0000794170DEF 14Afalse00007941702022-11-012023-10-31iso4217:USD00007941702021-11-012022-10-3100007941702020-11-012021-10-310000794170tol:PensionValueAdjustmentsChangeInPensionValueInSummaryCompensationTableMemberecd:PeoMember2022-11-012023-10-310000794170tol:PensionValueAdjustmentsChangeInPensionValueInSummaryCompensationTableMemberecd:PeoMember2021-11-012022-10-310000794170tol:PensionValueAdjustmentsChangeInPensionValueInSummaryCompensationTableMemberecd:PeoMember2020-11-012021-10-310000794170ecd:PeoMembertol:PensionValueAdjustmentsPensionServiceCostMember2022-11-012023-10-310000794170ecd:PeoMembertol:PensionValueAdjustmentsPensionServiceCostMember2021-11-012022-10-310000794170ecd:PeoMembertol:PensionValueAdjustmentsPensionServiceCostMember2020-11-012021-10-310000794170ecd:PeoMembertol:EquityValueAdjustmentsGrantDateFairValueOfOptionAwardsAndStockAwardsGrantedInFiscalYearMember2022-11-012023-10-310000794170ecd:PeoMembertol:EquityValueAdjustmentsGrantDateFairValueOfOptionAwardsAndStockAwardsGrantedInFiscalYearMember2021-11-012022-10-310000794170ecd:PeoMembertol:EquityValueAdjustmentsGrantDateFairValueOfOptionAwardsAndStockAwardsGrantedInFiscalYearMember2020-11-012021-10-310000794170tol:EquityValueAdjustmentsFairValueAtFiscalYearEndOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInFiscalYearMemberecd:PeoMember2022-11-012023-10-310000794170tol:EquityValueAdjustmentsFairValueAtFiscalYearEndOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInFiscalYearMemberecd:PeoMember2021-11-012022-10-310000794170tol:EquityValueAdjustmentsFairValueAtFiscalYearEndOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInFiscalYearMemberecd:PeoMember2020-11-012021-10-310000794170tol:EquityValueAdjustmentsChangeInFairValueOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInPriorFiscalYearsMemberecd:PeoMember2022-11-012023-10-310000794170tol:EquityValueAdjustmentsChangeInFairValueOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInPriorFiscalYearsMemberecd:PeoMember2021-11-012022-10-310000794170tol:EquityValueAdjustmentsChangeInFairValueOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInPriorFiscalYearsMemberecd:PeoMember2020-11-012021-10-310000794170tol:EquityValueAdjustmentsFairValueAtVestingOfOptionAwardsAndStockAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMemberecd:PeoMember2022-11-012023-10-310000794170tol:EquityValueAdjustmentsFairValueAtVestingOfOptionAwardsAndStockAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMemberecd:PeoMember2021-11-012022-10-310000794170tol:EquityValueAdjustmentsFairValueAtVestingOfOptionAwardsAndStockAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMemberecd:PeoMember2020-11-012021-10-310000794170tol:EquityValueAdjustmentsChangeInFairValueAsOfVestingDateOfOptionAndStockAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMemberecd:PeoMember2022-11-012023-10-310000794170tol:EquityValueAdjustmentsChangeInFairValueAsOfVestingDateOfOptionAndStockAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMemberecd:PeoMember2021-11-012022-10-310000794170tol:EquityValueAdjustmentsChangeInFairValueAsOfVestingDateOfOptionAndStockAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMemberecd:PeoMember2020-11-012021-10-310000794170ecd:PeoMembertol:EquityValueAdjustmentsFairValueAsOfPriorFiscalYearEndOfOptionAndStockAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalYearMember2022-11-012023-10-310000794170ecd:PeoMembertol:EquityValueAdjustmentsFairValueAsOfPriorFiscalYearEndOfOptionAndStockAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalYearMember2021-11-012022-10-310000794170ecd:PeoMembertol:EquityValueAdjustmentsFairValueAsOfPriorFiscalYearEndOfOptionAndStockAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalYearMember2020-11-012021-10-310000794170ecd:NonPeoNeoMembertol:PensionValueAdjustmentsChangeInPensionValueInSummaryCompensationTableMember2022-11-012023-10-310000794170ecd:NonPeoNeoMembertol:PensionValueAdjustmentsChangeInPensionValueInSummaryCompensationTableMember2021-11-012022-10-310000794170ecd:NonPeoNeoMembertol:PensionValueAdjustmentsChangeInPensionValueInSummaryCompensationTableMember2020-11-012021-10-310000794170ecd:NonPeoNeoMembertol:PensionValueAdjustmentsPensionServiceCostMember2022-11-012023-10-310000794170ecd:NonPeoNeoMembertol:PensionValueAdjustmentsPensionServiceCostMember2021-11-012022-10-310000794170ecd:NonPeoNeoMembertol:PensionValueAdjustmentsPensionServiceCostMember2020-11-012021-10-310000794170ecd:NonPeoNeoMembertol:PensionValueAdjustmentsAboveMarketNonQualifiedDeferredCompensationMember2022-11-012023-10-310000794170ecd:NonPeoNeoMembertol:PensionValueAdjustmentsAboveMarketNonQualifiedDeferredCompensationMember2021-11-012022-10-310000794170ecd:NonPeoNeoMembertol:PensionValueAdjustmentsAboveMarketNonQualifiedDeferredCompensationMember2020-11-012021-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsGrantDateFairValueOfOptionAwardsAndStockAwardsGrantedInFiscalYearMember2022-11-012023-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsGrantDateFairValueOfOptionAwardsAndStockAwardsGrantedInFiscalYearMember2021-11-012022-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsGrantDateFairValueOfOptionAwardsAndStockAwardsGrantedInFiscalYearMember2020-11-012021-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsFairValueAtFiscalYearEndOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInFiscalYearMember2022-11-012023-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsFairValueAtFiscalYearEndOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInFiscalYearMember2021-11-012022-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsFairValueAtFiscalYearEndOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInFiscalYearMember2020-11-012021-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsChangeInFairValueOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInPriorFiscalYearsMember2022-11-012023-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsChangeInFairValueOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInPriorFiscalYearsMember2021-11-012022-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsChangeInFairValueOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInPriorFiscalYearsMember2020-11-012021-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsFairValueAtVestingOfOptionAwardsAndStockAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2022-11-012023-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsFairValueAtVestingOfOptionAwardsAndStockAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2021-11-012022-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsFairValueAtVestingOfOptionAwardsAndStockAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2020-11-012021-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsChangeInFairValueAsOfVestingDateOfOptionAndStockAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMember2022-11-012023-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsChangeInFairValueAsOfVestingDateOfOptionAndStockAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMember2021-11-012022-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsChangeInFairValueAsOfVestingDateOfOptionAndStockAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMember2020-11-012021-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsFairValueAsOfPriorFiscalYearEndOfOptionAndStockAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalYearMember2022-11-012023-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsFairValueAsOfPriorFiscalYearEndOfOptionAndStockAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalYearMember2021-11-012022-10-310000794170ecd:NonPeoNeoMembertol:EquityValueAdjustmentsFairValueAsOfPriorFiscalYearEndOfOptionAndStockAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalYearMember2020-11-012021-10-31000079417012022-11-012023-10-31000079417022022-11-012023-10-31000079417032022-11-012023-10-31000079417042022-11-012023-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box: | | | | | | | | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material under §240.14a-12 |

TOLL BROTHERS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): | | | | | | | | | | | | | | |

| ý | | No fee required. |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | | Title of each class of securities to which transaction applies: |

| | (2) | | | Aggregate number of securities to which transaction applies: |

| | (3) | | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | | Proposed maximum aggregate value of transaction: |

| | (5) | | | Total fee paid: |

| | | | |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | | Amount Previously Paid: |

| | (2) | | | Form, Schedule or Registration Statement No.: |

| | (3) | | | Filing Party: |

| | (4) | | | Date Filed: |

TOLL BROTHERS, INC.

1140 Virginia Drive

Fort Washington, Pennsylvania 19034

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held on Tuesday, March 12, 2024

The 2024 Annual Meeting of Stockholders (the “Meeting”) of Toll Brothers, Inc., a Delaware corporation (the “Company,” "we," "us" or "our") will be held on Tuesday, March 12, 2024 at 9:00 am Eastern standard time, at the offices of the Company, 1140 Virginia Drive, Fort Washington, Pennsylvania 19034, for the following purposes:

1.To elect the 11 directors nominated by the Board of Directors of the Company (the “Board” or the "Board of Directors") and named in the proxy statement to hold office until the 2025 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified.

2.To ratify, in a non-binding vote, the re-appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2024 fiscal year.

3.To approve, in an advisory and non-binding vote, the compensation of the Company’s named executive officers as disclosed in the proxy statement.

4.To transact such other business as may properly come before the Meeting or any adjournment or postponement thereof.

The Board has fixed the close of business on January 18, 2024 as the record date for the Meeting (the "Record Date"). Only stockholders of record at that time are entitled to notice of and to vote at the Meeting and any adjournment or postponement thereof.

The enclosed proxy card is solicited by the Board. Reference is made to the attached proxy statement for further information with respect to the business to be transacted at the Meeting. This proxy statement, our annual report, and the enclosed proxy card are first being sent to stockholders on or about February 1, 2024. The Board requests that you sign, date, and return the enclosed proxy card promptly, although you are cordially invited to attend the Meeting in person. The return of the enclosed proxy card will not affect your right to vote in person if you do attend the Meeting.

Please note the admission policy and procedures regarding attendance at the Meeting, which are set forth below.

By Order of the Board of Directors,

KEVIN J. COEN

Secretary

January 31, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MARCH 12, 2024

The proxy statement and 2023 Annual Report of Toll Brothers, Inc. are available at:

http://astproxyportal.com/ast/12483

ANNUAL MEETING INFORMATION

The Meeting will be held at the Company’s offices at 1140 Virginia Drive, Fort Washington, Pennsylvania 19034 and will begin promptly at 9:00 am Eastern standard time. You must present a valid photo identification to be admitted to the Meeting. Cameras, recording devices and other electronic devices, and the use of cellular phones, will not be permitted during the Meeting. Representatives will be at the entrance to the Meeting, and these representatives will have the authority, on the Company’s behalf, to determine whether the admission policy and procedures have been followed and whether you will be granted admission to the Meeting.

