WERN-2014.12.31-10K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

| |

[Mark one] |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to __________

Commission File Number: 0-14690

WERNER ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

|

| | |

NEBRASKA | | 47-0648386 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

14507 FRONTIER ROAD POST OFFICE BOX 45308 OMAHA, NEBRASKA | | 68145-0308 |

(Address of principal executive offices) | | (Zip Code) |

(402) 895-6640

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, $0.01 Par Value | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | | | |

Large accelerated filer | ý | | Accelerated filer | o | | Non-accelerated filer | o | | Smaller reporting company | o |

| | | | | | (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The aggregate market value of the common equity held by non-affiliates of the Registrant (assuming for these purposes that all executive officers and Directors are “affiliates” of the Registrant) as of June 30, 2014, the last business day of the Registrant's most recently completed second fiscal quarter, was approximately $1.197 billion (based on the closing sale price of the Registrant's Common Stock on that date as reported by Nasdaq).

As of February 19, 2015, 72,087,926 shares of the registrant’s common stock, par value $0.01 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement of Registrant for the Annual Meeting of Stockholders to be held May 12, 2015, are incorporated in Part III of this report.

WERNER ENTERPRISES, INC.

INDEX

|

| | |

| | PAGE |

|

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

|

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

|

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

|

Item 15. | | |

This Annual Report on Form 10-K for the year ended December 31, 2014 (this “Form 10-K”) and the documents incorporated herein by reference contain forward-looking statements based on expectations, estimates and projections as of the date of this filing. Actual results may differ materially from those expressed in such forward-looking statements. For further guidance, see Item 1A of Part I and Item 7 of Part II of this Form 10-K.

PART I

General

We are a transportation and logistics company engaged primarily in transporting truckload shipments of general commodities in both interstate and intrastate commerce. We also provide logistics services through our Value Added Services (“VAS”) division. We believe we are one of the largest truckload carriers in the United States (based on total operating revenues), and our headquarters are located in Omaha, Nebraska, near the geographic center of our truckload service area. We were founded in 1956 by Clarence L. Werner, who started the business with one truck at the age of 19 and currently serves as our Chairman Emeritus. We were incorporated in the State of Nebraska in September 1982 and completed our initial public offering in June 1986 with a fleet of 632 trucks as of February 1986. At the end of 2014, we had a fleet of 7,050 trucks, of which 6,400 were company-operated and 650 were owned and operated by independent contractors. Our VAS division operated an additional 55 intermodal drayage trucks at the end of 2014.

We have two reportable segments – Truckload Transportation Services (“Truckload”) and VAS. You can find financial information regarding these segments and the geographic areas in which we conduct business in the Notes to Consolidated Financial Statements under Item 8 of this Form 10-K.

Our Truckload segment is comprised of the One-Way Truckload and Specialized Services units. One-Way Truckload includes the following operating fleets: (i) the regional short-haul (“Regional”) fleet transports a variety of consumer nondurable products and other commodities in truckload quantities within geographic regions across the United States using dry van trailers; (ii) the medium-to-long-haul van (“Van”) fleet provides comparable truckload van service over irregular routes; and (iii) the expedited (“Expedited”) fleet provides time-sensitive truckload services utilizing driver teams. Specialized Services provides truckload services dedicated to a specific customer, generally for a retail distribution center or manufacturing facility, including services for products requiring specialized trailers such as flatbed or temperature-controlled trailers. Our Truckload fleets operate throughout the 48 contiguous U.S. states pursuant to operating authority, both common and contract, granted by the U.S. Department of Transportation (“DOT”) and pursuant to intrastate authority granted by various U.S. states. We also have authority to operate in several provinces of Canada and to provide through-trailer service into and out of Mexico. The principal types of freight we transport include retail store merchandise, consumer products, grocery products and manufactured products. We focus on transporting consumer nondurable products that generally ship more consistently throughout the year and whose volumes are generally more stable during a slowdown in the economy.

Our VAS segment is a non-asset-based transportation and logistics provider. VAS is comprised of the following four operating units that provide non-trucking services to our customers: (i) truck brokerage (“Brokerage”) uses contracted carriers to complete customer shipments; (ii) freight management (“Freight Management”) offers a full range of single-source logistics management services and solutions; (iii) the intermodal (“Intermodal”) unit offers rail transportation through alliances with rail and drayage providers as an alternative to truck transportation; and (iv) Werner Global Logistics international (“WGL”) provides complete management of global shipments from origin to destination using a combination of air, ocean, truck and rail transportation modes. Our Brokerage unit had transportation services contracts with approximately 10,900 carriers as of December 31, 2014.

Marketing and Operations

Our business philosophy is to provide superior on-time customer service at a significant value for our customers. To accomplish this, we operate premium modern tractors and trailers. This equipment has fewer mechanical and maintenance issues and helps attract and retain experienced drivers. We continually develop our business processes and technology to improve customer service and driver retention. We focus on customers who value the broad geographic coverage, diversified truck and logistics services, equipment capacity, technology, customized services and flexibility available from a large financially-stable transportation and logistics provider.

We operate in the truckload and logistics sectors of the transportation industry. Our Truckload segment provides specialized services to customers based on (i) each customer’s trailer needs (such as van, flatbed and temperature-controlled trailers), (ii) geographic area (regional and medium-to-long-haul van, including transport throughout Mexico and Canada), (iii) time-sensitive shipments (expedited) or (iv) conversion of their private fleet to us (dedicated). In 2014, trucking revenues (net of fuel

surcharge) and trucking fuel surcharge revenues accounted for 79% of total operating revenues, and non-trucking and other operating revenues (primarily VAS revenues) accounted for 21% of total operating revenues. Our VAS segment manages the transportation and logistics requirements for customers, providing customers with additional sources of truck capacity, alternative modes of transportation, a global delivery network and systems analysis to optimize transportation needs. VAS services include (i) truck brokerage, (ii) freight management, (iii) intermodal transport and (iv) international. The VAS international services are provided through our domestic and global subsidiary companies and include (i) ocean, air and ground transportation services, (ii) door-to-door freight forwarding and (iii) customs brokerage. Most VAS international services are provided throughout North America and Asia with additional coverage throughout Australia, Europe, South America and Africa. VAS is a non-asset-based transportation and logistics provider that is highly dependent on qualified associates, information systems and the services of qualified third-party capacity providers. You can find the revenues generated by services that accounted for more than 10% of our consolidated revenues, consisting of Truckload and VAS, for the last three years under Item 7 of Part II of this Form 10-K.

We have a diversified freight base but are dependent on a relatively small number of customers for a significant portion of our freight. During 2014, our largest 5, 10, 25 and 50 customers comprised 25%, 41%, 60% and 74% of our revenues, respectively. No single customer generated more than 10% of our revenues in 2014. The industry groups of our top 50 customers are 44% retail and consumer products, 27% grocery products, 15% manufacturing/industrial and 14% logistics and other. Many of our One-Way Truckload customer contracts may be terminated upon 30 days’ notice, which is common in the truckload industry. Most of our Specialized Services customer contracts are one to three years in length and may be terminated by either party upon 30 to 90 days’ notice following the expiration of the contract’s first year, and we review rates in these contracts annually.

Virtually all of our company and independent contractor tractors are equipped with communication devices. These devices enable us and our drivers to conduct two-way communication using standardized and freeform messages. This technology also allows us to plan and monitor shipment progress. We automatically monitor truck movement and obtain specific data on the location of all trucks in the fleet every 15 minutes. Using the real-time data obtained from the devices, we have advanced application systems to improve customer and driver service. Examples of such application systems include: (i) an electronic logging system which records and monitors drivers’ hours of service and integrates with our information systems to pre-plan driver shipment assignments based on real-time available driving hours; (ii) software that pre-plans shipments drivers can trade enroute to meet driver home-time needs without compromising on-time delivery schedules; and (iii) automated “possible late load” tracking that informs the operations department of trucks possibly operating behind schedule, allowing us to take preventive measures to avoid late deliveries. In 1998, we began a successful pilot program and subsequently became the first trucking company in the United States to receive an exemption from DOT to use a global positioning system-based paperless log system as an alternative to the paper logbooks traditionally used by truck drivers to track their daily work activities. We have used electronic logging devices ("ELDs") to monitor and enforce drivers' hours of service since 1996.

