UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSRS

Investment Company Act file number: 811-04670

Deutsche DWS Global/International Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

875 Third Avenue

New York, NY 10022-6225

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 454-4500

Diane Kenneally

100 Summer Street

Boston, MA 02110

(Name and Address of Agent for Service)

| Date of fiscal year end: | 8/31 |

| Date of reporting period: | 2/28/2022 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

| (a) | |

| 2 | | | DWS International Growth Fund |

| DWS International Growth Fund | | | 3 |

| Performance Summary | February 28, 2022 (Unaudited) |

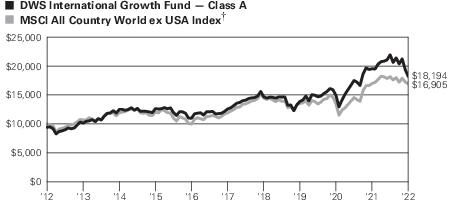

| Class A | 6-Month ‡ | 1-Year | 5-Year | 10-Year |

| Average Annual Total Returns as of 2/28/22 | ||||

| Unadjusted for Sales Charge | –17.06% | –6.86% | 7.67% | 6.80% |

| Adjusted

for the Maximum Sales Charge (max 5.75% load) |

–21.83% | –12.21% | 6.40% | 6.17% |

| MSCI All Country World ex USA Index† | –6.95% | –0.40% | 7.26% | 5.39% |

| Average Annual Total Returns as of 12/31/21 (most recent calendar quarter end) | ||||

| Unadjusted for Sales Charge | 7.89% | 12.38% | 9.85% | |

| Adjusted

for the Maximum Sales Charge (max 5.75% load) |

1.69% | 11.05% | 9.20% | |

| MSCI All Country World ex USA Index† | 7.82% | 9.61% | 7.28% | |

| Class C | 6-Month ‡ | 1-Year | 5-Year | 10-Year |

| Average Annual Total Returns as of 2/28/22 | ||||

| Unadjusted for Sales Charge | –17.39% | –7.59% | 6.85% | 5.99% |

| Adjusted

for the Maximum Sales Charge (max 1.00% CDSC) |

–18.19% | –7.59% | 6.85% | 5.99% |

| MSCI All Country World ex USA Index† | –6.95% | –0.40% | 7.26% | 5.39% |

| Average Annual Total Returns as of 12/31/21 (most recent calendar quarter end) | ||||

| Unadjusted for Sales Charge | 7.01% | 11.53% | 9.02% | |

| Adjusted

for the Maximum Sales Charge (max 1.00% CDSC) |

7.01% | 11.53% | 9.02% | |

| MSCI All Country World ex USA Index† | 7.82% | 9.61% | 7.28% | |

| Class R | 6-Month ‡ | 1-Year | 5-Year | 10-Year |

| Average Annual Total Returns as of 2/28/22 | ||||

| No Sales Charges | –17.19% | –7.15% | 7.37% | 6.51% |

| MSCI All Country World ex USA Index† | –6.95% | –0.40% | 7.26% | 5.39% |

| Average Annual Total Returns as of 12/31/21 (most recent calendar quarter end) | ||||

| No Sales Charges | 7.56% | 12.07% | 9.56% | |

| MSCI All Country World ex USA Index† | 7.82% | 9.61% | 7.28% | |

| 4 | | | DWS International Growth Fund |

| Class R6 | 6-Month ‡ | 1-Year | 5-Year | Life

of Class* |

| Average Annual Total Returns as of 2/28/22 | ||||

| No Sales Charges | –16.92% | –6.52% | 8.07% | 7.97% |

| MSCI All Country World ex USA Index† | –6.95% | –0.40% | 7.26% | 7.95% |

| Average Annual Total Returns as of 12/31/21 (most recent calendar quarter end) | ||||

| No Sales Charges | 8.27% | 12.80% | 11.23% | |

| MSCI All Country World ex USA Index† | 7.82% | 9.61% | 9.32% | |

| Class S | 6-Month ‡ | 1-Year | 5-Year | 10-Year |

| Average Annual Total Returns as of 2/28/22 | ||||

| No Sales Charges | –16.93% | –6.57% | 7.99% | 7.09% |

| MSCI All Country World ex USA Index† | –6.95% | –0.40% | 7.26% | 5.39% |

| Average Annual Total Returns as of 12/31/21 (most recent calendar quarter end) | ||||

| No Sales Charges | 8.19% | 12.71% | 10.15% | |

| MSCI All Country World ex USA Index† | 7.82% | 9.61% | 7.28% | |

| Institutional Class | 6-Month ‡ | 1-Year | 5-Year | 10-Year |

| Average Annual Total Returns as of 2/28/22 | ||||

| No Sales Charges | –16.95% | –6.60% | 8.02% | 7.12% |

| MSCI All Country World ex USA Index† | –6.95% | –0.40% | 7.26% | 5.39% |

| Average Annual Total Returns as of 12/31/21 (most recent calendar quarter end) | ||||

| No Sales Charges | 8.16% | 12.75% | 10.18% | |

| MSCI All Country World ex USA Index† | 7.82% | 9.61% | 7.28% | |

| DWS International Growth Fund | | | 5 |

| * | Class R6 shares commenced operations on June 1, 2016. |

| † | The Morgan Stanley Capital International (MSCI) All Country World ex USA Index is an unmanaged equity index which captures large and mid-capitalization representation across 22 of 23 developed markets countries excluding the U.S. and 26 emerging markets countries. It covers approximately 85% of the global equity opportunity set outside of the U.S. |

| ‡ | Total returns shown for periods less than one year are not annualized. |

| 6 | | | DWS International Growth Fund |

| Class A | Class C | Class R | Class R6 | Class S | Institutional

Class | |

| Net Asset Value | ||||||

| 2/28/22 | $40.84 | $38.39 | $40.56 | $40.81 | $40.81 | $40.80 |

| 8/31/21 | $50.93 | $47.72 | $50.50 | $50.99 | $50.96 | $50.96 |

| Distribution Information as of 2/28/22 | ||||||

| Income Dividends, Six Months | $ .86 | $ .43 | $ .70 | $ 1.03 | $ 1.00 | $ 1.00 |

| Capital Gain Distributions | $ .76 | $ .76 | $ .76 | $ .76 | $ .76 | $ .76 |

| DWS International Growth Fund | | | 7 |

| 8 | | | DWS International Growth Fund |

| Portfolio Summary | (Unaudited) |

| Asset Allocation (As a % of Investment Portfolio excluding Securities Lending Collateral) | 2/28/22 | 8/31/21 |

| Common Stocks | 97% | 98% |

| Cash Equivalents | 1% | 0% |

| Preferred Stocks | 1% | 1% |

| Other Investments | 1% | 1% |

| 100% | 100% |

| Sector

Diversification (As a % of Investment Portfolio excluding Securities Lending Collateral and Cash Equivalents) |

