0000793074DEF 14AFALSE00007930742023-01-012023-12-31iso4217:USD00007930742022-01-012022-12-3100007930742021-01-012021-12-3100007930742020-01-012020-12-310000793074wern:StockAwardsAdjustmentMemberecd:PeoMember2023-01-012023-12-310000793074wern:EquityAwardsGrantedInCurrentYearFairValueAdjustmentMemberecd:PeoMember2023-01-012023-12-310000793074wern:EquityAwardsAdjustmentUnvestedGrantedInPriorYearsMemberecd:PeoMember2023-01-012023-12-310000793074wern:EquityAwardsAdjustmentVestedGrantedInPriorYearsMemberecd:PeoMember2023-01-012023-12-310000793074ecd:PeoMemberwern:EquityAwardsThatFailedToMeetVestingConditionsMember2023-01-012023-12-310000793074wern:StockAwardsAdjustmentMemberecd:PeoMember2022-01-012022-12-310000793074wern:EquityAwardsGrantedInCurrentYearFairValueAdjustmentMemberecd:PeoMember2022-01-012022-12-310000793074wern:EquityAwardsAdjustmentUnvestedGrantedInPriorYearsMemberecd:PeoMember2022-01-012022-12-310000793074wern:EquityAwardsAdjustmentVestedGrantedInPriorYearsMemberecd:PeoMember2022-01-012022-12-310000793074ecd:PeoMemberwern:EquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310000793074wern:StockAwardsAdjustmentMemberecd:PeoMember2021-01-012021-12-310000793074wern:EquityAwardsGrantedInCurrentYearFairValueAdjustmentMemberecd:PeoMember2021-01-012021-12-310000793074wern:EquityAwardsAdjustmentUnvestedGrantedInPriorYearsMemberecd:PeoMember2021-01-012021-12-310000793074wern:EquityAwardsAdjustmentVestedGrantedInPriorYearsMemberecd:PeoMember2021-01-012021-12-310000793074ecd:PeoMemberwern:EquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310000793074wern:StockAwardsAdjustmentMemberecd:PeoMember2020-01-012020-12-310000793074wern:EquityAwardsGrantedInCurrentYearFairValueAdjustmentMemberecd:PeoMember2020-01-012020-12-310000793074wern:EquityAwardsAdjustmentUnvestedGrantedInPriorYearsMemberecd:PeoMember2020-01-012020-12-310000793074wern:EquityAwardsAdjustmentVestedGrantedInPriorYearsMemberecd:PeoMember2020-01-012020-12-310000793074ecd:PeoMemberwern:EquityAwardsThatFailedToMeetVestingConditionsMember2020-01-012020-12-310000793074wern:StockAwardsAdjustmentMemberecd:NonPeoNeoMember2023-01-012023-12-310000793074wern:EquityAwardsGrantedInCurrentYearFairValueAdjustmentMemberecd:NonPeoNeoMember2023-01-012023-12-310000793074wern:EquityAwardsAdjustmentUnvestedGrantedInPriorYearsMemberecd:NonPeoNeoMember2023-01-012023-12-310000793074wern:EquityAwardsAdjustmentVestedGrantedInPriorYearsMemberecd:NonPeoNeoMember2023-01-012023-12-310000793074ecd:NonPeoNeoMemberwern:EquityAwardsThatFailedToMeetVestingConditionsMember2023-01-012023-12-310000793074wern:StockAwardsAdjustmentMemberecd:NonPeoNeoMember2022-01-012022-12-310000793074wern:EquityAwardsGrantedInCurrentYearFairValueAdjustmentMemberecd:NonPeoNeoMember2022-01-012022-12-310000793074wern:EquityAwardsAdjustmentUnvestedGrantedInPriorYearsMemberecd:NonPeoNeoMember2022-01-012022-12-310000793074wern:EquityAwardsAdjustmentVestedGrantedInPriorYearsMemberecd:NonPeoNeoMember2022-01-012022-12-310000793074ecd:NonPeoNeoMemberwern:EquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310000793074wern:StockAwardsAdjustmentMemberecd:NonPeoNeoMember2021-01-012021-12-310000793074wern:EquityAwardsGrantedInCurrentYearFairValueAdjustmentMemberecd:NonPeoNeoMember2021-01-012021-12-310000793074wern:EquityAwardsAdjustmentUnvestedGrantedInPriorYearsMemberecd:NonPeoNeoMember2021-01-012021-12-310000793074wern:EquityAwardsAdjustmentVestedGrantedInPriorYearsMemberecd:NonPeoNeoMember2021-01-012021-12-310000793074ecd:NonPeoNeoMemberwern:EquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310000793074wern:StockAwardsAdjustmentMemberecd:NonPeoNeoMember2020-01-012020-12-310000793074wern:EquityAwardsGrantedInCurrentYearFairValueAdjustmentMemberecd:NonPeoNeoMember2020-01-012020-12-310000793074wern:EquityAwardsAdjustmentUnvestedGrantedInPriorYearsMemberecd:NonPeoNeoMember2020-01-012020-12-310000793074wern:EquityAwardsAdjustmentVestedGrantedInPriorYearsMemberecd:NonPeoNeoMember2020-01-012020-12-310000793074ecd:NonPeoNeoMemberwern:EquityAwardsThatFailedToMeetVestingConditionsMember2020-01-012020-12-31000079307412023-01-012023-12-31000079307422023-01-012023-12-31000079307432023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| | | | | | | | | | | | | | |

| Filed by the Registrant | ý | | Filed by a Party other than the Registrant | o |

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

WERNER ENTERPRISES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| ý | No fee required |

| o | Fee paid previously with preliminary materials |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Post Office Box 45308

Omaha, Nebraska 68145-0308

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 14, 2024

Dear Stockholders:

Notice is hereby given that the 2024 Annual Meeting of Stockholders of Werner Enterprises, Inc., a Nebraska corporation (the “Company”), will be held at the Embassy Suites Omaha-La Vista Hotel & Conference Center, 12520 Westport Parkway, La Vista, Nebraska, on Tuesday, May 14, 2024, at 10:00 a.m. Central Time for the following purposes:

