kbh-202011300000795266FALSE2020FYus-gaap:AccountingStandardsUpdate201409MemberP2YP2YP3Yus-gaap:OtherAssetsus-gaap:AccountsPayableAndAccruedLiabilitiesCurrentAndNoncurrent0.80.40.7us-gaap:AccountsPayableAndAccruedLiabilitiesCurrentAndNoncurrentus-gaap:AccountsPayableAndAccruedLiabilitiesCurrentAndNoncurrent0.30.30.40.7P2Y0.10.70.90.30.90.300007952662019-12-012020-11-300000795266us-gaap:CommonStockMember2019-12-012020-11-300000795266us-gaap:RightsMember2019-12-012020-11-30iso4217:USD00007952662020-05-31xbrli:shares00007952662020-12-310000795266us-gaap:SubsequentEventMember2020-12-3100007952662018-12-012019-11-3000007952662017-12-012018-11-300000795266us-gaap:HomeBuildingMember2019-12-012020-11-300000795266us-gaap:HomeBuildingMember2018-12-012019-11-300000795266us-gaap:HomeBuildingMember2017-12-012018-11-300000795266us-gaap:FinancialServiceMember2019-12-012020-11-300000795266us-gaap:FinancialServiceMember2018-12-012019-11-300000795266us-gaap:FinancialServiceMember2017-12-012018-11-30iso4217:USDxbrli:shares0000795266us-gaap:HomeBuildingMember2020-11-300000795266us-gaap:HomeBuildingMember2019-11-300000795266us-gaap:FinancialServiceMember2020-11-300000795266us-gaap:FinancialServiceMember2019-11-3000007952662020-11-3000007952662019-11-300000795266us-gaap:CommonStockMember2017-11-300000795266us-gaap:TrustForBenefitOfEmployeesMember2017-11-300000795266us-gaap:TreasuryStockMember2017-11-300000795266us-gaap:AdditionalPaidInCapitalMember2017-11-300000795266us-gaap:RetainedEarningsMember2017-11-300000795266us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-11-3000007952662017-11-300000795266us-gaap:RetainedEarningsMember2017-12-012018-11-300000795266us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-012018-11-300000795266us-gaap:CommonStockMember2017-12-012018-11-300000795266us-gaap:AdditionalPaidInCapitalMember2017-12-012018-11-300000795266us-gaap:TrustForBenefitOfEmployeesMember2017-12-012018-11-300000795266us-gaap:TreasuryStockMember2017-12-012018-11-300000795266us-gaap:CommonStockMember2018-11-300000795266us-gaap:TrustForBenefitOfEmployeesMember2018-11-300000795266us-gaap:TreasuryStockMember2018-11-300000795266us-gaap:AdditionalPaidInCapitalMember2018-11-300000795266us-gaap:RetainedEarningsMember2018-11-300000795266us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-11-3000007952662018-11-300000795266srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2018-11-300000795266srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-11-300000795266us-gaap:RetainedEarningsMember2018-12-012019-11-300000795266us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-012019-11-300000795266us-gaap:CommonStockMember2018-12-012019-11-300000795266us-gaap:AdditionalPaidInCapitalMember2018-12-012019-11-300000795266us-gaap:TrustForBenefitOfEmployeesMember2018-12-012019-11-300000795266us-gaap:TreasuryStockMember2018-12-012019-11-300000795266us-gaap:CommonStockMember2019-11-300000795266us-gaap:TrustForBenefitOfEmployeesMember2019-11-300000795266us-gaap:TreasuryStockMember2019-11-300000795266us-gaap:AdditionalPaidInCapitalMember2019-11-300000795266us-gaap:RetainedEarningsMember2019-11-300000795266us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-11-300000795266us-gaap:AccountingStandardsUpdate201602Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2019-11-300000795266us-gaap:AccountingStandardsUpdate201602Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-11-300000795266us-gaap:RetainedEarningsMember2019-12-012020-11-300000795266us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-012020-11-300000795266us-gaap:CommonStockMember2019-12-012020-11-300000795266us-gaap:TreasuryStockMember2019-12-012020-11-300000795266us-gaap:AdditionalPaidInCapitalMember2019-12-012020-11-300000795266us-gaap:TrustForBenefitOfEmployeesMember2019-12-012020-11-300000795266us-gaap:CommonStockMember2020-11-300000795266us-gaap:TrustForBenefitOfEmployeesMember2020-11-300000795266us-gaap:TreasuryStockMember2020-11-300000795266us-gaap:AdditionalPaidInCapitalMember2020-11-300000795266us-gaap:RetainedEarningsMember2020-11-300000795266us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-11-3000007952662019-09-012019-11-30utr:Rate00007952662020-06-012020-08-310000795266us-gaap:EmployeeSeveranceMember2020-03-012020-05-310000795266kbh:ComputerEquipmentIncludingCapitalizedSoftwareMembersrt:MinimumMember2019-12-012020-11-300000795266srt:MaximumMemberkbh:ComputerEquipmentIncludingCapitalizedSoftwareMember2019-12-012020-11-300000795266srt:MinimumMemberkbh:ModelFurnishingsandSalesOfficeImprovementsMember2019-12-012020-11-300000795266srt:MaximumMemberkbh:ModelFurnishingsandSalesOfficeImprovementsMember2019-12-012020-11-300000795266srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2019-12-012020-11-300000795266srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2019-12-012020-11-30xbrli:pure0000795266us-gaap:HomeBuildingMemberus-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMember2019-12-012020-11-300000795266us-gaap:HomeBuildingMemberus-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMember2018-12-012019-11-300000795266srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2018-12-0100007952662019-12-010000795266srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2019-12-01kbh:segment0000795266kbh:FinancialServicesMember2019-12-012020-11-300000795266kbh:KBHSLLCMemberkbh:StearnsLendingLLCMember2020-11-300000795266us-gaap:HomeBuildingMemberkbh:WestCoastMember2019-12-012020-11-300000795266us-gaap:HomeBuildingMemberkbh:WestCoastMember2018-12-012019-11-300000795266us-gaap:HomeBuildingMemberkbh:WestCoastMember2017-12-012018-11-300000795266us-gaap:HomeBuildingMemberkbh:SouthwestMember2019-12-012020-11-300000795266us-gaap:HomeBuildingMemberkbh:SouthwestMember2018-12-012019-11-300000795266us-gaap:HomeBuildingMemberkbh:SouthwestMember2017-12-012018-11-300000795266us-gaap:HomeBuildingMemberkbh:CentralMember2019-12-012020-11-300000795266us-gaap:HomeBuildingMemberkbh:CentralMember2018-12-012019-11-300000795266us-gaap:HomeBuildingMemberkbh:CentralMember2017-12-012018-11-300000795266kbh:SoutheastMemberus-gaap:HomeBuildingMember2019-12-012020-11-300000795266kbh:SoutheastMemberus-gaap:HomeBuildingMember2018-12-012019-11-300000795266kbh:SoutheastMemberus-gaap:HomeBuildingMember2017-12-012018-11-300000795266us-gaap:HomeBuildingMemberus-gaap:CorporateAndOtherMember2019-12-012020-11-300000795266us-gaap:HomeBuildingMemberus-gaap:CorporateAndOtherMember2018-12-012019-11-300000795266us-gaap:HomeBuildingMemberus-gaap:CorporateAndOtherMember2017-12-012018-11-300000795266us-gaap:HomeBuildingMemberkbh:WestCoastMember2020-11-300000795266us-gaap:HomeBuildingMemberkbh:WestCoastMember2019-11-300000795266us-gaap:HomeBuildingMemberkbh:SouthwestMember2020-11-300000795266us-gaap:HomeBuildingMemberkbh:SouthwestMember2019-11-300000795266us-gaap:HomeBuildingMemberkbh:CentralMember2020-11-300000795266us-gaap:HomeBuildingMemberkbh:CentralMember2019-11-300000795266kbh:SoutheastMemberus-gaap:HomeBuildingMember2020-11-300000795266kbh:SoutheastMemberus-gaap:HomeBuildingMember2019-11-300000795266us-gaap:HomeBuildingMemberus-gaap:CorporateAndOtherMember2020-11-300000795266us-gaap:HomeBuildingMemberus-gaap:CorporateAndOtherMember2019-11-300000795266kbh:ConvertibleSeniorNotesDueTwoThousandNineteenAtOnePointThreeSevenFivePercentMemberMember2013-01-290000795266us-gaap:LandMember2017-12-012018-11-300000795266us-gaap:LandMember2019-12-012020-11-300000795266us-gaap:LandMember2018-12-012019-11-30kbh:property0000795266srt:MinimumMember2019-12-012020-11-300000795266srt:MaximumMember2019-12-012020-11-300000795266srt:MinimumMember2018-12-012019-11-300000795266srt:MaximumMember2018-12-012019-11-300000795266srt:MinimumMember2017-12-012018-11-300000795266srt:MaximumMember2017-12-012018-11-30kbh:delivery0000795266us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-11-300000795266us-gaap:EstimateOfFairValueFairValueDisclosureMember2019-11-300000795266us-gaap:EstimateOfFairValueFairValueDisclosureMember2018-11-300000795266kbh:LandOptionContractAbandonmentMember2019-12-012020-11-300000795266kbh:LandOptionContractAbandonmentMember2018-12-012019-11-300000795266kbh:LandOptionContractAbandonmentMember2017-12-012018-11-30kbh:joint_venture0000795266us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2019-11-300000795266us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2020-11-300000795266kbh:NonVIELandOptionContractsAndOtherSimilarContractsMember2020-11-300000795266kbh:NonVIELandOptionContractsAndOtherSimilarContractsMember2019-11-300000795266us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2019-12-012020-11-300000795266us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2018-12-012019-11-300000795266us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2017-12-012018-11-300000795266us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2020-11-300000795266us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2019-11-300000795266us-gaap:ComputerEquipmentMember2020-11-300000795266us-gaap:ComputerEquipmentMember2019-11-300000795266kbh:ModelFurnishingAndSalesOfficeImprovementsMember2020-11-300000795266kbh:ModelFurnishingAndSalesOfficeImprovementsMember2019-11-300000795266kbh:LeaseholdImprovementsOfficeFurnitureAndEquipmentMember2020-11-300000795266kbh:LeaseholdImprovementsOfficeFurnitureAndEquipmentMember2019-11-300000795266us-gaap:StateAndLocalJurisdictionMember2018-12-012019-11-300000795266us-gaap:StateAndLocalJurisdictionMember2017-12-012018-11-3000007952662019-03-012019-05-3100007952662019-12-012020-02-2900007952662020-08-310000795266srt:MaximumMember2020-11-3000007952662017-12-012018-02-2800007952662018-09-012018-11-300000795266srt:ScenarioForecastMember2021-12-012022-11-300000795266srt:ScenarioForecastMember2022-11-300000795266kbh:TaxCreditCarryforwardExpiringIn2038Member2019-12-012020-11-300000795266us-gaap:StateAndLocalJurisdictionMember2020-11-300000795266kbh:MortgagesAndLandContractsDueToLandSellersAndOtherLoansMembersrt:MinimumMember2020-11-300000795266srt:MaximumMemberkbh:MortgagesAndLandContractsDueToLandSellersAndOtherLoansMember2020-11-300000795266kbh:MortgagesAndLandContractsDueToLandSellersAndOtherLoansMember2019-11-300000795266kbh:MortgagesAndLandContractsDueToLandSellersAndOtherLoansMember2020-11-300000795266kbh:SeniorNotesDueTwoThousandTwentyOneAtSevenPointZeroZeroPercentMemberus-gaap:SeniorNotesMember2020-11-300000795266kbh:SeniorNotesDueTwoThousandTwentyOneAtSevenPointZeroZeroPercentMemberus-gaap:SeniorNotesMember2019-11-300000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandTwentyTwoAtSevenPointFiveZeroPercentMember2020-11-300000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandTwentyTwoAtSevenPointFiveZeroPercentMember2019-11-300000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandTwentyThreeAtSevenPointSixTwoFivePercentMember2020-11-300000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandTwentyThreeAtSevenPointSixTwoFivePercentMember2019-11-300000795266kbh:SeniorNotesDueTwoThousandTwentySevenAtSixPointEightSevenFivePercentMemberus-gaap:SeniorNotesMember2020-11-300000795266kbh:SeniorNotesDueTwoThousandTwentySevenAtSixPointEightSevenFivePercentMemberus-gaap:SeniorNotesMember2019-11-300000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandTwentyNineAtFourPointEightPercentMember2020-11-300000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandTwentyNineAtFourPointEightPercentMember2019-11-300000795266us-gaap:RevolvingCreditFacilityMember2020-11-300000795266us-gaap:LetterOfCreditMember2020-11-300000795266us-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2019-12-012020-11-300000795266srt:MaximumMemberus-gaap:RevolvingCreditFacilityMember2019-12-012020-11-300000795266kbh:LOCFacilitiesMember2020-11-300000795266kbh:LOCFacilitiesMember2019-11-300000795266kbh:SeniorNotesDueTwoThousandTwentyOneAtSevenPointZeroZeroPercentMemberus-gaap:SeniorNotesMember2013-10-290000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandTwentyTwoAtSevenPointFiveZeroPercentMember2012-07-310000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandTwentyThreeAtSevenPointSixTwoFivePercentMember2015-02-170000795266kbh:SeniorNotesDueTwoThousandTwentySevenAtSixPointEightSevenFivePercentMemberus-gaap:SeniorNotesMember2019-02-200000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandTwentyNineAtFourPointEightPercentMember2019-11-040000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandTwentyNineAtFourPointEightPercentMember2013-10-290000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandTwentyThreeAtSevenPointSixTwoFivePercentMember2013-10-290000795266kbh:SeniorNotesDueTwoThousandTwentySevenAtSixPointEightSevenFivePercentMemberus-gaap:SeniorNotesMember2013-10-290000795266us-gaap:SeniorNotesMember2020-11-300000795266us-gaap:SeniorNotesMemberkbh:ConvertibleSeniorNotesDueTwoThousandNineteenAtOnePointThreeSevenFivePercentMemberMember2019-02-012019-02-010000795266us-gaap:SeniorNotesMemberkbh:ConvertibleSeniorNotesDueTwoThousandNineteenAtOnePointThreeSevenFivePercentMemberMember2019-02-010000795266kbh:SeniorNotesDueTwoThousandTwentySevenAtSixPointEightSevenFivePercentMemberus-gaap:SeniorNotesMember2019-02-202019-02-200000795266kbh:SeniorNotesDueTwoThousandTwentySevenAtSixPointEightSevenFivePercentMemberus-gaap:SeniorNotesMember2019-12-012020-11-300000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandTwentyThreeAtSevenPointSixTwoFivePercentMember2019-02-202019-02-200000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandTwentyThreeAtSevenPointSixTwoFivePercentMember2019-12-012020-11-3000007952662019-02-202019-02-200000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandNineteenatFourPointSevenFivePercentMember2019-03-082019-03-080000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandNineteenatFourPointSevenFivePercentMember2019-03-080000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandTwentyNineAtFourPointEightPercentMember2019-11-042019-11-040000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandTwentyAtEightPointZeroZeroPercentMember2019-11-222019-11-220000795266us-gaap:SeniorNotesMemberkbh:SeniorNotesDueTwoThousandTwentyAtEightPointZeroZeroPercentMember2019-11-220000795266us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2020-11-300000795266us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-012020-11-300000795266us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2019-11-300000795266us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2018-12-012019-11-300000795266us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2020-11-300000795266us-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-11-300000795266us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2019-11-300000795266us-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-11-30kbh:Home0000795266us-gaap:DamagesFromProductDefectsMember2019-12-012020-11-300000795266kbh:SelfInsuranceMember2020-11-300000795266kbh:SelfInsuranceMember2019-11-300000795266kbh:SelfInsuranceMember2019-12-012020-11-300000795266kbh:SelfInsuranceMember2018-12-012019-11-300000795266kbh:SelfInsuranceMember2017-12-012018-11-30kbh:claim_filed0000795266kbh:Chapter558oftheFloridaStatutesMember2019-12-012020-11-3000007952662016-11-300000795266srt:MinimumMember2020-11-300000795266kbh:LOCFacilitiesMember2019-12-012020-11-300000795266kbh:January2016StockRepurchaseProgramMember2018-05-140000795266kbh:January2016StockRepurchaseProgramMember2016-01-120000795266kbh:January2016StockRepurchaseProgramMember2017-12-012018-11-300000795266kbh:DirectorPlanSARsMember2014-07-170000795266kbh:DirectorPlanSARsMember2020-11-3000007952662020-03-012020-05-3100007952662020-09-012020-11-3000007952662018-12-012019-02-2800007952662019-06-012019-08-3100007952662018-06-012018-08-3100007952662018-03-012018-05-310000795266kbh:NotPartofaShareRepurchaseProgramMember2019-12-012020-11-300000795266kbh:NotPartofaShareRepurchaseProgramMember2018-12-012019-11-300000795266kbh:NotPartofaShareRepurchaseProgramMember2017-12-012018-11-300000795266us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-11-300000795266us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-12-012019-11-300000795266us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-11-300000795266us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-012020-11-300000795266srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-11-300000795266us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-11-300000795266kbh:SavingPlanMember2019-12-012020-11-300000795266kbh:SavingPlanMember2018-12-012019-11-300000795266kbh:SavingPlanMember2017-12-012018-11-300000795266kbh:SavingPlanMember2020-11-300000795266kbh:SavingPlanMember2019-11-300000795266kbh:SavingPlanMember2018-11-300000795266kbh:EquityIncentiveTwoThousandFourteenPlanMember2016-04-070000795266kbh:EquityIncentiveTwoThousandFourteenPlanMember2014-04-030000795266kbh:EquityIncentiveTwoThousandFourteenPlanMember2020-11-300000795266kbh:EquityIncentiveTwoThousandTenPlanMember2019-12-012020-11-300000795266kbh:EquityIncentiveTwoThousandFourteenPlanMember2019-12-012020-11-300000795266us-gaap:StockOptionMember2019-12-012020-11-300000795266us-gaap:StockOptionMember2018-12-012019-11-300000795266us-gaap:StockOptionMember2017-12-012018-11-300000795266us-gaap:RestrictedStockMember2019-12-012020-11-300000795266us-gaap:RestrictedStockMember2018-12-012019-11-300000795266us-gaap:RestrictedStockMember2017-12-012018-11-300000795266us-gaap:PerformanceSharesMember2019-12-012020-11-300000795266us-gaap:PerformanceSharesMember2018-12-012019-11-300000795266us-gaap:PerformanceSharesMember2017-12-012018-11-300000795266kbh:NonEmployeeDirectorStockUnitsMember2019-12-012020-11-300000795266kbh:NonEmployeeDirectorStockUnitsMember2018-12-012019-11-300000795266kbh:NonEmployeeDirectorStockUnitsMember2017-12-012018-11-300000795266kbh:RangeOneMember2019-12-012020-11-300000795266kbh:RangeOneMember2020-11-300000795266kbh:RangeTwoMember2019-12-012020-11-300000795266kbh:RangeTwoMember2020-11-300000795266kbh:RangeThreeMember2019-12-012020-11-300000795266kbh:RangeThreeMember2020-11-300000795266kbh:RangeFourMember2019-12-012020-11-300000795266kbh:RangeFourMember2020-11-300000795266us-gaap:StockOptionMember2020-11-300000795266us-gaap:RestrictedStockMember2019-11-300000795266us-gaap:RestrictedStockMember2018-11-300000795266us-gaap:RestrictedStockMember2017-11-300000795266us-gaap:RestrictedStockMember2020-11-300000795266us-gaap:PerformanceSharesMembersrt:MinimumMember2019-12-012020-11-300000795266srt:MaximumMemberus-gaap:PerformanceSharesMember2019-12-012020-11-300000795266us-gaap:PerformanceSharesMember2020-10-082020-10-080000795266us-gaap:PerformanceSharesMember2019-10-032019-10-030000795266us-gaap:PerformanceSharesMember2018-10-052018-10-050000795266us-gaap:PerformanceSharesMember2019-11-300000795266us-gaap:PerformanceSharesMember2018-11-300000795266us-gaap:PerformanceSharesMember2017-11-300000795266us-gaap:PerformanceSharesMember2020-11-300000795266kbh:PSU2016Memberus-gaap:PerformanceSharesMember2019-12-012020-11-300000795266us-gaap:PerformanceSharesMemberkbh:PSU2015Member2018-12-012019-11-300000795266us-gaap:PerformanceSharesMemberkbh:PSU2014Member2017-12-012018-11-300000795266kbh:DirectorPlanSARsMember2019-12-012020-11-300000795266kbh:DirectorPlanSARsMember2020-11-300000795266kbh:DirectorPlanSARsMember2019-11-300000795266kbh:DirectorPlanSARsMember2018-11-300000795266kbh:NonEmployeeDirectorDeferredCommonStockDomain2020-11-300000795266kbh:NonEmployeeDirectorDeferredCommonStockDomain2019-11-300000795266kbh:NonEmployeeDirectorDeferredCommonStockDomain2018-11-300000795266us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2020-11-300000795266us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2019-11-300000795266us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2018-12-012019-11-300000795266us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2019-12-012020-11-300000795266us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2017-12-012018-11-300000795266us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2020-11-300000795266us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2019-11-300000795266us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2018-12-012019-11-300000795266us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2019-12-012020-11-300000795266us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2017-12-012018-11-300000795266us-gaap:HomeBuildingMember2020-11-300000795266us-gaap:HomeBuildingMember2019-11-300000795266us-gaap:HomeBuildingMember2018-11-300000795266kbh:FinancialServicesMember2020-11-300000795266kbh:FinancialServicesMember2019-11-300000795266kbh:FinancialServicesMember2018-11-300000795266us-gaap:AccountingStandardsUpdate201409Member2020-11-300000795266us-gaap:AccountingStandardsUpdate201409Member2018-12-010000795266us-gaap:AccountingStandardsUpdate201409Member2018-11-300000795266kbh:InspiradaBuildersLLCMember2019-12-012020-11-300000795266kbh:InspiradaBuildersLLCMember2018-12-012019-11-300000795266kbh:InspiradaBuildersLLCMember2017-12-012018-11-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended November 30, 2020