2/28/22 | 8/31/21 |

| Information Technology | 24% | 26% |

| Industrials | 21% | 20% |

| Financials | 16% | 13% |

| Health Care | 13% | 14% |

| Consumer Discretionary | 8% | 9% |

| Consumer Staples | 6% | 6% |

| Materials | 6% | 6% |

| Communication Services | 4% | 4% |

| Energy | 2% | 2% |

| 100% | 100% |

| Geographical Diversification (As a % of Investment Portfolio excluding Securities Lending Collateral and Cash Equivalents) | 2/28/22 | 8/31/21 |

| Germany | 13% | 14% |

| France | 12% | 11% |

| Netherlands | 10% | 9% |

| Japan | 9% | 10% |

| Switzerland | 9% | 8% |

| Canada | 8% | 8% |

| United States | 7% | 8% |

| China | 5% | 5% |

| Ireland | 5% | 4% |

| Argentina | 4% | 3% |

| United Kingdom | 3% | 3% |

| Singapore | 3% | 2% |

| Taiwan | 3% | 2% |

| Korea | 2% | 2% |

| Sweden | 2% | 3% |

| Hong Kong | 2% | 2% |

| Brazil | 1% | 3% |

| Other | 2% | 3% |

| 100% | 100% |

| DWS International Growth Fund | | | 9 |

| Ten

Largest Equity Holdings at February 28, 2022 (27.6% of Net Assets) |

Country | Percent |

| 1 Brookfield Asset Management, Inc. | Canada | 4.3% |

| Asset management company focused on the real estate and power generation sectors | ||