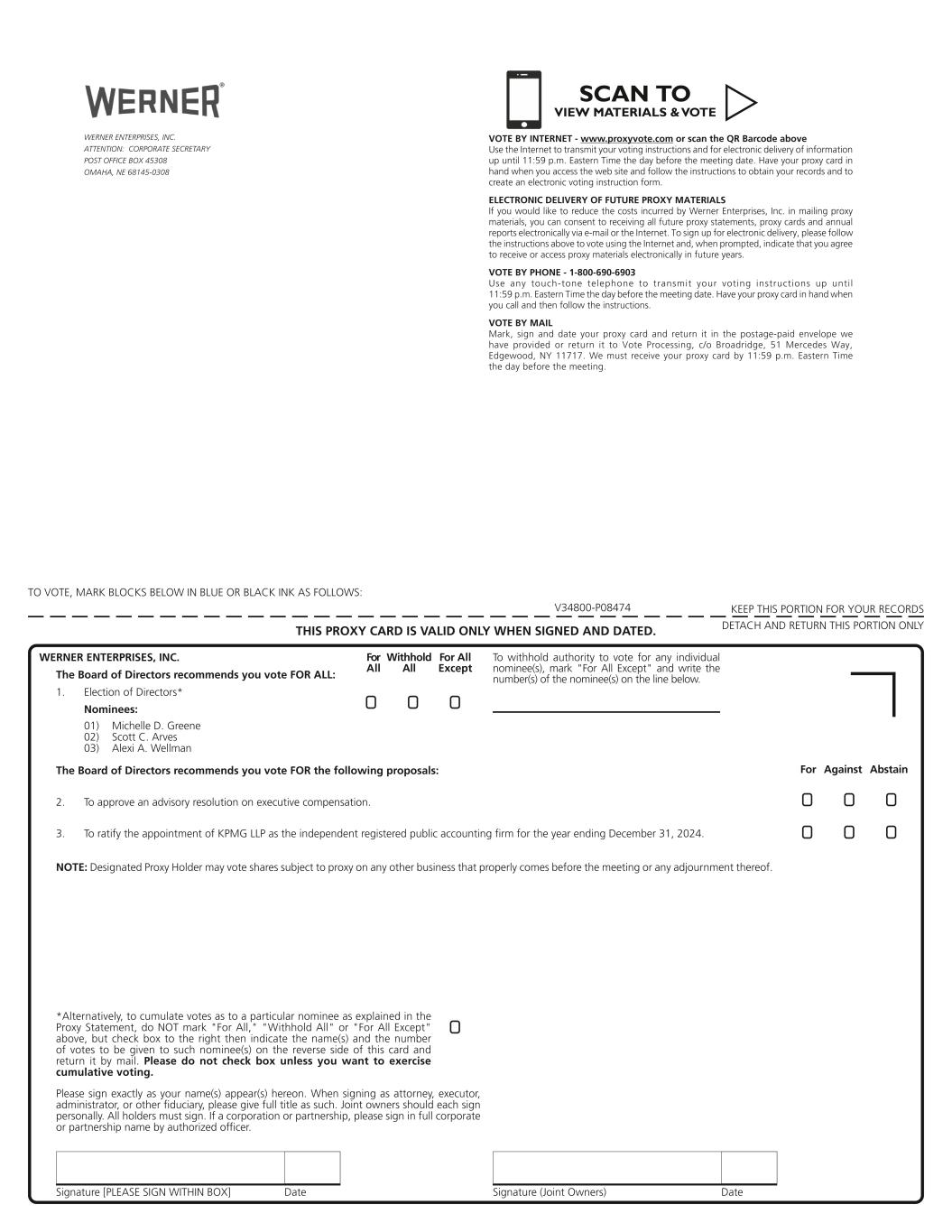

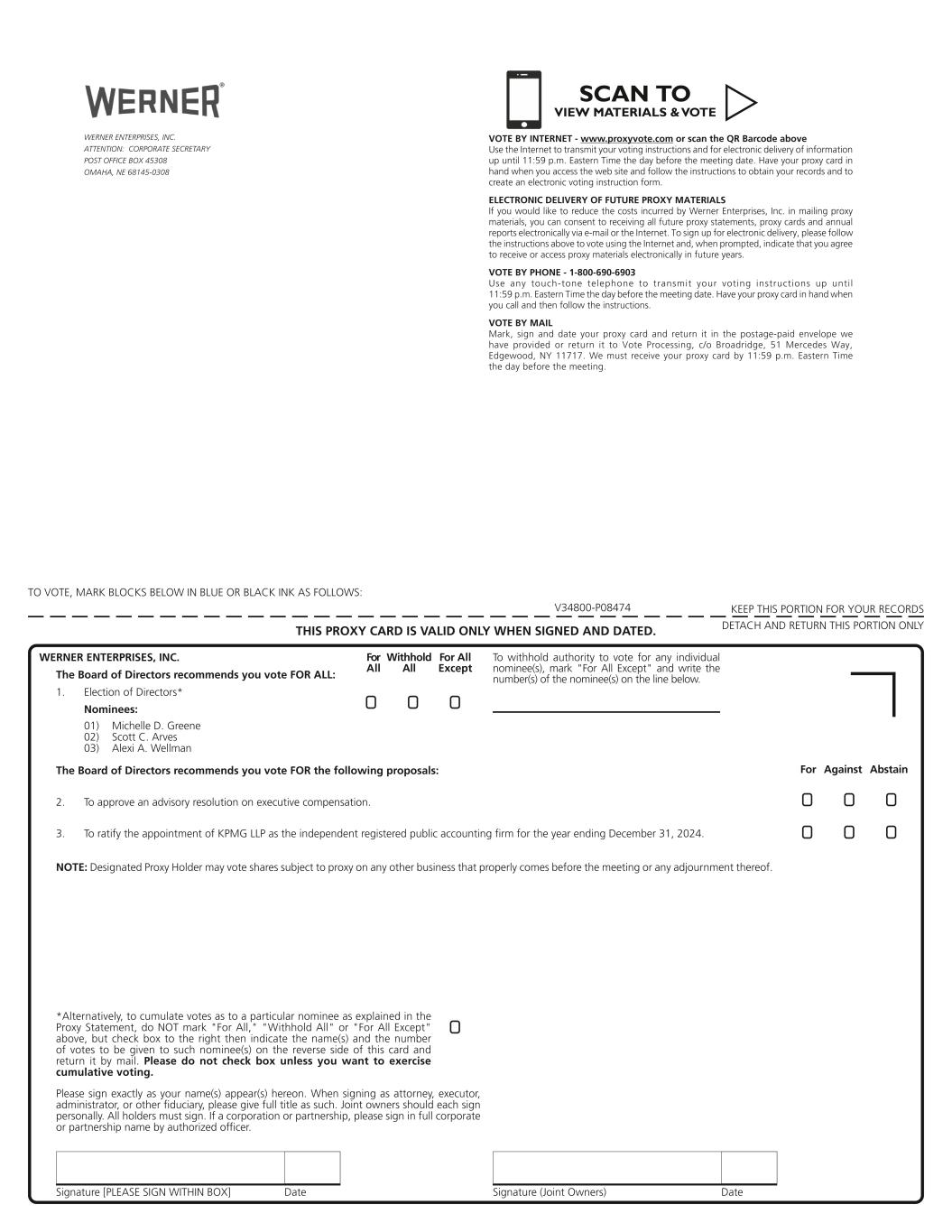

1.To elect one Class I director to serve for a one-year term expiring at the 2025 Annual Meeting of Stockholders and two Class III directors to each serve for a three-year term expiring at the 2027 Annual Meeting of Stockholders.

2.To approve an advisory resolution on executive compensation.

3.To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024.

4.To transact such other business as may properly come before the meeting or any adjournment thereof.

Only stockholders of record (“registered stockholders”) with our transfer agent, Equiniti Trust Company, at the close of business on March 25, 2024, our record date, will be entitled to receive notice of and to vote at the 2024 Annual Meeting or any adjournment thereof.

Please see Important Notice Regarding the Availability of Proxy Materials on the next page.

| | | | | | | | |

| | By Order of the Board of Directors, |

| | |

| | Diane M. Stewart-Ferro |

| Omaha, Nebraska | | Corporate Secretary |

| April 3, 2024 | | |

| | | | | | | | |

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 14, 2024 | |

| We are delivering proxy materials to registered stockholders for the 2024 Annual Meeting under the “Notice and Access” rules of the U.S. Securities and Exchange Commission. The rules permit us to furnish our “Proxy Materials” (the Notice of Annual Meeting, the Proxy Statement and proxy card for the meeting, our 2023 Annual Report to Stockholders containing our Annual Report on Form 10-K for the year ended December 31, 2023, and any amendments or additional soliciting materials) via a Notice of Internet Availability of Proxy Materials (“Availability Notice”), which instructs registered stockholders on how to access and review the Proxy Materials, free of charge, and submit proxies on the Internet, which we encourage them to do. This method of furnishing the Proxy Materials, versus mailing bulky printed copies and proxies to all registered stockholders, aligns with our environmental goals and reduces our printing and distribution expenses. A registered stockholder may request and receive printed Proxy Materials and a proxy card by following the instructions in the Availability Notice. We encourage you to access and review all the important information in the Proxy Materials prior to voting. YOUR VOTE IS IMPORTANT If you are a registered stockholder, follow the instructions in the Availability Notice to vote and submit your proxy as soon as possible, even if you plan to attend the meeting. If you hold your shares through brokerage firms, banks or other nominees, follow the voting instructions they send you. To help the environment and further our cost savings, please choose, if prompted, to receive email notices regarding the online availability of proxy materials.

PROXY MATERIALS ARE AVAILABLE AT WWW.PROXYVOTE.COM. FOLLOW THE INSTRUCTIONS YOU RECEIVE TO ACCESS PROXY MATERIALS AND VOTE. | |

| | |

WERNER ENTERPRISES, INC.

Post Office Box 45308

Omaha, Nebraska 68145-0308

________________

PROXY STATEMENT FOR

ANNUAL MEETING OF STOCKHOLDERS

MAY 14, 2024

________________________

PROXY STATEMENT SUMMARY AND BUSINESS OVERVIEW

We are furnishing you this Proxy Statement in connection with the solicitation of proxies by our Board of Directors (the “Board”) for the 2024 Annual Meeting of Stockholders (the “Annual Meeting” or “2024 Annual Meeting”) of Werner Enterprises, Inc. The Annual Meeting will be held at the time and place and for the purposes set forth in the Notice of Annual Meeting of Stockholders to be held on May 14, 2024 located on the cover page of the Proxy Statement (the “Meeting Notice”). Additional meeting information is set forth in Annual Meeting and Voting Information.

On or about April 3, 2024, Broadridge Financial Solutions, Inc. (“Broadridge”), sent on our behalf the Notice of Internet Availability of Proxy Materials (“Availability Notice”) to “registered stockholders” at the close of business on the “record date” (each as defined below). The Availability Notice explains how to access our “Proxy Materials” (defined below) and how to vote proxies via the Internet, phone or mail. Registered stockholders will not receive printed copies unless they request them as instructed in the Availability Notice.

In this Proxy Statement, we also use the following terms and abbreviations:

•We refer to Werner Enterprises, Inc. as the “Company,” “Werner,” “we,” “our” or “us”

•Reference to the “SEC” means the U.S. Securities and Exchange Commission

•The term “record date” means March 25, 2024

•The term “registered stockholders” means stockholders of record with our transfer agent, Equiniti Trust Company (“Equiniti”), as of the close of business on the record date

•References to “2023” and “for the year ended December 31, 2023” mean the Company’s fiscal year for the period beginning January 1, 2023 and ending December 31, 2023

•References to the “2023 Form 10-K” mean our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 26, 2024

•References to the “2023 Annual Report” mean our Annual Report containing the 2023 Form 10-K

•References to “Proxy Materials” mean the Meeting Notice, this Proxy Statement, the proxy card, the 2023 Annual Report, and any amendments or additional solicitation materials

•The term “executive officers” means those executives listed in Executive Officer Information

•References to “our website” means www.werner.com under the “Investors” link

The Proxy Materials are available through www.proxyvote.com, the website of Broadridge Financial Services, Inc. The materials refer to certain reports and forms filed with the SEC. Our SEC filings, including the Proxy Materials, are available on our website under the Financial Information heading, as well as on the SEC website at www.sec.gov. You may request copies of the Proxy Materials as instructed in the Availability Notice. You may request copies of other SEC filings from our Corporate Secretary as provided in the Contacting the Corporate Secretary and Executive Offices.

