UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-04661 | |

| Exact name of registrant as specified in charter: | Prudential Global Total Return Fund, Inc. | |

| Address of principal executive offices: | 655 Broad Street, 17th Floor | |

| Newark, New Jersey 07102 | ||

| Name and address of agent for service: | Deborah A. Docs | |

| 655 Broad Street, 17th Floor | ||

| Newark, New Jersey 07102 | ||

| Registrant’s telephone number, including area code: | 800-225-1852 | |

| Date of fiscal year end: | 10/31/2017 | |

| Date of reporting period: | 10/31/2017 | |

Item 1 – Reports to Stockholders

PRUDENTIAL GLOBAL TOTAL RETURN FUND

ANNUAL REPORT

OCTOBER 31, 2017

To enroll in e-delivery, go to pgiminvestments.com/edelivery

| Objective: Total return, made up of current income and capital appreciation |

Highlights

| • | The Fund outperformed the Bloomberg Barclays Global Aggregate Bond Index primarily because of strong sector and issuer selection across hard currency emerging markets sovereign debt, bonds in non-core European countries, high yield corporate bonds, and high-quality structured securities. |

| • | Yield curve and duration positioning also helped Fund performance. |

| • | An underweight relative to the Index in investment-grade corporate bonds was a drag on performance, as spreads tightened in response to additional asset purchases by global central banks and continued strong corporate earnings. |

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. © 2017 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| 2 | Visit our website at pgiminvestments.com |

PRUDENTIAL FUNDS — UPDATE

The Board of Directors/Trustees for the Fund has approved renaming the Fund’s Class Q shares as Class R6 shares, effective on or about June 15, 2018. The renaming of Class Q shares as Class R6 shares will not result in any changes to pricing, eligibility, or shareholder rights and obligations. The renamed Class R6 shares will not be exchangeable with Class R6 shares of the Prudential Day One Funds or the Prudential 60/40 Allocation Fund.

LR993

| Prudential Global Total Return Fund | 3 |

PRUDENTIAL FUNDS — UPDATE

Effective on or about June 1, 2018 (the “Effective Date”), the Fund’s Class A, Class C, Class R, and Class Z shares, as applicable, will be closed to investments by new group retirement plans, except as discussed below. Existing group retirement plans as of the Effective Date may keep their investments in their current share class and may continue to make additional purchases or exchanges of that class of shares. As of the Effective Date, all new group retirement plans wishing to add the Fund as a new addition to the plan generally will be into one of the available Class Q shares, Class R2 shares, or Class R4 shares of the Fund.

In addition, on or about the Effective Date, the Class R shares of the Fund will be closed to all new investors, except as discussed below. Due to the closing of the Class R shares to new investors, effective on or about the Effective Date new IRA investors may only purchase Class A, Class C, Class Z, or Class Q shares of the Fund, subject to share class eligibility. Following the Effective Date, no new accounts may be established in the Fund’s Class R shares and no Class R shares may be purchased or acquired by any new Class R shareholder, except as discussed below.

| Class A | Class C | Class Z | Class R | |||||

|

Existing Investors (Group Retirement Plans, IRAs, and all other investors) |

No Change | No Change | No Change | No Change | ||||

| New Group Retirement Plans | Closed to group retirement plans wishing to add the share classes as new additions to plan menus on or about June 1, 2018, subject to certain exceptions below | |||||||

| New IRAs |

No Change | No Change | No Change | Closed to all new investors on or about June 1, 2018, subject to certain exceptions below | ||||

| All Other New Investors | No Change | No Change | No Change | |||||

| 4 | Visit our website at pgiminvestments.com |

However, the following new investors may continue to purchase Class A, Class C, Class R, and Class Z shares of the Fund, as applicable:

| • | Eligible group retirement plans who are exercising their one-time 90-day repurchase privilege in the Fund will be permitted to purchase such share classes. |

| • | Plan participants in a group retirement plan that offers Class A, Class C, Class R, or Class Z shares of the Fund as of the Effective Date will be permitted to purchase such share classes of the Fund, even if the plan participant did not own shares of that class of the Fund as of the Effective Date. |

| • | Certain new group retirement plans will be permitted to offer such share classes of the Fund after the Effective Date, provided that the plan has or is actively negotiating a contractual agreement with the Fund’s distributor or service provider to offer such share classes of the Fund prior to or on the Effective Date. |

| • | New group retirement plans that combine with, replace, or are otherwise affiliated with a current plan that invests in such share classes prior to or on the Effective Date will be permitted to purchase such share classes. |

The Fund also reserves the right to refuse any purchase order that might disrupt management of the Fund or to otherwise modify the closure policy at any time on a case-by-case basis.

| Prudential Global Total Return Fund | 5 |

This Page Intentionally Left Blank

| 6 | Visit our website at pgiminvestments.com |

Letter from the President

Dear Shareholder:

We hope you find the annual report for the Prudential Global Total Return Fund informative and useful. The report covers performance for the 12-month period ended October 31, 2017.

Significant events during the reporting period included a new US president, followed by uncertainty in Congress over implementing the Trump

administration’s policy initiatives. Elsewhere, Britain began its formal legal process to leave the European Union. France elected a more centrist president, which was viewed as a pro-euro referendum. North Korea’s missile launches escalated geopolitical tensions. Also, late in the period, a series of hurricanes caused damage in the US and the Caribbean.

Despite some turbulence in the macro-environment, solid economic fundamentals in the US economy included moderate gross domestic product expansion, robust employment, and accelerating corporate profit growth. Inflation remained tame. The Federal Reserve raised its federal funds rate twice in 2017, and is in the process of winding down its stimulus program.

Global economic growth remained mostly positive. Equities in the US reached new highs amid low volatility, while international equities posted strong gains. European stocks continued to gain. Asian markets were solid, and emerging markets outperformed most regions. Fixed income markets were mixed. High yield and emerging markets bonds were the top performers.

Given the uncertainty in today’s investment environment, we believe that active professional portfolio management offers a potential advantage. Active managers often have the knowledge and flexibility to find the best investment opportunities in the most challenging markets.

Even so, it’s best if investment decisions are based on your long-term goals rather than on short-term market and economic developments. We also encourage you to work with an experienced financial advisor who can help you set goals, determine your tolerance for risk, and build a diversified plan that’s right for you and make adjustments when necessary.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. We’re part of PGIM, a top-10 global investment manager with more than $1 trillion in assets under management. This investment expertise allows us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

Prudential Global Total Return Fund

December 15, 2017

| Prudential Global Total Return Fund | 7 |

Your Fund’s Performance (unaudited)

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.pgiminvestments.com or by calling (800) 225-1852.

| Average Annual Total Returns as of 10/31/17 (with sales charges) |

||||||||||||||||

| One Year (%) | Five Years (%) | Ten Years (%) | Since Inception (%) | |||||||||||||

| Class A | 0.39 | 1.54 | 4.84 | — | ||||||||||||

| Class B | –0.80 | 1.52 | 4.53 | — | ||||||||||||

| Class C | 3.19 | 1.70 | 4.65 | — | ||||||||||||

| Class Q | 5.21 | 2.93 | N/A | 3.72 (2/3/12) | ||||||||||||

| Class Z | 5.35 | 2.72 | 5.58 | — | ||||||||||||

| Bloomberg Barclays Global Aggregate Bond Index | 1.18 | 0.43 | 3.11 | — | ||||||||||||

| Lipper Global Income Funds Average* | 2.80 | 1.25 | 3.48 | — | ||||||||||||

| Lipper Custom Global Income Funds Average* | 3.12 | 0.92 | 3.65 | — | ||||||||||||

| Average Annual Total Returns as of 10/31/17 (without sales charges) |

||||||||||||||||

| One Year (%) | Five Years (%) | Ten Years (%) | Since Inception (%) | |||||||||||||

| Class A | 5.12 | 2.48 | 5.32 | — | ||||||||||||

| Class B | 4.20 | 1.70 | 4.53 | — | ||||||||||||

| Class C | 4.19 | 1.70 | 4.65 | — | ||||||||||||

| Class Q | 5.21 | 2.93 | N/A | 3.72 (2/3/12) | ||||||||||||

| Class Z | 5.35 | 2.72 | 5.58 | — | ||||||||||||

| Bloomberg Barclays Global Aggregate Bond Index | 1.18 | 0.43 | 3.11 | — | ||||||||||||

| Lipper Global Income Funds Average* | 2.80 | 1.25 | 3.48 | — | ||||||||||||

| Lipper Custom Global Income Funds Average* | 3.12 | 0.92 | 3.65 | — | ||||||||||||

*The Lipper Custom Global Income Funds Average consists only of unhedged funds within Lipper’s Global Income Funds Universe and not the entire Global Income Funds Universe, although Lipper classifies the Fund in the Global Income Funds Performance Universe. The Lipper Custom Global Income Funds Average is utilized because the Fund’s manager believes that the funds included in this universe provide a more appropriate basis for Fund performance comparisons.

| 8 | Visit our website at pgiminvestments.com |

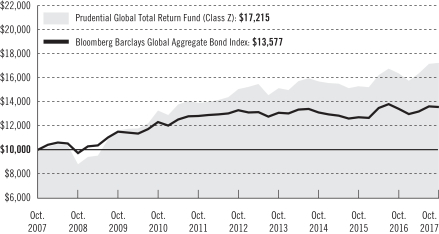

Growth of a $10,000 Investment

The graph compares a $10,000 investment in Prudential Global Total Return Fund (Class Z shares) with a similar investment in the Bloomberg Barclays Global Aggregate Bond Index by portraying the initial account values at the beginning of the 10-year period for Class Z shares (October 31, 2007) and the account values at the end of the current fiscal year (October 31, 2017) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for Class A, Class B, Class C, and Class Q shares will vary due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the Fund’s returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

| Prudential Global Total Return Fund | 9 |

Your Fund’s Performance (continued)

Source: PGIM Investments LLC and Lipper Inc.