ATTENDANCE AT THE MEETING

Attendance at the Meeting is limited to stockholders, who may be "record holders" who own shares directly in their names, or who may hold shares in “street name” through banks, brokerages, or other intermediaries. In addition to photo identification, you must present evidence of ownership as of the Record Date, such as a letter from the bank, broker, or other intermediary confirming ownership, or the relevant portion of a bank or brokerage firm account statement. If you are the authorized representative of an entity that is a beneficial holder, you must present a letter from the entity certifying the beneficial ownership of the entity and your status as an authorized representative.

Your vote is important. You are invited to attend the meeting in person, although anyone who does not feel well should not attend. In addition, you are required to notify the Company's Secretary in the manner set forth below if you plan to attend the meeting. If it is determined that a change in the date, time or location of the Meeting or a change to a virtual meeting format is advisable or required, an announcement of such changes will be made through a press release, additional proxy materials filed with the Securities and Exchange Commission ("SEC"), and on the Investor Relations section of our website. Please check our website in advance of the meeting date if you are planning to attend in person.

If you plan to vote by proxy but attend the Meeting in person:

•Indicate your votes on your proxy card or voting instruction card;

•Mark the box on your proxy card or voting instruction card indicating your intention to attend the Meeting;

•Return the proxy card or voting instruction card to the address indicated; and

•Follow the admission policies set forth above.

If you plan to attend and vote at the Meeting:

•If you are a "record holder," bring your proxy card with you to the Meeting;

•If you hold your shares in "street name," contact your bank or broker to obtain a written legal proxy form in order to vote your shares at the Meeting;

•Send written notice* of your intention to attend the Meeting to the Company's headquarters by February 28, 2024 to the attention of Kevin J. Coen, Secretary; and

•Follow the admissions policies set forth above.

* Written notice should include: (1) your name, complete mailing address and phone number; (2) if you are a beneficial holder, evidence of your ownership; and (3) if you are a beneficial holder who is not a natural person and will be naming a representative to attend on your behalf, the name, complete mailing address and phone number of that individual. If you do not provide the requested information by February 28, 2024, you may not gain admission to the Meeting.

TOLL BROTHERS, INC.

PROXY STATEMENT

Annual Meeting of Stockholders

Tuesday, March 12, 2024

PROXY SUMMARY

A summary of certain information in this proxy statement is provided below. Please review the complete proxy statement and our Annual Report on Form 10-K for the fiscal year ended October 31, 2023 before you vote.

