0000794619DEF 14AFALSE00007946192022-05-012023-04-300000794619amwd:MrCulbrethMember2022-05-012023-04-30iso4217:USDxbrli:pure0000794619amwd:MrCulbrethMember2021-05-012022-04-3000007946192021-05-012022-04-300000794619amwd:MrCulbrethMember2020-05-012021-04-300000794619amwd:SCaryDunstonMember2020-05-012021-04-3000007946192020-05-012021-04-30000079461912022-05-012023-04-300000794619amwd:EquityAwardsReportedValueMemberecd:PeoMemberamwd:MrCulbrethMember2022-05-012023-04-300000794619amwd:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2022-05-012023-04-300000794619amwd:EquityAwardsReportedValueMemberecd:PeoMemberamwd:MrCulbrethMember2021-05-012022-04-300000794619amwd:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2021-05-012022-04-300000794619amwd:EquityAwardsReportedValueMemberecd:PeoMemberamwd:MrCulbrethMember2020-05-012021-04-300000794619amwd:EquityAwardsReportedValueMemberecd:PeoMemberamwd:SCaryDunstonMember2020-05-012021-04-300000794619amwd:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2020-05-012021-04-300000794619amwd:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMemberamwd:MrCulbrethMember2022-05-012023-04-300000794619amwd:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2022-05-012023-04-300000794619amwd:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMemberamwd:MrCulbrethMember2021-05-012022-04-300000794619amwd:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2021-05-012022-04-300000794619amwd:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMemberamwd:MrCulbrethMember2020-05-012021-04-300000794619amwd:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMemberamwd:SCaryDunstonMember2020-05-012021-04-300000794619amwd:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2020-05-012021-04-300000794619ecd:PeoMemberamwd:EquityAwardsGrantedInPriorYearsUnvestedMemberamwd:MrCulbrethMember2022-05-012023-04-300000794619amwd:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-05-012023-04-300000794619ecd:PeoMemberamwd:EquityAwardsGrantedInPriorYearsUnvestedMemberamwd:MrCulbrethMember2021-05-012022-04-300000794619amwd:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-05-012022-04-300000794619ecd:PeoMemberamwd:EquityAwardsGrantedInPriorYearsUnvestedMemberamwd:MrCulbrethMember2020-05-012021-04-300000794619ecd:PeoMemberamwd:EquityAwardsGrantedInPriorYearsUnvestedMemberamwd:SCaryDunstonMember2020-05-012021-04-300000794619amwd:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-05-012021-04-300000794619ecd:PeoMemberamwd:MrCulbrethMemberamwd:EquityAwardsGrantedInPriorYearsVestedMember2022-05-012023-04-300000794619ecd:NonPeoNeoMemberamwd:EquityAwardsGrantedInPriorYearsVestedMember2022-05-012023-04-300000794619ecd:PeoMemberamwd:MrCulbrethMemberamwd:EquityAwardsGrantedInPriorYearsVestedMember2021-05-012022-04-300000794619ecd:NonPeoNeoMemberamwd:EquityAwardsGrantedInPriorYearsVestedMember2021-05-012022-04-300000794619ecd:PeoMemberamwd:MrCulbrethMemberamwd:EquityAwardsGrantedInPriorYearsVestedMember2020-05-012021-04-300000794619ecd:PeoMemberamwd:EquityAwardsGrantedInPriorYearsVestedMemberamwd:SCaryDunstonMember2020-05-012021-04-300000794619ecd:NonPeoNeoMemberamwd:EquityAwardsGrantedInPriorYearsVestedMember2020-05-012021-04-300000794619ecd:PeoMemberamwd:MrCulbrethMemberamwd:AdditionsForVariousReasonsMember2022-05-012023-04-300000794619ecd:NonPeoNeoMemberamwd:AdditionsForVariousReasonsMember2022-05-012023-04-300000794619ecd:PeoMemberamwd:MrCulbrethMemberamwd:AdditionsForVariousReasonsMember2021-05-012022-04-300000794619ecd:NonPeoNeoMemberamwd:AdditionsForVariousReasonsMember2021-05-012022-04-300000794619ecd:PeoMemberamwd:MrCulbrethMemberamwd:AdditionsForVariousReasonsMember2020-05-012021-04-300000794619ecd:PeoMemberamwd:SCaryDunstonMemberamwd:AdditionsForVariousReasonsMember2020-05-012021-04-300000794619ecd:NonPeoNeoMemberamwd:AdditionsForVariousReasonsMember2020-05-012021-04-300000794619ecd:PeoMemberamwd:EquityAwardsGrantedDuringTheYearVestedMemberamwd:MrCulbrethMember2022-05-012023-04-300000794619amwd:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2022-05-012023-04-300000794619ecd:PeoMemberamwd:EquityAwardsGrantedDuringTheYearVestedMemberamwd:MrCulbrethMember2021-05-012022-04-300000794619amwd:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2021-05-012022-04-300000794619ecd:PeoMemberamwd:EquityAwardsGrantedDuringTheYearVestedMemberamwd:MrCulbrethMember2020-05-012021-04-300000794619ecd:PeoMemberamwd:EquityAwardsGrantedDuringTheYearVestedMemberamwd:SCaryDunstonMember2020-05-012021-04-300000794619amwd:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2020-05-012021-04-300000794619ecd:PeoMemberamwd:ChangeInPensionValueMemberamwd:MrCulbrethMember2022-05-012023-04-300000794619amwd:ChangeInPensionValueMemberecd:NonPeoNeoMember2022-05-012023-04-300000794619ecd:PeoMemberamwd:ChangeInPensionValueMemberamwd:MrCulbrethMember2021-05-012022-04-300000794619amwd:ChangeInPensionValueMemberecd:NonPeoNeoMember2021-05-012022-04-300000794619ecd:PeoMemberamwd:ChangeInPensionValueMemberamwd:MrCulbrethMember2020-05-012021-04-300000794619ecd:PeoMemberamwd:ChangeInPensionValueMemberamwd:SCaryDunstonMember2020-05-012021-04-300000794619amwd:ChangeInPensionValueMemberecd:NonPeoNeoMember2020-05-012021-04-300000794619ecd:PeoMemberamwd:MrCulbrethMemberamwd:ChangeInPensionAdjustmentsMember2022-05-012023-04-300000794619ecd:NonPeoNeoMemberamwd:ChangeInPensionAdjustmentsMember2022-05-012023-04-300000794619ecd:PeoMemberamwd:MrCulbrethMemberamwd:ChangeInPensionAdjustmentsMember2021-05-012022-04-300000794619ecd:NonPeoNeoMemberamwd:ChangeInPensionAdjustmentsMember2021-05-012022-04-300000794619ecd:PeoMemberamwd:MrCulbrethMemberamwd:ChangeInPensionAdjustmentsMember2020-05-012021-04-300000794619ecd:PeoMemberamwd:ChangeInPensionAdjustmentsMemberamwd:SCaryDunstonMember2020-05-012021-04-300000794619ecd:NonPeoNeoMemberamwd:ChangeInPensionAdjustmentsMember2020-05-012021-04-300000794619ecd:PeoMemberamwd:TotalAdjustmentsMemberamwd:MrCulbrethMember2022-05-012023-04-300000794619amwd:TotalAdjustmentsMemberecd:NonPeoNeoMember2022-05-012023-04-300000794619ecd:PeoMemberamwd:TotalAdjustmentsMemberamwd:MrCulbrethMember2021-05-012022-04-300000794619amwd:TotalAdjustmentsMemberecd:NonPeoNeoMember2021-05-012022-04-300000794619ecd:PeoMemberamwd:TotalAdjustmentsMemberamwd:MrCulbrethMember2020-05-012021-04-300000794619ecd:PeoMemberamwd:TotalAdjustmentsMemberamwd:SCaryDunstonMember2020-05-012021-04-300000794619amwd:TotalAdjustmentsMemberecd:NonPeoNeoMember2020-05-012021-04-30000079461922022-05-012023-04-30000079461932022-05-012023-04-30000079461942022-05-012023-04-30

| | | | | | | | | | | | | | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| | | | | |

| SCHEDULE 14A |

| | | | | |

| Proxy Statement Pursuant to Section 14(a) of the |

| Securities Exchange Act of 1934 |

| (Amendment No. ) |

| Filed by the Registrant [X] | Filed by a Party other than the Registrant [ ] | | |

| Check the appropriate box: |

| [ ] Preliminary Proxy Statement |

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] Definitive Proxy Statement |

| [ ] Definitive Additional Materials |

| [ ] Soliciting Material Pursuant to §240.14a-12 |

| | | | | |

| American Woodmark Corporation |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