2023 Financial Highlights. The Company’s financial results in 2023 were impacted by a prolonged and challenging operating environment with revenues flat and operating income decreasing 45%. Earnings per diluted share decreased 53% due primarily to market dynamics including lower equipment gains, inflationary headwinds and rate pressure in One-Way. Despite these challenges, we generated record cash flow from operations of $474.4 million and ended the year with a net debt to earnings before interest, income taxes, depreciation, and amortization (EBITDA) ratio of 1.21 times.

| | | | | |

•Total revenues $3.3 billion | •Cash flow from operations $474.4 million |

•Operating income $176.4 million | •Capital expenditures, net $408.7 million |

•Net income attributable to Werner $112.4 million | •Dividends paid $34.2 million |

•Earnings per diluted share $1.76 | •Stockholders’ equity $1.5 billion |

•Operating ratio 94.6% | |

2023 Executive Compensation Program. Our executive compensation program has been instrumental to achieving our business objectives. Our total compensation mix allows us to retain qualified, innovative executive officers who possess the necessary experience and expertise to effectively lead and manage the Company, contribute to our long-standing success and create value for our stockholders. The overall design of our compensation program, including the three primary pay components, has remained consistent year over year.

| | | | | |

| Annual Base Salary | •Fixed element of annual compensation |

| •Two named executive officers received base salary increases in 2023 with an average increase of 5% |

| Cash Annual Incentive Compensation | •Short-term cash incentive with variable payout opportunities based on two Company performance metrics measured against pre-defined annual goals and an individual performance metric |

| •Target cash annual incentive payouts as a percentage of base salary increased from 115% in 2022 to 120% in 2023 for the Chief Executive Officer (“CEO”) and remained the same at 70% in 2023 for the other named executive officers |

| Long-Term Incentive Compensation | •Long-term equity-based incentives split equally between restricted stock and performance stock (at target) with three-year vesting schedules |

| •Updated performance stock Total Shareholder Return (“TSR”) modifier to allow for a 25% increase or decrease in shares earned for outperforming or underperforming peers, respectively, rather than serving as a payout cap as it had in previous years |

Our executive compensation program includes the following best practices:

| | | | | |

| What we do | What we don’t do |

•Pay for performance | •Employment agreements for executive officers |

•Short-term and long-term incentive compensation | •Single-trigger severance arrangements |

•Recoupment policy for performance-based cash and equity awards | •Dividends or dividend equivalents on unvested or unearned equity awards |

•Annual say-on-pay vote | •Hedging and pledging of Werner securities |

•Independent compensation consultant | •Tax gross-ups beginning in 2022 |

•Stock ownership guidelines | |

•Limited perquisites | |

Environmental Social and Governance (“ESG”). ESG concepts have long been woven into the fabric of our history. The recent history of our formal ESG program includes:

| | |

2021 •Released an inaugural corporate social responsibility (“CSR”) report •Retained leaders in sustainability and in diversity, equity and inclusion •Formed an IDEAL (Inclusion Diversity, Equity, Accountability & Learning) Council to facilitate Associate Resource Groups (“ARGs”) that help drive associate engagement and encourage diverse voices and perspectives

|

2022 •Launched WernerBlue, a sustainability initiative that, through the work of a task force including executive leadership, focuses on progress toward ESG strategies and priorities •Environmental Social and Governance Committee (“ESG Committee”) of the Board was established, having the responsibilities described in Environmental Social and Governance Committee •Updated our inaugural CSR report

|

2023 •Posted a detailed CSR report (“2023 Report”) on our website under the ESG heading showing: ▪our ESG goals and the progress toward each ▪that ESG is a main pillar of Werner DRIVESM (Durable, Results, Innovation, Values, ESG), a strategy that incorporates sustainability, capital allocation, an outcome-oriented approach to operations, a drive to innovate, and a culture that supports and values team members ▪multiple awards we have received related to ESG efforts (awards are also shown in Item 1 of our 2023 Form 10-K)

|

2024 •Continuing to establish and measure progress toward meaningful, reportable ESG metrics and goals and work closely with the ESG Committee of the Board in, among other efforts: ▪building on our strong foundation as an industry leader focused on reducing our environmental impact and carbon footprint ▪fostering and empowering an inclusive culture that upholds our core values ▪upholding transparency, ethics and integrity in our governance practices

|

Highlights of our ESG program include:

| | |

Environmental •As shown in the 2023 Report, we are an award-winning EPA SmartWay Transportation Partner: ▪working to make our fleet more environmentally sustainable ▪investing in and testing alternative fuels and technology ▪including facilities in our carbon reduction efforts ▪executing a carbon reduction plan against an aggressive 2020 baseline (initial results of 16% in the 2023 Report)

|

Social •Commitment to several core Company values furthers this responsibility: ▪Safety - We strive to invest in new technology to help keep our professional drivers and communities safe –In 2023, we achieved a 19-year low (for our third quarter) in our U.S. Department of Transportation preventable accident rate ▪Inclusion - We have 11 ARGs to foster an inclusive workplace aligned with our corporate goals and values –In 2023, we formalized our supplier diversity program ▪Community – We are dedicated to addressing important societal issues –We connect associates participating in our longstanding Blue Brigade with volunteer opportunities in their communities –We are a leader in an industry-wide effort to combat human trafficking; in 2023, we rolled out training to all office associates

|

Governance •Our talented Board has strong business experience, relevant leadership skills and diversity among its membership, as shown in Director Information •Recent governance activity of the Board includes: ▪In 2023, we created a Lead Independent Director position and appointed a Lead Independent Director ▪In 2024, we separated the office of President from that of Chairman & Chief Executive Officer and appointed our Chief Legal Officer as President

|

PROPOSAL 1 — ELECTION OF DIRECTORS

Our Articles of Incorporation provide that the Board may be divided into two or three separate classes of directors. Each class must consist of not less than two, nor more than five, directors, and the classes should be nearly equal in number as possible. Our By-Laws provide for a range of not less than seven nor more than nine directors, divided into three classes (Class I, II and III), and each class should have the same number of directors to the extent possible. Subject to the terms and conditions of our By-laws, directors hold office for a term of three years and until a successor is elected and qualified, and the terms of office for each class of current directors expire at the Annual Meeting of Stockholders in the following years: Class I, 2025; Class II, 2026; and Class III, 2024.

DIRECTOR NOMINEES

You will be asked to elect one director in Class I to serve for a one-year term expiring at the 2025 Annual Meeting of Stockholders (“2025 Annual Meeting”) and two directors in Class III to each serve for a three-year term expiring

at the 2027 Annual Meeting of Stockholders (“2027 Annual Meeting”). The nominees for director at the Annual Meeting are:

| | | | | | | | |

| NOMINEES OF THE BOARD OF DIRECTORS |

| Class | Term Ends | Name |

| Class I | If elected, new term will expire

at 2025 Annual Meeting | Michelle D. Greene (1) |

| Class III | If elected, new term would expire

at 2027 Annual Meeting | Scott C. Arves

Alexi A. Wellman |

| | |

(1) Appointed in November 2023 to fill a directorship vacancy created by the retirement of Dr. Kenneth M. Bird, Ed.D. |

On February 27, 2024, former Class III director, Vikram Mansharamani, Ph.D. resigned from the Board. As a result, the number of directors decreased from nine to eight. As of the date of this Proxy Statement, the Board has three Class I, three Class II, and two Class III directors.

The individual qualifications, skills and experience of the nominees for director are discussed in their respective biographies in Director Information.

Each of the nominees designated in this Proxy Statement has indicated his or her intention to serve as a director if elected, and the Board does not know of any reason why any nominee will be unavailable for election. In the event any nominee becomes unwilling or unable to serve as a director, the shares represented by your accompanying proxy will be voted for any substitute nominee designated by the Board, unless you expressly withhold (whether on your proxy or in person at the Annual Meeting) authority to vote your shares for the unavailable nominee or substitute nominee.

There are no arrangements or understandings between any of the nominees and any other person pursuant to which any of the nominees was selected as a nominee.