Seasonality

In the trucking industry, revenues generally follow a seasonal pattern. Peak freight demand has historically occurred in the months of September, October and November. After the December holiday season and during the remaining winter months, our freight volumes are typically lower because some customers reduce shipment levels. Our operating expenses have historically been higher in the winter months due primarily to decreased fuel efficiency, increased cold weather-related maintenance costs of revenue equipment and increased insurance and claims costs attributed to adverse winter weather conditions. We attempt to minimize the impact of seasonality through our marketing program by seeking additional freight from certain customers during traditionally slower shipping periods and focusing on transporting consumer nondurable products. Revenue can also be affected by adverse weather conditions, holidays and the number of business days that occur during a given period because revenue is directly related to the available working days of shippers.

Employee Associates and Independent Contractors

As of December 31, 2014, we employed 9,091 drivers; 666 mechanics and maintenance associates for the trucking operation; 1,229 office associates for the trucking operation; and 1,192 associates for VAS, international and other non-trucking operations. We also had 650 independent contractors who provide both a tractor and a driver or drivers. None of our U.S., Canadian or Chinese associates are represented by a collective bargaining unit, and we consider relations with our associates to be good.

We recognize that our professional driver workforce is one of our most valuable assets. Most of our professional drivers are compensated on a per-mile basis. For most company-employed drivers, the rate per mile generally increases with the drivers’ length of service. Professional drivers may earn additional compensation through incentive performance pay programs and for performing additional work associated with their job (such as loading and unloading freight and making extra stops and shorter mileage trips).

At times, there are driver shortages in the trucking industry. Availability of experienced drivers can be affected by (i) changes in the demographic composition of the workforce; (ii) alternative employment opportunities other than truck driving that become available in the economy; and (iii) individual drivers’ desire to be home more frequently. The driver market was more challenging in 2014 compared to 2013, and the supply of recent driver training school graduates continues to tighten. We believe that a declining number of, and increased competition for, driver training school graduates, a gradually declining national unemployment rate, increased job competition from the strengthening housing construction and manufacturing industries, and changing industry safety regulations are tightening driver supply. We believe our strong mileage utilization, financial strength and safety record are attractive to drivers when compared to many other carriers. Additionally, we believe our large percentage of driving jobs in shorter-haul operations (such as Dedicated and Regional) that allow drivers to return home more often is attractive to drivers.

We utilize recent driver training school graduates as a significant source of new drivers. These drivers have completed a training program at a driver training school, hold a commercial driver’s license (“CDL”) and are further trained by Werner-certified trainer drivers for approximately 275 driving hours prior to that driver becoming a solo driver with their own truck. As mentioned above, the recruiting environment for recent driver training school graduates remained challenging in 2014. The availability of these drivers has been negatively impacted by the decreased availability of student loan financing for driver training schools.

As economic conditions improve, competition for experienced drivers and recent driver training school graduates may increase and could become more challenging in 2015. We cannot predict whether we will experience future shortages in the availability of experienced drivers or driver training school graduates. If such a shortage were to occur and additional driver pay rate increases became necessary to attract and retain experienced drivers or driver training school graduates, our results of operations would be negatively impacted to the extent that we could not obtain corresponding freight rate increases.

We also recognize that independent contractors complement our company-employed drivers. Independent contractors supply their own tractors and drivers and are responsible for their operating expenses. Because independent contractors provide their own tractors, less financial capital is required from us. Independent contractors also provide us with another source of drivers to support our fleet. We intend to maintain our emphasis on independent contractor recruiting, in addition to company driver recruitment. We, along with others in the trucking industry, however, continue to experience independent contractor recruitment and retention difficulties that have persisted over the past several years. Challenging operating conditions, including inflationary cost increases that are the responsibility of independent contractors and a shortage of financing available to independent contractors for equipment purchases, continue to make it difficult to recruit and retain independent contractors. If a shortage of independent contractors occurs, additional increases in per mile settlement rates (for independent contractors) and driver pay rates (for company drivers) may become necessary to attract and retain a sufficient number of drivers. This could negatively affect our results of operations to the extent that we could not obtain corresponding freight rate increases.

Revenue Equipment

As of December 31, 2014, we operated 6,400 company tractors and 650 tractors owned by independent contractors in our Truckload segment. Our VAS segment operated an additional 55 company tractors at the end of 2014. The company tractors were manufactured by Freightliner (a Daimler company), Peterbilt and Kenworth (both divisions of PACCAR), Volvo and International (a Navistar company). We adhere to a comprehensive maintenance program for both company tractors and trailers. We inspect independent contractor tractors prior to acceptance for compliance with Werner and DOT operational and safety requirements. We periodically inspect these tractors, in a manner similar to company tractor inspections, to monitor continued compliance. We also regulate the vehicle speed of company trucks to improve safety and fuel efficiency, and we have them set to not exceed 65 miles per hour.

The average age of our company truck fleet was 2.2 years at December 31, 2014, compared to 2.4 years at December 31, 2013. We increased our capital expenditures in the second half of 2014 to lower the average age of our truck fleet, and we currently expect to reduce our average truck age to under two years during 2015. As of December 31, 2014, nearly all of our company tractors have engines that comply with the U.S. Environmental Protection Agency (“EPA”) engine emissions standards that became effective for newly manufactured engines beginning in January 2010.

We operated 23,975 company-owned trailers at December 31, 2014. This total is comprised of 22,585 dry vans; 209 flatbeds; 1,159 temperature-controlled trailers; and 22 specialized trailers. Most of our trailers were manufactured by Wabash National Corporation. As of December 31, 2014, nearly all of our dry van trailer fleet consisted of 53-foot composite (DuraPlate®) trailers. We also provide other trailer lengths, such as 48-foot and 57-foot trailers, to meet the specialized needs of certain customers.

Our wholly-owned subsidiary, Fleet Truck Sales, sells our used trucks and trailers. Fleet Truck Sales has been in business since 1992 and operates in six locations. We may also trade used trucks to original equipment manufacturers when purchasing new trucks.

Fuel

In 2014, we purchased approximately 97% of our fuel from a predetermined network of fuel stops throughout the United States. Of this 97%, approximately 95% was purchased from three large fuel stop vendors. We negotiate discounted pricing based on historical purchase volumes with these fuel stop vendors. Bulk fueling facilities are maintained at seven of our terminals and one dedicated customer location.

Shortages of fuel, increases in fuel prices and rationing of petroleum products can have a material adverse effect on our operations and profitability. Our customer fuel surcharge reimbursement programs generally enable us to recover from our customers a majority, but not all, of higher fuel prices compared to normalized average fuel prices. These fuel surcharges, which automatically adjust depending on the U.S. Department of Energy (“DOE”) weekly retail on-highway diesel fuel prices, enable us to recoup much of the higher cost of fuel when prices increase and provide customers with the benefit of lower fuel costs when fuel prices decline. We do not generally recoup higher fuel costs for empty and out-of-route miles (which are not billable to customers) and truck idle time. We cannot predict whether fuel prices will increase or decrease in the future or the extent to which fuel surcharges will be collected from customers. As of December 31, 2014, we had no derivative financial instruments to reduce our exposure to fuel price fluctuations.

We maintain aboveground and underground fuel storage tanks at many of our terminals. Leakage or damage to these facilities could expose us to environmental clean-up costs. The tanks are routinely inspected to help prevent and detect such problems.

