UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, DC 20549

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. 1)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ | Preliminary Proxy Statement |

☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required | |

☐ | Fee paid previously with preliminary materials | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

PRELIMINARY COPY—SUBJECT TO COMPLETION

In accordance with Rule 14a-6(d) under Regulation 14A of the Securities Exchange Act of 1934, please be advised that Macy’s, Inc. intends to release definitive copies of this Proxy Statement to shareholders beginning on or about April [2], 2024

Notice of the 2024 Annual Meeting of Shareholders

| WHEN |

|

| WHERE |

|

| RECORD DATE |

May 17, 2024 9:00 a.m. Eastern Time | The Annual Meeting services.com/m24_vm | Shareholders of record at the close of business on March 21, 2024 are entitled to notice of, and to attend and vote during the Annual Meeting |

ITEMS OF BUSINESS | BOARD’S RECOMMENDATION | |||

1 | Election of director nominees | FOR each Macy’s, Inc. nominee | ||

2 | Ratification of the appointment of independent registered public accounting firm | FOR | ||

3 | Advisory vote to approve named executive officer compensation | FOR | ||

4 | Approval of the Macy’s, Inc. 2024 Equity and Incentive Compensation Plan | FOR | ||

5 | The Arkhouse Group proposal, if properly presented at the Annual Meeting, to repeal each provision of, and each other amendment to, the Amended and Restated By-Laws adopted by the Board without the approval of the shareholders of the Company subsequent to October 28, 2022 | AGAINST | ||

PROXY VOTING FOR REGISTERED HOLDERS (shares are held in your own name) | ||||

Over the Internet during the Annual Meeting at www.cesonline |

By telephone 24/7 |

Over the Internet 24/7 at the website shown on your WHITE proxy card |

By signing, dating and completing your WHITE proxy card and returning it by mail in the postage-paid envelope provided | |

If your shares are held in “street name” with a broker or similar party, you have a right to direct that organization on how to vote the shares held in your account. You can vote by signing, dating, completing and returning your WHITE voting instruction form by mail in the postage-paid envelope provided, or by following the instructions for voting via telephone or the internet set forth on the WHITE voting instruction form. Street name holders may vote online during the Annual Meeting only if they submit a legal proxy from their bank, broker or other nominee.

If you are a participant in our 401(k) Retirement Investment Plan, you may attend and participate in the Annual Meeting, but you will not be able to vote the shares held in this plan electronically during the Annual Meeting. You must vote in advance of the Annual Meeting online, by phone, or by mail.

Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares by completing, signing, dating and returning your WHITE proxy card or WHITE voting instruction form promptly, or by voting by telephone or over the Internet, following the instructions set forth on the WHITE proxy card or WHITE voting instruction form . |

Please note that Arkhouse Management Co. LP (Arkhouse), which is affiliated with certain other persons and entities identified in Arkhouse’s proxy solicitation materials filed with the U.S. Securities and Exchange Commission (SEC) (collectively, the Arkhouse Group), has provided notice of its intent to nominate nine nominees for election as directors at the Annual Meeting in opposition to the nominees recommended by the Macy’s Inc. (Macy’s) Board of Directors (Board). Pursuant to SEC rules, Macy’s is required to show the Arkhouse Group nominees on our WHITE proxy card; however, our Board urges you not to vote for any of the Arkhouse Group nominees and instead use the WHITE proxy card to vote “FOR” only each of the Macy’s director nominees. Additionally, you may receive solicitation materials from the Arkhouse Group, including proxy statements and BLUE proxy cards. Macy’s is not responsible for the accuracy or completeness of any information provided by or relating to the Arkhouse Group or its nominees contained in solicitation materials filed or disseminated by or on behalf of the Arkhouse Group or any other statements the Arkhouse Group may make.

Our Board does NOT endorse any of the Arkhouse Group’s nominees and unanimously recommends that you use the WHITE proxy card to vote “FOR” only each of the Macy’s director nominees and in accordance with our Board’s recommendation on each other proposal properly presented at the Annual Meeting. Our Board strongly urges you to disregard any materials sent to you by the Arkhouse Group, including any BLUE proxy card, and NOT to vote using any BLUE proxy card that may be sent to you by the Arkhouse Group. If you have already voted using a BLUE proxy card you have every right to change your vote and we strongly urge you to revoke that proxy any time before it is exercised at the Annual Meeting by (i) following the instructions on your WHITE proxy card or WHITE voting instruction card to vote by Internet or telephone, (ii) marking, dating, signing, and returning your WHITE proxy card in the postage-paid envelope provided or (iii) voting at the Annual Meeting. Only your latest dated, validly executed proxy that you submit will be counted, and any proxy may be revoked at any time prior to its exercise at the Annual Meeting.

We encourage you to vote and submit your WHITE proxy card as promptly as possible, even if you plan to attend the virtual meeting.

Virtual Annual Meeting Participation

Any shareholder of record can attend and participate in the Annual Meeting live via the Internet at www.cesonline services.com/m24_vm. You will need the control number shown on your WHITE proxy card to vote and submit questions during the Annual Meeting. Beneficial holders need to obtain and submit a legal proxy from their bank, broker or other nominee in order to attend and vote at the Annual Meeting.

Additional information on how you can attend and participate in the virtual Annual Meeting is set forth under “Information About the Annual Meeting” in the accompanying proxy statement.

By Order of the Board, | ||

| ||

Tracy M. Preston | ||

Chief Legal Officer and Secretary |

April [2], 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS |

The Notice of Annual Meeting of Shareholders, Proxy Statement and Annual Report on Form 10-K for the year |

Table of Contents

81 | ||

81 | ||

84 | ||

86 | ||

86 | ||

87 | ||

89 | ||

91 | ||

92 | ||

97 | ||

98 | ||

99 | ||

102 | ||

103 | ||

103 | ||

104 | ||

109 | ||

112 | ||

Change-in-Control Arrangements Specifically Triggered by Board Turnover | 119 | |

120 | ||

120 | ||

121 | ||

123 | ||

125 | ||

125 | ||

125 | ||

Securities Authorized for Issuance Under Equity Compensation Plans | 127 | |

128 | ||

129 | ||

135 | ||

136 | ||

Appendix A - Macy’s, Inc. 2024 Equity and Incentive Compensation Plan | 137 | |

Appendix B - Supplemental Information Regarding Participants in the Solicitation | 152 |

Forward Looking Statements

All statements in this proxy statement that are not statements of historical fact are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are based upon the current beliefs and expectations of Macy’s management and are subject to significant risks and uncertainties. Actual results could differ materially from those expressed in or implied by the forward-looking statements contained in this proxy statement because of a variety of factors, including Macy’s ability to successfully implement A Bold New Chapter strategy, including the ability to realize the anticipated benefits within the expected time frame or at all, conditions to, or changes in the timing of proposed real estate and other transactions, prevailing interest rates and non-recurring charges, the effect of potential changes to trade policies, store closings, competitive pressures from specialty stores, general merchandise stores, off-price and discount stores, manufacturers’ outlets, the Internet and catalogs and general consumer spending levels, including the impact of the availability and level of consumer debt, possible systems failures and/or security breaches, the potential for the incurrence of charges in connection with the impairment of tangible and intangible assets, including goodwill, declines in credit card revenues, Macy’s reliance on foreign sources of production, including risks related to the disruption of imports by labor disputes, regional or global health pandemics, and regional political and economic conditions, the effect of weather, inflation, inventory shortage, labor shortages, the amount and timing of future dividends and share repurchases, our ability to execute on our strategies or achieve expectations related to environmental, social and governance matters, and other factors identified in documents filed by the Company with the U.S Securities and Exchange Commission, including under the captions “Forward-Looking Statements” and “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended February 3, 2024. Macy’s disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

