UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-04681 | |

|

Name of Registrant: |

Vanguard Bond Index Funds | |

|

Address of Registrant: |

P.O. Box 2600 | |

| Valley Forge, PA 19482 | ||

|

Name and address of agent for service: |

Heidi Stam, Esquire | |

| P.O. Box 876 | ||

| Valley Forge, PA 19482 | ||

|

Registrant’s telephone number, including area code: (610) 669-1000 | ||

|

Date of fiscal year end: December 31 | ||

|

Date of reporting period: January 1, 2015 – December 31, 2015 | ||

|

Item 1: Reports to Shareholders | ||

Annual Report | December 31, 2015

Vanguard Bond Index Funds

Vanguard Short-Term Bond Index Fund

Vanguard Intermediate-Term Bond Index Fund

Vanguard Long-Term Bond Index Fund

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds. Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 4 |

| Short-Term Bond Index Fund. | 11 |

| Intermediate-Term Bond Index Fund. | 31 |

| Long-Term Bond Index Fund. | 51 |

| About Your Fund’s Expenses. | 73 |

| Glossary. | 76 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the

risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Pictured is a sailing block on the Brilliant, a 1932 schooner docked in Mystic, Connecticut. A type of pulley, the

sailing block helps coordinate the setting of the sails. At Vanguard, the intricate coordination of technology and people allows

us to help millions of clients around the world reach their financial goals.

Your Fund’s Total Returns

| Fiscal Year Ended December 31, 2015 | ||||

| 30-Day SEC | Income | Capital | Total | |

| Yield | Returns | Returns | Returns | |

| Vanguard Short-Term Bond Index Fund | ||||

| Investor Shares | 1.37% | 1.23% | -0.38% | 0.85% |

| ETF Shares | 1.43 | |||

| Market Price | 0.91 | |||

| Net Asset Value | 0.92 | |||

| Admiral™ Shares | 1.43 | 1.30 | -0.38 | 0.92 |

| Institutional Shares | 1.46 | 1.33 | -0.38 | 0.95 |

| Institutional Plus Shares | 1.51 | 1.35 | -0.38 | 0.97 |

| Barclays U.S. 1–5 Year Government/Credit Float | ||||

| Adjusted Index | 0.97 | |||

| 1–5 Year Investment-Grade Debt Funds Average | 0.25 | |||

| 1–5 Year Investment-Grade Debt Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | ||||

| Vanguard Intermediate-Term Bond Index Fund | ||||

| Investor Shares | 2.66% | 2.62% | -1.41% | 1.21% |

| ETF Shares | 2.67 | |||

| Market Price | 1.13 | |||

| Net Asset Value | 1.23 | |||

| Admiral Shares | 2.69 | 2.68 | -1.41 | 1.27 |

| Institutional Shares | 2.73 | 2.72 | -1.41 | 1.31 |

| Institutional Plus Shares | 2.77 | 2.74 | -1.41 | 1.33 |

| Barclays U.S. 5–10 Year Government/Credit Float | ||||

| Adjusted Index | 1.28 | |||

| Core Bond Funds Average | -0.11 | |||

Core Bond Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements. Institutional Shares and

Institutional Plus Shares are available to certain institutional investors who meet specific administrative, service, and account-size criteria.

The Vanguard ETF® Shares shown are traded on the NYSE Arca exchange and are available only through brokers. The table provides ETF

returns based on both the NYSE Arca market price and the net asset value for a share. U.S. Pat. Nos. 6,879,964; 7,337,138; 7,720,749;

7,925,573; 8,090,646; and 8,417,623.

1

| Your Fund’s Total Returns | ||||

| Fiscal Year Ended December 31, 2015 | ||||

| 30-Day SEC | Income | Capital | Total | |

| Yield | Returns | Returns | Returns | |

| Vanguard Long-Term Bond Index Fund | ||||

| Investor Shares | 4.07% | 3.73% | -7.20% | -3.47% |

| ETF Shares | 4.09 | |||

| Market Price | -4.01 | |||

| Net Asset Value | -3.45 | |||

| Institutional Shares | 4.16 | 3.83 | -7.20 | -3.37 |

| Institutional Plus Shares | 4.21 | 3.85 | -7.20 | -3.35 |

| Barclays U.S. Long Government/Credit Float | ||||

| Adjusted Index | -3.31 | |||

| Corporate A-Rated Debt Funds Average | -0.75 | |||

Corporate A-Rated Debt Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements. Institutional Shares and

Institutional Plus Shares are available to certain institutional investors who meet specific administrative, service, and account-size criteria.

The Vanguard ETF® Shares shown are traded on the NYSE Arca exchange and are available only through brokers. The table provides ETF

returns based on both the NYSE Arca market price and the net asset value for a share. U.S. Pat. Nos. 6,879,964; 7,337,138; 7,720,749;

7,925,573; 8,090,646; and 8,417,623.

For the ETF Shares, the market price is determined by the midpoint of the bid-offer spread as of the closing time of the New York Stock

Exchange (generally 4 p.m., Eastern time). The net asset value is also determined as of the NYSE closing time. For more information about

how the ETF Shares' market prices have compared with their net asset value, visit vanguard.com, select your ETF, and then select the Price

and Performance tab. The ETF premium/discount analysis there shows the percentages of days on which the ETF Shares' market price was

above or below the NAV.

2

Your Fund’s Performance at a Glance

| December 31, 2014, Through December 31, 2015 | ||||

| Distributions Per Share | ||||

| Starting | Ending | |||

| Share | Share | Income | Capital | |

| Price | Price | Dividends | Gains | |

| Vanguard Short-Term Bond Index Fund | ||||

| Investor Shares | $10.48 | $10.43 | $0.130 | $0.010 |

| ETF Shares | 79.87 | 79.49 | 1.039 | 0.077 |

| Admiral Shares | 10.48 | 10.43 | 0.137 | 0.010 |

| Institutional Shares | 10.48 | 10.43 | 0.140 | 0.010 |

| Institutional Plus Shares | 10.48 | 10.43 | 0.142 | 0.010 |

| Vanguard Intermediate-Term Bond Index Fund | ||||

| Investor Shares | $11.46 | $11.26 | $0.302 | $0.038 |

| ETF Shares | 84.41 | 82.95 | 2.227 | 0.283 |

| Admiral Shares | 11.46 | 11.26 | 0.309 | 0.038 |

| Institutional Shares | 11.46 | 11.26 | 0.313 | 0.038 |

| Institutional Plus Shares | 11.46 | 11.26 | 0.315 | 0.038 |

| Vanguard Long-Term Bond Index Fund | ||||

| Investor Shares | $14.26 | $13.20 | $0.546 | $0.035 |

| ETF Shares | 93.73 | 86.80 | 3.565 | 0.230 |

| Institutional Shares | 14.26 | 13.20 | 0.560 | 0.035 |

| Institutional Plus Shares | 14.26 | 13.20 | 0.563 | 0.035 |

3

Chairman’s Letter

Dear Shareholder,

Toward the close of 2015, the Federal Reserve took the long-awaited step of raising its target for overnight interest rates, which had hovered near zero since the Great Recession. Its vote of confidence in the U.S. economy’s resiliency helped short-term bond yields finish higher than where they started for the fiscal year ended December 31, 2015. The upward movement of intermediate-and long-term yields, however, was more muted given the fragile state of global growth and the subdued outlook for inflation.

With yields rising, bond prices adjusted downward, as the two move in opposite directions. The income generated by Vanguard Short- and Intermediate-Term Bond Index Funds was enough to offset the price depreciation of the bonds they held. The Short-Term Fund returned 0.85% and the Intermediate-Term Fund 1.21% for the fiscal year. With prices of longer-dated bonds falling more sharply, however, Vanguard Long-Term Bond Index Fund returned –3.47%. (All returns and yields cited in this letter are for the funds’ Investor Shares.)

The funds performed roughly in line with their expense-free benchmark indexes; the gap between the two ranged from 7 to 16 basis points. (A basis point is one-hundredth of a percentage point.) The Short- and Intermediate-Term Funds outperformed their peer group averages but the Long-Term Fund did not, in part because of its longer duration.

4

With yields rising, the 30-day SEC yield for the Short-Term Fund climbed to 1.37%, from 0.98% a year earlier. That yield rose to 2.66%, from 2.39%, for the Intermediate-Term Fund and to 4.07%, from 3.60%, for the Long-Term Fund.