| 2 Globant SA | Argentina | 3.1% |

| Provider of engineering, design and innovation services | ||

| 3 Lonza Group AG | Switzerland | 3.0% |

| Producer of chemicals and plastics | ||

| 4 LVMH Moet Hennessy Louis Vuitton SE | France | 2.8% |

| Diversified luxury goods group | ||

| 5 Nestle SA | Switzerland | 2.7% |

| Multinational company that markets a wide range of food products | ||

| 6 DBS Group Holdings Ltd. | Singapore | 2.7% |

| Provider of banking and financing services | ||

| 7 Taiwan Semiconductor Manufacturing Co., Ltd. | Taiwan | 2.6% |

| Manufacturer of integrated circuits and other semiconductor devices | ||

| 8 Experian PLC | Ireland | 2.2% |

| Provider of credit and marketing services | ||

| 9 Teleperformance | France | 2.1% |

| Provider of customer relationship management services | ||

| 10 Deutsche Boerse AG | Germany | 2.1% |

| Provider of financial services |

| 10 | | | DWS International Growth Fund |

| Investment Portfolio | as of February 28, 2022 (Unaudited) |

| Shares | Value ($) | ||

| Common Stocks 97.0% | |||

| Argentina 3.5% | |||

| Globant SA* | 60,326 | 16,529,324 | |

| MercadoLibre, Inc.* | 2,140 | 2,411,031 | |

| (Cost $6,452,640) | 18,940,355 | ||

| Brazil 0.8% | |||

| Magazine Luiza SA | 1,047,365 | 1,213,093 | |

| Pagseguro Digital Ltd. “A” * (a) (b) | 181,184 | 2,888,073 | |

| (Cost $9,106,862) | 4,101,166 | ||

| Canada 8.5% | |||

| Agnico Eagle Mines Ltd. | 116,500 | 5,885,203 | |

| Alimentation Couche-Tard, Inc. | 153,630 | 6,030,053 | |

| Brookfield Asset Management, Inc. “A” | 420,000 | 22,953,373 | |

| Canadian National Railway Co. | 77,659 | 9,634,005 | |

| Nuvei Corp. 144A* | 19,513 | 1,059,321 | |

| (Cost $20,127,689) | 45,561,955 | ||

| China 5.0% | |||

| Alibaba Group Holding Ltd. (ADR)* | 40,000 | 4,207,600 | |

| ANTA Sports Products Ltd. | 135,000 | 2,054,040 | |

| Dada Nexus Ltd. (ADR)* | 17,597 | 146,231 | |

| JD.com, Inc. “A” * | 8,433 | 301,294 | |

| Minth Group Ltd. | 490,633 | 1,764,234 | |

| Ping An Insurance (Group) Co. of China Ltd. “H” | 1,155,500 | 8,931,001 | |

| Tencent Holdings Ltd. | 177,100 | 9,545,533 | |

| (Cost $22,828,362) | 26,949,933 | ||

| France 11.8% | |||

| Capgemini SE | 38,900 | 8,213,008 | |

| Cie de Saint-Gobain | 70,000 | 4,391,375 | |

| LVMH Moet Hennessy Louis Vuitton SE | 19,899 | 14,723,522 | |

| Orpea SA | 34,880 | 1,448,604 | |

| Schneider Electric SE | 29,120 | 4,563,928 | |

| Teleperformance | 30,605 | 11,389,430 | |

| TotalEnergies SE | 188,000 | 9,610,142 | |

| Vinci SA | 86,539 | 9,171,448 | |

| (Cost $42,531,176) | 63,511,457 | ||

| Germany 12.2% | |||

| adidas AG | 10,230 | 2,432,295 | |

| DWS International Growth Fund | | | 11 |

| Shares | Value ($) | ||

| Allianz SE (Registered) | 44,250 | 10,086,790 | |

| Auto1 Group SE 144A* | 89,671 | 1,298,520 | |

| BASF SE | 62,200 | 4,132,198 | |

| Brenntag SE | 51,200 | 4,298,710 | |

| Deutsche Boerse AG | 64,400 | 11,026,235 | |

| Deutsche Post AG (Registered) | 104,600 | 5,296,488 | |

| Evonik Industries AG | 200,920 | 6,057,819 | |

| Evotec SE* | 127,160 | 3,784,023 | |

| KION Group AG | 22,399 | 1,812,289 | |

| SAP SE | 54,500 | 6,191,474 | |

| TeamViewer AG 144A* | 225,823 | 3,637,275 | |

| Wacker Chemie AG | 15,000 | 2,333,601 | |

| Zalando SE 144A* | 42,500 | 2,839,172 | |

| (Cost $71,136,656) | 65,226,889 | ||

| Hong Kong 1.7% | |||

| Techtronic Industries Co., Ltd. (Cost $1,510,155) | 543,501 | 9,076,201 | |

| Ireland 4.6% | |||

| Experian PLC | 302,500 | 11,902,228 | |

| ICON PLC* (c) | 21,000 | 4,998,210 | |

| Kerry Group PLC “A” | 64,070 | 7,629,245 | |

| (Cost $15,168,392) | 24,529,683 | ||

| Israel 0.8% | |||

| Kornit Digital Ltd.* (c) (Cost $4,870,219) | 47,000 | 4,457,010 | |

| Japan 8.8% | |||

| Daikin Industries Ltd. | 48,200 | 8,890,367 | |

| Fast Retailing Co., Ltd. | 7,300 | 3,926,056 | |

| Hoya Corp. | 75,100 | 9,703,914 | |

| Keyence Corp. | 19,600 | 9,168,773 | |

| Lasertec Corp. | 15,500 | 2,809,725 | |

| MISUMI Group, Inc. | 122,489 | 3,904,859 | |

| Shimadzu Corp. | 139,900 | 4,995,342 | |

| Shiseido Co., Ltd. | 64,200 | 3,666,657 | |

| (Cost $29,001,623) | 47,065,693 | ||

| Korea 2.1% | |||

| LG Chem Ltd. | 2,850 | 1,339,252 | |

| Samsung Electronics Co., Ltd. | 166,742 | 9,998,834 | |

| (Cost $9,609,744) | 11,338,086 | ||

| Luxembourg 1.0% | |||

| Eurofins Scientific SE (Cost $2,952,290) | 53,700 | 5,451,514 | |

| 12 | | | DWS International Growth Fund |

| Shares | Value ($) | ||

| Netherlands 9.6% | |||

| Adyen NV 144A* | 2,810 | 5,874,187 | |

| Airbus SE* | 37,000 | 4,766,769 | |

| ASML Holding NV | 16,335 | 10,969,221 | |

| ING Groep NV | 534,868 | 6,295,866 | |

| Koninklijke DSM NV | 38,880 | 7,293,308 | |

| Koninklijke Philips NV | 129,784 | 4,415,085 | |

| NXP Semiconductors NV (c) | 28,000 | 5,323,360 | |

| Prosus NV | 40,959 | 2,545,178 | |

| Universal Music Group NV | 170,665 | 3,890,310 | |

| (Cost $42,144,831) | 51,373,284 | ||

| Singapore 2.7% | |||

| DBS Group Holdings Ltd. (Cost $9,088,308) | 582,600 | 14,533,844 | |

| Sweden 2.1% | |||

| Assa Abloy AB “B” | 126,600 | 3,362,759 | |

| Hexagon AB “B” | 243,873 | 3,314,839 | |

| Spotify Technology SA* (a) | 28,000 | 4,373,320 | |

| (Cost $8,954,817) | 11,050,918 | ||

| Switzerland 8.5% | |||

| Alcon, Inc. | 20,948 | 1,623,578 | |

| Lonza Group AG (Registered) | 23,397 | 16,261,310 | |

| Nestle SA (Registered) | 112,558 | 14,700,902 | |

| Roche Holding AG (Genusschein) | 24,309 | 9,273,257 | |

| Sportradar Holding AG “A” * (b) (c) | 100,000 | 1,465,000 | |

| Zur Rose Group AG* | 13,100 | 2,294,036 | |

| (Cost $23,041,921) | 45,618,083 | ||

| Taiwan 2.6% | |||

| Taiwan Semiconductor Manufacturing Co., Ltd. (Cost $3,898,944) | 644,000 | 13,768,641 | |

| United Kingdom 3.4% | |||

| Clarivate PLC* (a) (b) | 232,000 | 3,475,360 | |

| Farfetch Ltd. “A” * (a) | 87,700 | 1,670,685 | |

| Halma PLC | 127,243 | 4,115,493 | |

| Rentokil Initial PLC | 1,250,000 | 8,515,174 | |

| VTEX “A” * (a) (b) | 67,294 | 539,698 | |

| (Cost $20,005,745) | 18,316,410 | ||

| United States 7.3% | |||

| Activision Blizzard, Inc. | 47,700 | 3,887,550 | |

| EPAM Systems, Inc.* | 25,000 | 5,193,750 | |

| Marsh & McLennan Companies, Inc. | 53,393 | 8,297,806 | |

| DWS International Growth Fund | | | 13 |

| Shares | Value ($) | ||

| MasterCard, Inc. “A” | 17,570 | 6,339,608 | |

| NVIDIA Corp. | 29,065 | 7,087,500 | |

| Schlumberger NV | 83,604 | 3,280,621 | |

| Thermo Fisher Scientific, Inc. | 9,640 | 5,244,160 | |

| (Cost $14,640,206) | 39,330,995 | ||

| Total Common Stocks (Cost $357,070,580) | 520,202,117 | ||

| Preferred Stocks 1.0% | |||

| Germany | |||

| Sartorius AG (Cost $2,977,318) | 11,944 | 5,279,208 | |

| Other Investments 0.7% | |||

| Brazil | |||

| Companhia Vale do Rio Doce (Cost $0) | 389,000 | 3,885,393 | |

| Securities Lending Collateral 1.6% | |||

| DWS Government & Agency Securities Portfolio “DWS Government Cash Institutional Shares” , 0.01% (d) (e) (Cost $8,591,199) | 8,591,199 | 8,591,199 | |

| Cash Equivalents 1.1% | |||

| DWS Central Cash Management Government Fund, 0.06% (d) (Cost $6,012,087) | 6,012,087 | 6,012,087 | |

| %

of Net Assets |

Value ($) | ||

| Total Investment Portfolio (Cost $374,651,184) | 101.4 | 543,970,004 | |

| Other Assets and Liabilities, Net | (1.4) | (7,606,887) | |

| Net Assets | 100.0 | 536,363,117 |

| 14 | | | DWS International Growth Fund |

| Value

($) at 8/31/2021 |

Pur-

chases Cost ($) |

Sales

Proceeds ($) |

Net

Real- ized Gain/ (Loss) ($) |

Net

Change in Unreal- ized Appreci- ation (Depreci- ation) ($) |

Income

($) |

Capital

Gain Distri- butions ($) |

Number

of Shares at 2/28/2022 |

Value

($) at 2/28/2022 |

| Securities Lending Collateral 1.6% | ||||||||

| DWS Government & Agency Securities Portfolio “DWS Government Cash Institutional Shares” , 0.01% (d) (e) | ||||||||

| 9,366,274 | — | 775,075 (f) | — | — | 411,101 | — | 8,591,199 | 8,591,199 |

| Cash Equivalents 1.1% | ||||||||

| DWS Central Cash Management Government Fund, 0.06% (d) | ||||||||

| 2,873,460 | 43,926,064 | 40,787,437 | — | — | 984 | — | 6,012,087 | 6,012,087 |

| 12,239,734 | 43,926,064 | 41,562,512 | — | — | 412,085 | — | 14,603,286 | 14,603,286 |

| * | Non-income producing security. |

| (a) | Listed on the New York Stock Exchange. |

| (b) | All or a portion of these securities were on loan. In addition, “Other Assets and Liabilities, Net” may include pending sales that are also on loan. The value of securities loaned at February 28, 2022 amounted to $8,281,707, which is 1.5% of net assets. |

| (c) | Listed on the NASDAQ Stock Market, Inc. |

| (d) | Affiliated fund managed by DWS Investment Management Americas, Inc. The rate shown is the annualized seven-day yield at period end. |

| (e) | Represents cash collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates. |

| (f) | Represents the net increase (purchase cost) or decrease (sales proceeds) in the amount invested in cash collateral for the period ended February 28, 2022. |

| 144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| ADR: American Depositary Receipt |