PROXY SUMMARY

Proxy Summary

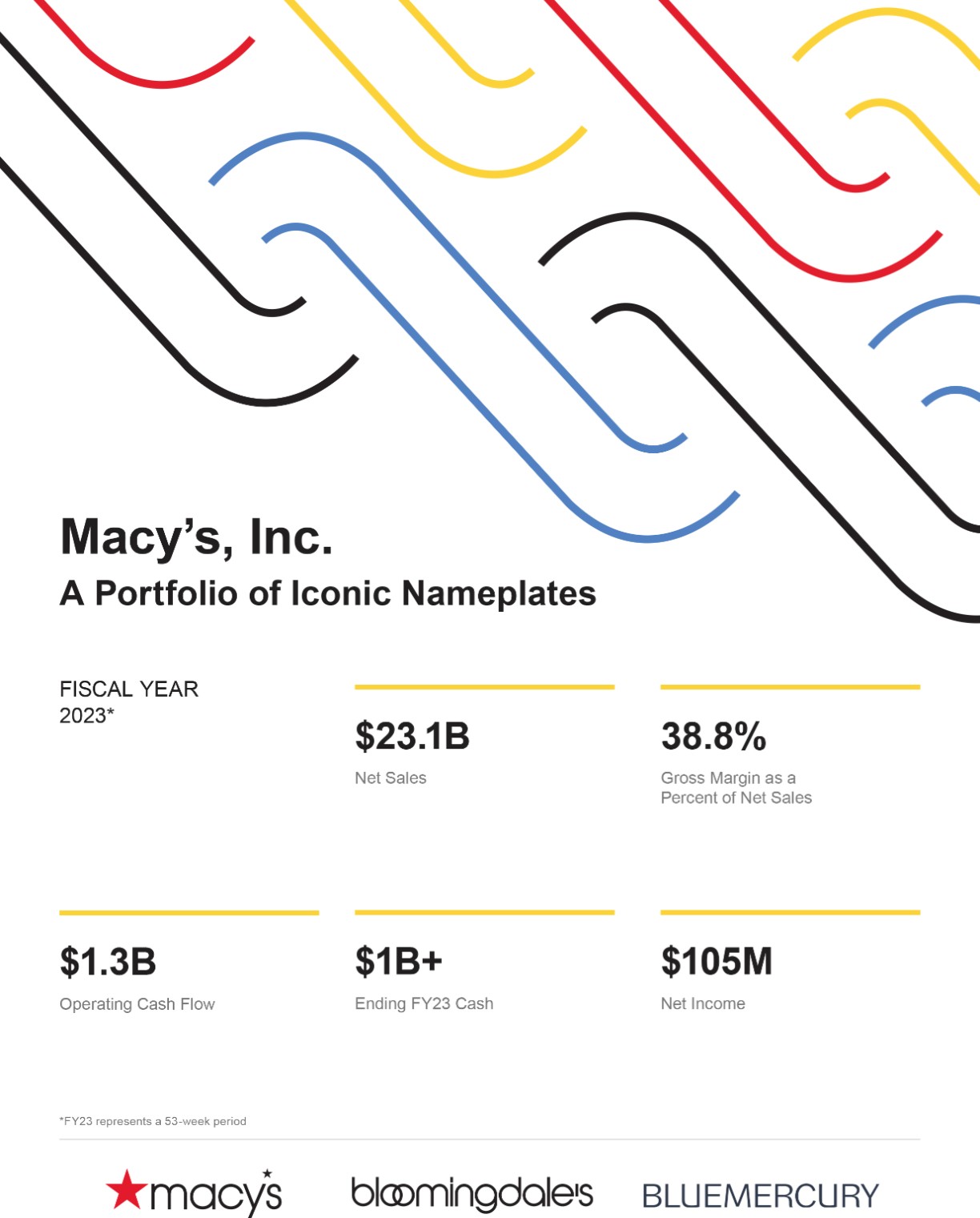

We are providing the enclosed proxy materials in connection with the solicitation by the board of directors (the Board) of Macy’s, Inc. (Macy’s or the Company) of proxies to be voted at the Annual Meeting of Shareholders to be held on May 17, 2024 (the Annual Meeting). We began giving these proxy materials to our shareholders on April [2], 2024.

This summary highlights certain information contained elsewhere in our proxy statement. This summary does not contain all the information you should consider. You should read the entire proxy statement carefully before voting. We encourage you to participate in having your views reflected on the matters described in this proxy statement by voting on the WHITE proxy card or WHITE voting instruction form as promptly as possible, even if you plan to attend the Annual Meeting.

Voting Matters

ITEMS | BOARD’S RECOMMENDATION | SEE PAGE | ||

1 | Election of director nominees |

| FOR each Macy’s nominee | 16 |

2 | Ratification of the appointment of independent registered public accounting firm |

| FOR | 59 |

3 | Advisory vote to approve named executive officer compensation |

| FOR | 64 |

4 | Approval of the Macy’s, Inc. 2024 Equity and Incentive Compensation Plan |

| FOR | 66 |

5 | The Arkhouse Group proposal, if properly presented at the Annual Meeting, to repeal each provision of, and each other amendment to, the Amended and Restated By-Laws adopted by the Board without the approval of the shareholders of the Company subsequent to October 28, 2022 |

| AGAINST | 123 |

PROXY SUMMARY

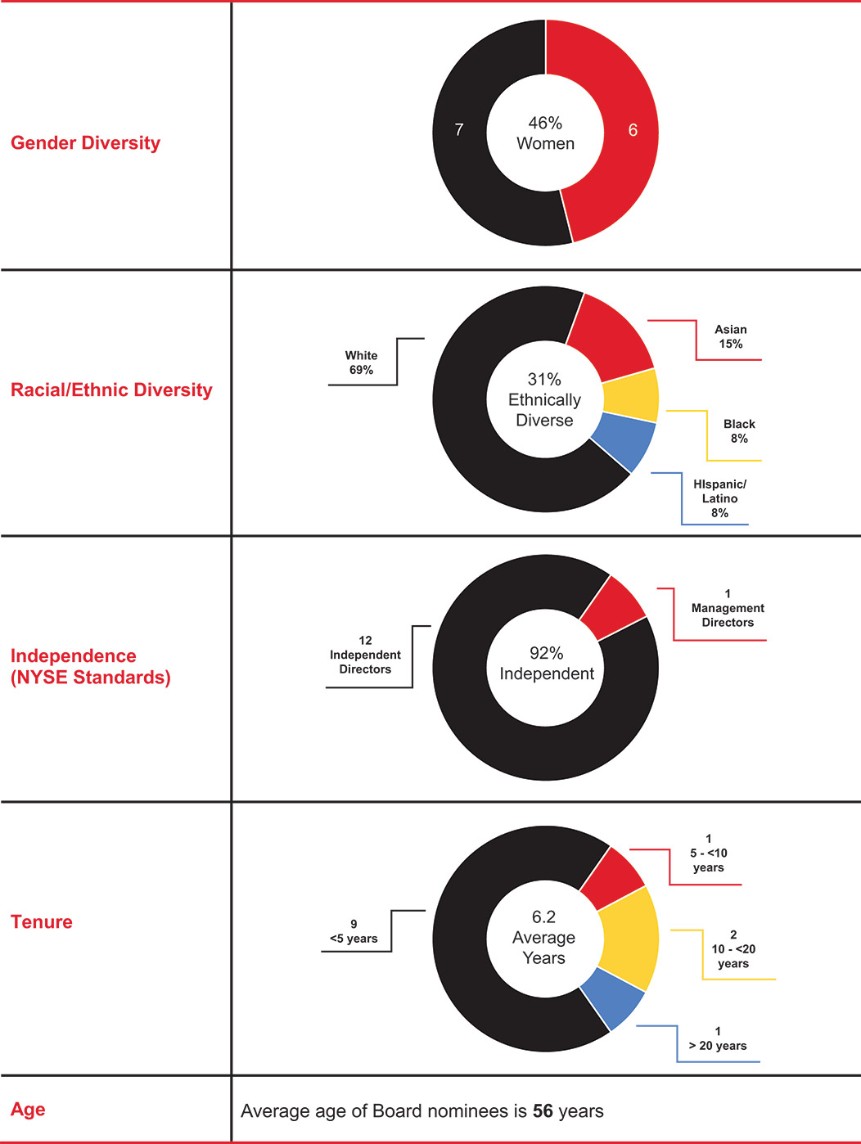

Corporate Governance Highlights

We believe that good governance is integral to achieving long-term shareholder value. We are committed to governance policies and practices that serve the interests of the Company and our shareholders. Our corporate governance policies and practices include:

HIGHLIGHTS OF CORPORATE GOVERNANCE | |||||

| 12 Director nominees are independent |

| Lead independent director | ||

| Annual Board and Committee evaluations |

| Majority voting in uncontested director elections | ||

| Annual election of all directors |

| No shareholder rights plan | ||

| Board and Committee oversight of risk |

| Policy prohibiting pledging and hedging ownership of Macy’s stock | ||

| Confidential shareholder voting policy |

| Proxy access | ||

| Director resignation policy |

| Regular executive sessions of independent directors | ||

| Director retirement policy |

| Share ownership guidelines for directors and executive officers | ||

| Diverse Board in terms of gender, ethnicity, experience and skills |

| One share, one vote policy | ||

| Independent Board Committees | ||||

|

| ||

6 |

|

PROXY SUMMARY

Macy’s Nominees for Director

The following tables provide summary information about Macy’s director nominees. The Board unanimously recommends that you use the WHITE proxy card to vote “FOR” only each of our Board’s director nominees:

DIRECTOR | PRINCIPAL | OTHER | KEY COMMITTEE | ||||||||

NAME/AGE | EXPERIENCE | SINCE | OCCUPATION | INDEPENDENT | BOARDS | A | CMD | F | NCG | ||

| Emilie Arel | ● Senior Leadership ● Retail ● Technology | ● Marketing/Brand Management ● Risk Management | 2022 | Former President and CEO, Casper Sleep Inc. | ✓ | 0 |

|

| ||

| Torrence N. Boone | ● Senior Leadership ● Retail ● Technology | ● Marketing/Brand Management ● Investment Banking | 2019 | Vice President, Global Client Partnerships, Google, Inc. | ✓ | 0 |

|

| ||

| Ashley Buchanan | ● Senior Leadership ● Finance/Accounting ● Retail | ● Marketing/Brand Management ● Supply Chain ● Technology | 2021 | CEO, The Michaels Companies, Inc. | ✓ | 0 |

|

| ||

| Marie Chandoha | ● Senior Leadership ● Finance/Accounting ● Investment Banking | ● Risk Management ● Technology | 2022 | Former President and CEO, Charles Schwab Investment Management, Inc. | ✓ | 1 |

|

| ||

| Naveen K. Chopra (50) | ● Senior Leadership ● Finance/Accounting | ● Marketing/Brand Management ● M&A/Strategy | 2023 | Executive Vice President and CFO, Paramount Global | ✓ | 0 |

|

| ||

| Deirdre P. Connelly | ● Senior Leadership ● Human Resources | ● Marketing/Brand Management | 2008 | Former President, North American Pharmaceuticals, GlaxoSmithKline | ✓ | 2 |

|

| ||

| Jill Granoff | ● Senior Leadership ● Retail | ● Brand Management ● Asset Management | 2022 | Senior Advisor, Eurazeo Brands | ✓ | 0 |

|

| ||

| William H. Lenehan | ● Senior Leadership ● Finance/Accounting | ● Investment Banking & Real Estate ● Risk Management | 2016 | President and CEO, Four Corners Property Trust, Inc. | ✓ | 1 |