A strong U.S. dollar depressed international bond returns

International bond markets (as measured by the Barclays Global Aggregate Index ex USD) returned –6.02%, reduced by the dollar’s strength against many foreign currencies. Without this currency effect, returns were modestly positive.

Although the Fed raised its interest rate target in mid-December, to 0.25%–0.5%, returns for money market funds and savings accounts remained limited by the 0%–0.25% level that had previously been in place for seven years.

Despite troubles, U.S. stocks eked out a seventh year of gains

U.S. stocks returned 0.48% for the 12 months. Although the broad market recorded its worst performance since 2008, it still advanced for the seventh straight year when dividends are factored in.

Stocks rose modestly over the first half of the year but slid in August and September as concerns mounted that China’s economic slowdown would spread globally. Falling oil and commodity prices also affected economies and markets across the world, for better or

| Market Barometer | |||

| Average Annual Total Returns | |||

| Periods Ended December 31, 2015 | |||

| One | Three | Five | |

| Year | Years | Years | |

| Bonds | |||

| Barclays U.S. Aggregate Bond Index (Broad taxable | |||

| market) | 0.55% | 1.44% | 3.25% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 3.30 | 3.16 | 5.35 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.03 | 0.02 | 0.04 |

| Stocks | |||

| Russell 1000 Index (Large-caps) | 0.92% | 15.01% | 12.44% |

| Russell 2000 Index (Small-caps) | -4.41 | 11.65 | 9.19 |

| Russell 3000 Index (Broad U.S. market) | 0.48 | 14.74 | 12.18 |

| FTSE All-World ex US Index (International) | -4.72 | 2.04 | 1.48 |

| CPI | |||

| Consumer Price Index | 0.73% | 1.00% | 1.53% |

5

worse. Central banks in Europe and Asia bolstered their stimulus efforts against weak growth and low inflation. And the Fed’s move in December ended months of uncertainty over its plans.

International stocks returned about –5%, restrained by the U.S. dollar’s strength. Emerging markets fared the worst.

Rising bond yields dampened returns over the period

As the Fed wound down its third round of stimulative bond-buying toward the end of 2014, speculation turned to when it might begin to raise short-term rates. The economy’s rebound from an early 2015 slowdown and further improvements in employment were favorable developments. On the other hand, inflation remained worryingly low as oil prices continued to fall. Greece’s debt crisis and slowing economic activity in China and other emerging markets may also have contributed to the Fed’s holding off on a rate increase until December.

Yields ended the fiscal year higher than where they started. The yield of the 2-year Treasury note, for example, climbed 38 basis points to 1.07%. (A basis point is one-hundredth of a percentage point.) The 10-year Treasury note rose 11 basis points to 2.30%, and longer maturities rose more than that.

Although higher interest rates should benefit buy-and-hold bond investors over the long term, their rise over the 12 months pushed bond prices down,

| Expense Ratios | ||||||

| Your Fund Compared With Its Peer Group | ||||||

| Peer | ||||||

| Investor | ETF | Admiral | Institutional | Institutional | Group | |

| Shares | Shares | Shares | Shares | Plus Shares | Average | |

| Short-Term Bond Index Fund | 0.20% | 0.10% | 0.10% | 0.07% | 0.05% | 0.79% |

| Intermediate-Term Bond Index Fund | 0.20 | 0.10 | 0.10 | 0.07 | 0.05 | 0.83 |

| Long-Term Bond Index Fund | 0.20 | 0.10 | — | 0.07 | 0.05 | 0.91 |

The fund expense ratios shown are from the prospectus dated April 28, 2015, and represent estimated costs for the current fiscal year. For the

fiscal year ended December 31, 2015, the funds’ expense ratios were: for the Short-Term Bond Index Fund, 0.16% for Investor Shares, 0.09%

for ETF Shares, 0.09% for Admiral Shares, 0.06% for Institutional Shares, and 0.04% for Institutional Plus Shares; for the Intermediate-Term

Bond Index Fund, 0.16% for Investor Shares, 0.09% for ETF Shares, 0.09% for Admiral Shares, 0.06% for Institutional Shares, and 0.04% for

Institutional Plus Shares; and for the Long-Term Bond Index Fund, 0.16% for Investor Shares, 0.09% for ETF Shares, 0.06% for Institutional

Shares, and 0.04% for Institutional Plus Shares. Peer-group expense ratios are derived from data provided by Lipper, a Thomson Reuters

Company, and capture information through year-end 2014.

Peer groups: For the Short-Term Bond Index Fund, 1–5 Year Investment-Grade Debt Funds; for the Intermediate-Term Bond Index Fund, Core

Bond Funds; for the Long-Term Bond Index Fund, Corporate A-Rated Debt Funds.

6

especially for longer-dated bonds, which are more sensitive to rate movements. That’s reflected in the capital returns for the funds, which were –0.38% for the Short-Term Fund and –1.41% for the Intermediate-Term Fund, and worse than –7% for the Long-Term Fund.

Treasuries, whose weightings in the funds ranged from roughly 39% in the Long-Term Fund to about 66% in the Short-Term Fund, returned close to 1%. Differences by maturity were fairly modest: short- and intermediate-term Treasuries remained in the black, while their long-term counterparts returned roughly –1%.

Investment-grade corporate bonds, however, dipped into negative territory as price declines outweighed the income they earned over the period. The difference, or “spread,” in their yields versus Treasuries widened, notably in the industrial sector among bonds issued by metals and mining companies and energy producers whose creditworthiness was hurt by falling

| Total Returns | |

| Ten Years Ended December 31, 2015 | |

| Average | |

| Annual Return | |

| Short-Term Bond Index Fund Investor Shares | 3.17% |

| Spliced Barclays U.S. 1–5 Year Government/Credit Float Adjusted Index | 3.32 |

| 1–5 Year Investment-Grade Debt Funds Average | 2.44 |

| For a benchmark description, see the Glossary. | |

| 1–5 Year Investment-Grade Debt Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| Intermediate-Term Bond Index Fund Investor Shares | 5.39% |

| Spliced Barclays U.S. 5–10 Year Government/Credit Float Adjusted Index | 5.45 |

| Spliced Intermediate Investment-Grade Debt Funds Average | 3.93 |

| For a benchmark description, see the Glossary. | |

| Spliced Intermediate Investment-Grade Debt Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| Long-Term Bond Index Fund Investor Shares | 6.37% |

| Spliced Barclays U.S. Long Government/Credit Float Adjusted Index | 6.45 |

| Corporate A-Rated Debt Funds Average | 4.19 |

| For a benchmark description, see the Glossary. | |

| Corporate A-Rated Debt Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be

lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our

website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so

an investor’s shares, when sold, could be worth more or less than their original cost.

7

commodity prices. The spread widened less for bonds issued by financial institutions, as regulatory changes have led to stronger balance sheets overall in that sector.

Returns by maturity varied more for corporate bonds than for Treasuries. Here, too, the returns of short- and intermediate-term securities were positive, but those of long-term corporates were close to –5%. By credit quality, lower-rated investment-grade corporate bonds tended to underper-form their higher-rated counterparts.

Although it’s important to keep an eye on how your investments are performing, it’s also good not to lose sight of why you hold them. Bond returns may not be as strong going forward as we have become accustomed to in recent decades, but we believe they will continue to fulfill an important role as a diversifier for equities and other riskier assets you may have in your portfolio.

| Vanguard’s outlook for investors: Not bearish, but cautious |

| In Vanguard’s recently published global economic and investment outlook, Global Chief |

| Economist Joseph Davis and his team discuss various market and economic events 2016 |

| may bring, along with challenges and opportunities for investors. |

| Our forecast includes “frustratingly fragile” economic growth and more modest long-term |

| returns from the global stock and bond markets. The report cautions that for the decade ending |

| 2025, returns for a balanced portfolio are likely to be moderately below historical averages. |

| Our simulations indicate that the average annualized returns of a 60% equity/40% bond |

| portfolio for the decade are most likely to be centered in the 3%–5% range after inflation, |

| below the actual average after-inflation return of 5.5% for the same portfolio since 1926. |

| Even so, Vanguard’s steadfast belief in its principles for investing success—focusing on clear |

| goals, a suitable asset allocation, low costs, and long-term discipline—remains unchanged. |

| For more information about our expectations and the probability of various outcomes, see |

| Vanguard’s Economic and Investment Outlook, available at vanguard.com/research. |

| IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model® (VCMM) |

| regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment |

| results, and are not guarantees of future results. Distribution of return outcomes from VCMM, derived from |

| 10,000 simulations for U.S. equity returns and fixed income returns. Simulations as of September 30, 2015. |

| Results from the model may vary with each use and over time. For more information, please see page 9. |

8

Over a decade, the funds closely tracked their indexes

Every index fund aims to track the performance of its target index. That’s actually a taller order than you might think. Indexes incur no expenses, so they have a leg up from the start. Bond funds also have the challenge of negotiating prices, as bonds generally aren’t traded on central exchanges the way stocks are. And because these bond funds sample rather than replicate their benchmark indexes, the funds’ advisor has the challenge of putting together portfolios with a smaller number of bonds that nevertheless produce benchmark-like returns.

