UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04656

ELLSWORTH GROWTH AND INCOME FUND LTD.

(Exact name of registrant as specified in charter)

65 Madison Avenue, Morristown, New Jersey 07960-7308

(Address of principal executive offices) (Zip code)

Thomas H. Dinsmore

ELLSWORTH GROWTH AND INCOME FUND LTD.

65 Madison Avenue

Morristown, New Jersey 07960-7308

(Name and address of agent for service)

Registrant’s telephone number, including area code: (973) 631-1177

Date of fiscal year end: September 30

Date of reporting period: September 30, 2015

ITEM 1. REPORTS TO STOCKHOLDERS.

ELLSWORTH GROWTH AND

INCOME FUND LTD.

2015 Annual Report

September 30, 2015

2015 Annual Report

September 30, 2015

Ellsworth Growth and Income Fund Ltd. operates as a closed-end, diversified management investment company and invests primarily in convertible and equity securities, with the objectives of providing income and the potential for capital appreciation; which objectives the Fund considers to be relatively equal, over the long-term, due to the nature of the securities in which it invests.

Highlights

Performance through September 30, 2015 with dividends reinvested

| Calendar | Annualized | 10 Year | ||||||||||

| YTD | 1 Year | 3 Years | 5 Years | 10 Years | Volatility | |||||||

| Ellsworth market price | (6.83)% | (2.32)% | 6.96% | 6.12% | 5.84% | 15.58% | ||||||

| Ellsworth net asset value | (3.76) | (0.78) | 8.62 | 7.96 | 5.75 | 12.36 | ||||||

| Bank of America Merrill Lynch All U.S. | ||||||||||||

| Convertibles Index | (3.81) | (2.25) | 10.58 | 9.02 | 6.63 | 12.55 | ||||||

| Barclays Balanced U.S. | ||||||||||||

| Convertibles Index | (4.29) | (3.92) | 6.23 | 6.75 | NA | NA | ||||||

| S&P 500® Index | (5.27) | (0.62) | 12.36 | 13.31 | 6.79 | 15.20 | ||||||

Bank of America Merrill Lynch All U.S. Convertibles Index and S&P 500® Index performance in the table above are from the Bloomberg L.P. pricing service. Barclays Balanced U.S. Convertibles Index performance is from Barclays Capital.

Ellsworth’s net asset value performance in the table above has not been adjusted for expenses. Performance data represents past results and does not reflect future performance.

Volatility is a measure of risk based on the standard deviation of the return. The greater the volatility, the greater the chance of a profit or risk of a loss.

Quarterly History of NAV and Market Price (NYSE MKT symbol: ECF)

| Net Asset Value | Market Price | |||||||||||||||||||||||

| Qtr. Ended | High | Low | Close | High | Low | Close | ||||||||||||||||||

| 12/31/14 | $ | 10.37 | $ | 9.78 | $ | 10.19 | $ | 8.71 | $ | 7.81 | $ | 8.71 | ||||||||||||

| 3/31/15 | 10.44 | 9.99 | 10.27 | 8.85 | 8.25 | 8.76 | ||||||||||||||||||

| 6/30/15 | 10.67 | 10.26 | 10.38 | 9.20 | 8.69 | 8.83 | ||||||||||||||||||

| 9/30/15 | 10.56 | 9.32 | 9.45 | 8.96 | 7.78 | 7.82 | ||||||||||||||||||

Dividend Distributions (12 Months)

| Short-Term | Long-Term | |||||||||||||||||

| Record | Payment | Capital | Capital | |||||||||||||||

| Date | Date | Income | Gains | Gains | Total | |||||||||||||

| 10/31/14 | 11/26/14 | $ | 0.0380 | — | $ | 0.3120 | $ | 0.3500 | ||||||||||

| 2/12/15 | 2/26/15 | — | — | 0.1075 | 0.1075 | |||||||||||||

| 5/14/15 | 5/28/15 | 0.1085 | — | — | 0.1085 | |||||||||||||

| 8/13/15 | 8/27/15 | 0.1020 | $ | 0.007 | — | 0.1090 | ||||||||||||

| $ | 0.2485 | $ | 0.007 | $ | 0.4195 | $ | 0.6750 | |||||||||||

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D . 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

To Our Shareholders

November 19, 2015

As we discussed in our last letter, a special shareholder meeting was held on October 19, 2015. At the meeting shareholders approved a new investment advisory agreement with Gabelli Funds, LLC. The portfolio management team continues as the Dinsmore Group of Gabelli Funds. We are pleased that shareholders voted in favor of this arrangement, and believe that together we have the opportunity to improve the overall management of Ellsworth Growth and Income Fund Ltd. We will continue to manage the portfolio as we have, while adding access to Gabelli’s 30+ analysts, a more robust back office operation, and a dedicated shareholder ombudsman.

At Ellsworth, we have always looked at convertible securities as alternatives to equities with reduced volatility. As we have introduced more common stocks into the portfolio we have focused on equities that have attractive, increasing yields. These stocks tend to be less volatile than the broader markets and fit in nicely with our overall strategy; to participate in rising equity markets while seeing less downside in volatile times. As volatility re-emerged this year, Ellsworth’s standard deviation stayed well below that of the S&P 500 ®.

Looking forward, there has been much talk in the markets about if and when we may see an increase in interest rates, and some investors may be concerned about what will happen to convertibles in a rising interest rate environment. We have conducted a study of the last eight 100 basis point rises in 10 year treasury yields, going back to January 1996. In each case, the convertible market moved higher, acting more like equities than bonds. A rising rate environment would likely see an increase in convertible issuance as companies find them to be a more attractive way to raise money than higher rate bonds.

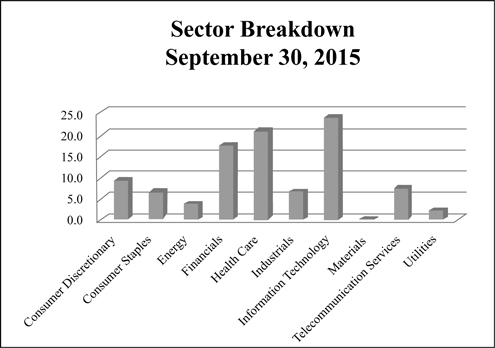

Performance for Ellsworth’s fourth fiscal quarter ended September 30, 2015 was enhanced by exposure to the Consumer Staples and Utilities sectors. Performance was held back by the Fund’s exposure to the Energy and Health Care sectors. The Fund’s largest sector exposures as of September 30, 2015 were in Information Technology (24.1%), Health Care (20.9%) and Financials (17.5%).

Ellsworth’s portfolio at September 30, 2015 consisted of 46.8% cash-pay convertible bonds and notes, 12.3% mandatory convertible issues, 8.7% convertible preferred stock, and 30.1% common stock. At that date, the bonds had an average current annual yield of 2.35%; the mandatory convertible securities, 6.20%; the preferred shares, 6.60%; and the common shares, 3.74%. The Fund’s convertible securities holdings at September 30, 2015 had a median premium-to-conversion value of 25.2%. We calculate that equities and equity-sensitive convertible issues at that date made up 53% of the Fund’s portfolio, with credit-sensitive issues accounting for 9% of the Fund’s portfolio, and total-return convertible issues at 38%.

The Board of Trustees has authorized the continuation of its 5% minimum distribution policy. The Board also authorized the repurchase of the Fund’s shares in the open market, from time to time, when the shares are trading at a discount of 10% or more from net asset value.

continued on the following page

| Page 1 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D . 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

To Our Shareholders (continued)

At its October 19, 2015 meeting, the Board of Trustees declared a distribution of $0.467 per share. The distribution consists of $0.008 undistributed net investment income, and net realized gains on investments of $0.459. The distribution is payable on December 11, 2015 to shareholders of record on November 12, 2015. This is the largest single distribution by the Fund since fiscal year 2007; further, this year’s total annual distribution is also the largest since 2007.