|

| ||

| Sara Levinson | ● Senior Leadership ● Technology | ● Marketing/Brand Management | 1997 | Former Director, Katapult | ✓ | 1 |

|

| ||

| Douglas W. Sesler (62) | ● Senior Leadership ● Finance/Accounting ● Retail | ● Real Estate ● M&A/Strategy | 2024 | Founder and President, Fair Street Partners | ✓ | 1 | ||||

| Tony Spring (59) | ● Senior Leadership ● Retail ● Risk Management | ● Marketing/Brand Management | 2023 | Chief Executive Officer and Chairman-Elect, Macy’s, Inc. | 0 | |||||

| Paul C. Varga | ● Senior Leadership ● Finance/Accounting ● Retail | ● Marketing/Brand Management ● Risk Management | 2012 | Former Chairman and CEO, Brown-Forman Corporation | ✓ | 1 |

|

| ||

| Tracey Zhen | ● Senior Leadership ● Finance/Accounting | ● Investment Banking ● Technology | 2021 | Former President, Zipcar, a subsidiary of Avis Budget Group, Inc. | ✓ | 0 |

|

| ||

* | Francis S. Blake, who is currently serving as a Non-Employee Director, has not been nominated to stand for reelection and will retire from the Board immediately upon the conclusion of the Annual Meeting in accordance with our director retirement policy. Mr. Blake is currently the Chair of the Finance Committee. |

Jeff Gennette, who has served as a director since 2016, served as Chief Executive Officer of Macy’s from March 2017 until February 2024, and who currently serves as Non-Executive Chairman of the Board, has not been nominated to stand for reelection and will retire from the Board immediately upon the conclusion of the Annual Meeting.

Legend | A | Audit Committee |

| Committee Chair |

CMD | Compensation and Management Development Committee | |||

F | Finance Committee | |||

NCG | Nominating and Corporate Governance Committee |

| Committee Member | |

|

| ||

MACY’S, INC. | 7 |

PROXY SUMMARY

Our director nominees provide an effective mix of experience and perspectives, as well as gender, age and racial/ethnic diversity.

|

| ||

8 |

|

PROXY SUMMARY

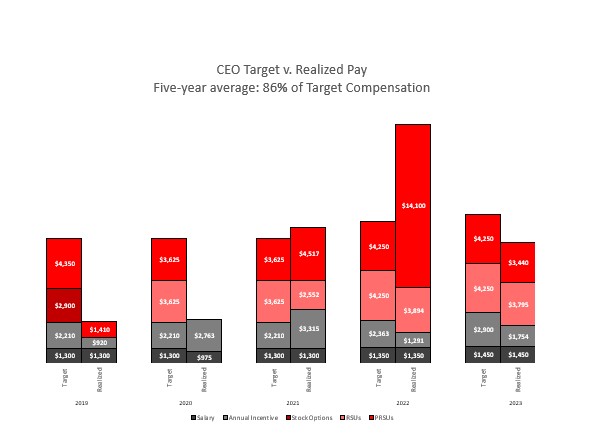

Executive Compensation Program

Our compensation program objectives are to provide competitive and reasonable compensation opportunities through programs aligned with key business strategies and plans, foster a performance-based culture, and attract, motivate, reward and retain key executives. Balancing these primary program objectives helps ensure accountability to our shareholders. For a detailed discussion of our short- and long-term incentive programs, see page 89.

2023 Compensation Program Design

The 2023 executive compensation program focused on 2023 financial objectives and key priorities, as well as absolute and relative stock price appreciation. The plan framework and goals reflect a focus on driving business performance in the context of a business climate that continued to have a level of uncertainty around both the consumer and macro environment at the time the plans were set.

| ● | The incentive plans were designed to motivate and engage the organization and leadership with linkage between strategy, business plan and incentives. |

| ● | Plan design focused on Growth, Profit and Colleague. |

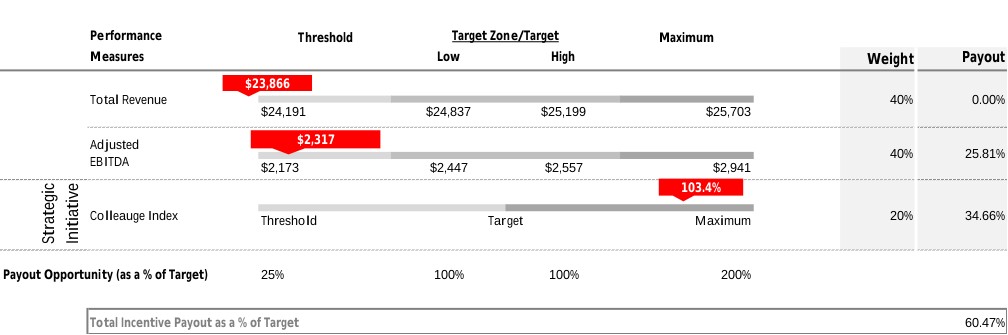

Annual Incentive Plan

The annual incentive plan design reflected a focus on key 2023 business priorities.

| ● | Metrics were weighted 80% on the financial goals of Adjusted EBITDA and total revenue (weighted 40% each) and 20% on a Culture Index. |

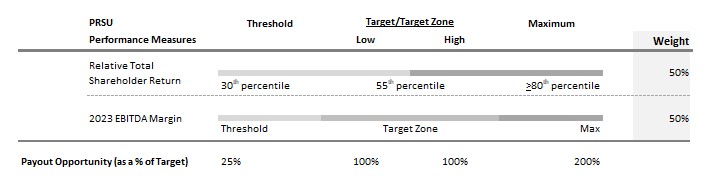

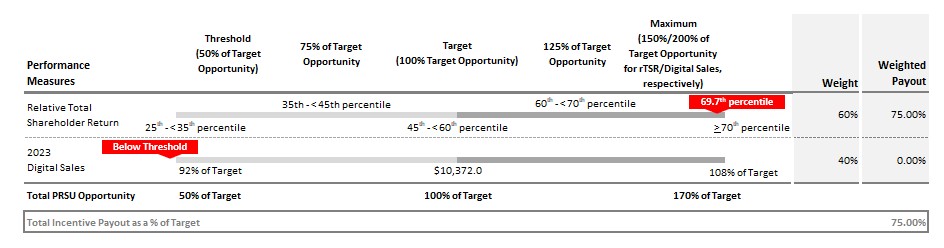

Long-term Incentive Plan

We continued to use performance-based restricted stock units (PRSUs) and time-based restricted stock units (RSUs) in the long-term incentive plan with a mix of 50% each for all NEOs. The 2023 PRSU awards had two equally weighted metrics: relative total shareholder return (rTSR) and 2023 Adjusted EBITDA margin.

| ● | Given the uncertainty in the macro environment and the volatility of the retail industry, the CMD Committee made the decision to use 2023 Adjusted EBITDA margin in the PRSU plan. Following the one-year performance period, there is an additional two-year vesting period to align with our historic vesting practices and help ensure retention. |

| ● | The rTSR metric continues to be based on a three-year performance period and uses the S&P Retail Select Industry Index as the benchmark group. |

The payout ranges in both the annual and long-term incentive plans were 25% to 200% of target, consistent with 2022.

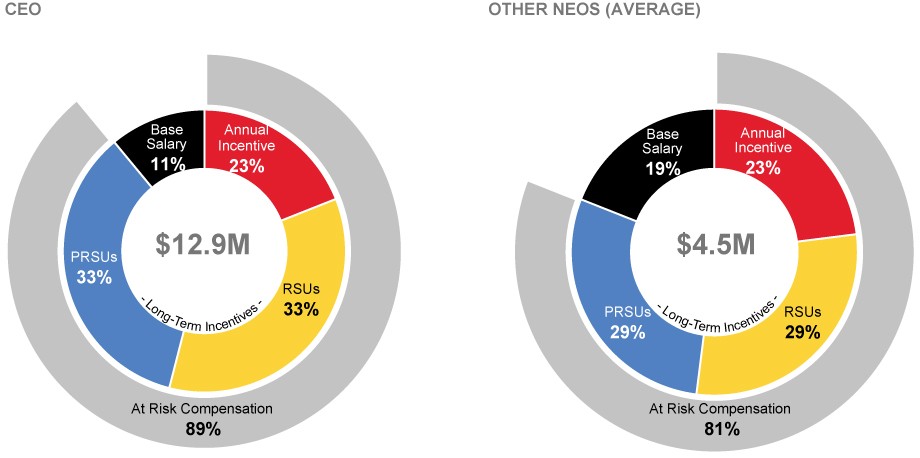

Compensation Mix

Within our primary pay elements of base salary, performance-based annual incentive and long-term incentives, we emphasize at risk pay over fixed pay with at least 70% of our NEOs’ target compensation linked to a variety of metrics, including pre-determined performance objectives (financial and strategic) and/or stock price performance. The program also balances the importance of the achievement of short-term and long-term objectives.

Our executive compensation program and our methodology for setting pay opportunities and approving payouts are further discussed in the Compensation Discussion and Analysis (CD&A) on page 81.

|

| ||

MACY’S, INC. | 9 |

PROXY SUMMARY

Corporate Social Responsibility

We believe we have a responsibility to manage our resources, maximize our positive social impact and proactively engage on issues that span the breadth of our operations including through transparency, product responsibility and supply chain management, energy management, diversity, equity and inclusion and building resilient communities.

Consumers have a rising expectation that how companies do business is as important as what they sell. Our social purpose is a strategy and framework that supports our business and empowers more voice, choice and ownership of our colleagues, customers, and communities.