Regulations

We are a motor carrier regulated by DOT in the United States and similar governmental transportation agencies in foreign countries in which we operate. DOT generally governs matters such as safety requirements, registration to engage in motor carrier operations, drivers’ hours of service and certain mergers, consolidations and acquisitions. We currently have, and have always maintained, a satisfactory DOT safety rating, which is the highest available rating, and we continually take efforts to maintain our satisfactory rating. A conditional or unsatisfactory DOT safety rating could adversely affect us because some of our customer contracts require a satisfactory rating. Equipment weight and dimensions are also subject to federal, state and international regulations with which we are required to comply.

The Federal Motor Carrier Safety Administration's (“FMCSA”) Compliance, Safety, Accountability, (“CSA”) safety initiative monitors the safety performance of both individual drivers and carriers. In December 2010, FMCSA made public on its website the Safety Measurement System (“SMS”), which includes monthly reports of specific safety rating measurement and percentile ranking scores for over 500,000 trucking companies. Through the SMS, the public can access carrier scores and data (including a carrier’s roadside safety inspection, out-of-service and moving violation histories) for five Behavior Analysis and Safety Improvement Categories (“BASICs”). As carriers, shippers, brokers, vendors and others review, evaluate and make operational and business decisions using CSA data, we anticipate that drivers and trucking companies will leave the market, although it is difficult to predict the duration and extent to which this may occur and the extent to which this could affect our business. This may limit our ability to attract and retain experienced drivers. We will continue to monitor any CSA developments and continue our CSA compliance efforts.

All truckload carriers are subject to the hours of service (“HOS”) regulations issued by FMCSA. In December 2011, FMCSA adopted and issued a final rule that amended the driver HOS regulations, which became effective July 1, 2013. The rule includes provisions which affect restart periods, rest breaks, on-duty time and penalties for violations. We modified and tested our electronic HOS system and began dispatching drivers under the revised HOS rules effective July 1, 2013. The Company believes these HOS changes negatively impacted miles per truck by two to three percent. We have taken steps to minimize the financial impact of the HOS changes. However, government restrictions of available driving hours will continue to negatively impact the productivity of some drivers and some fleets within our company. On August 2, 2013, the U.S. Court of Appeals for the D.C. Circuit issued its decision related to petitions of the rule changes by the trucking industry association and consumer advocate groups. The court generally affirmed the FMCSA's final rule and vacated only the application of the 30-minute rest break to short-haul drivers as defined in 49 CFR 395.1(e). On December 13, 2014, Congress passed the Consolidated and Further Continuing Appropriations Act of 2015 (the "Act"), which for one year temporarily suspends the requirement that all qualifying restarts contain two consecutive periods of time between 1:00 a.m. and 5:00 a.m. and that it can only be used once every 168 hours (or seven days). In addition, the Act requires FMCSA to study the safety impact caused by the restart rule which became effective on July 1, 2013. The restart rule reverts back to the simple 34-hour restart in effect from 2003 to June 30, 2013. We believe this will reduce the negative impact of the July 1, 2013 HOS changes during the one year suspension period.

On January 31, 2011, FMCSA issued proposed rules regarding the required installation and use of ELDs by nearly all carriers to enhance the monitoring and enforcement of the driver HOS rules. Federal legislation required DOT to promulgate rules and regulations mandating the use of ELDs by July 2013 with full adoption for all trucking companies by no later than July 2015. However, FMCSA does not currently expect a final ELD rule to be published until November 2015. It is expected that there will

be a two year implementation period following the publishing of the final ELD rule. We are the recognized industry leader for electronic logging of driver hours as we proactively adopted a paperless log system in 1996 that was subsequently approved for our use by FMCSA in 1998. In order to improve compliance, and by extension safety performance and leveling the field upon which carriers compete, Werner supports a broad-based mandate for ELDs.

In May 2011, FMCSA published a final rule that (i) sets new standards that must be met before states issue commercial learner’s permits (“CLP”), (ii) revises the knowledge and skills testing standards that must be met to obtain both a CLP and a CDL, and (iii) improves anti-fraud measures with the CDL program. States must be in compliance with the new requirements by July 8, 2015. In September 2013, FMCSA withdrew its proposed rule regarding minimum requirements for entry-level driver training programs and plans to initiate new rulemaking. FMCSA is establishing an Entry-Level Driver Training Advisory Committee ("ELDTAC") to conduct a negotiated rulemaking ("Reg Neg") to implement the entry-level driver training provisions in the Moving Ahead for Progress in the 21st Century Act ("MAP-21"). Either of these rules could materially impact the number of potential new drivers entering the industry, and we currently cannot predict how the adoption of such rules would affect our driver recruitment and the overall driver market.

We have unlimited authority to carry general commodities in interstate commerce throughout the 48 contiguous states. We also have authority to carry freight on an intrastate basis in 46 states. The Federal Aviation Administration Authorization Act of 1994 (the “FAAA Act”) amended sections of the Interstate Commerce Act to prevent states from regulating motor carrier rates, routes or service after January 1, 1995. The FAAA Act did not address state oversight of motor carrier safety and financial responsibility or state taxation of transportation. If a carrier wishes to operate in intrastate commerce in a state where the carrier did not previously have intrastate authority, the carrier must, in most cases, still apply for authority in such state.

WGL, through its domestic and global subsidiary companies, holds a variety of licenses required to carry out its international services. These licenses permit us to provide services as a Non-Vessel Operating Common Carrier (“NVOCC”), customs broker, freight forwarder, indirect air carrier, accredited cargo agent and others. These international services subject us to regulation by the Transportation Security Administration (“TSA”) and Customs and Borders Protection (“CBP”) agencies of the U.S. Department of Homeland Security, the U.S. Federal Maritime Commission (“FMC”), the International Air Transport Association (“IATA”), as well as similar regulatory agencies in foreign jurisdictions.

Our operations are subject to various federal, state and local environmental laws and regulations, many of which are implemented by the EPA and similar state regulatory agencies. These laws and regulations govern the management of hazardous wastes, discharge of pollutants into the air and surface and underground waters and disposal of certain substances. We do not believe that compliance with these regulations has a material effect on our capital expenditures, earnings and competitive position.

The EPA mandated a series of stringent engine emissions standards for all newly manufactured truck engines, which became effective in October 2002, January 2007 and January 2010, resulting in increases in the costs of new trucks. The 2010 regulations required a significant decrease in particulate matter (soot and ash) and nitrogen oxide emitted from on-road diesel engines. Engine manufacturers responded to the 2010 standards by modifying engines to produce cleaner combustion with selective catalytic reduction (“SCR”) technologies to remove pollutants from exhaust gases exiting the combustion chamber. The SCR technology also requires the ongoing periodic use of a urea-based diesel exhaust fluid. Trucks with 2010-standard engines have a higher purchase price than trucks manufactured to meet the 2007 standards but are more fuel efficient. In 2014, we continued to purchase new trucks with the 2010-standard engines to replace older trucks we sell or trade, and as of December 31, 2014, nearly all of our company tractors had engines that comply with the 2010 emission standards.

The State of California enacted restrictions on transport refrigeration unit (“TRU”) emissions that require companies to operate compliant TRUs in California. The California regulations apply not only to California intrastate carriers, but also to carriers outside of California who wish to enter the state with TRUs. In January 2009, the EPA enabled California to phase in its Low-Emission TRU In-Use Performance Standards over several years. Enforcement of California’s in-use performance standards for TRU engines began in January 2010 for 2002 and older TRUs and will be phased in annually for later model years. We have complied with all compliance deadlines through December 31, 2014 that applied to model year 2007 and older TRU engines. California also required the registration of all California-based TRUs by July 31, 2009. For compliance purposes, we completed the California TRU registration process and continue to structure our plan to operate compliant TRUs over the next several years as the regulations gradually become effective.