Over the decade ended December 31, 2015, the average annual return was 3.17% for the Short-Term Fund, 5.39% for the Intermediate-Term Fund, and 6.37% for the Long-Term Fund. The indexing skills of the fund’s advisor as well as their low expense ratio helped all three funds come in 15 basis points or less behind their benchmarks. The funds also outpaced the average returns of their peers.

To reach your long-term goals, be realistic and try to save more

Although there have been times when it felt as if stocks and bonds were riding a roller coaster, the markets have generally risen in recent years. The broad global stock market in particular has posted some impressive gains since its turnaround began in 2009.

But 2015 served as a reminder that markets aren’t always favorable. The U.S. stock and bond markets were basically flat, and international stocks and unhedged bonds finished in the red.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model (VCMM)

regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual

investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the

historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios

unobserved in the historical period on which the model estimation is based.

The VCMM is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research

and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset

classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income

markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment

strategies. The theoretical and empirical foundation for the VCMM is that the returns of various asset classes reflect the

compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates

of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on

available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model

then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset

classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for

each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these

simulations. Results produced by the tool will vary with each use and over time.

9

In Vanguard’s recently updated long-term look at the economy and markets, our global economists explain why they expect economic growth to remain “frustratingly fragile,” and why their outlook for stock and bond markets is the most guarded since 2006. (For more details, see the box on page 8 and Vanguard’s Economic and Investment Outlook, available at vanguard.com/research.)

Given these muted expectations, what’s the best course of action? I’ve often encouraged shareholders to focus on the things they can control. That advice holds true today.

Consider saving more than you think you may need. That’s one way you can prepare for the volatility that may lie ahead, particularly as markets adjust to changes in policies from the Fed and other central banks.

And, as always, investors would be well-served to follow Vanguard’s principles for investing success:

• Goals. Create clear, appropriate investment goals.

• Balance. Develop a suitable asset allocation using broadly diversified funds.

• Cost. Minimize cost.

• Discipline. Maintain perspective and long-term discipline.

As with saving, each of these principles is within your control, and focusing on them can keep you on the right path.

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

January 19, 2016

10

Short-Term Bond Index Fund

Fund Profile

As of December 31, 2015

| Share-Class Characteristics | |||||

| Investor | Admiral | Institutional | Institutional | ||

| Shares | ETF Shares | Shares | Shares | Plus Shares | |

| Ticker Symbol | VBISX | BSV | VBIRX | VBITX | VBIPX |

| Expense Ratio1 | 0.20% | 0.10% | 0.10% | 0.07% | 0.05% |

| 30-Day SEC Yield | 1.37% | 1.43% | 1.43% | 1.46% | 1.51% |

| Financial Attributes | |||

| Barclays | |||

| 1–5 Year | |||

| Gov/ | Barclays | ||

| Credit | Aggregate | ||

| Float Adj | Float Adj | ||

| Fund | Index | Index | |

| Number of Bonds | 2,239 | 2,965 | 9,681 |

| Yield to Maturity | |||

| (before expenses) | 1.6% | 1.7% | 2.6% |

| Average Coupon | 1.9% | 2.2% | 3.1% |

| Average Duration | 2.7 years | 2.7 years | 5.8 years |

| Average Effective | |||

| Maturity | 2.8 years | 2.8 years | 7.9 years |

| Short-Term | |||

| Reserves | 0.6% | — | — |

| Sector Diversification (% of portfolio) | |

| Finance | 10.9% |

| Foreign | 7.1 |

| Industrial | 14.1 |

| Treasury/Agency | 66.3 |

| Utilities | 1.5 |

| Other | 0.1 |

The agency and mortgage-backed securities sectors may include issues from government-sponsored enterprises; such issues are

generally not backed by the full faith and credit of the U.S. government.

| Volatility Measures | ||

| Barclays | ||

| 1–5 Year | ||

| Gov/ | ||

| Credit | Barclays | |

| Float Adj | Aggregate Float | |

| Index | Adj Index | |

| R-Squared | 0.98 | 0.80 |

| Beta | 1.01 | 0.37 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

| Distribution by Credit Quality (% of portfolio) | |

| U.S. Government | 66.3% |

| Aaa | 5.2 |

| Aa | 4.3 |

| A | 12.2 |

| Baa | 12.0 |

Credit-quality ratings are obtained from Barclays and are from Moody's, Fitch, and S&P. When ratings from all three agencies are

used, the median rating is shown. When ratings from two of the agencies are used, the lower rating for each issue is shown. "Not

Rated" is used to classify securities for which a rating is not available. Not rated securities include a fund's investment in

Vanguard Market Liquidity Fund or Vanguard Municipal Cash Management Fund, each of which invests in high-quality money

market instruments and may serve as a cash management vehicle for the Vanguard funds, trusts, and accounts. For more information

about these ratings, see the Glossary entry for Credit Quality.

| Distribution by Effective Maturity | |

| (% of portfolio) | |

| Under 1 Year | 1.5% |

| 1 - 3 Years | 57.9 |

| 3 - 5 Years | 40.6 |

1 The expense ratios shown are from the prospectus dated April 28, 2015, and represent estimated costs for the current fiscal year. For the fiscal

year ended December 31, 2015, the expense ratios were 0.16% for Investor Shares, 0.09% for ETF Shares, 0.09% for Admiral Shares, 0.06% for

Institutional Shares, and 0.04% for Institutional Plus Shares.

11

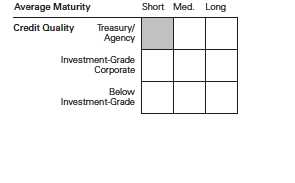

Short-Term Bond Index Fund

Investment Focus

12

Short-Term Bond Index Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: December 31, 2005, Through December 31, 2015

Initial Investment of $10,000

| Average Annual Total Returns | |||||

| Periods Ended December 31, 2015 | |||||

| Final Value | |||||

| One | Five | Ten | of a $10,000 | ||

| Year | Years | Years | Investment | ||

| Short-Term Bond Index Fund Investor | |||||

| Shares | 0.85% | 1.39% | 3.17% | $13,663 | |

| Spliced Barclays U.S. 1–5 Year | |||||

| •••••••• | |||||

| Government/Credit Float Adjusted | |||||

| Index | 0.97 | 1.61 | 3.32 | 13,860 | |

| – – – – | 1–5 Year Investment-Grade Debt Funds | ||||

| Average | 0.25 | 1.52 | 2.44 | 12,730 | |

| Spliced Barclays U.S. Aggregate Float | |||||

| Adjusted Index | 0.44 | 3.25 | 4.52 | 15,559 | |

| For a benchmark description, see the Glossary. | |||||

| 1–5 Year Investment-Grade Debt Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |||||

| Since | Final Value | |||

| One | Five | Inception | of a $10,000 | |

| Year | Years | (4/3/2007) | Investment | |

| Short-Term Bond Index Fund | ||||

| ETF Shares Net Asset Value | 0.92% | 1.49% | 3.08% | $13,036 |

| Spliced Barclays U.S. 1–5 Year | ||||

| Government/Credit Float Adjusted Index | 0.97 | 1.61 | 3.14 | 13,100 |

| Spliced Barclays U.S. Aggregate Float | ||||

| Adjusted Index | 0.44 | 3.25 | 4.50 | 14,694 |

| "Since Inception" performance is calculated from the ETF Shares’ inception date for both the fund and its comparative standards. | ||||

See Financial Highlights for dividend and capital gains information.