561 Shady Elm Road

Winchester, Virginia 22602

Notice of Annual Meeting of Shareholders

TO THE SHAREHOLDERS OF

AMERICAN WOODMARK CORPORATION:

The Annual Meeting of Shareholders ("Annual Meeting") of American Woodmark Corporation (the "Company") will be held at the corporate offices of American Woodmark Corporation, 561 Shady Elm Road, Winchester, Virginia, on Thursday, August 24, 2023, at 9:00 a.m., Eastern Daylight Time, for the following purposes:

| | | | | | | | |

| 1. | To elect as directors the eight nominees listed in the attached proxy statement to serve a one-year term on the Company's Board of Directors; |

| 2. | To ratify the selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending April 30, 2024; |

| 3. | To approve the American Woodmark Corporation 2023 Stock Incentive Plan; |

| 4. | To approve on an advisory basis the Company's executive compensation; |

| 5. | To approve on an advisory basis the frequency of future advisory votes on the Company's executive compensation; and |

| 6. | To transact such other business as may properly come before the Annual Meeting or any adjournments thereof. |

Only shareholders of record of shares of the Company's common stock at the close of business on June 20, 2023 will be entitled to vote at the Annual Meeting or any adjournments thereof.

Whether or not you plan to attend the Annual Meeting, please mark, sign, and date the enclosed proxy and promptly return it in the enclosed envelope. If for any reason you desire to revoke your proxy, you may do so at any time before it is voted.

All shareholders are cordially invited to attend the Annual Meeting.

| | | | | |

| By Order of the Board of Directors |

| Paul Joachimczyk |

| Secretary |

July 10, 2023

AMERICAN WOODMARK CORPORATION

561 Shady Elm Road

Winchester, Virginia 22602

Proxy Statement

PROXY SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider. Please read the entire Proxy Statement carefully before voting. This Proxy Statement will be mailed to shareholders of American Woodmark Corporation (the "Company," "American Woodmark" or "us") on or about July 10, 2023.

| | | | | |

| Annual Stockholders meeting |

| |

| Date | August 24, 2023 |

| |

| Time | 9:00 a.m. Eastern Daylight Time |

| |

| Place | American Woodmark Corporation Corporate Office |

| 561 Shady Elm Road |

| Winchester, Virginia 22602 |

| |

| Record date | June 20, 2023 |

| |

| Voting | Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. |

•Election of eight directors

•Ratification of Ernst & Young LLP ("EY") as our independent registered public accounting firm for fiscal year ending April 30, 2024 ("fiscal 2024")

•Approval of the American Woodmark Corporation 2023 Stock Incentive Plan

•Advisory approval of executive compensation

•Advisory approval of frequency of future advisory votes on executive compensation

•Transact other business that may properly come before the meeting

| | | | | | | | | | | | | | | | | | | | | | | |

| Voting Matter and Vote Recommendation |

| | | | | | | |

| Item | | Board recommendation | | Reasons for recommendations | | More information |

| | | | | | | |

| 1. | Election of eight directors

| | FOR | | The Board and Governance, Sustainability and Nominating Committee believe that the eight director nominees possess the skills and experience to effectively monitor performance, provide oversight, and advise management on the Company's long-term strategy. | | Page 6 |

| | | | | | | |

| 2. | Ratification of EY as our independent registered public accounting firm for fiscal 2024 | | FOR | | Based on the Audit Committee's assessment of EY's qualifications and performance, it believes that their retention for fiscal 2024 is in the best interests of the Company. | | Page 52 |

| | | | | | | |

| 3. | Approval of the American Woodmark Corporation 2023 Stock Incentive Plan | | FOR | | The Board believes it is important to attract and retain experienced and qualified employees | | Page 52 |

| | | | | | | |

| 4. | Advisory approval of executive compensation | | FOR | | The Company's executive compensation programs demonstrate the Company's pay for performance philosophy. | | Page 58 |

| | | | | | | |

| 5. | Advisory approval of frequency of future advisory votes on executive compensation | | 1 YEAR | | The Board believes frequency of one year for holding future advisory votes on the compensation of the Company’s named executive officers is appropriate.

| | Page 58 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Company Management Profile |

| The following table provides summary information about each current director. | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Committee memberships | | | | |

| Name | | Age | | Director since calendar year | | Independent | | Other public boards | | AC | | CC | | GC | | Attended at least 75% of Board and committee meetings | | Up for election at current Annual Meeting |

| James G. Davis, Jr. | | 64 | | 2002 | | Yes | | 0 | | M, F | | | | C | | Yes | | Yes |

| Daniel T. Hendrix | | 68 | | 2005 | | Yes | | 1 | | C, F | | | | | | Yes | | Yes |

| Andrew B. Cogan | | 60 | | 2009 | | Yes | | 0 | | | | M | | | | Yes | | Yes |

| Vance W. Tang | | 56 | | 2009 | | Yes | | 1 | | | | M | | M | | Yes | | Yes |

| M. Scott Culbreth | | 52 | | 2020 | | No | | 1 | | | | | | | | Yes | | Yes |

| David A. Rodriguez | | 64 | | 2020 | | Yes | | 1 | | | | C | | M | | Yes | | Yes |

| Emily C. Videtto | | 41 | | 2021 | | Yes | | 0 | | M | | | | M | | Yes | | Yes |

| Latasha M. Akoma | | 52 | | 2022 | | Yes | | 1 | | M | | | | | | Yes | | Yes |

AC - Audit Committee C - Chair

CC - Compensation and Social Principles Committee M - Member

GC - Governance, Sustainability and Nominating Committee F - Financial Expert

Voting Rights, Procedures, and Solicitation

Proxy Solicitation

This Proxy Statement, mailed to shareholders of American Woodmark Corporation (the "Company") on or about July 10, 2023, is furnished in connection with the solicitation of proxies by the Company's Board of Directors (the "Board") in the accompanying form for use at the 2023 Annual Meeting of Shareholders (the "Annual Meeting") to be held at the corporate offices of American Woodmark Corporation, 561 Shady Elm Road, Winchester, Virginia, on Thursday, August 24, 2023, at 9:00 a.m., Eastern Daylight Time, and at any adjournments thereof. A copy of the annual report of the Company for the fiscal year ended April 30, 2023 is being mailed to you with this Proxy Statement.

In addition to the solicitation of proxies by mail, the Company's officers and other employees, without additional compensation, may solicit proxies by telephone and personal interview. The Company will bear the cost of all solicitation efforts. The Company also will request brokerage houses and other custodians, nominees and fiduciaries to forward soliciting material to the beneficial owners of the Company's common stock held as of the record date by those parties and will reimburse those parties for their expenses in forwarding soliciting material.

Record Date and Voting Rights

On June 20, 2023, the record date for determining the shareholders entitled to receive notice of and to vote at the Annual Meeting, there were 16,376,579 shares of common stock of the Company outstanding and entitled to vote. Each such share of common stock entitles the owner to one vote on each matter presented.