Our Mission Every One social purpose platform is working to create a brighter future with bold representation for all. Our initial commitment of $5 billion through 2025 will be directed to our people, partners, products and programs to create a more equitable and sustainable future. A portion of the Company’s overall $5 billion commitment will support retail and non-retail diverse-owned or underrepresented businesses, investments in diverse and inclusive development programs and expand the sustainable products backed by third-party certifications that we offer. Across Macy’s, Bloomingdale’s, and Bluemercury, digital shopping through online and app experiences, and new smaller off-mall store formats, Macy’s fosters a comprehensive supplier ecosystem that advocates for businesses at all levels of growth and across a vast array of categories and size.

OUR COMMITMENT PILLARS INCLUDE:

PEOPLE | PLANET | COMMUNITY |

We seek to recognize and reward our colleagues and partners to fuel mutual growth, innovation, and impact. | We strive to curate and create sustainable products and services so people and planet can thrive together. | We endeavor to empower the curiosity and confidence of young people on their journey to become the leaders of tomorrow. |

This work is brought to life by initiatives across diversity, equity and inclusion, sustainability, and corporate giving matters. | ||

People

In 2023, we continued our efforts to enhance diversity and inclusion across all levels of our organization to enable us to more closely and effectively engage with all of our customers. Our accomplishments included:

| ● | 30.1% ethnically diverse representation at the director+ levels |

| ● | Improved retention and focused on building pipelines for internal promotions and talent pools for external hiring of diverse colleagues at the director+ levels |

| ● | Maintained female representation in leadership roles |

Planet

During 2023, we enhanced our environmental initiatives by disclosing certain environmental performance metrics and designing programs to reduce our carbon emissions impact:

Submitted fiscal year 2022 (FY22) CDP Climate Change Report in July 2023 that included the following highlights:

| ● | Installed LED lighting at 61 retail spaces in 2022, reducing electric power consumption by 12.5M kWh and avoiding 4,764 metric tons of CO2e |

| ● | Provided approximately 4 million miles of free electric vehicle charging at a total of 126 stations, avoiding 974 metric tons of driver-related emissions in FY22 |

| ● | Published comprehensive Scope 3 greenhouse gas emissions |

| ● | In November 2022, Macy’s committed to set near-term company-wide emission reductions in line with the Science Based Targets initiative (SBTi) |

|

| ||

10 |

|

PROXY SUMMARY

We took steps to extend our efforts in environmental stewardship to our product sales:

| ● | Increased customer sales of environmentally-responsible products while expanding related programs within private brand products managed by the Macy’s Sourcing team |

| ● | Expanded the assortment of environmentally-responsible products on macys.com and bloomingdales.com |

| ● | Furthered environmentally-responsible initiatives for Private Brands Products Managed by the Macy’s Sourcing Teams: |

– | Joined US Cotton Trust Protocol |

– | Partnered with World Wildlife Fund (WWF) to publish Water Stewardship Policy |

– | Published an Animal Welfare Policy, an updated Fur Policy, an Exotic Skins Policy, and a preferred material policy to include synthetic fibers |

In addition, we took steps to extend our efforts in responsible sourcing:

| ● | Participated in RISE: Reimagining Industry to Support Equality, formerly HERproject, an initiative to support collaborative industry action at scale to advance gender equality in global garment, footwear and home-textiles supply chains |

| ● | Published Human Rights policy |

Community

| ● | During 2023, we continued to drive impact through relationships that reflect our goals and values and deepened relationships with existing partners aligned with Mission Every One and CEO Action for Racial Equity |

| ● | Raised and directed over $33 million to nonprofit partners and colleagues volunteered 66,000 hours to support our communities |

| ● | Maintained our $1 million commitment to organizations advancing social justice and racial equity |

| ● | Committed $750,000 to various education and research foundations of The Divine Nine sororities to support youth scholarships, leadership and development programs in celebration of the apparel collection at Macy’s |

| ● | Furthered commitment to Future of Style Fund – providing funding to nonprofits to support the creation of scholarships, programming (design/styling) and to support real-life sustainability projects |

Background of the Solicitation

The summary below details the significant communications and interactions between the Company and Arkhouse Management Co. LP (“Arkhouse”) in connection with Arkhouse’s nomination of nine individuals for election to the Board. This summary does not purport to catalogue every conversation of or among members of the Board, the Company’s management, the Company’s advisors and representatives of Arkhouse and its advisors relating to Arkhouse’s solicitation.

On November 29, 2023, the Company’s then-Chief Executive Officer, Jeff Gennette, received an email from Gavriel Kahane, Managing Partner of Arkhouse, requesting a conversation. Mr. Kahane said that Arkhouse was a substantial Macy’s, Inc. shareholder and had interest in an acquisition of the Company.

On November 30, 2023, Mr. Gennette and Adrian V. Mitchell, the Company’s Chief Operating Officer and Chief Financial Officer, had a call with Mr. Kahane, Jon Blackwell, Managing Partner of Arkhouse, and Matt Perkal, Partner at Brigade Capital Management (“Brigade,” and together with Arkhouse, the “Investor Group”). Mr. Kahane explained that Brigade was part of the Investor Group and that the intent of the Investor Group was to acquire Macy’s, Inc. in order to unlock what they believed to be unrealized real estate value on the Company’s balance sheet. Mr. Gennette said he would communicate this information to the Board.

|

| ||

MACY’S, INC. | 11 |

PROXY SUMMARY

On December 1, 2023, the Company received a letter from the Investor Group outlining a proposal to acquire all of the outstanding shares of the Company for $21.00 per share in cash. Mr. Gennette sent an email to Mr. Kahane acknowledging that the letter had been received. The proposal was non-binding and subject to various conditions, including satisfactory due diligence. In regards to financing, the letter said only that the Investor Group intended to finance its proposal with new debt and preferred equity, and pointed the Board to an accompanying “highly confident letter” from Jefferies LLC, financial advisor to Arkhouse (“Jefferies”). In its short letter, Jefferies stated that it was confident in its ability to arrange financing for the potential transaction, subject to the following preconditions:“(i) no material adverse change in the business or prospects of the Company; (ii) satisfactory market conditions; (iii) receipt of ratings from Moody’s and Standard and Poor’s that are satisfactory to Jefferies and the purchasers of the [financing]; (iv) delivery of customary documentation satisfactory to Jefferies and the purchasers of the [financing]; (v) satisfactory completion of [Jefferies’] due diligence on the Company and Arkhouse; (vi) Jefferies receipt of an executed engagement agreement with terms, including indemnification, acceptable to Jefferies; and (vii) approval from [Jefferies’] internal committees.”

On December 6, 2023, Mr. Kahane reached out to Mr. Gennette by email for an update on the timing of the Company’s response to the Investor Group’s proposal. Mr. Gennette responded later that day, noting that the Board was in the process of reviewing the proposal and that he would revert once those discussions had concluded.

On December 7 and December 8, 2023, the Board met during a regularly scheduled meeting and reviewed the Investor Group’s proposal. The Board was assisted in its review by its independent financial advisors, Bank of America Securities (“Bank of America”) and Wells Fargo (“Wells Fargo”), and its independent legal advisor, Wachtell, Lipton, Rosen & Katz (“Wachtell Lipton”).

On December 10, 2023, news of Arkhouse’s proposal was leaked to the public through The Wall Street Journal. Macy’s, Inc. declined to publicly respond to the leak.

On December 14, 2023, the Board sent a response letter to the Investor Group, requesting additional information regarding the group’s ability to finance its proposal. The Board cautioned that, based on the information the Investor Group had provided to date, the Board did not view their proposal as actionable.

On December 15, 2023, the Board met virtually and continued its review of the Investor Group’s proposal.

On December 19, 2023, representatives of Bank of America and Wells Fargo met virtually with Jefferies in an effort to obtain more information about the Investor Group’s financing plan. Jefferies presented to the Company’s financial advisors certain details regarding the Investor Group’s sources and uses, indicating, among other things, that the Investor Group had not secured any committed debt or equity financing to fund their non-binding proposal. Jefferies’ representatives highlighted that the Investor Group’s financing plan (i) contemplated a proposed common equity contribution of only 25% of the required capital and (ii) was reliant on a large amount of debt-like payment-in-kind preferred securities that would require a subordinated lien on the Company’s real estate.

Following the holiday season, on January 9, 2024, Mr. Kahane emailed Mr. Gennette regarding the status of the Company’s response to the Investor Group’s non-binding proposal and proposing to initiate the process of entering into a non-disclosure agreement. Later that day, Mr. Gennette responded by email that the Board was in the process of reviewing the Investor Group’s non-binding proposal. Mr. Gennette also noted that it would be premature to discuss a non-disclosure agreement.

On January 15, 2024, representatives of Bank of America and Wells Fargo reached out to representatives from Jefferies to ask whether the Investor Group had made any progress with respect to financing its proposal to acquire Macy’s, Inc. Representatives from Jefferies reported that they had no updates to share.

On January 17, 2024, Mr. Gennette reached out to Mr. Kahane to inform him that the Board was continuing to review the Investor Group’s non-binding proposal and would respond once the Board had completed its review process.