13

Short-Term Bond Index Fund

| Average Annual Total Returns | ||||

| Periods Ended December 31, 2015 | ||||

| Final Value | ||||

| One | Five | Ten | of a $10,000 | |

| Year | Years | Years | Investment | |

| Short-Term Bond Index Fund Admiral Shares | 0.92% | 1.49% | 3.27% | $13,789 |

| Spliced Barclays U.S. 1–5 Year | ||||

| Government/Credit Float Adjusted Index | 0.97 | 1.61 | 3.32 | 13,860 |

| Spliced Barclays U.S. Aggregate Float | ||||

| Adjusted Index | 0.44 | 3.25 | 4.52 | 15,559 |

| Since | Final Value | ||

| One | Inception | of a $5,000,000 | |

| Year | (9/27/2011) | Investment | |

| Short-Term Bond Index Fund Institutional | |||

| Shares | 0.95% | 1.17% | $5,253,598 |

| Barclays U.S. 1–5 Year Government/Credit | |||

| Float Adjusted Index | 0.97 | 1.25 | 5,271,851 |

| Barclays U.S. Aggregate Float Adjusted | |||

| Index | 0.44 | 2.35 | 5,520,161 |

| "Since Inception" performance is calculated from the Institutional Shares’ inception date for both the fund and its comparative standards. | |||

| Since | Final Value | ||

| One | Inception | of a $100,000,000 | |

| Year | (9/29/2011) | Investment | |

| Short-Term Bond Index Fund Institutional Plus | |||

| Shares | 0.97% | 1.19% | $105,160,467 |

| Barclays U.S. 1–5 Year Government/Credit | |||

| Float Adjusted Index | 0.97 | 1.25 | 105,429,115 |

| Barclays U.S. Aggregate Float Adjusted Index | 0.44 | 2.29 | 110,106,734 |

| "Since Inception" performance is calculated from the Institutional Plus Shares’ inception date for both the fund and its comparative standards. | |||

| Cumulative Returns of ETF Shares: April 3, 2007, Through December 31, 2015 | |||

| Since | |||

| One | Five | Inception | |

| Year | Years | (4/3/2007) | |

| Short-Term Bond Index Fund ETF Shares Market | |||

| Price | 0.91% | 7.63% | 30.43% |

| Short-Term Bond Index Fund ETF Shares Net Asset | |||

| Value | 0.92 | 7.68 | 30.36 |

| Spliced Barclays U.S. 1–5 Year Government/Credit | |||

| Float Adjusted Index | 0.97 | 8.31 | 31.00 |

| "Since Inception" performance is calculated from the ETF Shares’ inception date for both the fund and its comparative standards. | |||

14

Short-Term Bond Index Fund

| Fiscal-Year Total Returns (%): December 31, 2005, Through December 31, 2015 | ||||

| Spliced | ||||

| Barclays | ||||

| 1–5 Year | ||||

| Gov/Credit | ||||

| Investor Shares | FA Index | |||

| Fiscal Year | Income Returns | Capital Returns | Total Returns | Total Returns |

| 2006 | 4.39% | -0.30% | 4.09% | 4.22% |

| 2007 | 4.79 | 2.43 | 7.22 | 7.27 |

| 2008 | 3.95 | 1.48 | 5.43 | 5.12 |

| 2009 | 2.91 | 1.37 | 4.28 | 4.62 |

| 2010 | 2.22 | 1.70 | 3.92 | 4.08 |

| 2011 | 1.85 | 1.11 | 2.96 | 3.13 |

| 2012 | 1.46 | 0.49 | 1.95 | 2.24 |

| 2013 | 1.10 | -1.03 | 0.07 | 0.29 |

| 2014 | 1.11 | 0.05 | 1.16 | 1.43 |

| 2015 | 1.23 | -0.38 | 0.85 | 0.97 |

| For a benchmark description, see the Glossary. | ||||

15

Short-Term Bond Index Fund

Financial Statements

Statement of Net Assets—Investments Summary

As of December 31, 2015

This Statement summarizes the fund’s holdings by asset type. Details are reported for each of the fund’s 50 largest individual holdings and for investments that, in total for any issuer, represent more than 1% of the fund’s net assets. The total value of smaller holdings is reported as a single amount within each category.

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the complete listing of the fund’s holdings is available electronically on vanguard.com and on the Securities and Exchange Commission’s website (sec.gov), or you can have it mailed to you without charge by calling 800-662-7447. For the first and third fiscal quarters, the fund files the lists with the SEC on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| Face | Market | Percentage | |||

| Maturity | Amount | Value• | of Net | ||

| Coupon | Date | ($000) | ($000) | Assets | |

| U.S. Government and Agency Obligations | |||||

| U.S. Government Securities | |||||

| United States Treasury Note/Bond | 1.500% | 11/30/19 | 729,865 | 727,128 | 1.7% |

| United States Treasury Note/Bond | 1.250% | 11/30/18 | 717,184 | 715,950 | 1.7% |

| United States Treasury Note/Bond | 1.625% | 11/30/20 | 707,950 | 703,858 | 1.7% |

| United States Treasury Note/Bond | 1.375% | 8/31/20 | 635,075 | 624,952 | 1.5% |

| United States Treasury Note/Bond | 0.625% | 9/30/17 | 565,125 | 561,237 | 1.3% |

| United States Treasury Note/Bond | 1.625% | 7/31/20 | 543,474 | 540,925 | 1.3% |

| United States Treasury Note/Bond | 1.375% | 2/29/20 | 536,907 | 530,781 | 1.3% |

| United States Treasury Note/Bond | 1.750% | 12/31/20 | 530,600 | 530,271 | 1.2% |

| United States Treasury Note/Bond | 1.375% | 10/31/20 | 530,380 | 521,098 | 1.2% |

| United States Treasury Note/Bond | 1.375% | 3/31/20 | 494,988 | 488,954 | 1.2% |

| United States Treasury Note/Bond | 1.000% | 5/31/18 | 479,115 | 476,719 | 1.1% |

| United States Treasury Note/Bond | 1.625% | 8/31/19 | 461,569 | 462,940 | 1.1% |

| United States Treasury Note/Bond | 1.500% | 5/31/19 | 458,140 | 458,571 | 1.1% |

| United States Treasury Note/Bond | 1.000% | 8/15/18 | 433,954 | 431,311 | 1.0% |

| United States Treasury Note/Bond | 1.250% | 1/31/20 | 433,842 | 427,200 | 1.0% |

| United States Treasury Note/Bond | 1.500% | 5/31/20 | 418,712 | 415,245 | 1.0% |

| United States Treasury Note/Bond | 0.750% | 1/15/17 | 414,800 | 414,476 | 1.0% |

| United States Treasury Note/Bond | 1.500% | 2/28/19 | 402,200 | 403,455 | 1.0% |

| United States Treasury Note/Bond | 0.875% | 11/30/17 | 402,328 | 401,197 | 0.9% |

| United States Treasury Note/Bond | 1.375% | 9/30/18 | 376,790 | 378,026 | 0.9% |

| United States Treasury Note/Bond | 1.750% | 9/30/19 | 368,231 | 370,764 | 0.9% |

| United States Treasury Note/Bond | 1.000% | 3/15/18 | 362,819 | 361,628 | 0.9% |

| United States Treasury Note/Bond | 0.875% | 4/15/17 | 348,715 | 348,659 | 0.8% |

| United States Treasury Note/Bond | 1.500% | 1/31/19 | 342,060 | 343,288 | 0.8% |

| United States Treasury Note/Bond | 1.625% | 6/30/19 | 336,566 | 338,091 | 0.8% |

| United States Treasury Note/Bond | 0.875% | 4/30/17 | 336,019 | 335,861 | 0.8% |

| United States Treasury Note/Bond | 1.375% | 9/30/20 | 339,758 | 333,918 | 0.8% |

| United States Treasury Note/Bond | 1.625% | 4/30/19 | 321,394 | 323,303 | 0.8% |

| United States Treasury Note/Bond | 1.000% | 9/15/17 | 321,935 | 321,784 | 0.8% |

| United States Treasury Note/Bond | 0.625% | 8/31/17 | 314,972 | 312,953 | 0.7% |

| United States Treasury Note/Bond | 0.500% | 7/31/17 | 314,520 | 312,161 | 0.7% |

