Exhibit 99.1

FOR IMMEDIATE RELEASE

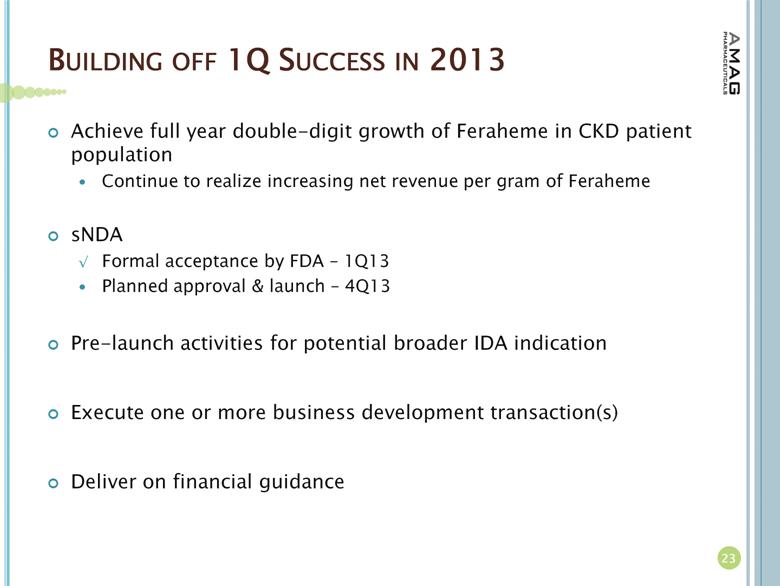

AMAG Announces First Quarter 2013 Financial Results

Total revenue increased 16%, operating expenses decreased 24%, resulting in a 69% reduction in net loss

Conference call scheduled for 4:30 EDT today

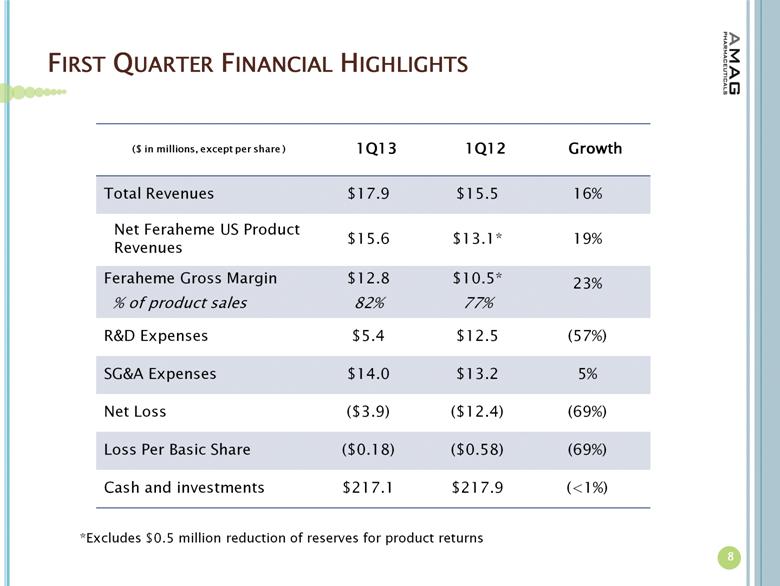

LEXINGTON, MA (April 23, 2013) — AMAG Pharmaceuticals, Inc. (NASDAQ: AMAG), a specialty pharmaceutical company, today reported unaudited consolidated financial results for the quarter ended March 31, 2013. Total revenues for the first quarter of 2013 were $17.9 million, 16 percent greater than the first quarter of 2012, driven by increased Feraheme® (ferumoxytol) U.S. sales. As of March 31, 2013, the company’s cash, cash equivalents and investments totaled approximately $217 million.

