As filed with the Securities and Exchange Commission on December 12, 2023

Registration No. 333-267366

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact Name of Registrant as Specified in Its Charter)

| (State

or Other Jurisdiction of Incorporation or Organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Christopher Furman

Chief Executive Officer

3200 Cherry Creek Drive South, Suite 410

Denver, Colorado 80209

(855) 848-7627

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

| Copies to: | ||||

Ross Carmel Jeff Cahlon Sichenzia Ross Ference Carmel LLP 1185 Avenue of the Americas New York, NY 10036 |

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large

accelerated filer ☐ Accelerated filer ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION |

DATED DECEMBER 12, 2023 |

1,957,845 Shares

Common Stock

Vitro Biopharma, Inc.

This prospectus relates to the registration of the resale of up to 1,957,845 shares of our common stock by our stockholders identified in this prospectus (the “Registered Stockholders”), including 1,224,183 outstanding shares, 20,000 shares issuable pursuant to a consulting agreement, 133,550 shares issuable pursuant to a financial advisory agreement, 413,446 shares issuable upon conversion of outstanding notes (including accrued interest as of October 31, 2023), and 166,666 shares issuable upon exercise of outstanding warrants. Unlike an initial public offering, the resale by the Registered Stockholders is not being underwritten on a firm-commitment basis by any investment bank. The Registered Stockholders may, or may not, elect to sell their shares of common stock covered by this prospectus, as and to the extent they may determine. If the Registered Stockholders utilize a broker-dealer in the sale of the shares of common stock being offered by this prospectus on the Nasdaq Capital Market, or Nasdaq, such broker-dealer may receive commissions in the form of discounts, concessions, or commissions which may be in excess of those customary in the types of transactions involved. See “Plan of Distribution.” If the Registered Stockholders choose to sell their shares of common stock, we will not receive any proceeds from the sale of shares of common stock by the Registered Stockholders.

No public market for our common stock currently exists. Further, the listing of our common stock on Nasdaq, without a firm-commitment underwritten offering, is a novel method for commencing public trading in shares of our common stock, and consequently, the trading volume and price of shares of our common stock may be more volatile than if shares of our common stock were initially listed in connection with an initial public offering underwritten on a firm-commitment basis.

On the day that our shares of common stock are initially listed on Nasdaq, Nasdaq will begin accepting, but not executing, pre-opening buy and sell orders and will begin to continuously generate the indicative Current Reference Price (as defined below) on the basis of such accepted orders. The Current Reference Price is calculated each second and, during a 10-minute “Display Only” period, is disseminated, along with other indicative imbalance information, to market participants by Nasdaq on its NOII and BookViewer tools. Following the “Display Only” period, a “Pre-Launch” period begins, during which Spartan Capital Securities LLC (the “Advisor” or “Spartan”), in its capacity as our financial advisor, must notify that our shares are “ready to trade.” Once the Advisor has notified that our shares of common stock are ready to trade, will confirm the Current Reference Price for our shares of common stock, in accordance with the rules. If the Advisor then approves proceeding at the Current Reference Price, the applicable orders that have been entered will be executed at such price and regular trading of our shares of common stock on will commence, subject to conducting validation checks in accordance with the rules. Under the rules, the “Current Reference Price” means: (i) the single price at which the maximum number of orders to buy or sell can be matched; (ii) if there is more than one price at which the maximum number of orders to buy or sell can be matched, then it is the price that minimizes the imbalance between orders to buy or sell (i.e. minimizes the number of shares that would remain unmatched at such price); (iii) if more than one price exists under (ii), then it is the entered price (i.e. the specified price entered in an order by a customer to buy or sell) at which our shares of common stock will remain unmatched (i.e. will not be bought or sold); and (iv) if more than one price exists under (iii), a price determined by Nasdaq in consultation with the Advisor in its capacity as our financial advisor. In the event that more than one price exists under (iii), the Advisor will exercise any consultation rights only to the extent that it can do so consistent with the anti-manipulation provisions of the federal securities laws, including Regulation M, or applicable relief granted thereunder. The Registered Stockholders will not be involved in Nasdaq’s price-setting mechanism, including any decision to delay or proceed with trading, nor will they control or influence the Advisor in carrying out its role as a financial adviser. The Advisor will determine when our shares of common stock are ready to trade and approve proceeding at the Current Reference Price primarily based on considerations of volume, timing and price. In particular, the Advisor will determine, based primarily on pre-opening buy and sell orders, when a reasonable amount of volume will cross on the opening trade such that sufficient price discovery has been made to open trading at the Current Reference Price. For more information, see “Plan of Distribution.”

On June 23, 2023, our Board of Directors (the “Board”) approved a reverse split of our issued and outstanding common stock at a ratio of 1 share for 26 shares and a reduction of the number of shares of our authorized common stock by the same ratio (the “Reverse Stock Split”). Except where otherwise noted, all references to our common stock presented in this prospectus have been adjusted to reflect the Reverse Stock Split of 1 share for 26 shares, which became effective on July 6, 2023.

We intend to apply to list our common stock on Nasdaq under the symbol “VTRO”. We expect our common stock to begin trading on Nasdaq on or about ________.

Investing in our common stock involves a high degree of risk. See the section titled “Risk Factors” beginning on page 13.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023

| ii |

TABLE OF CONTENTS

Neither we nor any of the Registered Stockholders have authorized anyone to provide any information different from, or in addition to, the information contained in this prospectus. Neither we nor any of the Registered Stockholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The Registered Stockholders are offering to sell, and seeking offers to buy, shares of their common stock only under the circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since such date.

For investors outside the United States: Neither we nor any of the Registered Stockholders have done anything that would permit the use of or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stock by the Registered Stockholders and the distribution of this prospectus outside the United States.

| iii |

ABOUT THIS PROSPECTUS

This prospectus is a part of a registration statement on Form S-1 that we filed with the SEC using a “shelf” registration or continuous offering process. Under this process, the Registered Stockholders may, from time to time, sell the common stock covered by this prospectus in the manner described in the section titled “Plan of Distribution.” Additionally, we may provide a prospectus supplement to add information to, or update or change information contained in, this prospectus, including the section titled “Plan of Distribution”. You may obtain this information without charge by following the instructions under the “Where You Can Find Additional Information” section appearing elsewhere in this prospectus. You should read this prospectus and any prospectus supplement before deciding to invest in our common stock.

In this prospectus, “Vitro,” the “Company,” “we,” “us,” and “our” refer to Vitro Biopharma, Inc. and, unless otherwise indicated, its subsidiaries.

“Vitro Biopharma,” “AlloRx,” “MSC-Gro,” the Vitro logos, and other trade names, trademarks, or service marks of Vitro appearing in this prospectus are the property of Vitro. Other trade names, trademarks, or service marks appearing in this prospectus are the property of their respective holders. Solely for convenience, trade names, trademarks, and service marks referred to in this prospectus appear without the ®, ™ and SM symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trade names, trademarks, and service marks.

Reverse Stock Split

On June 23, 2023, the Board approved a reverse split of our issued and outstanding common stock at a ratio of 1 share for 26 shares and a reduction of the number of shares of our authorized common stock by the same ratio. Except where otherwise noted, all references to our common stock presented in this prospectus have been adjusted to reflect the Reverse Stock Split of 1 share for 26 shares, which became effective on July 6, 2023 (the “Reverse Stock Split Effective Date”).

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that you should consider before deciding to invest in our common stock. You should read this entire prospectus carefully, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business,” and our audited consolidated financial statements and unaudited condensed consolidated financial statements and related notes included elsewhere in this prospectus before making an investment decision.

Overview

We are an innovative biotechnology company targeting autoimmune diseases and inflammatory disorders. Through our proprietary platform, AlloRx Stem Cell therapy, we are developing novel cellular therapeutic candidates that are derived from culture-expanded mesenchymal stem cells (“MSCs”) sourced from the Wharton’s jelly of umbilical cords (“UCs”) donated by healthy volunteers following childbirth. In the United States, we are authorized to conduct two clinical trials under two U.S. Food and Drug Administration (“FDA”) Investigational New Drug (“IND”) applications to assess the safety and efficacy of AlloRx Stem Cell therapy in Pitt Hopkins syndrome (“PTHS”) and post-acute sequelae to SARs-CoV-2 (“PASC”), or long COVID (“Long COVID”), and expect to commence those trials in early 2024 As of September 1, 2023, over 440 subjects have received treatment with our AlloRx Stem Cells, primarily in foreign clinical studies conducted by third parties. Our lead clinical program is expected to focus on PTHS, a rare neurogenetic disorder primarily affecting children that is characterized by global developmental delays including autistic features, language delays, intellectual disability, neuro-irritability and significant behavioral concerns. We generate revenue from our other technologies through a number of other activities, including through the sale of our stem cell products as well as cosmeceuticals through InfiniVive MD, LLC (“InfiniVive MD”), our wholly-owned subsidiary, which helps to alleviate our capital expenses.