Portfolio Managers:

James A. Dinsmore

Thomas H. Dinsmore

Jane D. O’Keeffe

| Page 2 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D . 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Largest Investment Holdings by underlying common stock

| Value | % Total | |||||||

| (Note 1) | Net Assets | |||||||

| Allergan plc | $ | 2,175,225 | 1.8 | % | ||||

| Allergan

plc is a pharmaceutical company. The company is focused on developing, manufacturing and commercializing pharmaceuticals, generic and over-the-counter medicines and biologic products for patients around the world. It produces and markets generic, branded and over-the-counter (OTC) pharmaceutical products covering all therapeutic classes. | ||||||||

| Gilead Sciences, Inc. | 2,144,378 | 1.8 | ||||||

| Gilead

Sciences is a research- based biopharmaceutical company that discovers, develops and commercializes medicines. Gilead’s primary areas of focus include human immunodeficiency virus (HIV)/AIDS, liver diseases, and cardiovascular/metabolic and respiratory conditions. | ||||||||

| The Priceline Group Inc. | 2,115,938 | 1.7 | ||||||

| Priceline

is an online travel company that offers its customers hotel room reservations at over 295,000 hotels worldwide through the Booking.com, priceline.com and Agoda brands. In the United States, it also offers its customers reservations for car rentals, airline tickets, vacation packages, destination services and cruises through the priceline.com brand. | ||||||||

| Equinix, Inc. | 2,050,500 | 1.7 | ||||||

| Equinix

provides core Internet exchange services to networks, Internet infrastructure companies, enterprises and content providers. | ||||||||

| Molina Healthcare Inc. | 1,745,000 | 1.4 | ||||||

| Molina

provides Medicaid-related solutions to meet the health care needs of families and individuals and to assist state agencies in their administration of the Medicaid program. The company derives its revenues primarily from health insurance premiums and service revenues. | ||||||||

| Wells Fargo & Co. | 1,723,970 | 1.4 | ||||||

| Wells

Fargo is a financial services and bank holding company. The company’s segments are community banking, wholesale banking, and wealth and brokerage and retirement. | ||||||||

| Church & Dwight Co., Inc. | 1,678,000 | 1.4 | ||||||

| Church

& Dwight develops, manufactures and markets a range of household, personal care and specialty products. | ||||||||

| Huntington Bancshares, Inc. | 1,672,500 | 1.4 | ||||||

| Huntington

Bancshares is a diversified regional bank holding company. It provides commercial, small business, consumer and mortgage banking services, automobile financing, equipment leasing, investment management, trust services, brokerage services, insurance programs, and other financial products and services. | ||||||||

| Jarden Corp. | 1,665,312 | 1.4 | ||||||

| Jarden

provides a broad range of consumer products through product segments that include Outdoor Solutions, Consumer Solutions and Branded Consumables. The company sells branded products through a variety of distribution channels, including club, department store, drug, grocery, mass merchant, sporting goods and specialty retailers, as well as direct to consumers. | ||||||||

| Total | $ | 16,970,823 | 14.0 | % | ||||

| Page 3 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D .. 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Major Industry Exposure

| % Total | ||||

| Net Assets | ||||

| Software | 10.4% | |||

| Pharmaceuticals | 9.8 | |||

| Biotechnology | 6.9 | |||

| Real Estate Investment Trusts | 6.9 | |||

| Food Products | 4.7 | |||

| Semiconductors & Semiconductor Equipment | 4.3 | |||

| Internet Software & Services | 4.2 | |||

| Diversified Telecommunications Services | 4.0 | |||

| Health Care Providers & Services | 3.6 | |||

| Oil, Gas & Consumable Fuels | 3.3 | |||

| Total | 58.1% | |||

Major Portfolio Changes by underlying common stock

Six months ended September 30, 2015

| ADDITIONS | REDUCTIONS |

| Allergan plc | A.M. Castle & Co. |

| Anthem, Inc. | Chesapeake Energy Corp. |

| Bottomline Technologies, Inc. | Chevron Corp. |

| InterDigital, Inc. | ConAgra Foods, Inc. |

| Kindred Healthcare, Inc. | ConocoPhillips |

| NXP Semiconductors N.V. | Gilead Sciences, Inc. |

| SanDisk Corp. | Iconix Brand Group, Inc. |

| SolarCity Corp. | Incyte Corp. |

| Stericycle, Inc. | InvenSense, Inc. |

| Isis Pharmaceuticals, Inc. | |

| JinkoSolar Holding Co., Ltd. | |

| Lexington Realty Trust | |

| Mylan Inc. | |

| SBA Communications Corp. | |

| Stratasys Ltd. | |

| United Technologies Corp. |

| Page 4 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D .. 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Portfolio of Investments September 30, 2015

| Principal | Identified | Value | ||||||||||

| Amount | Cost | (Note 1) | ||||||||||

| Convertible Bonds and Notes - 46.8% | ||||||||||||

| Air Freight & Logistics - 1.5% | ||||||||||||

| Atlas Air Worldwide Holdings, Inc., 2.25%, Due 6/1/22 | $ | 1,000,000 | $ | 984,464 | $ | 806,250 | ||||||

| Echo Global Logistics, Inc., 2.50%, Due 5/1/20 | 1,125,000 | 1,141,929 | 1,010,391 | |||||||||

| 2,126,393 | 1,816,641 | |||||||||||

| Automobiles - 0.2% | ||||||||||||

| Tesla Motors, Inc., 1.25%, Due 3/1/21 | 200,000 | 200,000 | 189,250 | |||||||||

| Biotechnology - 5.6% | ||||||||||||

| Array BioPharma Inc., 3.00%, Due 6/1/20 | 250,000 | 241,309 | 247,656 | |||||||||

| Emergent BioSolutions Inc., 2.875%, Due 1/15/21 | 800,000 | 808,744 | 910,500 | |||||||||

| Exelixis, Inc., 4.25%, Due 8/15/19 | 250,000 | 319,945 | 302,969 | |||||||||

| Gilead Sciences, Inc., 1.625%, Due 5/1/16 | 500,000 | 508,073 | 2,144,378 | |||||||||

| Incyte Corp., 1.25%, Due 11/15/20 | 500,000 | 654,341 | 1,087,812 | |||||||||

| OPKO Health Inc., 3.00%, Due 2/1/33 | 200,000 | 204,178 | 280,250 | |||||||||

| PTC Therapeutics, Inc., 3.00%, Due 8/15/22 (1) | 500,000 | 500,000 | 445,000 | |||||||||

| Regeneron Pharmaceuticals, Inc., 1.875%, Due 10/1/16 | 250,000 | 248,859 | 1,380,156 | |||||||||

| 3,485,449 | 6,798,721 | |||||||||||

| Communications Equipment - 2.9% | ||||||||||||

| CalAmp Corp., 1.625%, Due 5/15/20 (1) | 1,550,000 | 1,529,803 | 1,393,062 | |||||||||

| InterDigital, Inc., 1.50%, Due 3/1/20 (1) | 1,500,000 | 1,446,514 | 1,447,500 | |||||||||

| Oclaro, Inc., 6.00%, Due 2/15/20 | 500,000 | 544,013 | 685,312 | |||||||||

| 3,520,330 | 3,525,874 | |||||||||||

| Construction & Engineering - 0.8% | ||||||||||||

| Dycom Industries, Inc., 0.75%, Due 9/15/21 (1) | 1,000,000 | 1,004,343 | 992,500 | |||||||||

| Consumer Finance - 0.8% | ||||||||||||

| Encore Capital Group, Inc., 3.00%, Due 7/1/20 | 1,000,000 | 1,084,090 | 996,875 | |||||||||

| Diversified Consumer Services - 0.9% | ||||||||||||

| Carriage Services, Inc., 2.75%, Due 3/15/21 | 1,000,000 | 1,020,678 | 1,114,375 | |||||||||

| Diversified Telecommunication Services - 0.8% | ||||||||||||

| Alaska Communications Systems Group, Inc., 6.25%, Due 5/1/18 | 1,000,000 | 958,051 | 1,011,250 | |||||||||

| Electrical Equipment - 0.6% | ||||||||||||

| SolarCity Corp., 2.75%, Due 11/1/18 | 750,000 | 759,726 | 680,156 | |||||||||

| Health Care Equipment & Supplies - 0.8% | ||||||||||||

| Quidel Corp., 3.25%, Due 12/15/20 | 500,000 | 519,015 | 465,312 | |||||||||

| Trinity Biotech Investment Ltd., 4.00%, Due 4/1/45 (1) | 500,000 | 500,000 | 436,875 | |||||||||

| 1,019,015 | 902,187 | |||||||||||

| Health Care Providers & Services - 1.5% | ||||||||||||

| Molina Healthcare Inc., 1.125%, Due 1/15/20 | 1,000,000 | 1,056,668 | 1,745,000 | |||||||||

S e e a c c o m p a n y i n g n o t e s t o f i n a n c i a l s t a t e m e n t s

| Page 5 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D .. 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Portfolio of Investments September 30, 2015 (continued)

| Principal | Identified | Value | ||||||||||

| Amount | Cost | (Note 1) | ||||||||||

| Convertible Bonds and Notes - continued | ||||||||||||

| Household Durables - 1.4% | ||||||||||||

| Jarden Corp., 1.875%, Due 9/15/18 | $ | 500,000 | $ | 504,274 | $ | 803,750 | ||||||

| Jarden Corp., 1.125%, Due 3/15/34 | 750,000 | 759,738 | 861,562 | |||||||||

| 1,264,012 | 1,665,312 | |||||||||||

| Internet & Catalog Retail - 1.8% | ||||||||||||

| The Priceline Group Inc., 1.00%, Due 3/15/18 | 1,500,000 | 1,668,600 | 2,115,938 | |||||||||

| Internet Software & Services - 2.5% | ||||||||||||

| Blucora, Inc., 4.25%, Due 4/1/19 | 1,000,000 | 977,740 | 951,250 | |||||||||

| Monster Worldwide, Inc., 3.50%, Due 10/15/19 | 500,000 | 520,129 | 688,125 | |||||||||

| Web.com Group, Inc., 1.00%, Due 8/15/18 | 1,500,000 | 1,491,234 | 1,413,750 | |||||||||