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Index and the Lipper Average are measured from the inception date for the indicated share class.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| Class A* | Class B** | Class C* | Class Q | Class Z* | ||||||

| Maximum initial sales charge | 4.50% of the public offering price | None | None | None | None | |||||

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or net asset value at redemption) | 1.00% on sales of $1 million or more made within 12 months of purchase | 5% (Yr. 1) 4% (Yr. 2) 3% (Yr. 3) 2% (Yr. 4) 1% (Yr. 5/6) 0% (Yr. 7) | 1.00% on sales made within 12 months of purchase | None | None | |||||

| Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | 0.25% | 1.00% | 1.00% | None | None |

*Certain share classes will be generally closed to investments by new group retirement plans effective on or about June 1, 2018. Please see the “PRUDENTIAL FUNDS—UPDATE” on page 4 of this report for more information.

**Class B shares are closed to all purchase activity and no additional Class B shares may be purchased or acquired except by exchange from Class B shares of another Fund or through dividend or capital gains reinvestment.

Benchmark Definitions

Bloomberg Barclays Global Aggregate Bond Index—The Bloomberg Barclays Global Aggregate Bond Index is an unmanaged index of global investment-grade fixed income markets. The three major components of this index are the US Aggregate, the Pan-European Aggregate, and the Asian-Pacific Aggregate Indices. The index also includes euro dollar and euroyen corporate bonds, Canadian government, and agency and corporate securities. The average annual total return for the Index measured from the month-end closest to the inception date of the Fund’s Class Q shares through 10/31/17 is 0.88%.

Lipper Global Income Funds Average—The Lipper Global Income Funds Average (Lipper Average) is based on the average return of all funds in the Lipper Global Income Funds universe for the periods noted. Funds in the Lipper Average invest primarily in US dollar and non-US dollar debt securities of issuers located in at least three countries, one of which may be the United States. The average annual total return for the Lipper Average measured from the month-end closest to the inception date of the Fund’s Class Q shares through 10/31/17 is 1.81%.

| 10 | Visit our website at pgiminvestments.com |

Lipper Custom Global Income Funds Average—The Lipper Custom Global Income Funds Average (Lipper Custom Average) consists only of unhedged funds within Lipper’s Global Income Funds universe and not the entire Global Income Funds universe, although Lipper classifies the Fund in the Global Income Funds Performance universe. The average annual total return for the Lipper Custom Average measured from the month-end closest to the inception date of the Fund’s Class Q shares through 10/31/17 is 1.63%.

Investors cannot invest directly in an index or average. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Averages reflect the deduction of operating expenses, but not sales charges or taxes.

| Distributions and Yields as of 10/31/17 | ||||||

| Total Distributions Paid for 12 Months ($) |

SEC 30-Day Subsidized Yield* (%) |

SEC 30-Day Unsubsidized Yield** (%) | ||||

| Class A | 0.22 | 1.53 | 1.37 | |||

| Class B | 0.17 | 0.86 | 0.69 | |||

| Class C | 0.17 | 0.86 | 0.69 | |||

| Class Q | 0.24 | 1.87 | 1.90 | |||

| Class Z | 0.24 | 1.84 | 1.67 | |||

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements).

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses.

| Credit Quality expressed as a percentage of total investments as of 10/31/17 (%) | ||||

| AAA | 29.3 | |||

| AA | 8.1 | |||

| A | 20.4 | |||

| BBB | 21.4 | |||

| BB | 8.4 | |||

| B | 5.8 | |||

| CCC | 0.4 | |||

| Not Rated | 4.2 | |||

| Cash/Cash Equivalents | 2.1 | |||

| Total | 100.0 | |||

| Prudential Global Total Return Fund | 11 |

Your Fund’s Performance (continued)

Source: PGIM Fixed Income

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investor Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by a NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

| 12 | Visit our website at pgiminvestments.com |

Strategy and Performance Overview

How did the Fund perform?

The Prudential Global Total Return Fund’s Class Z shares returned 5.35% during the 12-month period ended October 31, 2017, outperforming the 1.18% return of the Bloomberg Barclays Global Aggregate Bond Index and the 2.80% return of the Lipper Global Income Funds Average.

What were market conditions?

| • | November and December 2016 were largely about the surprise result of the US presidential election, in which populist Donald Trump managed an electoral college win against former US Senator Hillary Clinton. Given that Trump campaigned on tax cuts and deregulation, bond investors responded by sending US intermediate- and longer-term interest rates higher and driving credit spreads tighter. Credit spreads are differences in yield between government bonds and debt securities of comparable maturity but lower credit quality. |

| • | In the first quarter of 2017, US 10-year yields fell back somewhat, as market participants began to see that recent inflation increases were the result of a recovery in commodity prices, rather than the tightening of slack in the global labor markets and an overheating world economy. Emerging markets currencies rallied, interest rates broadly declined, and spreads continued to compress. |

| • | During the second quarter, bond yields stayed flat, as the market focused on the potential downside of the Trump administration’s protectionist agenda, instead of the Federal Reserve’s (Fed) plans to shrink its balance sheet. Considering how difficult it was to find yield globally, investors spent the quarter looking for opportunities further out among spread sectors, with emerging markets debt drawing an especially large inflow of assets. Spread sectors are corporate bonds, emerging markets debt, and other types of debt securities that provide extra yield (spread) over similar-maturity government bond sectors to compensate for the greater credit risk associated with investing in them. |

| • | In the third quarter and through October 2017, overall economic growth rates remained somewhat below those recorded before the 2008-2009 financial crisis, but the global expansion became increasingly balanced across regions, with the US, the eurozone, Japan, and China all growing in tandem at above-potential rates. In this environment, US intermediate-term interest rates remained rather flat, but the front, or short-term, end of the US Treasury yield curve rose in anticipation of ongoing tighter monetary policy by the Fed. Spreads continued to compress because of the scarcity of yield globally and strong corporate earnings. |

What worked?

| • | During the reporting period, the Fund’s sector allocation emphasized global spread sectors rather than government bond sectors. The Fund outperformed the Index primarily |

| Prudential Global Total Return Fund | 13 |

Strategy and Performance Overview (continued)

| because of strong sector and issuer selection across hard currency emerging markets sovereign debt, bonds in non-core European countries, high yield corporate bonds, and high-quality structured securities. |

| • | Yield curve and duration positioning also helped Fund performance. This positive contribution was driven by the flattening of the US Treasury yield curve, as the Fed continued to tighten monetary policy without a change in inflation expectations priced into the longer end of the curve. Duration is a measure of the interest rate sensitivity of a bond portfolio or individual debt securities that is expressed as a number of years. The longer the duration, the greater the potential risk or reward when interest rates move. A steepening yield curve means the difference between shorter- and longer-term yields widens. |

| • | Currency positions also added to relative returns, with tactical positioning in Mexico generating gains as the US dollar rallied in the wake of the US election. The Fund’s overweight positions compared to the Index in the Indian rupee and Russian ruble also bore fruit. |

What didn’t work?

| • | An underweight relative to the Index in investment-grade corporate bonds was a drag on performance, as spreads tightened in response to additional asset purchases by global central banks and continued strong corporate earnings. |

| • | The Fund’s positioning overall in emerging markets interest rates hurt relative returns in the immediate aftermath of the US presidential election and the subsequent rise in US interest rates and the US dollar. Late in the period, some of these losses were offset by the Fund’s positioning in Mexican, Czech Republic, and Colombian interest rates. |

Did the Fund hold derivatives and how did they affect performance?

| • | During the reporting period, the Fund utilized derivative instruments. Interest rate derivatives were additive to performance, currency derivatives were a contributor, and credit derivatives also had a positive impact. For additional information regarding the Fund’s derivative exposures please refer to the Fund’s Financial Statements. |

Current outlook

| • | PGIM Fixed Income maintains a positive view of credit sectors, and at the end of the reporting period, the Fund continues to have exposure to an array of spread sectors, including high yield corporate bonds, developed and emerging markets sovereign debt, and structured products, including commercial mortgage-backed securities (CMBS) and asset-backed securities. |

| • | The Fund is also overweight the debt of bonds in non-core European countries, as well as a select group of emerging markets issues, mostly sovereign debt. |

| 14 | Visit our website at pgiminvestments.com |

| • | In terms of currency positioning, relative to the Index, the Fund holds underweight positions in the US dollar, Japanese yen, and Swiss franc while maintaining an overweight to the euro. |

| • | Additionally, the Fund maintains a select set of small allocations, both underweight and overweight, within emerging markets and “commodity” currencies. These include overweights in the Indian rupee, Russian ruble, Indonesian rupiah, and Mexican peso and underweights in the Taiwanese dollar, Singaporean dollar, and Israeli new shekel. |

| • | US government-related sectors, including Treasuries, agency bonds, and agency mortgage-backed securities, remain a significant underweight as PGIM Fixed Income finds more compelling value in the aforementioned sectors. |

| Prudential Global Total Return Fund | 15 |

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended October 31, 2017. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of Prudential funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses

| 16 | Visit our website at pgiminvestments.com |

paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Prudential Global

Total Return Fund |

Beginning Account May 1, 2017 |

Ending

Account Value October 31, 2017 |

Annualized Expense Ratio Based on the Six-Month Period |

Expenses

Paid During the Six-Month Period* |

||||||||||||||

| Class A | Actual | $ | 1,000.00 | $ | 1,051.20 | 0.88 | % | $ | 4.55 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,020.77 | 0.88 | % | $ | 4.48 | ||||||||||

| Class B | Actual | $ | 1,000.00 | $ | 1,047.40 | 1.63 | % | $ | 8.41 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,016.99 | 1.63 | % | $ | 8.29 | ||||||||||

| Class C | Actual | $ | 1,000.00 | $ | 1,047.40 | 1.63 | % | $ | 8.41 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,016.99 | 1.63 | % | $ | 8.29 | ||||||||||

| Class Q | Actual | $ | 1,000.00 | $ | 1,052.20 | 0.58 | % | $ | 3.00 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,022.28 | 0.58 | % | $ | 2.96 | ||||||||||

| Class Z | Actual | $ | 1,000.00 | $ | 1,052.30 | 0.63 | % | $ | 3.26 | |||||||||

| Hypothetical | $ | 1,000.00 | $ | 1,022.03 | 0.63 | % | $ | 3.21 | ||||||||||

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2017, and divided by the 365 days in the Fund’s fiscal year ended October 31, 2017 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying funds in which the Fund may invest.