California also adopted regulations to improve the fuel efficiency of heavy-duty tractors that pull 53-foot or longer box-type trailers within the state. The tractors and trailers subject to these regulations must either use EPA SmartWay-certified tractors and trailers or retrofit their existing fleet with SmartWay-verified technologies that have been demonstrated to meet or exceed fuel savings percentages specified in the regulations. Examples of these technologies include tractor and trailer aerodynamics packages (such as tractor fairings and trailer skirts) and the use of low-rolling resistance tires on both tractors and trailers. Enforcement of these regulations for 2011 model year equipment began in January 2010 and is being phased in over several years for older

equipment. In order to comply with the California Air Resources Board’s (“CARB”) fuel efficiency regulations, we submitted a large fleet compliance plan to CARB on June 30, 2010, to install skirting on our dry van trailers by certain deadlines through 2016. We will continue monitoring our compliance with these CARB regulations.

Various provisions of the North American Free Trade Agreement (“NAFTA”) may alter the competitive environment for shipping into and out of Mexico. In July 2011, a portion of NAFTA was implemented allowing U.S. and Mexican carriers to travel beyond the border to transport cargo within one another's countries. We currently believe we are well prepared to respond to any changes that may result from this agreement. We conduct a substantial amount of business in international freight shipments to and from the United States and Mexico (see Note 10 in the Notes to Consolidated Financial Statements under Item 8 of Part II of this Form 10-K), and we believe we are one of the largest truckload carriers in terms of freight volume shipped to and from the United States and Mexico.

Competition

The freight transportation industry is highly competitive and includes thousands of trucking and non-asset-based logistics companies. We have a small share of the markets we target. Our Truckload segment competes primarily with other truckload carriers. Logistics companies, intermodal companies, railroads, less-than-truckload carriers and private carriers provide competition for both our Truckload and VAS segments. Our VAS segment also competes for the services of third-party capacity providers.

Competition for the freight we transport or manage is based primarily on service, efficiency, available capacity and, to some degree, on freight rates alone. We believe that few other truckload carriers have greater financial resources, own more equipment or carry a larger volume of freight than us. We believe we are one of the largest carriers in the truckload transportation industry based on total operating revenues.

Internet Website

We maintain an Internet website where you can find additional information regarding our business and operations. The website address is www.werner.com. On the website, we make certain investor information available free of charge, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, stock ownership reports filed under Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and any amendments to such reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. This information is included on our website as soon as reasonably practicable after we electronically file or furnish such materials to the U.S. Securities and Exchange Commission (“SEC”). The website also includes Interactive Data Files required to be posted pursuant to Rule 405 of SEC Regulation S-T. We also provide our corporate governance materials, such as Board committee charters and our Code of Corporate Conduct, on our website free of charge, and we may occasionally update these materials when necessary to comply with SEC and NASDAQ rules or to promote the effective and efficient governance of our company. Information provided on our website is not incorporated by reference into this Form 10-K.

The following risks and uncertainties may cause our actual results, business, financial condition and cash flows to materially differ from those anticipated in the forward-looking statements included in this Form 10-K. Caution should be taken not to place undue reliance on forward-looking statements made herein because such statements speak only to the date they were made. Unless otherwise required by applicable securities laws, we undertake no obligation or duty to revise or update any forward-looking statements contained herein to reflect subsequent events or circumstances or the occurrence of unanticipated events. Also refer to the Cautionary Note Regarding Forward-Looking Statements in Item 7 of Part II of this Form 10-K.

Our business is subject to overall economic conditions that could have a material adverse effect on our results of operations.

We are sensitive to changes in overall economic conditions that impact customer shipping volumes, industry freight demand and industry truck capacity. When shipping volumes decline or available truck capacity increases, freight pricing generally becomes more competitive as carriers compete for loads to maintain truck productivity. We may be negatively affected by future economic conditions including employment levels, business conditions, fuel and energy costs, interest rates and tax rates. Economic conditions may also impact the financial condition of our customers, resulting in a greater risk of bad debt losses, and that of our suppliers, which may affect negotiated pricing or availability of needed goods and services.

Difficulty in recruiting and retaining experienced drivers, recent driver training school graduates and independent contractors could impact our results of operations and limit growth opportunities.

At times, the trucking industry has experienced driver shortages. Driver availability may be affected by changing workforce demographics, alternative employment opportunities (i.e., housing construction and manufacturing industries), national unemployment rates, freight market conditions, availability of financial aid for driver training schools and changing industry regulations. If such a shortage were to occur and additional driver pay rate increases were necessary to attract and retain drivers, our results of operations would be negatively impacted to the extent that we could not obtain corresponding freight rate increases. Additionally, a shortage of drivers could result in idled equipment, which could affect our profitability.

Independent contractor availability may also be affected by both inflationary cost increases that are the responsibility of independent contractors and the availability of equipment financing. If a shortage of independent contractors occurs, additional increases in per mile settlement rates (for independent contractors) and driver pay rates (for company drivers) may become necessary to attract and retain a sufficient number of drivers. This could negatively affect our results of operations to the extent that we would be unable to obtain corresponding freight rate increases.

Increases in fuel prices and shortages of fuel can have a material adverse effect on the results of operations and profitability.

To lessen the effect of fluctuating fuel prices on our margins, we have fuel surcharge programs with our customers. These programs generally enable us to recover a majority, but not all, of the fuel price increases. The remaining portion is generally not recoverable because it results from empty and out-of-route miles (which are not billable to customers) and truck idle time. Fuel prices that change rapidly in short time periods also impact our recovery because the surcharge rate in most programs only changes once per week. Fuel shortages, increases in fuel prices and petroleum product rationing could have a material adverse impact on our operations and profitability. To the extent that we cannot recover the higher cost of fuel through customer fuel surcharges, our financial results would be negatively impacted. As of December 31, 2014, we had no derivative financial instruments to reduce our exposure to fuel price fluctuations.

We operate in a highly competitive industry, which may limit growth opportunities and reduce profitability.

The freight transportation industry is highly competitive and includes thousands of trucking and non-asset-based logistics companies. We compete primarily with other truckload carriers in our Truckload segment. Logistics companies, intermodal companies, railroads, less-than-truckload carriers and private carriers also provide a lesser degree of competition in our Truckload segment, but such providers are more direct competitors in our VAS segment. Competition for the freight we transport or manage is based primarily on service, efficiency, available capacity and, to some degree, on freight rates alone. This competition could have an adverse effect on either the number of shipments we transport or the freight rates we receive, which could limit our growth opportunities and reduce our profitability.

We operate in a highly regulated industry. Changes in existing regulations or violations of existing or future regulations could adversely affect our operations and profitability.

We are regulated by the DOT in the United States and similar governmental transportation agencies in foreign countries in which we operate. We are also regulated by agencies in certain U.S. states. These regulatory agencies have the authority to govern transportation-related activities, such as safety, authorization to conduct motor carrier operations and other matters. The Regulation subsection in Item 1 of Part I of this Form 10-K describes several proposed and pending regulations that may have a significant effect on our operations including our productivity, driver recruitment and retention and capital expenditures. The subsidiaries of WGL hold a variety of licenses required to carry out its international services, and the loss of any of these licenses could adversely impact the operations of WGL.

The seasonal pattern generally experienced in the trucking industry may affect our periodic results during traditionally slower shipping periods and winter months.

In the trucking industry, revenues generally follow a seasonal pattern which may affect our results of operations. After the December holiday season and during the remaining winter months, our freight volumes are typically lower because some customers reduce shipment levels. Our operating expenses have historically been higher in the winter months because of cold temperatures and other adverse winter weather conditions which result in decreased fuel efficiency, increased cold weather-related maintenance costs of revenue equipment and increased insurance and claims costs. Revenue can also be affected by adverse weather conditions, holidays and the number of business days during a given period because revenue is directly related to the available working days of shippers.

We depend on key customers, the loss or financial failure of which may have a material adverse effect on our operations and profitability.