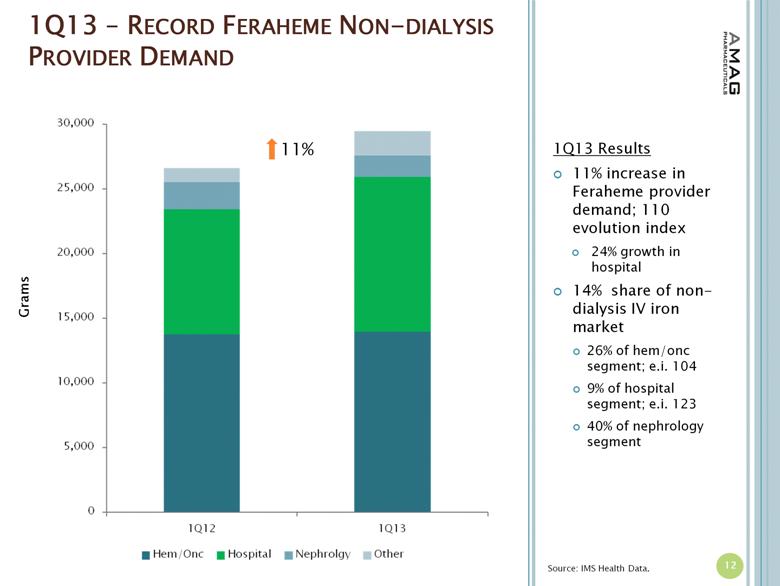

“We have gotten off to a very strong start in 2013, delivering record results through a combination of solid top-line growth and disciplined financial management,” said William Heiden, president and chief executive officer of AMAG. “In the first quarter, we achieved our largest volume of non-dialysis Feraheme sales since launch. Our new chief commercial officer, Greg Madison, and his team did an excellent job of driving Feraheme performance this quarter, achieving especially strong growth in the largest segment of the non-dialysis IV iron market, the hospital segment.”