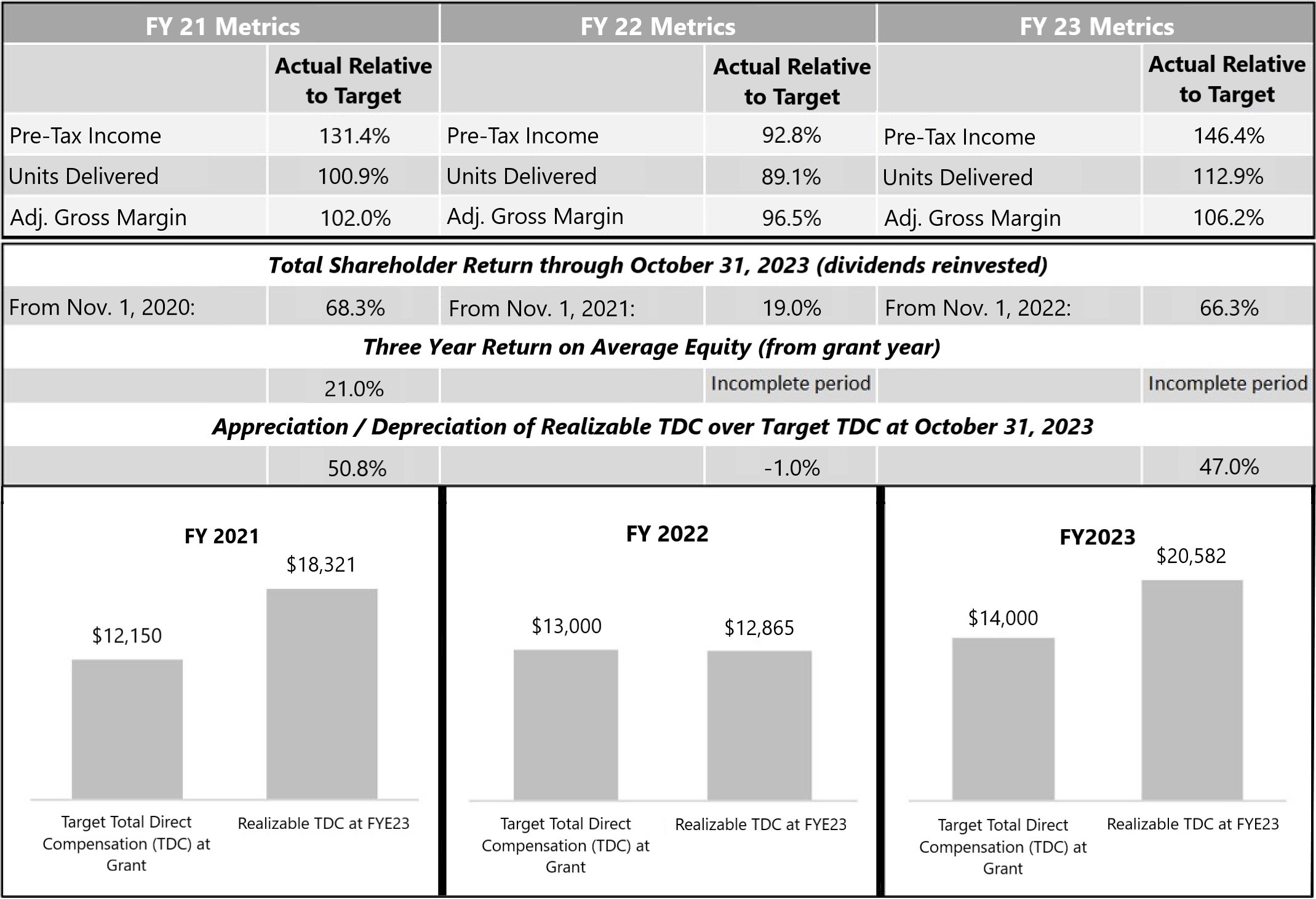

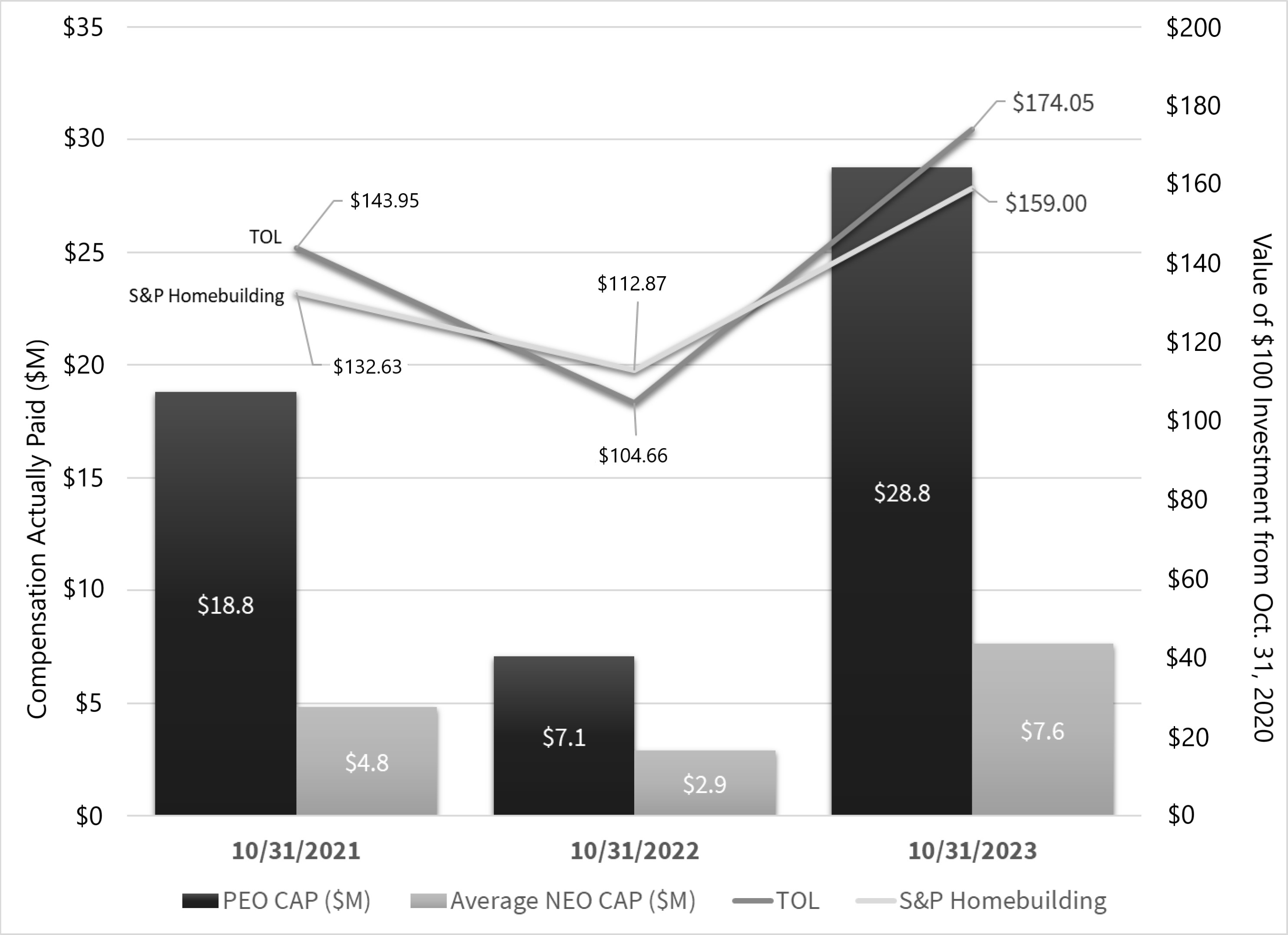

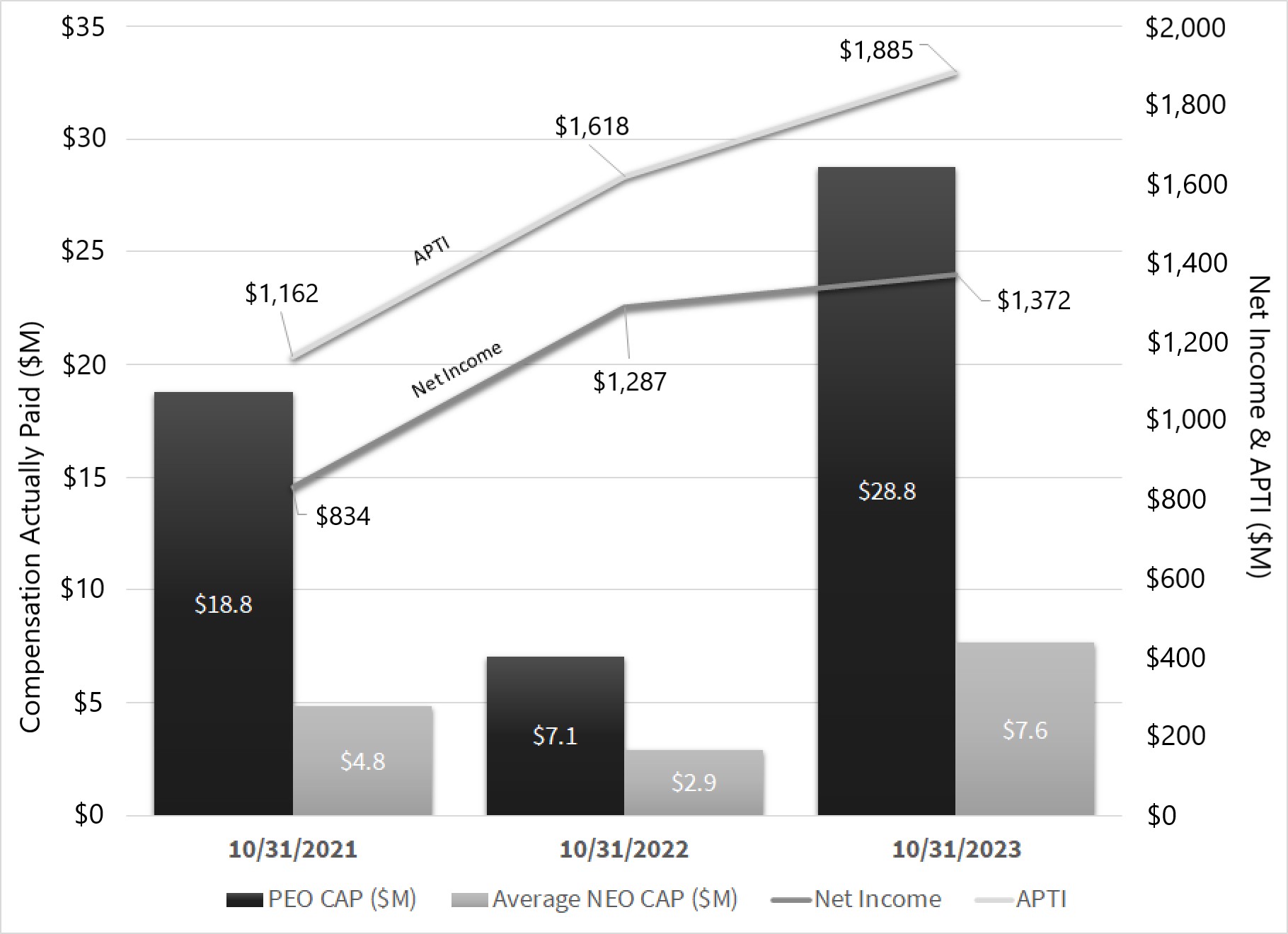

Toll Brothers Strategy and Fiscal 2023 Highlights

In fiscal 2023, we delivered 9,597 new homes at an average price of $1,028,000, generating $9.9 billion in home sales revenues. We achieved a full year home sales gross margin of 26.9%, a 140-basis point increase compared to fiscal year 2022. Excluding interest in cost of home sales of approximately 1.4% and inventory write downs of approximately 0.3%, our adjusted home sales gross margin was 28.7% for the full year. Selling, general & administrative (SG&A) expenses were 9.2% of home sales revenues compared to 10.1% in fiscal 2022. These margin improvements were driven by leverage from top line growth as well as our continued focus on operational efficiency. They contributed to the record $1.8 billion of pre-tax income we earned in fiscal 2023 ($1.4 billion after taxes) and $12.36 in earnings per diluted share, a 13% increase over the $10.90 we generated in fiscal 2022. These earnings drove a return on beginning equity of 22.8% in fiscal 2023 and contributed to a three-year return on average equity of 21.0%.

Our success in fiscal 2023 was due in large part to strategies we began to implement in the latter half of 2022. In particular, we chose not to chase sales at lower margins during the second half of 2022, when home demand was weak owing to the dramatic increase in mortgage rates that occurred over the course of the year. Because of the strength of our backlog at the end of fiscal 2022, we were able to take a patient approach to new sales while diligently working to convert our backlog and maintain margins. We also concentrated on replenishing our inventory of quick move-in (or "spec") homes and increasing community count into the spring selling season when there is typically a higher level of demand for homes. This strategy also allowed us to take advantage of improving supply chains and labor conditions. As a result, in fiscal 2023 we were able to deliver high-margin homes out of our backlog while also generating new home sales for deliveries in both fiscal 2023 and 2024.

While these decisions contributed to fiscal 2023's results, our success was also grounded in our multi-year strategy of expanding our product lines, price points and the geographic markets in which we operate, as well as our focus on increasing profitability and improving our capital efficiency. Expanding our product lines, price points and geographies has allowed us to appeal to a broader range of customers while mitigating geographic and product concentration risks. It has also facilitated our spec strategy by enabling us to build more quickly and efficiently. With a wider range of products, including more affordable luxury and active adult homes that tend to carry lower prices compared to our traditional luxury move-up product, we are also able to pursue more growth opportunities that are aligned with our spec strategy. A natural result of this is a lower average sales price for the homes in our portfolio, as the mix of homes we sell expands to include more affordable products and lower priced geographies. Notwithstanding lower average sales prices, we expect to continue growing home sales revenues over the long term through increased volume and faster inventory turns.

In fiscal 2024 and beyond, we will continue to focus on ways to improve operating efficiency. In recent years, we have expended considerable time and effort in optimizing our home designs, reducing SKUs and curating our design studio offerings, with the goal of improving the speed and efficiency of construction while continuing to offer the stunning floorplans, architectural details and high-end finishes

that are hallmarks of the Toll Brothers brand. We have also continued to focus on improving our cost structure through tighter controls on items such as headcount, advertising, model home expenses and broker commissions, and using technology to streamline the building, marketing and purchasing of our homes. While we are pleased with the margins we achieved in fiscal 2023, we continue to look for ways to reduce overhead and improve operating efficiency.

Our land position and sound financial footing position us well for continued success. In fiscal 2023, we continued to pursue strategies to drive capital efficiency and return on equity by controlling a significant percentage of our land through options rather than outright ownership. We owned or controlled approximately 70,700 lots at fiscal year-end 2023 compared to approximately 76,000 at fiscal year-end 2022. We continue to evaluate all land opportunities, whether new land acquisitions or lot takedowns under existing options, using underwriting standards that are focused on both margins and returns, and which take into account local market conditions. Of the approximate 70,700 lots we held at fiscal year end, nearly 50% were controlled through options, and an additional 9.3% were allocated to lots in our backlog. We continue to target an overall mix (including lots in backlog) of 60% optioned lots and 40% owned over the long term.

We ended fiscal 2023 with over $3.0 billion of liquidity, including $1.3 billion of cash and cash equivalents and $1.8 billion available under our long-term $1.9 billion multi-bank revolving credit facility. During the fiscal year, we generated approximately $1.3 billion in cash from operations, repurchased 7.9 million shares of stock for $565.9 million, paid dividends of $91 million, and retired approximately $400 million of public debt. Our book value per share was $65.49 at fiscal year end and our debt-to-capital ratio was 29.6%, or 17.7% on a net basis after adjusting for cash and cash equivalents and $100 million of loans made by our mortgage subsidiary. We have no significant debt maturities until fiscal 2026. Our balance sheet is in excellent shape, which should allow us to continue investing in our business while returning capital to our stockholders. Our strategy also includes growing community count in fiscal 2024. This growth, combined with the nearly 6,600 homes in backlog at fiscal year-end 2023 and our pipeline of spec homes under construction for delivery in fiscal 2024, give us confidence that fiscal 2024 will be another strong year.

