|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

FORM 10-K

(Mark One)

|

[ √ ]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2019

or

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

For the

transition period from

to

Commission

File No. 0-15905

BLUE DOLPHIN ENERGY COMPANY

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

73-1268729

|

|

|

(State

or other jurisdiction of incorporation or

organization)

|

|

(I.R.S.

Employer Identification No.)

|

|

|

|

|

|

|

|

801 Travis Street, Suite 2100, Houston, Texas

|

|

z77002

|

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

|

|

713-568-4725

|

|

||

|

(Registrant’s

telephone number, including area code)

|

|

||

Securities registered pursuant to Section 12(b) of the Act:

None

|

|

|

|

Securities

registered pursuant to Section 12(g) of the Act:

|

Common Stock, par value $0.01 per share

|

|

(Title

of class)

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as

defined in Rule 405 of the Securities Act. Yes [ ] No [ √ ]

Indicate

by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act. Yes

[ ] No [ √ ]

Indicate

by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes [

√ ] No [

]

Indicate

by check mark whether the registrant has submitted electronically

and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405

of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). Yes [ √ ] No [

]

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, a smaller reporting

company, or emerging growth company. See the definition of

“large accelerated filer,” “accelerated

filer,” “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the

Act.

|

|

Large

accelerated filer

|

[ ]

|

|

Accelerated

filer

|

[ ]

|

|

|

Non-accelerated

filer

|

[ ]

|

|

Smaller

reporting company

|

[√ ]

|

|

|

|

|

|

Emerging

growth company

|

[ ]

|

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate

by check mark whether the registrant is a shell company (as defined

in Rule 12b-2 of the Act). Yes [

] No [ √ ]

The

aggregate market value of shares of common stock held by

non-affiliates of the registrant was $2,100,065 as of June 28, 2019

(the last trading day of the registrant’s most recently

completed second fiscal quarter) based on the number of shares of

common stock held by non-affiliates and the last reported sale

price of the registrant's common stock on June 28,

2019.

|

Number

of shares of common stock, par value $0.01 per share, outstanding

at March 30, 2020: 12,327,365

|

|

PART

I

|

7

|

|

|

|

|

|

|

ITEM 1.

|

BUSINESS

|

7

|

|

ITEM 1A.

|

RISK FACTORS

|

13

|

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

24

|

|

ITEM 2.

|

PROPERTIES

|

24

|

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

24

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

24

|

|

|

|

|

|

PART

II

|

25

|

|

|

|

|

|

|

ITEM 5.

|

MARKET FOR REGISTRANTS COMMON EQUITY, RELATED STOCKHOLDER MATTERS

AND ISSUER PURCHASES OF EQUITY SECURITIES

|

25

|

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

25

|

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

|

26

|

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET

RISK

|

36

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

37

|

|

|

Report of Independent Registered Public Accounting

Firm

|

37

|

|

|

Consolidated Balance Sheets

|

38

|

|

|

Consolidated Statements of Operations

|

39

|

|

|

Consolidated Statements of Stockholders’ Equity

(Deficit)

|

40

|

|

|

Consolidated Statements of Cash Flows

|

41

|

|

|

Notes to Consolidated Financial Statements

|

42

|

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

|

66

|

|

ITEM 9A.

|

CONTROLS AND PROCEDURES

|

66

|

|

ITEM 9B.

|

OTHER INFORMATION

|

68

|

|

|

|

|

|

PART

III

|

69

|

|

|

|

|

|

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

69

|

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

74

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND

RELATED STOCKHOLDER MATTERS

|

76

|

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE

|

77

|

|

ITEM 14.

|

PRINCIPAL ACCOUNTING FEES AND SERVICES

|

77

|

|

|

|

|

|

PART

IV

|

78

|

|

|

|

|

|

|

ITEM 15.

|

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

78

|

|

ITEM 16.

|

FORM 10-K SUMMARY

|

78

|

|

|

|

|

|

SIGNATURES

|

83

|

|

|

Glossary of Terms

|

|

|

Glossary of Terms

Throughout

this Annual Report on Form 10-K, we have used the following

terms:

|

Affiliate.

Refers, either individually or collectively, to certain related

parties including, Jonathan Carroll, Chairman and Chief Executive

Officer of Blue Dolphin, and his affiliates (including C&C,

Ingleside, and Lazarus Capital) and/or LEH and its affiliates

(including Lazarus Midstream, LMT, and LTRI). Together, Jonathan

Carroll and LEH own approximately 82% of Blue Dolphin’s

Common Stock.

AMT.

Alternative Minimum Tax.

Amended Pilot Line

of Credit. Line of Credit Agreement dated May 3, 2019,

between Pilot and NPS and subsequently amended on May 9, 2019 and

May 10, 2019 and September 3, 2019, the last amendment being

Amendment No. 1; line of credit amount is $13.0

million.

Amended and

Restated Operating Agreement. Affiliate agreement dated

April 1, 2017 between Blue Dolphin, LEH, and LE governing

LEH’s operation and management of Blue Dolphin’s

assets; expires on April 1, 2020; the Board plans to extend the

agreement.

ARO. Asset

retirement obligations.

ASU.

Accounting Standards Update.

AGO.

Atmospheric gas oil, which is the heaviest product boiled by a

crude distillation tower operating at atmospheric pressure. This

fraction ordinarily sells as distillate fuel oil, either in pure

form or blended with cracked stocks. Certain ethylene plants,

called heavy oil crackers, can take AGO as

feedstock.

bbl.

Barrel; a unit of volume equal to 42 U.S.

gallons.

BDPC.

Blue Dolphin Petroleum Company, a wholly owned subsidiary of Blue

Dolphin.

BDPL.

Blue Dolphin Pipe Line Company, a wholly owned subsidiary of Blue

Dolphin.

BDSC.

Blue Dolphin Services Co., a wholly owned subsidiary of Blue

Dolphin.

bpd. Barrel

per day;a measure of the bbls of daily output produced in a

refinery or transported through a pipeline.

Board. Board

of Directors of Blue Dolphin Energy Company.

BOEM. Bureau

of Ocean Energy Management.

BSEE. Bureau

of Safety and Environmental Enforcement.

C&C.

Carroll & Company Financial Holdings, L.P., an affiliate of

Jonathan Carroll.

Capacity

Utilization Rate. A percentage measure that indicates the

amount of available capacity that is being used in a refinery or

transported through a pipeline. With respect to the crude

distillation tower, the rate is calculated by dividing total

refinery throughput or total refinery production on a bpd basis by

the total capacity of the crude distillation tower (currently

15,000 bpd).

CAA. Clean

Air Act.

CERLA.

Comprehensive Environmental Response, Compensation, and Liability

Act of 1980.

CIP.

Construction in progress.

COVID-19. An

infectious disease first identified in 2019 in Wuhan, the capital

of China's Hubei province; the disease has since spread globally,

resulting in the ongoing 2019-2020 coronavirus

pandemic.

CWA. Clean

Water Act.

Common

Stock. Blue Dolphin common stock, par value $0.01 per

share.

Complexity.