| 2,989,103 | 3,053,125 | |||||||||||

| IT Services - 1.0% | ||||||||||||

| CSG Systems International, Inc., 3.00%, Due 3/1/17 | 900,000 | 907,447 | 1,234,688 | |||||||||

| Leisure Equipment & Products - 0.5% | ||||||||||||

| JAKKS Pacific, Inc., 4.875%, Due 6/1/20 (1) | 617,000 | 675,278 | 633,196 | |||||||||

| Media - 0.8% | ||||||||||||

| Global Eagle Entertainment Inc., 2.75%, Due 2/15/35 | 1,125,000 | 1,134,192 | 1,006,172 | |||||||||

| Oil, Gas & Consumable Fuels - 1.1% | ||||||||||||

| Cheniere Energy, Inc., 4.25%, Due 3/15/45 | 1,500,000 | 1,205,950 | 940,312 | |||||||||

| Clean Energy Fuels Corp., 5.25%, Due 10/1/18 | 500,000 | 503,601 | 272,500 | |||||||||

| Goodrich Petroleum Corp., 5.00%, Due 10/1/32 | 517,000 | 525,340 | 108,570 | |||||||||

| 2,234,891 | 1,321,382 | |||||||||||

| Personal Products - 0.5% | ||||||||||||

| IGI Laboratories, Inc., 3.75%, Due 12/15/19 | 750,000 | 758,479 | 650,625 | |||||||||

| Pharmaceuticals - 3.1% | ||||||||||||

| ANI Pharmaceuticals, Inc., 3.00%, Due 12/1/19 | 750,000 | 857,590 | 693,750 | |||||||||

| Horizon

Pharma Investment Ltd., 2.50%, Due 3/15/22 (1) cv. into Horizon Pharma plc ordinary shares | 1,000,000 | 1,092,929 | 971,250 | |||||||||

| Jazz

Investments I Ltd., 1.875%, Due 8/15/21 guaranteed by Jazz Pharmaceuticals plc and cv. into Jazz Pharmaceuticals plc ordinary shares | 710,000 | 825,968 | 725,088 | |||||||||

| The Medicines Co., 2.50%, Due 1/15/22 (1) | 1,000,000 | 1,078,904 | 1,306,250 | |||||||||

| 3,855,391 | 3,696,338 | |||||||||||

| Real Estate Investment Trusts - 2.0% | ||||||||||||

| Colony Capital, Inc., 5.00%, Due 4/15/23 | 1,000,000 | 1,035,539 | 991,250 | |||||||||

| Extra Space Storage LP, 3.125%, Due 10/1/35 (1) | 1,000,000 | 1,000,000 | 1,011,875 | |||||||||

| Spirit Realty Capital, Inc., 3.75%, Due 5/15/21 | 500,000 | 500,000 | 457,190 | |||||||||

| 2,535,539 | 2,460,315 | |||||||||||

S e e a c c o m p a n y i n g n o t e s t o f i n a n c i a l s t a t e m e n t s

| Page 6 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D .. 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Portfolio of Investments September 30, 2015 (continued)

| Principal | Identified | Value | ||||||||||

| Amount | Cost | (Note 1) | ||||||||||

| Convertible Bonds and Notes - continued | ||||||||||||

| Real Estate Management & Development - 0.9% | ||||||||||||

| Forest City Enterprises, Inc., 3.625%, Due 8/15/20 | $ | 1,000,000 | $ | 1,002,698 | $ | 1,036,250 | ||||||

| Semiconductors & Semiconductor Equipment - 3.3% | ||||||||||||

| Micron Technology, Inc., 3.00%, Due 11/15/43 | 1,500,000 | 1,389,515 | 1,268,438 | |||||||||

| NXP Semiconductors N.V., 1.00%, Due 12/1/19 (1) | 1,500,000 | 1,657,592 | 1,664,062 | |||||||||

| Spansion LLC, 2.00%, Due 9/1/20 | 200,000 | 200,000 | 328,625 | |||||||||

| SunEdison, Inc., 2.75%, Due 1/1/21 | 500,000 | 481,740 | 355,312 | |||||||||

| SunEdison, Inc., 0.25%, Due 1/15/20 (1) | 750,000 | 517,011 | 430,781 | |||||||||

| 4,245,858 | 4,047,218 | |||||||||||

| Software - 9.4% | ||||||||||||

| Bottomline Technologies, Inc., 1.50%, Due 12/1/17 | 1,250,000 | 1,313,682 | 1,330,469 | |||||||||

| EnerNOC, Inc., 2.25%, Due 8/15/19 | 850,000 | 685,605 | 595,531 | |||||||||

| FireEye, Inc., 1.625%, Due 6/1/35 (1) | 1,500,000 | 1,555,892 | 1,334,062 | |||||||||

| Mentor Graphics Corp., 4.00%, Due 4/1/31 | 1,250,000 | 1,403,500 | 1,582,031 | |||||||||

| MercadoLibre, Inc., 2.25%, Due 7/1/19 | 500,000 | 505,491 | 491,562 | |||||||||

| Proofpoint, Inc., 0.75%, Due 6/15/20 (1) | 1,250,000 | 1,314,491 | 1,313,281 | |||||||||

| PROS Holdings, Inc., 2.00%, Due 12/1/19 | 500,000 | 503,011 | 489,688 | |||||||||

| Synchronoss Technologies, Inc., 0.75%, Due 8/15/19 | 1,250,000 | 1,305,583 | 1,267,188 | |||||||||

| Take-Two Interactive Software, Inc., 1.75%, Due 12/1/16 | 500,000 | 524,872 | 773,125 | |||||||||

| TeleCommunication Systems, Inc., 7.75%, Due 6/30/18 | 1,000,000 | 986,725 | 980,000 | |||||||||

| Verint Systems Inc., 1.50%, Due 6/1/21 | 1,250,000 | 1,266,185 | 1,197,656 | |||||||||

| 11,365,037 | 11,354,593 | |||||||||||

| Specialty Retail - 0.4% | ||||||||||||

| GNC Holdings, Inc., 1.50%, Due 8/15/20 (1) | 500,000 | 502,280 | 463,750 | |||||||||

| Technology, Hardware & Storage - 1.0% | ||||||||||||

| SanDisk Corp., 1.50%, Due 8/15/17 | 1,000,000 | 1,232,048 | 1,246,250 | |||||||||

| Trading Companies & Distributors - 0.7% | ||||||||||||

| Kaman Corp., 3.25%, Due 11/15/17 | 750,000 | 785,364 | 881,719 | |||||||||

| Total Convertible Bonds and Notes | 53,390,960 | 56,639,700 | ||||||||||

| Convertible Preferred Stock - 8.7% | ||||||||||||

| Shares | ||||||||||||

| Capital Markets - 0.4% | ||||||||||||

| Cowen Group, Inc., 5.625% (1) | 500 | 500,000 | 433,150 | |||||||||

| Commercial Banks - 1.9% | ||||||||||||

| Huntington Bancshares, Inc., 8.50% | 1,250 | 1,552,500 | 1,672,500 | |||||||||

| Wells Fargo & Co., 7.50% | 500 | 437,200 | 584,000 | |||||||||

| 1,989,700 | 2,256,500 | |||||||||||

| Commercial Services & Supplies - 0.8% | ||||||||||||

| Stericycle, Inc., 5.25%, Due 9/15/18 | 10,000 | 1,002,500 | 1,016,400 | |||||||||

| Diversified Financial Services - 0.9% | ||||||||||||

| Bank of America Corp., 7.25% | 1,000 | 872,030 | 1,077,000 | |||||||||

S e e a c c o m p a n y i n g n o t e s t o f i n a n c i a l s t a t e m e n t s

| Page 7 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D .. 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Portfolio of Investments September 30, 2015 (continued)

| Identified | Value | |||||||||||

| Shares | Cost | (Note 1) | ||||||||||

| Convertible Preferred Stock - continued | ||||||||||||

| Food Products - 0.8% | ||||||||||||

| Bunge Ltd., 4.875% | 10,000 | $ | 949,905 | $ | 981,300 | |||||||

| Machinery - 0.9% | ||||||||||||

| Stanley Black & Decker, Inc., 6.25% | 10,000 | 1,031,784 | 1,125,000 | |||||||||

| Oil, Gas & Consumable Fuels - 0.4% | ||||||||||||

| Chesapeake Energy Corp., 5.75% | 1,050 | 911,496 | 451,826 | |||||||||

| Real Estate Investment Trusts - 1.0% | ||||||||||||

| Welltower Inc., 6.50% | 20,000 | 1,142,341 | 1,223,000 | |||||||||

| Specialty Retail - 0.6% | ||||||||||||

| Amerivon Holdings LLC, 4.00%, (1,2,3) | 682,393 | 1,500,000 | 733,636 | |||||||||

| Amerivon Holdings LLC, common equity units, (1,2,3) | 272,728 | 0 | 16,364 | |||||||||

| 1,500,000 | 750,000 | |||||||||||

| Thrift & Mortgage Finance - 1.0% | ||||||||||||

| New York Community Capital Trust V, 6.00% | 24,000 | 1,043,554 | 1,200,000 | |||||||||