| Prudential Global Total Return Fund | 17 |

Schedule of Investments

as of October 31, 2017

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| LONG-TERM INVESTMENTS 96.0% |

||||||||||||||||

| FOREIGN BONDS 58.0% |

||||||||||||||||

| Argentina 1.3% |

||||||||||||||||

| Argentine Bonos del Tesoro, Unsec’d. Notes |

22.750 | % | 03/05/18 | ARS | 35,378 | $ | 1,982,667 | |||||||||

| Argentine Republic Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

3.375 | 10/12/20 | CHF | 3,860 | 4,018,335 | |||||||||||

| Sr. Unsec’d. Notes |

3.875 | 01/15/22 | EUR | 3,715 | 4,472,817 | |||||||||||

| Unsec’d. Notes(a) |

5.000 | 01/15/27 | EUR | 3,000 | 3,525,126 | |||||||||||

|

|

|

|||||||||||||||

| 13,998,945 | ||||||||||||||||

| Australia 0.2% |

||||||||||||||||

| Australia Government Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

3.000 | 03/21/47 | AUD | 2,400 | 1,685,295 | |||||||||||

| Sr. Unsec’d. Notes |

4.250 | 04/21/26 | AUD | 600 | 517,040 | |||||||||||

| New South Wales Treasury Corp., Local Gov’t. Gtd. Notes |

5.000 | 08/20/24 | AUD | 200 | 175,704 | |||||||||||

|

|

|

|||||||||||||||

| 2,378,039 | ||||||||||||||||

| Austria 0.3% |

||||||||||||||||

| Austria Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes, 144A, EMTN |

5.000 | 12/20/24 | CAD | 2,500 | 2,239,071 | |||||||||||

| Sr. Unsec’d. Notes, 144A, MTN |

5.375 | 12/01/34 | CAD | 1,000 | 1,000,516 | |||||||||||

|

|

|

|||||||||||||||

| 3,239,587 | ||||||||||||||||

| Belgium 0.9% |

||||||||||||||||

| Belgium Government Bond, Sr. Unsec’d. Notes, 144A |

0.800 | 06/22/27 | EUR | 680 | 806,504 | |||||||||||

| Belgium Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

9.375 | 02/21/20 | GBP | 2,302 | 3,637,486 | |||||||||||

| Unsec’d. Notes, 144A |

8.875 | 12/01/24 | 500 | 695,839 | ||||||||||||

| Unsec’d. Notes, EMTN |

5.000 | 04/24/18 | GBP | 2,850 | 3,866,519 | |||||||||||

| Unsec’d. Notes, EMTN |

5.700 | 05/28/32 | GBP | 150 | 281,766 | |||||||||||

|

|

|

|||||||||||||||

| 9,288,114 | ||||||||||||||||

| Brazil 1.4% |

||||||||||||||||

| Brazil Minas SPE via State of Minas Gerais, Sec’d. Notes |

5.333 | 02/15/28 | 3,800 | 3,866,500 | ||||||||||||

| Brazilian Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

2.875 | 04/01/21 | EUR | 4,528 | 5,630,463 | |||||||||||

| Sr. Unsec’d. Notes |

4.625 | 01/13/28 | 540 | 536,220 | ||||||||||||

| Brazilian Loan Trust I, First Lien |

5.477 | 07/24/23 | 1,534 | 1,599,756 | ||||||||||||

| JBS USA LUX SA/JBS USA Finance, Inc., |

||||||||||||||||

| Gtd. Notes, 144A |

5.750 | 06/15/25 | 545 | 528,650 | ||||||||||||

| Gtd. Notes, 144A |

7.250 | 06/01/21 | 190 | 193,701 | ||||||||||||

See Notes to Financial Statements.

| Prudential Global Total Return Fund | 19 |

Schedule of Investments (continued)

as of October 31, 2017

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| FOREIGN BONDS (Continued) |

| |||||||||||||||

| Brazil (cont’d.) |

||||||||||||||||

| Petrobras Global Finance BV, |

||||||||||||||||

| Gtd. Notes |

3.750 | % | 01/14/21 | EUR | 1,050 | $ | 1,314,588 | |||||||||

| Gtd. Notes(a) |

4.250 | 10/02/23 | EUR | 1,400 | 1,791,213 | |||||||||||

|

|

|

|||||||||||||||

| 15,461,091 | ||||||||||||||||

| Bulgaria 1.0% |

||||||||||||||||

| Bulgaria Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

2.950 | 09/03/24 | EUR | 6,765 | 9,042,537 | |||||||||||

| Unsec’d. Notes, GMTN(a) |

2.625 | 03/26/27 | EUR | 1,000 | 1,297,908 | |||||||||||

|

|

|

|||||||||||||||

| 10,340,445 | ||||||||||||||||

| Canada 1.1% |

||||||||||||||||

| Agrium, Inc., Sr. Unsec’d. Notes |

6.125 | 01/15/41 | 25 | 31,402 | ||||||||||||

| Barrick Gold Corp., Sr. Unsec’d. Notes |

5.250 | 04/01/42 | 35 | 40,736 | ||||||||||||

| Barrick North America Finance LLC, Gtd. Notes |

5.700 | 05/30/41 | 45 | 55,068 | ||||||||||||

| Barrick PD Australia Finance Pty. Ltd., Gtd. Notes |

5.950 | 10/15/39 | 50 | 62,680 | ||||||||||||

| Canadian Government Bond, |

||||||||||||||||

| Unsec’d. Notes |

1.750 | 09/01/19 | CAD | 600 | 468,238 | |||||||||||

| Unsec’d. Notes |

4.000 | 06/01/41 | CAD | 650 | 656,908 | |||||||||||

| Canadian Pacific Railway Co., Sr. Unsec’d. Notes |

6.500 | 05/15/18 | 77 | 78,875 | ||||||||||||

| City of Toronto, Sr. Unsec’d. Notes |

3.500 | 06/02/36 | CAD | 2,000 | 1,605,767 | |||||||||||

| City of Vancouver, Unsec’d. Notes |

4.500 | 06/01/20 | CAD | 200 | 165,333 | |||||||||||

| Hydro-Quebec, Local Gov’t. |

||||||||||||||||

| Gtd. Notes |

8.400 | 01/15/22 | 12 | 14,565 | ||||||||||||

| Gtd. Notes |

8.625 | 06/15/29 | 600 | 883,782 | ||||||||||||

| Gtd. Notes |

9.400 | 02/01/21 | 180 | 216,429 | ||||||||||||

| Municipal Finance Authority of British Columbia, Unsec’d. Notes |

4.450 | 06/01/20 | CAD | 2,100 | 1,737,330 | |||||||||||

| Ontario Teachers’ Finance Trust, Gtd. Notes, 144A |

2.125 | 09/19/22 | 1,750 | 1,732,016 | ||||||||||||

| Province of British Columbia, |

||||||||||||||||

| Unsec’d. Notes |

3.200 | 06/18/44 | CAD | 200 | 160,340 | |||||||||||

| Unsec’d. Notes |

7.875 | 11/30/23 | CAD | 1,552 | 1,553,149 | |||||||||||

| Province of Manitoba, Unsec’d. Notes |

2.550 | 06/02/26 | CAD | 250 | 193,018 | |||||||||||

| Province of Nova Scotia, Sr. Unsec’d. Notes |

8.250 | 11/15/19 | 10 | 11,107 | ||||||||||||

| Province of Quebec, |

||||||||||||||||

| Unsec’d. Notes |

7.125 | 02/09/24 | 1,246 | 1,551,543 | ||||||||||||

| Unsec’d. Notes, MTN |

6.350 | 01/30/26 | 100 | 122,669 | ||||||||||||

| Unsec’d. Notes, MTN |

7.140 | 02/27/26 | 430 | 546,045 | ||||||||||||

|

|

|

|||||||||||||||

| 11,887,000 | ||||||||||||||||

See Notes to Financial Statements.