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission File No. 001-09195

KB HOME

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 95-3666267 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

10990 Wilshire Boulevard, Los Angeles, California 90024

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (310) 231-4000

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange

on which registered |

| Common Stock (par value $1.00 per share) | | KBH | | New York Stock Exchange |

| Rights to Purchase Series A Participating Cumulative Preferred Stock | | | | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting common stock held by non-affiliates of the registrant on May 31, 2020 was $3,236,693,083, including 7,317,336 shares held by the registrant’s grantor stock ownership trust and excluding 24,525,786 shares held in treasury.

There were 91,637,771 shares of the registrant’s common stock, par value $1.00 per share, outstanding on December 31, 2020. The registrant’s grantor stock ownership trust held an additional 7,124,317 shares of the registrant’s common stock on that date.

Documents Incorporated by Reference

Portions of the registrant’s definitive Proxy Statement for the 2021 Annual Meeting of Stockholders (incorporated into Part III).

KB HOME

FORM 10-K

FOR THE YEAR ENDED NOVEMBER 30, 2020

TABLE OF CONTENTS

| | | | | | | | |

| | | Page

Number |

|

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Information about our Executive Officers | |

|

|

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

|

|

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

|

|

| Item 15. | | |

| Item 16. | | |

| |

PART I

Item 1.BUSINESS

General

KB Home is one of the largest and most recognized homebuilding companies in the U.S. We have been building homes for over 60 years, with nearly 645,000 homes delivered since our founding in 1957. We build a variety of new homes designed primarily for first-time and first move-up, as well as second move-up and active adult homebuyers, including attached and detached single-family residential homes, townhomes and condominiums. We offer homes in development communities, at urban in-fill locations and as part of mixed-use projects. Our homebuilding operations represent the majority of our business, accounting for 99.6% of our total revenues in 2020. Our financial services operations, which accounted for the remaining .4% of our total revenues in 2020, offer various insurance products to our homebuyers in the markets where we build homes and provide title services in certain of those markets. Our financial services operations also provide mortgage banking services, including residential consumer mortgage loan (“mortgage loan”) originations, to our homebuyers indirectly through KBHS Home Loans, LLC (“KBHS”), an unconsolidated joint venture we formed with Stearns Ventures, LLC (“Stearns”).

Unless the context indicates otherwise, the terms “we,” “our” and “us” used in this report refer to KB Home, a Delaware corporation, and its predecessors and subsidiaries. We also use the following terms in our business with the corresponding meanings: “home” is a single-family residence, whether it is a single-family home or other type of residential property; “homes delivered” are homes for which the sale has closed and title has passed to a customer; “community” is a single development in which new homes are constructed as part of an integrated plan; and “community count” is the number of communities we have open for sales with at least five homes/lots left to sell.

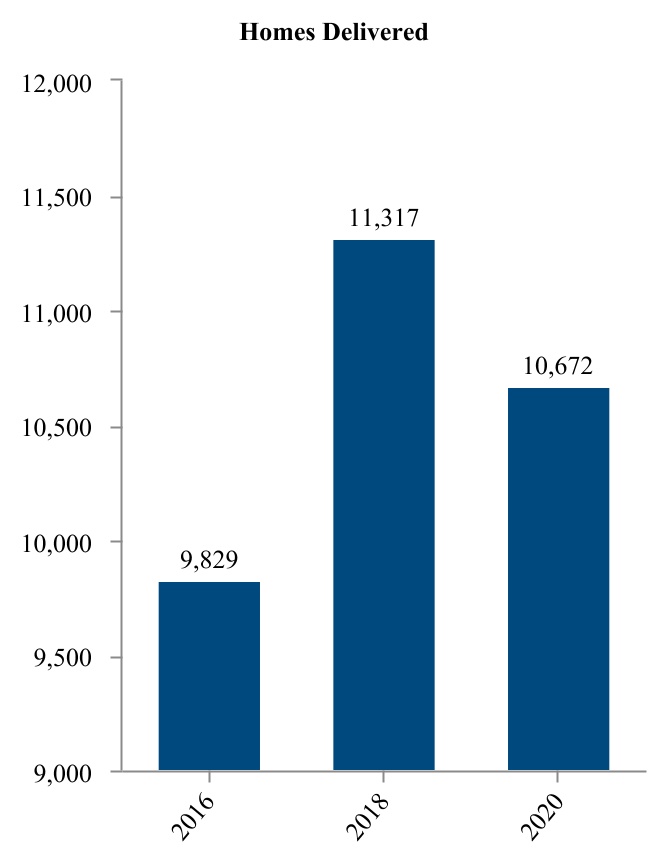

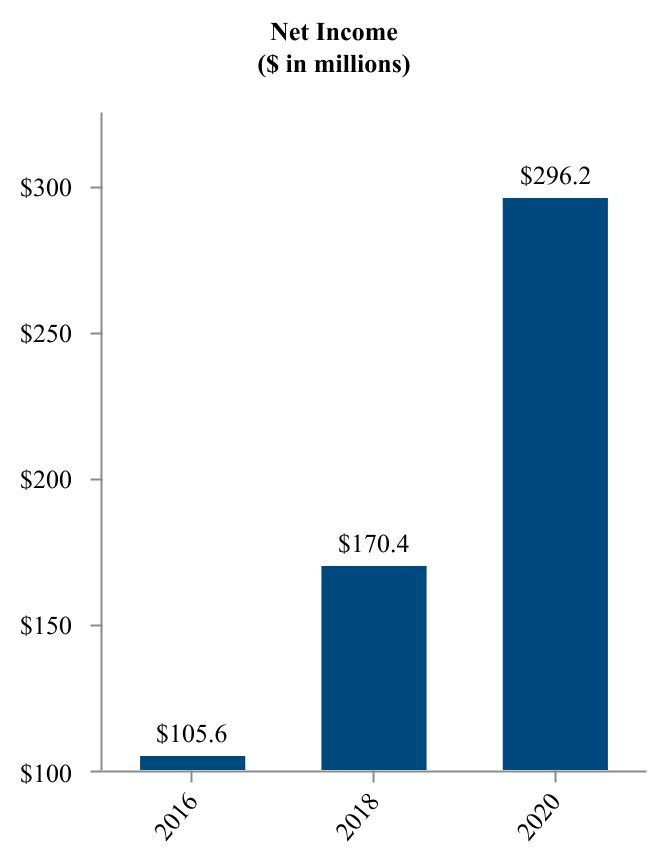

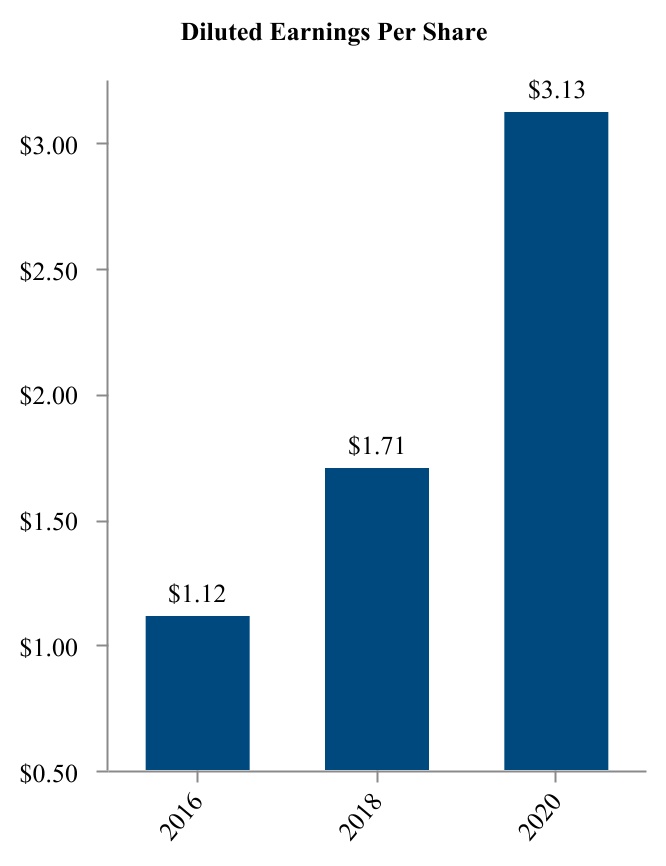

The following charts present homes delivered, homebuilding revenues, net income and diluted earnings per share for the years ended November 30, 2016, 2018 and 2020:

Markets

Reflecting the geographic reach of our homebuilding business, we have ongoing operations in the eight states and 45 major markets presented below. We also operate in various submarkets within these major markets. We may refer to these markets and submarkets collectively as our “served markets.” For reporting purposes, we organize our homebuilding operations into four segments — West Coast, Southwest, Central and Southeast.

| | | | | | | | | | | | | | |

| Segment | | States | | Major Market(s) |

| | | | |

| West Coast | | California | | Contra Costa County, Elk Grove, Fresno, Los Angeles, Hollister, Madera, Modesto, Oakland, Orange County, Riverside, Sacramento, Salinas, San Bernardino, San Diego, San Francisco, San Jose, Santa Rosa-Petaluma, Stockton, Vallejo, Ventura and Yuba City |

| | Washington | | Olympia and Seattle |

| Southwest | | Arizona | | Phoenix and Tucson |

| | Nevada | | Las Vegas |

| Central | | Colorado | | Denver, Erie, Firestone and Loveland |

| | Texas | | Austin, Dallas, Fort Worth, Houston and San Antonio |

| Southeast | | Florida | | Fort Myers, Jacksonville, Lakeland, Melbourne, Orlando, Palm Coast, Sarasota and Tampa |

| | North Carolina | | Charlotte and Raleigh |

Segment Operating Information. The following table presents certain operating information for our homebuilding reporting segments for the years ended November 30, 2020, 2019 and 2018 (dollars in millions, except average selling price):

| | | | | | | | | | | | | | | | | |

| | Years Ended November 30, |

| | 2020 | | 2019 | | 2018 |

| West Coast: | | | | | |

| Homes delivered | 2,869 | | | 3,214 | | | 3,152 | |

| Percentage of total homes delivered | 27 | % | | 27 | % | | 28 | % |

| Average selling price | $ | 609,400 | | | $ | 592,300 | | | $ | 661,500 | |

| Homebuilding revenues (a) | $ | 1,748.6 | | | $ | 1,912.2 | | | $ | 2,085.3 | |

| Southwest: | | | | | |

| Homes delivered | 2,385 | | | 2,346 | | | 2,301 | |

| Percentage of total homes delivered | 22 | % | | 20 | % | | 20 | % |

| Average selling price | $ | 327,300 | | | $ | 322,000 | | | $ | 307,300 | |

| Homebuilding revenues (a) | $ | 796.8 | | | $ | 764.8 | | | $ | 707.1 | |

| Central: | | | | | |

| Homes delivered | 3,932 | | | 4,291 | | | 4,113 | |

| Percentage of total homes delivered | 37 | % | | 36 | % | | 36 | % |

| Average selling price | $ | 303,400 | | | $ | 293,500 | | | $ | 297,400 | |

| Homebuilding revenues (a) | $ | 1,192.9 | | | $ | 1,267.9 | | | $ | 1,239.3 | |

| Southeast: | | | | | |

| Homes delivered | 1,486 | | | 2,020 | | | 1,751 | |

| Percentage of total homes delivered | 14 | % | | 17 | % | | 16 | % |

| Average selling price | $ | 288,600 | | | $ | 293,200 | | | $ | 286,600 | |

| Homebuilding revenues (a) | $ | 429.4 | | | $ | 592.8 | | | $ | 502.1 | |

| Total: | | | | | |

| Homes delivered | 10,672 | | | 11,871 | | | 11,317 | |

| Average selling price | $ | 388,900 | | | $ | 380,000 | | | $ | 399,200 | |

| Homebuilding revenues (a) | $ | 4,167.7 | | | $ | 4,537.7 | | | $ | 4,533.8 | |

(a)Homebuilding revenues include revenues from housing and, if applicable, land sales.

The above table does not include homes delivered or revenues from unconsolidated joint ventures in which we participate. These unconsolidated joint ventures acquire and develop land in various markets where our homebuilding operations are located and, in some cases, build and deliver homes on the land developed.

Additional financial and operational information related to our homebuilding reporting segments, including revenues, operating income (loss), pretax income (loss), inventories and assets, is provided below under Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations and in Note 2 – Segment Information in the Notes to Consolidated Financial Statements in this report.

Business Strategy

Overview. Our core business strategy, which we refer to as KB Edge, is to expand our scale primarily within our current geographic footprint to achieve a top-five position in each of our served markets (based on homes delivered). KB Edge is a systematic, fact-based and process-driven approach to homebuilding that is grounded in gaining a detailed understanding of consumers’ location and product preferences and product price-to-value perceptions. In our business, we use the term “product” to mean and encompass a home’s floor plan design and interior/exterior style, amenities, functions and features.

KB Edge consists of the following key principles with respect to customers, land, products and operations:

•Customers. With our Built-to-Order® homebuying process, we provide each of our homebuyers with a highly personalized experience where they can make a wide range of structural and design choices for their future new home, as discussed further below under “Customer Obsession.” We believe this highly interactive, “customer-first” experience that puts our homebuyers firmly in control of designing the home they want based on how they live and

what they value, at an affordable price, gives us a meaningful and distinct competitive advantage over other homebuilders and resale and rental homes.

•Land. We seek to manage our working capital and reduce our operating risks by primarily acquiring entitled land parcels within attractive submarkets identified by our market research activities. We typically focus on metropolitan areas with favorable long-term economic and population growth prospects that we believe have the potential to sustain a minimum of 800 homes delivered per year, and target land parcels that meet our investment return standards. Identified consumer preferences and home sales activity largely direct where our land acquisition teams search for available land. We focus on investments that provide a one- to two-year supply of land or lots per product line, per community, and individual assets that are generally between 50 to 200 lots in size. Our primary focus continues to be our existing geographic footprint, encompassing markets we identified for their long-term economic and demographic growth potential. We leverage the relationships we have with land owners, developers and brokers to find and acquire land parcels, and use our experience in working with municipalities to efficiently obtain development approvals.

•Products. We offer our customers a base product with a standardized set of functions and features that is generally priced to be affordable for those with household incomes near the local area’s median level. With our Built-to-Order approach, our customers have the opportunity to select their lot location within a community, floor plan, elevation and structural options, and to personalize their homes with numerous interior design options and upgrades in our design studios. Our design studios, generally centrally located within our served markets, are a key component of our Built-to-Order process, and the mix of design options and upgrades they offer are primarily based on the preferences identified by our market survey and purchase frequency data, as discussed further below under “Customer Obsession.” We utilize a centralized internal architectural group that designs homes to meet or exceed customers’ price-to-value expectations while being as efficient as possible to construct. To enhance the simplicity and efficiency of our products and processes, our architectural group has developed a core series of high-frequency, flexible floor plans and elevations that we can offer across many of our served markets. Our standardized plans allow us to more effectively shift with local demand and developable land attributes, help us to better understand the cost to build our products and enable us to compare and implement best practices across divisions and communities. We also incorporate energy-efficient features into our product designs to help lower our homebuyers’ total cost of homeownership and reduce our homes’ impact on the environment, as further discussed below under “Sustainability.”

•Operations. In addition to differentiating us from other high-production homebuilders, our Built-to-Order process helps drive low-cost production. We generally commence construction of a home only after we have a signed purchase contract with a homebuyer and have obtained preliminary credit approval or other evidence of the homebuyer’s financial ability to purchase the home, and seek to build a backlog of sold homes. By maintaining a substantial backlog, along with centralized scheduling and standardized reporting processes, we have established a disciplined and scalable operational platform that helps us sustain an even-flow production of pre-sold homes. This reduces our inventory risk, promotes construction efficiencies, enhances our relationships with independent subcontractors and other business partners, and provides us with greater visibility and predictability on future deliveries as we grow.

There may be market-driven circumstances where we believe it is necessary or appropriate to temporarily deviate from certain of the above principles. These deviations may include starting construction on a small number of homes in a community before corresponding purchase contracts are signed with homebuyers to more quickly meet customer delivery expectations and generate revenues; or acquiring land parcels in peripheral neighborhoods of a core metropolitan area that otherwise fit our growth strategy and meet our investment return standards. In addition, other circumstances could arise in the future that may lead us to make specific short-term shifts from these principles.

An underlying tenet of our business approach is to continue to improve our asset efficiency by, among other things:

•Calibrating home sales rates and selling prices at each of our communities to enhance profitability;

•Further controlling our direct construction costs within our communities;

•Accelerating inventory turns;

•Structuring land acquisitions to minimize upfront costs where possible, as further discussed below under “Community Development and Land Inventory Management”;

•Reactivating communities that have been held for future development; and

•Deploying excess cash flow from operations to help fuel additional revenue growth and/or reduce debt.

The anticipated associated revenue and pretax income growth from this strategic approach should help drive the utilization of our deferred tax assets and allow us to realize substantial tax cash savings that can be productively deployed in our business and/or to enhance our capital structure.

Customer Obsession. Based on more than 60 years of experience, we believe the best homes start with the people who live in them. Our customer-centric approach comes from a deep-rooted operational philosophy and company culture animated by a paramount objective: to be the most customer-obsessed homebuilder in the world. Driven by this ambitious guidepost, our team seeks to provide a compelling, simple and personalized homebuying process distinguished by phenomenal customer service. We want our customers to know they have a real partner when buying a home with us, and to feel that once their home is built, they can see themselves in their new home. Our team members, supported through our training and development programs, are encouraged to make decisions intended to produce the best results for our customers and our organization. Our customer obsession mindset is built around the following key principles:

•Find out what customers want and offer them choice to attain it. Design plays an important role in the homes we build for our customers. We ascertain homebuyer product design and location preferences through surveys we conduct of recent buyers of both new and resale homes across our served markets. We also obtain data from our own homebuyers’ selections and post-sale feedback. We use this information on what matters most to homebuyers when making purchase and trade-off decisions to develop and refine our products, as well as our land acquisition targets.