DIRECTOR INFORMATION

Identified in the table below are the director nominees and the other directors whose terms will continue after the Annual Meeting. Certain information provided to us by our directors and director nominees regarding their qualifications, skills and experience is also set forth in Director Biographies and in the Director Skills and Diversity matrix. None of the corporations or other organizations referenced in the biographies is a parent, subsidiary or affiliate of the Company.

| | | | | | | | | | | | | | |

| MEMBERS AND NOMINEES OF THE BOARD OF DIRECTORS |

| Name | Principal Occupation | Term Ends | Class |

| Scott C. Arves, Director & Nominee | Former Director, President & Chief Executive Officer

of Transport America, Inc. | 2024 | III |

| Diane K. Duren, Director | Former Executive Vice President and Corporate

Secretary of Union Pacific Corporation | 2026 | II |

| Michelle D. Greene, Director & Nominee | Executive Vice President, Chief Information Officer,

Global Technology and Business Services

of Cardinal Health | 2024 | I |

| Jack A. Holmes, Director | Chairman of EmergeTMS;

Former President of UPS Freight | 2025 | I |

| Derek J. Leathers, Director | Chairman & Chief Executive Officer

of Werner Enterprises, Inc. | 2026 | II |

| Michelle D. Livingstone, Director | Former Vice President-Transportation

of The Home Depot | 2026 | II |

| Carmen A. Tapio, Director | Founder and Chief Executive Officer

of North End Teleservices, LLC | 2025 | I |

| Alexi A. Wellman, Director & Nominee | Chief Executive Officer of Altaba, Inc. | 2024 | III |

Director Biographies. The information below includes the name, age, principal occupation for at least the last five years and other biographical information for each of our continuing directors and director nominees.

SCOTT C. ARVES, 67, was elected as a Company director in May 2021. Mr. Arves retired from Transport America, Inc. in January 2017 after serving as Director, President & Chief Executive Officer for ten years. Prior to that, he had a 27-year career with Schneider National, Inc., where he most recently served as President of the Transportation Sector from May 2000 to June 2006. In that capacity, he was responsible for all of Schneider’s trucking and intermodal business, which was a $3 billion business employing approximately 20,000 people. He is currently a member of the Board of Advisors of CSM Companies and was a director of Commercial Vehicle Group from May 2005 to May 2019 and a director of TFI International from May 2016 to December 2018. Mr. Arves brings to our Board substantial business experience in the truckload industry and previous board experience. Mr. Arves was appointed Chair of our Nominating and Corporate Governance Committee effective May 2022 and Lead Independent Director effective February 2023.

DIANE K. DUREN, 64, was elected as a Company director in 2017. In February 2017, Ms. Duren retired from Union Pacific Corporation, having served as Executive Vice President, Chief Administrative Officer and Corporate Secretary for four years, after serving as Vice President and General Manager–Chemicals in Marketing & Sales. Since joining Union Pacific in 1985, she held a variety of positions in the Finance and Marketing & Sales departments, including Vice President and General Manager–Agricultural Products. In 2011, she was awarded the Creighton University College of Business Alumni Merit Award. Prior to her employment at Union Pacific, she was a certified public accountant with Deloitte, Haskins & Sells in Omaha. Ms. Duren is a member of the board of directors of U.S. Silica Holdings, Inc. and serves on its audit committee and is Chair of its compensation committee. Ms. Duren is a member of the board of directors of Savage Companies, a privately held transportation, logistics, materials handling, and industrial services company, and serves on its audit committee and is Chair of its compensation committee. She has been active on multiple community and industry boards including American Red Cross, of which she served as chair of the Heartland Chapter in 2010 and 2011. In 2014, Ms. Duren was appointed by Omaha Mayor Jean Stothert to the Metropolitan Entertainment & Convention Authority Board of Directors and

in 2019 was reappointed by the Omaha City Council and is the current Chairwoman of the Board. She also served on the board of Children’s Hospital and Medical Center where she was Chair from 2019 to 2021. In 2018, Ms. Duren joined Peter Kiewit Foundation as a Community Advisor and in 2019 became a Trustee. She also joined Creighton University’s Board of Trustees in 2019 and currently serves as Vice Chair. Ms. Duren’s vast experience in the transportation industry, multiple leadership roles, and accounting and financial experience add great value and insight to the Board. She also qualifies as an audit committee financial expert. Ms. Duren served as Chair of our Nominating and Corporate Governance Committee during 2019 and was appointed Chair of our Compensation Committee effective April 2020.

MICHELLE D. GREENE, 54, was appointed by our Board in November 2023 to fill a vacant directorship position. Ms. Greene is Executive Vice President, Chief Information Officer, Global Technology and Business Services at Cardinal Health, a distributor of pharmaceuticals, a global manufacturer and distributor of medical and laboratory products, and a provider of performance and data solutions for healthcare facilities. In her role as Chief Information Officer, Ms. Greene manages the teams charged with Digital and Commercial Technologies, Pharma and Medical segment information technology, Global Business Services and Information Security. In addition to her day-to-day responsibilities at Cardinal Health, Ms. Greene serves on the board for The Cardinal Health Foundation, actively sponsors the company’s STEM Initiative, co-sponsors BOLD, the Black and African American employee resource group and is an executive advisor for the Black and African American Equity Cabinet. In the community, Ms. Greene serves on numerous boards including Goodwill of Southeastern Wisconsin, Goodwill Manufacturing, Inc., GreenPath Financial Wellness and Detroit Public Television. She is also an active member of ITSMF (IT Senior Management Forum), Chief and Black Women on Boards. With her experience in business strategy, including technology solutions, and in information technology infrastructure and cybersecurity, Ms. Greene adds valuable acumen to our Board.

JACK A. HOLMES, 64, was appointed by our Board in August 2018 to fill the directorship position created by the expansion of the Board in 2018 and was elected by the stockholders at the 2019 Annual Meeting of Stockholders. Mr. Holmes served as President of UPS Freight from 2007 until his retirement in 2016. He began his career in transportation in 1979 outside of Philadelphia, Pennsylvania, when he joined UPS and served in several positions before holding leadership positions in Operations, Engineering and Human Resources. He also led the UPS transition team for the 2005 purchase of Overnite Transportation, now UPS Freight. Mr. Holmes currently serves as the Chairman and a director of EmergeTMS in Scottsdale, Arizona; formerly served as a director of Sharps Compliance, on which he served as Chairman of the Nominating and Corporate Governance Committee and the Compensation Committee; and as a director of Redwood Logistics and LaserShip. With his extensive leadership experience in the transportation industry, Mr. Holmes adds thoughtful insight through industry expertise to our Board. Mr. Holmes served as Chair of our Nominating and Corporate Governance Committee from April 2020 to April 2022.

DEREK J. LEATHERS, 54, was appointed by our Board in May 2020 to fill a directorship vacancy and appointed Vice Chairman of the Board. In May 2021, he was elected as a Company director by the stockholders and appointed Chairman of the Board. He served as our President from 2011 to January 2024 and has been our Chief Executive Officer since May 2016. Mr. Leathers has worked in the transportation and logistics industry for over 30 years. Throughout his tenure at Werner, he has held integral roles in many facets of the organization, including the establishment of Werner’s Mexico operations and oversight for all the asset operating groups. Prior to joining Werner in 1999, Mr. Leathers was employed by Schneider National, a large truckload carrier, for eight years, during which time he was based out of Mexico City for several years and was one of the first foreign members of Mexico’s trucking association (CANACAR). Mr. Leathers is active in a number of local, state and national professional organizations and boards. He currently serves as the chair of the American Transportation Research Institute board of directors, is a founder and board member of PlaySmart, and is a board member and Executive Committee member of the Greater Omaha Chamber of Commerce. Mr. Leathers brings to the Board a unique understanding of our business and operations as well as his significant and extensive knowledge of the transportation industry.

MICHELLE D. LIVINGSTONE, 65, was appointed by our Board in May 2022 to fill a vacant directorship and was elected by the stockholders at the 2023 Annual Meeting of Stockholders. Ms. Livingstone served as Vice President - Transportation for The Home Depot (a multinational home improvement retail business) in Atlanta from 2007 to 2021. During this time, she was a founding member of the Supply Chain Leadership Team and served on the Environmental Council to drive sustainability efforts. From 2005 to 2007, Ms. Livingstone was Senior Vice President – Transportation for C&S Wholesale Grocers in Keene, New Hampshire and was Vice President –

Transportation for J.C. Penney of Plano, Texas from 2002 to 2005. Ms. Livingstone was Senior Director of Supply Chain and Transportation for Kraft Foods of North America, Inc. of Madison, Wisconsin from 1985 to 2002. Ms. Livingstone currently serves as a board member for Mastery Logistics Systems, Rainbow Village, The Transportation and Supply Chain Institute of the University of Denver, and Indiana University Kelley School of Business Transportation Executive Board. With her extensive leadership experience in the transportation industry, Ms. Livingstone adds thoughtful insight through industry expertise to our Board.