16

Short-Term Bond Index Fund

| Face | Market | Percentage | ||||

| Maturity | Amount | Value• | of Net | |||

| Coupon | Date | ($000) | ($000) | Assets | ||

| United States Treasury Note/Bond | 1.500% | 8/31/18 | 308,780 | 310,855 | 0.7% | |

| United States Treasury Note/Bond | 1.000% | 9/15/18 | 312,335 | 310,186 | 0.7% | |

| United States Treasury Note/Bond | 1.375% | 4/30/20 | 312,770 | 308,713 | 0.7% | |

| United States Treasury Note/Bond | 0.750% | 6/30/17 | 308,210 | 307,248 | 0.7% | |

| United States Treasury Note/Bond | 0.875% | 10/15/17 | 306,475 | 305,565 | 0.7% | |

| United States Treasury Note/Bond | 0.875% | 8/15/17 | 298,815 | 298,161 | 0.7% | |

| United States Treasury Note/Bond | 0.625% | 5/31/17 | 298,795 | 297,486 | 0.7% | |

| United States Treasury Note/Bond | 1.625% | 7/31/19 | 294,605 | 295,663 | 0.7% | |

| United States Treasury Note/Bond | 0.875% | 6/15/17 | 295,100 | 294,823 | 0.7% | |

| United States Treasury Note/Bond | 0.625% | 2/15/17 | 293,885 | 293,197 | 0.7% | |

| United States Treasury Note/Bond | 1.000% | 3/31/17 | 281,775 | 282,260 | 0.7% | |

| United States Treasury Note/Bond | 0.875% | 2/28/17 | 282,024 | 282,199 | 0.7% | |

| United States Treasury Note/Bond | 0.625% | 11/30/17 | 279,970 | 277,697 | 0.7% | |

| United States Treasury Note/Bond | 0.875% | 7/15/18 | 278,540 | 276,103 | 0.6% | |

| United States Treasury Note/Bond | 1.625% | 3/31/19 | 268,390 | 270,151 | 0.6% | |

| United States Treasury Note/Bond | 0.750% | 2/28/18 | 256,685 | 254,519 | 0.6% | |

| United States Treasury Note/Bond | 1.000% | 5/15/18 | 254,995 | 253,799 | 0.6% | |

| United States Treasury Note/Bond | 1.875% | 10/31/17 | 249,746 | 253,415 | 0.6% | |

| United States Treasury Note/Bond | 0.875% | 11/15/17 | 252,417 | 251,589 | 0.6% | |

| United States Treasury | ||||||

| Note/Bond | 0.500%–9.125% | 3/31/16–10/31/20 | 6,303,137 | 6,325,474 | 14.9% | |

| 25,665,807 | 60.6% | |||||

| Agency Bonds and Notes | ||||||

| 1 Federal Home Loan Banks | 0.625%–5.375% | 3/10/17–12/11/20 | 496,715 | 508,427 | 1.2% | |

| 2 Federal Home Loan | ||||||

| Mortgage Corp. | 0.500%–5.500% | 1/27/17–5/1/20 | 711,236 | 714,023 | 1.7% | |

| 2 Federal National | ||||||

| Mortgage Assn. | 0.000%–5.000% | 1/30/17–12/28/20 | 923,465 | 920,880 | 2.2% | |

| Agency Bonds and Notes—Other † | 142,437 | 0.3% | ||||

| 2,285,767 | 5.4% | |||||

| Total U.S. Government and Agency Obligations (Cost $28,037,051) | 27,951,574 | 66.0% | ||||

| Corporate Bonds | ||||||

| Finance | ||||||

| 3 Banking † | 3,725,626 | 8.8% | ||||

| Brokerage † | 100,271 | 0.2% | ||||

| 3 Finance Companies † | 194,953 | 0.5% | ||||

| Insurance † | 406,473 | 1.0% | ||||

| Other Finance † | 3,003 | 0.0% | ||||

| 3 Real Estate Investment Trusts † | 223,525 | 0.5% | ||||

| 4,653,851 | 11.0% | |||||

| Industrial | ||||||

| Basic Industry † | 327,691 | 0.8% | ||||

| Capital Goods † | 589,516 | 1.4% | ||||

| 3 Communication † | 737,400 | 1.7% | ||||

| Consumer Cyclical † | 826,045 | 2.0% | ||||

| 3 Consumer Noncyclical † | 1,567,769 | 3.7% | ||||

| 3 Energy † | 1,003,445 | 2.4% | ||||

| Other Industrial † | 3,578 | 0.0% | ||||

| 3 Technology † | 739,380 | 1.7% | ||||

| 3 Transportation † | 140,807 | 0.3% | ||||

| 5,935,631 | 14.0% | |||||

17

Short-Term Bond Index Fund

| Face | Market | Percentage | ||

| Maturity | Amount | Value• | of Net | |

| Coupon Date | ($000) | ($000) | Assets | |

| Utilities | ||||

| Electric † | 561,253 | 1.3% | ||

| Natural Gas † | 55,684 | 0.1% | ||

| Other Utility † | 215 | 0.0% | ||

| 617,152 | 1.4% | |||

| Total Corporate Bonds (Cost $11,276,219) | 11,206,634 | 26.4% | ||

| Sovereign Bonds (U.S. Dollar-Denominated) | ||||

| European Investment Bank | 0.875%–5.125% 12/15/16–12/15/20 | 474,540 | 475,590 | 1.1% |

| FMS Wertmanagement | ||||

| AoeR | 0.625%–1.750% 1/30/17–3/17/20 | 64,075 | 63,830 | 0.1% |

| 4 KFW | 0.750%–4.875% 10/5/16–10/1/20 | 456,120 | 460,824 | 1.1% |

| 3 Sovereign Bonds | ||||

| (U.S. Dollar-Denominated)—Other † | 1,938,178 | 4.6% | ||

| Total Sovereign Bonds (Cost $2,947,933) | 2,938,422 | 6.9% | ||

| Taxable Municipal Bonds (Cost $45,307) † | 45,342 | 0.1% | ||

| Shares | ||||

| Temporary Cash Investment | ||||

| Money Market Fund | ||||

| 5 Vanguard Market Liquidity Fund | ||||

| (Cost $568,741) | 0.363% | 568,740,878 | 568,741 | 1.4% |

| Total Investments (Cost $42,875,251) | 42,710,713 | 100.8% | ||

| Amount | ||||

| ($000) | ||||

| Other Assets and Liabilities | ||||

| Other Assets | ||||

| Investment in Vanguard | 3,649 | |||

| Receivables for Investment Securities Sold | 253,489 | |||

| Receivables for Accrued Income | 205,294 | |||

| Receivables for Capital Shares Issued | 42,154 | |||

| Other Assets | 31,302 | |||

| Total Other Assets | 535,888 | 1.3% | ||

| Liabilities | ||||

| Payables for Investment Securities Purchased | (797,931) | |||

| Payables for Capital Shares Redeemed | (42,131) | |||

| Payables for Distributions | (3,260) | |||

| Payables to Vanguard | (15,821) | |||

| Other Liabilities | (8,133) | |||

| Total Liabilities | (867,276) | (2.1%) | ||

| Net Assets | 42,379,325 | 100.0% | ||

18

| Short-Term Bond Index Fund | |

| At December 31, 2015, net assets consisted of: | |

| Amount | |

| ($000) | |

| Paid-in Capital | 42,543,835 |

| Undistributed Net Investment Income | 28 |

| Accumulated Net Realized Losses | — |

| Unrealized Appreciation (Depreciation) | (164,538) |

| Net Assets | 42,379,325 |

| Investor Shares—Net Assets | |

| Applicable to 221,103,601 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 2,307,003 |

| Net Asset Value Per Share—Investor Shares | $10.43 |

| ETF Shares—Net Assets | |

| Applicable to 218,912,541 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 17,401,550 |

| Net Asset Value Per Share—ETF Shares | $79.49 |

| Admiral Shares—Net Assets | |

| Applicable to 1,405,252,685 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 14,662,473 |

| Net Asset Value Per Share—Admiral Shares | $10.43 |

| Institutional Shares—Net Assets | |

| Applicable to 431,840,208 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 4,505,837 |

| Net Asset Value Per Share—Institutional Shares | $10.43 |

| Institutional Plus Shares—Net Assets | |

| Applicable to 335,676,186 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 3,502,462 |

| Net Asset Value Per Share—Institutional Plus Shares | $10.43 |

• See Note A in Notes to Financial Statements.

† Represents the aggregate value, by category, of securities that are not among the 50 largest holdings and, in total for any issuer, represent

1% or less of net assets.

1 The issuer operates under a congressional charter; its securities are generally neither guaranteed by the U.S. Treasury nor backed by the full

faith and credit of the U.S. government.