| DWS International Growth Fund | | | 15 |

| Assets | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks | ||||

| Argentina | $ 18,940,355 | $ — | $— | $ 18,940,355 |

| Brazil | 2,888,073 | 1,213,093 | — | 4,101,166 |

| Canada | 45,561,955 | — | — | 45,561,955 |

| China | 26,949,933 | — | — | 26,949,933 |

| France | 63,511,457 | — | — | 63,511,457 |

| Germany | 65,226,889 | — | — | 65,226,889 |

| Hong Kong | 9,076,201 | — | — | 9,076,201 |

| Ireland | 24,529,683 | — | — | 24,529,683 |

| Israel | 4,457,010 | — | — | 4,457,010 |

| Japan | 47,065,693 | — | — | 47,065,693 |

| Korea | 11,338,086 | — | — | 11,338,086 |

| Luxembourg | 5,451,514 | — | — | 5,451,514 |

| Netherlands | 51,373,284 | — | — | 51,373,284 |

| Singapore | 14,533,844 | — | — | 14,533,844 |

| Sweden | 11,050,918 | — | — | 11,050,918 |

| Switzerland | 45,618,083 | — | — | 45,618,083 |

| Taiwan | — | 13,768,641 | — | 13,768,641 |

| United Kingdom | 18,316,410 | — | — | 18,316,410 |

| United States | 39,330,995 | — | — | 39,330,995 |

| Preferred Stocks | 5,279,208 | — | — | 5,279,208 |

| Other Investments | 3,885,393 | — | — | 3,885,393 |

| Short-Term Investments (a) | 14,603,286 | — | — | 14,603,286 |

| Total | $528,988,270 | $14,981,734 | $ — | $543,970,004 |

| (a) | See Investment Portfolio for additional detailed categorizations. |

| 16 | | | DWS International Growth Fund |

| Assets | |

| Investments in non-affiliated securities, at value (cost $360,047,898) — including $8,281,707 of securities loaned | $ 529,366,718 |

| Investment in DWS Government & Agency Securities Portfolio (cost $8,591,199)* | 8,591,199 |

| Investment in DWS Central Cash Management Government Fund (cost $6,012,087) | 6,012,087 |

| Foreign currency, at value (cost $125,048) | 124,519 |

| Receivable for investments sold | 962,315 |

| Receivable for Fund shares sold | 18,313 |

| Dividends receivable | 155,064 |

| Interest receivable | 1,580 |

| Foreign taxes recoverable | 759,677 |

| Other assets | 56,386 |

| Total assets | 546,047,858 |

| Liabilities | |

| Payable upon return of securities loaned | 8,591,199 |

| Payable for investments purchased | 492,289 |

| Payable for Fund shares redeemed | 54,682 |

| Accrued management fee | 267,279 |

| Accrued Directors' fees | 3,208 |

| Other accrued expenses and payables | 276,084 |

| Total liabilities | 9,684,741 |

| Net assets, at value | $ 536,363,117 |

| Net Assets Consist of | |

| Distributable earnings (loss) | 179,017,321 |

| Paid-in capital | 357,345,796 |

| Net assets, at value | $ 536,363,117 |

| * | Represents collateral on securities loaned. |

| DWS International Growth Fund | | | 17 |

| Net Asset Value | |

| Class A | |

| Net

Asset Value and redemption price per share ($42,438,255 ÷ 1,039,154 shares of capital stock outstanding, $.01 par value, 50,000,000 shares authorized) |

$ 40.84 |

| Maximum offering price per share (100 ÷ 94.25 of $40.84) | $ 43.33 |

| Class C | |

| Net

Asset Value, offering and redemption price (subject to contingent deferred sales charge) per share ($700,822 ÷ 18,256 shares of capital stock outstanding, $.01 par value, 20,000,000 shares authorized) |

$ 38.39 |

| Class R | |

| Net

Asset Value, offering and redemption price per share ($1,095,327 ÷ 27,004 shares of capital stock outstanding, $.01 par value, 50,000,000 shares authorized) |

$ 40.56 |

| Class R6 | |

| Net

Asset Value, offering and redemption price per share ($15,532 ÷ 381 shares of capital stock outstanding, $.01 par value, 50,000,000 shares authorized)** |

$ 40.81 |

| Class S | |

| Net

Asset Value, offering and redemption price per share ($484,303,232 ÷ 11,868,536 shares of capital stock outstanding, $.01 par value, 100,000,000 shares authorized) |

$ 40.81 |

| Institutional Class | |

| Net

Asset Value, offering and redemption price per share ($7,809,949 ÷ 191,402 shares of capital stock outstanding, $.01 par value, 100,000,000 shares authorized) |

$ 40.80 |

| ** | Net asset value and redemption price per share may not recalculate due to rounding of net assets and/or shares outstanding. |

| 18 | | | DWS International Growth Fund |

| Investment Income | |

| Income: | |

| Dividends (net of foreign taxes withheld of $306,566) | $ 2,490,151 |

| Income distributions — DWS Central Cash Management Government Fund | 984 |

| Non cash dividends | 307,576 |

| Securities lending income, net of borrower rebates | 411,101 |

| Total income | 3,209,812 |

| Expenses: | |

| Management fee | 1,917,239 |

| Administration fee | 299,955 |

| Services to shareholders | 397,320 |

| Distribution and service fees | 68,007 |

| Custodian fee | 28,362 |

| Professional fees | 50,388 |

| Reports to shareholders | 23,967 |

| Registration fees | 38,259 |

| Directors' fees and expenses | 10,270 |

| Other | 22,023 |

| Total expenses before expense reductions | 2,855,790 |

| Expense reductions | (378) |

| Total expenses after expense reductions | 2,855,412 |

| Net investment income | 354,400 |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) from: | |

| Investments | 19,895,113 |

| Foreign currency | (99,306) |

| 19,795,807 | |

| Change in net unrealized appreciation (depreciation) on: | |

| Investments | (131,089,246) |

| Foreign currency | (3,178) |

| (131,092,424) | |

| Net gain (loss) | (111,296,617) |

| Net increase (decrease) in net assets resulting from operations | $ (110,942,217) |

| DWS International Growth Fund | | | 19 |

| Six

Months Ended February 28, 2022 |

Year

Ended August 31, | |

| Increase (Decrease) in Net Assets | (Unaudited) | 2021 |

| Operations: | ||

| Net investment income | $ 354,400 | $ 2,439,134 |

| Net realized gain (loss) | 19,795,807 | 20,250,278 |

| Change

in net unrealized appreciation (depreciation) |

(131,092,424) | 119,174,338 |

| Net increase (decrease) in net assets resulting from operations | (110,942,217) | 141,863,750 |

| Distributions to shareholders: | ||

| Class A | (1,659,685) | (259,087) |

| Class C | (24,396) | — |

| Class R | (36,918) | (6,100) |

| Class R6 | (659) | (149) |

| Class S | (20,556,454) | (4,569,462) |

| Institutional Class | (326,738) | (65,052) |

| Total distributions | (22,604,850) | (4,899,850) |

| Fund share transactions: | ||

| Proceeds from shares sold | 4,389,608 | 11,309,683 |

| Reinvestment of distributions | 21,198,833 | 4,611,930 |

| Payments for shares redeemed | (27,858,036) | (53,993,269) |

| Net increase (decrease) in net assets from Fund share transactions | (2,269,595) | (38,071,656) |

| Increase (decrease) in net assets | (135,816,662) | 98,892,244 |

| Net assets at beginning of period | 672,179,779 | 573,287,535 |

| Net assets at end of period | $ 536,363,117 | $672,179,779 |

| 20 | | | DWS International Growth Fund |

| DWS International Growth Fund — Class A | ||||||

| Six

Months Ended 2/28/22 |

Years Ended August 31, | |||||

| (Unaudited) | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per Share Data | ||||||