| 20 |

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| FOREIGN BONDS (Continued) |

| |||||||||||||||

| Cayman Islands 0.2% |

||||||||||||||||

| Cayman Islands Government Bond, Sr. Unsec’d. Notes |

5.950 | % | 11/24/19 | 2,150 | $ | 2,316,625 | ||||||||||

| Chile 0.1% |

||||||||||||||||

| Chile Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

1.625 | 01/30/25 | EUR | 100 | 122,873 | |||||||||||

| Sr. Unsec’d. Notes |

1.750 | 01/20/26 | EUR | 240 | 295,182 | |||||||||||

| Sr. Unsec’d. Notes |

1.875 | 05/27/30 | EUR | 400 | 480,500 | |||||||||||

|

|

|

|||||||||||||||

| 898,555 | ||||||||||||||||

| China 0.1% |

||||||||||||||||

| China Development Bank, Sr. Unsec’d. Notes, EMTN |

0.500 | 06/01/21 | EUR | 1,000 | 1,169,730 | |||||||||||

| Sinopec Group Overseas Development 2015 Ltd., Gtd. Notes, 144A |

2.500 | 04/28/20 | 500 | 500,624 | ||||||||||||

|

|

|

|||||||||||||||

| 1,670,354 | ||||||||||||||||

| Colombia 1.1% |

||||||||||||||||

| Colombia Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

4.000 | 02/26/24 | 1,000 | 1,041,000 | ||||||||||||

| Sr. Unsec’d. Notes |

8.375 | 02/15/27 | 2,395 | 2,933,875 | ||||||||||||

| Sr. Unsec’d. Notes |

10.375 | 01/28/33 | 800 | 1,244,000 | ||||||||||||

| Sr. Unsec’d. Notes |

11.750 | 02/25/20 | 715 | 866,938 | ||||||||||||

| Sr. Unsec’d. Notes, EMTN |

3.875 | 03/22/26 | EUR | 4,430 | 5,972,491 | |||||||||||

|

|

|

|||||||||||||||

| 12,058,304 | ||||||||||||||||

| Croatia 0.1% |

||||||||||||||||

| Croatia Government International Bond, Sr. Unsec’d. Notes |

3.875 | 05/30/22 | EUR | 1,000 | 1,305,458 | |||||||||||

| Cyprus 1.8% |

| |||||||||||||||

| Cyprus Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes, EMTN |

3.750 | 07/26/23 | EUR | 10,600 | 14,206,776 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

4.250 | 11/04/25 | EUR | 825 | 1,149,549 | |||||||||||

| Unsec’d. Notes, EMTN(a) |

3.875 | 05/06/22 | EUR | 2,500 | 3,325,599 | |||||||||||

|

|

|

|||||||||||||||

| 18,681,924 | ||||||||||||||||

| Denmark 0.1% |

| |||||||||||||||

| Denmark Government Bond, |

||||||||||||||||

| Unsec’d. Notes |

1.750 | 11/15/25 | DKK | 3,520 | 620,302 | |||||||||||

| Unsec’d. Notes |

3.000 | 11/15/21 | DKK | 3,000 | 533,714 | |||||||||||

| Unsec’d. Notes |

4.500 | 11/15/39 | DKK | 1,800 | 478,119 | |||||||||||

|

|

|

|||||||||||||||

| 1,632,135 | ||||||||||||||||

See Notes to Financial Statements.

| Prudential Global Total Return Fund | 21 |

Schedule of Investments (continued)

as of October 31, 2017

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| FOREIGN BONDS (Continued) |

| |||||||||||||||

| Dominican Republic 0.4% |

| |||||||||||||||

| Dominican Republic International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

7.500 | % | 05/06/21 | 4,000 | $ | 4,425,000 | ||||||||||

| Sr. Unsec’d. Notes |

9.040 | 01/23/18 | 66 | 66,656 | ||||||||||||

|

|

|

|||||||||||||||

| 4,491,656 | ||||||||||||||||

| Finland 0.1% |

| |||||||||||||||

| Finland Government International Bond, Sr. Unsec’d. Notes |

6.950 | 02/15/26 | 600 | 762,890 | ||||||||||||

| France 3.9% |

| |||||||||||||||

| Agence Francaise de Developpement, Sr. Unsec’d. Notes |

1.625 | 01/21/20 | 2,000 | 1,981,426 | ||||||||||||

| Caisse d’Amortissement de la Dette Sociale, Sr. Unsec’d. Notes, EMTN |

4.450 | 10/26/18 | CAD | 700 | 556,920 | |||||||||||

| Credit Agricole Assurances SA, Sub. Notes |

4.250 | 12/31/49 | EUR | 2,000 | 2,620,911 | |||||||||||

| Dexia Credit Local SA, |

||||||||||||||||

| Gov’t. Liquid Gtd. Notes |

2.250 | 02/18/20 | 250 | 250,571 | ||||||||||||

| Gov’t. Liquid Gtd. Notes, 144A |

1.875 | 09/15/21 | 1,500 | 1,474,924 | ||||||||||||

| Gov’t. Liquid Gtd. Notes, EMTN |

1.125 | 02/24/19 | GBP | 400 | 533,062 | |||||||||||

| Gov’t. Liquid Gtd. Notes, EMTN |

2.000 | 01/22/21 | EUR | 1,000 | 1,246,487 | |||||||||||

| France Government Bond OAT, |

||||||||||||||||

| Unsec’d. Notes |

0.500 | 05/25/26 | EUR | 350 | 410,184 | |||||||||||

| Unsec’d. Notes |

1.750 | 11/25/24 | EUR | 300 | 388,524 | |||||||||||

| Unsec’d. Notes |

2.750 | 10/25/27 | EUR | 18,000 | 25,259,379 | |||||||||||

| Unsec’d. Notes |

3.500 | 04/25/26 | EUR | 4,000 | 5,876,899 | |||||||||||

| Horizon Parent Holdings Sarl, Sr. Sec’d. Notes, Cash coupon 8.250% or PIK 9.000%, 144A |

8.250 | 02/15/22 | EUR | 300 | 373,480 | |||||||||||

|

|

|

|||||||||||||||

| 40,972,767 | ||||||||||||||||

| Germany 1.1% |

| |||||||||||||||

| Bundesrepublik Deutschland, |

||||||||||||||||

| Unsec’d. Notes |

0.250 | 02/15/27 | EUR | 1,970 | 2,286,951 | |||||||||||

| Unsec’d. Notes |

0.392 | (s) | 08/15/26 | EUR | 1,170 | 1,338,784 | ||||||||||

| Unsec’d. Notes |

1.750 | 07/04/22 | EUR | 1,465 | 1,881,360 | |||||||||||

| Unsec’d. Notes |

1.750 | 02/15/24 | EUR | 310 | 404,733 | |||||||||||

| Unsec’d. Notes |

2.000 | 01/04/22 | EUR | 855 | 1,100,698 | |||||||||||

| Douglas GmbH, Sr. Sec’d. Notes |

6.250 | 07/15/22 | EUR | 750 | 934,879 | |||||||||||

| IHO Verwaltungs GmbH, |

||||||||||||||||

| Sr. Sec’d. Notes, Cash coupon 3.250% or PIK 4.000%, 144A |

3.250 | 09/15/23 | EUR | 480 | 586,413 | |||||||||||

| Sr. Sec’d. Notes, Cash coupon 3.750% or PIK 4.500%, 144A |

3.750 | 09/15/26 | EUR | 465 | 579,571 | |||||||||||

See Notes to Financial Statements.

| 22 |

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| FOREIGN BONDS (Continued) |

| |||||||||||||||

| Germany (cont’d.) |

| |||||||||||||||

| Kreditanstalt fuer Wiederaufbau, Gov’t. Gtd. Notes |

4.700 | % | 06/02/37 | CAD | 179 | $ | 167,817 | |||||||||

| Nidda Healthcare Holding AG, Sr. Sec’d. Notes, 144A |

3.500 | 09/30/24 | EUR | 1,000 | 1,192,340 | |||||||||||

| Unitymedia Hessen GmbH & Co. KG/Unitymedia NRW GmbH, Sr. Sec’d. Notes |

4.000 | 01/15/25 | EUR | 350 | 434,251 | |||||||||||

| Volkswagen International Finance NV, Gtd. Notes |

3.750 | 12/31/49 | EUR | 1,000 | 1,251,572 | |||||||||||

|

|

|

|||||||||||||||

| 12,159,369 | ||||||||||||||||

| Greece 2.4% |

| |||||||||||||||

| Hellenic Republic Government Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