On January 18, 2024, the Finance Committee of the Board, in consultation with its independent legal and financial advisors, met to discuss potential next steps with respect to the Investor Group’s proposal.

|

| ||

12 |

|

PROXY SUMMARY

On Sunday, January 21, 2024, news of the Investor Group confirming it had made a proposal to acquire Macy’s, Inc. for $21.00 per share in cash was leaked to the public through The Wall Street Journal. The Investor Group simultaneously sent a second letter to the Board discussing its non-binding proposal and requesting a response within the week. Following the publication of The Wall Street Journal story, the Investor Group issued a press release publicly confirming that it had made a proposal to acquire Macy’s, Inc. for $21.00 per share in cash, declaring that it would pursue all necessary steps to achieve this goal. Shortly thereafter, the Board sent a response to the Investor Group and the Company issued a press release disclosing the Board’s determination that the Investor Group’s non-binding proposal did not constitute a basis to enter into a non-disclosure agreement or provide due diligence information. The Board noted that the proposal was not actionable, as the Investor Group had failed to provide evidence of a viable financing plan and that the proposal lacked compelling value. In light of these concerns, the Board concluded that entering into a non-disclosure agreement with the Investor Group would unnecessarily distract the Company’s management team as it continues to drive value for shareholders through execution of the Company’s business strategy and value creation levers. The Board emphasized that it continued to be open to opportunities that are in the best interests of the Company and all of its shareholders – and that it was open to considering any new information the Investor Group might have to share.

On February 2, 2024, Macy’s, Inc. announced that, in connection with its previously disclosed leadership succession plan, Tony Spring would take the helm as Chief Executive Officer and Chair-Elect of the Company, effective February 4, 2024. Mr. Spring previously served as president and CEO-elect, leading the Company’s digital, customer, merchandising, and brand teams, and also overseeing Bloomingdale’s and Bluemercury.

On February 7, 2024, the Board received another letter from the Investor Group, expressing disappointment in the Board’s response to the group’s non-binding proposal and purporting to respond to the Board’s concerns. Mr. Gennette directed Bank of America and Wells Fargo to reengage with Jefferies to see whether any further clarity on the Investor Group’s financing plans could be ascertained.

On February 8, 2024, representatives of Bank of America and Wells Fargo had a call with Jefferies to provide further clarity on the types of additional financing information the Investor Group could provide to potentially advance discussions with the Board, including delivery of commitment letters from the equity sources referenced in the Investor Group’s February 7 letter; information regarding how much debt (if any) Brigade was prepared to commit to the transaction; a draft or executed commitment letter from Jefferies indicating what debt (if any) Jefferies was prepared to commit to the transaction; summary term sheets for each of the proposed debt financing tranches; and a list of specific diligence topics required to solidify the financing.

On February 10, 2024, counsel for the Company received a phone call from counsel for Arkhouse. During the call, counsel for Arkhouse noted that the deadline for nominating directors to the Board was approaching and informed counsel for the Company that Arkhouse intended to submit director nominations. Counsel for Arkhouse then requested that the Company extend its nomination window by a few weeks, in order to provide Arkhouse with additional time to advance discussions with respect to the Investor Group’s non-binding proposal. Counsel for the Company advised that he would take this request back to the Company’s management and the Board.

The next day, the Board received a letter from Arkhouse claiming that it had responded to all of the Board’s outstanding issues and memorializing the request for a postponement of the deadline to submit director nominations by 10 days, to 5:00 p.m., New York time, on February 29, 2024. Arkhouse requested a response to its letter within two days, by 5:00 p.m., New York time, on Tuesday, February 13, 2024.

On February 13, 2024, on behalf of the Board, Mr. Gennette responded to the Investor Group’s February 11, 2024 letter, stating that the Company’s by-laws clearly set out the deadlines for submission of director nominations and shareholder proposals, and that the Company intends to follow these well-established procedures for an orderly and timely meeting in accordance with applicable law.

On February 14, 2024, Macy’s, Inc. received a formal notice (the “Notice”) of nomination from Arkhouse naming nine director nominees—Richard Clark, Richard L. Markee, Mohsin Y. Meghji, Mitchell Schear, Nadir Settles, Gerald L. Storch, Sharen J. Turney, Andrea M. Weiss, and Isaac Zion—for election to the Board at the 2024 Annual Meeting. The Notice stated that

|

| ||

MACY’S, INC. | 13 |

PROXY SUMMARY

certain entities affiliated with Arkhouse beneficially owned 4,021,687 shares of common stock of the Company. The Arkhouse nominees did not beneficially own any shares of the Company as of the date of the Notice.

On February 20, 2024, the Company issued a press release announcing that Arkhouse had nominated nine directors for election to the Board and stated that, notwithstanding the sole objective of Arkhouse is a sale of Macy’s, Inc., the Company’s Nominating and Corporate Governance Committee would evaluate Arkhouse’s director nominees in due course. Arkhouse also issued a press release on February 20, 2024 announcing their nominations.

On February 26, 2024, acting on behalf of the Board, Wachtell Lipton delivered to counsel for Arkhouse a request to interview the Arkhouse director nominees and provided a disclosure and authorization form requesting consent to perform third-party background checks, consistent with standard procedure for potential directors of the Company. On February 29, 2024, counsel for Arkhouse responded that Arkhouse would make its nominees available for interviews but believed a background check would be “premature” and offered to discuss after the interviews were completed.

On February 28, 2024, counsel for Arkhouse, on behalf of Arkhouse Value Fund I LP in its capacity as a stockholder of the Company, delivered to the Company a request for certain books and records pursuant to Section 220 of the General Corporation Law of the State of Delaware. The Company responded to this request on March 6, 2024.

On March 3, 2024, a reporter from The Wall Street Journal reached out to the Company for comment on an article the Journal was planning to publish about an increased acquisition proposal from the Investor Group. Within the next hour, the Board received a letter from the Investor Group indicating that, after reviewing the Company’s fourth quarter and full-year 2023 earnings, it was prepared to increase its non-binding proposal to acquire all of the outstanding shares of the Company to $24.00 per share in cash. Regarding financing, the Investor Group represented that it had signed equity commitments for both the preferred securities and the common equity (in aggregate representing 50% of the capital the Investor Group believed was required to finance its non-binding proposal) and that it would be willing to share copies of the commitments with the Company under a confidentiality agreement. The letter also included an updated sources and uses table for the proposed transaction. Shortly thereafter, The Wall Street Journal reported that the Investor Group had raised its proposal to acquire the Company to $24.00 per share, and Arkhouse issued a press release stating the Investor Group had submitted an increased proposal to acquire the Company for $24.00 per share in cash.

On the evening of March 3, 2024, the Company issued a press release confirming that it had received the revised, unsolicited, non-binding proposal from the Investor Group. The Company indicated that the Board would carefully review and evaluate the revised proposal consistent with the Board’s fiduciary duties, in consultation with its financial and legal advisors.

Also on March 3, 2024, Mr. Perkal emailed Mr. Gennette to propose an in-person meeting during the upcoming week. On the morning of March 4, 2024, Mr. Gennette sent an email to Mr. Perkal offering to meet in-person on Tuesday, March 5.

Also on March 4, 2024, the Board sent a letter to the Investor Group indicating that it would be customary for a transaction of the nature proposed by the Investor Group and helpful for the Board to review the signed equity commitments referenced in the March 3, 2024 letter.

On March 5, 2024, Mr. Perkal and Philip Shannon, another representative of Brigade, met with Mr. Gennette and Mr. Spring in person. During this meeting, the Brigade representatives discussed their sector experience, including their prior investments in Sears and JC Penney, and identified certain diligence requests. The representatives of Brigade also provided a brief opportunity for Mr. Gennette and Mr. Spring to view, but not retain, copies of apparent commitment letters/proposals from financing sources of the Investor Group.

On March 5, 2024, counsel for the Company spoke to counsel for Arkhouse and counsel for the Investor Group to discuss the Company’s March 4 letter. Later that day, certain documents regarding the proposed financing were provided for review by the Company’s legal and financial advisors. Over the following days, representatives of the Company’s financial advisors met with certain proposed financing sources of the Investor Group.

|

| ||

14 |

|

PROXY SUMMARY

On March 11, 2024, the Board sent a response letter to the Investor Group along with a draft confidentiality agreement. On March 13, 2024, representatives of the Investor Group’s financial advisors provided a due diligence request list to representatives of the Company’s financial advisors.

On March 19, 2024, the Company and the Investor Group executed a confidentiality agreement providing, among other things, that the Investor Group may, for the next 10 months, only use the Company’s confidential information to pursue an offer for at least $24.00 per share in cash. The Company has since begun to provide the Investor Group with certain confidential information in accordance with the confidentiality agreement.

On March 22, 2024, the Company filed its Annual Report on Form 10-K with the Securities and Exchange Commission.

Prior to the date of this Proxy Statement, the Chair of the Company’s Nominating & Corporate Governance Committee interviewed each of Arkhouse’s nine director nominees along with two other members of the Board who each participated in about half of the nominee interviews. Following the completion of these interviews, counsel for the Company reissued its request for authorization to perform third-party background checks on the Arkhouse nominees, consistent with standard procedure for potential directors of the Company, but counsel for Arkhouse has yet to grant this request.

|

| ||

MACY’S, INC. | 15 |

ITEM 1 |

Election of Directors |

The Board recommends that you vote “FOR” the election of each of the following Macy’s Director nominees on the WHITE proxy card: |

•Emilie Arel |

•Torrence N. Boone |

•Ashley Buchanan |

•Marie Chandoha •Naveen K. Chopra •Deirdre P. Connelly •Jill Granoff •William H. Lenehan •Sara Levinson •Douglas W. Sesler •Tony Spring |

•Paul C. Varga •Tracey Zhen |

and WITHHOLD on each of the |

Arkhouse Group nominees. |

ITEM 1: ELECTION OF DIRECTORS

In accordance with the recommendation of the Nominating and Corporate Governance (NCG) Committee, the Board has nominated the following individuals for election as directors. If elected, each nominee will serve for a one-year term expiring at our annual meeting of shareholders in 2025 or until his or her successor is duly elected and qualified.