| Total Convertible Preferred Stock | 10,943,310 | 10,514,176 | ||||||||||

| Mandatory Convertible Securities - 12.3% (4) | ||||||||||||

| Automobiles - 0.5% | ||||||||||||

| Fiat Chrysler Automobiles N.V., 7.875%, Due 12/15/16 | 5,000 | 500,000 | 593,100 | |||||||||

| Biotechnology - 1.3% | ||||||||||||

| AmSurg Corp., 5.25%, Due 7/1/17 | 10,500 | 1,093,816 | 1,555,312 | |||||||||

| Diversified Telecommunication Services - 0.8% | ||||||||||||

| Frontier Communications Corp, 11.125%, Due 6/29/18 | 10,000 | 1,001,125 | 936,500 | |||||||||

| Electric Utilities - 1.3% | ||||||||||||

| NextEra Energy, Inc., 6.371%, Due 12/31/49 | 30,000 | 1,496,250 | 1,543,500 | |||||||||

| Food Products - 0.8% | ||||||||||||

| Tyson Foods, Inc., 4.75%, Due 7/15/17 | 20,000 | 1,011,210 | 1,025,200 | |||||||||

| Health Care Providers & Services - 2.1% | ||||||||||||

| Anthem, Inc., 5.25%, Due 5/1/18 | 30,000 | 1,514,723 | 1,450,200 | |||||||||

| Kindred Healthcare, Inc., 7.50%, Due 11/19/17 | 1,250 | 1,271,683 | 1,055,625 | |||||||||

| 2,786,406 | 2,505,825 | |||||||||||

| Insurance - 0.8% | ||||||||||||

| Maiden Holdings, Ltd., 7.25%, Due 9/15/16 | 20,000 | 1,006,250 | 1,008,200 | |||||||||

S e e a c c o m p a n y i n g n o t e s t o f i n a n c i a l s t a t e m e n t s

| Page 8 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D .. 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Portfolio of Investments September 30, 2015 (continued)

| Identified | Value | |||||||||||

| Shares | Cost | (Note 1) | ||||||||||

| Mandatory Convertible Securities - continued | ||||||||||||

| Multi-Utilities - 0.8% | ||||||||||||

| Dominion Resources, Inc., 6.375%, Due 7/1/17 | 20,000 | $ | 997,000 | $ | 992,200 | |||||||

| Oil, Gas & Consumable Fuels - 0.3% | ||||||||||||

| Anadarko Petroleum Corp, 7.50%, Due 6/7/18 cv. into Western Gas Equity Partners LP common stock | 10,000 | 498,250 | 371,300 | |||||||||

| Pharmaceuticals - 1.8% | ||||||||||||

| Allergan plc, 5.50%, Due 3/1/18 | 2,300 | 2,366,046 | 2,175,225 | |||||||||

| Real Estate Investment Trusts - 1.2% | ||||||||||||

| Weyerhaeuser Co., 6.375%, Due 7/1/16 | 30,000 | 1,540,725 | 1,443,000 | |||||||||

| Wireless Telecommunication Services - 0.6% | ||||||||||||

| T-Mobile US, Inc., 5.50%, Due 12/15/17 | 10,000 | 500,000 | 690,600 | |||||||||

| Total Mandatory Convertible Securities (4) | 14,797,078 | 14,839,962 | ||||||||||

| Common Stock - 30.1% | ||||||||||||

| Automobiles - 1.1% | ||||||||||||

| Ford Motor Co. | 100,000 | 1,498,550 | 1,357,000 | |||||||||

| Capital Markets - 1.0% | ||||||||||||

| BlackRock Capital Investment Corp. | 131,034 | 1,245,744 | 1,160,961 | |||||||||

| Commercial Banks - 0.9% | ||||||||||||

| Wells Fargo & Co. | 22,200 | 1,104,926 | 1,139,970 | |||||||||

| Diversified Financial Services - 1.2% | ||||||||||||

| Citigroup Inc. | 29,546 | 1,371,950 | 1,465,777 | |||||||||

| Diversified Telecommunication Services - 2.4% | ||||||||||||

| AT&T Inc. | 50,000 | 1,342,822 | 1,629,000 | |||||||||

| Verizon Communications Inc. | 30,000 | 1,016,179 | 1,305,300 | |||||||||

| 2,359,001 | 2,934,300 | |||||||||||

| Energy Equipment & Services - 0.5% | ||||||||||||

| Chevron Corp. | 7,000 | 757,729 | 552,160 | |||||||||

| Food Products - 3.1% | ||||||||||||

| B&G Foods, Inc. | 35,000 | 1,088,044 | 1,275,750 | |||||||||

| ConAgra Foods, Inc. | 35,000 | 1,122,305 | 1,417,850 | |||||||||

| Unilever N.V. (ADR) | 24,000 | 1,015,518 | 964,800 | |||||||||

| 3,225,867 | 3,658,400 | |||||||||||

S e e a c c o m p a n y i n g n o t e s t o f i n a n c i a l s t a t e m e n t s

| Page 9 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D .. 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Portfolio of Investments September 30, 2015 (continued)

| Identified | Value | |||||||||||

| Shares | Cost | (Note 1) | ||||||||||

| Common Stock - continued | ||||||||||||

| Household Products - 1.4% | ||||||||||||

| Church & Dwight Co., Inc. | 20,000 | $ | 1,300,369 | $ | 1,678,000 | |||||||

| Industrial Conglomerates - 1.0% | ||||||||||||

| General Electric Co. | 50,000 | 1,326,590 | 1,261,000 | |||||||||

| Insurance - 0.8% | ||||||||||||

| MetLife, Inc. | 20,175 | 928,470 | 951,251 | |||||||||

| Internet Software & Services - 1.7% | ||||||||||||

| Equinix, Inc. | 7,500 | 1,950,738 | 2,050,500 | |||||||||

| Media - 1.3% | ||||||||||||

| Walt Disney Co. | 15,000 | 454,782 | 1,533,000 | |||||||||

| Oil, Gas & Consumable Fuels - 1.5% | ||||||||||||

| ConocoPhillips | 13,000 | 730,341 | 623,480 | |||||||||

| Kinder Morgan, Inc. | 45,000 | 1,561,603 | 1,245,600 | |||||||||

| 2,291,944 | 1,869,080 | |||||||||||

| Pharmaceuticals - 4.9% | ||||||||||||

| AbbVie Inc. | 25,000 | 963,829 | 1,360,250 | |||||||||

| Eli Lilly & Co. | 15,000 | 800,268 | 1,255,350 | |||||||||

| Merck & Co., Inc. | 22,651 | 839,335 | 1,118,733 | |||||||||

| Pfizer Inc. | 40,000 | 923,760 | 1,256,400 | |||||||||

| Roche Holdings Ltd. (ADR) | 27,500 | 1,022,106 | 906,125 | |||||||||

| 4,549,298 | 5,896,858 | |||||||||||

| Real Estate Investment Trusts - 2.7% | ||||||||||||

| American Tower Corp. | 15,000 | 1,342,800 | 1,319,700 | |||||||||

| Crown Castle International Corp. | 16,100 | 1,281,573 | 1,269,807 | |||||||||

| Invesco Mortgage Capital Inc. | 58,700 | 1,005,202 | 718,488 | |||||||||

| 3,629,575 | 3,307,995 | |||||||||||

| Semiconductors & Semiconductor Equipment - 1.0% | ||||||||||||

| Intel Corp. | 40,000 | 937,400 | 1,205,600 | |||||||||

| Software - 1.0% | ||||||||||||

| Microsoft Corp. | 28,600 | 762,471 | 1,265,836 | |||||||||

| Wireless Telecommunication Services - 2.6% | ||||||||||||

| SBA Communications Corp. (5) | 15,000 | 1,470,771 | 1,571,100 | |||||||||

| Vodafone Group PLC (ADR) | 50,909 | 1,906,142 | 1,615,854 | |||||||||

| 3,376,913 | 3,186,954 | |||||||||||

| Total Common Stock | 33,072,317 | 36,474,642 | ||||||||||

S e e a c c o m p a n y i n g n o t e s t o f i n a n c i a l s t a t e m e n t s

| Page 10 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D .. 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Portfolio of Investments September 30, 2015 (continued)

| Identified | Value | |||||||

| Cost | (Note 1) | |||||||

| Total Convertible Bonds and Notes - 46.8% | $ | 53,390,960 | $ | 56,639,700 | ||||

| Total Convertible Preferred Stock - 8.7% | 10,943,310 | 10,514,176 | ||||||

| Total Mandatory Convertible Securities - 12.3% | 14,797,078 | 14,839,962 | ||||||