Revocability and Voting of Proxy

A form of proxy for use at the Annual Meeting and a return envelope for the proxy are enclosed. Any shareholder who provides a proxy may revoke such proxy at any time before it is voted. Proxies may be revoked by:

| | | | | | | | | | | |

| • | | filing with the Secretary of the Company written notice of revocation which bears a later date than the date of the proxy; |

| • | | duly executing and filing with the Secretary of the Company a later dated proxy relating to the same shares; or |

| • | | attending the Annual Meeting and voting in person. |

Votes will be tabulated by one or more inspectors of election. A proxy, if properly executed and not revoked, will be voted as specified by the shareholder. If the shareholder does not specify his or her choice but returns a properly executed proxy card, the shares will be voted as follows:

| | | | | | | | | | | |

| • | | "FOR" the election of the eight nominees for director named herein; |

| • | | "FOR" the ratification of EY as the independent registered public accounting firm of the Company for fiscal 2024; |

| • | | "FOR" the approval of the American Woodmark Corporation 2023 Stock Incentive Plan; |

| • | | "FOR" the approval on an advisory basis of the compensation of the Company's named executive officers ("NEOs") as disclosed in this Proxy Statement; |

| • | | “1 YEAR” as the selection on an advisory basis of the frequency for holding future advisory votes on the compensation of the Company’s named executive officers as disclosed in this Proxy Statement; and |

| • | | In the proxies' discretion on any other matters properly coming before the Annual Meeting or any adjournment thereof. |

A majority of the total outstanding shares of common stock of the Company entitled to vote on matters to be considered at the Annual Meeting, represented in person or by proxy, constitutes a quorum. Once a share is

represented for any purpose at the Annual Meeting, it is deemed to be present for quorum purposes for the remainder of the meeting. Abstentions and shares held of record by a broker or its nominee ("Broker Shares") that are voted on any matter are included in determining the number of votes present or represented at the Annual Meeting. However, Broker Shares that are not voted on any matter at the Annual Meeting will not be included in determining whether a quorum is present at the meeting.

The Company's bylaws require that, in uncontested elections, each director receive a majority of the votes cast with respect to that director (the number of shares voted "for" a director nominee must exceed the number of votes cast "against" that nominee). Actions on all other matters to come before the meeting will be approved if the votes cast "for" that action exceed the votes cast "against" it, with the exception of the advisory vote on the frequency of future advisory votes on the compensation of the Company's named executive officers for which the frequency receiving the most votes will be deemed the preference of the shareholders. Abstentions and Broker Shares that are not voted on a particular matter are not considered votes cast and, therefore, will have no effect on the outcome of the election of directors or any other matter.

Participants in the American Woodmark Corporation Retirement Savings Plan will receive a proxy packet from the Company's transfer agent and registrar, Computershare Shareholder Services, enabling them to provide instructions for voting the shares of the Company's common stock held in their plan accounts. The Newport Group, the plan's administrator, will determine the number of shares beneficially owned by each participant and communicate that information to the transfer agent. Each participant's voting instructions must be properly executed and returned in the envelope provided in order for the participant's shares to be voted. If a participant does not return voting instructions, then the shares held in the participant's account will be voted by the trustee of the plan in the same manner as shares voted by other plan participants.

Strategy Highlights

We believe the strength of our culture and connections will deliver profitability through Growth, Digital Transformation, and Platform Design ("GDP"). Our GDP strategy is the lens we view long-term decision-making, enabling growth and profitability through the cycle. Growth will maximize our market opportunity through key initiatives. Digital Transformation will strengthen our goal of becoming "One American Woodmark." Lastly, Platform Design will leverage complexity reduction and operational excellence to drive margin improvement.

| | | | | | | | | | | |

| Growth | Product Innovation |

| • | Target launches of opening price point brands into new markets |

| • | Relevancy across Made-to-Stock, Made-to-Order, Framed, Frameless categories |

| |

| Channel Initiatives |

| • | Dealer/Distributor penetration |

| • | E-commerce Expansion |

| Highlights |

| Our key growth drivers have funneled through product innovation & capacity investments and expanding channel opportunities. We are building on nearly 30% of Made-to-Order sales from products introduced in the last three years, and our facility expansions in Mexico and NC will strengthen our Made-to-Stock product line. By gaining share with the Origins brand and expanding our offerings across the home building market, we are achieving our goal of improving affordability. We saw Origins become our fastest-growing brand for three years in a row. |

| | | | | | | | | | | |

| Digital Transformation | One American Woodmark |

| • | Investments in technology infrastructure to operate as one company |

| • | Faster marketing cycles |

| |

| Driving Deeper Channel Penetration |

| • | E-commerce expanding with improved product offerings content, and experience |

| • | Accelerate customer conversion with easy-to-use design and shopping tools |

| Highlights |

| Our digital transformation is a long-term strategy to strengthen our customer loyalty and drive efficiencies. In the last year, we have focused on improving content and personalization throughout the consumer journey to grow digital engagement. |

Content Improvements: Across digital properties, we have improved key metrics to drive sales and achieve our goal of becoming the best-in-class for digital content in all sales categories. In our commitment to exceeding our content performance targets on home center websites, we’ve seen a 92% increase in page visits. |

Technology: We’re continuing to implement and leverage our expanding technology capabilities to launch multiple new high-performing websites, allowing us to identify what matters to our customers and proactively change a customer’s experience based on their preferences in every step along their journey. Our current capabilities allow us to create and act upon a 360-degree view of the product. |

Test and Learn: We believe our customer’s digital experience is one of our highest priorities. We regularly complete rigorous testing across our digital platforms to continuously improve key elements and ensure our customer consistently returns with high-engagement activities. In fiscal 2023, we launched a full test-and-learn program, allowing us to provide numerous potential experiences to our customers across five brands. |

| Platform Design | Customer Experience (CX) |

| • | Kitchen and Bath Center of Excellence |

| • | Delivery, quality, response rate |

| |

| Operational Excellence (OPEX) |

| • | Design For Manufacturing & Assembly (DFMA), materials, logistics, and labor savings |

| • | Drive production and efficiency through a balanced manufacturing footprint |

| |

| Automation |

| • | Reduce labor costs and waste |

| • | Improve lead times and quality |

| • | Make our employee's jobs easier |

| Highlights |

| Expansion of Made-to-Stock Manufacturing Operations to better serve the east coast market utilizing automation and Design for Manufacturing & Assembly methodology. Our new Monterrey, MX facility and the expansion of our Hamlet, NC facility will strengthen our Made-to-Stock Kitchen & Bath supply chain and create a new Bath Manufacturing Center of Excellence. These changes will address growth opportunities, improve services for the repair and remodel market, lower the cost of production, modernize assets, and strengthen our supply chain. Both of these facilities are expected to be completed in fiscal 2024. Alongside our new facility and expanding facility, we have ongoing efforts to make continuous improvements in our existing plants to drive innovation through optimized levels of complexity & standardization of processes. |

ITEM 1 – ELECTION OF DIRECTORS

The Board is currently comprised of eight members, each of whom have been recommended by the Governance, Sustainability and Nominating Committee to the Board and nominated by the Board for election at the Annual Meeting to continue to serve on the Board. Unless otherwise specified, if returned and properly executed, the enclosed proxy will be voted for the eight persons named below to serve until the next Annual Meeting and until their successors are elected and duly qualified.

Martha M. Hayes, who turned 72 during the past fiscal year, will not stand for re-election due to the Board of Directors mandatory retirement age policy and retired effective at our May 2023 board meeting and the size of the Board of Directors was reduced from nine to eight directors. Our Board has added four new board members in the last three fiscal years and therefore determined not to immediately replace Ms. Hayes in the current director election. However, the Board and the Governance, Sustainability and Nominating Committee are considering whether to add another new board member during fiscal 2024. If it takes such action, gender diversity will be a consideration among other key factors.

The Governance, Sustainability and Nominating Committee is responsible for identifying and recommending to the Board nominees for election to the Board. In identifying potential nominees, the Governance, Sustainability and Nominating Committee considers candidates recommended by shareholders, current members of the Board or management, as well as any other qualified candidates that may come to the Governance, Sustainability and Nominating Committee's attention. From time to time, the Governance, Sustainability and Nominating Committee may engage an independent firm to assist in identifying potential director nominees. The Governance, Sustainability and Nominating Committee evaluates all potential director nominees in the same manner regardless of the source of the recommendation. Please see Procedures for Shareholder Nominations of Directors on page 15 for more information.