Francis S. Blake, who has served as a director since November 2015, has not been nominated to stand for reelection and will retire from the Board immediately upon the conclusion of the Annual Meeting in accordance with our director retirement policy. Jeff Gennette, who has served as a director since 2016, served as Chief Executive Officer of Macy’s from March 2017 until February 2024, and currently serves as Non-Executive Chairman of the Board, has not been nominated to stand for reelection and will retire from the Board immediately upon the conclusion of the Annual Meeting. We thank Mr. Blake and Mr. Gennette for their many years of service to Macy’s and our shareholders.

The Board currently intends to fix the size of the Board at 13 Directors as of the Annual Meeting.

Information regarding Macy’s director nominees is set forth below. Ages are as of March 21, 2024. The criteria considered and process undertaken by the NCG Committee in recommending qualified director candidates is described under “Further Information Concerning the Board of Directors — Director Nomination and Qualifications.”

As described above, the Arkhouse Group has notified Macy’s of its intent to nominate nine directors — Richard (Ric) Clark, Richard L. Markee, Mohsin (Mo) Y. Meghji, Mitchell Schear, Nadir Settles, Gerald (Jerry) L. Storch, Sharen J. Turney, Andrea M. Weiss, and Isaac Zion — for election as directors at the Annual Meeting in opposition to the nominees recommended by our Board. As a result, assuming such nominees are in fact proposed for election at the Annual Meeting and all such nominations have not been withdrawn by the Arkhouse Group, the election of directors will be considered a contested election under Section 13(d) of our Amended and Restated By-Laws (the By-Laws). Due to such contested election, all director nominees will be elected by a plurality of votes cast. Any shares not voted “FOR” a particular director nominee as a result of a “WITHHOLD” vote, failure to vote or a broker non-vote (as described under “Information About the Annual Meeting”) will not be counted in that director nominee’s favor and will not otherwise affect the outcome of the election (except to the extent they otherwise reduce the number of shares voted “FOR” such director nominee).

In the event that the Arkhouse Group nominees are not put up for election at the Annual Meeting and there are instead only the nominees proposed by Macy’s, the election will be considered an uncontested election and each director nominee will be elected by the affirmative vote of the majority of the votes cast by the holders of stock present or represented by proxy at the Annual Meeting and entitled to vote in the election. The Board does NOT endorse the Arkhouse Group’s nominees and unanimously recommends that you use the WHITE proxy card to vote “FOR” only each of the nominees proposed by the Board (Emilie Arel, Torrence N. Boone, Ashley Buchanan, Marie Chandoha, Naveen K. Chopra, Deirdre P. Connelly, Jill Granoff, William H. Lenehan, Sara Levinson, Douglas W. Sesler, Tony Spring, Paul C. Varga, and Tracey Zhen). The Board strongly urges you to disregard any materials sent to you by the Arkhouse Group, including any BLUE proxy card, and NOT to vote using any BLUE proxy card that may be sent to you by the Arkhouse Group. If you have already voted using a BLUE proxy card sent to you by the Arkhouse Group, you have every right to change your vote and we strongly urge you to revoke that proxy by voting in favor of the Board’s nominees by following the instructions set forth on the WHITE proxy card to vote by Internet or telephone, or by marking, dating, signing, and returning the enclosed WHITE proxy card by mail in the postage-paid envelope provided. Only the latest dated, validly executed proxy that you submit will be counted, and any proxy may be revoked at any time prior to its exercise at the Annual Meeting. If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Innisfree M&A Incorporated, at 1 (877) 800-5192 (toll-free from the U.S. and Canada) or 1 (412) 232-3651 from other countries.

In the event that the Arkhouse Group withdraws its nominees, abandons its solicitation, or fails to comply with the universal proxy rules after a shareholder has already granted proxy authority, shareholders can still use a WHITE proxy card to submit a later-dated vote by the Internet, telephone, or mail. In the event that the Arkhouse Group withdraws its nominees, abandons its solicitation, or fails to comply with the universal proxy rules, any votes cast in favor of the Arkhouse Group’s candidates will be disregarded and not be counted, whether such vote is provided on Macy’s WHITE proxy card or the Arkhouse Group’s BLUE proxy card.

ITEM 1: ELECTION OF DIRECTORS

Although Macy’s is required to include all nominees for election on its universal proxy card, for additional information regarding the Arkhouse Group nominees, including the information required by Item 7 of Schedule 14A and any other related information, please refer to the Arkhouse Group’s proxy statement, which [is/will be] accessible without cost at www.sec.gov. You may receive solicitation materials from the Arkhouse Group, including proxy statements and BLUE proxy cards. Macy’s is not responsible for the accuracy or completeness of any information provided by or relating to the Arkhouse Group or its nominees contained in solicitation materials filed or disseminated by or on behalf of the Arkhouse Group or any other statements the Arkhouse Group may make.

If you are a registered holder and submit a validly executed WHITE proxy card but do not specify how you want to vote your shares with respect to the election of directors, then your shares will be voted in line with the Board’s recommendation with respect to the proposal, i.e., “FOR” the nominees proposed by your Board and named in this proxy statement.

Each Macy’s nominee has agreed to serve if elected. If any nominee becomes unavailable to serve before the Annual Meeting, the Board may designate a substitute nominee and the persons named as proxies may, in their discretion, vote your shares for the substitute nominee. Alternatively, the Board may reduce the number of directors to be elected at the Annual Meeting. At this time, the Board knows of no reason why any of the Board’s nominees would not be able to serve as a director if elected.

If you are a beneficial holder and properly mark, sign and return your WHITE voting instruction form by mail or complete your proxy via Internet or by telephone, your shares will be voted as you direct your bank or broker. If you date, sign and return your WHITE voting instruction form but do not specify how you want your shares voted with respect to the election of directors, they will be voted “FOR” the nominees proposed by your Board and named in this proxy statement. It is therefore important that you provide specific instructions to your broker or bank regarding the election of directors so that your vote with respect to this item is counted.

If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Innisfree M&A Incorporated, at (877) 800-5192 (toll-free from the U.S. and Canada) or +(412) 232-3651 (from other countries).

ITEM 1: ELECTION OF DIRECTORS

Nominees for Election as Directors:

| ||

Emilie Arel Former President and Chief Executive Officer of Casper Sleep Inc. Independent Age: 46 Director Since: 2022 Race/Ethnicity: White Committees: ● CMD ● NCG Previous Public Directorships During Casper Sleep Inc. | 0BProfessional Background

● Chief Executive Officer, Casper Sleep Inc. (2021 to 2024), President (2019 to 2024) ● Chief Commercial Officer, Casper Sleep Inc. (2019 to 2021) ● Chief Executive Officer, FULLBEAUTY Brands Inc. (2017 to 2019) ● Chief Executive Officer, Quidsi Inc. (2015 to 2017), Senior Vice President, Retail, Merchandising and Supply Chain (2014 to 2015) ● Various leadership positions, The Gap, Inc. (2007 to 2014) including Vice President and General Manager, Kids and Brand Licensing, Old Navy (2013 to 2014), Vice President, Stores, Old Navy (2012 to 2013) ● Various leadership positions, Target Corporation (2001 to 2004)

Relevant Skills and Experience ● Leadership Experience – Ms. Arel is a three-time CEO with over two decades of experience serving in senior leadership positions at large publicly traded companies. As CEO of Casper Sleep, she oversaw multiple transactions including its IPO and subsequent go-private transaction, and while the CEO of FULLBEAUTY Brands, she led the company through a successful restructuring. Ms. Arel spent seven years with The Gap Inc. where she held multiple merchandising and licensing positions and led a team of 12,000+ employees and 220+ stores. ● Industry Knowledge and Experience – Ms. Arel brings experience leading complex omnichannel retail businesses and brick-and-mortar retail stores, including Target, The Gap Inc., FULLBEAUTY Brands and Quidsi. She also has retail merchandising expertise, and a proven ability to develop retail partnerships and maximize the customer experience via omnichannel strategies. ● Sales and Marketing and Technology Experience – Ms. Arel has extensive experience across digital-first marketing, e-commerce, commercial and brand strategy and digital transformation. In her role as President and CEO at Casper Sleep, Ms. Arel oversaw the company’s comprehensive business strategy and was responsible for implementing complex e-commerce and omnichannel strategies to drive consistency for consumers. During her tenure as CEO of FULLBEAUTY Brands, she successfully led its digital transformation from 2017 – 2019. |

|

| ||

MACY’S, INC. | 19 |

ITEM 1: ELECTION OF DIRECTORS

| ||

Torrence N. Boone Vice President, Global Client Partnerships, Google, Inc. Independent Age: 54 Director Since: 2019 Race/Ethnicity: Black Committees: ● Audit ● NCG | Professional Background ● Vice President, Global Client Partnerships, Google, Inc. (2010 to current) ● Chief Executive Officer, Team Dell, a division of WPP (2008 to 2010) ● President and General Manager, Digitas (2001 to 2008) and Avenue A, now Razorfish (1999-2000) ● Senior Manager, Bain & Company (1995 to 2000) Relevant Skills and Experience ● Leadership Experience – Mr. Boone has served as the Vice President of Global Client Partnerships at Google, Inc. since 2010, and leads a team focused on large scale global strategic partnerships across a portfolio of the world’s largest global advertisers, spanning the tech, health, beauty and consumer packaged goods industries, to achieve breakthrough marketing results. Mr. Boone previously held senior agency leadership positions at WPP & Publicis. He has been recognized as an advocate for ethnic diversity and inclusion in education and business and was named by Savoy Magazine as one of the Top 100 Most Influential Blacks in Corporate America and one of the Most Influential Black Corporate Directors. Mr. Boone has also been named to the Financial Times UPstanding Leaders' List and the Crain’s NY Power 25 List. ● Sales and Marketing and Technology Experience – Mr. Boone possesses over two decades of experience in advertising, marketing and technology, most recently in his role at Google, a multinational technology company. Mr. Boone is a well-respected leader in the advertising industry, with a depth of knowledge and experience particularly in digital marketing. ● Industry Knowledge and Experience – Through his experience at Google, Mr. Boone brings multigenerational knowledge and a global view of the consumer. He was also a senior manager at Bain & Company, where he advised a broad range of clients on corporate and business strategy, mergers and acquisitions, new product development and interactive strategy for five years. | |