| 1 |

Our Science

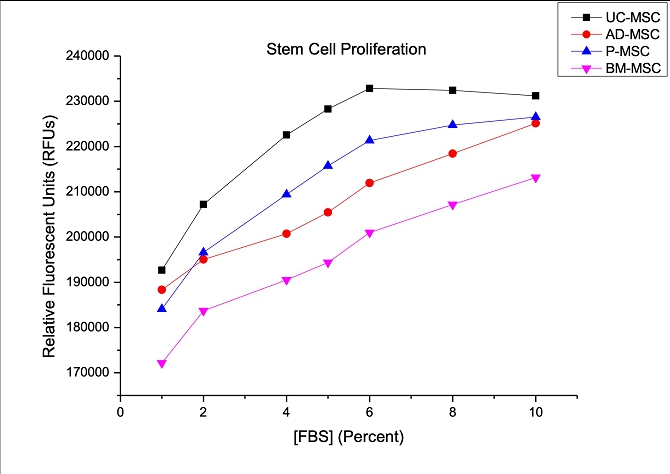

The starting raw material source for our AlloRx Stem Cells is the Wharton’s jelly of donated UCs. Based on extensive pre-clinical studies and research conducted by us and third-parties, as further described herein, we believe UC-derived MSCs like AlloRx Stem Cells may have advantages compared to MSCs derived from other starting raw material sources, such as MSCs derived from bone-marrow (“BM-MSCs”), adipose/fat (“AD-MSCs”), and placenta (“P-MSCs”). In our extensive pre-clinical, in vitro studies described below, we analyzed various biological characteristics of AlloRx Stem Cells (UC-derived MSCs) in head-to-head comparisons to AD-MSCs, BM-MSCs, and P-MSCs, including:

Growth rate. Because MSCs must be expanded in vitro prior to use in a clinical setting, we believe that the growth and expansion characteristics of MSCs in vitro are an important consideration. In a pre-clinical, in vitro study, we analyzed MSCs’ growth in cell cultures in head-to-head comparisons and observed that AlloRx Stem Cells (UC-derived MSCs) doubled in size in vitro after only 25 hours, as compared to longer doubling times of 35 hours, 40 hours and 53 hours for AD-MSCs, P-MSCs and BM-MSCs, respectively, indicating an increased growth rate of AlloRx Stem Cells as compared to these other MSCs.

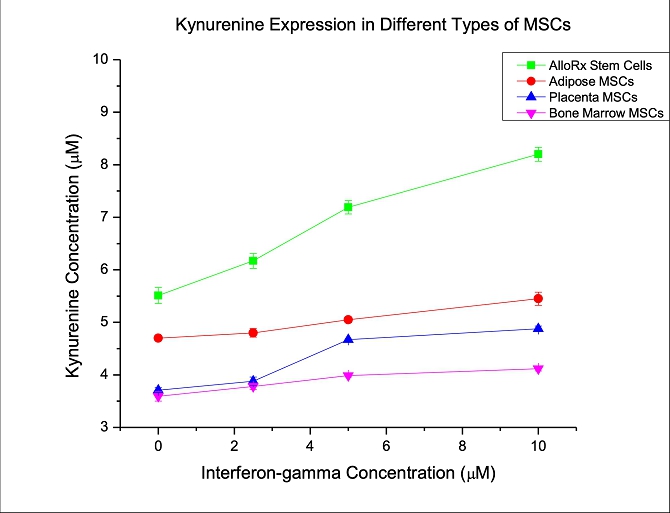

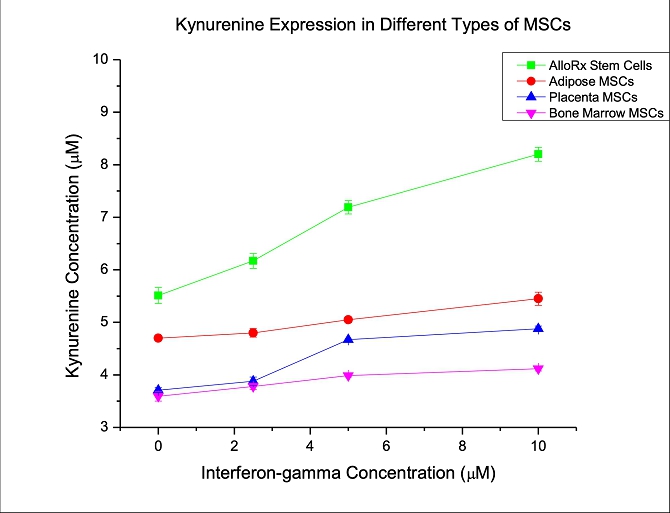

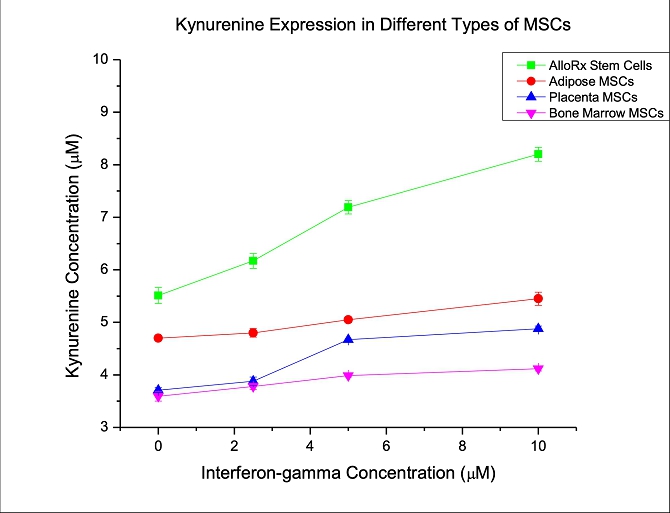

Immunomodulatory potency by quantification of γ-IFN-induced IDO activity: In a pre-clinical, in vitro study, we analyzed the immunomodulatory potency of AlloRx Stem Cells (UC-derived MSCs) in a head-to-head comparison to AD-MSCs, BM-MSCs, and P-MSCs by measuring the activity of γ-IFN-induced indoleamine 2,3-dioxygenase (“IDO”), as quantified by the conversion of tryptophan to kynurenine. IDO, an immunomodulatory substance secreted by MSCs, initiates the conversion of tryptophan to kynurenine, and kynurenine expression plays a critical role in regulating the body’s immune response. As illustrated in the chart below, we observed a significant difference in γ-IFN-induced IDO activity in AlloRx Stem Cells (UC-derived MSCs) as compared to AD-MSCs, BM-MSCs, and P-MSCs. Maximal IDO activity at 10 ng/ml γ-IFN was approximately two-fold greater in AlloRx Stem Cells versus the MSCs derived from other sources. We believe these results indicate UC-derived MSCs like AlloRx Stem Cells may have greater immunomodulatory cellular potency by quantification of γ-IFN-induced IDO activity, as compared to AD-MSCs, P-MSCs, and BM-MSCs.

Immunomodulatory potency of AlloRx Stem Cells (UC-derived MSCs), AD-MSCs, P-MSCs and BM-MSCs by the γ-IFN induced IDO activity assay is shown above.

| 2 |

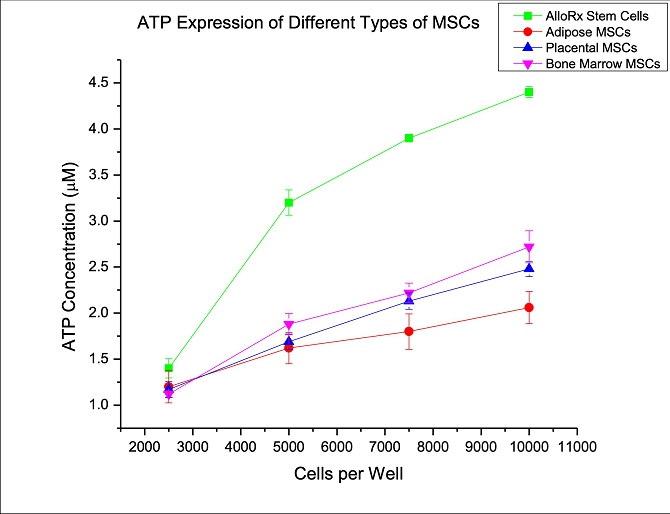

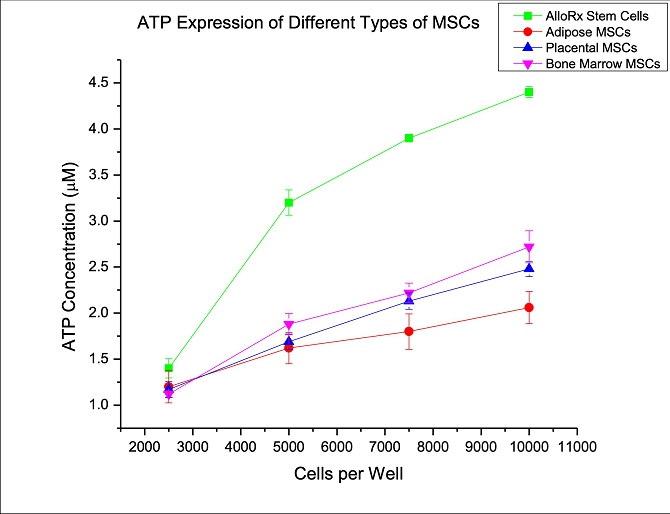

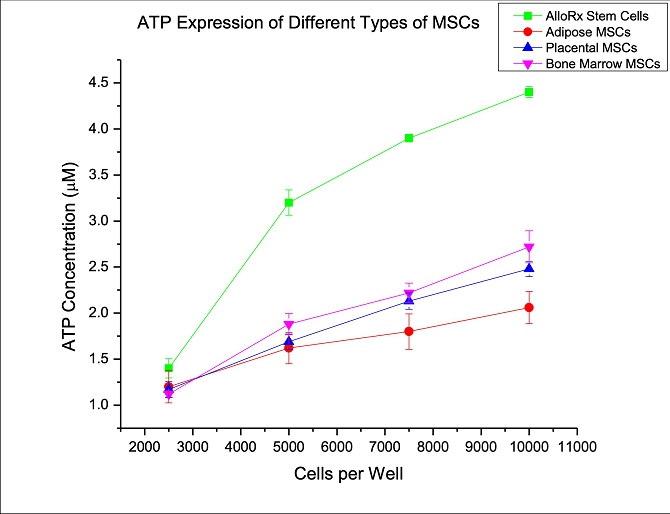

Cellular ATP expression (an energy molecule): In a pre-clinical, in vitro study, we performed a quantitative assessment of mitochondrial function by measuring ATP expression of AlloRx Stem Cells (UC-derived MSCs) in a head-to-head comparison to AD-MSCs, BM-MSCs, and P-MSCs. As illustrated in the chart below, AlloRx Stem Cells (UC-derived MSCs) showed a significant difference in cellular ATP-content. ATP expression is a measure of cellular energy, as ATP is the primary molecule that stores and transfers energy in a cell and powers metabolic processes within the body. Due to the fact that mitochondria produce most ATP within the body, we believe these results indicate the potential for increased mitochondrial functionality of UC-derived MSCs like AlloRx Stem Cells as compared to AD-MSCs, P-MSCs, and BM-MSCs.