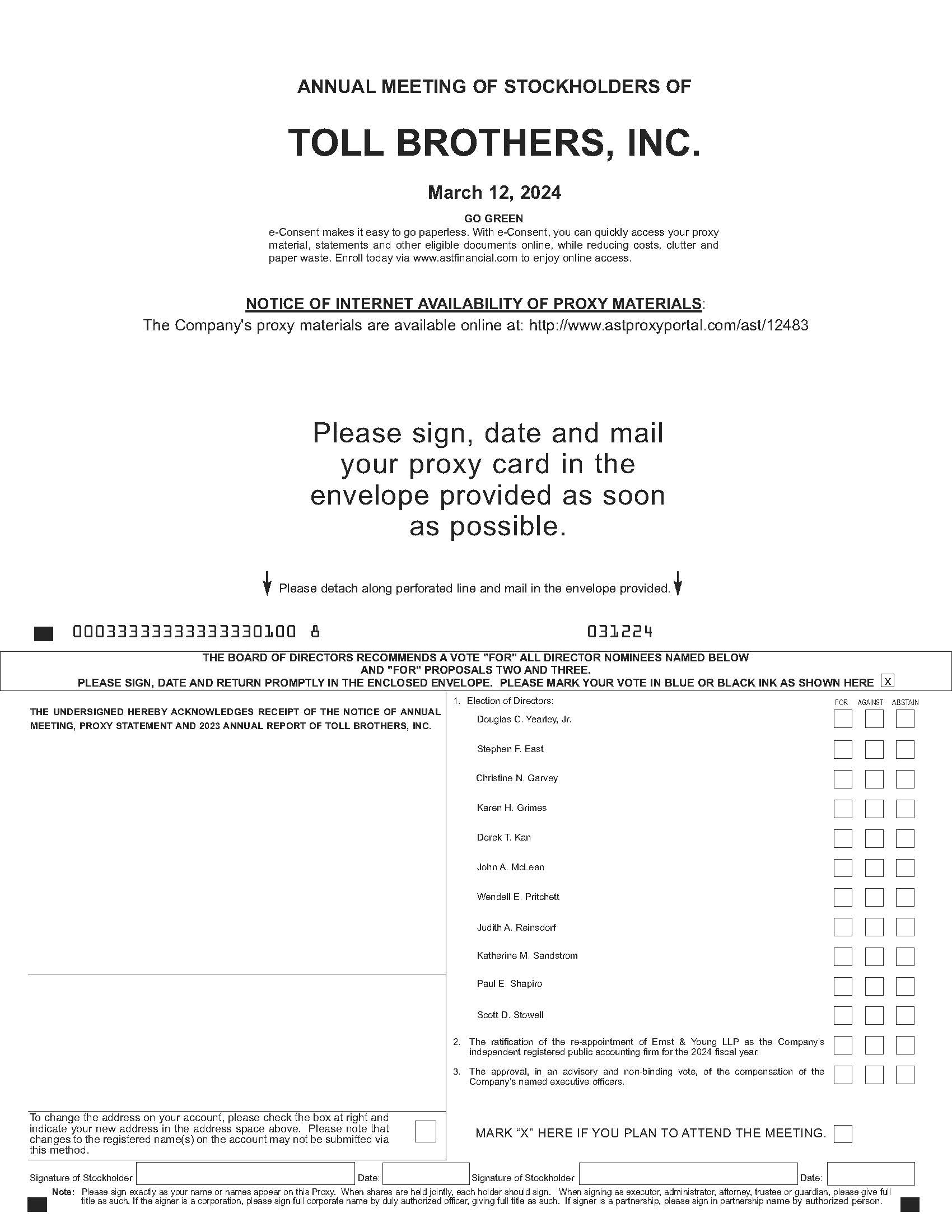

Meeting Agenda Items

Proposal One—Election of Directors. We are asking stockholders to elect 11 director nominees to hold office until the 2025 Annual Meeting of Stockholders and until his or her respective successor has been duly elected and qualified. The Board has nominated 11 of our current directors for re-election at the Meeting.

Set forth below is summary information concerning our director nominees. For more information regarding the experience and qualifications of our director nominees, see “Proposal One—Election of Directors” on page 8.

| | | | | | | | | | | | | | |

| Name | Age | Director

Since | Principal Occupation | Independent |

| | | | |

| Douglas C. Yearley, Jr. | 63 | 2010 | Chairman and Chief Executive Officer, Toll Brothers, Inc. | |

| Stephen F. East | 60 | 2020 | Retired Managing Director, Senior Consumer Analyst and Head of Homebuilding and Building Products Research, Wells Fargo & Company | ü |

| Christine N. Garvey | 78 | 2009 | Retired Global Head of Corporate Real Estate Services, Deutsche Bank AG | ü |

| Karen H. Grimes | 67 | 2019 | Retired Partner, Senior Managing Director, and Equity Portfolio Manager, Wellington Management Company | ü |

| Derek T. Kan | 45 | 2021 | Vice President, Operations at Shopify Inc. | ü |

| John A. McLean | 54 | 2016 | Senior Managing Director, New York Life Investment

Management | ü |

| Wendell E. Pritchett | 59 | 2018 | Riepe Presidential Professor of Law and Education, University of Pennsylvania Carey Law School | ü |

| Judith A. Reinsdorf | 60 | 2023 | Retired Executive Vice President and General Counsel, Johnson Controls International plc | ü |

| Katherine M. Sandstrom | 54 | 2023 | Retired Senior Managing Director, Heitman LLC | ü |

| Paul E. Shapiro | 82 | 1993 | Chairman, Q Capital Holdings LLC | ü |

| Scott D. Stowell | 65 | 2021 | Former Executive Chairman, CalAtlantic Group, Inc. and President and CEO, Capital Thirteen LLC. | ü |

The Board of Directors recommends that you vote “FOR” all Nominees

Proposal Two—Ratification of the Re-Appointment of Independent Registered Public Accounting Firm. We are asking stockholders to ratify, in a non-binding vote, the re-appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending October 31, 2024. For more information regarding our engagement of Ernst & Young LLP, including the fees billed for services rendered by Ernst & Young LLP in fiscal 2023 and fiscal 2022, see “Proposal Two—Ratification of the Re-Appointment of Independent Registered Public Accounting Firm” on page 15.

The Board of Directors recommends that you vote “FOR” Proposal Two

Proposal Three—Advisory and Non-Binding Vote on Executive Compensation (Say on Pay). As described on page 16 under “Proposal Three—Advisory and Non-Binding Vote on Executive Compensation (Say on Pay)," we are asking stockholders to approve, on an advisory basis, the compensation of our named executive officers ("NEOs"). We hold this advisory vote on an annual basis.

The Board of Directors recommends that you vote “FOR” Proposal Three

GENERAL INFORMATION

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors for use at the Meeting, which will be held on the date, at the time and place, and for the purposes set forth in the foregoing notice, and any adjournment or postponement thereof. The Board does not intend to bring any matter before the Meeting except as specifically indicated in the notice and does not know of anyone else who intends to do so; however, if any other matters properly come before the Meeting, Mr. Douglas C. Yearley, Jr. and Mr. Martin P. Connor, or either of them, will vote or otherwise act thereon in accordance with his or their judgment on such matters, acting as proxies for stockholders who have returned an executed proxy to us.

If the enclosed proxy card is properly executed and returned to and received by us prior to voting at the Meeting, the shares represented thereby will be voted in accordance with the instructions marked thereon. If the enclosed proxy card is properly executed, returned, and received by us prior to voting at the Meeting without specific instructions, Mr. Douglas C. Yearley, Jr. and Mr. Martin P. Connor, or either of them, acting as your proxies, will vote your shares “FOR” all nominees under Proposal One, and “FOR” Proposals Two and Three. Any proxy card may be revoked at any time before its exercise by notifying the Secretary of the Company in writing, by delivering a duly executed proxy card bearing a later date, or by attending the Meeting and voting in person.

VOTING SECURITIES AND BENEFICIAL OWNERSHIP

The Record Date fixed by our Board for the determination of stockholders entitled to notice of and to vote at the Meeting is January 18, 2024. At the close of business on the Record Date, there were 104,288,855 shares of the Company's common stock outstanding and eligible to vote at the Meeting. We have no other class of voting securities outstanding. At the Meeting, stockholders will be entitled to one vote for each share of common stock owned at the close of business on the Record Date. Dissenters' rights are not applicable to any of the matters being voted upon at the Meeting.

The presence at the Meeting, in person or by proxy, of persons entitled to cast the votes of a majority of such outstanding shares of common stock will constitute a quorum for the proposals expected to be voted on at the Meeting. Abstentions and broker non-votes represented by submitted proxies will be included in the calculation of the number of shares present at the Meeting for the purposes of determining a quorum. “Broker non-votes” are shares held of record by a broker that are not voted on a matter because the broker has not received voting instructions from the beneficial owner of the shares and lacks the authority to vote the shares in its discretion.

Under the New York Stock Exchange (NYSE) rules, your brokerage firm or other nominee may not vote your shares with respect to Proposals One and Three without specific instructions from you as to how to vote, because these proposals are not considered “routine” matters under the NYSE rules. Proposal Two is considered a “routine” matter, and brokerage firms and nominees that are members of the NYSE are permitted to vote their customers’ shares if the customers have not furnished voting instructions prior to the Meeting. In determining whether each Proposal receives the requisite number of affirmative votes, abstentions and broker non-votes are not considered "votes cast" and therefore will have no effect on the outcome of such proposals.

To elect directors and adopt the other proposals, the following votes are required:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Effect of Broker Non-Votes and Abstentions |

| Proposal | | Vote Required | | Broker

Discretionary

Voting Allowed | | Broker Non-

Votes | | Abstentions |

| | | | | | | | | |

| 1. | Election of each director | | Majority of votes cast | | No | | No effect | | No effect |

| 2. | Ratification of independent auditors | | Majority of votes cast | | Yes | | Not applicable | | No effect |

| 3. | Advisory say on

pay vote | | Majority of votes cast | | No | | No effect | | No effect |

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth beneficial ownership, as of the Record Date, of the Company's common stock by: (1) each person known to us to be the beneficial owner of more than 5% of the Company's common stock; (2) each of our directors (which includes all nominees for director) and named executive officers; and (3) all of our directors and executive officers as a group. To the best of our knowledge, each of the persons named in the table below as beneficially owning the shares set forth therein has sole voting power and sole investment power with respect to such shares, unless otherwise indicated. Except as otherwise noted, the address of each beneficial owner is c/o Toll Brothers, Inc., 1140 Virginia Drive, Fort Washington, Pennsylvania 19034. | | | | | | | | | | | | | | |

| Name and Address of Beneficial Owner | | Amount and Nature of

Beneficial Ownership (1) | | Percent of

Common Stock |

| | | | |

| The Vanguard Group (2) | | 11,689,517 | | 11.21% |

100 Vanguard Blvd.

Malvern, Pennsylvania 19355 | | | | |

| BlackRock, Inc. (3) | | 10,426,357 | | 10.00% |

55 East 52nd Street

New York, New York 10055 | | | | |

| Capital International Investors (4) | | 7,490,389 | | 7.18% |

333 South Hope Street, 55th Floor

Los Angeles, California 90071 | | | | |

| Greenhaven Associates, Inc. (5) | | 5,544,987 | | 5.32% |

3 Manhattanville Road

Purchase, New York 10577 | | | | |

| Stephen F. East | | 12,834 | | * |

| Christine N. Garvey | | 13,274 | | * |

| Karen H. Grimes | | 11,202 | | * |

| Derek T. Kan | | 1,509 | | * |

| Carl B. Marbach (6) | | 67,608 | | * |

| John A. McLean | | 17,168 | | * |

| Wendell E. Pritchett | | 15,125 | | * |

| Judith A. Reinsdorf | | — | | * |

| Katherine M. Sandstrom | | — | | * |

| Paul E. Shapiro | | 136,166 | | * |

| Scott D. Stowell | | 1,646 | | * |

| Douglas C. Yearley, Jr. | | 1,103,057 | | 1.05% |

| Martin P. Connor | | 187,250 | | * |

| Robert Parahus | | 49,391 | | * |

| Directors, nominees and executive officers as a group (14 persons) (1) | | 1,616,230 | | 1.54% |