CARMEN A. TAPIO, 58, was appointed by our Board in November 2020 to fill a directorship vacancy and was elected by the stockholders at the 2021 Annual Meeting of Stockholders. She is the founder and Chief Executive Officer of North End Teleservices, LLC, in Omaha, Nebraska, which provides advanced contact center solutions. She has held this position since 2017 and previously served as President and Chief Operating Officer of North End Teleservices from 2015 to 2017. From 2010 to 2015, Ms. Tapio was the owner and manager of Core Advantage Consulting in Omaha, Nebraska and from 2001 to 2009 served in several leadership positions with Carlson Companies of Minneapolis, Minnesota. Since 2021, Ms. Tapio has served on the Board of Directors of the Federal Reserve Bank of Kansas City, Omaha Branch. Ms. Tapio is active in local community organizations and currently serves as the chair of the Greater Omaha Chamber of Commerce board of directors and as the chair for its Commitment to Opportunity, Diversity and Equity (“CODE”) and CEOs for CODE councils. She also served as chair of the Leadership, Diversity and Inclusion Council for the state of Nebraska’s Blueprint Nebraska strategy. In 2022, Ms. Tapio was named USA TODAY’s Women of the Year honoree from Nebraska. She brings a unique perspective to business, having worked for Fortune 500 and 100 companies in the United States, Australia, Mexico and throughout Europe. Her career has taken multiple paths, holding both executive and general management business roles and executive cultural roles, including chief diversity officer and vice president of Responsible Business. Ms. Tapio was appointed Chair of our Environmental Social and Governance Committee effective January 2022.

ALEXI A. WELLMAN, 53, was elected as a Company director in May 2021. Ms. Wellman has been the Chief Executive Officer of Altaba, Inc., a closed-end management investment company, since January 2022. From June 2017 until her current appointment, Ms. Wellman served as Chief Financial Officer of Altaba, Inc. She was Vice President, Finance and ultimately Vice President, Global Controller of Yahoo, Inc. from November 2013 to June 2017 and Chief Financial Officer of Nebraska Book Company from December 2011 to June 2013. Prior to her employment with Nebraska Book Company, she was a practicing certified public accountant with KPMG LLP for 18 years, seven of which she served as an audit partner. She was the audit engagement partner on the Company’s annual audit for the year ended December 31, 2010, prior to her departure in 2011. Ms. Wellman currently serves on the board and is the audit committee chair of ESS Inc. Ms. Wellman has significant knowledge and experience in financial management, accounting processes and corporate governance. She brings substantial accounting and financial expertise, overall board experience and comprehension of our business operations and industry that contribute to the Board’s collective qualifications, skills and experience. Ms. Wellman also qualifies as an audit committee financial expert. Ms. Wellman was appointed Chair of our Audit Committee effective May 2021.

Director Skills and Diversity. The Nominating and Corporate Governance Committee (“Governance Committee”) considers the particular experience, qualifications, and skills of each director and the relevance of such key competencies to the Company’s business and operations when determining whether an individual should serve as a Company director. The matrix that follows summarizes the skills and diversity of the continuing directors and director nominees, which the Governance Committee considered in its evaluation. The Company is continuing to refresh, diversify and add new capabilities to our Board, and as a result six of the eight directors have a tenure of less than five years.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DIRECTOR SKILLS AND DIVERSITY |

| Scott C. Arves | Diane K. Duren | Michelle D. Greene | Jack A. Holmes | Derek J. Leathers | Michelle D. Livingstone | Carmen A. Tapio | Alexi A. Wellman | % |

| Skills | | | | | | | | | |

| Strategy development and risk management | X | X | X | X | X | | X | X | 88% |

| CEO experience | X | | | X | X | | X | X | 63% |

| Cybersecurity experience | | | X | X | X | | X | X | 63% |

| Marketing and sales | X | X | | X | X | | X | | 63% |

| Public company officer or director | X | X | X | X | X | X | X | X | 100% |

| Government affairs, public policy, regulatory | | | | X | X | X | | | 38% |

| Industry | X | X | | X | X | X | | | 63% |

| Corporate governance | X | X | | X | | | | X | 50% |

| Financial | | X | | X | X | | X | X | 63% |

Demographics | | | | | | | | | |

| Race/Ethnicity: | | | | | | | | | |

| African American or Black | | | X | | | | X | | 25% |

| White | X | X | | X | X | X | | X | 75% |

| Gender: | | | | | | | | | |

| Female | | X | X | | | X | X | X | 63% |

| Male | X | | | X | X | | | | 38% |

Board Tenure | | | | | | | | | |

| Approximate Years | 3 | 7 | 0.5 | 6 | 4 | 2 | 3 | 3 | N/A |

RECOMMENDATION OF THE BOARD OF DIRECTORS — PROPOSAL 1

The Board unanimously recommends that stockholders vote FOR the election of each director nominee. A Designated Proxy Holder of proxies solicited by the Board in this Proxy Statement will vote the proxies as directed on each proxy, or if no instruction is made, for the election of all director nominees.

CORPORATE GOVERNANCE

DIRECTOR INDEPENDENCE DETERMINATIONS

The Board has affirmatively determined that all members of and nominees to our Board are independent pursuant to SEC and Nasdaq rules, except for Mr. Leathers. The Board has also determined that each member of Board committees satisfies the applicable independence requirements of Nasdaq and the SEC.

In making its independence determinations, our Board evaluated the following relationships and affirmatively determined that they did not materially affect the respective directors’ objectivity or independence:

•Ms. Livingstone is a member of the board of directors of Mastery Logistics Systems, Inc. (“MLSI”). We purchase MLSI’s cloud-based transportation management system solution. On January 24, 2023, we purchased a $25.0 million subordinated promissory note from MLSI and have invested in MLSI as described in notes 6, 7 and 9 to the Consolidated Financial Statements in our 2023 Form 10-K. Ms. Livingstone does not participate in board decisions at either MLSI or Werner regarding the MLSI-Werner relationship and is obligated to protect the Company’s confidential information.

•Ms. Tapio is the founder and Chief Executive Officer of North End Teleservices, LLC. The Company’s transactions with North End Teleservices, LLC are described in Transactions with Related Persons. The relationship between North End Teleservices, LLC and the Company is arms-length.

At its annual meeting, the Governance Committee reviewed the (i) legal and regulatory standards for assessing Board and Board committee independence, (ii) criteria for determining a director’s “audit committee financial

expert,” “non-employee director” and “outside director” status, and (iii) responses to annual questionnaires completed by our directors and director nominees. After completing its review, the Governance Committee submitted its independence recommendations to our Board. Our Board then made its independence determinations based on the Governance Committee’s recommendations and after considering the information available to such committee.

ROLE AND LEADERSHIP OF THE BOARD OF DIRECTORS

One of the primary roles of the Board is to oversee our senior management in the competent and ethical operation of our business and to ensure that our stockholders’ interests are being properly served. To achieve these objectives, the Board establishes and maintains high standards of responsibility and ethics designed to contribute to our overall success.

The Board appoints our Chairman and our Chief Executive Officer. Derek J. Leathers is serving in both roles, subject to his resignation, removal, or inability to serve due to death or incapacity, pursuant to Section 2 of Article III of our By-Laws. As Chairman, Mr. Leathers is actively involved in determining agendas for and presides over Board meetings and serves as a liaison between our Board and management.

We believe our current leadership structure, with a non-independent director serving as both Chairman and CEO, is effective for us. This configuration demonstrates to our stockholders, employees and customers that our primary leadership roles are served by a qualified person who has an extensive depth of knowledge about the Company’s business and industry and is committed to our development and success.

We also have a Lead Independent Director (Scott C. Arves) whose responsibilities include the following: (i) preside at Board meetings at which the Chairman and CEO is not present, including executive sessions of the independent directors, (ii) ensure that independent directors have adequate opportunities to meet and discuss issues without management present and call executive sessions of the independent directors as needed, (iii) review information sent to the Board and provide advice with respect to the agenda, schedule and other materials sent for Board meetings, (iv) communicate with the Chairman and CEO regarding discussions held in executive sessions of the Board, (v) serve as a liaison between the Chairman and CEO and the independent directors, (vi) be available for consultation and communication with major stockholders as deemed appropriate by the Board, (vii) lead the Board in succession planning for the Chairman and CEO, as well as succession planning for the Lead Independent Director, (viii) retain outside advisors and consultants who report directly to the Board on Board-wide issues, and (ix) be available to assist with the interviews of all director candidates and make recommendations to the Governance Committee. The Lead Independent Director Charter further describes the position and responsibilities of the role and is available under the Corporate Governance heading of our website.

Our independent directors regularly meet in “executive sessions,” which are meetings conducted without the presence of management. These executive sessions are typically conducted after each quarterly Board meeting and may also be held when deemed appropriate by the independent directors. Since his appointment as Lead Independent Director, Mr. Arves has presided over the executive sessions of the independent directors and acted as a liaison between the independent directors, management and the full Board. Further information regarding the 2023 executive sessions is provided in Committees of the Board of Directors.

We believe that by having each Board committee (including their respective Chairs) and the majority of our Board comprised of independent directors (who meet regularly in executive sessions) and having a Lead Independent Director, we have an effective and strong Board leadership structure for the Company. Our Board has the flexibility to continue or modify our leadership structure in the future, as the Board deems appropriate.