In the chart above, cellular ATP is shown as a function of cells per well. Cellular potency is measured by the slope of this relation.

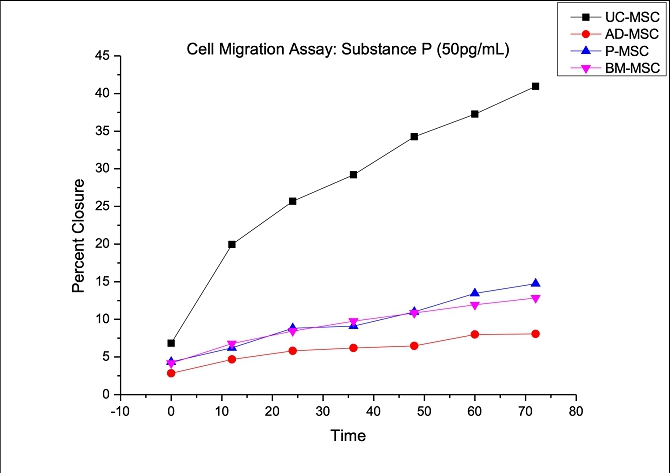

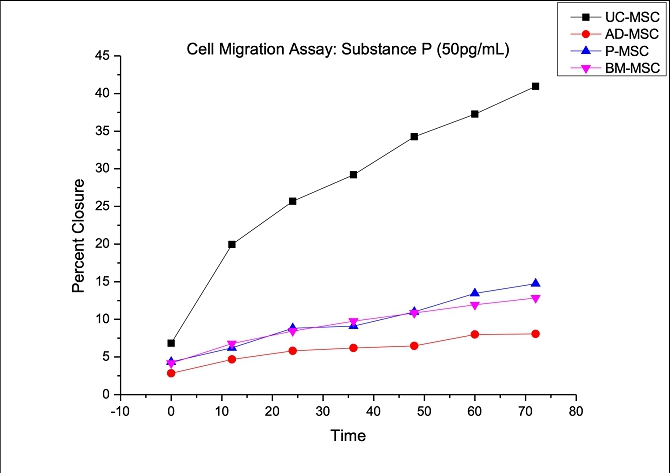

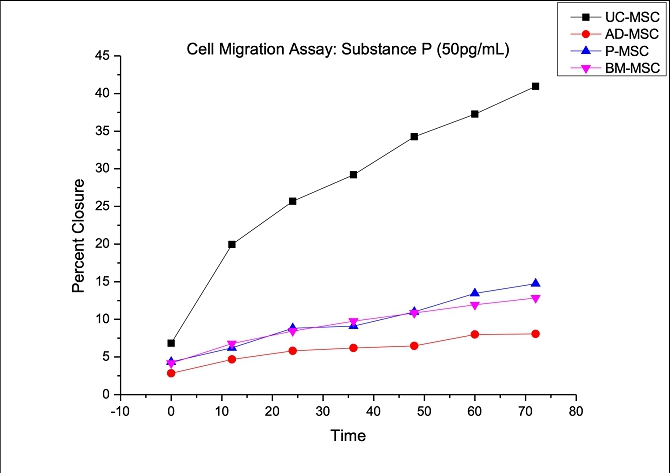

Cell migration in response to Substance P: In a pre-clinical, in vitro study, we analyzed the migration of AlloRx Stem Cells in a head-to-head comparison to AD-MSCs, BM-MSCs, and P-MSCs, in response to exposure to Substance P. Substance P is a peptide that presents itself when an injury occurs, thus simulating an environment of injury. As illustrated in the chart below, AlloRx Stem Cells (UC-derived MSCs) showed a significant difference in cell migration in response to Substance P, as AlloRx Stem Cells (UC-derived MSCs) showed greatest closure at 50 pg/mL Substance P (~40% closure), while AD-MSC, P-MSC, and BM-MSC had a closure between 5-15% all within a 72-hour period. Due to the fact that Substance P is a peptide that presents itself in response to an injury, we believe that UC-derived MSCs’ ability to migrate to Substance P reaction at a faster rate may be indicative of an ability to more quickly migrate to the source of injury within the body as compared to AD-MSCs, P-MSCs, and BM-MSCs.

Comparison of migration into cell-free regions. Migration was measured by percent closure of the occluded plate region and is plotted as a function of time following exposure to 50 pg/ml Substance P.

| 3 |

In addition, UC-derived MSCs are also the youngest stem cells and are therefore generally free from issues related to age (such as mutations), and prior medical conditions that come with the use of BM-MSCs and AD-MSCs. In addition, unlike BM-MSCs or AD-MSCs, UC-derived MSCs involve a non-invasive collection process, are sourced and collected after childbirth, and may provide significant economies of scale in the manufacturing process, as further described below. We believe these factors taken together may provide us with a competitive and financial advantage compared to other cell therapies currently in development that are derived from BM-MSCs, AD-MSCs, or P-MSCs.