2 The issuer was placed under federal conservatorship in September 2008; since that time, its daily operations have been managed by the

Federal Housing Finance Agency and it receives capital from the U.S. Treasury, as needed to maintain a positive net worth, in exchange for

senior preferred stock.

3 Certain of the fund’s securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in

transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2015, the aggregate value of these

securities was $301,372,000, representing 0.7% of net assets.

4 Guaranteed by the Federal Republic of Germany.

5 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the

7-day yield.

See accompanying Notes, which are an integral part of the Financial Statements.

19

Short-Term Bond Index Fund

Statement of Operations

| Year Ended | |

| December 31, 2015 | |

| ($000) | |

| Investment Income | |

| Income | |

| Interest1 | 563,182 |

| Total Income | 563,182 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 1,019 |

| Management and Administrative—Investor Shares | 3,140 |

| Management and Administrative—ETF Shares | 12,122 |

| Management and Administrative—Admiral Shares | 10,121 |

| Management and Administrative—Institutional Shares | 2,121 |

| Management and Administrative—Institutional Plus Shares | 893 |

| Marketing and Distribution—Investor Shares | 650 |

| Marketing and Distribution—ETF Shares | 1,672 |

| Marketing and Distribution—Admiral Shares | 1,746 |

| Marketing and Distribution—Institutional Shares | 378 |

| Marketing and Distribution—Institutional Plus Shares | 221 |

| Custodian Fees | 224 |

| Auditing Fees | 48 |

| Shareholders’ Reports—Investor Shares | 42 |

| Shareholders’ Reports—ETF Shares | 368 |

| Shareholders’ Reports—Admiral Shares | 253 |

| Shareholders’ Reports—Institutional Shares | 17 |

| Shareholders’ Reports—Institutional Plus Shares | 12 |

| Trustees’ Fees and Expenses | 29 |

| Total Expenses | 35,076 |

| Net Investment Income | 528,106 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold | 46,617 |

| Futures Contracts | 87 |

| Realized Net Gain (Loss) | 46,704 |

| Change in Unrealized Appreciation (Depreciation) of Investment Securities | (219,526) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 355,284 |

| 1 Interest income from an affiliated company of the fund was $340,000. | |

See accompanying Notes, which are an integral part of the Financial Statements.

20

Short-Term Bond Index Fund

Statement of Changes in Net Assets

| Year Ended December 31, | ||

| 2015 | 2014 | |

| ($000) | ($000) | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net Investment Income | 528,106 | 436,769 |

| Realized Net Gain (Loss) | 46,704 | 73,646 |

| Change in Unrealized Appreciation (Depreciation) | (219,526) | (42,803) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 355,284 | 467,612 |

| Distributions | ||

| Net Investment Income | ||

| Investor Shares | (30,328) | (31,983) |

| ETF Shares | (213,621) | (175,470) |

| Admiral Shares | (183,186) | (93,269) |

| Signal Shares | — | (58,165) |

| Institutional Shares | (59,798) | (50,579) |

| Institutional Plus Shares | (41,145) | (27,303) |

| Realized Capital Gain1 | ||

| Investor Shares | (2,326) | (3,865) |

| ETF Shares | (16,283) | (21,832) |

| Admiral Shares | (13,790) | (17,249) |

| Signal Shares | — | (1,282) |

| Institutional Shares | (4,296) | (6,217) |

| Institutional Plus Shares | (3,151) | (3,512) |

| Total Distributions | (567,924) | (490,726) |

| Capital Share Transactions | ||

| Investor Shares | (350,525) | (335,640) |

| ETF Shares | 1,832,192 | 1,738,776 |

| Admiral Shares | 1,526,203 | 8,220,185 |

| Signal Shares | — | (7,071,916) |

| Institutional Shares | 22,761 | 1,228,775 |

| Institutional Plus Shares | 1,006,832 | 649,762 |

| Net Increase (Decrease) from Capital Share Transactions | 4,037,463 | 4,429,942 |

| Total Increase (Decrease) | 3,824,823 | 4,406,828 |

| Net Assets | ||

| Beginning of Period | 38,554,502 | 34,147,674 |

| End of Period2 | 42,379,325 | 38,554,502 |

1 Includes fiscal 2015 and 2014 short-term gain distributions totaling $0 and $7,265,000, respectively. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

2 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $28,000 and $0.

See accompanying Notes, which are an integral part of the Financial Statements.

21

Short-Term Bond Index Fund

Financial Highlights

| Investor Shares | |||||

| For a Share Outstanding | Year Ended December 31, | ||||

| Throughout Each Period | 2015 | 2014 | 2013 | 2012 | 2011 |

| Net Asset Value, Beginning of Period | $10.48 | $10.49 | $10.63 | $10.61 | $10.55 |

| Investment Operations | |||||

| Net Investment Income | .130 | .116 | .116 | .153 | .193 |

| Net Realized and Unrealized Gain (Loss) | |||||

| on Investments | (.040) | .005 | (.109) | .052 | .117 |

| Total from Investment Operations | .090 | .121 | .007 | .205 | .310 |

| Distributions | |||||

| Dividends from Net Investment Income | (.130) | (.116) | (.116) | (.153) | (.193) |

| Distributions from Realized Capital Gains | (. 010) | (. 015) | (. 031) | (. 032) | (. 057) |

| Total Distributions | (.140) | (.131) | (.147) | (.185) | (. 250) |

| Net Asset Value, End of Period | $10.43 | $10.48 | $10.49 | $10.63 | $10.61 |

| Total Return1 | 0.85% | 1.16% | 0.07% | 1.95% | 2.96% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $2,307 | $2,667 | $3,003 | $3,185 | $3,802 |

| Ratio of Total Expenses to Average Net Assets | 0.16% | 0.20% | 0.20% | 0.20% | 0.22% |

| Ratio of Net Investment Income to | |||||

| Average Net Assets | 1.23% | 1.10% | 1.09% | 1.44% | 1.81% |

| Portfolio Turnover Rate2 | 52% | 45% | 50% | 51% | 67% |

1 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

2 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares,

including ETF Creation Units.

See accompanying Notes, which are an integral part of the Financial Statements.

22

Short-Term Bond Index Fund

Financial Highlights

| ETF Shares | |||||

| For a Share Outstanding | Year Ended December 31, | ||||

| Throughout Each Period | 2015 | 2014 | 2013 | 2012 | 2011 |

| Net Asset Value, Beginning of Period | $79.87 | $79.89 | $80.94 | $80.80 | $80.35 |

| Investment Operations | |||||

| Net Investment Income | 1.039 | .959 | .950 | 1.239 | 1.538 |

| Net Realized and Unrealized Gain (Loss) | |||||

| on Investments | (.303) | .094 | (. 813) | .384 | .885 |

| Total from Investment Operations | .736 | 1.053 | .137 | 1.623 | 2.423 |

| Distributions | |||||

| Dividends from Net Investment Income | (1.039) | (.959) | (.950) | (1.239) | (1.538) |

| Distributions from Realized Capital Gains | (.077) | (.114) | (.237) | (.244) | (.435) |

| Total Distributions | (1.116) | (1.073) | (1.187) | (1.483) | (1.973) |

| Net Asset Value, End of Period | $79.49 | $79.87 | $79.89 | $80.94 | $80.80 |

| Total Return | 0.92% | 1.32% | 0.17% | 2.02% | 3.04% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $17,402 | $15,655 | $13,926 | $9,292 | $7,482 |

| Ratio of Total Expenses to Average Net Assets | 0.09% | 0.10% | 0.10% | 0.10% | 0.11% |

| Ratio of Net Investment Income to | |||||

| Average Net Assets | 1.30% | 1.20% | 1.19% | 1.54% | 1.92% |

| Portfolio Turnover Rate1 | 52% | 45% | 50% | 51% | 67% |

| 1 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. | |||||

See accompanying Notes, which are an integral part of the Financial Statements.