| Net asset value, beginning of period | $50.93 | $40.84 | $34.50 | $34.79 | $33.55 | $28.76 |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)a | (.04) | .06 | .26 | .24 | .26 | .04 |

| Net realized and unrealized gain (loss) | (8.43) | 10.26 | 6.35 | (.25) | 1.05 | 4.75 |

| Total from investment operations | (8.47) | 10.32 | 6.61 | (.01) | 1.31 | 4.79 |

| Less distributions from: | ||||||

| Net investment income | (.86) | (.23) | (.27) | (.28) | (.07) | — |

| Net realized gains | (.76) | — | — | — | — | — |

| Total distributions | (1.62) | (.23) | (.27) | (.28) | (.07) | — |

| Redemption fees | — | — | — | — | — | .00 * |

| Net asset value, end of period | $40.84 | $50.93 | $40.84 | $34.50 | $34.79 | $33.55 |

| Total Return (%)b | (17.06) ** | 25.35 | 19.22 c | .16 c | 3.91 c | 16.66 c |

| Ratios to Average Net Assets and Supplemental Data | ||||||

| Net assets, end of period ($ millions) | 42 | 53 | 47 | 46 | 55 | 51 |

| Ratio

of expenses before expense reductions (%) |

1.19 *** | 1.19 | 1.22 | 1.24 | 1.26 | 1.53 |

| Ratio

of expenses after expense reductions (%) |

1.19 *** | 1.19 | 1.22 | 1.24 | 1.25 | 1.40 |

| Ratio of net investment income (loss) (%) | (.15) *** | .13 | .72 | .73 | .73 | .14 |

| Portfolio turnover rate (%) | 4 ** | 15 | 13 | 12 | 73 | 68 |

| a | Based on average shares outstanding during the period. |

| b | Total return does not reflect the effect of any sales charges. |

| c | Total return would have been lower had certain expenses not been reduced. |

| * | Amount is less than $.005. |

| ** | Not annualized |

| *** | Annualized |

| DWS International Growth Fund | | | 21 |

| DWS International Growth Fund — Class C | ||||||

| Six

Months Ended 2/28/22 |

Years Ended August 31, | |||||

| (Unaudited) | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per Share Data | ||||||

| Net asset value, beginning of period | $47.72 | $38.38 | $32.45 | $32.70 | $31.71 | $27.38 |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)a | (.21) | (.31) | (.00) * | (.02) | .01 | (.17) |

| Net realized and unrealized gain (loss) | (7.93) | 9.65 | 5.93 | (.16) | .98 | 4.50 |

| Total from investment operations | (8.14) | 9.34 | 5.93 | (.18) | .99 | 4.33 |

| Less distributions from: | ||||||

| Net investment income | (.43) | — | — | (.07) | — | — |

| Net realized gains | (.76) | — | — | — | — | — |

| Total distributions | (1.19) | — | — | (.07) | — | — |

| Redemption fees | — | — | — | — | — | .00 * |

| Net asset value, end of period | $38.39 | $47.72 | $38.38 | $32.45 | $32.70 | $31.71 |

| Total Return (%)b | (17.39) c** | 24.34 | 18.27 c | (.51) c | 3.12 c | 15.81 c |

| Ratios to Average Net Assets and Supplemental Data | ||||||

| Net assets, end of period ($ millions) | 1 | 1 | 2 | 3 | 4 | 15 |

| Ratio

of expenses before expense reductions (%) |

2.04 *** | 2.00 | 2.01 | 1.97 | 1.99 | 2.26 |

| Ratio

of expenses after expense reductions (%) |

2.00 *** | 2.00 | 2.01 | 1.96 | 1.98 | 2.15 |

| Ratio of net investment income (loss) (%) | (.96) *** | (.74) | (.01) | (.05) | .02 | (.60) |

| Portfolio turnover rate (%) | 4 ** | 15 | 13 | 12 | 73 | 68 |

| a | Based on average shares outstanding during the period. |

| b | Total return does not reflect the effect of any sales charges. |

| c | Total return would have been lower had certain expenses not been reduced. |

| * | Amount is less than $.005. |

| ** | Not annualized |

| *** | Annualized |

| 22 | | | DWS International Growth Fund |

| DWS International Growth Fund — Class R | ||||||

| Six

Months Ended 2/28/22 |

Years Ended August 31, | |||||

| (Unaudited) | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per Share Data | ||||||

| Net asset value, beginning of period | $50.50 | $40.51 | $34.23 | $34.50 | $33.30 | $28.62 |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)a | (.03) | (.10) | .17 | .15 | .15 | (.02) |

| Net realized and unrealized gain (loss) | (8.45) | 10.20 | 6.28 | (.22) | 1.05 | 4.70 |

| Total from investment operations | (8.48) | 10.10 | 6.45 | (.07) | 1.20 | 4.68 |

| Less distributions from: | ||||||

| Net investment income | (.70) | (.11) | (.17) | (.20) | — | — |

| Net realized gains | (.76) | — | — | — | — | — |

| Total distributions | (1.46) | (.11) | (.17) | (.20) | — | — |

| Redemption fees | — | — | — | — | — | .00 * |

| Net asset value, end of period | $40.56 | $50.50 | $40.51 | $34.23 | $34.50 | $33.30 |

| Total Return (%)b | (17.19) ** | 24.96 | 18.89 | (.07) | 3.60 | 16.35 |

| Ratios to Average Net Assets and Supplemental Data | ||||||

| Net assets, end of period ($ millions) | 1 | 2 | 2 | 3 | 3 | 4 |

| Ratio

of expenses before expense reductions (%) |

1.53 *** | 1.56 | 1.57 | 1.58 | 1.59 | 1.87 |

| Ratio

of expenses after expense reductions (%) |

1.50 *** | 1.51 | 1.50 | 1.49 | 1.53 | 1.64 |

| Ratio of net investment income (loss) (%) | (.14) *** | (.22) | .47 | .46 | .45 | (.06) |

| Portfolio turnover rate (%) | 4 ** | 15 | 13 | 12 | 73 | 68 |

| a | Based on average shares outstanding during the period. |

| b | Total return would have been lower had certain expenses not been reduced. |

| * | Amount is less than $.005. |

| ** | Not annualized |

| *** | Annualized |

| DWS International Growth Fund | | | 23 |

| DWS International Growth Fund — Class R6 | ||||||

| Six

Months Ended 2/28/22 |

Years Ended August 31, | |||||

| (Unaudited) | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per Share Data | ||||||

| Net asset value, beginning of period | $50.99 | $40.90 | $34.56 | $34.85 | $33.56 | $28.74 |

| Income (loss) from investment operations: | ||||||

| Net investment incomea | .05 | .23 | .39 | .31 | .44 | .13 |

| Net realized and unrealized gain (loss) | (8.44) | 10.27 | 6.37 | (.20) | 1.01 | 4.73 |

| Total from investment operations | (8.39) | 10.50 | 6.76 | .11 | 1.45 | 4.86 |

| Less distributions from: | ||||||

| Net investment income | (1.03) | (.41) | (.42) | (.40) | (.16) | (.04) |

| Net realized gains | (.76) | — | — | — | — | — |

| Total distributions | (1.79) | (.41) | (.42) | (.40) | (.16) | (.04) |

| Net asset value, end of period | $40.81 | $50.99 | $40.90 | $34.56 | $34.85 | $33.56 |