We also cultivate and leverage close supplier and business partner relationships to integrate into or offer with our products architectural elements (such as flex spaces that can serve multiple purposes, quiet zones or home offices), building materials, construction techniques, and structural and non-structural systems, components and devices that are aligned with the preferences identified in our surveys and other data sources, including with the design options and upgrades we offer. With our focus on affordability, we seek out innovative techniques, materials and items to help meet homebuyers’ priorities at attainable price points.

From our synthesis of the foregoing consumer research and related activities, we give our homebuyers a wide array of choice to craft the new home that fits their particular lifestyle and priorities, including their homesite, floor plan, elevation and structural options. Our homebuyers can visit our KB Home Design Studios, where they get both advice and the opportunity to select from a broad range of included features, design upgrades and options that will help personalize their home.

•Create collaborative customer relationships. In our view, we are not just selling a house. We are in the business of delivering an exceptional, personalized experience that enables our customers to achieve perhaps the most meaningful purchase they will ever make and an important landmark in their life’s journey — their own home. From this perspective, we strive to form close relationships with our homebuyers. We endeavor to learn key details about what they want, their top priorities today and where they see themselves in the future, so we can co-create a home for their day-to-day lives. We support each person or family, whether it is their first time or they have already been homeowners, with a dedicated community team of construction supervisors, sales representatives, design consultants and other personnel. This team is available to guide each homebuyer through each major step of the design, construction and closing of their KB home and aims to make the process as easy and straightforward as possible.

•Continue to listen to customers after the sale is done. To help learn and improve our customer experience, we schedule follow up visits with our customers 30 days after they move in, as well as three, six, 10 and 18 months later, to hear about their experience in their new home and to address any concerns they may have, including warranty claims. Information about our KB Home 10-year Limited Warranty program is provided in Note 17 – Commitments and Contingencies in the Notes to Consolidated Financial Statements in this report.

We believe our approach differentiates us in the homebuilding industry and, along with our company culture that sustains it, enhances customer satisfaction. We are proud of the high levels of satisfaction our homebuyers have reported to us and on outside surveys. In 2020, even with the challenges we faced associated with the outbreak of the 2019 coronavirus disease (“COVID-19”), we achieved the top rank for customer satisfaction among homebuilders in third-party surveys, which we believe reflects the effective dedication we have to our homebuyers.

Promotional Marketing Strategy. To emphasize the distinct combination of innovative designs, personalization, affordability and partnership we offer to our homebuyers and the importance we place on customer satisfaction, we have centered our external brand identity and messaging around Built on Relationships®. Built on Relationships also encapsulates the importance of customer, as discussed above, and other key relationships – with suppliers, trade contractors, land sellers and municipalities – to the success of our business. The key components we highlight as part of our brand identity include:

•Offering Innovative Designs. We believe we offer our homebuyers product designs that distinctively blend consumer-preferred elements, such as open floor plans, flexible living spaces and extra storage, as discussed above under “Customer Obsession;” quality construction standards; and superior energy efficiency, compared to other new homes and resale homes with which we compete.

•A Personalized Home. We give our homebuyers considerable ability to personalize their new home from floor plans to design features to where they live in the community. At our KB Home Design Studio, our homebuyers are able to get both advice and the opportunity to select from a broad range of included features, design upgrades and options that will help personalize their home.

•Affordable Today and a Lower Cost of Homeownership Tomorrow. We offer a variety of homes generally priced to be affordable for those with household incomes near the local area’s median level. Our ENERGY STAR® certified homes can provide long-term significant savings on utility bills compared to typical resale homes and to competitive new homes that are not ENERGY STAR certified.

•A Partner Every Step of the Way. Our dedicated team of sales counselors, design studio consultants, construction superintendents and customer service representatives, as well as KBHS loan officers, work closely with our homebuyers throughout the homebuying process.

We typically sell our homes through our commissioned sales associate employees from sales offices located in or adjacent to furnished model homes in each community. With the outbreak of COVID-19 and the related responses by public health and governmental authorities to contain and combat its outbreak and spread (“COVID-19 control responses”), we adapted and progressively enhanced our electronic sales capabilities during 2020 to give our customers a variety of convenient ways to shop for and purchase a new KB home, including, among other things:

•Offering virtual home tours for prospective homebuyers;

•Providing access to interactive floor plans available at their desired community;

•Enabling live chats with sales counselors;

•Conducting virtual appointments and tours of the design studios with our studio professionals;

•Continuing to have KBHS qualify homebuyers for mortgages who may be or are purchasing a home, and utilizing online tools and/or contactless methods to serve homebuyers where possible;

•Organizing virtual events with the broker community to introduce new communities;

•Presenting homebuyers with the ability to virtually see and walk through their home at various points during its construction and prior to closing; and/or

•Arranging virtual or drive-through closings, where permitted.

In addition, as part of our commitment to sustainability, which is discussed further below, and providing our customers a simple path to homeownership, we continue to work towards the goal of paperless homebuying. Over the past few years, we have eliminated a significant amount of paper from our home purchase contract by reducing the number of forms required to complete the process and digitizing as many of the remaining forms as possible. We plan to make additional investments in our digital sales and marketing tools in 2021.

To the extent permitted in 2020, our communities have been open to walk-in traffic, following appropriate safety protocols and applicable public health guidelines.

We market our homes to prospective homebuyers and real estate brokers through a variety of media, and use data analytics to target our advertising and measure its effectiveness and efficiency in terms of generating leads and net orders. In recent years and in response to the growing number of millennial and Generation Z homebuyers, we have increased our emphasis on digital marketing, through search engine marketing, interactive Internet-based applications, email, social media outlets, our website and other evolving communication technologies. We also use print media, billboards, radio, magazine and newspaper advertising in our served markets, as necessary.

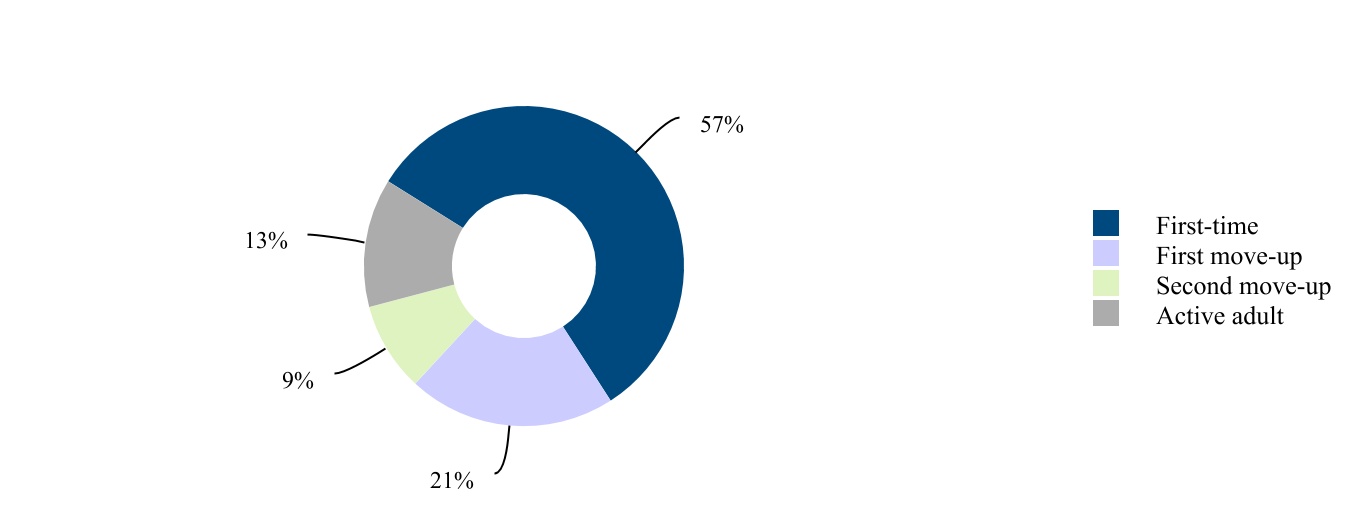

Homebuyer Profile. We focus on bracketing within a range around the median household income in a submarket in order to position our product and pricing to be attainable for the largest demand segments of that submarket. Across our portfolio, we offer an array of products, from smaller, higher density homes, with average selling prices typically suited for first-time homebuyers, to larger homes in premium locations with additional amenities, with higher average selling prices that generally

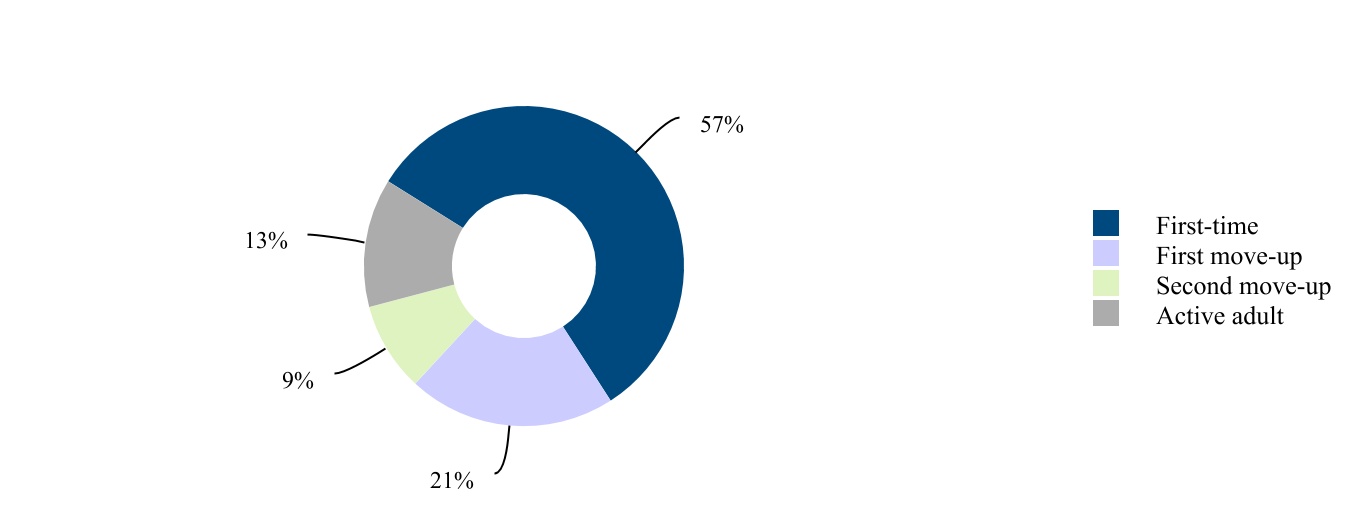

attract a first or second move-up homebuyer. We also offer a variety of single-story floorplans that typically appeal to an active adult homebuyer age 55 and over, as well as multi-story floorplans that attract a wide range of homebuyers. For more than a decade, approximately 75% of our annual deliveries have been to first-time and first move-up homebuyers; in 2020, it was 78% of our deliveries, as shown in the following chart:

Operational Structure. We operate our homebuilding business through divisions with experienced management teams who have in-depth local knowledge of their particular served markets, which helps us acquire land in preferred locations; develop communities with products that meet local demand; and understand local regulatory environments. Our division management teams exercise considerable autonomy in identifying land acquisition opportunities; developing land and communities; implementing product, marketing and sales strategies; and controlling costs. To help maintain consistent execution within the organization, our division management teams and other employees are continuously trained on KB Edge principles and are evaluated, in part, based on their achievement of relevant operational objectives.

Our corporate management and support personnel develop and oversee the implementation of company-wide strategic initiatives, our overall operational policies and internal control standards, and perform various centralized functions, including architecture; purchasing and national contracts; treasury and cash management; land acquisition approval; risk and litigation management; accounting and financial reporting; internal audit and compliance activities; information technology systems; marketing; and investor and media relations.

Community Development and Land Inventory Management

Developable land for the production of homes is a core resource for our business. Based on our current strategic plans, we seek to own or control land sufficient to meet our forecasted production goals for the next three to five years. In 2021, we intend to continue to invest in and develop land positions within attractive submarkets and selectively acquire or control additional land that meets our investment return standards. However, we may periodically sell certain land interests or monetize land previously held for future development.

Our community development process generally consists of four phases: land acquisition, land development into finished lots for a community (if necessary), home construction and delivery of completed homes to homebuyers. Historically, our community development process has typically ranged from 12 to 18 months in our West Coast homebuilding reporting segment, with a somewhat shorter duration in our other homebuilding reporting segments. The development process in our West Coast homebuilding reporting segment is typically longer than in our other segments due to the municipal and regulatory requirements that are generally more stringent in California. Our community development process varies based on, among other things, the extent and speed of required government approvals and utility service activations, the overall size of a particular community, the scope of necessary site preparation activities, the type of product(s) that will be offered, weather conditions, time of year, promotional marketing results, the availability of construction resources, consumer demand, local and general economic and housing market conditions, and other factors.

Although they vary significantly in size and complexity, our single-family residential home communities typically consist of 50 to 200 lots per product line, with lots ranging in size from 1,900 to 9,000 square feet. In our communities, we typically offer three to 15 home design choices. We also generally build one to three model homes at each community so that prospective homebuyers can preview the various products available. Depending on the community, we may offer premium lots

containing more square footage, better views and/or location benefits. Some of our communities consist of multiple-story structures that encompass several attached condominium-style units.

Land Acquisition and Land Development. We continuously evaluate land acquisition opportunities against our investment return standards, while balancing competing needs for financial strength, liquidity and land inventory for future growth. When we acquire land, we generally focus on parcels with lots that are entitled for residential construction and are either physically developed to start home construction (referred to as “finished lots”) or partially finished. However, depending on market conditions and available opportunities, we may acquire undeveloped and/or unentitled land. We may also invest in land that requires us to repurpose and re-entitle the property for residential use, such as urban in-fill developments. We expect that the overall balance of undeveloped, unentitled, entitled, partially finished and finished lots in our inventory will vary over time, and in implementing our strategic growth initiatives, we may acquire a greater proportion of undeveloped or unentitled land in the future if and as the availability of reasonably priced land with finished or partially finished lots diminishes.

We generally structure our land acquisition and land development activities to minimize, or defer the timing of, expenditures in order to reduce both the market risks associated with holding land and our working capital and financial commitments, including interest and other carrying costs. We typically use contracts that, in exchange for a small initial option payment or earnest money deposit, give us an option or similar right to acquire land at a future date, usually at a pre-determined price and pending our satisfaction with the feasibility of developing and selling homes on the land and/or an underlying land seller’s completion of certain obligations, such as securing entitlements, developing infrastructure or finishing lots. We refer to land subject to such option or similar contractual rights as being “controlled.” Our decision to exercise a particular land option or similar right is based on the results of our due diligence and continued market viability analysis after entering into such a contract. Information related to our land option contracts and other similar contracts is provided in Note 7 – Inventory Impairments and Land Option Contract Abandonments and Note 8 – Variable Interest Entities (“VIEs”) in the Notes to Consolidated Financial Statements in this report.

The following table presents the number of inventory lots we owned, in various stages of development, or controlled under land option contracts or other similar contracts by homebuilding reporting segment as of November 30, 2020 and 2019:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Homes Under Construction | | Land Under Development | | Land Under Option (a) | | Total Land

Owned or Under Option |

| | 2020 | | 2019 | | 2020 | | 2019 | | 2020 | | 2019 | | 2020 | | 2019 |

| West Coast | 2,128 | | | 1,615 | | | 8,467 | | | 7,889 | | | 6,395 | | | 5,682 | | | 16,990 | | | 15,186 | |

| Southwest | 1,265 | | | 1,186 | | | 6,975 | | | 6,039 | | | 4,050 | | | 3,966 | | | 12,290 | | | 11,191 | |

| Central | 2,363 | | | 2,058 | | | 11,947 | | | 12,738 | | | 9,389 | | | 11,075 | | | 23,699 | | | 25,871 | |

| Southeast | 976 | | | 788 | | | 5,926 | | | 5,726 | | | 7,157 | | | 6,148 | | | 14,059 | | | 12,662 | |

Total | 6,732 | | | 5,647 | | | 33,315 | | | 32,392 | | | 26,991 | | | 26,871 | | | 67,038 | | | 64,910 | |

(a)Land under option as of November 30, 2020 and 2019 includes 10,254 and 9,212 lots, respectively, under land option contracts or other similar contracts where the associated deposits were refundable at our discretion.

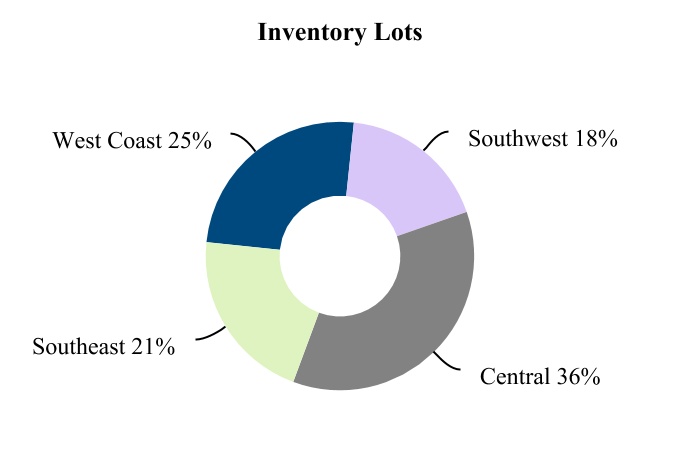

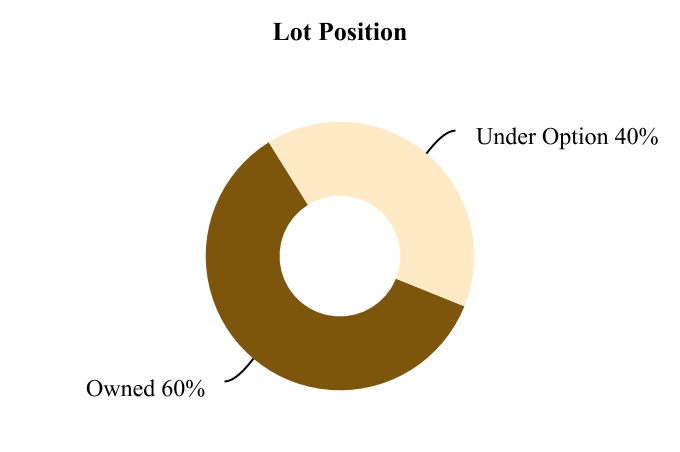

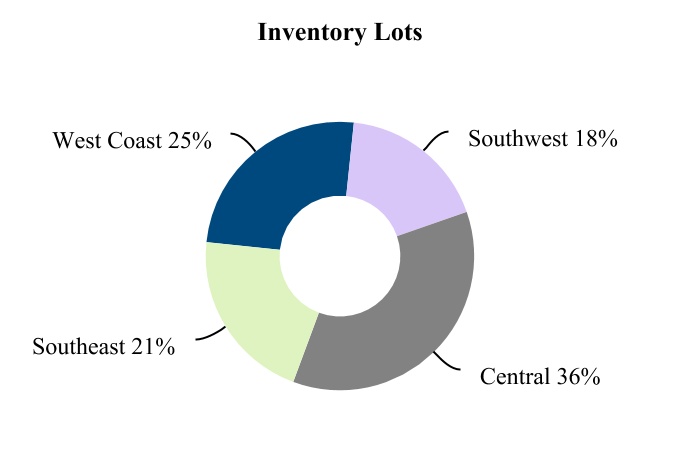

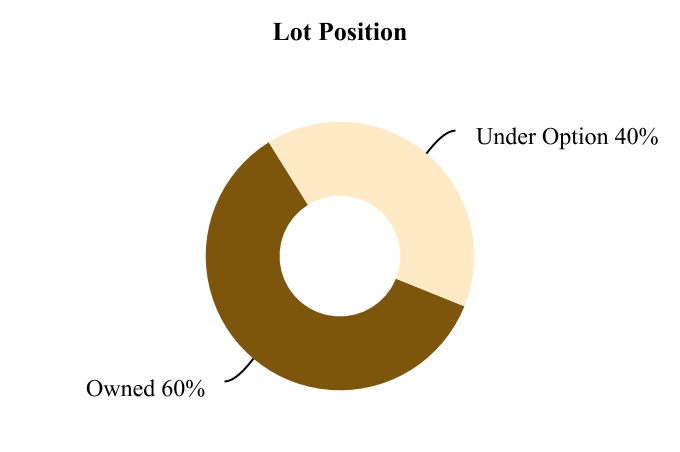

The following charts present the percentage of inventory lots we owned or had under land option contracts or other similar contracts by homebuilding reporting segment and the percentage of total lots we owned and had under option as of November 30, 2020:

Home Construction and Deliveries. Following the acquisition of land and, if necessary, the development of the land into finished lots, we typically begin constructing model homes and marketing homes for sale. To minimize the costs and risks of unsold homes in production, we generally commence construction of a home only after we have a signed purchase contract with a homebuyer and have obtained preliminary credit approval or other evidence of the homebuyer’s financial ability to purchase the home. Other than model homes, our inventories typically do not consist of a significant number of completed unsold homes. However, cancellations of home purchase contracts prior to the delivery of the underlying homes, the construction of attached products with some unsold units, or specific marketing or other strategic considerations will result in our having some unsold completed or partially completed homes in our inventory. Our cycle time from home sale to delivery is typically six to seven months.

We act as the general contractor for the majority of our communities, and engage outside general contractors in all other instances. We, or the outside general contractors we engage, contract with a variety of independent subcontractors, who are typically locally based, to perform all land development and home construction work through their own employees or subcontractors. We do not self-perform any land development or home construction work. These independent subcontractors also supply some of the building materials required for such production activities. Our contracts with these independent subcontractors require that they comply with all laws applicable to their work, including wage and safety laws, meet performance standards, follow local building codes and permits, and abide by our Ethics Policy referenced under Item 10 – Directors, Executive Officers and Corporate Governance in this report.

Raw Materials. Outside of land, the principal raw materials used in our production process are concrete and forest products. Other primary materials used in home construction include drywall, and plumbing and electrical items. We source all of our building materials from third parties. We attempt to enhance the efficiency of our operations by using, where practical, standardized materials that are commercially available on competitive terms from a variety of outside sources. In addition, we have national and regional purchasing programs for certain building materials, appliances, fixtures and other items that allow us to benefit from large-quantity purchase discounts and, where available, participate in outside manufacturer or supplier rebate programs. When possible, we arrange for bulk purchases of these products at favorable prices from such manufacturers and suppliers.

Backlog

Our “backlog” consists of homes that are under a purchase contract but have not yet been delivered to a homebuyer. Ending backlog represents the number of homes in backlog from the previous period plus the number of net orders (new orders for homes less cancellations) generated during the current period minus the number of homes delivered during the current period. Our backlog at any given time will be affected by cancellations, homes delivered and our community count. Backlog value represents potential future housing revenues from homes in backlog. Our cancellation rates and the factors affecting such rates are further discussed below under both Item 1A – Risk Factors and Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations in this report.

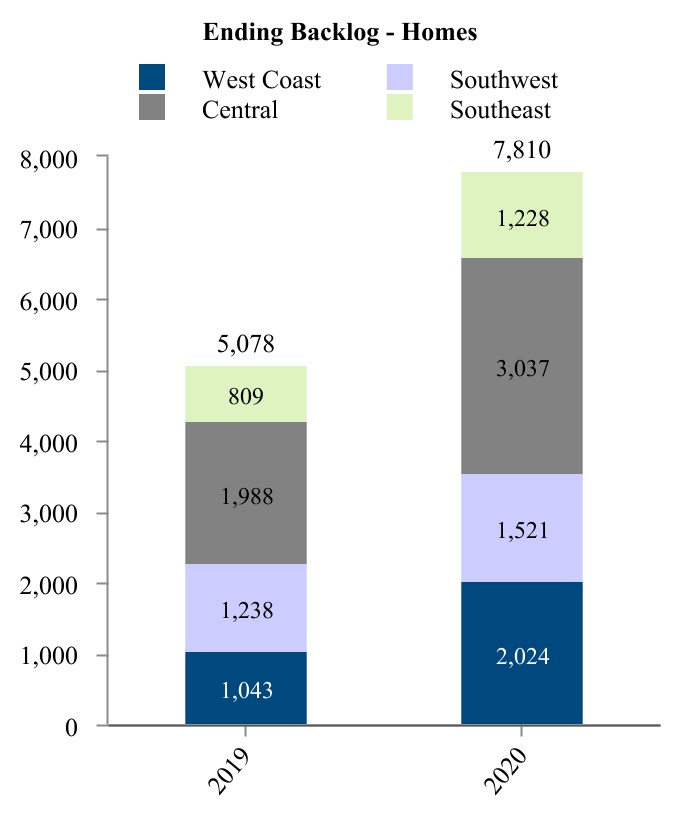

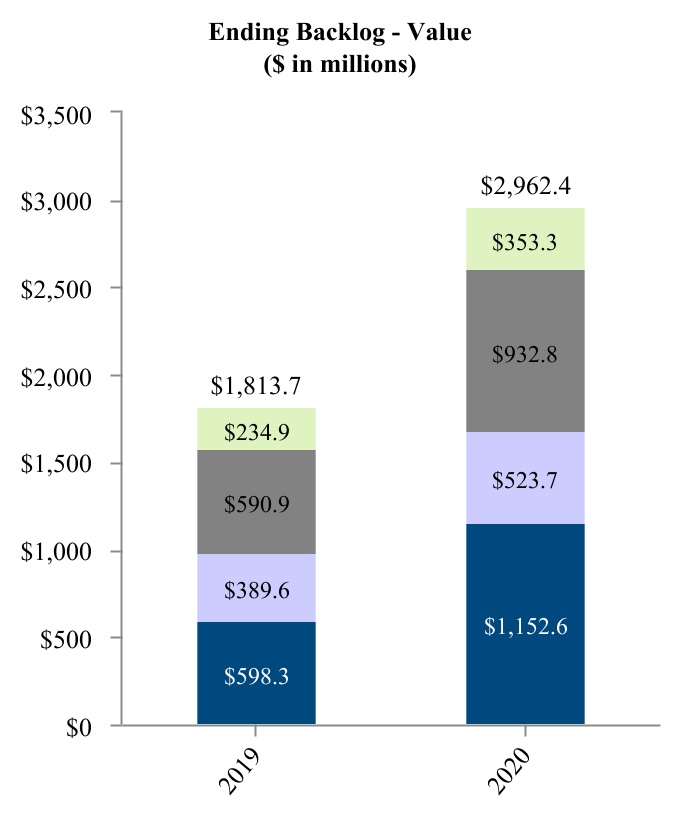

The following charts present our ending backlog (number of homes and value) by homebuilding reporting segment as of November 30, 2019 and 2020:

Human Capital Resources

At December 31, 2020 and 2019, we had approximately 1,776 and 2,140 full-time employees, respectively. None of our employees are represented by a collective bargaining agreement.

To help drive consistent execution of our business strategy, including our customer obsession philosophy, and support their development, we provide training opportunities to our employees that align with their responsibilities over the arc of their career with us. We maintain a dedicated Internet-based learning platform with a broad portfolio of written, audio-visual and interactive enterprise-wide and discipline-specific policy and training materials. This platform includes a library of nearly 300 self-directed courses and virtual, instructor-led programs for employees at all levels of our organization. New employee orientations, functional role training and ethics training and certification, which is required annually for all employees, take place on this platform. During 2020, our team members completed more than 17,000 courses in total, an average of more than eight courses per employee. Included in this total were numerous courses and certifications associated with pandemic-related challenges such as virtual selling processes and protocols for safe business operations. Managers and supervisors are provided training to help their reports progress in their professional development.

We are committed to maintaining a work culture that treats all employees fairly and with respect, promotes inclusivity, provides equal opportunities for the professional growth of the diverse individuals who join us, and advancement based on merit. At December 31, 2020, females constituted approximately 42% of our workforce and 33% of our managerial employees. Also at December 31, 2020, ethnic and racial minorities constituted approximately 33% of our workforce and 21% of our managerial employees. We intend to continue using a combination of targeted recruiting, talent development and internal promotion strategies to expand the diversity of our employee base across all roles and functions.

In order to achieve our strategic goals, it is essential for us to attract, promote and retain qualified personnel, particularly the leaders who manage our autonomous, local divisions in our served markets and are responsible for partnering with all constituents. Our top division and regional leaders average nearly 11 years of tenure with us, and the local leaders responsible for land acquisition, entitlement, and development average approximately 10 years with us. In addition, our named executive officers who are responsible for setting our overall strategy average approximately 16 years with us and average more than two decades in homebuilding.

To attract and retain top talent in our highly competitive industry, we have designed our compensation and benefits programs to provide a balanced and effective reward structure. Our short- and long-term incentive programs are aligned with key business objectives and are intended to motivate strong performance. Our employees are eligible for medical, dental and vision insurance, a savings/retirement plan, life and disability insurance, various wellness programs and tuition reimbursement, along with an array of voluntary benefits designed to meet individual needs. We engage nationally recognized outside compensation and benefits consulting firms to objectively evaluate our programs and benchmark them against peers and other similarly situated organizations.

To recognize and promote outstanding employees, we conduct a comprehensive talent and succession planning review process on an annual basis, focused on identifying top-performing, high-potential, and diverse team members for advancement to key field and corporate leadership roles. This review process is overseen by the management development and compensation committee of our board of directors, which also guides updates and refinements to our human capital growth strategies.