Our Lead Product Candidate and Pipeline

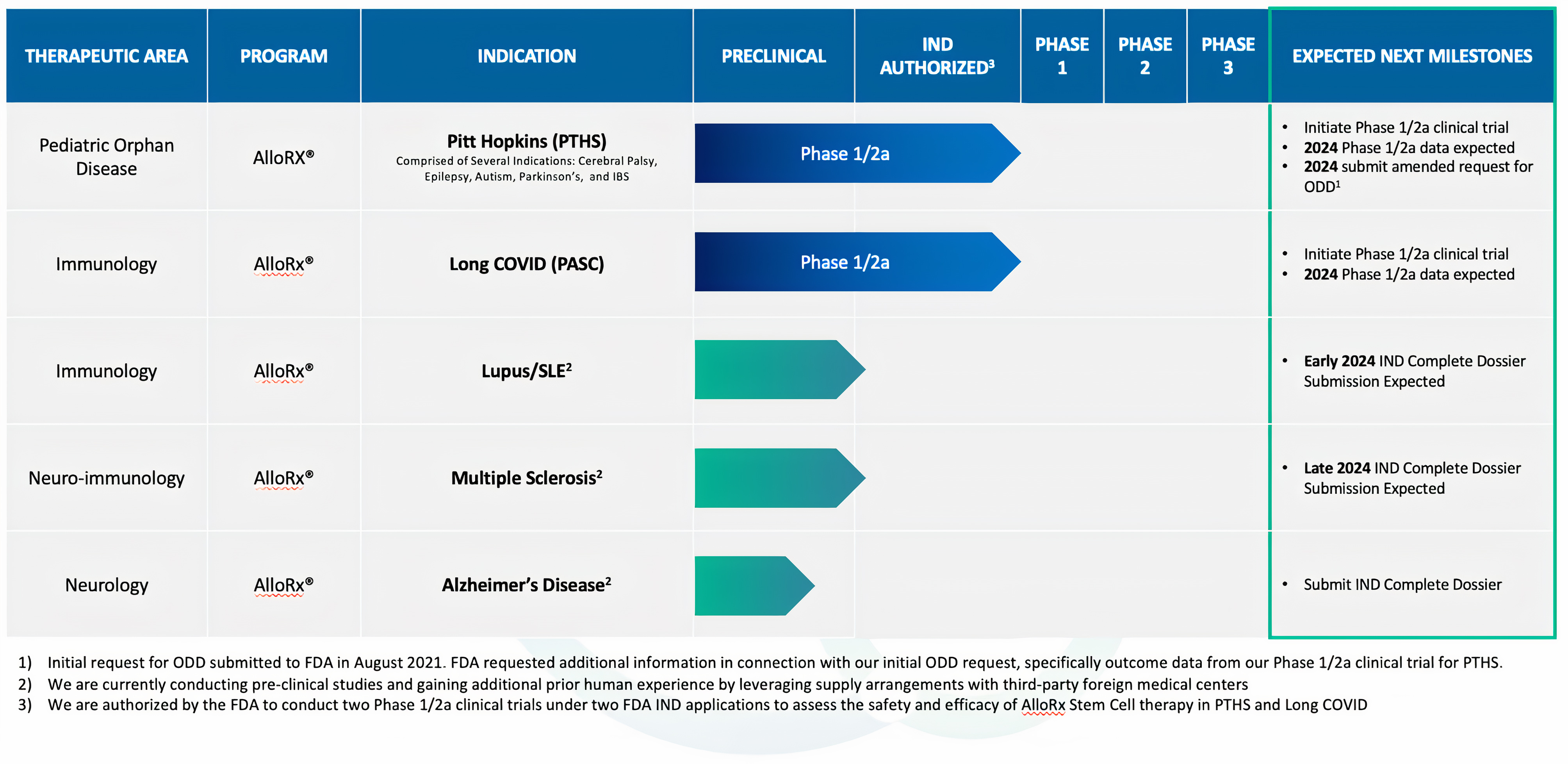

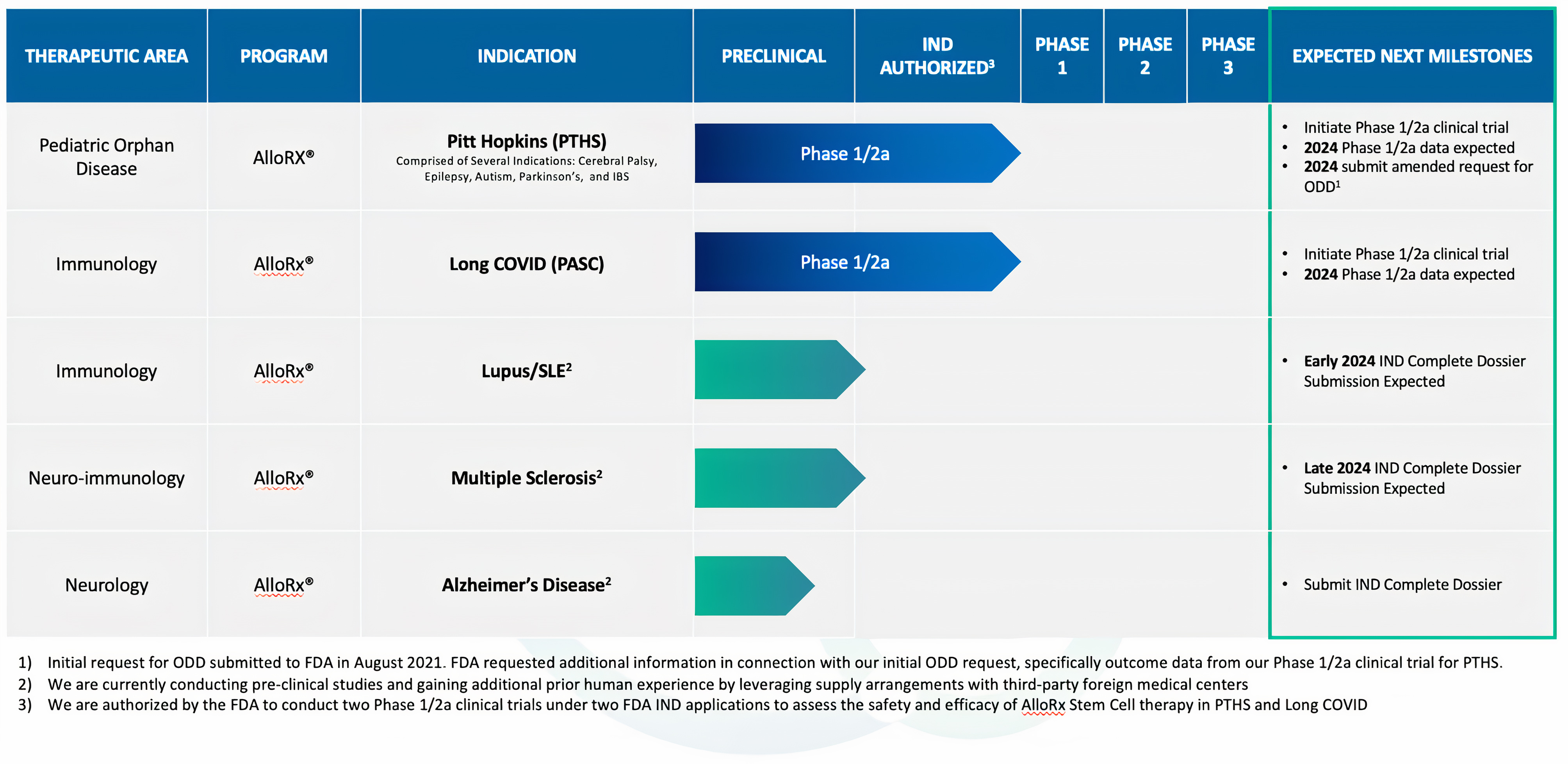

Our pipeline includes five core development programs:

Phase 1/2a clinical trial of Pitt Hopkins syndrome. According to the Pitt Hopkins Research Foundation, PTHS impacts between 1 in 34,000 and 1 in 41,000 individuals according to some estimates. Although the exact incidence of PTHS is unknown, we believe it would meet the prevalence requirements for an Orphan Drug Designation (“ODD”) from the FDA if the other designation requirements are met, although any determination as to whether PTHS qualifies as a “rare disease or condition” will be made by FDA.

Phase 1/2a clinical trial of PASC/Long COVID. Long COVID is a newly recognized condition following the onset of the COVID-19 pandemic, which is characterized by persistent and prolonged symptoms or long-term complications four weeks or more after first being infected with the SARs-CoV-2 virus. Long COVID results from COVID-19 infection and produces prolonged symptoms of fatigue, cognitive impairment and various additional symptoms that can be debilitating. According to the Centers for Disease Control and Prevention (“CDC”), a recent study found that approximately two-thirds of respondents who had tested positive for COVID-19 experienced long-term symptoms often associated with SARs-CoV-2 infection. Given the emerging nature of COVID-19 and new virus variants resulting from mutations, we believe the incidence of Long COVID will continue to increase. More recently, a report published in March 2022 by the Science, Technology Assessment, and Analytics (“STAA”) team of the U.S. Government Accountability Office found that Long COVID has potentially affected up to 23 million Americans, pushing an estimated 1 million people out of work.

We intend to initiate our FDA cleared clinical trials for PTHS and Long COVID in early 2024 pending and institutional review board (“IRB”) approval of clinical trial agreements or other agreements with contemplated collaborators and clinical trial sites. In addition, we are also currently focused on our pre-clinical development programs for multiple sclerosis (“MS”), Lupus/systemic lupus erythematosus (“Lupus (SLE)”) and Alzheimer’s disease. We plan to submit two additional IND applications to FDA to initiate Phase 1/2a clinical trials to assess the safety and efficacy of AlloRx Stem Cell therapy in adults with Lupus (SLE) sometime in early 2024 and in adults with MS in late 2024, which will be subject to FDA clearance prior to the initiation of any clinical trials for these indications. We are also advancing and actively pursuing preclinical research and development activities of AlloRx Stem Cell therapy for the potential treatment of Alzheimer’s disease with the goal of progressing towards a potential IND filing for this indication in the future.

| 4 |

Our development programs are illustrated in the pipeline chart below:

MSC-Gro™

Our “clinical grade” formulation of MSC-Gro™ (“MSC-Gro”), our proprietary specialty culture media, is sold by us to a single customer in Australia that utilizes MSC-Gro to manufacture its stem cell therapy product candidate currently being investigated for the potential treatment of osteoarthritis; this customer is planning to commence a pivotal Phase 3 clinical trial in Australia in late 2023 and, upon a successful outcome, expects that its stem cell therapy product candidate may be eligible to obtain regulatory approval for commercialization in Australia in 2026. If this customer’s stem cell therapy product candidate is ultimately approved for commercialization in Australia, we expect to benefit from the increased sales of MSC-Gro to this particular customer as it scales up manufacturing to meet commercial demand.

Our Market

We are currently focused on the treatment of autoimmune diseases and inflammatory disorders, which represent a significant burden to society and the healthcare systems. There are over 80 recognized autoimmune disorders, which are caused by an acute or chronic imbalance in the immune system where the immune system recognizes proteins of the body as foreign and elicits a specific immune response that leads to the immune system improperly attacking certain bodily tissues, cells or organs (for example, in MS, the immune system recognizes myelin basic protein as foreign). Some inflammatory and autoimmune conditions are caused by genetic or environmental factors, or a combination of both, while others may be caused from complications associated with other diseases or trauma or the treatment of other diseases or trauma. In general, inflammatory and autoimmune disorders share certain biological characteristics, in that the immune system imbalance results from the improper activation of certain immune cells that can lead to extensive tissue damage and destruction and cause pain and loss of function. Inflammatory and autoimmune disorders represent major areas of unmet clinical needs, as well as substantial commercial opportunities.