A numerical score that denotes, for a given refinery, the extent,

capability, and capital intensity of the refining processes

downstream of the crude distillation tower. Refinery complexities

range from the relatively simple crude distillation tower

(“topping unit”), which has a complexity of 1.0, to the

more complex deep conversion (“coking”) refineries,

which have a complexity of 12.0.

Condensate.

Liquid hydrocarbons that are produced in conjunction with natural

gas. Although condensate is sometimes like crude oil, it is usually

lighter.

Cost of Goods

Sold. Reflects the cost of crude oil and condensate, fuel

use, and chemicals.

|

|

|

Crude distillation

tower. A tall column-like vessel in which crude oil and

condensate is heated and its vaporized components are distilled by

means of distillation trays. This process turns crude oil and other

inputs into intermediate and finished petroleum products. (Commonly

referred to as a crude distillation unit or an atmospheric

distillation unit.)

Crude

oil. A mixture of

thousands of chemicals and compounds, primarily hydrocarbons. Crude

oil quality is measured in terms of density (light to heavy) and

sulfur content (sweet to sour). Crude oil must be broken down into

its various components by distillation before these chemicals and

compounds can be used as fuels or converted to more valuable

products.

Depropanizer

unit. A distillation column that is used to isolate propane

from a mixture containing butane and other heavy

components.

Distillates.

The result of crude distillation and therefore any refined oil

product. Distillate is more commonly used as an abbreviated form of

middle distillate. There are mainly four (4) types of distillates:

(i) very light oils or light distillates (such as naphtha), (ii)

light oils or middle distillates (such as our jet fuel), (iii)

medium oils, and (iv) heavy oils (such as our low- sulfur diesel

and HOBM, reduced crude, and AGO).

Distillation.

The first step in the refining process whereby crude oil and

condensate is heated at atmospheric pressure in the base of a

distillation tower. As the temperature increases, the various

compounds vaporize in succession at their various boiling points

and then rise to prescribed levels within the tower per their

densities, from lightest to heaviest. They then condense in

distillation trays and are drawn off individually for further

refining. Distillation is also used at other points in the refining

process to remove impurities.

Downtime.

Scheduled and/or unscheduled periods in which the crude

distillation tower is not operating. Downtime may occur for a

variety of reasons, including bad weather, power failures, and

preventive maintenance.

EIA. Energy

Information Administration.

EPA.

Environmental Protection Agency.

Eagle Ford

Shale. A hydrocarbon-producing geological formation

extending across South Texas from the Mexican border into East

Texas.

Exchange

Act. Securities Exchange Act of 1934, as

amended.

FASB.

Financial Accounting Standards Board.

FDIC.

Federal Deposit Insurance Corporation.

Feedstocks.

Crude oil and other hydrocarbons, such as condensate and/or

intermediate products, that are used as basic input materials in a

refining process. Feedstocks are transformed into one or more

finished products.

Finished petroleum

products. Materials or products which have received the

final increments of value through processing operations, and which

are being held in inventory for delivery, sale, or

use.

GEL. GEL Tex

Marketing, LLC, a Delaware limited liablity company and an

affiliate of Genesis Energy, LLC.

GEL Final

Arbitration Award.

Damages and attorney fees and related expenses awarded to GEL by an

arbitrator on August 11, 2017.

GEL Interim

Payments. Cash payments of $0.5 million at the end of each

calendar month by the Lazarus Parties to GEL until the GEL

Settlement Payment was made.

GEL

Settlement. When all conditions of the GEL Settlement

Agreement were met by the Lazarus Parties under the GEL Settlement

Agreement, and whereby GEL and the Lazarus Parties agreed to

mutually release all claims against each other and to file a

stipulation of dismissal with prejudice in connection with

arbitration proceedings between LE and GEL related to a contractual

dispute involving a crude oil supply and throughput services

agreement, each between LE and GEL dated August 12,

2011.

GEL Settlement

Agreement. Settlement Agreement dated July 20, 2018, between

the Lazarus Parties and GEL outlining the terms and conditions for

a settlement, including: (i) the GEL Settlement Payment by the GEL

Settlement Date and (ii) GEL Interim Payments.

GEL Settlement

Date. The effective date of the GEL

Settlement.

GEL Settlement

Payment. A lump sum cash payment of $10.0 million as paid by

the Lazarus Parties to GEL under the GEL Settlement

Agreement.

|

|

Glossary of Terms

|

|

Gross

Profit. Calculated as total revenue less cost of goods

sold; reflected as a dollar ($) amount.

HOBM. Heavy

oil-based mud blendstock; see also

“distillates.”

HUBZone.

Historically Underutilized Business Zones program established by

the SBA to help small businesses in both urban and rural

communities.

IBLA.

Interior Board of Land Appeals.

INC.

Incident of Noncompliance issued by BOEM and/or

BSEE.

Ingleside.

Ingleside Crude, LLC, an affiliate of Jonathan

Carroll.

Intermediate

petroleum products. A petroleum product that might require

further processing before it is saleable to the ultimate consumer.

This further processing might be done by the producer or by another

processor. Thus, an intermediate petroleum product might be a final

product for one company and an input for another company that will

process it further.

IRC Section

382. Title 26, Internal Revenue Code, Subtitle A –

Income Taxes, Subchapter C – Corporate Distributions and

Adjustments, Part V Carryovers, § 382. Limits NOL

carryforwards and certain built-in losses following ownership

change.

IRS.

Internal Revenue Service.

Jet fuel. A

high-quality kerosene product primarily used in aviation.

Kerosene-type jet fuel (including Jet A and Jet A-1) has a carbon

number distribution between 8 and 16 carbon atoms per molecule;

wide-cut or naphtha-type jet fuel (including Jet B) has between 5

and 15 carbon atoms per molecule.

Lazarus

Capital. Lazarus Capital, LLC, an affiliate of Jonathan

Carroll.

Lazarus

Midstream. Lazarus Midstream Partners, L.P., an affiliate of

LEH.

Lazarus

Parties. Blue

Dolphin, C&C, NPS, LE, LEH, and Jonathan

Carroll.

LE. Lazarus

Energy, LLC, a wholly owned subsidiary of Blue

Dolphin.

LEH. Lazarus

Energy Holdings, LLC, an affiliate of Jonathan Carroll and

controlling shareholder of Blue Dolphin.

LEH Operating

Fee. A management fee paid to LEH under the Amended and

Restated Operating Agreement; calculated as 5% of Blue

Dolphin’s incurred direct operating expenses; previously

reflected within refinery operating expenses in our consolidated

statements of operations.

Leasehold

interest. The interest of a lessee under an oil and gas

lease.

Light crude.

A liquid petroleum that has a low density and flows freely at room

temperature. It has a low viscosity, low specific gravity, and a

high American Petroleum Institute gravity due to the presence of a

high proportion of light hydrocarbon fractions.

LMT. Lazarus

Marine Terminal I, LLC, an affiliate of LEH.

LRM. Lazarus

Refining & Marketing, LLC, a wholly owned subsidiary of Blue

Dolphin.

LTRI.

Lazarus Texas Refinery I, an affiliate of LEH.

NAAQS.

National Ambient Air Quality Standards.

Naphtha. A

refined or partly refined light distillate fraction of crude oil.