During 2020, to address the safety and health of our workforce due to the COVID-19 pandemic, we implemented the following, among other steps:

•Temporarily closing our offices and establishing new safety protocols and procedures;

•Maintaining regular communication regarding the impacts of the pandemic on our team members and operations;

•Developing and distributing a playbook to guide the safe return to offices, communities, and work sites;

•Providing paid time-off for those directly impacted by COVID-19, and instructing those who are infected to stay home;

•Increasing cleaning protocols across all locations;

•Establishing physical distancing procedures, modifying workspaces, and providing personal protective equipment and cleaning supplies for employees who need to be onsite; and

•Creating and refining protocols to address actual and suspected COVID-19 cases and potential exposure of our team members, customers, and trade partners.

Competition, Seasonality, Delivery Mix and Other Factors

Competition. The homebuilding industry and housing market are highly competitive with respect to selling homes; contracting for construction services, such as carpentry, roofing, electrical and plumbing; and acquiring attractive developable land, though the intensity of competition can vary and fluctuate between and within individual markets and submarkets. We compete for homebuyers, construction resources and desirable land against numerous homebuilders, ranging from regional and national firms to small local enterprises. As to homebuyers, we primarily compete with other homebuilders on the basis of selling price, community location and amenities, availability of financing options, home designs, reputation, home construction cycle time, and the design options and upgrades that can be included in a home. In some cases, this competition occurs within larger residential development projects containing separate sections other homebuilders design, plan and develop. We also compete for homebuyers against housing alternatives to new homes, including resale homes, apartments, single-family rentals and other rental housing.

In markets experiencing extensive construction activity, including areas recovering from earthquakes, wildfires, hurricanes, flooding or other natural disasters, there can be severe craft and skilled trade shortages that limit independent subcontractors’ ability to supply construction services to us, which in turn tends to drive up our costs and/or extend our production schedules. Elevated construction activity, and reallocations of staff for public safety priorities after natural disasters or otherwise, has also contributed to measurable increases in the amount of time needed to obtain governmental approvals or utility service activations and, combined with tariffs imposed or increased by the U.S. and other governments, the cost of certain raw building materials, such as steel, Canadian lumber, drywall and concrete, or finished products. In 2020, we experienced building material cost pressures, particularly for lumber, and production capacity issues with some of our main product suppliers, reflecting increases in homebuilding and renovation activity and supply chain constraints over the course of the year largely associated with COVID-19 control responses. Since 2013, we also have seen higher prices for desirable land amid heightened competition with homebuilders and other developers and investors (both domestic and international), particularly in the land-constrained areas where we operate. We expect these upward cost trends to continue in 2021, if and as housing market activity grows and there is greater competition for these resources.

Seasonality. Our performance is affected by seasonal demand trends for housing. Traditionally, there has been more consumer demand for home purchases and we tend to generate more net orders in the spring and early summer months (corresponding to most of our second quarter and part of our third quarter) than at other times of the year. This “selling season” demand results in our typically delivering more homes and generating higher revenues from late summer through the fall months (corresponding to part of our third quarter and all of our fourth quarter). However, as illustrated in the table below, the outbreak of COVID-19 and the related COVID-19 control responses beginning in mid-March disrupted our usual seasonal patterns in 2020, with our second quarter net order activity measurably constrained followed by a significant rebound in our third and fourth quarters, resulting in a higher percentage of net orders in those quarters, compared to corresponding quarters in previous years. The pattern of our homes delivered and housing revenues in 2020 was affected by the above-mentioned impact on our net orders in the second quarter as well as a slowdown in our housing starts in that quarter.

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| First Quarter | | Second Quarter | | Third Quarter | | Fourth Quarter |

| Net Orders | | | | | | | |

| 2020 | 26 | % | | 13 | % | | 32 | % | | 29 | % |

| 2019 | 21 | % | | 32 | % | | 26 | % | | 21 | % |

| 2018 | 25 | % | | 32 | % | | 25 | % | | 18 | % |

| | | | | | | |

| Homes Delivered | | | | | | | |

| 2020 | 26 | % | | 23 | % | | 24 | % | | 27 | % |

| 2019 | 18 | % | | 23 | % | | 26 | % | | 33 | % |

| 2018 | 20 | % | | 24 | % | | 26 | % | | 30 | % |

| | | | | | | |

| Housing Revenues | | | | | | | |

| 2020 | 26 | % | | 22 | % | | 23 | % | | 29 | % |

| 2019 | 18 | % | | 23 | % | | 25 | % | | 34 | % |

| 2018 | 19 | % | | 24 | % | | 27 | % | | 30 | % |

| | | | | | | |

Delivery Mix and Other Factors. In addition to the overall volume of homes we sell and deliver, our results in a given period are significantly affected by the geographic mix of markets and submarkets in which we operate; the number and characteristics of the communities we have open for sales in those markets and submarkets; and the products we sell from those communities during the period. While there are some similarities, there are differences within and between our served markets in terms of the number, size and nature of the communities we operate and the products we offer to consumers. These differences reflect, among other things, local homebuyer preferences; household demographics (e.g., large families or working professionals; income levels); geographic context (e.g., urban or suburban; availability of reasonably priced finished lots; development constraints; residential density); and the shifts that can occur in these factors over time. These factors in each of our served markets will affect the costs we incur and the time it takes to locate, acquire rights to and develop land, open communities for sales, and market and build homes; the size of our homes; our selling prices (including the contribution from homebuyers’ purchases of design options and upgrades); the pace at which we sell and deliver homes and close out communities; and our housing gross profits and housing gross profit margins. Therefore, our results in any given period will fluctuate compared to other periods based on the proportion of homes delivered from areas with higher or lower selling prices and on the corresponding land and overhead costs incurred to generate those deliveries, as well as from our overall community count.

Sustainability

We have made a dedicated effort to further differentiate ourselves from other homebuilders and resale homes through our ongoing commitment to become a leading national company in sustainability. We seek out innovative technologies and systems to further improve the energy and water efficiency of our homes. We also engage in campaigns and other educational efforts, sometimes together with other companies, organizations and groups, to increase consumer awareness of the importance and impact of sustainability in selecting a home and the products within a home. Under our commitment to sustainability, we, among other things:

•Build energy- and water-efficient new homes to achieve a 20% improvement on average compared to homes built to code and even more compared to resale homes. We also seek to contribute to the reduction of greenhouse gas emissions over the long term. Overall, we have built nearly 150,000 ENERGY STAR certified new homes since 2000, more than any other homebuilder. These ENERGY STAR certified homes are estimated to have cumulatively saved our homeowners approximately $780 million in utility bills and reduced carbon emissions by approximately 5 billion pounds;

•Provide a KB Home Energy Savings Comparison™, or ESC, that gives home shoppers an estimate of both monthly energy costs and monthly savings of our homes over a typical resale home;

•Include in our product offerings advanced home automation technologies, components (e.g., smart appliances and smart power lighting) and systems that can increase convenience for our homebuyers;

•Built more than 16,000 WaterSense® labeled and WaterSmart homes;

•Installed 700,000 WaterSense labeled fixtures, saving homeowners roughly 1.5 billion gallons of water each year; and

•Delivered more than 11,000 homes with solar-paneled power systems, producing an estimated total of 428 million kilowatt hours of electrical power and reducing carbon dioxide emissions by approximately 668 million pounds.

We have been building homes with solar-paneled power systems for nearly 15 years. We were one of the first national homebuilders to offer solar to new-home buyers. In 2011, we introduced our first all-solar community in California. In June 2020, we were the first national homebuilder to offer a complete roof-integrated solar-paneled system. Our solar-paneled systems can be financed with the home purchase or leased from a third-party provider.

For several years, we have been recognized by the U.S. Environmental Protection Agency for our sustainability achievements, and have earned awards under all of the agency’s programs aimed at homebuilders: ENERGY STAR, which sets energy efficiency standards; WaterSense, which establishes water efficiency standards; and Indoor airPLUS®, which focuses on indoor air quality. In 2020, we received the ENERGY STAR Partner of the Year — Sustained Excellence Award for the 10th consecutive year, and the WaterSense Sustained Excellence Award for water efficiency for the sixth consecutive year. We strive to utilize the latest building science and upgraded air filtration systems in the homes we deliver, making the impact of indoor environments on one’s health a key area of our sustainable building commitment.

More information about our sustainability commitment can be found in our annual sustainability reports, which we have published on our website since 2008. We intend to continue to research, evaluate and utilize new or improved products and construction and business practices consistent with our commitment and believe our sustainability initiatives can help put us in a better position, compared to resale homes and homebuilders with less-developed programs, to comply with evolving local, state and federal rules and regulations intended to protect natural resources and to address climate change and similar environmental concerns.

Government Regulations and Environmental Matters

Our operations are subject to myriad legal and regulatory requirements concerning land development (including governmental permits, taxes, assessments and fees), the homebuilding process, employment conditions and worksite health and safety. These requirements often provide broad discretion to government authorities, and they could be interpreted or revised in ways that delay or prohibit project development or home sales, and/or make these activities more costly. The costs to comply, or associated with any noncompliance, are, or can be, significant and variable from period to period.

Under applicable environmental laws (including those aimed at protecting against climate change impacts), we may be responsible for, among other things, removing or remediating hazardous or toxic substances even where we were not aware of their presence or on land we previously owned. In addition to incurring clean-up costs, the presence of harmful substances on or near our properties may prevent us from performing land development or selling homes. Also, we are subject to federal, state and local rules that can require us to undertake extensive measures to prevent or minimize discharges of stormwater and other materials from our communities, and to protect wetlands and other designated areas.

As part of our due diligence process for land acquisitions, we often use third-party environmental consultants to investigate potential environmental risks, and we require disclosures, representations and warranties from land sellers regarding environmental risks. We also take steps prior to our acquisition of the land to gain reasonable assurance as to the precise scope of any remediation work required and the costs associated with removal, site restoration and/or monitoring. To the extent contamination or other environmental issues have occurred in the past, we will attempt to recover restoration costs from third parties, such as the generators of hazardous waste, land sellers or others in the prior chain of title and/or their insurers.

However, despite these efforts, there can be no assurance that we will avoid material liabilities relating to the existence or removal of toxic wastes, site restoration, monitoring or other environmental matters affecting properties currently or previously owned or controlled by us, and no estimate of any potential liabilities can be made.