23

Short-Term Bond Index Fund

Financial Highlights

| Admiral Shares | |||||

| For a Share Outstanding | Year Ended December 31, | ||||

| Throughout Each Period | 2015 | 2014 | 2013 | 2012 | 2011 |

| Net Asset Value, Beginning of Period | $10.48 | $10.49 | $10.63 | $10.61 | $10.55 |

| Investment Operations | |||||

| Net Investment Income | .137 | .126 | .127 | .164 | .205 |

| Net Realized and Unrealized Gain (Loss) | |||||

| on Investments | (.040) | .005 | (.109) | .052 | .117 |

| Total from Investment Operations | .097 | .131 | .018 | .216 | .322 |

| Distributions | |||||

| Dividends from Net Investment Income | (.137) | (.126) | (.127) | (.164) | (.205) |

| Distributions from Realized Capital Gains | (. 010) | (. 015) | (. 031) | (. 032) | (. 057) |

| Total Distributions | (.147) | (.141) | (.158) | (.196) | (. 262) |

| Net Asset Value, End of Period | $10.43 | $10.48 | $10.49 | $10.63 | $10.61 |

| Total Return1 | 0.92% | 1.26% | 0.17% | 2.05% | 3.08% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $14,662 | $13,212 | $5,035 | $4,401 | $4,094 |

| Ratio of Total Expenses to Average Net Assets | 0.09% | 0.10% | 0.10% | 0.10% | 0.11% |

| Ratio of Net Investment Income to | |||||

| Average Net Assets | 1.30% | 1.20% | 1.19% | 1.54% | 1.92% |

| Portfolio Turnover Rate2 | 52% | 45% | 50% | 51% | 67% |

1 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

2 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares,

including ETF Creation Units.

See accompanying Notes, which are an integral part of the Financial Statements.

24

Short-Term Bond Index Fund

Financial Highlights

| Institutional Shares | |||||

| Sept. 27, | |||||

| 20111 to | |||||

| For a Share Outstanding | Year Ended December 31, | Dec. 31, | |||

| Throughout Each Period | 2015 | 2014 | 2013 | 2012 | 2011 |

| Net Asset Value, Beginning of Period | $10.48 | $10.49 | $10.63 | $10.61 | $10.66 |

| Investment Operations | |||||

| Net Investment Income | .140 | .130 | .130 | .167 | .050 |

| Net Realized and Unrealized Gain (Loss) | |||||

| on Investments | (.040) | .005 | (.109) | .052 | (.001) |

| Total from Investment Operations | .100 | .135 | .021 | .219 | .049 |

| Distributions | |||||

| Dividends from Net Investment Income | (.140) | (.130) | (.130) | (.167) | (.050) |

| Distributions from Realized Capital Gains | (. 010) | (. 015) | (. 031) | (. 032) | (. 049) |

| Total Distributions | (.150) | (.145) | (.161) | (.199) | (. 099) |

| Net Asset Value, End of Period | $10.43 | $10.48 | $10.49 | $10.63 | $10.61 |

| Total Return | 0.95% | 1.29% | 0.20% | 2.08% | 0.47% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $4,506 | $4,505 | $3,282 | $2,652 | $843 |

| Ratio of Total Expenses to Average Net Assets | 0.06% | 0.07% | 0.07% | 0.07% | 0.07%2 |

| Ratio of Net Investment Income to | |||||

| Average Net Assets | 1.33% | 1.23% | 1.22% | 1.57% | 1.96%2 |

| Portfolio Turnover Rate 3 | 52% | 45% | 50% | 51% | 67% |

| 1 Inception. | |||||

| 2 Annualized. | |||||

| 3 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. | |||||

See accompanying Notes, which are an integral part of the Financial Statements.

25

Short-Term Bond Index Fund

Financial Highlights

| Institutional Plus Shares | |||||

| Sept. 29, | |||||

| 20111 to | |||||

| For a Share Outstanding | Year Ended December 31, | Dec. 31, | |||

| Throughout Each Period | 2015 | 2014 | 2013 | 2012 | 2011 |

| Net Asset Value, Beginning of Period | $10.48 | $10.49 | $10.63 | $10.61 | $10.66 |

| Investment Operations | |||||

| Net Investment Income | .142 | .132 | .132 | .169 | .051 |

| Net Realized and Unrealized Gain (Loss) | |||||

| on Investments | (.040) | .005 | (.109) | .052 | (.001) |

| Total from Investment Operations | .102 | .137 | .023 | . 221 | .050 |

| Distributions | |||||

| Dividends from Net Investment Income | (.142) | (.132) | (.132) | (.169) | (. 051) |

| Distributions from Realized Capital Gains | (. 010) | (. 015) | (. 031) | (. 032) | (. 049) |

| Total Distributions | (.152) | (.147) | (.163) | (. 201) | (.100) |

| Net Asset Value, End of Period | $10.43 | $10.48 | $10.49 | $10.63 | $10.61 |

| Total Return | 0.97% | 1.31% | 0.22% | 2.10% | 0.47% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $3,502 | $2,515 | $1,868 | $1,103 | $711 |

| Ratio of Total Expenses to Average Net Assets | 0.04% | 0.05% | 0.05% | 0.05% | 0.05%2 |

| Ratio of Net Investment Income to | |||||

| Average Net Assets | 1.35% | 1.25% | 1.24% | 1.59% | 1.98%2 |

| Portfolio Turnover Rate 3 | 52% | 45% | 50% | 51% | 67% |

1 Inception.

2 Annualized.

3 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares,

including ETF Creation Units.

See accompanying Notes, which are an integral part of the Financial Statements.

26

Short-Term Bond Index Fund

Notes to Financial Statements

Vanguard Short-Term Bond Index Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. Certain of the fund’s investments are in corporate debt instruments; the issuers’ abilities to meet their obligations may be affected by economic developments in their respective industries. The fund offers five classes of shares: Investor Shares, ETF Shares, Admiral Shares, Institutional Shares, and Institutional Plus Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. ETF Shares are listed for trading on Nasdaq; they can be purchased and sold through a broker. Admiral Shares, Institutional Shares, and Institutional Plus Shares are designed for investors who meet certain administrative, service, and account-size criteria. Prior to October 24, 2014, the fund offered Signal Shares. Effective at the close of business on October 24, 2014, the Signal Shares were converted to Admiral Shares.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Bonds, and temporary cash investments acquired over 60 days to maturity, are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Structured debt securities, including mortgages and asset-backed securities, are valued using the latest bid prices or using valuations based on a matrix system that considers such factors as issuer, tranche, nominal or option-adjusted spreads, weighted average coupon, weighted average maturity, credit enhancements, and collateral. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Other temporary cash investments are valued at amortized cost, which approximates market value. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value.

2. Futures Contracts: The fund uses futures contracts to invest in fixed income asset classes with greater efficiency and lower cost than is possible through direct investment, to add value when these instruments are attractively priced, or to adjust sensitivity to changes in interest rates. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of bonds held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract.

Futures contracts are valued at their quoted daily settlement prices. The aggregate settlement values of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

During the year ended December 31, 2015, the fund’s average investments in long and short futures contracts each represented 0% of net assets, based on the average of aggregate settlement values at each quarter-end during the period. The fund had no open futures contracts at December 31, 2015.

27

Short-Term Bond Index Fund

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (December 31, 2012–2015), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions from net investment income are declared daily by all share classes except ETF Shares, and paid on the first business day of the following month. Monthly income dividends from ETF Shares, and annual distributions from realized capital gains, if any, are recorded on the ex-dividend date.

5. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard”) participate in a $3 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.06% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate equal to the higher of the federal funds rate or LIBOR reference rate plus an agreed-upon spread.

The fund had no borrowings outstanding at December 31, 2015, or at any time during the period then ended.

6. Other: Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund investment advisory, corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees. Vanguard does not require reimbursement in the current period for certain costs of operations (such as deferred compensation/benefits and risk/insurance costs); the fund’s liability for these costs of operations is included in Payables to Vanguard on the Statement of Net Assets.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At December 31, 2015, the fund had contributed to Vanguard capital in the amount of $3,649,000, representing 0.01% of the fund’s net assets and 1.46% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

28

Short-Term Bond Index Fund

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following table summarizes the market value of the fund’s investments as of December 31, 2015, based on the inputs used to value them:

| Level 1 | Level 2 | Level 3 | |

| Investments | ($000) | ($000) | ($000) |

| U.S. Government and Agency Obligations | — | 27,951,574 | — |

| Corporate Bonds | — | 11,206,634 | — |

| Sovereign Bonds | — | 2,938,422 | — |

| Taxable Municipal Bonds | — | 45,342 | — |

| Temporary Cash Investments | 568,741 | — | — |

| Total | 568,741 | 42,141,972 | — |

D. Capital gain distributions are determined on a tax basis and may differ from realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when gains or losses are recognized in different periods for financial statement and tax purposes. These differences will reverse at some time in the future.