Business Highlights

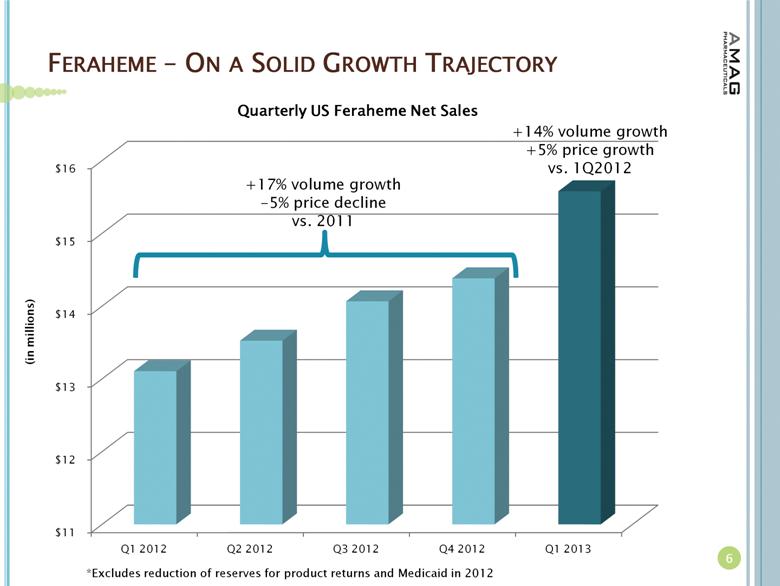

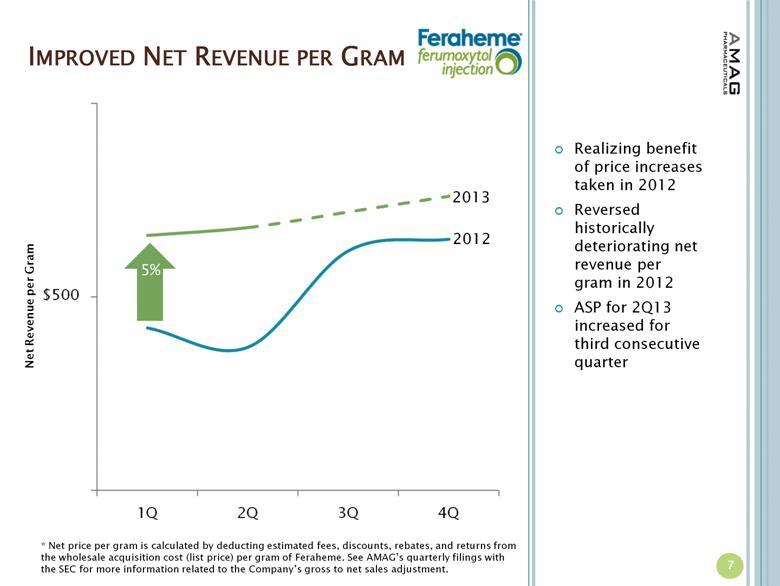

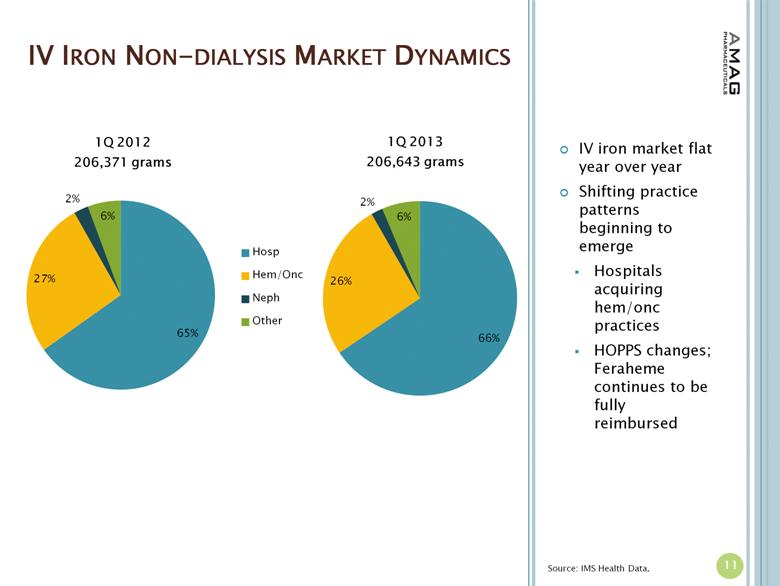

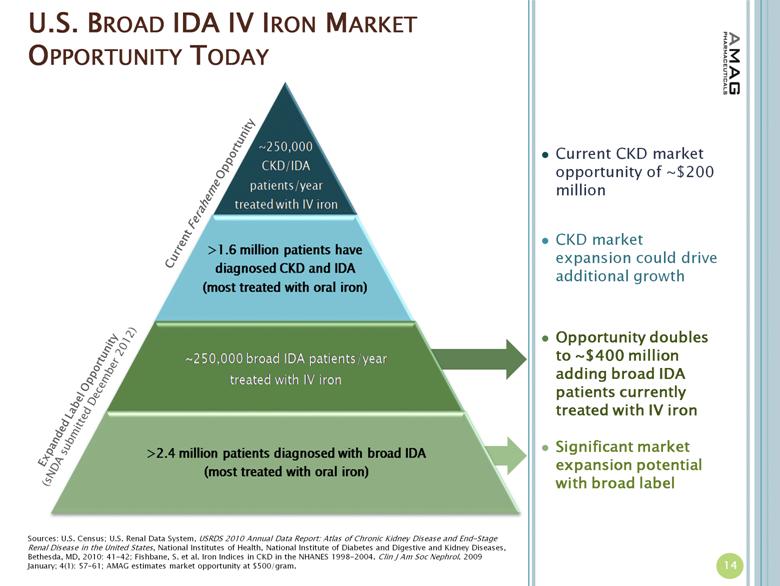

· The company reported $15.6 million in U.S. Feraheme net product sales, compared to $13.1 million (excluding $0.5 million reduction of reserves for product returns) in the first quarter of 2012, representing a 19 percent increase. The growth in U.S. product sales was driven by increased utilization of Feraheme for the treatment of iron deficiency anemia (IDA) in chronic kidney disease (CKD) patients and an increase in net revenue per gram of Feraheme. Total Feraheme provider demand for the first quarter of 2013 was approximately 29,500 grams, representing an 11 percent increase in provider demand over the first quarter of 2012.(1)

· Total operating expenses for the first quarter of 2013 declined 24 percent compared to the same period in 2012 as the company remains focused on driving the business towards profitability.

· AMAG is beginning to see the positive financial impact of the change to a fully outsourced supply chain that occurred in the fourth quarter of 2012, with gross margin on sales of Feraheme increasing to more than 82 percent in the first quarter of 2013 driven by improvements in cost of goods sold (COGS).