The Board believes that the Company's directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the Company's shareholders. When searching for new directors, the Governance, Sustainability and Nominating Committee considers a candidate's managerial experience, as well as business judgment, background, integrity, ethics and conflicts of interest. The Governance, Sustainability and Nominating Committee does not have a formal policy with respect to diversity; however, the Board and the Governance, Sustainability and Nominating Committee believe it is essential that Board members represent diverse backgrounds and viewpoints. The Governance, Sustainability and Nominating Committee considers issues such as diversity of professional experience, skills, viewpoints, education, gender and ethnicity. In considering candidates for the Board, the Governance, Sustainability and Nominating Committee considers the entirety of each candidate's credentials in the context of these criteria. With respect to the nomination of continuing directors for re-election, the individual's contributions to the Board are also considered.

Each nominee listed below has consented to serve as a director, and the Company anticipates all of the nominees named below will be able to serve, if elected. If at the time of the Annual Meeting any nominee is unable or unwilling to serve, then shares represented by properly executed proxies will be voted at the discretion of the persons named therein for such other person as the Board of Directors may designate.

If a nominated director does not receive a majority of the votes cast at the Annual Meeting, Virginia law and the Company's bylaws provide that such director would continue to serve on the Board as a "holdover director." Under the bylaws, each incumbent director submits an advance, contingent, irrevocable offer of resignation that the Board may accept if the nominee does not receive a majority of the votes cast. In that situation, the Board's Governance, Sustainability and Nominating Committee would make a recommendation to the Board about whether to accept or reject the offer of resignation. The Board would act on the Governance, Sustainability and Nominating Committee's recommendation within 90 days after the date that the election results were certified and would promptly publicly disclose its decision and, if applicable, the rationale for rejecting the offer of resignation.

Information Regarding Nominees

The names and ages of the Company's nominees, their business experience, and other information regarding each nominee are set forth below.

| | | | | | | | | | | |

Name |

Age |

Business Experience During the Last Five Years and Directorship(s) in Public Companies | Director of Company Since |

| James G. Davis, Jr. | 64 | Chief Executive Officer, James G. Davis Construction Corporation (a | 2002 |

| | private commercial general contractor) from 1979 to present; Director, Provident Bankshares Corporation (a public company and financial institution) from October 2006 to July 2009. Mr. Davis's career in the construction industry has been highlighted with leadership roles in operations. Mr. Davis's experience as a chief executive officer of a construction company provides the Board with an important perspective. | |

| | | |

| Daniel T. Hendrix | 68 | Chairman of Interface, Inc. (a public company and manufacturer of modular | 2005 |

| | flooring products) from October 2011 to present; President and Chief Executive Officer, from January 2020 to April 2022 and July 2001 to March 2017; Director, Interface, Inc. from 1996 to present. Mr. Hendrix's 30+ year career in the building products industry has been highlighted with leadership roles in finance and operations. Mr. Hendrix's experience as a chief executive officer of a publicly traded company in the building products industry provides the Board with an important perspective. | |

| | | |

| Andrew B. Cogan | 60 | Chief Executive Officer of Sonneman - A Way of Light (a private company | 2009 |

| | and leader in design and manufacturing of contemporary lighting) March 2022 to present and Director September 2021 to present; Chairman of The Rug Company London, UK (a privately-held manufacturer of handmade rugs) January 2022 to present; Chairman and Chief Executive Officer, Knoll, Inc. ("Knoll", a public company and manufacturer of furnishings, textiles and fine leathers) from May 2018 to July 2021; President and Chief Executive Officer, Knoll from May 2016 to May 2018; Chief Executive Officer, Knoll from April 2001 to May 2016; Director, Knoll from 1996 to July 2021. Director, Interface, Inc. from 2013 to February 2020. Mr. Cogan's 25+ year career in the manufacturing industry has been highlighted with leadership roles in design and marketing. Mr. Cogan's experience as a chief executive officer of a publicly traded company provides the Board with a valuable perspective. | |

| | | |

| Vance W. Tang | 56 | Non-Executive Chair of the Board of Directors since 2020; Company | 2009 |

| | Lead Independent Director from 2019 to 2020; Retired; President and Chief Executive Officer of the U.S. subsidiary of KONE Corporation (a Finnish public company and a leading global provider of elevators and escalators) and Executive Vice President of KONE Corporation from 2007 to 2012; Director, Comfort Systems USA (a publicly traded leader in specialty contracting and a service provider for mechanical, electrical and plumbing building systems) from December 2012 to present. Since 2012, Mr. Tang has served as President of VanTegrity Consulting providing leadership and strategy consulting to a range of clients. Mr. Tang's 30+ year career in industry has been highlighted with leadership roles in operations. Mr. Tang's former experience as a chief executive officer in the construction industry and his CERT Certificate in Cybersecurity Oversight provide the Board with a valuable perspective. | |

| | | |

| | | |

| | | |

| | | | | | | | | | | |

Name |

Age |

Business Experience During the Last Five Years and Directorship(s) in Public Companies | Director of Company Since |

| M. Scott Culbreth | 52 | Company Chief Executive Officer and President from July 2020 to present; | 2020 |

| | Company Senior Vice President and Chief Financial Officer from February 2014 to July 2020; Board Member of FlexSteel Industries, Inc. from December 2021 to present. Mr. Culbreth's 20+ year career in the manufacturing industry has been highlighted with leadership roles in finance. Mr. Culbreth's role as the Company's Chief Executive Officer and former Chief Financial Officer provides the Board with intimate knowledge of the Company's operations and performance. | |

| | | |

| David A. Rodriguez | 64 | Retired from his role as Executive Vice President and Global Chief Human | 2020 |

| | Resources Officer, Marriott International (a public company and worldwide operator, franchisor, and licensor of hotel, residential and timeshare properties) from 2006 to 2021; Board Member, Globe Life, Inc. from 2023 - present; Board Member, Society for Industrial & Organizational Psychology Foundation from 2022 to present. Board Member, HR Policy Association from 2008 to 2021; Board Member, American Health Policy Institute from 2017 to 2019. Mr. Rodriguez's 20+ year career in the hospitality industry has been highlighted with leadership roles in human resources. Mr. Rodriguez's experience as a chief human resources officer of a publicly traded company provides the Board with a valuable perspective. | |

| | | |

| Emily C. Videtto | 41 | Executive Vice President, Sales and Marketing, Pella Corporation (a | 2021 |

| | privately-held manufacturer of windows and doors) from 2021 to present; Vice President and Chief Marketing Officer of Pella Corporation from 2016 to 2021; Director, Window and Door Manufacturers Association from 2017 to present. Ms. Videtto's experience in the consumer durables space, as well as her expertise around marketing, digital and innovation provides the Board with a valuable perspective. | |

| | | |

| Latasha M. Akoma | 52 | Operating Partner at GenNx360 Capital Partners (a private equity firm that | 2022 |

| | specializes in middle market companies and operations specialists) from 2014 to present and interim Chief Compliance Officer in 2021; Board Member, Lion Electric from 2022 to present. Ms. Akoma's experience in operations and manufacturing provides the Board with a valuable perspective. | |

| | | | | | | | | | | |

| Board Diversity Matrix (As of June 27, 2023) |

| Total Number of Directors | 8 |

| | | |

| Female | | Male |

| Part I: Gender Identity: | | | |

| Directors | 2 | | 6 |

| Part II: Demographic Background | | | |

| African American or Black | 1 | | 0 |

| Hispanic or Latinx | 0 | | 1 |

| White | 1 | | 5 |

The information in the Board Diversity Matrix is based on voluntary, self-reported information from our Board members. The categories included in the table have the meanings set forth in NASDAQ Rule 5605(f). Diversity characteristics not applicable to our Board have been excluded from the table. For our Board Diversity Matrix as of June 29, 2022, see our proxy statement filed with the SEC on June 29, 2022.