— | (p) | 10/15/42 | EUR | 153,880 | 627,365 | ||||||||||

| Sr. Unsec’d. Notes |

3.000 | (cc) | 02/24/23 | EUR | 1,045 | 1,153,312 | ||||||||||

| Sr. Unsec’d. Notes(a) |

3.000 | (cc) | 02/24/24 | EUR | 3,685 | 3,988,950 | ||||||||||

| Sr. Unsec’d. Notes(a) |

3.000 | (cc) | 02/24/25 | EUR | 2,075 | 2,211,946 | ||||||||||

| Sr. Unsec’d. Notes |

3.000 | (cc) | 02/24/26 | EUR | 1,145 | 1,200,377 | ||||||||||

| Sr. Unsec’d. Notes |

3.000 | (cc) | 02/24/27 | EUR | 4,724 | 4,863,880 | ||||||||||

| Sr. Unsec’d. Notes |

3.000 | (cc) | 02/24/28 | EUR | 1,220 | 1,218,947 | ||||||||||

| Sr. Unsec’d. Notes |

3.000 | (cc) | 02/24/29 | EUR | 1,300 | 1,268,851 | ||||||||||

| Sr. Unsec’d. Notes |

3.000 | (cc) | 02/24/31 | EUR | 3,425 | 3,222,779 | ||||||||||

| Sr. Unsec’d. Notes |

3.000 | (cc) | 02/24/32 | EUR | 1,055 | 980,061 | ||||||||||

| Sr. Unsec’d. Notes |

3.000 | (cc) | 02/24/35 | EUR | 1,810 | 1,615,607 | ||||||||||

| Sr. Unsec’d. Notes, 144A |

4.375 | 08/01/22 | EUR | 2,640 | 3,069,790 | |||||||||||

| Hellenic Republic Government International Bond, Sr. Unsec’d. Notes |

5.200 | 07/17/34 | EUR | 500 | 520,974 | |||||||||||

|

|

|

|||||||||||||||

| 25,942,839 | ||||||||||||||||

| Hong Kong 0.2% |

| |||||||||||||||

| Hong Kong SAR Government Bond, Unsec’d. Notes |

5.125 | 07/23/19 | HKD | 5,000 | 680,798 | |||||||||||

| Hong Kong Sukuk Ltd., Sr. Unsec’d. Notes |

3.132 | 02/28/27 | 1,500 | 1,520,352 | ||||||||||||

|

|

|

|||||||||||||||

| 2,201,150 | ||||||||||||||||

| Hungary 1.5% |

| |||||||||||||||

| Hungary Government Bond, |

||||||||||||||||

| Unsec’d. Notes |

3.000 | 10/27/27 | HUF | 300,000 | 1,174,807 | |||||||||||

| Unsec’d. Notes |

5.500 | 12/20/18 | HUF | 100,000 | 397,151 | |||||||||||

| Hungary Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

4.000 | 03/25/19 | 332 | 341,587 | ||||||||||||

| Sr. Unsec’d. Notes |

5.375 | 02/21/23 | 2,850 | 3,192,000 | ||||||||||||

| Sr. Unsec’d. Notes |

5.750 | 06/11/18 | EUR | 500 | 602,810 | |||||||||||

| Sr. Unsec’d. Notes |

5.750 | 11/22/23 | 2,850 | 3,275,807 | ||||||||||||

| Sr. Unsec’d. Notes |

6.250 | 01/29/20 | 3,200 | 3,467,910 | ||||||||||||

| Sr. Unsec’d. Notes |

6.375 | 03/29/21 | 2,530 | 2,830,438 | ||||||||||||

See Notes to Financial Statements.

| Prudential Global Total Return Fund | 23 |

Schedule of Investments (continued)

as of October 31, 2017

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| FOREIGN BONDS (Continued) |

| |||||||||||||||

| Hungary (cont’d.) |

| |||||||||||||||

| MFB Magyar Fejlesztesi Bank Zrt, Gov’t. Gtd. Notes |

6.250 | % | 10/21/20 | 400 | $ | 440,656 | ||||||||||

|

|

|

|||||||||||||||

| 15,723,166 | ||||||||||||||||

| Iceland 0.6% |

| |||||||||||||||

| Iceland Government International Bond, Sr. Unsec’d. Notes, EMTN |

2.500 | 07/15/20 | EUR | 5,006 | 6,204,436 | |||||||||||

| India 0.1% |

| |||||||||||||||

| Export-Import Bank of India, |

||||||||||||||||

| Sr. Unsec’d. Notes, EMTN |

5.090 | 04/18/18 | MXN | 2,390 | 123,035 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

5.760 | 04/05/18 | AUD | 1,000 | 772,502 | |||||||||||

|

|

|

|||||||||||||||

| 895,537 | ||||||||||||||||

| Indonesia 1.4% |

| |||||||||||||||

| Indonesia Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

3.375 | 07/30/25 | EUR | 5,005 | 6,492,834 | |||||||||||

| Sr. Unsec’d. Notes, 144A, MTN |

2.150 | 07/18/24 | EUR | 1,395 | 1,681,026 | |||||||||||

| Sr. Unsec’d. Notes, MTN |

2.875 | 07/08/21 | EUR | 546 | 688,478 | |||||||||||

| Sr. Unsec’d. Notes, MTN |

3.750 | 06/14/28 | EUR | 3,220 | 4,249,299 | |||||||||||

| Majapahit Holding BV, Gtd. Notes |

7.750 | 01/20/20 | 800 | 883,040 | ||||||||||||

| Pertamina Persero PT, Sr. Unsec’d. Notes, 144A, MTN |

4.300 | 05/20/23 | 500 | 528,124 | ||||||||||||

|

|

|

|||||||||||||||

| 14,522,801 | ||||||||||||||||

| Ireland 0.3% |

||||||||||||||||

| CRH America, Inc., Gtd. Notes |

8.125 | 07/15/18 | 110 | 114,860 | ||||||||||||

| Ireland Government Bond, |

||||||||||||||||

| Unsec’d. Notes |

2.400 | 05/15/30 | EUR | 1,200 | 1,619,491 | |||||||||||

| Unsec’d. Notes |

5.400 | 03/13/25 | EUR | 900 | 1,432,337 | |||||||||||

|

|

|

|||||||||||||||

| 3,166,688 | ||||||||||||||||

| Israel 0.3% |

||||||||||||||||

| Israel Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes, EMTN |

1.500 | 01/18/27 | EUR | 2,000 | 2,385,029 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

4.625 | 03/18/20 | EUR | 330 | 425,916 | |||||||||||

|

|

|

|||||||||||||||

| 2,810,945 | ||||||||||||||||

| Italy 4.7% |

||||||||||||||||

| Intesa Sanpaolo SpA, Sr. Unsec’d. Notes, 144A |

3.125 | 07/14/22 | 4,125 | 4,135,928 | ||||||||||||

| Italy Buoni Poliennali Del Tesoro, |

||||||||||||||||

| Sr. Unsec’d. Notes |

0.650 | 10/15/23 | EUR | 2,000 | 2,289,258 | |||||||||||

| Sr. Unsec’d. Notes |

1.350 | 04/15/22 | EUR | 535 | 645,852 | |||||||||||

See Notes to Financial Statements.

| 24 |

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| FOREIGN BONDS (Continued) |

| |||||||||||||||

| Italy (cont’d.) |

| |||||||||||||||

| Italy Buoni Poliennali Del Tesoro, (cont’d.) |

||||||||||||||||

| Sr. Unsec’d. Notes |

2.000 | % | 12/01/25 | EUR | 2,200 | $ | 2,659,794 | |||||||||

| Sr. Unsec’d. Notes |

3.750 | 09/01/24 | EUR | 7,855 | 10,665,115 | |||||||||||

| Sr. Unsec’d. Notes |

4.500 | 03/01/26 | EUR | 8,545 | 12,264,476 | |||||||||||

| Sr. Unsec’d. Notes |

6.500 | 11/01/27 | EUR | 2,695 | 4,490,398 | |||||||||||

| Unsec’d. Notes |

2.050 | 08/01/27 | EUR | 2,100 | 2,497,065 | |||||||||||

| Italy Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

6.875 | 09/27/23 | 2,700 | 3,220,020 | ||||||||||||

| Sr. Unsec’d. Notes, EMTN |

5.200 | 07/31/34 | EUR | 250 | 383,078 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

5.250 | 12/07/34 | GBP | 572 | 905,797 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

6.000 | 08/04/28 | GBP | 661 | 1,085,981 | |||||||||||

| Sr. Unsec’d. Notes, MTN |

5.375 | 06/15/33 | 590 | 681,522 | ||||||||||||

| Moby SpA, Sr. Sec’d. Notes, 144A |

7.750 | 02/15/23 | EUR | 450 | 524,245 | |||||||||||

| Telecom Italia SpA, Sr. Unsec’d. Notes, EMTN |

5.875 | 05/19/23 | GBP | 500 | 776,383 | |||||||||||

| Wind Tre SpA, |

||||||||||||||||

| Sr. Sec’d. Notes, 144A |

2.625 | 01/20/23 | EUR | 640 | 748,859 | |||||||||||

| Sr. Sec’d. Notes, 144A |

3.125 | 01/20/25 | EUR | 1,320 | 1,542,214 | |||||||||||

|

|

|

|||||||||||||||

| 49,515,985 | ||||||||||||||||

| Japan 3.7% |

||||||||||||||||

| Japan Bank for International Cooperation, |

||||||||||||||||

| Gov’t. Gtd. Notes |

1.500 | 07/21/21 | 2,000 | 1,943,242 | ||||||||||||

| Gov’t. Gtd. Notes |

1.750 | 05/29/19 | 1,400 | 1,394,417 | ||||||||||||

| Gov’t. Gtd. Notes |

2.250 | 02/24/20 | 600 | 602,030 | ||||||||||||

| Japan Finance Organization for Municipalities, |

||||||||||||||||

| Gov’t. Gtd. Notes, EMTN |

5.750 | 08/09/19 | GBP | 400 | 574,893 | |||||||||||

| Sr. Unsec’d. Notes, 144A, MTN |

2.000 | 09/08/20 | 2,200 | 2,183,684 | ||||||||||||

| Sr. Unsec’d. Notes, 144A, MTN |

2.125 | 04/13/21 | 1,000 | 989,660 | ||||||||||||

| Sr. Unsec’d. Notes, EMTN |

0.875 | 09/22/21 | EUR | 2,535 | 3,017,665 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

1.375 | 02/05/18 | 1,000 | 998,189 | ||||||||||||

| Sr. Unsec’d. Notes, EMTN |

2.125 | 02/12/21 | 600 | 593,931 | ||||||||||||

| Sr. Unsec’d. Notes, EMTN |

2.125 | 04/13/21 | 1,200 | 1,187,592 | ||||||||||||

| Sr. Unsec’d. Notes, EMTN |

2.500 | 09/12/18 | 2,000 | 2,005,364 | ||||||||||||

| Sr. Unsec’d. Notes, EMTN |

2.625 | 04/20/22 | 1,000 | 1,003,055 | ||||||||||||

| Japan Government Twenty Year Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