A significant portion of our revenue is generated from key customers. During 2014, our largest 5, 10 and 25 customers accounted for 25%, 41% and 60% of revenues, respectively. No single customer generated more than 10% of our revenues in 2014, and our largest customer accounted for 6% of our revenues in 2014. We do not have long-term contractual relationships with many of our key One-Way Truckload customers. Our contractual relationships with our Specialized Services customers are typically one to three years in length and may be terminated by either party upon 30 to 90 days’ notice following the expiration of the contract’s first year, and we review rates in these contracts annually. We cannot provide any assurance that key customer relationships will continue at the same levels. If a key customer substantially reduced or terminated our services, it could have a material adverse effect on our business and results of operations. We review our customers’ financial conditions for granting credit, monitor changes in customers’ financial conditions on an ongoing basis, and review individual past-due balances and collection concerns. However, a key customer’s financial failure may negatively affect our results of operations.

We depend on the services of third-party capacity providers, the availability of which could affect our profitability and limit growth in our VAS segment.

Our VAS segment is highly dependent on the services of third-party capacity providers, such as other truckload carriers, less-than-truckload carriers, railroads, ocean carriers and airlines. Many of those providers face the same economic challenges as we do and therefore are actively and competitively soliciting business. These economic conditions may have an adverse effect on the availability and cost of third-party capacity. If we are unable to secure the services of these third-party capacity providers at reasonable rates, our results of operations could be adversely affected.

If we cannot effectively manage the challenges associated with doing business internationally, our revenues and profitability may suffer.

Our results are affected by the success of our operations in Mexico, China and other foreign countries in which we operate. We are subject to risks of doing business internationally, including fluctuations in foreign currencies, changes in the economic strength of the countries in which we do business, difficulties in enforcing contractual obligations and intellectual property rights, burdens of complying with a wide variety of international and United States export and import laws, and social, political, and economic instability. Additional risks associated with our foreign operations, including restrictive trade policies and imposition of duties, taxes, or government royalties by foreign governments, are present but largely mitigated by the terms of NAFTA for Mexico and Canada. The agreement permitting cross border movements for both United States and Mexican based carriers into the United States and Mexico presents additional risks in the form of potential increased competition and the potential for increased congestion on the cross border lanes between countries.

Our earnings could be reduced by increases in the number of insurance claims, cost per claim, costs of insurance premiums or availability of insurance coverage.

We are self-insured for a significant portion of liability resulting from bodily injury, property damage, cargo and associate workers’ compensation and health benefit claims. This is supplemented by premium-based insurance with licensed insurance companies above our self-insurance level for each type of coverage. To the extent we experience a significant increase in the number of claims, cost per claim or insurance premium costs for coverage in excess of our retention amounts, our operating results would be negatively affected. Healthcare legislation and inflationary cost increases could also have a negative effect on our results.

Decreased demand for our used revenue equipment could result in lower unit sales, resale values and gains on sales of assets.

We are sensitive to changes in used equipment prices and demand, especially with respect to tractors. We have been in the business of selling our company-owned trucks since 1992, when we formed our wholly-owned subsidiary Fleet Truck Sales. Reduced demand for used equipment could result in a lower volume of sales or lower sales prices, either of which could negatively affect our gains on sales of assets.

Our operations are subject to various environmental laws and regulations, the violation of which could result in substantial fines or penalties.

In addition to direct regulation by DOT, EPA and other federal, state, and local agencies, we are subject to various environmental laws and regulations dealing with the handling of hazardous materials, aboveground and underground fuel storage tanks, discharge and retention of storm-water, and emissions from our vehicles. We operate in industrial areas, where truck terminals and other industrial activities are located and where groundwater or other forms of environmental contamination have occurred. Our operations involve the risks of fuel spillage or seepage, environmental damage and hazardous waste disposal, among others. We also maintain bulk fuel storage at several of our facilities. If we are involved in a spill or other accident involving hazardous

substances, or if we are found to be in violation of applicable laws or regulations, it could have a material adverse effect on our business and operating results. If we fail to comply with applicable environmental regulations, we could be subject to substantial fines or penalties and to civil and criminal liability. Tractors and trailers used in our daily operations have been affected by regulatory changes related to air emissions and fuel efficiency, and may be adversely affected in the future by new regulatory actions.

We rely on the services of key personnel, the loss of which could impact our future success.

We are highly dependent on the services of key personnel, including our executive officers. Although we believe we have an experienced and highly qualified management team, the loss of the services of these key personnel could have a significant adverse impact on us and our future profitability.

Difficulty in obtaining goods and services from our vendors and suppliers could adversely affect our business.

We are dependent on our vendors and suppliers. We believe we have good vendor relationships and that we are generally able to obtain favorable pricing and other terms from vendors and suppliers. If we fail to maintain satisfactory relationships with our vendors and suppliers, or if our vendors and suppliers experience significant financial problems, we could experience difficulty in obtaining needed goods and services because of production interruptions or other reasons. Consequently, our business could be adversely affected.

We use our information systems extensively for day-to-day operations, and service disruptions could have an adverse impact on our operations.

The efficient operation of our business is highly dependent on our information systems. Much of our software was developed internally or by adapting purchased software applications to suit our needs. Our information systems are used for receiving and planning loads, dispatching drivers and other capacity providers, billing customers and providing financial reports. If any of our critical information systems fail or become unavailable, we would have to perform certain functions manually, which could temporarily affect our ability to efficiently manage our operations. We maintain information security policies to protect our systems and data from cyber security events and threats. We purchased redundant computer hardware systems and have our own off-site disaster recovery facility approximately ten miles from our headquarters for use in the event of a disaster. We took these steps to reduce the risk of disruption to our business operation if a disaster occurred. We believe any such disruption would be minimal or moderate; however, we cannot predict the degree to which any disaster would affect our information systems or disaster recovery facility. Any system failure, disruption, or security breach could interrupt or delay our operations, damage our reputation, cause us to lose customers, or impact our ability to manage our operations, any of which could have an adverse effect on our operations.

|

| |

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

We have not received any written comments from SEC staff regarding our periodic or current reports that were issued 180 days or more preceding the end of our 2014 fiscal year and that remain unresolved.

Our headquarters are located on approximately 197 acres near U.S. Interstate 80 west of Omaha, Nebraska, 107 acres of which are held for future expansion. Our headquarters office building includes a computer center, drivers’ lounges, cafeteria and company store. The Omaha headquarters also includes a driver training facility, equipment maintenance and repair facilities and a sales office for selling used trucks and trailers. These maintenance facilities contain a central parts warehouse, frame straightening and alignment machine, truck and trailer wash areas, equipment safety lanes, body shops for tractors and trailers, two paint booths and a reclaim center. Our headquarter facilities have suitable space available to accommodate planned needs for at least the next three to five years.