|

| ||

20 |

|

ITEM 1: ELECTION OF DIRECTORS

| ||||

Ashley Buchanan Chief Executive Officer of The Michaels Companies, Inc. Independent Age: 50 Director Since: 2021 Race/Ethnicity: White Committees: ● Audit ● NCG Previous Public Directorships During TreeHouse Foods, Inc. The Michaels Companies, Inc. | 4BProfessional Background ● Chief Executive Officer, The Michaels Companies, Inc. (2020 to current) ● Executive Vice President and Chief Merchandising Officer, U.S. eCommerce, Walmart, Inc. (2019 to 2020) ● Executive Vice President and Chief Merchandising Officer, Sam’s Club (2017 to 2019) ● Senior Vice President, Walmart, Dry Grocery (2016 to 2017), Senior Vice President, Snacks and Beverages (2014 to 2016), Vice President, Walmart Innovations (2007 to 2014) ● Finance Manager, Dell, Inc. (2004 to 2007) ● Manager, Retail Practice at Accenture LLP (1999 to 2004) Relevant Skills and Experience ● Leadership Experience – Mr. Buchanan’s leadership experience as a Chief Executive Officer and senior executive of large publicly traded companies with global operations greatly contributes to our Board. Notably, since his appointment as The Michaels Companies, Inc.’s CEO in 2020, the company has experienced record growth, financial and operational performance. Mr. Buchanan also had a distinctive and successful career at Walmart, serving in various roles of increased leadership and responsibility that culminated in the role of Chief Merchandising and Chief Operating Officer for Walmart U.S. eCommerce. ● Industry Knowledge and Experience – Mr. Buchanan brings significant knowledge of the retail industry given his extensive background in merchandising and general management of large retail organizations. ● Technology Experience – Mr. Buchanan is also recognized for his expertise in successfully leading traditional, established retail corporations through complex digital transformations, first at Walmart and currently at The Michaels Companies, Inc. | |||

|

| ||

MACY’S, INC. | 21 |

ITEM 1: ELECTION OF DIRECTORS

| ||||

Marie Chandoha Former President and Chief Executive Officer, Charles Schwab Investment Management, Inc. Independent Age: 62 Director Since: 2022 Race/Ethnicity: White Committees: ● Audit (Chair) ● Finance Other Current Public Directorships: State Street Corporation | Professional Background: ● President and Chief Executive Officer, Charles Schwab Investment Management, Inc (2010 to retirement in 2019) ● Managing Director and Global Head, Fixed Income Business of BlackRock, Inc. (2009 to 2010) ● Global Head, Fixed Income Business of Barclays Global Investors, Inc. (acquired by BlackRock, Inc. in 2009) (2007 to 2009) ● Co-Head and Senior Portfolio Manager, Montgomery Fixed Income, Wells Capital Management Incorporated (1999 to 2007) ● Senior Bond Strategist, The Goldman Sachs Group, Inc. (1996 to 1999) ● Various leadership positions, Credit Suisse Group AG (1986 to 1996) Relevant Skills and Experience ● Leadership Experience – Ms. Chandoha has over 35 years of leadership experience as a former Chief Executive Officer and senior executive in the financial services industry, in addition to currently serving on public company boards. She has a track record of transforming previously underperforming businesses, scaling them and creating value. Most recently, she served as President and Chief Executive Officer of Charles Schwab Investment Management for nearly ten years, where she led the company’s product and technology transformation, improving profitability and more than doubling the firm’s assets under management. ● Finance Experience – Beyond Charles Schwab Investment Management, Ms. Chandoha’s career in financial services has spanned executive roles at major global financial institutions, including leading the fixed income business of Barclays Global Investors and BlackRock. Her core competencies include finance, investment management, strategy, regulatory dynamics and risk management, among others. Ms. Chandoha serves as Chair of the Risk Committee and Member of the Audit Committee on the State Street Corporation board, and American Banker recognized her each year from 2014 to 2018 as one of the 20 Most Powerful Women in Finance. ● ESG Experience – Ms. Chandoha has built a reputation for developing diverse, high performing teams and organizations. As Chief Executive Officer of Charles Schwab Investment Management, Inc., Ms. Chandoha reorganized the leadership team and added strong governance and risk management policies. In addition, Ms. Chandoha has served on the board of trustees of the Nature Conservancy of California for the last 12 years, becoming Chairwoman in 2023. | |||

|

| ||

22 |

|

ITEM 1: ELECTION OF DIRECTORS

| ||||

Naveen K. Chopra Executive Vice President and Chief Financial Officer of Paramount Global Independent Age: 50 Director Since: 2023 Race/Ethnicity: Asian Indian Committees: ● Audit ● Finance Previous Public Directorships During Vonage Holdings Corp. (acquired by Telefonaktiebolaget LM Ericsson) | Professional Background ● Executive Vice President and Chief Financial Officer, Paramount Global (2020 to current) ● Vice President and Chief Financial Officer, Devices and Services Worldwide, Amazon.com, Inc. (2019 to 2020) ● Chief Financial Officer, Pandora Media, Inc. (acquired by Sirius XM Holdings in 2019) (2017 to 2019), Interim Chief Executive Officer (during 2017) ● Various leaderships positions, TiVo Corporation (2003 to 2016) including Interim Chief Executive Officer and Chief Financial Officer (2016), Chief Financial Officer and Senior Vice President, Corporate Development and Strategy (2012 to 2016), Senior Vice President, Corporate Development (2009 to 2012), Vice President, Global Business Development (2006 to 2009), Director, Business Development (2003 to 2006) Relevant Skills and Experience ● Leadership Experience – Mr. Chopra brings over 20 years of experience as a senior executive of large publicly traded companies across the consumer, technology and media industries through phases of growth and transformation. Chopra spent several years across a variety of leadership roles at TiVo, including interim CEO, CFO, and head of Corporate and Business Development. He also served as interim CEO at Pandora Media. Mr. Chopra was previously a board member at Vonage Holdings, a publicly traded multi-billion-dollar cloud-communications company, and where the stock rose close to 200% during his tenure. ● Finance Experience – Mr. Chopra is an established financial and operational leader with proven expertise managing and overseeing treasury, tax, accounting, investor relations and information security functions for high-growth, innovative companies. Notably, in his Chief Financial Officer role, he oversaw some of Amazon’s fastest-growing businesses, including Alexa and Echo, FireTV, Ring and Kindle. At Vonage, he served on the audit and compensation committees. ● Real Estate Experience – As Executive Vice President, Chief Financial Officer of Paramount, Mr. Chopra oversees the company’s financial operations, including its real estate, as well as global corporate development and strategy. Additionally, Mr. Chopra managed the real estate division of Pandora Media during his tenure as CFO. | |||

|

| ||

MACY’S, INC. | 23 |

ITEM 1: ELECTION OF DIRECTORS

| ||||

Deirdre P. Connelly Former President, North American Pharmaceuticals of GlaxoSmithKline Independent Age: 63 Director Since: 2008 Race/Ethnicity: Hispanic/Latino Committees: ● CMD ● NCG (Chair) Other Current Public Directorships: Lincoln National Corporation Genmab A/S | Professional Background ● President, North American Pharmaceuticals of GlaxoSmithKline, (2009 to retirement in 2015) ● President, U.S. Operations, Eli Lilly and Company (2005 to 2009) ● Senior Vice President, Human Resources, Eli Lilly and Company (2004 to 2005) ● President, Women’s Health Business, U.S. Operations, Eli Lilly and Company (2001 to 2003) Relevant Skills and Experience ● Leadership Experience – Ms. Connelly possesses many years of leadership experience as a senior executive of large publicly traded companies with global operations. Notably, she served in senior leadership roles at global pharmaceutical companies including Eli Lilly, where her responsibilities included leading an R&D global product development organization, and GlaxoSmithKline, where she also served as Co-Chair of the Global Product Investment Board for six years. For nine consecutive years, Ms. Connelly was recognized by Fortune magazine as one of the 50 most powerful women in business and was listed on Forbes 100 World’ Most Powerful Women in 2011. ● Sales and Marketing Experience – Ms. Connelly’s decades of experience in senior executive positions provide her with extensive knowledge and expertise in strategy, operations, product development, brand marketing and merchandising. From her roles at Eli Lilly and GlaxoSmithKline, she has gained deep insight into building strong organizations and marketing to defined customer segments. ● R&D and Product Development – Ms. Connelly led an R&D global product development organization at Eli Lilly and Co-Chaired the Global Product Investment Board at GlaxoSmithKline for six years. ● Human Capital Management and ESG Experience – As a former Human Resources executive, Ms. Connelly has valuable insight in compensation/benefits oversight and managing a large-scale, diverse workforce along with experience in identifying, assessing and managing risk exposure at public companies. | |||