BOARD OVERSIGHT OF RISK MANAGEMENT

Company management is responsible for risk assessment and mitigation on a Company-wide basis, and our Board oversees and reviews these risk management efforts overall. Our Board believes that risk oversight fundamentally includes understanding the material risks we confront and how management responds to such risks, as well as a comprehension of risk levels appropriate for us. Typically, management identifies and measures various risks facing the Company and analyzes the factors associated with such risks, such as the probability and frequency of occurrence and potential impact on our cash flow, financial results and overall business and operations. Diverse

types of risk are identified which are generally competitive, economic, regulatory or technological in nature. Management then develops response plans to address, mitigate and monitor identified risks and also reports and discusses these risks and plans with the Board. In its risk oversight role, our Board regularly evaluates and confers with management about the objectives of and risks involved with each plan. The Board also considers risk when assessing our business strategies and objectives, which is also integral to the Board’s risk management and tolerance evaluations.

While our Board has overall responsibility for risk oversight, each of the Board committees considers certain risks within its respective area of responsibility. Our Audit Committee assists the Board in fulfilling its oversight responsibilities by reviewing the Company’s financial statements and audits thereof, and any other financial reports the Company files with the SEC; systems of internal controls regarding financial reporting; and auditing, accounting and financial reporting processes generally. In consultation with the independent auditors and the Internal Audit Department, the Audit Committee reviews the adequacy of the Company’s internal control environment, risk management processes, and procedures designed to ensure compliance with laws and regulations. It oversees policies and procedures related to the protection of Company proprietary and customer information and compliance with data privacy requirements and risk management related to cybersecurity. It reviews with the Company’s counsel any legal matter that could have a significant impact on the Company’s financial statements.

As discussed in Risk Management Related to Compensation, our Compensation Committee considers whether our executive compensation program encourages executive officers to take unreasonable risks relating to our business. Our ESG Committee identifies and assesses ESG risks and presents its findings to the Board and management. Our Governance Committee reviews risks related to legal and regulatory compliance concerning various corporate governance matters. The risk oversight roles of the Board, Audit Committee, Compensation Committee, ESG Committee, and Governance Committee do not impact our Board leadership structure because our Board is comprised of a majority, and such Board committees consist entirely, of independent directors.

CORPORATE GOVERNANCE POLICIES AND MATERIALS

The members of our Board possess a variety of experience, knowledge and judgment, and the diversity of these skills complements our corporate governance structure. Our corporate governance policies are designed to enable effective and thorough decision-making and to allow proper and comprehensive monitoring of the Company’s performance and compliance. These policies are also meant to provide our Board with practical guidelines that are regularly reviewed and can be appropriately revised and updated in response to regulatory developments and evolving business and governance practices. Our fundamental corporate governance principles and practices are set forth in our Code of Corporate Conduct and other policies available on our website under the Corporate Governance heading. Pursuant to SEC rules, we will disclose amendments to or waivers from our Code of Corporate Conduct, as they relate to our CEO, Chief Financial Officer (“CFO”) and Chief Accounting Officer (“CAO”), on our website or in a Current Report on Form 8-K filed with the SEC. To date, we have not granted any waivers from our Code of Corporate Conduct to the CEO, CFO or CAO.

HEDGING AND PLEDGING POLICY

The Board has formally adopted a policy on hedging and pledging of the Company’s common stock by directors and executive officers (officers who are subject to Section 16 of the Securities Exchange Act of 1934 (the “Exchange Act”)). The policy prohibits purchasing any financial instrument or entering into any transaction that is designed to hedge or offset any decrease in the market value of the Company’s common stock, including puts, calls, prepaid variable forward contracts, equity swaps, collars, exchange funds (excluding broad-based index funds), and other financial instruments that are designed to or have the effect of hedging or offsetting any decrease in the market value of the Company’s common stock. The policy also provides that directors and executive officers shall not pledge, hypothecate, or otherwise encumber shares of the Company’s common stock as collateral for indebtedness including, but not limited to, holding shares in a margin account or any other account that could cause the Company’s common stock to be subject to a margin call or otherwise be available as collateral for a margin loan. Each director and executive officer certified to compliance with this policy in their annual questionnaire completed at the end of 2023.

COMMITTEES OF THE BOARD OF DIRECTORS

The Board conducts its business through (i) meetings of the Board, (ii) actions taken by written consent in lieu of meetings, (iii) actions of its committees, and (iv) discussions with management, the independent auditors and other consultants. The Board has four standing committees: the Audit Committee, the Compensation Committee, the ESG Committee, and the Governance Committee. The Governance Committee evaluates each committee’s composition and appoints committee members annually, subject to Board approval. A majority of full committee membership elects committee Chairs, unless elected by the full Board. Committee members cannot be removed except by a majority vote of independent directors in office at the time.

Our Board delegates various responsibilities and authority to the committees to foster the effective governance of the Company. Each committee also meets periodically or when appropriate and reports their respective activities and actions to the full Board. The committees operate pursuant to written charters (including any amendments thereto) approved and adopted by the Board.

The composition of each Board committee is as follows:

| | | | | | | | | | | | | | | | | | | | |

| BOARD COMMITTEE MEMBERSHIP AND 2023 MEETINGS HELD |

Name | Audit Committee | Compensation Committee | ESG Committee | Governance Committee | Board of Directors |

| Scott C. Arves | | | X | Chair | X |

| Diane K. Duren | X | Chair | | | X |

| Michelle D. Greene | X | | X | | X |

| Jack A. Holmes | | X | | X | X |

| Derek J. Leathers | | | | | X |

| Michelle D. Livingstone | | X | X | | X |

Carmen A. Tapio | | | Chair | X | X |

| Alexi A. Wellman | Chair | X | | | X |

| Number of Meetings | 4 | 6 | 3 | 3 | 5 (1) |

| | | | | | |

(1) | Four (4) executive sessions of the independent directors were held in 2023. |

ATTENDANCE AT BOARD AND BOARD COMMITTEE MEETINGS AND 2023 ANNUAL MEETING

During 2023, each incumbent director attended and participated in at least 75% or more of the aggregate of (i) the total number of meetings of the Board (held during the period for which he or she has been a director) and (ii) the total number of meetings held by all Board committees on which he or she served (during the periods that he or she served). Under normal circumstances, we encourage directors to attend annual meetings of stockholders, although we do not have a formal policy regarding director attendance at these meetings. Eight of our nine directors then serving attended our Annual Meeting of Stockholders in May 2023, and the single absence was due to illness. The number of meetings conducted in 2023 by the Board and each Board committee are provided in the Board Committee Membership and 2023 Meetings Held table.

AUDIT COMMITTEE

In accordance with Section 3(a)(58)(A) of the Exchange Act, our Board established a separately-designated standing Audit Committee, the primary purpose of which is to assist the Board in fulfilling its oversight responsibilities by reviewing the Company’s financial statements and audits thereof, and any other financial reports the Company files with the SEC; systems of internal controls regarding financial reporting; and auditing, accounting and financial reporting processes generally. Such oversight is performed in accordance with applicable SEC and Nasdaq rules. Please refer to the Report of the Audit Committee section for the 2023 report. As more fully described in its charter,

available on our website under the Corporate Governance heading, the Audit Committee’s oversight responsibility includes but is not limited to:

•Discussing the annual audit and resulting letter of comments with management;

•Reviewing with auditors and management the adequacy of the Company’s internal control environment, risk management processes, and procedures designed to ensure compliance with laws and regulations;

•Reviewing our financial statements with management and the independent auditors prior to their release;

•Appointing the independent auditors for the next fiscal year;

•Reviewing and approving all audit and non-audit services and fees;

•Overseeing the work of our internal audit department and independent auditors;

•Assessing and maintaining procedures for the anonymous submission of complaints concerning accounting and auditing irregularities;

•Overseeing policies and procedures related to the protection of Company proprietary and customer information and compliance with data privacy requirements; and

•Overseeing risk management related to cybersecurity.

The Audit Committee meets in executive session with our independent auditors and also in a separate executive session with the head of our internal audit department. These meetings are conducted without the presence of our management and occur at each quarterly Audit Committee meeting. In 2023, as Audit Committee Chair, Ms. Wellman also participated in four additional meetings with management and the independent auditors for the purpose of reviewing the Company’s financial results prior to the issuance of our quarterly earnings press releases.

Audit Committee Independence and Financial Expert. Our Board has determined that each Audit Committee member (i) meets the independence criteria prescribed by Rule 10A-3(b)(1) and Section 10A(m)(3) of the Exchange Act; (ii) is independent under Nasdaq rules, and (iii) has sufficient abilities for Audit Committee service under Nasdaq rules. The Board also designated Mses. Duren and Wellman as having financial sophistication under Nasdaq rules and as “audit committee financial experts” under SEC rules.

COMPENSATION COMMITTEE

The Compensation Committee is responsible for determining and approving the compensation of our executive officers. The Compensation Committee may consider the recommendations of our Chairman and CEO. Prior to making any such compensation determinations, the committee performs an annual review of all compensation elements for our executive officers, including, but not limited to, base salary, incentive cash bonuses and stock awards. Our Compensation Committee is tasked with evaluating and approving our overall executive compensation strategy and elements to ensure such components align with our business objectives, stockholder interests and responsible corporate practices and culture. Additionally, the Compensation Committee is responsible for recommending to the Board the compensation policies for our independent directors and overall Board members. The Compensation Committee has responsibility for determining awards of equity compensation pursuant to the stockholder-approved Werner Enterprises, Inc. 2023 Long-Term Incentive Plan (the “2023 LTIP”) and for oversight of awards under such plan and the “Prior Plan” as defined therein, which includes the Werner Enterprises, Inc. Amended and Restated Equity Plan ratified by stockholders on May 14, 2013, and amended and restated on February 7, 2018 and February 23, 2021.