| 5 |

Our Business Model

While our primary business strategy is to become a leading regenerative medicine and cellular therapy company through the development and commercialization of AlloRx Stem Cell therapy, we currently generate revenue from our proprietary technologies through a variety of sources further described below:

| ● | In addition to selling our clinical grade formulation of MSC-Gro to a single customer in Australia, as further described above, we sell multiple variations of our “research grade” formulation of MSC-Gro, along with a variety of other stem cell products and technologies developed by us, directly to leading biopharmaceutical institutions, university research labs, clinics, investigators and sponsors. These products include native MSCs, several lines of Cancer-Associated Fibroblasts (“CAFs”) and native fibroblasts that are used by these institutions for stem cell research and the development of advanced immunotherapy of cancer. | |

| ● | We supply AlloRx Stem Cells to certain foreign clinics and medical centers that use AlloRx Stem Cells to conduct open-label, patient-sponsored clinical studies for the potential treatment of a wide variety of indications, including osteoarthritis, MS, Lupus (SLE), chronic obstructive pulmonary disease (“COPD”), Amyotrophic Lateral Sclerosis (“ALS”), also known as Lou Gehrig’s disease, and Alzheimer’s disease, in other countries. In addition to generating revenue from these supply arrangements, we leverage safety, tolerability and dosing data, along with certain other anecdotal data and information, generated by these foreign clinical studies to support our internal research and development activities and for the efficient and informed internal development of our AlloRx Stem Cell therapy development programs. | |

| ● | Through InfiniVive MD, our wholly-owned subsidiary, we develop and sell topical cosmetic conditioned media and exosome-containing serums, which are manufactured using derivatives of AlloRx Stem Cells, to plastic surgeons, cosmetic surgeons, aestheticians and consumers in the United States and internationally; these products are designed to moisturize and hydrate the skin to reduce the appearance of aging, including lines and wrinkles, and we believe the inclusion of derivatives of AlloRx Stem Cells may promote healthy looking skin and the appearance of rejuvenation. | |

| ● | We had a drug discovery and development contract to develop novel biologic products with European Wellness Biomedical Group (“European Wellness”), a multinational company based in Europe, and its U.S. subsidiary, Bio Peptides LLC (“BioPep”). The goal of this agreement was to discover, develop and commercialize biological products with application to regenerative medicine. We had been working with BioPep to establish manufacturing and regulatory support aimed at gaining FDA approval for specific products derived from AlloEx Exosomes (as defined below) that could potentially be used for treatment of various conditions, including aesthetic dermatology and skin revitalization; our work with BioPep has been suspended since April 2023 pending discussions regarding amounts believed to be owed to us under that agreement for work already completed. If those discussions are unsuccessful, we may not be able to collect all of the amounts believed to be owed to us or the other amounts originally expected to be received by us under the agreement. In addition, if those discussions are unsuccessful, our agreement with them, which expired in accordance with its terms on July 31, 2023, would not be expected to be renewed. While discussions are ongoing, management does not currently expect our agreement with them to be renewed. Regardless of whether the agreement is renewed, however, we intend to continue to seek to recover all amounts believed to be owed to us under that agreement for work completed. AlloEx Exosomes® (“AlloEx Exosomes”) are a derivative of AlloRx Stem Cells that are developed and manufactured by us. AlloEx Exosomes are derived from cultured AlloRx Stem Cells at the latter part of their growth curve by our proprietary cell culture process. In the United States, AlloEx Exosomes are regulated by the FDA as a biological product. |

Our Strategy

Our primary business strategy is to become a leading regenerative medicine and cellular therapy company through the development and commercialization of novel cell therapy products for unmet medical needs, with an emphasis on autoimmune disorders and inflammatory disease indications. Key elements of our business strategy are as follows:

| ● | Initiate and conduct clinical development in an effort to establish clinical proof-of-concept and biological activity for AlloRx Stem Cell therapy and continue to deepen our understanding of therapeutic mechanisms of action. We intend to initiate Phase 1/2a clinical trials in PTHS and Long COVID in accordance with FDA-authorized INDs with the intent to establish safety, tolerability and efficacy proof-of-concept and evidence of biological activity in these indications. We seek to initiate and conduct well-designed Phase 1/2a clinical studies for AlloRx Stem Cell therapy for PTHS, Long COVID and potentially other indications in our pipeline in hopes of establishing a solid foundation for later-stage clinical trials, development and partnering activity, and expansion into complementary indications. We are committed to a rigorous clinical approach, which we believe will help us advance our programs efficiently, providing high quality, transparent communications and regulatory submissions with FDA. In addition, we hope to continue to refine our understanding of AlloRx Stem Cell therapy’s activities and mechanisms of action to prepare the foundation for product enhancements and expansion into additional treatment opportunities. We are also currently focused on our pre-clinical development programs for MS, Lupus (SLE) and Alzheimer’s disease. |

| 6 |

| ● | Explore new potential treatment opportunities by leveraging prior human experience derived from our supply arrangements with foreign medical centers and our results from other programs. We are committed to efficiently exploring potential clinical indications where AlloRx Stem Cell therapy may achieve a superior profile to the current standards of care and where we believe we can effectively address significant unmet medical needs. | |

| ● | Expand our scalable manufacturing platform and refine our manufacturing processes. We operate a manufacturing facility that is designated as current Good Manufacturing Practices (“cGMP”) compliant, with a quality management system (“QMS”) that is globally recognized as ISO 9001:2015 and ISO 13485:2016 certified. We manufacture AlloRx Stem Cells and certain other of our stem cell products and technologies, including CAFs and native fibroblasts, at the manufacturing facility in Golden, Colorado. We currently have the capacity to manufacture over 300 AlloRx Stem Cell therapy treatments per month. | |

| ● | Continue to generate value by commercializing our existing products and technologies to support internal development efforts for AlloRx Stem Cell therapy. We intend to continue to broaden our commercial access for AlloRx Stem Cells and our other proprietary stem cell products and technologies. Unlike many of our competitors that do not generate revenue, we currently generate value from our proprietary products and technologies through a number of distinct revenue-generating activities. | |

| ● | Pursue additional collaboration arrangements and out-licensing opportunities. We intend to be opportunistic and consider pursuing co-development, out-licensing, commercialization or other supply or collaboration agreements for the purpose of commercializing AlloRx Stem Cell therapy, AlloRx Stem Cells and our other products and product candidates, both domestically and internationally. | |

| ● | Seek non-dilutive funding and grant awards to support our clinical research and product candidate development. We intend to continue to seek non-dilutive funding and grant awards to support our clinical research and product candidate development. These funding awards are non-dilutive, may further limit our reliance on external financing, and would allow us to collaborate with state and federal partners in pursuing safe and effective therapeutics for disorders that have few, if any, available approved treatments. |

Manufacturing

We manufacture under strict environmental and laboratory controls in accordance with cGMP. The manufacturing facility that we lease in Golden, Colorado is cGMP compliant, with a QMS that is globally recognized as ISO 9001:2015 and ISO 13485:2016 certified. We manufacture AlloRx Stem Cells and certain other of our products and technologies, including CAFs, at this manufacturing facility. With 30 years of research and by leveraging the potential biological advantages of UC-derived MSCs, we believe we may have a significant cost and competitive advantage over our competitors, within our scalable and standardized manufacturing process.

Our Team

We are led by a team of executives with extensive experience in corporate finance and biologics drug discovery and development. Christopher Furman, our Chief Executive Officer and a director, is a finance industry leader with more than 25 years’ experience in private and public capital markets. Dr. Jim Musick, the co-founder of Vitro, is our Chief Science Officer, a director and previously served as Chief Executive Officer from 1986 to 2020. Nathan Haas, our Chief Financial Officer, previously served as Chief Financial Officer of InfiniVive MD as well as Fitore, Inc. (“Fitore”), a company he co-founded, until their acquisition by us in August 2021. Dr. Caroline Mosessian, our Chief Regulatory Officer and a director, has an extensive background in regulatory science including a PhD and Masters in Regulatory Sciences & Quality Systems in addition to Health Administration degrees, and has led numerous clinical studies of medical devices and pharmaceuticals through regulatory agency approval. We have a talented core of cell processing and manufacturing experts who oversee and manage our in-house manufacturing of AlloRx Stem Cells, AlloEx Exosomes, our research products and our other experimental product candidates.

| 7 |

Financial Overview

We have experienced significant losses since inception and, as of July 31, 2023, had an accumulated deficit of approximately $26.2 million. We expect to incur additional losses in the future and expect cumulative losses to increase. Since 2017, we have received over $8.0 million in new capital. In fiscal year 2022 and the nine months ended July 31, 2023, we generated approximately $3.3 million and $1.2 million, respectively, in non-grant revenue, primarily from our sales of research products, our collaboration with European Wellness as further described below, and sales of AlloRx Stem Cells to foreign third-party clinics and medical centers.

Summary of Risk Factors

Our business and operations are subject to a number of risks, which you should be aware of prior to making a decision to invest in our common stock. These risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. Below is a summary of these risks.

Risks Related To Our Financial Condition

| ● | There is substantial doubt about our ability to continue as a going concern, and if we are unable to continue, you may lose your entire investment; | |

| ● | We have incurred substantial losses in recent years and may never be profitable; | |

| ● | A significant portion of our revenue has been concentrated on a few large customers and our agreement with one of those customers, European Wellness/BioPep, expired in accordance with its terms on July 31, 2023; | |

| ● | The use of our current or future product candidates and our other products in individuals may expose us to product liability claims, and we may not be able to obtain adequate product liability insurance; and | |

| ● | In order to successfully implement our plans and strategies, we will need to grow our organization, and we may experience difficulties in managing this growth. |

Risks Related To Our Business

| ● | We are heavily dependent on the successful development and commercialization of AlloRx Stem Cell therapy, and we may not be able to successfully develop and commercialize the product candidate and obtain the necessary regulatory approvals; | |

| ● | If the potential of our product candidates, particularly AlloRx Stem Cell therapy, to treat various diseases and conditions is not realized, the value of our technology and development programs could be significantly reduced; | |

| ● | We have never commercialized a biologic or drug product candidate before and may lack the necessary expertise, personnel and resources to successfully commercialize any products on our own or together with suitable collaborators; | |

| ● | We have a limited operating history with our current business model, which may make it difficult for you to evaluate our current business and predict our future success and viability; | |

| ● | Our product development programs are based on novel technologies and are inherently risky; | |

| ● | The lack of any existing FDA-approved allogeneic, cell-based therapies for PTHS, Long COVID, Lupus (SLE), MS or Alzheimer’s disease could complicate and delay FDA approval of AlloRx Stem Cell therapy for these indications; | |

| ● | If we are not able to recruit and retain additional qualified management and scientific personnel, we may fail in obtaining financing, pursuing collaborations or developing our technologies and product candidates; | |

| ● | Our collaborations we intend to enter into with one or more medical institutions to help us develop our product candidates and commercialize our products may never materialize, and our ability to commercialize such products may be impaired or delayed if collaborations are unsuccessful; | |

| ● | Our business could be harmed if the third-party healthcare professionals on whom we rely to administer AlloRx Stem Cell therapy and AlloRx Stem Cells to patients administer these incorrectly or fail to follow our instructions or recommendations; | |

| ● | We may be unable to develop a new manufacturing facility on a timely basis or at all; |

| 8 |

| ● | Interim, “topline” and preliminary data from our clinical trials that we announce or publish may change as more data become available and are subject to audit and verification procedures that could result in material changes in the final data; | |

| ● | We may expend our limited resources to pursue a particular product candidate or indication and fail to capitalize on other product candidates or indications that may be more profitable or for which there is a greater likelihood of success; | |

| ● | Our competitors may develop similar or comparable treatments for the target indications of our product candidates that are approved more quickly, marketed more successfully or are demonstrated to be safer or more effective than our product candidates, and we may not compete successfully with them; and | |

| ● | Our product candidates are derived from human UCs and therefore have the potential for disease transmission and are susceptible to ethical and other concerns surrounding the use of stem cell therapy or human tissue. |