(1) IMS Health

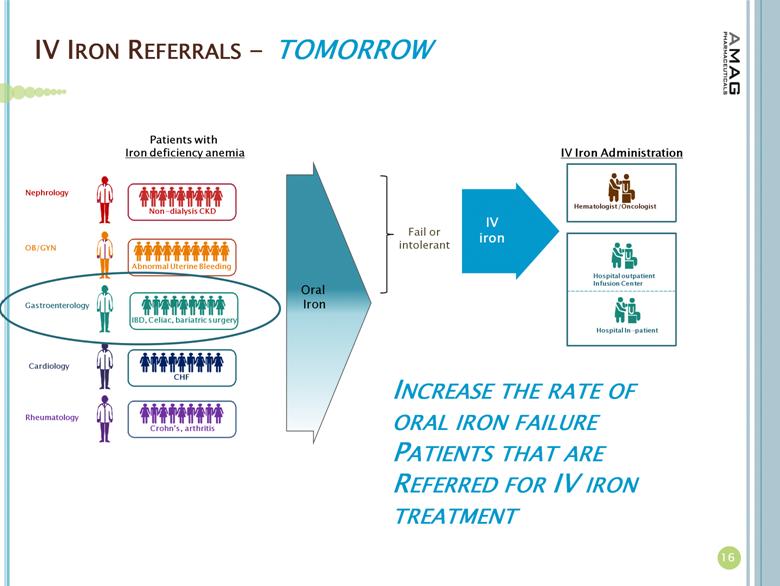

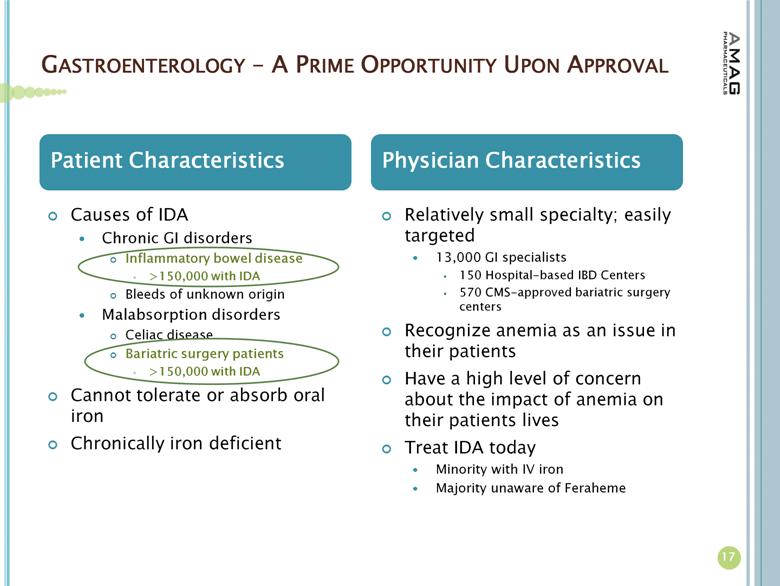

· In March 2013, AMAG received notification that its supplemental new drug application (sNDA) was accepted for review by the U.S. Food and Drug Administration (FDA) and that the FDA is targeting October 21, 2013 as the PDUFA action date for the filing. AMAG submitted the sNDA in December 2012, seeking to expand the indication for Feraheme beyond the current CKD indication to include all adult patients with IDA who have failed or otherwise cannot take oral iron therapy.

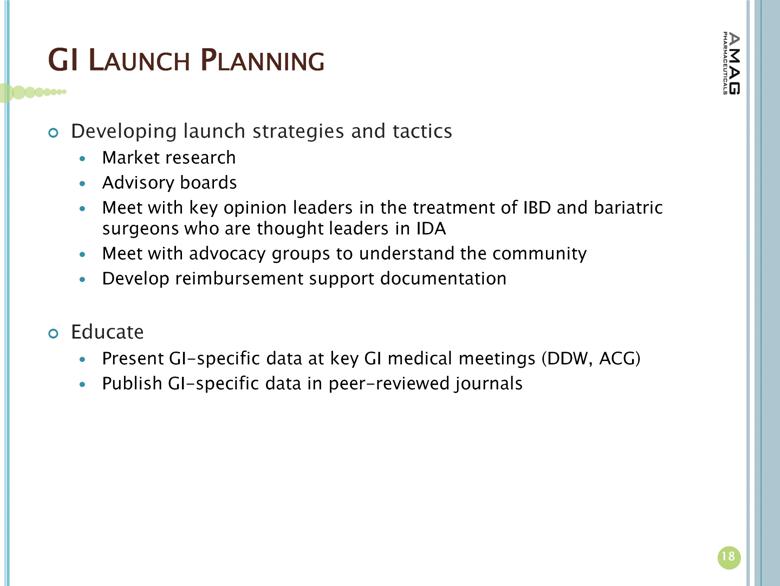

· AMAG continues to prepare for the potential approval of its sNDA for Feraheme in patients with IDA, regardless of underlying cause, who cannot take oral iron. These activities include conducting physician market research and product message development and testing. Other related activities include corporate disease awareness initiatives and support for the presentations/publications of data from AMAG’s phase III IDA clinical program in medical journals and at medical conferences.