As illustrated in the tables above, our Board members bring instrumental depth, breadth, and perspective to our Company. Each member of the Board has made numerous tours of American Woodmark facilities and customer

sites. This gives them a first-hand look at innovative projects and processes as well as a valuable opportunity to interact with employees and customers. Our Board supports the Company's inclusive culture and its engagement in the communities where we live and work. Both as a group and as individuals, Board members keep themselves current on Board-related matters by reading corporate governance periodicals, attending meetings of the National Association of Corporate Directors, the Conference Board and other such organizations, and hearing from the Company's outside counsel and other experts on pertinent topics.

CORPORATE GOVERNANCE

Codes of Business Conduct and Ethics

The Code of Business Conduct and Ethics (the "Code") applies to all directors, officers, and other employees of the Company, and sets forth important Company policies and procedures on conducting the Company's business in a legal, ethical, and responsible manner. The Code requires all employees, including officers, and directors to respect and obey all applicable laws and regulations when conducting the Company's business and includes policies addressing employee conduct and safety, equality and inclusion, conflicts of interest, insider trading, confidentiality, internal and external communications, environmental compliance, and other matters. The Code also sets forth Company policies and procedures for ensuring that disclosures in the Company's financial reports and documents filed with or furnished to the SEC and other public communications are full, fair, accurate, timely, and understandable.

The Code is available on the Governance Documents page of the Company's website at

https://investors.americanwoodmark.com/investors/governance-documents. Any amendments to, or waivers from, any code provisions that apply to the Company's directors or executive officers will be promptly posted on the Governance Documents page of the Company's website. Any amendments to the Code or waivers from any provisions of the Code that apply to the Company's directors or executive officers must be approved by the Board. No amendments or waivers were requested or granted during the fiscal year ended April 30, 2023.

Social and Environmental Responsibility Principles

American Woodmark is committed to social and environmental responsibility. Our culture and core values drive us to ensure that we as a company contribute to the communities in which we live and work. We aim to be a responsible business that meets the highest standards of ethics and professionalism through compliance and a proactive stance. To that end, the Board has adopted a policy for the Company of Social and Environmental Responsibility Principles that describes the Company's commitment to social and environmental responsibility. Under these principles, we at American Woodmark strive to:

| | | | | | | | | | | |

| • | | Engage our key stakeholders including employees, customers, shareholders and suppliers, to ensure their needs and concerns are heard and addressed, and if appropriate, incorporated into our strategy; |

| • | | Integrate social and environmental impact considerations in our decision-making processes; |

| • | | Maintain a safe, fair, and enriching working environment where all employees are treated with respect and are able to achieve their full potential; |

| • | | Identify and minimize potential negative environmental impacts of our operations, including recycling and energy conservation initiatives; |

| • | | Work with vendors in our supply chain to strengthen the social and environmental aspects of products and services we deliver to our customers; |

| • | | Fund the American Woodmark Foundation and its support of non-profit organizations in the communities we operate; and |

| • | | Encourage employees to volunteer through internally or externally organized events. |

A copy of these principles can be found on the Corporate Governance page of the Company's website at https://investors.americanwoodmark.com/investors/governance-documents. Our approach is reviewed with our Board of Directors at least every two years and, if necessary, revised to ensure continuous improvements to our social and environmental efforts.

Board Structure

The Company's Board currently consists of eight directors, all of whom are subject to annual shareholder elections to one-year terms of service. Due to the Board's mandatory retirement age policy, Ms. Hayes is not standing for re-election at the next Annual Meeting. At its May 2023 meeting, the Board approved an amendment to the Company's bylaws, which decreased the number of directors of the Company from nine to eight. Each of the Company's independent directors sits on at least one of the three standing Board committees, which include the Audit Committee, the Compensation and Social Principles Committee, and the Governance, Sustainability and Nominating Committee.

As Chair of our Board, Mr. Tang is responsible for chairing Board and shareholder meetings, setting the agendas for the Board meetings, attending meetings of the Board's committees with the approval of the respective committee if he is not a committee member, and assisting management in representing the Company to external groups as needed and as appropriate. His duties also include presiding over executive sessions of the Company's independent directors, facilitating information flow and communication among the directors and serving as a point of contact between the independent directors and the Chief Executive Officer. The Board elects its Chair annually.

Mr. Culbreth, as Chief Executive Officer, oversees the day-to-day affairs of the Company and directs the formulation and implementation of our strategic plans. Our Board believes that this leadership structure is currently the most appropriate for the Company because it allows our Chief Executive Officer to focus primarily on our business strategy and operations while leveraging the experience and abilities of our Chair to direct the business of the Board.

Our Board periodically reviews its leadership structure and recognizes that, depending on the circumstances, a different model might be appropriate. The Board has no fixed policy on whether the roles of Chair and Chief Executive Officer should be separate or combined, which provides the Board flexibility to choose a leadership structure based on the Company's needs and the Board's assessment of the Company's leadership at a given time. Our Governance, Sustainability and Nominating Committee Charter and Independent Lead Director Charter do provide that the Board appoint an independent lead director in the event the Chief Executive Officer is elected Chair or the Chair otherwise does not qualify as independent.

The Company's independent directors meet in regularly scheduled executive sessions at each of the Company's regularly scheduled Board meetings, without management present, and discuss such matters as certain Board policies, processes and practices, the performance and compensation of the Company's Chief Executive Officer, management succession and other matters relating to the Company and the functioning of the Board.

Risk Management Oversight

The Board, both directly and through its committees, has an active role in overseeing management of the Company's risks. The entire Board regularly reviews information concerning the Company's operations, liquidity, and competitive position and personnel, as well as the risks associated with each. The Company's Compensation and Social Principles Committee is responsible for overseeing the Company's management of risks relating to the Company's executive and long-term compensation plans and risks related to employee compensation in general. The Audit Committee oversees the Company's management of risks pertaining to internal controls, cybersecurity, adherence to generally accepted accounting principles and financial reporting. The Governance, Sustainability and Nominating Committee oversees the Company's management of risks pertaining to potential conflicts of interest and independence of board members. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is regularly informed through committee reports about such risks.

Director Independence

The Board of Directors of the Company is composed of a majority of directors who are independent directors as defined under the NASDAQ Marketplace Rules. The Board's Audit and Compensation and Social

Principles Committee members also meet additional independence requirements pursuant to the NASDAQ Marketplace Rules and SEC rules.

To be independent under the NASDAQ Marketplace Rules, the Board must determine that a director has no relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The NASDAQ Marketplace Rules specify certain persons who cannot be considered independent. The Board reviews the independence of all directors at least annually.

Based upon this review, the Board affirmatively determined that seven of its eight current directors are independent as defined by the NASDAQ Marketplace Rules. The independent directors are: Ms. Akoma, Mr. Cogan, Mr. Davis, Mr. Hendrix, Mr. Rodriguez, Mr. Tang, and Ms. Videtto, each of whom is standing for election at the Annual Meeting. In addition, all of the members of the Audit Committee, the Compensation and Social Principles Committee, and the Governance, Sustainability and Nominating Committee are independent. The members of the Audit and Compensation and Social Principles Committees also meet the additional independence requirements applicable to them under the NASDAQ Marketplace Rules and SEC rules.

Communicating Concerns to the Board of Directors

The Audit Committee and the independent non-management directors have established procedures to enable any shareholder or employee who has a concern about the Company's conduct or policies, or any employee who has a concern about the Company's accounting, internal accounting controls or auditing matters, to communicate that concern directly to the Board, to the independent directors, or to the Audit Committee. Such communications may be confidential or anonymous. Such communications may be submitted by utilizing the ethics hotline, which is hosted by EthicsPoint's secure services:

Woodmark.ethicspoint.com

U.S.: 1-844-471-7681

Mexico: 001-844-240-4029

The Company's Director of Internal Audit reviews all such correspondence and, as appropriate, discloses details to the Audit Committee and the external auditors of the Company. The Audit Committee will review this information and determine a course of action as appropriate based on the information received.