Blended further or mixed with other materials it can make

high-grade motor gasoline or jet fuel. It is also a generic term

applied to the lightest and most volatile petroleum

fractions.

Natural Gas.

A naturally occurring hydrocarbon gas mixture

consisting primarily of methane, but commonly including varying

amounts of other higher alkanes, and sometimes a small percentage

of carbon dioxide, nitrogen, hydrogen sulfide, or

helium.

NPS. Nixon

Product Storage, LLC, a wholly owned subsidiary of Blue

Dolphin.

NOL. Net

operating losses.

NSR/PSD. New

Source Review/Prevention of Significant

Deterioration.

OPA 90. Oil

Pollution Act of 1990.

|

|

|

Operating

Days. Represents the number of days in a period in which the

crude distillation tower operated. Operating days is calculated by

subtracting downtime in a period from calendar days in the same

period.

OSHA.

Occupational Safety and Health Administration.

OSRO. Oil

Spill Response Organization.

Other conversion

costs. Represents the combination of direct labor costs and

manufacturing overhead costs. These are the costs that are

necessary to convert our raw materials into refined

products.

Other Operating

Expenses. Represents costs associated with our natural gas

processing, treating, and redelivery facility, as well as our

pipeline assets and leasehold interests in oil and gas

properties.

PCAOB.

Public Company Accounting Oversight Board.

Petroleum. A

naturally occurring flammable liquid consisting of a complex

mixture of hydrocarbons of various molecular weights and other

liquid organic compounds. The name petroleum covers both the

naturally occurring unprocessed crude oils and petroleum products

that are made up of refined crude oil.

PHMSA.

Pipeline and Hazardous Materials Safety Administration of the U.S.

Department of Transportation.

Pilot. Pilot

Travel Centers LLC, a Delaware limited liability

company.

Preferred

Stock. Blue Dolphin preferred stock, par value $0.10 per

share.

Product

Slate. Represents type and quality of products

produced.

Propane. A

by-product of natural gas processing and petroleum refining.

Propane is one of a group of liquified petroleum gases. Others

include butane, propylene, butadiene, butylene, isobutylene and

mixtures thereof.

Refined

Products. Hydrocarbon compounds, such as jet fuel and

residual fuel, that are produced by a refinery.

Refinery.

Within the oil and gas industry, a refinery is an industrial

processing plant where crude oil, condensate, and

intermediate feeds are separated and transformed into

petroleum products.

Refining

Gross Profit per Bbl.

Calculated as refinery operations revenue less total cost of goods

sold divided by the volume, in bbls, of refined products sold

during the period; reflected as a dollar ($) amount per

bbl.

RCRA.

Federal Resource Conservation and Recovery Act.

RFS2. Second

Renewable Fuels Standard.

ROU.

Right-of-use.

SEC.

Securities and Exchange Commission.

Segment

Contribution Margin. For our refinery operations and tolling

and terminaling business segments, represents net revenues

(excluding intercompany fees and sales) attributable to the

respective business segment less associated intercompany fees and

sales less associated operation costs and

expenses.

SEMS. Safety

and Environmental Management System.

Sour crude.

Crude oil containing sulfur content of more than

0.5%.

Stabilizer

unit. A distillation column intended to remove the lighter

boiling compounds, such as butane or propane, from a

product.

Sweet crude.

Crude oil containing sulfur content of less than

0.5%.

Sulfur.

Present at various levels of concentration in many hydrocarbon

deposits, such as petroleum, coal, or natural gas. Also, produced

as a by-product of removing sulfur-containing contaminants from

natural gas and petroleum. Some of the most commonly used

hydrocarbon deposits are categorized per their sulfur content, with

lower sulfur fuels usually selling at a higher, or premium, price

and higher sulfur fuels selling at a lower, or discounted,

price.

Topping

unit. A type of petroleum refinery that engages in only the

first step of the refining process -- crude distillation. A topping

unit uses atmospheric distillation to separate crude oil and

condensate into constituent petroleum products. A topping unit has

a refinery complexity range of 1.0 to 2.0.

|

|

Glossary of Terms

|

|

Throughput.

The volume processed through a unit or a refinery or transported

through a pipeline.

Total Refinery

Production. Refers to the volume processed as output through

the crude distillation tower. Refinery production includes finished

petroleum products, such as jet fuel, and intermediate petroleum

products, such as naphtha, HOBM and AGO.

Total Refinery

Throughput. Refers

to the volume processed as input through the crude distillation

tower. Refinery throughput includes crude oil and condensate and

other feedstocks.

TMT. Texas

margins tax; a form of business tax imposed on an entity’s

gross profit rather than on its net income.

Turnaround.

Scheduled large-scale maintenance activity wherein an entire

process unit is taken offline for a week or more for comprehensive

revamp and renewal.

USACOE. U.S.

Army Corps of Engineers.

|

|

|

USDA. U.S.

Department of Agriculture.

U.S. GAAP.

Accounting principles generally accepted in the United States of

America.

Veritex.

Veritex Community Bank, successor in interest to Sovereign Bank by

merger.

WSJ Prime

Rate. A measure of the U.S. prime rate as defined by the

Wall Street Journal.

XBRL.

eXtensible Business Reporting Language.

Yield.

The percentage of refined products that is produced from crude oil

and other feedstocks.

|

|

Important Information Regarding Forward Looking Statements

|

Important Information Regarding Forward-Looking

Statements

This

report (including information incorporated by reference) contains

“forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Exchange Act, including, but not limited to, those under

“Item 1. Business,” “Item 1A. Risk

Factors,” and “Item 7. Management’s Discussion

and Analysis of Financial Condition and Results of

Operations.” All statements other than statements of

historical fact, including without limitation statements regarding

expectations regarding revenue, cash flows, capital expenditures,

and other financial items, our business strategy, goals and

expectations concerning our market position, future operations and

profitability, are forward-looking statements. Forward-looking

statements may be identified by use of the words

“anticipate,” “believe,”

“could,” “estimate,” “expect,”

“intend,” “may,” “plan,”

“predict,” “project,” “will,”

“would” and similar terms and phrases. Although we

believe our assumptions concerning future events are reasonable,

several risks, uncertainties, and other factors could cause actual

results and trends to differ materially from those projected,

including but not limited to:

|

Business and Industry

●

Our going concern

status.

●

Inadequate

liquidity to sustain operations due to defaults under our secured

loan agreements, historic net losses, and working capital

deficits.

●

Substantial debt in

the current portion of long-term debt, which is currently in

default.

●

Ability to regain

compliance with the terms of our outstanding

indebtedness.

●

Increased costs of

capital or a reduction in the availability of credit.

●

Affiliate common

stock ownership and transactions that could cause conflicts of

interest.

●

Operational hazards

inherent in refining and natural gas processing operations and in

transporting and storing crude oil and condensate and refined

products.

●

Geographic

concentration of our assets, creating significant exposure to

regional economy risks and other conditions.

●

Geographic

concentration of our refining operations and customers within the

Eagle Ford Shale.

●

Competition from

companies having greater financial and other

resources.

●

Federal, state, and

local environmental, economic, health and safety, energy and other

policies and regulations, including those related to climate

change, and any changes therein, and any legal and regulatory

investigations, delays in obtaining necessary approvals and

permits, compliance costs or other factors beyond our

control.