“We made several changes to the way we operate our business in 2012, and we are now realizing the full benefit of those changes in our financial results,” stated Frank Thomas, chief operating officer of AMAG. “The nineteen percent increase in U.S. Feraheme sales versus 2012 was driven by strong volume gains as well as an increase in net revenue per gram, each of which we accomplished while maintaining a lower operating cost structure in the first quarter.”

First Quarter 2013 Financial Results (unaudited)

Total revenues for the quarter ended March 31, 2013 were $17.9 million, as compared to $15.5 million for the same period in 2012. The increase in total revenues in the first quarter of 2013 was primarily due to higher Feraheme product sales. Net U.S. Feraheme product sales for the quarter ended March 31, 2013 were $15.6 million, as compared to $13.1 million (excluding a $0.5 million reduction of reserves for product returns) for the same period in 2012.

Feraheme COGS in the first quarter of 2013 were $2.8 million, or 18 percent of global Feraheme product sales, compared to $2.6 million, or 23 percent of Feraheme product sales (excluding $0.5 million reduction of reserves for product returns) in the first quarter of 2012. Total operating expenses for the quarter ended March 31, 2013 were $19.4 million, compared to $25.6 million for the same period in 2012. The decrease in operating expenses in the first quarter of 2013 versus the first quarter of 2012 was primarily attributable to lower research and development expenses due to the 2012 completion of AMAG’s phase III IDA clinical program and a leaner internal R&D cost structure.

The company reported a net loss of $3.9 million, or a loss of $0.18 per share, for the quarter ended March 31, 2013, as compared to a net loss of $12.4 million, or a loss of $0.58 per share, for the same period in 2012.

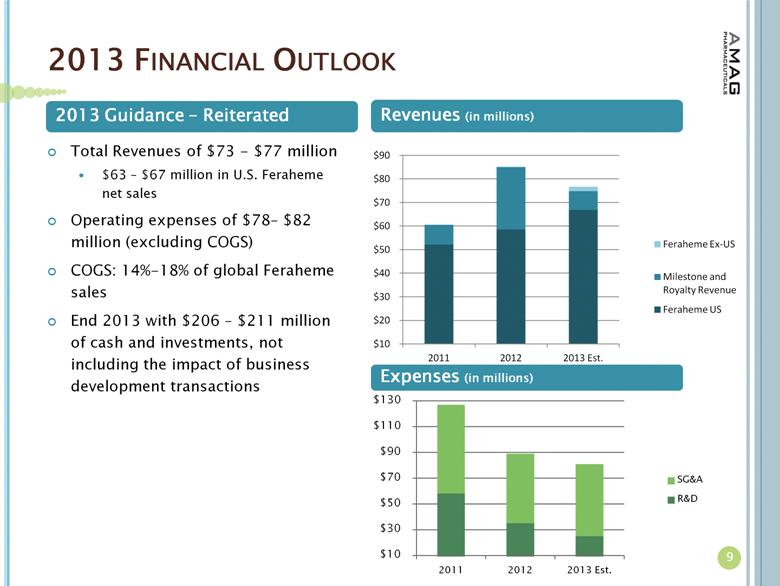

2013 Financial Outlook

The company reiterates the following guidance for 2013:

· Total revenues of between $73 million and $77 million, including:

· Feraheme U.S. net product sales of between $63 million and $67 million;

· Revenue from royalties, ex-U.S. product sales and milestones of approximately $10 million;

· COGS of between 14 percent and 18 percent of net Feraheme global product sales;

· Total operating expenses of between $78 million and $82 million; and

· A 2013 year-end cash and investments balance of between $206 million and $211 million, not including the impact of business development transactions.