We also have several terminals throughout the United States, consisting of office and/or maintenance facilities. Our terminal locations are described below:

|

| | | | | | | | | | |

Location | | Owned or Leased | | Description | | Segment |

Omaha, Nebraska | | Owned | | Corporate headquarters, maintenance | | Truckload, VAS, Corporate |

Omaha, Nebraska | | Owned | | Disaster recovery, warehouse | | Corporate |

Phoenix, Arizona | | Owned | | Office, maintenance | | Truckload |

Fontana, California | | Owned | | Office, maintenance | | Truckload |

Denver, Colorado | | Owned | | Office, maintenance | | Truckload |

Atlanta, Georgia | | Owned | | Office, maintenance | | Truckload, VAS |

Indianapolis, Indiana | | Leased | | Office, maintenance | | Truckload |

Springfield, Ohio | | Owned | | Office, maintenance | | Truckload |

Allentown, Pennsylvania | | Leased | | Office, maintenance | | Truckload |

Dallas, Texas | | Owned | | Office, maintenance | | Truckload, VAS |

Laredo, Texas | | Owned | | Office, maintenance, transloading | | Truckload, VAS |

Lakeland, Florida | | Leased | | Office | | Truckload |

El Paso, Texas | | Owned | | Office, maintenance | | Truckload |

Brownstown, Michigan | | Owned | | Maintenance | | Truckload |

Tomah, Wisconsin | | Leased | | Maintenance | | Truckload |

Newbern, Tennessee | | Leased | | Maintenance | | Truckload |

Chicago, Illinois | | Leased | | Maintenance | | Truckload |

We currently lease (i) small sales offices, brokerage offices and trailer parking yards in various locations throughout the United States and (ii) office space in Mexico, Canada, China and Australia. We own (i) a 96-room motel located near our Omaha headquarters; (ii) a 71-room private driver lodging facility at our Dallas terminal; (iii) a warehouse facility in Omaha; and (iv) a terminal facility in Queretaro, Mexico, which we lease to a related party (see Note 9 in the Notes to Consolidated Financial Statements under Item 8 of Part II of this Form 10-K). We also have 50% ownership in a 125,000 square-foot warehouse located near our headquarters in Omaha. The Fleet Truck Sales network currently has six locations, which are located in certain of our terminals listed above.

We are a party subject to routine litigation incidental to our business, primarily involving claims for bodily injury, property damage, cargo and workers’ compensation incurred in the transportation of freight. We have maintained a self-insurance program with a qualified department of risk management professionals since 1988. These associates manage our bodily injury, property damage, cargo and workers’ compensation claims. An actuary reviews our undiscounted self-insurance reserves for bodily injury, property damage and workers’ compensation claims at year-end.

Since August 1, 2004, our self-insured retention ("SIR") and deductible amount for liability claims has been $2.0 million, plus administrative expenses, for each occurrence involving bodily injury or property damage. We are also responsible for varying annual aggregate amounts of liability for claims in excess of the SIR/deductible. The following table reflects the SIR/deductible levels and aggregate amounts of liability for bodily injury and property damage claims since August 1, 2011:

|

| | | | |

Coverage Period | | Primary Coverage | | Primary Coverage SIR/Deductible |

August 1, 2011 – July 31, 2012 | | $5.0 million | | $2.0 million (1) |

August 1, 2012 – July 31, 2014 | | $5.0 million | | $2.0 million (1) |

August 1, 2013 – July 31, 2014 | | $5.0 million | | $2.0 million (1) |

August 1, 2014 – July 31, 2015 | | $5.0 million | | $2.0 million (1) |

| |

(1) | Subject to an additional $8.0 million aggregate in the $2.0 to $5.0 million layer. |

Our primary insurance covers the range of liability under which we expect most claims to occur. If any liability claims are in excess of coverage amounts listed in the table above, such claims are covered under premium-based policies (issued by insurance companies) to coverage levels that our management considers adequate. For claims in excess of $5.0 million and less than $10.0 million, we are responsible for the first $5.0 million of claims in this layer. We are also responsible for administrative expenses for each occurrence involving bodily injury or property damage. See also Note 1 and Note 8 in the Notes to Consolidated Financial Statements under Item 8 of Part II of this Form 10-K.

We are responsible for workers’ compensation claims up to $1.0 million per claim and have premium-based insurance coverage for individual claims above $1.0 million. We also maintain a $32.6 million bond for the State of Nebraska and a $6.9 million bond for our workers’ compensation insurance carrier.

Information regarding material pending legal proceedings is incorporated by reference from Note 5 and Note 8 in the Notes to Consolidated Financial Statements under Item 8 of Part II of this Form 10-K.

|

| |

ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable

PART II

|

| |

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Price Range of Common Stock

Our common stock trades on the NASDAQ Global Select MarketSM tier of the NASDAQ Stock Market under the symbol “WERN”. The following table sets forth, for the quarters indicated from January 1, 2013 through December 31, 2014, (i) the high and low trade prices per share of our common stock quoted on the NASDAQ Global Select MarketSM and (ii) our dividends declared per common share.

|

| | | | | | | | | | | |

| 2014 | | 2013 |

| High | | Low | | Dividends Declared Per Common Share | | High | | Low | | Dividends Declared Per Common Share |

Quarter Ended: | | | | | | | | | | | |

March 31 | $26.87 | | $24.26 | | $0.05 | | $25.02 | | $22.02 | | $0.05 |

June 30 | 27.01 | | 24.72 | | 0.05 | | 25.44 | | 21.80 | | 0.05 |

September 30 | 27.04 | | 24.31 | | 0.05 | | 25.33 | | 22.61 | | 0.05 |

December 31 | 31.71 | | 23.50 | | 0.05 | | 25.24 | | 22.86 | | 0.05 |

As of February 19, 2015, our common stock was held by 242 stockholders of record. Because many of our shares of common stock are held by brokers and other institutions on behalf of stockholders, we are unable to estimate the total number of stockholders represented by these record holders. The high and low trade prices per share of our common stock in the NASDAQ Global Select MarketSM as of February 19, 2015 were $32.15 and $31.26, respectively.

Dividend Policy

We have paid cash dividends on our common stock following each fiscal quarter since the first payment in July 1987. We currently intend to continue paying a regular quarterly dividend. We do not currently anticipate any restrictions on our future ability to pay such dividends. However, we cannot give any assurance that dividends will be paid in the future or of the amount of any such quarterly or special dividends because they are dependent on our earnings, financial condition and other factors.

Equity Compensation Plan Information

For information on our equity compensation plans, please refer to Item 12 of Part III of this Form 10-K.