|

| ||

24 |

|

ITEM 1: ELECTION OF DIRECTORS

| ||||

Jill Granoff Senior Advisor, Eurazeo Brands Independent Age: 61 Director Since: 2022 Race/Ethnicity: White Committees: ● CMD (Chair) ● Finance Previous Public Directorships During Unibail-Rodamco-Westfield SE | Professional Background ● Senior Advisor, Eurazeo Brands (2024 to current); Managing Partner, Eurazeo (2020 to 2024),Chief Executive Officer, Eurazeo Brands (2017 to 2024) ● Chief Executive Officer, Vince Holding Corp. (2013 to 2015), Chief Executive Officer, Kellwood Company, LLC (2012 to 2013) ● Chief Executive Officer, Kenneth Cole Productions, Inc. (2008 to 2011) ● Executive Vice President, Direct Brands, Liz Claiborne, Inc. (2007 to 2008), Group President, Direct to Consumer (2006 to 2007) ● Various senior leadership positions, L Brands Inc. (1999 to 2006), including President and Chief Operating Officer, Victoria’s Secret Beauty (2005 to 2006) and Co-Leader and Chief Operating Officer, Victoria’s Secret Beauty (2004 to 2005) ● Various senior leadership positions, The Estée Lauder Companies Inc., including Senior Vice President, Strategic Planning, Finance and IT (1990 to 1999) Relevant Skills and Experience ● Leadership Experience – Ms. Granoff has over 30 years of experience leading large consumer-driven organizations. She is currently Senior Advisor to Eurazeo Brands, a global consumer growth equity platform, following her successful tenures as its Chief Executive Officer and as Managing Partner of Eurazeo. Ms. Granoff is a two-time public company Chief Executive Officer, including of Vince Holding Corp., where she led the company’s IPO, and Kenneth Cole Productions. Ms. Granoff is a long-standing member of Fortune’s Most Powerful Women and has received numerous awards for her visionary leadership. She has extensive experience on audit, compensation, nominating and governance, and strategic planning committees, having served on the boards of Unibail-Rodamco-Westfield, Demandware, Cosmetic Executive Women, and the Fashion Institute of Technology. ● Industry Knowledge and Experience – Ms. Granoff is widely known as a strategist, operator and brand builder in the beauty, fashion and retail industries. She brings a unique ability to recognize and position companies to meet evolving consumer needs and has successfully driven profitable growth for numerous brands including Estee Lauder, Victoria’s Secret, Vince, Kate Spade and Juicy Couture. Ms. Granoff has managed over 1000 retail stores and websites and has a deep understanding of omni-channel business dynamics. ● Finance Experience – As Managing Partner of Eurazeo, a leading global investment group with a diversified portfolio of $35 billion in assets under management, Ms. Granoff was responsible for leading investment activities and overseeing the performance of the firm’s Brands portfolio globally. Her tenure included a review more than 2,000 investment opportunities in beauty, fashion, food and beverage and home. | |||

|

| ||

MACY’S, INC. | 25 |

ITEM 1: ELECTION OF DIRECTORS

| ||||

William H. Lenehan President and Chief Executive Officer of Four Corners Property Trust, Inc. Independent Age: 47 Director Since: 2016 Race/Ethnicity: White Committees: ● Audit ● Finance Other Current Public Directorships: Four Corners Property Trust, Inc. | Professional Background: ● President and Chief Executive Officer, Four Corners Property Trust, Inc. (2015 to current) ● Special Advisor to the Board of Directors of EVOQ Properties, Inc. (2012 to 2014) ● Interim Chief Executive Officer of MI Developments, Inc. (now known as Granite Real Estate Investment Trust) (2011) ● Investment Professional, Farallon Capital Management LLC (2001 to 2011) Relevant Skills and Experience: ● Leadership Experience – Mr. Lenehan brings valuable experience as a two-time public company Chief Executive Officer and six-time public company board member, with specific expertise in strategy, finance, M&A and corporate governance through his many years of service on board committees. He currently serves as President and Chief Executive Officer of Four Corners Property Trust, overseeing a portfolio of over 1,000 commercial properties across the U.S. ● Real Estate Experience – Mr. Lenehan has extensive real estate investment expertise, both with public companies and private assets. In his role at Four Corners Property Trust, Mr. Lenehan has overseen the company’s acquisition of more than 700 buildings and the management of its portfolio that encompasses retail, restaurants, auto-service, medical retail and more, and includes outparcels to malls and shopping centers. Mr. Lenehan’s approximately 25 years in the real estate industry also includes a decade of experience specific to companies with an Operating Company / Property Company structure and experience in monetizing real estate held by operating companies. ● Finance Experience – Mr. Lenehan brings considerable experience in finance as an asset manager, including serving as a real estate investment professional for the first decade of his career. During his tenure at Farallon Capital Management LLC, Mr. Lenehan was involved with numerous public and private equity investments in the real estate sector and helped execute the approximately $8 billion take-private transaction of one of the largest public mall companies, The Mills, by Simon Property Group. | |||

|

| ||

26 |

|

ITEM 1: ELECTION OF DIRECTORS

| ||||

Sara Levinson Retired Director of Katapult Independent Age: 73 Director Since: 1997 Race/Ethnicity: White Committees: ● CMD ● NCG Other Current Public Directorships: Harley Davidson, Inc. | Professional Background ● Co-Founder and a Director, Katapult, formerly known as Kandu (2013 to 2023) ● Non-Executive Chairman, ClubMom, Inc. (2002 to 2008) ● Chairman and Chief Executive Officer, ClubMom, Inc. (2000 to 2002) ● President, Women’s Group of publisher Rodale, Inc. (2002 to 2005) ● President, NFL Properties, Inc. (1994 to 2000) ● Co-President and Executive Vice President, MTV: Music Television (division of Viacom) (1990 to 1994) ● Executive Vice President, MTV Networks (Division of Viacom) (1986 to 1990) Relevant Skills and Experience ● Leadership Experience – Ms. Levinson possesses over three decades of leadership experience, serving as a senior executive at major consumer-oriented companies in the entertainment, media, sports and technology industries. She co-founded Katapult, a digital entertainment company, and has worked with iconic brands including the NFL, MTV and Showtime to produce innovative strategies that resonate with diverse audiences. At the NFL, Ms. Levinson oversaw a $3 billion licensing consumer products and e-commerce division, corporate sponsorship, marketing, special events, club services, and publishing. Ms. Levinson also brings experience serving as a director on public company boards and expertise in strategy, governance and executive compensation through her service on board committees. ● Industry Knowledge and Experience – Ms. Levinson brings deep expertise in social networking, e-commerce and technology innovation through her more than ten years as Co-founder and Director of Katapult and her tenure as Chairman and Chief Executive Officer of ClubMom, Inc. (later named Café Media), an online social networking community for mothers. ● Sales and Marketing and Technology Experience – Ms. Levinson has extensive knowledge and expertise in marketing, merchandising and trademark licensing. As Co-President of MTV Networks, Ms. Levinson led the company’s global expansion, bringing the network to almost every continent and into publishing, merchandising, and licensing. Ms. Levinson also built the NFL’s first marketing and research departments and is credited with expanding the league’s fan development and marketing, targeting women and children for the first time in League history. | |||

|

| ||

MACY’S, INC. | 27 |

ITEM 1: ELECTION OF DIRECTORS

| ||||

Douglas W. Sesler Founder and President, Fair Street Partners Independent Age: 62 Director Since: 2024 Nominee Race/Ethnicity: White Other Current Public Directorships: Urban Edge Properties Previous Public Directorships During Last Five Years: Gazit Globe Ltd., now G City | Professional Background: ● Founder and President, Fair Street Partners (2021 to Current) ● Head of Real Estate, Macy’s, Inc. (2016 to 2021) ● President, True Square Capital LLC (2011 to 2016) ● Co-Head, Global Real Estate Investment Banking and Global Head of Real Estate Principal Investments, Bank of America Merrill Lynch (2005 to 2011) ● Managing Director, Global Real Estate Investment Bank Group, Citigroup (1994 to 2005) Relevant Skills and Experience: ● Leadership Experience – Mr. Sesler brings over 35 years of leadership experience, having served in senior roles at Macy’s, Inc., True Square Capital LLC and Bank of America Merrill Lynch and Citigroup, leading domestic and global real estate and investment teams. As founder of Fair Street Partners, a private real estate investment and development platform, Mr. Sesler has actively invested in real estate developments, including conversion of retail real estate into alternative uses, and acted as financial advisor in the restructuring of real estate investments. ● Real Estate Experience – Mr. Sesler’s real estate industry expertise spans real estate advisory, investing, finance and restructuring. Prior to founding Fair Street Partners, Mr. Sesler was responsible for Macy’s, Inc.’s real estate portfolio totaling over 100 million square feet, including overseeing the overall strategy to enhance real estate value and the completion of over 160 transactions to monetize and develop over $2 billion of real estate. During his time at Bank of America Merrill Lynch, he managed an $8 billion portfolio of opportunistic real estate for the firm's balance sheet and for third party fund investors. Mr. Sesler has also served as a member of the Real Estate Roundtable, Urban Land Institute, the National Association of Real Estate Investment Trusts, and ICSC. ● Finance Experience – Mr. Sesler led Macy’s, Inc.’s financial restructuring during the COVID-19 pandemic, raising $4.5 billion to recapitalize the Company. Mr. Sesler has been responsible for hundreds of M&A transactions, initial public offerings and capital raising efforts throughout his career, including the sale of Archstone, the $18 billion multifamily platform owned by the Lehman Brothers Estate and the $40 billion sale of Equity Office Properties to Blackstone, numerous acquisitions on behalf of New Plan Realty and Brookfield Properties and IPO's for DLF (India's largest real estate company), Digital Realty and Douglas Emmett. | |||

|

| ||

28 |

|

ITEM 1: ELECTION OF DIRECTORS

| ||