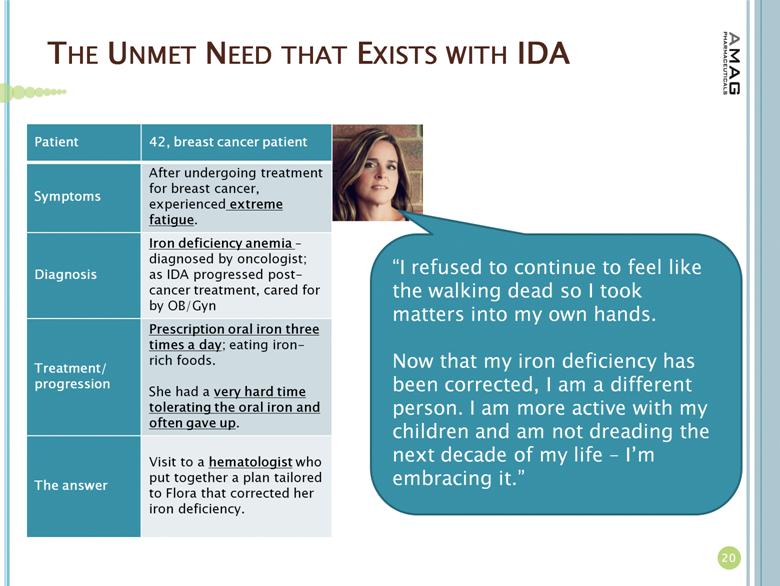

About Iron Deficiency Anemia

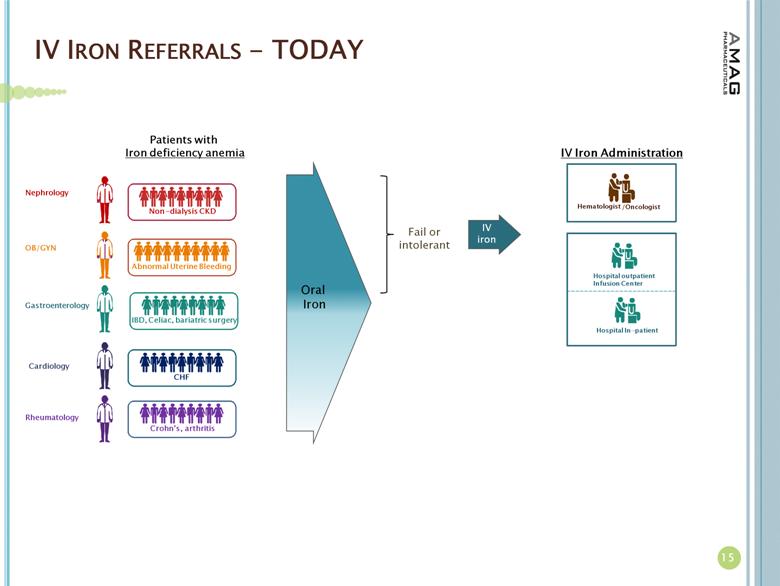

More than 4 million Americans have IDA; 1.6 million of whom are estimated to have CKD, while the other 2.4 million suffer from anemia due to other causes.(2) For these patients with anemia due to other causes, the underlying diseases or issues causing IDA include abnormal uterine bleeding, gastrointestinal disorders, inflammatory diseases and chemotherapy-induced anemia. Many IDA patients fail treatment with oral iron due to intolerability or side effects.(3)

About AMAG

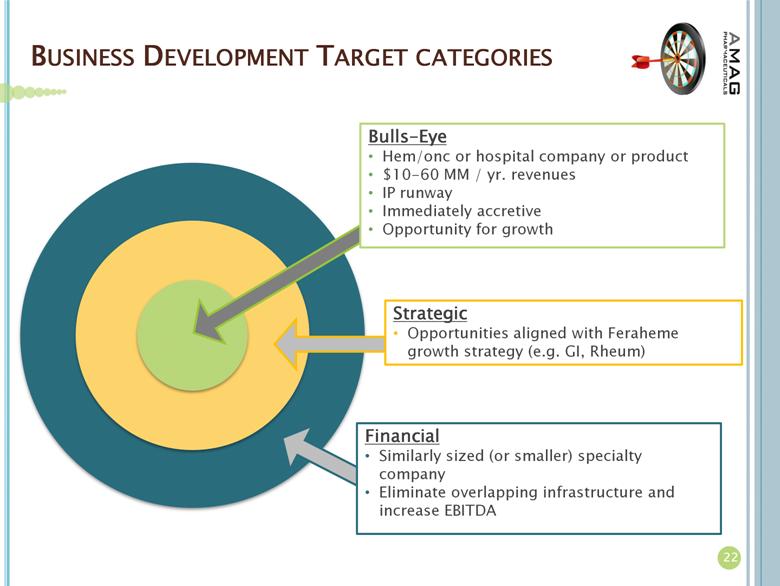

AMAG Pharmaceuticals, Inc. is a specialty pharmaceutical company that manufactures and markets Feraheme® (ferumoxytol) Injection for Intravenous (IV) use in the United States. Along with driving organic growth of its lead product, AMAG intends to expand its portfolio with additional commercial-stage specialty pharmaceuticals. The company is seeking complementary products that leverage the company’s commercial footprint and focus on hematology and oncology centers and hospital infusion centers. For additional company information, please visit www.amagpharma.com.

AMAG Pharmaceuticals and Feraheme are registered trademarks of AMAG Pharmaceuticals, Inc.