●

Environmental laws

and regulations that could require us to make substantial capital

expenditures to remain in compliance or remediate current or future

contamination that could give rise to material

liabilities.

●

Changes in

insurance markets impacting costs and the level and types of

coverage available.

●

NOL carryforwards

to offset future taxable income for U.S. federal income tax

purposes that are subject to limitation.

●

Direct or indirect

effects on our business resulting from actual or threatened

terrorist or activist incidents, cyber-security breaches, or acts

of war.

●

Outbreak of

COVID-19, or an outbreak of another highly infectious or contagious

disease, could adversely impact our business, financial condition,

and results of operations.

|

|

Refinery

and Tolling and Terminaling Operations

●

Timing and extent

of changes in commodity prices and demand for refined

products.

●

Availability and

costs of crude oil and other feedstocks.

●

Price volatility of

fuel and utility services to operate the Nixon

facility.

●

Disruptions due to

equipment interruption or failure at the Nixon

facility.

●

Changes in our cash

flow from operations and working capital requirements, shortfalls

of which Affiliates may not fund.

●

Ability to remain

in compliance with the terms of our outstanding

indebtedness.

●

Key personnel loss,

labor relations, and workplace safety.

●

Loss of market

share by and a material change in profitability of our key

customers.

●

Contract

cancellation, non-renewal, or failure to perform by those in our

supply and distribution chains, and the ability to replace such

contracts and/or customers.

●

Changes in the cost

or availability of third-party vessels, pipelines, trucks, and

other means of delivering and transporting crude oil and

condensate, feedstocks, and refined products.

●

Sourcing of a

substantial amount, if not all, of our crude oil and condensate

from the Eagle Ford Shale.

●

Geographic

concentration of our refining operations and customers within the

Eagle Ford Shale.

●

Weather conditions,

hurricanes or other natural disasters affecting operations by us or

our key customers or the areas in which our customers

operate.

Pipeline and Facilities and Oil and Gas Assets

●

Assessment of civil

penalties by BOEM for failure to satisfy orders to increase

supplemental pipeline bonds within the time period

prescribed.

●

Assessment of civil

penalties by BSEE for failure to decommission platform and pipeline

assets within the time period prescribed.

Common Stock

●

Our stock price may

decline due to sales of shares by Affiliates.

●

Issuance of

additional shares of Common Stock and Preferred Stock may

significantly dilute the equity ownership of current

holders.

|

All

forward-looking statements included in this report are based on

information available to us on the date of this report. We

undertake no obligation to revise or update any forward-looking

statements as a result of new information, future events, or

otherwise.

|

Business

|

|

|

Unless

the context otherwise requires, references in this report to

“Blue Dolphin,” “we,” “us,”

“our,” or “ours” refer to Blue Dolphin

Energy Company, one or more of its consolidated subsidiaries, or

all of them taken as a whole.

Part I

should be read in conjunction with “Part II, Item 7.”

and “Part II, Item 8.”

PART I

ITEM 1.

BUSINESS

Overview

Blue

Dolphin is an independent downstream energy company operating in

the Gulf Coast region of the United States. Our subsidiaries

operate a light sweet-crude, 15,000-bpd crude distillation tower

with approximately 1.2 million bbls of petroleum storage tank

capacity in Nixon, Texas. Blue Dolphin was formed in 1986 as a

Delaware corporation and is traded on the OTCQX under the ticker

symbol “BDCO”.

Our

assets are primarily organized in two segments: refinery operations

(owned by LE) and tolling and terminaling services (owned by LRM

and NPS). Subsidiaries that are reflected in corporate and other

include BDPL (inactive pipeline and facilities assets), BDPC

(inactive leasehold interests in oil and gas wells), and BDSC

(administrative services). See "Item 1.,” “Item

2.,” and “Note (4)” to our consolidated financial

statements for more information related to our business segments

and properties.

Affiliates

Affiliates

control approximately 82% of the voting power of our

Common Stock. An Affiliate operates and manages all Blue Dolphin

properties and funds working capital requirements during periods of

working capital deficits, and an Affiliate is a significant

customer of our refined products. Blue Dolphin and certain of its

subsidiaries are currently parties to a variety of agreements with

Affiliates. See “Item 1A.” and “Note (3)”

to our consolidated financial statements for additional disclosures

related to Affiliate risk factors, Affiliate agreements and

arrangements, and risks associated with working capital

deficits.

Going Concern

See

“Item 1A.” and “Note (1)” to our

consolidated financial statements regarding going concern factors

and associated risks.

Operating Risks

See

“Note (1)” to our consolidated financial statements

regarding factors that have negatively

impacted our business plan execution.

Refinery Operations

Our

refinery operations segment consists of the following assets and

operations:

|

Property

|

|

Key

Products

Handled

|

|

Operating

Subsidiary

|

|

Location

|

|

|

|

|

|

|

|

|

|

Nixon

facility

● Crude

distillation tower (15,000 bpd)

● Petroleum

storage tanks

● Loading

and unloading facilities

● Land

(56 acres)

|

|

Crude

Oil

Refined

Products

|

|

LE

|

|

Nixon,

Texas

|

|

|

|

|

|

|

|

|

See

below under “Refinery Operations Process Summary” for

an overview diagram of our refinery operations.

Capital Improvement Expansion Project. Since 2015, the Nixon

facility has been undergoing a capital improvement expansion

project. Refinery operations capital improvements have primarily

related to construction of new petroleum storage tanks. However,

smaller efficiency improvements have been made as well. In the

short-term, increased petroleum storage capacity has helped with

de-bottlenecking the refinery. In the long-term, additional

petroleum storage capacity will allow for increased refinery

throughput of up to approximately 30,000 bpd.

|

7

|

|

Business

|

|

|

Crude Oil and Condensate Supply. Operation of the

Nixon refinery depends on our ability to purchase adequate amounts

of crude oil and condensate. We have a long-term crude supply

agreement in place with Pilot. Under the initial term of the crude

supply agreement, Pilot will sell us approximately 24.8 million net

bbls of crude oil. Thereafter, the crude supply agreement will

continue on a one-year evergreen basis. Pilot may terminate the

crude supply agreement at any time by providing us 60 days prior

written notice. We may terminate the agreement upon the expiration

of the initial term or at any time during a renewal term by giving

Pilot 60 days prior written notice.

Pilot also stores crude oil at the Nixon facility under a terminal

services agreement. Under the terminal services agreement, Pilot

stores crude oil at the Nixon facility at a specified rate per bbl

of the storage tank’s shell capacity. The terminal services

agreement has an initial term that expires April 30, 2020.

Thereafter, the terminal services agreement will continue on a

one-year evergreen basis. Either party may terminate the terminal

services agreement by providing the other party 60 days prior

written notice. However, the terminal services agreement will

automatically terminate upon expiration or termination of the crude

supply agreement.

Our

financial health could be adversely affected by defaults under our

secured loan agreements, historic net losses, and working capital

deficits, which could impact our ability to acquire crude oil and

condensate. A failure to acquire crude oil and condensate when

needed will have a material effect on our business results and

operations. See “Item 1A.” for risks associated with

crude supply.