0.200 | 06/20/36 | JPY | 450,000 | 3,726,723 | |||||||||||

| Sr. Unsec’d. Notes |

0.400 | 03/20/36 | JPY | 100,000 | 861,624 | |||||||||||

| Sr. Unsec’d. Notes |

0.600 | 12/20/36 | JPY | 665,000 | 5,895,372 | |||||||||||

| Sr. Unsec’d. Notes |

0.700 | 03/20/37 | JPY | 150,000 | 1,349,611 | |||||||||||

| Sr. Unsec’d. Notes(k) |

1.400 | 09/20/34 | JPY | 145,000 | 1,474,816 | |||||||||||

| Sr. Unsec’d. Notes |

1.500 | 06/20/34 | JPY | 50,000 | 515,562 | |||||||||||

| Sr. Unsec’d. Notes |

1.800 | 12/20/31 | JPY | 148,000 | 1,574,849 | |||||||||||

See Notes to Financial Statements.

| Prudential Global Total Return Fund | 25 |

Schedule of Investments (continued)

as of October 31, 2017

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| FOREIGN BONDS (Continued) |

| |||||||||||||||

| Japan (cont’d.) |

||||||||||||||||

| Japan International Cooperation Agency, Gov’t. Gtd. Notes |

1.875 | % | 11/13/19 | 2,000 | $ | 1,987,714 | ||||||||||

| Japanese Government CPI Linked Bond, Sr. Unsec’d. Notes |

0.100 | 03/10/27 | JPY | 217,645 | 2,015,567 | |||||||||||

| Tokyo Metropolitan Government, |

||||||||||||||||

| Sr. Unsec’d. Notes |

1.625 | 06/06/18 | 1,000 | 998,990 | ||||||||||||

| Sr. Unsec’d. Notes |

2.000 | 05/17/21 | 1,000 | 983,848 | ||||||||||||

| Sr. Unsec’d. Notes |

2.125 | 05/20/19 | 400 | 400,268 | ||||||||||||

| Sr. Unsec’d. Notes |

2.125 | 05/19/20 | 1,000 | 995,414 | ||||||||||||

|

|

|

|||||||||||||||

| 39,274,080 | ||||||||||||||||

| Kuwait 0.2% |

||||||||||||||||

| Kuwait International Government Bond, Sr. Unsec’d. Notes, 144A |

2.750 | 03/20/22 | 2,050 | 2,067,938 | ||||||||||||

| Latvia 0.1% |

||||||||||||||||

| Latvia Government International Bond, Sr. Unsec’d. Notes |

2.750 | 01/12/20 | 1,000 | 1,011,500 | ||||||||||||

| Lithuania 0.5% |

||||||||||||||||

| Lithuania Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

6.125 | 03/09/21 | 2,100 | 2,352,000 | ||||||||||||

| Sr. Unsec’d. Notes |

6.625 | 02/01/22 | 1,200 | 1,402,791 | ||||||||||||

| Sr. Unsec’d. Notes |

7.375 | 02/11/20 | 1,090 | 1,218,162 | ||||||||||||

|

|

|

|||||||||||||||

| 4,972,953 | ||||||||||||||||

| Luxembourg 0.1% |

||||||||||||||||

| B&M European Value Retail SA, Sr. Sec’d. Notes, 144A, MTN |

4.125 | 02/01/22 | GBP | 400 | 550,741 | |||||||||||

| Macedonia 0.1% |

||||||||||||||||

| Macedonia Government International Bond, Sr. Unsec’d. Notes, 144A |

3.975 | 07/24/21 | EUR | 500 | 620,457 | |||||||||||

| Malaysia 0.3% |

||||||||||||||||

| Malaysia Government Bond, Sr. Unsec’d. Notes |

4.048 | 09/30/21 | MYR | 13,815 | 3,305,471 | |||||||||||

| Mexico 2.1% |

||||||||||||||||

| Mexican Bonos, Sr. Unsec’d. Notes |

8.000 | 06/11/20 | MXN | 39,000 | 2,081,193 | |||||||||||

| Mexico Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

1.375 | 01/15/25 | EUR | 620 | 721,183 | |||||||||||

See Notes to Financial Statements.

| 26 |

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| FOREIGN BONDS (Continued) |

| |||||||||||||||

| Mexico (cont’d.) |

||||||||||||||||

| Mexico Government International Bond, (cont’d.) |

||||||||||||||||

| Sr. Unsec’d. Notes |

1.875 | % | 02/23/22 | EUR | 1,400 | $ | 1,707,926 | |||||||||

| Sr. Unsec’d. Notes(a) |

2.750 | 04/22/23 | EUR | 3,275 | 4,171,963 | |||||||||||

| Sr. Unsec’d. Notes |

4.000 | 03/15/2115 | EUR | 450 | 491,001 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

2.375 | 04/09/21 | EUR | 100 | 124,524 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

5.500 | 02/17/20 | EUR | 100 | 131,265 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

5.625 | 03/19/2114 | GBP | 200 | 285,551 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

6.750 | 02/06/24 | GBP | 840 | 1,380,606 | |||||||||||

| Sr. Unsec’d. Notes, GMTN |

1.625 | 03/06/24 | EUR | 1,400 | 1,676,386 | |||||||||||

| Sr. Unsec’d. Notes, GMTN |

3.000 | 03/06/45 | EUR | 500 | 548,935 | |||||||||||

| Petroleos Mexicanos, |

||||||||||||||||

| Gtd. Notes |

3.125 | 11/27/20 | EUR | 500 | 624,652 | |||||||||||

| Gtd. Notes |

5.500 | 02/24/25 | EUR | 2,100 | 2,840,792 | |||||||||||

| Gtd. Notes, EMTN |

3.750 | 02/21/24 | EUR | 2,400 | 2,987,705 | |||||||||||

| Gtd. Notes, EMTN(a) |

3.750 | 04/16/26 | EUR | 700 | 835,840 | |||||||||||

| Gtd. Notes, EMTN |

8.250 | 06/02/22 | GBP | 928 | 1,536,963 | |||||||||||

|

|

|

|||||||||||||||

| 22,146,485 | ||||||||||||||||

| Netherlands 0.7% |

||||||||||||||||

| ABN AMRO Bank NV, Sub. Notes, 144A |

4.750 | 07/28/25 | 1,000 | 1,059,800 | ||||||||||||

| Bank Nederlandse Gemeenten NV, |

||||||||||||||||

| Sr. Unsec’d. Notes |

5.150 | 03/07/25 | CAD | 1,000 | 898,101 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

0.500 | 03/03/21 | NZD | 2,000 | 1,247,935 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

0.500 | 05/12/21 | ZAR | 10,000 | 526,875 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

0.500 | 06/22/21 | ZAR | 6,000 | 315,830 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

0.500 | 06/07/22 | ZAR | 10,000 | 479,604 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

3.184 | (s) | 04/05/28 | CAD | 700 | 386,923 | ||||||||||

| Sr. Unsec’d. Notes, EMTN |

7.000 | 12/09/21 | AUD | 2,000 | 1,771,446 | |||||||||||

| Sr. Unsec’d. Notes, MTN |

5.500 | 05/23/22 | AUD | 338 | 289,917 | |||||||||||

| Ziggo Bond Finance BV, Sr. Unsec’d. Notes |

4.625 | 01/15/25 | EUR | 750 | 932,608 | |||||||||||

|

|

|

|||||||||||||||

| 7,909,039 | ||||||||||||||||

| New Zealand 0.6% |

||||||||||||||||

| Auckland Council, |

||||||||||||||||

| Sr. Sec’d. Notes |

2.900 | 09/16/27 | AUD | 1,000 | 729,711 | |||||||||||

| Sr. Sec’d. Notes |

3.500 | 03/09/26 | AUD | 2,000 | 1,541,524 | |||||||||||

| New Zealand Government Bond, Sr. Unsec’d. Notes |

4.500 | 04/15/27 | NZD | 1,500 | 1,158,173 | |||||||||||

| New Zealand Local Government Funding Agency, |

||||||||||||||||

| Sr. Unsec’d. Notes |

2.750 | 04/15/25 | NZD | 1,800 | 1,165,771 | |||||||||||

| Sr. Unsec’d. Notes |

4.500 | 04/15/27 | NZD | 1,800 | 1,296,437 | |||||||||||

| Sr. Unsec’d. Notes |

6.000 | 05/15/21 | NZD | 500 | 379,547 | |||||||||||

|

|

|

|||||||||||||||

| 6,271,163 | ||||||||||||||||

See Notes to Financial Statements.