| Total Common Stock - 30.1% | 33,072,317 | 36,474,642 | ||||||

| Total Investments - 97.9% | $ | 112,203,665 | $ | 118,468,480 | ||||

| Other Assets and Liabilites, Net - 2.1% | 2,479,659 | |||||||

| Total Net Assets - 100.0% | $ | 120,948,139 | ||||||

| (1) | Security not registered under the Securities Act of 1933, as amended (the “Securities Act”) (e.g., the security was purchased in a Rule 144A or a Regulation D transaction). The security may be resold only pursuant to an exemption from registration under the Securities Act, typically to qualified institutional buyers. The Fund generally has no rights to demand registration of such securities. The aggregate market value of these unregistered securities at September 30, 2015 was $15,026,594, which represented 12.4% of the Fund’s net assets. |

| (2) | Investment is valued at fair value as determined in good faith pursuant to procedures adopted by the Board of Trustees. It is possible that the estimated value may differ significantly from the amount that might ultimately be realized in the near term, and the difference could be material. The fair value of these securities amounted to $750,000 at September 30, 2015, which represented 0.62% of the Fund’s net assets. |

| (3) | Restricted securities include securities that have not been registered under the Securities Act of 1933, as amended, and securities that are subject to restrictions on resale. The Fund may invest in restricted securities that are consistent with the Fund’s investment objective and investment strategies. In some cases, the issuer of restricted securities has agreed to register such securities for resale, at the issuer’s expense either upon demand by the Fund or in connection with another registered offering of the securities. Investments in restricted securities are valued at fair value as determined in good faith in accordance with procedures adopted by the Board of Trustees. It is possible that the estimated value may differ significantly from the amount that might ultimately be realized in the near term, and the difference could be material. As of September 30, 2015, the Fund was invested in the following restricted securities: |

| Price | % Net | |||||||||||||||||||||

| Security | Acquisition Date | Shares | Cost | per Share | Value | Assets | ||||||||||||||||

| Amerivon

Holdings LLC series A cv. pfd. | April 1, 2010 | 682,393 | $ | 1,500,000 | $ | 1.075 | $ | 733,636 | 0.61 | % | ||||||||||||

| Amerivon Holdings LLC

common equity units | April 1, 2010 | 272,728 | 0 | 0.060 | 16,364 | 0.01 | % | |||||||||||||||

| (4) | Mandatory Convertible Securities are required to be converted on the dates listed; they generally may be converted prior to these dates at the option of the holder. See Note 1(i) of the Notes to Financial Statements. |

| (5) | Non-income producing. |

ADR = American Depositary Receipt.

S e e a c c o m p a n y i n g n o t e s t o f i n a n c i a l s t a t e m e n t s

| Page 11 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D .. 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Statement of Assets and Liabilities

| September 30, 2015 | ||||

| Assets: | ||||

| Investments at value (cost $112,203,665) (Note 1) | $ | 118,468,480 | ||

| Cash | 867,739 | |||

| Receivable for securities sold | 1,067,510 | |||

| Dividends and interest receivable | 577,701 | |||

| Prepaid insurance | 18,100 | |||

| Total assets | 120,999,530 | |||

| Liabilities: | ||||

| Accrued management fee (Note 2) | 11,189 | |||

| Accrued expenses | 40,202 | |||

| Total liabilities | 51,391 | |||

| Net Assets: | $ | 120,948,139 | ||

| Net Assets consist of: | ||||

| Capital shares (unlimited shares of $0.01 par value authorized) (Note 3) | $ | 127,987 | ||

| Additional paid-in capital | 111,961,574 | |||

| Accumulated net investment income loss | (4,379,066 | ) | ||

| Accumulated net realized gain from investment transactions | 6,972,829 | |||

| Unrealized appreciation on investments | 6,264,815 | |||

| Net Assets | $ | 120,948,139 | ||

| Net asset value per share ($120,948,139 ÷ 12,798,717 outstanding shares) | $ | 9.45 | ||

Statement of Operations

For the Year Ended September 30, 2015

| Investment Income (Note 1): | ||||

| Interest | $ | 476,753 | ||

| Dividends | 2,767,794 | |||

| Total Income | 3,244,547 | |||

| Expenses (Note 2): | ||||

| Management fees | 918,251 | |||

| Custodian | 12,936 | |||

| Transfer agent | 33,587 | |||

| Legal fees | 95,663 | |||

| Audit fees | 43,700 | |||

| Trustees’ fees | 108,750 | |||

| Administrative services fees | 66,766 | |||

| Reports to shareholders | 63,259 | |||

| Insurance | 31,073 | |||

| Other | 57,676 | |||

| Total Expenses | 1,431,661 | |||

| Net Investment Income | 1,812,886 | |||

| Realized and Unrealized Gain/(Loss) on Investments: | ||||

| Net realized gain from investment transactions | 7,675,118 | |||

| Net change in unrealized appreciation of investments | (11,920,501 | ) | ||

| Net loss on investments | 4,245,383 | |||

| Net Decrease in Net Assets Resulting from Operations | $ | (2,432,497 | ) |

S e e a c c o m p a n y i n g n o t e s t o f i n a n c i a l s t a t e m e n t s

| Page 12 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D . 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Statements of Changes in Net Assets

For the Years Ended October 31, 2015 and 2014

| 2015 | 2014 | |||||||

| Change in net assets from operations: | ||||||||

| Net investment income | $ | 1,812,886 | $ | 1,851,887 | ||||

| Net realized gain from investment transactions | 7,675,118 | 13,837,265 | ||||||

| Net change in unrealized appreciation of investments | (11,920,501 | ) | (3,015,876 | ) | ||||

| Net change in net assets resulting from operations | (2,432,497 | ) | 12,673,276 | |||||

| Distributions to shareholders from: | ||||||||

| Net investment income | (3,208,673 | ) | (3,182,349 | ) | ||||

| Net realized gain on investments | (5,604,005 | ) | — | |||||

| Total distributions | (8,812,678 | ) | (3,182,349 | ) | ||||

| Capital share transactions (Note 3): | ||||||||

| Value of shares issued on reinvestment of distributions | 1,632,409 | 305,503 | ||||||

| Cost of shares purchased | (4,706,210 | ) | (3,343,583 | ) | ||||

| Change in net assets resulting from capital share transactions | (3,073,801 | ) | (3,038,080 | ) | ||||

| Change in net assets | (14,318,976 | ) | 6,452,847 | |||||

| Net assets at beginning of year | 135,267,115 | 128,814,268 | ||||||

| Net assets at end of year | $ | 120,948,139 | $ | 135,267,115 | ||||

| Accumulated net investment loss at end of year | $ | (4,379,066 | ) | $ | (3,052,951 | ) | ||

Financial Highlights Selected data for a share of beneficial interest outstanding:

| Years Ended September 30, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Operating Performance: | ||||||||||||||||||||

| Net asset value, beginning of year | $ | 10.29 | $ | 9.54 | $ | 8.48 | $ | 7.46 | $ | 7.95 | ||||||||||

| Net investment income | 0.13 | 0.14 | 0.18 | 0.19 | 0.22 | |||||||||||||||

| Net realized and unrealized gain (loss) | (0.29 | ) | 0.80 | 1.15 | 1.08 | (0.46 | ) | |||||||||||||

| Total from investment operations | (0.16 | ) | 0.94 | 1.33 | 1.27 | (0.24 | ) | |||||||||||||

| Less Distributions: | ||||||||||||||||||||

| Dividends from net investment income | (0.25 | ) | (0.24 | ) | (0.26 | ) | (0.25 | ) | (0.25 | ) | ||||||||||

| Distributions from realized gains | (0.43 | ) | — | — | — | — | ||||||||||||||

| Total distributions | (0.68 | ) | (0.24 | ) | (0.26 | ) | (0.25 | ) | (0.25 | ) | ||||||||||

| Capital Share Transactions: | ||||||||||||||||||||

| Anti-dilutive effect of share repurchases | 0.06 | 0.05 | — | (b) | — | — | ||||||||||||||

| Dilutive effect of dividend reinvestment | — | (b) | — | (0.01 | ) | — | — | (b) | ||||||||||||

| Net asset value, end of year | $ | 9.45 | $ | 10.29 | $ | 9.54 | $ | 8.48 | $ | 7.46 | ||||||||||

| Market value, end of year | $ | 7.82 | $ | 8.65 | $ | 7.87 | $ | 7.35 | $ | 6.43 | ||||||||||

| Total Return (a): | ||||||||||||||||||||

| Market Value Return (%) | (2.32 | ) | 13.03 | 10.84 | 18.41 | (7.13 | ) | |||||||||||||

| Net Asset Value Return (%) | (0.78 | ) | 10.92 | 16.45 | 17.75 | (2.82 | ) | |||||||||||||

| Ratios/Supplemental Data: | ||||||||||||||||||||

| Net assets, end of year (in thousands) | $ | 120,948 | $ | 135,267 | $ | 128,814 | $ | 114,154 | $ | 100,008 | ||||||||||

| Ratio of expenses to average net assets (%) | 1.1 | 1.1 | 1.1 | 1.1 | 1.1 | |||||||||||||||

| Ratio of net investment income to average net assets (%) | 1.4 | 1.3 | 1.9 | 2.3 | 2.6 | |||||||||||||||

| Portfolio turnover rate (%) | 45 | 48 | 48 | 39 | 47 | |||||||||||||||

| (a) | Market value total return is calculated assuming a purchase of Fund shares on the opening of the first business day and a sale on the closing of the last business day of each period reported. Dividends and distributions are assumed for the purposes of this calculation to be reinvested at prices obtained under the Fund’s Automatic Dividend Investment and Cash Payment Plan. Net asset value total return is calculated on the same basis, except that the Fund’s net asset value is used on the purchase and sale dates instead of market value. | |

| (b) | Amount less than $0.01. |

S e e a c c o m p a n y i n g n o t e s t o f i n a n c i a l s t a t e m e n t s

| Page 13 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D . 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Notes to Financial Statements

NOTE 1 - ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

(a) Organization - Ellsworth Growth and Income Fund Ltd. (formerly Ellsworth Fund Ltd.) (the “Fund”), is registered under the Investment Company Act of 1940, as amended, as a diversified, closed-end management investment company.