Risks Related To Intellectual Property

| ● | If our intellectual property does not adequately protect our products and uses, others could compete against us more directly, which could harm our business and have a material adverse effect on our business, financial condition, and results of operations; | |

| ● | If we fail to obtain assignment of rights of our intellectual property from all inventors, we may not own or exclusively own our intellectual property, which could adversely affect our ability to protect our product and have a materially effect on our business; | |

| ● | Our commercial success depends in part on our avoiding infringement of the patents and proprietary rights of third parties and if one or more third parties were to assert that we infringe their patents or are otherwise employing their proprietary technology without authorization, it could impair our ability to commercialize our product candidates and otherwise significantly harm our business; and | |

| ● | If we do not obtain patent term extension for our product candidates and/or methods of their use, our business may be materially harmed. |

Risks Related To Regulatory Approval And Other Government Regulations

| ● | We cannot market and sell our product candidates in the United States or in other countries if we fail to obtain the necessary regulatory approvals; | |

| ● | If we are not able to conduct our clinical trials properly and on schedule, marketing approval by FDA and other regulatory authorities may be delayed or denied; | |

| ● | Final marketing approval of our product candidates by the FDA or other regulatory authorities for commercial use may be delayed, limited, or denied, any of which could adversely affect our ability to generate operating revenues; | |

| ● | Producing and marketing an approved drug or other medical product is subject to significant and costly post-approval regulation; | |

| ● | We and any of our future development partners will be required to report to regulatory authorities if any of our approved products cause or contribute to adverse medical events; | |

| ● | We may not ultimately qualify for or benefit from orphan drug exclusivity, breakthrough therapy designation, fast track designation, or priority review; and | |

| ● | The FDA and other regulatory agencies actively enforce the laws and regulations prohibiting the promotion of off-label uses. |

Additional Risks Related To Our Supply Arrangements With Third-Party Foreign Medical Centers

| ● | FDA could prohibit us from exporting products for use in compassionate use programs or clinical studies in foreign jurisdictions; | |

| ● | FDA, FTC, and other regulatory agencies actively enforce against medical tourism companies and medical providers advertising to patients in the United States if the claims or procedures are not substantiated or in compliance with the local countries’ laws; and | |

| ● | The FDA and other comparable foreign regulatory authorities may not accept data from trials or studies conducted in locations outside of their jurisdiction. |

| 9 |

Risks Related To Ownership Of Our Common Stock

| ● | Our principal stockholders and management, including our Chief Science Officer and our former Chief Executive Officer in particular, own a significant percentage of our stock and will be able to exert significant control over matters subject to stockholder approval; | |

| ● | The price of our stock may be volatile, and you could lose all or part of your investment; | |

| ● | Management identified a material weakness in our internal control over financial reporting that previously caused us to restate our financial statements for the three and nine months ended July 31, 2022, and there is no assurance that we will be able to remediate this material weakness and otherwise implement and maintain an effective system of internal control over financial reporting, accurately report our financial results or prevent fraud in the future; and | |

| ● | Provisions in our third amended and restated articles of incorporation and amended and restated bylaws, and Nevada law might discourage, delay or prevent a change in control of our company or changes in our management and, therefore, depress the market price of our common stock. |

Our Company

We were incorporated under the laws of the State of Nevada on March 31, 1986 under the name Imperial Management, Inc. On December 17, 1986, we merged with Labtek, Inc., a Colorado corporation, and the name of the company was changed to Labtek, Inc. The name of the company was thereafter changed to Vitro Diagnostics, Inc on February 6, 1987. From November 1990 to July 31, 2000, we were engaged in the development, manufacture and distribution of purified human antigens and the development of diagnostic products and related technologies. In August 2000, we sold the assets used in that business, following which we focused on developing therapeutic products, our stem cell technology, our patent portfolio and proprietary technology and cell lines for applications in autoimmune diseases and inflammatory disorders and stem cell research. On February 3, 2021, our name was changed to Vitro Biopharma, Inc. and in August 2021, we completed the acquisitions of InfiniVive MD and Fitore. On July 6, 2022, Christopher Furman joined our Board and became our Chief Executive Officer. Our principal executive offices are located at 3200 Cherry Creek Drive South, Suite 410, Denver, CO 80209, and our telephone number is (855) 848-7627.

Our website address is www.vitrobiopharma.com. The information on, or that can be accessed through, our website is not part of this prospectus and is not incorporated by reference herein. We have included our website address as an inactive textual reference only.

Our common stock was previously registered under Section 12 of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act, and until 2016, we filed reports with the Securities and Exchange Commission, which we refer to as the SEC, under Section 13(a) of the Exchange Act as required by reason of our Section 12 registration. In October 2020, our registration under Section 12 was revoked by the SEC for our failure to file the reports required by Section 13(a). Commencing after our fiscal year ended October 31, 2021, we again became required to register our common stock under Section 12(g) of the Exchange Act because the value of our total assets and number of stockholders exceeded applicable limits, and to file with the SEC thereafter reports and other documents required under Section 13(a) of the Exchange Act by virtue of that Section 12(g) registration. On September 12, 2022, we filed a registration statement on Form 10 with the SEC to again register our common stock under the Exchange Act in accordance with the requirements of Section 12(g), which such registration statement, as amended, became effective on November 11, 2022. As a result, we are required to file reports with the SEC under Section 13(a) of the Exchange Act, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

| 10 |

Implications of Being a Smaller Reporting Company

We are a smaller reporting company as defined in the Exchange Act. We may take advantage of certain of the scaled disclosures available to smaller reporting companies and will be able to take advantage of these scaled disclosures for so long as (i) the market value of our voting and non-voting common stock held by non-affiliates is less than $250 million measured on the last business day of our second fiscal quarter or (ii) our annual revenue is less than $100 million during the most recently completed fiscal year and the market value of our voting and non-voting common stock held by non-affiliates is less than $700 million measured on the last business day of our second fiscal quarter. Specifically, as a smaller reporting company, we may choose to present only the two most recent fiscal years of audited financial statements in our annual reports on Form 10-K and have reduced disclosure obligations regarding executive compensation, and if we are a smaller reporting company with less than $100 million in annual revenue, we would not be required to obtain an attestation report on internal control over financial reporting issued by our independent registered public accounting firm.

About this Offering

In May 2022, we issued two convertible promissory notes in the aggregate principal amount of $200,000 (each, a “2022 Convertible Note” and collectively, the “2022 Convertible Notes”). The 2022 Convertible Notes bear interest at the rate of five per cent per year and are payable solely in shares of our common stock. They may be converted at any time at the option of the holder and are payable in full at the earliest of (i) the completion of a qualified financing, (ii) a change in control, or (iii) the maturity date, five years from the date of issuance. A qualified financing is any financing completed after the date of issuance involving the sale of our equity securities primarily for capital raising purposes resulting in gross proceeds to us of at least $5 million Upon completion of a qualified financing, the notes are convertible into the securities issued in such financing in an amount determined by dividing (i) the outstanding principal on the notes plus all accrued interest by (ii) the lower of (x) the Discounted Qualified Financing Price and (y) the Capped Price. The Discounted Qualified Financing Price is the per share price at which the shares of the Qualified Financing Securities are to be sold generally in such Qualified Financing as determined for accounting purposes under GAAP multiplied by 0.75 (subject in all instances to a minimum per share price to the holders of $1.00). The Capped Price is the per share price implied by a fully-diluted (on an as-converted to common stock basis), pre-money valuation of $400,000,000 for the Company.

