as released recently by the SEC, could affect sourcing at competitive prices and availability in sufficient quantities of minerals used in the manufacture of our products. In addition, because our supply chain is complex, we may face commercial challenges if we are unable to verify sufficiently the origins for all metals used in our products through the due diligence procedures that we implement and otherwise may become obliged to disclose publicly those efforts with regard to conflict minerals. Moreover, we may encounter challenges to satisfy those customers who require that all of the components of our products be certified as conflict free, which could place us at a competitive disadvantage if we are unable to do so.

Implementation of our acquisition strategy may not be successful, which could affect our ability to increase our revenues or our profitability.

One of our strategies is to increase our revenues and profitability and expand our business through acquisitions that will provide us with complementary products and increase market share for our existing product lines. We cannot be certain that we will be able to identify, acquire or profitably manage additional companies or successfully integrate such additional companies without substantial costs, delays or other problems. Also, companies acquired recently and in the future may not achieve revenues, profitability or cash flows that justify our investment in them. We have faced increasing competition for acquisition candidates, which has resulted in significant increases in the purchase prices of many acquisition candidates. This competition, and the resulting purchase price increases, may limit

12

the number of acquisition opportunities available to us, possibly leading to a decrease in the rate of growth of our revenues and profitability. In addition, acquisitions may involve a number of risks, including, but not limited to:

- •

- inadequate internal controls over financial reporting and our ability to bring such controls into compliance with the

requirements of Section 404 of the Sarbanes-Oxley Act of 2002 in a timely manner;

- •

- adverse short-term effects on our reported operating results;

- •

- diversion of management's attention;

- •

- investigations of, or challenges to, acquisitions by competition authorities;

- •

- loss of key personnel at acquired companies;

- •

- unanticipated management or operational problems or legal liabilities; and

- •

- potential goodwill, indefinite-lived intangible assets, or long-lived asset impairment charges.

We are subject to risks related to product defects, which could result in product recalls and could subject us to warranty claims in excess of our warranty provisions or which are greater than anticipated due to the unenforceability of liability limitations.

We maintain strict quality controls and procedures, including the testing of raw materials and safety testing of selected finished products. However, we cannot be certain that our testing will reveal latent defects in our products or the materials from which they are made, which may not become apparent until after the products have been sold into the market. We also cannot be certain that our suppliers will always eliminate latent defects in products we purchase from them. Accordingly, there is a risk that product defects will occur, which could require a product recall. Product recalls can be expensive to implement and, if a product recall occurs during the product's warranty period, we may be required to replace the defective product. In addition, a product recall may damage our relationship with our customers and we may lose market share with our customers. Our insurance policies may not cover the costs of a product recall.

Our standard warranties contain limits on damages and exclusions of liability for consequential damages and for misuse, improper installation, alteration, accident or mishandling while in the possession of someone other than us. We may incur additional operating expenses if our warranty provision does not reflect the actual cost of resolving issues related to defects in our products. If these additional expenses are significant, it could adversely affect our business, financial condition and results of operations.

We face risks from product liability and other lawsuits, which may adversely affect our business.

We have been and expect to continue to be subject to various product liability claims or other lawsuits, including, among others, that our products include inadequate or improper instructions for use or installation, or inadequate warnings concerning the effects of the failure of our products. If we do not have adequate insurance or contractual indemnification, damages from these claims would have to be paid from our assets and could have a material adverse effect on our results of operations, liquidity and financial condition. Like other manufacturers and distributors of products designed to control and regulate fluids and gases, we face an inherent risk of exposure to product liability claims and other lawsuits in the event that the use of our products results in personal injury, property damage or business interruption to our customers. Although we maintain strict quality controls and procedures, including the testing of raw materials and safety testing of selected finished products, we cannot be certain that our products will be completely free from defect. In addition, in certain cases, we rely on third-party manufacturers for our products or components of our products. Although we have product liability and general insurance coverage, we cannot be certain that this insurance coverage will continue to be available to us at a reasonable cost, or, if available, will be adequate to cover any such liabilities.

13

For more information, see "Item 1. Business—Product Liability, Environmental and Other Litigation Matters."

Economic and other risks associated with international sales and operations could adversely affect our business and future operating results.