| Prudential Global Total Return Fund | 27 |

Schedule of Investments (continued)

as of October 31, 2017

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| FOREIGN BONDS (Continued) |

| |||||||||||||||

| Norway 0.5% |

||||||||||||||||

| City of Oslo, |

||||||||||||||||

| Sr. Unsec’d. Notes |

3.600 | % | 12/06/22 | NOK | 1,000 | $ | 132,485 | |||||||||

| Sr. Unsec’d. Notes |

3.650 | 11/08/23 | NOK | 9,000 | 1,198,786 | |||||||||||

| Unsec’d. Notes |

4.900 | 11/04/19 | NOK | 5,000 | 658,343 | |||||||||||

| Kommunalbanken AS, Sr. Unsec’d. Notes, MTN |

5.125 | 05/14/21 | NZD | 2,850 | 2,097,856 | |||||||||||

| Silk Bidco AS, Sr. Sec’d. Notes |

7.500 | 02/01/22 | EUR | 750 | 913,388 | |||||||||||

|

|

|

|||||||||||||||

| 5,000,858 | ||||||||||||||||

| Panama 0.3% |

||||||||||||||||

| Panama Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

4.000 | 09/22/24 | 400 | 426,400 | ||||||||||||

| Sr. Unsec’d. Notes |

8.125 | 04/28/34 | 138 | 187,680 | ||||||||||||

| Sr. Unsec’d. Notes |

9.375 | 01/16/23 | 622 | 785,275 | ||||||||||||

| Sr. Unsec’d. Notes |

9.375 | 04/01/29 | 800 | 1,202,000 | ||||||||||||

| Sr. Unsec’d. Notes |

10.750 | 05/15/20 | 275 | 330,688 | ||||||||||||

|

|

|

|||||||||||||||

| 2,932,043 | ||||||||||||||||

| Peru 0.8% |

||||||||||||||||

| Peru Enhanced Pass-Through Finance Ltd., |

||||||||||||||||

| Pass-Through Certificates |

2.933 | (s) | 06/02/25 | 1,000 | 860,000 | |||||||||||

| Pass-Through Certificates, 144A |

1.426 | (s) | 05/31/18 | 650 | 640,172 | |||||||||||

| Peruvian Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

2.750 | 01/30/26 | EUR | 3,920 | 5,079,909 | |||||||||||

| Sr. Unsec’d. Notes |

3.750 | 03/01/30 | EUR | 1,400 | 1,973,418 | |||||||||||

|

|

|

|||||||||||||||

| 8,553,499 | ||||||||||||||||

| Poland 1.1% |

||||||||||||||||

| Poland Government Bond, |

||||||||||||||||

| Unsec’d. Notes |

1.750 | 07/25/21 | PLN | 2,000 | 537,205 | |||||||||||

| Unsec’d. Notes |

2.500 | 07/25/27 | PLN | 8,000 | 2,028,819 | |||||||||||

| Unsec’d. Notes |

3.250 | 07/25/19 | PLN | 1,000 | 282,861 | |||||||||||

| Unsec’d. Notes |

3.250 | 07/25/25 | PLN | 5,050 | 1,386,688 | |||||||||||

| Poland Government International Bond, Sr. Unsec’d. Notes |

5.000 | 03/23/22 | 7,155 | 7,866,923 | ||||||||||||

|

|

|

|||||||||||||||

| 12,102,496 | ||||||||||||||||

| Portugal 2.5% |

||||||||||||||||

| Portugal Government International Bond, Sr. Unsec’d. Notes, EMTN |

5.125 | 10/15/24 | 4,000 | 4,234,560 | ||||||||||||

See Notes to Financial Statements.

| 28 |

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| FOREIGN BONDS (Continued) |

| |||||||||||||||

| Portugal (cont’d.) |

||||||||||||||||

| Portugal Obrigacoes do Tesouro OT, |

||||||||||||||||

| Sr. Unsec’d. Notes, 144A |

3.875 | % | 02/15/30 | EUR | 7,565 | $ | 9,994,581 | |||||||||

| Sr. Unsec’d. Notes, 144A |

5.650 | 02/15/24 | EUR | 8,375 | 12,330,804 | |||||||||||

|

|

|

|||||||||||||||

| 26,559,945 | ||||||||||||||||

| Romania 0.9% |

||||||||||||||||

| Romanian Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

6.500 | 06/18/18 | EUR | 1,000 | 1,212,047 | |||||||||||

| Sr. Unsec’d. Notes, 144A, MTN |

2.375 | 04/19/27 | EUR | 2,800 | 3,313,112 | |||||||||||

| Unsec’d. Notes, 144A, MTN |

2.875 | 05/26/28 | EUR | 1,100 | 1,340,724 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

3.625 | 04/24/24 | EUR | 730 | 977,134 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

3.875 | 10/29/35 | EUR | 900 | 1,131,888 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

6.750 | 02/07/22 | 300 | 346,045 | ||||||||||||

| Unsec’d. Notes, MTN |

2.875 | 05/26/28 | EUR | 700 | 853,188 | |||||||||||

|

|

|

|||||||||||||||

| 9,174,138 | ||||||||||||||||

| Russia 0.3% |

||||||||||||||||

| Gazprom OAO Via Gaz Capital SA, |

||||||||||||||||

| Sr. Unsec’d. Notes |

4.250 | 04/06/24 | GBP | 500 | 690,667 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

2.850 | 10/25/19 | CHF | 2,000 | 2,069,143 | |||||||||||

| Russia Foreign Bond, Sr. Unsec’d. Notes |

4.500 | 04/04/22 | 400 | 426,468 | ||||||||||||

|

|

|

|||||||||||||||

| 3,186,278 | ||||||||||||||||

| Saudi Arabia 0.6% |

||||||||||||||||

| KSA Sukuk Ltd., Sr. Unsec’d. Notes, 144A, MTN |

2.894 | 04/20/22 | 1,500 | 1,501,650 | ||||||||||||

| Saudi Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes, 144A, MTN |

2.375 | 10/26/21 | 1,200 | 1,179,648 | ||||||||||||

| Sr. Unsec’d. Notes, 144A, MTN |

2.875 | 03/04/23 | 3,335 | 3,321,660 | ||||||||||||

|

|

|

|||||||||||||||

| 6,002,958 | ||||||||||||||||

| Singapore 0.1% |

||||||||||||||||

| Singapore Government Bond, Sr. Unsec’d. Notes |

3.000 | 09/01/24 | SGD | 500 | 390,727 | |||||||||||

| Temasek Financial I Ltd., Gtd. Notes, GMTN |

3.265 | 02/19/20 | SGD | 500 | 381,142 | |||||||||||

|

|

|

|||||||||||||||

| 771,869 | ||||||||||||||||

| Slovak Republic 0.2% |

||||||||||||||||

| Slovakia Government International Bond, Sr. Unsec’d. Notes |

2.125 | 10/16/23 | CHF | 2,000 | 2,259,309 | |||||||||||

See Notes to Financial Statements.

| Prudential Global Total Return Fund | 29 |

Schedule of Investments (continued)

as of October 31, 2017

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| FOREIGN BONDS (Continued) |

| |||||||||||||||

| Slovenia 1.0% |

||||||||||||||||

| Slovenia Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

4.750 | % | 05/10/18 | 1,500 | $ | 1,521,750 | ||||||||||

| Sr. Unsec’d. Notes |

5.250 | 02/18/24 | 213 | 242,150 | ||||||||||||

| Sr. Unsec’d. Notes, 144A |

5.250 | 02/18/24 | 7,709 | 8,764,023 | ||||||||||||

|

|

|

|||||||||||||||

| 10,527,923 | ||||||||||||||||

| South Africa 0.4% |

||||||||||||||||

| Sappi Papier Holding GmbH, Gtd. Notes |

3.375 | 04/01/22 | EUR | 600 | 716,732 | |||||||||||

| South Africa Government Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

6.750 | 03/31/21 | ZAR | 10,000 | 679,268 | |||||||||||

| Unsec’d. Notes |

7.000 | 02/28/31 | ZAR | 1,800 | 101,618 | |||||||||||

| Unsec’d. Notes |

10.500 | 12/21/26 | ZAR | 5,000 | 383,101 | |||||||||||

| South Africa Government International Bond, Sr. Unsec’d. Notes(a) |

3.750 | 07/24/26 | EUR | 1,000 | 1,206,532 | |||||||||||

| ZAR Sovereign Capital Fund Propriety Ltd., Sr. Unsec’d. Notes, 144A |

3.903 | 06/24/20 | 1,000 | 1,013,300 | ||||||||||||

|

|

|

|||||||||||||||

| 4,100,551 | ||||||||||||||||

| South Korea 0.4% |

||||||||||||||||

| Export-Import Bank of Korea, |

||||||||||||||||

| Sr. Unsec’d. Notes |

5.125 | 10/15/19 | NZD | 200 | 141,365 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

2.711 | 12/05/19 | CAD | 200 | 155,301 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

3.500 | 09/26/19 | AUD | 100 | 76,903 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

4.430 | 09/14/18 | AUD | 2,318 | 1,787,301 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

5.375 | 09/12/19 | AUD | 1,000 | 797,768 | |||||||||||

| Sr. Unsec’d. Notes, MTN |

3.500 | 07/28/21 | NZD | 1,500 | 1,025,197 | |||||||||||

| Korea International Bond, Sr. Unsec’d. Notes |

2.125 | 06/10/24 | EUR | 100 | 125,074 | |||||||||||

|

|

|

|||||||||||||||

| 4,108,909 | ||||||||||||||||

| Spain 5.0% |

||||||||||||||||

| Adif-Alta Velocidad, |

||||||||||||||||

| Sr. Unsec’d. Notes, EMTN |

1.875 | 01/28/25 | EUR | 800 | 975,659 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

3.500 | 05/27/24 | EUR | 400 | 539,078 | |||||||||||

| Banco Santander SA, Sr. Unsec’d. Notes |

3.800 | 02/23/28 | 400 | 399,768 | ||||||||||||

| Instituto de Credito Oficial, |

||||||||||||||||

| Gov’t. Gtd. Notes, 144A |

1.625 | 09/14/18 | 1,000 | 996,349 | ||||||||||||

| Gov’t. Gtd. Notes, EMTN |

3.250 | 06/28/24 | CHF | 300 | 354,533 | |||||||||||

| Gov’t. Gtd. Notes, EMTN |

5.000 | 03/31/20 | CAD | 1,800 | 1,469,719 | |||||||||||

| Spain Government Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes(k) |

1.400 | 01/31/20 | EUR | 1,800 | 2,173,107 | |||||||||||

| Sr. Unsec’d. Notes(k) |

2.750 | 04/30/19 | EUR | 1,150 | 1,401,867 | |||||||||||

See Notes to Financial Statements.