Rienso is a registered trademark of Takeda Pharmaceutical Company Limited.

Conference Call and Webcast Access

AMAG Pharmaceuticals, Inc. will host a conference call and webcast with slides today at 4:30 p.m. EDT, during which management will discuss the company’s financial results, commercial progress and business development initiatives. To access the conference call via telephone, please dial (877) 412-6083 from the United States or (702) 495-1202 for international access. A telephone replay will be available from approximately 7:30 p.m. EDT on April 23, 2013 through midnight April 30, 2013. To access a replay of the conference call, dial (855) 859-2056 from the United States or (404) 537-3406 for international access. The pass code for the live call and the replay is 37544923.

The call will be webcast with slides and accessible through the Investors section of the company’s website at www.amagpharma.com. The webcast replay will be available from approximately 7:30 p.m. EDT on April 23, 2013 through midnight May 23, 2013.

(2) U.S. Census; U.S. Renal Data System, USRDS 2010 Annual Data Report: Atlas of Chronic Kidney Disease and End-Stage Renal Disease in the United States, National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases, Bethesda, MD, 2010: 41-42; Fishbane, S. et al. Iron Indices in CKD in the NHANES 1998-2004. Clin J Am Soc Nephrol. 2009 January; 4(1): 57–61.

(3) Barton, James et al. Intravenous iron dextran therapy in patients with iron deficiency and normal renal function who failed to respond to or did not tolerate oral iron supplementation. Am J Medicine. 2000; 109: 27-32.

AMAG Pharmaceuticals, Inc.

Condensed Consolidated Statements of Operations

(unaudited, amounts in thousands, except for per share data)

|

|

|

Three Months Ended March 31, |

| ||||

|

|

|

2013 |

|

2012 |

| ||

|

Revenues: |

|

|

|

|

| ||

|

U.S. product sales, net |

|

$ |

15,578 |

|

$ |

13,626 |

|

|

International product sales and royalties |

|

63 |

|

— |

| ||

|

License fee and other collaboration revenues |

|

2,003 |

|

1,753 |

| ||

|

Other product sales and royalties |

|

236 |

|

101 |

| ||

|

Total revenues |

|

17,880 |

|

15,480 |

| ||

|

|

|

|

|

|

| ||

|

Operating costs and expenses: |

|

|

|

|

| ||

|

Cost of product sales |

|

2,942 |

|

2,646 |

| ||

|

Research and development expenses |

|

5,404 |

|

12,462 |

| ||

|

Selling, general and administrative expenses |

|

14,005 |

|

13,181 |

| ||

|

Total operating costs and expenses |

|

22,351 |

|

28,289 |

| ||

|

|

|

|

|

|

| ||

|

Operating loss |

|

(4,471 |

) |

(12,809 |

) | ||

|

|

|

|

|

|

| ||

|

Interest and dividend income, net |

|

271 |

|

393 |

| ||

|

Other income |

|

6 |

|

— |

| ||

|

Gain on disposal of fixed assets |

|

299 |

|

— |

| ||

|

|

|

|

|

|

| ||

|

Net loss |

|

$ |

(3,895 |

) |

$ |

(12,416 |

) |

|

|

|

|

|

|

| ||

|

Net loss per share - basic and diluted |

|

$ |

(0.18 |

) |

$ |

(0.58 |

) |

|

|

|

|

|

|

| ||

|

Weighted average shares outstanding used to compute net loss per share: |

|

|

|

|

| ||

|

|

|

|

|

|

| ||

|

Basic and diluted |

|

21,544 |

|

21,349 |

| ||

AMAG Pharmaceuticals, Inc.

Condensed Consolidated Balance Sheets

(unaudited, amounts in thousands)