| Total Return (%)b | (16.92) * | 25.81 | 19.68 | .59 | 4.33 | 16.94 |

| Ratios to Average Net Assets and Supplemental Data | ||||||

| Net assets, end of period ($ thousands) | 16 | 19 | 15 | 12 | 63 | 12 |

| Ratio

of expenses before expense reductions (%) |

.93 ** | .95 | .97 | .98 | .89 | 1.32 |

| Ratio

of expenses after expense reductions (%) |

.83 ** | .83 | .83 | .83 | .84 | 1.14 |

| Ratio of net investment income (%) | .20 ** | .50 | 1.08 | .94 | 1.26 | .44 |

| Portfolio turnover rate (%) | 4 * | 15 | 13 | 12 | 73 | 68 |

| a | Based on average shares outstanding during the period. |

| b | Total return would have been lower had certain expenses not been reduced. |

| * | Not annualized |

| ** | Annualized |

| 24 | | | DWS International Growth Fund |

| DWS International Growth Fund — Class S | ||||||

| Six

Months Ended 2/28/22 |

Years Ended August 31, | |||||

| (Unaudited) | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per Share Data | ||||||

| Net asset value, beginning of period | $50.96 | $40.87 | $34.53 | $34.82 | $33.56 | $28.74 |

| Income (loss) from investment operations: | ||||||

| Net investment incomea | .03 | .19 | .36 | .34 | .36 | .13 |

| Net realized and unrealized gain (loss) | (8.42) | 10.27 | 6.36 | (.26) | 1.06 | 4.73 |

| Total from investment operations | (8.39) | 10.46 | 6.72 | .08 | 1.42 | 4.86 |

| Less distributions from: | ||||||

| Net investment income | (1.00) | (.37) | (.38) | (.37) | (.16) | (.04) |

| Net realized gains | (.76) | — | — | — | — | — |

| Total distributions | (1.76) | (.37) | (.38) | (.37) | (.16) | (.04) |

| Redemption fees | — | — | — | — | — | .00 * |

| Net asset value, end of period | $40.81 | $50.96 | $40.87 | $34.53 | $34.82 | $33.56 |

| Total Return (%) | (16.93) ** | 25.71 | 19.57 | .48 | 4.23 b | 16.94 b |

| Ratios to Average Net Assets and Supplemental Data | ||||||

| Net assets, end of period ($ millions) | 484 | 606 | 516 | 473 | 517 | 538 |

| Ratio

of expenses before expense reductions (%) |

.90 *** | .90 | .92 | .94 | .95 | 1.22 |

| Ratio

of expenses after expense reductions (%) |

.90 *** | .90 | .92 | .94 | .94 | 1.15 |

| Ratio of net investment income (%) | .14 *** | .42 | 1.01 | 1.04 | 1.04 | .41 |

| Portfolio turnover rate (%) | 4 ** | 15 | 13 | 12 | 73 | 68 |

| a | Based on average shares outstanding during the period. |

| b | Total return would have been lower had certain expenses not been reduced. |

| * | Amount is less than $.005. |

| ** | Not annualized |

| *** | Annualized |

| DWS International Growth Fund | | | 25 |

| DWS International Growth Fund — Institutional Class | ||||||

| Six

Months Ended 2/28/22 |

Years Ended August 31, | |||||

| (Unaudited) | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per Share Data | ||||||

| Net asset value, beginning of period | $50.96 | $40.87 | $34.55 | $34.85 | $33.58 | $28.75 |

| Income (loss) from investment operations: | ||||||

| Net investment incomea | .03 | .20 | .33 | .37 | .37 | .14 |

| Net realized and unrealized gain (loss) | (8.43) | 10.26 | 6.40 | (.28) | 1.08 | 4.74 |

| Total from investment operations | (8.40) | 10.46 | 6.73 | .09 | 1.45 | 4.88 |

| Less distributions from: | ||||||

| Net investment income | (1.00) | (.37) | (.41) | (.39) | (.18) | (.05) |

| Net realized gains | (.76) | — | — | — | — | — |

| Total distributions | (1.76) | (.37) | (.41) | (.39) | (.18) | (.05) |

| Redemption fees | — | — | — | — | — | .00 * |

| Net asset value, end of period | $40.80 | $50.96 | $40.87 | $34.55 | $34.85 | $33.58 |

| Total Return (%) | (16.95) ** | 25.73 | 19.60 | .53 | 4.31 | 17.00 b |

| Ratios to Average Net Assets and Supplemental Data | ||||||

| Net assets, end of period ($ millions) | 8 | 9 | 7 | 4 | 14 | 16 |

| Ratio

of expenses before expense reductions (%) |

.90 *** | .91 | .91 | .86 | .87 | 1.11 |

| Ratio

of expenses after expense reductions (%) |

.90 *** | .91 | .91 | .86 | .87 | 1.10 |

| Ratio of net investment income (%) | .13 *** | .44 | .93 | 1.12 | 1.07 | .48 |

| Portfolio turnover rate (%) | 4 ** | 15 | 13 | 12 | 73 | 68 |

| a | Based on average shares outstanding during the period. |

| b | Total return would have been lower had certain expenses not been reduced. |