In January 2023, we issued five 8% Convertible Notes in the aggregate principal amount of $405,000. In addition, we issued three additional 8% Convertible Notes in the aggregate principal amount of $237,600 on March 15, 2023, two additional 8% Convertible Notes in the aggregate principal amount of $350,000 on March 30, 2023 and one additional 8% Convertible Note in the aggregate principal amount of $200,000 on April 14, 2023. In June 2023, we issued two additional 8% Convertible Notes in the aggregate principal amount of $425,000. In July 2023, we issued one additional 8% Convertible Note in the aggregate principal amount of $100,000. The 8% Convertible Notes bear interest at the rate of eight per cent per year and are payable solely in shares of the Company’s common stock. The 8% Convertible Notes may be converted at any time at the option of the holder and are payable in full at the earliest of (i) the completion of a “Qualified Financing,” as defined below, (ii) a change in control, (iii) in the event of default, or (iv) the maturity date, which is five years from the date of issuance. A Qualified Financing is defined as any financing completed after the date of issuance involving the sale of the Company’s equity securities primarily for capital raising purposes resulting in gross proceeds to the Company of at least $5 million. Upon completion of a Qualified Financing, each Convertible Note is convertible into the securities issued in such financing (the “Qualified Financing Securities”) in an amount determined by dividing (i) the outstanding principal on the Note plus all accrued interest by (ii) the lessor of (x) the “Discounted Qualified Financing Price” and (y) the “Capped Price.” In the event of a change in control or default, voluntary conversion or upon maturity, each Note is convertible into that number of shares of the Company’s common stock that equals (i) the outstanding principal amount of the Note plus any accrued but unpaid interest, divided by (ii) the Capped Price. The Discounted Qualified Financing Price is defined as the per share price at which the shares of the Qualified Financing Securities are sold in such Qualified Financing as determined for accounting purposes under GAAP, multiplied by 0.75. The Capped Price is the per share price implied by a fully-diluted (on an as-converted to common stock basis), pre-money valuation of $200,000,000 for the Company.

On November 16, 2023, we entered into a securities purchase agreement (the “November 2023 Purchase Agreement”) with an accredited investor, pursuant to which the Company issued and sold to the investor, in a private placement, (i) a senior secured convertible note (the “November 2023 Note”) in the principal amount of $2,500,000, for a purchase price of $2,000,000 (reflecting a 20% original issue discount), and warrants to purchase shares of common stock of the Company (the “November 2023 Warrants”).

| 11 |

Interest on the November 2023 Note will accrue commencing on the earlier of the maturity date or upon an event of default, at the annual rate of 20%, due the first day of each calendar month following such date. The November 2023 Note will mature at the earlier of (i) May 16, 2024 (six months from the issuance date) and (ii) the occurrence of a Liquidity Event (as defined in the November 2023 Note), provided that the Company may extend the maturity date to August 16, 2024. The November 2023 Note is secured by all of the Company’s assets pursuant to a security agreement between the Company and the investor. The November 2023 Note will be convertible into common stock commencing on the maturity date, at a conversion price equal to the product of (x) the Liquidity Event Price (as defined in the Note) and (y) 0.70 (or 0.60 if the Company has extended the maturity date), provided however, that if no Liquidity Event has occurred by the maturity date then the conversion price will be the amount obtained by dividing (i) $95,000,000 by (ii) the number of shares of common stock outstanding on such date calculated on a fully-diluted basis. In addition, the Company will have the right to effect conversion of the November 2023 Note if, at the time (a) a Liquidity Event has occurred and (b) the underlying shares are registered for resale.

The November 2023 Warrants will be exercisable into the number the shares of common stock obtained by dividing 100% of the original principal amount of the November 2023 Note by (ii) the Liquidity Event Price (as defined in the Note); provided, however, that if no Liquidity Event has occurred by the maturity date, then such percentage will be 150%. The November 2023 Warrants will be exercisable for a period of five years and have an exercise price equal to the Liquidity Event Price provided however, that if no Liquidity Event has occurred by the maturity date then the exercise price will be the amount obtained by dividing (i) $95,000,000 by (ii) the number of shares of common stock outstanding on such date calculated on a fully-diluted basis.

In connection with the November 2023 Purchase Agreement, the Company entered into a registration rights agreement with the investor (the “Registration Rights Agreement”). Pursuant to the Registration Rights Agreement, the Company agreed to file a registration statement for the resale of the shares underlying the November 2023 Note and the November 2023 Warrants with the Securities and Exchange Commission within 30 days of execution of the Registration Rights Agreement and to have such registration statement declared effective by the maturity date of the Note.

On November 16, 2023, the Company entered into a consulting agreement (the “Alchemy Consulting Agreement”) with Alchemy Advisory LLC (“Alchemy”), pursuant to which the Company engaged Alchemy as a strategy business consultant for a term of six months. Pursuant to the Alchemy Consulting Agreement, the Company paid Alchemy a fee of $50,000 and agreed to pay Alchemy an additional fee of $50,000 upon the Company’s initial public offering or direct listing of the Company’s common stock. In addition to such cash fees, the Company agreed to issue to Alchemy, 20,000 shares of common stock; provided that in the event that the initial public offering or direct listing price per share is less than $15 then the number shares of common stock will equal $300,000 (valued based on the initial public offering or direct listing price).

On October 4, 2023, we entered into an amendment to our engagement agreement, dated March 17, 2023 (as amended, the “Bridgeway Agreement”) with Bridgeway Capital Partners and Bridgeway Capital Partners II (collectively, “Bridgeway Capital Partners”) pursuant to which we engaged Bridgeway Capital Partners to assist the Company in identifying a registered broker-dealer partner to help the Company achieve a direct listing on a US stock exchange. Pursuant to the Bridgeway Agreement, upon the successful direct listing of our common stock on Nasdaq, Bridgeway Capital Partners will be entitled to receive a stock fee equal to 2.0% of our current fully diluted shares outstanding.

This prospectus covers the resale by the selling stockholders of (i) an aggregate of 175,351 shares of common stock underlying the 2022 Convertible Notes and the 8% Convertible Notes issued between January 2023 and July 2023 (the “8% Convertible Notes”), including accrued interest thereon through October 31, 2023 (based on an assumed conversion price of $11.25), (ii) 238,095 shares underlying the November 2023 Note (equal to 125% of the shares underlying the November 2023 Note at an assumed conversion price of $10.50, in accordance with the terms of the Registration Rights Agreement), (iii) 166,666 shares underlying the November 2023 Warrants (equal to 125% of the shares underlying the November 2023 Warrants at an assumed exercise price of $15.00, in accordance with the terms of the Registration Rights Agreement), (iv) 20,000 shares issuable pursuant to the Alchemy Consulting Agreement, (vi) 133,550 shares issuable pursuant to the Bridgeway Agreement, and (vii) an aggregate of an additional 1,224,183 outstanding shares held by certain selling stockholders.

| 12 |

Unless we specifically state otherwise or the context otherwise requires, this prospectus reflects and assumes the following:

| ● | the adoption, filing and effectiveness of our third amended and restated articles of incorporation and amended and restated bylaws, each of which became effective on June 30, 2023; and | |

| ● | the adoption, filing and effectiveness of a certificate of change pursuant to Nevada Revised Statutes 78.209 (the “Reverse Stock Split Charter Certificate”) to our third amended and restated articles of incorporation giving effect to the Reverse Stock Split at a ratio of 1 share for 26 shares, which became effective on July 6, 2023; |

RISK FACTORS

Investing in shares of our common stock involves a high degree of risk. You should carefully consider the following risks and uncertainties, together with all of the other information contained in this prospectus, including our financial statements and related notes included elsewhere in this prospectus, before making an investment decision. The risks described below are not the only ones facing us. The occurrence of any of the following risks, or of additional risks and uncertainties not presently known to us or that we currently believe to be immaterial, could materially and adversely affect our business, financial condition, reputation, or results of operations. In such case, the trading price of shares of our common stock could decline, and you may lose all or part of your investment.

Risks Related To Our Financial Condition

As described in the report of our auditors for the years ended October 31, 2022 and 2021 and the notes to our consolidated financial statements, there is substantial doubt about our ability to continue as a going concern, and if we are unable to continue, you may lose your entire investment.

The uncertainty about our ability to continue in operation is based on our continuing losses from operation, limited revenue and limited working capital, among other things which existed as of year-end October 31, 2022 and July 31, 2023. As of July 31, 2023, we had a cash balance of approximately $0.29 million, a working capital deficit of approximately $0.77 million and an accumulated deficit of approximately $26.2 million. Included in the accumulated deficit are losses of $6.9 million for the year ended October 31, 2022 and $3.5 million for the nine months ended July 31, 2023. Given all these facts, we are dependent on obtaining funding from operations and the sale of debt or equity to continue as a going concern. The financial statements do not include any adjustments relating to the recoverability of assets and classification of liabilities that might be necessary should we be unable to continue as a going concern.

Our ability to continue as a going concern depends on the success of this offering and receipt of additional funds through debt or equity financing and our operations. In the event we are unable to obtain such funding, we may have to delay, reduce or eliminate certain of our planned operations, including some of our research and development and/or clinical trials, reduce overall overhead expense, or divest assets. This in turn may have an adverse effect on our ability to realize the value of our assets. If we are unable to continue as a going concern, you may lose all or part of your investment.

We have limited revenue and cash flow and are dependent on improving operations, along with receipt of additional working capital, to fund continued development and implementation of our business plan, and our failure to obtain this capital may cause the partial or total loss of your investment.

As of July 31, 2023, our ongoing cash flow is inadequate to implement our business plan. In the recent past, we have relied on equity and debt financing to supplement operations to provide necessary cash flow and will depend on the receipt of funds through additional debt or equity financings, for the foreseeable future. Since significant amounts of capital are required for companies to pursue clinical trials in pursuit of FDA approval, we are dependent on improving our cash flow and revenue, as well as receipt of additional working capital, to fund continued development and implementation of our business plan. In addition to funds required for research and the development of our product candidates, we will require capital to pay our administrative expenses, including salaries and rent. Any future equity financing may be at prices or on terms that are disadvantageous to existing stockholders. We may not be able to obtain additional capital at all and may be forced to curtail or cease our operations. We will continue to rely on equity or debt financing and limited revenue to finance operations until such time, if ever, that we generate sufficient cash flow. The inability to obtain necessary financing may adversely impact our ability to develop our product candidates and to expand our business operations.

| 13 |

We have incurred substantial losses in recent years and may never be profitable.