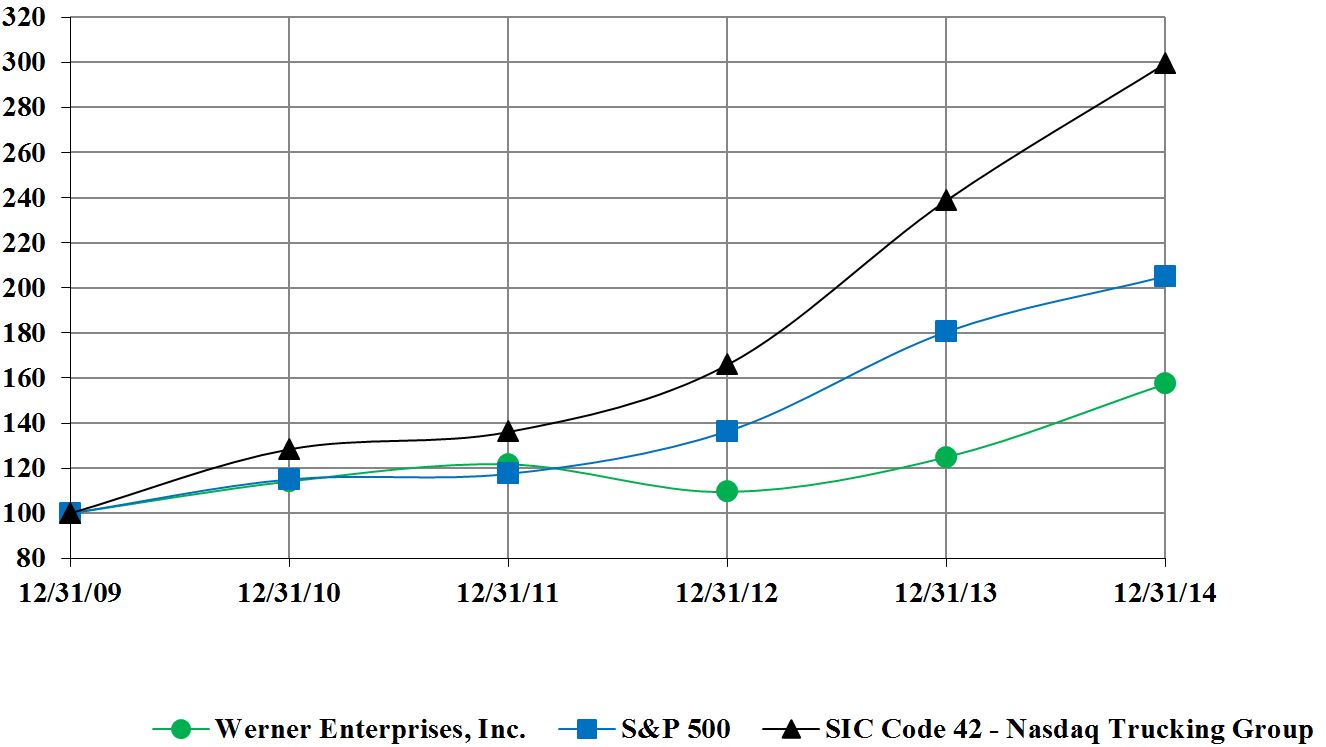

Performance Graph

Comparison of Five-Year Cumulative Total Return

The following graph is not deemed to be “soliciting material” or to be “filed” with the SEC or subject to the liabilities of Section 18 of the Exchange Act, and the report shall not be deemed to be incorporated by reference into any prior or subsequent filing by us under the Securities Act of 1933 or the Exchange Act except to the extent we specifically request that such information be incorporated by reference or treated as soliciting material.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 12/31/2009 | | 12/31/2010 | | 12/31/2011 | | 12/31/2012 | | 12/31/2013 | | 12/31/2014 |

Werner Enterprises, Inc. (WERN) | | $ | 100 |

| | $ | 114 |

| | $ | 122 |

| | $ | 109 |

| | $ | 125 |

| | $ | 157 |

|

Standard & Poor’s 500 | | $ | 100 |

| | $ | 115 |

| | $ | 117 |

| | $ | 136 |

| | $ | 180 |

| | $ | 205 |

|

NASDAQ Trucking Group (SIC Code 42) | | $ | 100 |

| | $ | 128 |

| | $ | 136 |

| | $ | 166 |

| | $ | 239 |

| | $ | 299 |

|

Assuming the investment of $100 on December 31, 2009, and reinvestment of all dividends, the graph above compares the cumulative total stockholder return on our common stock for the last five fiscal years with the cumulative total return of Standard & Poor’s 500 Market Index and an index of other companies included in the trucking industry (NASDAQ Trucking Group – Standard Industrial Classification Code 42) over the same period. Our stock price was $31.15 as of December 31, 2014. This price was used for purposes of calculating the total return on our common stock for the year ended December 31, 2014.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

On October 15, 2007, we announced that on October 11, 2007 our Board of Directors approved an increase in the number of shares of our common stock that Werner Enterprises, Inc. (the “Company”) is authorized to repurchase. Under this authorization, the Company is permitted to repurchase an additional 8,000,000 shares. As of December 31, 2014, the Company had purchased 3,062,291 shares pursuant to this authorization and had 4,937,709 shares remaining available for repurchase. The Company may purchase shares from time to time depending on market, economic and other factors. The authorization will continue unless withdrawn by the Board of Directors.

No shares of common stock were repurchased during the fourth quarter of 2014 by either the Company or any “affiliated purchaser”, as defined by Rule 10b-18 of the Exchange Act.

|

| |

ITEM 6. | SELECTED FINANCIAL DATA |

The following selected financial data should be read in conjunction with the consolidated financial statements and notes under Item 8 of Part II of this Form 10-K.

|

| | | | | | | | | | | | | | | | | | | |

(In thousands, except per share amounts) | 2014 | | 2013 | | 2012 | | 2011 | | 2010 |

Operating revenues | $ | 2,139,289 |

| | $ | 2,029,183 |

| | $ | 2,036,386 |

| | $ | 2,002,850 |

| | $ | 1,815,020 |

|

Net income | 98,650 |

| | 86,785 |

| | 103,034 |

| | 102,757 |

| | 80,039 |

|

Diluted earnings per share | 1.36 |

| | 1.18 |

| | 1.40 |

| | 1.40 |

| | 1.10 |

|

Cash dividends declared per share | 0.20 |

| | 0.20 |

| | 1.70 |

| | 0.70 |

| | 1.80 |

|

Total assets | 1,480,462 |

| | 1,354,097 |

| | 1,334,900 |

| | 1,302,416 |

| | 1,151,552 |

|

Total debt | 75,000 |

| | 40,000 |

| | 90,000 |

| | — |

| | — |

|

Stockholders’ equity | 833,860 |

| | 772,519 |

| | 714,897 |

| | 725,147 |

| | 668,975 |

|

Book value per share (1) | 11.58 |

| | 10.62 |

| | 9.76 |

| | 9.95 |

| | 9.21 |

|

Return on average stockholders’ equity (2) | 12.4 | % | | 11.7 | % | | 13.6 | % | | 14.5 | % | | 11.1 | % |

Return on average total assets (3) | 7.0 | % | | 6.5 | % | | 7.7 | % | | 8.3 | % | | 6.6 | % |

Operating ratio (consolidated) (4) | 92.5 | % | | 93.1 | % | | 91.6 | % | | 91.3 | % | | 92.6 | % |

| |

(1) | Stockholders’ equity divided by common shares outstanding as of the end of the period. Book value per share indicates the dollar value remaining for common shareholders if all assets were liquidated at recorded amounts and all debts were paid at recorded amounts. |

| |

(2) | Net income expressed as a percentage of average stockholders’ equity. Return on equity is a measure of a corporation’s profitability relative to recorded shareholder investment. |

| |

(3) | Net income expressed as a percentage of average total assets. Return on assets is a measure of a corporation’s profitability relative to recorded assets. |

| |

(4) | Operating expenses expressed as a percentage of operating revenues. Operating ratio is a common measure used in the trucking industry to evaluate profitability. |

|

| |

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) summarizes the financial statements from management’s perspective with respect to our financial condition, results of operations, liquidity and other factors that may affect actual results. The MD&A is organized in the following sections:

| |

• | Cautionary Note Regarding Forward-Looking Statements |

| |

• | Liquidity and Capital Resources |

| |

• | Contractual Obligations and Commercial Commitments |

| |

• | Off-Balance Sheet Arrangements |

| |

• | Critical Accounting Policies and Estimates |

Cautionary Note Regarding Forward-Looking Statements:

This Annual Report on Form 10-K contains historical information and forward-looking statements based on information currently available to our management. The forward-looking statements in this report, including those made in this Item 7 (Management’s Discussion and Analysis of Financial Condition and Results of Operations), are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. These safe harbor provisions encourage reporting companies to provide prospective information to investors. Forward-looking statements can be identified by the use of certain words, such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project” and other similar terms and language. We believe the forward-looking statements are reasonable based on currently available information. However, forward-looking statements involve risks, uncertainties and assumptions, whether known or unknown, that could cause our actual results, business, financial condition and cash flows to differ materially from those anticipated in the forward-looking statements. A discussion of important factors relating to forward-looking statements is included in Item 1A (Risk Factors) of Part I of this Form 10-K. Readers should not unduly rely on the forward-looking statements included in this Form 10-K because such statements speak only to the date they were made. Unless otherwise required by applicable securities laws, we undertake no obligation or duty to update or revise any forward-looking statements contained herein to reflect subsequent events or circumstances or the occurrence of unanticipated events.

Overview:

We have two reportable segments, Truckload and VAS, and we operate in the truckload and logistics sectors of the transportation industry. In the truckload sector, we focus on transporting consumer nondurable products that generally ship more consistently throughout the year. In the logistics sector, besides managing transportation requirements for individual customers, we provide additional sources of truck capacity, alternative modes of transportation, a global delivery network and systems analysis to optimize transportation needs. Our success depends on our ability to efficiently and effectively manage our resources in the delivery of truckload transportation and logistics services to our customers. Resource requirements vary with customer demand, which may be subject to seasonal or general economic conditions. Our ability to adapt to changes in customer transportation requirements is essential to efficiently deploy resources and make capital investments in tractors and trailers (with respect to our Truckload segment) or obtain qualified third-party capacity at a reasonable price (with respect to our VAS segment). Although our business volume is not highly concentrated, we may also be affected by our customers’ financial failures or loss of customer business.