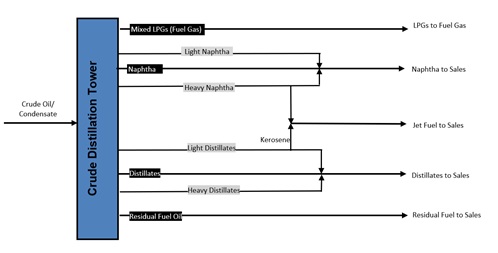

Refinery Operations Process Summary. The Nixon refinery is

considered a “topping unit” because it is primarily

comprised of a crude oil distillation tower or unit, the first

stage of the crude oil refining process. The crude distillation

tower separates crude oil and condensate into finished and

intermediate petroleum products. The below diagram represents a

high-level overview of the current crude oil and condensate

refining process at the Nixon refinery.

Example represents a simplified outut of refined

products.

A

regional electric cooperative supplies electrical power to our

facility in Nixon, Texas. Fuel gas is produced as a by-product at

the Nixon refinery and is primarily used as fuel within the

refinery. In addition, small amounts of propane are occasionally

acquired for use in starting-up the Nixon refinery.

Products and Markets. Our market is the Gulf Coast region of

the U.S., which is represented by the EIA as Petroleum

Administration for PADD 3. We sell our products primarily in

the U.S. within PADD 3. Occasionally we sell refined products to

customers that export to Mexico.

The

Nixon refinery’s product slate is moderately adjusted based

on market demand. We currently produce a single finished product

– jet fuel – and several intermediate products,

including naphtha, HOBM, and AGO. Our jet fuel is sold to an

Affiliate, which is HUBZone certified. Our intermediate products

are primarily sold in nearby markets to wholesalers and refiners as

a feedstock for further blending and processing. See “Note

(3)” and “Note (16)” to our consolidated

financial statements for additional disclosures related to

Affiliates arrangements and transactions.

Customers. Customers

for our refined products include distributors, wholesalers and

refineries primarily in the lower portion of the Texas Triangle

(the Houston - San Antonio - Dallas/Fort Worth area). We have bulk

term contracts in place with most of our customers, including

month-to-month, six months, and up to one-year terms. Certain of

our contracts require our customers to prepay and us to sell fixed

quantities and/or minimum quantities of finished and intermediate

petroleum products. Many of these arrangements are subject to

periodic renegotiation on a forward-looking basis, which could

result in higher or lower relative prices on future sales of our

refined products. See “Item 1A.” and “Note

(5)” to our consolidated financial statements for disclosures

related to concentration of risk associated with significant

customers.

|

8

|

|

Business

|

|

|

Competition. Many of our competitors are

substantially larger than us and are engaged on a national or

international level in many segments of the oil and gas industry,

including exploration and production, gathering and transportation,

and marketing. These competitors may have greater flexibility in

responding to or absorbing market changes occurring in one or more

of these business segments. We compete primarily based on cost. Due

to the low complexity of our simple “topping unit”

refinery, we can be relatively nimble in adjusting our refined

products slate because of changing commodity prices, market demand,

and refinery operating costs.

Safety and Downtime. Our

refinery operations are operated in a manner consistent with

industry safe practices and standards. These operations are subject

to regulations under OSHA, the EPA, and comparable state and local

requirements. Together, these regulations are designed for

personnel safety, process safety management, and risk management,

as well as to prevent or minimize the probability and consequences

of an accidental release of toxic, reactive, flammable, or

explosive chemicals. Storage tanks used for refinery

operations are designed for crude oil and condensate and refined

products, and most are equipped with appropriate controls that

minimize emissions and promote safety. Our refinery operations have

response and control plans, spill prevention and other programs to

respond to emergencies. See “Government Regulations”

below for specific federal, state and local regulations for which

our refinery operations are subject.

The Nixon refinery periodically experiences planned and unplanned

temporary shutdowns. Unplanned shutdowns can occur for a variety of

reasons, including voluntary regulatory compliance measures,

cessation or suspension by regulatory authorities, or disabled

equipment. However, in Texas the most typically reason is excessive

heat or power outages from high winds and thunderstorms. Planned

turnarounds are used to repair, restore, refurbish, or

replace refinery equipment. Refineries typically undergo a major

turnaround every three to five years. Since the Nixon refinery was

placed back in service in 2012 (commonly referred to as

“recommissioning”), turnarounds are needed more

frequently for unanticipated maintenance or repairs.

We are particularly vulnerable to disruptions in our operations

because all our refining operations are conducted at a single

facility. Any scheduled or unscheduled downtime will result in lost

margin opportunity, potential increased maintenance expense, and a

reduction of refined products inventory, which could reduce our

ability to meet our payment obligations. See “Item 1A.”

for risks sociated with Nixon refinery downtime.

Tolling and Terminaling Operations

Our

tolling and terminaling segment consists of the following assets

and operations:

|

Property

|

|

Key

Products

Handled

|

|

Operating

Subsidiary

|

|

Location

|

|

|

|

|

|

|

|

|

|

Nixon

facility

● Petroleum

storage tanks

● Loading

and unloading facilities

|

|

Crude

Oil

Refined

Products

|

|

LRM,

NPS

|

|

Nixon,

Texas

|

|

|

|

|

|

|

|

|

Capital Improvement Expansion Project. As previously noted,

the Nixon facility has been undergoing a capital improvement

expansion project since 2015. Tolling and terminaling capital

improvements have primarily related to construction of new

petroleum storage tanks to significantly increase petroleum storage

capacity. Increased petroleum storage capacity will provide an

opportunity to generate additional tolling and terminaling

revenue.

Products and Customers. The

Nixon facility’s petroleum storage tanks and infrastructure

are primarily suited for crude oil and condensate and refined

products, such as naphtha, jet fuel, diesel and fuel oil. Storage

customers are typically refiners in the lower portion of the

Texas Triangle (the Houston - San Antonio - Dallas/Fort Worth

area). Shipments are received and redelivered from within the Nixon

facility via pipeline or from third parties via truck. Contract

terms range from month-to-month to three years.

Operations Safety. Our tolling and terminal operations are

operated in a manner consistent with industry safe practices and

standards. These operations are subject to regulations under OSHA

and comparable state and local regulations. Storage tanks used for

terminal operations are designed for crude oil and condensate and

refined products, and most are equipped with appropriate controls

that minimize emissions and promote safety. Our terminal operations

have response and control plans, spill prevention and other

programs to respond to emergencies. See “Government

Regulations” below for specific federal, state and local

regulations for which our tolling and terminaling operations are

subject.

|

9

|

|

Business

|

|

|

Inactive Operations

We own

certain other pipeline and facilities assets and have leasehold

interests in oil and gas properties. These assets, which are shown

below and included in corporate and other, are not operational and

are fully impaired.

|

Property

|

|

Operating

Subsidiary

|

|

|

Location

|

|

|

|

|

|

|

|

|

Freeport

facility

● Crude

oil and natural gas separation and dehydration

● Natural

gas processing, treating, and redelivery

● Vapor

recovery unit

● Two

onshore pipelines

● Land

(162 acres)

|

|

BDPL

|

|

|

Freeport,

Texas

|

|

Offshore

Pipelines (Trunk Line and Lateral Lines)

|

|

BDPL

|

|

|

Gulf of

Mexico

|

|

Oil and

Gas Leasehold Interests

|

|

BDPC

|

|

|

Gulf of

Mexico

|

|

|

|

|

|

|

|

We

fully impaired our pipeline assets at December 31, 2016 and our oil

and gas properties at December 31, 2011. Our pipeline and oil and

gas properties had no revenue during the years ended December 31,

2019 and 2018. See “Item 1A.” and “Note

(16)” to our consolidated financial statements related to

idle iron decommissioning requirements and related

risks.