* Less than 1%

(1)Shares issuable pursuant to restricted stock units (“RSUs”) vesting and stock options exercisable within 60 days after the Record Date are deemed to be beneficially owned. Accordingly, the information presented above includes the following number of shares of common stock underlying RSUs and stock options held by the following individuals, and all directors and executive officers as a group: Mr. East, 4,662 shares; Ms. Garvey, 4,866 shares; Ms. Grimes, 4,766 shares; Mr. Kan, 1,509 shares; Mr. Marbach, 17,142 shares; Mr. McLean, 7,077 shares; Dr. Pritchett, 4,681 shares; Mr. Shapiro, 16,462 shares; Mr. Stowell, 1,646 shares; Mr. Yearley, 674,128 shares; Mr. Connor, 132,529 shares; Mr. Parahus, 21,766 shares; and all directors and executive officers as a group, 891,234 shares.

(2)The Vanguard Group ("Vanguard") filed a Schedule 13G/A dated February 9, 2023, which states that Vanguard had sole dispositive power with respect to 11,497,040 shares, shared dispositive power with respect to 192,477 shares, and shared voting power with respect to 85,240 shares. According to the Schedule 13G/A filed by Vanguard, one or more other persons were known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Company's common stock. No one other person's interest in the Company's common stock was more than 5% of the total outstanding common stock, as of the date the Schedule 13G/A was filed.

(3)BlackRock, Inc. (“BlackRock”) filed a Schedule 13G/A dated January 24, 2024, which states that BlackRock had sole voting power with respect to 10,137,300 shares and sole dispositive power with respect to 10,426,357 shares. According to the Schedule 13G/A filed by BlackRock, various persons had the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the shares, and no one person’s interest in the Company's common stock was more than 5% of the total outstanding common stock, as of the date the Schedule 13G/A was filed.

(4)Capital International Investors ("CII") filed a Schedule 13G dated February 14, 2023, which states that CII had sole voting and dispositive power with respect to 7,490,389 shares.

(5)Greenhaven Associates, Inc. ("Greenhaven") filed a Schedule 13G/A dated January 3, 2024, which states that Greenhaven had sole voting and dispositive power with respect to 2,136,187 shares and shared voting and dispositive power with respect to 3,408,800 shares. According to the Schedule 13G/A filed by Greenhaven, one or more other persons were known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Company's common stock. No one person's interest in the Company's common stock was more than 5% of the total outstanding common stock, as of the date the Schedule 13G was filed.

(6)Amount includes an aggregate of 9,400 shares beneficially owned by individual retirement accounts (“IRAs”) for the benefit of Mr. Marbach and his wife. Mr. Marbach disclaims beneficial ownership of the 4,700 shares held by his wife’s IRA.

PROPOSAL ONE—ELECTION OF DIRECTORS

Board Membership Criteria

Our Board believes that it is necessary for our directors to possess many diverse qualities and skills. The Nominating and Corporate Governance Committee of the Board of Directors (the "Governance Committee") is charged with identifying individuals qualified to become members of the Board of Directors consistent with criteria approved by the Board. In selecting, or in recommending the selection of, nominees for directors, the Governance Committee considers the evolving needs of our Board, as well as applicable legal and NYSE requirements, including, when appropriate, those applicable to membership on the Audit and Risk Committee and the Executive Compensation Committee (the "Compensation Committee"), as well as other criteria it deems appropriate.

The Governance Committee will consider candidates nominated by stockholders, directors, officers and other sources. Stockholders wishing to recommend a prospective candidate for membership on the Board should follow the procedures described under "Procedures for Recommending Candidates for Nomination to the Board of Directors" on page 70. At a minimum, candidates must possess a background that includes a strong education, extensive business experience, and the requisite judgment, background, reputation, character, integrity, skills and temperament, which, in the view of the Governance Committee, have prepared them for dealing with the multi-faceted financial, business, governance, and other issues that confront a board of directors of a corporation with the size, complexity, reputation, and success of the Company. When evaluating director candidates, the Governance Committee first considers a candidate’s business experience and then considers other factors, including that candidate’s background, reputation, character, integrity, skills, temperament and other personal characteristics, including whether the candidate would add to the Board's diversity.

Board Composition, Evaluation and Refreshment

The Governance Committee continually assesses the composition of the Board, including through a review of Board size, the skills and qualifications represented on the Board, and director tenure. In its review of the skills and qualifications of each director, the Governance Committee considers the characteristics that it believes should be represented on the Board as well as on each Committee of the Board.

The findings of the Governance Committee's annual review of Board composition are reported to and discussed with the full Board. Based on its evaluation, the Governance Committee may recommend an increase or decrease in the size of the Board or changes in the composition of the Board to best reflect the objectives and needs of the Company and the desired skill sets of the directors. Similarly, the Governance Committee establishes processes for developing and recruiting candidates for Board membership and conducting searches for Board candidates.

As part of its annual review of Board composition, the Governance Committee considers director age and tenure, as well as the diversity of the Board. The Governance Committee seeks to ensure an appropriate mix of age and tenure of the directors, taking into account the benefits of directors with longer tenures, including greater board stability, continuity of organizational knowledge and experience gained through prior real estate cycles, and the benefits of directors with shorter tenures, including fresh perspectives and viewpoints. Our Board views diversity in a broad sense, taking into consideration not only racial, ethnic and gender diversity, but also the mix of qualifications and personal characteristics of our existing directors including age, tenure, experience levels and types of experience, including both industry and subject matter expertise. Although we do not have a separate policy specifically governing diversity, when considering board candidates, the Governance Committee considers whether an individual would bring a diverse viewpoint to the Board, which includes a candidate’s gender, race and ethnicity. To assist in its review, the Chair of the Governance Committee periodically conducts individual meetings with the independent directors to discuss Board composition and determine whether each such director's future plans may assist the Governance Committee in its consideration of the issue of director tenure.

Our Lead Independent Director leads the annual Board self-evaluation process to review the effectiveness of the Board and each of its committees and to identify any opportunities for improvement. As part of this process, the Lead Independent Director receives feedback from each director regarding Board and committee composition, Board practices, Board accountability, and director standards of conduct. The Lead Independent Director presides over the discussion with the Board to review this information and to identify any areas for improvement. The Board believes that, through its annual review of Board composition and the nomination process, coupled with its annual self-evaluation procedure and refreshment process, the Board will continue to evolve and meet the current and future needs of the Company. As illustrated below, in recent years, the Governance Committee and the Board have focused a great deal of attention on renewing and refreshing the perspectives, skills and backgrounds that are represented on the Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Select Board Statistics |

| | | | | | | | | | |

| AGE | | TENURE |

| | | | | | | | | | |

| | March 2015 | | March 2024 | | | March 2015 | | March 2024 | |

| 45-55 | 10 | % | | 27 | % | | 0-5 years | 10 | % | | 55 | % | |

| 56-65 | — | % | | 45 | % | | 6-15 years | 30 | % | | 36 | % | |

| 66+ | 90 | % | | 27 | % | | 16+ years | 60 | % | | 9 | % | |

| | | | | | | | | | |

| RACIAL / ETHNIC DIVERSITY | | GENDER DIVERSITY |

| | | | | | | | | | |

| | March 2015 | | March 2024 | | | March 2015 | | March 2024 | |

| Diverse | 10 | % | | 27 | % | | Female | 10 | % | | 36 | % | |

| Non-Diverse | 90 | % | | 73 | % | | Male | 90 | % | | 64 | % | |

| | | | | | | | | | |

| During this period, seven directors have retired and eight new members have joined the Board | |

Our Director Nominees

Upon the recommendation of the Governance Committee, the Board has nominated 11 directors for election, including two new nominees (Mses. Reinsdorf and Sandstrom) who are standing for election by stockholders for the first time. Mr. Marbach has decided not to stand for re-election at the Meeting. The Board thanks Mr. Marbach for his many years of dedicated and valuable service to the Company and wishes him well in retirement.

Each director nominee is standing for election to hold office until the 2025 Annual Meeting of Stockholders and until his or her respective successor has been duly elected and qualified. Each nominee has indicated a willingness to serve as a director.

Under our Bylaws, Board nominees are elected using a majority voting standard for uncontested elections. Under a majority voting standard, in uncontested elections, a nominee for director shall be elected to the Board if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election. Directors are elected by plurality vote in the event of a contested election.

In connection with our stockholder engagement efforts in recent years, we have had discussions with stockholders regarding the composition of our Board and the criteria the Governance Committee considers when nominating candidates for Board positions. The Governance Committee continues to review the composition of the Board in an effort to provide a balance of skills, tenure and experience that best serves the Company and its stockholders. Since March 2015, seven directors have retired (or announced their intention not to stand for re-election), and we have added eight new directors to the Board, deepening the Board's diversity of composition, thought and experience, adding fresh perspectives, and preparing the Board for the retirement of long-serving members. Following a thorough

recruitment and vetting process, Mses. Reinsdorf and Sandstrom were appointed to the Board in December 2023 and have been nominated for election by stockholders at the Meeting. Ms. Reinsdorf was brought to the attention of the Governance Committee as a potential candidate by a member of management who is not an executive officer. Ms. Sandstrom was identified by an incumbent non-management director. In each case, following interviews with each member of the Governance Committee and other members of the Board, the Governance Committee recommended that each individual be appointed to the Board and be nominated for election based on the criteria described below and in their biographies. Ms. Reinsdorf brings to the Board corporate governance expertise as well as extensive management experience at large and complex U.S. public companies across multiple industries. Ms. Sandstrom has deep real estate industry experience, well developed financial and investment acumen and experience on other public company boards. In addition, they both have significant transactional experience and are well versed in management succession planning and related activities. In recommending these candidates, the Governance Committee considered each individual's current obligations, responsibilities and commitments made to other organizations, including with respect to service on other public company boards, and made an affirmative determination that each of them has sufficient capacity to fully participate in Board activities. The Board believes that, with the addition of Mses. Reinsdorf and Sandstrom, and combined with our existing directors’ deep experience and knowledge of the Company and home building industry, the Board is well positioned to continue leading Toll Brothers as it executes on its strategic priorities.