Revenues for our Truckload segment operating units (One-Way Truckload and Specialized Services) are typically generated on a per-mile basis and also include revenues such as stop charges, loading and unloading charges, equipment detention charges and equipment repositioning charges. To mitigate our risk to fuel price increases, we recover from our customers additional fuel surcharges that generally recoup a majority of the increased fuel costs; however, we cannot assure that current recovery levels will continue in future periods. Because fuel surcharge revenues fluctuate in response to changes in fuel costs, we identify them separately and exclude them from the statistical calculations to provide a more meaningful comparison between periods. The key statistics used to evaluate trucking revenues, net of fuel surcharge, are (i) average revenues per tractor per week, (ii) average percentage of empty miles (miles without trailer cargo), (iii) average trip length (in loaded miles) and (iv) average number of tractors in service. General economic conditions, seasonal trucking industry freight patterns and industry capacity are important factors that impact these statistics. Our Truckload segment also generates a small amount of revenues categorized as non-trucking revenues, related to shipments delivered to or from Mexico where the Truckload segment utilizes a third-party capacity provider. We exclude such revenues from the statistical calculations.

Our most significant resource requirements are company drivers, independent contractors, tractors and trailers. Our financial results are affected by company driver and independent contractor availability and the markets for new and used revenue equipment. We are self-insured for a significant portion of bodily injury, property damage and cargo claims; workers’ compensation claims; and associate health claims (supplemented by premium-based insurance coverage above certain dollar levels). For that reason, our financial results may also be affected by driver safety, medical costs, weather, legal and regulatory environments and insurance coverage costs to protect against catastrophic losses.

The operating ratio is a common industry measure used to evaluate our profitability and that of our Truckload segment operating fleets. The operating ratio consists of operating expenses expressed as a percentage of operating revenues. The most significant variable expenses that impact the Truckload segment are driver salaries and benefits, fuel, fuel taxes (included in taxes and licenses expense), payments to independent contractors (included in rent and purchased transportation expense), supplies and maintenance and insurance and claims. As discussed further in the comparison of operating results for 2014 to 2013, several industry-wide issues have caused, and could continue to cause, costs to increase in future periods. These issues include shortages of drivers or independent contractors, changing fuel prices, higher new truck and trailer purchase prices and compliance with new or proposed regulations. Our main fixed costs include depreciation expense for tractors and trailers and equipment licensing fees (included in taxes and licenses expense). The Truckload segment requires substantial cash expenditures for tractor and trailer purchases. We fund these purchases with net cash from operations and financing available under our existing credit facilities, as management deems necessary.

We provide non-trucking services primarily through the four operating units within our VAS segment (Brokerage, Freight Management, Intermodal and WGL). Unlike our Truckload segment, the VAS segment is less asset-intensive and is instead dependent upon qualified associates, information systems and qualified third-party capacity providers. The largest expense item related to the VAS segment is the cost of purchased transportation we pay to third-party capacity providers. This expense item is recorded as rent and purchased transportation expense. Other operating expenses consist primarily of salaries, wages and benefits. We evaluate the VAS segment's financial performance by reviewing the gross margin percentage (revenues less rent and purchased transportation expenses expressed as a percentage of revenues) and the operating income percentage. The gross margin percentage can be impacted by the rates charged to customers and the costs of securing third-party capacity. We generally do not have contracted long-term rates for the cost of third-party capacity, and we cannot assure that our operating results will not be adversely impacted in the future if our ability to obtain qualified third-party capacity providers changes or the rates of such providers increase.

Results of Operations:

The following table sets forth the Consolidated Statements of Income in dollars and as a percentage of total operating revenues and the percentage increase or decrease in the dollar amounts of those items compared to the prior year.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2014 | | 2013 | | 2012 | | Percentage Change in Dollar Amounts |

(Amounts in thousands) | $ | | % | | $ | | % | | $ | | % | | 2014 to 2013 (%) | | 2013 to 2012 (%) |

Operating revenues | $ | 2,139,289 |

| | 100.0 |

| | $ | 2,029,183 |

| | 100.0 |

| | $ | 2,036,386 |

| | 100.0 |

| | 5.4 |

| | (0.4 | ) |

| | | | | | | | | | | | |

|

| | |

Operating expenses: | | | | | | | | | | | | |

|

| | |

Salaries, wages and benefits | 584,006 |

| | 27.3 |

| | 545,419 |

| | 26.9 |

| | 544,322 |

| | 26.7 |

| | 7.1 |

| | 0.2 |

|

Fuel | 346,058 |

| | 16.2 |

| | 371,789 |

| | 18.3 |

| | 401,417 |

| | 19.7 |

| | (6.9 | ) | | (7.4 | ) |

Supplies and maintenance | 188,437 |

| | 8.8 |

| | 179,172 |

| | 8.8 |

| | 172,505 |

| | 8.5 |

| | 5.2 |

| | 3.9 |

|

Taxes and licenses | 85,468 |

| | 4.0 |

| | 86,686 |

| | 4.3 |

| | 90,002 |

| | 4.4 |

| | (1.4 | ) | | (3.7 | ) |

Insurance and claims | 80,375 |

| | 3.7 |

| | 71,177 |

| | 3.5 |

| | 65,593 |

| | 3.2 |

| | 12.9 |

| | 8.5 |

|

Depreciation | 176,984 |

| | 8.3 |

| | 173,019 |

| | 8.5 |

| | 166,957 |

| | 8.2 |

| | 2.3 |

| | 3.6 |

|

Rent and purchased transportation | 498,782 |

| | 23.3 |

| | 456,885 |

| | 22.5 |

| | 420,480 |

| | 20.7 |

| | 9.2 |

| | 8.7 |

|

Communications and utilities | 14,220 |

| | 0.7 |

| | 13,506 |

| | 0.7 |

| | 13,745 |

| | 0.7 |

| | 5.3 |

| | (1.7 | ) |

Other | 4,871 |

| | 0.2 |

| | (8,196 | ) | | (0.4 | ) | | (10,079 | ) | | (0.5 | ) | | 159.4 |

| | 18.7 |

|

Total operating expenses | 1,979,201 |

| | 92.5 |

| | 1,889,457 |

| | 93.1 |

| | 1,864,942 |

| | 91.6 |

| | 4.7 |

| | 1.3 |

|

| | | | | | | | | | | | |

|

| | |

Operating income | 160,088 |

| | 7.5 |

| | 139,726 |

| | 6.9 |

| | 171,444 |

| | 8.4 |

| | 14.6 |

| | (18.5 | ) |

Total other expense (income) | (1,686 | ) | | (0.1 | ) | | (1,985 | ) | | (0.1 | ) | | (1,722 | ) | | (0.1 | ) | | 15.1 |

| | (15.3 | ) |

Income before income taxes | 161,774 |

| | 7.6 |

| | 141,711 |

| | 7.0 |

| | 173,166 |

| | 8.5 |

| | 14.2 |

| | (18.2 | ) |

Income taxes | 63,124 |

| | 3.0 |

| | 54,926 |

| | 2.7 |

| | 70,132 |

| | 3.4 |

| | 14.9 |

| | (21.7 | ) |

Net income | $ | 98,650 |

| | 4.6 |

| | $ | 86,785 |

| | 4.3 |

| | $ | 103,034 |

| | 5.1 |

| | 13.7 |

| | (15.8 | ) |

The following tables set forth the operating revenues, operating expenses and operating income for the Truckload segment, as well as certain statistical data regarding our Truckload segment operations for the periods indicated.

|

| | | | | | | | | | | | | | | | | |

| 2014 | | 2013 | | 2012 |