The Report of the Compensation Committee section contains the 2023 report. For more information about the Compensation Committee’s activities, refer to Compensation Discussion and Analysis and Report of the Compensation Committee. The Compensation Committee’s functions are also described in its charter available on our website under the Corporate Governance heading.

Compensation Committee Independence. Our Board has determined that all current Compensation Committee members satisfy the applicable SEC and Nasdaq independence requirements. Each Compensation Committee member is also (i) a “non-employee director” as defined by Rule 16b-3 under the Exchange Act and (ii) an “outside

director” as defined in Section 162(m) of the Internal Revenue Code and U.S. Treasury Regulation Section 1.162-27.

Compensation Committee Interlocks and Insider Participation. No member of the Compensation Committee was an officer or employee of the Company at any time during 2023 or on the date of this Proxy Statement. In 2023, except for Ms. Tapio, who served on the Compensation Committee for a portion of 2023, no other member of the Compensation Committee had any relationships or transactions with the Company that would require disclosure as a “related person transaction” under SEC rules and in Transactions with Related Persons. During 2023, none of our executive officers served on the board of directors or compensation committee of any other entity whose executive officer(s) served as a member of our Board or Compensation Committee.

ENVIRONMENTAL SOCIAL AND GOVERNANCE COMMITTEE

The Company formed an ESG Committee effective January 1, 2022. The primary functions of the ESG Committee are to: (i) support and oversee Company policies, in conjunction with other Board committees, relating to environmental, social, corporate social responsibility, sustainability, and public policy matters relevant to the Company; and (ii) assist management in setting general strategy relating to ESG matters and provide oversight to the Company’s underlying ESG programs and policies. The ESG Committee makes policy, program and strategy recommendations to the Board concerning current and emerging ESG trends that may affect our business, operations, performance, or public image. Committee members also play an active role in the creation of our periodic Corporate Responsibility Report. A more complete description of the ESG Committee’s functions is provided in its charter available on our website under the Corporate Governance heading.

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

Our Governance Committee is comprised only of directors whom the Board has determined satisfy the applicable SEC and Nasdaq independence requirements. The Governance Committee is responsible for the director nomination process. These duties include assisting the Board in identifying, evaluating and recruiting qualified potential candidates for election to the Board. The Governance Committee recommends for the Board’s approval the director nominees for any election of directors. This process is described further in Director Nomination Process.

The Governance Committee is also responsible for various corporate governance matters, including the development and oversight of our corporate governance policies, compliance practices and ethical standards of conduct for our directors, officers and employees. The committee makes recommendations to the Board regarding our corporate governance processes and reviews our Code of Corporate Conduct. The Governance Committee also monitors the effectiveness, and advises on the composition, structure and size, of our Board and Board committees. It also annually assists our Board with its independence and expertise determinations. The Governance Committee has oversight of the administration of our policies regarding “related person transactions” (as discussed in Transactions with Related Persons), and the committee reviews and approves or disapproves any such transaction when such approval is required by SEC and Nasdaq rules. A more complete description of the Governance Committee’s functions is provided in its charter available on our website under the Corporate Governance heading.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

The Board established a process by which stockholders and other parties may communicate directly with members of the Board or the independent directors as a group. This process is described in our Stockholder Communications Procedure for Communicating with the Board of Directors, included under the Corporate Governance heading of our website. You may direct any matter intended for the Board or independent directors by writing to the intended recipients in care of our Corporate Secretary at our executive offices. Generally, the Corporate Secretary will forward any received correspondence according to the stockholder’s instructions. The Corporate Secretary, however, reserves the right not to forward any abusive, threatening or otherwise inappropriate materials. A majority of our independent directors approved the process for collecting stockholder communications received by our Corporate Secretary on the Board’s behalf.

DIRECTOR NOMINATION PROCESS

Generally, the Governance Committee considers director candidates recommended by Board members, management and stockholders. Nominees for the Board are then selected by the Governance Committee according to the process summarized below and described in our current Nominating Committee Directorship Guidelines and Selection Policy (the “Directorship Guidelines Policy”) and Policy Regarding Director Recommendations by Stockholders (the “Stockholder Recommendation Policy”). Both policies are available free of charge on our website under the Corporate Governance heading. Stockholders may also request a copy of these policies by contacting our Corporate Secretary at our executive office address or telephone number provided in Contacting the Corporate Secretary and Executive Offices. Each policy was approved by the Board and is administered by the Governance Committee. The Governance Committee evaluates the policies regularly and may update and revise the policies from time to time, subject to Board approval, when appropriate and as applicable legal or listing standards change.

Stockholder Recommendations for Director Candidates. With respect to director candidates identified by stockholders, the Stockholder Recommendation Policy applies. In accordance with the Stockholder Recommendation Policy, the Governance Committee will consider candidates proposed by only “qualified stockholders.” A “qualified stockholder” is an individual stockholder or group of stockholders that has beneficially owned at least 2% of our issued and outstanding common stock for at least one year (and will hold such percentage of stock through the date of the annual meeting, and if the recommended candidate is elected, through his or her term of service). Such stock ownership is determined as of the date the stockholder recommendation is submitted. You must submit stockholder director candidate recommendations in a written proposal, and each proposal must include all information required and requested by such policy.

In order for a stockholder’s candidate to be evaluated and considered as a prospective nominee, you must submit your recommendation to our Corporate Secretary not less than 120 days before the one-year anniversary of the release date of the previous year’s proxy statement. (For example, the release date of the 2023 proxy statement was April 3, 2023. Stockholder recommendations intended for consideration for director elections at the 2024 Annual Meeting were due by December 5, 2023.) Stockholder recommendations for director nominees for the 2025 Annual Meeting must be submitted no later than the close of business on December 4, 2024.

Stockholder recommendations for director candidates must be accompanied by a description of each candidate’s qualifications in sufficient detail to permit the Governance Committee to evaluate whether each candidate satisfies the independence, financial literacy and experience requirements under SEC, Nasdaq or other applicable rules. Director candidates proposed by stockholders in accordance with the Stockholder Recommendation Policy are evaluated by the Governance Committee in the same manner as any other prospective candidate during the director nominee selection process. We have not engaged and have not paid any fees to any third party for assistance with the director nomination process.

In addition to the requirements described above and in the Stockholder Recommendation Policy, all written stockholder proposals containing director candidate recommendations must comply with Rule 14a-8 of the Exchange Act. Rule 14a-8 sets forth the requirements for the inclusion of stockholder proposals in company-sponsored proxy materials. Corporate Secretary contact information is provided in Contacting the Corporate Secretary and Executive Offices.

Further, in addition to satisfying the requirements above and in our charter documents, stockholders who intend to solicit proxies in support of director nominees other than the nominees proposed by our Board must provide notice that meets all the requirements set forth in Rule 14a-19 under the Exchange Act no later than March 17, 2025.

We reserve the right to reject, rule out of order, or take other appropriate action with respect to any director nomination or stockholder proposal that does not comply with our restated bylaws and other applicable requirements.

Desirable Skills and Traits for Director Candidates. Generally, candidates for director positions should possess the following skills and traits:

•Relevant business and financial expertise and experience, including an understanding of fundamental financial statements;

•The highest character and integrity and a reputation for working constructively with others;

•Sufficient time to devote to meetings and consultation on Board matters; and

•Freedom from conflicts of interest that would interfere with the candidate’s performance as a director.

The Governance Committee evaluates prospective nominees against certain minimum standards and qualifications, as identified in the Directorship Guidelines Policy, and the Committee will strive to recommend director nominees who satisfy these standards and qualifications in large part. The basic standards and qualifications set forth in the Directorship Guidelines Policy include but are not limited to those skills and traits listed above and as follows:

•Representation of our stockholders as a whole;

•Background that contributes to a Board comprised of individuals with varied occupational experience and perspective;

•Leadership experience and ability to exercise sound business judgment;

•Accomplishments, credentials and recognition in their respective field;

•Contributions to the Board’s skills, competency and qualifications through expertise in an area of business significant to our Company;

•Personal and professional reputation for integrity, honesty, fairness and other similar traits; and

•Knowledge of issues affecting us and critical aspects of our business and operations.

The Governance Committee also considers other relevant factors, such as the balance of management and independent directors, the need for Audit Committee or other Board committee expertise, relevant industry experience and the candidate’s understanding of financial matters and financial sophistication, literacy and proficiency. The Governance Committee values diversity in its candidates and considers it desirable if potential nominees complement and contribute to the Board’s overall diversity and composition. In this respect, we broadly construe diversity to mean an array of opinions, perspectives, skills, personal and professional experiences and backgrounds and other attributes, including gender, race and ethnic diversity.