| 30 |

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| FOREIGN BONDS (Continued) |

| |||||||||||||||

| Spain (cont’d.) |

||||||||||||||||

| Spain Government Bond, (cont’d.) |

||||||||||||||||

| Sr. Unsec’d. Notes, 144A |

1.450 | % | 10/31/27 | EUR | 1,785 | $ | 2,077,543 | |||||||||

| Sr. Unsec’d. Notes, 144A(k) |

3.800 | 04/30/24 | EUR | 1,520 | 2,116,530 | |||||||||||

| Sr. Unsec’d. Notes, 144A(k) |

4.650 | 07/30/25 | EUR | 15,050 | 22,331,495 | |||||||||||

| Sr. Unsec’d. Notes, 144A |

5.150 | 10/31/28 | EUR | 1,800 | 2,848,465 | |||||||||||

| Sr. Unsec’d. Notes, 144A(k) |

5.850 | 01/31/22 | EUR | 3,705 | 5,360,705 | |||||||||||

| Sr. Unsec’d. Notes, 144A |

5.900 | 07/30/26 | EUR | 500 | 809,716 | |||||||||||

| Unsec’d. Notes, 144A(k) |

1.600 | 04/30/25 | EUR | 300 | 366,502 | |||||||||||

| Spain Government International Bond, Sr. Unsec’d. Notes, EMTN |

5.250 | 04/06/29 | GBP | 5,445 | 8,548,866 | |||||||||||

|

|

|

|||||||||||||||

| 52,769,902 | ||||||||||||||||

| Supranational Bank 2.7% |

||||||||||||||||

| African Development Bank, |

||||||||||||||||

| Sr. Unsec’d. Notes, EMTN |

0.500 | 09/29/20 | AUD | 445 | 317,920 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

0.500 | 09/21/21 | NZD | 1,500 | 934,816 | |||||||||||

| Corp. Andina de Fomento, |

||||||||||||||||

| Sr. Unsec’d. Notes |

2.200 | 07/18/20 | 400 | 399,568 | ||||||||||||

| Sr. Unsec’d. Notes |

2.750 | 01/06/23 | 1,350 | 1,346,935 | ||||||||||||

| Sr. Unsec’d. Notes |

4.375 | 06/15/22 | 3,300 | 3,555,288 | ||||||||||||

| Sr. Unsec’d. Notes, EMTN |

1.875 | 05/29/21 | EUR | 400 | 493,759 | |||||||||||

| Sr. Unsec’d. Notes, MTN |

4.000 | 03/31/21 | AUD | 1,636 | 1,278,772 | |||||||||||

| EUROFIMA, |

||||||||||||||||

| Sr. Unsec’d. Notes, EMTN |

5.150 | 12/13/19 | CAD | 540 | 446,663 | |||||||||||

| Sr. Unsec’d. Notes, MTN |

6.250 | 12/28/18 | AUD | 1,300 | 1,042,542 | |||||||||||

| European Bank for Reconstruction & Development, |

||||||||||||||||

| Sr. Unsec’d. Notes, EMTN |

0.500 | 09/01/23 | AUD | 400 | 263,789 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

0.500 | 11/21/23 | AUD | 1,200 | 760,857 | |||||||||||

| European Investment Bank, |

||||||||||||||||

| Sr. Unsec’d. Notes, 144A, EMTN |

4.600 | 01/30/37 | CAD | 1,500 | 1,384,986 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

0.500 | 06/21/23 | AUD | 2,500 | 1,656,910 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

0.500 | 07/21/23 | AUD | 800 | 530,602 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

0.500 | 08/10/23 | AUD | 1,210 | 799,990 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

0.500 | 10/26/23 | AUD | 6,930 | 4,542,775 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

1.250 | 05/12/25 | SEK | 16,500 | 2,019,076 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

3.250 | 05/24/23 | NOK | 10,000 | 1,336,423 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

4.600 | 01/30/37 | CAD | 150 | 139,446 | |||||||||||

| Inter-American Development Bank, |

||||||||||||||||

| Sr. Unsec’d. Notes, EMTN |

0.500 | 05/23/23 | CAD | 744 | 523,412 | |||||||||||

| Unsec’d. Notes, EMTN |

0.500 | 10/30/20 | ZAR | 2,250 | 124,788 | |||||||||||

| Unsec’d. Notes, EMTN |

0.500 | 11/30/20 | ZAR | 1,840 | 102,170 | |||||||||||

See Notes to Financial Statements.

| Prudential Global Total Return Fund | 31 |

Schedule of Investments (continued)

as of October 31, 2017

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| FOREIGN BONDS (Continued) |

| |||||||||||||||

| Supranational Bank (cont’d.) |

||||||||||||||||

| International Bank for Reconstruction & Development, |

||||||||||||||||

| Sr. Unsec’d. Notes, EMTN |

0.500 | % | 07/29/22 | AUD | 350 | $ | 238,685 | |||||||||

| Unsec’d. Notes, EMTN |

0.500 | 03/07/22 | AUD | 1,145 | 790,498 | |||||||||||

| Unsec’d. Notes, EMTN |

0.500 | 03/28/22 | AUD | 200 | 138,456 | |||||||||||

| International Finance Corp., Sr. Unsec’d. Notes, EMTN |

0.500 | 09/13/19 | AUD | 2,000 | 1,463,763 | |||||||||||

| Nordic Investment Bank, Sr. Unsec’d. Notes, MTN |

3.875 | 09/02/25 | NZD | 2,000 | 1,400,998 | |||||||||||

| North American Development Bank, Sr. Unsec’d. Notes |

2.400 | 10/26/22 | 750 | 745,036 | ||||||||||||

|

|

|

|||||||||||||||

| 28,778,923 | ||||||||||||||||

| Sweden 0.7% |

||||||||||||||||

| Intrum Justitia AB, Sr. Unsec’d. Notes, 144A |

3.125 | 07/15/24 | EUR | 560 | 669,328 | |||||||||||

| Kommuninvest I Sverige AB, |

||||||||||||||||

| Local Gov’t. Gtd. Notes, EMTN |

0.625 | 11/13/23 | SEK | 15,000 | 1,777,784 | |||||||||||

| Local Gov’t. Gtd. Notes, EMTN |

1.500 | 05/12/25 | SEK | 7,000 | 862,319 | |||||||||||

| Local Gov’t. Gtd. Notes, EMTN |

1.625 | 01/22/20 | CAD | 4,000 | 3,087,063 | |||||||||||

| Local Gov’t. Gtd. Notes, MTN |

4.750 | 08/17/22 | AUD | 200 | 165,459 | |||||||||||

| Swedish Export Credit Corp., |

||||||||||||||||

| Sr. Unsec’d. Notes, EMTN |

3.760 | 05/28/19 | AUD | 787 | 614,669 | |||||||||||

| Sr. Unsec’d. Notes, EMTN |

4.910 | 04/23/19 | NZD | 985 | 689,935 | |||||||||||

|

|

|

|||||||||||||||

| 7,866,557 | ||||||||||||||||

| Switzerland 0.5% |

||||||||||||||||

| Credit Suisse Group AG, Sr. Unsec’d. Notes, 144A(a) |

2.997 | 12/14/23 | 1,590 | 1,585,973 | ||||||||||||

| Credit Suisse Group Funding Guernsey Ltd., |

||||||||||||||||

| Gtd. Notes |

3.800 | 06/09/23 | 970 | 1,006,719 | ||||||||||||

| Gtd. Notes |

4.550 | 04/17/26 | 500 | 536,818 | ||||||||||||

| Gtd. Notes, EMTN |

1.000 | 04/14/23 | CHF | 1,000 | 1,036,073 | |||||||||||

| UBS Group Funding Switzerland AG, Gtd. Notes, 144A |

3.491 | 05/23/23 | 1,100 | 1,127,413 | ||||||||||||

|

|

|

|||||||||||||||

| 5,292,996 | ||||||||||||||||

| Turkey 0.7% |

||||||||||||||||

| Turkey Government Bond, Unsec’d. Notes |

9.000 | 07/24/24 | TRY | 3,000 | 699,081 | |||||||||||

| Turkey Government International Bond, |

||||||||||||||||

| Sr. Unsec’d. Notes |

4.125 | 04/11/23 | EUR | 2,965 | 3,713,296 | |||||||||||

| Sr. Unsec’d. Notes |

5.875 | 04/02/19 | EUR | 247 | 308,367 | |||||||||||

| Sr. Unsec’d. Notes |

7.000 | 06/05/20 | 1,800 | 1,949,436 | ||||||||||||

| Sr. Unsec’d. Notes, EMTN |

3.250 | 06/14/25 | EUR | 750 | 874,074 | |||||||||||

|

|

|

|||||||||||||||

| 7,544,254 | ||||||||||||||||

See Notes to Financial Statements.

| 32 |

| Description | Interest Rate |

Maturity Date |

Principal Amount (000)# |

Value | ||||||||||||

| FOREIGN BONDS (Continued) |

| |||||||||||||||

| Ukraine 0.2% |

||||||||||||||||

| Ukraine Government International Bond, Sr. Unsec’d. Notes, 144A |

7.375 | % | 09/25/32 | 1,875 | $ | 1,848,510 | ||||||||||

| United Arab Emirates 0.2% |

||||||||||||||||

| Abu Dhabi Government International Bond, Sr. Unsec’d. Notes, 144A |

2.500 | 10/11/22 | 2,365 | 2,349,628 | ||||||||||||

| United Kingdom 3.7% |