As part of its annual review process and the recruitment of Mses. Reinsdorf and Sandstrom, the Board adopted a formal over-boarding policy, which is included in the Company's Corporate Governance Guidelines. The policy requires directors to obtain the consent of the Governance Committee before accepting an invitation to serve on another public company board. In such a situation, the Governance Committee will assess the individual circumstances to determine whether service on the other board would create unacceptable regulatory issues or conflicts of interest, impair the Director’s ability to fully participate in all Board and committee activities to which the director has been assigned or to otherwise discharge his or her fiduciary duties as a Board member. The Board believes that, due to the substantial variation in time commitments and responsibilities that individuals undertake and that varying boards demand, a case-by-case assessment of individual circumstances is necessary when evaluating whether a director has sufficient capacity to serve on another public company board while remaining on the Board. In these circumstances, the Governance Committee will also take into consideration any over-boarding policies adopted by significant stockholders.

The Governance Committee has also reviewed the experience, qualifications and contributions of each of our incumbent director nominees and believes that each nominee continues to bring significant value to the Board and to the Company. Our directors' business experiences, their knowledge and understanding of the Company's operations, governance, personnel, and business ethics gained by them over time, and each of their unique perspectives, insights, and skill sets have led the Governance Committee and the Board of Directors to recommend that each director be re-elected to the Board for an additional term of office.

2024 Director Nominees

Set forth below is biographical information about our director nominees.

Douglas C. Yearley, Jr. has been a member of our Board since June 2010. He joined us in 1990, specializing in land acquisitions and project finance. He has been an officer since 1994, holding the position of Senior Vice President from January 2002 until November 2005, and the position of Regional President from November 2005 until November 2009, when he was promoted to Executive Vice President. Since June 2010, he has been our Chief Executive Officer and, in October 2018, he was elected Chairman of the Board. Prior to joining us, Mr. Yearley practiced law in New Jersey as a commercial litigator. He brings to the Board a deep understanding of our industry and our business as a result of his significant operational and executive roles with the Company, his managerial and leadership experience, and his legal background.

Stephen F. East has been a member of our Board since March 2020. He is a member of the Audit and Risk Committee and the Compensation Committee and the Chair of the Public Debt and Equity Securities Committee. Prior to his retirement in July 2019, Mr. East served as a Managing Director and Senior Consumer Analyst at Wells Fargo & Company, heading the equity research team that covered the home building and building products sectors. Prior to joining Wells Fargo, he spent four years with Evercore ISI, an independent research firm, as a Partner and Senior Managing Director heading the firm's housing research efforts, and, prior to that, spent nearly two decades in equity research and investment management at various firms. Mr. East holds the Chartered Financial Analyst designation. Mr. East brings valuable experience to the Board in the form of his extensive knowledge of the home building industry, analytical abilities, financial acumen and strategic insights.

Christine N. Garvey has been a member of our Board since September 2009. She is the Chair of the Audit and Risk Committee and a member of the Compensation Committee and Public Debt and Equity Securities Committee. Ms. Garvey was the Global Head of Corporate Real Estate Services at Deutsche Bank AG from 2001 to 2004. Prior to that, she served as Vice President of Worldwide Real Estate and Workplace Resources at Cisco Systems, Inc. and as Group Executive Vice President at Bank of America Corporation. Ms. Garvey has been a member of the board of directors of Healthpeak Properties, Inc., a publicly traded real estate investment trust, since 2007. She previously served on the boards of directors of Prologis, Inc. through May 2017 and Hilton Hotels Corporation through October 2007. Ms. Garvey brings to the Board her extensive knowledge of and background in real estate and banking and her experience in executive leadership positions and board memberships with various public entities in the national real estate market.

Karen H. Grimes has been a member of our Board since March 2019. She is a member of the Audit and Risk Committee and the Governance Committee. She held the position of Senior Managing Director, Partner, and Equity Portfolio Manager at Wellington Management Company LLP, an investment management firm, from January 2008 through December 2018. Prior to joining Wellington Management Company in 1995, she held the position of Director of Research and Equity Analyst at Wilmington Trust Company, a financial investment and banking services firm, from 1988 to 1995. Before that, Ms. Grimes was a Portfolio Manager and Equity Analyst at First Atlanta Corporation from 1983 to 1986 and at Butcher and Singer from 1986 to 1988. She is a member of the Board of Directors of Tegna Inc., a publicly traded broadcast, digital media and marketing services company, as well as its audit committee and governance, public policy and corporate responsibility committee. She is also a member of the Board of Directors of Corteva, Inc., a publicly traded global agriculture company, where she serves on its audit committee and people and compensation committee. Ms. Grimes holds the Chartered Financial Analyst designation. Ms. Grimes' extensive executive-level experience, leadership abilities, financial acumen, investment expertise, and risk management experience reinforce the Board's abilities in these areas and bring a valuable investor-oriented perspective to the Board.

Derek T. Kan has been a member of our Board since December 2021. He is a member of the Audit and Risk Committee. From December 2020 until its acquisition by Shopify Inc. in July 2022, he was Chief Business Officer at Deliverr, Inc., an e-commerce fulfillment technology company. He is now Vice President, Operations at Shopify. Previously, he held a number of senior positions in the U.S. federal government, including Deputy Director of the White House Office of Management and Budget from June 2019 through December 2020 and Under Secretary at the U.S. Department of Transportation from June 2017 through July 2019, where he served as a principal advisor to the Secretary and spearheaded initiatives involving technology and innovation in the transportation sector. He was also a founding member of the White House COVID Task Force and Operation Warp Speed. Nominated by President Biden and confirmed by the United States Senate, Mr. Kan currently serves on the United States Postal Service Board of Governors. Prior to his recent public service, Mr. Kan held various positions focused on emerging technologies, including as the General Manager for Lyft. Earlier in his career, Mr. Kan was a policy advisor to the former Senate Majority Leader and was a Presidential Management Fellow at the White House Office of Management and Budget. Mr. Kan brings to the Board his familiarity and experience with the U.S. federal government, his financial and accounting acumen, and his extensive experience in the area of innovation and the implementation of new technologies.

John A. McLean has been a member of our Board since March 2016. He is Chair of the Compensation Committee and a member of the Governance Committee. Mr. McLean is a Senior Managing Director of New York Life Investment Management LLC, where he oversees U.S. distribution. Prior to joining New York Life in June 2018, Mr. McLean was the Chief Executive Officer and Distribution Principal for Hartford Funds Distributors, a subsidiary of investment firm Hartford Funds, from January 2013 to April 2018. From April 2009 to May 2012, he was the Head of U.S. Retail and Offshore Sales at Eaton Vance Investment Managers, a financial services firm. Prior to that time, Mr. McLean held positions of increasing responsibility at brokerage firm MFS Fund Distributors. He serves on the Board of Trustees of The Gateway to Leadership Foundation. Mr. McLean brings to the Board his expertise in building and leading high performance sales and marketing organizations and his strategic and tactical leadership skills.

Wendell E. Pritchett has been a member of our Board since March 2018. He is a member of the Governance Committee and the Compensation Committee. He is the Riepe Presidential Professor of Law and Education at the University of Pennsylvania. Dr. Pritchett previously served as the Interim President of the University of Pennsylvania from February 2022 to June 2022 and as the University Provost from 2017 to 2021. In 2018, he was appointed Chairman of the Nominating Panel of the Philadelphia School Board by Philadelphia Mayor James Kenney. Dr. Pritchett first joined the University of Pennsylvania Law faculty in 2002 and served as Interim Dean and Presidential Professor from 2014 to 2015 and as Associate Dean for Academic Affairs from 2006 to 2007. A Professor at the University of Pennsylvania Carey School of Law from 2001 to 2009, Dr. Pritchett also served as Chancellor of Rutgers-Camden from 2009 to 2014, and in 2008 served as Deputy Chief of Staff and Director of Policy for Philadelphia Mayor Michael Nutter, who also appointed him to the School Reform Commission, where he served from 2011 to 2014. Dr. Pritchett served as Chair of the Redevelopment Authority of Philadelphia and as President of the Philadelphia Housing Development Corporation from 2008 to 2011. Dr. Pritchett serves on the board of directors of Clarivate plc, a publicly traded information services company. He brings to the Board his leadership and administrative skills, expertise in real estate and housing law, and experience as policymaker, political advisor, and leader in nonprofit organizations with a particular focus on urban development.

Judith A. Reinsdorf has been a member of our Board since December 2023. She most recently served as executive vice president and general counsel of Johnson Controls International plc, a global leader in building products and technology and integrated solutions, from September 2016 to November 2017, following its merger with Tyco International plc, where she served as executive vice president and general counsel from March 2007 until September 2016. Prior to that, Ms. Reinsdorf served as General Counsel and Secretary of C.R. Bard, Inc., Vice President and Associate General Counsel of Pharmacia Corporation and Chief Legal Counsel of Monsanto Company. She currently serves on the board of directors of EnPro Industries, Inc., an industrial technology company, where she is chair of the nominating and corporate governance committee and a member of each of its board’s other committees, and Nurix Therapuetics, Inc., a biopharmaceutical company, where she is a member of the audit and nominating and corporate governance committees. She is a member of the Board of Trustees of the University of Rochester and is on the board of the New Jersey chapter of the National Association of Corporate Directors. Ms. Reinsdorf’s qualifications to serve on our Board of Directors include her extensive management experience at large and complex U.S. public companies across multiple industries, her expertise in corporate governance, risk management and legal matters, and her transactional experience in areas including acquisitions, divestitures, integrations and management transitions.