The Audit Committee reviews and regularly provides the Board of Directors with a summary of all communications received from shareholders and employees and the actions taken or recommended to be taken if an action requires approval of the full Board as a result of such communications. Directors may, at any time, review a log of all correspondence received by the Company which is addressed to the Board, members of the Board or the Audit Committee and may request copies of any such correspondence.

Board of Directors and Committees

The Company's Board of Directors presently consists of eight directors. The Board held five meetings during fiscal 2023. All of the directors attended at least 75% of the total number of Board meetings and meetings of all committees of the Board held during periods when they were members of the Board or such committees. The Board of Directors believes that attendance at the Company's annual meeting demonstrates a commitment to the Company, responsibility and accountability to shareholders, and support of management and employees. Therefore, it is a policy of the Board that all members attend the annual meeting of shareholders. All members of the Board attended last year's annual meeting. The Board of Directors also believes it is important for it to conduct location visits with employees of the Company. In fiscal 2023, the majority of the Board visited our plant in Anaheim, California as part of the May 2022 Board meeting, and the majority of the Board visited our manufacturing operations in Hamlet, North Carolina at the February 2023 Board Meeting.

The Company's bylaws specifically allow for the Board to create one or more committees and to appoint members of the Board to serve on them. Our current standing committees are the Audit Committee, the Compensation and Social Principles Committee, and the Governance, Sustainability and Nominating Committee.

The Board annually appoints individuals from among its independent members to serve on these three committees. Each committee operates under a written charter adopted by the Board, as amended from time to time. On an annual basis, each committee reviews and reassesses the adequacy of its committee charter. The Audit Committee is scheduled to meet at least quarterly and the Compensation and Social Responsibility and Governance, Sustainability and Nominating Committees meet as required, typically at least two to three times per year. The committees may hold special meetings as necessary. These committees report regularly to the full Board of Directors with respect to their fulfillment of the responsibilities and duties outlined in their respective charters. These charters can be found on the Corporate Governance page of the Company's website at https://investors.americanwoodmark.com/investors/governance-documents.

Audit Committee

The Audit Committee consists of Mr. Hendrix, who chairs the Committee, Ms. Akoma, Mr. Davis, and Ms. Videtto. All members have been determined by the Board of Directors to be "independent" as defined under the NASDAQ Marketplace Rules and SEC rules, including the additional independence requirements applicable to audit committee members. The Board of Directors has determined that Mr. Hendrix and Mr. Davis are "audit committee financial experts" as defined under SEC rules.

Purpose and Duties. The Audit Committee provides oversight for the integrity of the Company's financial statements, the Company's compliance with legal and regulatory requirements, the independence, and qualifications of the Company's independent registered public accounting firm, the performance of the internal audit function and independent registered public accounting firm, and the adequacy and competency of the Company's finance and accounting staff.

The Audit Committee's duties include but are not limited to: (1) selecting and overseeing the performance of the Company's independent registered public accounting firm, (2) reviewing the scope of the audits to be conducted by them, as well as the results of their audits, (3) overseeing the Company's financial reporting activities, including the Company's financial statements included in the Company's Annual Report on Form 10-K as well as the Company's Quarterly Reports on Form 10-Q, and the accounting standards and principles that are followed, (4) approving audit and non-audit services provided to the Company by the Company's independent registered public accounting firm, (5) reviewing the organization and scope of the Company's internal audit function and internal controls, (6) reviewing and approving or ratifying transactions with related persons required to be disclosed under SEC rules, (7) overseeing matters related to cybersecurity risk, and (8) conducting other reviews relating to compliance by employees with Company policies and applicable laws.

The Audit Committee met nine times during fiscal 2023. The Audit Committee is governed by a written charter approved by the Board of Directors, which can be viewed on the Corporate Governance page of the Company's website at https://investors.americanwoodmark.com/investors/governance-documents. The Report of the Audit Committee is found beginning on page 50.

Compensation and Social Principles Committee

The Compensation and Social Principles Committee is composed of Mr. Rodriguez , who chairs the Committee, Mr. Cogan, and Mr. Tang. All members have been determined by the Board of Directors to be "independent" as defined under the NASDAQ Marketplace Rules and SEC rules, including the additional independence requirements applicable to Compensation and Social Principles committee members.

Purpose and Duties. The Compensation and Social Principles Committee is primarily concerned with designing and managing competitive compensation programs to facilitate the attraction and retention of talented senior executives and directors and overseeing the Company's policies and practices with respect to social principles, including human capital matters. The activities of the Compensation and Social Principles Committee include reviewing, evaluating, and approving senior executive compensation plans and evaluating and recommending director compensation plans for approval by the Board. The Compensation and Social Principles Committee also provides oversight for all of the Company's employee benefit plans and for the integration of social principles into the Company's business strategy and decision-making. The Compensation and Social Principles Committee

delegates certain aspects of implementation and day-to-day management of compensation administration to officers of the Company.

The Compensation and Social Principles Committee's duties include but are not limited to: (1) reviewing, evaluating, and approving corporate goals and objectives relevant to the Chief Executive Officer's and other senior executive officers' compensation, (2) evaluating the Chief Executive Officer's and other senior executive officers' performance in light of those goals and objectives, (3) determining and approving the Chief Executive Officer's and other senior executive officers' compensation levels based on this evaluation, (4) overseeing the compensation and benefit plans, policies, and programs of the Company, and (5) periodically reviewing the Company's practices with respect to, as risks associated with, human capital matters and other social principles, including community engagement and reputational matters, and evaluating the Company's progress towards achieving any objectives with respect to such matters.

The Compensation and Social Principles Committee determines the Chief Executive Officer's compensation after reviewing his performance with the independent directors of the Board and without members of management being present and shares this information with the full Board. The Compensation and Social Principles Committee determines the compensation of the other senior executives after considering a recommendation from the Chief Executive Officer. The Compensation and Social Principles Committee does not delegate its authority with regard to executive compensation decisions.

The Compensation and Social Principles Committee administers and approves awards under the Company's 2016 Employee Stock Incentive Plan, the Company's 2015 Non-Employee Directors Restricted Stock Unit Plan, and if approved at the Annual Meeting, the Company's 2023 Stock Incentive Plan.

The Compensation and Social Principles Committee met four times during fiscal 2023. The Compensation and Social Principles Committee's charter can be viewed on the Corporate Governance page of the Company's website at https://investors.americanwoodmark.com/investors/governance-documents. Additional information on the Company's philosophy and policies pertaining to executive compensation are addressed in the Compensation Discussion and Analysis beginning on page 19. The Compensation and Social Principles Committee Report can be found beginning on page 40.

Governance, Sustainability and Nominating Committee

The Governance, Sustainability and Nominating Committee is composed of Mr. Davis, who chairs the Committee, Mr. Tang, Mr. Rodriguez, and Ms. Videtto. All members have been determined by the Board of Directors to be "independent" as defined under the NASDAQ Marketplace Rules.

Purpose and Duties. The Governance, Sustainability and Nominating Committee is responsible for identifying and recommending to the Board director nominees for the Board, recommending directors for appointment to committees and chairs, and ensuring that the size, composition, and practices of the Board best serve the Company and its shareholders, and overseeing the overall corporate governance of the Company and the Company's sustainability programs and initiatives. From time to time, the Committee may engage an independent firm to assist in identifying potential director nominees.