Since we sell and manufacture our products worldwide, our business is subject to risks associated with doing business internationally. Our business and future operating results could be harmed by a variety of factors, including:

- •

- unexpected geo-political events in foreign countries in which we operate, which could adversely affect

manufacturing and our ability to fulfill customer orders. Although our manufacturing operations have not been materially affected to date, we can give no assurance that future operations will not be

adversely affected by unforeseen political events in foreign countries;

- •

- trade protection measures and import or export licensing requirements, which could increase our costs of doing business

internationally;

- •

- potentially negative consequences from changes in tax laws, which could have an adverse impact on our profits;

- •

- difficulty in staffing and managing widespread operations, which could reduce our productivity;

- •

- costs of compliance with differing labor regulations, especially in connection with restructuring our overseas operations;

- •

- laws of some foreign countries, which may not protect our intellectual property rights to the same extent as the laws of

the United States;

- •

- unexpected changes in regulatory requirements, which may be costly and require time to implement; and

- •

- foreign exchange rate fluctuations, which could also materially affect our reported results. A portion of our sales and certain portions of our costs, assets and liabilities are denominated in currencies other than U.S. dollars, and the percentage of our revenues denominated in a particular currency may not match the percentage of our expenses denominated in that currency. Approximately 48.3% of our sales during the year ended December 31, 2012 were from sales outside of the U.S. compared to 48.7% for the year ended December 31, 2011. We cannot predict whether currencies such as the Euro, Canadian dollar or Chinese yuan will appreciate or depreciate against the U.S. dollar in future periods or whether future foreign exchange rate fluctuations will have a positive or negative impact on our reported results.

Our ability to achieve savings through our restructuring plans may be adversely affected by local regulations or factors beyond the control of management.

We have implemented a number of restructuring plans, which include steps that we believe are necessary to reduce operating costs and increase efficiencies throughout our manufacturing, sales and distribution footprint. Although we have considered the impact of local regulations, negotiations with employee representatives, the timing of capital expenditures necessary to prepare facilities and the related costs associated with these activities, factors beyond the control of management may affect the timing and therefore affect when the savings will be achieved under the plans. Further, if we are not successful in completing the restructuring projects in the time frames contemplated or if additional issues arise during the projects that add costs or disrupt customer service, then our operating results could be negatively affected.

14

Future operating results could be negatively affected by the resolution of various uncertain tax positions and by potential changes to tax incentives.

In the ordinary course of our business, there are many transactions and calculations where the ultimate tax determination is uncertain. Significant judgment is required in determining our worldwide provision for income taxes. We periodically assess our exposures related to our worldwide provision for income taxes and believe that we have appropriately accrued taxes for contingencies. Any reduction of these contingent liabilities or additional assessment would increase or decrease income, respectively, in the period such determination was made. Our income tax filings are regularly under audit by tax authorities and the final determination of tax audits could be materially different than that which is reflected in historical income tax provisions and accruals. As issues arise during tax audits we adjust our tax accrual accordingly. Additionally, we benefit from certain tax incentives offered by various jurisdictions. If we are unable to meet the requirements of such incentives, our inability to use these benefits could have a material negative effect on future earnings.

We are currently a decentralized company, which presents certain risks.

We are currently a decentralized company, which sometimes places significant control and decision-making powers in the hands of local management. This presents various risks such as the risk of being slower to identify or react to problems affecting a key business. Additionally, we are implementing in a phased approach a company-wide initiative to selectively standardize and upgrade our enterprise resource planning (ERP) systems. This initiative could be more challenging and costly to implement because divergent legacy systems currently exist. Further, if the ERP updates are not successful, we could incur substantial business interruption, including our ability to perform routine business transactions, which could have a material adverse effect on our financial results.

The requirements to evaluate goodwill, indefinite-lived intangible assets and long-lived assets for impairment may result in a write-off of all or a portion of our recorded amounts, which would negatively affect our operating results and financial condition.