During the fiscal years ended October 31, 2022 and 2021, we incurred losses of approximately $6.9 million and $4.5 million, respectively. During the nine months ended July 31, 2023, we incurred losses of approximately $3.5 million. In the future, our ability to become profitable will depend on our ability to commercialize one or more of our product candidates, expand sales of our subsidiaries and generate revenue sufficient to cover our costs and expenses. As we advance the preclinical and clinical development of our programs, we expect to continue to incur significant expenses and operating losses, for which we do not have sufficient offsetting revenue. We expect that our sales, research and development and general and administrative costs will increase in connection with conducting additional preclinical studies and clinical trials for our current and future programs and product candidates, contracting with contract research organizations (“CROs”) to support preclinical studies and clinical trials, expanding our intellectual property portfolio, and providing general and administrative support for our operations. There is no assurance that we will ever be profitable.

The acquisitions of our two subsidiaries were only recently completed and we may not successfully grow those businesses to be profitable and contribute to our cash flow. We expect that sales of Fitore products in the future will be limited.

The acquisition of both InfiniVive MD and Fitore were completed effective August 1, 2021. Accordingly, we have had only a limited time to become familiar with the businesses and determine whether and how we can grow the businesses. Neither entity is profitable on a stand-alone basis and each contributed to our net loss in 2022. In June 2022, we terminated the chief executive officer and all other employees of Fitore and are currently selling Fitore products solely from remaining inventory and with minimal marketing efforts. We do not anticipate manufacturing any additional Fitore products in the foreseeable future or at all. Consequently, we expect that sales of Fitore products in the future will be limited. Our ability to grow the business of InfiniVive MD is dependent on our ability to improve marketing and sales to the point that revenue will be sufficient to offset operating expenses of that entity. If we are unable to grow this business, our operations will consume the proceeds of this offering sooner than we expect, and our stock price may suffer.

A significant portion of our revenue has been concentrated on a few large customers and our agreement with one of those customers, European Wellness, recently expired. As a result, we expect our consulting revenue in the future to be more limited and, if we lose more customers, our results of operations would be expected to be further adversely impacted.

Our revenue has been concentrated in a small number of our domestic customers and European Wellness/BioPep. The sales to three domestic customers accounted for approximately 17%, 15% and 14% of our sales in fiscal year 2022. The consulting revenue from European Wellness/BioPep accounted for approximately 18% of our sales in fiscal year 2022. With respect to European Wellness/BioPep, we had suspended delivering work product to it under our agreement since April 2023 while we engaged in discussions regarding amounts believed to be owed to us under that agreement for work already completed, and our agreement with them expired in accordance with its terms on July 31, 2023 and is not expected to be renewed. Although we intend to continue to seek to recover and recognize as revenue or other project income all amounts believed to be owed to us under that agreement, we may not be able to collect or recognize as revenue or other project income all of the amounts believed to be owed to us through the date of expiration or the other amounts originally expected to be received by us under the agreement for completion of all services thereunder as originally contemplated. Because our contract with European Wellness expired on July 31, 2023 and has not been renewed, we expect our consulting revenue in the future will be materially adversely affected, in particular if we are unsuccessful in ultimately recognizing our deferred revenue or other project income associated with this agreement or collecting other amounts from them for work already completed, unless and until an alternative consulting partnership or collaboration becomes available to us. The loss of all or a part of our revenue from any of the other customers could have a material adverse effect on our revenue, cash flow, operating results and financial condition until an alternative partnership or collaboration might be developed, and there can be no assurance that an alternative partnership or collaboration will be available to us, on terms acceptable to us or at all, in such a circumstance.

| 14 |

Servicing our debt may require a significant amount of cash. We may not have sufficient cash flow from our business to pay our indebtedness.

As of July 31, 2023, we have outstanding approximately $2.3 million in indebtedness to our Chief Science Officer on account of past-due compensation and accrued interest, and approximately $0.53 million to a former officer on account of the acquisition of Fitore. These obligations mature on December 31, 2025 and on July 31, 2024, respectively. Our ability to make scheduled payments of the principal of, to pay interest on or to refinance our indebtedness, depends on our future performance and receipt of additional capital, which is subject to economic, financial, competitive and other factors beyond our control. Our business may not generate cash flow from operations in the future sufficient to service our debt and make necessary capital expenditures. Repayment of these obligations, even if we are able to obtain the requisite capital, would decrease the funds available to further our business plan. In addition, any of our future debt agreements may contain restrictive covenants that may prohibit us from adopting any of these alternatives. Our failure to comply with these covenants could result in an event of default which, if not cured or waived, could result in the acceleration of our debt.

Our ability to recognize the benefits of deferred tax assets is dependent on future cash flows and taxable income.

We recognize deferred tax assets when the tax benefit is considered to be more likely than not of being realized; otherwise, a valuation allowance is applied against deferred tax assets. Assessing the recoverability of deferred tax assets requires management to make significant estimates related to expectations of future taxable income. Estimates of future taxable income are based on forecasted cash flows from operations and the application of existing tax laws in each jurisdiction. To the extent that future cash flows and taxable income differ significantly from estimates, our ability to realize the deferred tax assets could be impacted. Additionally, future changes in tax laws could limit our ability to obtain the future tax benefits represented by our deferred tax assets. As of July 31, 2023, our net deferred tax assets were $3.7 million. We have recorded a full valuation allowance against this asset.

The use of our product candidates and our other products, including AlloRx Stem Cells, InfiniVive MD products, MSC-Gro, CAFs and our other products, or any future products in individuals may expose us to product liability claims, and we may not be able to obtain adequate product liability insurance.

Because of the nature of our products, including our product candidates like AlloRx Stem Cell therapy as well as our AlloRx Stem Cells, InfiniVive MD products, MSC-Gro, CAFs and our other products, we face an inherent risk of product liability claims. None of our product candidates or other products have been widely used over an extended period of time, and our safety data is therefore limited. We derive the raw materials for our product candidates from human donor sources, the manufacturing process is complex, and the handling requirements are specific, all of which increase the likelihood of quality failures and subsequent product liability claims. In addition, we supply AlloRx Stem Cells to certain foreign clinics pursuant to purchase orders issued by our customers, which are likely to be favorable to those customers. We generally do not enter into long-term purchase agreements with our customers that obligate them to purchase our products or protect us from product liability claims made by the patients such customers treat using AlloRx Stem Cells. We will need to increase our insurance coverage if and when we receive approval for and begin commercializing our product candidates. We may not be able to obtain or maintain product liability insurance on acceptable terms with adequate coverage or at all. If we are unable to obtain insurance, or if claims against us substantially exceed our coverage, then our business could be adversely impacted. Whether or not we are ultimately successful in any product liability litigation, such litigation either before or after product approval and marketing could consume substantial amounts of our financial and managerial resources and could result in, among other things:

| ● | significant awards against us; | |

| ● | substantial litigation costs; | |

| ● | recall of products or termination of clinical trials; |

| 15 |

| ● | FDA withdrawal of marketing approval of products or suspension or revocation of an IND for a product candidate; | |

| ● | injury to our reputation; | |

| ● | withdrawal of clinical trial participants; | |

| ● | withdrawal of clinical trial sites or investigators; or | |

| ● | adverse regulatory action. |

Any of these results could have a material adverse effect on our business, financial condition, and results of operations.

In order to successfully implement our plans and strategies, we will need to grow our organization, and we may experience difficulties in managing this growth.

As of July 31, 2023, we had 10 full-time employees, 1 part time employees, 2 full-time consultants, and 6 part-time consultants. Of these full-time employees and consultants, 8 are engaged in research and development activities. In order to successfully implement our development and commercialization plans and strategies, and as we transition into operating as a public company, we expect to need additional managerial, operational, sales, marketing, financial and other personnel. Future growth would impose significant added responsibilities on members of management, including:

| ● | identifying, recruiting, integrating, maintaining and motivating additional employees; | |

| ● | managing our internal development efforts effectively, including preclinical and clinical studies and investigations, as well as FDA and other comparable foreign regulatory agencies’ review process for any current or future product candidates, while complying with any contractual obligations to contractors and other third parties we may have; and | |

| ● | improving our operational, financial and management controls, reporting systems and procedures. |

Our future financial performance and our ability to successfully develop and, if approved, commercialize, any current or future product candidates will depend, in part, on our ability to effectively manage any future growth, and our management may also have to divert a disproportionate amount of its attention away from day-to-day activities in order to devote a substantial amount of time to managing these growth activities.

We currently rely, and for the foreseeable future will continue to rely, in substantial part on certain independent organizations, advisors and consultants to provide certain services, including key aspects of clinical development and manufacturing. We cannot assure you that the services of independent organizations, advisors and consultants will continue to be available to us on a timely basis when needed, or that we can find qualified replacements. In addition, if we are unable to effectively manage our outsourced activities or if the quality or accuracy of the services provided by third party service providers is compromised for any reason, our clinical trials may be extended, delayed or terminated, and we may not be able to obtain marketing approval of our current and future product candidates or otherwise advance our business. We cannot assure you that we will be able to manage our existing third-party service providers or find other competent outside contractors and consultants on economically reasonable terms, or at all.

If we are not able to effectively expand our organization by hiring new employees and/or engaging additional third-party service providers, we may not be able to successfully implement the tasks necessary to further develop and commercialize our current and future product candidates and, accordingly, may not achieve our research, development and commercialization goals.

| 16 |

We have in the past and may in the future enter into transactions that give rise to conflicts of interest with our affiliates and related parties and such transactions may harm our business and financial condition if they are not structured in our best interest.