In evaluating candidates for nomination to serve on the Board, the Governance, Sustainability and Nominating Committee will assess the candidate's character and professional ethics, judgment, business experience, independence, understanding of the Company's or other related industries, and other factors deemed pertinent in light of the current needs of the Board. Each candidate will be recommended without regard to gender, race, age, religion or national origin. Specific qualities and skills established by the Committee for candidates, which are included in the Governance, Sustainability and Nominating Committee charter, include:

| | | | | | | | | | | |

| • | | each candidate must be an individual that has consistently demonstrated the highest character and integrity; |

| • | | each candidate must have demonstrated professional and managerial proficiency, an openness to new and unfamiliar experiences and the ability to work in a team environment; |

| | | | | | | | | | | |

| • | | each candidate must be free of any conflicts of interest which would violate applicable law or regulation or interfere with the proper performance of the responsibilities of a director; |

| • | | each candidate should possess substantial and significant experience which would be of particular relevance to the Company and its shareholders in the performance of the duties of a director; and |

| • | | each candidate must demonstrate commitment to the responsibilities of being a director, including the investment of the time, energy, and focus required to carry out the duties of a director. |

The Governance, Sustainability and Nominating Committee's responsibilities also include, but are not limited to: (1) regularly assessing the effectiveness of the Board, (2) annually reviewing the performance of each director, (3) determining whether any director conflicts of interest exist, (4) reviewing any director related party transactions, (5) periodically reviewing the Company's corporate governance policies, (6) ensuring the size, composition, and practices of the Board and its Committees are structured in a way that best serves the objectives and interests of the Company, the shareholders, and all primary constituents; and (7) reviewing, overseeing and monitoring the Company's strategies and efforts with respect to sustainability and corporate governance matters.

The Governance, Sustainability and Nominating Committee met four times during fiscal 2023. The Governance, Sustainability and Nominating Committee's charter can be viewed on the Corporate Governance page of the Company's website at https://investors.americanwoodmark.com/investors/governance-documents.

Procedures for Shareholder Nominations of Directors

A shareholder of record may nominate a person or persons for election as a director at the 2024 Annual Meeting if any such nomination is submitted in writing to the Secretary of the Company in accordance with the Company's bylaws and is received in the Company's principal executive offices on or before April 26, 2024. The nomination must include the name and address of the director nominee and a description of the director nominee's qualifications for serving as a director and the following information:

| | | | | | | | | | | |

| • | | the name and address of the shareholder making the nomination; |

| • | | a representation that the shareholder is a record holder of the Company's common stock entitled to vote at the meeting and, if necessary, would appear in person or by proxy at the meeting to nominate the person or persons specified in the nomination; |

| • | | a description of all arrangements or understandings between the shareholder and the nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder; |

| • | | such other information regarding the nominee as would be required to be included in a proxy statement filed under the proxy rules of the SEC if the director nominee were to be nominated by the Board of Directors; |

| • | | information regarding the nominee's independence as defined by applicable NASDAQ listing standards; and |

| • | | the consent of the nominee to serve as a director of the Company if elected. |

Any shareholder nomination must also comply with the requirements of Rule 14a-19(b) under the Securities Exchange Act of 1934, as amended (the "Exchange Act").

The Governance, Sustainability and Nominating Committee may subsequently request additional information regarding the director nominee or the shareholder making the nomination. The Chair of the Governance, Sustainability and Nominating Committee may refuse to acknowledge the nomination of any person not made in compliance with these procedures.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG)

As a leading manufacturer of cabinetry in the U.S., American Woodmark is committed to conducting business in a manner that incorporates effective environmental, social, and governance practices in order to improve our long-term sustainability and results. Our governance efforts are described throughout this Proxy Statement and our environmental and social practices are summarized below. As discussed elsewhere in this Proxy Statement, in May 2021 (fiscal 2022), we revised our Board committee charters to expressly charge the renamed Governance, Sustainability and Nominating Committee with oversight of our sustainability programs and initiatives and the renamed Compensation and Social Principles Committee with oversight of our policies and practices with respect to social principles, including human capital matters.

Health and Safety

Our associates’ safety is of utmost importance to American Woodmark. We are dedicated to maintaining and continuously improving the safety of our working environment both in our facilities and in the field. Safety performance and improvement is driven by management through the organization by cascading goals and scorecards at all levels. We have a comprehensive set of safety policies that govern how our facilities operate to meet and exceed OSHA standards. These policies govern all American Woodmark sites both in the U.S. and in Mexico. We maintain a corporate team of Environmental, Health & Safety (EH&S) professionals that work with local EH&S teams to ensure Safety remains top of mind, share best practices, and encourage continuous improvement. Each site maintains comprehensive safety rules, reaction plans, and invests in and employs technology where practicable to ensure our operations are safe and reduce risk.

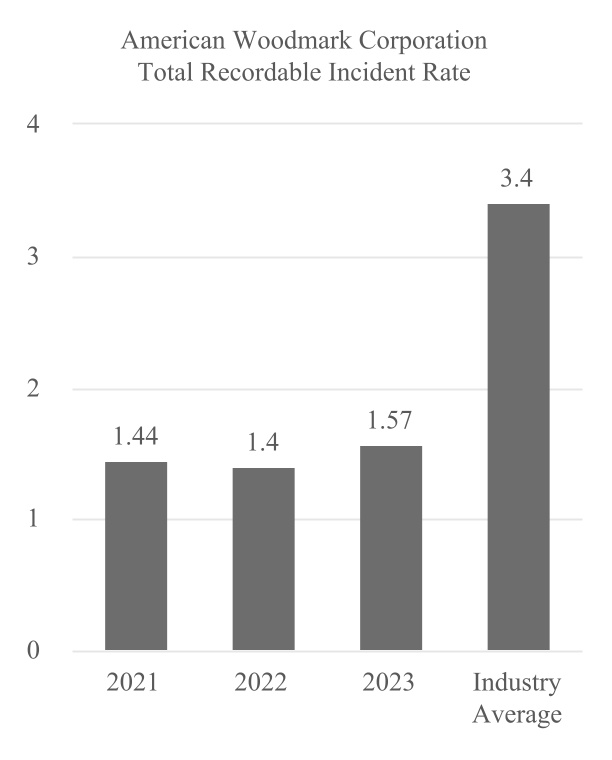

These programs and activities have enabled us to continuously build upon our solid Safety foundation and improve through the years. We use two main metrics to evaluate our safety performance: Total Recordable Incidence Rate (OSHA’s TRIR) and Lost Time Rate (LTR). For our fiscal 2023 the TRIR was 1.57 54% better performance than industry average and the LTR was 0.75. 32% better performance than industry average. The national average for total recordable cases is 3.4% and 1.1% for lost time incident rate according to the U.S. Department of Labor.

Environmental and Sustainability Matters

We recognize the potential impact of our operations on the environment as well as the potential impact of environmental issues on our operations. We have established Corporate Environmental, Health and Safety programs with the goal of ensuring compliance with all applicable local, state and federal environmental and safety laws and regulations, and we monitor our performance under these programs through formal agency audits as well as internal audits. We have a formal program in place to identify opportunities in our manufacturing facilities to eliminate or minimize the use of certain hazardous materials and we seek to employ leading technologies to reduce emissions from our manufacturing operations to the extent practicable. We have implemented recycling and energy efficiency programs throughout our organization in an effort to reduce our consumption of resources. These efforts include manufacturing processes that repurpose wood waste into saleable products or divert it to other industries in order to reduce waste. We encourage appropriate suppliers of hardwood and other wood products to participate in a sustainable forestry program through formal training and advocacy, and we require all of our suppliers to comply with applicable environmental and safety laws and regulations.

In recent years, we have vigorously embarked on a journey of commitments to Environmental and Sustainability at American Woodmark. We have established internal working teams to improve our efforts related to sustainability, environmental and social impact, developed internal scorecards to measure progress against our goals, increased the amount of environmental and sustainability information we share with the public and investment community, and developed a long-term vision for environmental sustainability.