As of December 31, 2012, our balance sheet included goodwill, indefinite-lived intangible assets, amortizable intangible assets and property, plant and equipment of $508.2 million, $41.8 million, $104.8 million, and $223.6 million, respectively. In lieu of amortization, we are required to perform an annual impairment review of both goodwill and indefinite-lived intangible assets. In performing our annual reviews in both 2012 and 2011, we recognized non-cash pre-tax charges of approximately $0.4 million and $1.4 million, respectively, as impairments of the indefinite-lived intangible assets. In 2012 and 2011, we recognized pre-tax non-cash goodwill impairment charges of $1.0 million and $1.2 million related to our Blue Ridge Atlantic Enterprises, Inc. (BRAE) reporting unit within our North America segment. We are also required to perform an impairment review of our long-lived assets if indicators of impairment exist. In 2012, we recognized a pre-tax non-cash charge of $1.6 million to write down long-term assets. In 2011, we recognized pre-tax non-cash long-lived asset impairment charges of $14.8 million related to our Austroflex Rohr-Isoliersysteme GmbH (Austroflex) operations within our EMEA segment. There can be no assurances that future goodwill, indefinite-lived intangible assets or other long-lived asset impairments will not occur. We perform our annual test for indications of goodwill and indefinite-lived intangible assets impairment in the fourth quarter of our fiscal year or sooner if indicators of impairment exist.

The loss or financial instability of a major customer could have an adverse effect on our results of operations.

In 2012, our top ten customers accounted for approximately 21% of our total net sales with no one customer accounting for more than 10% of our total net sales. Our customers generally are not obligated to purchase any minimum volume of products from us and are able to terminate their relationships with us at any time. In addition, increases in the prices of our products could result in a reduction in orders from our customers. A significant reduction in orders from, or change in terms of contracts with, any significant customers could have a material adverse effect on our future results of

15

operations. Furthermore, some of our major customers are facing financial challenges due to market declines and heavy debt levels; should these challenges become acute, our results could be materially adversely affected due to reduced orders and/or payment delays or defaults.

Certain indebtedness may limit our ability to pay dividends, incur additional debt and make acquisitions and other investments.

Our revolving credit facility and other senior indebtedness contain operational and financial covenants that restrict our ability to make distributions to stockholders, incur additional debt and make acquisitions and other investments unless we satisfy certain financial tests and comply with various financial ratios. If we do not maintain compliance with these covenants, our creditors could declare a default under our revolving credit facility or senior notes and our indebtedness could be declared immediately due and payable. Our ability to comply with the provisions of our indebtedness may be affected by changes in economic or business conditions beyond our control. Further, one of our strategies is to increase our revenues and profitability and expand our business through acquisitions. We may require capital in excess of our available cash and the unused portion of our revolving credit facility to make large acquisitions, which we would generally obtain from access to the credit markets. There can be no assurance that if a large acquisition is identified that we would have access to sufficient capital to complete such acquisition. Given the current condition of the credit markets, should we require additional debt financing above our existing credit limit, we cannot be assured such financing would be available to us or available to us on reasonable economic terms.

A break-up of the Euro Zone and its common currency could have a material effect on our business prospects, operations, financial condition and cash flow.

Approximately 40% of our annualized consolidated sales are generated in the Euro Zone. Sovereign debt concerns within certain European countries could precipitate a break-up of the Euro Zone. Leaders from key European countries have proposed solutions to the issue, but a comprehensive program addressing all pan European concerns has not yet been identified. There are a number of scenarios that could occur as to which countries may leave the Euro Zone and its single currency. A sovereign country's decision to exit the Euro Zone would, among other things, trigger a redenomination of monetary assets and liabilities into a new national currency, interrupt that country's banking system and could affect various commercial contracts that were written assuming a standard Eurocurrency. We would be exposed to potential devaluation of our asset base and our operating results, we could experience liquidity issues within a given country and we could be subject to disputes over business transactions with various third parties over how contractual obligations should be settled. We cannot be assured that the Euro Zone will continue as presently constructed nor can we determine the breadth and scope of a potential break-up of the Euro Zone.

One of our stockholders can exercise substantial influence over our Company.

Our Class B Common Stock entitles its holders to ten votes for each share and our Class A Common Stock entitles its holders to one vote per share. As of January 31, 2013, Timothy P. Horne beneficially owned approximately 18.6% of our outstanding shares of Class A Common Stock (assuming conversion of all shares of Class B Common Stock beneficially owned by Mr. Horne into Class A Common Stock) and approximately 99.2% of our outstanding shares of Class B Common Stock, which represents approximately 69.2% of the total outstanding voting power. As long as Mr. Horne controls shares representing at least a majority of the total voting power of our outstanding stock, Mr. Horne will be able to unilaterally determine the outcome of most stockholder votes, and other stockholders will not be able to affect the outcome of any such votes.