Pipeline and Facilities Safety.

Although

our pipeline and facility assets are inactive, they require upkeep

and maintenance and are subject to safety regulations under OSHA,

PHMSA, BOEM, BSEE, and comparable state and local regulations. We

have response and control plans, spill prevention and other

programs to respond to emergencies related to these assets. See

“Government Regulations” below for specific federal,

state and local regulations for which our pipeline and facilities

assets are subject.

Personnel

We have

no employees. We rely on an Affiliate to manage our facilities

pursuant to the Amended and Restated Operating Agreement. Services

under the Amended and Restated Operating Agreement include

personnel serving in a variety of capacities, including, but not

limited to corporate executives, operations and maintenance,

environmental, health and safety, and administrative and

professional services. At December 31, 2019, the Affiliate had a

total of 216 employees, 165 full-time and 51 part-time. No

personnel were covered by collective bargaining agreements. See

“Note (3)” to our consolidated financial statements for

additional disclosures related to Affiliate

arrangements.

Insurance and Risk Management

Our

operations are subject to significant hazards and risks inherent in

crude oil and condensate refining operations, as well as the

transportation and storage of crude oil and condensate and refined

products. We have property damage and business interruption

coverage at the Nixon facility. Business interruption coverage is

for 24 months from the date of the loss, subject to a deductible

with a 45-day waiting period. Our property damage insurance has

deductibles ranging from $5,000 to $500,000. In addition, we have a

full suite of insurance policies covering workers’

compensation, general liability, directors’ and

officers’ liability, environmental liability, and other

business risks. These coverages are supported by safety and other

risk management programs.

Intellectual Property

We rely

on intellectual property laws to protect our brand, as well as

those of our subsidiaries. “Blue Dolphin Energy

Company” is a registered trademark in the U.S. in name and

logo form. “Petroport, Inc.” is a registered trademark

in the U.S. in name form. In addition,

“www.blue-dolphin-energy.com” is a registered domain

name.

Website Access to Reports and Other Information

Our

Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q,

Current Reports on Form 8-K, and other public filings with the SEC

are available, free of charge, on our website (http://www.blue-dolphin-energy.com)

as soon as reasonably practical after we file them with, or furnish

them to, the SEC. Information contained on our website is not part

of this report. You may also access these reports on the

SEC’s website at http://www.sec.gov.

|

10

|

|

Business

|

|

|

Government Regulations

General. Our operations are subject to extensive and

frequently changing federal, state, and local laws, regulations,

permits, and ordinances relating to the protection of the

environment. Among other things, these laws and regulations govern

obtaining and maintaining construction and operating permits, the

emission and discharge of pollutants into or onto the land, air,

and water, the handling and disposal of solid, liquid, and

hazardous wastes and the remediation of contamination. Compliance

with existing and anticipated environmental laws and regulations

increases our overall cost of business, including our capital costs

to construct, maintain, operate and upgrade equipment and

facilities. Failure to comply with these laws and regulations may

trigger a variety of administrative, civil, and criminal

enforcement measures, including the assessment of monetary

penalties. Certain environmental statutes impose strict, joint and

several liability for costs required to clean up and restore sites

where hazardous substances, hydrocarbons or wastes have been

disposed or otherwise released. Moreover, it is not uncommon for

neighboring landowners and other third parties to file claims for

personal injury and property damage allegedly caused by the release

of hazardous substances, hydrocarbons, or other waste products into

the environment. These requirements may also significantly affect

our customers’ operations and may have an indirect effect on

our business, financial condition and results of operations.

However, we do not expect such effects will have a material impact

on our financial position, results of operations, or

liquidity.

Air Emissions and Climate Change Regulations. Our operations are

subject to the Clean Air Act and comparable state and local

statutes. Under these laws, we are required to obtain permits, as

well as test, monitor, report, and implement control requirements.

If regulations become more stringent, additional emission control

technologies may be required to be installed at the Nixon facility

and certain emission sources located offshore, and our ability to

secure future permits may become less certain. Any such future

obligations could require us to incur significant additional

capital or operating costs.

The EPA

has undertaken significant regulatory initiatives under authority

of the Clean Air Act’s NSR/PSD program to further reduce

emissions of volatile organic compounds, nitrogen oxides, sulfur

dioxide, and particulate matter. These regulatory initiatives have

been targeted at industries with large manufacturing facilities

that are significant sources of emissions, such as refining, paper

and pulp, and electric power generating industries. The basic

premise of these initiatives is the EPA’s assertion that many

of these industrial establishments have modified or expanded their

operations over time without complying with NSR/PSD regulations

adopted by the EPA that require permits and new emission controls

in connection with any significant facility modifications or

expansions that can result in emission increases above certain

thresholds. As part of this ongoing NSR/PSD regulatory initiative,

the EPA has consent decrees with several refiners that require

refiners to make significant capital expenditures to install

emissions control equipment at selected facilities. We have not

been selected by the EPA to enter a consent decree. If selected, as

a small refiner we do not expect any additional requirements to

have a material impact on our financial position, results of

operations, or liquidity.

The EPA

strengthened the NAAQS for ground-level ozone to 70 parts per

billion in 2015 from the 75-parts per billion level set in 2008. To

implement the revised ozone NAAQS, all states will need to review

their existing air quality management infrastructure State

Implementation Plan for ozone and ensure it is appropriate and

adequate. Where areas remain in ozone non-attainment, or come into

ozone non-attainment as a result of the revised NAAQS, it is likely

that additional planning and control obligations will be required.

States may impose additional emissions control requirements on

stationary sources, changes in fuels specifications, and changes in

fuels mix and mobile source emissions controls. The ongoing and

potential future requirements imposed by states to meet the ozone

NAAQS could have direct impacts on terminaling facilities through

additional requirements and increased permitting costs and could

have indirect impacts through changing or decreasing fuel

demand.

The

Energy Independence and Security Act of 2007 created RFS2 requiring

the total volume of renewable transportation fuels (including

ethanol and advanced biofuels) sold or introduced in the U.S. to

reach 36.0 billion gallons by 2022. We applied for an extension of

the temporary exemption afforded small refineries through December

31, 2010. The EPA granted the Nixon refinery a small refinery

exemption from RFS2 requirements for 2013 and 2014. Since 2014, the

Nixon refinery has solely produced HOBM, a non-transportation

lubricant blend product that does not fall under RFS2.