(b) Indemnification - Under the Fund’s organizational documents, each trustee, officer or other agent of the Fund (including the Fund’s investment adviser) is indemnified against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss as a result of such indemnification is considered remote.

(c) Security Valuation - Investments in securities traded on a national securities exchange are valued at market using the last reported sales price, supplied by an independent pricing service, as of the close of regular trading. Listed securities, for which no sales were reported, are valued at the mean between closing reported bid and asked prices as of the close of regular trading. Unlisted securities traded in the over-the-counter market are valued using an evaluated quote provided by the independent pricing service, or, if an evaluated quote is unavailable, such securities are valued using prices received from dealers, provided that if the dealer supplies both bid and asked prices, the price to be used is the mean of the bid and asked prices. The independent pricing service derives an evaluated quote by obtaining dealer quotes, analyzing the listed markets, reviewing trade execution data and employing sensitivity analysis. Evaluated quotes may also reflect appropriate factors such as individual characteristics of the issue, communications with broker-dealers, and other market data. Securities for which quotations are not readily available, restricted securities and other assets are valued at fair value as determined in good faith pursuant to procedures approved by the Board of Trustees. Short-term debt securities with original maturities of 60 days or less are valued at amortized cost.

The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

Level 1 - Quoted unadjusted prices for identical instruments in active markets.

Level 2 - Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-driven valuation in which all significant inputs and significant value drivers are observable in active markets. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers, and those received from an independent pricing service.

Level 3 - Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price an asset or liability based on the best available information.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of the markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The net change in unrealized depreciation from Level 3 investments held as of September 30, 2015 was ($29,969) and is included in net unrealized appreciation of investments on the Statement of Operations. Transfers into, or out of, Level 3 are valued utilizing values as of the end of the period. Transfers into Level 3 were due to a decline in market activity (e.g., frequency of trades), which resulted in a lack of available market inputs to determine price.

| Page 14 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D . 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Notes to Financial Statements (continued)

NOTE 1 - ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued)

The following is a summary of the inputs used to value the net assets of Ellsworth Growth and Income Fund Ltd. as of September 30, 2015:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Investments in Securities: | ||||||||||||||||

| Common Stock: | ||||||||||||||||

| Consumer Discretionary | $ | 2,890,000 | $ | — | $ | — | $ | 2,890,000 | ||||||||

| Consumer Staples | 5,336,400 | — | — | 5,336,400 | ||||||||||||

| Energy | 2,421,240 | — | — | 2,421,240 | ||||||||||||

| Financials | 13,922,812 | — | — | 13,922,812 | ||||||||||||

| Industrials | 1,261,000 | — | — | 1,261,000 | ||||||||||||

| Information Technology | 4,521,936 | — | — | 4,521,936 | ||||||||||||

| Telecommunication Services | 6,121,254 | — | — | 6,121,254 | ||||||||||||

| Total Common Stock | 36,474,642 | — | — | 36,474,642 | ||||||||||||

| Convertible Bonds and Notes: | ||||||||||||||||

| Consumer Discretionary | — | 7,187,993 | — | 7,187,993 | ||||||||||||

| Consumer Staples | — | 650,625 | — | 650,625 | ||||||||||||

| Energy | — | 1,321,382 | — | 1,321,382 | ||||||||||||

| Financials | — | 4,493,440 | — | 4,493,440 | ||||||||||||

| Health Care | — | 13,142,246 | — | 13,142,246 | ||||||||||||

| Industrials | — | 4,371,016 | — | 4,371,016 | ||||||||||||

| Information Technology | — | 24,461,748 | — | 24,461,748 | ||||||||||||

| Telecommunication Services | — | 1,011,250 | — | 1,011,250 | ||||||||||||

| Total Convertible Bonds and Notes | — | 56,639,700 | — | 56,639,700 | ||||||||||||

| Convertible Preferred Stock: | ||||||||||||||||

| Consumer Discretionary | — | — | 750,000 | 750,000 | ||||||||||||

| Consumer Staples | — | 981,300 | — | 981,300 | ||||||||||||

| Energy | — | 451,826 | — | 451,826 | ||||||||||||

| Financials | — | 6,189,650 | — | 6,189,650 | ||||||||||||

| Industrials | — | 2,141,400 | — | 2,141,400 | ||||||||||||

| Total Preferred Stock | — | 9,764,176 | 750,000 | 10,514,176 | ||||||||||||

| Mandatory Convertible Securities: | ||||||||||||||||

| Consumer Discretionary | — | 593,100 | — | 593,100 | ||||||||||||

| Consumer Staples | — | 1,025,200 | — | 1,025,200 | ||||||||||||

| Energy | — | 371,300 | — | 371,300 | ||||||||||||

| Financials | — | 2,451,200 | — | 2,451,200 | ||||||||||||

| Health Care | — | 6,236,362 | — | 6,236,362 | ||||||||||||

| Telecommunication Services | — | 1,627,100 | — | 1,627,100 | ||||||||||||

| Utilities | — | 2,535,700 | — | 2,535,700 | ||||||||||||

| Total Mandatory Convertible Securities | — | 14,839,962 | — | 14,839,962 | ||||||||||||

| Total Investments | $ | 36,474,642 | $ | 81,243,838 | $ | 750,000 | $ | 118,468,480 | ||||||||

Refer to the Fund’s Portfolio of Investments for a detailed breakdown of Common Stock, Convertible Bonds and Notes, Convertible Preferred Stock and Mandatory Convertible Securities. Transfers between levels are recognized at September 30, 2015, the end of the reporting period. The Fund recognized no transfers to or from Level 1 to Level 2.

The following is a reconciliation of assets for which Level 3 inputs were used in determining value:

| Description | Investments in Securities | |||

| Balance as of September 30, 2014 | $ | 779,969 | ||

| Proceeds from sales | — | |||

| Gain/loss | — | |||

| Change in unrealized appreciation (depreciation) (1) | (29,969 | ) | ||

| Net transfers in/out of Level 3 | — | |||

| Balance as of September 30, 2015 | $ | 750,000 | ||

(1) Included in the net change of unrealized appreciation on investments in the Statement of Operations.

| Page 15 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D . 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Notes to Financial Statements (continued)

NOTE 1 - ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued)

The following table presents additional information about valuation methodologies and inputs used for investments that are measured at fair value and categorized within Level 3 as of September 30, 2015:

| Fair Value

September 30, 2015 | Valuation Methodologies | Unobservable Input (1) | Impact to Valuation

from an Increase in Input (2) | |||||||

| Amerivon Holdings LLC series A cv. pfd. and common equity units | $750,000 | Market Comparables/ Sum of the Parts Valuation/ Dividend Analysis | Liquidity Discount | Decrease | ||||||

(1) In determining certain of these inputs, management evaluates a variety of factors including economic conditions, industry and market developments, market valuations of comparable companies and company specific developments.

(2) This column represents the directional change in the fair value of the Level 3 investments that would result from an increase to the corresponding unobservable input. A decrease to the unobservable input would have the opposite effect.

(d) Federal Income Taxes - The Fund’s policy is to distribute substantially all of its taxable income within the prescribed time and to otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. Therefore, no provision for federal income or excise taxes is believed necessary.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more-likely-than-not” to be sustained assuming examination by taxing authorities. Management of the Fund has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years (2012-2014), or expected to be taken in the Fund’s 2015 tax returns. The major tax authority for the Fund is the Internal Revenue Service. The Fund is not aware of any tax positions for which it is reasonably likely that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

(e) Securities Transactions and Related Investment Income - Securities transactions are accounted for on the trade date (the date the order to buy or sell is executed) with gain or loss on the sale of securities being determined based upon identified cost. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis, including accretion of discounts and amortization of non-equity premium. For certain securities, known as “contingent payment debt instruments,” Federal tax regulations require the Fund to record non-cash, “contingent” interest income in addition to interest income actually received. Contingent interest income amounted to approximately $0.00 per share for the twelve months ended September 30, 2015.

(f) Distributions to Shareholders - Distributions to shareholders from net investment income are recorded by the Fund on the ex-dividend date. Distributions from capital gains, if any, are recorded on the ex-dividend date and paid annually.