16

Conversion and sale of a significant number of shares of our Class B Common Stock could adversely affect the market price of our Class A Common Stock.

As of January 31, 2013, there were outstanding 28,661,416 shares of our Class A Common Stock and 6,588,680 shares of our Class B Common Stock. Shares of our Class B Common Stock may be converted into Class A Common Stock at any time on a one for one basis. Under the terms of a registration rights agreement with respect to outstanding shares of our Class B Common Stock, the holders of our Class B Common Stock have rights with respect to the registration of the underlying Class A Common Stock. Under these registration rights, the holders of Class B Common Stock may require, on up to two occasions that we register their shares for public resale. If we are eligible to use Form S-3 or a similar short-form registration statement, the holders of Class B Common Stock may require that we register their shares for public resale up to two times per year. If we elect to register any shares of Class A Common Stock for any public offering, the holders of Class B Common Stock are entitled to include shares of Class A Common Stock into which such shares of Class B Common Stock may be converted in such registration. However, we may reduce the number of shares proposed to be registered in view of market conditions. We will pay all expenses in connection with any registration, other than underwriting discounts and commissions. If all of the available registered shares are sold into the public market the trading price of our Class A Common Stock could decline.

Item 1B. UNRESOLVED STAFF COMMENTS.

None.

As of December 31, 2012, we maintained approximately 32 principal manufacturing, warehouse and distribution centers worldwide, including our corporate headquarters located in North Andover, Massachusetts. Additionally, we maintain numerous sales offices and other smaller manufacturing facilities and warehouses. The principal properties in each of our three geographic segments and their location, principal use and ownership status are set forth below:

North America:

Location

|

Principal Use | Owned/Leased | ||

|---|---|---|---|---|

| North Andover, MA | Corporate Headquarters | Owned | ||

| Burlington, ON, Canada | Distribution | Owned | ||

| Chesnee, SC | Manufacturing | Owned | ||

| Export, PA | Manufacturing | Owned | ||

| Franklin, NH | Manufacturing/Distribution | Owned | ||

| Kansas City, KS | Manufacturing | Owned | ||

| St. Pauls, NC | Manufacturing | Owned | ||

| San Antonio, TX | Warehouse/Distribution | Owned | ||

| Spindale, NC | Distribution Center | Owned | ||

| Kansas City, MO | Manufacturing/Distribution | Leased | ||

| Peoria, AZ | Manufacturing/Distribution | Leased | ||

| Reno, NV | Distribution Center | Leased | ||

| Springfield, MO | Manufacturing/Distribution | Leased | ||

| Vernon, BC, Canada | Manufacturing/Distribution | Leased | ||

| Woodland, CA | Manufacturing | Leased |

17

Europe, Middle East and Africa:

Location

|

Principal Use | Owned/Leased | ||

|---|---|---|---|---|

| Eerbeek, Netherlands | EMEA Headquarters/Manufacturing | Owned | ||

| Biassono, Italy | Manufacturing/Distribution | Owned | ||

| Hautvillers, France | Manufacturing | Owned | ||

| Landau, Germany | Manufacturing/Distribution | Owned | ||

| Mery, France | Manufacturing | Owned | ||

| Plovdiv, Bulgaria | Manufacturing | Owned | ||

| Vildjberg, Denmark | Manufacturing/Distribution | Owned | ||

| Virey-Le-Grand, France | Manufacturing/Distribution | Owned | ||

| Gardolo, Italy | Manufacturing | Leased | ||

| Gödersdorf, Austria | Manufacturing/Distribution | Leased | ||

| Monastir, Tunisia | Manufacturing | Leased | ||

| Rosières, France | Manufacturing/Distribution | Leased | ||

| Sorgues, France | Distribution Center | Leased |

Asia:

Location

|

Principal Use | Owned/Leased | |||

|---|---|---|---|---|---|

| Shanghai, China | Asian Headquarters | Leased | |||

| Ningbo, Beilun District, China | Distribution Center | Leased | |||

| Ningbo, Beilun, China | Manufacturing | Owned | |||

| Taizhou, Yuhuan, China | Manufacturing | Owned | |||

Certain of our facilities are subject to mortgages and collateral assignments under loan agreements with long-term lenders. In general, we believe that our properties, including machinery, tools and equipment, are in good condition, well maintained and adequate and suitable for their intended uses.