| * | Amount is less than $.005. |

| ** | Not annualized |

| *** | Annualized |

| 26 | | | DWS International Growth Fund |

| Notes to Financial Statements | (Unaudited) |

| A. | Organization and Significant Accounting Policies |

| DWS International Growth Fund | | | 27 |

| 28 | | | DWS International Growth Fund |

| DWS International Growth Fund | | | 29 |

| 30 | | | DWS International Growth Fund |

| B. | Purchases and Sales of Securities |

| C. | Related Parties |

| DWS International Growth Fund | | | 31 |

| Class A | 1.26% |

| Class C | 2.01% |

| Class R | 1.51% |

| Class R6 | 1.01% |

| Class S | 1.01% |

| Institutional Class | 1.01% |

| Class A | 1.25% | ||

| Class C | 2.00% | ||

| Class R | 1.50% | ||

| Class R6 | 1.00% | ||

| Class S | 1.00% | ||

| Institutional Class | 1.00% |

| 32 | | | DWS International Growth Fund |

| Class C | $ 172 |

| Class R | 197 |

| Class R6 | 9 |

| $ 378 |

| Services to Shareholders | Total

Aggregated |

Unpaid

at February 28, 2022 |

| Class A | $ 9,837 | $ 3,372 |

| Class C | 428 | 137 |

| Class R | 186 | 54 |

| Class R6 | 13 | 4 |

| Class S | 139,630 | 46,757 |

| Institutional Class | 249 | 76 |

| $ 150,343 | $ 50,400 |

| DWS International Growth Fund | | | 33 |

| Sub-Recordkeeping | Total

Aggregated |

| Class A | $ 28,759 |

| Class C | 783 |

| Class R | 1,602 |

| Class S | 168,721 |

| Institutional Class | 4,883 |

| $ 204,748 |

| Distribution Fee | Total

Aggregated |

Unpaid

at February 28, 2022 |

| Class C | $ 3,333 | $ 430 |

| Class R | 1,834 | 218 |

| $ 5,167 | $ 648 |

| Service Fee | Total

Aggregated |

Unpaid

at February 28, 2022 |

Annualized

Rate |

| Class A | $ 59,988 | $ 16,830 | .24% |

| Class C | 1,024 | 660 | .23% |

| Class R | 1,828 | 441 | .25% |

| $ 62,840 | $ 17,931 |

| 34 | | | DWS International Growth Fund |

| D. | Line of Credit |

| DWS International Growth Fund | | | 35 |

| E. | Fund Share Transactions |

| Six

Months Ended February 28, 2022 |

Year

Ended August 31, 2021 | |||

| Shares | Dollars | Shares | Dollars | |

| Shares sold | ||||

| Class A | 24,996 | $ 1,183,991 | 61,175 | $ 2,805,740 |

| Class C | 756 | 33,046 | 2,400 | 102,221 |

| Class R | 2,948 | 133,854 | 7,358 | 325,394 |

| Class S | 42,416 | 2,018,345 | 129,843 | 5,913,328 |

| Institutional Class | 21,261 | 1,020,372 | 47,766 | 2,163,000 |

| $ 4,389,608 | $ 11,309,683 | |||

| Shares issued to shareholders in reinvestment of distributions | ||||

| Class A | 32,175 | $ 1,519,949 | 5,263 | $ 236,723 |

| Class C | 549 | 24,396 | — | — |

| Class R | 786 | 36,918 | 137 | 6,100 |

| Class R6 | 14 | 659 | 4 | 149 |

| Class S | 408,934 | 19,293,508 | 95,828 | 4,304,616 |

| Institutional Class | 6,855 | 323,403 | 1,432 | 64,342 |

| $ 21,198,833 | $ 4,611,930 | |||

| Shares redeemed | ||||

| Class A | (67,017) | $ (3,184,578) | (159,600) | $ (7,254,331) |

| Class C | (3,770) | (161,379) | (32,489) | (1,329,307) |

| Class R | (24,947) | (1,163,813) | (19,817) | (888,168) |

| Class S | (471,470) | (22,307,254) | (953,193) | (43,384,032) |

| Institutional Class | (22,242) | (1,041,012) | (24,654) | (1,137,431) |

| $ (27,858,036) | $ (53,993,269) | |||

| 36 | | | DWS International Growth Fund |

| Six

Months Ended February 28, 2022 |

Year

Ended August 31, 2021 | |||

| Shares | Dollars | Shares | Dollars | |

| Net increase (decrease) | ||||

| Class A | (9,846) | $ (480,638) | (93,162) | $ (4,211,868) |

| Class C | (2,465) | (103,937) | (30,089) | (1,227,086) |

| Class R | (21,213) | (993,041) | (12,322) | (556,674) |

| Class R6 | 14 | 659 | 4 | 149 |

| Class S | (20,120) | (995,401) | (727,522) | (33,166,088) |

| Institutional Class | 5,874 | 302,763 | 24,544 | 1,089,911 |

| $ (2,269,595) | $ (38,071,656) | |||

| F. | Other — COVID-19 Pandemic |

| DWS International Growth Fund | | | 37 |

| — | Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses (but not transaction costs) paid on a $1,000 investment in the Fund using the Fund’s actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Expenses Paid per $1,000” line under the share class you hold. |

| — | Hypothetical 5% Fund Return. This helps you to compare your Fund’s ongoing expenses (but not transaction costs) with those of other mutual funds using the Fund’s actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. |

| 38 | | | DWS International Growth Fund |

| Actual Fund Return | Class A | Class C | Class R | Class R6 | Class S | Institutional

Class |

| Beginning Account Value 9/1/21 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value 2/28/22 | $ 829.40 | $ 826.10 | $ 828.10 | $ 830.80 | $ 830.70 | $ 830.50 |

| Expenses Paid per $1,000* | $ 5.40 | $ 9.06 | $ 6.80 | $ 3.77 | $ 4.09 | $ 4.08 |

| Hypothetical 5% Fund Return | Class A | Class C | Class R | Class R6 | Class S | Institutional

Class |

| Beginning Account Value 9/1/21 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value 2/28/22 | $1,018.89 | $1,014.88 | $1,017.36 | $1,020.68 | $1,020.33 | $1,020.33 |

| Expenses Paid per $1,000* | $ 5.96 | $ 9.99 | $ 7.50 | $ 4.16 | $ 4.51 | $ 4.51 |

| * | Expenses are equal to the Fund’s annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by 181 (the number of days in the most recent six-month period), then divided by 365. |

| Annualized Expense Ratios | Class A | Class C | Class R | Class R6 | Class S | Institutional

Class |

| DWS International Growth Fund | 1.19% | 2.00% | 1.50% | .83% | .90% | .90% |

| DWS International Growth Fund | | | 39 |

| 40 | | | DWS International Growth Fund |

| — | During the entire process, all of the Fund’s Directors were independent of DIMA and its affiliates (the “Independent Directors” ). |

| — | The Board met frequently during the past year to discuss fund matters and dedicated a substantial amount of time to contract review matters. Over the course of several months, the Board reviewed extensive materials received from DIMA, independent third parties and independent counsel. These materials included an analysis of the Fund’s performance, fees and expenses, and profitability from a fee consultant retained by the Fund’s Independent Directors (the “Fee Consultant” ). |

| — | The Board also received extensive information throughout the year regarding performance of the Fund. |

| — | The Independent Directors regularly met privately with counsel to discuss contract review and other matters. In addition, the Independent Directors were advised by the Fee Consultant in the course of their review of the Fund’s contractual arrangements and considered a comprehensive report prepared by the Fee Consultant in connection with their deliberations. |

| — | In connection with reviewing the Agreement, the Board also reviewed the terms of the Fund’s Rule 12b-1 plan, distribution agreement, administrative services agreement, transfer agency agreement and other material service agreements. |

| DWS International Growth Fund | | | 41 |

| 42 | | | DWS International Growth Fund |

| DWS International Growth Fund | | | 43 |

| 44 | | | DWS International Growth Fund |

| For More Information | The automated telephone system allows you to access personalized account information and obtain information on other DWS funds using either your voice or your telephone keypad. Certain account types within Classes A, C and S also have the ability to purchase, exchange or redeem shares using this system. |

| For

more information, contact your financial representative. You may also access our automated telephone system or speak with a Shareholder Service representative by calling: (800) 728-3337 | |

| Web Site | dws.com View your account transactions and balances, trade shares, monitor your asset allocation, subscribe to fund and account updates by e-mail, and change your address, 24 hours a day. |

| Obtain prospectuses and applications, news about DWS funds, insight from DWS economists and investment specialists and access to DWS fund account information. | |

| Written Correspondence | DWS

PO Box 219151 Kansas City, MO 64121-9151 |

| Proxy Voting | The Fund’s policies and procedures for voting proxies for portfolio securities and information about how the Fund voted proxies related to its portfolio securities during the most recent 12-month period ended June 30 are available on our Web site — dws.com/en-us/resources/proxy-voting — or on the SEC’s Web site — sec.gov. To obtain a written copy of the Fund’s policies and procedures without charge, upon request, call us toll free at (800) 728-3337. |