We will continue on this path by doing the following:

| | | | | | | | | | | |

| • | | Continuing to implement sustainability training for all team members; |

| • | | Continuing to provide a safe and healthy working environment, striving to achieve a sub 1.00 incident recordable rate; |

| • | | Obtaining a majority of SmartWay Technology shipping fleet; |

| • | | Reducing fossil fuel dependency; total energy use will be from renewables; |

| • | | Developing an internal certification program for our suppliers; and |

| • | | Striving towards virtual elimination of waste through the Reduce, Reuse, and Recycle methodologies. |

Social Matters

At American Woodmark, we believe the way we conduct our business and interact with our customers, our vendors, the communities in which we operate, and other stakeholders is driven by our core principles of Customer Satisfaction, Integrity, Teamwork and Excellence. We define these principles as follows:

| | | | | | | | | | | |

| • | | Customer Satisfaction: Provide the best possible quality, service, and value to the greatest number of people by doing whatever is reasonable and sometimes unreasonable. |

| • | | Integrity: Do what is right; act fairly and responsibly, care about the dignity of each person and be a good citizen within the community. |

| • | | Teamwork: Understand that we must all work together in order to succeed. Realize that each person must contribute to the team to be part of the team. |

| • | | Excellence: Strive to perform every job or action in a superior way. Be innovative, always helping others become the best they can be. |

By living out these principles, we believe we will be best positioned to attract, develop and retain a diverse and well-qualified workforce and to conduct our business in a responsible, ethical and professional manner.

Inclusion & Diversity

At American Woodmark, people are our most important resource. We believe the most creative solutions emerge in an environment where diverse voices are heard, ideas are considered, innovative thinking is valued, and people can grow into their fullest potential. We are an equal opportunity employer and strive to create an environment free from discrimination and harassment and in which each employee is valued, treated with dignity

and respect, and managed in an inclusive manner. We believe that a workplace that encourages the interaction of different perspectives and backgrounds creates superior solutions, approaches and innovations. Accordingly, we aim to foster a culture where each employee has an equal opportunity to thrive and advance his or her career and is therefore engaged and invested in our continued success. We also seek to leverage each employee's unique ideas and perspectives in order to better understand our markets and customers and otherwise improve our business and operations.

In recent years, we have been fully committed to exploring and evaluating diversity and inclusion (D&I) at American Woodmark. In 2020, we embarked on the strategic development of an Inclusion, Diversity, Equity and Alignment team (IDEA) that was established to define the diversity and inclusion strategy, aligning with local Right Environment Council (REC) efforts. Since then, we have achieved deploying company-wide social initiatives, including adding a D&I section to our employee engagement survey, administered specific diversity and inclusion training to all salaried and hourly employees, and launched a quarterly podcast series committed to discussing diversity and inclusion topics company-wide. In continuing our action towards our enterprise-wide inclusion and diversity strategy, we implemented representation metrics as part of our organizational scorecard and incentive pay components. Going forward, we intend to continue developing our strategy with the goal of enhancing our culture of inclusion while increasing the diversity of people, thought, and perspectives represented throughout our Company.

We intend to continue to refine our inclusion and diversity strategy with the help of our IDEA team which will deliver recommended actions to develop a strong D&I focus within our Company culture and drive actionable change across the business. We also intend to:

| | | | | | | | | | | |

| • | | Continue to leverage our Inclusion, Diversity, Equity & Alignment Roadmap with strategic initiatives to help foster an environment of inclusion throughout the organization; |

| • | | Further develop training opportunities directly related to D&I content for people leaders within the organization; |

| • | | Create and expand a framework committed to developing an environment with equitable gender and race representation across leadership roles within the organization; |

| • | | Continue to leverage our Career Orientation and Development program and Organizational Development Matrix, as well as other internal evaluation systems, to identify, recruit and train employees who are gender and/or racially/ethnically diverse for internal advancement opportunities; |

| • | | Utilize structured, internal evaluation methods to identify qualified employees who are gender and/or racially/ethnically diverse for promotion to key roles within the organization; and |

| • | | Deepen our relationships with Historically Black Colleges and University and Hispanic Serving Institutes. |

Employee Training

At American Woodmark, we strive to attract, develop, and retain high-performing talent, and we support and reward employee performance. Employee training and development are critical components of our employee value proposition. Throughout the year, we invest a significant number of hours in onboarding, cultural, safety, regulatory, supervisory, and managerial training activities. Through these activities, as well as our tuition reimbursement programs, employee referral programs, succession planning, partnerships with local and national education institutions for the recruitment of direct hires, interns, executive development opportunities, formal and informal cross-training activities and other operational training offerings, we strive to establish American Woodmark as an organization dedicated to providing the training and development opportunities necessary to maintain a well-qualified workforce that upholds our social responsibilities by implementing our core principles on a daily basis.

Our training is designed and developed at the corporate and local site level in order to further our goals of enterprise alignment and local integration. We seldom adopt a "one and done" approach to training. Depending on the course, our training and development opportunities are offered on an on-demand, semi-annual, annual or biannual basis.

Leadership Engagement

Our leadership team is actively involved in the development of our employees at American Woodmark and is committed to their success. The leadership team also values employee feedback, offering several opportunities for engagement throughout the year:

| | | | | | | | | | | |

| • | | Employee Engagement Survey – Employee feedback provides direction for action plans on communication, process improvement and culture change initiatives. Our employee engagement survey is launched on an annual basis. |

| • | | Town hall meetings – Frequent video town hall meetings with the CEO to update the organization on the business as well as current events. This meeting also allows for Q&A. |

| • | | Leadership Development Courses – Leadership engages in actively owning and facilitating key cultural courses at American Woodmark twice per year with a series of three leadership courses available to people leaders within the organization: Supervisory Development, Management Development and Leadership & Cultural Change. |

Philanthropy & Community Engagement

American Woodmark is committed to being a socially responsible corporate citizen and giving back to the communities in which we operate. We support non-profit organizations that align with our Company’s values in the locations where our employees and customers work and live. We truly believe in order to care for and engage with our employees, we must care for and engage with the communities in which they live and work.

We maintain a scholarship fund, the Holcomb Scholarship, which is available to children of full-time American Woodmark employees preparing for post-secondary education. The purpose of the scholarship fund is to encourage scholarship, service and continued learning in the children of American Woodmark employees and to support the development of future leaders who may return to the communities in which we operate. We also fund the American Woodmark Foundation, a 501(c)(3) organization, which was formed in 1995 solely for the philanthropic purposes of sustaining our communities, enabling the work and mission of charitable organizations and ensuring that we are a good neighbor in each of the communities in which we operate. The Foundation has invested over $7 million since inception.

Most recently, we launched American Woodmark Cares, a fund created to help American Woodmark employees who are in need of immediate financial assistance following an unforeseen disaster or personal hardship. This fund is solely supported by company, employee and other outside tax-deductible donations and is administered by the Emergency Assistance Foundation. Also, given that we have a variety of operations across North America, we often utilize our Right Environment Councils to develop and implement our workforce and community engagement initiatives at the local level as opposed to relying solely on our corporate office to drive our engagement efforts. We believe this approach encourages increased employee engagement and better serves our communities.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis ("CD&A") contains information about the executive compensation program for our named executive officers ("NEOs") for fiscal year 2023 ("fiscal 2023"). Our NEOs for fiscal 2023 were the following:

•M. Scott Culbreth (President and Chief Executive Officer)

•Paul Joachimczyk (Senior Vice President and Chief Financial Officer)

•Robert J. Adams, Jr. (Senior Vice President, Manufacturing and Technical Operations)

•Teresa M. May (Former Senior Vice President and Chief Marketing Officer)

Executive Leadership Change

On January 12, 2023, Ms. May retired. In connection with this leadership change, we entered into a separation agreement and release with Ms. May which is described in more detail below under "Separation Agreement for Ms. May."

Compensation Principles

The compensation provided to our senior leaders is driven by the following principles:

| | | | | |

Aligned with shareholders - Compensation should align directly with the long-term interests of our shareholders. Our leaders are expected to be long-term shareholders. | Performance-Based - Compensation should be based on financial, operational, and cultural goals. The goals should be challenging, but achievable, in light of expected market conditions. |