The amount and character of income and capital gains to be distributed are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. The tax character of distributions paid during the fiscal years ended September 30, 2015 and 2014 were as follows:

| 2015 | 2014 | |||||||

| Ordinary income | $ | 3,298,705 | $ | 3,182,349 | ||||

| Long-term gain on investments | 5,513,973 | — | ||||||

| $ | 8,812,678 | $ | 3,182,349 | |||||

At September 30, 2015, the components of distributable earnings and federal tax cost were as follows:

| Unrealized appreciation | $ | 11,490,944 | ||

| Unrealized depreciation | (7,177,200 | ) | ||

| Net unrealized appreciation | 4,313,744 | |||

| Undistributed ordinary income | 203,918 | |||

| Undistributed capital gains | 4,340,918 | |||

| Total distributable net earnings | 4,544,836 | |||

| Total accumulated earnings | $ | 8,858,580 | ||

| Cost for federal income tax purposes | $ | 114,154,736 |

| Page 16 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D . 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Notes to Financial Statements (continued)

NOTE 1 - ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued)

The differences between book-basis and tax-basis unrealized appreciation/depreciation is attributable to differing methods of recognizing interest and ordinary income on bonds for tax purposes.

To the extent the Fund’s net realized capital gains, if any, can be offset by capital loss carryforwards, it is the policy of the Fund not to distribute such gains. As determined at September 30, 2015, the Fund had no capital loss carryforwards and no Post October losses.

(g) Use of Estimates - The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

(h) Regulated Investment Company Modernization Act - On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the Modernization Act) was signed into law. The Modernization Act modernizes several of the federal income and excise tax provisions related to regulated investment companies (“RICs”).

New capital losses may now be carried forward indefinitely and retain the character of the original loss. Under pre-enactment law, capital losses could be carried forward for eight years, and carried forward as short-term capital losses, irrespective of the character of the original loss. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

(i) Market Risk - It is the Fund’s policy to invest at least 65% of its assets in convertible securities. Although convertible securities do derive part of their value from that of the securities into which they are convertible, they are not considered derivative financial instruments. However, the Fund’s mandatory convertible securities include features which render them more sensitive to price changes of their underlying securities. Thus they expose the Fund to greater downside risk than traditional convertible securities, but generally less than that of the underlying common stock. The market value of those securities was $14,839,962 at September 30, 2015, representing approximately 12.3% of net assets.

(j) Reclassification of Capital Accounts - Accounting principles generally accepted in the United States require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. At September 30, 2015 the Fund decreased undistributed net investment loss by $69,672 and decreased accumulated net realized gain on investments by $69,672.

NOTE 2 - MANAGEMENT FEE AND OTHER TRANSACTIONS WITH AFFILIATES

The Fund has entered into an investment advisory agreement with Dinsmore Capital Management Co. (“Dinsmore Capital”). Pursuant to the investment advisory agreement, Dinsmore Capital provides the Fund with investment advice, office space and facilities. Under the terms of the investment advisory agreement, the Fund pays Dinsmore Capital on the last day of each month an advisory fee for such month computed at an annual rate of 0.75% of the first $100,000,000 and 0.50% of the excess over $100,000,000 of the Fund’s net asset value in such month.

The Fund, pursuant to an administrative services agreement with Dinsmore Capital, has agreed to pay Dinsmore Capital for certain accounting and other administrative services provided to the Fund. Under the administrative services agreement, the Fund pays Dinsmore Capital on the last day of each month a fee for such month computed at an annual rate of 0.05% of the Fund’s net asset value in such month.

Certain officers and trustees of the Fund are officers and directors of Dinsmore Capital.

See Note 5 “Subsequent Events.”

| Page 17 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D . 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Notes to Financial Statements (continued)

NOTE 3 - PORTFOLIO ACTIVITY

At September 30, 2015, there were 12,798,717 shares of beneficial interest outstanding, with a par value of $0.01 per share. During the twelve months ended September 30, 2015, 191,825 shares were issued in connection with reinvestment of dividends from net investment income, resulting in an increase in paid-in capital of $1,632,411.

At September 30, 2014, there were 13,140,692 shares of beneficial interest outstanding, with a par value of $0.01 per share. During the twelve months ended September 30, 2014, 38,046 shares were issued in connection with reinvestment of dividends from net investment income, resulting in an increase in paid-in capital of $305,503.

During the twelve months ended September 30, 2015 the Fund repurchased 533,800 capital shares in the open market at a cost of $4,706,210. The weighted average discount of these purchases comparing the average purchase price to net asset value was 14.95%.

During the twelve months ended September 30, 2014 the Fund repurchased 405,236 capital shares in the open market at a cost of $3,343,583. The weighted average discount of these purchases comparing the average purchase price to net asset value was 16.65%.

Purchases and sales of investments, exclusive of corporate short-term notes, aggregated $59,095,602 and $68,417,470, respectively, for the twelve months ended September 30, 2015.

NOTE 4 - NEW ACCOUNTING PRONOUNCEMENT

In May 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2015-07 “Disclosure for Investments in Certain Entities that Calculate Net Asset Value per Share (or Its Equivalent).” The amendments in ASU No. 2015-07 remove the requirement to categorize within the fair value hierarchy investments measured using the NAV practical expedient. The ASU also removes certain disclosure requirements for investments that qualify, but do not utilize, the NAV practical expedient. The amendments in the ASU are effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. Management is currently evaluating the impact these changes will have on the Fund’s financial statements and related disclosures.

NOTE 5 - SUBSEQUENT EVENTS

In preparing the financial statements as of September 30, 2015, management considered the impact of subsequent events for potential recognition or disclosure in these financial statements.

On October 19, 2015 shareholders of the Fund (1) approved a new investment advisory agreement with Gabelli Funds, LLC and (2) elected new trustees. The new investment advisory agreement was effective on November 1, 2015, and the Fund is now managed by the Dinsmore Group of Gabelli Funds, LLC.

Gabelli Funds, LLC (the “Adviser”) was also retained as the Fund’s administrator under the agreement.

Effective November 1, 2015, the Fund has entered into an investment advisory agreement (the “Advisory Agreement”) with the Adviser which provides that the Fund will pay the Adviser a fee, computed daily and paid monthly, equal on an annual basis to 0.80% of the first $100,000,000 of the Fund’s average weekly net assets and 0.55% of the Fund’s average weekly net assets in excess of $100,000,000. In accordance with the Advisory Agreement, the Adviser provides a continuous investment program for the Fund’s portfolio and oversees the administration of all aspects of the Fund’s business and affairs.

| Page 18 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D . 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Report of Independent Registered

Public Accounting Firm

To the Shareholders and Board of Trustees of

Ellsworth Growth and Income Fund Ltd.

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments of Ellsworth Growth and Income Fund Ltd. (formerly Ellsworth Fund Ltd.) (the “Fund”) as of September 30, 2015, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2015, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Ellsworth Growth and Income Fund Ltd. as of September 30, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

November 20, 2015

| Page 19 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D . 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Miscellaneous Notes (unaudited)

Automatic Dividend Investment and Cash Payment Plan

The Fund has an Automatic Dividend Investment and Cash Payment Plan (the “Plan”). Any shareholder may elect to join the Plan by sending an application to American Stock Transfer & Trust Company, P.O. Box 922, Wall Street Station, New York, NY 10269-0560 (the “Plan Agent”). You may also obtain information about the Plan, as well as the Plan application, by calling the Plan Agent toll free at (888) 888-0314. If your shares are held by a broker or other nominee, you should instruct the nominee to join the Plan on your behalf. Some brokers may require that your shares be taken out of the broker’s “street name” and re-registered in your own name. Shareholders should also contact their broker to determine whether shares acquired through participation in the Plan can be transferred to another broker and thereafter, whether the shareholder can continue to participate in the Plan.

Under the Plan, all dividends and distributions are automatically invested in additional Fund shares. Depending on the circumstances, shares may either be issued by the Fund or acquired through open market purchases at the current market price or net asset value, whichever is lower (but not less than 95% of market price). For shareholder distributions made with respect to income earned during each of the first three fiscal quarters, when the market price of a share of Fund beneficial shares is lower than such share’s net asset value, the Plan Agent will combine the distributions of all Plan participants and purchase shares in the open market, thereby taking advantage of the lower commissions on larger purchases. There is no other charge for this service. For shareholder distributions made with respect to capital gains realized during the fiscal year and income earned during the fourth fiscal quarter, when the market price of a share of Fund shares is lower than such share’s net asset value, the Fund will issue shares at the market price.

All dividends and distributions made by the Fund (including capital gain dividends and dividends designated as qualified dividend income, which are eligible for taxation at lower rates) remain taxable to Plan participants, regardless of whether such dividends and distributions are reinvested in additional shares of the Fund through open market purchases or through the issuance of new shares. Plan participants will be treated as receiving the cash used to purchase shares on the open market and, in the case of any dividend or distribution made in the form of newly issued shares, will be treated as receiving an amount equal to the fair market value of such shares as of the reinvestment date. Accordingly, a shareholder may incur a tax liability even though such shareholder has not received a cash distribution with which to pay the tax.