|

|

|

March 31, 2013 |

|

December 31, 2012 |

| ||

|

Cash and cash equivalents |

|

$ |

33,845 |

|

$ |

46,293 |

|

|

Short-term investments |

|

183,224 |

|

180,750 |

| ||

|

Accounts receivable |

|

8,519 |

|

6,410 |

| ||

|

Inventories |

|

11,292 |

|

12,451 |

| ||

|

Receivable from collaboration |

|

108 |

|

263 |

| ||

|

Assets held for sale |

|

1,931 |

|

2,000 |

| ||

|

Other current assets |

|

6,219 |

|

6,213 |

| ||

|

Total current assets |

|

245,138 |

|

254,380 |

| ||

|

|

|

|

|

|

| ||

|

Net property, plant & equipment |

|

2,670 |

|

3,297 |

| ||

|

Other assets |

|

460 |

|

460 |

| ||

|

Total assets |

|

$ |

248,268 |

|

$ |

258,137 |

|

|

|

|

|

|

|

| ||

|

Accounts payable |

|

$ |

2,325 |

|

$ |

3,515 |

|

|

Accrued expenses and other short-term liabilities |

|

15,130 |

|

20,338 |

| ||

|

Deferred revenues - short term |

|

9,262 |

|

9,104 |

| ||

|

Total current liabilities |

|

26,717 |

|

32,957 |

| ||

|

|

|

|

|

|

| ||

|

Deferred revenues - long term |

|

48,376 |

|

50,350 |

| ||

|

Other long term liabilities |

|

1,922 |

|

2,033 |

| ||

|

Total long term liabilities |

|

50,298 |

|

52,383 |

| ||

|

|

|

|

|

|

| ||

|

Total stockholders’ equity |

|

171,253 |

|

172,797 |

| ||

|

|

|

|

|

|

| ||

|

Total liabilities and stockholders’ equity |

|

$ |

248,268 |

|

$ |

258,137 |

|

About Feraheme® (ferumoxytol)/Rienso

In the United States, Feraheme (ferumoxytol) Injection for Intravenous (IV) use is indicated for the treatment of iron deficiency anemia in adult chronic kidney disease (CKD) patients. Feraheme received marketing approval from the U.S. Food and Drug Administration on June 30, 2009 and was commercially launched by AMAG in the U.S. shortly thereafter. Ferumoxytol received marketing approval in Canada in March 2012, where it is marketed by Takeda as Feraheme, and in the European Union in June 2012 and Switzerland in August 2012, where it is marketed by Takeda as Rienso®. For additional product information, please visit www.feraheme.com.

Feraheme ® (ferumoxytol) Injection for Intravenous (IV) is indicated for the treatment of iron deficiency anemia in adult patients with chronic kidney disease. Feraheme is contraindicated in patients with known hypersensitivity to Feraheme or any of its components.

Serious hypersensitivity reactions, including anaphylactic-type reactions, some of which have been life-threatening and fatal, have been reported in patients receiving Feraheme. Serious adverse reactions of clinically significant hypotension have been reported. In the post-marketing setting, life-threatening anaphylactic type reactions, cardiac/cardiorespiratory arrest, clinically significant hypotension, syncope, unresponsiveness and other safety events have been reported in patients being treated with Feraheme. In clinical trials, the most commonly occurring adverse reactions for Feraheme-treated patients were nausea, dizziness, hypotension, peripheral edema, headache, edema and vomiting. A full list of adverse events can be found in the full prescribing information for Feraheme.

For full prescribing information, please visit www.feraheme.com.

Forward-looking Statement

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Any statements contained herein which do not describe historical facts, including but not limited to, the market for Feraheme and our future revenues and profitability; our operating expenses and cost of goods sold; expectations regarding the FDA’s review of our sNDA for Feraheme; our expectations for revenue growth and the expanded indication for Feraheme; AMAG’s pursuit of activities in preparation for the potential approval of our sNDA; the impact of 2012 changes to our business; our expected 2013 Feraheme product revenue; our expected 2013 operating expenses and cost of goods sold; our expected 2013 year-end cash and investments balance; potential Feraheme milestone or royalty payments; and our plans to expand the reach of Feraheme to new indications and geographic territories are forward-looking statements which involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward-looking statements.

Such risks and uncertainties include: (1) uncertainties regarding our and Takeda’s ability to successfully compete in the intravenous iron replacement market both in the US and outside the US, including the EU, (2) uncertainties regarding our ability to successfully and timely complete our clinical development programs and obtain regulatory approval for Feraheme/Rienso in the broader IDA indication both in the US and outside of the US, including the EU, (3) the possibility that significant safety or drug interaction problems could arise with respect to Feraheme/Rienso, (4) uncertainties regarding, and our dependence on third parties for, the manufacture of Feraheme/Rienso, (5) uncertainties relating to our patents and proprietary rights, both in the US and outside of the US, (6) the risk of an Abbreviated New Drug

Application (ANDA) filing following the FDA’s draft bioequivalence recommendation for ferumoxytol, and (7) other risks identified in our Securities and Exchange Commission filings, including our Annual Report on Form 10-K for the year ended December 31, 2012 and subsequent filings with the SEC. We caution you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made.

We disclaim any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements.

AMAG Pharmaceuticals, Inc. Contact

Amy Sullivan, 617-498-3303