The following table summarizes certain self-identified personal characteristics of our directors in accordance with Nasdaq Listing Rule 5605(f). Each term used in the table has the meaning given to it in the rule and related instructions.

| | | | | | | | | | | | | | |

BOARD DIVERSITY MATRIX (AS OF April 3, 2024) |

| Total Number of Directors | 8 |

| | Female | Male | Non-Binary | Did Not

Disclose

Gender |

| Part I: Gender Identity |

| Directors | 5 | 3 | 0 | 0 |

| Part II: Demographic Background |

| African American or Black | 2 | 0 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 0 | 0 | 0 | 0 |

| Hispanic or Latinx | 0 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 3 | 3 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 0 |

| Did Not Disclose Demographic Background | 0 |

DIRECTOR COMPENSATION AND BENEFITS

Only independent directors on our Board receive compensation for their service as one of our directors. The independent directors receive an annual compensation package that is designed to attract, motivate and retain highly qualified independent professionals to represent our stockholders. Directors who are employees of the Company do not receive any compensation for their service on our Board.

Compensation of Directors for 2023. Our current 2023 annual compensation package for independent directors is comprised of the annual cash retainers and restricted stock awards provided in the Independent Director Annual Retainers and Fees table that follows. We will also reimburse each independent director at cost for all of their respective reasonable out-of-pocket travel expenses incurred in connection with their attendance at Board and Board committee meetings and for other reasonable out-of-pocket expenses directly related to their Board and Board committee service.

| | | | | |

| INDEPENDENT DIRECTOR ANNUAL RETAINERS AND FEES |

| Fee or Retainer | Amount and Frequency of Payment |

| Cash Retainer for Board Membership | $75,000

(paid in quarterly installments of $18,750 each) |

| Cash Retainer for the Lead Independent Director | $25,000

(paid in quarterly installments of $6,250 each) |

| Cash Retainer for the Audit Committee Chair | $15,000

(paid in quarterly installments of $3,750 each) |

| Cash Retainer for the Compensation Committee Chair | $10,000

(paid in quarterly installments of $2,500 each) |

| Cash Retainer for the ESG Committee Chair | $10,000

(paid in quarterly installments of $2,500 each) |

| Cash Retainer for the Governance Committee Chair | $10,000

(paid in quarterly installments of $2,500 each) |

| Restricted Stock Award for Board Membership | $100,000

(three year vesting period from the date of grant) |

The Director Compensation for 2023 table presents the compensation of each individual serving as an independent director during 2023 for service on our Board and its committees. This table does not include those directors who are also Company employees because such directors are not considered independent directors and thus did not receive any compensation in 2023 for their service on our Board. (Derek Leathers is a director and named executive officer, and the compensation paid to him by the Company is discussed in Executive Compensation and provided in the Summary Compensation Table.) Our independent directors do not participate in any benefit, pension or nonqualified deferred compensation plan of the Company or receive stock option or non-equity incentive compensation awards; thus, we have omitted columns that would otherwise be required by SEC rules.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DIRECTOR COMPENSATION FOR 2023 |

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) (1)(2) | All Other Compensation ($) | Total ($) |

Scott C. Arves (3) | | 103,750 | | | 100,000 | | — | | 203,750 | |

Kenneth M. Bird, Ed.D. (4) | | 75,000 | | | 100,000 | | — | | 175,000 | |

| Diane K. Duren | | 85,000 | | | 100,000 | | — | | 185,000 | |

Michelle D. Greene (4) | | 9,375 | | | 50,000 | | — | | 59,375 | |

| Jack A. Holmes | | 75,000 | | | 100,000 | | — | | 175,000 | |

| Michelle D. Livingstone | | 75,000 | | | 100,000 | | — | | 175,000 | |

Vikram Mansharamani, Ph.D. (5) | | 75,000 | | | 100,000 | | — | | 175,000 | |

| Carmen A. Tapio | | 85,000 | | | 100,000 | | — | | 185,000 | |

| Alexi A. Wellman | | 90,000 | | | 100,000 | | — | | 190,000 | |

|

(1) | On May 9, 2023, each of the independent directors then serving on the Board received an annual award of 2,274 shares of restricted stock with a grant date fair value of $43.97 per share. On November 6, 2023, Ms. Greene was awarded 1,384 shares of restricted stock, a prorated award in conjunction with her appointment to the Board, with a grant date fair value of $36.13 per share. The grant date fair value is based upon the market price of the underlying common stock on the grant date, reduced by the present value of estimated future dividends because the award is not entitled to receive dividends prior to vesting. The present values of estimated future dividends for the May 9, 2023 and November 6, 2023 grants were calculated based on a $0.14 quarterly dividend amount per share and 4.0% and 4.5% risk-free interest rates, respectively. Further discussion of the valuation and assumptions regarding our stock awards is provided in Note 11 of our Consolidated Financial Statements in the 2023 Form 10-K. |

(2) | The aggregate number of shares of unvested restricted stock outstanding at December 31, 2023 for each independent director who served in 2023 is as follows: Mr. Arves 4,429; Ms. Duren 4,429; Ms. Greene 1,384; Mr. Holmes 4,429; Ms. Livingstone 3,865; Dr. Mansharamani 4,429; Ms. Tapio 4,429; and Ms. Wellman 4,429. No option awards were outstanding. |

(3) | Mr. Arves was appointed Lead Independent Director effective February 2023. |

(4) | Dr. Bird retired from the Board and Ms. Greene was appointed to the Board effective November 6, 2023. Upon Dr. Bird’s retirement, his unvested restricted stock awards became fully vested. |

(5) | Dr. Mansharamani resigned from the Board effective February 27, 2024, upon which his unvested restricted stock awards became fully vested. |

During 2023, restricted stock was granted to the independent directors then serving on the Board on May 9, 2023 and to Ms. Greene on November 6, 2023. The grants of restricted stock to the independent directors were made in accordance with our 2023 LTIP, and pursuant to the Restricted Stock Award Agreements, the restricted stock is subject to service-based vesting provisions. Beginning one year after the grant date of each award, the restricted stock will vest annually in three increments of 34%, 33% and 33%, respectively. The awards will then become fully vested on May 9, 2026 and November 6, 2026, respectively. The independent directors do not have any voting or dividend rights with respect to such stock until it is vested, and there are not any post-vesting sales restrictions on the shares. (The 2023 LTIP was included as an exhibit to our Current Report on Form 8-K filed with the SEC on May 9, 2023, and the Form of Restricted Stock Award Agreement was included as an exhibit to our Quarterly Report on Form 10-Q for the quarter ending June 30, 2023 filed with the SEC on August 8, 2023.) We did not grant any other forms of equity awards to our independent directors in 2023.

Director Stock Ownership. In February 2020, formal stock ownership guidelines for all independent directors were adopted. Stock ownership includes common stock owned (directly or indirectly) and time-vested restricted stock. Prior to March 2022, the ownership guidelines required independent directors to own stock with a market value equal to or in excess of 3.0 times the current independent director annual cash retainer. In March 2022, the stock ownership guidelines were updated to require independent directors to own stock with a market value equal to or in excess of 5.0 times the current independent director annual cash retainer. Independent directors have five years from the later of the date of this policy change or from their date of election to meet the ownership guidelines and are required to retain all restricted stock granted as fees for Board membership until such time as they meet the ownership guidelines. Ms. Duren and Mr. Holmes already met the revised ownership guidelines as of December 31, 2023. Mr. Arves and Mses. Greene, Livingstone, Tapio and Wellman have either served as a director for less than five years or will have five years from the date of this policy change to comply. The individual stock ownership of

each independent director is set forth in the table under Stock Ownership of Directors, Executive Officers and Certain Beneficial Owners.

EXECUTIVE OFFICERS

Pursuant to the By-Laws, our Board appoints our executive officers from time to time. Our By-Laws provide that each executive officer holds his or her respective office until he or she resigns, is removed, or is unable to serve due to death or incapacity.

EXECUTIVE OFFICER INFORMATION

The table that follows identifies our current executive officers and the capacities in which they now serve. Set forth following the table is certain biographical information provided to us by these executive officers regarding their acquired business skills and experience.

| | | | | | | | | | | |

| EXECUTIVE OFFICERS |

| Name | Position with the Company | Age |

| Derek J. Leathers | Chairman & Chief Executive Officer | 54 |

| Nathan J. Meisgeier | President & Chief Legal Officer | 50 |

| Craig T. Callahan | Executive Vice President & Chief Commercial Officer | 50 |

| Eric J. Downing | Executive Vice President & Chief Operating Officer | 51 |

| James L. Johnson | Executive Vice President & Chief Accounting Officer | 60 |

| Daragh P. Mahon | Executive Vice President & Chief Information Officer | 55 |

| H. Marty Nordlund | Executive Vice President of Strategic Partnerships | 62 |

| Jim S. Schelble | Executive Vice President & Chief Administrative Officer | 63 |

| Christopher D. Wikoff | Executive Vice President, Treasurer & Chief Financial Officer | 49 |

For information regarding the business experience of Derek J. Leathers, please refer to Director Information.