We are from time to time involved in various legal and administrative proceedings. See Item 1. "Business—Product Liability, Environmental and Other Litigation Matters," which is incorporated herein by reference and see Note 14.

Item 4. MINE SAFETY DISCLOSURES.

Not applicable.

18

Item 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

The following table sets forth the high and low sales prices of our Class A Common Stock on the New York Stock Exchange during 2012 and 2011 and cash dividends paid per share.

| |

2012 | 2011 | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

High | Low | Dividend | High | Low | Dividend | |||||||||||||

First Quarter |

$ | 42.38 | $ | 34.97 | $ | 0.11 | $ | 40.75 | $ | 34.91 | $ | 0.11 | |||||||

Second Quarter |

41.59 | 31.61 | 0.11 | 39.04 | 32.13 | 0.11 | |||||||||||||

Third Quarter |

40.29 | 30.88 | 0.11 | 36.95 | 24.49 | 0.11 | |||||||||||||

Fourth Quarter |

43.39 | 36.45 | 0.11 | 38.27 | 24.31 | 0.11 | |||||||||||||

There is no established public trading market for our Class B Common Stock, which is held by members of the Horne family. The principal holders of such stock are subject to restrictions on transfer with respect to their shares. Each share of our Class B Common Stock (10 votes per share) is convertible into one share of Class A Common Stock (1 vote per share).

On February 19, 2013, we declared a quarterly dividend of eleven cents ($0.11) per share on each outstanding share of Class A Common Stock and Class B Common Stock.

Aggregate common stock dividend payments in 2012 were $16.0 million, which consisted of $13.0 million and $3.0 million for Class A shares and Class B shares, respectively. Aggregate common stock dividend payments in 2011 were $16.3 million, which consisted of $13.3 million and $3.0 million for Class A shares and Class B shares, respectively. While we presently intend to continue to pay comparable cash dividends, the payment of future cash dividends depends upon the Board of Directors' assessment of our earnings, financial condition, capital requirements and other factors.

The number of record holders of our Class A Common Stock as of January 31, 2013 was 200. The number of record holders of our Class B Common Stock as of January 31, 2013 was 8.

We satisfy the minimum withholding tax obligation due upon the vesting of shares of restricted stock and the conversion of restricted stock units into shares of Class A Common Stock by automatically withholding from the shares being issued a number of shares with an aggregate fair market value on the date of such vesting or conversion that would satisfy the withholding amount due.

The following table includes information with respect to shares of our Class A Common Stock withheld to satisfy withholding obligations during the quarter ended December 31, 2012.

Issuer Purchases of Equity Securities

Period

|

(a) Total Number of Shares (or Units) Purchased |

(b) Average Price Paid per Share (or Unit) |

(c) Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs |

(d) Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

October 1, 2012 - October 28, 2012 |

275 | $ | 38.07 | — | — | ||||||||

October 29, 2012 - November 25, 2012 |

— | — | — | — | |||||||||

November 26, 2012 - December 31, 2012 |

4,311 | $ | 41.19 | — | — | ||||||||

Total |

4,586 | $ | 41.01 | — | — | ||||||||

19

Performance Graph

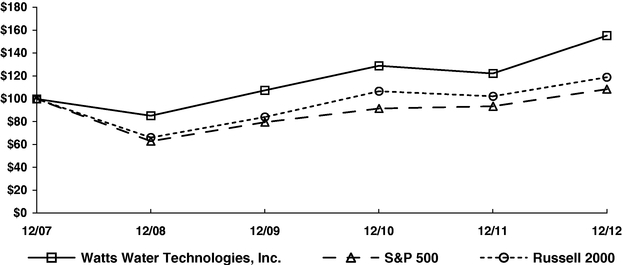

Set forth below is a line graph comparing the cumulative total shareholder return on our Class A Common Stock for the last five years with the cumulative return of companies on the Standard & Poor's 500 Stock Index and the Russell 2000 Index. We chose the Russell 2000 Index because it represents companies with a market capitalization similar to that of Watts Water. The graph assumes that the value of the investment in our Class A Common Stock and each index was $100 at December 31, 2007 and that all dividends were reinvested.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Watts Water Technologies, Inc., the S&P 500 Index

and the Russell 2000 Index

- *

- $100 invested on 12/31/07 in stock or index, including reinvestment of dividends. Fiscal year ending December 31.