Currently,

multiple legislative and regulatory measures to address greenhouse

gas emissions are in various phases of discussion or

implementation. These include actions to develop national, state,

or regional programs, each of which would require reductions in our

greenhouse gas emissions or those of our customers. In 2015, the

EPA amended the Petroleum and Natural Gas Systems source category

(Subpart W) of the Greenhouse Gas Reporting Program, to include

among other things a new Onshore Petroleum and Natural Gas

Gathering and Boosting segment that encompasses greenhouse gas

emissions from equipment and sources within the petroleum and

natural gas gathering boosting systems. In 2016, the EPA

promulgated regulations regarding performance standards for methane

emissions from new and modified oil and gas production and natural

gas processing and transmission facilities, and in September 2018,

proposed targeted improvements to these standards to streamline

implementation of the rules. These and other legislative regulatory

measures will impose additional burdens on our business and those

of our customers.

Hazardous Substances and Waste Regulations. The CERCLA imposes strict, joint and

several liability on a broad group of potentially responsible

parties for response actions necessary to address a release of

hazardous substances into the environment. The law authorizes

two kinds of response actions: (i) short-term removals, where

actions may be taken to address releases or threatened releases

requiring prompt response, and (ii) long-term remedial response

actions, that permanently and significantly reduce the dangers

associated with releases or threats of releases of hazardous

substances that are serious, but not immediately life threatening.

Neither we nor any of our predecessors have been designated as a

potentially responsible party under CERCLA or a similar state

statute.

|

11

|

|

Business

|

|

|

We

generate petroleum product wastes, solid wastes, and ordinary

industrial wastes, such as from paints and solvents, that are

regulated under RCRA and comparable state statues. We are not

currently required to comply with a substantial portion of the RCRA

requirements because we are considered small quantity generators of

hazardous wastes by the EPA and state regulations. However, it is

possible that additional wastes, which could include wastes

currently generated during operations, will in the future be

designated as hazardous wastes. Hazardous wastes are subject to

more rigorous and costly disposal requirements than are

non-hazardous wastes. The Hazardous Waste Generator Improvement

Rule of the EPA provides some additional flexibility for small

generators but also increases certain recordkeeping and

administrative burdens. Several states are now in the process of

adopting this rule. Any additional changes in the regulations could

increase our capital and operating costs.

We

currently own properties where crude oil, refined petroleum

hydrocarbons, and fuel additives have been handled for many years

by previous owners. At some facilities, hydrocarbons or other waste

may have been disposed of or released on or under the properties

owned by us or on or under other locations where these wastes have

been taken for disposal. Although prior owners and operators may

have used operating and waste disposal practices that were standard

in the industry at the time, these properties and wastes disposed

thereon are now subject to CERCLA, RCRA and analogous state laws.

Under these laws, we could be required to remove or remediate

previously disposed or released wastes (including wastes disposed

of or released by prior owners or operators), to clean up

contaminated property (including impacted groundwater), or to

perform remedial operations to prevent future contamination to the

extent we are not indemnified for such matters.

Water Pollution Regulations. Our operations can result in the

discharge of pollutants, including chemical components of crude oil

and refined products, into federal and state waters. The CWA prohibits the discharge of pollutants into

U.S. waters except as authorized by the terms of a permit issued by

the EPA or a state agency with delegated authority. The

transportation and storage of crude oil and refined products over

and adjacent to water involves risks and subjects us to the

provisions of the CWA, OPA 90, and related state

requirements.

Spill

prevention, control, and countermeasure requirements mandate the

use of structures, such as berms and other secondary containment,

to prevent hydrocarbons or other pollutants from reaching a

jurisdictional body of water in the event of a spill or leak. These

requirements prevent pollutant releases and minimize potential

impacts should a release occur. We have federally certified OSROs

available to respond to a spill and, in the case of our offshore

pipelines, we maintain the statutory $35.0 million coverage

required proof of financial responsibility. In the event of an oil

spill into navigable waters, we can be subject to strict, joint,

and potentially unlimited liability for removal costs and other

consequences.

Wastewater

is subject to restrictions and strict controls under the CWA.

Federal and state regulatory agencies can impose administrative,

civil, and criminal penalties for non-compliance with discharge

permits. Process wastewater from the

Nixon refinery is tested and discharged to a nearby municipal

treatment facility pursuant to applicable process wastewater

permits. Wastewater from our offshore facilities, including our oil

and natural gas pipelines and anchor platform, is tested and

discharged pursuant to applicable produced water permits.

Stormwater at the Nixon facility is tested and discharged pursuant

to applicable stormwater permits.

Offshore “Idle Iron” Decommissioning

Regulations. In

2018 BSEE updated its earlier 2010 guidance and regulations on

decommissioning that mandates lessees and rights-of-way holders

permanently abandon and/or remove platforms and other structures

when no longer useful for operations. To cover the various

obligations of lessees and rights-of-way holders operating in

federal waters of the Gulf of Mexico, BOEM evaluates an

operator’s financial ability to carry out present and future

obligations to determine whether the operator must provide

additional security beyond the minimum bonding requirements. Such

obligations include the cost of plugging and abandoning wells and

decommissioning and removing platforms and pipelines at the end of

production or service activities. Once plugging and abandonment

work has been completed, the collateral backing the financial

assurance is released by BOEM.

We are

required by BOEM to: (i) maintain acceptable financial assurance

(pipeline bonds) for the decommissioning of our assets offshore in

federal waters and (ii) decommission these assets following a

certain period of inactivity. As of December 31, 2019, we

maintained approximately $0.9 million in credit and cash-backed

pipeline rights-of-way bonds issued to the BOEM. As of December 31,

2019, we maintained $2.6 million in AROs related to abandonment of

these assets. See “Item 1A.,” “Note (12),”

and “Note (16)” to our consolidated financial

statements for additional disclosures related to idle iron

decommissioning requirements for our pipelines and facilities

assets and related risks.

Health, Safety and Maintenance

We are

subject to the requirements of OSHA and other federal and state

agencies that address employee health and safety. In general, we

believe current expenditures are fulfilling the OSHA requirements

and protecting the health and safety of our employees. Based on new

regulatory developments, we may increase expenditures in the future

to comply with higher industry and regulatory safety standards.

However, such increases in our expenditures, and the extent to

which they might be offset, cannot be estimated at this

time.

BSEE

also requires offshore operators to employ a SEMS

plan. SEMS are designed to reduce human and

organizational errors as root causes of work-related accidents and

offshore spills, develop protocols as to who at the facility has

the ultimate operational safety and decision-making authority, and

establish procedures to provide all personnel with “stop

work” authority. We have a SEMS program in

place.

|

12

|

|

Risk Factors

|

|

|

ITEM 1A. RISK FACTORS

You should carefully consider the risks described below, in

addition to the other information contained in this document.

Realization of any of the following risks could have a material

adverse effect on our business, financial condition, cash flows and

results of operations.

A.

Risks Related to Our Business and Industry

A1.

Management has determined that there is, and the report of our

independent registered public accounting firm expresses,

substantial doubt about our ability to continue as a going

concern.