Katherine M. Sandstrom has been a member of our Board since December 2023. She is the chair of the board of Healthpeak Properties, Inc., a leading owner, operator and developer of real estate for healthcare discovery and delivery. She served as an advisor from July 2018 to March 2019 and as senior managing director and global head of Heitman LLC’s public real estate securities business from 2013 to 2018. Ms. Sandstrom joined Heitman, a real estate management firm, in 1996 and held several senior leadership positions across multiple facets of the institutional real estate investment industry. Additionally, she served on the firm’s global management committee, the board of managers and the allocation committee. Ms. Sandstrom also serves on the boards of EastGroup Properties, Inc., a REIT, since July

2020 and Urban Edge Properties, also a REIT, since October 2022. She is a certified public accountant. Ms. Sandstrom’s qualifications to serve on our Board of Directors include her substantial leadership positions at Heitman LLC and her more than 20 years of real estate finance and investment experience. She has an extensive background overseeing buy-side investment teams for real estate securities, strategies and assets. In addition, she has extensive experience on boards of other public companies.

Paul E. Shapiro has been a member of our Board since December 1993. He is the Lead Independent Director (a role he intends to relinquish in March 2024 - see "Corporate Governance Guidelines and Practices — Leadership Structure" on page 20) and Chair of the Governance Committee. He is also a member of the Audit and Risk Committee. Since June 2004, Mr. Shapiro has been Chairman of the board of directors of Q Capital Holdings LLC, an investment management firm. From January 2004 to June 2004, Mr. Shapiro was Senior Vice President of MacAndrews & Forbes Holdings, Inc., a private holding company of operating businesses. Beginning in 1994, Mr. Shapiro held positions as Chief Administrative Officer of each of Revlon, Inc. and Sunbeam Corporation, and general counsel of each of Coleman Company, Inc. and Marvel Entertainment, Inc. Prior thereto, he practiced corporate and securities law as a managing shareholder of the Palm Beach County office of Greenberg Traurig LLP and was a partner in Wolf, Block, Schorr and Solis-Cohen LLP. He brings to the Board his extensive business experience in executive positions with various nationally known companies, which he has served in a wide variety of capacities that have drawn upon his legal and entrepreneurial skills, including those in the areas of corporate governance and the corporate regulatory environment.

Scott D. Stowell has been a member of our Board since November 2021. He is a member of the Governance Committee. He is the President and Chief Executive Officer of Capital Thirteen LLC, a company he founded that specializes in advisory, real estate investment, and angel investing. From 2015 to 2018, he served as executive chairman of CalAtlantic Group, Inc., the 5th largest U.S. home builder in 2017, and oversaw the merger of CalAtlantic with Lennar Corporation. Mr. Stowell served on the board of directors of Lennar from 2018 until April 2021. From 2012 to 2015, he served as Chief Executive Officer of Standard Pacific Homes, which he joined in 1986, and oversaw its merger in 2015 with the Ryland Group, resulting in the creation of CalAtlantic. Mr. Stowell serves on the Board of Pacific Mutual Holding Company, where he currently serves on the compensation and personnel committee (as Chair) and the governance and nominating committee. He also serves on the executive committees of HomeAid America and the First Point Volleyball Foundation. He is a member of the Dean’s Advisory Board at University of California, Irvine’s Merage Business School. Mr. Stowell brings to the Board a wealth of experience in the home building industry, as well as significant leadership abilities and managerial experience gained from his years as a Chief Executive Officer and Chairman of publicly traded home builders.

The table below summarizes certain key qualifications, characteristics and skills of each director nominee that were relevant to the decision to nominate him or her to serve on the Board. The lack of a mark does not mean the director does not possess that qualification or skill; rather, a mark indicates a specific area of focus or expertise on which the Board relies most heavily.

| | | | | | | | | | | | | | | | | | | | | | | |

| Key Qualifications, Characteristics and Skills of Our Director Nominees |

| Name | Leadership | Industry | Operating and Investment | Accounting

and

Financial | Business Development and Marketing | Corporate Governance and Law | Other Boards |

| | | | | | | |

| Douglas C. Yearley, Jr. | ● | ● | ● | | ● | ● | |

| Stephen F. East | ● | ● | ● | ● | ● | | |

| Christine N. Garvey | ● | ● | ● | ● | | ● | ● |

| Karen H. Grimes | ● | | ● | ● | | | ● |

| Derek T. Kan | ● | | ● | ● | ● | ● | ● |

| John A. McLean | ● | | ● | ● | ● | | |

| Wendell E. Pritchett | ● | ● | ● | | ● | ● | ● |

| Judith A. Reinsdorf | ● | | ● | | | ● | ● |

| Katherine M. Sandstrom | ● | ● | ● | ● | | | ● |

| Paul E. Shapiro | ● | ● | ● | ● | ● | ● | ● |

| Scott D. Stowell | ● | ● | ● | | ● | | ● |

| | | | | | | |

| Gender diversity: | 36% women |

| Racial / ethnic diversity: | 27% diverse |

Required Vote

Each director nominee is elected by a majority of the votes cast at the Meeting.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” ALL NOMINEES.

PROPOSAL TWO—RATIFICATION OF THE RE-APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As part of its oversight of the Company’s relationship with our independent auditors, the Audit and Risk Committee (the "Audit Committee") reviews annually our independent auditors’ qualifications, performance, and independence. Based on the results of this review, the Audit Committee re-appointed Ernst & Young LLP to serve as the Company’s independent auditors for the fiscal year ending October 31, 2024. Ratification is being sought at the Meeting in a non-binding vote of stockholders. Although ratification is not required by our bylaws or otherwise, the Board is submitting the selection of Ernst & Young LLP to our stockholders for ratification because we value our stockholders' views on the Company’s independent auditors. Ernst & Young LLP has served as our independent auditor since 1983, and we believe that the continued retention of Ernst & Young LLP is in the best interests of the Company. If our stockholders fail to ratify the selection, it will be considered notice to the Board and Audit Committee to consider the selection of a different firm.

A representative of Ernst & Young LLP is expected to be present at the Meeting, will be afforded the opportunity to make a statement, and is expected to be available to respond to appropriate questions. We have been advised by Ernst & Young LLP that neither the firm, nor any member of the firm, has any financial interest, direct or indirect, in any capacity in us or our subsidiaries.

Audit and Non-Audit Fees

The following table sets forth the fees earned for services rendered by Ernst & Young LLP for professional services for the fiscal years ended October 31, 2023 and 2022: | | | | | | | | | | | | | | |

| | 2023 | | 2022 |

| | | | |

| Audit Fees (1) | | $ | 2,210,000 | | | $ | 2,080,000 | |

| Audit-Related Fees | | — | | | — | |

| Tax Fees | | — | | | — | |

| All Other Fees | | — | | | — | |

| | $ | 2,210,000 | | | $ | 2,080,000 | |

(1)“Audit Fees” include fees billed for (a) the audit of the Company and its consolidated subsidiaries, (b) the audit of the Company’s internal control over financial reporting, (c) the review of quarterly financial information, and (d) the issuance of consents in filings with the SEC.

The Audit Committee meets and agrees upon the annual audit fee directly with our independent auditors. The Audit Committee also establishes pre-approved limits for which our management may engage our independent auditors for specified services. Any work that exceeds these pre-approved limits for the specified services in a quarter requires the advance approval of the Audit Committee. Each quarter the Audit Committee reviews the matters worked on by the independent auditors during the previous quarter and establishes any pre-approved limits for the current quarter. The Audit Committee also reviews and approves the compatibility of any proposed non-audit services, including tax services, with Ernst & Young LLP’s independence. The Audit Committee reviewed and pre-approved the services provided by Ernst & Young LLP and approved the fees paid to Ernst & Young LLP for all services for fiscal 2023.

Required Vote

To be approved, this proposal must receive an affirmative majority of the votes cast on the proposal at the Meeting.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” PROPOSAL TWO.

PROPOSAL THREE—ADVISORY AND NON-BINDING VOTE

ON EXECUTIVE COMPENSATION (SAY ON PAY)

In the most recent advisory vote, our stockholders voted in favor of the annual submission of the Company’s compensation of its NEOs to our stockholders for approval on a non-binding basis, and our Board has adopted this approach. In accordance with the outcome of those stockholder votes and regulations under Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we are including in this proxy statement a separate resolution, subject to a non-binding stockholder vote, to approve the compensation of our NEOs as disclosed in this proxy statement.

Our executive compensation program has consistently received strong support from our stockholders. The results of our Say on Pay votes held over the past five years are as follows:

| | | | | | | | |

| Annual Meeting Year | | Stockholder Support on

Say on Pay Vote |

| | |

| 2023 | | 95% |

| 2022 | | 96% |

| 2021 | | 98% |

| 2020 | | 97% |

| 2019 | | 96% |

We conduct an annual outreach to our largest stockholders and proxy advisory firms to receive feedback regarding, among other matters, our executive compensation program. During fiscal 2023 and 2024, we solicited feedback from investors representing well over half of our outstanding shares. We value our stockholders' perspective on our business and are committed to continuing the constructive dialogue that we have established with our stockholders in recent years.

Our Compensation Committee has developed and maintained a compensation program that is intended to reward performance and to encourage actions that drive success in our short- and long-term business strategy, which is described in the “Compensation Discussion and Analysis” and the compensation tables (and accompanying narrative) on pages 29 to 61. In determining fiscal 2023 compensation for our NEOs, the Compensation Committee considered Company performance in fiscal 2023 and our management’s achievements in fiscal 2023 set forth in the “Compensation Discussion and Analysis.”

We are asking our stockholders to approve, in a non-binding vote, the following resolution in respect of this Proposal Three:

“RESOLVED, that the stockholders approve, in a non-binding vote, the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the 'Compensation Discussion and Analysis' included in this proxy statement and the related compensation tables and narrative discussion."

Required Vote

To be approved, this proposal must receive an affirmative majority of the votes cast on the proposal at the Meeting.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” PROPOSAL THREE.