| |

12/31/07 | 12/31/08 | 12/31/09 | 12/31/10 | 12/31/11 | 12/31/12 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Watts Water Technologies, Inc |

100.00 | 85.31 | 107.60 | 129.13 | 122.35 | 155.58 | |||||||||||||

S & P 500 |

100.00 | 63.00 | 79.67 | 91.67 | 93.61 | 108.59 | |||||||||||||

Russell 2000 |

100.00 | 66.21 | 84.20 | 106.82 | 102.36 | 119.09 | |||||||||||||

The above Performance Graph and related information shall not be deemed "soliciting material" or to be "filed" with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing.

20

Item 6. SELECTED FINANCIAL DATA.

The selected financial data set forth below should be read in conjunction with our consolidated financial statements, related Notes thereto and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included herein.

FIVE-YEAR FINANCIAL SUMMARY

(Amounts in millions, except per share and cash dividend information)

| |

Year Ended 12/31/12(1)(6) |

Year Ended 12/31/11(2)(6) |

Year Ended 12/31/10(3)(6) |

Year Ended 12/31/09(4)(6) |

Year Ended 12/31/08(5)(6) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Statement of operations data: |

||||||||||||||||

Net sales |

$ | 1,445.6 | $ | 1,428.1 | $ | 1,274.6 | $ | 1,225.9 | $ | 1,431.4 | ||||||

Net income from continuing operations |

70.6 | 64.4 | 63.1 | 41.0 | 45.2 | |||||||||||

Income (loss) from discontinued operations, net of taxes |

(2.2 | ) | 2.0 | (4.3 | ) | (23.6 | ) | 1.4 | ||||||||

Net income |

68.4 | 66.4 | 58.8 | 17.4 | 46.6 | |||||||||||

DILUTED EPS |

||||||||||||||||

Income (loss) per share: |

||||||||||||||||

Continuing operations |

1.96 | 1.72 | 1.69 | 1.10 | 1.23 | |||||||||||

Discontinued operations |

(0.06 | ) | 0.05 | (0.12 | ) | (0.63 | ) | 0.04 | ||||||||

NET INCOME |

1.90 | 1.78 | 1.57 | 0.47 | 1.26 | |||||||||||

Cash dividends declared per common share |

$ | 0.44 | $ | 0.44 | $ | 0.44 | $ | 0.44 | $ | 0.44 | ||||||

Balance sheet data (at year end): |

||||||||||||||||

Total assets |

$ | 1,709.0 | $ | 1,694.0 | $ | 1,646.1 | $ | 1,599.2 | $ | 1,660.1 | ||||||

Long-term debt, net of current portion |

$ | 307.5 | $ | 397.4 | $ | 378.0 | $ | 304.0 | $ | 409.8 | ||||||

- (1)

- For

the year ended December 31, 2012, net income from continuing operations includes the following net pre-tax costs: restructuring

charges of $5.3 million, goodwill and other long-lived asset impairment of $3.4 million, net legal and customs costs of $2.5 million, an adjustment to the gain on sale

of Tianjin Watts Valve Company Ltd. (TWVC) of $1.6 million, retention charges related to our former Chief Financial Officer of $1.5 million, and a charge of $0.4 million

for costs related to the 2012 acquisition of tekmar, offset by a pre-tax gain for an earn-out adjustment of $1.0 million. Additionally, net income includes tax benefits

totaling $0.7 million, primarily related to a tax law change in Italy. The net after-tax cost of these items was $8.0 million.

- (2)

- For

the year ended December 31, 2011, net income includes the following net pre-tax costs: restructuring charges of $10.0 million,

intangibles and goodwill impairment charges of $17.4 million, pension curtailment charges of $1.5 million, separation costs related to our former Chief Executive Officer of

$6.3 million, and costs related to our acquisition of Danfoss Socla S.A.S (Socla) in France of $5.8 million offset by pre-tax gains of $1.2 million for an