Plan participants may also voluntarily send cash payments of $100 to $10,000 per month to the Plan Agent, to be combined with other Plan monies, for purchase of additional Fund shares in the open market. You pay only a bank service charge of $1.25 per transaction, plus your proportionate share of the brokerage commission. All shares and fractional shares purchased will be held by the Plan Agent in your dividend reinvestment account. You may deposit with the Plan Agent any Fund share certificates you hold, for a one-time fee of $7.50.

At any time, a Plan participant may instruct the Plan Agent to liquidate all or any portion of such Plan participant’s account. To do so, a Plan participant must deliver written notice to the Plan Agent prior to the record date of any dividend or distribution requesting either liquidation or a share certificate. The Plan Agent will combine all liquidation requests it receives from Plan participants on a particular day and will then sell shares of the Fund that are subject to liquidation requests in the open market. The amount of proceeds a Plan participant will receive shall be determined by the average sales price per share, after deducting brokerage commissions, of all shares sold by the Plan Agent for all Plan participants who have given the Plan Agent liquidation requests.

The Plan Agent or the Fund may terminate the Plan for any reason at any time by sending written notice addressed to the Plan participant’s address as shown on the Plan Agent’s records. Following the date of termination, the Plan Agent shall send the Plan participant either the proceeds of liquidation, or a share certificate or certificates for the full shares held by the Plan Agent in the Plan participant’s account. Additionally, a check will be sent for the value of any fractional interest in the Plan participant’s account based on the market price of the Fund’s shares on that date.

| Page 20 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D . 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Miscellaneous Notes (unaudited) (continued)

Distribution Information

Shareholders were sent notices from the Fund that set forth estimates on a per share basis of the source or sources from which distributions were paid in calendar year 2015. Subsequently, certain of these estimates have been corrected. Listed below is a written statement of the sources of these distributions, as corrected, on a generally accepted accounting principles (“GAAP”) basis.

| Gain from | ||||||||||||||||

| Sale of | Return of | Total | ||||||||||||||

| Payable Date | Net Income | Securities | Capital | Distribution | ||||||||||||

| 2/26/15 | $ | 0.0000 | $ | 0.1075 | $ | 0.0000 | $ | 0.1075 | ||||||||

| 5/28/15 | $ | 0.1085 | $ | 0.0000 | $ | 0.0000 | $ | 0.1085 | ||||||||

| 8/27/15 | $ | 0.1020 | $ | 0.0070 | $ | 0.0000 | $ | 0.1090 | ||||||||

Please note that the information in the preceding chart is for financial accounting purposes only. Shareholders should be aware that the tax treatment of distributions likely differs from GAAP treatment. The tax treatment of distributions will be set forth in a Form 1099-DIV for the 2015 calendar year. This information is being provided to comply with certain U.S. Securities and Exchange Commission requirements.

For the year ended September 30, 2015, the Fund designated $3,208,673 as ordinary income, $90,032 as short term capital gains and $5,513,973 as long-term capital gains for purposes of the dividends paid deduction.

For the year ended September 30, 2015, certain dividends paid by the Fund may be subject to a maximum tax rate of l5%, as provided by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The percentage of dividends declared from net investment income designated as qualified dividend income for the Fund was 53.0%.

For corporate shareholders in the Fund, the percent of ordinary income distributions qualifying for the corporate dividends received deduction for the year ended September 30, 2015 was 49.0%.

The percentage of taxable ordinary income distributions that are designated as short-term capital gains distributions under Internal Revenue Section 87l(k)(2)(C) for the Fund was 2.7%.

| Page 21 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D . 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Miscellaneous Notes (unaudited)(continued)

Notice of Privacy Policy

The Fund has adopted a privacy policy in order to protect the confidentiality of nonpublic personal information that we have about you. We receive personal information, such as your name, address and account balances, when transactions occur in Fund shares registered in your name.

We may disclose this information to companies that perform services for the Fund, such as the Fund’s transfer agent or proxy solicitors. These companies may only use this information in connection with the services they provide to the Fund, and not for any other purpose. We will not otherwise disclose any nonpublic personal information about our shareholders or former shareholders to anyone else, except as required by law.

Access to nonpublic information about you is restricted to our employees and service providers who need that information in order to provide services to you. We maintain physical, electronic and procedural safeguards that comply with federal standards to guard your nonpublic personal information.

For More Information About Portfolio Holdings

In addition to the semi-annual and annual reports that Ellsworth delivers to shareholders and makes available through the Fund’s public website, the Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the Fund’s first and third fiscal quarters on Form N-Q. Ellsworth does not deliver the schedule of portfolio holdings for the first and third fiscal quarters to shareholders, however, the schedules are available without charge, upon request, by calling (800) 914-1177 or at the Fund’s public website, www.ellsworthfund.com. You may obtain the Form N-Q filings by accessing the SEC’s website at www.sec.gov. You may also review and copy them at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the SEC’s Public Reference Room may be obtained by calling the SEC at (800) SEC-0330.

Proxy Voting Policies and Procedures / Proxy Voting Record

The Fund’s policies and procedures with respect to the voting of proxies relating to the Fund’s portfolio securities is available without charge, upon request, by calling (800) 914-1177, or on the Fund’s website at www.ellsworthfund.com. In addition, information on how the Fund voted such proxies relating to portfolio securities during the most recent twelve-month period ended June 30, is available without charge at the above sources. This information is also available on the SEC’s website at www.sec.gov.

Declared Distribution

A distribution of $0.467 per share was declared on October 19, 2015, payable December 11, 2015 to shareholders of record at the close of business November 12, 2015. The distribution consists of $0.008 undistributed net investment income, net realized short-term gains on investments of $0.009 and net realized long-term gains on investments of $0.45.

The Fund is a member of the Closed-End Fund Association (CEFA), a non-profit national trade association (www.cefa.com).

Pursuant to Section 23 of the Investment Company Act of 1940, notice is hereby given that the Fund may in the future purchase beneficial shares of the Fund from time to time, at such times, and in such amounts, as may be deemed advantageous to the Fund. Nothing herein shall be considered a commitment to purchase such shares.

| Page 22 |

E L L S W O R T H G R O W T H A N D I N C O M E F U N D L T D . 2 0 1 5 A N N U A L R E P O R T T O S H A R E H O L D E R S

Trustees

Each trustee is also a trustee of Bancroft Fund Ltd. (Bancroft) (a closed-end management investment company). Dinsmore Capital Management Co. (Dinsmore Capital) is the Fund’s investment adviser and is also the investment adviser to Bancroft. Because of this connection, the Fund and Bancroft make up a Fund Complex. Therefore, each trustee oversees two investment companies in the Fund Complex. This information is as of September 30, 2015.

| Personal | Principal Occupation(s) During Past Five Years; Other |

| Information | Directorship(s) |

| INDEPENDENT TRUSTEES | |

|

Kinchen C. Bizzell, CFA 65 Madison Avenue, Suite 550 Morristown, NJ 07960 Term expires 2018 Trustee since 2008 - Born 1954 |

Since August 2013, Managing Director of CAVU Securities (an institutional securities broker-dealer); formerly Managing Director of Burson-Marsteller (a global public relations and communications firm) (1998 to 2003) and a Senior Counselor with Burson-Marsteller (2004 to 2013); Trustee of Bancroft. |

|

Elizabeth C. Bogan, Ph.D. 65 Madison Avenue, Suite 550 Morristown, NJ 07960 Term expires 2016 Trustee since 1986 - Born 1944 |

Senior Lecturer in Economics at Princeton University; Trustee of Bancroft. |

|

Daniel D. Harding, CFA 65 Madison Avenue, Suite 550 Morristown, NJ 07960 Term expires 2017 Trustee since 2007 - Born 1952 |

Managing General Partner of the Global Equity Income Fund, a private investment fund; Director of Tax Receivables Corp., a private asset management firm; prior to 2008, Senior Advisor with Harding Loevner Management LP (an investment advisory firm); a general partner of Latitude Capital Partners, LLC, a private investment firm (2010 to 2012); Trustee of Bancroft. |

|

Nicolas W. Platt 65 Madison Avenue, Suite 550 Morristown, NJ 07960 Term expires 2016 Trustee since 1997 - Born 1953 |

A private investor; member of NYSE MKT LLC U.S. Committee of Securities Listing Qualifications Panel; formerly Managing Director of FTI Consulting Inc. (an international consulting company) (2009 to 2011); currently Mayor of Township of Harding, New Jersey; Trustee of Bancroft. |

| INTERESTED TRUSTEES | |

|

Thomas H. Dinsmore, CFA (1) 65 Madison Avenue, Suite 550 Morristown, NJ 07960 Term expires 2017 Trustee since 1986 Chairman of the Board since 1996 - Born 1953 |

Chairman and Chief Executive Officer of the Fund, Bancroft and Dinsmore Capital; Trustee of Bancroft and Director of Dinsmore Capital. |

|

Jane D. O’Keeffe (1) 65 Madison Avenue, Suite 550 Morristown, NJ 07960 Term expires 2018 Trustee since 1995 - Born 1955 |