| Portfolio Holdings | Following the Fund’s fiscal first and third quarter-end, a complete portfolio holdings listing is posted on dws.com, and is available free of charge by contacting your financial intermediary, or if you are a direct investor, by calling (800) 728-3337. In addition, the portfolio holdings listing is filed with SEC on the Fund’s Form N-PORT and will be available on the SEC’s Web site at sec.gov. Additional portfolio holdings for the Fund are also posted on dws.com from time to time. Please see the Fund’s current prospectus for more information. |

| Principal Underwriter | If

you have questions, comments or complaints, contact:DWS Distributors, Inc. 222 South Riverside Plaza Chicago, IL 60606-5808 (800) 621-1148 |

| DWS International Growth Fund | | | 45 |

| Investment Management | DWS Investment Management Americas, Inc. (“DIMA” or the “Advisor” ), which is part of the DWS Group GmbH & Co. KGaA (“DWS Group” ), is the investment advisor for the Fund. DIMA and its predecessors have more than 90 years of experience managing mutual funds and DIMA provides a full range of investment advisory services to both institutional and retail clients. DIMA is an indirect, wholly owned subsidiary of DWS Group. |

| DWS Group is a global organization that offers a wide range of investing expertise and resources, including hundreds of portfolio managers and analysts and an office network that reaches the world’s major investment centers. This well-resourced global investment platform brings together a wide variety of experience and investment insight across industries, regions, asset classes and investing styles. |

| Class A | Class C | Class S | Institutional Class | |

| Nasdaq Symbol | SGQAX | SGQCX | SCOBX | SGQIX |

| CUSIP Number | 25156A 775 | 25156A 817 | 25156A 833 | 25156A 700 |

| Fund Number | 407 | 707 | 2007 | 1407 |

| For shareholders of Class R and Class R6 | |||

| Automated Information Line | DWS/Ascensus Plan Access (800) 728-3337 | ||

| 24-hour access to your retirement plan account. | |||

| Web Site | dws.com | ||

| Obtain

prospectuses and applications, news about DWS funds, insight from DWS economists and investment specialists and access to DWS fund account information. | |||

| Log in/register to manage retirement account assets at https://www.mykplan.com/participantsecure_net/login.aspx. | |||

| For More Information | (800) 728-3337 | ||

| To speak with a service representative. | |||

| Written Correspondence | DWS

Service Company222 South Riverside Plaza Chicago, IL 60606-5806 | ||

| Class R | Class R6 | |

| Nasdaq Symbol | SGQRX | SGQTX |

| CUSIP Number | 25156A 825 | 25156A 643 |

| Fund Number | 1512 | 1607 |

| 46 | | | DWS International Growth Fund |

| FACTS | What Does DWS Do With Your Personal Information? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The

types of personal information we collect and share can include: — Social Security number — Account balances — Purchase and transaction history — Bank account information — Contact information such as mailing address, e-mail address and telephone number |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information, the reasons DWS chooses to share and whether you can limit this sharing. |

| Reasons we can share your personal information | Does DWS share? | Can

you limit this sharing? |

| For our everyday business purposes —such as to process your transactions, maintain your account(s), respond to court orders or legal investigations | Yes | No |

| For our marketing purposes — to offer our products and services to you | Yes | No |

| For joint marketing with other financial companies | No | We do not share |

| For our affiliates’ everyday business purposes — information about your transactions and experiences | No | We do not share |

| For our affiliates’ everyday business purposes — information about your creditworthiness | No | We do not share |

| For non-affiliates to market to you | No | We do not share |

| Questions? | Call (800) 728-3337 or e-mail us at service@dws.com |

| DWS International Growth Fund | | | 47 |

| Who we are | |

| Who is providing this notice? | DWS

Distributors, Inc; DWS Investment Management Americas, Inc.; DWS Trust Company; the DWS Funds |

| What we do | |

| How does DWS protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards, secured files, and secured buildings. |

| How does DWS collect my personal information? | We

collect your personal information, for example, when you: — open an account — give us your contact information — provide bank account information for ACH or wire transactions — tell us where to send money — seek advice about your investments |

| Why can’t I limit all sharing? | Federal

law gives you the right to limit only — sharing for affiliates’ everyday business purposes — information about your creditworthiness — affiliates from using your information to market to you — sharing for non-affiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

| Definitions | |

| Affiliates | Companies

related by common ownership or control. They can be financial or non-financial companies. Our affiliates include financial companies with the DWS or Deutsche Bank (“DB” ) name, such as DB AG Frankfurt. |

| Non-affiliates | Companies

not related by common ownership or control. They can be financial and non-financial companies. Non-affiliates we share with include account service providers, service quality monitoring services, mailing service providers and verification services to help in the fight against money laundering and fraud. |

| Joint marketing | A

formal agreement between non-affiliated financial companies that together market financial products or services to you. DWS does not jointly market. |

| 48 | | | DWS International Growth Fund |

| (b) Not applicable | ||

| ITEM 2. | CODE OF ETHICS | |

| Not applicable. | ||

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT | |

| Not applicable | ||

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | |

| Not applicable | ||

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS | |

| Not applicable | ||

| ITEM 6. | SCHEDULE OF INVESTMENTS | |

| Not applicable | ||

| ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES | |

| Not applicable | ||

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES | |

| Not applicable | ||

| ITEM 9. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS | |

| Not applicable | ||

| ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | |

| There were no material changes to the procedures by which shareholders may recommend nominees to the Fund’s Board. The primary function of the Nominating and Governance Committee is to identify and recommend individuals for membership on the Board and oversee the administration of the Board Governance Guidelines. Shareholders may recommend candidates for Board positions by forwarding their correspondence by U.S. mail or courier service to Keith R. Fox, DWS Funds Board Chair, c/o Thomas R. Hiller, Ropes & Gray LLP, Prudential Tower, 800 Boylston Street, Boston, MA 02199-3600. | ||

| ITEM 11. | CONTROLS AND PROCEDURES | |

| (a) | The Chief Executive and Financial Officers concluded that the Registrant’s Disclosure Controls and Procedures are effective based on the evaluation of the Disclosure Controls and Procedures as of a date within 90 days of the filing date of this report. | |

| (b) | There have been no changes in the registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal controls over financial reporting. | |

| ITEM 12. | Disclosure of Securities Lending Activities for Closed-End Management Investment Companies. | |

| Not applicable | ||

| ITEM 13. | EXHIBITS | |

| (a)(1) | Not applicable | |

| (a)(2) | Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2(a)) is filed and attached hereto as Exhibit 99.CERT. | |

| (b) | Certification pursuant to Rule 30a-2(b) under the Investment Company Act of 1940 (17 CFR 270.30a-2(b)) is furnished and attached hereto as Exhibit 99.906CERT. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Registrant: | DWS International Growth Fund, a series of Deutsche DWS Global/International Fund, Inc. |

| By: |

/s/Hepsen Uzcan Hepsen Uzcan President |

| Date: | 4/29/2022 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: |

/s/Hepsen Uzcan Hepsen Uzcan President |

| Date: | 4/29/2022 |

| By: |

/s/Diane Kenneally Diane Kenneally Chief Financial Officer and Treasurer |

| Date: | 4/29/2022 |