During the year ended December 31, 2015, the fund realized $9,027,000 of net capital gains resulting from in-kind redemptions—in which shareholders exchanged fund shares for securities held by the fund rather than for cash. Because such gains are not taxable to the fund, and are not distributed to shareholders, they have been reclassified from accumulated net realized losses to paid-in capital.

The fund used a tax accounting practice to treat a portion of the price of capital shares redeemed during the year as distributions from realized capital gains. Accordingly, the fund has reclassified $6,934,000 from accumulated net realized gains to paid-in capital.

The fund used capital loss carryforwards of $2,302,000 to offset taxable capital gains realized during the year ended December 31, 2015, reducing the amount of capital gains that would otherwise be available to distribute to shareholders.

At December 31, 2015, the cost of investment securities for tax purposes was $42,875,251,000. Net unrealized depreciation of investment securities for tax purposes was $164,538,000, consisting of unrealized gains of $47,785,000 on securities that had risen in value since their purchase and $212,323,000 in unrealized losses on securities that had fallen in value since their purchase.

E. During the year ended December 31, 2015, the fund purchased $3,430,703,000 of investment securities and sold $3,210,366,000 of investment securities, other than U.S. government securities and temporary cash investments. Purchases and sales of U.S. government securities were

29

Short-Term Bond Index Fund

$19,652,508,000 and $17,532,454,000, respectively. Total purchases and sales include $3,123,497,000 and $1,315,239,000, respectively, in connection with in-kind purchases and redemptions of the fund’s capital shares.

F. Capital share transactions for each class of shares were:

| Year Ended December 31, | ||||

| 2015 | 2014 | |||

| Amount | Shares | Amount | Shares | |

| ($000) | (000) | ($000) | (000) | |

| Investor Shares | ||||

| Issued | 656,917 | 62,463 | 734,113 | 69,806 |

| Issued in Lieu of Cash Distributions | 28,303 | 2,692 | 30,025 | 2,855 |

| Redeemed | (1,035,745) | (98,434) | (1,099,778) | (104,595) |

| Net Increase (Decrease)—Investor Shares | (350,525) | (33,279) | (335,640) | (31,934) |

| ETF Shares | ||||

| Issued | 3,163,771 | 39,500 | 2,741,125 | 34,200 |

| Issued in Lieu of Cash Distributions | — | — | — | — |

| Redeemed | (1,331,579) | (16,600) | (1,002,349) | (12,500) |

| Net Increase (Decrease) —ETF Shares | 1,832,192 | 22,900 | 1,738,776 | 21,700 |

| Admiral Shares | ||||

| Issued1 | 5,402,211 | 513,722 | 10,637,578 | 1,009,964 |

| Issued in Lieu of Cash Distributions | 169,734 | 16,145 | 94,252 | 8,968 |

| Redeemed | (4,045,742) | (384,837) | (2,511,645) | (238,842) |

| Net Increase (Decrease)—Admiral Shares | 1,526,203 | 145,030 | 8,220,185 | 780,090 |

| Signal Shares | ||||

| Issued | — | — | 1,694,734 | 161,120 |

| Issued in Lieu of Cash Distributions | — | — | 29,645 | 2,818 |

| Redeemed1 | — | — | (8,796,295) | (834,734) |

| Net Increase (Decrease)—Signal Shares | — | — | (7,071,916) | (670,796) |

| Institutional Shares | ||||

| Issued | 2,055,471 | 195,516 | 2,459,196 | 233,839 |

| Issued in Lieu of Cash Distributions | 58,533 | 5,567 | 52,456 | 4,989 |

| Redeemed | (2,091,243) | (198,930) | (1,282,877) | (122,048) |

| Net Increase (Decrease) —Institutional Shares | 22,761 | 2,153 | 1,228,775 | 116,780 |

| Institutional Plus Shares | ||||

| Issued | 1,442,064 | 137,165 | 1,249,032 | 118,811 |

| Issued in Lieu of Cash Distributions | 39,926 | 3,799 | 27,262 | 2,593 |

| Redeemed | (475,158) | (45,207) | (626,532) | (59,603) |

| Net Increase (Decrease) —Institutional Plus Shares | 1,006,832 | 95,757 | 649,762 | 61,801 |

| 1 Admiral Shares Issued and Signal Shares Redeemed include $6,737,297,000 from the conversion of Signal Shares to Admiral Shares during the 2014 fiscal year. | ||||

G. Management has determined that no material events or transactions occurred subsequent to December 31, 2015, that would require recognition or disclosure in these financial statements.

30

Intermediate-Term Bond Index Fund

Fund Profile

As of December 31, 2015

| Share-Class Characteristics | |||||

| Investor | Admiral | Institutional | Institutional | ||

| Shares | ETF Shares | Shares | Shares | Plus Shares | |

| Ticker Symbol | VBIIX | BIV | VBILX | VBIMX | VBIUX |

| Expense Ratio1 | 0.20% | 0.10% | 0.10% | 0.07% | 0.05% |

| 30-Day SEC Yield | 2.66% | 2.67% | 2.69% | 2.73% | 2.77% |

| Financial Attributes | |||

| Barclays | |||

| 5–10 Year | |||

| Gov/ | Barclays | ||

| Credit | Aggregate | ||

| Float Adj | Float Adj | ||

| Fund | Index | Index | |

| Number of Bonds | 1,824 | 2,106 | 9,681 |

| Yield to Maturity | |||

| (before expenses) | 2.8% | 2.9% | 2.6% |

| Average Coupon | 3.0% | 3.0% | 3.1% |

| Average Duration | 6.5 years | 6.5 years | 5.8 years |

| Average Effective | |||

| Maturity | 7.2 years | 7.2 years | 7.9 years |

| Short-Term | |||

| Reserves | 1.0% | — | — |

| Sector Diversification (% of portfolio) | |

| Finance | 12.6% |

| Foreign | 6.6 |

| Industrial | 25.2 |

| Treasury/Agency | 53.5 |

| Utilities | 2.0 |

| Other | 0.1 |

The agency and mortgage-backed securities sectors may include issues from government-sponsored enterprises; such issues are generally not backed by the full faith and credit of the U.S. government.

| Volatility Measures | ||

| Barclays | ||

| 5–10 Year | ||

| Gov/ | ||

| Credit | Barclays | |

| Float Adj | Aggregate Float | |

| Index | Adj Index | |

| R-Squared | 0.99 | 0.97 |

| Beta | 1.03 | 1.47 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

| Distribution by Credit Quality (% of portfolio) | |

| U.S. Government | 53.3% |

| Aaa | 3.1 |

| Aa | 4.3 |

| A | 15.5 |

| Baa | 23.7 |

| Less Than Baa | 0.1 |

Credit-quality ratings are obtained from Barclays and are from Moody's, Fitch, and S&P. When ratings from all three agencies are

used, the median rating is shown. When ratings from two of the agencies are used, the lower rating for each issue is shown. "Not

Rated" is used to classify securities for which a rating is not available. Not rated securities include a fund's investment in

Vanguard Market Liquidity Fund or Vanguard Municipal Cash Management Fund, each of which invests in high-quality money

market instruments and may serve as a cash management vehicle for the Vanguard funds, trusts, and accounts. For more information

about these ratings, see the Glossary entry for Credit Quality.

| Distribution by Effective Maturity | |

| (% of portfolio) | |

| Under 1 Year | 0.2% |

| 1 - 3 Years | 0.1 |

| 3 - 5 Years | 2.1 |

| 5 - 10 Years | 97.5 |

| 10 - 20 Years | 0.1 |

1 The expense ratios shown are from the prospectus dated April 28, 2015, and represent estimated costs for the current fiscal year. For the fiscal

year ended December 31, 2015, the expense ratios were 0.16% for Investor Shares, 0.09% for ETF Shares, 0.09% for Admiral Shares, 0.06% for

Institutional Shares, and 0.04% for Institutional Plus Shares.

31

Intermediate-Term Bond Index Fund

Investment Focus

32

Intermediate-Term Bond Index Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

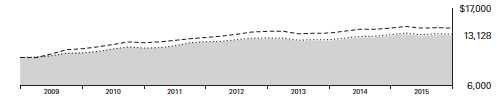

Cumulative Performance: December 31, 2005, Through December 31, 2015

Initial Investment of $10,000

| Average Annual Total Returns | |||||

| Periods Ended December 31, 2015 | |||||

| Final Value | |||||

| One | Five | Ten | of a $10,000 | ||

| Year | Years | Years | Investment | ||