Management

has determined that conditions exist that raise substantial doubt

about our ability to continue as a going concern due to defaults

under our secured loan agreements, historic net losses, and working

capital deficits. A ‘going concern’ opinion could

impair our ability to finance our operations through the sale of

equity, incurring debt, or other financing alternatives. Our

ability to continue as a going concern will depend on sustained

positive operating margins and working capital to sustain

operations, including the purchase of crude oil and condensate and

payments on long-term debt. If we are unable to achieve these

goals, our business would be jeopardized, and we may not be able to

continue. If we are unable to make required debt payments, we would

likely have to consider other options, such as selling assets,

raising additional debt or equity capital, cutting costs or

otherwise reducing our cash requirements, or negotiating with our

creditors to restructure our applicable obligations.

A2.

Inadequate liquidity to sustain operations due to defaults under

our secured loan agreements, historic net losses, and working

capital deficits, any of which could have a material adverse effect

on us.

We

currently rely on revenue from operations, Affiliates, and

borrowings under bank facilities to meet our liquidity needs. Our

short-term working capital needs are primarily related to

acquisition of crude oil and condensate to operate the Nixon

refinery, repayment of short-term debt obligations, and capital

expenditures for maintenance, upgrades, and refurbishment of

equipment at the Nixon facility. Our long-term working capital

needs are primarily related to repayment of long-term debt

obligations. In addition, we continue to utilize capital to reduce

operational, safety and environmental risks. We may incur

substantial compliance costs relating to any new environmental,

health and safety regulations. The Amended Pilot Line of Credit

will mature in May 2020. Our liquidity will affect our ability to

satisfy any of these needs.

We had

a working capital deficit of $59.4 million and $71.9 million at

December 31, 2019 and 2018, respectively. Excluding the current

portion of long-term debt, we had a working capital deficit of

$19.6 million and $30.0 million at December 31, 2019 and 2018,

respectively. We had cash and cash equivalents and restricted cash

(current portion) of $0.07 million and $0.05 million, respectively,

at December 31, 2019. Comparatively, we had cash and cash

equivalents and restricted cash (current portion) of $0.01 million

and $0.05 million, respectively, at December 31, 2018.

While

we believe that we can fund our operations through revenue from

operations and Affiliate financing, we may not be able to, among

other things, (i) maintain our current general and administrative

spending levels; (ii) fund certain obligations as they become due;

and (iii) respond to competitive pressures or unanticipated capital

requirements. We cannot provide any assurance that financing will

be available to us in the future on acceptable terms.

A3.

Defaults under our secured loan agreements could have a material

adverse effect on our business, financial condition, and results of

operations and materially adversely affect the value of an

investment in our common stock.

As

described elsewhere in this report, we are in default under our

secured loan agreements. Defaults include events of default and

financial covenant violations. Defaults under our secured loan

agreements permit Veritex to declare the amounts owed under these

loan agreements immediately due and payable, exercise its rights

with respect to collateral securing obligors’ obligations

under these loan agreements, and/or exercise any other rights and

remedies available. The debt associated with these loans was

classified within the current portion of long-term debt on our

consolidated balance sheets at December 31, 2019 and

2018.

In

September 2017, Veritex notified obligors of events of default,

including, but not limited to, the occurrence of the GEL Final

Arbitration Award, associated material adverse effect conditions,

failure by LE to replenish a $1.0 million payment reserve account,

and the occurrence of events of default by obligors under our other

secured loan agreements with Veritex, all of which constituted

events of default under our secured loan agreements. Further,

Veritex informed obligors that it would consider a final

confirmation of the GEL Final Arbitration Award to be a material

event of default under the loan agreements. Veritex did not

accelerate or call due our secured loan agreements considering

these factors. Instead, Veritex expressly reserved all its rights,

privileges and remedies related to events of default.

|

13

|

|

Risk Factors

|

|

|

In

April 2019, obligors were notified by Veritex that the bank agreed

to waive certain covenant defaults and forbear from enforcing its

remedies under our secured loan agreements subject to: (i) the

agreement and concurrence of the USDA and (ii) the replenishment of

the payment reserve account on or before August 31, 2019. Following

the GEL Settlement, the associated mutual releases became effective

and GEL filed a stipulation of dismissal of claims against LE. As

of the date of this report, LE had not replenished the payment

reserve account and obligors were still in default under our

secured loan agreements with Veritex.

At

December 31, 2019, LE and LRM were in violation of the debt service

coverage ratio, current ratio, and debt to net worth ratio

financial covenants under our secured loan agreements with

Veritex.

Any

exercise by Veritex of its rights and remedies under our secured

loan agreements would have a material adverse effect on our

business operations, including crude oil and condensate procurement

and our customer relationships; financial condition; and results of

operations. In such a case, the trading price of our common stock

and the value of an investment in our common stock could

significantly decrease, which could lead to holders of our common

stock losing their investment in our common stock in its

entirety.

We can

provide no assurance that: (i) our assets or cash flow will be

sufficient to fully repay borrowings under outstanding long-term

debt, either upon maturity or if accelerated, (ii) LE and LRM will

be able to refinance or restructure the payments on the long-term

debt, and/or (iii) Veritex, as first lien holder, will provide

future default waivers. Defaults under our secured loan agreements

and any exercise by Veritex of its rights and remedies related to

such defaults may have a material adverse effect on the trading

prices of our common stock and on the value of an investment in our

common stock, and holders of our common stock could lose their

investment in our common stock in its entirety.

A4.

We

will need to repay or refinance borrowings under the Amended Pilot

Line of Credit.

The

Amended Pilot Line of Credit is scheduled to mature in May 2020. We

will need to repay, refinance, replace or otherwise extend the

maturity of this line of credit. Our ability to repay, refinance,

replace or extend this facility by its maturity date will be

dependent on, among other things, business conditions, our

financial performance and the general condition of the financial

markets. If a financial disruption were to occur at the time that

we are required to repay this indebtedness, we could be forced to

undertake alternate financings, including a sale of additional

common stock, negotiate for an extension of the maturity or sell

assets and delay capital expenditures in order to generate proceeds

that could be used to repay such indebtedness. We cannot provide

any assurance that we will be able to consummate any such

transaction on terms that are commercially reasonable, on terms

acceptable to us or at all.

A5.

Our substantial current debt, which is included in the current

portion of long-term debt (in default), the current portion of

long-term debt, related party (in default), and line of credit

payable, could adversely affect our financial health and make us

more vulnerable to adverse economic conditions.

As of

December 31, 2019 and 2018, we had current debt of $51.3 million

and $41.9 million, respectively, consisting of bank debt, related

party debt, and a line of credit payable. Blue Dolphin, as parent

company, has guaranteed the indebtedness of certain subsidiaries.

In addition, Affiliates have guaranteed the indebtedness of Blue

Dolphin and certain of its subsidiaries. This level of debt in

current liabilities and the cross guarantee agreements could have

important consequences, such as: (i) limiting our ability to obtain

additional financing to fund our working capital, capital

expenditures, debt service requirements or potential growth, or for

other purposes; (ii) increasing the cost of future borrowings;

(iii) limiting our ability to use operating cash flow in other

areas of our business because we must dedicate a substantial

portion of these funds to make payments on our debt; (iv) placing

us at a competitive disadvantage compared to competitors with less

debt; and (v) increasing our vulnerability to adverse economic and

industry conditions.

As of

the filing date of this report, we were current with the monthly

payments required under our bank debt and line of credit payable.