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information as of October 31, 2023, our fiscal year end, with respect to compensation plans (including individual compensation arrangements) under which the Company’s equity securities are authorized for issuance. There are no plans that have not been approved by stockholders. | | | | | | | | | | | | | | | | | | | | |

| Plan Category | | Number of

Securities to be

Issued Upon

Exercise of

Outstanding

Options,

Warrants

and Rights(1) | | Weighted-

Average

Exercise Price

of Outstanding

Options,

Warrants

and Rights(2) | | Number of Securities

Remaining Available

for Future Issuance

Under Equity

Compensation Plans

(Excluding Securities

Reflected in Column (a)) |

| | | | | | |

| | (a) | | (b) | | (c) |

| | | (In thousands) | | | | (In thousands) |

Equity compensation plans approved by security holders | | 3,158 | | | $ | 35.30 | | | 3,733 | |

Equity compensation plans not approved by security holders | | — | | | — | | | — | |

| Total | | 3,158 | | | $ | 35.30 | | | 3,733 | |

(1)Amount includes 1,215,000 shares and 1,943,000 shares underlying stock options and RSUs, respectively, outstanding as of October 31, 2023. The amount of performance-based RSUs ("PRSUs"), which is included in the RSU amount, reflects the maximum number of shares that could be issued under awards granted in fiscal 2023 and 2022 as to which performance had not been determined as of October 31, 2023, as further described under "Fiscal 2023 Long-Term Incentive Compensation - Fiscal 2023 Performance-Based RSUs" on page 40.

(2)The weighted-average exercise price does not take into account 1,943,000 shares underlying RSUs outstanding as of October 31, 2023.

CORPORATE GOVERNANCE

Our Board is committed to sound corporate governance policies that enable our Company to operate ethically and with integrity, and which promote long-term value creation for our stockholders and other stakeholders. Our approach to corporate governance has been to implement policies that enable the success of our strategy and business objectives, are rooted in a robust ongoing dialogue with our stockholders, and are inspired by best practices. Consistent with this approach, we continue to build upon a strong framework of corporate governance policies and practices, including the items summarized below: | | | | | | | | |

| Strong Independent Leadership |

| Independence | | A majority of our directors must be independent. All of our director nominees other than Mr. Yearley, our Chairman and Chief Executive Officer ("CEO"), are independent, and all of our Committees consist exclusively of independent directors. |

| Lead Independent Director | | Whenever our CEO is also the Chair of the Board, we require a Lead Independent Director position with specific responsibilities to provide independent oversight of management. Both the Lead Independent Director and the Chair of the Board are elected annually by our Board. Mr. Shapiro was first appointed to serve as our Lead Independent Director in March 2021 and currently serves in this role. Mr. Shapiro intends to step down from the role at the conclusion of the March 2024 stockholders meeting. The Board has made a preliminary determination to then appoint Mr. Stowell to this role. |

| Commitment to Board refreshment | | The Governance Committee continually assesses the composition of the Board, including a review of Board size, diversity and the skills and qualifications represented on the Board, as well as director tenure. Recognizing the importance of continued Board refreshment, since March 2015, eight new directors have joined our Board and seven have retired or announced their intention to do so. This turnover has deepened the diversity of the Board's composition, thought and experience, and brought fresh perspectives to its already strong membership. |

| Stockholder Engagement |

| Proactive engagement | | We aim to maintain an active dialogue with our stockholders to ensure a diversity of perspectives is thoughtfully considered on a broad range of issues including strategy, business performance, corporate governance, risk and compensation practices, and other environmental, social, and governance concerns. We conduct an annual outreach to our largest stockholders and proxy advisory firms to receive feedback regarding these matters. |

| Availability of independent directors | | We make our lead independent director and other independent directors available, as appropriate, for engagements with our top stockholders. |

| Accountability to Stockholders |

| Board evaluations and refreshment | | The Board and its committees regularly evaluate their performance and composition. These evaluations, including assessments of the skills, qualifications and diversity of Board members, are considered in light of the Company’s business strategy and operations and the anticipated makeup of the Board following potential director retirements to identify the desired characteristics of future Board members. |

| | | | | | | | |

| Director commitments | | Directors are expected to ensure that other commitments, including outside board memberships, do not interfere with their duties and responsibilities as members of the Company’s Board. Members of the Board must pre-clear any invitation to serve on another public company board with the Governance Committee. |

| Annual elections | | All directors are elected annually. |

| Majority voting standard | | Our bylaws require that any director be elected by a “majority of votes cast” in uncontested director elections. In other words, each director must receive more votes “For” his or her election than votes “Against” in order to be elected. |

| Director resignation policy | | An incumbent director that does not meet the majority voting standard must promptly offer to resign. The Governance Committee will consider the resignation offer and make a recommendation as to whether the Board should accept the resignation. |

| Voting Rights that are Proportionate to Economic Interests |

| Single voting class | | Toll Brothers has a single class of voting stock outstanding. |

| One share, one vote | | Each share of common stock is entitled to one vote. |

| Management, Human Capital and Risk Oversight |

| Management development and succession planning | | Our Board regularly reviews management development and succession planning, in particular with respect to the CEO role. |

| Human capital management | | We believe our employees are among our most important resources and are critical to our continued success. We focus significant attention on attracting and retaining talented and experienced individuals to manage and support our operations, and our management team routinely reviews employee turnover rates and employee engagement and satisfaction surveys at various levels of the organization. |

| Risk oversight | | Our Board and its committees devote significant time and effort to understanding and reviewing enterprise risks. This includes oversight of our Company’s strategy and reputation as well as a review of risks related to financial reporting, compensation practices, succession matters and cybersecurity, among other risks. |

| Compensation Governance |

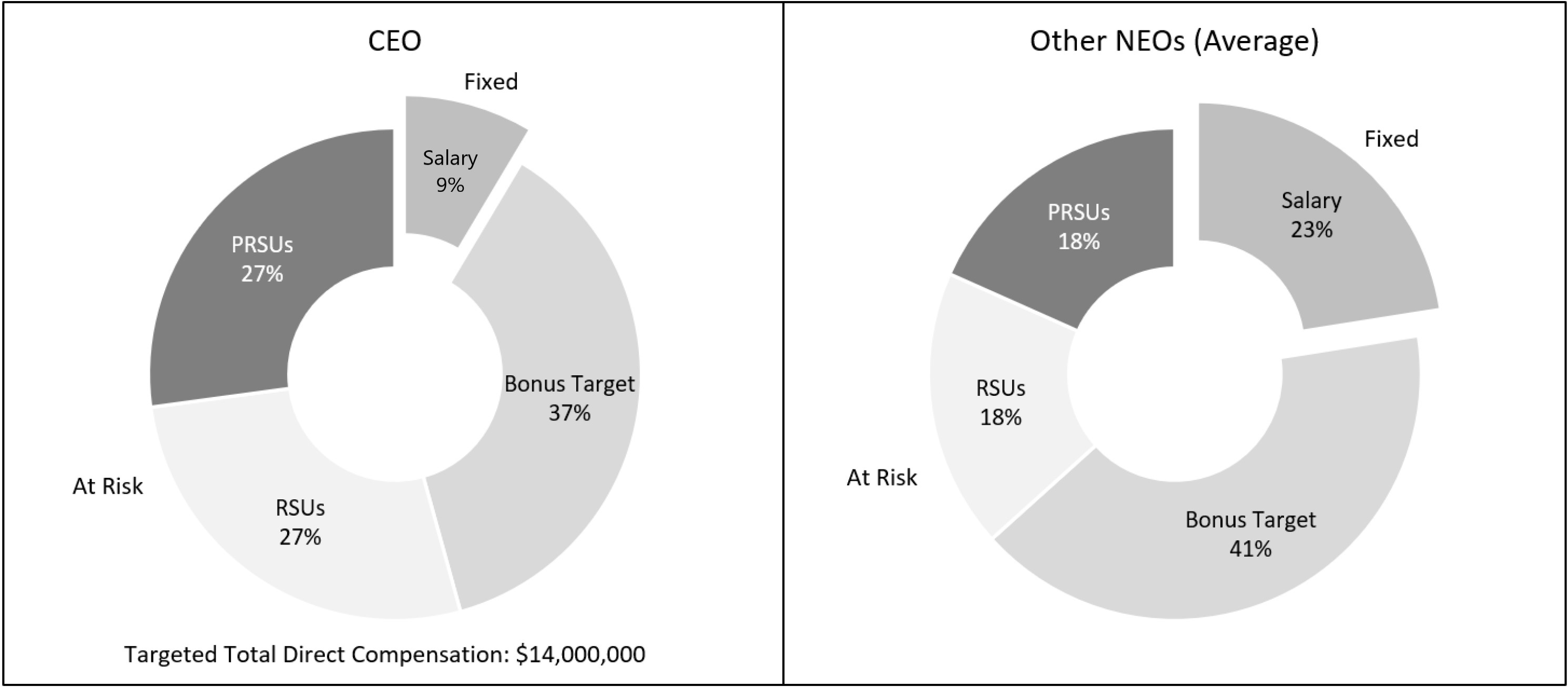

| Pay program tied to performance | | A majority of our CEO's pay is long-term and at-risk with no guaranteed bonuses or salary increases. The Compensation Committee has identified performance goals that underpin our strategy and has incorporated those goals into executive compensation plans to serve as drivers of incentive awards. |

| Stock ownership guidelines | | Stock ownership guidelines align executive and director interests with those of stockholders. These guidelines require our CEO to retain qualifying equity equal to six times his annual base salary (three times for other executive officers), and for our Board members to retain qualifying equity equal to five times their annual base cash retainer. |

| Hedging and pledging prohibition | | We prohibit all hedging, pledging and transactions in derivatives related to Toll Brothers securities for all directors and executives. |

| | | | | | | | |

| Clawbacks | | The Company is required to recover certain incentive-based compensation erroneously awarded to current or former executive officer based on financial reporting measures that are required to be restated, pursuant to a policy that we adopted this year and which is compliant with Section 303A.14 of the NYSE Listed Company Policy. This policy also applies to certain employees below the level of executive officer at the discretion of the Board's Compensation Committee. |

| No tax gross-ups | | We do not pay tax gross-ups on payments to executives. |

Corporate Governance Guidelines and Practices